The Streaming-ification of AI: How Chat GPT and Gemini Are Becoming Netflix-like Platforms

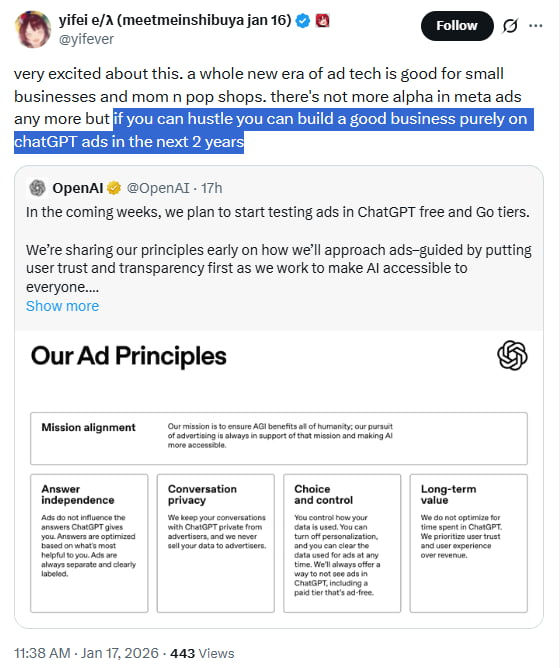

The artificial intelligence landscape is experiencing a fundamental shift in how companies monetize their products. When Open AI announced advertisements coming to Chat GPT, it marked a pivotal moment in the industry's evolution. Rather than relying solely on subscription revenue, major AI platforms are increasingly adopting business models reminiscent of streaming services like Netflix, Prime Video, and Disney+. This transition reveals important insights about the future of AI accessibility, user experience, and the competitive dynamics between platforms.

The decision to introduce advertising into free-tier AI services isn't surprising when you consider the massive infrastructure costs associated with running large language models. A single query to Chat GPT costs Open AI money in computational resources. As millions of users interact with these systems daily, the economics become challenging. However, the shift toward advertising raises important questions: How will ads affect user experience? Will users tolerate interruptions in their workflow? What does this mean for premium subscription tiers? And critically, are there better alternatives that align with different user priorities?

The streaming services offer a proven playbook for this model. Netflix, which pioneered the tiered subscription approach with an ad-supported option, generated $1.5 billion in ad revenue in 2023, demonstrating that viewers will accept advertising if the service remains largely functional. Prime Video saw similar success, with advertising revenue contributing meaningfully to Amazon's overall streaming business. These platforms proved that audiences will accept lower-cost plans with advertisements, creating a sustainable revenue stream without entirely alienating free-tier users.

Yet the parallel isn't perfect. Streaming services offer passive entertainment where ads can integrate naturally between episodes. AI assistants occupy a different role in users' lives—they're productivity tools, research aids, and creative partners. Interrupting a user midway through generating a crucial document with an advertisement feels fundamentally different from watching ads on a show. This distinction matters because it affects not just user satisfaction but also the practical utility of the tool.

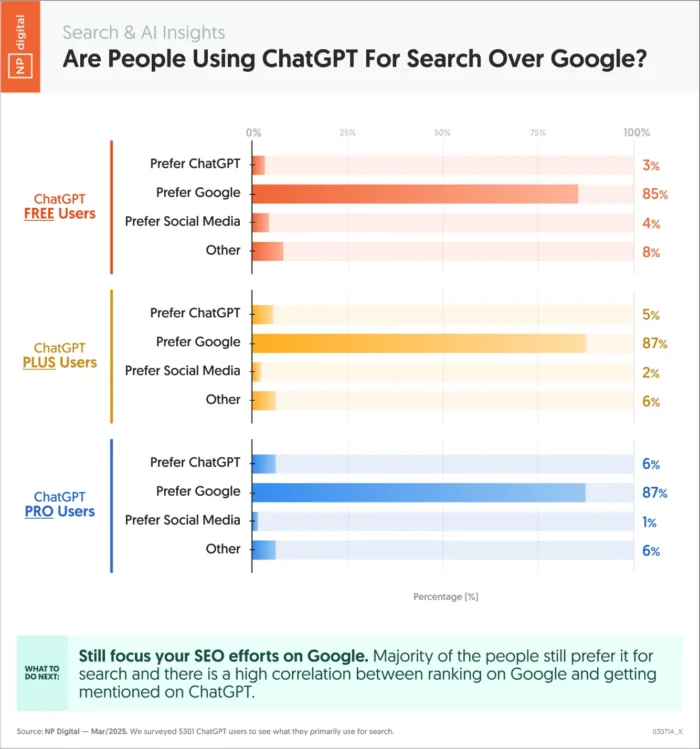

The broader context reveals an industry-wide trend. Google's Gemini, while not yet confirmed to have advertising, operates within Alphabet's advertising empire. The company has decades of experience monetizing free services through ads. Microsoft's investment in Open AI suggests it's watching these developments carefully, as Bing Chat and other services already display sponsored results. The question isn't whether advertising will spread across AI platforms—it's how it will be implemented and whether users will accept it.

For teams and developers evaluating their AI tool stack, this evolution has immediate implications. Organizations must consider not just the technical capabilities of a platform, but also how its business model aligns with their workflow needs and privacy expectations. Some teams may find that free tiers with advertisements suit their use cases perfectly. Others might require uninterrupted experiences that justify paid subscriptions. Still others may explore alternatives that prioritize different monetization approaches entirely.

Understanding the Streaming Model: Why Major Platforms Are Making This Shift

The economics driving this transition are straightforward but consequential. Training and running large language models requires significant computational infrastructure. A single conversation with an advanced AI model uses processing power that costs the company real money. When a service is offered for free, these costs must be absorbed by the company, funded through venture capital, corporate investment, or cross-subsidization from other revenue streams.

Open AI's financial situation illustrates the pressure points. The company has operated at substantial losses as it scales its infrastructure to serve millions of users. Its most recent funding rounds valued the company at $80 billion, but valuation without profitability creates pressure to find sustainable revenue models. The company can't rely indefinitely on generous investors willing to fund losses. Introducing advertising to free tiers offers a practical solution: users get continued free access, Open AI generates revenue to offset infrastructure costs, and advertisers gain access to an audience of millions.

The streaming services faced similar pressures. Netflix, despite massive subscriber bases, struggled with profitability in certain markets. The company's move toward advertising wasn't driven solely by greed—it was a financial necessity. Streaming content is expensive to produce and distribute. Adding an ad-supported tier allowed Netflix to serve price-sensitive customers who might otherwise not subscribe while generating additional revenue per user. The model worked: Netflix's ad business grew faster than projections, and subscriber growth accelerated as the lower-priced option attracted new users.

Google faces a different but related challenge. The company dominates search advertising, generating over $200 billion in annual advertising revenue. Yet AI poses an existential threat to search as a platform. If Chat GPT and other AI assistants can answer questions directly without forcing users to click through to websites, Google's ad-supported model breaks. By integrating advertising into Gemini and AI-powered search results, Google is attempting to preserve its advertising business while adapting to AI-enabled search.

Microsoft's approach reveals another strategic angle. The company invested $13 billion in Open AI and integrated Chat GPT capabilities into Copilot, Bing, and Office products. Microsoft can afford to subsidize free access because it benefits from cross-selling subscriptions to Microsoft 365, Azure, and other services. However, even Microsoft has financial incentives to monetize AI services directly, not just as customer acquisition tools for other products.

The key insight is that free AI services aren't sustainable at scale without revenue. This creates a forcing function for monetization. Companies have three primary levers: subscriptions (paid access), advertising (monetizing free users), and data/API sales (B2B revenue). Most major platforms are pursuing all three simultaneously. Open AI has Chat GPT Plus subscriptions ($20/month), API access for developers, and now advertising. This multi-pronged approach hedges against any single revenue stream falling short.

However, the shift has important consequences. When platforms introduce advertising, the incentive structure changes. The platform's primary goal becomes maximizing user engagement and ad impressions, not necessarily maximizing user outcomes. A streaming service that plays ads wants you to stay engaged so they can show you more ads. An AI assistant monetized through advertising might be optimized to keep you in conversation longer, show you ads, and encourage sharing (which brings new users and more ad inventory).

This represents a potential conflict of interest that didn't exist when platforms were purely subscription-based. A user paying $20/month for Chat GPT Plus expects the service to optimize for their productivity. That user's satisfaction directly affects retention and revenue. A free user seeing ads has a different relationship with the platform. Their satisfaction matters because engagement drives ad impressions, but the relationship is more complex and potentially misaligned.

