The Moment Crypto Regulation Nearly Died

It was supposed to be a landmark moment for the entire cryptocurrency industry. After years of operating in regulatory limbo, crypto was finally about to get the rules it had been chasing since Bitcoin's inception. The Senate CLARITY Act represented something extraordinary: genuine bipartisan consensus on how to structure digital asset regulation in America.

Then, at 11:47 PM on Wednesday night, Brian Armstrong posted to X and blew it all up.

The Coinbase CEO announced his exchange was withdrawing support from the bill they'd championed for months. Not because the fundamentals were wrong. Not because crypto wasn't ready. He pulled out because of specific provisions that would affect Coinbase's bottom line more than any other player in the industry.

What happened next was unprecedented in crypto politics. Instead of rallying around the industry's largest exchange, competitors like Kraken, Ripple, and a 16z publicly criticized Coinbase. David Sacks, the White House's special advisor on AI and crypto, urged Armstrong to reconsider. The broader crypto community watched in disbelief as one company single-handedly threatened to derail the biggest regulatory opportunity the industry would likely see for another decade.

This wasn't just another policy disagreement. This was an inflection point for how the crypto industry would operate in American politics going forward. And it revealed something uncomfortable about the incentives that drive the most powerful players in the space.

TL; DR

- Coinbase withdrew support from the Senate CLARITY Act hours before committee markup, citing concerns about stablecoin yield restrictions favoring traditional banks, as detailed in Yahoo Finance.

- The rest of the industry opposed Coinbase's move, with Kraken, Ripple, a 16z, and White House advisors urging the exchange to resolve differences rather than abandon years of progress, according to Disruption Banking.

- The deadline is real: Midterm election season will make bipartisan crypto legislation nearly impossible after March, creating urgency to salvage the bill, as reported by Politico.

- This was about money, not principles: Coinbase's objections directly threatened its profitable stablecoin yield accounts, giving the exchange outsize leverage it was willing to use, as noted in CryptoSlate.

- The precedent matters: One company showing it can derail industry consensus signals to other exchanges and regulators that unified crypto advocacy is fragile, as highlighted by Chainalysis.

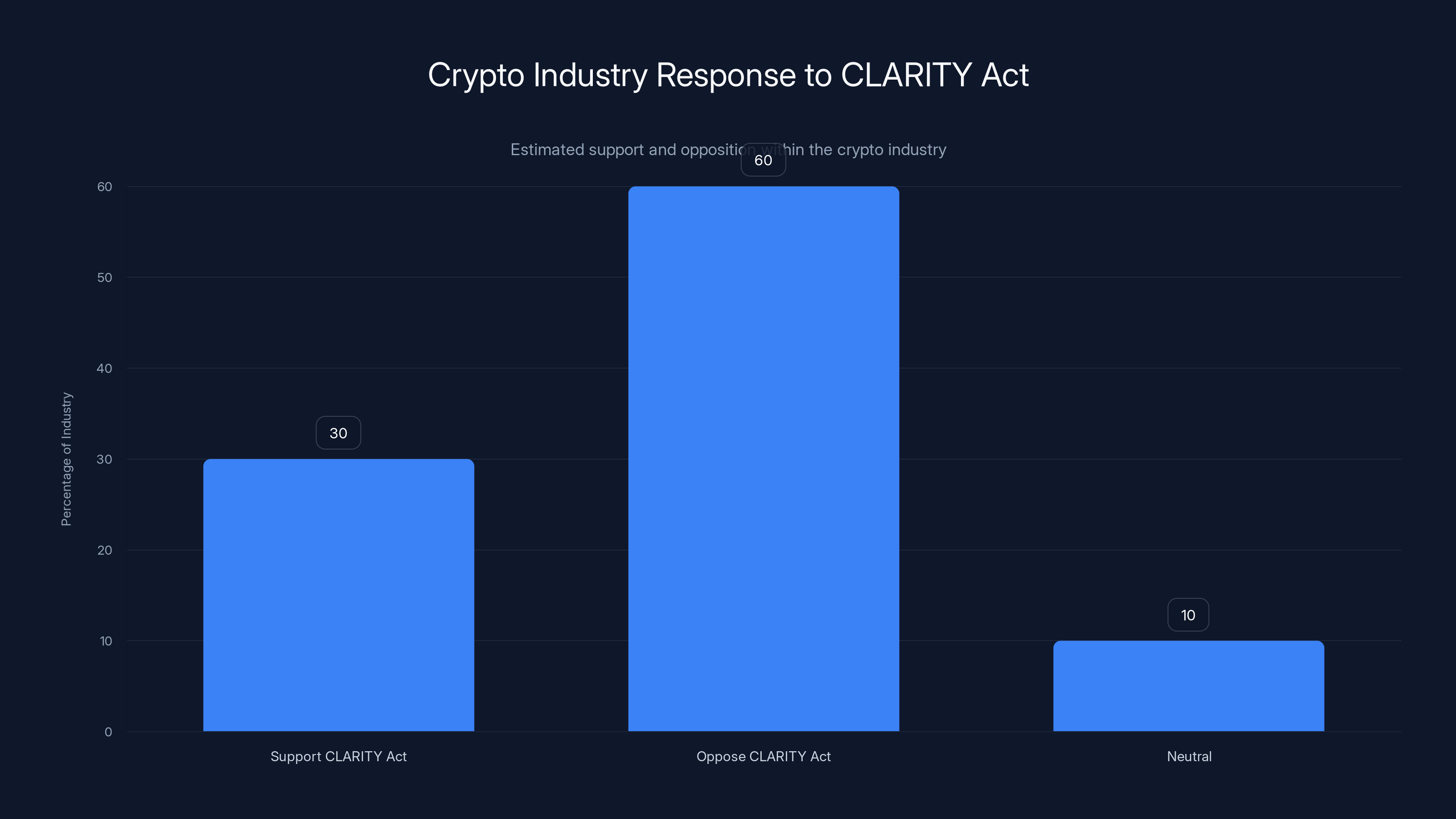

Estimated data shows that a majority of the crypto industry opposes the CLARITY Act due to concerns about its impact on innovation and competition with traditional banking.

What the CLARITY Act Actually Does

To understand why Coinbase's withdrawal landed like a bomb, you need to understand what was actually in the bill. The CLARITY Act wasn't theoretical crypto advocacy. It was hundreds of pages of specific regulatory architecture that would reshape how the entire American crypto market functions.

At its core, the act answers a question that's haunted the crypto industry since the SEC and CFTC both claimed overlapping jurisdiction: what is a cryptocurrency, legally speaking? Is it a security subject to SEC oversight, or a commodity subject to CFTC rules? Some tokens could be both. Some might be neither. The regulatory gray zone had created years of uncertainty.

The CLARITY Act would draw a line. Digital assets would be classified into discrete categories, each with its own regulatory framework, compliance requirements, and legal protections. Stablecoins would get their own designation with specific requirements. Token networks would be treated differently from trading platforms. Retail investors would have clearer protections. Companies would finally know what rules applied to them, as explained by Forbes.

This structure mattered more than the specific rules themselves. For twenty years, crypto companies operated on the assumption that regulations could change overnight depending on which agency felt most threatened. A sympathetic SEC chair might issue guidance. Then the chair changed and the guidance reversed. Companies couldn't invest in compliance infrastructure when the rules weren't stable.

The CLARITY Act promised stability. Once it passed, the fundamental structure of crypto regulation would require Congress to change it, not just a new agency director. That created the possibility of long-term business planning. That's what Coinbase had been supporting.

How We Got Here: Years of Bipartisan Progress

The CLARITY Act didn't emerge from nowhere in January 2025. It was the culmination of years of work, genuine negotiation, and recognition from both parties that crypto regulation needed to happen.

The House had already passed their version months earlier. The White House was ready to sign. Democrats and Republicans both had crypto constituencies and understood that American regulatory leadership mattered. If the US didn't establish clear rules, other countries would. Europe was already moving forward with MiCA. Asia was pushing its own frameworks. American policymakers understood that ceding ground on crypto regulation meant ceding technological and financial leadership, as noted in Investor's Business Daily.

