The Chat GPT Advertising Gold Rush: Why Open AI Is Playing a Different Game

Open AI just quietly announced something that could reshape the entire digital advertising landscape, and most companies haven't even noticed yet. The company is rolling out ads on Chat GPT starting this month, but here's the twist that actually matters: they're charging roughly

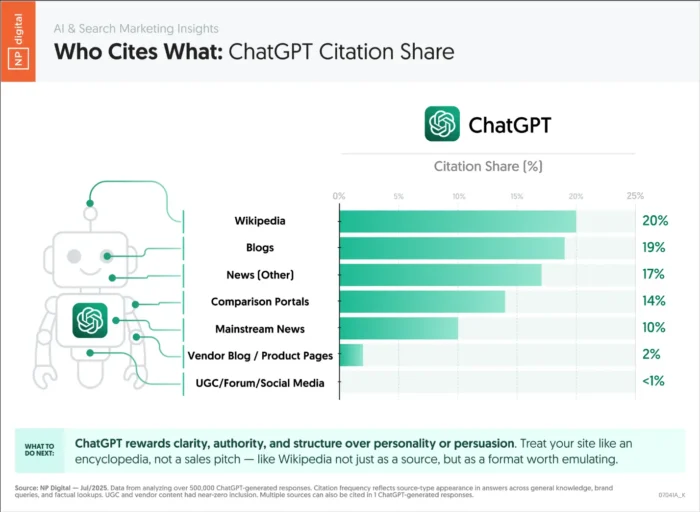

But the real story isn't just the premium pricing. It's the fact that Open AI is fundamentally rewriting the rules of digital advertising by doing something no major ad platform has done before: offering massive scale while explicitly refusing to hand over the detailed behavioral data that built Google and Meta's advertising empires.

This creates a fascinating tension. Marketers are being asked to pay more for access to Chat GPT's roughly 200 million weekly active users, but they'll receive minimal targeting information in return. No granular analytics. No pixel-level tracking. No ability to see whether someone who saw their ad actually bought something. Just high-level metrics: impressions, clicks, and aggregate engagement data.

So what's really happening here? Is Open AI insane for pricing at this level? Or are they betting something smarter—that there's a massive untapped market of advertisers who will pay premium rates just to reach engaged users in a context where AI is helping people make actual decisions?

Let's dig into the details, because this move could either reshape digital advertising or become a cautionary tale about overestimating your leverage.

