Disney Plus Vertical Video: How Streaming is Becoming Like Tik Tok

Something fundamental is shifting in how we watch entertainment. Disney announced at CES 2026 that it's rolling out vertical video feeds to Disney Plus later this year, turning the traditional streaming platform into something closer to social media. This isn't some throwaway experiment. This is Disney—the company that spent decades perfecting the 16:9 widescreen experience—now betting big on 9:16 vertical feeds.

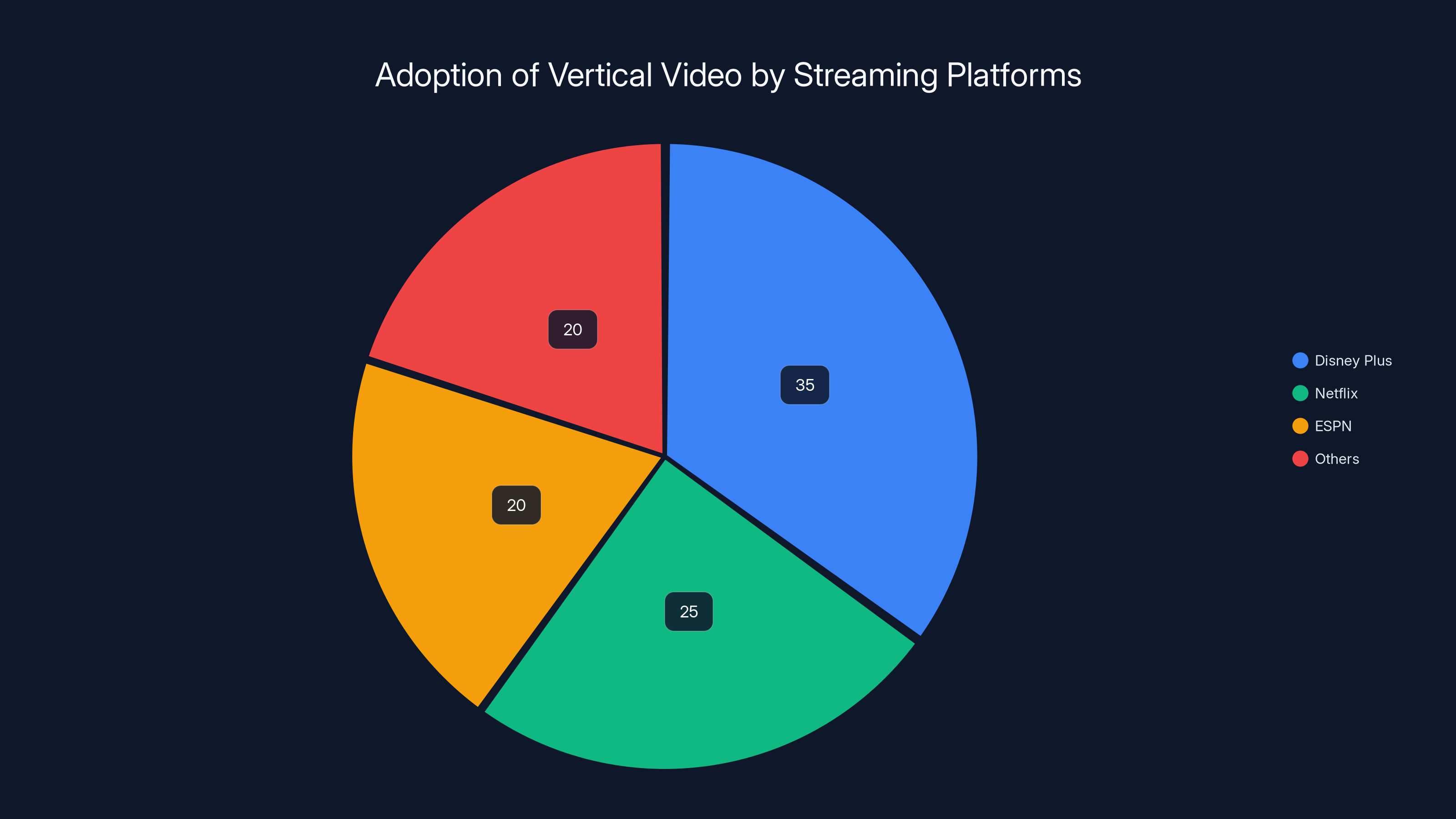

The vertical video trend didn't come out of nowhere. Netflix has been testing vertical video feeds with clips from shows and movies, and last year ESPN added a "Verts" vertical video tab to its redesigned app. But Disney's move feels different. This is a company with the largest library of premium content in the world saying: we're going to meet users where they are. And where they are right now is scrolling through vertical feeds.

Here's why this matters beyond just Disney trying to stay relevant. Vertical video represents a fundamental shift in how media companies think about attention, engagement, and the relationship between creator and audience. It's not about the screen orientation. It's about treating streaming like social media, where discoverability happens through scrolling, algorithms push content dynamically, and users spend hours without planning what to watch next.

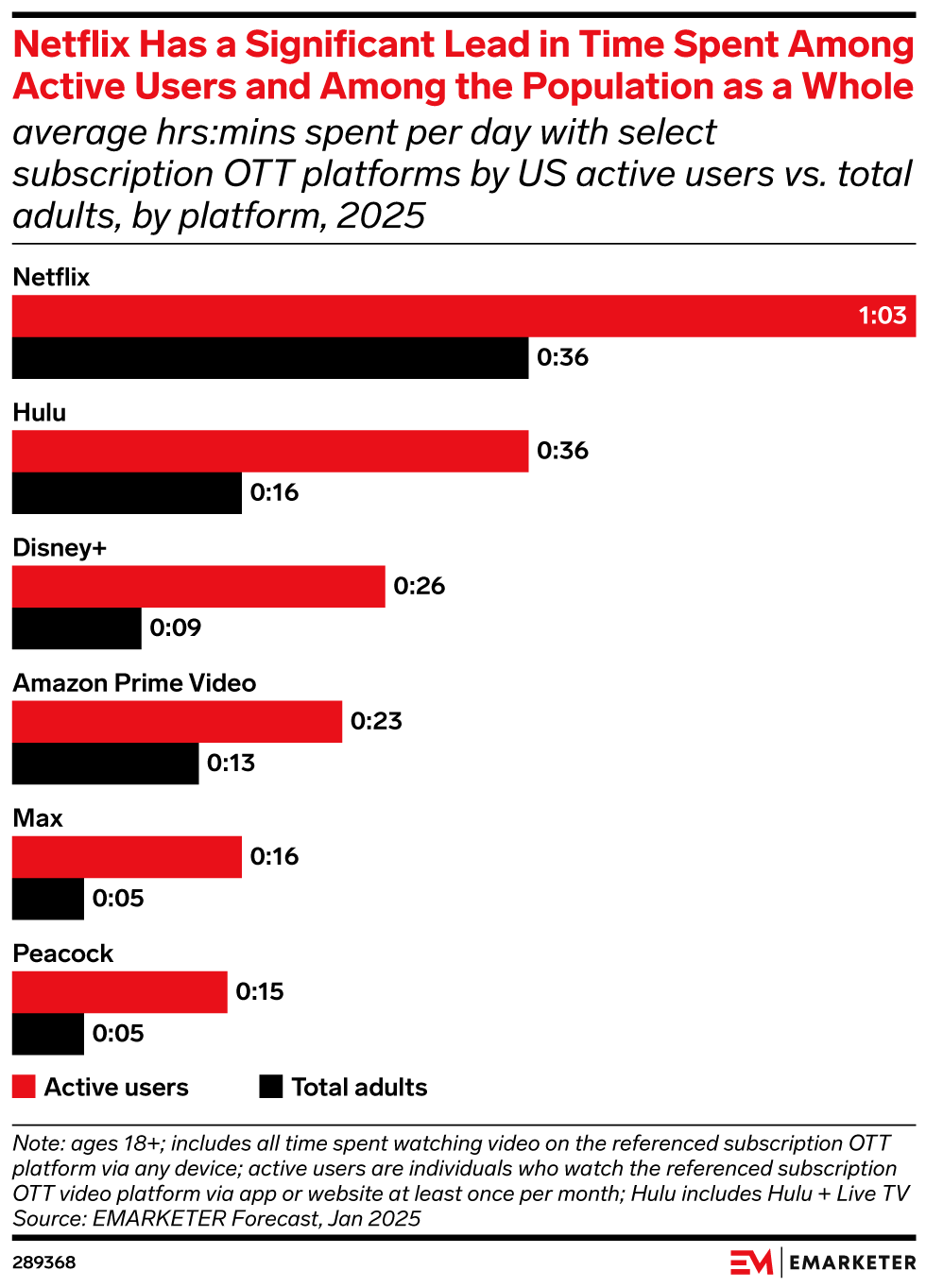

Disney's announcement reveals something the entertainment industry has been quietly wrestling with: traditional streaming models are hitting saturation. Netflix's password-sharing crackdown worked, but it also proved that streaming's growth ceiling exists. Now, the play is to increase time spent in the app, boost daily active users, and monetize attention through algorithmic feeds. It's the social media playbook, applied to premium television.

