Understanding Chat GPT's Youth Dominance in India's AI Boom

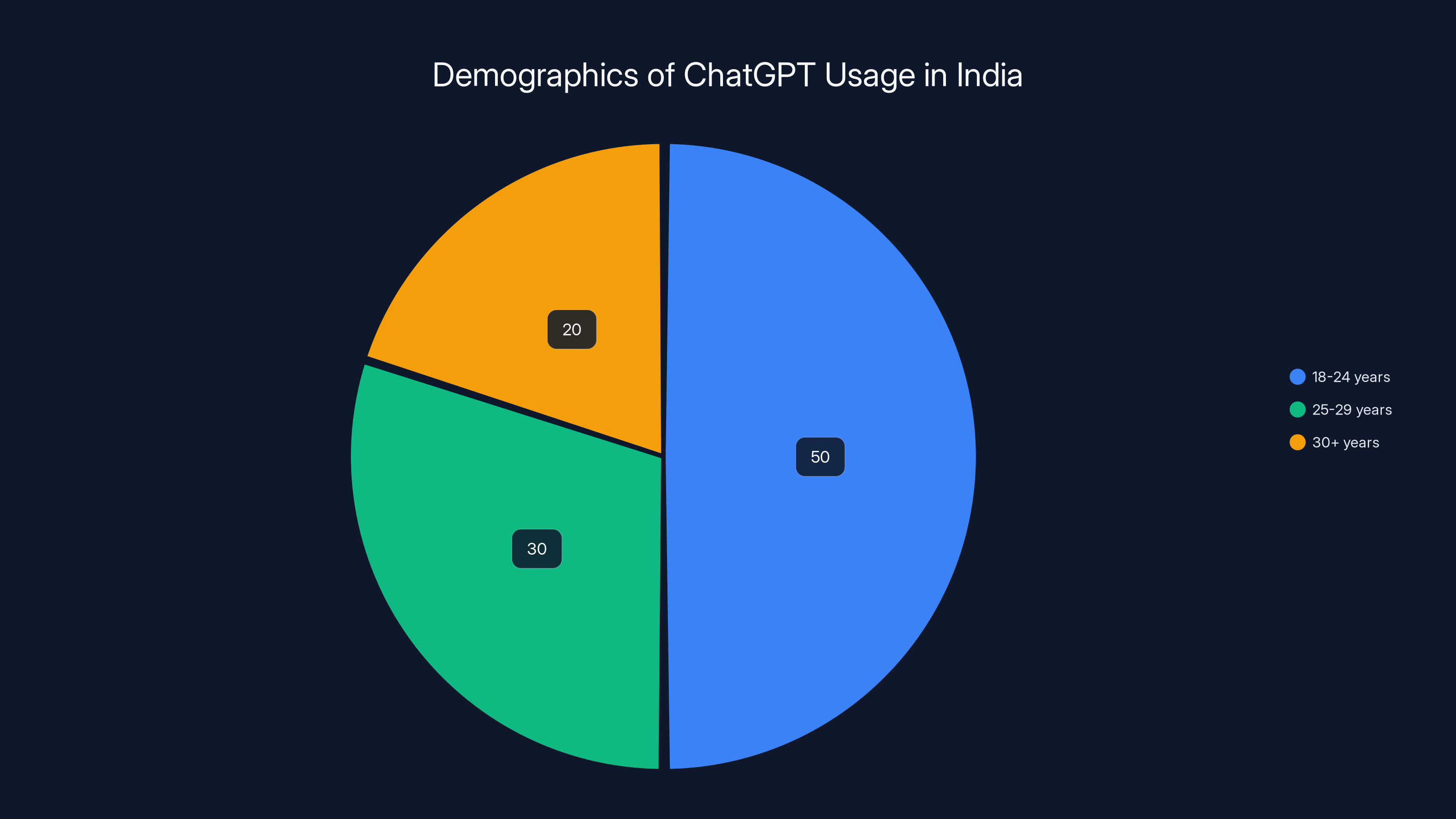

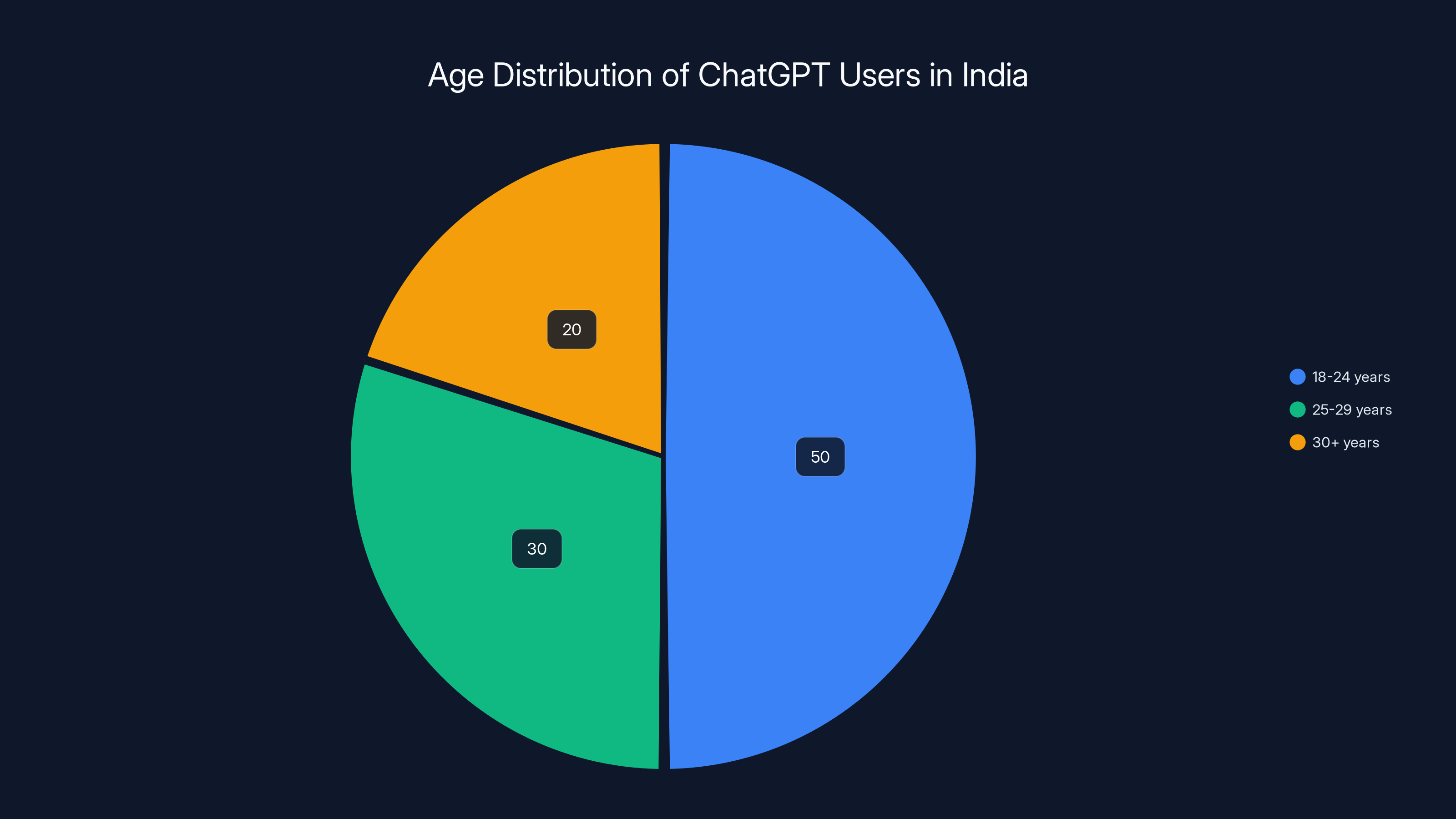

There's something happening in India that most Western tech observers are still catching up to. While conversations in Silicon Valley and San Francisco focus on whether AI adoption is slowing, India's data tells a completely different story. The numbers are staggering enough to make any product manager sit up straight: nearly 50% of all messages sent to Chat GPT in India come from users between 18 and 24 years old, as reported by Storyboard18. Even more remarkable, users under 30 account for 80% of all Chat GPT usage in the country.

