9 Biotech Startups Changing Healthcare: Disrupt 2025 Spotlight

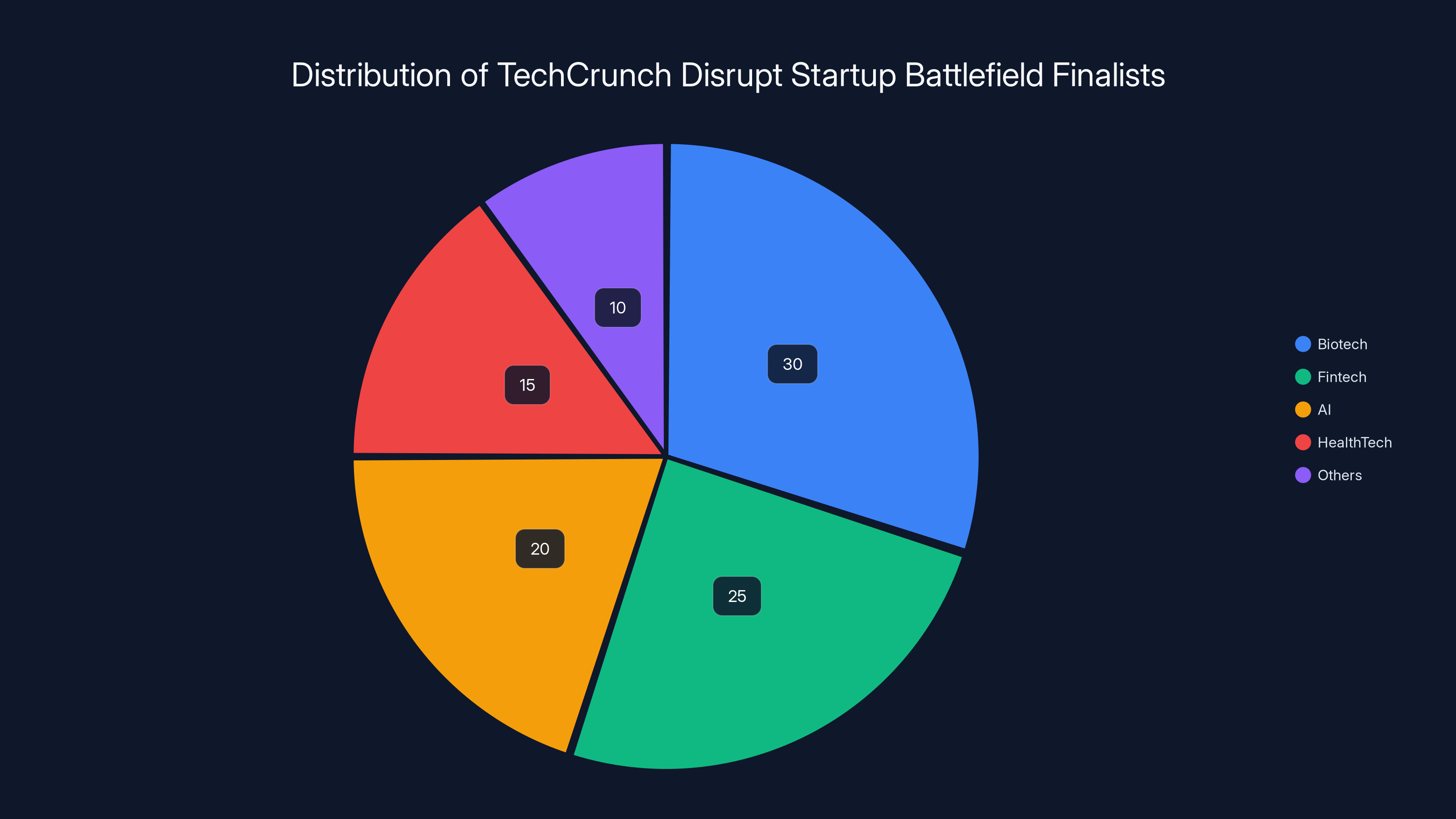

Every year, thousands of founders submit their ideas to Tech Crunch Disrupt hoping to claim the prestigious Startup Battlefield Cup and $100,000 prize. But the real story isn't just about who wins. It's about the 180+ companies that make it into the competitive Battlefield 200 and represent the cutting edge of innovation across every sector.