TL; DR

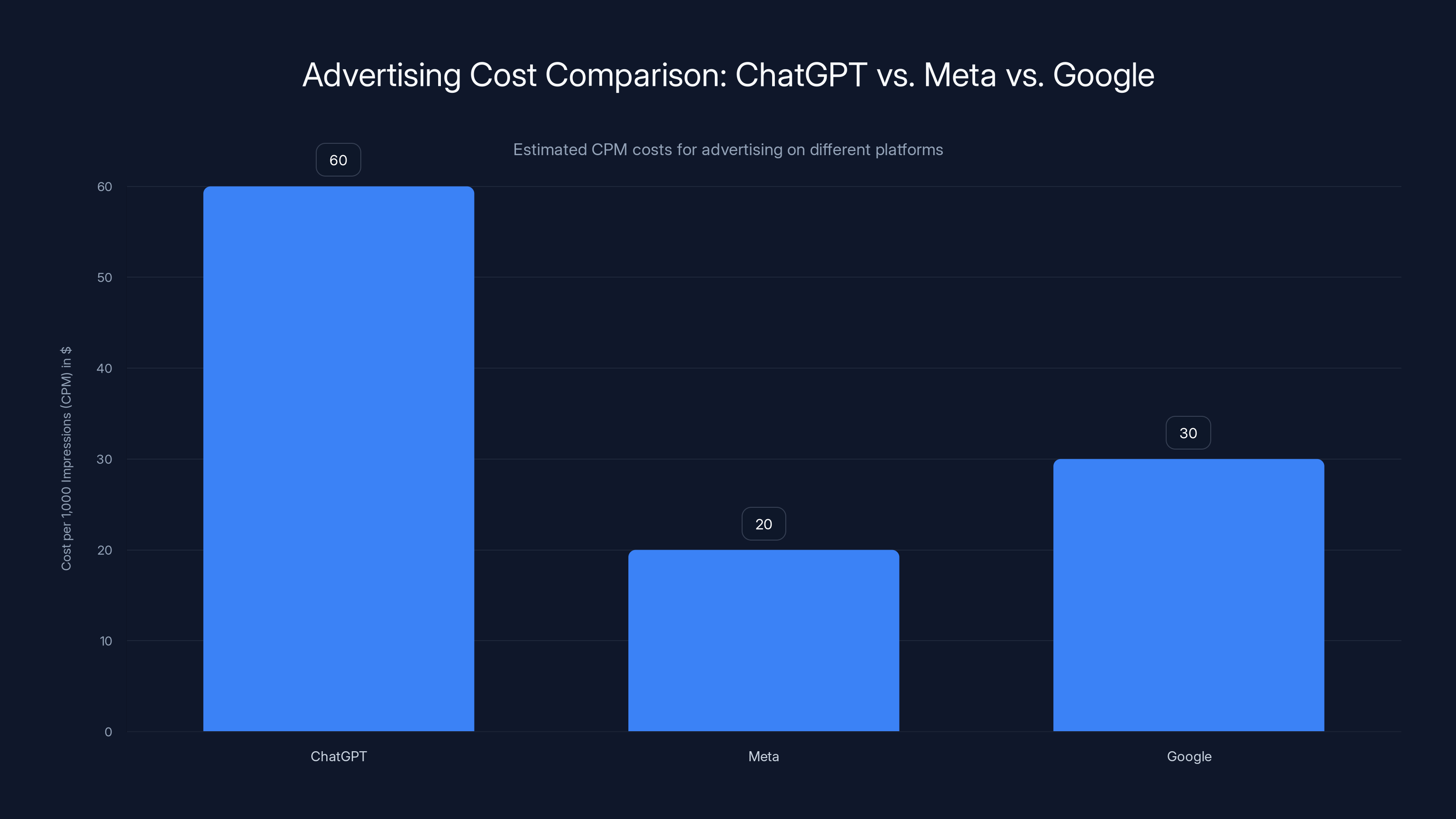

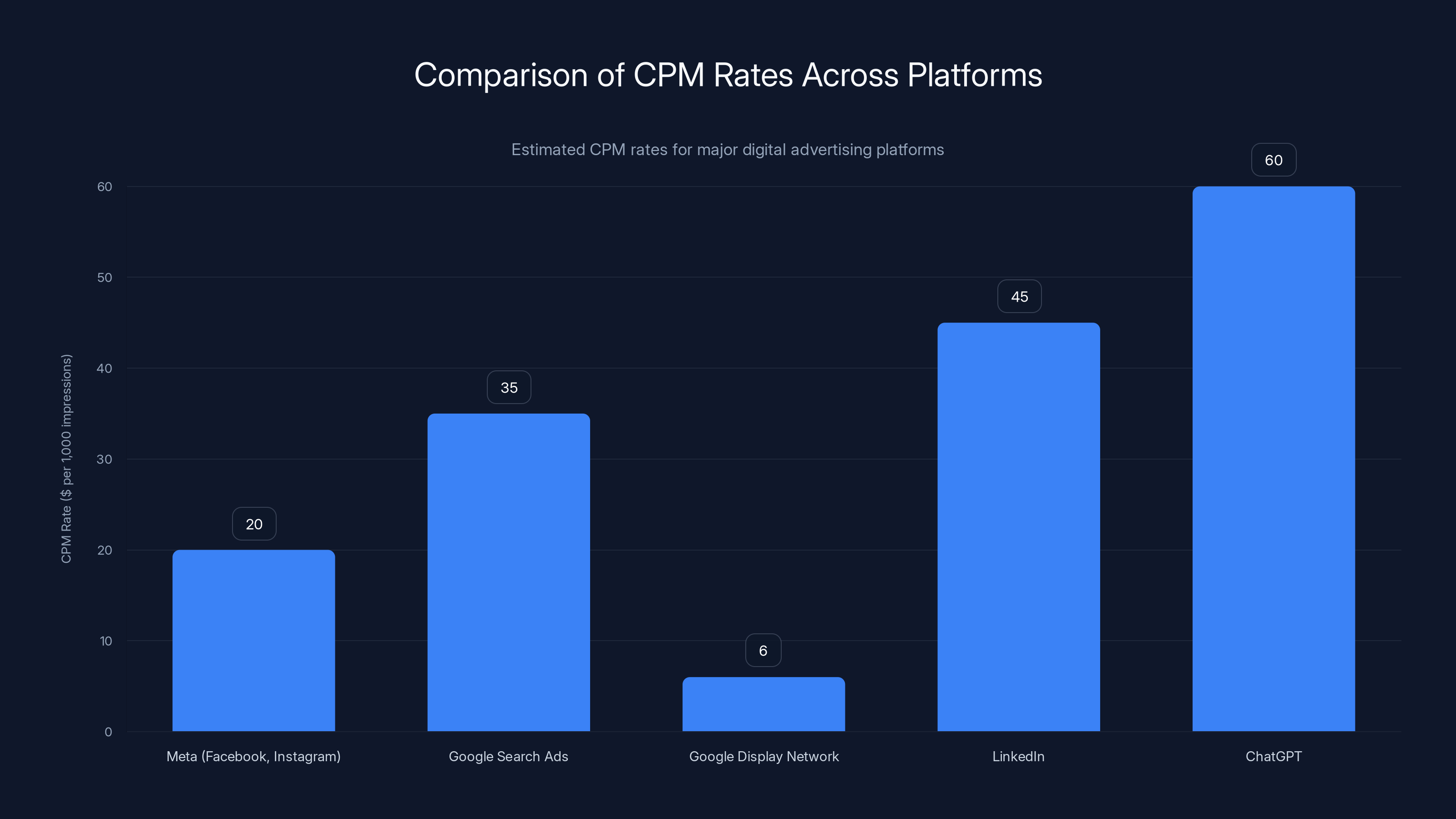

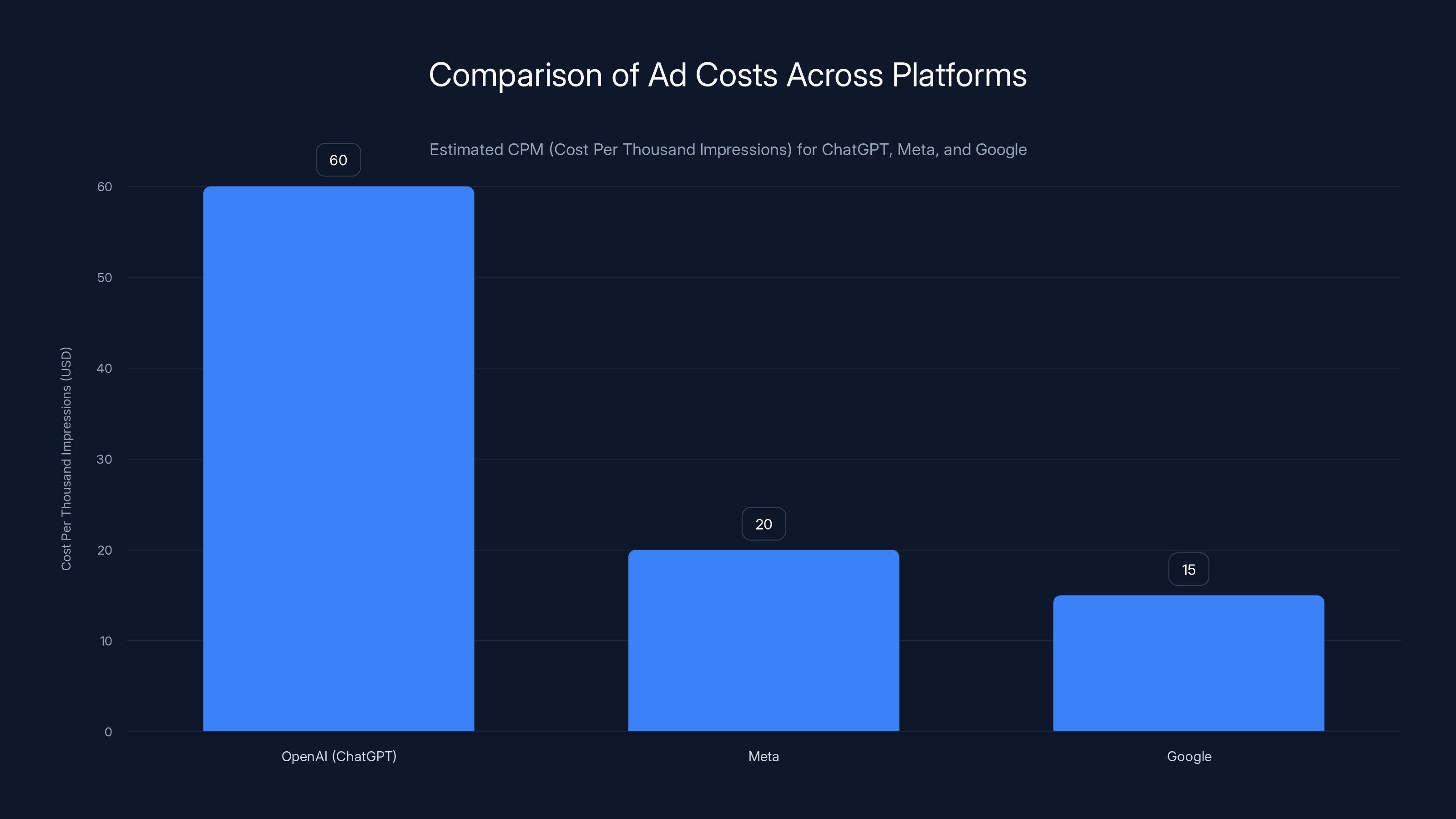

- Open AI pricing strategy: Chat GPT ads cost $60 per 1,000 impressions, roughly 3x Meta's rates and 2-4x typical Google CPMs

- Limited data transparency: Advertisers get only "high-level" performance metrics (impressions, clicks) with no conversion tracking, pixel data, or user behavior insights

- Privacy positioning: Open AI explicitly committed to never selling user conversation data to advertisers, differentiating from Google and Meta's data-driven model

- Launch scope: Ads initially appear on free and lower-tier Go plans, excluding users under 18 and sensitive topic conversations

- Market implications: This represents a fundamental shift from behavior-based targeting to context-based targeting in a high-intent environment

