The Energy-Data Disconnect in European Startups

Walk into any major European tech conference and you'll feel the buzz. Founders are talking bigger, investors are nodding along, and the general vibe screams opportunity. But pull up the actual numbers, and you get a different narrative entirely.

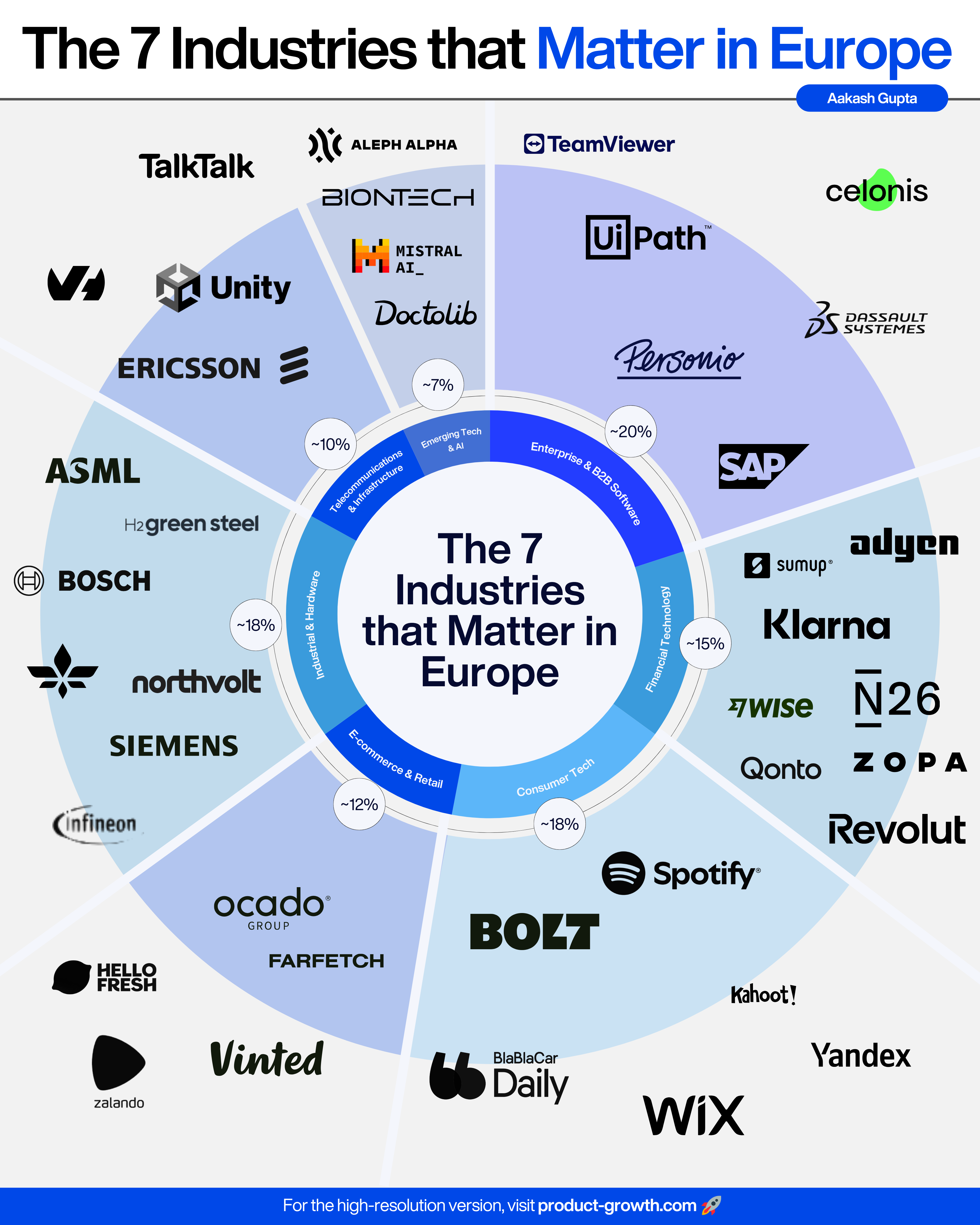

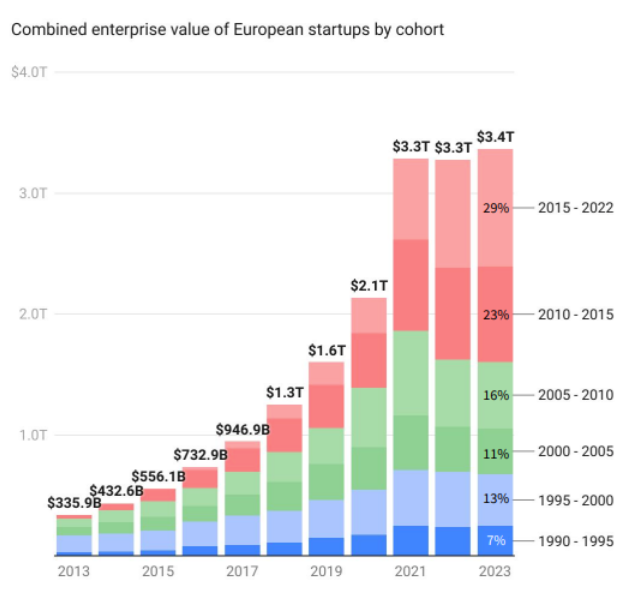

This gap between perception and reality has become the defining tension in Europe's startup ecosystem. The region's energy is undeniable, yet the financial metrics tell a story of stagnation and struggle. Founders are building with global ambition. Conferences overflow with attendees. Success stories like Klarna's IPO and Mistral's funding rounds make headlines. But underneath, the venture capital machinery that powers startup ecosystems is grinding slower than it should.

The disconnect isn't small. It's the kind of gap that makes investors pause before writing checks, that makes founders question whether they should relocate to Silicon Valley, and that keeps regulators and policymakers up at night wondering if Europe is falling behind in the race to build the next generation of transformative companies.

Understanding this gap matters because it shapes the future of European innovation. If Europe can't close the data-energy divide, it risks cementing itself as a secondary market where good ideas go to get funded elsewhere. But if the region can bridge this gap, the implications are enormous. Europe's talent pool, regulatory environment, and market size could position it as a genuine counterweight to American dominance in tech.

So what's actually happening? Let's break down the numbers, examine why they're lagging, and explore the real signals suggesting a turnaround is brewing.

