Introduction: When AI Hype Meets Market Reality

You probably saw the headlines about Fractal Analytics going public in India. On paper, it looked perfect: India's first pure-play AI company hitting the public markets, backed by billion-dollar valuations, backed by heavyweight investors like TPG. The story practically wrote itself. Tech innovation from India. AI-powered future. Growth potential. All the buzzwords.

But then something unexpected happened. The stock opened flat. Enthusiasm didn't materialize. Investors showed up, sure, but they weren't exactly throwing money at it. The IPO that was supposed to signal India's arrival as an AI powerhouse instead revealed something more complicated and honestly more interesting: the gap between AI hype and actual market confidence.

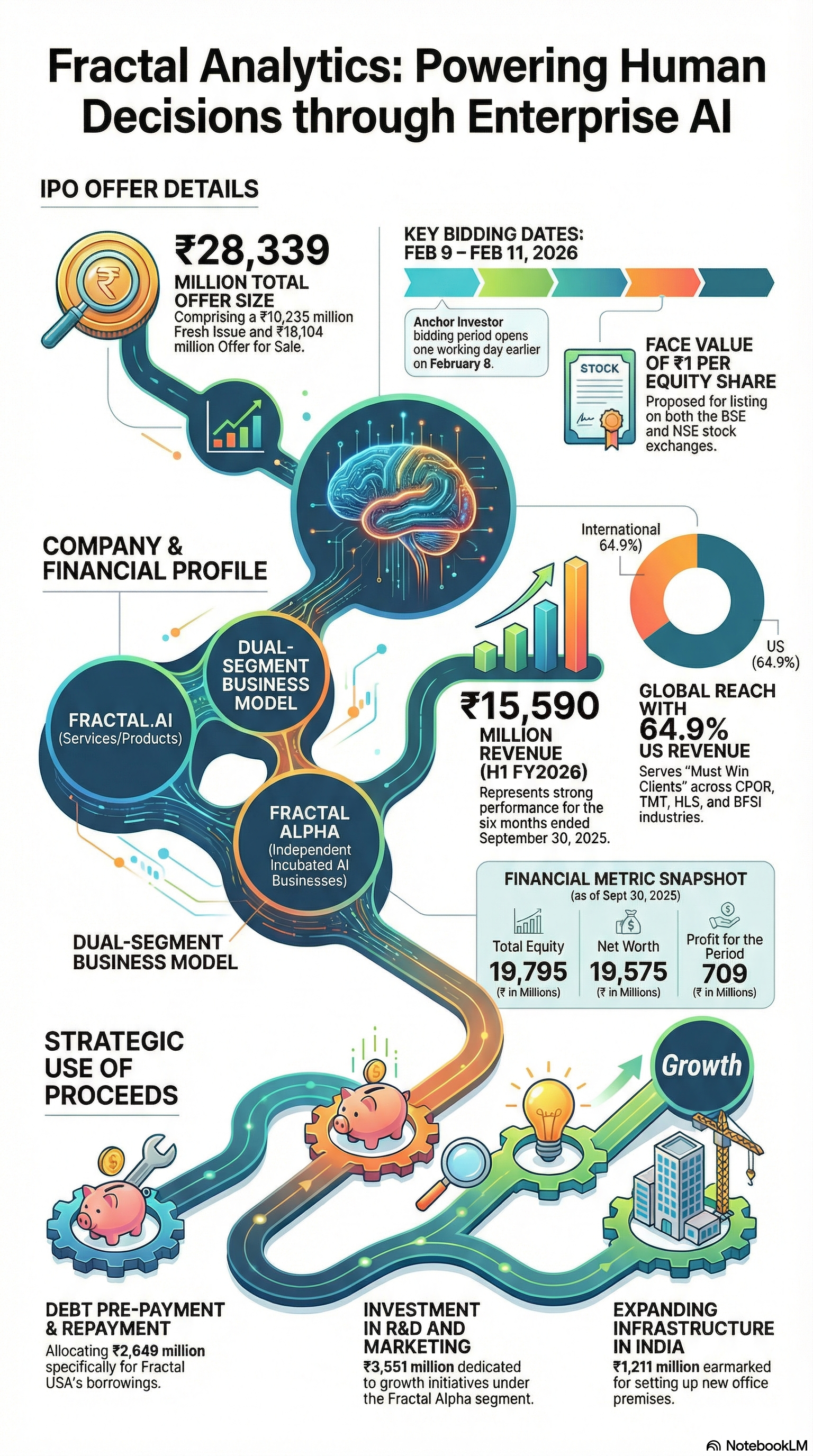

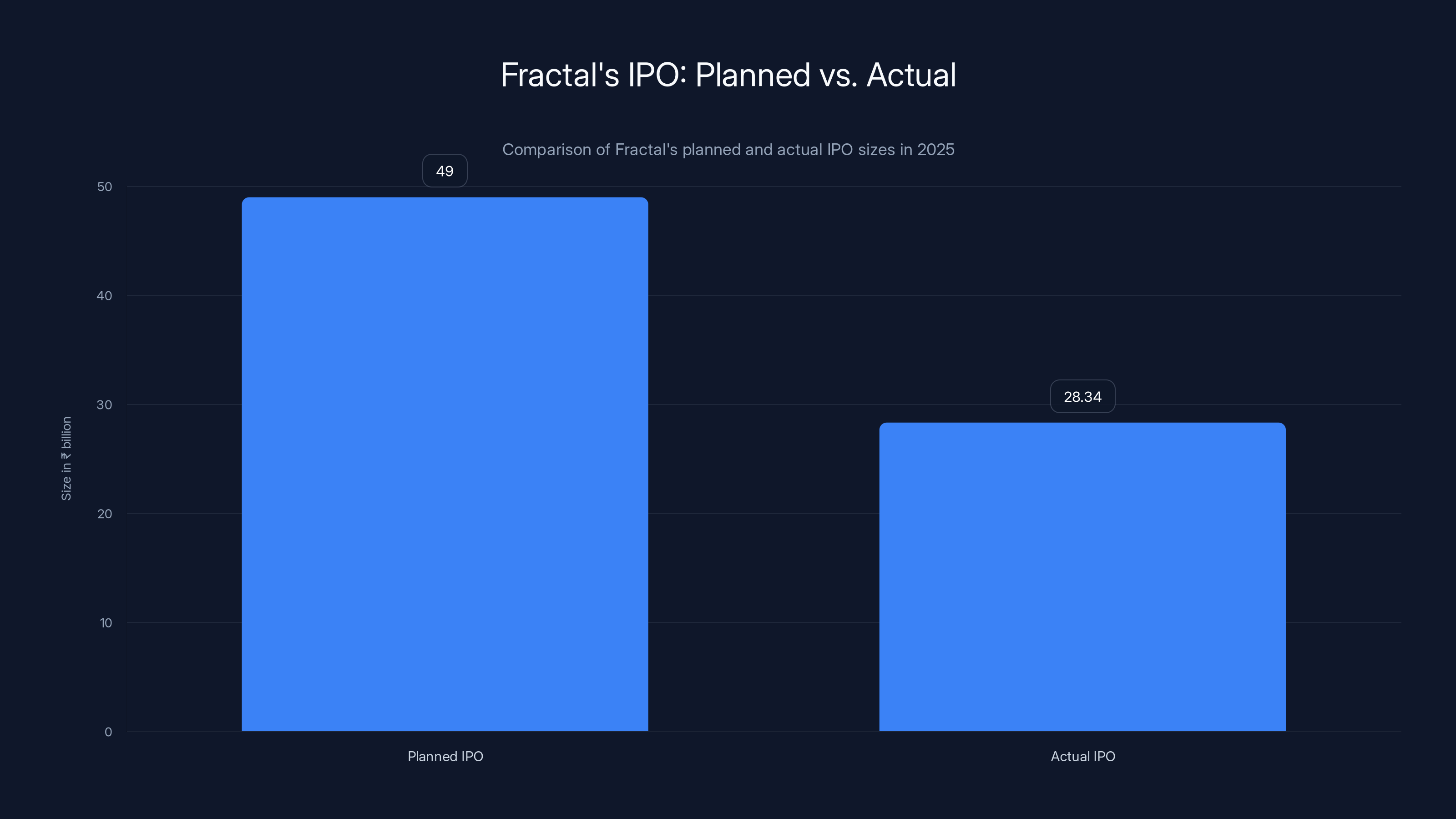

Fractal Analytics went public in February 2025, becoming India's first dedicated AI company to make the leap to public markets. That should've been a massive moment. Instead, the company had to cut its offering by 40% just weeks before launch. The valuation dropped from its July 2025 private round valuation of $2.4 billion. This wasn't a catastrophe, but it wasn't a triumph either. It was muted. Cautious. Realistic.

Here's what makes this genuinely important beyond just a single company's IPO performance: Fractal's stumble tells us something real about where enterprise AI actually is right now. Not where people say it is. Not where LinkedIn posts claim it is. But where the smart money actually thinks it is. And that's a story worth understanding, especially if you're building products, investing in technology, or trying to figure out which AI startups will actually survive the next few years.