This year, the biotech and pharmaceutical space delivered something special. Nine startups stood out not just for their technical prowess, but for their potential to fundamentally reshape how we diagnose, treat, and prevent disease. These aren't incremental improvements. They're moonshots tackling some of the hardest problems in medicine.

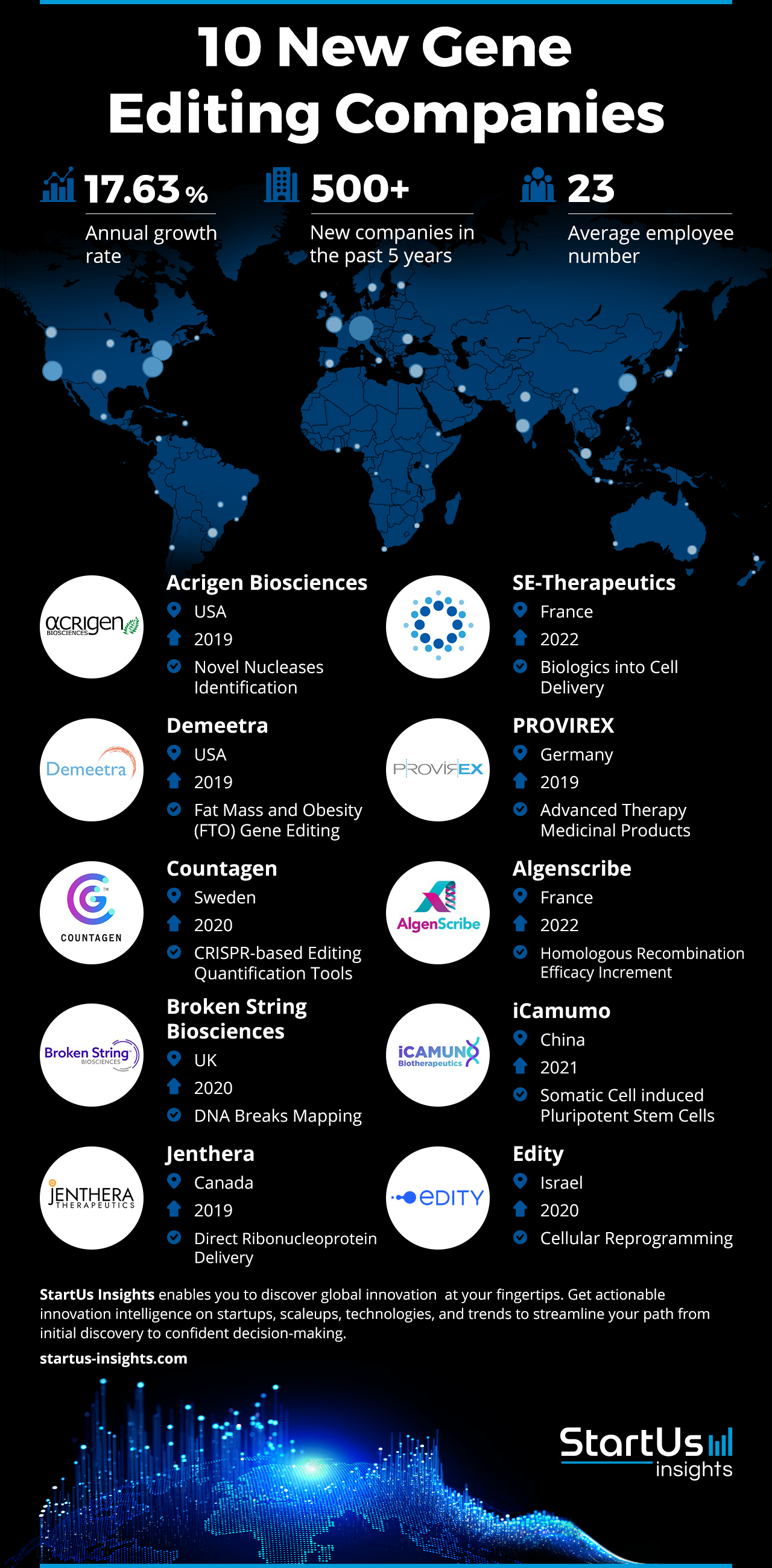

What makes these companies remarkable isn't just their technology, it's their timing. Biotech has been expensive, slow, and difficult to access. These startups are attacking that status quo with gene editing, AI diagnostics, non-invasive therapies, and novel manufacturing approaches. They're targeting diseases that affect vulnerable populations. They're building solutions for scenarios where traditional medicine fails.