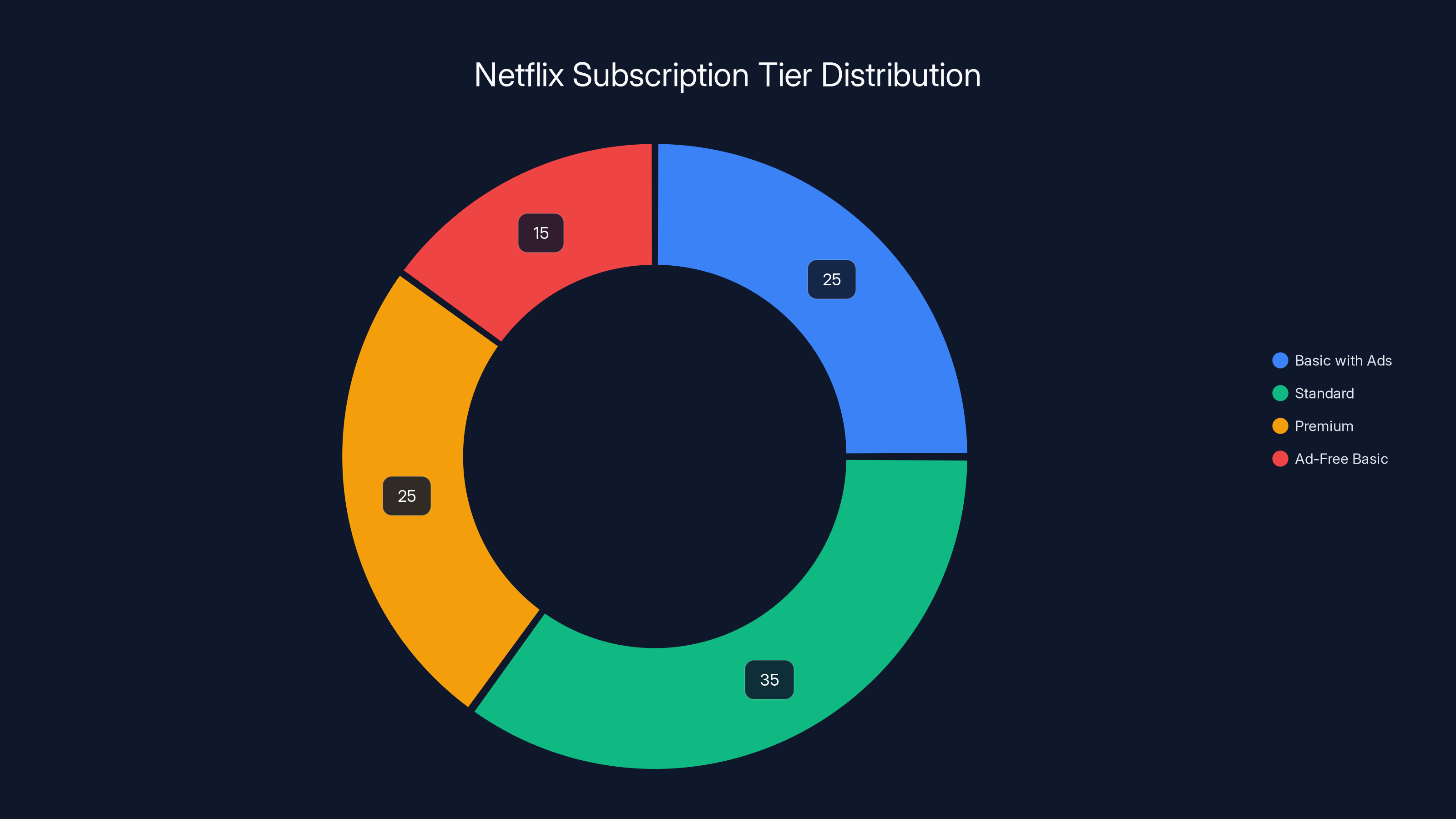

Estimated data shows a significant portion of Netflix users opting for the Basic with Ads tier, highlighting the demand for lower-cost options. Estimated data.

How Streaming Services Pioneered the Tiered Monetization Model

Netflix's evolution from pure subscription to tiered advertising represents the most instructive case study for how major platforms approach this transition. The company launched in 1997 with a straightforward model: users paid a monthly subscription for unlimited streaming. For over two decades, this model worked well. Netflix built brand loyalty, gathered massive amounts of user data about viewing preferences, and scaled to hundreds of millions of subscribers.

Yet by 2022, growth was slowing. Netflix reported its first subscriber loss in a decade, shocking investors and signaling market saturation. The company faced pressure to increase revenue from existing subscribers, but raising prices risked accelerating churn. Instead of choosing between high-price and low-price, Netflix chose both: they introduced a Basic with Ads tier at

The announcement was controversial. Critics argued it contradicted Netflix's brand promise. Some high-profile creators threatened to pull content. Yet the strategy worked. Within months, millions of new users signed up at the lower price point. Many existing users didn't downgrade (as feared) because they preferred the ad-free experience. Remarkably, some Basic subscribers gradually upgraded to ad-free tiers as their usage patterns revealed that ads were more intrusive than they'd anticipated.

Netflix proved three crucial insights: First, a substantial market exists for discounted, ad-supported services, even among people who can afford premium. Second, offering a choice doesn't cannibalize higher tiers as severely as predicted. Third, advertising can be lucrative once you've built sufficient scale and audience data. Netflix's advertising business scaled from zero to significant revenue within 18 months, partly because the company's data on user preferences makes their ads relatively targeted and valuable.

Prime Video followed a similar path. Amazon integrated advertising into Prime Video without introducing a separate tier initially. Prime members could watch ad-free; those paying for Prime Video without Prime paid less than Netflix but saw ads. This integration made sense for Amazon because Prime is the core product—Prime Video is a value-add that encourages Prime membership. The advertising revenue became a bonus on top of Prime subscription fees.

Disney+ took yet another approach. Rather than initially offering an ad tier, Disney kept the service ad-free and premium-priced. This aligned with Disney's brand positioning as a family-friendly, quality service willing to charge accordingly. However, as competition intensified and growth slowed, Disney shifted strategy. They introduced a basic tier with ads at lower pricing, learning from Netflix's success. The move generated immediate results, attracting price-sensitive customers and boosting total subscribers despite some cannibalization from premium tiers.

These case studies reveal important patterns. First, tiered monetization is standard practice in mature media platforms. It's not an anomaly or a desperate measure—it's the expected model. Second, advertising is effective at generating revenue at scale, particularly when the advertiser has rich user data. Third, the introduction of ads can actually accelerate growth by serving segments that wouldn't otherwise pay for the service. Fourth, brand positioning and implementation details matter tremendously. Disney+ implemented ads in a way that felt premium (fewer ad interruptions, higher-quality ads), while You Tube's aggressive advertising approach created backlash that drives Premium subscription conversion.

However, there are important differences between streaming media and AI services. Streaming services own their content and control the creative product completely. Netflix doesn't worry that ads will interfere with episode quality or availability. An AI assistant adding ads directly to the conversation might genuinely impact the user experience and utility. Additionally, streaming services serve primarily for entertainment and passive consumption. AI assistants are active tools where interruption has practical costs.