Connor Brown, head of strategy for the Bitcoin Policy Institute, articulated the core industry position perfectly: "We don't want to be in a place where, with the change of every administration, what you can and can't do with software, or what you can and can't publish, changes."

That wasn't a left-wing or right-wing position. It was an argument about predictability. Businesses can't plan when rules change every few years. Investors can't allocate capital when frameworks are unstable. The crypto industry had spent two decades proving it wasn't a passing fad. Now it needed regulatory frameworks that reflected that reality.

The Senate Banking Committee chairman, Tim Scott (R-SC), was prepared to move forward. The committee markup was scheduled for Thursday. This was the moment where the serious work began, the detailed negotiation over every clause, amendment, and provision. The moment where the bill would be shaped into its final form before a full Senate vote.

Then midnight came.

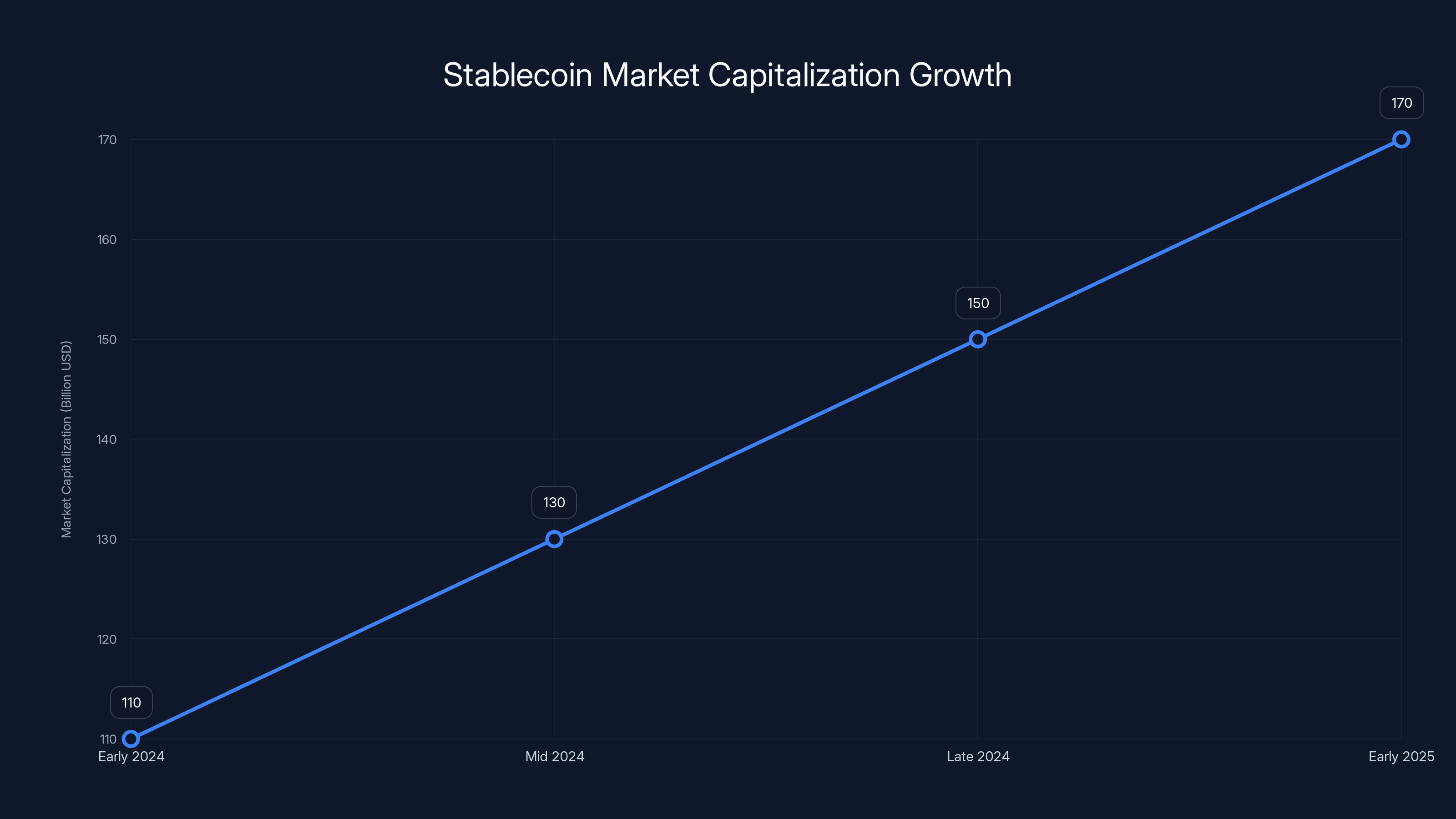

The stablecoin market capitalization is projected to grow from

The Coinbase Withdrawal: How It Happened

Coinbase had spent months supporting the CLARITY Act. Armstrong had been on Capitol Hill. The exchange had been involved in negotiations. Then, in the final hours before committee markup, Coinbase reviewed the draft and announced they were pulling out entirely.

"We'd rather have no bill than a bad bill," Armstrong said on X. He then blamed the big banks, claiming their lobbyists had inserted provisions at the last minute designed to protect traditional banking interests at crypto's expense, as reported by Yahoo Finance.

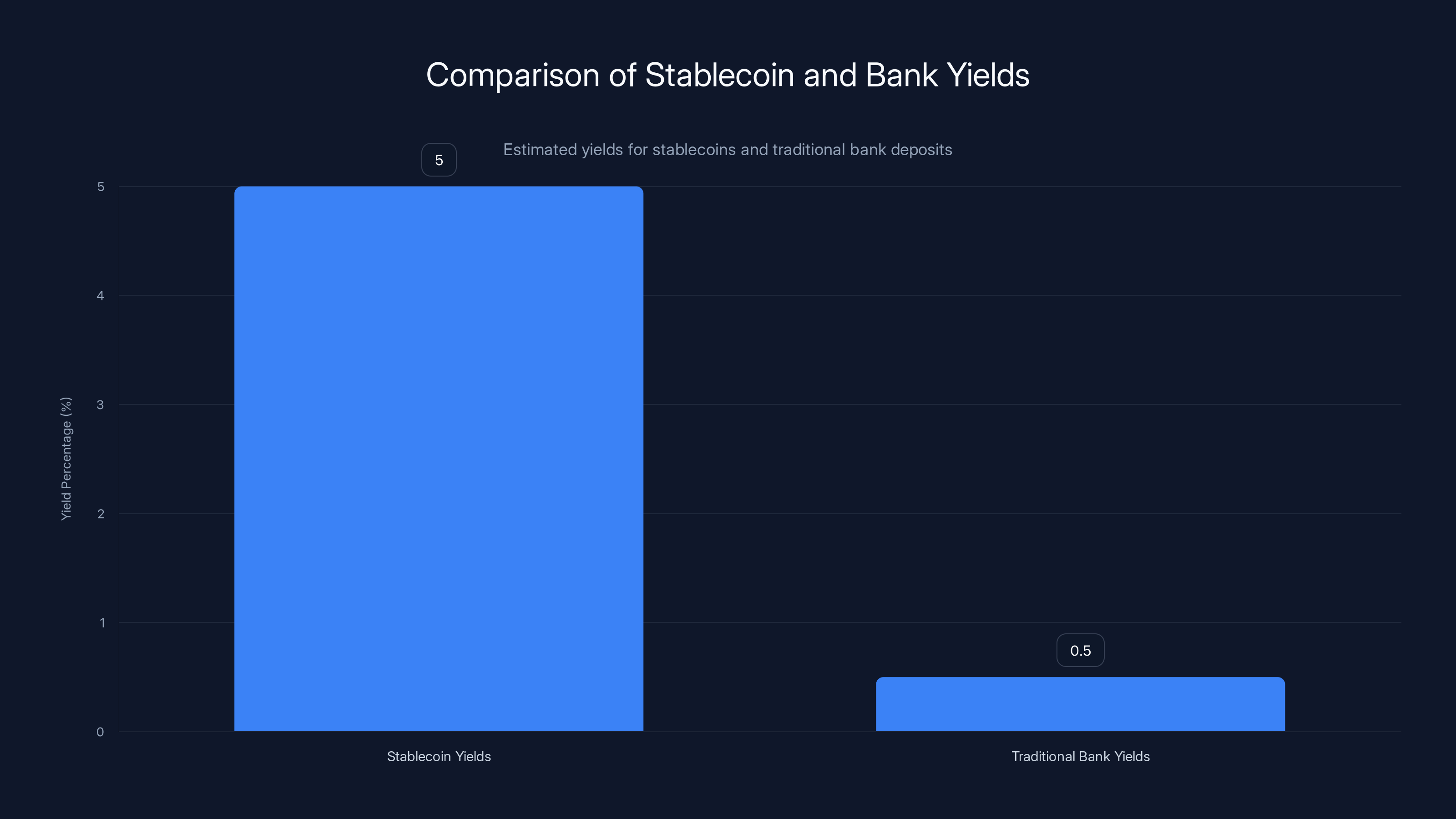

The specific complaint: whether crypto holders could earn interest on stablecoins. In traditional banking, depositors earn interest on savings accounts. Banks lend out deposits and pay a portion of the earnings back to savers. This is how banking economics work. Stablecoins function similarly—they're held in reserve pools and can generate yield.