The Numbers: Europe's 2025 Venture Reality Check

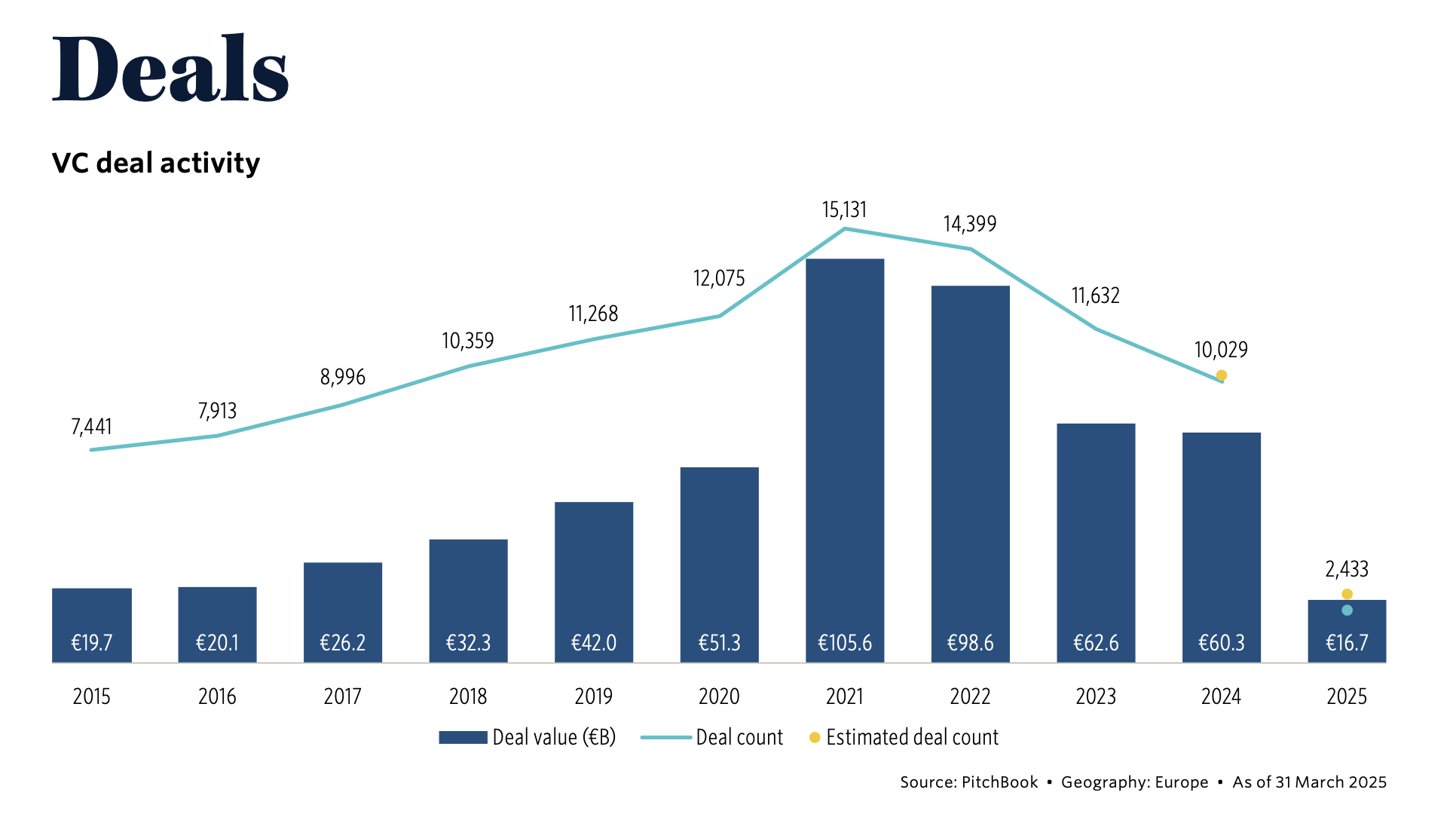

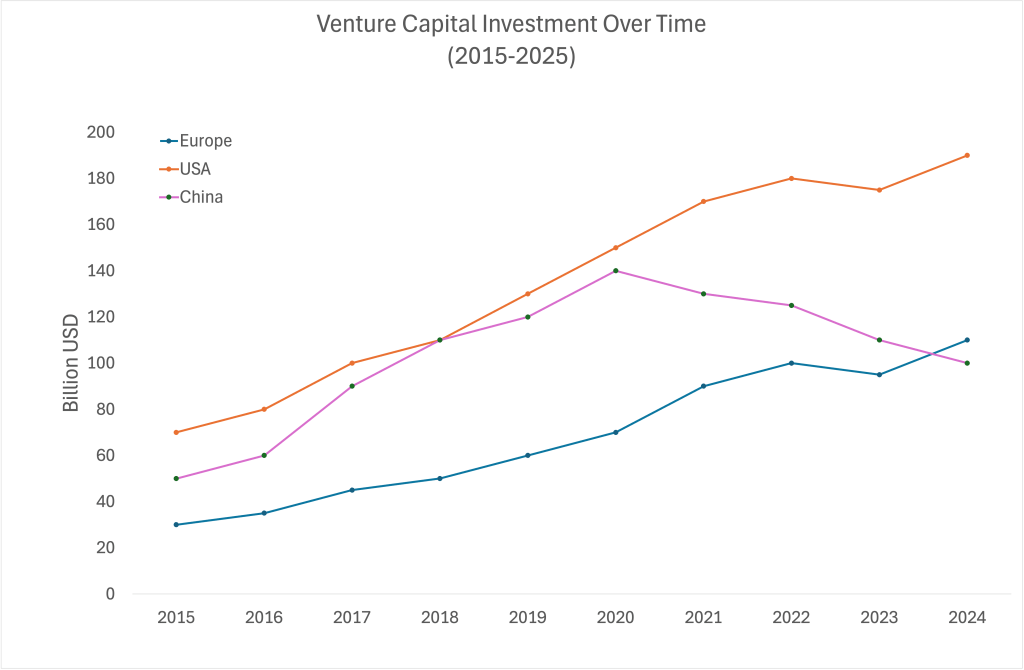

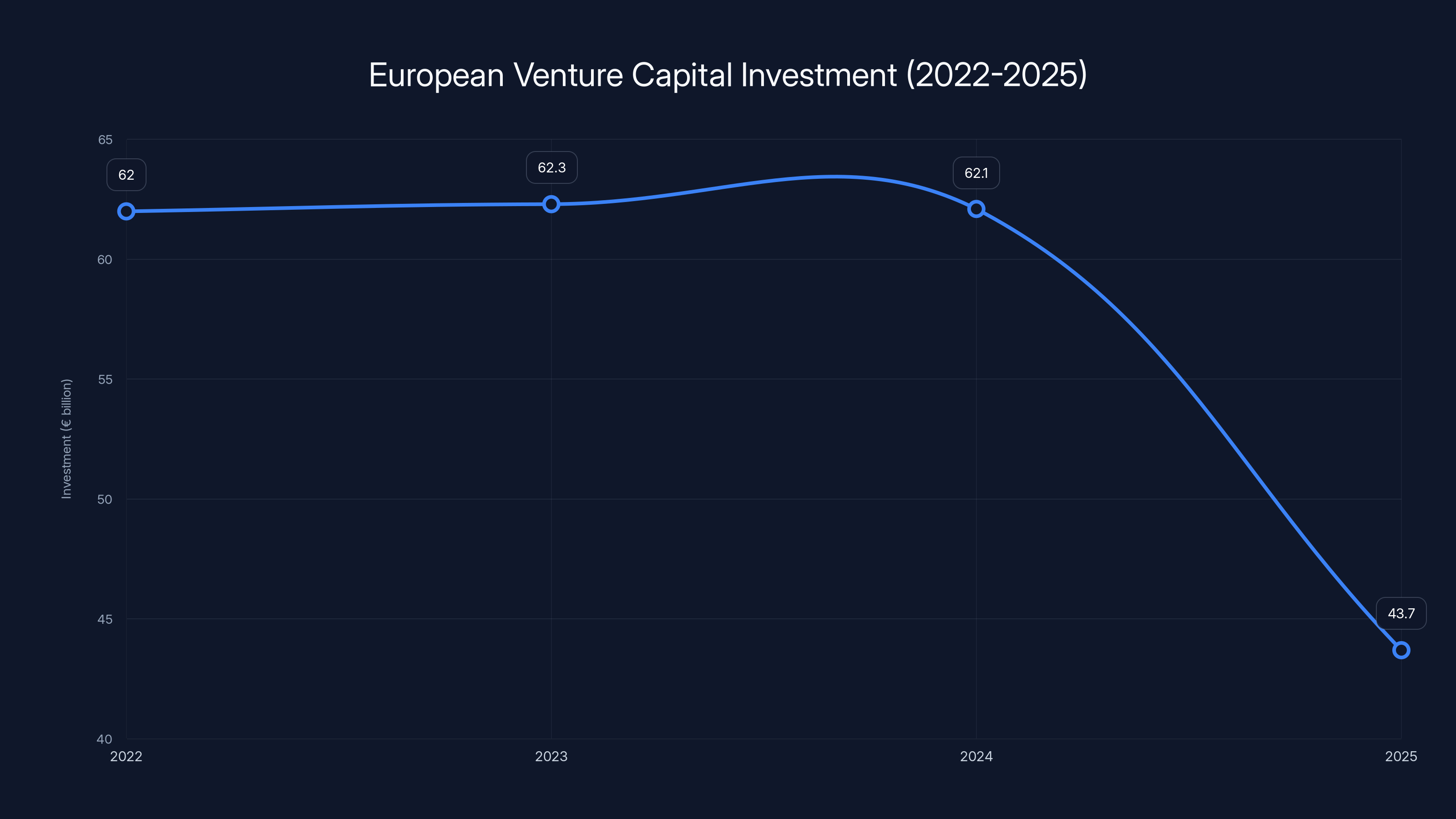

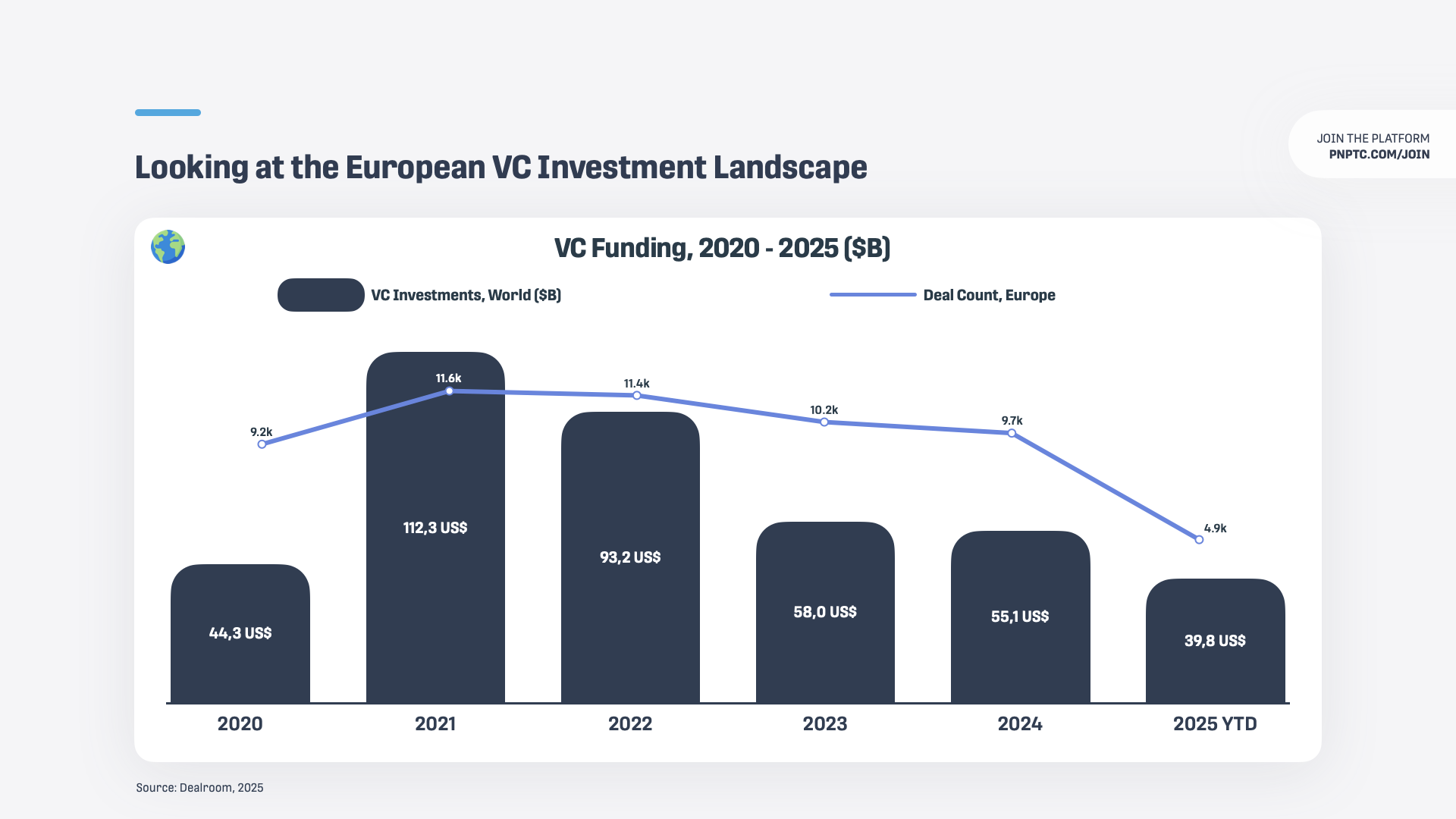

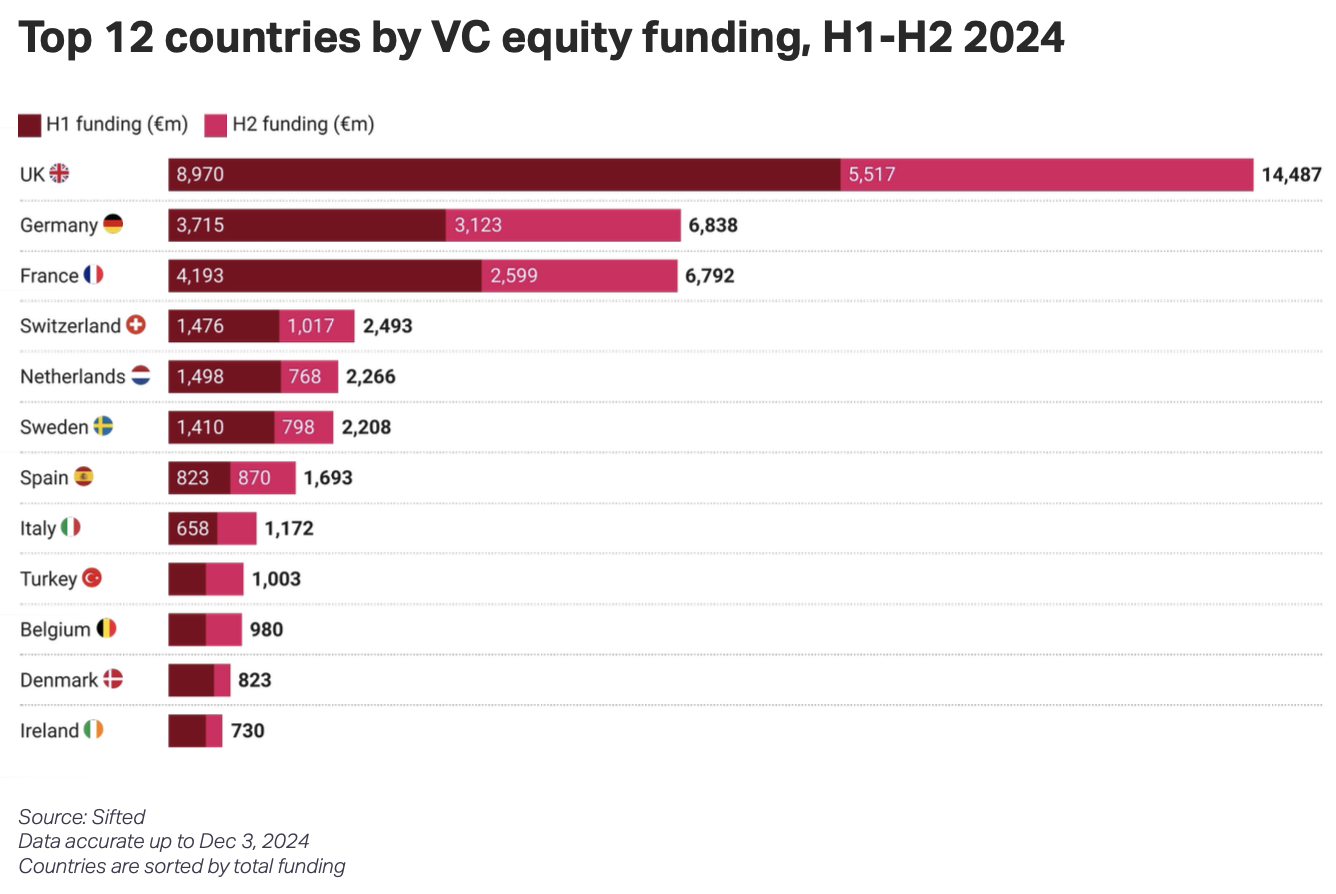

Numbers don't lie, even when they're disappointing. In 2025, European startups raised €43.7 billion ($52.3 billion) across 7,743 deals through the third quarter. On the surface, that sounds substantial. Billions of dollars flowing into startups, thousands of deals closing every quarter.

But context kills the celebration. That pace puts Europe squarely on track to match the €62.1 billion invested in 2024 and €62.3 billion in 2023. It's not recovery. It's treading water.

Compare this to the United States. American venture deal volume had already surpassed 2022, 2023, and 2024 combined by the end of Q3 2025. The U.S. market bounced back faster and stronger. Investors there rotated risk back into growth-stage ventures. Capital flowed more freely. The recovery was real and measurable.

Europe? Still waiting.

The deal count itself reveals another layer of concern. 7,743 deals sounds like vibrancy, but the average deal size matters just as much as the count. Smaller average checks mean less capital per startup, which means longer runways get shorter faster, which means more companies burn through cash without reaching meaningful scale.

The broader issue becomes clear when you zoom out. European venture markets have essentially flatlined since the 2022-2023 correction. While that wasn't a crash—markets did crash, but European fundraising was already slowing—the region never recovered with the same momentum as other major markets. This matters because momentum is self-reinforcing. Successful exits breed confidence. Confidence attracts new capital. New capital funds bold startups. Bold startups create more exits. Europe broke that cycle.