What's interesting is the timing. Disney Plus has been hemorrhaging subscribers and struggling with profitability. The vertical video play isn't desperation, exactly. It's strategic repositioning. If vertical feeds can convince users to open Disney Plus daily instead of just when they've decided what to watch, the entire economics change. You go from a subscription with occasional dips to a destination people visit compulsively.

But there's a tension here worth exploring. Vertical video feeds require constant content creation at scale. Disney has the library, sure, but turning decades of movies and shows into an endless stream of short-form clips? That's a different creative challenge. And there's the question of audience fragmentation. Some people want intentional viewing experiences. Others want algorithmic serendipity. Can one app serve both?

Why Every Streamer is Chasing the Vertical Video Playbook

The shift to vertical video isn't random. It's a direct response to changing user behavior and platform competition. When Tik Tok proved that vertical feeds could capture billions of hours of daily viewing time, every platform took notice. YouTube added Shorts. Instagram pushed Reels. YouTube Shorts now generates over 70 billion daily views, according to the platform's public statements.

Streaming companies watched this happen and realized something uncomfortable: they'd built their entire business model around intentional viewing. Users subscribe, open the app, decide what to watch, and settle in for 30 minutes to three hours. It's predictable. It's old.

Vertical video changes everything. The feed does the deciding for you. You scroll mindlessly, and content appears. Sometimes you watch five seconds. Sometimes you watch twenty minutes. The algorithm learns what keeps you engaged and pushes more. You lose track of time. The app becomes sticky.

For streaming platforms, this is the holy grail. Disney's chief executive Bob Iger has been explicit about this: the goal isn't to increase content library size. It's to increase daily active users and time spent in the app. Vertical feeds accomplish both.

There's also an advertising angle here that shouldn't be ignored. Vertical video feeds create natural advertising insertion points. Instagram Reels show you ads between videos. YouTube Shorts does the same. Disney Plus currently has an ad-supported tier, and vertical video feeds offer unprecedented opportunities for ad placement. You could watch two short-form clips, then an ad, then more clips. The engagement metrics are exceptional.

But the real insight is this: vertical video feeds solve a problem that streaming platforms have struggled with since day one. How do you help users discover content? Netflix built its entire business on recommendation algorithms because browsing a catalog of ten thousand titles is paralyzing. But algorithms have limits. They optimize for what users have already watched and liked. Vertical feeds flip this. Instead of "what should I watch based on my history," it becomes "here's something interesting, watch if you like it, scroll if you don't."

This is fundamentally different. And it works because it mirrors how humans actually discover content on social media, which is how most people discover entertainment now.

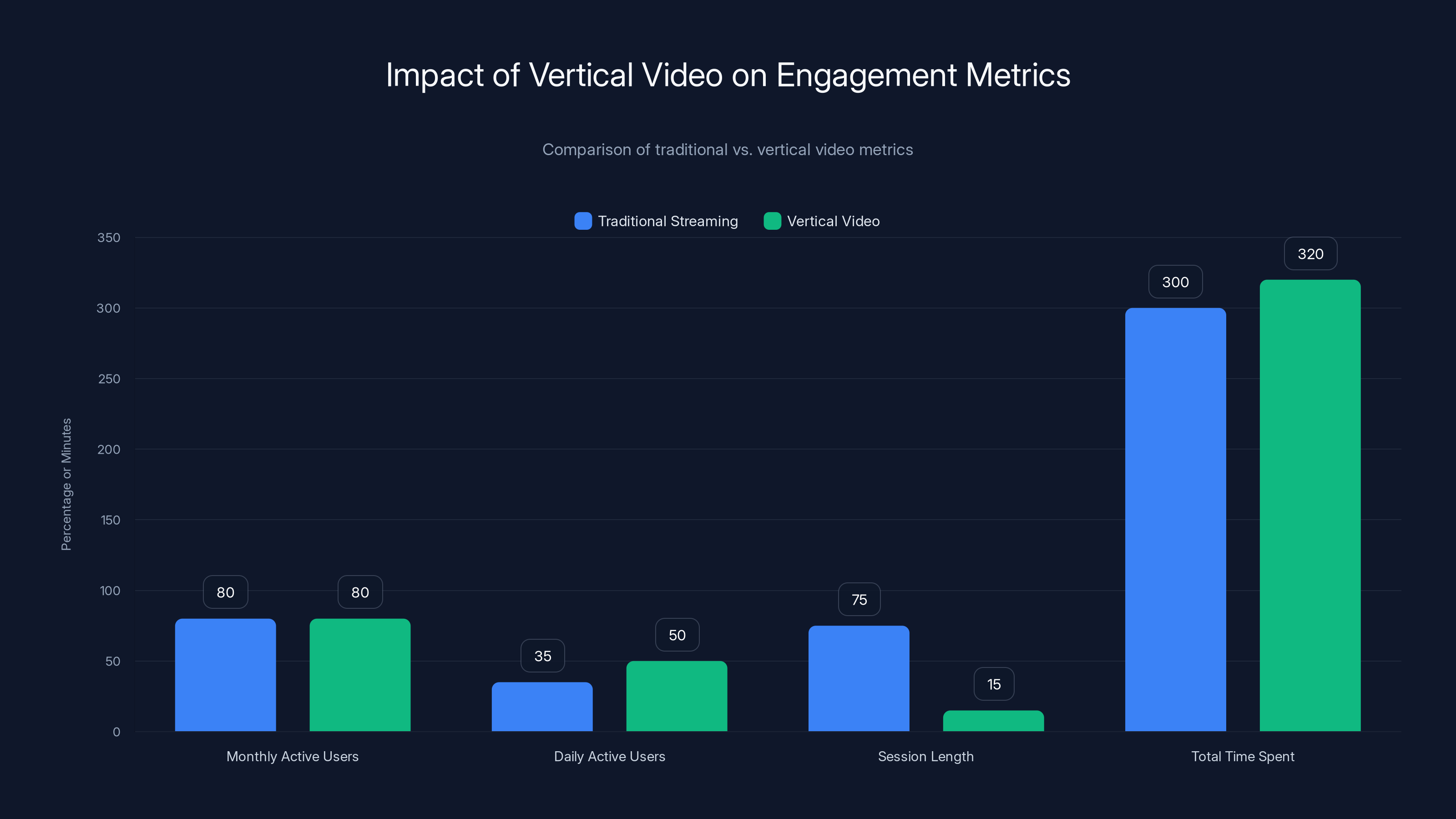

Vertical video significantly increases daily active users from 35% to 50% while maintaining similar total time spent compared to traditional streaming. Estimated data.

