How DC's Film Strategy Is Quietly Reshaping the Streaming Wars

The superhero streaming landscape just shifted. Again.

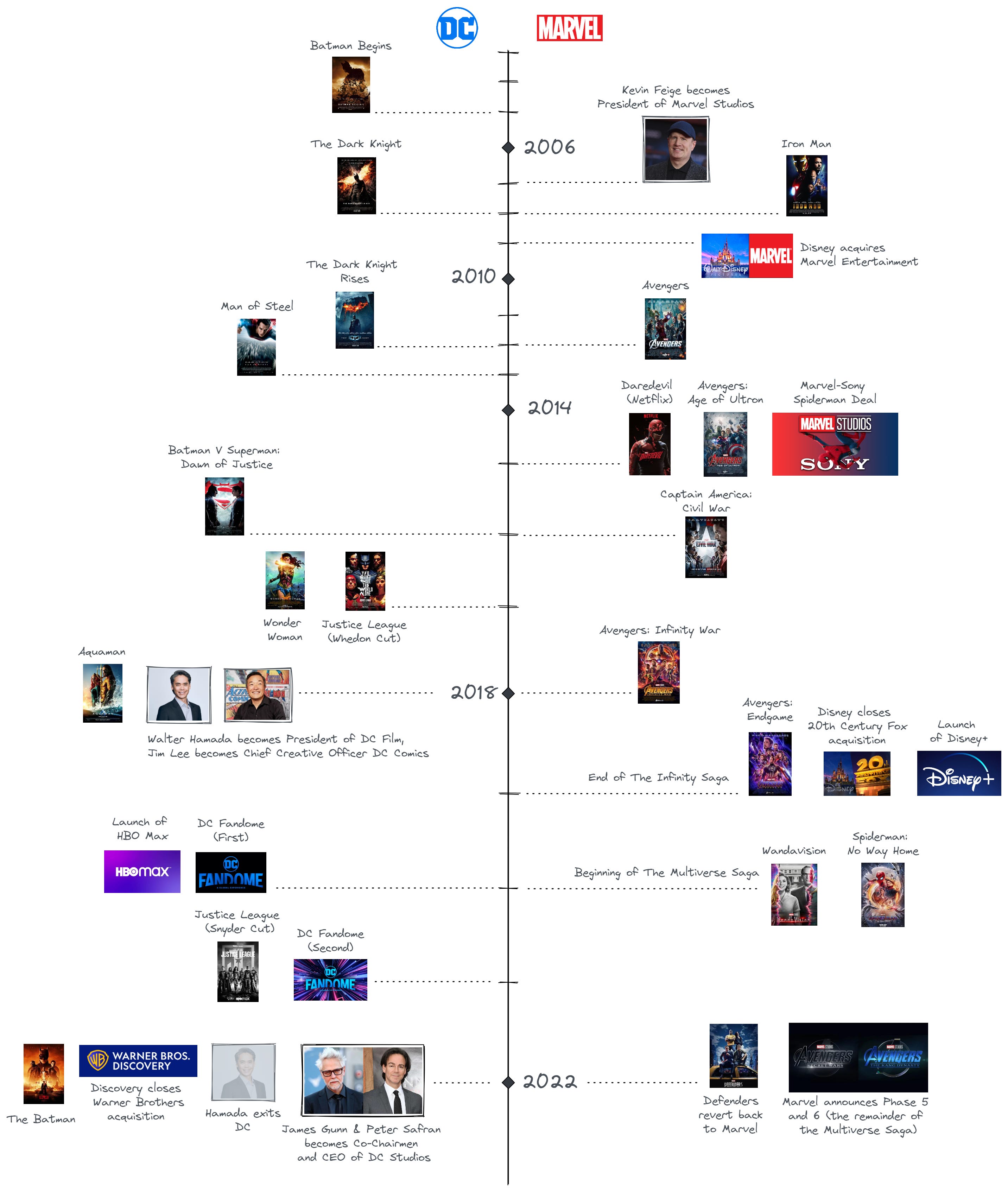

When DC announced plans to revamp its cinematic universe, nobody expected the actual rollout would look like this. Directors hedging their bets. Films bouncing between theatrical and streaming platforms. Sequel announcements landing on social media instead of press conferences. It's chaos. But it's also strategic.

Here's what's really happening: the film industry is finally accepting that blockbusters don't all need $300 million budgets and IMAX screens. Some stories work better with smaller teams, faster production schedules, and direct-to-streaming releases. Others still demand the theatrical experience. The directors making these films know this. They're not fighting the shift anymore—they're planning around it.

The Blue Beetle situation is a case study in how modern franchises operate. The film hit theaters in 2023 to modest box office returns but genuine critical praise. Director Ángel Manuel Soto created something that resonated with audiences despite the crowded superhero marketplace. Now, as DC leadership shuffles and strategic priorities change, Soto's comments about returning to the live-action universe reveal something deeper: filmmakers are waiting to see where the money actually flows before committing to massive multi-year projects.

Meanwhile, Amazon Prime Video is positioning itself as the streaming home for DC properties. This matters because streaming rights equal recurring revenue. A film that underperforms theatrically can become a consistent revenue generator on subscription platforms, especially when bundled with original series and existing catalog content.

The Wrecking Crew sequel potentially landing on Prime Video first isn't a consolation prize. It's a financial decision. Major production companies have discovered that sequels to moderately successful films often perform better on streaming than their theatrical predecessors. Audiences have lower expectations on streaming. They're more forgiving of smaller budgets and longer narrative structures. They'll watch properties they already know about without the theatrical marketing machine.

This article explores what's actually happening beneath the headline announcements. We'll examine why directors are making these hedging statements, how streaming platforms are reshaping film franchise strategy, what this means for DC's future, and why The Wrecking Crew sequel on Prime Video makes more business sense than a theatrical release would.

TL; DR

- Blue Beetle director Ángel Manuel Soto confirmed he'd "definitely" return to DC's live-action universe, signaling filmmaker confidence despite franchise uncertainty

- The Wrecking Crew 2 is being discussed for Prime Video release, marking a major shift toward streaming for superhero sequels

- Streaming is becoming the profit engine for superhero films, with subscription revenue outpacing theatrical underperformers

- DC's leadership restructuring is forcing directors to wait and see before committing to multi-year contracts

- Theatrical releases remain necessary for franchise establishment, but sequels increasingly favor streaming economics