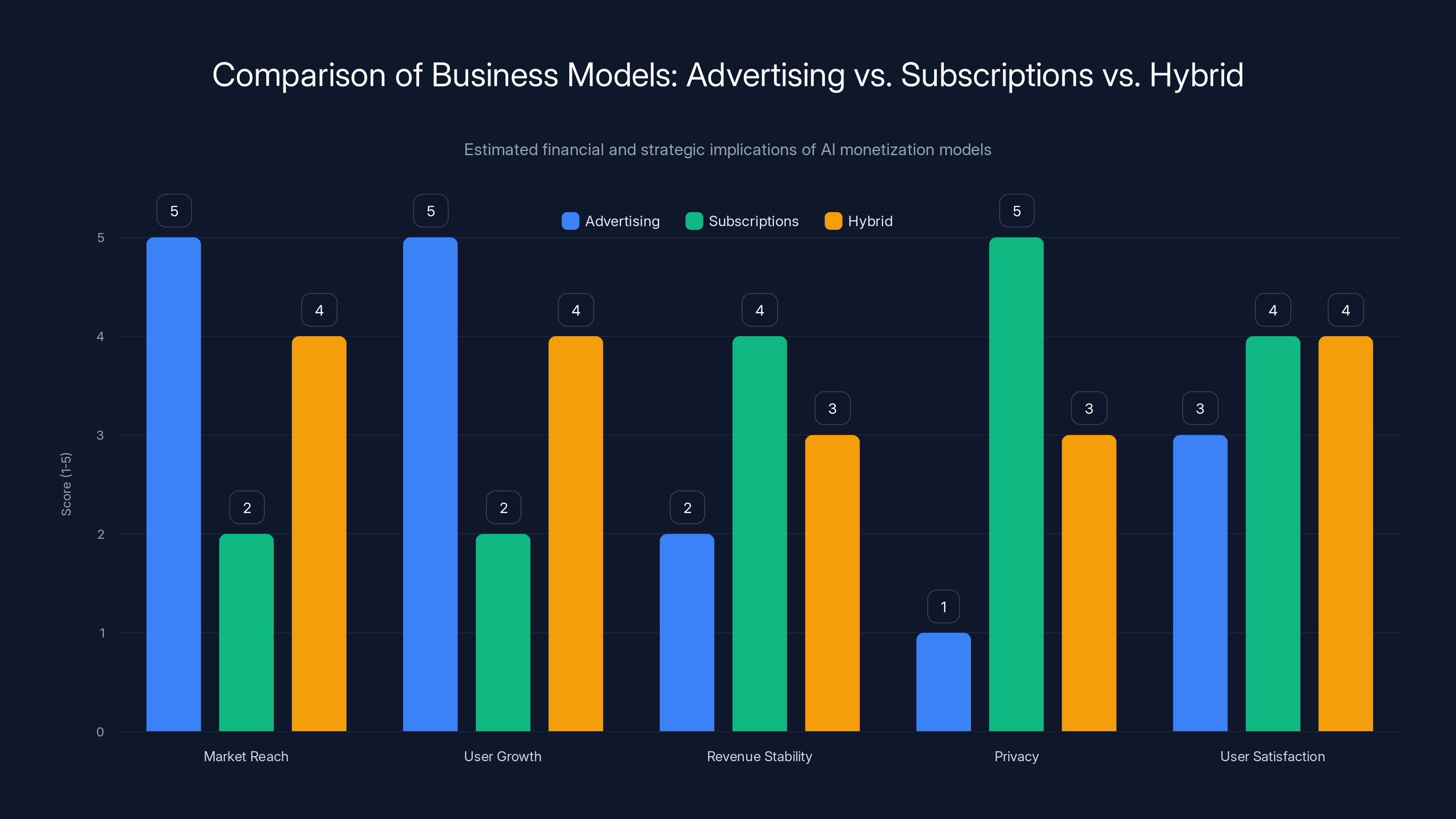

The advertising model excels in market reach and user growth but lags in privacy and revenue stability. Subscriptions offer better privacy and user satisfaction but struggle with market reach. The hybrid model balances these aspects. (Estimated data)

Chat GPT's Ad Implementation: What We Know and What It Means

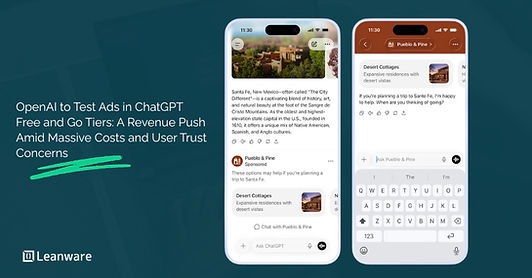

When Open AI announced advertising for Chat GPT, the company was characteristically vague on implementation details. Based on available information and industry patterns, we can construct a reasonable understanding of how this likely works and what it implies.

The advertising is appearing on Chat GPT's free tier, which makes strategic sense. Free users represent the largest user base and generate the least revenue. By introducing ads to free users, Open AI preserves the value proposition of paid Chat GPT Plus subscriptions while monetizing the largest group. This follows Netflix's and Disney+'s playbook exactly: the free or lowest tier gets ads; paid tiers remain ad-free.

The specific placement and format of ads in Chat GPT remain somewhat opaque, but based on industry standards and user reports, they likely appear in several forms: sponsored content in search results (similar to Google), promoted products or services in the sidebar or footer, or banner ads within the interface. The company is unlikely to interrupt conversations with mid-conversation ads (that would be too intrusive), but instead integrates ads into the interface, search results, or in suggestions for Chat GPT Plus.

This implementation is more subtle than streaming service ads but potentially more effective because it leverages Open AI's massive dataset about user behavior and interests. The company knows what people ask Chat GPT, what topics they engage with, what their apparent interests are—this data is extraordinarily valuable for advertisers. A company selling productivity software could target ads to people searching for automation solutions. A language learning app could target people asking about grammar. The advertising potential is immense.

For users, the practical implications are mixed. Chat GPT Plus subscribers (paying $20/month) will see no ads, preserving their uninterrupted experience. This maintains the premium value proposition. Free users will see ads, but the extent to which ads disrupt their experience depends on implementation. If ads are subtle (similar to Google Search results), impact is minimal. If ads are aggressive (pop-ups, autoplay), users will likely migrate to Plus or competing platforms.

The financial implications for Open AI are significant. With an estimated 100+ million monthly active users, even a small per-user revenue from advertising could generate substantial income. If Open AI achieves even

For advertisers, Chat GPT represents an attractive new channel. The platform has credibility and authority in users' eyes. A recommendation from Chat GPT carries weight—if the AI suggests a particular tool as "the best for your use case," users often trust that suggestion more than traditional advertising. This creates incentives for subtle ad integration: rather than obvious ads, promoted products presented as recommendations. This is ethically complex because it blurs the line between the AI's genuine advice and paid promotion.

The introduction of ads also signals Open AI's path toward profitability and sustainability. The company is signaling to investors that it has identified a multi-pronged revenue strategy: subscriptions from individuals willing to pay, enterprise API access, and advertising. This diversification reduces financial pressure and suggests the company doesn't need to raise venture capital indefinitely to sustain operations.

Google Gemini and the Broader Trend: When Will AI Advertising Become Universal?

While Google hasn't officially announced advertising within Gemini conversations, the company's history and incentives strongly suggest it will follow Open AI's path. Google is fundamentally an advertising company—over 80% of Alphabet's revenue comes from ads. The company has invested heavily in AI and positioned Gemini as a core product. For Google to avoid monetizing Gemini through advertising would contradict its entire business strategy.

Google faces a unique challenge with AI-powered search. Traditional Google Search generates advertising revenue by forcing users to click through to websites. If Gemini answers questions directly (as it's designed to do), Google loses the click-through traffic that justifies its advertising premiums. By monetizing Gemini with ads directly, Google preserves revenue even if users stop clicking through to search results.

We're likely to see advertising in Gemini emerge gradually. Initially, it might appear in limited contexts: Gemini searches within the Google ecosystem, integration with Google products like Workspace, or enterprise Gemini API. The company might offer a free tier with ads and a premium tier without ads, following the Netflix model. Or it might integrate ads subtly through sponsored suggestions or product recommendations, similar to You Tube's approach.

The broader trend suggests that advertising will become standard across all major AI platforms within the next 2-3 years. Here's why: First, the financial incentives are overwhelming. Every major AI platform faces the same economic reality: running these systems costs enormous amounts of money. Advertising is a proven, lucrative monetization method. Second, competition is intensifying. As more AI platforms launch, those without clear revenue streams face pressure to monetize. Third, user base diversity is growing. Most AI platforms now serve both individuals and enterprises. The individuals paying nothing (relying on free tiers) represent untapped revenue potential. Fourth, precedent exists. Streaming services normalized tiered monetization with ads. Users broadly accept this model as long as it's implemented respectfully.

The key variable is implementation quality. Companies that introduce ads subtly and non-intrusively will retain users and advertising appeal. Companies that are aggressive with ads will drive users toward competitors. This creates an interesting competitive dynamic: in the short term, companies with more aggressive advertising might generate higher revenue. But in the medium term, they risk losing users to platforms with less intrusive ad experiences.

Microsoft's approach is particularly interesting because the company has multiple revenue levers. Microsoft can afford to monetize Copilot and Bing Chat through advertising, subscriptions, and enterprise licensing. Additionally, Microsoft benefits when users subscribe to Microsoft 365, use Azure cloud services, or purchase other products. This allows Microsoft to be patient and strategic with AI monetization rather than desperate for immediate advertising revenue.

Apple's approach remains unclear. The company has emphasized privacy and control, positioning Apple Intelligence as on-device where possible. Apple has historically avoided advertising (focusing on premium hardware pricing) but has quietly grown an advertising business. If Apple's AI services require cloud processing, expect subtle advertising or premium tiers eventually. If Apple keeps AI on-device, advertising becomes less relevant.

Estimated data shows that ads have a moderate impact on students (3/5) and a higher impact on professionals (4/5), influencing their decision to upgrade to paid tiers.

User Experience Implications: How Ads Change the AI Conversation

The introduction of advertising fundamentally alters the user-platform relationship in ways that deserve careful analysis. In a purely subscription-based model, the platform's incentives align entirely with user satisfaction. More satisfied users renew subscriptions. In a free-tier-with-ads model, platform incentives become more complex.

Consider the implications for response quality. In a subscription model, Chat GPT has incentive to provide the most accurate, helpful response possible because users pay for quality. With ads in free tiers, the platform might benefit from users remaining engaged in longer conversations (generating more ad impressions). This creates subtle pressure to optimize for engagement rather than solution quality. A user asking about productivity tools might receive a longer, more detailed response (with embedded ads) rather than a concise answer that fully solves their problem.