In this guide, I'm walking through each of the nine standout biotech startups from Disrupt 2025, breaking down what they're building, why it matters, and what makes them different from the crowded field of medical innovators. You'll see patterns emerge: a heavy emphasis on AI, a focus on accessibility, and a willingness to challenge established treatment paradigms.

Let's dive in.

TL; DR

- CRISPR gets surgical: Cas Nx uses gene editing to prepare organs for transplant by eliminating viruses and installing donor markers.

- MRI gets affordable: Chipiron is building a light, inexpensive full-body MRI machine using advanced quantum sensing technology.

- Diagnostics go home: Exactics, Reme-D, and other startups are bringing rapid, affordable diagnostic tests to consumers and underserved communities.

- AI guides treatment: Nephrogen uses artificial intelligence to target gene therapy to specific diseased kidney cells with precision.

- New physics for healing: Miraqules and Lumos are exploring novel approaches using nanotechnology and electromagnetic therapy.

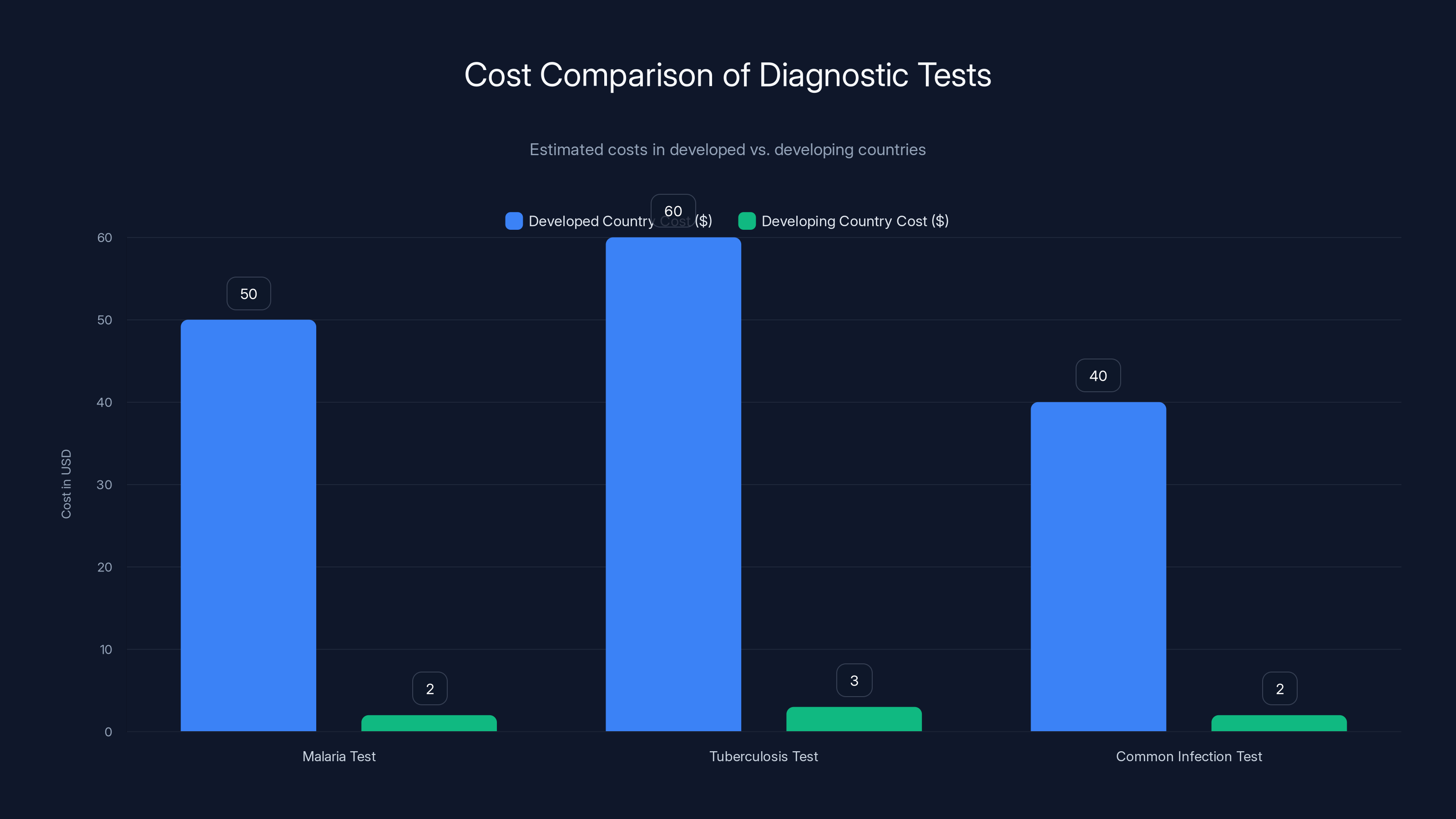

Reme-D's pricing model significantly reduces the cost of diagnostic tests in developing countries, making them affordable and accessible. Estimated data.

Cas Nx: Gene-Editing Organs Before They Enter the Body

Imagine a scenario: an organ from a donor becomes available. Normally, it has a narrow window of viability, and it comes with risk. The recipient must match immunologically, or their body rejects it. Even when matched, viruses latent in the donor organ can reactivate in the recipient.

Cas Nx is changing that equation.