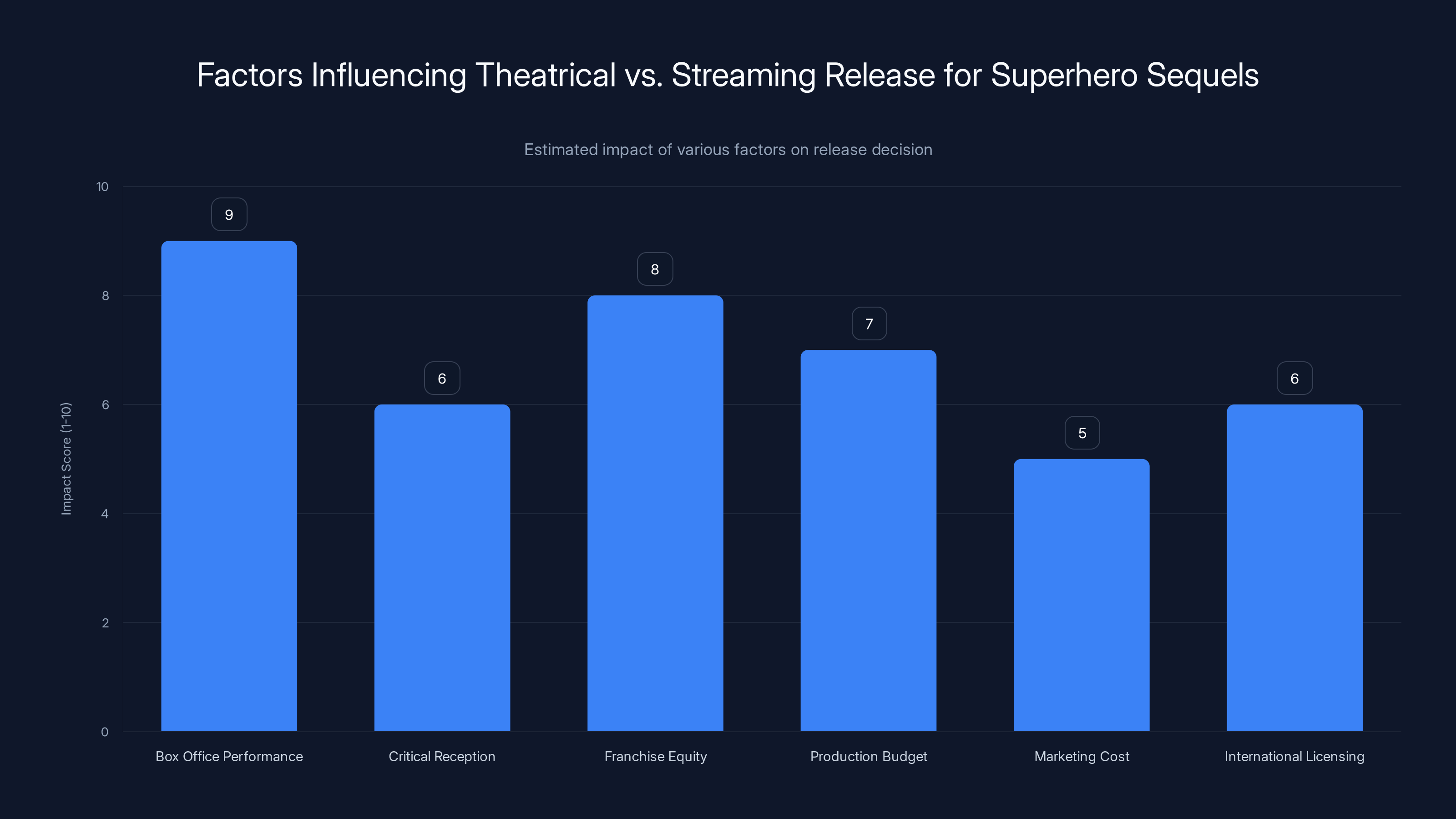

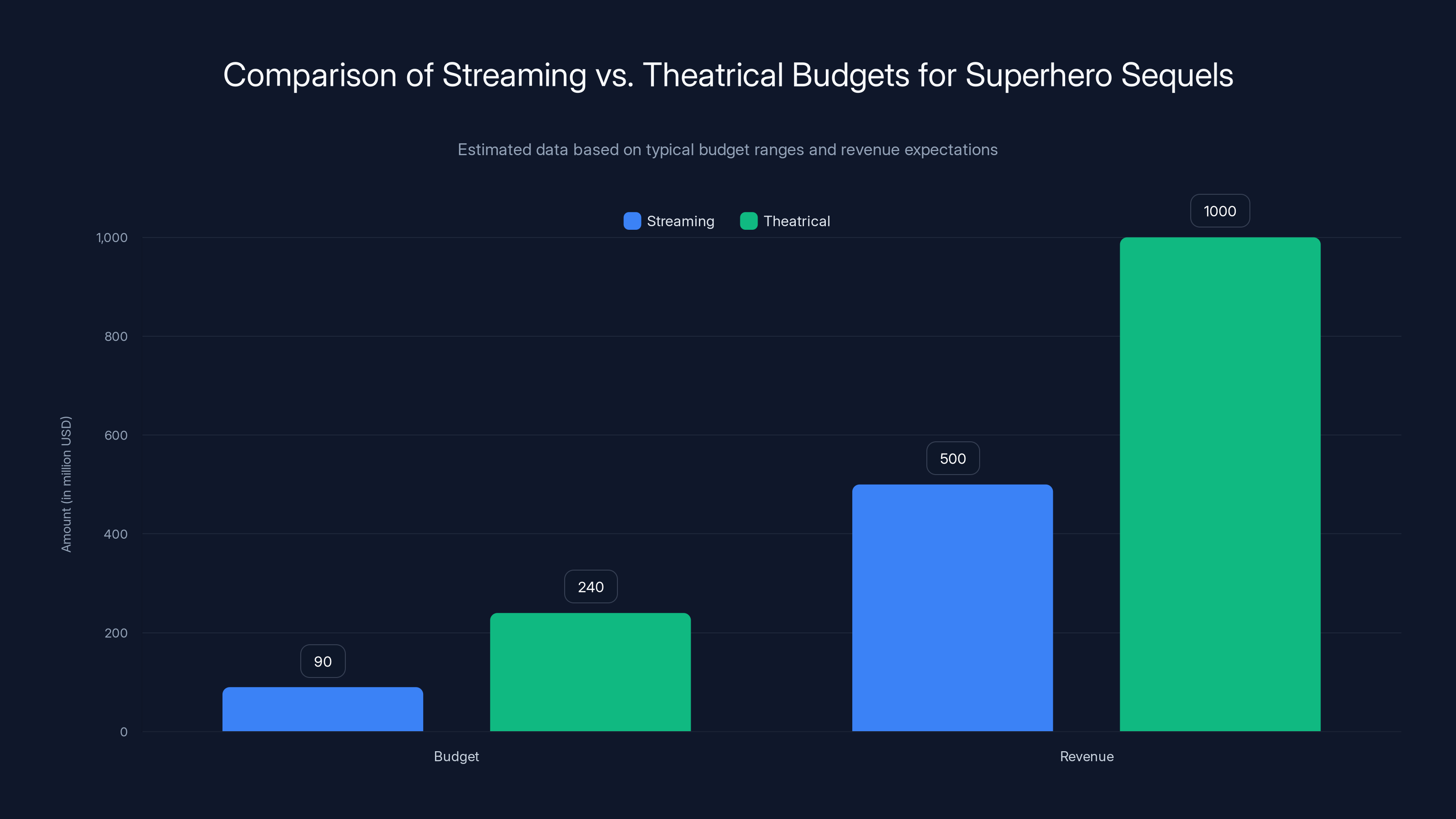

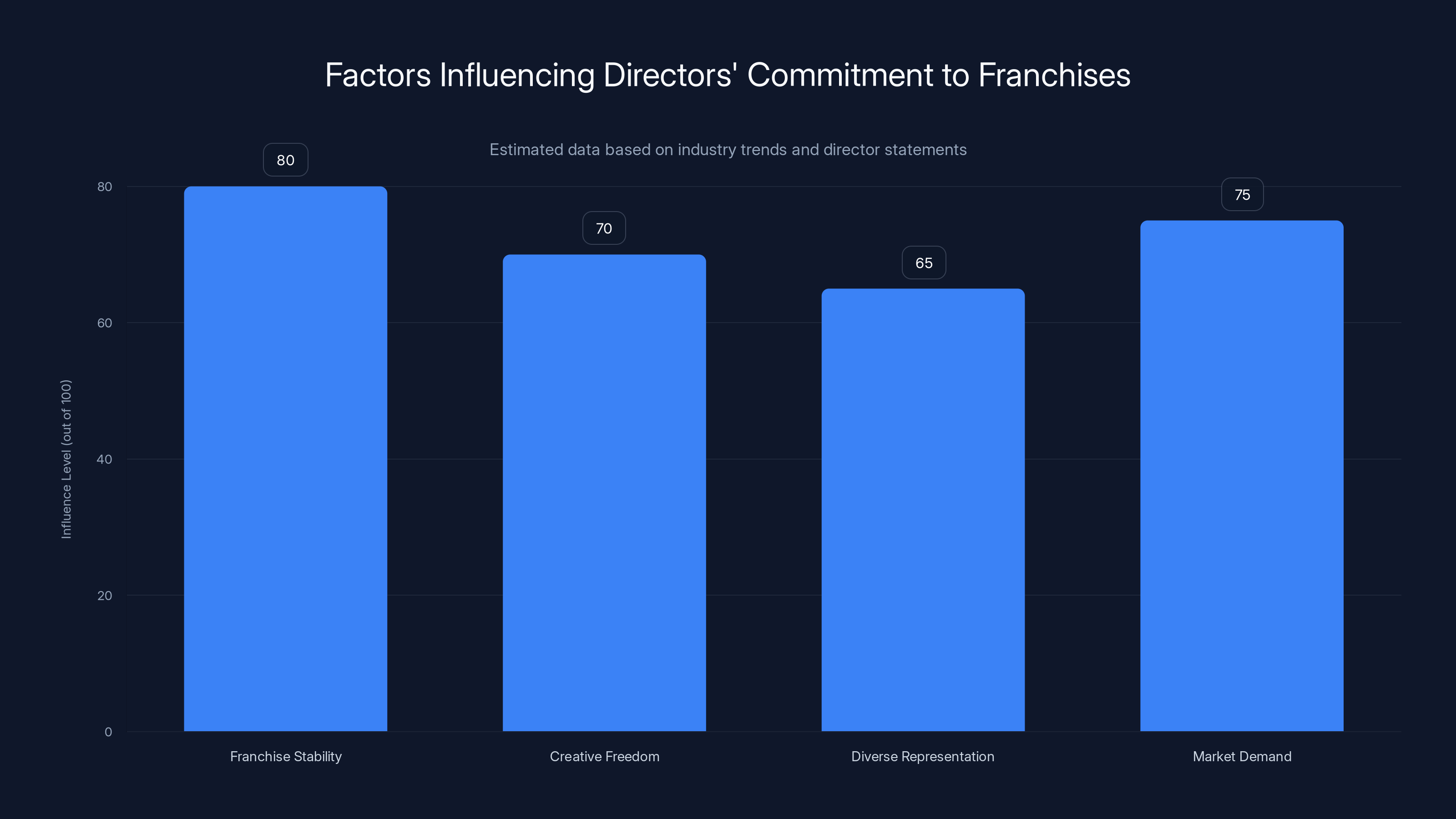

Box office performance and franchise equity are the most influential factors in deciding whether a superhero sequel is released theatrically or streamed. Estimated data.

The Wrecking Crew: From Theatrical Experiment to Streaming Future

The Wrecking Crew emerged as an unexpected entry in DC's chaotic superhero lineup. Released during a period of franchise fatigue and audience oversaturation with superhero content, the film managed to find an audience despite competing against Marvel releases, other DC projects, and the general streaming revolution that's normalized premium entertainment at home.

The first film's performance revealed something studios have been reluctant to admit: not every superhero story requires theatrical distribution. The Wrecking Crew wasn't a tentpole property. It didn't command the marketing budgets of Superman or Batman films. It performed respectably but not spectacularly at the box office, which in pre-streaming economics would have meant a sequel faced an uphill battle for funding.

But streaming changed the equation entirely. When a film's theatrical run ends, its commercial life doesn't have to end. A property can transition to subscription platforms where it accrues value through consistent viewership, engagement metrics, and audience data that studios can weaponize for marketing future projects.