This isn't necessarily malicious. Platform engineers don't consciously think "let's make answers worse to show more ads." Instead, optimization metrics shift. When advertising is a revenue lever, metrics like "session length," "return frequency," and "impression count" gain importance alongside "user satisfaction." These metrics can pull in opposite directions.

Similarly, advertising affects incentives around data collection. Advertising effectiveness improves dramatically with more user data. Platforms monetized through ads have stronger incentives to collect, analyze, and monetize user data. This creates potential privacy tension. A subscription-based AI service can argue that it doesn't need extensive user tracking because it's monetized through subscriptions. An ad-supported service struggles to justify minimal data collection when richer data directly enables higher advertising revenue.

For workplace and educational use cases, advertising introduces practical problems. Imagine a student using free Chat GPT to learn programming, or a professional using it to draft documents. Ads interrupting or cluttering the interface represent a genuine distraction. Studies on attention show that interruptions from ads reduce cognitive performance on the task at hand. A student might pay for Chat GPT Plus specifically because ads impair their learning. A professional might choose an alternative platform that offers an ad-free experience.

The competitive implications are significant. If Chat GPT's ads become intrusive, users will migrate to competitors. Google's Gemini (when it adds ads) might have advantages because Google can integrate ads more subtly through familiarity with search ads. Microsoft's Copilot might emphasize its enterprise focus (where ads are less common and potentially less acceptable). Alternative platforms like Claude (Anthropic) or emerging competitors might position themselves as "ad-free alternatives" to build market share.

There are also psychological implications worth considering. Research on advertising shows that even subtle ads affect user perception and decision-making. When users see ads for a particular tool within an AI assistant, they're more likely to trust and use that tool, even if it's not objectively the best choice. This creates conflicts of interest where the AI's recommendations might be influenced by advertising arrangements rather than user benefit.

For content creators and professionals using AI for work, advertising is particularly problematic. A marketer creating ad copy for clients doesn't want to see ads cluttering Chat GPT. A writer generating content ideally sees a clean interface. These professional users almost certainly migrate to paid tiers or alternative platforms, further segmenting the market between free-tier consumers (accepting ads) and professional users (paying for ad-free experiences).

The longer-term implication is increasing stratification in AI access. The free-with-ads tier serves students, hobbyists, and price-sensitive users. Paid tiers serve professionals and those preferring uninterrupted experiences. Enterprise tiers serve organizations. This mirrors streaming services but with a key difference: in streaming, paid tiers get better content quality (4K resolution, simultaneous screens). In AI, paid tiers primarily get no ads and potentially unlimited usage. The actual intelligence level might be identical. This creates potential fairness concerns—are free users receiving intentionally worse AI performance, or just ads?

The Business Model Comparison: Advertising vs. Subscriptions vs. Hybrid

To understand where AI platforms are heading, it helps to compare the financial and strategic implications of different monetization models. Each approach has distinct advantages and drawbacks.

Pure Subscription Model

Companies like Anthropic's Claude have historically pursued a pure subscription approach. Users pay for access; the company is entirely dependent on willingness-to-pay. This model has several advantages. First, it aligns incentives perfectly: the company succeeds only if users value the service highly enough to pay. Second, it preserves privacy because the company isn't monetizing user data for advertisers. Third, it avoids conflicts of interest where advertising arrangements might affect recommendations or output quality.

However, pure subscription faces challenges at scale. Many potential users won't pay for AI services, particularly in developing markets where willingness-to-pay is lower. This limits the addressable market. Additionally, subscription revenue is vulnerable to churn—if satisfaction drops 10%, revenue drops 10%. The company needs continuous innovation to justify retention. Finally, pure subscription requires higher per-user revenue to sustain operations, which limits market size.

Companies pursuing pure subscription typically position themselves as premium alternatives—higher quality, better service, more privacy, more control. This works for Anthropic (which emphasizes safety and reliability) and could work for other platforms that can credibly differentiate on quality. However, in a commodity market where most AI assistants deliver similar results, pure subscription alone struggles.

Pure Advertising Model

Optionally, companies could monetize entirely through advertising, offering free services. This maximizes addressable market—anyone can use the service regardless of ability or willingness to pay. It accelerates user growth and builds network effects. However, pure advertising faces challenges. First, marginal revenue per user can be low, particularly for users in regions with lower advertising rates. Second, it creates conflicts of interest as discussed previously. Third, it requires massive scale to generate significant revenue, because average revenue per user (ARPU) from ads is typically low compared to subscriptions.

Google Search works well with pure advertising because the company achieves enormous scale (billions of queries daily) and sophisticated ad targeting. For AI assistants with smaller user bases, pure advertising alone struggles to generate sufficient revenue. Additionally, the nature of AI interactions (longer, more engaged conversations) might be less compatible with intrusive advertising than passive content consumption.

Hybrid Model (Subscription + Advertising)

The emerging standard is hybrid models, where platforms offer both paid tiers (no ads) and free tiers (with ads). Netflix pioneered this; now it's becoming standard across tech platforms. The hybrid model combines advantages: broad accessibility through free tiers, monetization efficiency through ads, and premium revenue through paid tiers.

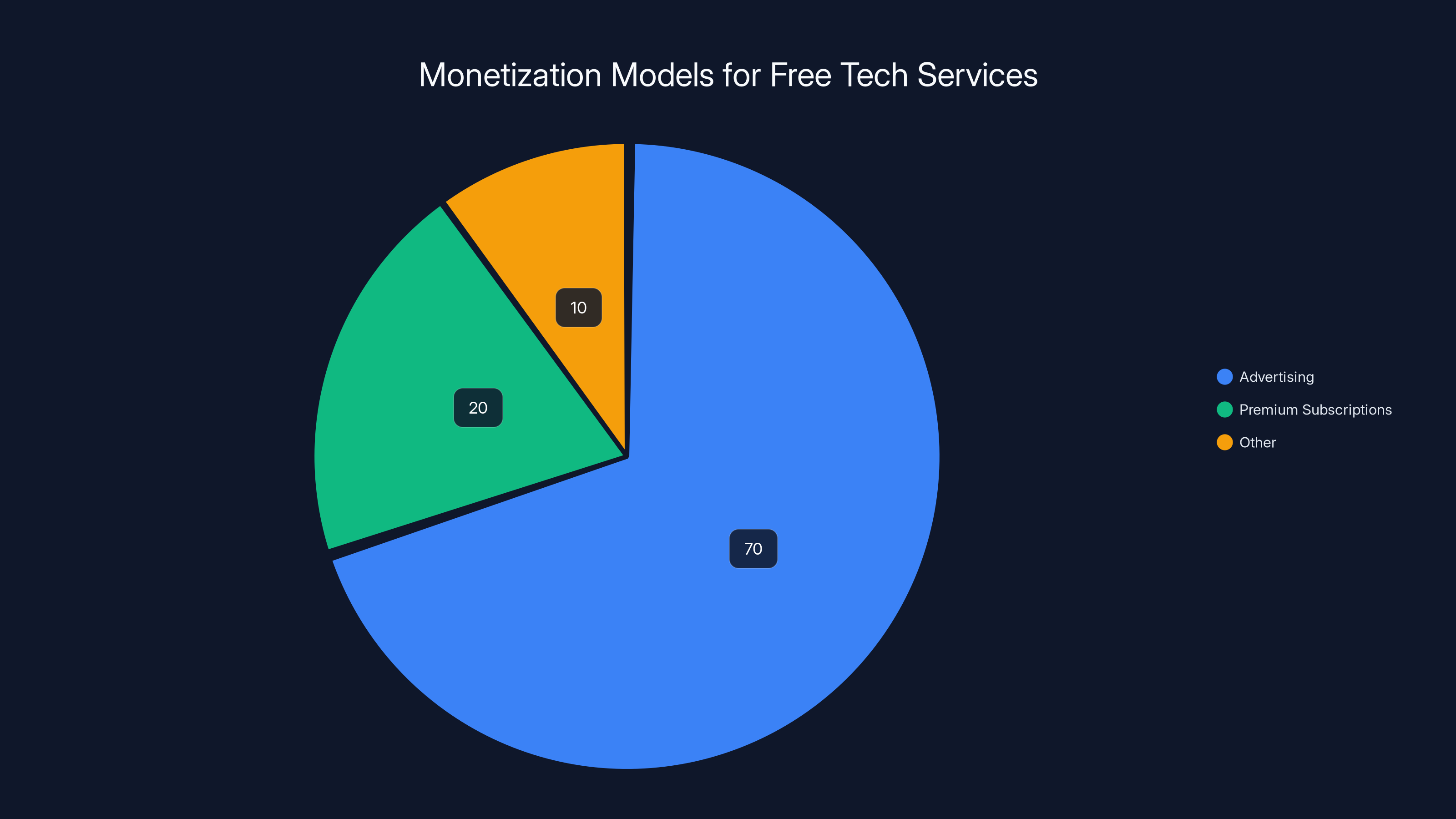

The hybrid model's effectiveness depends on the revenue split. If subscription revenue dominates (e.g., 70% subscription, 30% ads), the company retains subscription-aligned incentives. If advertising dominates (70% ads, 30% subscription), the company starts optimizing for engagement and data monetization. The revenue split thus becomes a critical strategic decision.