The question isn't whether Fractal Analytics is a good company. By all accounts, it is. The question is why the world's biggest AI-hungry market—India—isn't more excited about its first major AI player going public. The answer tells us something about investor confidence, enterprise adoption timelines, and what "AI company" actually means in 2025.

The Setup: Fractal's Journey From Analytics to AI

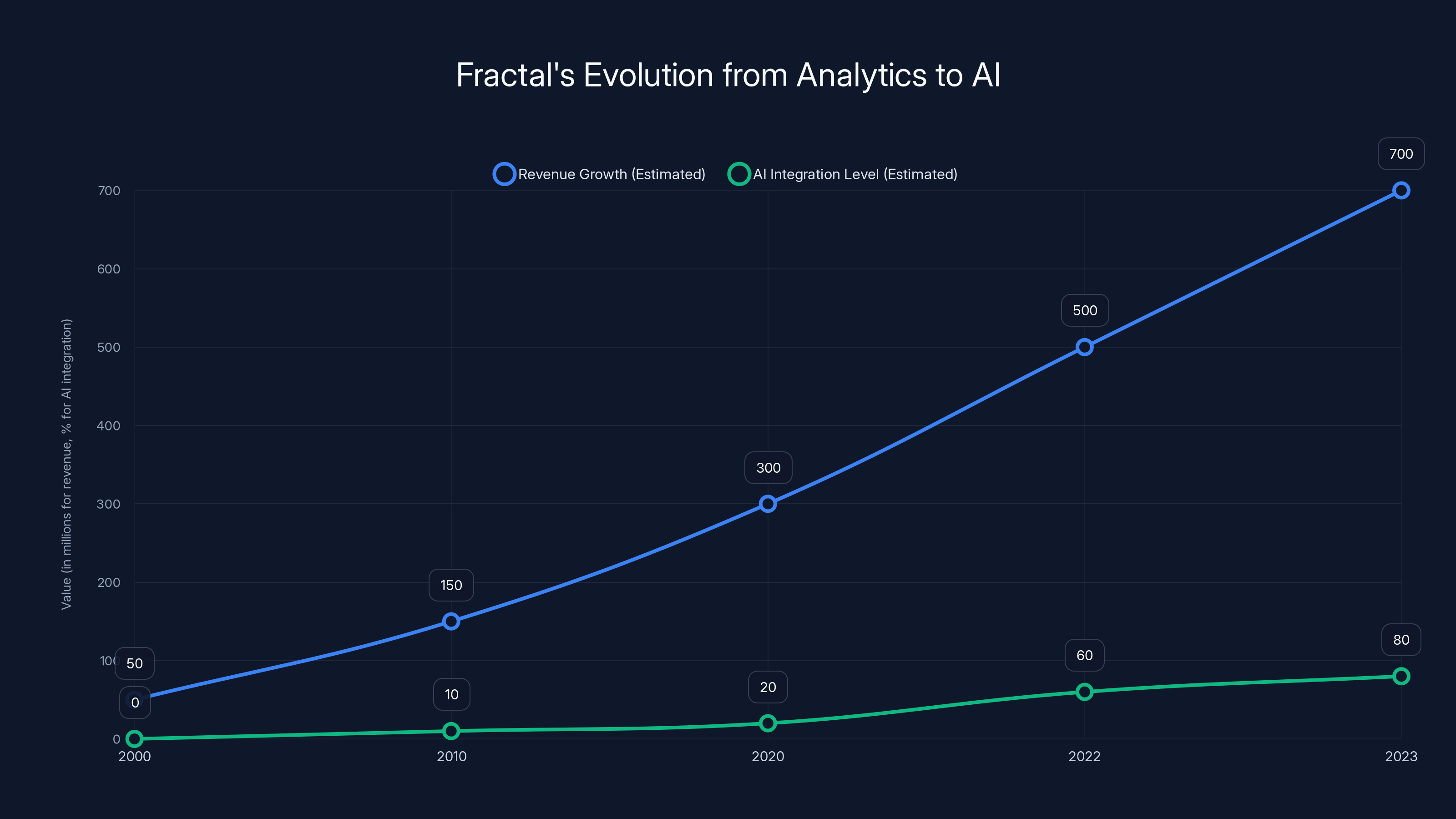

Fractal Analytics wasn't born as an AI company. It started in 2000 as a traditional data analytics firm, grinding through more than two decades of data consulting work for large enterprises. The business model was solid: you hire smart people, you help Fortune 500 companies understand their data, you charge well for the expertise. It's not exciting, but it's predictable and profitable.

For more than 20 years, Fractal operated exactly that way. This wasn't a flashy startup. It was a real business with real customers, generating actual revenue from household-name companies in financial services, retail, and healthcare. The company built something most AI startups never achieve: sustainable revenue from enterprise customers who actually need the work.

But around 2022, something shifted. The founding team realized what everyone else was realizing: the things they could do with AI and data science were about to get exponentially more powerful. So they pivoted. Not completely, but deliberately. Fractal reoriented itself toward AI-powered solutions while keeping the enterprise relationships that made it valuable in the first place.

This is actually harder than it sounds. Most analytics firms that tried this pivot failed because they either abandoned their customer base chasing the AI gold rush, or they stayed too tied to legacy business models and couldn't adapt fast enough. Fractal tried to do both. Keep the customers. Modernize the product. Add AI capabilities that could genuinely make their software smarter.