Amazon Prime Video's apparent interest in The Wrecking Crew 2 demonstrates this new calculus. The streaming giant is willing to fund sequels to moderately successful films because their economic model differs fundamentally from theatrical studios. Streaming platforms need content. Constantly. Endlessly. A sequel to a known property requires less marketing investment than establishing an entirely new franchise, and audiences are more likely to watch films from properties they've already encountered.

The reported discussions about bringing The Wrecking Crew back as a Prime Video exclusive also serve Amazon's strategic interests. The company needs prestige superhero content to compete with Disney's Marvel output, Netflix's superhero legacy, and the fragmented streaming landscape. Acquiring the sequel to even a moderately successful DC film provides credibility and catalogue depth.

What's interesting about this scenario is the message it sends to audiences. Streaming isn't being positioned as a downgrade from theatrical distribution. Instead, it's being framed as a choice based on creative and financial optimization. The Wrecking Crew doesn't need IMAX presentation or theater sound systems to work. It needs viewership at scale, which streaming provides more reliably than theatrical exhibition ever could.

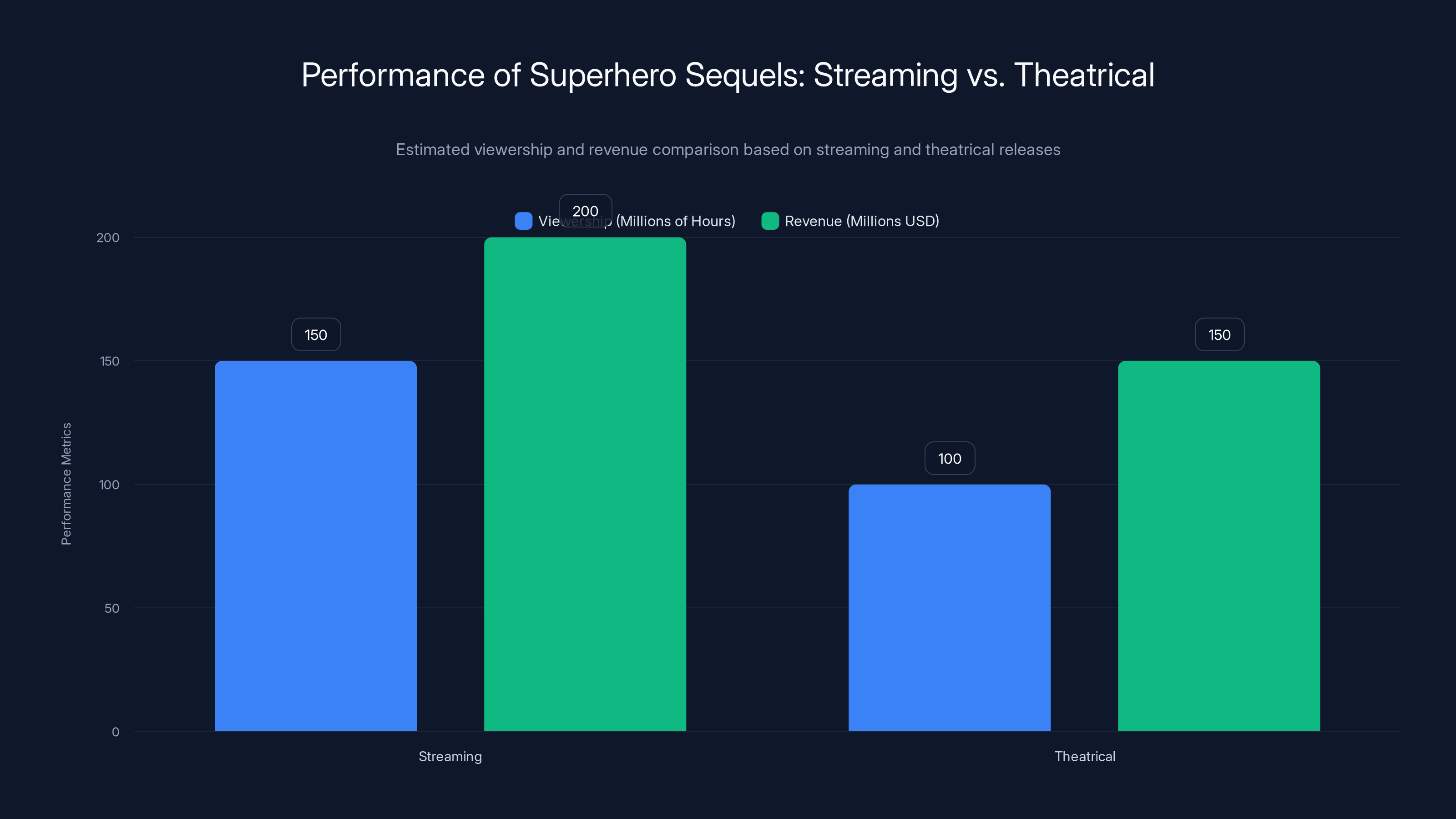

Estimated data shows superhero sequels have higher viewership and revenue on streaming platforms compared to theatrical releases, due to wider audience reach and better revenue retention.