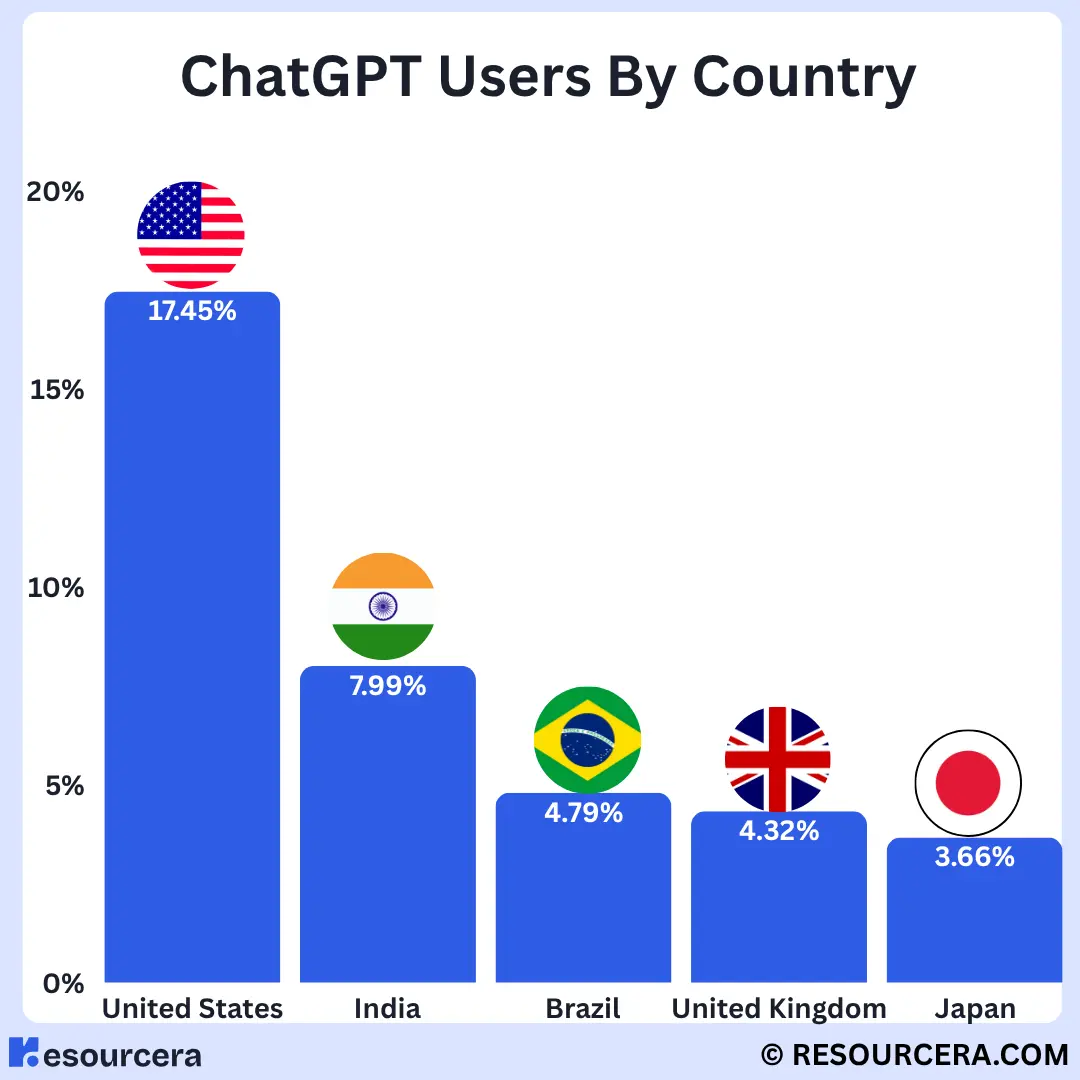

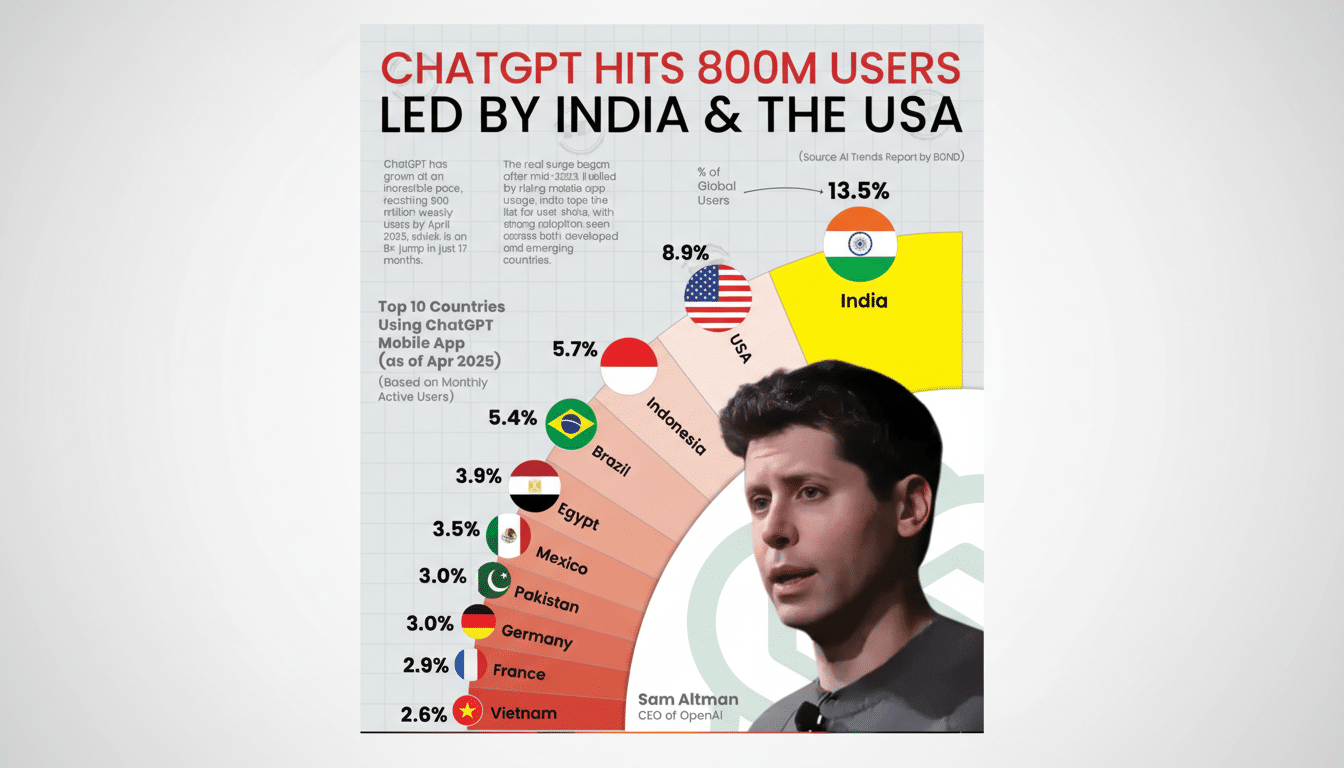

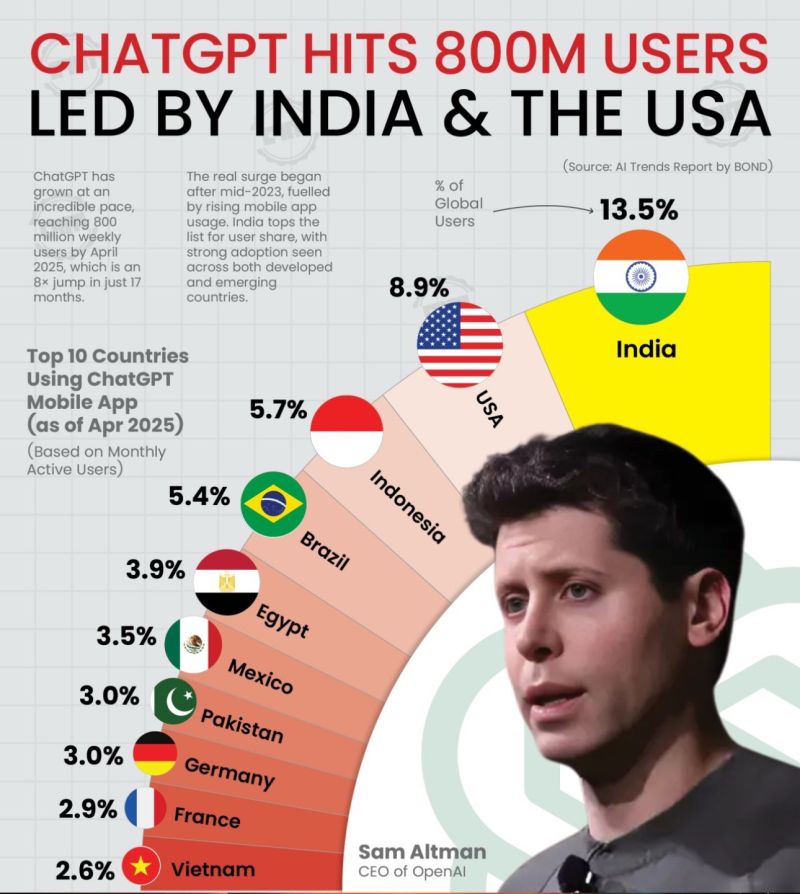

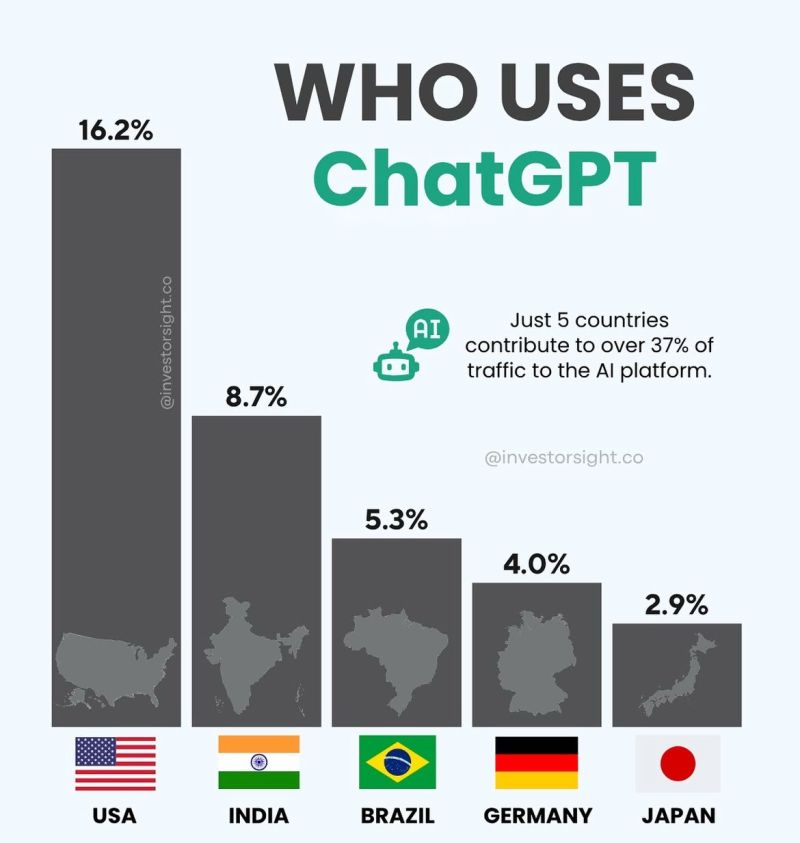

To put this in perspective, these aren't marginal differences. These are generational divides that would make demographers take notice. You're looking at a country where young people haven't just adopted an AI tool—they've integrated it into their daily professional and educational lives at a scale that's unprecedented. India is now Open AI's second-largest market with over 100 million weekly active users, according to Reuters, and the demographic breakdown reveals something crucial about where AI adoption is really happening.