The timing wasn't random. By 2022, it was obvious that enterprise AI was going mainstream. Companies were ready to spend real money on it. Venture capital was flowing into AI companies at record rates. The conditions seemed perfect for a company that had enterprise customers, solid fundamentals, and a credible AI product.

Fractal raised

Then came July 2025. Fractal raised

Except markets are weird. And investors are skeptical in ways that don't always make it into press releases.

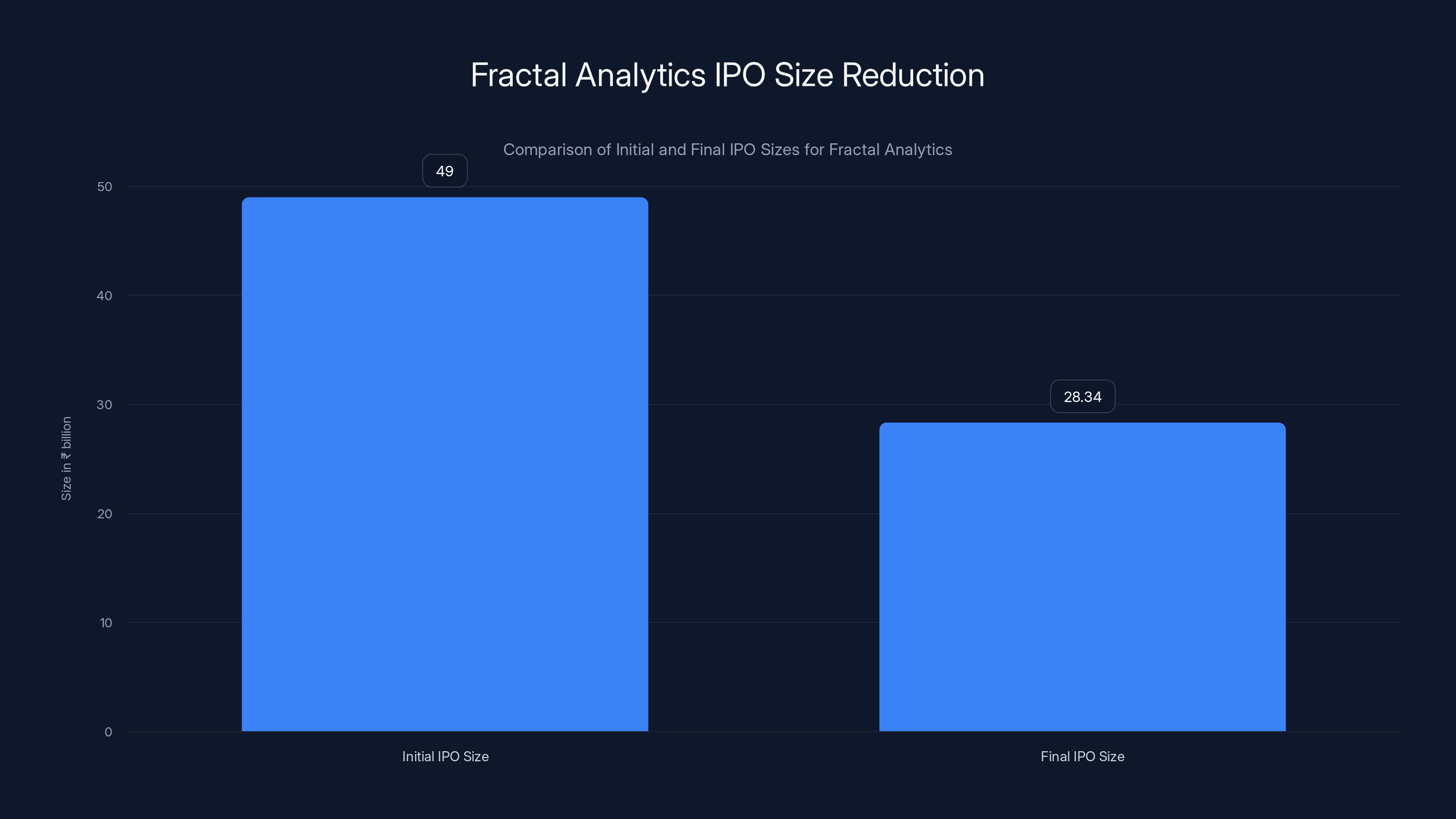

Fractal Analytics reduced its IPO size by 40% from ₹49 billion to ₹28.34 billion due to lower than expected investor demand.

The IPO: What Happened and Why It Matters

Let's talk numbers because numbers don't lie, even when they're disappointing.

Fractal's bankers initially planned an IPO of ₹49 billion, roughly $540 million. That was the original target. The company had already jumped through all the regulatory hoops. The roadshow was scheduled. Momentum seemed real.

Then in early February, just weeks before launch, everything got recalibrated. The bankers sat down with Fractal's leadership and basically said: "We need to be conservative here." The IPO size got cut by more than 40%. The new target was ₹28.34 billion, about

Why? Because investors weren't showing up with the enthusiasm the bankers expected. The roadshow was revealing something: appetite for Fractal was real, but it was cautious. Investors wanted to buy, but at lower valuations than recent private rounds suggested.

The IPO actually happened on February 16, 2025. The stock opened and, well, it didn't pop. There was no dramatic first-day surge. No excitement. No rush. The stock traded essentially flat around the offer price. For an IPO, especially for India's supposedly big AI story, that's underwhelming.

But here's the thing: it's not a disaster either. The IPO wasn't withdrawn. The stock didn't tank. Fractal has raised capital, has a path to fund growth and acquisitions, and is now a public company. From a functional standpoint, it worked. From a narrative standpoint, it failed to deliver the big moment everyone expected.