Despite positive sentiment, European venture capital deal volume has stagnated at 2023-2024 levels, indicating a disconnect between market optimism and actual financial flows. (Estimated data)

The Real Crisis: VC Firm Fundraising

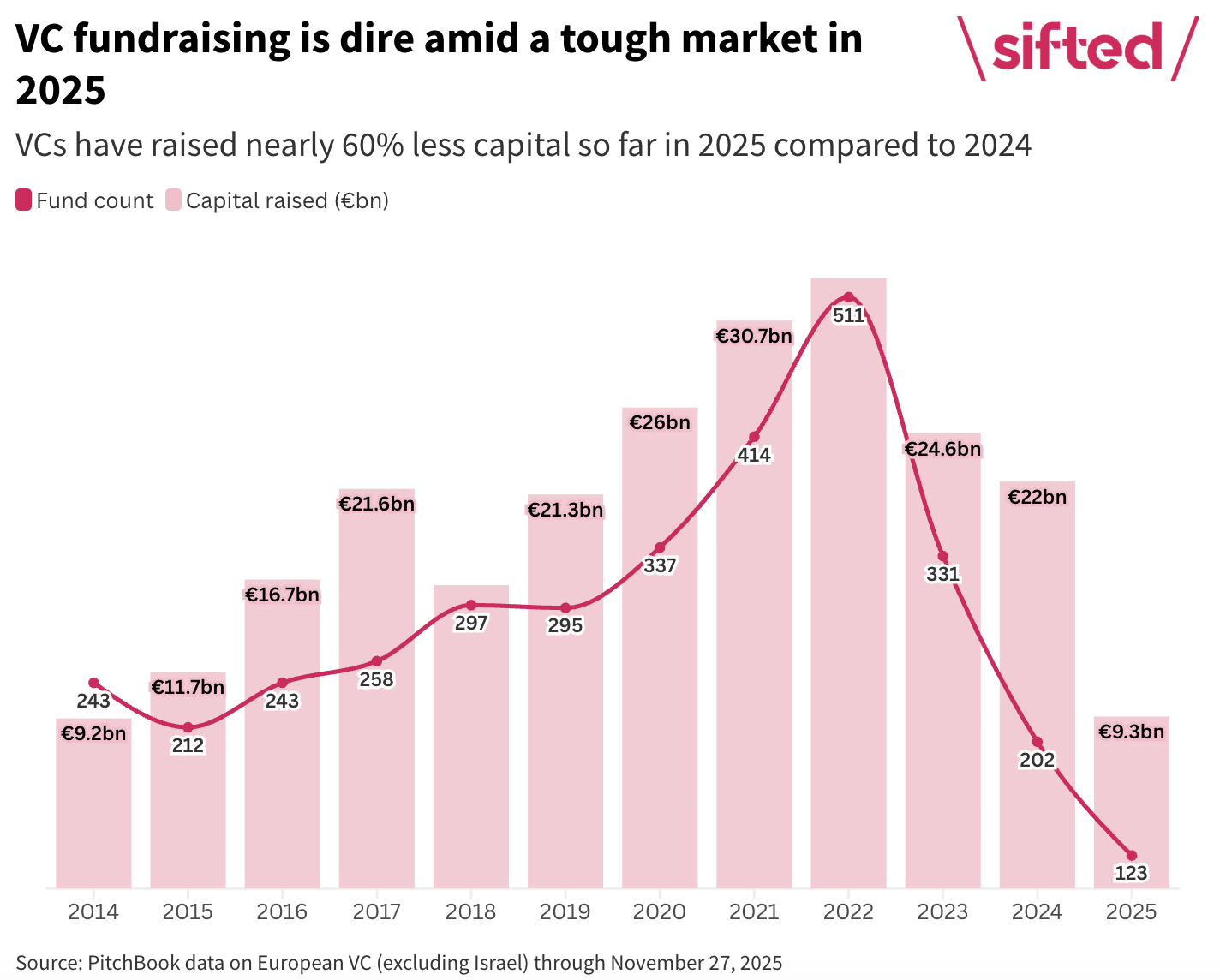

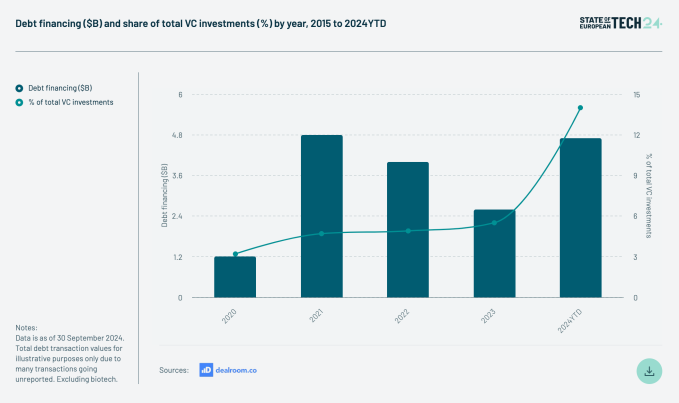

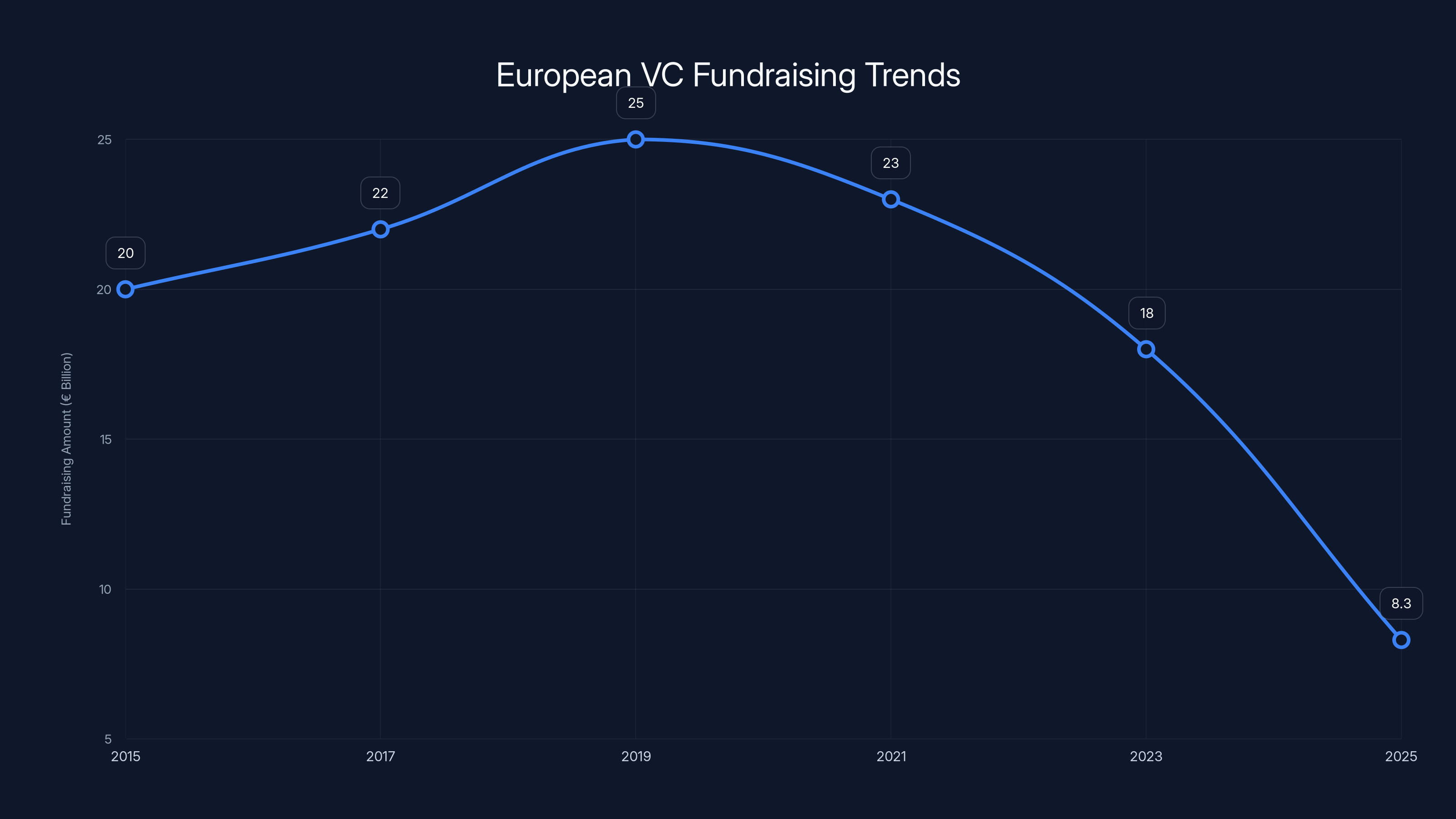

Here's the uncomfortable truth nobody wants to lead with: the deal slowdown isn't Europe's biggest problem. The real crisis is VC firm fundraising.