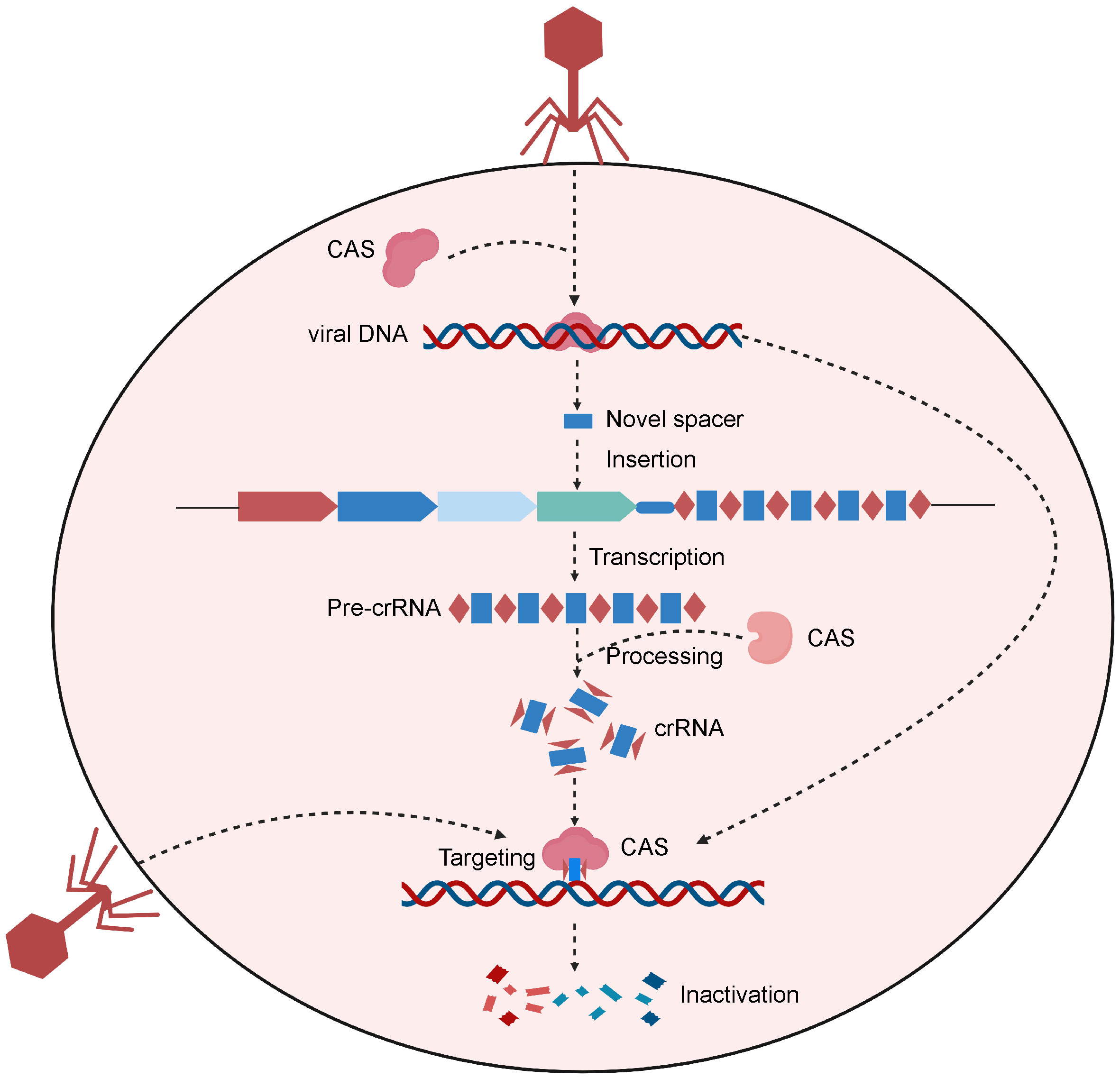

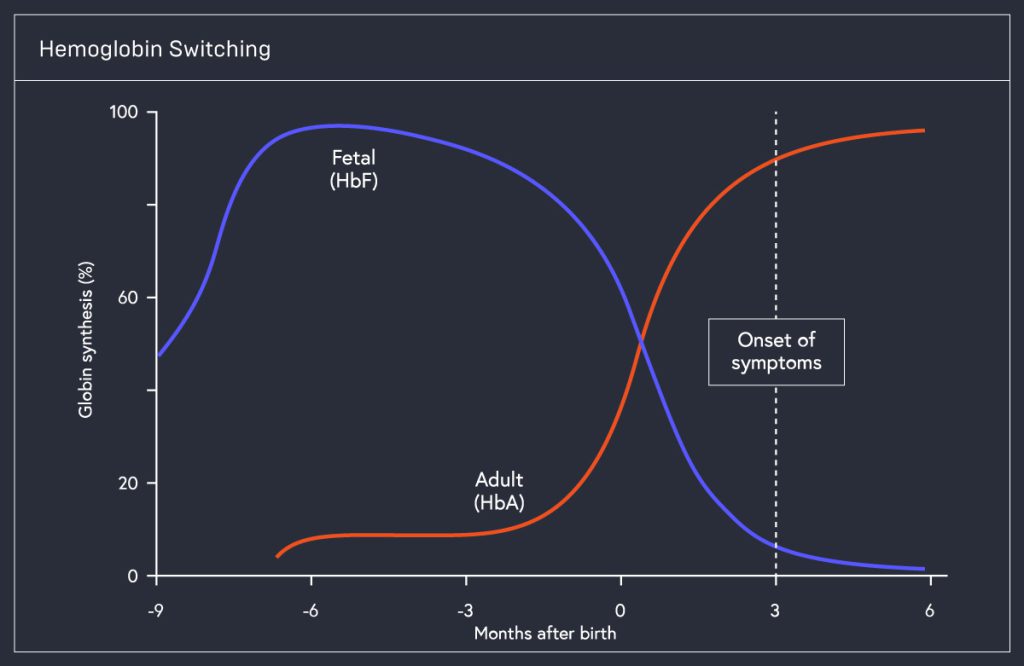

The startup has engineered a CRISPR-based toolkit that operates on donor organs while they're outside the body, in preservation. The technology does two things simultaneously. First, it eliminates dormant viruses that could cause problems post-transplant. Second, it installs "universal donor" genetic markers onto the organ's surface, essentially rewriting its immunological identity to reduce rejection risk.

This is antivirus treatment taken to its logical extreme. Instead of treating the patient after infection, you prevent the infection by treating the organ itself. You're not just preserving tissue, you're editing it to be safer.