The Content Strategy Behind Vertical Video Feeds

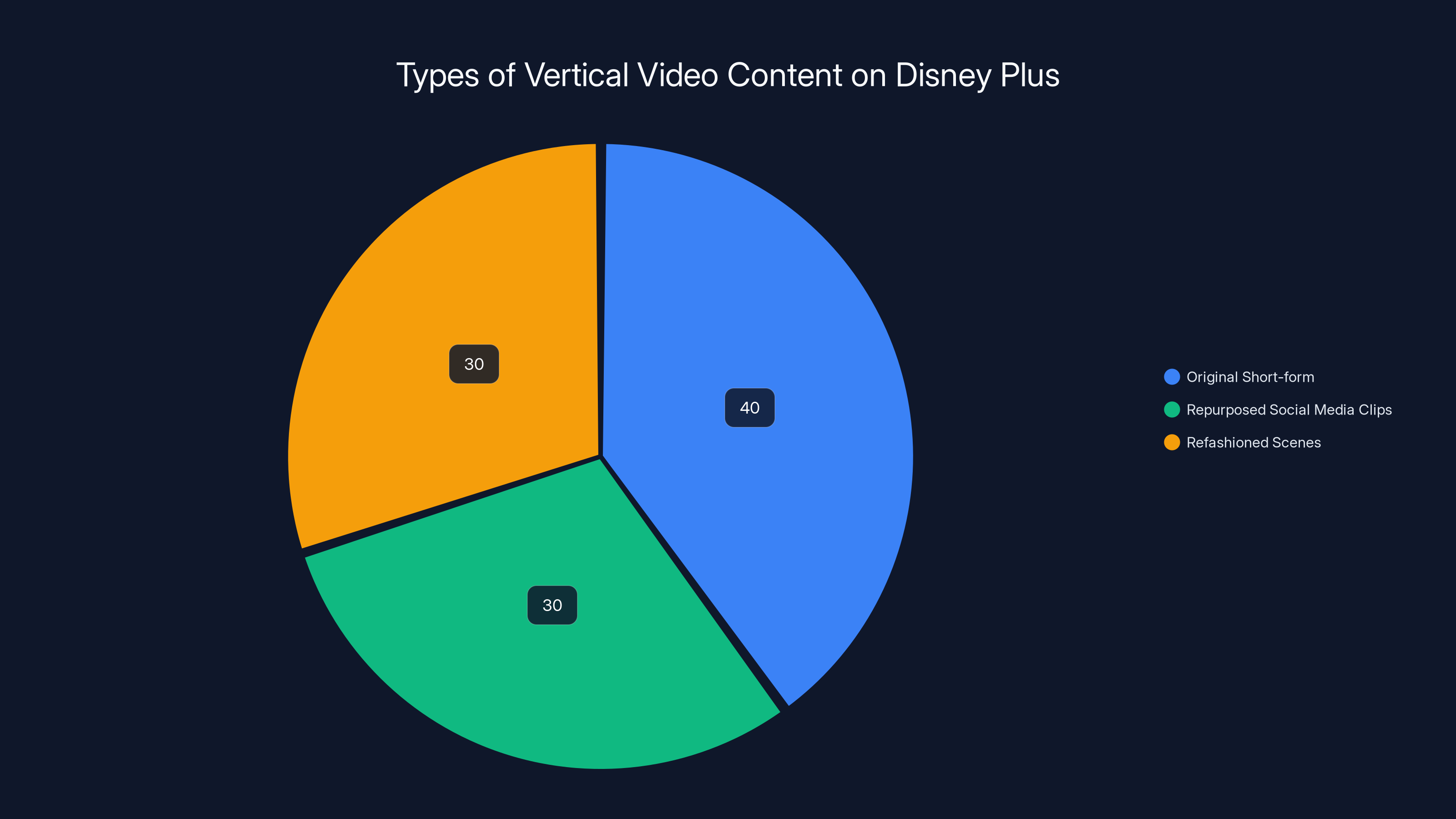

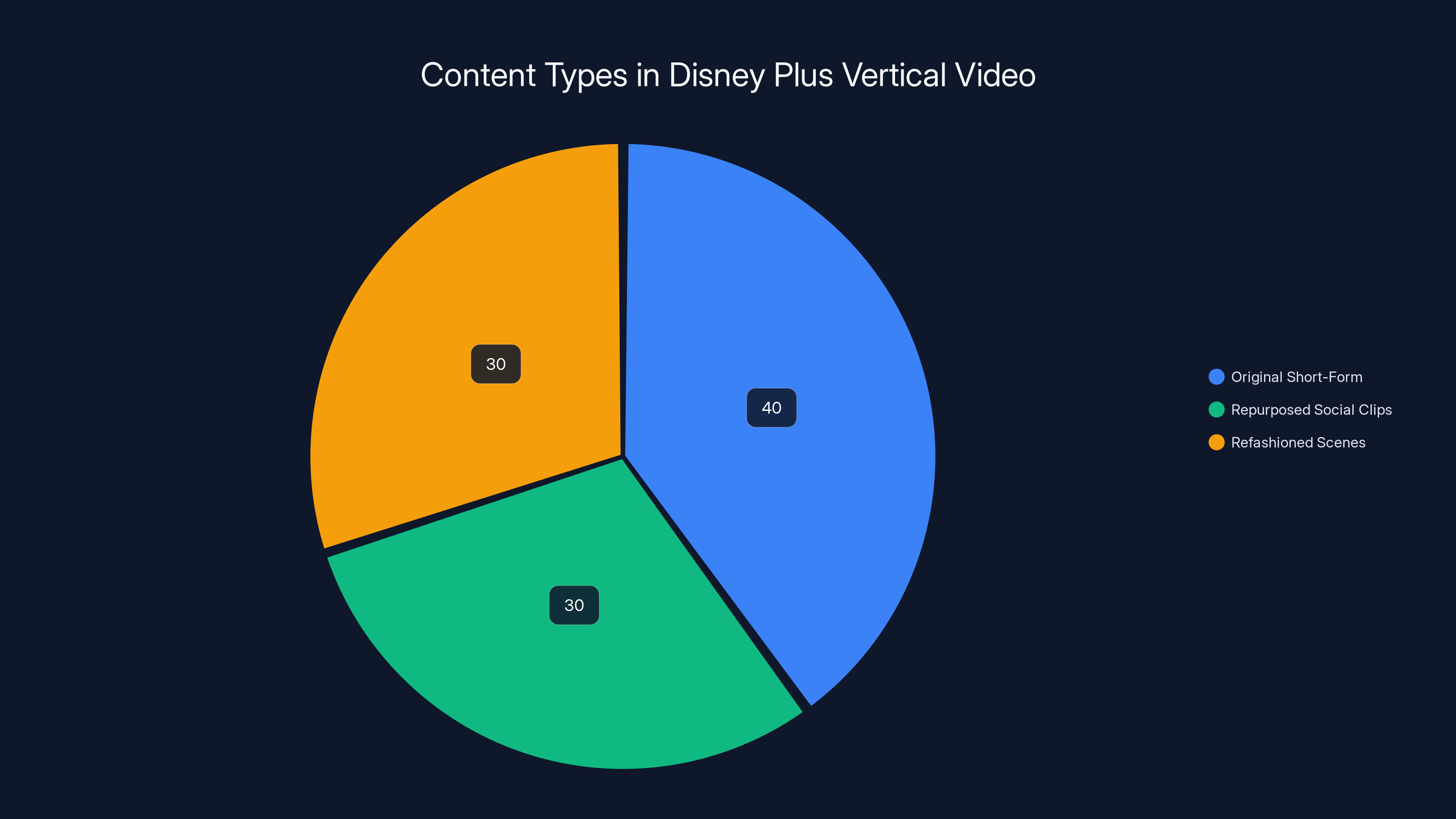

Here's where Disney's play gets really smart. According to announcements, Disney Plus vertical video will include three types of content: original short-form programming, repurposed social clips, and refashioned scenes from existing shows and movies. That's a framework, not a constraint.

Let's break down what each category means. Original short-form programming means Disney will actually commission new content specifically for vertical format. Think Marvel short clips. Star Wars scenes filmed vertically. Disney Plus Originals adapted for quick viewing. This costs money, but it signals commitment. You're not just repackaging old stuff.

Repurposed social clips are existing content that went viral on Tik Tok or Instagram, now fed back to Disney Plus users. It's meta. Users discover content on social, then see the same content in the app, creating a loop. This is low-cost content that's already proven engagement.

Refashioned scenes from longer-form content are the most interesting. Imagine watching a five-minute scene from The Mandalorian edited specifically for vertical viewing. Then another scene from Marvel. Then a clip from a National Geographic documentary. The vertical feed becomes a highlight reel of your entire streaming library.

The content strategy reveals Disney's actual goal. They're not trying to replace traditional television watching. They're trying to capture micro-engagement moments. You have five minutes before a meeting? Scroll vertical video. You're waiting for a friend? Scroll vertical video. This isn't the primetime slot. This is the attention scraps throughout your day.

That sounds cynical. It's not meant to be. It's just honest about what's happening. Streaming used to be about choice freedom. Watch what you want, when you want. Now it's about algorithmic discovery at scale. The vertical feed is the next evolution of that.

What's not yet clear is how Disney will balance this. If vertical feeds are too good at capturing your attention, people might stop engaging with traditional Disney Plus browsing entirely. You'd open the app, scroll vertical video, leave without ever intentionally selecting a full episode. That's actually fine if engagement metrics are what matter. But it changes the relationship with content from purposeful to passive.

Disney is betting that it can thread this needle. Create enough engaging short-form content to keep people scrolling, but not so much that they abandon full-episode watching. Theoretically possible. Practically? We'll see.

Vertical video could generate

How Vertical Video Changes Platform Engagement Metrics

If you want to understand why Disney is doing this, forget about entertainment strategy for a second. Think about business metrics. There are four numbers that matter to streaming platforms: monthly active users, daily active users, average time spent per session, and overall time spent per month.

Traditional streaming excels at monthly and overall metrics but struggles with daily and session metrics. You subscribe, then you use it when you remember. Sessions are long, but infrequent. Vertical video feeds flip this. They're designed to increase daily active users significantly.

Here's the math. If vertical video increases your daily active user percentage from 35% to 50% of your subscriber base, that's a massive swing. A $15/month subscriber is worth more if they use the service daily versus weekly. Because daily users develop habits. Weekly users fall off when they forget to renew.

The session length metric gets more interesting. Traditional streaming sessions are long, 60-90 minutes typically. Vertical video sessions might be shorter, 10-15 minutes. But if users visit more frequently, total time spent goes up. You might watch 20 minutes of vertical video on Monday evening, another 15 minutes Wednesday morning, another 20 minutes Friday lunch. That's 55 minutes across three sessions versus one 90-minute weekend binge. Both represent similar engagement, but the daily interaction pattern changes behavior.