The temptation is to treat this as just another tech adoption curve. Younger people use new technology first, right? But dig deeper into the numbers and you'll find something more nuanced. Indians aren't just using Chat GPT as a curiosity. They're using it to solve real problems: building careers in software engineering, navigating complex job markets, and accessing educational opportunities that were previously out of reach. The platform has become essential infrastructure for millions of young Indians trying to compete in a global economy.

What makes India's adoption pattern particularly fascinating is the speed and depth. While developed markets like the United States have seen years of gradual technology adoption, India's youth have compressed decades of digital transformation into months. They've leapfrogged traditional learning methods entirely. A 22-year-old engineering student in Bangalore today isn't using Chat GPT as a supplementary tool—it's their primary learning partner. They're using it to understand algorithms, debug code, prepare for job interviews, and master skills that employers actually want.

Open AI has noticed this pattern and responded strategically. The company has made specific bets on India that go far beyond hoping for adoption. They've introduced a sub-$5 subscription tier specifically priced for Indian economic conditions. They've launched promotional campaigns. They're opening offices in Mumbai and Bengaluru. They've secured partnerships with massive conglomerates like Tata Group. These aren't passive moves—these are the actions of a company that sees India not as a secondary market, but as the future.

The broader context matters too. India is home to over 1.4 billion people, a substantial portion of whom are under 30. The country has a young, educated workforce hungry for tools that level the playing field globally. Previous generation tools required expensive subscriptions, required English proficiency that wasn't universal, or required computational resources most Indians didn't have access to. Chat GPT removed several of these barriers simultaneously. It works on smartphones. It's accessible over any internet connection. It works in multiple languages. And at $4.99 per month, it's affordable.

The Demographics Behind the Numbers: Who's Actually Using Chat GPT in India

When Open AI released usage statistics for India, they didn't just reveal adoption numbers. They revealed a window into how AI is being integrated into the lives of young Indians. Breaking down the 18-24 age group reveals some critical insights about this demographic.

First, understand the economic context. India has one of the world's youngest populations, with a median age around 27 years old. This means that the 18-24 age bracket represents a massive cohort by absolute numbers. But numbers alone don't explain the 50% concentration of Chat GPT messages. What's driving this isn't just population size—it's a perfect storm of economic incentive, educational hunger, and technological accessibility.

The typical Chat GPT user in this age group in India is likely a college student or early-career professional. They're not necessarily wealthy. Many are using the platform on smartphones because desktops aren't affordable. They're accessing it through Wi-Fi at colleges, internet cafes, or home connections that might be unreliable. Despite these constraints, they're finding ways to integrate Chat GPT into their lives because the tool solves specific, immediate problems.

For engineering students, Chat GPT is essentially a free tutor available 24/7. Code explanations that might cost hundreds of rupees per hour in private tutoring are available instantly. For commerce students, it's research assistance that never gets tired. For aspiring professionals in any field, it's interview prep, resume building, and skill development combined.

The secondary cohort—users aged 24-30—adds another 30% to the total, bringing under-30 usage to 80%. This group typically includes young professionals in their first few jobs, early entrepreneurs, and graduate students. They use Chat GPT differently than the college-aged cohort. Where the 18-24 group uses it for learning fundamentals, the 24-30 group uses it for productivity and professional advancement. They're automating routine work. They're writing better emails. They're preparing presentations. They're handling customer communications more effectively.

What's notable is what's NOT in the data: older age groups are significantly underrepresented. Users over 30 account for just 20% of usage. This suggests a strong age-bias toward digital natives and those comfortable with AI interactions. But it also reveals something about the innovation adoption curve in India. The country is skipping past the early majority phase entirely. AI isn't diffusing gradually through society. It's being adopted intensively by the youngest, most economically motivated cohort first.

The gender breakdown, while not explicitly stated in the available data, is worth considering. India has historical gender gaps in technology adoption, though these have been narrowing. The concentration of young users likely skews toward male in early adoption, though this is rapidly changing as awareness increases and educational initiatives expand access.

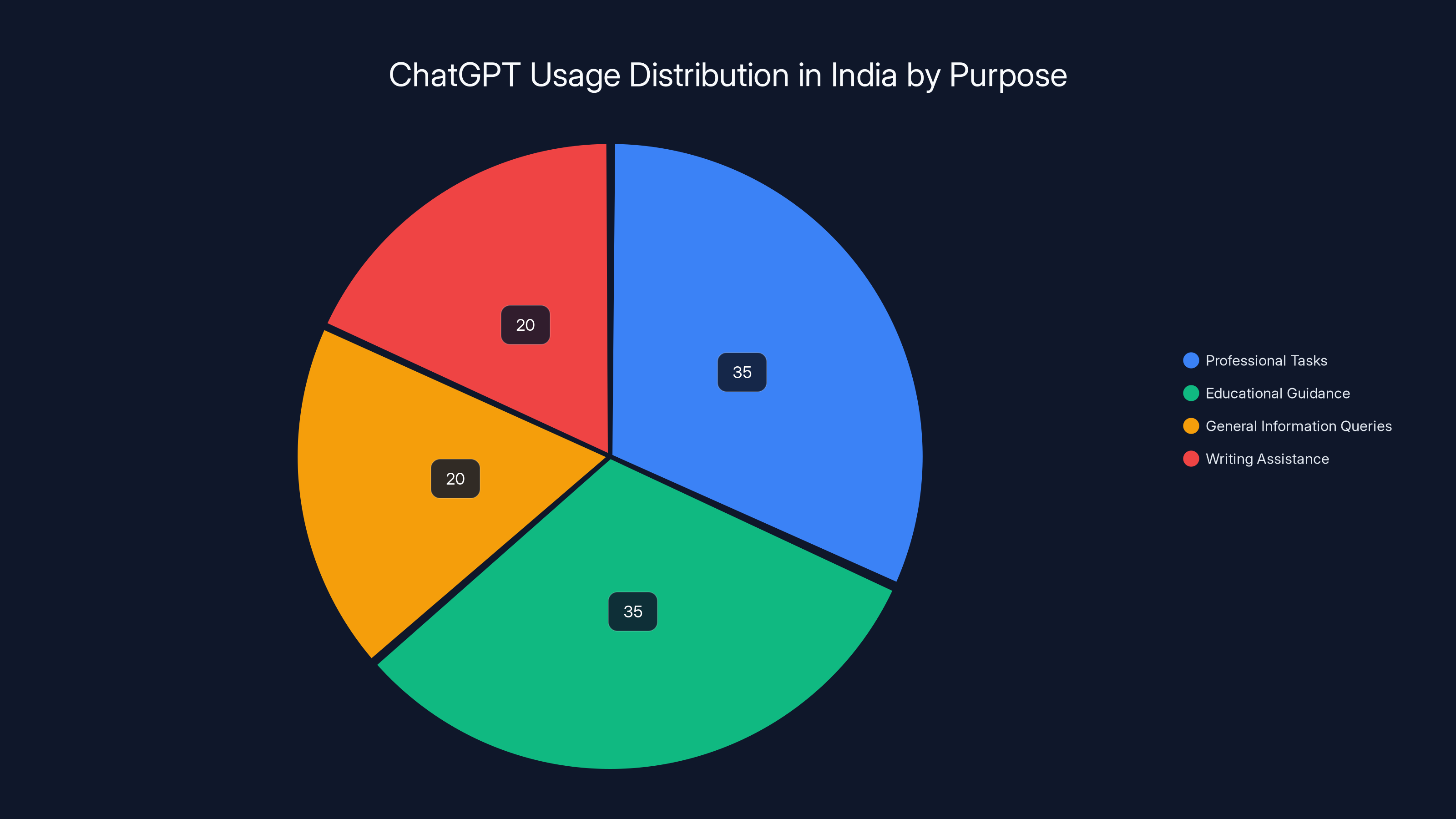

In India, 35% of ChatGPT usage is for professional tasks, with the remaining 65% split equally between educational guidance, general information queries, and writing assistance. This highlights a strong focus on professional development.

Work vs. Personal Use: How 35% of Indian Chat GPT Messages Are Professional

One of the most significant revelations from Open AI's data is how Indians use Chat GPT: 35% of all messages relate to professional tasks. Compare this to the global average of 30%, and you see India is 16% more work-focused than the rest of the world. This isn't a casual difference. It reflects a fundamental shift in how young Indians view AI—not as entertainment or curiosity, but as professional infrastructure.

