Introduction: The Year Netflix's Ad Business Exploded

A few years ago, the idea of Netflix showing ads seemed ridiculous. The company built its entire brand on the promise of ad-free streaming. But here's what actually happened in the real world: people's streaming habits changed, wallets got lighter, and Netflix realized something fundamental about the market. Advertising wasn't a failure—it was an untapped revenue stream worth billions.

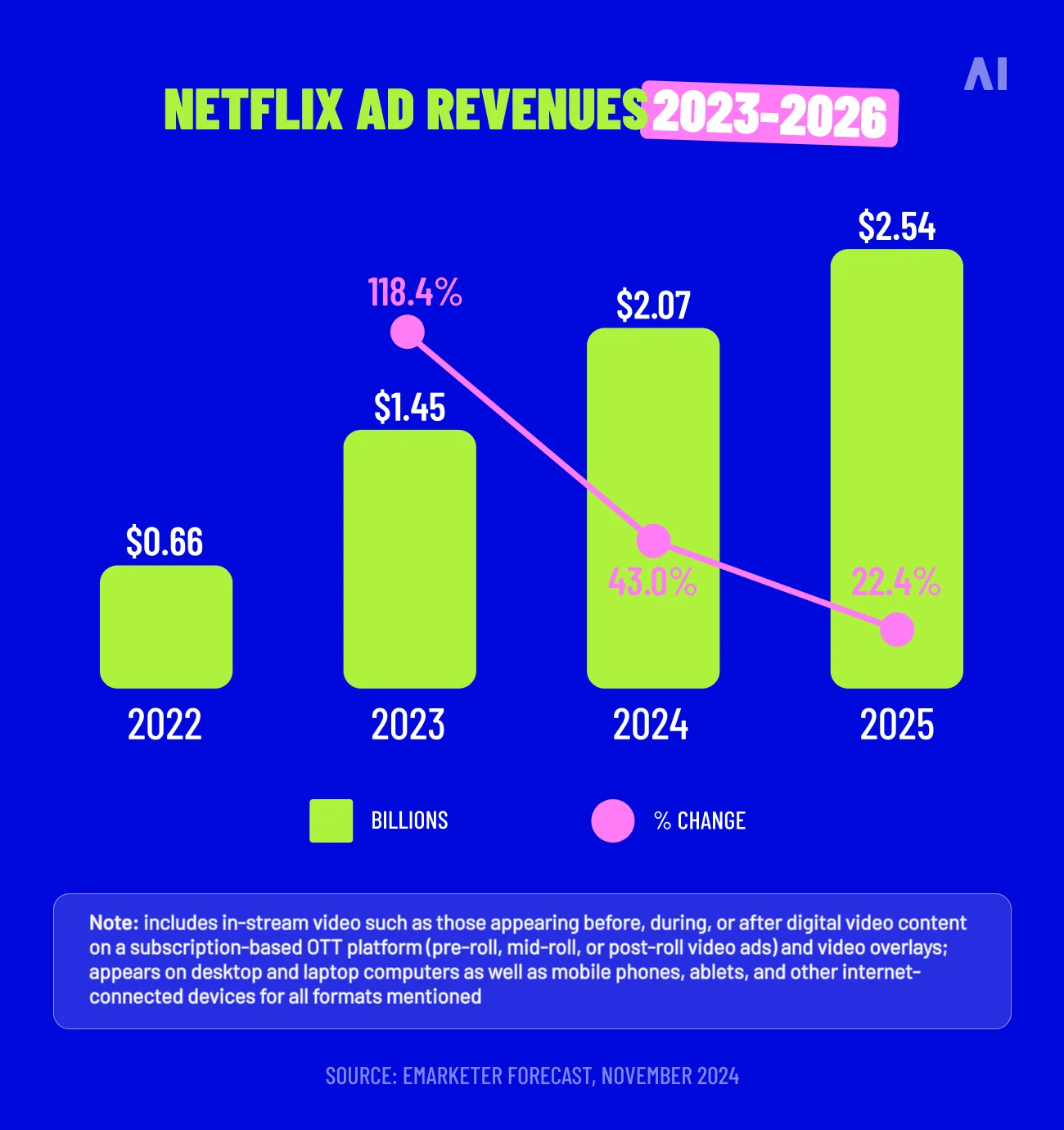

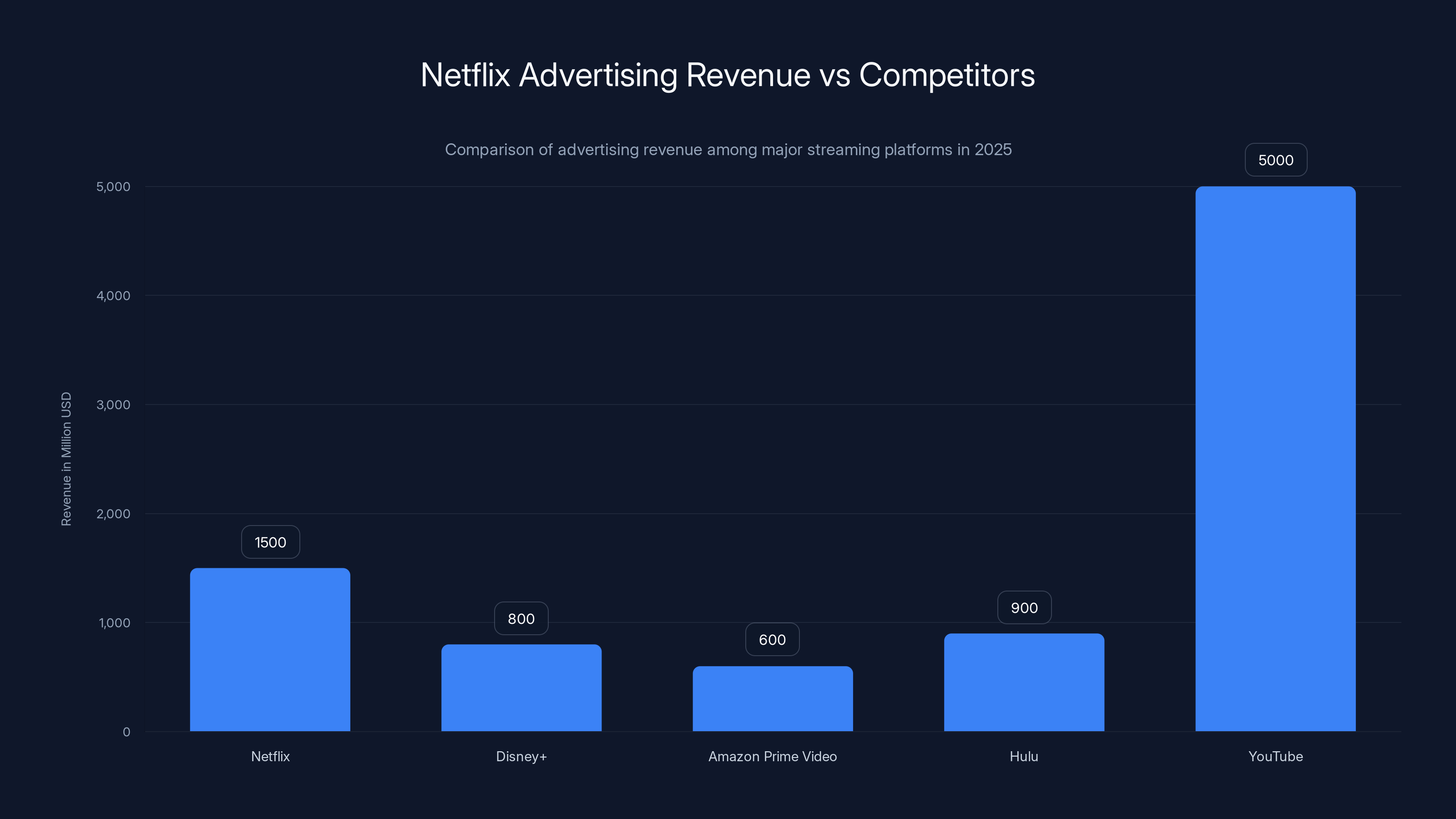

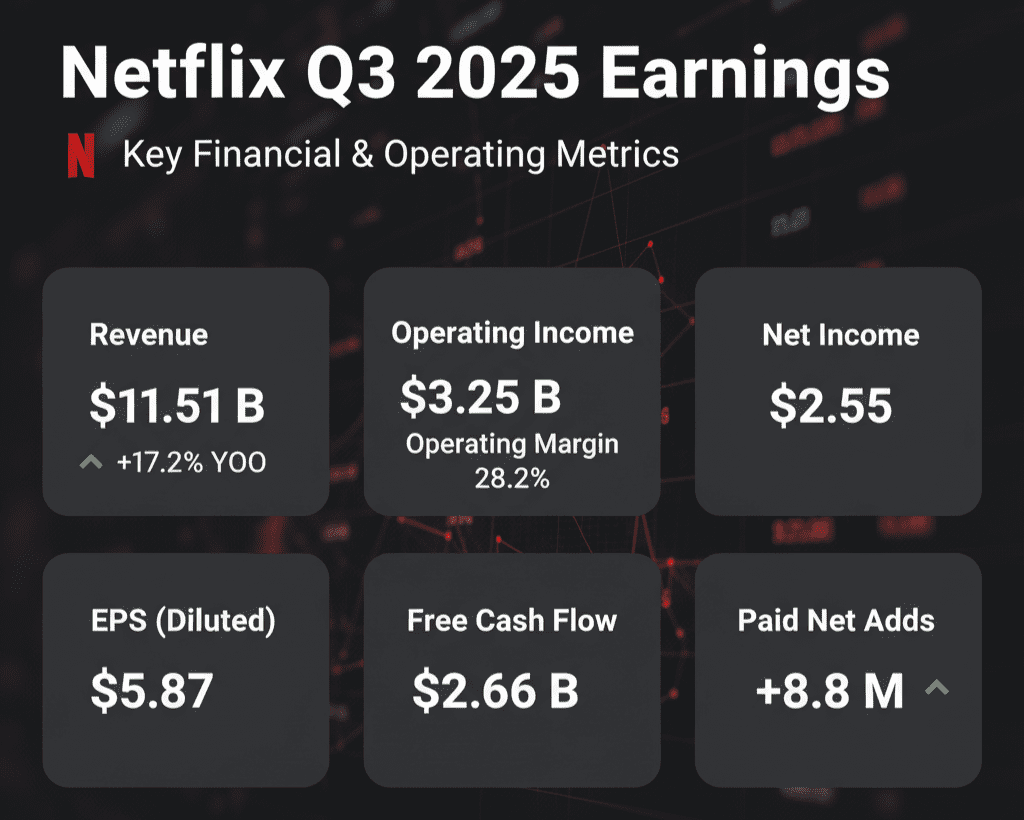

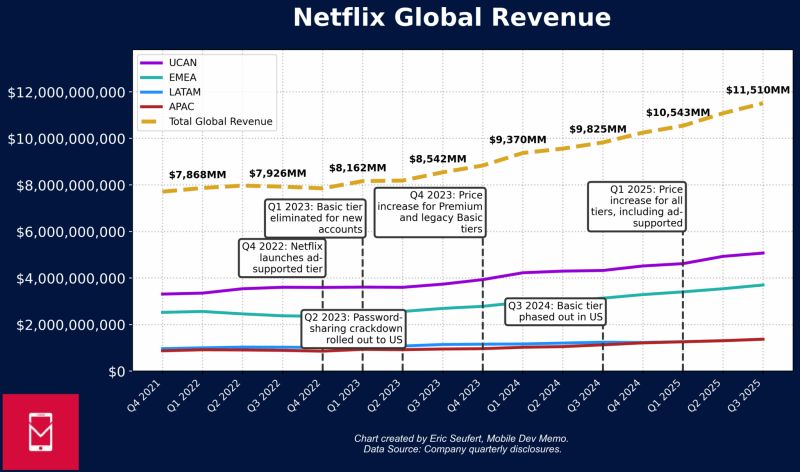

In 2025, Netflix's advertising business crossed a threshold that nobody expected to hit this fast. The company earned $1.5 billion from ads, more than doubling the previous year's numbers. That's not just growth. That's validation that Netflix's gamble on an ad-supported tier actually worked.

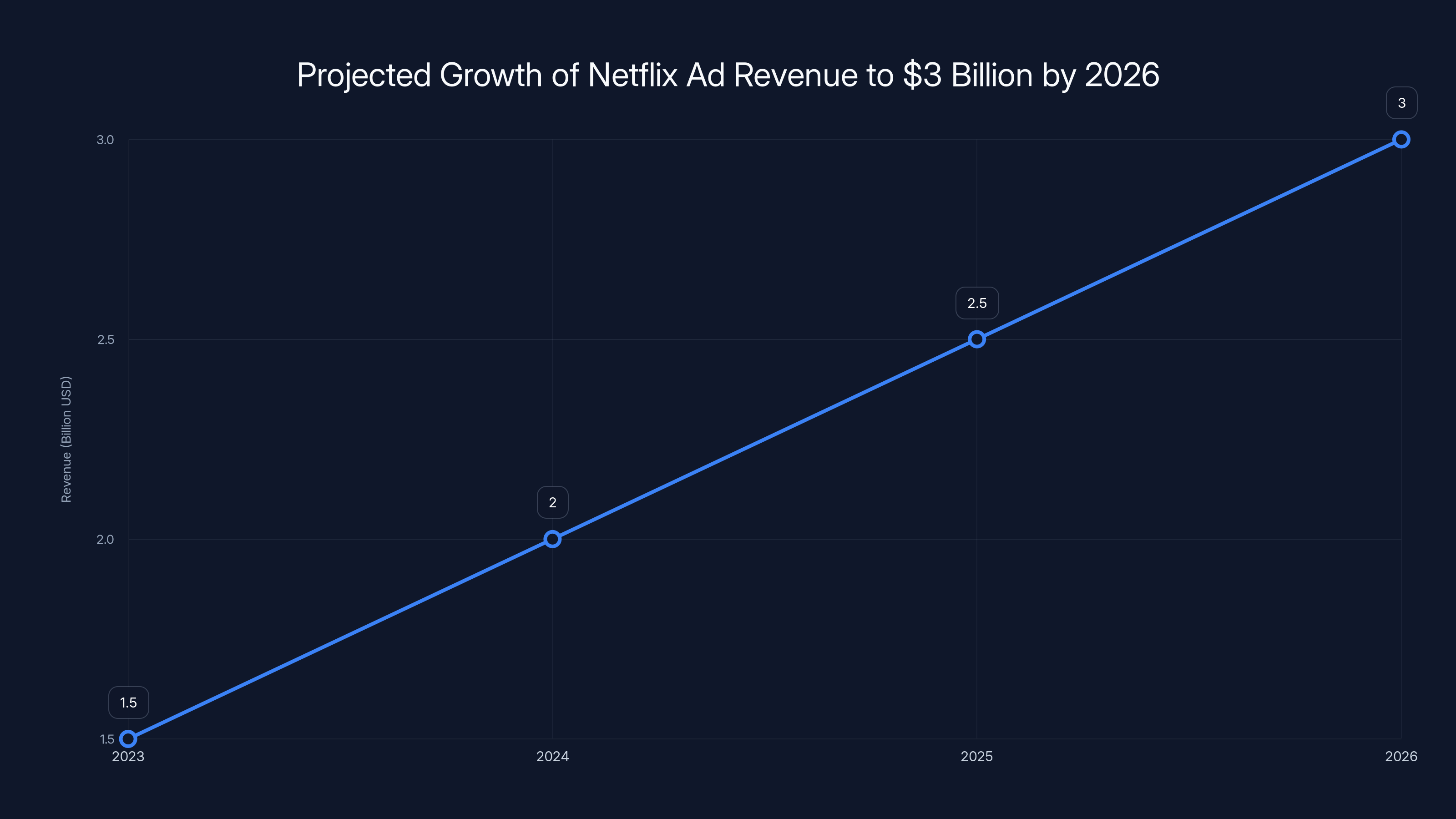

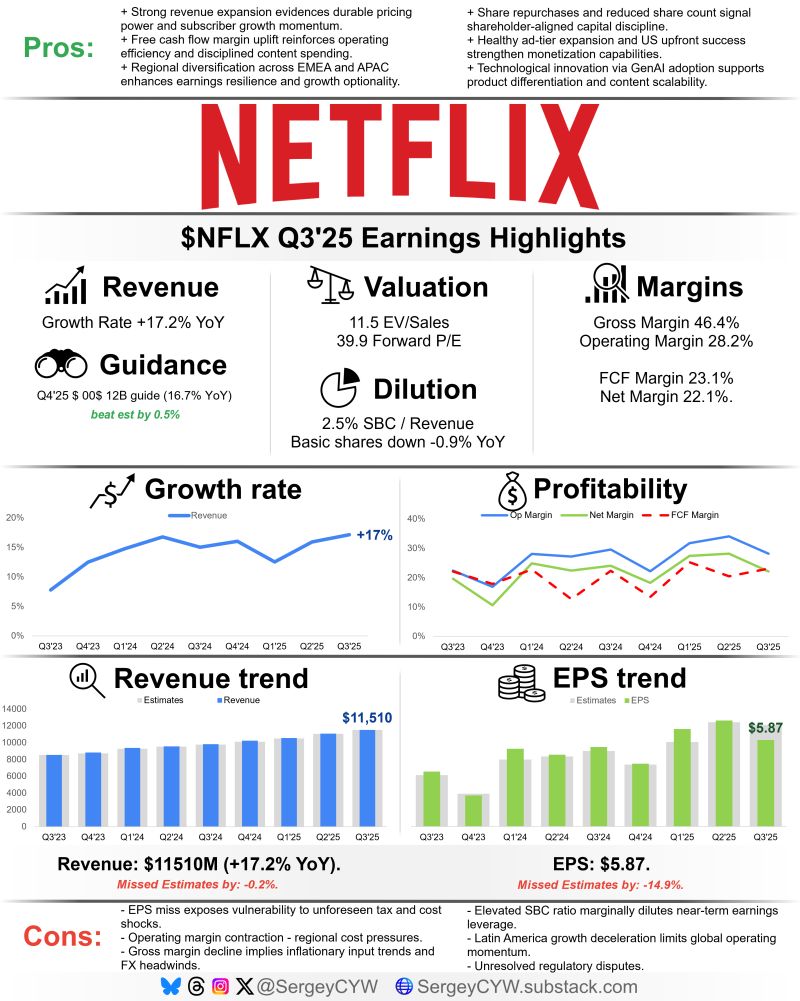

But here's where it gets interesting. Netflix co-CEO Greg Peters didn't just announce these numbers and move on. He said the company expects to roughly double that again in 2026 to around $3 billion. Think about that trajectory for a second. We're talking about a business line that didn't even exist five years ago becoming a multi-billion-dollar revenue stream. This fundamentally changes how we should think about Netflix's economics, its competitive position, and what comes next for the entire streaming industry.

The bigger picture is this: Netflix proved that premium content and advertising aren't mutually exclusive. You can charge $7.99 a month for ad-supported streaming and still make it work. You can have 94 million monthly active users on an ad-supported plan and continue growing. And you can build advertising infrastructure sophisticated enough to make brand partners actually want to use it.

What Netflix is doing right now isn't just about squeezing more revenue from subscribers who can't afford the premium tier. It's about fundamentally repositioning streaming as a mainstream advertising platform. It's about competing with YouTube, network TV, and traditional media in a market segment that's been growing for decades.

This article breaks down what's really happening inside Netflix's advertising business, why the numbers matter more than they seem, and what the next chapter looks like for both Netflix and the entire streaming ecosystem.