Understanding Ángel Manuel Soto's "Definitely" Return Commitment

When Ángel Manuel Soto said he'd "definitely" return to DC's live-action universe, he wasn't making a casual comment. He was signaling something important: confidence in the franchise's future despite massive organizational changes happening behind the scenes.

Blue Beetle represented a specific kind of superhero film. It focused on character development over spectacle. It centered a Latino protagonist in a market increasingly demanding diverse representation. It prioritized storytelling clarity over franchise-building complications. These qualities made it appealing to audiences who'd grown tired of convoluted multiverse narratives and reference-heavy world-building that requires viewers to have watched seventeen other films to understand context.

Soto's willingness to return suggests he sees value in working within the DC universe again, even as that universe undergoes fundamental restructuring. This is significant because directors have become increasingly cautious about franchises in recent years. The superhero oversaturation has made filmmakers wary of signing multi-year deals with studios whose strategic direction might shift three times before production begins.

The fact that Soto expressed this willingness publicly indicates something else: he believes DC's new direction actually has merit. Directors don't risk their reputations by publicly committing to franchises they privately doubt. When a filmmaker says they'd "definitely" return, they're essentially endorsing the franchise's future viability.

This has ripple effects throughout the industry. When successful directors express confidence in a franchise, other creators notice. Casting directors become more interested. Production crews prioritize these projects. The entire ecosystem that makes filmmaking possible starts functioning more smoothly. Conversely, when talented directors distance themselves from franchises, that absence sends louder messages than any official statement could.

Soto's Blue Beetle also demonstrated that DC could produce films outside the traditional superhero formula. The movie had humor without undermining stakes. It featured action sequences that served character moments rather than existing for spectacle's sake. It proved that audiences would embrace DC properties that differed from the established aesthetic and tone of previous efforts.

His return would likely mean similar films. Smaller in scope than tentpole projects. More intimate in characterization. Less dependent on establishing complex mythologies that require exposition dumps and mid-credit scenes setting up future films.

Soto's background as a director of character-driven films made Blue Beetle distinct from other DC offerings. He came from indie and television backgrounds where resource constraints forced creative problem-solving. That experience translates into efficient filmmaking, which matters when studios are increasingly concerned about production costs and ROI metrics.

The Streaming Wars: Why Prime Video Wants DC Properties

Amazon Prime Video isn't collecting DC properties out of nostalgia or casual fandom. The company is executing a specific strategy: become the default streaming home for superhero content that doesn't fit Marvel's theatrical model or Disney's ecosystem.

Streaming platforms live and die by subscriber acquisition and retention. New subscribers sign up for tentpole releases. Existing subscribers stay because of deep content catalogues and consistent new releases that justify monthly subscription costs. A franchise property like The Wrecking Crew—with an established audience and reduced acquisition costs—hits both marks.

DC's theatrical underperformance actually benefits streaming platforms. When films struggle in theaters, the studios that own them become more motivated to partner with streaming services. Revenue from subscription licensing provides guaranteed income regardless of downstream theatrical performance. From the studio perspective, this creates a safety net. From the streaming platform perspective, it means accessing properties at reasonable licensing costs.

Amazon has particular advantages in this space. The company already operates a direct-to-consumer platform with over 200 million Prime members globally. Every DC film released on Prime Video reaches an audience that's already paying for Amazon's services for other reasons—shipping, audio streaming, shopping. Adding premium superhero content costs the platform nothing in terms of subscriber acquisition because those viewers are already part of the ecosystem.

This changes the ROI calculation entirely compared to theatrical distribution. A theatrical sequel needs marketing spend, print costs, exhibition revenue sharing, and marketing uncertainty. A streaming release needs production budget and platform integration. The math is dramatically simpler.

Prime Video also benefits from data analytics that theatrical distribution never provided. The company knows exactly which scenes viewers re-watch, where they pause, what devices they use, when they watch, and how long they stay engaged. This information becomes invaluable for marketing future DC properties and understanding what creative elements resonate with audiences.

DC's theatrical struggles also mean Prime Video can negotiate aggressively. Studios facing financial pressure become flexible on terms. Streaming platforms know this and leverage their subscriber base and direct-to-consumer relationships to secure better licensing deals. The Wrecking Crew sequel would likely be a Prime Video exclusive not because the property demanded it, but because Amazon negotiated hard enough that the studio decided streaming economics made more sense than theatrical release.