What does "professional use" actually mean when we're talking about developing economies? The category likely encompasses multiple activities. There's job-related learning: preparing for certifications, understanding technical concepts, building skills employers value. There's work productivity: drafting documents, creating presentations, writing emails, managing project information. There's entrepreneurship: people building side hustles and small businesses using AI to handle tasks they'd otherwise struggle to manage alone.

Consider the engineering student angle more deeply. A software engineer in India today faces different pressures than counterparts in Western countries. They're competing globally for remote positions. They're trying to land roles at multinational companies that set very high bars. They're working to master frameworks, languages, and concepts that might not be well-covered in their local curriculum. Chat GPT becomes force multiplier. It's like having access to a senior engineer's expertise whenever you need it.

The professional focus also reflects economic necessity. In developing markets, there's less margin for error. You can't afford to spend two years in a job that doesn't teach you valuable skills. You need to learn faster, advance faster, and build capabilities that translate to global opportunity. That's where 35% of the Chat GPT usage concentration comes from. It's not voluntary—it's survival-driven adoption.

Beyond individual work use, there's corporate adoption happening at scale too. Tata Group's partnership with Open AI, distributing Chat GPT Enterprise through TCS to potentially tens of thousands of employees, suggests that professional use is spreading beyond just individuals. When major Indian conglomerates embrace these tools for their workforces, it validates the professional use case and drives further adoption.

The remaining 65% of usage breaks down into educational guidance (35%), general information (20%), and writing assistance (20%). The educational guidance piece is significant. This isn't formal education—this is self-directed learning. Young Indians are using Chat GPT as a personal tutor, research assistant, and knowledge guide. The 20% for general information covers everything from health questions to current events to practical life advice. The writing assistance includes both professional writing and personal writing projects.

What this usage breakdown reveals is that Chat GPT serves multiple roles in the lives of young Indians. It's not siloed into one function. It's integrated across learning, work, and personal development. This multi-faceted integration likely drives the high engagement metrics and daily active user rates.

The $4.99/month pricing strategy in India expanded OpenAI's potential user base from 1 million to 20 million, demonstrating the power of affordable pricing in emerging markets. Estimated data.

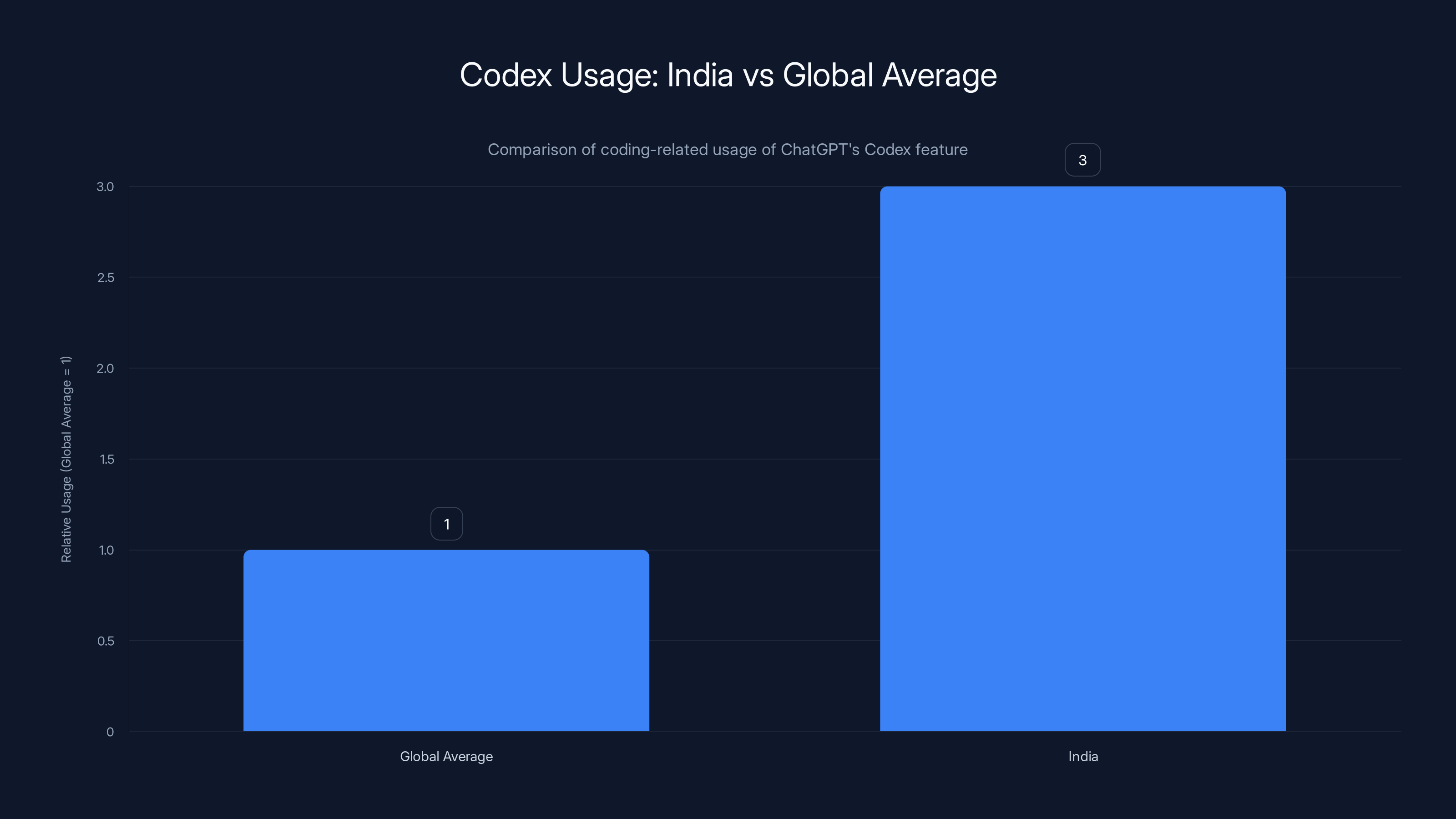

Coding Obsession: Why Indians Use Chat GPT's Codex Three Times More Than Global Average

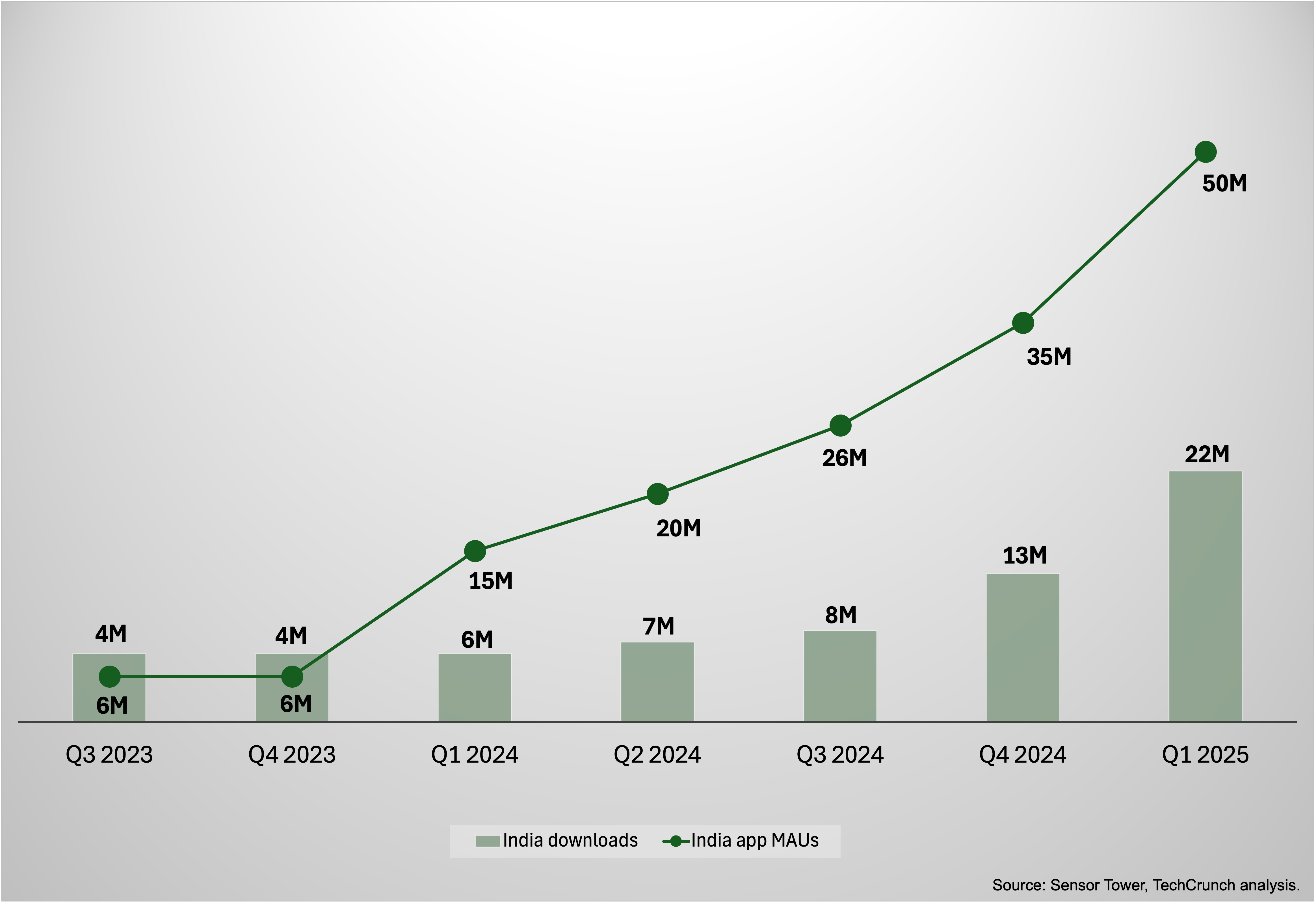

Here's where India's Chat GPT story gets particularly interesting. While general usage is high, coding-specific usage is three times higher than the global median. Indians are asking three times as many coding-related questions as the average global user. Open AI's Codex feature—the AI coding assistant—has exploded in usage since its Mac app launched two weeks before the announcement. Weekly Codex usage increased by 4x during that period.