But traditional banks had lobbied to restrict this. If crypto customers could earn better interest yields on stablecoins than they could on traditional savings accounts, they might shift deposits away from banks and into crypto platforms. From the banking industry's perspective, this was an existential threat. They wanted the bill to prohibit or severely restrict stablecoin yields, as detailed in America's Credit Unions.

Coinbase, which operates Coinbase Earn and other yield-bearing stablecoin accounts, would be directly harmed by such restrictions. This wasn't an abstract principle for the exchange. It was thousands of dollars in lost revenue per day.

But here's where Armstrong's argument got complicated. He was right that the banking industry had pushed for these restrictions. He was also correct that such restrictions would harm the crypto ecosystem. But was refusing to pass any bill better than passing an imperfect one? That question would divide the industry in a way few expected.

Why the Industry Turned on Coinbase

What shocked observers was how quickly the rest of the crypto industry rejected Coinbase's position. This wasn't unanimous agreement that the CLARITY Act was perfect. It was consensus that a flawed bill was better than no bill at all.

Kraken CEO Arjun Sethi released a statement almost immediately: "Reasonable people can disagree on specific provisions. That is precisely why the final stage of this process matters. The right response to outstanding issues is to resolve them not to abandon years of bipartisan progress and start over from scratch."

This wasn't a subtle critique. Sethi was saying Coinbase was being unreasonable. More importantly, he was correct about the timing. The committee markup process—the exact moment when outstanding issues get resolved—was about to start. This was the designated time to negotiate specific language, propose amendments, and work out compromises. Coinbase had just walked away from the negotiating table before negotiations officially began.

Chris Dixon, Andreessen Horowitz's managing partner, backed Sethi's position. A16z had enormous stakes in crypto regulation. They'd invested billions in crypto companies. But Dixon understood the bigger picture: getting a flawed crypto law passed now was better than hoping for a perfect one later, as noted by Cryptonomist.

Brad Garlinghouse, CEO of Ripple, also reaffirmed support for moving forward. David Sacks, the White House's crypto point person, explicitly urged Coinbase to "resolve any remaining differences" before the end of the month.

The message was clear: work within the process or accept the bill as written. Don't blow up the process itself.

But Coinbase wasn't backing down. Armstrong had drawn a line on the stablecoin yield issue. His position put him at odds with not just competitors but with influential venture capital investors, other exchange operators, and the White House itself.

The Stablecoin Yield Question: More Than Just Money

On the surface, the disagreement was about whether stablecoin holders could earn interest. But the issue cut deeper into fundamental questions about how crypto fits into the American financial system.

Traditional banks generate profit by taking deposits, lending them out, and keeping the spread between what they pay depositors and what they charge borrowers. That spread is interest. The banking model is built on this math: deposits in, loans out, profit in the middle.

Crypto could disrupt this entirely. If a stablecoin operator could lend out stablecoins and pay holders better yields than banks offered on savings accounts, why would anyone keep money in a bank? For crypto advocates, this is the whole point—providing better financial services to people by removing the traditional banking middleman.

For traditional banks, this is an existential threat. They don't want to compete on yields with crypto platforms. They want crypto restricted from offering yields that could attract deposits away from traditional banking.

The CLARITY Act draft that Coinbase saw apparently included restrictions favoring traditional banking. Maybe the restrictions were total prohibitions on stablecoin yields. Maybe they were caps on yields. Maybe they included reporting requirements that made yields uneconomical. The specific language mattered, but the direction was clear: the bill was being shaped to protect traditional banking interests, as outlined by Digital Watch.

Coinbase's objection was correct in principle. But their response—walking away from an entire regulatory framework that would legalize crypto—seemed disproportionate to the stakes. The broader industry understood something Coinbase maybe didn't: this might be the only opportunity for a generation.

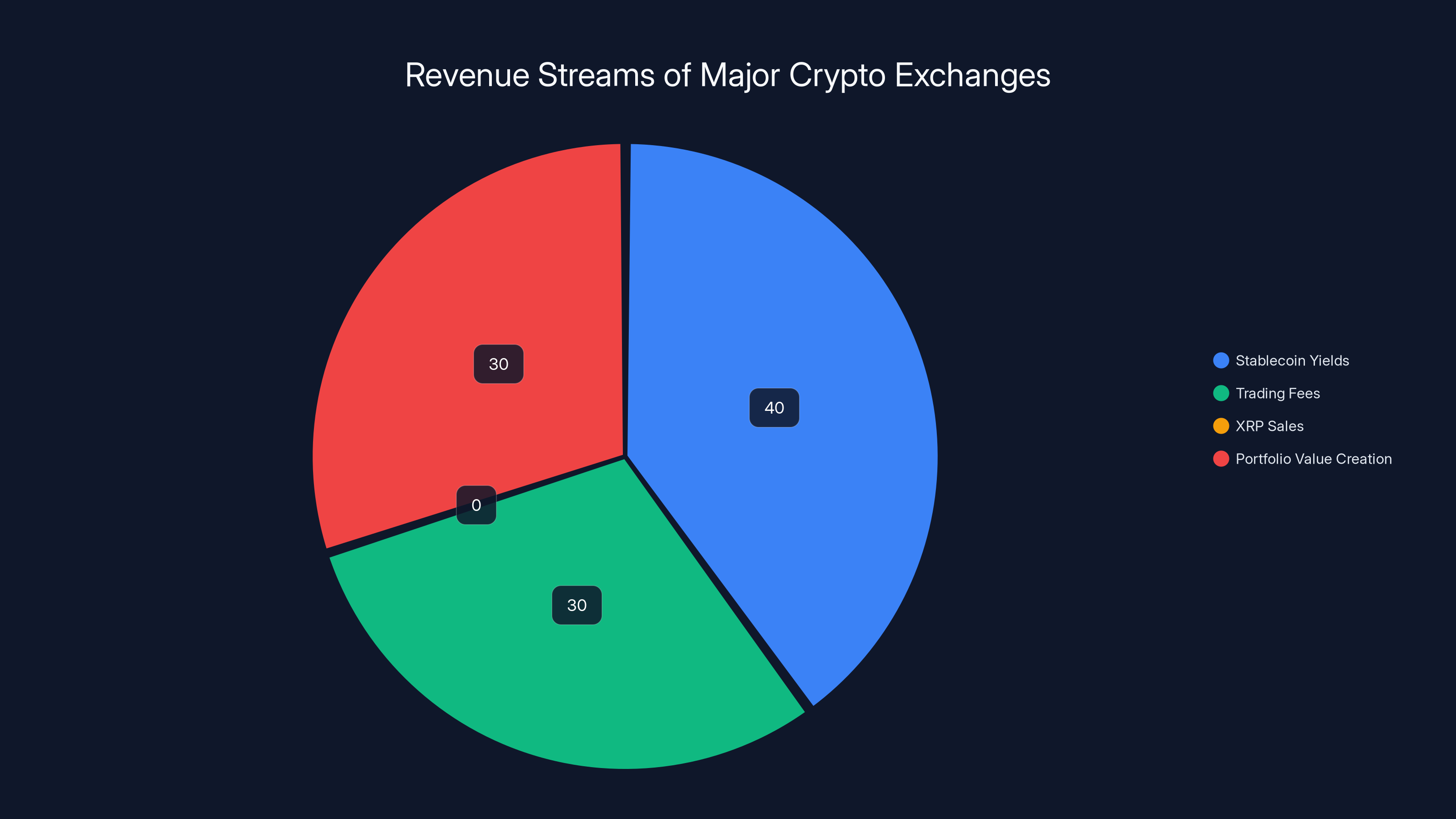

Coinbase relies heavily on stablecoin yields, unlike its competitors who have more diversified revenue streams. Estimated data.