TL; DR

- Netflix earned $1.5 billion from ads in 2025, more than doubling 2024 revenue with 325 million total subscribers

- $3 billion revenue target for 2026 represents aggressive growth as the ad-supported tier reaches 94 million monthly active users

- Interactive video ads launching in Q2 2026 alongside AI-powered ad tools designed to blend ads seamlessly with show content

- Competitive threat to traditional TV and YouTube as Netflix builds the most valuable advertising inventory in streaming

- Strategic acquisition of Warner Bros. (HBO, HBO Max) for $82.7 billion expands advertising reach and content library exponentially

Netflix's ad revenue is projected to grow from

How Netflix Built a $1.5 Billion Advertising Business

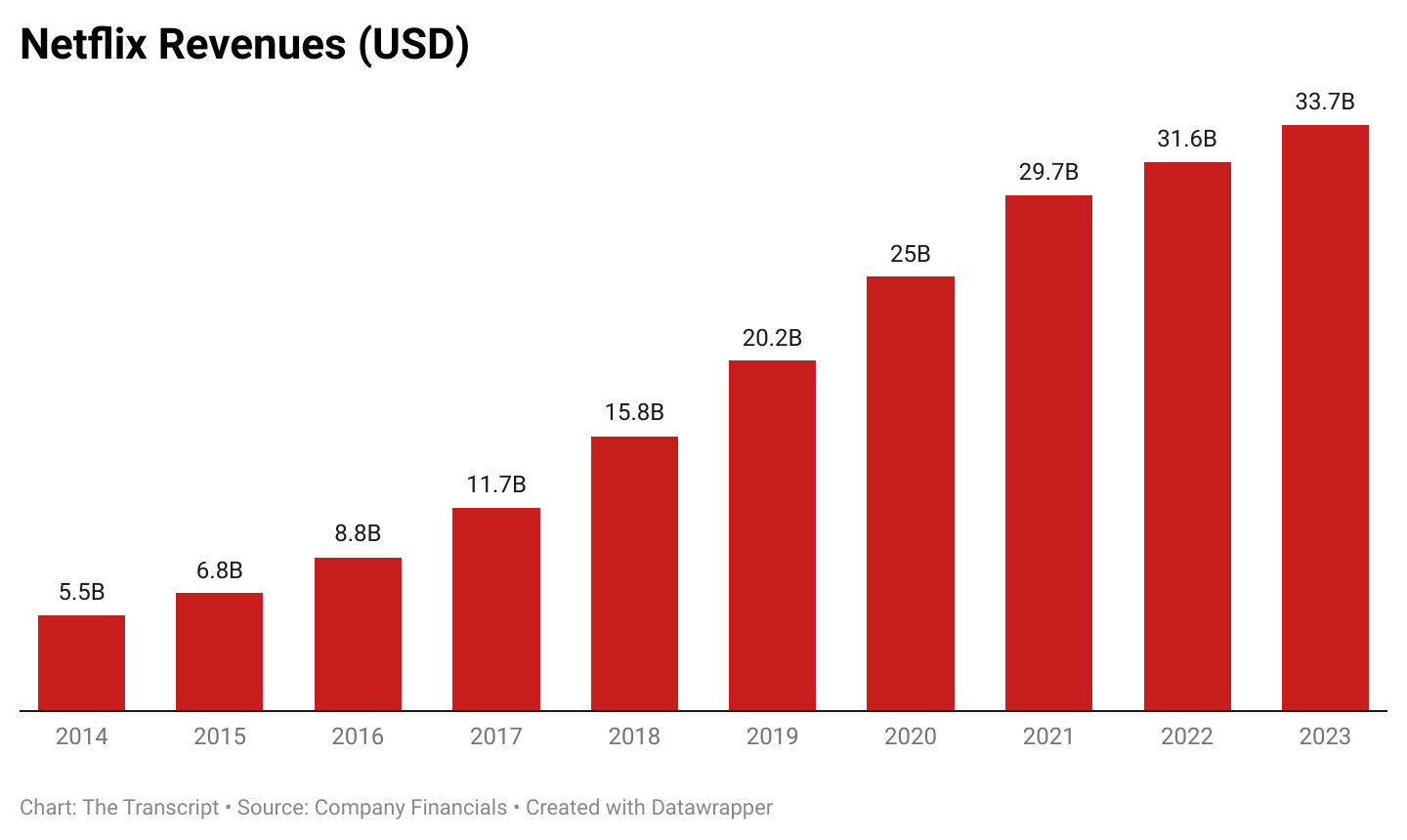

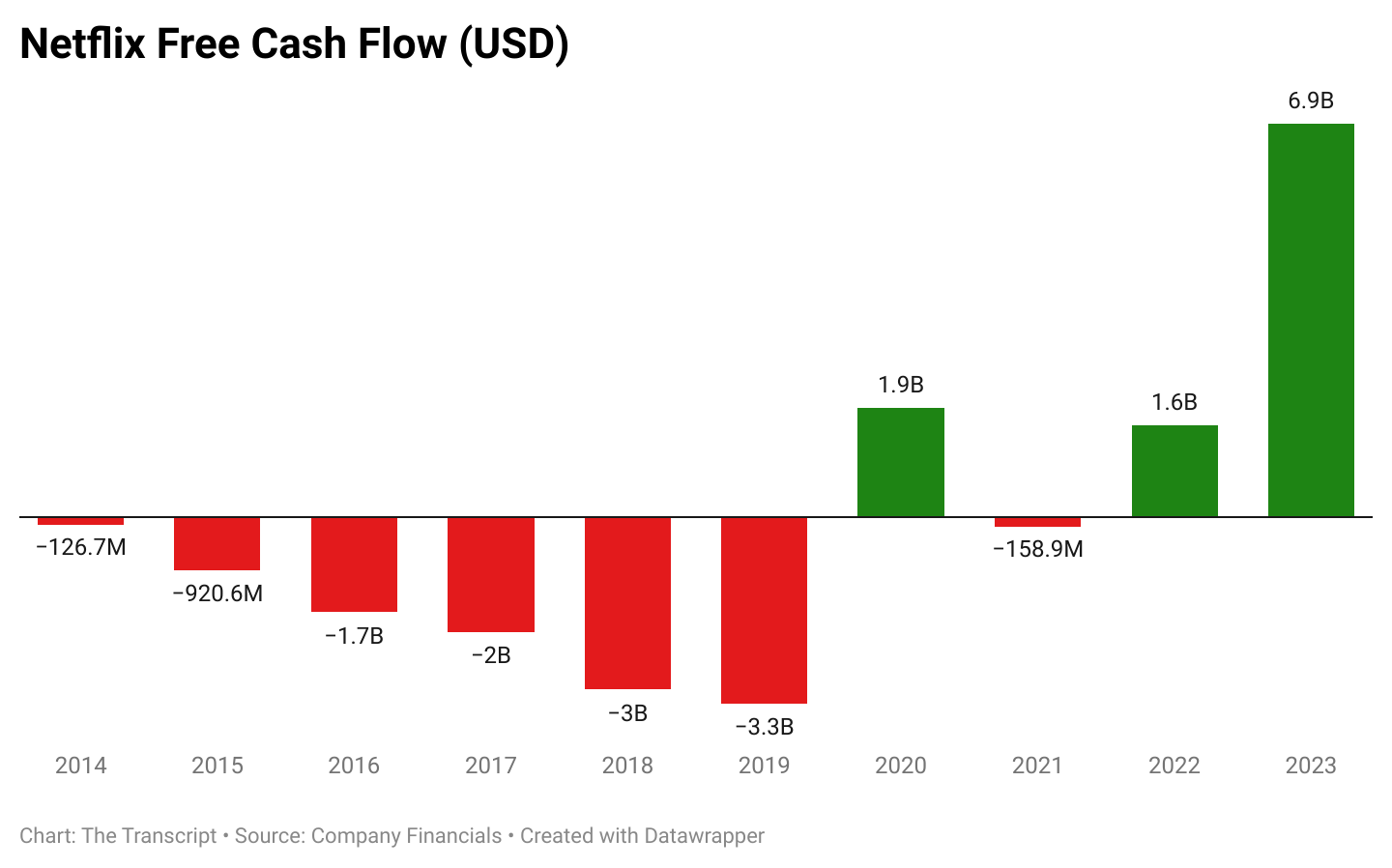

The journey to $1.5 billion in annual advertising revenue didn't happen by accident. It was the result of Netflix making a series of calculated bets that ran counter to the company's founding mythology.

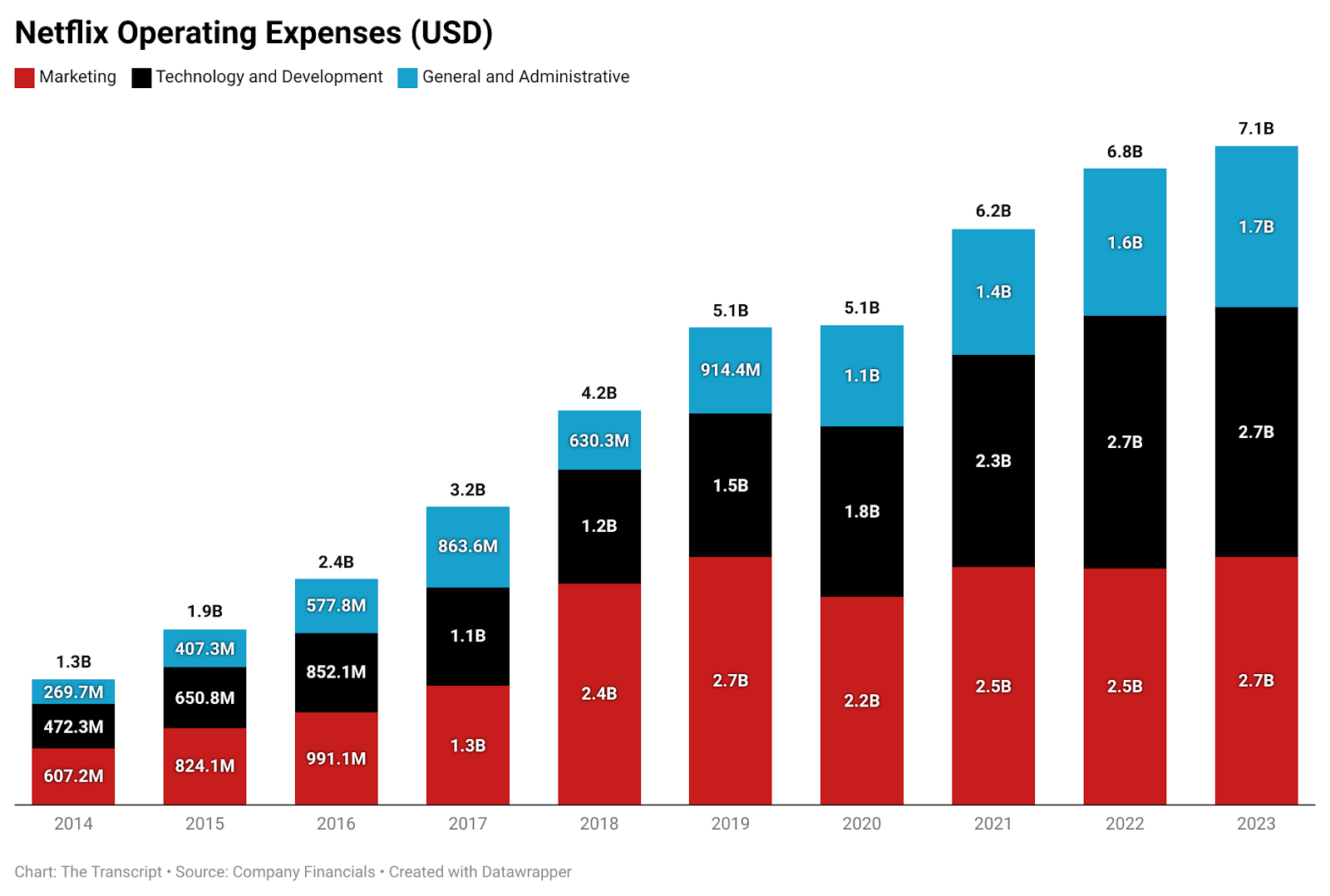

When Netflix launched its ad-supported tier in November 2022, it felt like a compromise. The service had spent over a decade telling subscribers they were paying to escape ads entirely. That was the Netflix promise. But the economics of streaming changed. Production costs soared. Password sharing cost the company an estimated $6 billion annually. And growth stalled because the company had already saturated its premium market.