This concentration of coding interest connects directly to labor economics. India produces more software engineers than any country except possibly the United States. The tech industry is one of the largest employers and is viewed as a pathway to prosperity. Remote work means an Indian engineer can earn global salaries for Indian living costs—an enormous financial advantage. But competing for those global roles requires skills.

Challenge is, technical education in India is variable. Some institutions are world-class. Many are not. Most engineering students can't afford private tutoring or bootcamps. They can't attend universities that guarantee placement in tech jobs. They need to teach themselves. This is where Codex becomes revolutionary.

Codex doesn't just answer coding questions—it learns your context and suggests completions. It explains why code works the way it does. It helps debug errors. It teaches patterns and best practices. A young engineer in tier-two or tier-three Indian cities can now access essentially the same coding mentorship as someone at a Stanford or MIT. The leveling effect is immense.

The 4x increase in weekly Codex usage after the Mac app launch reveals something about accessibility. When AI coding tools required browser access or command-line interfaces, adoption was constrained. Once it became available as a native application, usage exploded. This suggests that ease-of-access is more important than awareness. Millions probably knew Codex existed. But actual use required removing friction points.

Beyond individual learning, Codex adoption signals the emergence of an India-based software development wave. Companies, startups, and freelancers are using these tools to increase productivity. An engineer using Codex effectively can write code 3-5x faster than without it. In a competitive market where you win on speed and quality, that's a massive advantage. Indian startups are now competing globally against well-funded Silicon Valley companies while benefiting from lower labor costs and increasingly AI-augmented productivity.

The concentration of coding use in India also reflects the specific goals of young users. They're not just learning to code. They're learning to code well enough to compete for positions paying $100k+ annually—positions that would be inaccessible otherwise. The intensity of engagement makes sense when you understand the economic stakes.

Anthropologic's Claude AI reported similar patterns, with 45.2% of Claude's tasks in India mapping to software-related use cases. This cross-platform concentration in coding use cases confirms it's not Chat GPT-specific. It's a fundamental pattern in how Indian youth are adopting AI tools.

India's Position as Open AI's Second-Largest Market: Strategic Implications

With over 100 million weekly active users, India is now Open AI's second-largest market by volume. This isn't accidental. This is the result of deliberate strategy, and it has enormous implications for how AI will be adopted globally.

First, understand what "100 million weekly active users" means. This is a massive number. For context, entire countries have fewer people than this. India's tech-savvy population is being accessed at unprecedented scale. If anything, this number is potentially conservative, because it only counts those using Chat GPT directly. It doesn't include people using Chat GPT through third-party integrations, enterprise partners, or educational institutions.

To reach 100 million weekly users in any market requires removing multiple barriers. Accessibility is the first. Chat GPT needs to work on multiple devices, multiple internet speeds, multiple languages. Open AI has optimized for this. The platform works on old phones with slow connections. It's available in languages beyond English (though English proficiency in India is reasonably high among the online population).

Affordability is the second barrier. The sub-

The third barrier is trust and localization. Open AI has built partnerships with local companies. They've engaged with governments and education systems. They've attended AI summits and made strategic announcements. They've signaled commitment to the market through infrastructure investment (opening offices in Mumbai and Bengaluru). These moves matter. They signal that Open AI isn't treating India as a secondary market but as core to its global strategy.

Being the second-largest market has ripple effects. It means Indian developers are building integrations around Chat GPT. Indian businesses are building products on top of Chat GPT's APIs. Indian students are learning AI fundamentals using Chat GPT. This builds network effects. As more people use the platform, more use cases emerge, more innovation happens, and more people have incentive to join. The market compounds.

From a strategic perspective, Open AI's India focus also protects against geopolitical risk. The United States market is mature and competitive. Europe has regulatory restrictions through GDPR and pending AI regulations. China has its own AI ecosystem. India represents growth and scale that's difficult to find elsewhere. It's also a democratic country with relatively open internet policies (compared to China) and emerging tech regulation (compared to Europe). It's an ideal market for scale.

The second-largest market status also means Open AI's products will increasingly be shaped by what works in India. Feature requests, bug reports, and usage patterns from 100 million Indian users will start influencing product development. This has already happened with Codex, where Indian demand for coding assistance drove significant investment. As India's influence grows, so will the tools' focus on solving problems that matter to developing-market users.

Indians use ChatGPT's Codex three times more than the global average, highlighting a significant interest in coding tools.

The Pricing Strategy That Cracked the Market: Why $4.99/Month Changed Everything

Open AI's decision to offer a sub-$5 subscription tier in India wasn't a minor pricing adjustment. It was the insight that unlocked an entire market. Understanding why this price point matters requires understanding income distribution and purchasing power in India.

In the United States, Chat GPT Plus costs

The $4.99 tier fundamentally changed the economics. At this price, even for lower-middle-class Indians, the subscription becomes accessible. It's less than a cheap meal at a restaurant. It's less than a month of basic cable TV. It's affordable enough that a college student can pay for it from weekend earnings or part-time work. A young professional can absorb it as a small work expense. Families can even buy it as a shared resource.

But here's what's crucial: at

Open AI also introduced free tier access with limitations, which creates a conversion funnel. Users start with free Chat GPT. Once they've integrated it into their workflow and hit limitations, the $4.99 tier becomes an easy upsell. It's how adoption funnels work in developing markets. Premium pricing comes after proving value, not before.

The sub-

Comparison to competitors is instructive too. Google's Bard started as free. Anthropic's Claude is available for free with a premium tier. But none of them had localized pricing for specific markets initially. Open AI's willingness to charge

The promotional campaigns Open AI ran alongside this pricing structure were equally important. Awareness doesn't spread organically, especially in a market with 1.4 billion people. By running targeted campaigns, they educated users about Chat GPT's value proposition and drove initial adoption. Some campaigns offered limited free periods or discounted initial months, lowering the barrier to trying the service.

This pricing strategy has global implications. It demonstrates that high-growth markets in developing economies may not support premium pricing, but they can support much larger volumes at lower prices. As other markets mature and become saturated, companies increasingly need to follow Open AI's approach: find pricing levels that work for the specific market's economics.

Educational Impact: Chat GPT as a Learning Infrastructure in Indian Universities

One of the quieter but most significant impacts of Chat GPT adoption in India is its role as educational infrastructure. Open AI's partnership with educational institutions to distribute its tools to over 100,000 students over six years represents formal recognition of this role.

Indian universities face structural challenges. Class sizes are often massive. Teacher-to-student ratios can be 1:500 or worse at large institutions. Personalized instruction is virtually impossible. Students who come from under-resourced schools struggle to catch up. Extracurricular learning resources like tutoring are expensive and often unavailable outside major cities. This is where Chat GPT becomes a game-changer.

For a student in Jaipur or Indore or Coimbatore without access to expensive tutoring, Chat GPT is essentially a personal tutor available 24/7. Need help understanding a complex concept? Ask. Need to work through example problems? Chat GPT will generate unlimited examples and explanations. Need feedback on your writing? You get instant critique and suggestions for improvement. The tutor never gets tired. Never gets expensive. Never limits your questions.

The impact on educational outcomes is already visible in early data. Students using Chat GPT report better understanding of difficult concepts. They report higher confidence in their ability to solve problems. They report being able to learn independently rather than waiting for class instruction. This is particularly valuable in India where the pacing of curriculum sometimes doesn't match individual learning speeds.

There are absolutely concerns about this shift. Academic integrity is the most obvious: how do you distinguish between students using Chat GPT to learn and students using it to cheat? Universities are grappling with this. But the reality is that Chat GPT adoption is faster than institutional policy-making. Students have already integrated it into their learning processes. The question isn't whether to use AI—it's how to use it responsibly.

What's interesting is how Chat GPT is democratizing education in India. Previously, access to quality tutoring or educational resources was tied to wealth. You had to be able to afford private school, expensive tuition, or tutoring centers. Those who grew up in wealthy families had advantages measured in thousands of dollars per year. Chat GPT collapsed this equation. For $5/month, any student can access tutoring that wealthy students previously had exclusive access to.

This has implications for social mobility. If educational outcomes become less dependent on family wealth and more dependent on individual motivation and access to tools, then the playing field starts to level. A motivated student from a poor family in a small town can now compete with wealthy students from metros. This is potentially transformative.

The partnership with educational institutions to distribute tools to 100,000 students also signals that the education market will be a focus going forward. This will likely include free or heavily discounted access for students, curriculum integrations, and potentially specialized tools designed for educational use cases. As this matures, AI-assisted education might become normal in Indian institutions.