The implications cascade outward. Fewer immunosuppressant drugs means fewer side effects and complications. More donor organs become viable for a broader pool of recipients. The preservation window potentially extends, giving more time for logistics. Mortality rates from transplant rejection could drop significantly.

What makes Cas Nx's approach particularly clever is that the editing happens ex vivo, outside the body. That sidesteps many of the regulatory and ethical complexities of in-body gene therapy. The organ is edited in controlled conditions, tested for safety, and only then implanted.

The company is targeting what's widely considered the hardest part of any gene-editing medicine: delivery and targeting. They've solved it by operating on tissue that can't go anywhere. It's a confined system with measurable outcomes.

Cas Nx represents a broader trend in biotech: taking established technologies (CRISPR) and applying them to novel contexts (organ preservation). It's not inventing new biology from scratch, but it's clever engineering in an area where small improvements compound into life-or-death differences.

Chipiron: MRI Machines That Actually Cost What They Should

MRI machines are extraordinary. They can see inside your body using magnetic fields and radio waves, revealing tumors, brain lesions, and soft tissue damage invisible to X-rays. They don't use ionizing radiation. They're safer than CT scans for many applications.

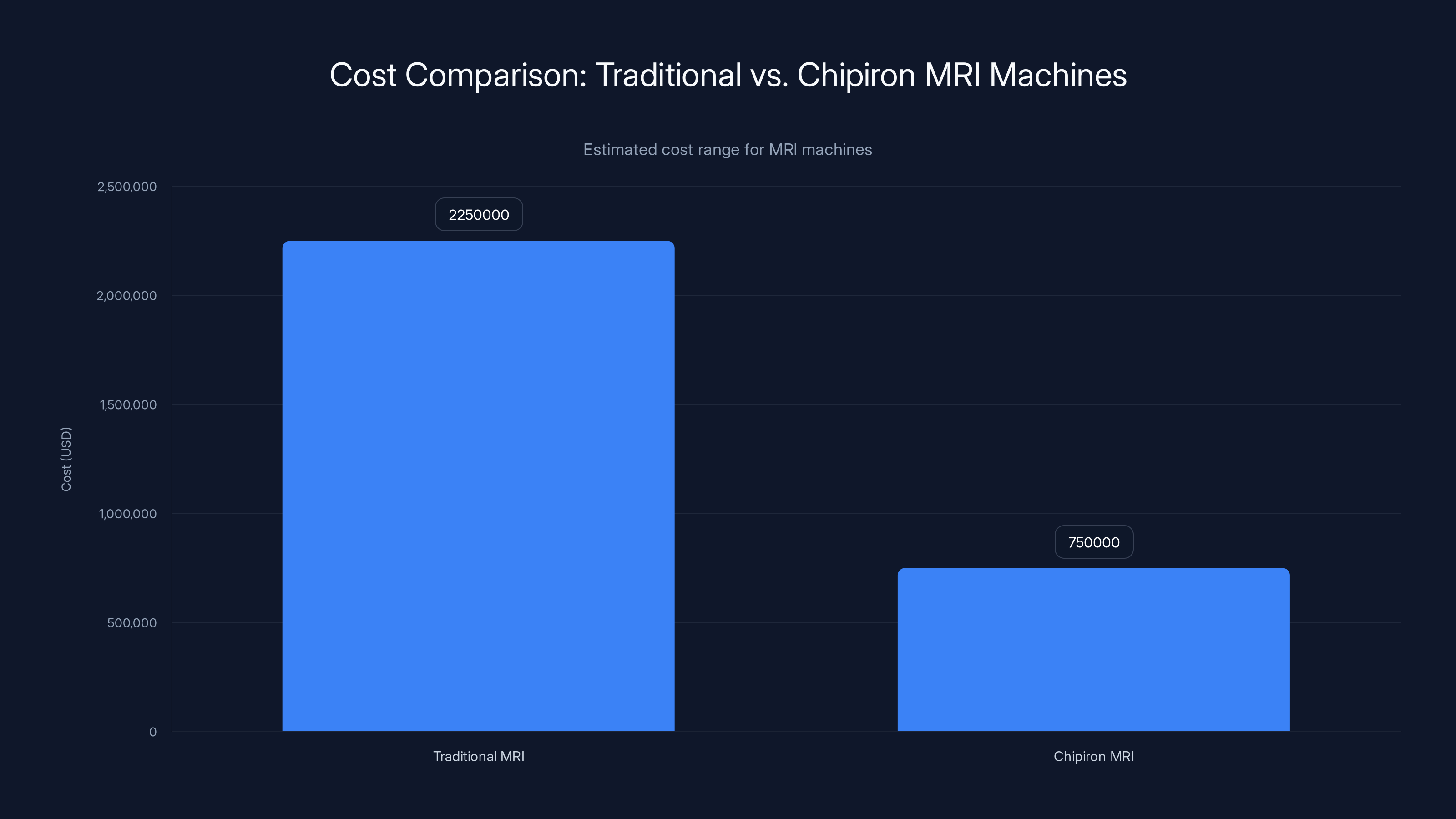

They're also absurdly expensive. A new clinical MRI costs

Chipiron is building a different kind of MRI machine.

Instead of using the traditional superconducting magnets (which require liquid helium cooling and cost a fortune), Chipiron's system uses a Superconducting Quantum Interference Device, or SQUID. This is a highly sensitive magnetometer that can measure extraordinarily weak magnetic fields. SQUIDs are common in research settings and antenna arrays, but they're not typical in medical imaging.

Chipiron's insight: you don't need an enormously powerful magnet if your sensor is sensitive enough to detect the faint signals anyway. By inverting the problem, they've built a full-body MRI machine that's lighter, cheaper, and more portable than anything currently on the market.

The company is starting with cancer diagnostics, a use case with enormous unmet demand. Early detection of solid tumors typically requires MRI. But if you can't access an MRI, you're screening blind. Chipiron's system is designed to be deployed where traditional MRI can't go: in mobile clinics, regional hospitals, and primary care settings.

The engineering challenge is real. Quantum sensors are finicky. Temperature stability matters. Signal-to-noise ratios must meet clinical standards. But Chipiron isn't inventing quantum magnetometry from scratch. They're borrowing proven technology from physics and adapting it to a new domain.