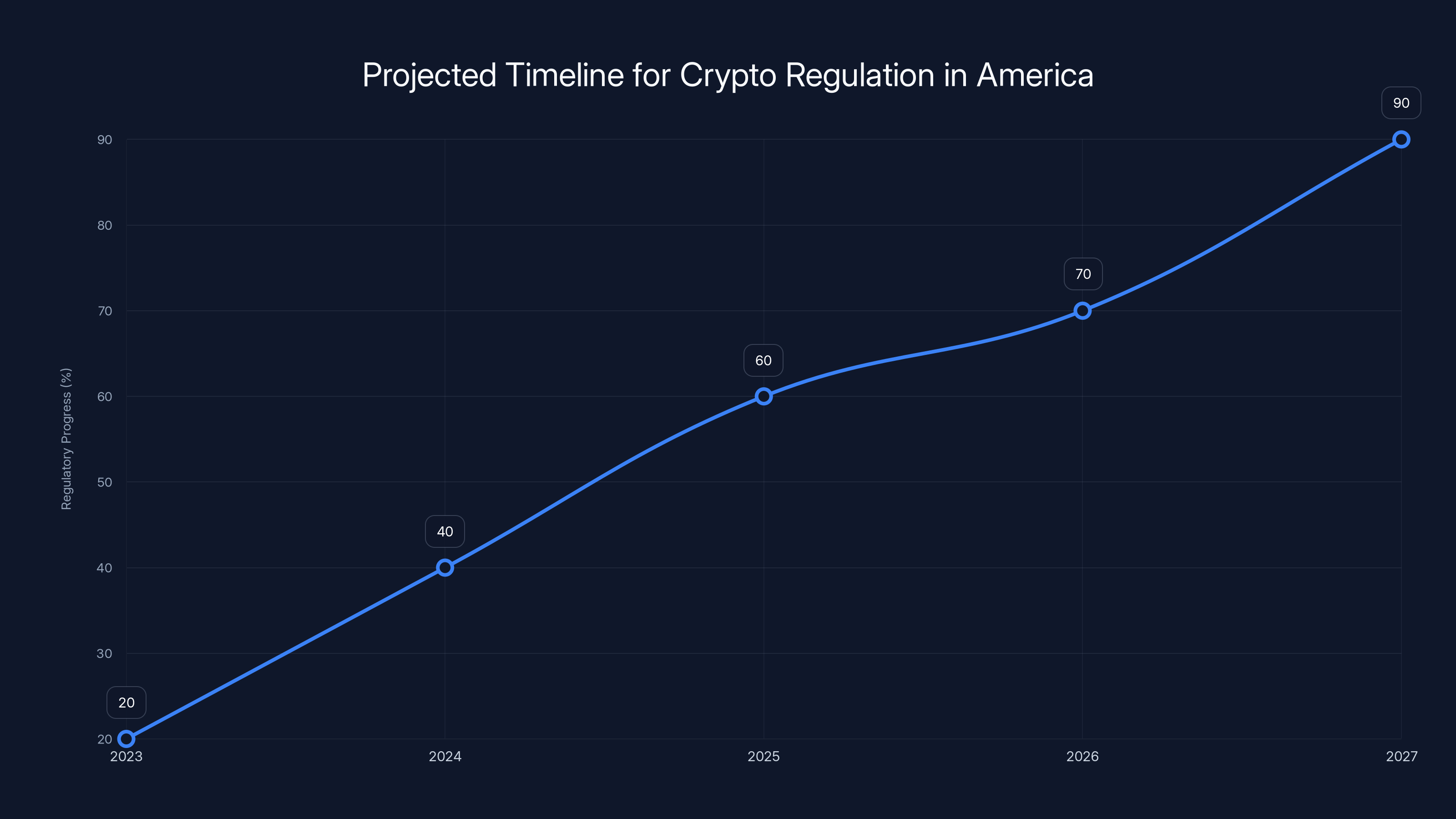

The Real Deadline: Midterm Elections

This is where the urgency becomes critical. And it's why so many industry players opposed Coinbase's walkout so forcefully.

Congress operates in cycles. Presidential election years are relatively stable. But the year after an election, something shifts. Members start thinking about reelection. By late spring, reelection campaigns are in full swing. Once campaigns begin, getting controversial legislation passed becomes nearly impossible. Members want to talk about their achievements, not defend difficult votes.

The midterm elections for 2026 would follow standard patterns. By mid-to-late March, campaigns would be ramping up. By May, most serious candidates would be in full campaign mode. That meant the window for passing bipartisan crypto legislation was essentially January and early February. Maybe stretch into March if they worked fast, as noted by SVB.

Coinbase's withdrawal happened in mid-January. Committee markup was supposed to happen the following week. If the committee passed an amended version by late January, the bill could hit the Senate floor in February. Maybe it passes by mid-March. That's a tight timeline, but achievable.

But if negotiations dragged, if Coinbase forced a do-over, if the bill had to start fresh in the House, the timeline collapsed. Start over in February, you're already behind. Start over in March, you've missed the window entirely. The bill would have to wait until 2026, after midterms, after the new Congress assembles. That's at least 18 months away. In that time, administrations change, party control of Congress could shift, the entire political alignment could transform.

Bradley Garlinghouse understood this completely. So did David Sacks. So did every serious player in the crypto industry except Coinbase. They understood they had a three-week window, maybe four weeks if they were lucky. Coinbase's demand to renegotiate the stablecoin yield provisions threatened to blow past that window.

Why Coinbase Had Unusual Leverage

Coinbase's unusual position came from a specific reality: they have more to lose from stablecoin yield restrictions than any other player in the industry.

Coinbase is a public company. It has earnings reports. Investors scrutinize revenue. The company has built significant revenue streams from stablecoin yield accounts. These accounts generate transaction fees, spread earnings, and yield income. If the CLARITY Act prohibited stablecoin yields, Coinbase's revenue model would face serious headwinds.

Other exchanges have diverse revenue streams. Kraken takes trading fees. Ripple sells XRP. A16z benefits from value creation across their entire portfolio. Coinbase is concentrated in spot trading and yield-bearing accounts. For Coinbase, the stablecoin yield issue wasn't theoretical—it was a direct hit to quarterly earnings.

This gave Coinbase unusual leverage. They could credibly threaten to withdraw support. The rest of the industry depended on Coinbase's participation for political credibility. If the largest exchange in the US opposed the bill, that would create doubt among policymakers. So Coinbase could use that threat as leverage to demand specific provisions.

But there was a cost to using that leverage. Once Coinbase revealed they were willing to derail the entire regulatory framework to protect a specific revenue stream, they revealed their incentives. They revealed they cared more about profits than about legal certainty. They revealed they would use their market position as leverage for financial gain.

That changed how the rest of the industry saw Coinbase. From then on, Coinbase wasn't seen as an industry leader but as a competitor willing to sacrifice industry consensus for personal advantage. That's a reputational hit that doesn't recover quickly.

The Response from Washington

Tim Scott's move was significant. The Banking Committee chairman immediately cancelled the markup. He didn't push forward without Coinbase. He didn't dismiss Armstrong's concerns. He called it a "brief pause" to renegotiate.

This was diplomatic language for: Coinbase just complicated everything, but we're not giving up. Scott understood the deadline. He understood the politics. But he also understood that ramming through a bill over the largest exchange's objections would poison the well for future crypto regulation.