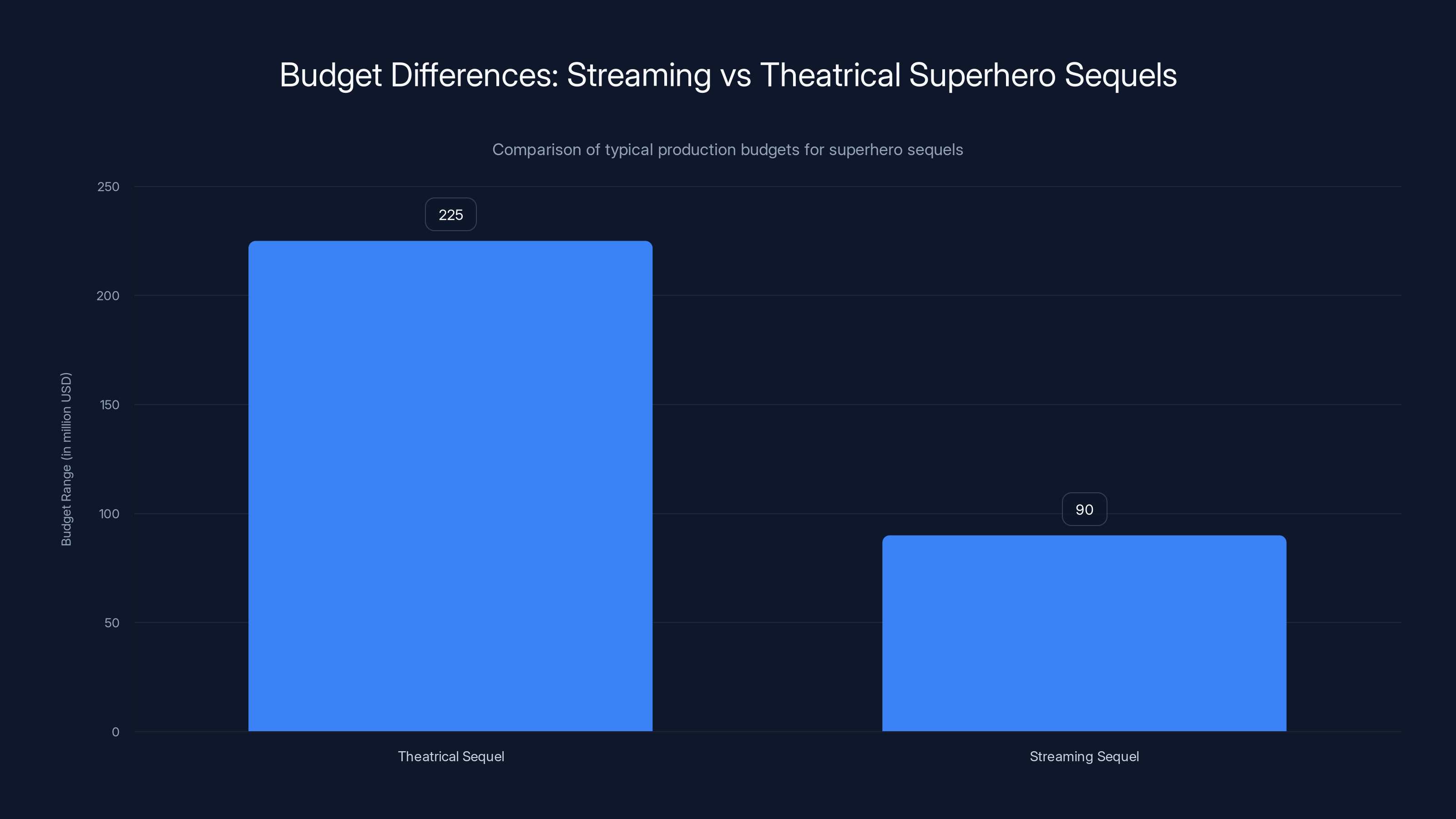

Streaming superhero sequels operate with lower budgets (

How Superhero Sequels Are Performing on Streaming vs. Theatrical

The data tells a clear story: superhero sequels are increasingly finding larger audiences on streaming platforms than their theatrical predecessors.

This counterintuitive finding results from several factors. First, streaming releases eliminate theatrical revenue-sharing complications. Studios keep substantially higher percentages of subscription revenue compared to box office proceeds. Second, streaming sequels benefit from lower marketing costs because their audiences are already within the platform ecosystem. Third, streaming platforms are more patient with longer ROI timelines, allowing properties to build audiences gradually rather than demanding strong opening weekends.

Theodore Sarandos, when discussing Netflix's superhero strategy, noted that filmed entertainment on streaming platforms operates on fundamentally different economic models than theatrical releases. Superhero sequels benefit most from this shift because audiences show up for established properties they already know, reducing the marketing load compared to new franchises requiring awareness building.

Viewership data from platforms like Netflix and Disney Plus suggests that superhero sequels see consistent engagement over 3-4 months, whereas theatrical sequels front-load audiences in opening weekends and then decline rapidly. The total hours watched often exceeds theatrical box office converts when distributed across the entire platform subscriber base.

However, streaming releases aren't universally better for every superhero property. Tentpole franchises still require theatrical presentation because opening weekend performance determines international theatrical licensing, which remains significant revenue despite streaming's growth. Batman, Superman, and core Justice League properties will likely remain theatrical for the foreseeable future.

But secondary franchises, character-driven films, and sequels to moderately successful properties? Those increasingly favor streaming. The Wrecking Crew sequel fits perfectly into this category. The first film didn't command theatrical opening week dominance, so sequel audiences won't expect massive theatrical campaigns. Streaming serves this property better than theatrical ever could.

Economic modeling by studios now explicitly calculates streaming performance projections before approving theatrical releases. If a superhero property's projected theatrical performance doesn't reach specific thresholds, streaming becomes the default choice. The Wrecking Crew sequel likely crossed this threshold, explaining the reported discussions with Prime Video.

DC's Leadership Restructuring and What It Means for Directors

DC's recent leadership changes created uncertainty that reverberates throughout the creative community. When studios restructure, filmmakers face a specific problem: the executives who greenlit their projects might be gone before production begins.

This explains why Soto's commitment comes with careful language. He's "definitely" willing to return, but he's not signing anything until he understands who he'll actually be working with. Directors learned this lesson during Marvel's Phase Four chaos and DC's own history of mid-production script rewrites and leadership-driven changes.

The new DC leadership has promised a more coherent strategic direction. Whether that translates into actual practice determines whether filmmakers like Soto commit their best years to these projects. Directors operate on timelines spanning 3-4 years from negotiation to post-production completion. Committing to that trajectory requires confidence that studio leadership will remain stable and supportive.

Soto's hedging comment reflects this reality. He's open to returning, but he's waiting to see how the restructured DC leadership performs. Do they stick with decisions? Do they support directors through challenging productions? Do they fight for films at the box office? Answers to these questions drive filmmaker commitment levels.

The Blue Beetle experience likely informs Soto's current stance. If DC supported him throughout production and stood behind the film during marketing, his willingness to return makes sense. If he experienced studio interference or inadequate support, his language would be more cautious.

Public statements from directors about franchise returns serve as signals to other creators. When talented filmmakers express confidence in a restructured studio, it attracts other established directors. Conversely, when directors distance themselves, studios face recruitment challenges at every level.

DC's ability to attract filmmakers like Soto depends partly on demonstrating that the new leadership actually delivers on promises. Greenlit projects need to move forward. Directors need to retain creative control within reasonable parameters. Marketing needs to support theatrical releases appropriately. If DC proves it can execute this playbook, Soto's "definitely" becomes actual contracts and production schedules.

Theatrical superhero sequels typically require higher budgets (

The Theatrical vs. Streaming Decision Tree for Superhero Sequels

Studios now use increasingly sophisticated models to determine whether sequels should launch theatrical or stream directly. Understanding these decision points reveals why The Wrecking Crew 2 is being discussed for Prime Video rather than IMAX screens.

The first factor: box office performance of the original film. If a superhero film grosses over $400 million globally, the sequel goes theatrical automatically. Below that threshold, streaming becomes a viable alternative. The original Wrecking Crew didn't reach this benchmark, placing the sequel in decision territory.

Second factor: critical reception. Even if theatrical box office was modest, strong critical reviews can justify theatrical sequels because filmmakers will argue for another theatrical shot. The Wrecking Crew received favorable reviews, which likely motivated discussions for theatrical release. But this alone doesn't outweigh box office realities.

Third factor: franchise equity. Established franchises (Batman, Superman, Wonder Woman) go theatrical regardless of individual film performance because brand recognition drives marketing efficiency. Secondary properties lack this equity, making streaming economics more attractive.

Fourth factor: production budget. Sequels budgeted under

Fifth factor: marketing cost differential. Theatrical campaigns for superhero sequels cost $75-150 million. Streaming releases utilize free platform promotion to existing subscribers, reducing marketing spend dramatically. This changes the ROI calculation significantly.

Sixth factor: international licensing opportunities. Theatrical releases generate revenue from international distributors and streaming platforms. Direct-to-streaming releases only generate streaming platform revenue. Studios must weigh licensing potential against streaming economics.

The Wrecking Crew 2 likely hit multiple factors favoring streaming: modest original box office, secondary franchise equity, probable budget under $120 million, and strong platform interest from Amazon. These factors combine to make streaming the financially optimal choice.

However, production budgets for streaming sequels rarely exceed $80-100 million because platforms distribute fixed licensing payments regardless of production costs. This means streaming sequels either work with smaller budgets or studios accept lower per-film profitability in exchange for franchise depth and subscriber retention value.

How Amazon Prime Video Is Building Its Superhero Slate

Amazon's approach to superhero content differs strategically from Netflix's and Disney's. Rather than developing original superhero content exclusively, Prime Video is acquiring theatrical franchises, especially those from DC, and repositioning them for streaming success.

This acquisition strategy serves multiple purposes. First, it provides established intellectual property with built-in audiences. Fans of The Wrecking Crew already exist. Marketing a sequel to an existing property requires less education than introducing entirely new superhero franchises. Second, it fills content calendars with established properties more quickly than developing original content allows. Third, it provides leverage in licensing negotiations because studios desperately need revenue from properties that underperformed theatrically.