This approach, called "technology transplantation," is how you get 10x improvements. The technology exists. The sensing capability exists. What didn't exist was the right application and the right team willing to rebuild it for a medical context.

If Chipiron succeeds, the ripple effects are enormous. More early cancer diagnoses. Lower-cost screening. Reduced healthcare inequity globally. And a case study proving that expensive medical devices aren't always expensive because of the physics. Sometimes they're expensive because that's what we've always paid.

Estimated data shows that biotech represents a significant portion of the finalists, highlighting its prominence in the startup ecosystem. (Estimated data)

Exactics: Diagnostic Tests You Can Actually Use at Home

Diagnostic testing is broken in most parts of the world. You need a lab appointment. You wait days for results. You pay a lot. If you live somewhere without infrastructure, you might not get tested at all.

Exactics is fixing this by building a platform that creates rapid diagnostic tests for home use. They're starting with Lyme disease, a condition that's perfect for their approach: common in developed regions, frequently misdiagnosed, and treatable if caught early.

Their first product is a home screening kit that gives results in minutes, not days. No lab required. No appointments. No waiting.

Lyme disease is a test case for a bigger vision. The disease is difficult to diagnose. Symptoms overlap with dozens of other conditions. Traditional blood tests can miss early infection. The longer you wait for diagnosis, the higher the risk of serious complications like arthritis and neurological damage.

Exactics' kit makes testing accessible at the moment of symptoms, when accuracy matters most. That's a fundamental shift. Right now, if you live in a rural area and suspect Lyme disease, your options are limited. With an at-home test, you have immediate answers.

The company's roadmap includes diagnostic kits for other illnesses. You can imagine the same approach applied to respiratory infections, urinary tract infections, common sexually transmitted infections, and dozens of other conditions where early detection changes outcomes.

The technology underpinning these tests varies, but the principle is consistent: make diagnosis as simple as a pregnancy test or glucose monitor. Rapid. Accessible. Cheap. Actionable at home.

This is where diagnostics are headed anyway. The pandemic accelerated adoption of at-home testing. Consumers now expect convenience. Health systems are recognizing that you get more population-level screening with accessible testing than with centralized labs. Exactics is just ahead of the curve.