Nearly 80% of ChatGPT users in India are under 30, highlighting the platform's appeal among younger demographics. Estimated data.

Government and Enterprise Partnerships: How Tata Group and Others Are Scaling AI Adoption

The Tata Group partnership is worth examining in detail because it represents how institutional adoption will scale in India. Tata is one of India's oldest and largest conglomerates, with operations across IT services, aviation, steel, hotels, and dozens of other sectors. The partnership commits 100 megawatts of AI compute capacity and deploying Chat GPT Enterprise through TCS (Tata Consultancy Services), which is one of the world's largest IT services companies.

What does this partnership actually mean? First, TCS's 500,000+ employees represent a potential user base for Chat GPT. If even 10% adopt it, that's 50,000 more enterprise users. More realistically, given TCS's structure as a software development company, adoption will be substantially higher. This creates immediate scale for Open AI's enterprise product.

Second, the 100 megawatts of compute capacity allocation is about ensuring that Chat GPT can reliably serve Indian users without latency issues. Compute capacity that's geographically distributed means faster response times. It means better service quality. It also means Open AI is making infrastructure investments in India's physical resources, not just accessing the market remotely. This level of commitment signals seriousness about India as a market.

Third, partnerships with TCS specifically matter because TCS works with thousands of enterprises across India and globally. When TCS deploys Chat GPT Enterprise as part of their offerings to clients, it introduces those clients to the product. It creates a distribution channel. It means Chat GPT Enterprise isn't just available to companies that go to Open AI directly—it's integrated into services that companies already use and trust.

Other partnerships mentioned—with fintech company Pine Labs, travel platforms Ixigo and Make My Trip, and food delivery company Eternal—serve similar functions. Each partnership makes Chat GPT available to customers and employees of these companies. A customer of Make My Trip might use Chat GPT through the platform to help plan a trip. Employees might use it to draft customer communications. Over time, these touchpoints drive familiarity and adoption.

The fintech partnership is particularly interesting. The financial services industry in India is rapidly growing, with more people accessing banking and investment services than ever. Integrating Chat GPT into fintech platforms means the tool can help with financial planning, investment research, and customer service. For an industry trying to serve financially unsophisticated populations, AI assistance is valuable.

Food delivery integration (through Eternal) might seem like an odd choice, but it makes sense in context. These platforms serve millions of small merchants and customers. Chat GPT could help merchants manage their listings, respond to customer inquiries, or handle administrative tasks. For customers, it could assist with dietary preferences, recommendations, or order management. The integration points are numerous.

The macro pattern here is that Open AI is pursuing vertical and horizontal integration simultaneously. Vertical integration means going deep in specific sectors (fintech, travel, food delivery, IT services). Horizontal integration means partnering with every major category of company. The goal is making Chat GPT omnipresent. If you work in any major sector of the Indian economy, you're going to encounter Chat GPT through one of these partnerships.

Demographic Insights: Why Age Skew Matters for Product Development

The demographic concentration—50% of usage from 18-24 year-olds, 80% from under 30—creates a specific feedback loop that shapes how Chat GPT evolves. Products tend to reflect the needs and preferences of their primary users. When 80% of your usage comes from one demographic, your product evolves to serve that demographic increasingly well.

For Chat GPT, this means the product is optimized for what young Indians want. They want quick responses, not detailed explanations. They want practical solutions, not theoretical foundations. They want help with immediate problems, not long-term planning. These preferences shape feature development. They shape UX decisions. They shape what kinds of outputs are prioritized.

This skew also means that older age groups who might use Chat GPT are potentially underserved. A 45-year-old professional might have different needs than a 22-year-old student. They might want different explanation depths, different use cases, different interface designs. But if they represent 20% of users, they're not going to drive product development priorities. This creates a potential market opportunity for competitors who can serve older users better.

The age skew is also telling about where AI adoption is happening globally. In developed countries, AI adoption has been more evenly distributed across age groups. Older people who are comfortable with technology are using Chat GPT too. But in India, the concentration in younger age groups suggests that AI adoption is happening through education and early career first, rather than through gradual diffusion across all ages.

This also suggests something about skill transfer. Young Indians using Chat GPT today will carry those skills and expectations throughout their careers. They'll expect AI tools in every role they work in. They'll be frustrated by organizations that don't use AI. They'll drive AI adoption in their own companies and projects as they advance. Twenty years from now, when these users are senior managers and entrepreneurs, they'll be the ones pushing AI integration most aggressively.

The gender dimension, while not explicitly reported, is worth considering. Tech adoption in India historically has had gender gaps, though these are narrowing. The concentration of young users likely includes both men and women, but the exact split isn't clear. As AI adoption becomes more mainstream, getting women equally integrated into the user base will be important for both equity and product development reasons.

The income dimension is also interesting. The 18-24 age group in India spans enormous economic range. Some are college students from wealthy families. Many are college students from middle-class families. Some are early-career workers earning their first salaries. The $4.99 pricing works across this spectrum, but different groups use the product differently. College students use it for learning. Early-career workers use it for productivity. Understanding these differences matters for product development.

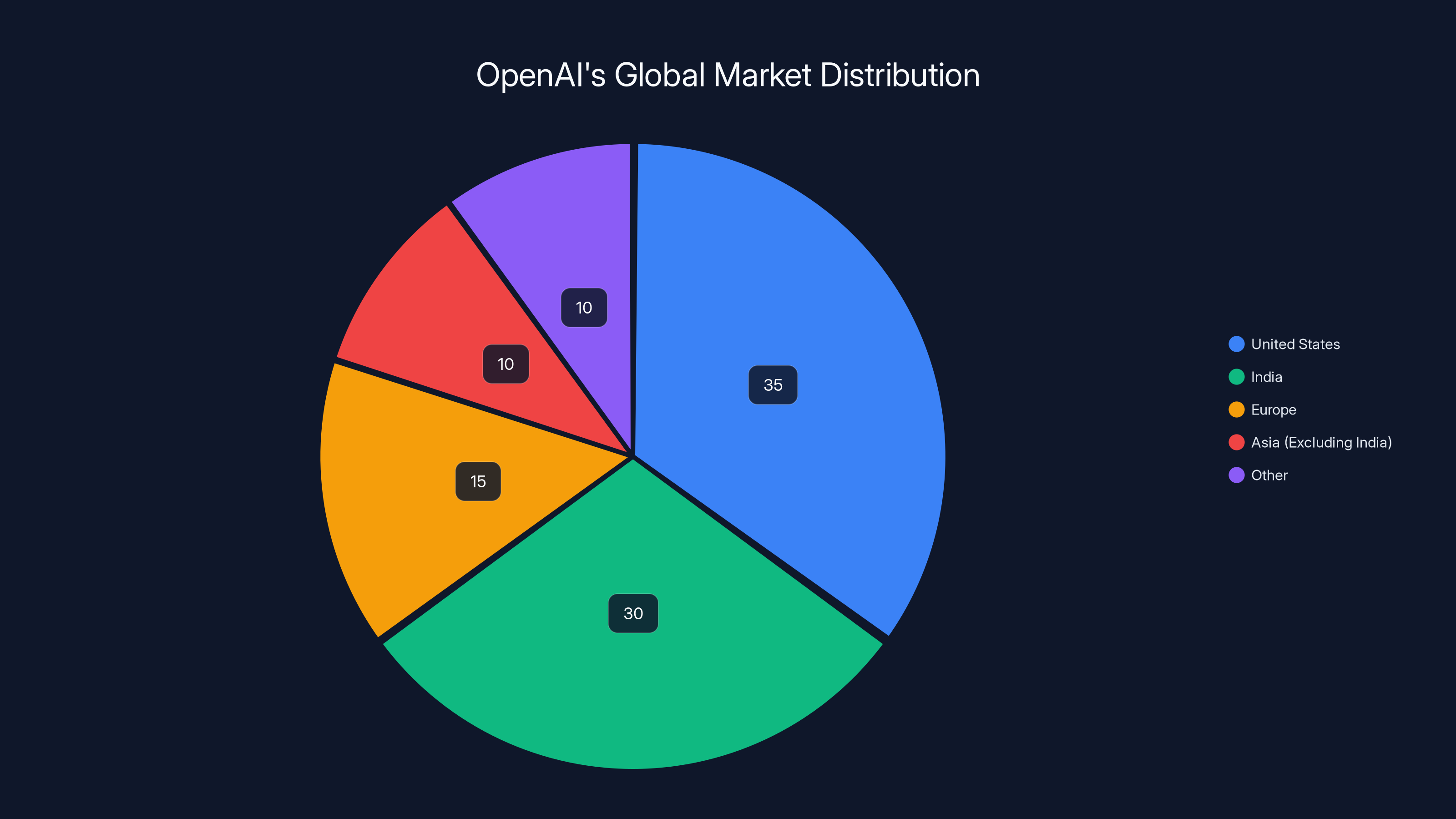

India accounts for 30% of OpenAI's user base, making it the second-largest market after the United States. Estimated data based on user volume.

Comparative Global Adoption: Why India Stands Out

Global context helps explain why India's adoption numbers are remarkable. Comparing Chat GPT usage in India to other major markets reveals patterns.

In the United States, Chat GPT has massive usage, but it's more evenly distributed across age groups. Adults aged 25-65 represent significant usage. There's no single demographic that accounts for 50% of usage. Older people are more likely to use Chat GPT than in India, where the under-30 category dominates. This suggests different adoption curves. In mature, wealthy markets, adoption diffuses across demographics. In India, it concentrates in economically motivated younger cohorts.