Open AI's approach appears to be subscription-dominated hybrid, where Chat GPT Plus subscriptions remain the primary revenue generator, with advertising as supplementary. This preserves subscription-aligned incentives while generating additional revenue. Google and Facebook (which derive 70-90% of revenue from advertising) likely pursue advertising-dominated hybrid models, where free tiers with ads generate far more revenue than paid tiers.

API and B2B Models

Many platforms also monetize through APIs and B2B access. Developers and organizations pay to use AI capabilities programmatically. Open AI generates significant revenue through API access (used by thousands of applications and services). This model is distinct from end-user monetization—it targets developers and organizations rather than individual users.

API models have advantages: B2B customers have higher lifetime value than individual users, they're less price-sensitive, and they often sign longer contracts with more predictable revenue. However, API models require developer adoption, which is competitive and dependent on technical quality and pricing competitiveness.

The most successful platforms pursue multiple monetization approaches simultaneously: individual subscriptions, advertising, API access, and potentially enterprise licensing. Open AI does this; Google does this; Microsoft does this. The diversification hedges against any single revenue stream underperforming.

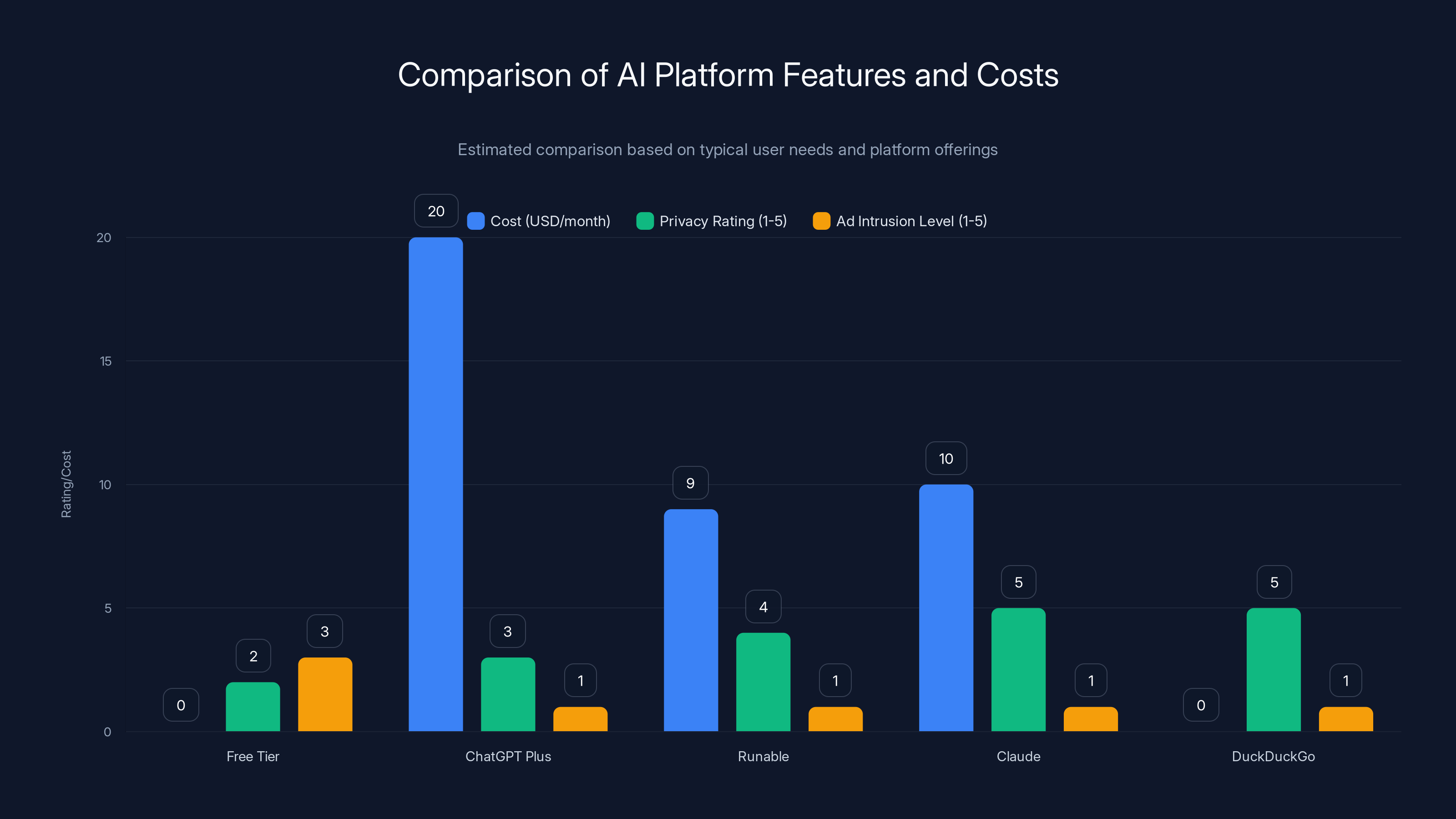

This chart compares AI platforms based on cost, privacy, and ad intrusion. Free tiers have no cost but higher ad intrusion, while platforms like Claude and DuckDuckGo offer high privacy ratings. (Estimated data)

Industry Precedent: How Other Tech Services Monetized Free Users

Before analyzing AI specifically, it's instructive to examine how other technology platforms monetized free users. The patterns are remarkably consistent.

Social Media: Facebook, Instagram, Tik Tok, and Snapchat all offer free services monetized entirely through advertising. These platforms generate enormous advertising revenue ($120+ billion annually for Meta) because they achieve massive scale (billions of daily active users) and possess rich data about user interests and demographics. Advertising is so effective because the platforms know precisely who users are and what they're interested in. You Tube operates similarly, though it offers both free (ad-supported) and paid (Premium) tiers.

The social media model is highly relevant to AI because both platforms benefit from network effects and engagement metrics. However, the key difference is that social media serves primarily entertainment and passive consumption, while AI assistants are active tools where interruption has productivity costs.

Email: Platforms like Gmail (Google), Outlook (Microsoft), and Yahoo offer free email with advertising. The ads are typically subtle (sidebar ads, sponsored messages) rather than interrupting the primary experience. This parallel is more relevant to AI than social media because email is also productivity-oriented. Users tolerate email ads because they're non-intrusive and subsidize service costs. However, if email ads were aggressive or intrusive, paid alternatives would gain market share.

Search: Google Search is primarily ad-supported, with ads appearing alongside organic results. Users accept search ads because they're relevant and solve problems (ads for a product you're searching for are useful, not intrusive). However, Google faces pressure from users who dislike ads—hence the growth of Duck Duck Go and other privacy-focused search engines. This suggests that even subtle ads create some user dissatisfaction, particularly among privacy-conscious users.

Office and Productivity: Microsoft Office Online is free with ads, while Microsoft 365 subscriptions remove ads and add features. Google Workspace is subscription-only for enterprise, free for basic consumer use. These models show that productivity tools can support advertising, though professionals tend to prefer paid, ad-free versions.

Cloud Storage: Dropbox, Google Drive, One Drive offer free tiers with ads or limited features, monetized through subscriptions or storage upgrades. The pattern is consistent: free tier attracts users; paid tiers serve those willing to pay for additional features, capacity, or ad-free experiences.

The consistent pattern across all these services: advertising works as a monetization mechanism for free tiers, particularly when implemented subtly and non-intrusively. However, every platform also observes that some users prefer to pay to avoid ads. This creates the opportunity for tiered monetization: free-with-ads for price-sensitive users; paid-without-ads for those preferring uninterrupted experiences.

For AI platforms, the crucial variable is how transparently the monetization affects service quality. When users can clearly distinguish between premium and free tiers (better features, no ads), they understand the value exchange. When tiers are similar except for ads, and ads themselves feel intrusive, users become resentful. The companies succeeding with this model (Netflix, Spotify, You Tube) implement the free tier experience as genuinely usable, just with clear limitations (ads, lower quality, fewer simultaneous streams) that justify the paid upgrade.

Implications for Different User Segments

Advertising in AI services affects different user segments very differently. Understanding these segmentation implications reveals how the market will likely evolve.

Students and Learners

Educational users benefit from unlimited, free access to powerful AI tools. For a student in a developing country who can't afford $20/month for Chat GPT Plus, free access with ads is transformative. The student can use AI for homework help, learning support, and skill development. Ads might be distracting, but the alternative (no access) is worse.