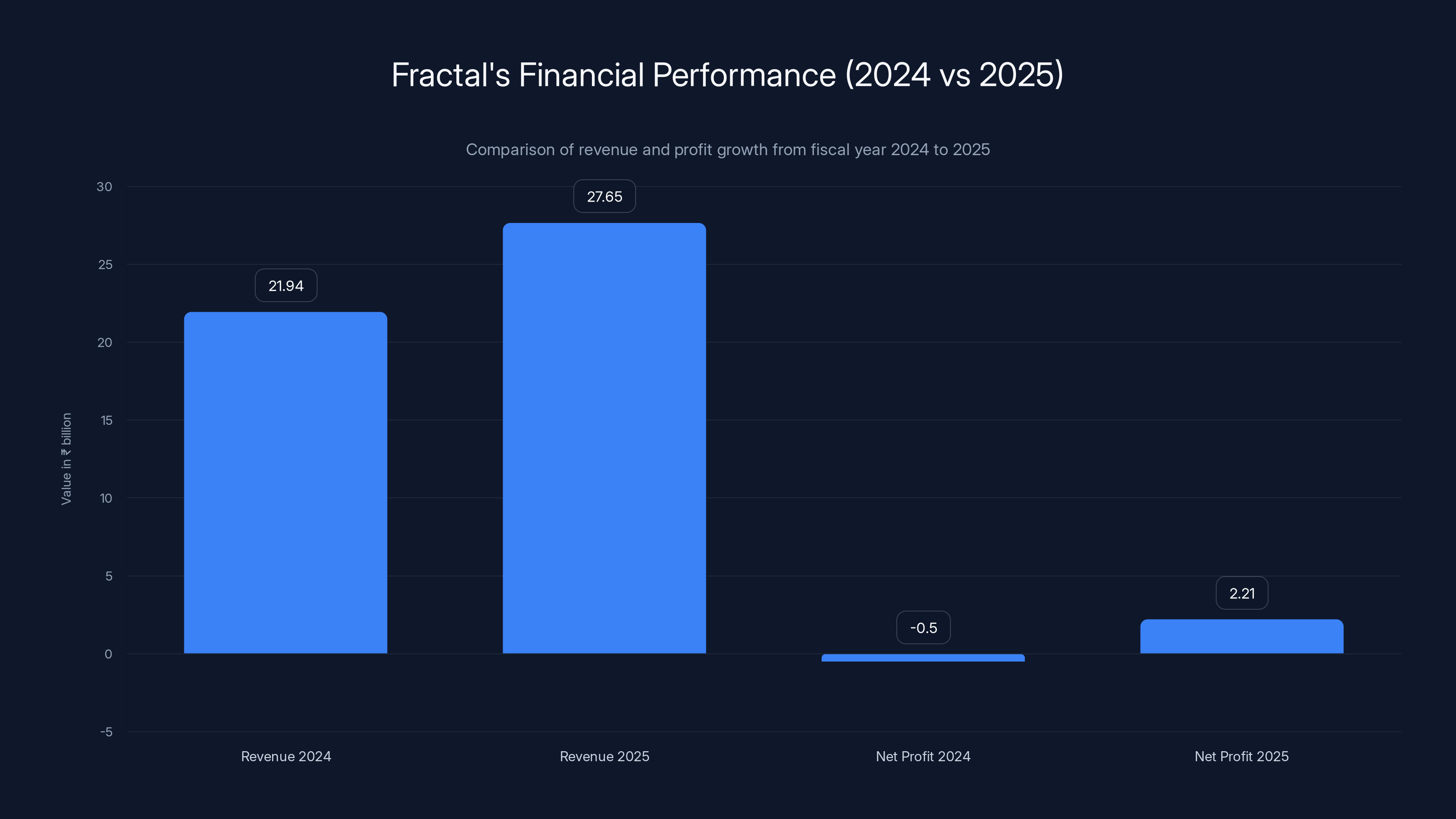

Fractal's financials tell a story of real growth. Revenue grew 26% to ₹27.65 billion (about

So the question becomes: why wasn't the market more enthusiastic about a profitable company with 26% revenue growth in the fastest-growing tech market in the world?

The Broader Context: Indian Software Stock Weakness

You can't understand Fractal's IPO in isolation. It happened in a specific moment in a specific market, and that market was sending mixed signals.

India's software and IT services sector had been having a rough time in the months leading up to Fractal's IPO. Major Indian IT companies were experiencing significant stock declines. TCS, Infosys, Wipro, HCL—the companies that have driven India's tech reputation globally—were all under pressure. Stock prices had fallen. Valuations had compressed. Investors were questioning growth trajectories.

Why? Several overlapping reasons. First, the AI impact on traditional IT services work isn't fully understood yet. Investors worry that AI will cannibalize the big consulting contracts that have made Indian IT companies profitable. If AI can do software development faster and cheaper, what happens to the massive staffing models that Accenture and TCS built their businesses on?

Second, there's genuine macroeconomic uncertainty. Interest rates are higher than they've been in years. Tech spending growth is slowing in some markets. Companies are asking harder questions about ROI before committing to major IT contracts. The easy capital and "just spend on tech" mentality of 2021-2022 has evaporated.

Third, the India growth story itself got questioned. For years, India was the "inevitable" AI hub because of its talent, its cost structure, and its market size. But that narrative got a dose of reality when people realized that pure talent and market size don't guarantee success. China also has massive talent and market size. Southeast Asia is coming up fast. India's advantages are real but not invincible.

Into this environment of softening sentiment toward Indian tech stocks came Fractal Analytics. It's a fundamentally different business model than traditional IT services—more SaaS, more software, more intellectual property. But investors don't always make those distinctions perfectly. They see "Indian tech company" and they think about the broader sector trends.

So Fractal faced headwinds that had nothing to do with Fractal specifically. The entire category was out of favor.

Fractal's revenue increased by 26% from ₹21.94 billion in 2024 to ₹27.65 billion in 2025, while net profit improved from a loss of ₹0.5 billion to a profit of ₹2.21 billion.

The AI Fear Factor: Enterprise Caution

Here's something that doesn't get talked about enough: enterprise customers are cautious about AI in ways that VCs never are.

Venture capitalists talk about AI disruption and transformation. They want to fund the next big thing. They're compensated to take risk and to find the next winner. Enterprises, on the other hand, run businesses that have to keep working day after day. When a bank considers deploying AI to its credit decisions, it's not thinking about disruption. It's thinking about what happens if something goes wrong.

Fractal makes its money from enterprises. That's where the revenue comes from. Financial services, retail, healthcare—these are industries where AI implementation has to be careful and deliberate. You can't just deploy an AI model and hope for the best. There's regulatory oversight, customer trust at stake, fiduciary responsibility.

The generative AI boom created weird expectations. Chat GPT went from zero to 100 million users in two months. Everyone assumed enterprise AI would follow the same trajectory. Instead, enterprise AI deployment has been... slower. More thoughtful. More skeptical.

Companies are asking legitimate questions: Does this AI actually improve our business outcomes? What are the legal and regulatory implications? What happens when the AI gets something wrong? Can we explain the decisions the AI makes? How do we manage the transition from human to AI decision-making?

These aren't obstacles to overcome. They're the actual work of real AI adoption. And they take time. Companies like Fractal make money by solving these problems, but solving them is slower and less dramatic than the startup ecosystem likes.

Investors know this, even if they don't always talk about it. They look at Fractal's enterprise customer base and they think: "Okay, these customers are going to be conservative about AI adoption. Growth is going to be steady but not explosive. The TAM is real but the penetration will be gradual." That's not a bad outcome, but it's not a venture-scale outcome either.

The Valuation Disconnect: Private vs. Public Market Reality

Fractal raised at a $2.4 billion valuation in July 2025, just seven months before the IPO. That was a secondary sale at the peak of private market confidence. The IPO happened at a lower valuation. That's not unusual, but the magnitude matters.

In private markets, valuations are often based on growth trajectory, market potential, and investor optimism. Public markets demand something different: proof. Revenue, profitability, runway—these matter more than potential. Private investors might accept "this could be a $10 billion company someday." Public market investors want to know the company is worth buying at today's price, not just at some theoretical future price.

The ₹28.34 billion IPO valuation works out to roughly $3.1-3.2 billion depending on exchange rates. So the IPO didn't crash the valuation, but it didn't support the highest private round price either. For a profitable company with solid growth, that compression shouldn't happen if everything was going perfectly.

What it suggests is that investors have a slightly different view of Fractal's future than private investors did. More realistic maybe. Less optimistic definitely.

This is actually healthy market behavior, even if it's not exciting. The public markets are saying: "We like this company. We see real business here. But we're not going to overpay for growth that might take longer to materialize than private investors assumed." That's rational.

The challenge for Fractal is now proving those public market investors wrong by executing faster than expected. That's the deal every company takes when it goes public at a lower valuation than hoped: you trade valuation for the capital and liquidity of being public, and you commit to delivering growth that justifies the belief investors showed by buying at that price.