In Europe, adoption is also more distributed. But regulatory concerns around GDPR and AI regulation have slowed adoption in some countries. People are more cautious. European usage is also skewed toward professionals and educated knowledge workers, while Indian usage includes broader swathes of the youth population.

In Southeast Asia, countries like Indonesia and Philippines have similar demographics to India and similar adoption patterns. Vietnam is similar too. But China's domestic market uses Baidu's Ernie or Alibaba's tools rather than Open AI's products, creating different competitive dynamics. Japan's market has mature internet adoption but an older demographic, so usage patterns are different. There's no other major market quite like India—huge population, young demographic, rapid internet growth, growing economy, and limited regulation.

The global median for coding questions is lower than India's, suggesting that software development as a career path is more concentrated in India (and other developing markets where tech careers offer the most dramatic economic improvement) than in developed markets where tech jobs are common but not exceptional.

Comparison to Claude (from Anthropic) showing 45.2% of tasks in India mapping to software-related use cases confirms this isn't Chat GPT-specific. It's a pattern across AI platforms. Young Indians are focused on coding and professional skills in ways that differ from global averages.

The Growth Trajectory: What's Coming Next for AI in India

Extrapolating from current trends is risky, but certain trajectories seem clear. First, the absolute number of Chat GPT users will continue growing. India's internet penetration is still expanding. Not everyone has internet access yet. But as connectivity reaches more people, more will become potential Chat GPT users. If the age skew holds, the 18-24 cohort in 2028 will use Chat GPT at even higher rates than today's cohort, because awareness will be broader.

Second, usage intensity will increase. Today's 100 million weekly users might use Chat GPT a few times per week. As integration into daily work and education deepens, weekly usage might become daily usage. People might shift from occasional queries to continuous interaction. This would increase message volume substantially.

Third, use cases will broaden. Right now, 35% of usage is work-related, focused heavily on coding and tech skills. As more people from other fields use Chat GPT, usage will spread to business, medicine, law, arts, and other sectors. The work-related percentage might actually decrease as absolute work-related usage stays stable but personal use grows.

Fourth, language localization will become increasingly important. Right now, most Chat GPT interactions are probably in English, which is widely spoken in India. But as broader populations adopt Chat GPT, interactions in Hindi, Tamil, Telugu, Kannada, and other Indian languages will increase. This will require investment in multilingual models and localization that Open AI is just beginning.

Fifth, the competitive landscape will intensify. Google will push Gemini harder. Meta will compete for attention. Indian companies will develop local alternatives. Open AI's first-mover advantage is substantial, but it's not insurmountable. Competitors will copy successful strategies and try to improve on them.

Sixth, enterprise adoption will drive much of the growth. Individual users have reached relatively high saturation in the under-30, economically motivated segments. Growth will increasingly come from institutions deploying Chat GPT at scale. This means the nature of usage will shift from personal to professional to institutional.

The majority of ChatGPT users in India are under 30, with 50% aged 18-24. This age skew influences product development to cater primarily to younger users.

Challenges and Barriers: What Could Slow Adoption

Not everything about India's adoption trajectory is positive momentum. Several barriers could slow further growth.

Internet reliability is the first challenge. While India's internet penetration is good in urban areas and among the demographic we're discussing, reliability and speed can still be issues. Chat GPT requires consistent connectivity. If connections drop frequently, the experience degrades. Rural areas have much less internet infrastructure. While the target demographic is mostly urban and educated, expanding beyond that will require better infrastructure.

Language is the second barrier. Chat GPT's abilities in Indian languages are improving but still inferior to English. If adoption is to spread beyond English-speaking educated cohorts to broader populations, language capabilities need to improve substantially. This is a technical challenge that requires investment in training data and model fine-tuning.

Regulation represents the third barrier. India's government is still formulating policy around AI. If regulations become overly restrictive, or if the government favors Indian-developed AI tools over Western ones, adoption could slow. Political dynamics matter. Trade tensions between the US and India could affect Open AI's ability to operate.

Access to compute is the fourth barrier. India's AI infrastructure is still developing. The partnership with Tata Group allocating 100 megawatts of compute helps, but this is limited. As demand grows, will India have sufficient computational resources? Will Open AI need to keep increasing investment in infrastructure?

Affluence is a fifth barrier. Right now, $4.99/month is accessible to the economically motivated segments using Chat GPT. But broader adoption might require free tier offerings or even lower pricing. Once you've captured the people willing to pay, growth requires serving those who aren't. This compresses margins and changes business models.

Competition represents the sixth barrier. Google has advantages in search and distribution. Meta has advantages in social networks and messaging. Indian companies might build better-localized competitors. Open AI's competitive moat isn't insurmountable. Maintaining market position requires continued product innovation.

The Broader Narrative: AI Adoption as Economic Opportunity

When you step back from the specific numbers about 18-24 year-olds and Chat GPT usage, what emerges is a broader narrative about how artificial intelligence is reshaping economic opportunity in developing markets.

For centuries, developed countries had advantages in education, technology, and capital that compounded over time. These advantages made it difficult for developing countries to catch up. AI changes this equation. A young person in a tier-2 Indian city can now access the same AI tools as someone in San Francisco. They can learn the same skills. They can compete for the same jobs. The geographic advantage partially collapses.

This doesn't mean perfect equality—there are still advantages to being in ecosystems with lots of capital, talent networks, and infrastructure. But the gap narrows. A competent Indian engineer using Chat GPT might be as productive as a competent American engineer, justifying similar salary expectations. This drives global wage convergence and opportunity expansion in lower-income countries.

The concentration of adoption in young people is important because it means this opportunity is being seized by the generation that will shape the next 30-40 years of economic activity. They're learning with AI. They're building with AI. They're competing with AI. By the time they're in senior roles, AI integration will be second nature.

This isn't unique to India. Similar patterns are happening in Brazil, Southeast Asia, Eastern Europe, and everywhere else with young populations and growing internet access. But India's scale—1.4 billion people, large young cohorts, growing economy, tech industry presence—means the global impact is particularly significant.

The business implications are substantial too. Companies that figure out how to serve India's market effectively will learn lessons applicable everywhere. Pricing models that work in India might work in Southeast Asia and Africa. Product decisions informed by Indian usage patterns might better serve broader global populations. The causality flows both ways—global companies improve by learning from India, and India improves by accessing global tools.

Strategic Takeaways: What Open AI's India Success Tells Us About Global AI Markets

If you're a founder, investor, or strategist trying to understand where AI adoption is heading globally, India's Chat GPT adoption provides important signals.

First, adoption follows economic incentive. Young Indians use Chat GPT intensely because it offers concrete career benefits. They're not using it for curiosity or entertainment primarily. They're using it because it helps them compete globally. Products that offer genuine value will be adopted regardless of maturity. Mature markets aren't always the best indicators of true utility.

Second, pricing matters more than features for emerging market adoption. Open AI's success in India started with pricing that matched the market, not with revolutionary new features. The $4.99 tier was more important than individual product improvements. As you scale into price-sensitive markets, pricing becomes the primary product lever.

Third, partnerships drive scale faster than direct distribution. Open AI's partnerships with Tata, travel platforms, fintech companies, and educational institutions are driving adoption faster than direct-to-consumer marketing could. In large diverse markets, you need distribution partners who have existing relationships and trust.

Fourth, young people are the early adopters and opinion leaders. If you want to reach mainstream adoption in developing markets, win the under-30 demographic first. They'll drive adoption through word-of-mouth and through their own companies as they advance. They're also the most economically motivated to learn new tools.

Fifth, the nature of AI adoption is different in developing markets. It's less about novelty and entertainment, more about necessity and career advancement. Products that appeal to developed-market curiosity might be less valuable in developing markets that need practical benefits. Understanding this shapes positioning and feature priorities.

Sixth, market size and growth matter more than profit margins. Capturing 100 million users at

The Role of AI in Global Wage Competition and Skills Development

One of the implications of India's Chat GPT adoption that isn't explicitly discussed is its role in global wage competition. This deserves deeper examination.

Historically, developing countries competed on labor cost. Companies would offshore work to countries where wages were lower. An engineer or accountant or customer service representative in India could be paid less than their developed-country counterparts, making outsourcing economically attractive. But wage gaps exist because of skill and education differences. Workers in high-wage countries had better training, better tools, and better working conditions.

AI tools like Chat GPT compress this. A skilled Indian engineer using Chat GPT might be as productive as a skilled American engineer using Chat GPT. If they're equally productive and the Indian engineer costs half as much, the economic incentive for offshoring doesn't decrease—it might increase. But it also means that Indian engineers can more easily compete for jobs that previously had to be done locally due to productivity gaps.

The wage implications are complex. On one hand, AI could accelerate wage convergence, meaning Indian tech workers could demand higher salaries as their productivity increases. On the other hand, if global labor supply suddenly becomes more fungible (everyone with Chat GPT is equally productive), then wages might actually pressure downward as more people can do the work. The net effect depends on demand relative to supply.

For developing countries like India, the calculus is probably positive. They have large supplies of educated young people eager to participate in global labor markets. AI tools lower the barriers to participation. Even if wage convergence is partial, moving from

For developed countries, the implications are more ambiguous. If productivity gaps narrow, high-wage workers face more competition. This could be deflationary for some roles. However, AI also creates new opportunities. Roles that combine AI capability with domain expertise become more valuable. American engineers who can use Chat GPT effectively might see wages increase, not decrease, if they can accomplish more.