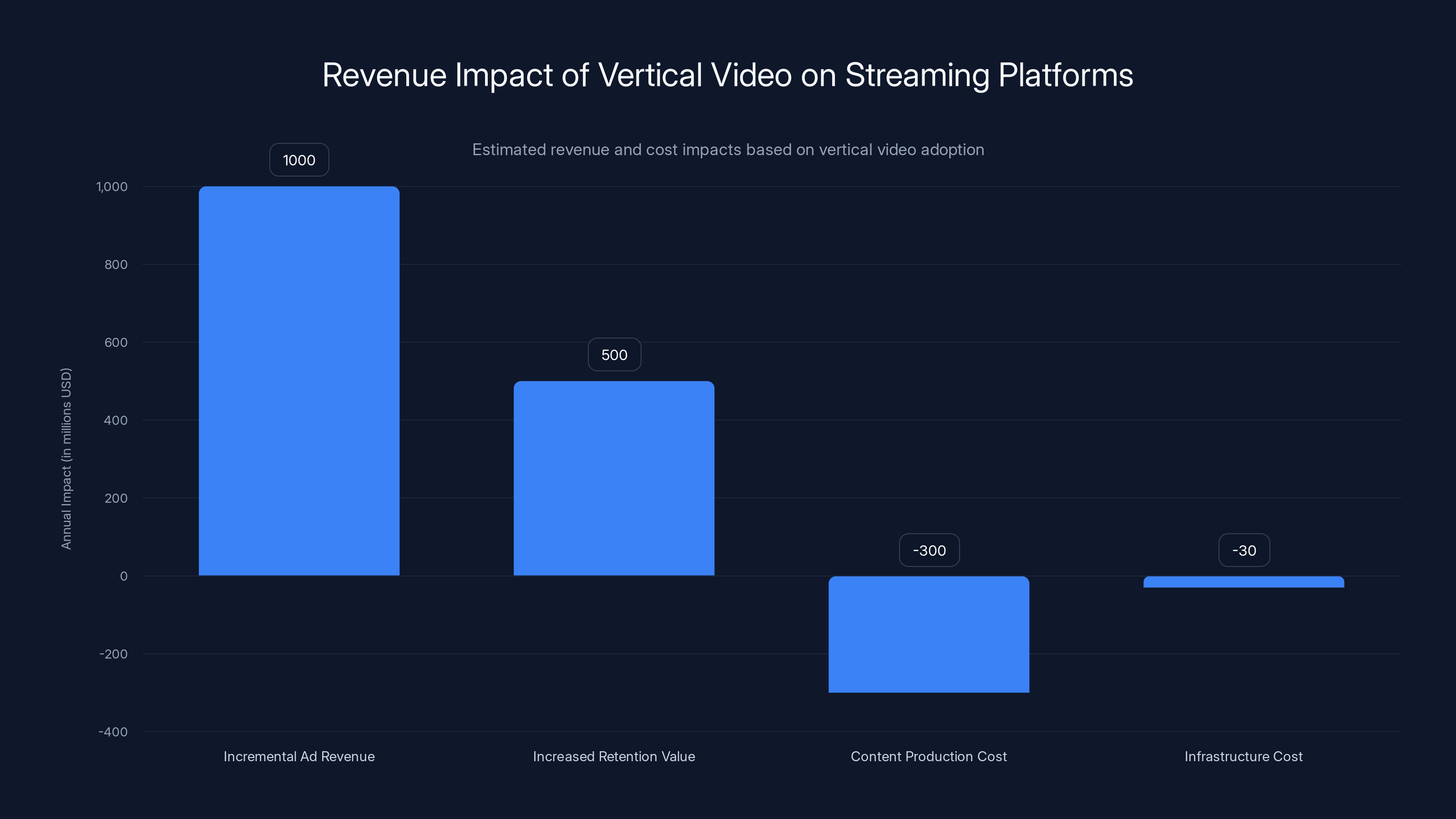

Advertising revenue also transforms. With vertical feeds, ad placement becomes more sophisticated. You could show an ad after every three clips, creating predictable advertising intervals. A traditional Disney Plus session might have one or two ad breaks. Vertical sessions could have four or five. That's a potential 200-300% increase in impressions without increasing overall viewing time.

For ad-supported tier subscribers, this matters enormously. Disney Plus Premium (with ads) currently costs $7.99/month. If vertical feeds triple ad impressions, Disney's effective revenue per user increases dramatically. They might not need to raise prices if they can increase ad inventory.

There's also the algorithm optimization problem. Streaming platforms invest billions in recommendation systems. Netflix's recommendation engine is famous, and with good reason: it's incredibly complex. But recommendation algorithms plateau. They work well when training data is abundant and patterns are clear. Vertical video feeds sidestep this problem. Instead of predicting what you'll watch, they let you discover through rapid-fire presentation.

It's simpler. It's more engaging. It's what works for social media, and social media companies have scale that streaming platforms envy.

The Netflix Vertical Video Experiment: What We Learned

Netflix has been testing vertical video feeds with clips from shows and movies, so we have a case study. What worked? What didn't?

First, the good news: Netflix users engaged with vertical video feeds. They didn't reject the format. People actually spent time scrolling through clips. The algorithm could identify what types of content drove engagement and push more. It wasn't a failed experiment.

But Netflix didn't roll vertical feeds out platform-wide. They kept it as a test. Why? Probably because the metrics didn't justify the engineering complexity. Or the content strategy didn't work. Or users preferred traditional browsing when making intentional viewing decisions. We don't know for sure because Netflix doesn't report on failed experiments in detail.

What we do know is that Netflix saw vertical video as worth testing, which means they identified genuine potential. But also that they didn't see it as a priority. Compare that to Tik Tok, YouTube Shorts, or Instagram Reels, where vertical video is the primary format. There's a difference between "testing a feature" and "making it the centerpiece of the platform."

Disney's approach feels bolder. They're not testing. They're rolling out vertical video to the main platform. That suggests Disney believes vertical video is essential to their future, not optional. Maybe they analyzed Netflix's test results and found something Netflix missed. Or maybe Disney is more desperate to increase daily active users, so they're willing to take bigger risks.

There's also a content library difference. Netflix has maybe 10,000 titles at any given time. Disney Plus has significantly more when you count all Disney, Pixar, Marvel, Star Wars, National Geographic, and ABC content. More content means more raw material for vertical clips. Netflix might have hit a content bottleneck with vertical testing. Disney might not.

Another factor: Disney has advertising relationships that Netflix is still building. Netflix's ad tier is younger and smaller. Disney has been running ads on ESPN for years. They know how to monetize vertically formatted content because ESPN's Verts is already doing it. Netflix is learning as it goes.

So Netflix's vertical video test tells us something important: vertical feeds work in theory, and users engage with them in practice. But implementation requires careful strategy. Get the content mix wrong, and engagement plummets. Get the algorithm wrong, and users stop returning daily. Get the monetization wrong, and the feature loses money.

Disney's vertical roll-out will reveal whether they solved those problems or whether they'll run into the same headwinds Netflix did.