What Fractal's Business Actually Does

This is important to understand because a lot of the AI fear in the market is based on confusion about what AI companies actually do.

Fractal doesn't build general-purpose AI models. It doesn't compete with Open AI or Anthropic or Meta. It doesn't make large language models or foundation models. That's not Fractal's business.

Fractal sells software and services that help enterprises extract value from their data using AI. Specifically, it does things like:

Data analytics and insights. Help companies understand patterns in their customer data, transaction data, operational data. AI makes this faster and more sophisticated than traditional analytics.

Predictive modeling. Build models that forecast customer behavior, market trends, equipment failures, fraud. This is classical machine learning work, now enhanced with more powerful AI tools.

Automated decision-making. Help companies automate decisions that used to require human judgment or statistical models. Credit decisions, inventory optimization, pricing. The AI handles the analysis, humans handle the edge cases and oversight.

Process optimization. Look at operational workflows and use AI to suggest improvements, identify bottlenecks, predict where problems will occur.

This is real work. It's valuable. It solves genuine business problems. But it's not flashy. It doesn't generate headlines. You don't see someone tweet about it.

More importantly, it's not something that companies will adopt overnight. Implementing any of these things requires integration with existing systems, training your team, probably hiring new talent, definitely changing workflows. That takes time. A company might spend 6-12 months going from "we should do this" to "this is actually working in production." Multiply that by a few dozen customers and you're looking at a multi-year ramp for growth.

Investors know this. They're not expecting Fractal to become a unicorn in three years. They're expecting steady growth, increasing profitability, and optionality for future acquisitions or expansion. That's a good outcome, but it's not a venture-scale outcome.

Fractal Analytics' valuation dropped by 40% from its private round in July 2025 to its IPO in February 2025, highlighting a gap between AI hype and market confidence.

The India AI Positioning Challenge

India has been working hard to position itself as a major AI hub. The government is investing. Companies are hiring AI talent. There are all the right signals. And there's legitimate reason to think India could be important in the global AI ecosystem: incredible talent pool, massive market size, growing enterprise spending on technology.

But here's the gap: India's strength is in AI implementation and integration, not in AI innovation or development. That's not a criticism. It's actually economically sound. India has built enormous value by taking technologies developed elsewhere and implementing them at scale for enterprises. That's how Indian IT companies became so successful.

The challenge is that the venture capital and public market narrative around AI is all about innovation. Foundation models. Breakthroughs. New capabilities. That's where the excitement is. And that's happening primarily in the US, China, and increasingly in Europe. India's role—taking those capabilities and making them work for enterprises—is crucial and valuable, but it's not the headline.

Fractal gets caught in this narrative gap. It's an AI company, but it's an AI company that implements AI, not invents it. It builds on top of models developed by other companies (though it's developing its own increasingly). That's a smart business strategy, but it's not exciting in venture capital terms.

India's first public AI company should theoretically be a moment of pride and validation. Instead, it's a moment of "okay, this is actually a professional services company that uses AI." That's not the narrative the ecosystem wanted.

Investor Sentiment: What the Data Shows

Let's look at what actually happened with investor interest in Fractal's IPO based on available data and market behavior.

First, the oversubscription multiple. When an IPO is heavily oversubscribed—meaning way more people want to buy than shares available—it suggests huge demand. Fractal's IPO was oversubscribed, but not dramatically. Not the kind of oversubscription that makes headlines. This matters because it tells you the fundamental appetite level.

Second, the first-day trading. Most IPOs either pop (trade significantly above offer price) or trade flat. Fractal traded basically flat. This tells you the market-clearing price was basically the offer price. Demand and supply matched almost perfectly. That's not a red flag, but it's not a sign of exceptional confidence either.

Third, the banking decision to cut the offering by 40%. This is the clearest signal. Bankers don't make that decision lightly. It means that during the roadshow, when they're pitching the deal to institutional investors, they encountered resistance at the original size and valuation. Not refusal—resistance. "I'll buy at this size, but not at that size," type of conversations.

Fourth, the broader market environment. Indian stock indices were mixed in the weeks before the IPO. Not crashing, not soaring. Some sectors were weak (IT services, software), others were strong. The overall sentiment wasn't "this is a great time to buy Indian tech." It was more "it depends."

What all of this suggests is that investors see Fractal as a legitimate company worth owning, but they're not betting that it will deliver venture-scale returns. They're betting it will be a solid, profitable business that grows steadily. That's not exciting, but it's realistic.

Software Sector Headwinds and Market Timing

Fractal's IPO happened in a moment when Indian software stocks were under pressure for specific reasons that matter for understanding the broader context.

Indian IT services companies have been struggling to articulate their value proposition in an AI-powered world. When Open AI released Chat GPT, it suddenly looked like AI could do some of the work that Indian IT services companies charged millions for. Why hire thousands of developers when an AI can generate code? Why hire business analysts when AI can analyze business processes?

These questions are still not fully answered. The reality is more nuanced: AI changes the job, but doesn't eliminate it. You still need skilled people to prompt the AI correctly, to integrate solutions, to handle edge cases. But that nuance doesn't sell in the market. The headline "AI will replace IT jobs" is easier to understand than "AI will change what IT jobs look like."

Companies like Infosys, Wipro, and TCS have been trying to reposition themselves around AI services. They've been making acquisitions, hiring AI talent, restructuring. But the market hasn't fully bought the story yet. Stock prices have reflected skepticism.

For a company like Fractal, which is smaller and less diversified, the challenge is harder. Investors wonder: if the big established IT services companies are struggling to convince the market they can win in AI, why should we believe a mid-size specialist can? It's not rational, but it's human.

The timing could've been better. If Fractal had gone public six months earlier, before the Indian IT sector started weakening, the reception might've been warmer. If it had gone public six months later, maybe the sector would've found better answers to the AI question. Instead, it hit in the middle, during the moment of maximum uncertainty.

Fractal's journey shows a steady growth in revenue and a significant increase in AI integration post-2020, marking a successful pivot towards AI solutions. Estimated data.

Fractal's Financial Performance and Path Forward

Let's get concrete about what the numbers actually show, because the narrative sometimes diverges from the reality.

Fractal reported ₹27.65 billion in revenue for the fiscal year ending March 2025, up 26% from the prior year. That's solid growth for a company of its size in an enterprise software market. Twenty-six percent annual growth is nothing to dismiss. Most mature software companies would be thrilled with that number.

More importantly, Fractal went from operating at a loss to operating at a profit. A net profit of ₹2.21 billion is significant. It means the company has scaled operations and now has positive unit economics. It's not just growing revenue; it's growing profitable revenue.

The company's plan for IPO proceeds is what you'd expect from a maturing tech company: repay borrowings (reduce leverage), invest in R&D (improve products), invest in sales and marketing (grow revenue), expand infrastructure (support growth), and pursue acquisitions (expand capabilities or customer base).

This is a company that's trying to balance growth with profitability, which is sensible and sustainable but not particularly exciting in venture capital terms.

Looking forward, Fractal's path isn't in doubt. The question is speed. Can it maintain 26% growth? Can it expand margins as it scales? Can it move into new verticals or geographies? These are execution questions, not business model questions. The model is proven.

The Bigger Question: Are We Over-Rotated on AI Hype?

Fractal's muted IPO tells us something important about where we actually are in the AI adoption cycle, rather than where we think we are.