So Netflix did what successful companies do when their original thesis stops working: they adapted. The ad-supported tier launched at

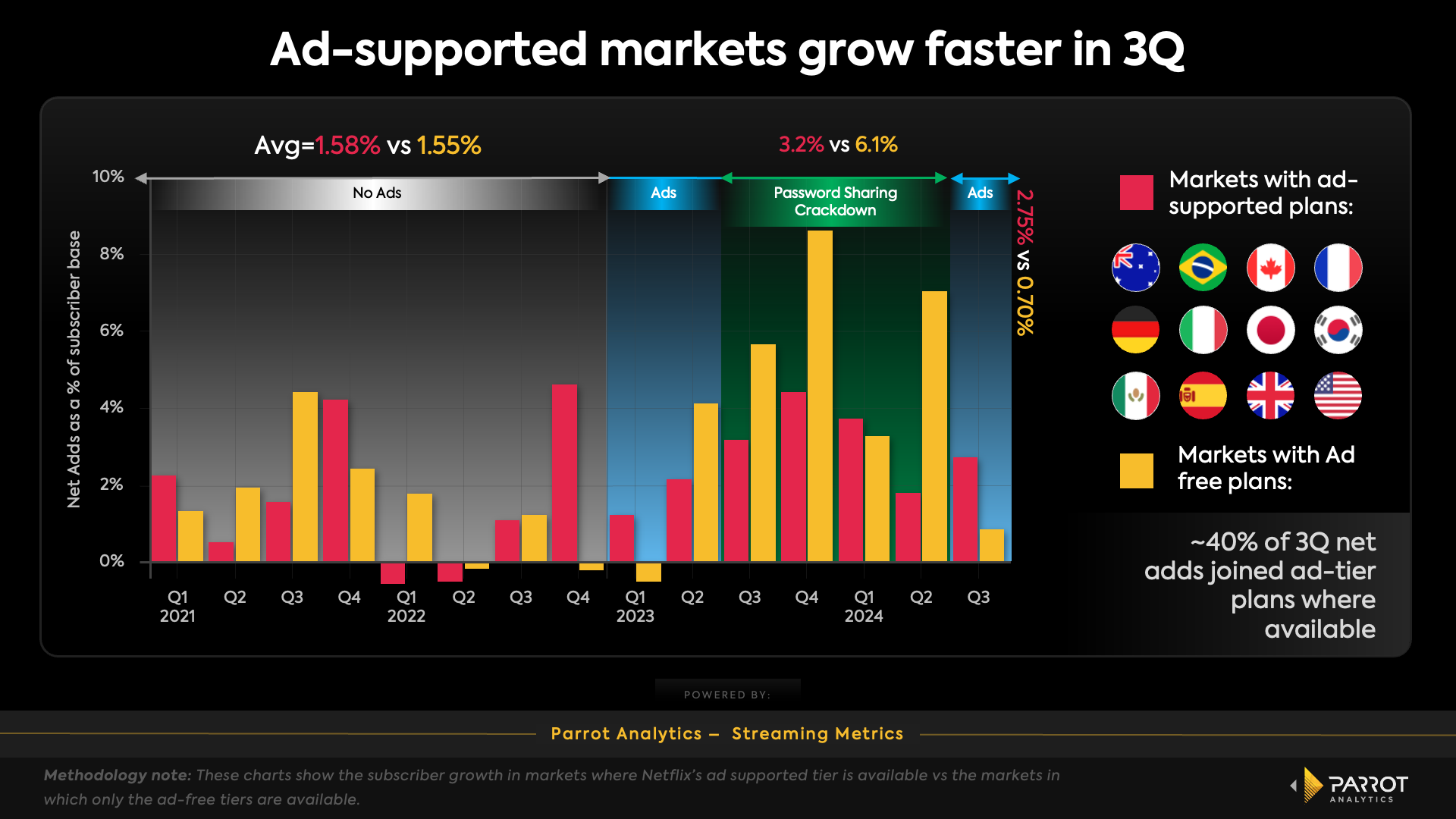

By May 2025, the ad-supported plan had grown to 94 million monthly active users. That's nearly a third of Netflix's total subscriber base using the ad tier. For context, that's larger than the total subscriber count of most competing services. Netflix didn't just create an ad-supported option. It created an advertising platform with nearly 100 million monthly users.

The revenue math is straightforward but powerful. Netflix sells advertising inventory to brands. Those brands pay for impressions, for placement, for integration opportunities. The company takes a cut. Even at relatively modest rates compared to traditional TV, 94 million monthly users multiplied by hundreds of ad placements per user per month creates a massive revenue pool.

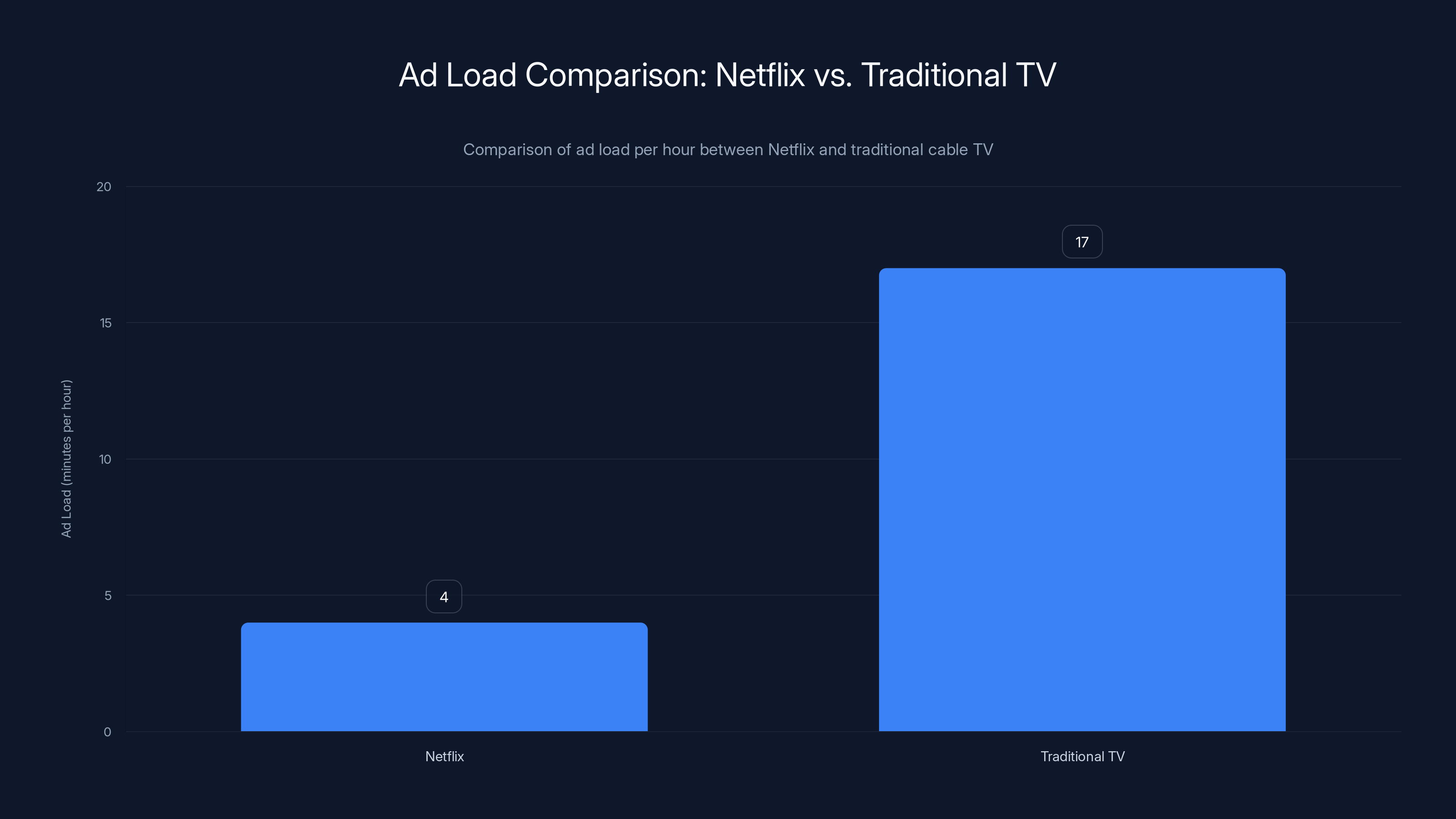

What made Netflix's approach different from other streaming services is that the company didn't rush to maximize ad load. Most services that launch ad-supported tiers immediately pack them with commercials to hit revenue targets fast. Netflix limited ads to maintain a premium experience. The goal was to keep churn low while building sustainable advertiser relationships. It's a lesson from traditional cable television: too many ads kills the product. Netflix got this right.

The Math Behind $3 Billion in 2026

When Greg Peters said Netflix expects to double advertising revenue to $3 billion in 2026, he wasn't throwing out an aggressive guess. The math is actually based on fairly conservative projections.

Start with what Netflix knows about its current business. 94 million monthly active users on the ad tier is the baseline. But that number isn't static. Netflix has added 13 million net new subscribers in 2025 alone. Not all of those will be on the ad-supported plan, but a significant portion will be. Even if ad-tier growth slows to 15-20% annually, the company reaches 108-112 million ad-tier users by end of 2026. That's 15-20% more inventory just from user growth.

Then there's average revenue per user (ARPU). Netflix's current advertising ARPU isn't publicly disclosed, but industry analysts estimate it's between

First, more sophisticated ad targeting. Netflix collects massive amounts of viewing data. The company knows what people watch, when they watch it, what devices they use, what geographic region they're in. As Netflix builds out its advertising technology platform, it can charge premium rates for targeted ad placement. A luxury brand targeting high-income viewers during premium content gets charged more than a local business targeting a broad audience.