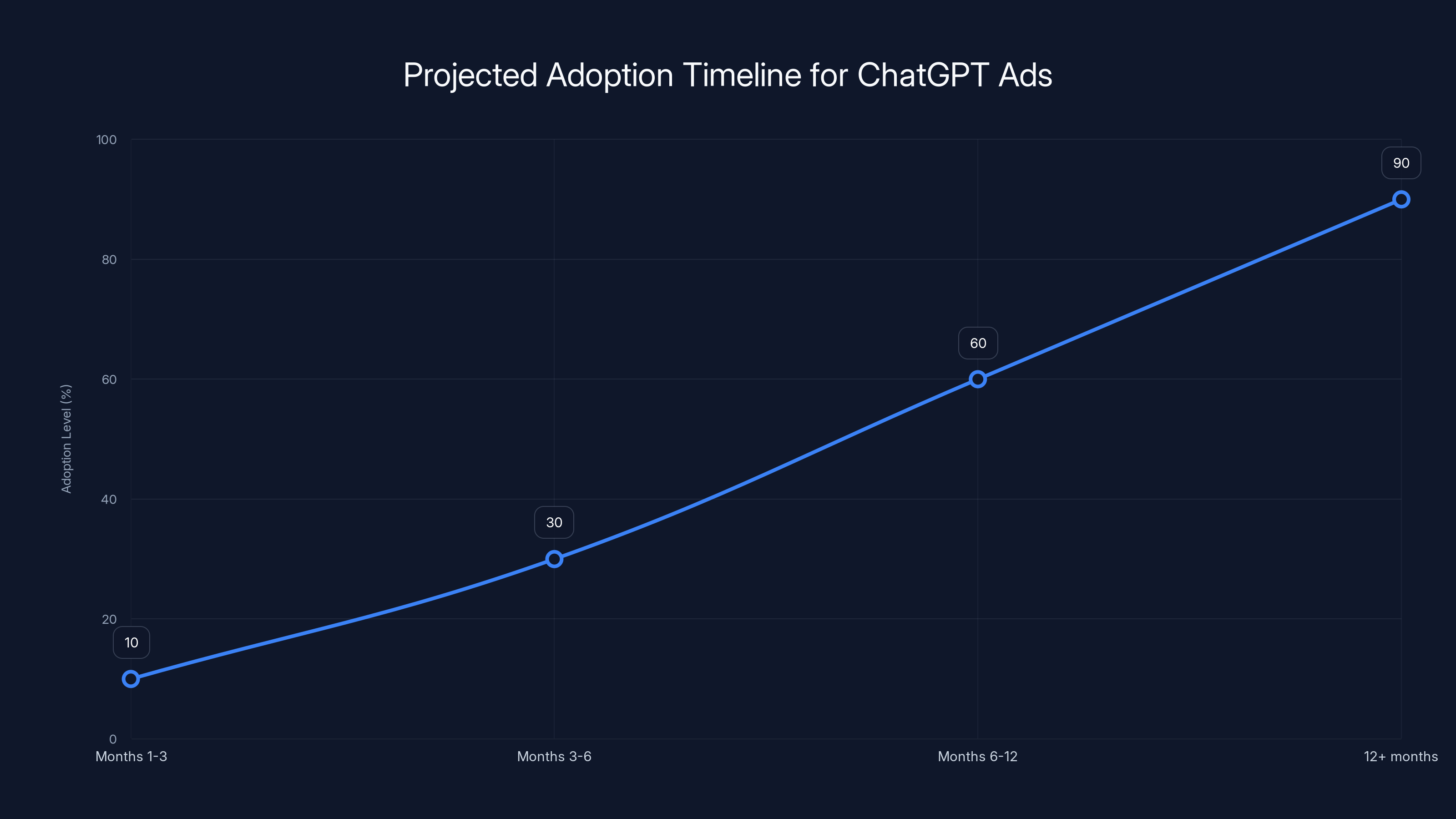

Estimated data suggests ChatGPT ads will see gradual adoption, reaching maturity within 12+ months. Initial phases focus on optimization and scaling.

Understanding the Chat GPT Ad Pricing Model

When Open AI announced Chat GPT ads earlier this year, the company was deliberately vague about pricing. Then, reports emerged suggesting they'd settled on approximately $60 per 1,000 impressions, and suddenly the strategy became clear: they're pricing Chat GPT as a premium advertising medium.

To understand why this matters, you need to know how digital advertising pricing actually works. The cost per thousand impressions (CPM) is the industry's baseline metric. It answers a simple question: how much does it cost to get your ad in front of a thousand people?

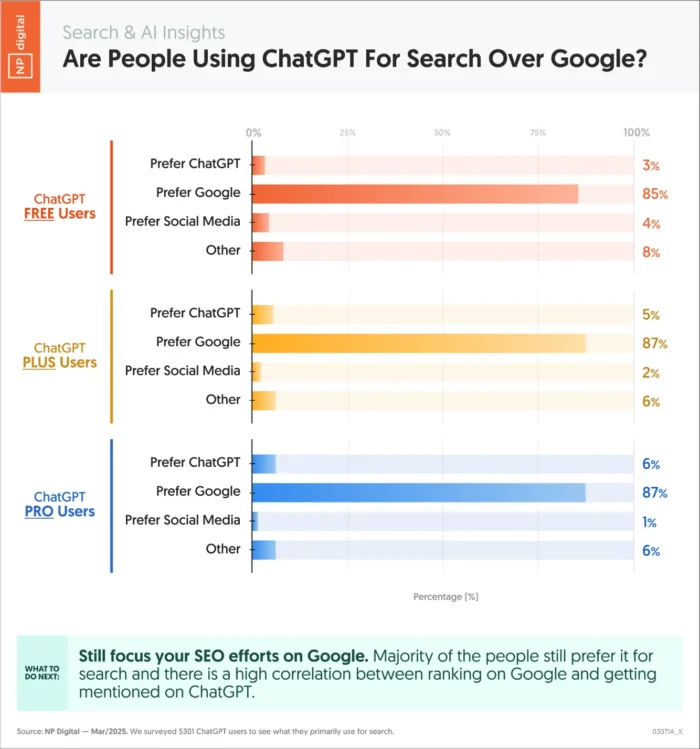

Here's where Chat GPT sits in the competitive landscape:

- Meta (Facebook, Instagram): $15-25 CPM on average, sometimes lower for non-targeted campaigns

- Google Search Ads: $20-50 CPM depending on industry (finance and legal typically cost more)

- Google Display Network: $2-10 CPM (much cheaper, but less targeted)

- Linked In: $40-50 CPM (premium B2B positioning)

- Chat GPT: $60 CPM (the new benchmark for AI-mediated advertising)

So Open AI is pricing Chat GPT somewhere between premium B2B platforms like Linked In and... nobody else, really. They're pricing it as a higher-tier offering than anything currently available at scale.