There's a huge gap between AI capability and AI adoption at scale. Large language models have reached an impressive level of sophistication. Multimodal AI is here. Reasoning capabilities are improving. But the number of enterprises that have actually deployed AI into production workflows and seen meaningful ROI is still relatively small.

Why? Because integration is hard. Training is required. Change management is painful. Legal and regulatory questions take time to sort out. You can't just plug in an AI model and have everything magically work better.

Fractal is in the business of doing that integration work. It's the unglamorous middle of the AI adoption cycle. Not the exciting innovation phase, not the mature scaling phase, but the hard work of actually making AI work for real companies in real situations.

Investors have started to realize this. The initial AI hype cycle peaked around late 2023 and early 2024. As it became clear that AI adoption would be slower and more deliberate than initially assumed, investor enthusiasm cooled. Not disappeared—cooled. That cooling is visible in Fractal's IPO reception.

This is actually healthy. Markets should price in reality rather than hype. Fractal should benefit from that as adoption accelerates and the company proves execution over time. But the first-day pop is unlikely.

India's AI Ambitions vs. Global Reality

India has been positioning itself as a major AI hub, and there's real foundation for that. The talent is there. The cost structure is there. The government is supportive. Companies are moving fast.

But globally, India's role in AI is more likely to be as a major implementer and integrator rather than an innovator. The companies developing foundation models, pushing forward on AI research, and setting the strategic direction are predominantly American or Chinese (with growing European presence).

That's not a criticism of India or Indian companies. It's just an honest assessment of where breakthrough AI work is happening. India's strength is turning those breakthroughs into enterprise solutions at scale and at cost that works for global companies.

Fractal is exactly positioned for that role. Which makes it valuable, but perhaps not exciting in the way investors hoped for India's first major AI IPO.

Fractal's IPO size was reduced by over 40% from ₹49 billion to ₹28.34 billion due to cautious investor interest.

What the IPO Means for Other Indian AI Companies

Fractal's muted reception will likely influence how other Indian AI companies approach going public.

First, expectations are being reset. If you're a founder thinking about an IPO in the next 18 months, Fractal's experience tells you that the market will not overpay for AI exposure. You need real fundamentals: revenue, growth, preferably profitability. The days of raising capital just on AI hype are over, at least in public markets.

Second, there's likely to be consolidation. Smaller AI companies that can't hit the fundamentals needed for IPO will get acquired by larger ones or will stay private longer while building more scale. Fractal's success in raising capital through the IPO but without a pop suggests that company acquisition multiples might actually be more attractive than IPO valuations for some companies.

Third, Indian AI companies might look more seriously at international expansion. Instead of betting on India as the primary market, they might position themselves as global companies that happen to be based in India. That changes the narrative and potentially makes them more attractive to global investors.

Finally, there will probably be more focus on profitable growth rather than growth-at-all-costs. Fractal's profitability was actually unusual and attractive. Other companies will try to follow that model.

The Competitive Landscape: Who Else Is Playing

Fractal isn't the only Indian company doing enterprise AI. There are others, at various stages of maturity.

But here's what's different about Fractal: it has real revenue from real customers, it's profitable, it has a proven business model (the old data analytics business), and it's making the transition to AI with that foundation intact. Many other Indian AI companies are earlier stage, faster growing, but less profitable.

The competitive advantage for Fractal is that it has proven enterprise adoption and retention. Enterprises trust it. That's harder to build than many people realize. Building that trust took 20 years. Building an AI product took a couple of years. Which do you think is more valuable?

Globally, Fractal competes with consulting firms doing AI integration, with software vendors selling AI tools, with specialized AI services firms. The competitive moat isn't necessarily that Fractal invented something amazing; it's that Fractal has enterprise relationships and has proven it can deliver results.

That's a defensible position, even if it's not romantic.

Looking At the Valuation Math

Let's do some basic valuation math to understand whether the IPO price makes sense.

Fractal's revenue is roughly

That would suggest a fair value range of

What that means is that if Fractal executes, the stock should do fine long-term. Not necessarily pop first day, but should appreciate as the company grows. That's actually what most IPOs should do, but it's not as exciting as the narrative hoped.

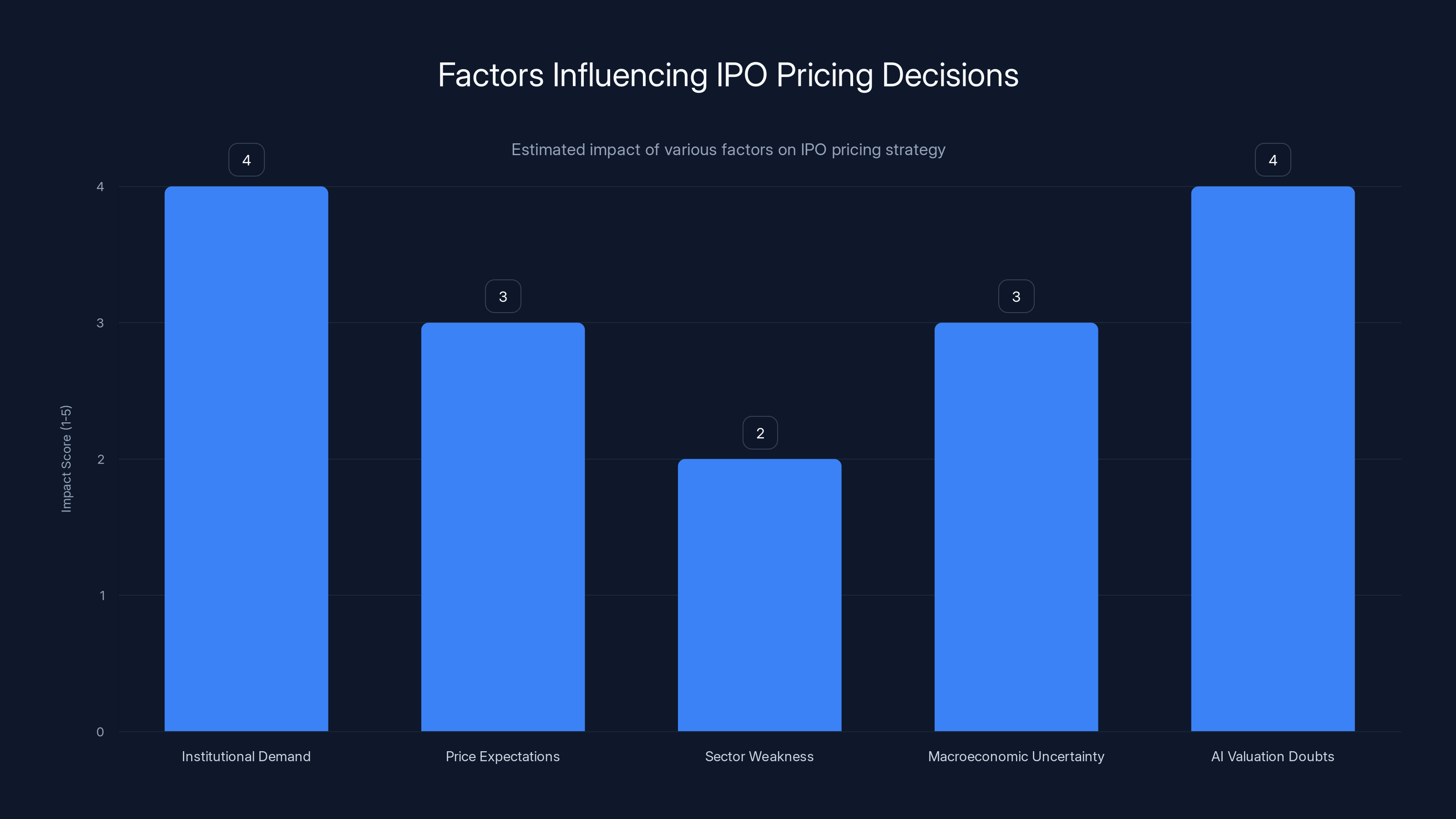

Estimated data shows institutional demand and AI valuation doubts as key influences on IPO pricing decisions, with scores indicating their relative impact.