Educational implications are also significant. If Chat GPT is becoming a primary learning tool in India, then students there are learning the fundamentals of coding, writing, analysis, and problem-solving alongside AI tools. This means their first jobs will probably involve heavy AI usage. They'll be native AI users in a way that current workers aren't. This creates a permanent shift in how work is done.

Inference and Prediction: Where This Trend Is Heading

If current trends continue, what should we expect in the next 2-5 years?

First, Open AI's India user base will probably exceed 200 million weekly active users within 24 months. Growth in absolute numbers is likely to decelerate (harder to reach new users as penetration increases), but it's still early enough that 2x growth is feasible.

Second, Chat GPT will become mainstream in Indian professional environments. It's not a novel tool anymore—it's basic infrastructure. Companies will expect their employees to use it. Educational institutions will teach with it. Government might mandate it or restrict it, but indifference isn't an option anymore.

Third, Indian-language capability will become much more important. Current users are English-capable. Next-wave users won't be. Chat GPT's abilities in Hindi, Tamil, Telugu, and other Indian languages need to improve substantially.

Fourth, competition will increase significantly. Google's Gemini will push harder. Indian companies will develop local alternatives. The market will become more competitive, and Open AI's first-mover advantage will narrow (though likely remain substantial).

Fifth, enterprise adoption will drive the bulk of growth. Consumer adoption among the young, educated, economically motivated cohort is already happening. Institutional adoption through companies, schools, and governments is where the next wave of growth comes from.

Sixth, the demographics will broaden. Right now, 80% of users are under 30. As adoption deepens in other age groups and as product development responds to broader user needs, this concentration will decrease. Older users, women, and less-educated populations will increase as a percentage.

These trends have global implications. India's adoption patterns will likely repeat in other large developing markets: Brazil, Indonesia, Philippines, Nigeria, and others with young populations and growing digital access. The playbook Open AI is executing in India becomes a template for scaling AI in other emerging markets. Understanding India's trajectory helps predict how AI adoption will unfold globally over the next decade.

Conclusion: India as the AI Adoption Frontier

The revelation that nearly 50% of Chat GPT messages in India come from 18-24 year-olds, with 80% of usage from the under-30 demographic, tells a story far larger than product adoption statistics. It reveals how artificial intelligence is reshaping economic opportunity, skill development, and global labor markets.

India has become Open AI's second-largest market not because of hype or novelty, but because Chat GPT solves real problems for millions of young Indians. It provides access to world-class tutoring for students in tier-2 and tier-3 cities. It enables young professionals to develop skills that command global salaries. It levels playing fields that previously tilted toward the wealthy and well-connected. The intensity of adoption reflects the depth of need and opportunity.

The specific design choices that enabled this adoption—$4.99 pricing, free tier offerings, strategic partnerships with institutions and enterprises, investment in local infrastructure—offer lessons for anyone trying to scale products in developing markets. Success isn't about revolutionary features or massive marketing budgets. It's about understanding local economics, removing friction, and offering genuine value at prices people can afford.

Looking forward, India's adoption trajectory suggests that AI integration will deepen substantially. What started as young individuals using Chat GPT will become institutional adoption through companies, schools, and government. What began in English will expand into Indian languages. What concentrated in coding and technical skills will broaden across industries and use cases.

The global implications are profound. If AI adoption follows this pattern in other large emerging markets, we're looking at a fundamental shift in global labor markets and educational outcomes. The geographic advantages that developed nations have historically enjoyed become less durable. Talent can compete globally regardless of where they're born. This doesn't erase all differences, but it narrows them significantly.

For Open AI, India's success is both validation of its product and evidence of where future growth lies. Developed markets in the US and Europe are important for revenue and profile, but emerging markets in India, Southeast Asia, and elsewhere represent where scale and impact happen. Understanding India's adoption patterns isn't just relevant for Open AI—it's relevant for anyone trying to understand where AI is actually being used, by whom, and for what purposes.

The story of Chat GPT in India is ultimately a story about opportunity, economic motivation, and how technology can reshape the possibilities available to billions of people. The young Indian using Chat GPT to learn to code isn't doing it for fun. They're doing it because coding skills might be their path to a stable career, a good income, and participation in global opportunity. That's why adoption is so intense. That's why it matters. And that's why India's Chat GPT story will likely shape how AI adoption unfolds everywhere else on the planet.

FAQ

What percentage of Chat GPT users in India are between 18 and 24 years old?

Nearly 50% of all messages sent to Chat GPT in India come from users aged 18-24, making this the single largest demographic group using the platform. When you include users under 30, they account for 80% of total usage, indicating that adoption is heavily concentrated among younger age groups compared to global usage patterns.

Why is Chat GPT adoption so high among young Indians?

Young Indians adopt Chat GPT intensely because it solves specific economic problems. For college students, it provides affordable access to tutoring and learning resources that would otherwise be expensive or unavailable. For early-career professionals, it enables skill development that can lead to better-paying jobs, including remote positions with global salaries. The economic motivation is stronger in India than in developed markets because the potential income gains from acquiring new skills are more dramatic relative to local wages.

How does Chat GPT usage vary between professional and personal purposes in India?

Approximately 35% of all Chat GPT messages from Indians relate to professional tasks, compared to 30% globally, making India's user base more work-focused than the worldwide average. The remaining 65% includes educational guidance (35%), general information queries (20%), and writing assistance (20%), showing that young Indians use Chat GPT across multiple dimensions but with a strong emphasis on professional development and skill building.

What is the significance of India being Open AI's second-largest market?

With over 100 million weekly active users, India represents Open AI's second-largest market after the United States, demonstrating the scale of AI adoption possible in emerging markets with large young populations. This market size gives India significant influence over Open AI's product development priorities and signals that growth markets in developing countries are now as important as mature developed-country markets for AI companies' strategies.

Why do Indians use Chat GPT's Codex coding assistant three times more than the global average?

Indians use Codex at three times the global median rate because software engineering represents one of the fastest paths to high-income employment for young Indians. Learning to code at a professional level is economically crucial, and Codex provides affordable, immediate access to coding mentorship and assistance. The 4x increase in weekly Codex usage after the Mac app launch demonstrates that accessibility matters—when the tool became easier to use, adoption exploded, suggesting many potential users were previously excluded by friction points.

What pricing strategy did Open AI use to crack the Indian market?

Open AI introduced a sub-

How is Open AI partnering with Indian institutions to expand adoption?

Open AI is pursuing multi-channel institutional partnerships to scale adoption beyond individual consumers. The Tata Group partnership allocates 100 megawatts of compute capacity and deploys Chat GPT Enterprise through TCS to potentially tens of thousands of employees. Simultaneously, partnerships with fintech companies, travel platforms, food delivery services, and educational institutions make Chat GPT available through existing trusted channels. Open AI also committed to distributing tools to over 100,000 students through educational partnerships, building the next generation of AI-native users.

What are the barriers that could slow Chat GPT adoption in India?

Several challenges could constrain future growth: internet reliability remains inconsistent outside major urban areas, Chat GPT's capabilities in Indian languages are still inferior to English, government regulation around AI is still being formulated and could restrict foreign-developed tools, computational infrastructure may not keep pace with demand growth, and competition from Google's Gemini and Indian-developed alternatives will intensify. Additionally, broadening adoption beyond the economically motivated under-30 demographic requires even lower pricing and different product positioning.

How will Chat GPT adoption in India affect global labor markets and wage competition?

Chat GPT adoption in India accelerates wage convergence by enabling Indian workers to become as productive as developed-country workers, potentially justifying higher salaries for Indian workers and more intense global competition. However, if global labor supply becomes more fungible (everyone with Chat GPT is equally productive), wages for some roles might face downward pressure in developed countries while still improving substantially for Indian workers. The net effect depends on whether AI generates new demand faster than it automates existing work, an open question with major economic implications.

What does India's Chat GPT adoption tell us about AI adoption in other emerging markets?

India's pattern demonstrates that strong AI adoption occurs when three conditions align: a large young population economically motivated to acquire new skills, internet infrastructure sufficient for digital tool access, and pricing that matches local purchasing power. Similar conditions exist in Indonesia, Philippines, Vietnam, Brazil, and other emerging markets, suggesting that India's adoption playbook will repeat globally. Companies succeeding in India will likely find that the strategies, partnerships, and pricing models they developed translate to other emerging markets with young populations seeking economic opportunity through skill development.

Ready to automate your workflow and boost team productivity? Runable helps teams create presentations, documents, and reports with AI-powered automation, starting at just $9/month. Whether you're generating reports from data, creating slides automatically, or building dynamic documents, Runable provides the AI infrastructure teams need to work smarter.

Key Takeaways

- Nearly 50% of ChatGPT messages in India come from 18-24 year-olds, with 80% of all usage from under-30 demographic

- Indians use ChatGPT 16% more for professional tasks (35%) than global average (30%), indicating work-focused adoption

- Codex coding assistant sees 3x higher usage in India than global median, with 4x growth after Mac app launch

- India is OpenAI's second-largest market with 100+ million weekly active users, driven by $4.99 localized pricing

- Strategic partnerships with Tata Group, educational institutions, and fintech platforms accelerate institutional adoption

- Economic motivation drives intense adoption: young Indians use ChatGPT to develop globally competitive job skills

- AI adoption patterns in India suggest similar trajectories in other emerging markets with young, educated populations

![ChatGPT in India: Why Young Users Drive 80% Adoption [2025]](https://tryrunable.com/blog/chatgpt-in-india-why-young-users-drive-80-adoption-2025/image-1-1771596423568.jpg)