However, research on distraction suggests that even subtle ads impair learning performance. Students optimizing for grades might upgrade to paid tiers if affordable. Alternatively, they might use free AI services for exploration and upgrade to paid tiers during exams or major projects when performance matters most. Schools and universities might negotiate educational pricing or licensing arrangements, further segmenting the market.

Professionals and Content Creators

Professionals using AI for work—writers, developers, marketers, designers—have different needs and incentives. For these users, ads represent a genuine cost: distraction reduces productivity; time spent viewing ads is time not spent on billable work. A professional billed at

For professionals, the value of uninterrupted AI access often exceeds the $20/month Chat GPT Plus price, justifying subscription. Additionally, professionals might prefer platforms that offer API access, enterprise licensing, or volume discounts. Open AI's API has always been paid (no free tier), positioning it for professional use. Similarly, Claude API is paid. This segmentation makes sense: free tiers serve individual consumers; paid tiers and APIs serve professionals.

Organizations and Enterprises

Organizations using AI internally face different economics. A company with 100 employees using AI tools spends approximately $20,000-30,000 annually on Chat GPT Plus subscriptions. However, enterprises often negotiate custom pricing, volume discounts, or private implementations. Additionally, enterprise use cases often require security, compliance, and control features that free tiers don't provide.

Enterprises will likely prioritize dedicated enterprise products rather than consumer tools with ads. Companies like Open AI are developing enterprise versions of Chat GPT with enhanced security, administration controls, and custom pricing. Similarly, companies will develop or purchase private AI instances that eliminate advertising entirely.

Developing Market Users

In regions with lower average income, free tiers with ads become primary access channels. Users in India, Southeast Asia, Africa, and Latin America might never upgrade to paid tiers but represent enormous user volume. For these markets, advertising can be the only sustainable monetization because willingness-to-pay for subscriptions is lower.

However, this creates potential fairness concerns. Will free tiers in developing markets have lower quality, more aggressive ads, or limited functionality? Or will they be equivalent to developed market free tiers? Companies following Netflix's approach tend to equalize the core service quality across regions while varying pricing and ad load. This maximizes global accessibility while maintaining revenue per region based on local economics.

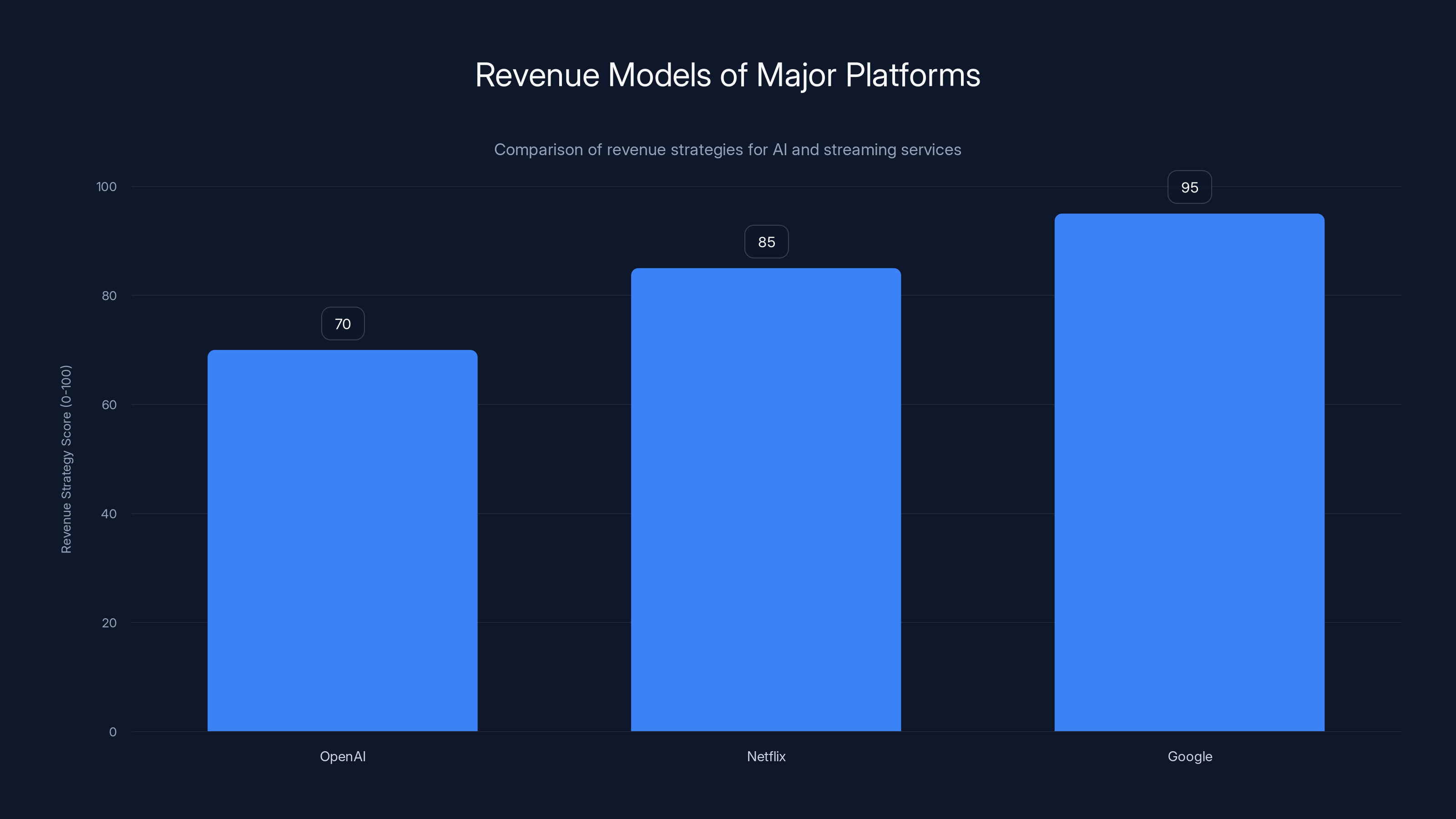

Estimated data shows Google leading with a strong advertising model, while Netflix's ad-supported tier boosts its strategy. OpenAI is exploring similar paths to offset costs.

Competitive Landscape: Which Platforms Will Dominate Post-Advertising?

The introduction of advertising creates a new competitive dynamic where companies differentiate on several dimensions: advertising intrusiveness, service quality, privacy, pricing, and specialized capabilities.

Open AI's Chat GPT enters the advertising era as the market leader, but with a challenge: dominant platforms face the most pressure to balance monetization with user experience. Aggressive advertising could trigger user migration. Conversely, minimal advertising might leave revenue on the table. Open AI's track record suggests they'll implement ads subtly, preserving the premium brand positioning while generating revenue. The company's continued investment in capabilities (GPT-5 and beyond) should sustain quality advantages that justify premium pricing.

Google Gemini enters with enormous advantages: Google's advertising technology is the most sophisticated in the world, Google's data on users is unmatched, and Google's existing user base (through Search, Gmail, etc.) provides distribution. However, Gemini's challenge is that Google's advertising insertion into AI conversations might feel more aggressive than Open AI's because Google is integrating ads across multiple services. Users accustomed to seeing search ads might object to similar ad styles in AI conversations.

Microsoft Copilot has a different competitive position. Microsoft benefits from enterprise relationships and can integrate Copilot into Microsoft 365, making it a value-add to productivity subscriptions. For enterprise users, advertising is unlikely to appear at all. For consumer Copilot (free), Microsoft can afford to monetize through advertising while also developing premium tiers. Microsoft's advantage is that it doesn't depend entirely on Copilot revenue—the company benefits through ecosystem engagement and Microsoft 365 subscriptions.

Anthropic's Claude faces interesting competitive choices. The company has positioned Claude as the "safe," "reliable," "privacy-focused" alternative to Chat GPT. Introducing advertising would contradict this positioning. Anthropic's approach seems to be remaining subscription-only and enterprise-focused, competing on quality and principles rather than network effects and market share. This is a viable strategy for a premium alternative but limits addressable market.

Emerging competitors (like platforms from Alibaba, Baidu, or Middle Eastern players) might use free-tier-with-ads to rapidly build market share in their regions. The competitive dynamics will vary by geography, with different platforms dominating in different regions based on local user preferences, regulatory environments, and language/cultural fit.

The broader competitive implication: differentiation will increasingly shift away from core AI quality (which is converging as models improve) toward user experience, privacy, monetization approach, and specialized capabilities. Companies offering better ad-free experiences will attract users willing to pay. Companies offering sophisticated, privacy-friendly ads will maximize free-tier revenue. Companies integrating AI deeply into existing ecosystems (Microsoft, Google, Amazon) will monetize through multiple channels. Specialized platforms (Anthropic, Hugging Face, etc.) will focus on specific use cases or users prioritizing specific attributes.