Through Q3 2025, European venture capital firms raised just €8.3 billion ($9.7 billion). Let that number sink in. Put Europe on pace for its lowest overall fundraising year in a decade. A decade. That's not a dip. That's a structural problem.

Why does this matter more than startup deal activity? Because VCs are the oxygen that startup ecosystems breathe. Without new venture funds being raised, limited partners (LPs) aren't putting fresh capital into the system. Without fresh capital, existing funds get stretched thin. Stretched-thin VCs write fewer checks. Fewer checks mean fewer startups get funded. And the cycle compounds.

The data shows a 50 to 60 percent decline in LP-to-GP fundraising in the first nine months of 2025 compared to historical norms. That's not a correction. That's a contraction.

What's making this even more challenging is the composition of who's raising. The fundraising that is happening is increasingly concentrated among emerging managers and smaller funds. The mega funds that closed their mega rounds last year? They're not raising again this year. The mega funds typically partner with emerging managers, co-invest at scale, and set the tone for the entire ecosystem. When they're not fundraising, the entire pyramid gets disrupted.

This shift has cascading effects. Emerging managers, while often hungry and innovative, typically deploy smaller tickets. They invest more carefully. They take longer to make decisions. They lack the brand gravity to attract the best LPs. When the ecosystem becomes dependent on emerging managers instead of experienced mega funds, capital deployment slows. Risk-taking decreases. The portfolio gets more conservative.

For European startups, this means fewer options for later-stage funding. A Series A is harder to raise because Series A funds are stretched. When Series A gets harder, Series B becomes nearly impossible. The pipeline backs up, capital gets trapped, and momentum dies.

U.S. venture capital participation in European deals is projected to increase from 19% in 2023 to 40% by 2026, driven by attractive valuations and world-class talent. Estimated data.

Why LPs Are Pulling Back on Europe

LPs didn't stop allocating to Europe out of spite. They're responding to real signals, and understanding those signals helps explain why VC fundraising has become so difficult.

First, returns matter. European venture capital has historically lagged American returns, and that gap widened significantly during the 2020s. The mega unicorns that define venture returns—the 50x or 100x outliers that pay for entire portfolios—have been disproportionately American. Europe produced some winners, but not enough to justify the allocation premium that Europe once enjoyed.

Second, macro environment shifted. In 2020 and 2021, LPs had excess capital and lower interest rates made venture allocations attractive. By 2023 and 2024, interest rates climbed, public equities offered better risk-adjusted returns, and LPs became more selective. In that environment, proven markets with proven managers outcompete emerging markets with unproven track records. Europe's venture ecosystem, relative to American markets, fit the latter description.

Third, geographic concentration of EU capital matters more than people admit. A significant portion of European VC fundraising comes from European LPs and institutional investors. When European sovereign wealth funds, pension funds, and family offices got nervous, there was no cushion from massive American LP dry powder. U.S.-based mega funds do raise from American LPs, but they also access global capital. European funds are more dependent on local sources.

Fourth, there's a narrative issue. When American venture capital outperforms and produces bigger exits, that narrative attracts capital. When Europe stagnates, the narrative inverts. Founders hear the story that Europe can't scale. LPs hear the story that American venture is where the returns are. The narrative becomes self-fulfilling.

The Bright Spot: U.S. Investor Interest Is Returning

But here's where the turnaround narrative starts to build. After a significant pullback, U.S.-based venture capital is re-engaging with European startups, and this shift has real implications.

In 2023, U.S.-based VCs participated in just 19 percent of European venture deals. That was a historic low. The pullback made sense given macro pressures, but it also meant European founders lost access to the capital, networks, and credibility that comes from American institutional investors.

Since that low point, U.S. investor participation has steadily increased. They're back in the mix. And importantly, they're not just picking at scraps. They're leading major rounds and writing substantial checks.

Why the return? Multiple reasons overlap. First, valuations. European tech companies, particularly in AI, trade at multiples that look cheap compared to U.S. equivalents. An American VC looking to enter the AI market in 2025 faces astronomical valuations in the U.S. The same AI talent and similar technology in Europe might be available at half the valuation multiple. That's a better entry point. The risk isn't lower, but the valuation provides margin for error.

Second, the talent is genuinely world-class. Europe's AI research, particularly in France with Mistral and elsewhere across the continent, rivals anything being built in Silicon Valley. American VCs noticed. When you can access frontier AI research at better valuations with world-class technical teams, the math changes.

Third, there's portfolio diversification. A U.S.-focused venture fund has concentration risk. When the entire portfolio is in the same market facing the same regulators and the same macro conditions, downturns hit harder. A few strategically placed European bets provide geographic diversification and hedge against U.S.-specific risks.

The evidence is visible in specific deals. Lovable, a Swedish AI-powered development tool, raised a $330 million Series B with participation from Salesforce Ventures, Capital G, and Menlo Ventures. Those aren't second-tier American investors—those are tier-one institutions writing nine-figure checks. Mistral, a French AI lab, raised €1.7 billion in Series C with Andreessen Horowitz and Nvidia alongside it.

These aren't anomalies. They're signals of a market re-engaging.

EQT's investment commitment in Europe is projected to more than double from

The Exit Signal: Klarna and What It Means

Exit events are the heartbeat of venture capital. When startups go public or get acquired at good valuations, LPs see returns, confidence builds, and new capital flows in to fund the next generation. Europe had been starved of major exits, and that starvation had real consequences.

Klarna's September 2025 IPO changed the narrative. The Swedish fintech raised $6.2 billion across two decades in private markets and finally went public at a substantial valuation. It wasn't just an exit—it was a validation that European companies could scale to global significance and create real returns for investors.

What makes Klarna significant extends beyond the numbers. First, it recycles capital back to European LPs and fund managers who can now deploy that capital into the next generation of startups. Money that was trapped in private positions for years suddenly becomes liquid and available again. That matters.

Second, it shifts narrative. When founders see Klarna succeed, when they hear stories of founders and early investors making real money, that changes how they think about their own companies. It's not theoretical anymore. It's a proven path.

Third, it attracts talent. Klarna's success means the top engineering talent, product people, and design talent in Europe see a path to scale without moving to the Valley. That retention of talent in Europe strengthens the entire ecosystem.

More broadly, successful exits validate the European market to institutions and LPs worldwide. It proves European companies can compete globally. It proves European investors can back winners. It proves the ecosystem works. A single exit doesn't restart a market, but it's proof of concept that the system isn't broken—it's just been dormant.

The Founder Mindset Shift

One of the most underrated signals of market recovery isn't a financial metric at all. It's how founders think about their ambitions.

Historically, European founders have tended to think in geographic terms. Win Germany. Win France. Win a European market. It's a reasonable approach—the European market is large, affluent, and available. But it's also limiting. It signals a mindset of consolidation over expansion, of optimizing a regional moat rather than building a global platform.

That mindset is shifting. A new generation of founders, inspired by European success stories like Spotify, Klarna, and Revolut, are starting companies with global ambition from day one. They're not asking "how do we win Europe." They're asking "how do we build a product so good it becomes the global standard."

This shift matters tremendously. Global ambition attracts better talent. Global ambition justifies higher burn rates and longer time horizons. Global ambition attracts international investors who see potential for 100x returns instead of 5x regional optimizations. When the founder mindset changes, the entire trajectory changes.

EQT, one of Europe's largest venture firms, noticed this shift and is doubling down accordingly. The firm committed to investing