David Sacks, though, was more direct. The White House special advisor urged Coinbase to work through the issues rather than abandon the bill entirely. That wasn't a suggestion. That was a signal from the administration that they wouldn't support Coinbase's walkout. They might negotiate on stablecoin yields. They would not allow the entire regulatory framework to collapse.

But the White House's position was also constrained. If Coinbase continued to resist, there wasn't much the administration could do besides apply political pressure. The bill would still need Senate votes. If Coinbase's withdrawal signaled to senators that the crypto industry was divided, some senators might get nervous. Division in an industry claiming to want regulation looks like the industry isn't actually united on what regulation should look like.

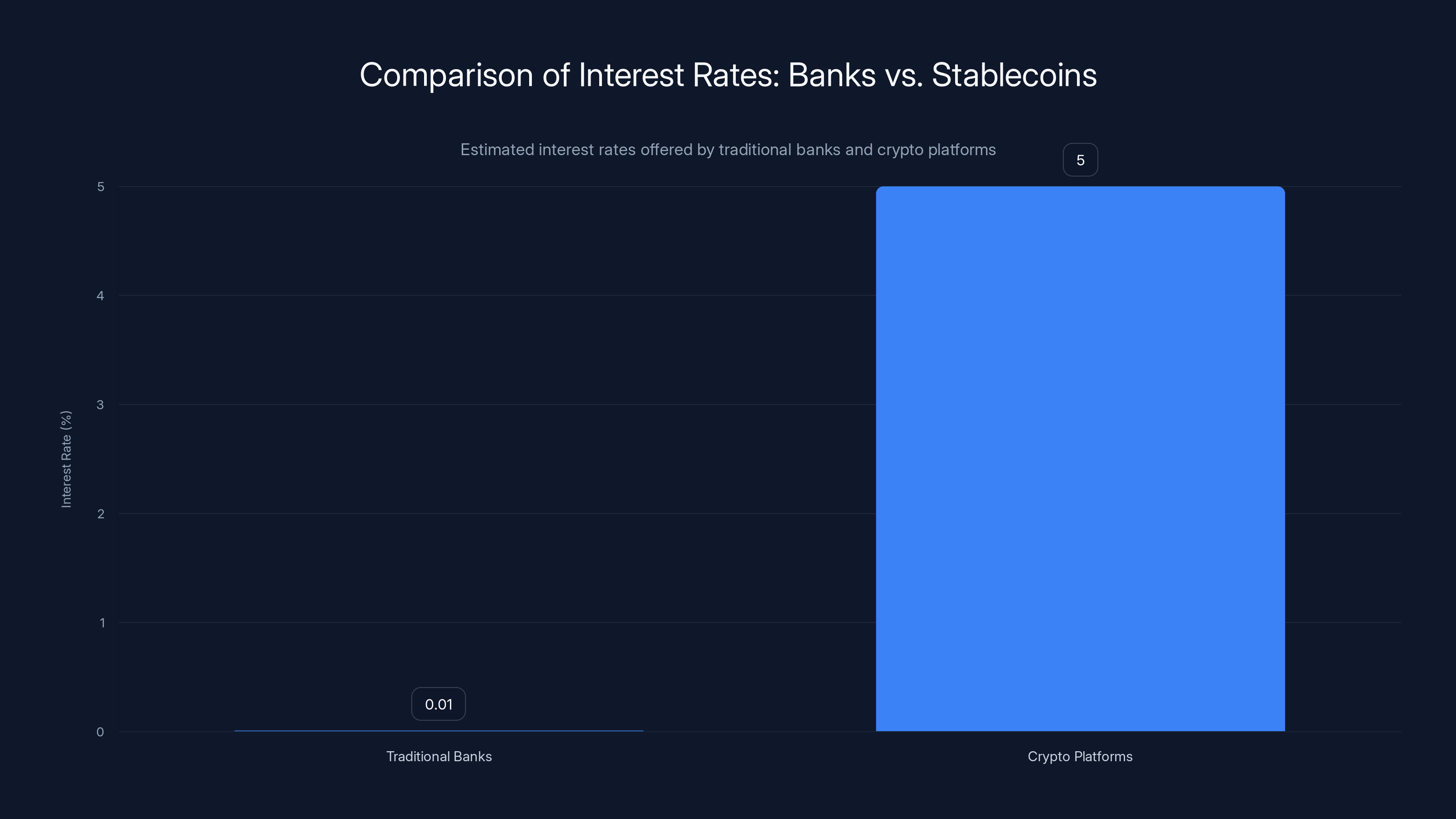

Crypto platforms offer significantly higher interest rates on stablecoins compared to traditional banks, highlighting a key competitive advantage (Estimated data).

Market Reaction and Industry Fallout

The crypto markets responded to the news almost immediately. Bitcoin, which had been rallying on regulatory clarity expectations, pulled back slightly. Not a crash, but enough to signal that investors had been pricing in regulatory passage.

The real fallout was organizational. Coinbase had positioned itself as an industry leader, the bridge between crypto and traditional finance. That positioning collapsed overnight. Competitors weren't shy about pointing out that Coinbase had prioritized its own profit over industry progress.

For Kraken, Coinbase's withdrawal was actually an opportunity. Arjun Sethi positioned Kraken as the responsible exchange willing to work within the political process. That doesn't get them positive headlines in the moment, but it builds credibility with policymakers. When the next round of negotiations happened, Kraken would be in the room as the reasonable voice.

For A16z, the situation was even more interesting. Chris Dixon's statement backing the bill actually increased A16z's credibility in Washington. They'd invested billions in crypto, but they weren't willing to blow up crypto policy for short-term gains. That's the kind of principled position that gets respect from policymakers.

For Ripple, the situation was complicated. Ripple's XRP had always been somewhat controversial in regulatory circles. Some saw it as too centralized, too much like a traditional corporate instrument rather than a true decentralized asset. But Brad Garlinghouse's support for the CLARITY Act, even the flawed draft version, signaled that Ripple was willing to work within the system. That shifted how some policymakers thought about the company.

Coinbase's position had been eroded from all sides. The White House opposed their walkout. Competitors opposed it. Sophisticated investors opposed it. The political establishment didn't support it.

Yet Armstrong held firm. That suggests either tremendous conviction in his position or recognition that backing down would make Coinbase look weak. Probably both.

The Broader Pattern: One Company's Leverage Problem

What Coinbase's situation revealed was a fundamental tension in crypto's relationship with politics and regulation. The industry is fragmented. Exchanges compete fiercely with each other. They have conflicting interests. Bitcoin maximalists oppose token features that PoW coins like Ethereum support. Layer 1 projects worry about regulations that favor Layer 2s. Stablecoin issuers have different incentives than decentralized finance platforms.

Bringing this fragmented industry to unified political consensus was already a miracle. For years, crypto couldn't agree on anything. Then they found something they could agree on: the need for regulatory clarity. Every segment of the industry benefited from knowing the rules.

But that unified consensus depended on the largest players being willing to accept imperfect outcomes. Bitcoin maximalists had to accept that altcoins would be regulated. Exchanges had to accept that certain token features would be prohibited. Everyone had to give something up.

Coinbase's withdrawal signaled that this consensus was more fragile than anyone realized. One company, with enough market power, could hold the entire framework hostage for its own financial interests.

This creates a precedent. If Coinbase can derail a bill by threatening to withdraw support, why wouldn't other exchanges do the same? Why wouldn't Kraken hold out for provisions favoring their business model? Why wouldn't Ripple demand protections for XRP?

Once you start down that road, industry consensus becomes impossible. Every player starts using their market position as leverage for their own interests. The unified position collapses. And that's exactly when policymakers lose patience with the industry.

The Stablecoin Yield Issue in Detail

Let's dig deeper into why this specific issue became the breaking point.

Stablecoins are the onramp and offramp for the entire crypto ecosystem. You want to trade crypto? You convert fiat to stablecoins first. You want to exit crypto? You convert to stablecoins and withdraw to your bank. Without liquid, widely-trusted stablecoins, the entire crypto ecosystem gets more friction.

But stablecoins also sit at the intersection of crypto and traditional finance. A stablecoin pegged to the US dollar essentially operates like a shadow banking system. When users hold stablecoins instead of dollars in a bank, they're making a choice about where to store their value.