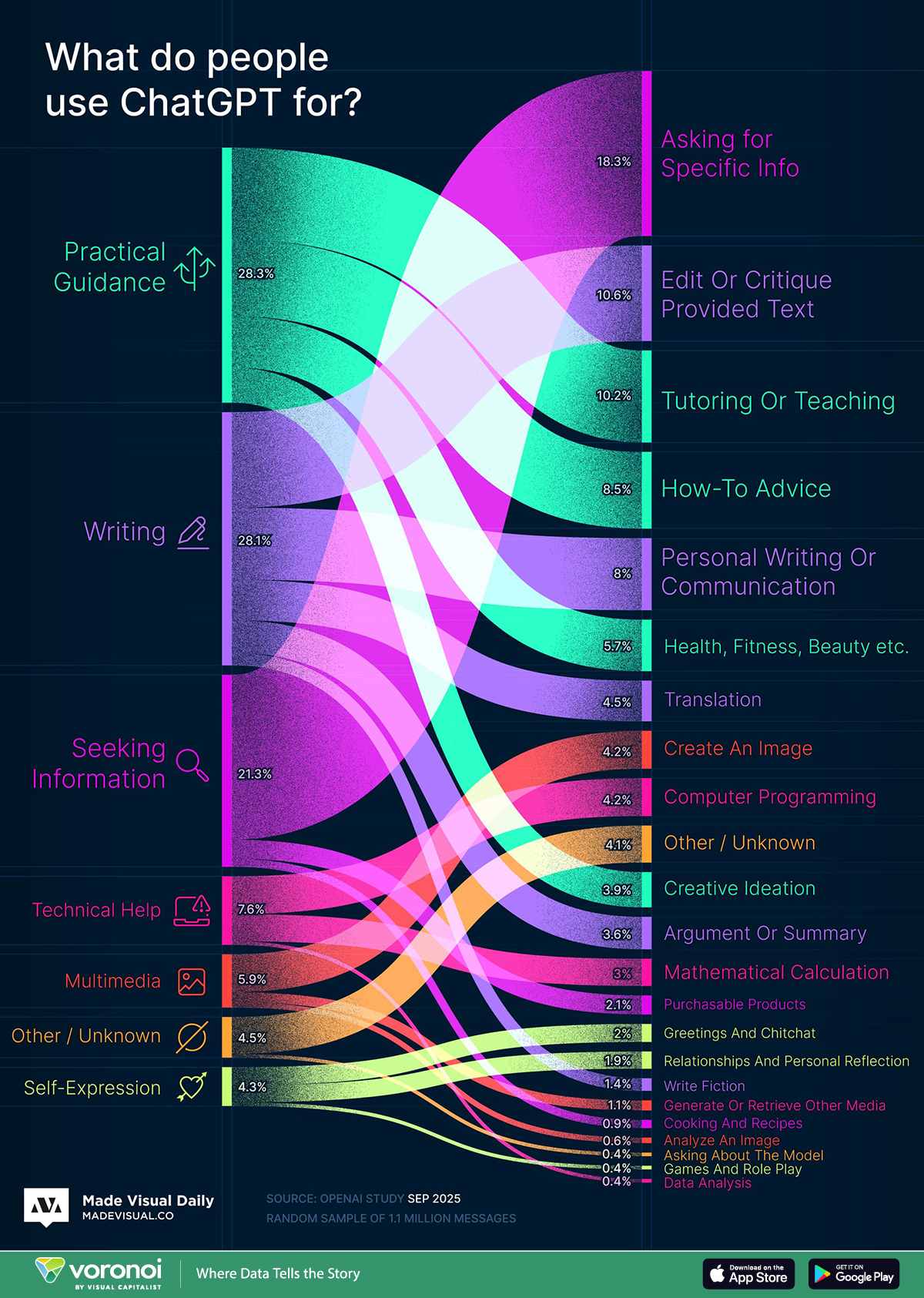

The fascinating part? This pricing might actually be defensible. Here's why: Chat GPT users aren't passively scrolling through a feed. They're actively engaged in problem-solving, research, decision-making, and information gathering. When someone opens Chat GPT to research a product, they're already in what advertisers call "high-intent mode." They're not there to waste time—they're there to find answers.

That fundamental difference in user behavior could justify a premium. A user researching "best project management software for startups" in Chat GPT is arguably more valuable to a project management software company than the same user scrolling through Instagram looking at cat videos.

The Data Problem: Premium Pricing Without Premium Insights

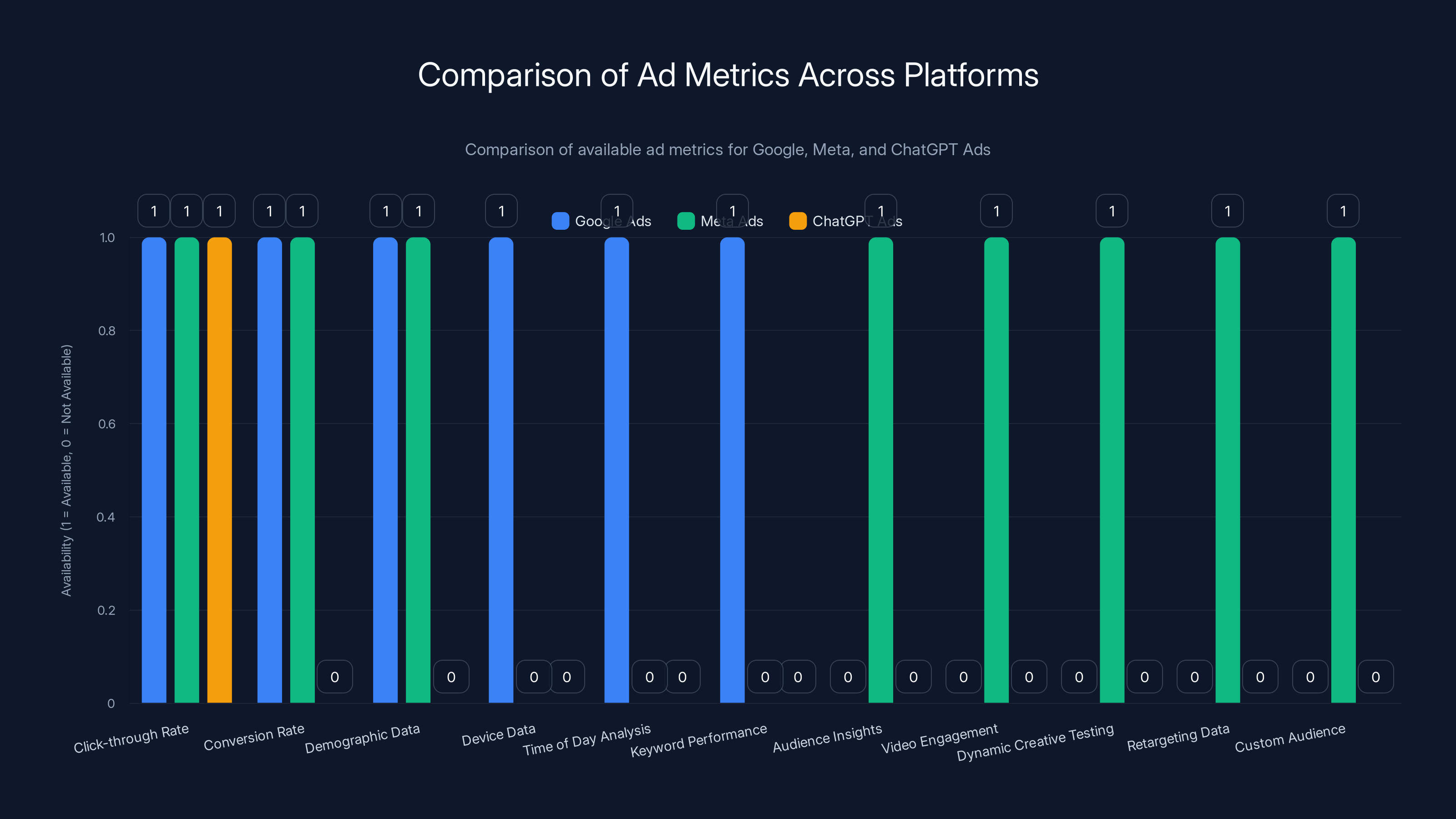

Here's where the strategy gets complicated, though. Open AI is asking for premium pricing while offering a service that's fundamentally different from what Google and Meta have trained advertisers to expect.

When you run ads on Google or Meta, you get mountains of data. Here's what's typically available:

Google Ads Standard Metrics:

- Click-through rate (exactly how many people clicked)

- Conversion rate (how many clicks led to a purchase or signup)

- Cost per conversion (ROI calculation)

- Demographic breakdowns (age, location, interests)

- Device data (mobile, desktop, tablet)

- Time of day analysis (when conversions happen)

- Keyword performance (which search terms drove traffic)

Meta Ads Standard Metrics:

- Detailed conversion tracking (purchases, signups, downloads)

- Audience insights (age, gender, location, interests, behaviors)

- Video engagement metrics (views, completion rates, replays)

- Dynamic creative testing (which variations perform best)

- Pixel-based retargeting data

- Custom audience uploads with match rates

Chat GPT Ads (Initial Launch):

- Total impressions (how many times the ad appeared)

- Total clicks (how many people clicked)

- Click-through rate (derived from impressions and clicks)

- That's roughly it

Open AI's reasoning is publicly stated and compelling: they've committed to user privacy. They explicitly promised that they will "never sell your data to advertisers" and will keep conversations private. This is their differentiator—their moral stance—but it directly conflicts with what makes Google and Meta so incredibly profitable.