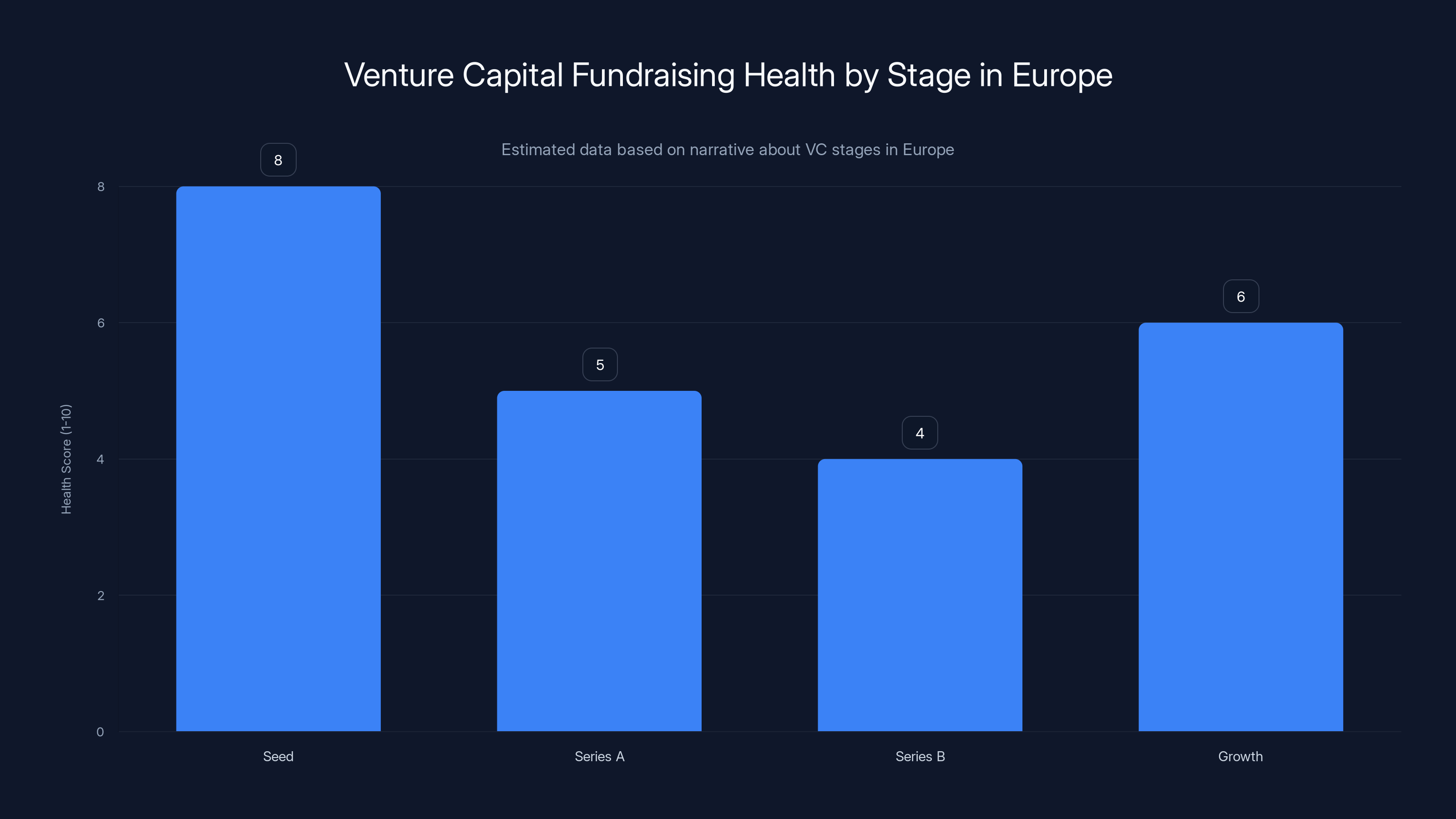

The health of venture capital fundraising in Europe is strong at the seed stage but declines significantly at Series A and B, indicating a funding gap. (Estimated data)

Understanding the AI Advantage

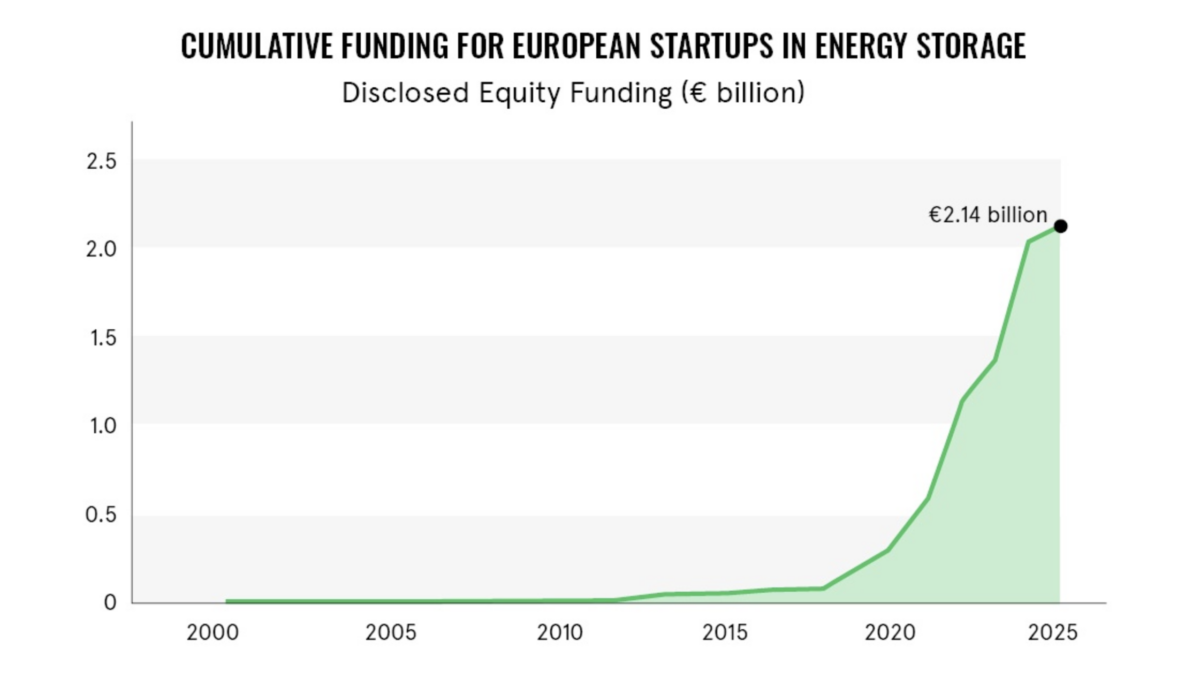

Europe's renaissance in venture capital is being driven significantly by AI, and this advantage deserves deep examination.

The U.S. dominates in large language models and generative AI infrastructure. But Europe is becoming the region for specialized AI, AI research, and AI applications. Mistral is building frontier AI models as a French company competing globally. Universities across Europe—ETH Zurich, University of Cambridge, Max Planck Institute—are producing world-class AI research. European companies are building on top of these models and creating applications.

Why does this matter for venture funding? Because AI is where the venture money is flowing. A European startup building an AI application can now raise from specialized AI-focused funds. A European AI research lab can raise from international investors seeking exposure to frontier research. The ability to participate in the fastest-moving part of tech creates fundraising tailwinds that didn't exist before.

Moreover, European AI companies operate in a unique regulatory environment. GDPR, AI Act compliance, and data privacy regulations that European companies navigate as routine are becoming competitive advantages. As AI regulation tightens globally, companies that already operate under strict European frameworks are ahead of the curve. They have compliance figured out. They have data practices that meet emerging global standards. This isn't a barrier—it's an advantage.

A European AI startup can market to global customers and say "we're already GDPR compliant, we're already AI Act compliant, we already handle data properly." That's a meaningful advantage, particularly as regulation tightens.

The Venture Capital Supply Chain

To understand Europe's recovery, you need to understand the venture capital supply chain, not just capital flows.

Venture capital operates in layers. At the base, you have seed and early-stage funds backing pre-product companies and first-time founders. Above that, Series A and B funds back companies with product-market fit and growth. At the top, growth and late-stage funds take proven companies to scale.

When capital is flowing normally, these layers interact fluidly. A successful seed fund produces Series A ready companies. Successful Series A funds produce Series B ready companies. Each layer validates the previous layer and attracts capital for the next layer.

Europe's problem isn't uniform across layers. Seed and early-stage fundraising actually looks relatively healthy. Emerging managers are raising seed funds. Angel networks are active. The problem concentrates in Series A and later stages. There's a "gap" where companies that were successfully seeded now struggle to raise Series A and B. They either stay in Europe and growth-constrained, or they relocate to raise capital in the U.S.

This gap explains much of the data disappointment. Total deal volume looks okay because seed deals are still happening. But average deal size shrinks because later-stage deals that would be multiples of seed deals aren't happening in Europe. Capital that would be deployed into Series B rounds instead gets stuck in earlier stage companies waiting longer for the next round.

Closing this gap requires mega funds and established managers committing to Series A and beyond in Europe. It's not exciting—it doesn't make headlines like Mistral Series C. But it's necessary infrastructure for the ecosystem to function.

European venture capital investments have remained relatively flat from 2022 to 2024, with a significant drop projected for 2025. Estimated data.