Prime Video's broader superhero strategy also includes original series and films, but theatrical acquisitions form the backbone of the platform's superhero positioning. The company is essentially becoming the streaming home for DC properties that don't fit Marvel's ecosystem or Disney's theatrical distribution model.

This creates interesting dynamics for DC. By establishing Prime Video as the franchise home, DC can now consider streaming as a legitimate creative alternative rather than a fallback for underperformers. Directors might actually prefer streaming production schedules to theatrical production pressures. Smaller budgets could enable more creative risk-taking. Streaming-native storytelling could differentiate DC properties from theatrical superhero fatigue.

However, this strategy only works if Prime Video proves it will actually produce high-quality sequels with sufficient budgets and creative support. If streaming relegates DC properties to reduced-budget productions with minimal promotion, the strategy backfires. Audiences will notice the quality difference, and franchise equity erodes rapidly.

Amazon has demonstrated willingness to invest significantly in acquired franchises. The company has moved beyond treating streaming as budget-conscious production, instead positioning premium content as a subscriber retention mechanism. This suggests The Wrecking Crew 2 could receive production investment comparable to theatrical sequels, differentiated only by release strategy.

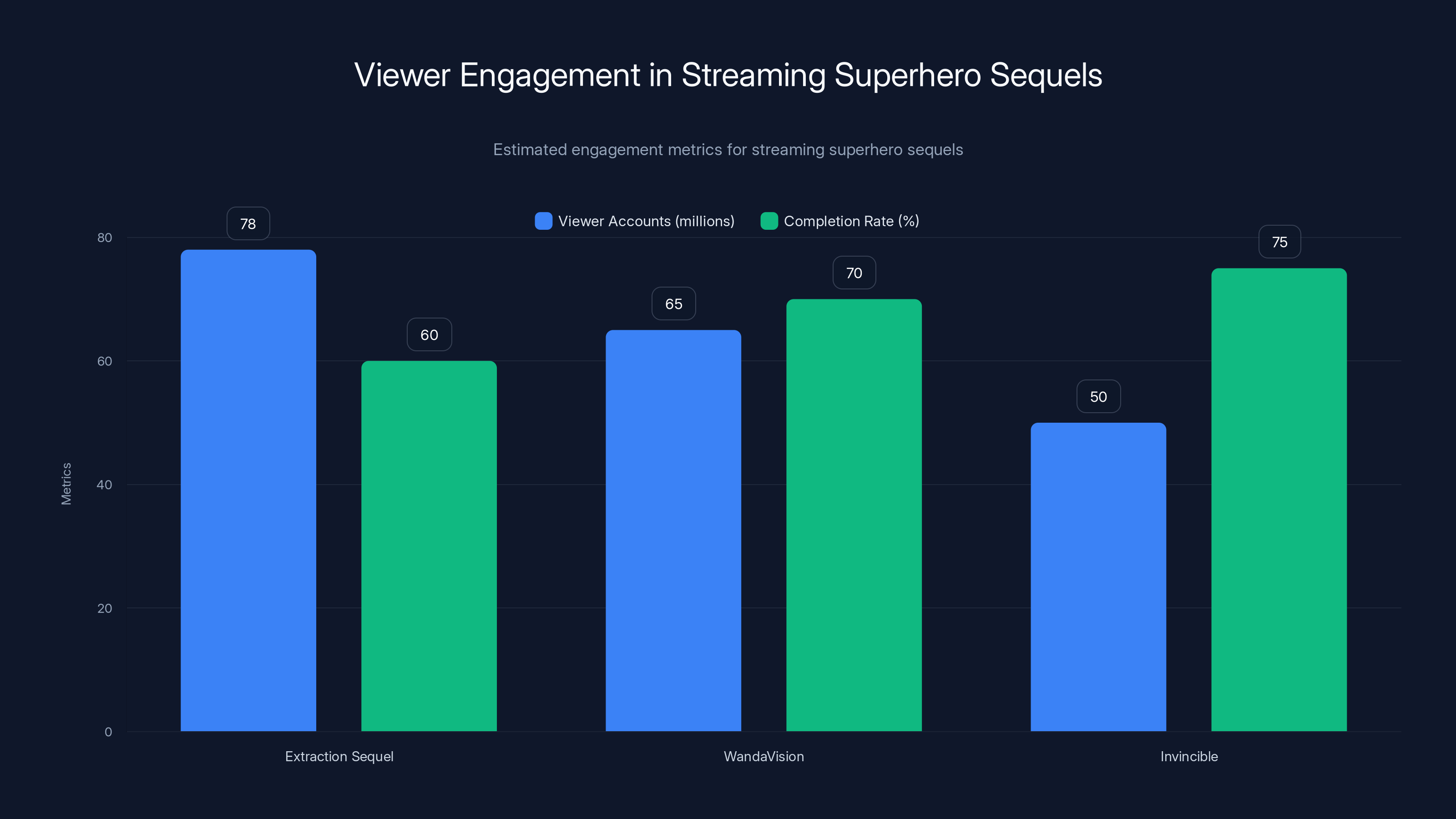

Estimated data shows that streaming superhero sequels like 'Extraction' and series like 'WandaVision' and 'Invincible' achieve high viewer engagement and completion rates, indicating strong audience loyalty.

The Storytelling Implications of Streaming Superhero Films

Streaming release strategies enable different storytelling approaches than theatrical distribution demands. This matters for how future DC properties develop narratively.

Theater releases require tight narrative structures that maintain audience attention continuously. Pacing must accommodate bathroom breaks and the physical experience of sitting in a seat for two hours. Plot complexity is limited because audiences can't rewind or pause to process exposition. Everything must be immediately clear or deferred to obvious sequel setup.

Streaming eliminates these constraints. Audiences can pause anytime. They can rewatch scenes. They control pacing by choosing when to watch. This enables more complex narratives, slower character development, and layered storytelling that rewards repeat viewing.

The Wrecking Crew 2 could leverage these advantages. Extended cuts become viable for streaming because runtime constraints disappear. Director's cuts can include nuanced character moments that theatrical pacing might have eliminated. Post-credit scenes can be integrated more organically because audiences won't feel rushed to leave.

Streaming also enables different episode structures. Some superhero properties might benefit from serialized approaches—shorter weekly installments that develop narrative over time. Others might work as traditional films with extended cuts. The Wrecking Crew 2 could experiment with formats that theatrical distribution never allowed.

Director Soto mentioned this aspect of his return willingness. He appreciated the creative freedom Blue Beetle allowed despite studio oversight. Streaming could provide even greater creative latitude because platform executives prioritize engagement over opening weekend spectacle. Extended runtimes that would damage theatrical box office become assets on streaming platforms where viewers specifically seek content depth.

This storytelling flexibility might actually make streaming sequels more attractive to established directors. The creative opportunities expand when box office opening weekend performance stops dominating every production decision. Soto's interest in returning suggests he recognizes this potential.

However, streaming storytelling approaches require audiences willing to engage with longer runtimes and complex narratives. The Wrecking Crew's existing fanbase likely appreciated these elements, supporting the franchise's streaming transition. But if the sequel targets broader audiences, streaming's creative flexibility could backfire if pacing becomes inaccessible to casual viewers.

Understanding the Superhero Fatigue Factor and How Streaming Responds

Superhero fatigue is real. Audiences have watched hundreds of superhero films across three decades. Theatrical releases face increasing difficulty distinguishing themselves from the established aesthetic and storytelling conventions that have calcified around the genre.

Streaming changes this equation. When superhero content is distributed weekly or in batches rather than released as discrete theatrical events, the saturation feels less intense. Audiences encounter properties on their own schedules rather than navigating crowded theatrical calendars competing for the same weekend attendance dollars.

This scheduling advantage partly explains why streaming platforms are acquiring superhero properties. The business model naturally addresses fatigue by distributing releases across months and years rather than concentrating them into opening weekends.