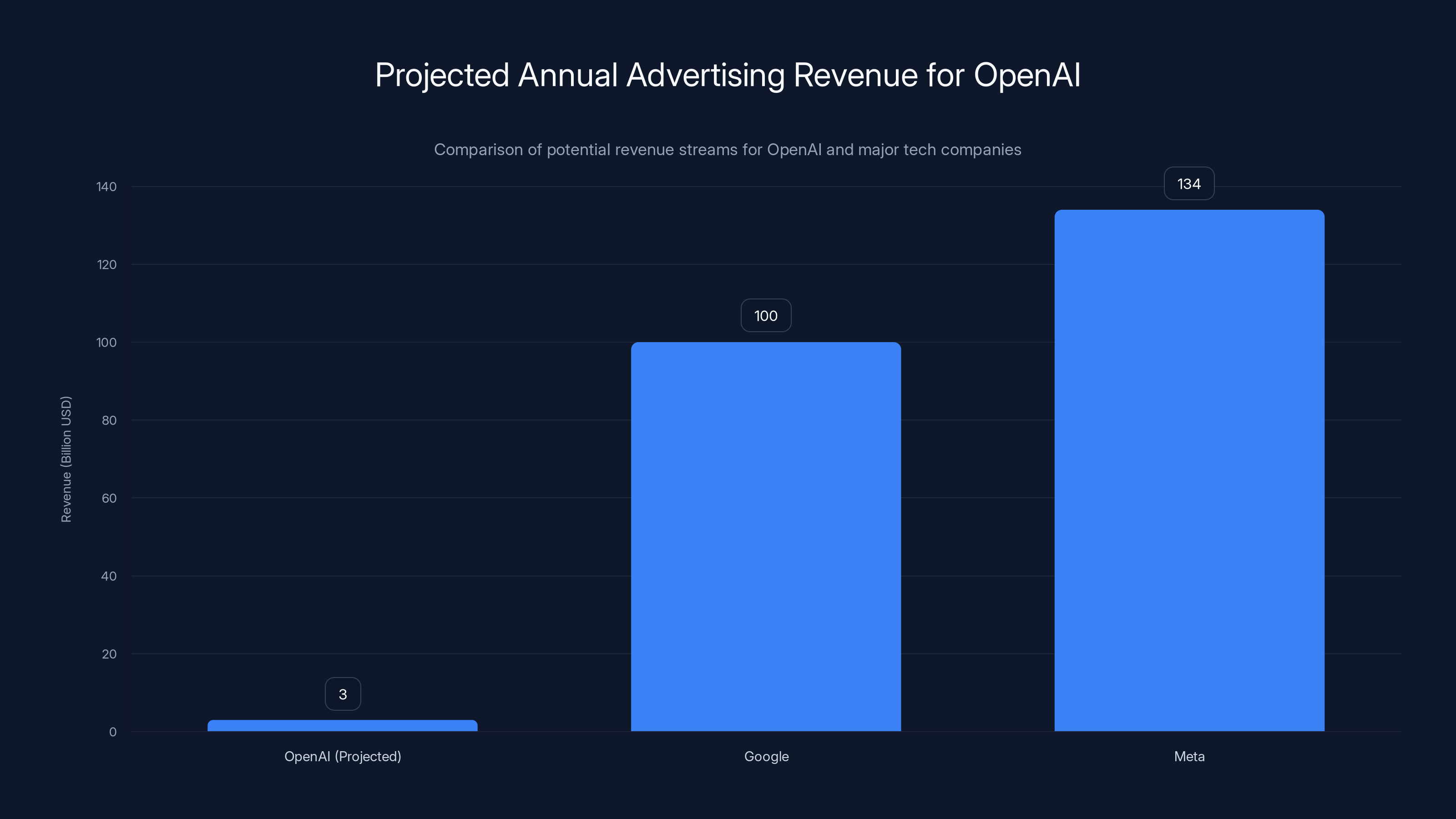

Meta alone generated $134 billion in advertising revenue last year, almost entirely because they know everything about everyone. They can tell an advertiser: "Here's exactly who saw your ad, whether they clicked, whether they bought, and what those people will probably want to buy next month." That's enormously valuable. Google does the same with search data.

Open AI is saying no to that model. Instead, they're saying: "We'll give you access to our users, but you don't get to spy on them." It's a cleaner, more ethical approach. But it fundamentally changes the value proposition for advertisers.

Open AI has suggested they might offer more detailed analytics down the line, which would be interesting. But if they do, they'll need to maintain their privacy promise—essentially offering Google-level analytics without Google-level data access. That's technically possible but challenging.

ChatGPT's CPM is approximately

Why Advertisers Might Actually Pay This Price

At this point, you might be thinking: "Why would any company pay three times the price for less data?" That's a fair question. But there are actually several compelling reasons this could work.

First, the quality of the audience matters more than the size. A thousand impressions in front of highly engaged, intent-driven users might be worth more than 3,000 impressions in front of scrolling users. Chat GPT users are actively seeking information and solutions. They're in a decision-making mindset. Compare that to someone scrolling Instagram while half-watching Netflix—the second person is probably not actually interested in buying anything.

Research on advertising effectiveness suggests that context matters enormously. An ad for productivity software appearing when someone is literally using a tool to research productivity software is inherently more likely to convert than the same ad appearing in their feed.

Second, the privacy angle is actually becoming a selling point. Apple's iOS privacy changes fundamentally broke Meta and Google's targeting capabilities. Advertisers have been struggling to measure ROI for years now because third-party cookies are disappearing. In this environment, Open AI's "we'll give you transparent impressions and clicks, nothing more" approach might actually feel honest compared to competitors making inflated claims about targeting precision they no longer actually have.

Third, novelty drives early adoption. Every advertising platform goes through a honeymoon phase where early adopters get outsize results, simply because there's less competition. Chat GPT ads are new. There will be early movers who capture disproportionate value before the market saturates. That's not guaranteed, but it's historically how these things work.

Fourth, Chat GPT is increasingly becoming part of purchase decisions. When someone searches for "best CRM for nonprofits," they might start with Google—but increasingly, they're also asking Chat GPT. If Chat GPT becomes a critical touchpoint in the buying journey, then being visible there becomes strategically important, regardless of price.

The Competitive Landscape: How Chat GPT Ads Compare

Let's zoom out and look at how this fits into the broader advertising ecosystem. There are basically four tiers of digital advertising right now:

Tier 1: Massive scale, minimal targeting (cheap) Programmatic display ads, banner ads on random websites. CPM: $2-5. Reach millions. Get no attention.

Tier 2: Large scale, behavioral targeting (moderate price) Facebook, Instagram, Google Display Network. CPM: $10-30. Reach hundreds of millions based on interests and behaviors. Get decent attention from partially relevant audiences.

Tier 3: Smaller scale, strong intent signals (higher price) Google Search Ads, Linked In, industry-specific ad networks. CPM: $30-80. Reach thousands to millions of highly intent-driven users. Get strong attention from seriously interested people.

Tier 4: Premium specialist platforms (highest price) Exclusive, niche networks. CPM: $75-150+. Reach thousands of specialized professionals. Get attention from exactly the right people.

Chat GPT is trying to sit at the intersection of Tier 2 and Tier 3. Large scale (200 million weekly active users) with strong intent signals (high engagement), but minimal targeting data. That's unusual. It doesn't perfectly fit any existing category.

Traditionally, you pay more when you get better targeting. Chat GPT is asking you to pay more while getting less targeting. That's a bold move. It only works if the fundamental quality of the audience is so superior that it justifies the reduced precision.

The Privacy-First Advertising Model: A Fundamental Shift

What Open AI is doing extends beyond just Chat GPT ads. They're essentially testing whether there's a viable privacy-first advertising model.

For forty years, advertising has operated on a simple principle: the more data you have about your users, the better your ads can be. This built Google and Meta into the two most valuable advertising platforms on Earth. But it also created massive privacy concerns, regulatory backlash, and fundamental incompatibility with user trust.

Open AI is asking a different question: what if we compete not on data access, but on context quality and user engagement? What if we say, "We'll never spy on your users, but we guarantee they're engaged and interested"?