The Reality of AI Adoption Timelines

One thing that separates realistic assessments of AI from hype is understanding adoption timelines.

Generative AI hit the mainstream in late 2022 with Chat GPT. It's now 2025. That's roughly two-and-a-half years. Some enterprises have deployed AI meaningfully. Most have not. Most are still in exploration and pilot phases.

Look at historical technology adoption curves: it took years for cloud computing to move from interesting to essential. It took years for mobile to transform IT. It took years for smartphones to become ubiquitous.

AI will be similar, except faster (because the benefits are clearer and the urgency is higher). But "faster" still means "multi-year." Probably 3-5 years before AI deployment becomes normal across enterprises. Maybe longer for specific verticals.

Fractal has 3-5 years of potential growth runway as companies move from pilot to production. That's real value. But it's not the kind of explosive growth that generates 50% pops on IPO day.

Investors who understand this timeline will see Fractal as a solid long-term play. Investors expecting rapid AI-driven explosive growth will be disappointed. That's probably where the disconnect came from.

The Role of IPO Underwriting and Pricing

The decision to cut the IPO by 40% deserves more examination because it tells you something about how underwriters read the market.

IPO underwriters (the investment banks that manage the process) are incentivized to size deals that succeed. A deal that's oversubscribed by 10x is embarrassing to underwriters because it suggests they mispriced it too low. A deal that's not fully subscribed is a disaster because it signals weak demand.

The ideal IPO is subscribed 3-5x. That suggests real demand but not excessive demand, and it gives the bankers credibility. For Fractal, cutting the size by 40% suggests that at the original size, subscription would've been lower than desired.

Why? Some combination of:

- Institutional investors had lower demand than the private market suggested

- Price expectations were too high for public market investors

- The Indian software sector weakness scared off some tech investors

- Broader macroeconomic uncertainty

- Investor doubts about AI valuations

Probably all of these factors. The bankers made a strategic decision: it's better to price conservatively and have a successful IPO than to price aggressively, miss subscription targets, and have the deal look weak.

That was the right call, even though it disappointed Fractal's investors expecting higher valuations. A failed or weak IPO would've been much worse for the company long-term.

International Expansion and Global Positioning

Fractal generates the bulk of its revenue from overseas markets, including the United States. This is actually important context that gets lost in the India-focused narrative.

Fractal is really a global company that happens to be headquartered in India and have significant operations there. It serves global enterprise customers. It competes globally.

That's good news because it means the company isn't solely dependent on Indian market adoption of AI. It's also bad news in some ways because it means growth is subject to global macro conditions, not just Indian conditions.

The IPO might've benefited from positioning Fractal more as a global AI enterprise software company rather than as India's AI champion. That might've attracted different investor profiles with different valuation expectations.

Looking forward, Fractal probably wants to grow even more international, which means building teams and customer relationships in the US and Europe. That requires capital, which the IPO provides. It also requires execution, which is the much harder part.

The Enterprise AI Software Market Timing

We're at an interesting moment in the evolution of enterprise AI software. Foundation models are available (from Open AI, Anthropic, Google, Meta, others). Infrastructure is standardizing (cloud platforms, AI platforms). The question is about application and integration.

That's exactly where Fractal plays. The question is whether the market recognizes that as a valuable position.

Historically, the companies that made the most money during gold rushes weren't always the miners—sometimes it was the people selling shovels and infrastructure. Fractal is kind of selling the shovels (the tools, integration expertise, implementation services) while the miners (enterprises) figure out how to extract value.

That's a defensible and ultimately quite profitable position. But it requires patience for the miners to actually start mining. That timeline is probably 2-3 years more than investors hoped.

Fractal's IPO valuation implicitly reflects a belief that the timeline will be extended. Fair enough.

What This Means for AI Investment Generally

Fractal's muted IPO is one data point in a broader pattern: the market is getting more realistic about AI timelines and outcomes.

What started as "AI will change everything" has evolved into "AI will change things, but in ways we're still figuring out, and it will take longer than we thought." That's more honest but less exciting.

For investors, this is actually good. It means we're past the pure hype phase and moving into the phase where actual business value matters more than narrative. Companies that can show sustainable business models and genuine customer value will do fine. Companies that are purely hype will have trouble raising capital and will see valuations compress.

For employees and founders, it means the gold rush mentality is fading. But that's okay because it means the companies that do succeed will be more stable and more sustainable.

Fractal's experience suggests that profitable, customer-focused AI companies can still raise capital and go public. They just won't get the venture-scale hype treatment. That's probably healthy for the ecosystem long-term.

Future Prospects and Key Metrics to Watch

If you're interested in how Fractal does post-IPO (and by extension, how the AI enterprise software market develops), here are the metrics that matter:

Revenue growth rate. Can they sustain 20%+ growth? If growth slows below 15%, it might suggest that the AI adoption ramp is slower than expected.

Profitability and margins. As they scale, do margins expand? Enterprise software should have improving margins as fixed costs spread across more revenue.

Customer concentration. How many customers represent what percentage of revenue? High concentration is riskier.

New customer acquisition cost and lifetime value. Is the business becoming more efficient at acquiring and retaining customers?

International expansion. Are they growing outside the US and India?

M&A activity. Do they use the capital to acquire complementary companies or to build organically?

These metrics will tell you whether Fractal's IPO was a start of a success story or a peak before reality set in.

Lessons for Other Tech Companies Going Public

Fractal's experience offers several lessons for other companies considering IPOs:

First, be realistic about valuation. The public market will pay for proven business value, not potential. If you're transitioning your business model (like Fractal from analytics to AI), make sure the new model is actually generating significant revenue before going public.

Second, understand your market sentiment. Fractal faced headwinds from broader sector weakness that had nothing to do with Fractal specifically. You need to be honest about whether it's a good time for your company to IPO, or whether you should wait.

Third, oversimplify your narrative at your peril. Fractal positioned itself as "India's AI company," which is fine, but it meant it got caught up in Indian tech sector weakness. Being more explicitly global might've helped.

Fourth, bankers aren't always right about sizing. It takes real market testing (the roadshow) to figure out what the market will actually pay. Be willing to adjust if the demand signals are weak.

Fifth, profitability matters more in public markets. VCs will fund unprofitable companies. Public market investors want to see a path to profitability and ideally profitability already achieved.

The Bigger Picture: Is AI in India Actually Stalling?

One narrative that could emerge from Fractal's IPO is that AI adoption in India is stalling or slowing. That would be wrong.