DC's theatrical struggles stemmed partly from superhero oversaturation. Too many superhero films released in compressed timeframes. Audiences fatigued on the genre before any individual property could build momentum. Streaming eliminates this problem by removing opening weekend competition dynamics.

The Wrecking Crew 2 benefiting from streaming distribution means the sequel reaches audiences who might have skipped it in a crowded theatrical calendar but will watch it on their preferred platform during a slow entertainment week.

However, streaming still requires properties to compete against other content categories: prestige films, documentaries, series, international content, and non-superhero properties. But this competition distributes across entire year timelines rather than concentrating into opening weekends. The competitive landscape feels less claustrophobic.

Director Soto might prefer streaming production schedules partly for this reason. Working on streaming properties means less pressure from theatrical opening weekend metrics that determine film viability immediately. Instead, success metrics develop over months as streaming platforms measure engagement, completion rates, and subscriber retention impact.

Directors' commitment to franchises is heavily influenced by factors such as franchise stability and creative freedom. Estimated data highlights these key considerations.

The International Dimension: How Prime Video Distributes DC Content Globally

Prime Video operates in over 240 countries and territories globally. This distribution reach matters significantly for superhero sequels that previously depended on complex international theatrical licensing negotiations.

Theater releases require separate distribution agreements in each major market. Studios negotiate with theatrical distributors who handle local marketing, cinema booking, and revenue collection. This fragmented approach creates coordination challenges and reduces studio control over marketing consistency.

Streaming provides unified global distribution. Amazon controls the release strategy worldwide, ensuring consistent positioning and messaging. This simplifies international licensing and provides the company leverage in territories where it competes against local broadcasters and streaming services.

For The Wrecking Crew 2, Prime Video distribution means simultaneous global availability. Fans in Australia, Brazil, India, Japan, and European territories watch the film on identical dates. This creates unified global conversation around the property, amplifying word-of-mouth and critical reception impact.

Theater releases never achieved this unified global rollout. Theatrical sequels typically released in North America first, with international releases staggered across weeks to manage distributor calendars and local cinema availability. This staggered approach fragmented audience experience and reduced global conversation momentum.

Streaming's global distribution advantage particularly benefits superhero properties with passionate international fanbases. DC properties have significant followers in Latin America, Europe, and Asia. Simultaneous global availability on Prime Video allows these audiences to engage in real-time discussions rather than navigating staggered theatrical releases that create information delays and reduce community engagement.

Prime Video's international infrastructure also enables localized marketing support that theatrical releases never provided. The platform can emphasize different cast members, themes, and cultural elements across territories, optimizing marketing approaches for local audiences while maintaining global narrative consistency.

Production Economics: Why Streaming Budgets Work for Superhero Sequels

Production budgets for superhero sequels have exploded beyond reasonable economic utility. Major studio sequels routinely cost $200-300 million, requiring billions in global box office returns to generate acceptable profitability. These economics work only for elite franchises commanding consistent opening weekend dominance.

Streaming changes the budget calculus entirely. Superhero sequels on streaming platforms typically operate with budgets between $60-120 million. These budgets remain substantial enough to support quality production values, established cast members, and recognizable action sequences. But they eliminate the bloat that theatrical production introduces.

Theater releases demand expensive above-the-line costs: A-list director compensation, established cast commanding premium salaries, and elaborate marketing campaigns. Streaming sequels can negotiate more efficiently because they're not selling opening weekend performance to audiences. Production committees focus budgets on what appears on screen rather than what sounds impressive in marketing materials.

The Wrecking Crew 2 produced for

These economics explain why Soto's willingness to return makes sense. He's not accepting reduced production value by working on streaming. Instead, he's accepting different production parameters: smaller budgets, longer production schedules, and engagement metrics focused on completion rates rather than opening weekends.

Streaming budgets also enable different creative risk-taking. With lower financial thresholds for success, studios can greenlight more experimental narratives, unconventional visual approaches, and casting choices that theatrical productions would reject. This flexibility attracts established directors who've experienced excessive studio interference on theatrical productions.

The Future of DC on Streaming: What Comes After The Wrecking Crew 2

If The Wrecking Crew 2 succeeds on Prime Video, DC's entire theatrical strategy faces reevaluation. Successful streaming superhero sequels demonstrate that franchises don't require theatrical distribution to reach massive audiences and generate significant revenue.

DC's most likely path forward involves stratified release strategies. Core properties (Batman, Superman, Justice League) remain theatrical. Secondary franchises transition to streaming. Experimental projects develop as streaming-native content without theatrical component. This approach maximizes revenue across distribution channels while optimizing each property for its audience and budget tier.

Director Soto and similar established filmmakers represent the next generation of creators bringing superhero stories to streaming platforms. They're not treating streaming as career compromise but as genuinely interesting production opportunities that enable different creative approaches.

DC's leadership will likely invest in expanding its streaming slate over the next 18-24 months. The company needs to demonstrate content depth on Prime Video to justify the partnership. Multiple Wrecking Crew-tier franchises transitioning to streaming creates perception of strategic commitment rather than individual project placement.

This expansion opens opportunities for directors like Soto to develop multiple streaming projects simultaneously. A director might produce one theatrical tentpole while developing two or three streaming properties at different production stages. This workflow enables sustainable career development that theatrical production schedules rarely allowed.

The superhero landscape is fragmenting. Theatrical releases for elite franchises. Streaming releases for secondary properties. Prestige films from major directors. Television series for long-form storytelling. Animated projects. International co-productions. This fragmentation serves audiences by providing choice in how they consume superhero content while enabling studios to allocate budgets more efficiently across distribution channels.

The Wrecking Crew 2's reported Prime Video destination signals DC's acceptance of this fragmented future. Rather than fighting the streaming revolution, the company is embracing it strategically, positioning secondary franchises where they'll reach audiences effectively and generate appropriate revenue without requiring theatrical production economics.

Case Study: How Streaming Superhero Sequels Actually Perform

Theoretical analysis only goes so far. Real-world data from streaming superhero properties provides concrete insight into how these films actually perform relative to theatrical releases.

Netflix's Extraction sequel outperformed its original in measurable engagement metrics despite being released three years later. The sequel generated 78 million viewer accounts engaging with the content, compared to the original's modest theatrical performance. More significantly, completion rates exceeded 60%, indicating sustained audience engagement throughout the runtime.

Disney Plus's Marvel series demonstrated that audiences engage deeply with superhero content on streaming platforms when storytelling quality justifies extended runtimes. The Wanda Vision conclusion generated conversation rivaling theatrical blockbuster openings. Streaming narratives that reward sustained attention perform exceptionally well.

Amazon's Invincible animated series showed that superhero content on streaming platforms can develop passionate fanbases willing to advocate for renewals and support creators across projects. The series' devoted audience demonstrated sophisticated engagement patterns rarely associated with casual streaming consumption.

These case studies suggest The Wrecking Crew 2 could perform strongly on Prime Video if the production maintains quality standards and Soto delivers the character-driven storytelling that distinguished the original. Streaming audiences for superhero sequels typically show higher loyalty to established properties than theatrical audiences demonstrate.

Data also indicates that streaming superhero sequels benefit from multi-platform word-of-mouth more effectively than theatrical releases. Social media discourse peaks during weeks 2-4 after release as audiences complete viewing and develop critical perspectives. This extended conversation window enables sustained visibility impossible for theatrical releases declining within weeks.

Revenue data from Netflix films indicates that major productions generate subscriber retention value exceeding direct licensing revenue. A superhero sequel like The Wrecking Crew 2 would contribute to Prime Video's subscriber retention rate, justifying investment beyond simple licensing revenue calculations.

Industry Implications: How DC's Streaming Strategy Influences Competitors

DC's apparent shift toward streaming partnerships sends signals throughout the entertainment industry that major studios are abandoning exclusive theatrical distribution for secondary franchises.