Traditional banks have been losing deposits to crypto for years. The Federal Deposit Insurance Corporation would never admit this officially, but banks know that every stablecoin user is potentially a depositor they've lost. Once users trust stablecoins enough to hold significant balances, why keep money in a bank earning 0.01% when crypto platforms offer 5% on stablecoins?

The banking industry's solution was to lobby for regulations that would prevent stablecoins from offering yields competitive with bank accounts. If stablecoins couldn't offer yields, or could only offer yields lower than traditional savings accounts, then users would have no reason to prefer stablecoins for holding value. They'd be useful for transactions but not as value storage.

Coinbase's position was that this was exactly the wrong approach. If you're trying to bring financial services to people outside the traditional banking system, you can't do that while restricting their ability to earn on their capital. That's the whole point of decentralized finance.

But the banking industry had leverage. They had political relationships. They had long histories working with regulators. And they were willing to use that leverage to protect their business model.

The CLARITY Act draft reflected banking industry influence. The compromise that everyone except Coinbase was willing to accept included provisions restricting stablecoin yields. Not total bans, but meaningful restrictions that would reduce yields below what crypto platforms would naturally offer.

Coinbase saw this compromise as unacceptable. Armstrong's position was that accepting yield restrictions meant accepting a regulatory framework specifically designed to protect traditional banking interests at crypto's expense. That's philosophically problematic and practically harmful to Coinbase's business.

But was that reason enough to blow up an entire regulatory framework? That's where industry opinion diverged from Coinbase.

Stablecoins typically offer higher yields (estimated at 5%) compared to traditional bank deposits (estimated at 0.5%), highlighting their attractiveness despite potential risks. Estimated data.

What Happens to Crypto Regulation If CLARITY Fails

The nightmare scenario for the entire crypto industry was that the CLARITY Act would fail completely. And if that happened, the blame would fall on Coinbase.

Without the CLARITY Act, crypto would continue operating in regulatory limbo. The SEC would keep claiming jurisdiction over tokens. The CFTC would keep claiming jurisdiction over futures and commodities. States would implement their own rules. Companies would continue making good-faith guesses about what was legal and what wasn't.

Some companies would get shut down for violations of regulations they didn't know existed. Others would operate for years before regulators decided to enforce rules retroactively. Innovation would slow because nobody could invest with confidence that their business model would still be legal in five years.

For mature companies like Coinbase, this is manageable. They have legal teams and regulatory relationships. They can navigate the ambiguity. But for startups and new entrants, regulatory ambiguity is paralyzing. If you can't be sure whether your idea is legal, you don't build it.

With the CLARITY Act, all of that changes. The rules are clear. Companies can plan. Investors can allocate capital. The industry can mature.

Without it, crypto stays in the gray zone. Growth slows. Innovation moves to other countries. America loses the competitive advantage in crypto that it still has.

The industry's calculation was: a flawed regulatory framework with clear rules is better than no framework at all. Coinbase calculated differently. Maybe they were right. Maybe yields are such a critical component of the crypto value proposition that accepting restrictions on them is worse than accepting no regulatory framework.

But that's a judgment call that Armstrong was making not just for Coinbase but for the entire industry. And most of the industry disagreed with his judgment.

The Precedent for Future Industry Organizing

One of the most significant impacts of Coinbase's withdrawal was what it signaled about how the crypto industry could organize politically going forward.

For the first 15 years of crypto, the industry basically couldn't agree on anything. Bitcoin people thought everything else was a scam. Ethereum people thought Bitcoin was outdated. DeFi advocates wanted no regulation. Traditional finance people who moved into crypto wanted heavy regulation.

The CLARITY Act happened because these different factions found something they could all agree on: the need for clear rules, even if the rules weren't perfect. That was huge. It represented an unprecedented level of industry coordination.

But it was also fragile. It depended on everyone being willing to accept outcomes that weren't ideal for their specific business model. The moment a major player said "no, I won't accept this compromise," the entire edifice of consensus became questionable.

Coinbase revealed that consensus. They showed that major players would be willing to walk away from industry-wide progress to protect their own financial interests. That's a message to every other exchange, every token project, every DeFi protocol: the consensus isn't as strong as it appears.

For future attempts at industry organization, Coinbase's withdrawal signals that unanimous consent is unachievable. Some players will always defect. That means future regulatory efforts will have to either (a) find ways to address the concerns of potential defectors before they defect, or (b) move forward without universal agreement and accept that some industry players will oppose the outcome.

Option (a) requires more sophisticated negotiation and willingness to compromise. Option (b) requires acceptance that industry consensus is a myth.

Most likely, future regulatory efforts will do both. They'll try harder to bring everyone to the table early. But they'll also move forward with less than unanimous agreement, understanding that perfect consensus is impossible when financial incentives diverge.

The White House's Crypto Strategy

David Sacks' involvement in pushing back against Coinbase revealed something about how the Trump administration was approaching crypto. They wanted crypto to have a seat at the regulatory table, but they wanted the industry to act as a mature adult. That meant accepting imperfect regulations and working within the political process rather than threatening to blow up the process when you didn't get your way.

Sacks had been brought in precisely because he understood both crypto and politics. He wasn't a crypto ideologue. He was a sophisticated operator who understood that crypto's long-term interests depended on being seen as willing to engage seriously with regulation.

Coinbase's withdrawal looked, from Sacks' perspective, like the industry throwing a tantrum because it didn't get everything it wanted. That's not the image the White House wanted crypto presenting to Congress.

The White House strategy seemed to be: support crypto regulation, but only if crypto shows it can handle the messy business of politics. That means accepting outcomes you don't like. It means negotiating in good faith. It means not threatening to blow up the process when things don't go your way.

Coinbase had violated that implicit bargain. They'd shown they were willing to blow up the process to protect their own financial interests. That made them less useful allies from the White House's perspective.

But Sacks also needed crypto regulation to pass. He needed something he could point to as a win for the administration. So he was still pushing to save the bill, but he was also making clear that if Coinbase continued to resist, the administration would move forward without Coinbase's support.

That's actually a powerful signal. It means Coinbase no longer had as much leverage as they thought. The White House, Congress, and the rest of the industry could all move forward without them. Coinbase could force themselves to the outside of the regulatory process they'd wanted to shape.

Estimated data suggests gradual progress in crypto regulation, with significant advancements expected by 2027 as industry and political alignment improve.

Historical Parallels: When Industries Fight Regulation

Coinbase's situation echoed historical patterns of how industries resist regulation.

When the SEC was created in the 1930s, some segments of the financial industry opposed it vehemently. They argued that any regulation would stifle innovation and hurt American competitiveness. But other segments recognized that some regulation was inevitable and better to shape that regulation than fight it entirely. The segments that fought hardest ended up with the worst regulatory outcomes. The segments that engaged seriously with regulators got better deals.

The same pattern played out with environmental regulation in the 1970s. Some industries fought the EPA entirely. Others engaged and shaped regulations to be more reasonable. The ones that fought hardest lost because regulators figured out how to regulate without their input.

Coinbase's situation was following this same pattern. By threatening to blow up the entire regulatory framework over stablecoin yields, Coinbase was essentially saying they'd rather fight than negotiate. But fighting regulations that policymakers are already committed to usually means losing worse than negotiating would have.

A company that accepts a 70% regulatory victory and builds goodwill usually does better long-term than a company that holds out for 100% and gets 0%. Coinbase seemed to be betting the opposite.

The Technical Reality of Stablecoin Yields

Understanding the actual mechanics of stablecoin yields helps explain why Coinbase made this stand and why everyone else thought they were overreaching.

When you deposit stablecoins on Coinbase, they don't just sit there. The platform lends them out or uses them for liquidity mining or other yield-generating activities. Some portion of that generated yield gets paid back to the account holder. The rest goes to Coinbase as fees and profit.

This is economically efficient. Capital that's sitting unused is capital that's not producing value. Lending it out at interest means the capital generates returns. Those returns get partially passed through to depositors, partially retained by the platform.