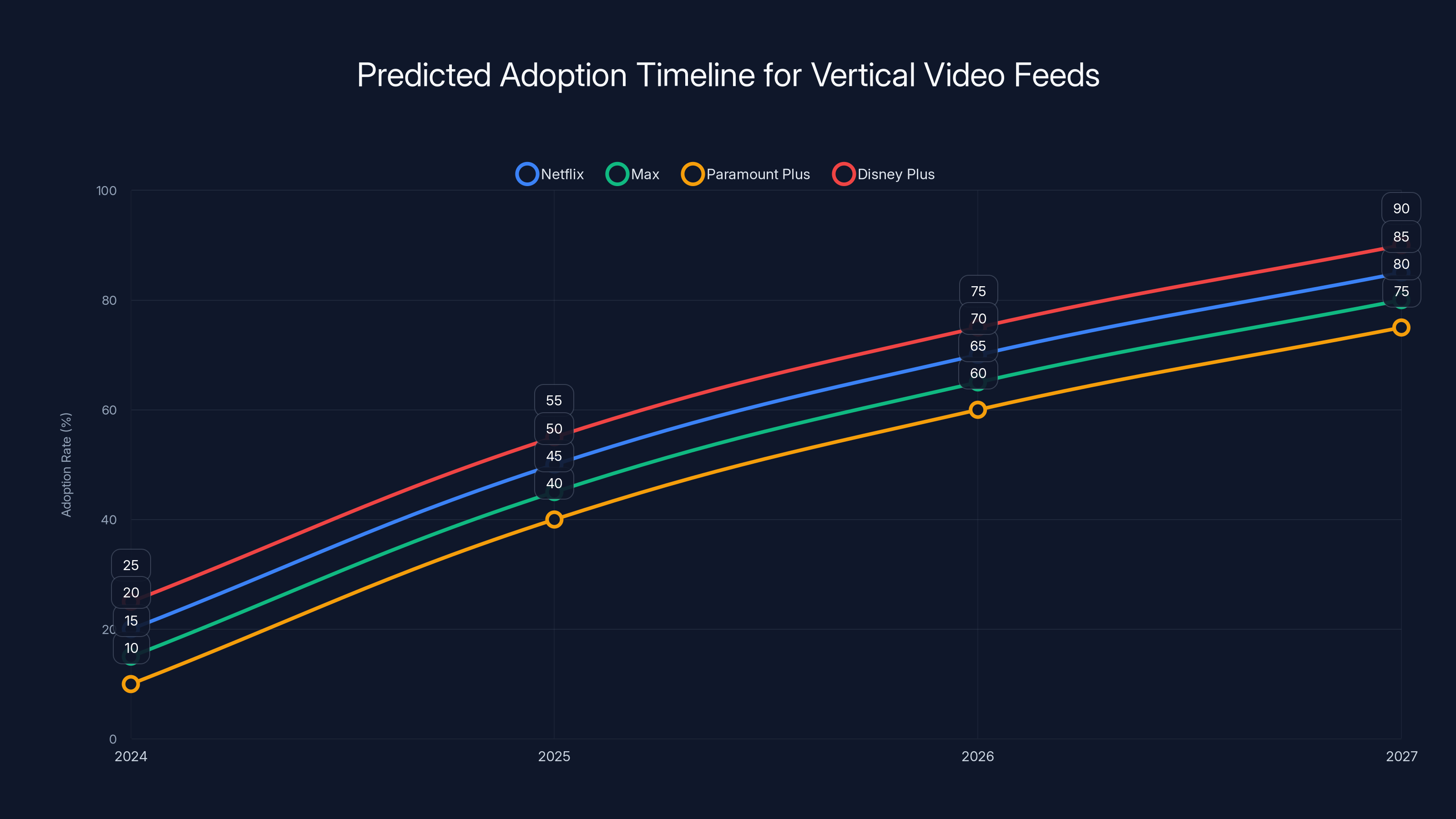

Estimated data suggests that by 2027, vertical video feeds will be a standard feature across major streaming platforms, with Disney Plus leading the adoption curve.

Why ESPN's "Verts" Tab Is the Real Test Case

Everyone talks about Tik Tok and Instagram as vertical video inspiration. But the closest example to what Disney Plus is doing is already running in ESPN's app. The "Verts" tab launched last year and it's the live experiment for how vertical video works in a sports media context.

ESPN's advantage: sports content is inherently clip-able. A home run, a three-pointer, a diving catch. These moments are naturally short-form, and fans want to rewatch them constantly. Vertical video is perfect for this. ESPN could show you five clips in two minutes, and you'd be engaged because each clip carries genuine information.

The question ESPN answered was: can vertical video increase daily active users for a traditionally desktop-bound app? The answer appears to be yes. People actually open the ESPN app specifically to scroll Verts. It's not replacing traditional ESPN browsing. It's complementing it.

But here's the crucial difference between ESPN and Disney Plus. Sports have inherent urgency. If you missed a game, you want the highlights immediately. Entertainment doesn't have that same pressure. You can watch a Mandalorian scene anytime. There's no deadline. That reduces the psychological stickiness of vertical feeds for entertainment content.

ESPN's Verts also revealed something about audience expectations. Sports fans don't feel weird about rewatching a clip they already know the outcome of. But entertainment fans often avoid spoilers and want first-time viewing experiences to be special. Vertical feeds naturally create spoiler risk. You scroll past a scene from your favorite show that you haven't watched yet. The surprise is gone.

Disney will need to solve this with user controls. Probably a toggle: "Include content from shows I haven't watched yet" or "Only show clips from shows I'm caught up on." Without this, engagement suffers because people leave the feed to avoid spoilers.

Another ESPN insight: vertical feeds work best with a consistent stream of new content. ESPN generates thousands of new clips daily. Disney Plus generates... whatever they actively produce plus new episodes of ongoing shows. The clip supply is different. ESPN can guarantee fresh content every single day. Disney can't guarantee that same frequency year-round.

These details matter because they explain why ESPN's vertical feeds work but might not translate perfectly to entertainment streaming. The underlying dynamics are different.

The Creator Economy Connection: Why Vertical Video Changes Everything

There's a dimension to Disney's vertical video strategy that doesn't get enough attention: the creator economy. Vertical video isn't just a distribution format. It's a creator format.

When YouTube Shorts launched, it democratized short-form video creation. You didn't need professional equipment. You recorded on your phone. Edited in the YouTube app. Posted. Millions of potential views.

Disney Plus is now operating in that ecosystem. If Disney encourages creators to make vertical content specifically for the platform, something interesting happens. Disney becomes a channel for creators, not just a library of content Disney owns. You get professional shows mixed with creator content. Authenticity mixed with polish. It's the YouTube model, applied to subscription streaming.

The financial model for this is different. YouTube pays creators through ads and share programs. Disney Plus could do the same, but more likely they'll acquire or license vertical content from successful creators. They see someone making great vertical Disney content on Tik Tok, they pay them to make an exclusive series for Disney Plus.

This could be revolutionary or a disaster. Revolutionary if it brings fresh voice and authenticity to streaming. Disaster if Disney suddenly floods the platform with mediocre creator content that dilutes the professional productions users pay for.

The creator angle also explains why Disney Plus vertical video is different from Netflix's test. Netflix tested repurposing content. Disney is signaling that original vertical content creation is part of the plan. That requires different infrastructure, different creator relationships, and different licensing models.

If Disney executes this well, they're not just competing with Tik Tok for short-form video. They're competing with YouTube for creator distribution. That's a bigger market than traditional streaming.

If they mess it up, they have a feed full of mediocre user-generated content mixed with their premium library, which confuses brand identity and dilutes value perception.

Estimated data suggests that Disney Plus will feature a balanced mix of original short-form content, repurposed social media clips, and refashioned scenes in its vertical video offerings.

Technical Challenges: Encoding, Bandwidth, and Scale

Implementing vertical video at Disney Plus scale isn't trivial. We're talking about a platform with hundreds of millions of users, millions of pieces of content, and complex licensing agreements.

First, the encoding problem. Video content needs to be encoded in different formats, resolutions, and aspect ratios for different devices. Disney Plus already encodes everything in 16:9 widescreen. Now they need 9:16 vertical versions. For their entire library.

That's not just re-rendering the same files. It's intelligent cropping or pillarboxing. Most movies and shows were shot in widescreen. Converting them to vertical requires either cropping (losing image information) or adding black bars (dead space). Neither is ideal. Disney will likely use a hybrid approach: AI-assisted cropping for scenes where it works, manual editing for important scenes.

This is expensive. Not catastrophically so, but it requires significant engineering and content prep. Multiply this across ten thousand titles and you're talking real investment.

Bandwidth is another problem. Video streaming uses more bandwidth than anything else on the internet. If vertical video feeds encourage shorter, rapid-fire viewing sessions, the bandwidth efficiency actually improves. Someone watching three five-minute clips uses less bandwidth than someone watching a full episode. So this might not be a problem. Might actually be an advantage.

The algorithmic challenge is substantial. Disney's current recommendation system trains on what users watch: full episodes, movies, viewing duration, completion percentage. Vertical feeds require different training data: clip views, completion rate of clips, rewatches, shares, likes. The algorithm needs to learn entirely different patterns.

They also need to train models that understand what makes short-form content engaging within their library. That's different from what makes a full TV episode engaging. Short clips need hooks, pacing, surprises. Full episodes have slow builds and character arcs. You can't just train one model on both.

There's also the personalization problem. If vertical feeds are algorithmic (which they almost certainly will be), Disney needs to be careful about filter bubbles. If someone watches a lot of Marvel, the algorithm shouldn't only feed them Marvel. It should introduce variety. Otherwise, users get bored and stop opening the feed.

Load balancing is another technical challenge. Vertical feeds create unpredictable usage patterns. Traditional streaming has peaks at evening hours. Vertical feeds could have constant traffic throughout the day as people scroll on breaks. This requires different infrastructure and caching strategies.

These are solvable problems. Disney has excellent engineers. But they're non-trivial, and they explain why vertical video roll-out takes time rather than launching immediately.

Privacy and Data Collection: The Hidden Cost

Vertical video feeds require extensive data collection to work well. Every pause, skip, rewatch, and share is tracked. This data trains the algorithm that decides what to show you next.

Disney already collects data from Disney Plus users, but vertical feeds require more granular tracking. Traditional streaming tracks which show you watch and for how long. Vertical feeds track which specific clips you watch, how long you watch each clip, which part of the clip you skip, whether you rewatch, whether you share.

This is valuable data for personalization. It's also personal data that raises privacy questions. Some users will opt out. Others won't care. Disney will need to balance tracking needs with privacy regulations like GDPR and CCPA.

There's also the content preference angle. Vertical feeds reveal what specific moments in shows you find engaging. Disney can use this to inform what they produce next. More romantic moments if clip data shows those drive engagement. More action if that's what keeps users scrolling.