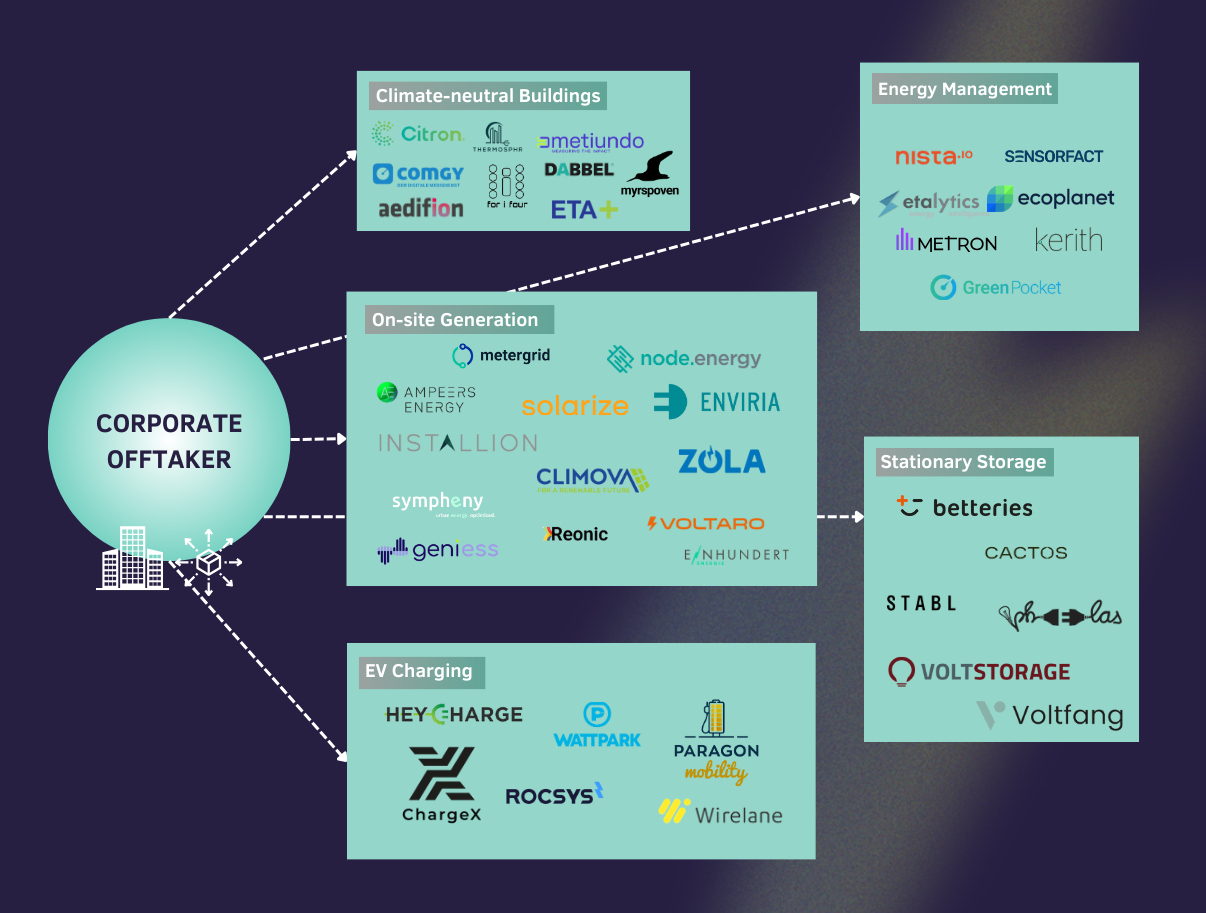

The Role of Corporate Venture Capital

One often-overlooked source of capital that's becoming more important to European startup funding is corporate venture capital. When traditional venture capital tightens, corporate strategic investors fill gaps.

Companies like Salesforce (through Salesforce Ventures), Google, and Microsoft increasingly invest in startups globally, including Europe. These aren't traditional venture funds, but they deploy real capital with founder-friendly terms because they benefit from the strategic relationships and potential acquisitions.

For European startups, corporate venture capital provides an alternative path when traditional VC is tight. A Series A round might come partly from a corporate strategic investor alongside a traditional VC, changing the mix but still enabling growth.

Corporate venture also signals market maturity. Established tech companies invest where they see innovation threats and opportunities. When Salesforce invests in European AI startups, it's a signal that European builders are creating tools that established companies need to engage with. That matters.

Macro Headwinds: Why Full Recovery Takes Time

Even with optimistic signals, full recovery from the VC funding gap takes time because several macro headwinds persist.

First, interest rates. As long as risk-free yields from government bonds remain elevated, the hurdle rate for venture returns increases. VCs need to target higher returns to justify the risk, which means they need to find larger opportunities. Europe's startup ecosystem, while talented, hasn't yet demonstrated the scale of opportunities that justify those higher hurdle rates consistently.

Second, macro uncertainty. Geopolitical tensions between Europe and Russia, economic slowdown concerns, and regulatory uncertainty all create hesitation. When the macro environment feels fragile, investors pull capital off the table and wait. Europe's economy is heavily trade-dependent, which means global slowdowns hit harder.

Third, brain drain. Top technical talent from Europe still has incentives to move to the U.S. where venture salaries run higher, valuations create more wealth, and the networks are larger. Every founder or engineer who relocates takes knowledge and ambition with them. Reversing that flow requires proven opportunities and cultural shifts that take years.

Fourth, regulatory friction. European startup founders frequently cite regulatory complexity as a friction point. GDPR compliance, employment laws, tax complexity, and AI regulations all require legal and compliance resources that U.S. startups don't need. This adds cost and complexity that ventures in frictionless environments don't face.

None of these are deal-breakers, but they're persistent headwinds that slow recovery. A turnaround happens not when headwinds disappear, but when capital deployment momentum overwhelms them.

European VC fundraising is projected to hit a decade low in 2025 with only €8.3 billion raised, highlighting a structural problem in the ecosystem. Estimated data.

The Opportunity in the Gap

Paradoxically, Europe's data-energy gap creates opportunity for sophisticated investors.

When sentiment diverges from fundamentals, mispricing appears. Right now, European startups and venture funds are undervalued relative to their actual quality, tech, and potential. An American investor looking for next-generation AI companies might find better risk-adjusted opportunities in Europe where valuations haven't peaked, capital is still available for quality founders, and excitement hasn't driven prices to unsustainable levels.

For European founders, this moment is odd. On one hand, capital is harder to raise. On the other hand, the best founders with real traction can actually negotiate better terms because there's less froth and fewer competitors bidding up prices.

For European venture firms, the current environment is painful but creates opportunities to build reputation and track record. A European VC that deploys capital successfully right now, while others are pulling back, builds the track record and narrative that attracts the next generation of LPs and capital.

This is how markets recover. Not through external force, but through participants recognizing that current conditions create asymmetric opportunities. When enough participants see those opportunities and deploy capital, momentum builds, narratives shift, and recovery accelerates.

What Recovery Actually Looks Like

For European venture to demonstrate real recovery, certain metrics need to move in the right direction simultaneously.

Venture deal volume needs to not just match 2023 and 2024 levels, but exceed them. The absolute number of deals in 2025 sitting at 7,743 through Q3 needs to accelerate in Q4 and then grow in 2026. More importantly, average deal size needs to increase, indicating larger capital deployments.

VC firm fundraising absolutely must break its decade-low trajectory. European VC needs to see new mega funds announced, established managers exceeding their previous fundraising targets, and emerging managers successfully raising first-time funds. Without VC firm fundraising recovery, deal volume recovery isn't sustainable.

LP allocation to European venture needs to increase. LPs need to actively allocate more capital to Europe, not just maintain existing allocations. This requires both U.S. LPs increasing European exposure and European LPs increasing allocation to European venture. Currently, both are happening slowly.

Exit activity needs acceleration. Klarna is one exit. Europe needs a pipeline of quality exits—IPOs and strategic acquisitions at meaningful valuations. Without exits, the entire venture cycle stalls.

Talent retention needs to improve. Brain drain slows. European founders increasingly see staying in Europe as enabling rather than limiting. The best engineers choose European opportunities over U.S. opportunities.

When those factors move together, that's recovery. It's not happening uniformly yet, but early indicators suggest it's beginning.

The Timeline Question: When Does Recovery Hit Full Stride?

If recovery is underway, when do European venture metrics look genuinely healthy again?

Based on historical recovery patterns, probably 2026-2027. The reason is timing. If major venture firms are successfully raising funds in late 2025 and early 2026, that capital gets deployed over 18-24 months. A fund raised in Q1 2026 deploys capital throughout 2026 and 2027. Multiple funds raising simultaneously means capital deployment accelerates in that window.

Exit activity typically lags capital deployment by 5-7 years. So exits in 2026-2027 would come from investments made in 2019-2021. We're already seeing some of those, like Klarna. More should follow.

By 2027-2028, if capital deployment is healthy, you should see measurable improvements in VC firm fundraising as LPs see successful exits and positive track records. That creates a self-reinforcing cycle.