What actually happened is more subtle: India's trajectory toward becoming an AI hub is real and continuing, but it's more gradual and boring than people hoped. There's no dramatic breakthrough moment. It's just steady expansion of AI capabilities across the economy.

Companies like Fractal will benefit from that long-term growth even if the short-term IPO excitement wasn't there. The market for AI-powered enterprise software will grow. India's role in that market will grow. But it will grow at maybe 20-25% annually, not 200% annually.

That's fine. That's actually how most good technologies work. The boring long-term story is better than the exciting hype story.

Conclusion: The Reality Check

Fractal Analytics' IPO wasn't a failure and it wasn't a triumph. It was real. It revealed where the market actually is with AI: excited but cautious. Interested but realistic.

The company has a solid business, profitable operations, and real enterprise customers. It's positioned in a market with genuine growth potential. It should do fine long-term, assuming it executes on its plans.

What the IPO didn't do was validate the hype. It didn't signal that the AI boom is creating incredible wealth creation opportunities. It signaled that AI is becoming normal, which is actually the most important thing that could happen.

For India, it means the country will play a meaningful role in the global AI ecosystem, but that role will be more about implementation and integration than innovation. That's a respectable position, even if it's less glamorous than hoped.

For investors, it means the AI market is maturing. The days of easy money for any company with "AI" in its pitch deck are ending. Companies will need to prove real business value. Fractal has that. Many others don't.

For the tech industry more broadly, it's a sign that hype cycles are cooling down and reality-checking is setting in. That's uncomfortable for some but healthy for everyone. The companies that survive and thrive in this environment will be the ones with sustainable business models, real customer value, and executable plans.

Fractal is one of those companies. The IPO showed that the market knows it, even if the stock didn't pop. Long-term, that honest assessment is worth more than any first-day surge.

FAQ

What is an IPO and why does it matter?

An IPO (Initial Public Offering) is when a private company sells shares to the public and starts trading on a stock exchange. It matters because it's a major milestone for a company, allowing it to raise capital, provides liquidity for early investors and employees, and signals that the company has reached significant scale and maturity. For Fractal, the IPO meant transitioning from a private company owned by investors like TPG to a publicly traded company accountable to public shareholders.

Why did Fractal Analytics cut its IPO size by 40%?

Fractal cut the IPO size from ₹49 billion to ₹28.34 billion because investor demand during the roadshow was lower than expected. Investment bankers typically test demand by pitching to institutional investors before finalizing the IPO terms. When demand signals suggest the original size and valuation won't be fully subscribed, banks recommend downsizing to ensure a successful offering. For Fractal, this decision, while disappointing to those expecting higher valuations, was strategically sound because a successful smaller IPO is better than a failed or weak larger one.

What is Fractal Analytics' actual business model?

Fractal sells AI-powered software and services to enterprise customers in financial services, retail, and healthcare. It doesn't develop foundational AI models; instead, it integrates AI into solutions for data analytics, predictive modeling, automated decision-making, and process optimization. The company generates the majority of its revenue from overseas markets, particularly the United States, making it truly a global enterprise software company headquartered in India rather than a purely India-focused firm.

Why is investor sentiment toward Indian software stocks weak?

Investor concerns about Indian software and IT services stocks stem from uncertainty about how AI will impact traditional IT services business models. As generative AI becomes more capable at software development and business process work, there's legitimate questions about whether companies like TCS, Infosys, and Wipro can maintain their growth. Additionally, higher interest rates, slower tech spending growth, and macroeconomic uncertainty have made investors more cautious about valuation multiples for Indian tech companies.

How profitable is Fractal Analytics?

Fractal achieved a major milestone in fiscal 2025 by swinging to profitability with a net profit of ₹2.21 billion (

What does Fractal's IPO mean for other Indian AI companies?

Fractal's experience sets realistic expectations for other Indian AI companies considering going public. It signals that the market will price companies based on actual business fundamentals—revenue, profitability, growth rates—rather than on AI narrative alone. Other companies will likely need to achieve similar financial milestones before attempting IPOs, may prioritize international expansion rather than focusing solely on India, and might pursue acquisition rather than IPO as an exit strategy if they can't achieve Fractal-like growth and profitability metrics.

Is India still positioned to be a major AI hub?

Yes, India has real advantages for becoming a major AI hub: enormous talent pool, cost-effective development and implementation, growing government support, and massive market size. However, India's role is likely to be more about implementing and integrating AI capabilities rather than developing foundational AI models. Companies like Open AI and Anthropic are focused on innovation, while Indian companies like Fractal excel at taking those innovations and making them work for enterprises at scale. That's a valuable role but less headline-grabbing than being on the innovation frontier.

Why did Fractal's stock trade flat on the first day instead of popping?

Flat first-day trading indicates that investor demand and the IPO price were well-balanced, with no shortage of supply or excess demand. Unlike some IPOs where strong demand drives prices up sharply, Fractal's flat first day means the market price discovery mechanism worked efficiently, and investors were willing to buy around the offer price but weren't desperate to. This is actually rational behavior in a maturing market where people care more about fundamentals than hype, even if it's less exciting than a traditional IPO pop.

How long will it take for AI adoption in enterprises to scale?

Based on historical technology adoption curves and current market signals, meaningful enterprise AI adoption probably has 3-5 years of significant growth runway. Most companies are still in exploration and pilot phases. Full production deployment, training, integration with existing systems, and change management will take time. During this window, companies like Fractal that help enterprises navigate AI implementation should see steady growth, though probably not the explosive growth that venture investors initially hoped for.

What should long-term investors watch about Fractal's performance?

Key metrics to monitor include: maintaining 20%+ annual revenue growth, expanding profit margins as the company scales, diversifying customer concentration to reduce risk, improving customer acquisition efficiency (lower cost to acquire, higher lifetime value), expanding outside the US and India, strategic acquisitions that complement capabilities, and actual ROI delivered to customers that validates the business model. These metrics will reveal whether the IPO marks the beginning of a successful scaling phase or represents a peak valuation before reality sets in.

Key Takeaways

- Fractal Analytics cut its IPO size by 40% due to softer investor demand, reflecting realistic market pricing of AI adoption timelines

- The company remains profitable with 26% annual revenue growth, proving strong fundamentals despite muted first-day trading

- Indian IT sector weakness created headwinds unrelated to Fractal's actual business quality or growth trajectory

- Enterprise AI adoption takes 12-18 months minimum from pilot to production, explaining why explosive growth isn't realistic short-term

- India's role in AI will be as a major implementer and integrator rather than an innovation leader, positioning companies like Fractal for steady long-term value

Related Articles

- Anthropic's $14B ARR: The Fastest-Scaling SaaS Ever [2025]

- Larry Ellison's 1987 AI Warning: Why 'The Height of Nonsense' Still Matters [2025]

- Why B2B Software Isn't Dead: What AI Really Means for SaaS [2025]

- The 10x ARR Club: Which SaaS Companies Still Trade at Premium Valuations [2025]

- Cohere's $240M ARR Milestone: The IPO Race Heating Up [2025]

- How Spotify's Top Developers Stopped Coding: The AI Revolution [2025]

![Fractal Analytics IPO Signals India's AI Market Reality [2025]](https://tryrunable.com/blog/fractal-analytics-ipo-signals-india-s-ai-market-reality-2025/image-1-1771243696116.jpg)