Privacy Considerations: How Advertising Intensifies Data Collection Pressures

The relationship between advertising and privacy deserves careful analysis, as it's a critical concern for many users and increasingly relevant to regulators.

Advertising effectiveness improves dramatically with first-party data (data directly about users) and contextual data (information about the specific interaction). A service knowing that a user asked about "productivity software" can show ads for productivity tools. A service knowing that the user is a software developer in San Francisco earning $150,000 annually can show more targeted (and thus more valuable) ads. More data enables more valuable ads; more valuable ads enable higher ad revenue.

This creates economic incentives for advertising-dependent platforms to collect, retain, and analyze user data extensively. In conversation-based AI, this means saving chat histories, analyzing conversation topics, inferring user attributes, and building detailed user profiles for advertising optimization.

Subscription-based platforms face weaker data collection incentives. A company monetizing purely through subscriptions benefits minimally from extensive user data collection. In fact, privacy-focused positioning can be a competitive advantage, attracting users concerned about data collection. Anthropic explicitly markets Claude as privacy-focused, suggesting the company is aware that this differentiation appeals to users.

Regulatory environment is increasingly relevant. The European Union's Digital Markets Act and Digital Services Act impose restrictions on data collection and usage. Regulations limiting data collection would substantially reduce advertising effectiveness and value. Companies dependent on advertising revenue face regulatory risk that subscription-based companies avoid.

For users, the privacy implications of AI advertising are significant: conversations with AI systems might be less private if the platform collects and analyzes conversations for advertising optimization. Users might not realize that questions asked to Chat GPT are being analyzed to build advertising profiles. This creates potential for manipulation—the AI might be subtly optimized to suggest advertised products, not based on merit but based on advertising arrangements.

Transparency is critical here. If platforms clearly disclose that conversations are analyzed for advertising, users can make informed choices. If data collection is hidden or unclear, users lack agency. The most sophisticated approach (used by Google and Meta) is to collect extensive data while maintaining plausible deniability about how granularly conversations are analyzed. Users assume some data collection but might not realize the full extent.

For organizations concerned about privacy, this consideration alone might justify paying for enterprise versions without advertising or data collection. Companies like Microsoft, Google, and Open AI all offer enterprise products with stricter data handling—conversations aren't used for advertising or model improvement (or the analysis is limited). However, these enterprise products cost significantly more than consumer subscriptions, creating a privacy tax.

Advertising dominates monetization strategies for free tech services, accounting for an estimated 70% of revenue, followed by premium subscriptions at 20%. (Estimated data)

Alternative Approaches: Non-Advertising Models for AI Monetization

Given the challenges that advertising poses (user experience, privacy, incentive conflicts), some platforms are exploring alternative approaches to monetization that might better align with user needs.

Pure Subscription with Freemium Limitations

Claude's approach illustrates one alternative: offer truly free access but with significant limitations. Free users might get 10-20 messages daily, slower response times, or access only to smaller models. Paid users get unlimited access, faster responses, and access to most advanced models. This model monetizes willingness-to-pay without advertising and avoids data monetization pressures.

The challenge is that it requires differentiation in features or quality to justify paid upgrades. For Claude, the company can differentiate on constitutional AI, safety, and reliability. For other platforms, if free and paid tiers offer identical quality with just usage limits, converting free users to paid becomes difficult.

Tiered Access by Capability

Some platforms might monetize through capability-based tiering rather than usage-based or ad-based models. For example: free tier uses open-source or smaller models; paid tier uses state-of-the-art models. This creates genuine feature differentiation—the paid tier is objectively more capable. Users perceiving the value difference will upgrade.

Open AI partially uses this approach: Chat GPT free tier uses GPT-3.5 or GPT-4o mini; Chat GPT Plus uses GPT-4 Turbo or advanced models. This creates clear differentiation without advertising. However, as advanced models become faster and cheaper to run, maintaining quality differentiation becomes harder. Eventually, free tiers might access the same models, just with usage limits.

Professional and Enterprise Licensing

Instead of consumer advertising, platforms might focus on professional licensing and enterprise contracts. This model works for companies like Anthropic (focusing on enterprise safety) and is feasible for any platform offering specialized capabilities or reliability guarantees.

The advantage is eliminating advertising and its complications entirely for professional segments. The disadvantage is that it limits addressable market to organizations with budgets for software licensing.

Cooperative and Non-Profit Models

Alternative organizational structures offer different monetization possibilities. What if an AI platform operated as a cooperative or non-profit? Such an organization could focus on maximizing user benefit rather than advertising revenue or subscription profit.

In theory, this would create the "best" outcome for users: free or cheap access without advertising. However, in practice, cooperatives and non-profits face funding challenges. Who pays for the enormous infrastructure costs? Some models rely on donations (Wikipedia model), grants (academic institutions), or subsidies from related businesses. For AI specifically, the computational costs are so high that the donation model seems infeasible.

Usage-Based Pricing for API and Compute

For developer-facing AI services, usage-based pricing (pay for what you use) is standard. Open AI's API, for instance, charges based on tokens consumed. This model aligns incentives well: users pay proportional to value received, and companies' revenue scales with user value creation.

However, usage-based pricing is unpredictable for consumers (they don't know monthly costs in advance) and doesn't work well for end-user-facing products where simplicity matters. Chat GPT with usage-based pricing would confuse many users. However, it works well for APIs and professional services.

The Future: Predictions for AI Monetization 2025-2030

Based on current trends and industry dynamics, several predictions seem likely for how AI monetization will evolve:

Prediction 1: Advertising will become standard across all major consumer-facing AI platforms by 2026-2027. The financial incentives are too strong for major platforms to resist. Open AI has already started; Google will follow; Microsoft will integrate advertising into free Copilot tiers. This will be controversial initially but will normalize as users adapt (similar to streaming services).

Prediction 2: Privacy will become a differentiator and competitive advantage. As users become aware that ads require extensive data collection, some will seek alternatives that prioritize privacy. Platforms like Anthropic (Claude), Duck Duck Go (developing AI), and others will differentiate on privacy, attracting users concerned about data monetization. This creates a bifurcated market: high-data-collection platforms maximizing ad revenue, and privacy-focused platforms serving privacy-conscious users.

Prediction 3: Enterprise and professional AI will remain advertisement-free. Organizations will demand ad-free environments as requirements for adopting AI tools. Platforms will maintain advertising-free enterprise products even as consumer products become ad-supported. The pricing gap between consumer and enterprise will widen accordingly.

Prediction 4: Regulation will constrain advertising practices. Regulators (particularly in Europe and potentially in the US) will impose restrictions on advertising practices in AI systems. These might include limiting data collection for advertising, requiring transparency about advertising arrangements affecting recommendations, or restricting certain forms of ads in AI systems. Companies complying with restrictions will market privacy and regulatory compliance as competitive advantages.

Prediction 5: AI will develop specialized alternatives for specific use cases. Rather than competing with Chat GPT directly on general-purpose AI, emerging platforms will develop specialized versions: medical AI (for doctors), legal AI (for lawyers), scientific AI (for researchers), creative AI (for artists), etc. These specialized platforms can monetize through professional licensing, subscriptions, or API access without relying on advertising, because their users have specific professional needs and higher willingness-to-pay.

Prediction 6: Open-source AI will proliferate. As AI models become more commoditized, open-source alternatives (like Llama, Mistral, and others) will improve rapidly. Users and organizations can self-host these models, avoiding advertising and data collection entirely. This creates a counterbalance to centralized, ad-supported platforms.

Prediction 7: Bundling with existing services will drive adoption. Microsoft (bundling Copilot with Microsoft 365), Google (bundling Gemini with existing services), and Amazon (bundling with AWS and Prime) will gain significant AI market share not through superior AI, but through bundling AI with existing subscriptions. This bundling strategy reduces the need for advertising monetization—the AI becomes a value-add to existing profitable businesses.

Practical Guidance: Choosing Between Platforms in an Advertising World

For users and organizations navigating this landscape, several decision factors matter:

For Individual Users

If you value free access and tolerate ads: Free tiers with subtle, non-intrusive advertising offer tremendous value. Tools like Chat GPT free (with ads) give you world-class AI capabilities at no cost. Ads typically don't significantly impact the user experience if implemented thoughtfully.

If you use AI professionally or frequently: Paid subscriptions like Chat GPT Plus, or alternative platforms like Runable (which offers AI agents for document generation and workflow automation at

If you prioritize privacy: Evaluate platforms' privacy policies carefully. Some platforms (Claude, Duck Duck Go) explicitly limit data collection for advertising. If privacy matters, you might pay for these alternatives even if free options exist.

For Organizations

Develop a tiered AI strategy: Use free tiers for experimentation and employee learning; use paid tiers or enterprise products for business-critical applications requiring reliability, security, and ad-free environments.