This is actually a three-part strategy:

Part 1: Differentiation through ethics. In an era where privacy consciousness is growing, especially among younger users, being the platform that doesn't sell user data is increasingly valuable. Meta has faced constant criticism for privacy practices. Google has faced multiple antitrust investigations partly around data access. Open AI is positioning as the clean alternative.

Part 2: Technical innovation in measurement. Open AI will likely invest heavily in converting-focused metrics that don't require detailed user tracking. They might develop proprietary models to estimate conversion probability based on aggregate data. They might create better attribution models. They're essentially saying, "We can measure what matters without measuring everything."

Part 3: Regulatory alignment. Privacy regulations like GDPR in Europe and increasingly restrictive regulations globally are making Google and Meta's data practices legally risky. A platform that never collects individual user data in the first place has fewer regulatory headaches. As regulations tighten, this becomes more valuable.

If this model works, it could reshape digital advertising. Not immediately—the data advantage Google and Meta have is enormous—but eventually.

OpenAI could potentially generate

Early Advertiser Response and Market Skepticism

How has the market actually responded to this announcement? With cautious interest mixed with skepticism.

Some early signals suggest that larger, brand-focused advertisers are more interested than performance-focused companies. This makes sense. If you're a major consumer brand just trying to build awareness and maintain relevance, Chat GPT's audience quality and scale might be enough. You don't need conversion tracking to measure whether "people who see our ad remember our brand."

But if you're an e-commerce company or Saa S startup where everything is measured in ROI, the lack of conversion tracking is a serious problem. How do you justify the spend to your finance team if you can't prove return on investment?

Open AI has addressed this by saying they'll "explore" offering more detailed metrics over time. That's essentially a promise that they'll figure out how to maintain privacy while offering better measurement. Whether that's actually possible remains to be seen.

The pricing also raises questions about whether Open AI's expectations are realistic. $60 CPM is expensive. At that price, you need to be very confident in the audience quality and user engagement. One of the biggest risks is that advertisers try Chat GPT, don't see strong results, and never return.

The Revenue Model: Why Open AI Needs This

Stepping back, it's worth understanding why Open AI is so aggressively pursuing advertising revenue in the first place.

Running Chat GPT is expensive. Each query requires computational resources. Open AI currently offers Chat GPT Plus at $20/month, which is a subscription model that gives predictable recurring revenue. But advertising is potentially much more lucrative.

Consider the math: if Chat GPT has 200 million weekly active users, and even just 10% of them use the free tier (where ads appear), that's 20 million active users. If each user sees an average of 10 ads per week, and those ads get a reasonable 2% click-through rate, Open AI could generate substantial revenue.

Let's do the calculation:

That's roughly

Of course, these numbers require heavy assumptions about adoption rates and user engagement. But the math shows why Open AI is so motivated to make this work, regardless of whether the pricing seems high.

How Chat GPT Ads Actually Work in Practice

Let's get specific about the mechanics. When ads start appearing on Chat GPT, here's what the user experience looks like:

Ads appear on the free and lower-tier Go plans, not on Plus or Pro subscriptions. This is a deliberate strategy—paid users have already opted out of ads by paying. Free users are the monetizable segment.

Ads don't appear in certain sensitive contexts. Specifically, Open AI has stated that ads won't show up in chats about mental health, politics, or other sensitive topics. This is both a privacy protection and a user experience decision. Nobody wants to see an ad for depression medication while discussing suicide prevention. So Open AI has some basic guardrails.

Ads also don't appear to users under 18. This is partly legal (COPPA restrictions on targeted advertising to minors) and partly ethical (Open AI's positioning).

Beyond those restrictions, ads can appear throughout the conversation. They're likely to be displayed:

- At the top of the conversation in a clearly labeled ad box

- In suggested follow-up prompts or recommendations

- Potentially in response suggestions when Chat GPT thinks something is relevant

The format is probably similar to Google Search ads: a headline, some description text, and a link. The key difference from Google Search is that Chat GPT can use conversational context to determine relevance. If someone asks "what's a good email marketing tool," Chat GPT understands the context and can surface relevant ads without needing the exact keyword match that Google requires.

This conversational understanding is actually one of Chat GPT's advantages as an ad platform. An email marketing tool company doesn't need to bid on exact keyword matches. They just need their product to be relevant when someone discusses email marketing, which Chat GPT can understand intuitively.

ChatGPT's CPM rate of $60 positions it as a premium advertising platform, surpassing LinkedIn and other major platforms. Estimated data based on industry averages.

Advertiser Categories and Use Cases

Which types of companies are most likely to actually advertise on Chat GPT?

Most likely to succeed:

- B2B Saa S companies (project management, CRM, document tools, automation tools) - Chat GPT users are actively trying to solve work problems

- Educational platforms (online courses, coding bootcamps, certification programs) - Chat GPT users are learning-oriented

- Professional services (consulting, legal, accounting) - People ask Chat GPT for professional advice

- Technical products (developer tools, APIs, cloud services) - Chat GPT's audience skews technical

- Consumer research and insights tools - Meta, Zapier, Runable, similar platforms

Moderately likely:

- E-commerce for niche products (technical books, programming courses, specialty software)

- Subscription services (productivity tools, research tools, writing software)

- Event and conference promotions (tech conferences, developer conferences)

Less likely to succeed:

- Mass-market consumer goods (shampoo, snacks, fashion) - Chat GPT users aren't asking for product recommendations in these categories

- Direct response campaigns ("limited time offer, buy now") - The lack of conversion tracking makes ROI measurement difficult

- Impulse purchase products - Chat GPT users are in research mode, not shopping mode

The pattern is clear: companies selling solutions to problems that Chat GPT users are actively trying to solve will do well. Companies trying to create demand for something people aren't already thinking about will struggle.

Privacy Promises and Long-Term Strategy

Open AI's core commitment is worth examining carefully: "We will never sell your data to advertisers."

This is simultaneously a very strong promise and a somewhat limited promise. Let's unpack it.

What they're promising: Open AI won't take individual user conversation data and sell it to advertisers. They won't say, "Here's how many times John Smith asked about productivity tools." They won't create individual user profiles based on conversation patterns and sell those profiles to data brokers.

What they're not necessarily promising: They might aggregate data in ways advertisers can use. They might say, "300,000 users asked about email marketing this month." They might identify user interests from conversations without identifying individual users. They might train their models on conversation data in ways that statistically improve ad targeting without selling individual data points.

The distinction matters. Complete anonymization might genuinely protect privacy. Or it might be a distinction without a real difference—if aggregate data is valuable enough to advertisers, the privacy benefit becomes theoretical rather than practical.

Over the long term, Open AI's strategy seems to be:

- Launch with minimal data sharing and strong privacy positioning

- Win advertiser trust and audience scale based on that positioning

- Gradually introduce more sophisticated measurement and insights without violating the core privacy principle

- Eventually compete with Google and Meta on reach and sophistication, but with better privacy positioning

If they pull this off, it's genuinely innovative. If they gradually erode their privacy commitments under advertiser pressure, it's just another platform repeating history.

The Comparison to Search-Based Advertising

It's worth noting that Chat GPT ads are more similar to Google Search ads than to social media ads, and that distinction is important.

Google Search ads work because of intent: when you search for "best CRM for small business," Google knows you're in the market for a CRM. The advertiser doesn't need to know anything about you. They just need to show up when someone demonstrates explicit intent to buy their type of product.

Chat GPT works similarly. When you ask "how do I choose between these email marketing tools," you're demonstrating explicit intent. An advertiser doesn't need to know your age, gender, interests, or browsing history. They just need to be visible when you express relevant intent.

Social media ads work differently. Facebook's entire value proposition is targeting: "We know so much about these people that we can show them ads for things they don't know they want yet." That's why Facebook charges less per impression but delivers higher-quality targeting.