This feedback loop is powerful. But it also means Disney's content strategy becomes increasingly data-driven. Human intuition and creative vision matter less. Algorithms matter more. That's not inherently bad, but it's a shift in how content gets created.

There's also the sharing angle. If vertical feeds let you share clips easily (which they should), you're uploading Disney content to social media platforms. This creates additional data points about what content resonates. But it also blurs the line between Disney Plus as a private subscription and Disney Plus as a social media platform.

Disney will need clear terms of service around clip sharing, whether users can monetize shares, and how Disney's rights are protected. This gets legally complex quickly.

The broader privacy picture: vertical feeds require Disney to become more sophisticated at tracking and analysis. That requires more data scientists, more storage, more infrastructure. It's an investment that improves the product but also increases Disney's surveillance capabilities over user behavior.

Some users will love this because it improves recommendations. Others will feel uncomfortable. Disney's challenge is managing both groups.

Disney Plus's vertical video strategy is estimated to focus 40% on original short-form content, with 30% each on repurposed social clips and refashioned scenes, highlighting a balanced approach to engaging users. Estimated data.

The Advertising Opportunity: Why This Might Actually Work

Here's the financial angle that makes vertical video inevitable for Disney Plus: advertising potential.

Disney Plus has an ad-supported tier that costs less than the ad-free version. Vertical feeds create unprecedented advertising inventory. Instead of one or two ad breaks in a 45-minute episode, you could have multiple ads in a two-minute vertical session.

The key insight is that vertical video ads don't feel as intrusive. You watch a 30-second clip, then a 15-second ad, then another clip. The rhythm is fast. It doesn't feel like you're being interrupted. Compare that to a traditional episode where you're settled in for drama, and an ad break jerks you out of it.

More importantly, vertical video ads can be native. Imagine scrolling through Disney Plus vertical feeds and seeing an ad for a new movie, formatted as a vertical clip. It feels native to the format. It doesn't disrupt the viewing experience. It's just content.

Advertisers will pay premium rates for this. Instead of a 30-second pre-roll ad that people skip (on platforms that allow skipping), they get in-stream ads within a fast-paced vertical feed. The engagement is different. The metrics are different.

Disney's strategy is becoming clearer when you look at the ad picture. Increase daily active users through vertical feeds. Increase ad impressions through vertical feed advertising. Increase monetization without raising subscription prices. It's the Netflix ad-tier playbook, but more aggressive.

There's also the targeting opportunity. Vertical feeds enable sophisticated behavioral targeting. Not just "this person watches Marvel content" but "this person watches this specific type of Marvel moment (action sequences, funny dialogue, emotional beats)." That level of granularity lets advertisers reach incredibly specific audiences.

For Disney, this is valuable because it lets them charge more for premium ad placements. An advertiser who wants to reach people who love Marvel action sequences will pay more than an advertiser who wants to reach "Marvel viewers." The specificity commands premium rates.

The question is whether users tolerate more advertising in exchange for a more engaging feed. Probably yes, especially for the ad-supported tier. These users already expect ads. If vertical feeds make the ad experience feel less intrusive, that's actually an improvement over traditional ad breaks.

For ad-free subscribers, vertical feeds don't change the value proposition. They get the same feature without ads. That's fine. The real revenue play is converting ad-free users to ad-supported by making the platform so engaging that the free ad-free version feels less valuable by comparison.

Competitive Threats: Why Other Streamers Can't Ignore This

If Disney succeeds with vertical video, pressure on other streaming platforms becomes intense. Netflix, Max (formerly HBO Max), Paramount Plus, Peacock, and others will all need to respond.

Netflix is in the best position. They already tested vertical video. They have the engineering expertise. They also have the subscriber base to make it work at scale. If Netflix rolls out vertical feeds platform-wide, Disney's advantage disappears. Netflix would probably do it better because Netflix's algorithm is more sophisticated.

Max is weaker positioned. HBO Max is known for intentional viewing experiences. Curated content. Vertical feeds conflict with that brand identity. But AT&T (which owns Max's parent) will pressure them to maximize user engagement and ad revenue. So they probably will launch vertical feeds, but reluctantly.

Paramount Plus has a similar position. They emphasize premium content and traditional viewing. Vertical feeds feel like compromise. But if investors demand growth and traditional metrics are plateauing, vertical feeds become inevitable.

Peacock is interesting because NBCUniversal already has NBC properties, sports, news. Like ESPN, they have content that's naturally clip-able. They could launch vertical feeds faster than other platforms.

Amazon Prime Video is oddly positioned. Prime isn't pure streaming. It's bundled with retail. Amazon doesn't need vertical feeds to keep Prime subscribers engaged because Prime isn't about streaming. But if Prime Video becomes more central to the bundle, vertical feeds could be a differentiator.

The competitive dynamics here are critical. If Disney's vertical feeds work and increase daily active users, other streamers will copy. Within two years, every major streaming platform probably has a vertical feed. Then the differentiation isn't the feature itself, it's the execution. Whose algorithm is best? Whose content library has the most clip-worthy moments? Whose vertical feed makes scrolling most addictive?

At that point, we're back to the core competency that always mattered: content. Disney has the advantage there. But Netflix and others won't surrender without a fight.

Estimated data shows Disney Plus leading in adopting vertical video format, followed by Netflix and ESPN. This shift highlights the growing trend of integrating social media-like experiences in streaming services.

The User Experience Question: Will People Actually Use This?

There's an assumption embedded in all this analysis: that users want vertical video feeds within their streaming apps. It's probably true, but not certainly. Some users might resist.

People who subscribe to Disney Plus to watch specific shows might find vertical feeds annoying. They open the app, want to find The Mandalorian, and instead get a feed of random clips. That friction increases unless vertical feeds are completely optional.

Disney's almost certainly making vertical feeds optional. You'll have the traditional browsing interface and the vertical feed as an alternative. Some users will ignore the feed entirely. Others will prefer it. That's fine.

But there's a subtle design question here. If vertical feeds are optional but primary (the default view when you open the app), most users will encounter them. Some will like them and stay. Others will dislike them and hunt for the traditional interface. If that traditional interface is harder to find, you get frustration.

Good UX design would make vertical feeds prominent but not mandatory. Let users choose their default view. Don't bury traditional browsing. Disney has good design teams. They probably get this right.

There's also the quality question. If Disney Plus fills vertical feeds with low-quality clips, nobody uses them. If they fill them with genuinely interesting moments, engagement explodes. This is content-dependent. You can't fake a good vertical feed.

The algorithm also needs to avoid burnout. Show someone the same clip twice in a week and they'll notice. Show them repetitive content and they'll stop scrolling. The feed needs constant variety. That requires either constant content creation or a sophisticated algorithm that surfaces lesser-known clips.

Disney has the library size to pull this off. But execution matters. Get the UX wrong, the content quality wrong, or the algorithm wrong, and vertical feeds become a feature nobody uses.

There's also the integration question. How do vertical feeds interact with the rest of Disney Plus? If you watch a clip of The Mandalorian in vertical format, can you tap it and jump to the full episode? That would be excellent UX. If you have to search for it separately, the feed loses value.

These details matter more than you'd think. Vertical feeds are simple in concept, complex in execution.

The Spoiler Problem: Content Discovery vs. Narrative Experience

Here's a problem Disney hasn't publicly addressed: spoilers. Vertical feeds necessarily show moments from shows without context. You scroll past a dramatic death, a plot twist, or a major reveal, and the surprise is gone.

This is particularly problematic for premium scripted content. Marvel shows have narratives that depend on surprise. Same with prestige dramas. Vertical feeds undermine that. Either you risk spoilers by scrolling, or you opt out of vertical feeds entirely.

Disney's going to need solutions here. Likely options include:

First, show/series indicators. Vertical clips should clearly indicate which show they're from and, ideally, which season/episode. Users can choose to avoid content from shows they haven't watched.

Second, spoiler warnings. Mark clips that contain major plot points. Give users the option to hide them.

Third, toggle settings. "Show clips from shows I've watched." "Show clips from shows I'm currently watching." "Show all clips." Let users choose their risk tolerance.

Fourth, non-spoiler clip selection. Prioritize moments that work without context. Funny scenes. Action sequences. Visually stunning moments. Avoid major plot beats.

Fifth, spoiler-free zones. Certain times (right after a new episode airs) or certain content (upcoming releases) get filtered from feeds.

The spoiler problem reveals a fundamental tension in vertical feeds. They work best with content that's independent and complete in itself. Sports highlights. Comedy sketches. Music performances. They work less well with narrative-dependent content. Dramas. Mysteries. Plot-driven shows.

Disney's library has both types. Vertical feeds work great for Marvel action sequences, animated moments, Disney magic. They work terribly for the mystery reveals in Lost or the character arcs in prestige dramas.

Disney's solution will probably be a hybrid approach. Show tons of non-narrative clips (visuals, comedy, action, music). When narrative content appears, flag it for spoiler risk. Let users decide.