Obviously, macro conditions could disrupt this timeline. A recession, geopolitical escalation, or interest rate shock would reset the clock. But absent major disruption, the trajectory suggests European venture recovery is measured in years, not decades.

The key is recognizing that recovery is probabilistic, not certain. The conditions are aligning, but execution matters. Founders need to execute, investors need to deploy capital wisely, and LPs need to remain committed. So far, early indicators suggest all three are happening, but validation requires monitoring actual metrics through 2026.

Strategic Implications for Ecosystem Participants

If you're a founder, investor, or policymaker in Europe, what do these dynamics mean for your decisions?

For founders, the current environment is actually favorable for first-time fundraising if you have real traction. Capital is scarce, which means frothy valuations are gone. But it also means investors are genuinely excited about the few companies they do fund. You're not competing on hype—you're competing on fundamentals. If you have a good product and real growth, capital is available and terms are actually favorable.

For Series A and B founders, patience might be required. The gap in funding at that stage means fewer options. Building more runway or seeking strategic investors alongside traditional VCs might be necessary. The path exists, but it's not as automatic as it was in 2021.

For venture investors, conviction matters more. Deploying capital into Europe right now when sentiment is cautious builds narrative and track record. The winners in the next cycle will be VCs who deployed capital when others pulled back. Sequoia didn't get rich by following the crowd during recovery.

For limited partners, this is a moment to selectively increase European allocation if you believe in the recovery narrative. But pick vehicles carefully. Not all European VCs are created equal. The best emerging managers will outperform the stagnant mega funds. Geographic diversification into quality European assets at current valuations might look wise in retrospect.

For policymakers, the data is clear—venture capital infrastructure matters and attracts global capital when conditions are right. Supporting VC firm formation, LP access, and talent retention has measurable economic impact. Conversely, regulatory friction costs real capital deployment.

Looking Forward: The Next Chapter

Europe's startup market stands at an inflection point. The data remains disappointing relative to ambitions, but the directional signals suggest the worst is likely over.

The return of American venture capital, the success of European AI companies, the optimism of major European funds committing more capital, and the founder mindset shift toward global ambition all point in the same direction. Recovery is probably underway, though it won't be linear and won't satisfy everyone immediately.

What happens next depends on execution. If European founders execute, if venture funds deploy capital wisely, if exits start multiplying, and if the narrative continues shifting positive, then 2026-2027 could see European venture metrics accelerate meaningfully. Europe might finally break the cycle of good energy and disappointing data.

But none of that is guaranteed. Markets are probabilistic. Recovery is possible, probable even, but not certain. The exciting part is that Europe is no longer in backslide territory. The region is in setup territory—positioned for potential recovery but not yet assured of it.

That's actually a better place to be than the data alone suggests. The energy at Slush wasn't just hype. It was recognition that something real is shifting. The data will eventually catch up. The question is whether European ecosystem participants can execute quickly enough to sustain momentum when the data does start improving.

Watch 2026. That's when the real test begins.

FAQ

What exactly is the data-energy gap in European venture capital?

The data-energy gap refers to the disconnect between the enthusiasm and optimism visible in Europe's startup ecosystem (conferences, founder ambitions, investor interest) and the actual financial metrics showing weak venture capital flows. Despite strong sentiment and talented founders, venture deal volume has stagnated at 2023-2024 levels, and VC firm fundraising has hit decade lows. This creates a paradox where the market looks active but capital deployment data tells a story of stagnation.

Why have European venture capital firms struggled to raise funds from limited partners?

LP fundraising challenges stem from multiple factors: lower historical returns compared to American venture capital, a shift in macro conditions that made venture less attractive than public equities, geographic concentration of European capital sources (unlike American funds that access global LP pools), and a negative narrative that American venture delivers better returns. When European LPs get nervous and don't allocate capital, there's no offset from global capital pools, unlike American funds that attract international LPs.

How is U.S. investor interest changing the European venture landscape?

U.S. venture investors are returning to European deals at increasing rates because of attractive valuations (European AI companies trade at multiples significantly below U.S. equivalents), access to world-class technical talent and research, and portfolio diversification benefits. This returning capital is meaningful—major deals like Lovable's $330 million Series B and Mistral's €1.7 billion Series C show tier-one American investors writing substantial checks into European startups, signaling confidence that was absent in 2023.

What does Klarna's IPO mean for European venture recovery?

Klarna's successful 2025 IPO signals that European companies can scale globally and generate real returns for early investors. Beyond the direct capital recycling back to LPs and fund managers, it shifts narrative substantially. Founders see a proven path to success without relocating. Talent stays in Europe. Investors see evidence the system works. Klarna proves European venture isn't broken—it's been dormant, but the infrastructure functions when conditions align.

Why are European founders becoming more globally ambitious?

European founders are increasingly starting companies with global ambition (rather than regional optimization) because of successful examples like Spotify, Klarna, and Revolut proving that European companies can achieve global scale. This visibility into successful global plays removes doubt about whether European companies can compete worldwide. Global ambition attracts better talent, justifies higher valuations, and attracts international investors seeking 100x returns rather than regional consolidation plays.

How does Europe's AI strength drive venture recovery?

Europe's exceptional AI research capabilities (Mistral, ETH Zurich, Max Planck Institute) and specialized AI applications create a focal point for venture capital allocation. AI is currently the fastest-growing sector for venture investment. European AI companies additionally benefit from regulatory advantages—they already operate under GDPR and AI Act frameworks that are becoming global standards, giving them compliance advantages when exporting globally. This combination attracts both traditional venture capital and strategic corporate investment.

What signs indicate European venture recovery is actually happening?

Multiple indicators point to recovery beginning: U.S. investor participation in European deals rebounding from 19% in 2023 toward 30%+ currently; major venture rounds being led by tier-one American investors; founder ambition shifting toward global rather than regional scaling; major European funds committing increased capital deployment (EQT's $250 billion commitment over five years); and successful exits like Klarna validating the ecosystem. No single indicator is conclusive, but the cluster of improving metrics suggests turnaround is probable.

How long until European venture data shows clear recovery?

Based on typical venture capital cycles, meaningful data-visible recovery probably takes until 2026-2027. Capital being raised in late 2025 and early 2026 gets deployed over 18-24 months. Exits from those deployments follow in 5-7 years. However, intermediate metrics like VC fundraising success and deal volume acceleration should show improvement within 12-18 months. The recovery is probabilistic—it depends on execution—but the timeline suggests late 2026 or 2027 shows clearer evidence than today.

Should European founders worry about the funding gap?

Seed-stage fundraising remains relatively healthy in Europe. Series A and B stages show the biggest funding gaps. If you have real product-market fit and measurable growth, capital exists—you just have fewer options and may need to incorporate strategic investors or explore corporate venture alongside traditional VCs. The favorable aspect of this environment is that valuations are realistic and investors who fund you actually believe in your business rather than betting on hype. Early-stage founders should proceed cautiously but not pessimistically.

Key Takeaways

- Data Mismatch: European venture capital shows strong energy and ambition, but financial metrics reveal stagnation—2025 deal volume is matching (not exceeding) 2023-2024 levels while VC fundraising sits at decade lows.

- Fundraising Crisis: European VC firms raised only €8.3 billion through Q3 2025, tracking toward the lowest annual fundraising in ten years, a structural problem that limits capital deployment.

- U.S. Investors Returning: American venture capital participation in European deals has recovered from a 2023 low of 19% and is steadily increasing, driven by attractive valuations and world-class technical talent.

- AI Opportunity: Europe's exceptional AI research and specialized AI applications, combined with regulatory compliance advantages, are attracting international capital and creating venture recovery tailwinds.

- Exit Validation: Klarna's successful 2025 IPO after two decades in private markets validates that European companies can scale globally, shifting founder mindset toward global ambition rather than regional optimization.

- Recovery Timeline: Meaningful recovery metrics likely emerge in 2026-2027 as recently-raised capital deploys and more exits validate the ecosystem, though recovery is probabilistic rather than certain.

Related Articles

- Best VPN Deals 2025: Save Up to 88% on Premium Services [2025]

- Best Live TV Streaming Services to Cut Cable [2026]

- Best Compact Soundbars for Small Spaces [2025]

- Malicious Chrome Extensions Stealing Data: What You Need to Know [2025]

- The Hidden Life of Professional Santas: A Year-Round Identity [2025]

- 9 Biotech Startups Changing Healthcare: Disrupt 2025 Spotlight [2025]

![Europe's Startup Market Gap: Why Data Lags Behind Energy [2025]](https://tryrunable.com/blog/europe-s-startup-market-gap-why-data-lags-behind-energy-2025/image-1-1766601351989.jpg)