Open AI is essentially competing in the search-based intent model, but with a

OpenAI's ChatGPT ad cost is significantly higher at $60 CPM, approximately 3 times Meta's rate and 2-4 times typical Google CPMs. Estimated data.

Challenges and Risks

Despite the strategic positioning, there are genuine challenges to this model.

Challenge 1: Advertiser adoption. $60 CPM is expensive. Advertisers will demand proof that Chat GPT ads outperform cheaper alternatives. Early results will be critical. If the first wave of advertisers sees disappointing ROI, the platform faces a crisis of confidence.

Challenge 2: Competition from Google. Google isn't sitting still. They're integrating AI directly into search results. If users get AI-powered answers directly in Google Search, there's less reason to open Chat GPT. Plus, Google has more advertiser relationships, better measurement tools, and deeper pockets. They can outbid Open AI for user attention.

Challenge 3: Privacy vs. performance. As I mentioned, there's genuine tension between Open AI's privacy commitments and advertisers' demands for measurement and targeting. Over time, pressure will build. Can Open AI really maintain a privacy-first position while scaling an advertising business? Historically, platforms haven't managed this well.

Challenge 4: User experience. The more ads that appear in Chat GPT, the less valuable the platform becomes for users. Too many ads risk degrading the experience and driving users to competitors. Finding the right balance between monetization and user experience is tricky.

Challenge 5: Regulatory scrutiny. Advertising platforms face increasing regulatory attention. If Chat GPT's ads become problematic (discriminatory targeting, misinformation amplification, etc.), Open AI could face legal challenges. Their privacy stance offers some protection, but not complete immunity.

Financial Implications for Open AI and the Broader AI Industry

Understanding why Open AI is making this move requires understanding their financial situation.

Open AI is a financially challenging business. Running large language models is expensive. Training costs are measured in the tens of millions. Inference costs (answering user queries) are significant at scale. Every additional user increases infrastructure costs.

Subscription revenue from Chat GPT Plus (

Advertising is the obvious choice. It's proven to scale, it leverages existing user traffic, and it can generate enormous revenue if done right. Google makes more money per user from advertising than Open AI makes from subscriptions.

But advertising requires scale and trust. Open AI's strategy seems to be: "We'll charge premium prices initially, prove the value to early advertisers, then scale aggressively as network effects kick in."

If successful, this could materially change Open AI's financial picture. If even 5% of Chat GPT's weekly active users generate $60 CPM in advertising revenue, that's billions annually. That's transformative.

For the broader AI industry, this is significant too. It suggests that AI companies see advertising revenue as a critical part of their long-term models. Every major AI platform is exploring similar approaches. Runable, for instance, is building AI-powered automation tools while exploring how to connect users with relevant services. The trend is clear: AI platforms are becoming advertising platforms.

Market Timeline and Adoption Expectations

How quickly will Chat GPT ads scale? Here's a likely timeline:

Months 1-3 (Launch phase): Small advertiser base, primarily early adopters and premium Saa S companies. Ads appear minimally in Chat GPT. Limited data available on effectiveness. Open AI focuses on feedback and iteration.

Months 3-6 (Optimization phase): Open AI releases initial performance data. If results are positive, more advertisers join. The platform becomes more visible. First case studies and success stories emerge. Pricing might stabilize or adjust based on demand.

Months 6-12 (Scaling phase): Industries with good results attract competitors. Advertising becomes more competitive. CPM might increase due to demand, or decrease as competition intensifies. Open AI likely introduces new ad formats and targeting options.

12+ months (Maturity phase): Chat GPT ads become a standard channel for certain industries. Measurement and reporting improve. Open AI likely integrates ads with broader product recommendations and offers.

Compare this to how Google Search Ads scaled: they started with roughly $2 CPM in 2000, reached meaningful scale in 2003, and by 2010 were generating billions annually. Chat GPT is starting at a higher price point but with an arguably better audience. Reaching similar financial scale might take 3-5 years.

Google and Meta offer a wide range of ad metrics, while ChatGPT Ads currently provide limited data, focusing on impressions and clicks. Estimated data based on typical offerings.

Strategies for Advertisers Considering Chat GPT Ads

If you're a company considering spending on Chat GPT ads, here's a strategic framework:

Step 1: Determine if your product is Chat GPT-relevant. Ask yourself: Do Chat GPT users actively ask about my product category? Would my target customer use Chat GPT to research purchase decisions? If the answer is no, skip this for now.

Step 2: Set realistic expectations for measurement. You won't get Google Search-level conversion tracking. Plan to track conversions on your own website using UTM parameters, unique promo codes, or other direct attribution methods.

Step 3: Start with a small test. Allocate maybe $5,000-10,000 initially. Run the test for 4-6 weeks. Track impressions, clicks, and actual website conversions. Calculate your real return on investment.

Step 4: Evaluate context quality. Are the users who click your Chat GPT ads actually interested, or are they just curious? Are they converting at higher rates than your other channels? Context quality is the bet Open AI is making—verify if it's true.

Step 5: Make a scaling decision. If the test works, consider scaling. If it doesn't, stop and re-evaluate. Don't commit to a full annual budget based on initial results—this channel is too new.

Step 6: Monitor competitive landscape. Watch what competitors are doing on Chat GPT. Track CPM inflation as more advertisers enter the market. Stay flexible.

The core principle: treat Chat GPT ads as experimental until proven otherwise. The $60 CPM is expensive enough that you need to validate ROI before committing significant budget.

The Broader Implications: Advertising in the Age of AI

Chat GPT ads represent a larger shift in how advertising will work as AI becomes ubiquitous.

Traditionally, advertising relied on distribution channels: TV networks had viewers, magazines had readers, Google had search users, Facebook had social users. Advertisers bought access to those distribution channels' audiences.

But AI changes the game. AI doesn't just deliver content—it generates content and recommendations. Chat GPT doesn't show you ads alongside answers. It can integrate product recommendations directly into answers. "Here's the best tool for your use case" might include an ad for that tool seamlessly woven into the response.

This is more powerful than traditional advertising, and therefore more controversial. It also suggests a fundamental reorganization of how companies reach customers.

If Chat GPT can recommend products directly in responses, the entire funnel changes:

- Google Search: "What's the best project management tool?" → Multiple search results → User researches options → User chooses → User buys

- Chat GPT: "What's the best project management tool?" → Chat GPT responds with recommendation → User trusts AI → User buys

Chat GPT is essentially shortcircuiting the research phase. That's incredibly valuable for relevant products and incredibly dangerous if Open AI's AI isn't actually recommending the best product.

This is why privacy and measurement matter so much. If Open AI is making product recommendations to users, advertisers need to trust that those recommendations are unbiased (privacy protection) and need to know whether the recommendations actually drive sales (measurement).

Open AI is trying to have it both ways, which is ambitious. It might work. Or it might prove that you can't fundamentally transform advertising without making uncomfortable trade-offs.

Future Iterations and Product Roadmap

What's next for Chat GPT advertising? Based on Open AI's positioning and industry trends, here are the likely next steps:

Near-term (next 6 months):

- Launch basic ad formats (text ads with links, possibly image ads)

- Expand to more user tiers and conversation types

- Roll out beta conversion tracking and attribution models

- Begin reporting case studies on advertiser performance

Medium-term (6-12 months):

- Introduce interactive ad formats (forms, product showcases, configurators)

- Launch advertiser dashboard improvements with better reporting

- Test sponsored content integrations (where Chat GPT recommendations could surface sponsored options)

- Expand to international markets

Long-term (12+ months):

- Develop AI-powered advertiser tools (automated bid management, creative optimization)

- Create industry-specific ad formats (e.g., "enterprise IT recommendations" vs. "consumer gadget recommendations")

- Integrate advertising with broader Open AI ecosystem (possibly including other products)

- Potentially introduce dynamic pricing based on competitive demand

The broader strategy seems to be: establish the platform, prove the value, scale the advertiser base, then innovate on formats and measurement to compete more directly with Google and Meta.