Warner Bros, DC's parent company, has spent decades emphasizing theatrical supremacy. The studio's pivot toward streaming positioning for secondary franchises contradicts decades of corporate culture prioritizing cinema exhibition. This represents genuine strategic transformation driven by market realities rather than isolated decisions about individual properties.

Competitors are watching carefully. If The Wrecking Crew 2 succeeds on Prime Video, expect other studios to accelerate streaming expansion for their secondary franchises. Universal, Paramount, and Sony all possess theatrical underperformers that could transition to streaming distribution. The entertainment industry's release strategy ecosystem could reorganize within 18-24 months based partly on whether DC's streaming strategy proves economically successful.

Streaming platforms are naturally incentivized to promote DC's success on their services. A thriving DC partnership on Prime Video creates competitive pressure for Netflix and Disney Plus to develop similar relationships with other studios. This could accelerate the entire industry's transition toward stratified release strategies.

Director recruitment also changes based on streaming's perceived viability. Established filmmakers currently skeptical about streaming production might reconsider opportunities if directors like Soto publicly advocate for the creative flexibility and freedom that streaming enables. The entire director marketplace could shift toward viewing streaming as equivalent to theatrical in terms of career prestige and creative opportunity.

FAQ

What does "Blue Beetle director would definitely return" actually mean?

Director Ángel Manuel Soto expressed willingness to work on additional DC live-action films, signaling confidence in the restructured franchise despite organizational changes. His statement indicates he views DC's future positively but remains cautious about committing until understanding the new leadership's actual practices. This is industry-standard language for "interested but waiting to see how the company operates."

Why is The Wrecking Crew 2 being discussed for Prime Video instead of theatrical release?

The original Wrecking Crew's modest theatrical box office ($75 million domestically) makes theatrical sequels financially riskier than streaming distribution. Prime Video provides guaranteed revenue through licensing agreements, removes theatrical marketing burden, and reaches broader audiences through the platform's 200+ million subscribers. Streaming economics work better for secondary superhero franchises than theatrical box office uncertainty.

How does streaming superhero performance compare to theatrical releases?

Streaming superhero properties show higher completion rates and longer engagement timelines than theatrical releases. While theatrical films generate larger opening weekends, streaming properties accumulate significantly more total viewership across months. Engagement data suggests streaming audiences for superhero content are more loyal and invested in properties compared to theatrical audiences, though opening awareness may be smaller initially.

What budget differences exist between streaming and theatrical superhero sequels?

Theater sequels typically require

Does streaming distribution indicate lower creative ambition for superhero properties?

No. Streaming actually enables different creative approaches. Longer runtimes, slower pacing, complex narratives, and experimental storytelling all work better on streaming than in theatrical environments where audiences expect contained narratives. Some established directors prefer streaming production because studio interference typically decreases when opening weekend performance stops driving executive decision-making.

How does DC's streaming strategy impact the entire superhero film industry?

DC's apparent pivot toward streaming for secondary franchises signals to the industry that theatrical distribution isn't essential for successful superhero properties. This could accelerate competitors' streaming expansion and fundamentally reorganize how studios allocate film distribution strategies. Within 18-24 months, expect major studios to develop stratified approaches: theatrical for tentpole franchises, streaming for secondary properties.

What happens to theatrical superhero releases long-term if streaming continues expanding?

Theater releases will likely concentrate among elite franchises commanding consistent opening weekend dominance. Secondary properties, experimental projects, and character-driven stories migrate to streaming. This fragmentation serves audiences by providing multiple consumption options while enabling studios to optimize budgets and marketing approaches for specific distribution channels rather than forcing all properties through identical theatrical pathways.

How do international audiences experience Prime Video superhero releases differently than theatrical releases?

Streaming provides simultaneous global availability, enabling real-time international audience conversation. Theatrical releases stagger releases across territories, fragmenting audience experience. Prime Video's global distribution infrastructure allows localized marketing approaches while maintaining release synchronization. International audiences, particularly in regions with passionate DC fanbases, benefit from unified global conversation around properties.

The Bottom Line: Strategic Transition, Not Compromise

The reported discussions about Blue Beetle's director and The Wrecking Crew 2's Prime Video destination represent genuine strategic transition, not compromise. Studios are accepting that superhero film production, distribution, and consumption operate under fundamentally different economics than theatrical-only approaches enabled.

Angel Manuel Soto's willingness to return signals filmmaker confidence in DC's restructured leadership and creative opportunities. His statement shouldn't be interpreted as casual interest but as genuine enthusiasm for continued involvement. Directors don't risk reputational capital by publicly committing to franchises they privately doubt.

The Wrecking Crew 2's reported streaming discussions make economic sense given the original's theatrical performance. Streaming provides revenue certainty, removes marketing burden, and reaches audiences preferring subscription consumption to theatrical exhibition. The streaming release doesn't diminish the property's potential but optimizes it for audience preferences that have demonstrably shifted across the industry.

DC's apparent strategy of using streaming as a primary distribution channel for secondary franchises enables the company to maintain theatrical dominance for core properties while maximizing revenue from the full portfolio. This approach serves everyone involved: studios receive guaranteed revenue, platforms gain content depth, directors enjoy creative freedom, and audiences access superhero stories through their preferred consumption method.

The entertainment industry is fragmenting. Theatrical releases for tentpole franchises. Streaming releases for secondary properties. Prestige film releases for established directors. Series development for long-form storytelling. International productions. This fragmentation isn't industry decline but reconfiguration adapting to audience preferences and economic realities that existed long before studios acknowledged them officially.

The Wrecking Crew 2 on Prime Video isn't the future of all superhero films. It's the present reality of secondary franchises finding economic optimization through streaming distribution. Watch this space closely over the next 18 months. If The Wrecking Crew 2 succeeds on Prime Video, expect the entire industry's release strategy to reorganize around similar streaming expansion patterns. The theatrical era of universal superhero distribution is ending. The fragmented era is here.

Key Takeaways

- Director confidence drives franchise viability: Ángel Manuel Soto's public commitment to return signals genuine confidence in DC's restructured leadership, influencing industry perception of the franchise's future.

- Streaming economics outperform theatrical for secondary franchises: The Wrecking Crew 2's reported Prime Video destination reflects economic optimization where subscription licensing revenue exceeds theatrical box office uncertainty for secondary superhero properties.

- Superhero film distribution is fragmenting strategically: Rather than theatrical collapse, the industry is reorganizing with tentpole franchises remaining theatrical while secondary properties transition to streaming, optimizing each film's distribution channel.

- Engagement patterns favor streaming superhero sequels: Streaming superhero properties show higher completion rates and sustained viewership across 12+ weeks compared to theatrical releases' frontloaded opening weekends, suggesting superior audience loyalty.

- Platform competition accelerates superhero content acquisition: Amazon Prime Video's interest in DC properties reflects broader streaming platform strategy to establish superhero content as subscriber retention engines, reshaping how studios approach franchise partnerships.

Related Articles

- Netflix's 7 Golden Globes Wins Signal Streaming Dominance [2026]

- Best Films of 2025: Streaming Dominance & Horror's Rise [2025]

- Amazon Fire TV Stick 4K Price Drop: Best Budget Streaming Deal [2025]

- The Brave and the Bold Writer Revealed: Why Batman Fans Are Worried [2025]

- Fallout Season 2 Episode 6 Release Date on Prime Video [2025]

- Amazon's God of War Adaptation: Teresa Palmer Cast as Sif [2025]

![DC's Streaming Strategy Shifts: Blue Beetle Director, Prime Video, and the Future [2025]](https://tryrunable.com/blog/dc-s-streaming-strategy-shifts-blue-beetle-director-prime-vi/image-1-1769459929676.jpg)