But this limiting what you can feature in vertical feeds. You're excluding some of Disney's best content because it depends on narrative context. That reduces the quality and variety of what appears in feeds.

It's a real problem with no perfect solution. Other platforms like Tik Tok don't face this because they're primarily comedy, music, and performance. Narrative tension doesn't apply. Streaming platforms have narrative content, so they deal with this tradeoff.

Generational Preferences: Who Actually Wants This?

Vertical video appeals primarily to younger users. Gen Z and younger millennials grew up with Tik Tok. Vertical scrolling is their native interface. For them, vertical video feeds on Disney Plus isn't strange. It's expected.

Older demographics might resist. Baby boomers and Gen X subscribers came to Disney Plus to watch shows intentionally. The idea of scrolling endlessly through random clips might feel overwhelming or low-quality.

Disney's challenge is serving both groups. The vertical feed attracts young users and increases engagement. Traditional browsing keeps older users satisfied. If Disney executes both well, they grow the demographic range.

There's also a content preference angle. Younger users gravitate toward short-form comedy, trending moments, viral clips. Older users prefer complete narratives and established shows. Vertical feeds should surface different content for different users.

The monetization picture differs by generation too. Younger users are more likely to tolerate ads for a cheaper subscription. Older users are more likely to pay for ad-free. Vertical feeds on the ad tier appeal to younger users specifically. This could drive tier segmentation where younger users cluster on the cheaper ad-supported plan.

That's not bad for Disney. Ad-supported revenue, if executed well, can actually be higher than subscription revenue due to CPM rates. But it changes the demographic profile of the subscriber base.

Disney's not trying to replace traditional streaming. They're trying to expand who uses Disney Plus and how frequently they use it. Vertical feeds accomplish that by appealing to users who otherwise might not engage with the platform.

The generational dimension also explains why competing platforms need to respond. If vertical feeds become the default way younger users discover content, platforms without them become invisible to that demographic. The pressure is enormous.

International Rollout: Does Vertical Video Work Everywhere?

Disney announced vertical video coming to Disney Plus "later this year," but didn't specify which markets get it first. There's an implicit assumption it's US-first, then international expansion.

That's the right strategy because vertical video works differently in different regions. Tik Tok dominates in Asia and among younger users globally, so vertical video feeds are expected there. In Western Europe and Australia, expectations are similar. In some developing markets, vertical video might be newer or less familiar.

Content also varies by region. Disney has different content libraries in different countries due to licensing. Vertical feeds need to respect those differences. You can't show the same clips everywhere if some content isn't licensed in certain markets.

Localization is critical. This isn't just translation. It's understanding what types of content drive engagement in different regions. Vertical feeds personalized for US audiences might not work in India or Brazil without adjustment.

There's also the infrastructure question. Vertical video feeds require data and processing. Not all regions have the same infrastructure capacity. Rollout speed might depend on backend readiness in different markets.

Disney's probably going to test vertical feeds in the US and English-speaking markets first, then expand based on learnings. That's the standard playbook for global platform features. It's the right approach, but it also means international users will have to wait months to see what's coming.

There's also a competitive dimension. International markets have their own dominant streaming platforms. In India, it's Hotstar and Jio Cinema. In Europe, it's Netflix and local providers. If Disney rolls out vertical feeds to the US and delays international expansion, competitors in those markets could launch vertical features first, gaining advantage.

Disney will balance speed with quality. Launch too fast and vertical feeds work poorly in some markets. Launch too slow and competitors get ahead. The sweet spot is getting it right in the US, then executing internationally with confidence.

The Economic Model: Does Vertical Video Actually Make Money?

This is the question that matters. Does vertical video increase revenue enough to justify the investment?

The math starts with daily active users. If vertical feeds increase DAU from 35% to 50% of subscribers, that's a 43% increase in engagement. For a platform with 150 million subscribers (rough Disney Plus number), that's an additional 22 million daily active users.

What's the value of a daily active user? That depends on whether they're ad-supported or premium. Ad-supported users generate CPM revenue, typically

Multiply that by 22 million additional daily users and you get

But that's just ad revenue. Premium subscribers who avoid ads don't generate CPM revenue, but they stay subscribed longer because the product is more engaging. Increased retention is worth maybe $5-10 additional lifetime value per user per year.

There's also the content production cost. If Disney produces original short-form content specifically for vertical feeds, that's additional production expense. Could be millions per year depending on scale.

There's the infrastructure cost: algorithms, encoding, storage, personalization. For Disney's scale, this is probably $10-50 million per year additional infrastructure expense.

So the rough math:

That's a game-changing number. It would essentially solve Disney Plus's profitability problem. For that reason alone, vertical video is strategically inevitable.

But this math assumes vertical feeds actually work as designed and deliver engagement increases. That's not guaranteed. Execution risk is real.

If vertical feeds increase DAU by only 10% instead of 43%, the revenue math looks very different. The investment might not pay off. That's why Disney tested internally and watched Netflix's experiments before committing.

What This Means for Content Creators

Vertical video feeds create new opportunities and challenges for independent creators. If Disney Plus opens vertical feeds to creators (which they might, based on the creator economy angle), anyone with Disney Plus could potentially create vertical content.

But that's probably not what Disney means. More likely, they'll commission vertical content from professional creators or license existing viral content. It's not user-generated content. It's professionally produced short-form content.

This creates demand for creators who specialize in short-form storytelling. Disney might hire creators who are successful on Tik Tok or YouTube Shorts to produce exclusive vertical content. That's potentially lucrative for creators, but it also means the vertical feed isn't random user uploads. It's curated professional content.

For Disney's existing content creators (directors, writers, producers), vertical feeds mean learning new skills. Editing for vertical format. Thinking in short-form narrative. Understanding what hooks an audience in 15 seconds instead of 45 minutes.

Some creators will thrive at this. Others will struggle. It's a different creative discipline. Directors who spent careers crafting feature films now need to think like Tik Tok editors.

There's also the remix angle. If Disney allows creators to license content for remix (common on Tik Tok), you could see fans creating vertical content using Disney media. That could be a powerful engagement tool or a brand control nightmare, depending on how Disney manages it.

My guess: Disney will be cautious at first. They'll start with commissioned and licensed professional content. If that works and user demand exists, they might open remix tools to creators later.

Predictions: Where Does This Go?

Assume Disney Plus vertical video launches and performs reasonably well (which is likely). What happens next?

First, all major streaming platforms launch vertical feeds within 12-18 months. Netflix goes first because they're fastest. Max follows. Paramount Plus eventually. Within two years, vertical feeds are standard.

Second, the feature becomes more sophisticated. AI generates personalized clips from content. Vertical feeds get creator collaboration tools. Maybe fan-made content appears alongside official clips.

Third, advertising becomes more aggressive. Native ads, brand integrations, sponsored clips. The line between content and advertising blurs. Regulators probably get involved.

Fourth, some users get fatigued and switch back to traditional browsing. The feature becomes optional. Younger users prefer vertical feeds. Older users stick with traditional interface. Platforms serve both.

Fifth, independent creators become more important. Platforms realize that professional short-form creators drive engagement as much as big-budget content. You see more collaboration between studios and independent creators.

Sixth, the market consolidates around a few platforms. Vertical feeds alone don't guarantee success. You need content, creator relationships, technology, and distribution. Not every platform survives the transition. Weaker platforms get acquired or shut down.

Seventh, regulatory scrutiny increases. Questions about algorithm transparency, data collection, and children's content. Some markets impose restrictions on vertical feeds or advertising. Privacy regulations tighten.

Eighth, vertical feeds become more conversational. Clips appear in context, with community comments and interactions. Streaming starts looking more like social media.

Ninth, the overall effect is that streaming becomes less about curated libraries and more about algorithmic discovery. Users spend more time passively consuming and less time intentionally selecting. The relationship with content changes.

Tenth, original series length shrinks. If short-form content is more engaging and more profitable, studios produce shorter episodes. 30-minute episodes give way to 15-minute episodes. This fundamentally changes storytelling.

All of this flows from one decision: Disney Plus adding vertical video. It's not just a feature. It's the beginning of a streaming paradigm shift.

The Bigger Picture: What Vertical Video Means for Entertainment

Zoom out and you see something important. Vertical video represents the final surrender of traditional media to algorithmic feeds. For decades, entertainment companies controlled what you watched and when. Networks had primetime schedules. Theaters had showtimes. Streaming promised freedom from that, but maintained intentional curation.

Vertical feeds eliminate that curation. An algorithm decides what you see, when you see it, and how long you look. Humans make initial decisions (what shows to produce, what clips to license), but the algorithm makes every subsequent decision.

This is how the internet always works. Search engines use algorithms. Social media uses algorithms. Now streaming, the last major hold-out for human curation, becomes algorithmic.

There are genuine benefits. Better discoverability. Less decision fatigue. More time discovering hidden gems. But there are costs. Less discovery serendipity. More filter bubbles. Less control over your own attention.