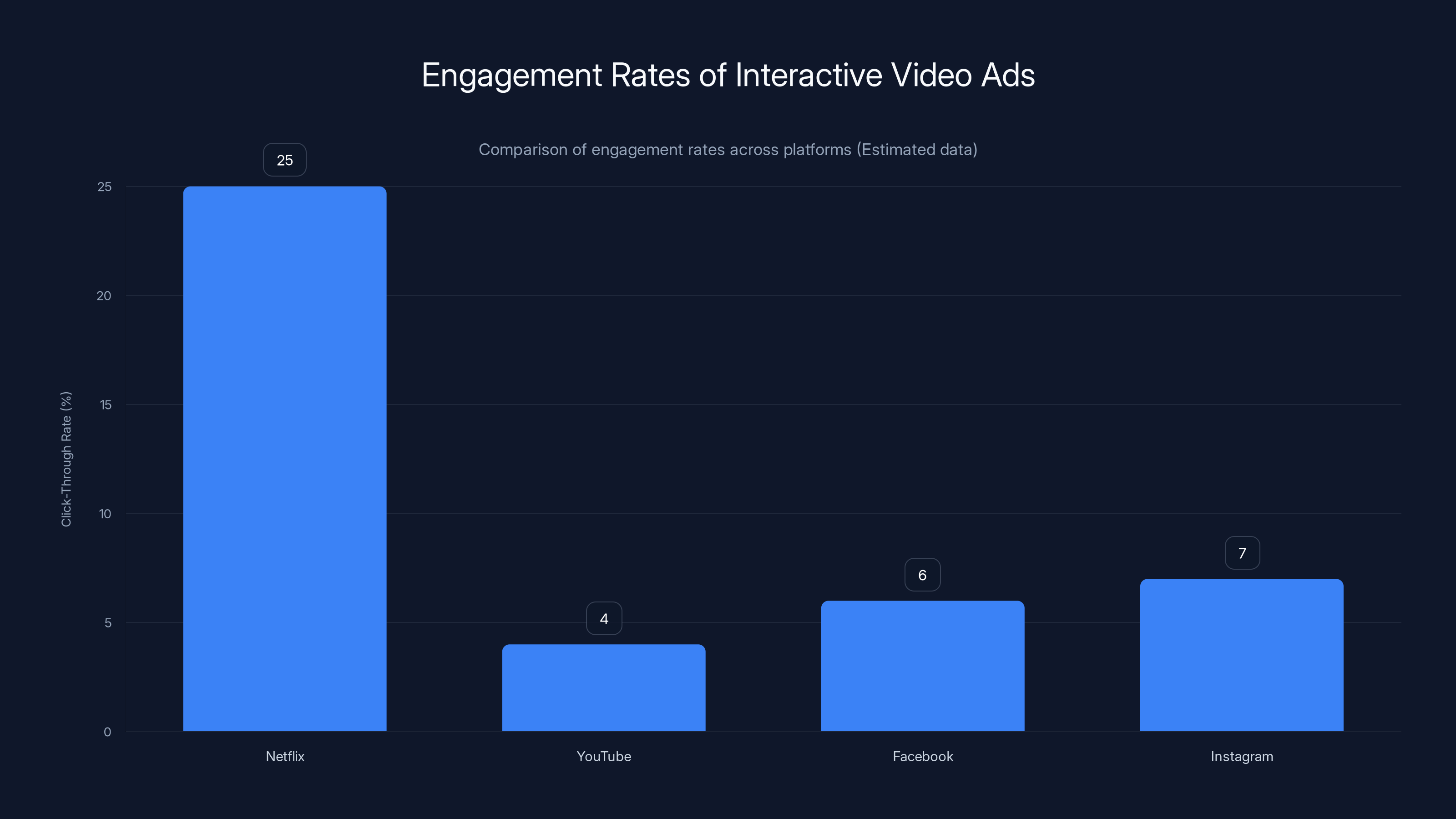

Second, interactive video ads. Netflix is launching these in Q2 2026. These aren't passive 30-second spots. They're ads where users can click to learn more, sign up, or take action without leaving the viewing experience. Brands will pay significantly more for interactive placements than for standard video ads. Industry precedent suggests interactive inventory commands 2-3x premium pricing.

Third, AI-powered advertiser tools. Netflix is building AI systems that blend brand ads seamlessly into show content. This is subtle but powerful. Instead of a commercial break that jolts you out of the show, imagine an actor wearing a branded product that naturally fits the scene. Or imagine product placement so well integrated that viewers don't consciously register it as advertising. These premium placements—what the industry calls "native advertising"—command the highest rates. A single well-integrated placement can be worth

Put these three factors together: 15-20% user growth, 20-30% ARPU growth from targeting and interactive ads, plus 30-50% growth from AI-driven premium placements. The math gets you to

Netflix's advertising revenue in 2025 was

Interactive Video Ads: The Next Evolution

When Netflix launches interactive video ads in Q2 2026, it's introducing a format that the streaming industry has largely overlooked. Interactive ads aren't new in digital marketing. Facebook, Instagram, and YouTube all have interactive options. But video-based interactive ads at scale, integrated into a content platform with 325 million subscribers, represents a different level of opportunity.

Here's what makes interactive video ads valuable. Traditional video ads are passive. You see them, you watch them (or skip them if you can), and you move on. Engagement is measured in whether someone sat through it or skipped it. Interactive video ads change the equation.

A Netflix user watching a show could see an interactive ad for a car where they can click to see different color options. Click again to configure features. Another click to see financing options. All of this happens without leaving Netflix. The brand gets direct engagement data. Netflix gets higher advertiser satisfaction and willingness to pay premium rates.

Or imagine an interactive ad for a streaming service (not Netflix). You can click to watch a trailer, add it to your watchlist, or see reviews. The brand gets leads. Netflix gets revenue. The user doesn't necessarily hate the experience because it's integrated smoothly into the viewing interface.

The key metric for interactive ads is click-through rate and engagement depth. Netflix's data indicates that users interact with about 20-30% of interactive ad placements offered. Compare that to YouTube, where typical video ad completion rates are 50-60% but click-through rates on interactive elements are often below 5%. Netflix's interactive format appears to drive higher engagement, which means advertisers see better ROI and will pay premium rates.

Where this gets really interesting is conversion tracking. Netflix can see when someone clicks an interactive ad, what they click, and whether they convert to a purchase on the advertiser's site. This direct attribution data is gold for performance marketers. A brand can see, dollar-for-dollar, what's working and what's not. That transparency justifies higher ad spend.

Expect Netflix to charge 200-400% premiums for interactive placements compared to standard video ads. If standard ads run at

The Warner Bros. Deal: Advertising Implications

In December 2025, Netflix announced an $82.7 billion deal to acquire Warner Bros.' studio, HBO, and HBO Max. Most analysis focused on content strategy and competitive positioning. But there's a massive advertising angle that deserves attention.

HBO is the most valuable advertising brand in premium television. For decades, HBO generated revenue from three sources: subscription fees, advertising on HBO/Max Channel, and brand partnerships. HBO Max launched without ads initially, but added an ad-supported tier. Now Netflix is acquiring all of that advertising infrastructure and brand equity.

What does Netflix get from the acquisition? First, massive content that drives higher engagement and longer viewing sessions. Longer sessions mean more ad inventory per user. Second, HBO's established relationships with premium advertisers. Brands have been buying HBO advertising for 50 years. Those relationships transfer to Netflix. Third, the HBO brand itself carries premium positioning. Luxury brands trust HBO. They'll trust Netflix's premium advertising platform because it carries the HBO legacy.

The advertising revenue implications are substantial. HBO's advertising business currently generates an estimated

Consider the synergies. Netflix can offer integrated packages: reach HBO Max viewers (legacy premium subscribers), plus Netflix's 94 million ad-tier users, plus the combined content library. A luxury brand wanting to reach affluent, premium audiences gets both traditional HBO prestige and Netflix's scale. That's a value proposition competitors can't match.

The deal also removes a major competitor from the advertising space. Before acquisition, HBO Max was building its own advertising platform separate from Netflix. Those resources, technology, and advertiser relationships now consolidate under Netflix's control. HBO Max's advertising capability essentially disappears as an independent player.

From a pure advertising standpoint, the Warner Bros. deal accelerates Netflix's path to

AI-Powered Ad Tools: The Game Changer

Netflix is investing heavily in AI-powered advertising tools. These tools do one fundamental thing: they help advertisers connect their brands with Netflix content in ways that feel natural and valuable to viewers.

Traditional advertising interrupts content. You're watching a show, a commercial break happens, and you wait for content to resume. It's disruptive. Audiences tolerate it on cable TV because that's the model everyone knows, but they don't love it.

AI-powered tools enable what the industry calls "brand integration" or "product placement at scale." Netflix's AI can analyze scenes from shows and movies and recommend optimal placement opportunities for brands. Imagine an AI system that reviews every episode of a hit show and identifies moments where product placement would feel natural. Then it matches those moments with relevant brands.

Here's a concrete example. A cooking show episode features a character making pasta. An AI system identifies that moment and flags it to food brands. Barilla could pay premium rates to have their pasta featured in that scene. The scene gets filmed with Barilla branding. When the episode airs, Barilla gets thousands or millions of views integrated seamlessly into content people chose to watch.

This is fundamentally different from traditional advertising. The audience isn't interrupted. They're watching content they want to watch. The brand integration is subtle enough that it doesn't destroy the viewing experience. Measurement is clearer because Netflix tracks which shows drive which brand lift metrics.

What makes Netflix's AI approach powerful is scale and automation. Manually managing product placement is expensive and time-consuming. An AI system can review hundreds of hours of content, flag placement opportunities, and match brands to opportunities automatically. This dramatically reduces the cost of production, which means Netflix can deploy the capability across more shows, reaching more placement opportunities.

Advertisers see direct ROI benefits. Instead of paying for ads that people skip or ignore, they pay for integration into premium content people actively choose to watch. Netflix captures premium pricing for these placements because the value to advertisers is demonstrably higher.

Expect Netflix's AI ad tools to become a competitive advantage that persists for years. Building this capability requires deep content expertise, AI sophistication, and advertiser relationship management. Competitors can build similar tools, but Netflix's head start and content library depth gives it structural advantages.

Netflix maintains a lighter ad load of 3-5 minutes per hour compared to traditional TV's 16-18 minutes, preserving user experience while generating revenue.