But regulators worry that stablecoin yields could function as uninsured deposits. If Coinbase promises 5% yields on stablecoins but then fails and can't pay those yields, depositors lose money. Unlike traditional bank deposits, stablecoin deposits aren't FDIC insured. So the yield could be attractive precisely because the risk isn't fully priced in.

The banking industry's concern was that stablecoins would offer higher yields than banks (because they don't have the overhead of traditional banking) and that depositors would treat stablecoins as risk-free because the yields made them attractive. Then if stablecoin platforms failed, you'd have a financial crisis.

Coinbase's response was that this concern, while theoretically valid, was overblown. Stablecoin platforms didn't have the same leverage problems banks had. They didn't make risky loans. They operated on smaller margins. The yield they could offer was sustainable.

Both sides had valid points. Regulators did need to think about yield-bearing stablecoin risks. But restricting yields entirely prevented stablecoins from being fully competitive with traditional banking, which was the whole point of crypto from the beginning.

The CLARITY Act draft apparently tried to thread this needle by allowing yields but with restrictions and reporting requirements. That wasn't perfect from either side's perspective, but it was a reasonable compromise.

Coinbase didn't see it that way. They wanted full freedom to offer yields without restrictions. When they didn't get that, they walked.

The Timing Question: Why January?

Coinbase's withdrawal happened in mid-January. Why then? Why not earlier when they could have shaped negotiations differently? Why not later when they could have tried to amend the bill?

The timing suggests that Coinbase was hoping the stablecoin yield issue would be resolved in their favor. When they reviewed the final draft and saw it wasn't, they made a sudden decision to pull out entirely.

But that decision was made at the worst possible time. The committee markup was literally about to start. This was the moment when amendments could still change the bill meaningfully. But Armstrong walked away right before that negotiation began.

It's possible that Coinbase had intelligence that negotiations wouldn't go their way. That their position on stablecoins wasn't winning in committee. That they were going to lose on this issue. So they decided to withdraw before they lost, hoping to force a renegotiation.

Or it's possible that Armstrong made an impulsive decision. His X posts had the tone of someone who'd just made up his mind and was acting on conviction rather than strategy. That would explain why the timing was so bad from a negotiating perspective.

Either way, the withdrawal happened at precisely the moment that made it hardest for the bill to recover and most likely to stall.

What Happens Next: The Three Scenarios

After Coinbase's withdrawal, three scenarios became possible.

Scenario One: Coinbase Gets What They Want

Coinbase's withdrawal forced renegotiation. Maybe they used their leverage correctly. Maybe their position on stablecoins was actually negotiable and they just hadn't pushed hard enough before. Maybe the committee comes back with a bill that allows stablecoin yields more freely.

In this scenario, Coinbase's gamble works. They get their preferred bill. But they've damaged their relationships with every other major industry player. They're no longer seen as an industry leader but as a company willing to hold up the entire sector for financial gain. That reputational cost is real.

Scenario Two: CLARITY Act Passes Despite Coinbase

The committee negotiates over several weeks. Coinbase stays in opposition but the rest of the industry stays supportive. The bill passes with or without Coinbase's backing. The stablecoin yield restrictions remain roughly as drafted.

In this case, Coinbase's objections are noted but overruled. They get a regulatory framework anyway, just not the one they wanted. But now they have to operate under regulations they actively opposed, which gives regulators less incentive to work with them going forward. And they've spent their political capital to get a worse outcome than they might have gotten by negotiating.

Scenario Three: The Bill Stalls and Dies

The renegotiation drags on. Attention shifts to other issues. Midterm elections start ramping up. The bill never makes it to a Senate floor vote. By 2025's end, it's effectively dead.

This is the nightmare scenario. Coinbase's withdrawal created just enough friction to keep the bill from moving. But the bill's failure becomes crypto's failure in the eyes of Congress. The industry becomes less trusted as a partner. Future regulatory efforts start from a worse position.

In the weeks after Coinbase's withdrawal, all three scenarios remained on the table. The industry was holding its breath to see which direction events would take.

Implications for Crypto's Political Future

Regardless of what happened with the CLARITY Act specifically, Coinbase's withdrawal signaled something profound about how crypto would organize politically going forward.

First, it revealed that industry unity is conditional and fragile. Major players will support each other's interests right up until those interests conflict with their own financial outcomes. Then all bets are off.

Second, it showed that market power matters in crypto politics. Coinbase's size meant they couldn't be ignored. They could force renegotiation on a bill already in final form. Smaller exchanges have no such leverage.

Third, it demonstrated that different segments of the crypto industry have genuinely conflicting interests. This isn't a unified ecosystem with aligned incentives. It's multiple businesses competing for the same customers and political attention.

Fourth, it proved that the White House and Congress don't need industry consensus to pass crypto regulation. They can move forward with industry support or without it. That actually gives them more leverage than if they depended on all-industry agreement.

For crypto's future political trajectory, this matters enormously. Policymakers learned that they can negotiate with the crypto industry more easily if they focus on reasonable players willing to compromise (Kraken, Ripple, A16z) while isolating unreasonable ones (Coinbase). That's a lesson they'll remember in future regulatory efforts.

The Stablecoin Wars: A Bigger Picture

Coinbase's objection to stablecoin yield restrictions wasn't unique to Coinbase. It was the opening salvo in what would likely become years of conflict between crypto and traditional finance over who controls the stablecoin ecosystem.

Stablecoins are the gateway between crypto and the real world. They're how people move fiat currency into crypto and back out again. They're how users hold value in a form that's not volatile. They're fundamental to crypto's utility.

But they're also potentially in competition with traditional banking and monetary policy. If everyone held stablecoins instead of dollar bank accounts, the Federal Reserve would lose control of monetary policy. Banks would lose access to deposits they rely on for lending.

This isn't a far-off concern. As of January 2025, over $170 billion in stablecoins were in circulation. That's not huge compared to the global money supply, but it's growing rapidly. In ten years at current growth rates, stablecoins could represent trillions in value.

Traditional finance sees stablecoins as an existential threat. They see crypto as trying to bypass the traditional financial system. Restricting stablecoin yields is one way to fight that threat. It's saying: if you want yields, you have to use traditional banking. You can use stablecoins for transactions, but not for value storage.

Coinbase correctly understood this dynamic. Their objection to yield restrictions was an objection to being cornered into just serving as a transaction layer while traditional finance retained all the profitable stuff (interest-bearing deposit accounts).

But the broader crypto industry seemed willing to accept that compromise, at least temporarily. They were willing to say: okay, we'll accept yield restrictions for now. Once crypto has legal framework and gets mainstream adoption, we can revisit this. Once stablecoins are genuinely decentralized and trusted, we can fight harder to allow yields.

Coinbase wasn't willing to accept that incremental approach. They wanted full permission to compete with traditional banking immediately. That's actually the right long-term vision. But it's asking for too much too fast politically.

Lessons for Future Regulatory Efforts

For the next attempt at crypto regulation, several lessons became clear from the CLARITY Act experience.

First, build consensus before you draft the bill. Make sure the major industry players are truly aligned before proposing language. The time to find out Coinbase objects to stablecoin yields is in early negotiations, not when the bill is finalized.

Second, identify which industry players have genuinely divergent interests and address those differences explicitly. Don't pretend the industry is unified when it's not. Build a coalition that includes most of the industry but acknowledges that some players might dissent.

Third, set firm deadlines. Make clear that negotiations happen in windows, and if the window closes without agreement, you move forward without it. That prevents last-minute threats from derailing everything.

Fourth, cultivate relationships with multiple industry players, not just one or two. Don't give any single company veto power over policy. If Coinbase had been one of five equally powerful exchanges, they couldn't have stopped the bill single-handedly.

Fifth, understand the specific financial incentives of major players and how those incentives align or conflict with broader industry progress. This isn't just politics. It's economics. Companies will prioritize profits over industry-wide progress when incentives push them that way.

Finally, remember that perfect consensus is impossible when interests diverge. Move forward with majority support and accept that some industry players will oppose you. That's normal, and it doesn't mean you're wrong.

Coinbase's withdrawal was actually valuable in that it taught these lessons early, before crypto regulation became entrenched in law. Future efforts could learn from this experience and structure negotiations more carefully.