Evaluate total cost of ownership: Consider not just subscription costs but also infrastructure, integration, training, and opportunity costs of limited capabilities. Sometimes cheaper alternatives cost more in implementation.

Negotiate enterprise agreements: Organizations considering significant AI adoption should negotiate enterprise licenses with providers. Volume discounts, custom terms, and enhanced support are often available.

Plan for multi-platform use: Rather than being entirely dependent on a single platform, use multiple AI tools for different purposes. This reduces vendor risk and allows specialization (Chat GPT for general-purpose, Claude for safety-critical tasks, specialized tools for specific domains).

For teams looking for comprehensive AI-powered automation capabilities without extensive advertising overhead, platforms like Runable offer interesting alternatives. Runable's approach (at $9/month) provides AI agents for content generation, document automation, and workflow optimization—targeting professionals and teams rather than competing on consumer scale. This allows Runable to avoid aggressive advertising while maintaining profitability through focused feature sets and professional pricing.

Conclusion: Navigating the Streaming-ified AI Landscape

The streaming-ification of AI represents a fundamental shift in how these platforms monetize. Open AI's introduction of advertising, Google's inevitable follow, and the broader industry trend toward tiered monetization with ads signal that free AI access will increasingly come with advertising. This mirrors successful models from Netflix, Prime Video, and other streaming services that normalized tiered monetization with ads.

This shift has important implications for users, developers, and organizations. Free access becomes more democratized, but with trade-offs in experience (ads), privacy (data collection), and potentially recommendations (advertising bias). Paid subscriptions and enterprise products become clearer value propositions, offering uninterrupted experiences and alignment of incentives around user benefit rather than advertising revenue.

The competitive landscape will segment accordingly: mainstream platforms (Chat GPT, Gemini) will pursue advertising and subscriptions at consumer scale; specialized platforms will differentiate on privacy, capabilities, or specific use cases; enterprise platforms will focus on security and control; and alternative platforms will offer different monetization philosophies entirely.

For individual users, the decision is straightforward: free tiers with ads offer tremendous value if you tolerate ads; paid tiers offer uninterrupted experiences if you use AI frequently or professionally. For organizations, the calculus involves evaluating reliability, security, integration, and total cost of ownership alongside raw pricing. Multi-platform strategies often make sense, using best-of-breed tools for different purposes rather than betting entirely on a single platform.

The most important insight is that monetization model affects incentives, and incentives affect outcomes. A subscription-based platform optimizes for user satisfaction and long-term value creation. An advertising-based platform optimizes for engagement and ad revenue. Neither is inherently evil—both can provide tremendous value—but the differences matter for users who want to understand why their AI assistants behave the way they do and what incentives are driving those behaviors.

As this landscape evolves, staying informed about monetization changes, privacy practices, and competitive alternatives becomes increasingly important. The AI platform you choose today might change its terms, introduce advertising, or alter its approach in ways affecting your experience. Maintaining flexibility to switch platforms, understanding the total cost of ownership (including privacy and attention costs), and evaluating tools based on alignment with your specific needs and values will be essential strategies for navigating the advertising-era AI landscape.

FAQ

What does it mean when AI platforms introduce advertising?

When AI platforms like Chat GPT introduce advertising, they're adding sponsored content, product recommendations, or banner ads to free-tier user interfaces. This follows the streaming service model where free access includes ads while paid subscriptions remain ad-free. The advertising generates revenue that helps offset the massive computational costs of running AI models, while keeping free access available for users who can't afford paid subscriptions.

How do AI advertising models differ from streaming service ads?

Streaming services show ads between episodes or during breaks in content—interrupting passive entertainment. AI assistants are active productivity tools where interruptions create practical costs. A developer interrupted mid-coding task by an ad loses context and focus, reducing productivity. Implementation matters tremendously: subtle, integrated ads (similar to Google Search) integrate better than interrupting ads. Additionally, AI systems that analyze conversations for ad targeting raise privacy concerns not as salient with streaming services.

Why are companies like Open AI and Google moving toward advertising if they have subscription revenue?

Subscription revenue alone is insufficient to cover the enormous computational infrastructure costs of running large language models at scale. Open AI has operated at substantial losses, spending billions on infrastructure and research. Adding advertising to free tiers generates supplementary revenue without requiring paid users to increase spending. This multi-pronged monetization (subscriptions plus ads plus API access) creates financial sustainability. Google faces additional incentive: AI threatens Google Search's click-through traffic, so monetizing AI directly preserves revenue even if users stop clicking to websites.

How will advertising affect the quality and honesty of AI recommendations?

Advertising creates subtle incentive conflicts where platforms benefit from suggesting advertised products, not necessarily the best products for users. A user asking Chat GPT "what's the best productivity tool" might receive recommendations influenced by advertising arrangements. This doesn't mean the AI will recommend inferior products—most advertised products are legitimately good—but the incentive structure changes. Subscription-based platforms have stronger incentives to recommend the genuinely best products because user satisfaction directly affects retention. This is a key reason some users prefer non-advertising platforms for critical decisions.

Are there high-quality AI alternatives that don't use advertising?

Yes, several platforms avoid advertising: Claude (Anthropic) uses pure subscription; Runable offers AI automation tools at $9/month with a subscription model; open-source alternatives like Llama and Mistral can be self-hosted; Duck Duck Go is developing ad-free AI search. These alternatives typically require paid subscriptions but avoid the data-collection pressures and incentive conflicts of advertising-based models. The trade-off is that advertising-free platforms often have smaller user bases, less developed communities, or more limited free tiers.

How can I minimize exposure to ads while using free AI services?

Choose platforms known for subtle, non-intrusive advertising implementation (Google Gemini, Open AI Chat GPT likely implement ads similarly to search ads—sidebar placements, minimal interruption). Alternatively, use paid tiers if you use AI frequently (Chat GPT Plus at

Will AI advertising become as aggressive as web banner ads and pop-ups?

Unlikely for major platforms. Aggressive advertising would drive users to competitors or paid tiers, hurting the platform's long-term growth. Netflix's success came from implementing ads subtly without aggressively interrupting content. Open AI and Google understand this—they'll likely implement ads similarly to search results and streaming services: non-interrupting, integrated into the interface, and targeted but not aggressive. However, as competition intensifies and pressure to maximize ad revenue increases, some platforms might test more aggressive approaches. Users uncomfortable with increasingly aggressive ads will migrate to alternatives, creating a filtering mechanism where aggressive platforms lose users to less aggressive competitors.

What's the long-term sustainability of advertising-based AI services?

Advertising can sustain AI services at scale if implemented efficiently and the platform achieves sufficient user volume. Google proves that advertising-supported search is sustainable and profitable. However, for AI specifically, several challenges exist: conversational AI generates fewer ad impressions than search (one conversation vs. multiple search queries), user data privacy regulations could constrain data collection necessary for effective targeting, and user backlash against aggressive ads could drive users to alternatives. The most sustainable approach seems to be multi-pronged monetization: subscriptions (for users willing to pay), advertising (for free-tier users), and API access (for developers). This diversification reduces dependence on any single revenue stream.

How should organizations evaluate AI platforms given the move toward advertising?

Organizations should prioritize enterprise products without advertising, use tiered strategies (free tiers for exploration, paid tiers for critical work), and negotiate volume licenses when possible. Key evaluation criteria: does the free tier meet your needs or is paid required? Does the paid tier offer adequate security and reliability for business-critical use? What's the privacy policy—is data collected for advertising? Does the platform offer API access for custom integration? Are there compliance requirements (SOC 2, HIPAA, GDPR) that constrain platform selection? By evaluating total cost of ownership including hidden costs (distraction from ads, data privacy risks, vendor lock-in), organizations can make informed decisions aligned with their specific needs and risk profiles.

Key Takeaways

- OpenAI's introduction of ads to ChatGPT signals industry-wide shift toward streaming-style tiered monetization (free with ads, paid without)

- Massive computational infrastructure costs make advertising essential for sustainability; subscriptions alone insufficient at consumer scale

- Advertising creates subtle incentive misalignment: platforms optimize for engagement and ad revenue rather than pure user benefit

- Privacy concerns intensify with advertising: platforms need extensive user data to target ads effectively, raising data collection pressures

- Enterprise and professional users will likely remain in ad-free tiers due to productivity impact; market segments into free (consumers tolerating ads) and paid (professionals requiring uninterrupted access)

- Regulation (EU Digital Markets Act) will constrain advertising practices; privacy-focused platforms will differentiate on compliance

- Alternative monetization (subscriptions, specialized licensing, open-source models) provides optionality for users and organizations prioritizing different values

- For team productivity, Runable offers AI automation at $9/month as ad-free alternative to consumer-tier tools with advertising

![ChatGPT Ads & AI Monetization: The Streaming Model Explained [2025]](https://tryrunable.com/blog/chatgpt-ads-ai-monetization-the-streaming-model-explained-20/image-1-1768842618206.jpg)