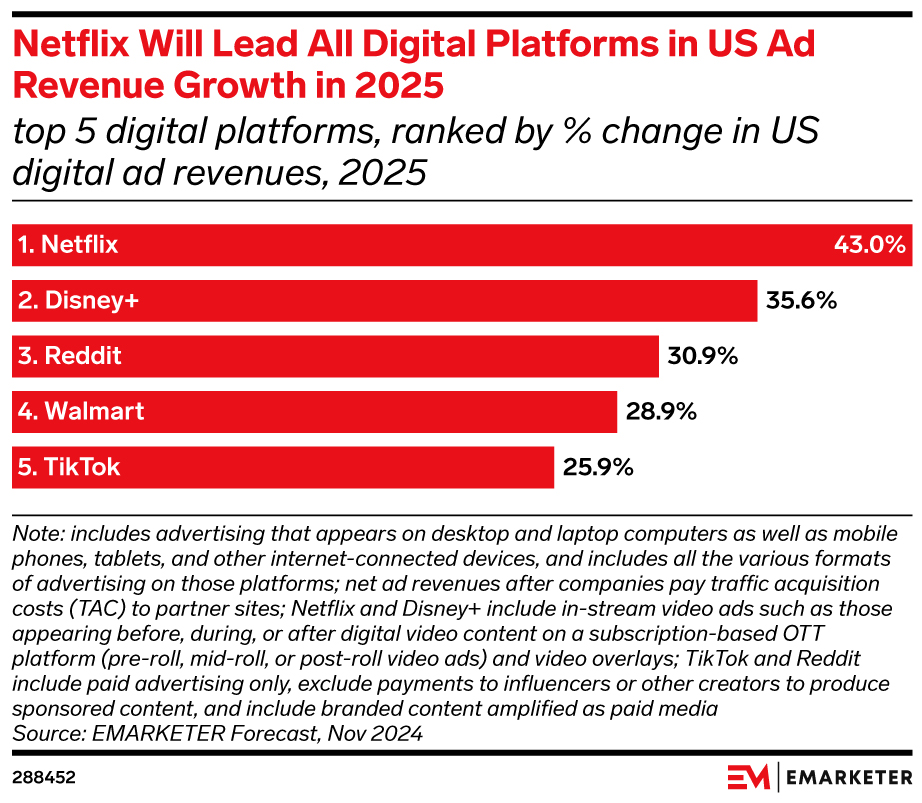

How Netflix's Ad Tier Compares to Competitors

Netflix isn't alone in the advertising space. Disney+, HBO Max (now owned by Netflix), Amazon Prime Video, and other services all offer ad-supported tiers. But Netflix's execution stands out in meaningful ways.

Ad Load: Netflix runs fewer ads than most competitors. The company limits ads to maintain premium positioning. This means lower revenue per user than competitors could theoretically achieve, but higher user satisfaction and lower churn. Netflix optimized for retention over short-term revenue extraction.

Advertiser Tools: Netflix's AI integration tools and interactive ad formats outpace what competitors offer. Disney+ has basic advertising. Prime Video has basic advertising. Hulu has traditional ad breaks. Netflix is building sophisticated, AI-driven, interactive formats. This gives Netflix's advertising platform a feature advantage.

Audience Data: Netflix's recommendation algorithm gives the company unmatched understanding of viewer behavior and preferences. This data feeds into targeting systems that are more sophisticated than what competitors deploy. Advertisers on Netflix can reach more precisely defined audiences than on competing platforms.

User Base Quality: Netflix's 94 million ad-tier users skew toward affluent, media-consuming audiences. Disney+ and Prime Video have massive user bases, but include more casual viewers. Premium advertisers prefer Netflix's audience quality.

Content Integration: Netflix's content library and production capabilities allow for more sophisticated native advertising. The company produces content domestically and internationally, which creates more natural product placement opportunities than services that rely primarily on licensed content.

The competitive advantage Netflix built in advertising isn't easily replicated. It comes from content strategy, technology investment, and advertiser relationship management. Competitors are playing catch-up.

The Pricing Architecture Behind Netflix's Ad Revenue

Understanding how Netflix actually prices advertising requires understanding several layers: inventory, audience, format, and placement.

Inventory Pricing: Netflix sells advertising by impressions (CPM, cost per thousand impressions). The base rate varies by geography and audience segment. In the United States, Netflix's CPM likely ranges from $25-50 depending on content. Premium content (shows with large audiences, loyal fanbases) commands higher CPM. Niche content commands lower CPM.

Audience Multiplier: Netflix can charge premium rates for precise audience targeting. A brand that wants to reach women aged 25-34 interested in true crime gets charged more than a brand willing to accept broad reach. Netflix's data allows for precise targeting, which justifies premium pricing.

Format Premium: Interactive ads command higher rates than passive video ads. Premium placements (product integration) command higher rates than ad breaks. These are 2-5x multipliers on base CPM.

Volume Discount: Large advertisers buying long-term commitments get volume discounts. A brand committing to $10 million in annual spend might negotiate rates 15-25% below list price. This is standard in advertising.

Netflix's revenue per ad-tier user (

Advertiser Demand: Why Brands Care About Netflix

Advertisers aren't flocking to Netflix just because the platform has users. They care about Netflix because the company solves specific advertiser problems that traditional media and YouTube don't solve as well.

Premium Content Context: Brands want their ads next to premium, engaging content. Netflix's shows and movies command intense audience attention. Unlike YouTube, where ads appear next to user-generated content of inconsistent quality, Netflix advertising always appears in premium environments. Luxury brands, consumer packaged goods companies, and automotive brands value this context premium.

Affluent Audience: Netflix's user base skews affluent with discretionary spending power. That's different from YouTube's massive but more economically diverse user base. For high-margin products, reaching affluent audiences at higher CPM rates delivers better ROI than reaching broad audiences at low CPM.

Measurement: Netflix can provide detailed performance data to advertisers. Impressions, engagement, conversion tracking, and audience sentiment can all be measured. This is sophisticated compared to traditional television but comparable to YouTube. Advertisers value measurement.

Brand Safety: Netflix moderates content to maintain advertiser safety. Brands know their ads won't appear adjacent to controversy, harmful content, or brand-unsafe environments. This is a major advantage over YouTube, where brand safety issues remain persistent.

Creative Opportunity: Netflix's interactive ad format and AI integration tools create creative opportunities that don't exist on other platforms. Brands can experiment with new formats and potentially capture audience attention more effectively.

Advertiser demand for Netflix inventory is strong and growing. In fact, it appears to be the primary constraint on Netflix's advertising growth, not supply. Netflix could theoretically load more ads onto the platform and make significantly more revenue. That it's choosing not to suggests advertiser demand is robust enough that Netflix can be selective and maintain pricing power.

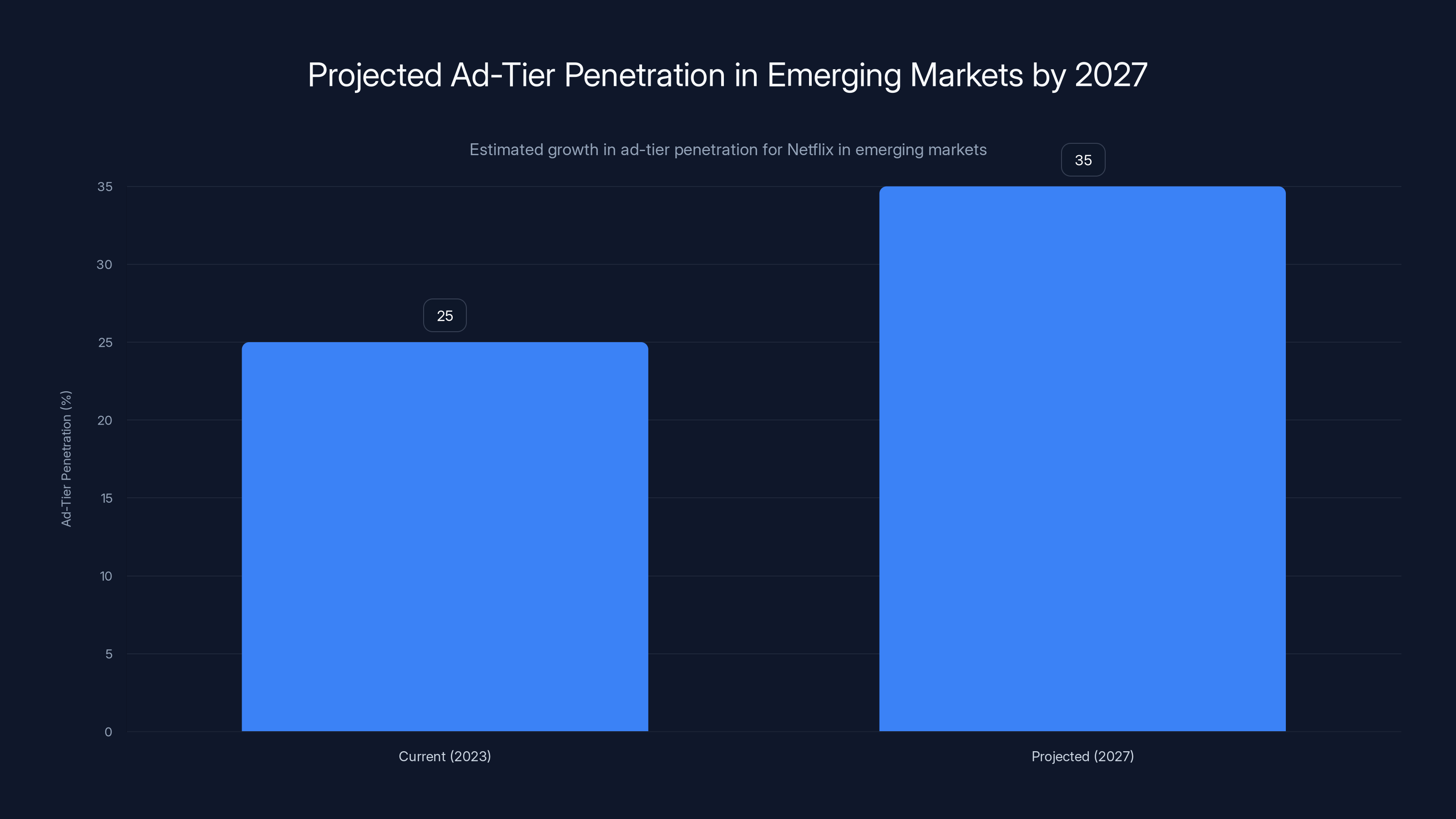

Estimated data shows Netflix's ad-tier penetration in emerging markets could grow from 25% in 2023 to 35% by 2027, unlocking significant revenue potential.

User Experience: How Netflix Balances Ads Without Breaking the Service

The biggest risk Netflix faces with advertising is killing the user experience. If ads become too intrusive, too frequent, or too disruptive, churn accelerates. Premium users get frustrated. The entire advertising advantage collapses if the product becomes unusable.

Netflix appears to have learned lessons from cable television and from Hulu's advertising experience. Hulu spent years iterating on ad load before getting to a sustainable model. Netflix is being more conservative, which suggests the company learned from others' mistakes.