Conclusion: The Future of Crypto Regulation in America

Coinbase's withdrawal from the CLARITY Act revealed fundamental truths about the crypto industry's relationship with regulation and about how politics works when financial interests diverge.

The basic facts are straightforward: one company prioritized its own financial interests above industry-wide progress. They used their market power as leverage. They miscalculated the timing and the reaction. The rest of the industry called them out for it.

But the implications extend far beyond Coinbase. This episode revealed that crypto's political future isn't predetermined. It depends on how different parts of the industry decide to organize. It depends on whether major players are willing to accept imperfect outcomes in service of broader progress. It depends on whether policymakers continue to trust crypto as a genuine partner in regulation or start to see it as just another industry fighting to protect profits.

In the short term, the CLARITY Act's fate was uncertain. Tim Scott's "brief pause" could lead to successful renegotiation or to indefinite stalling. The window for passing major crypto legislation was closing. The midterm elections were approaching. The political alignment that made crypto regulation possible could shift.

But in the longer term, something important had shifted. Crypto had proven it could partially organize politically. It had shown that major players could sometimes agree on fundamentals. It had demonstrated that it was willing to work within the regulatory process rather than fight it entirely.

Coinbase's withdrawal threatened that progress. It signaled that unity was conditional and fragile. It showed that when financial incentives diverged sharply enough, industry consensus would break.

But it also showed that the rest of the industry understood these stakes. They pushed back against Coinbase. They prioritized long-term progress over short-term gains. They kept talking about moving the bill forward despite the withdrawal.

Crypto's political future would be determined in the weeks and months following Coinbase's withdrawal. Would the bill survive? Would Coinbase be proven right about stablecoin yields being critical? Would the rest of the industry prove right that imperfect regulation was better than no regulation?

Those questions wouldn't be answered immediately. But what was already clear was that crypto had moved beyond being a fringe technology that governments ignored. It had become important enough to fight over. Important enough that companies would use significant leverage to protect their interests. Important enough that the financial industry would work hard to constrain its growth.

That's not success, exactly. But it's not failure either. It's the messy middle of how democratic capitalism works. Industries fight over regulations. Consensus breaks. Politics determines outcomes. Progress happens incrementally.

Coinbase had wanted a shortcut through that messy middle. They wanted full regulatory freedom for stablecoin yields without having to negotiate. When they didn't get it, they walked.

The question before Congress, the White House, and the rest of the crypto industry was whether Coinbase had walked away from something worth saving. History would judge. But in January 2025, the moment of that judgment was still ahead.

FAQ

What is the CLARITY Act and why is it important for crypto?

The CLARITY Act is comprehensive legislation that would create a unified federal regulatory framework for cryptocurrencies and digital assets in the United States. It addresses fundamental questions about whether tokens are securities or commodities, how stablecoins should be regulated, and what compliance responsibilities crypto companies have. The bill is important because it would replace the current regulatory gray zone where multiple agencies claim overlapping jurisdiction, creating certainty that crypto businesses need to plan long-term investments and operations.

Why did Coinbase withdraw support from the CLARITY Act?

Coinbase withdrew support over provisions restricting yield-bearing stablecoin accounts. The exchange operates profitable yield accounts where customers earn interest on stablecoins, but the final draft of the CLARITY Act included restrictions (backed by traditional banking industry lobbying) that would limit those yields to make stablecoins less competitive with bank savings accounts. Coinbase CEO Brian Armstrong argued this favored traditional banking over crypto innovation and was unacceptable enough to warrant pulling the exchange's entire support for the bill.

What stablecoin yields mean and why they matter?

Stablecoin yields refer to interest payments crypto platforms offer users for holding stablecoins, similar to how banks pay interest on savings accounts. These yields allow stablecoin holders to earn passive income while keeping their money in stable-value assets. They matter because they make stablecoins genuinely competitive with traditional banking products. If restricted, stablecoins become just transaction tools rather than value storage vehicles, limiting their ability to actually replace traditional banking for users.

How did the crypto industry respond to Coinbase's withdrawal?

Most of the crypto industry strongly opposed Coinbase's position. Kraken, Ripple, Andreessen Horowitz, and even White House crypto advisor David Sacks all publicly urged Coinbase to work within the negotiation process rather than abandon years of progress. Their argument was that an imperfect regulatory framework with clear rules was better than continuing to operate in regulatory uncertainty, and that the committee markup stage was precisely when outstanding issues could be resolved through negotiation.

What happens to crypto regulation if the CLARITY Act fails?

Without the CLARITY Act, crypto would continue operating in regulatory limbo with overlapping SEC and CFTC jurisdiction, state-level regulations, and fundamental uncertainty about legal status. Companies would struggle to plan investments. Startups would face paralyzing uncertainty about business models. Innovation would slow. Capital would move to other countries with clearer regulatory frameworks. The entire American crypto industry would be at competitive disadvantage to jurisdictions with established regulatory clarity.

Is the deadline for passing CLARITY Act really that tight?

Yes, the deadline is critical. By mid-to-late March 2025, members of Congress would shift focus to midterm reelection campaigns. Passing controversial legislation becomes extremely difficult during election season. If the CLARITY Act doesn't pass by then, it effectively must wait until after the 2026 midterm elections, delaying regulatory clarity by at least 18 months. That timeline delay creates risk that political alignments could shift, making passage significantly harder.

What did Coinbase's withdrawal reveal about crypto industry organization?

Coinbase's withdrawal exposed fundamental fragilities in crypto industry consensus. It showed that major players would prioritize their own financial interests above industry-wide progress when incentives diverged sharply. It demonstrated that one large company could potentially derail entire regulatory efforts through leverage tactics. And it revealed that while most of the industry understood the value of accepting imperfect regulations, the largest exchange's financial interests weren't aligned with that consensus.

How does traditional banking influence crypto regulation?

Traditional banks view stablecoins and yield-bearing crypto accounts as existential threats because they compete with traditional deposit accounts and money market funds. Banks use their political relationships, lobbying infrastructure, and regulatory expertise to shape crypto regulation in their favor. The CLARITY Act draft that Coinbase objected to included banking-friendly provisions restricting stablecoin yields, showing how effectively traditional finance can influence regulation even in bills theoretically designed to favor crypto.

Could Coinbase's strategy work long-term?

Coinbase's strategy of using withdrawal threat as leverage might secure better terms on stablecoin yields, but at significant cost. The exchange damaged relationships with competitors, venture investors, and policymakers. They're now seen as less reliable partners for future regulatory collaboration. Even if they win concessions on this bill, they've signaled that they'll prioritize profits over consensus, making them less trusted for future industry coordination.

What would successful crypto regulation look like?

Successful crypto regulation would clearly define which agencies have jurisdiction over which assets, establish transparent rules for what counts as a security versus commodity, create stable frameworks for stablecoin operations and yield generation, provide clear compliance pathways for companies, and protect consumers while allowing innovation. The CLARITY Act attempted this by creating comprehensive rules rather than leaving everything in regulatory gray zone, even if the specific rules weren't perfect from every perspective.

This article examined one of the most significant moments in crypto's regulatory journey. The outcome of these negotiations would shape not just how American crypto operates, but how the entire industry coordinates politically with government for years to come. Whether through the CLARITY Act or some future framework, the fundamental tension between protecting traditional finance and enabling crypto innovation would continue to define the regulatory landscape.

Key Takeaways

- Coinbase's withdrawal over stablecoin yield restrictions reveals fragile industry consensus on crypto regulation

- The rest of the crypto industry opposed Coinbase's pullout, understanding that imperfect regulation is better than regulatory limbo

- A tight political deadline until midterm elections makes this the only realistic window for passing major crypto legislation in 2025

- Traditional banking industry successfully lobbied to restrict stablecoin yields, creating the incentive for Coinbase to threaten withdrawal

- One company's willingness to use market leverage to derail consensus signals to future regulators that unified crypto industry positions are conditional

![Coinbase's CLARITY Act Withdrawal: What It Means for Crypto Regulation [2025]](https://tryrunable.com/blog/coinbase-s-clarity-act-withdrawal-what-it-means-for-crypto-r/image-1-1768743391468.jpg)