For content creators, vertical video means the old gatekeepers matter less. You don't need a network to reach millions of people. An algorithm can make you famous. But you're also dependent on the algorithm. If it doesn't favor your content, you get zero visibility.

For audiences, vertical feeds mean entertainment becomes more like social media. Scrolling. Passive consumption. Infinite feeds. The traditional TV experience (sit down, watch a show, turn off) becomes increasingly rare.

For studios, vertical video means understanding algorithmic engagement becomes as important as understanding storytelling. Data scientists matter as much as screenwriters. That's already happening, but vertical feeds accelerate the trend.

The long-term implication: entertainment becomes increasingly fragmented and algorithmic. Less primetime TV. More niche content tailored to individual preferences through AI. Less shared cultural moments. More personalized bubbles.

Vertical video isn't causing this shift. But it's accelerating it dramatically. Disney's decision to go vertical is a signal that the traditional streaming model is over. The algorithmic social media model is the future.

That's not inherently bad or good. It's just different. Different benefits, different drawbacks, different way of experiencing entertainment.

FAQ

What is vertical video?

Vertical video is content formatted in 9:16 aspect ratio (taller than it is wide) rather than the traditional 16:9 widescreen format. It's native to mobile phones and is the default format for social media platforms like Tik Tok, Instagram Reels, and YouTube Shorts. Disney Plus vertical video will present short clips and content in this format through a scrollable feed similar to social media.

Why is Disney Plus adding vertical video?

Disney is adding vertical video to increase daily active users, boost engagement, and generate additional advertising revenue. Vertical feeds encourage passive scrolling and frequent short visits rather than intentional viewing sessions. This increases total time spent in the app and provides more opportunities for ad impressions. The feature also helps Disney compete with social media platforms for user attention and positions Disney Plus as a daily destination rather than a weekly entertainment subscription.

How will vertical video work on Disney Plus?

According to announcements, Disney Plus vertical video will feature three types of content: original short-form programming created specifically for the vertical format, repurposed clips from Disney's social media platforms, and refashioned scenes from existing shows and movies edited for vertical viewing. The content will be presented in an algorithmically-driven feed similar to Tik Tok or Instagram Reels, where users scroll through clips and can interact through likes, shares, and comments. Users will still have access to traditional browsing for intentional show selection.

Will vertical video show spoilers for shows I haven't watched?

Disney will likely need to implement spoiler controls because vertical feeds naturally show moments from shows without context. Expected solutions include user toggles ("Only show clips from shows I've watched"), spoiler warnings for major plot points, and prioritization of non-narrative content (action sequences, comedy, visuals) that works without context. Users will probably be able to customize their feed to minimize spoiler risk, but some exposure is inherent to the feature.

When will vertical video launch on Disney Plus?

Disney announced that vertical video is coming to Disney Plus "later this year" (2025), though specific launch dates weren't announced. US launch will likely happen first, followed by international expansion. The rollout will probably be gradual, starting with testing in some markets before full platform deployment. Disney will monitor engagement metrics and user feedback before deciding on expansion timing.

Will I have to watch vertical video or is it optional?

Vertical video feeds will almost certainly be optional. Disney Plus will maintain traditional browsing and search for users who prefer intentional viewing. New users will likely see vertical feeds as the default option, but existing subscribers should be able to customize their default view to traditional browsing if they prefer. The feed will exist as an alternative discovery method, not a replacement for traditional navigation.

How will vertical video affect advertising on Disney Plus?

Vertical video feeds will significantly increase advertising inventory on the ad-supported Disney Plus tier. Rather than 1-2 ad breaks in a traditional episode, vertical feeds could accommodate 4-5 ads in a few minutes of viewing. Native advertising (ads designed to match the feed format) will become standard. Advertisers will likely pay premium rates for in-stream advertising within vertical feeds. Ad-free subscribers won't see increased ads, but the ad tier will become more aggressive with advertising placement.

Is Disney Plus vertical video copying Tik Tok?

Yes, but strategically. Disney is adapting the successful Tik Tok model (algorithmic feeds, short-form video, passive scrolling) to its streaming platform. This isn't copying for copying's sake—it's responding to how audiences now consume entertainment. Every major platform (YouTube with Shorts, Instagram with Reels, Netflix with testing) is doing something similar. Vertical feeds represent the evolution of streaming toward social media models that have proven more engaging than traditional library browsing.

Will other streaming platforms also add vertical video?

Most likely yes. Netflix has already tested vertical feeds. If Disney's implementation succeeds in increasing daily active users and engagement, other platforms (Max, Paramount Plus, Peacock) will probably follow within 12-18 months. Vertical feeds will become standard features across streaming platforms, similar to how all streaming platforms now have personalized recommendations. The differentiation will then shift to content quality, algorithm sophistication, and execution rather than the feature itself.

What does vertical video mean for content creators?

Vertical video creates demand for creators skilled in short-form storytelling and will probably increase opportunities for independent creators to work with major studios. Disney might commission vertical content from successful Tik Tok or YouTube Shorts creators, creating new revenue streams for independent creators. Existing Disney content creators (directors, writers) will need to develop skills in short-form editing and vertical composition, which are different disciplines from traditional TV or film production.

How will Disney Plus vertical video affect spoilers for new releases?

Spoilers are a genuine challenge for vertical feeds because clips necessarily show moments without context. Disney will probably implement time-based filtering (clips from new releases appear after a spoiler window) and user controls to avoid content from unwatched shows. However, some spoiler risk is inherent to algorithmically-driven feeds, especially when clips are shared on social media. Users concerned about spoilers may want to limit vertical feed usage during the first weeks after major releases.

The Final Takeaway

Disney Plus vertical video isn't just a feature update. It's the final evolution of streaming from intentional television replacement to passive social media platform. This shift has been coming for years—Netflix's algorithms, Tik Tok's dominance, user behavior changes—but Disney's official commitment makes it inevitable.

For Disney, vertical feeds solve a profitability problem. They increase daily active users, boost engagement, and create new advertising opportunities. The economics work, assuming execution goes well. For competitors, vertical feeds become table stakes. They can't ignore the trend without risking relevance loss.

For users, the impact is mixed. Vertical feeds make discovery easier and reduce decision fatigue. But they also mean less control over attention and more algorithmic manipulation. You gain convenience at the cost of agency.

For creators, vertical video creates opportunities and pressures. New formats mean new demand. But algorithmic feeds also mean visibility depends on what the algorithm favors, not just quality.

The bigger picture: entertainment is becoming algorithmic, social, and fragmented. Vertical video accelerates this shift. In five years, the traditional streaming experience (browse, select, watch) will feel quaint. Algorithmic feeds will be default everywhere.

Some will love this. Others will resent it. Both reactions are valid. But the direction is clear. The scroll is inevitable.

The thing is, Disney isn't breaking new ground here. They're following a path that platforms like Tik Tok, Instagram, and YouTube have already paved successfully. Disney's advantage is their content library. Vertical feeds work great when you have amazing content to feed into them. Disney has that in abundance.

Whether they execute vertical feeds well remains to be seen. But the strategic direction is right. If you want to survive in streaming, you need daily active users. Vertical feeds are how you get them.

So expect vertical video on Disney Plus sometime in 2025. Expect other platforms to follow. And expect your entertainment consumption to look increasingly like social media scrolling. The future of streaming isn't what you watch. It's what the algorithm thinks you should watch next. That's vertical video.

Key Takeaways

- Disney Plus is launching vertical video feeds in 2025, featuring original short-form content, repurposed social clips, and refashioned scenes from existing shows

- Vertical feeds increase daily active users and engagement by transforming streaming from intentional viewing to passive algorithmic scrolling, similar to TikTok and Instagram Reels

- The feature creates significant advertising opportunities on Disney Plus's ad-supported tier, potentially generating $1+ billion in annual incremental revenue

- Netflix tested vertical feeds and ESPN successfully launched Verts vertical tab, proving the format works for media platforms with short-form content

- All major streaming platforms will likely adopt vertical feeds within 18 months, making algorithmic feeds standard across the industry by 2026-2027

- Vertical video solves the spoiler problem and serves different generational preferences through user controls and optional adoption

- The shift to vertical feeds represents streaming's evolution from intentional curation to algorithmic social media, fundamentally changing the entertainment experience

Related Articles

- Spotify's Real-Time Listening Activity Sharing: How It Works [2025]

- AI Slop Songs Are Destroying YouTube Music—Here's Why Musicians Are Fighting Back [2025]

- MTV Rewind: The Developer-Built Tribute to 24/7 Music Channels [2025]

- Best TV Shows of 2025: Netflix, Prime Video, HBO Max [2025]

- YouTube Premium Needs These 5 Critical Upgrades in 2026

- Best Live TV Streaming Services to Cut Cable [2026]

![Disney Plus Vertical Video: The TikTok-Like Future of Streaming [2025]](https://tryrunable.com/blog/disney-plus-vertical-video-the-tiktok-like-future-of-streami/image-1-1767834540870.jpg)