Currently, Netflix ad-tier users encounter ads in two places: before content starts and during content. The company has not deployed mid-roll ads aggressively (ads in the middle of shows). This is a major concession compared to traditional TV, where mid-roll ad breaks are standard. By limiting ads to beginning and end, Netflix maintains reasonable user experience while still generating substantial revenue.

Ad frequency appears to be roughly 3-5 minutes of ads per hour of content. Compare that to traditional cable television, which runs 16-18 minutes of ads per hour. Netflix's ad load is substantially lighter, which maintains premium positioning and user satisfaction.

The company is also deploying ads intelligently based on content. A 30-minute sitcom episode might have fewer ads than a 90-minute movie. A show aimed at children has no ads (another Netflix constraint that protects user experience for younger audiences).

Interactive ad placements and AI-integrated product placement represent additional ways Netflix can grow advertising revenue without increasing ad frequency. Instead of more ads, Netflix can deploy higher-value ads. This is a smarter strategy than other services have pursued.

Looking forward, the question is how much room Netflix has to increase ad load without degrading user experience. Industry data suggests ad load could increase to 8-10 minutes per hour before churn accelerates materially. That would represent 60-70% more ad inventory from the current baseline. If Netflix maintains current CPM rates, that's another

The $82.7 Billion Warner Bros. Strategic Bet

The Warner Bros. acquisition is partially about content strategy, but it's also partially about advertising infrastructure. Netflix is acquiring HBO's brand, content library, and most importantly, HBO's relationships with premium advertisers who have been buying HBO advertising for 50+ years.

Consider what Netflix gains: HBO carries immense brand prestige. Luxury brands that wouldn't necessarily trust Netflix's advertising platform directly will trust Netflix because it now owns HBO. That credibility transfer is worth billions in potential advertising revenue.

Second, the acquisition removes a competitor. HBO Max was building its own advertising platform. That no longer happens. HBO's advertising business consolidates under Netflix. Resources that HBO was deploying to build independent advertising capability now deploy toward Netflix's platform.

Third, content synergies. HBO's premium scripted drama and sports content (though sports is being spun off separately) create inventory for premium advertising placements. Netflix's comedy and unscripted content create different inventory opportunities. Combined, Netflix has programming diversity that supports premium advertising across more genres and demographics.

The acquisition's strategic implications for advertising are underappreciated in most analysis. The company just acquired one of the most valuable advertising franchises in media history. HBO's advertising business has generated billions in revenue over decades. Netflix is integrating that business into a modern, data-driven, AI-powered platform. The leverage is enormous.

Expect the acquisition to accelerate Netflix's advertising growth significantly. Within 24 months of integration completing, the company should see meaningful contributions to advertising revenue from combined HBO and Netflix operations.

Competitive Threats: Disney, Amazon, and the Industry Response

Disney and Amazon understand what Netflix has accomplished with advertising. Both companies are investing in their own advertising platforms and attempting to replicate Netflix's success. Neither company is giving up easily.

Disney+: Disney has deployed advertising on Disney+ and Hulu, with some integrated capabilities. But Disney hasn't matched Netflix's sophistication in ad technology or ad formats. Disney is catching up but remains behind Netflix's curve. Disney's advantage is content (Star Wars, Marvel, Disney films) but that doesn't necessarily translate to superior advertising infrastructure.

Amazon Prime Video: Amazon has the advertising technology expertise (from Amazon Ads, which powers advertising across the Amazon platform). But Amazon hasn't deployed that technology into Prime Video's advertising platform as aggressively as Netflix has. Prime Video's advertising platform is functional but not compelling compared to Netflix's offerings. Amazon appears to be treating advertising as secondary to subscription revenue, while Netflix is treating it as primary.

YouTube: YouTube remains the dominant digital advertising platform with CPM rates that often exceed Netflix's. But YouTube's audience is economically diverse and brand safety is a constant concern. Netflix's premium positioning in a specific demographic could capture premium advertising spend that YouTube can't easily displace.

Traditional TV: Network television and cable are losing advertising budgets to streaming. Netflix is directly competing for the premium advertising dollars that used to flow to HBO, premium cable networks, and broadcast networks. Netflix is winning that competition because it offers better targeting, measurement, and ROI than traditional TV.

The competitive landscape is clear: Netflix is winning the streaming advertising race. Competitors are playing catch-up. Netflix's head start in technology, content, and advertiser relationships gives the company structural advantages that will be difficult to overcome.

Netflix's interactive video ads are estimated to achieve a 25% click-through rate, significantly outperforming YouTube's 4% and other social platforms. Estimated data.

Revenue Per User: The Math Gets Interesting

Netflix currently generates approximately

For context, YouTube generates roughly

If Netflix increases advertising ARPU to

The path from

- User growth of 15-20% (from 94 million to 108-112 million)

- ARPU growth of 25-30% (from 20-21 per user annually)

- Combined = 40-50% revenue growth, which gets Netflix to $2.1-2.25 billion

- Interactive ads, AI placement tools, and premium formats add another 30-40% on top

- Result: 3 billion target

The math is compelling and realistic based on industry benchmarks. Netflix isn't making optimistic assumptions. The company is extrapolating from observable trends in user growth, ARPU expansion, and format evolution.

International Expansion: The Untapped Market

Most of Netflix's current advertising growth is concentrated in North America and Europe. The company's 94 million ad-tier users are primarily in developed markets where advertising infrastructure, measurement, and advertiser sophistication are highest.

But Netflix has 325 million total subscribers globally. Most of those are in developed markets, but a growing portion are in emerging markets (Latin America, Asia, Middle East, Africa). Ad-supported penetration in emerging markets is significantly lower than in developed markets.

As Netflix expands advertising infrastructure into emerging markets, three things happen: (1) ad-tier adoption accelerates because pricing is lower and more relevant to local purchasing power, (2) advertiser participation grows as local and regional brands recognize Netflix as a valuable channel, and (3) CPM rates may be lower in emerging markets but volume more than compensates.

Mexico, Brazil, and India represent massive advertising opportunities. These countries have large populations, growing middle classes, and emerging digital advertising markets. Netflix's advertising business in these regions is nascent. Growth potential is enormous.

If Netflix can achieve 30-40% ad-tier penetration in emerging market regions by 2027 (versus current 20-30%), the company adds another 40-60 million ad-tier users. That's an immediate

International expansion is one of the highest-upside opportunities for Netflix's advertising business. Most investor analysis focuses on North America and Europe. The real growth lever is emerging markets.

The Long-Term Trajectory: From 5+ Billion

Netflix's path doesn't end at

The path involves several elements: continued user growth (new subscribers to the ad tier), ARPU expansion (better targeting, premium formats, international monetization), content library growth (HBO content adds advertising inventory), and advertising market maturation (more advertisers allocating budget to streaming versus traditional TV).

Specifically, if Netflix achieves:

- 150+ million ad-tier users by 2028 (58% growth from 2025)

- 16)

- Maintained CPM rates from improved content and targeting

- Full integration of HBO advertising properties

The company could realistically achieve $4.5-5 billion in advertising revenue by 2028-2029.

That would make Netflix's advertising business larger than most major media companies' entire revenue. Netflix would be competing with Disney, Paramount, and Fox for share of premium advertising budgets.

This trajectory also assumes Netflix doesn't face significant competitive disruption or advertiser market changes. That's an assumption worth monitoring. If competitors successfully deploy competing advertising platforms or if broader economic changes reduce advertising spend, projections adjust downward.

But the base case, assuming stable execution and market conditions, points toward Netflix becoming one of the top 3-5 advertising platforms globally by revenue within 3-4 years. That's a remarkable transformation from a company that fundamentally opposed advertising five years ago.

Netflix's ad pricing is influenced by various factors, with format premiums potentially tripling the base CPM. Estimated data.

What This Means for Consumers and the Streaming Industry

Netflix's advertising success has implications beyond Netflix. It signals to the broader streaming industry that advertising-supported tiers are viable and valuable. Every major streaming service is now investing in advertising infrastructure. The entire industry is pivoting toward advertising as a primary revenue lever.

For consumers, this means the ad-free streaming experience is becoming less common. Most future streaming services will have ad-supported tiers. Premium ad-free tiers will still exist but will command higher prices. The economics of content production are shifting toward model where advertising subsidizes content costs.

For the media industry broadly, this represents a fundamental shift. Advertising budgets that historically flowed to cable, network TV, and YouTube are migrating to streaming. Netflix's $1.5 billion in advertising revenue in 2025 represents dollars not spent on traditional media. That trend accelerates as streaming advertising becomes more sophisticated.

For brands and advertisers, streaming advertising becomes increasingly important. Netflix's premium inventory, sophisticated targeting, and measurement capabilities make streaming attractive for premium campaigns. The ability to reach affluent audiences in premium content contexts is valuable. Expect advertising spend to continue flowing toward streaming at the expense of traditional TV.

The emerging model is this: consumers can choose ad-free premium experience at

This model works if Netflix maintains reasonable user experience (not too many ads, ads are relevant, content is premium). Netflix appears to understand this balance. The company is constraining ad load and improving ad relevance through AI and targeting. This disciplined approach is why Netflix's advertising business can continue growing without destroying the core streaming business.

Future Challenges and Uncertainties

Netflix's advertising trajectory is compelling but not guaranteed. Several risks could disrupt the growth story.

Regulatory Scrutiny: Advertising regulation is increasingly strict globally. Netflix could face constraints on how it collects data for targeting, how it prices advertising, or how it integrates ads into content. European regulations in particular are getting tighter. Netflix has to navigate these constraints without compromising advertiser value.

Competitive Intensity: If Disney, Amazon, or YouTube successfully deploy compelling advertising alternatives, Netflix's growth could slow. The advertising market is large enough for multiple players, but Netflix's premium positioning could be undermined if competitors offer better targeting or lower prices.

User Retention: If ad load increases too aggressively, churn accelerates. Netflix has to balance revenue extraction with user satisfaction. The company seems disciplined on this front, but temptation to maximize advertising revenue could lead to mistakes.

Technology Execution: Netflix's AI advertising tools and interactive formats have to work reliably. If advertisers have bad experiences or get poor ROI, advertiser confidence erodes. Technology execution is critical.

Macroeconomic Headwinds: If global economic conditions worsen, advertising budgets contract. Netflix's advertising revenue is exposed to macro cyclicality like all advertising businesses. A recession could impact growth significantly.

Creator Pushback: As Netflix integrates more advertising into content, creators might resist. If creators feel their artistic vision is compromised by advertising integration, Netflix could face reputation damage. This is particularly true for prestige drama and film content.