Honest Assessment: Will This Actually Work?

Here's my genuine take: Chat GPT's advertising model is ambitious and potentially brilliant, but it's also unproven and risky.

The case for success:

- Chat GPT has genuine audience scale and engagement

- Users are in high-intent mode when using the platform

- Privacy-first positioning is increasingly valuable

- The market wants new advertising channels after iOS privacy changes broke existing tools

- Open AI has leverage and can iterate quickly

The case for challenges:

- $60 CPM is expensive and requires exceptional results to justify

- Measurement limitations might frustrate advertisers and limit adoption

- Google is a formidable competitor and can drop prices, improve measurement, and combine ads with AI

- User experience concerns if ads become too prominent

- Privacy commitments might be expensive to maintain at scale

My honest prediction: Chat GPT ads will work for certain vertical (Saa S, B2B, education, professional services). In those niches, Open AI's premium positioning and intent-driven platform will create value. But Open AI will face pressure to either lower prices or improve measurement. They'll probably do both gradually.

Within 2-3 years, Chat GPT could be a meaningful advertising channel generating hundreds of millions or low billions in annual revenue. Whether it becomes a truly competitive channel against Google's $200+ billion advertising empire is less clear. That requires either massive scale expansion, significant measurement improvements, or material innovation in ad formats. All three are possible but not guaranteed.

The wild card is regulation. If regulators tighten rules on AI-powered recommendations or automated product endorsements, the entire strategy becomes riskier. But for now, Open AI's approach is defensible and differentiated.

FAQ

What does it cost to advertise on Chat GPT?

Open AI is charging approximately $60 per 1,000 impressions (CPM) for Chat GPT ads, which is roughly three times what Meta charges and about 1.5-3x typical Google Search ad costs. This pricing applies to the initial launch phase and may change as the platform scales and advertiser demand settles.

How do I track whether Chat GPT ads are actually working?

Initially, Open AI will provide only high-level metrics: total impressions, total clicks, and click-through rate. For detailed conversion tracking, you'll need to implement your own measurement using UTM parameters, tracking pixels on your website, unique promo codes, or other methods. Open AI has indicated they may offer more sophisticated analytics in the future while maintaining privacy commitments.

Who is actually seeing Chat GPT ads right now?

Ads appear on Chat GPT's free and lower-tier Go plans, but not on Chat GPT Plus or Pro (paid tiers). Ads don't appear to users under 18 or in conversations about sensitive topics like mental health or politics. This means roughly 60-70% of Chat GPT users will see ads, but with important restrictions around user age and conversation type.

Why is Open AI charging so much more than Facebook or Google?

Open AI is betting that Chat GPT users are significantly more valuable because they're in high-intent mode (actively researching and making decisions) rather than passively scrolling. Additionally, the premium reflects Chat GPT's smaller advertiser base—as demand increases, CPM might decrease or stabilize. The price also reflects Open AI's commitment to privacy, which limits detailed targeting capabilities.

Can Chat GPT ads replace Google Search ads for my business?

Probably not entirely, but they might complement your existing strategy. Chat GPT works best for companies selling solutions to problems that users actively ask Chat GPT about (B2B Saa S, education, professional services). If your industry has established search advertising channels through Google, Chat GPT should be viewed as an additional channel rather than a replacement.

Will Open AI eventually sell user data to advertisers like Google and Meta do?

Open AI has explicitly committed to never selling user conversation data to advertisers. However, they might aggregate data in ways that benefit advertisers without compromising individual privacy (such as demographic trends without personal identifiers). Whether Open AI maintains this commitment long-term under advertiser and investor pressure remains to be seen.

How does Chat GPT's high-intent audience compare to Google Search?

Both platforms rely on user intent rather than data-driven targeting. However, Chat GPT provides conversational context that Google Search doesn't—Open AI knows not just what users asked, but the conversation that led to the question. This might enable better contextual ads. But Google Search currently scales larger and has more advertiser relationships, so it's not a direct replacement.

Should I allocate budget to Chat GPT ads right now?

Start with a small test ($5,000-10,000 for 4-6 weeks) if your product is relevant to Chat GPT users. Track real conversions on your website, not just clicks. Make a scaling decision based on actual ROI rather than theoretical value. Given the premium pricing, you need to validate that it works before committing significant budget.

What happens as more advertisers join Chat GPT and competition increases?

Historically, CPM tends to increase as platforms become more competitive (more bidders for limited inventory). However, it's also possible that CPM might decrease if advertiser supply grows faster than demand. Watch for case studies and industry reports on advertiser results—if early adopters see positive ROI, more advertisers will join and potentially drive CPM higher.

How will AI platform advertising change the broader advertising landscape?

AI-powered advertising represents a shift from behavioral targeting (Google, Meta) toward intent-driven, context-aware recommendations. If successful, this could reduce reliance on user data while potentially improving ad relevance. However, it also raises concerns about AI-generated recommendations being biased or influenced by advertising relationships. The regulatory and ethical implications of AI-mediated advertising are still being determined.

Conclusion: The Beginning of a New Advertising Paradigm

Chat GPT's entry into advertising represents more than just a new channel for marketers. It signals a fundamental shift in how digital advertising will work as AI becomes ubiquitous in how people find information and make decisions.

Open AI is making a bold bet: that they can charge premium prices by offering something Google and Meta can't—high-intent users in an AI-mediated context, paired with genuine privacy protections. It's ambitious. It's somewhat risky. But it's also genuinely innovative in an advertising landscape that hasn't fundamentally changed in decades.

For advertisers, the key insight is this: Chat GPT ads aren't trying to be Facebook. They're not trying to interrupt you with something you didn't know you wanted. They're trying to be visible at the exact moment you're actively researching a purchase decision. That's incredibly valuable for relevant products and worth the premium pricing—if the audience quality lives up to the promise.

For users, there's a genuine privacy benefit compared to Google and Meta. Open AI's commitment (so far) to not monetizing individual conversation data is refreshing in an industry where data collection is the default. Whether that's sustainable at scale is the real question.

For Open AI, advertising is a necessity. Running cutting-edge AI models is expensive, and subscription revenue isn't sufficient to sustain a company training frontier models. Advertising revenue could be transformative to the company's financial picture and help justify their valuation.

The next 6-12 months will be critical. If early advertisers see strong results, momentum builds and the platform scales. If results disappoint, the high CPM becomes a barrier to adoption and Open AI faces pressure to lower prices and improve measurement. Either way, we're watching the beginning of a conversation about how advertising works in an age when AI is part of how people make decisions.

That conversation is just getting started, and it's going to be complicated.

Use Case: Automating your marketing analytics and reporting by generating insights from campaign data in real-time using AI-powered tools.

Try Runable For Free

Key Takeaways

- ChatGPT ads cost $60 per 1,000 impressions, approximately 3x Meta's rates and 2-4x typical Google Search CPMs, reflecting premium positioning for high-intent users

- OpenAI explicitly limits advertiser data access to high-level metrics only (impressions, clicks), maintaining privacy commitments but reducing measurement capabilities compared to Google and Meta

- The platform potentially generates $600M+ annually at target adoption, making advertising essential to OpenAI's financial sustainability despite high computational costs

- B2B SaaS, education, and professional services companies are best positioned to succeed on ChatGPT ads where users actively research solutions, whereas mass-market consumer brands face challenges

- Success depends on proving that context-driven, privacy-respecting advertising can compete with data-intensive targeting—a fundamental test of whether privacy and profitability can coexist

![ChatGPT Advertising Strategy: Premium Pricing vs. Data Limitations [2025]](https://tryrunable.com/blog/chatgpt-advertising-strategy-premium-pricing-vs-data-limitat/image-1-1769447392773.jpg)