These risks are real but manageable. Netflix's management team has successfully navigated challenges before. The advertising business appears well-positioned to overcome most of these obstacles. But uncertainty persists, and investors should account for it.

The Broader Streaming Wars Context

Netflix's advertising success doesn't exist in isolation. It's part of the broader streaming wars where multiple services compete for subscriber and advertising dollars.

Disney+ is consolidating content (adding Star content internationally). HBO Max has merged with Discovery+. Amazon Prime Video is investing aggressively in original content. YouTube maintains dominant advertising share. Everyone is trying to build sustainable, profitable streaming businesses while competing for scarce consumer attention and advertising spend.

Netflix's advantage in this environment is scale, technology sophistication, and global reach. Netflix has 325 million subscribers, the most of any service. Netflix's advertising technology is more advanced than most competitors. Netflix's content library is globally diverse. These advantages compound. A company with advantages in reach, technology, and content can invest more in all three, widening the gap versus competitors.

In streaming wars contexts, leaders tend to maintain leadership. Once Netflix builds advantages in advertising technology, content, and scale, competitors have to run faster just to keep pace. The likelihood that a competitor will overtake Netflix in advertising is low. More likely, Netflix maintains or extends its advertising leadership.

That doesn't mean competitors won't succeed. Disney+, HBO Max, and Prime Video will all build meaningful advertising businesses. But Netflix will likely remain the largest and most sophisticated streaming advertising platform. That positioning is valuable and defensible.

Advertising as Strategic Pivot

Looking back, Netflix's decision to launch advertising in 2022 was a strategic inflection point. At the time, it felt like a concession. The company was under pressure to grow, faced churn from password sharing, and needed new revenue sources. Advertising looked like a desperation move.

In retrospect, it was brilliant strategic positioning. Netflix didn't just add an ad-supported tier. The company built a modern, data-driven, AI-powered advertising platform designed from the ground up to compete with television networks, YouTube, and digital advertising platforms.

The advertising move also allowed Netflix to reposition its business. Instead of a pure subscription service with slowing growth, Netflix became a diversified media company with subscription and advertising revenue. That positioning is more valuable to investors and more defensible against competition.

Additionally, advertising allowed Netflix to address the low-ARPU problem in emerging markets. Many potential Netflix subscribers in Latin America, Asia, and Africa couldn't afford

The strategic pivot from pure subscription to subscription-plus-advertising fundamentally changed Netflix's growth trajectory and business profile. The company went from maturity and slowing growth to a business with multiple growth levers. That shift is playing out over 2025-2026, and it's providing substantial value to investors.

Implications for Cord-Cutting and Traditional Media

Streaming advertising doesn't exist in isolation from traditional media. It's actively destroying the business model of cable television and network TV.

Traditional broadcasters and cable networks built their business models on advertising. They gathered audiences and sold access to those audiences to advertisers. As audiences migrate to streaming, advertising budgets follow. Netflix's $1.5 billion in advertising revenue is partly new money being created (because Netflix reaches audiences that traditional media couldn't), but it's also partly dollars that previously went to cable and broadcast.

For every dollar Netflix captures in advertising, traditional media loses that dollar. Given Netflix's global reach and premium positioning, Netflix is capturing disproportionately valuable advertising dollars that would have gone to premium cable networks and broadcast premium programming.

This dynamic accelerates cord-cutting. Cable networks lose both subscription revenue (subscribers leaving for streaming) and advertising revenue (advertisers moving to streaming). That double loss makes cable business model increasingly unsustainable. We're watching the end of cable television in real time, accelerated by Netflix's success in advertising.

The transition doesn't happen overnight. But the direction is clear. Advertising dollars migrate to streaming. Cable and traditional TV struggle to compete. Surviving cable networks consolidate or disappear. Remaining players become niche or specialty channels.

Netflix's advertising business is central to this transformation. The company isn't just growing a business. The company is redefining how media and advertising work in the age of streaming.

FAQ

How much did Netflix earn from advertising in 2025?

Netflix earned $1.5 billion from advertising in 2025, more than doubling the previous year's revenue. This represents the company's first full year with material advertising contribution, driven by the ad-supported tier reaching 94 million monthly active users.

How many users are on Netflix's ad-supported tier?

Netflix's ad-supported tier reached 94 million monthly active users as of May 2025. This represents roughly 29% of Netflix's total 325 million subscriber base. The ad tier has grown faster than premium tiers, indicating strong consumer demand for lower-priced, ad-supported streaming options.

What interactive video ads and when will they launch?

Netflix plans to launch interactive video ads in Q2 2026. These ads allow users to click and engage with branded content without leaving the Netflix experience. Users can view product options, access financing information, or take other actions directly within the ad unit. Interactive placements are expected to command premium pricing 2-3x higher than standard video ads.

How does Netflix's advertising revenue compare to competitors?

Netflix's advertising business is larger and more sophisticated than most competitors. Disney+ has basic advertising but hasn't deployed Netflix's level of targeting or interactive formats. Amazon Prime Video has advertising capabilities but doesn't emphasize advertising as a revenue priority. Hulu has established advertising but generates lower revenue per user than Netflix. YouTube remains the largest advertising platform but operates in a different category (user-generated content plus premium content).

What is Netflix's advertising revenue target for 2026?

Netflix expects advertising revenue to roughly double to $3 billion in 2026, according to co-CEO Greg Peters during the Q4 2025 earnings call. This assumes continued growth in ad-tier users, improved targeting and ARPU, and contribution from newly launched interactive ad formats.

How does the Warner Bros. acquisition impact Netflix's advertising business?

The

What AI-powered advertising tools is Netflix developing?

Netflix is building AI systems that identify product placement opportunities within shows and movies, then match those opportunities with relevant brands. These native advertising placements feel integrated into content rather than disruptive, commanding premium pricing. The company is also developing interactive video ad capabilities and improved targeting algorithms that use viewing data to reach specific audience segments more effectively.

How many ads does Netflix show compared to cable TV?

Netflix shows roughly 3-5 minutes of ads per hour of content on the ad-supported tier. Cable television shows 16-18 minutes of ads per hour. Netflix's lighter ad load is intentional, designed to maintain premium user experience and competitive positioning versus pure advertising platforms. The company prioritizes retention and satisfaction over maximum short-term advertising revenue.

What percentage of Netflix subscribers use the ad-supported tier?

Approximately 29% of Netflix's 325 million total subscribers (94 million users) have ad-supported tier memberships as of May 2025. Ad-tier growth is outpacing premium tier growth, indicating the price point and value proposition are attractive to consumers. Penetration varies by geography, with higher adoption in North America and Europe versus emerging markets.

Will Netflix increase ad load in the future?

Netflix could theoretically increase ad load from current 3-5 minutes per hour to 8-10 minutes per hour (comparable to premium cable) before experiencing meaningful churn. Industry analysis suggests 60-70% more advertising inventory is possible without destroying user experience. However, Netflix appears to be prioritizing format evolution (interactive ads, premium placements) over volume increases, suggesting confidence that higher-value ad formats will drive revenue growth more efficiently than higher volume.

Conclusion: The Advertising Business Netflix Built

Netflix didn't invent streaming advertising. But the company did something arguably more valuable: the company proved that premium streaming advertising could be built into a sustainable, growing business without destroying the core product.

The $1.5 billion in advertising revenue Netflix earned in 2025 represents vindication of a strategic bet made three years ago when the company launched an ad-supported tier that nobody was certain consumers would accept. Turns out consumers were willing to accept ads if the price was right. Turns out advertisers were willing to pay premium rates to reach Netflix's engaged, affluent, premium-content-consuming audiences.

The path from

What makes this more interesting is what happens after 2026. If Netflix maintains execution, the advertising business could reach $4-5 billion by 2028-2029. At that scale, Netflix's advertising business would be larger than most media companies' entire revenues. Netflix would be a top-5 global advertising platform by revenue. The company's original mission was to disrupt entertainment and replace cable. Turns out Netflix is also disrupting advertising and replacing traditional TV advertising revenue streams.

For investors, Netflix's advertising business represents a significant and growing revenue stream with margins that appear attractive based on publicly available information. For consumers, it represents lower-cost access to premium content at the price of watching ads. For brands and advertisers, it represents a premium inventory opportunity with sophisticated targeting and measurement capabilities. For the broader media industry, it represents the ongoing transformation from traditional to streaming.

The story of Netflix advertising is still in early chapters. $1.5 billion is impressive, but it's just the beginning. The trajectory Netflix is on suggests the company will be one of the world's largest and most sophisticated advertising platforms within 3-5 years. That wasn't the company's original vision, but it's becoming the company's future reality. And that reality is reshaping the entire media and advertising landscape in the process.

The next 12 months will be critical. Interactive ads need to deliver value to both advertisers and users. AI tools need to work reliably. International expansion needs to accelerate. Competition will intensify from Disney, Amazon, and other platforms desperate to match Netflix's advertising infrastructure. If Netflix executes well against these challenges, the company hits $3 billion in 2026 and establishes dominance in streaming advertising that will persist for years. If Netflix stumbles, competitors catch up and the opportunity compresses. For now, Netflix appears to be executing, and the advertising business appears to be growing as expected. That trajectory is worth watching closely over the coming year.

Key Takeaways

- Netflix earned $1.5 billion from advertising in 2025, more than doubling prior year revenue, with 94 million monthly active users on the ad-supported tier

- The company projects advertising revenue to reach $3 billion in 2026 through user growth, improved targeting, and new interactive ad formats launching in Q2

- Netflix's 300-500 million annual advertising potential

- Interactive video ads and AI-powered product placement tools will enable Netflix to increase revenue per user by 25-30% without increasing ad load or degrading user experience

- Netflix's advertising business is accelerating cord-cutting by capturing premium advertising dollars from traditional TV networks and cable, while international expansion offers additional growth opportunities

Related Articles

- Disney+ and Hulu Bundle Deal: Complete Guide to Streaming Savings [2025]

- Disney+ Hulu Bundle Deal: $10 First Month [2025]

- ChatGPT Ads Are Coming: Everything You Need to Know [2025]

- Disney+ and Hulu Bundle Deal: Complete 2025 Breakdown [Guide]

- Watch Shoresy Season 5 Free: Complete Streaming Guide [2025]

- Spotify Price Hike 2025: What You Need to Know [Analysis]

![Netflix Ads Revenue Hits $1.5B in 2025: What This Means [2025]](https://tryrunable.com/blog/netflix-ads-revenue-hits-1-5b-in-2025-what-this-means-2025/image-1-1768952304678.jpg)