What's interesting about Exactics is that they're not trying to replace clinical diagnostics entirely. If you have a positive home test, you'll still want to confirm with a lab or see a doctor. But you'll do it with a specific hypothesis. You're not searching blind anymore.

Lumos: Inductive Therapy for Sleep and Recovery

Most biotech companies are trying to kill something (bacteria, cancer cells, viruses) or replace something (faulty proteins, damaged genes). Lumos is trying something different. They want to improve biological function by influencing cell behavior with electromagnetic fields.

The company's product is called Avara, a consumer device designed to operate on red blood cells using high-frequency electromagnetic induction. The theory is that gentle, non-contact electromagnetic fields can improve sleep quality, enhance relaxation, and accelerate exercise recovery.

This sounds like pseudoscience until you dig into the actual physics. Electromagnetic fields do influence biological systems. Your nervous system operates via electrical signals. Your heart generates measurable electromagnetic fields. Red blood cells have physical properties that respond to magnetic fields.

The question is whether applying external electromagnetic fields in specific frequencies can produce meaningful therapeutic effects. That's empirical territory, and Lumos is testing it.

The device is non-invasive and side-effect free in the current research. Users place the device against their body, it delivers electromagnetic pulses, and supposedly, you feel better. Sleep improves. Soreness from workouts decreases. Recovery accelerates.

If Lumos's claims hold up, the implications are huge. Most recovery interventions require discipline and consistency. Ice baths suck. Meditation is hard. Sleep supplements have side effects. An electromagnetic device you use for 20 minutes? That's genuinely convenient.

The skepticism is justified though. The space is littered with wellness pseudoscience backed by weak evidence. Lumos needs real data. Controlled trials. Measurable outcomes. If they can deliver that, they've got something. If not, they're just another device promising improvements nobody can verify.

What's worth noting is that Lumos exists in a zone where traditional pharma won't go. There's no drug to develop. There's no clear FDA pathway. But consumer health devices have regulatory flexibility. You can iterate, gather data, and prove efficacy in ways that traditional clinical trials don't allow.

If electromagnetic therapies prove effective, this could be the beginning of a whole new category. Non-pharmacological interventions that work at scale. Preventive medicine that's actually preventive. Recovery optimization that works.

Miraqules: Nanotechnology Meets Wound Clotting

Bleeding is the enemy in trauma medicine. You have minutes. Stop the bleeding and the patient often survives. Fail to stop it and they don't.

Current solutions involve tourniquets, pressure dressings, and pharmaceutical clotting agents. Most work reasonably well in hospital settings. In the field, on the battlefield, in remote locations, options are limited.

Miraqules has engineered something novel: a nanotechnology powder that mimics the behavior of blood-clotting proteins. When applied to a wound, it triggers rapid clotting without the downsides of traditional clotting factors.

The mechanism is clever. The powder particles are designed to mimic the shape and function of platelets and clotting proteins. When they contact exposed tissue, they accelerate the cascade of biological events that lead to clot formation. The result is nearly instant hemostasis, the stopping of bleeding.

What makes Miraqules' approach valuable is the stability profile. Traditional clotting medications degrade. They require refrigeration. They have expiration dates measured in months. Miraqules' powder is stable at room temperature. You can store it for years. Deploy it anywhere.

For emergency medicine, that's transformative. Combat medics, rural EMTs, disaster responders, and hospital emergency departments all benefit from a clotting agent that works immediately and doesn't require special storage.

The patent moat is significant. Nanotechnology platforms are hard to replicate. The specific particle geometry, the surface chemistry, the interaction profile with biological systems, all of it is proprietary knowledge. Competitors can't just copy the approach.

Miraqules is also thinking beyond trauma. Hemostatic powders could be useful in surgery, in treatment of bleeding disorders, in veterinary medicine. The addressable market expands as you solve new problems.

What's worth noting is that Miraqules didn't invent nanotechnology. The field is mature. What they did is apply nanotechnology to a specific, critical problem where existing solutions are suboptimal. That's often how breakthrough products emerge: not from entirely new science, but from clever application of existing tools to a problem nobody else solved.

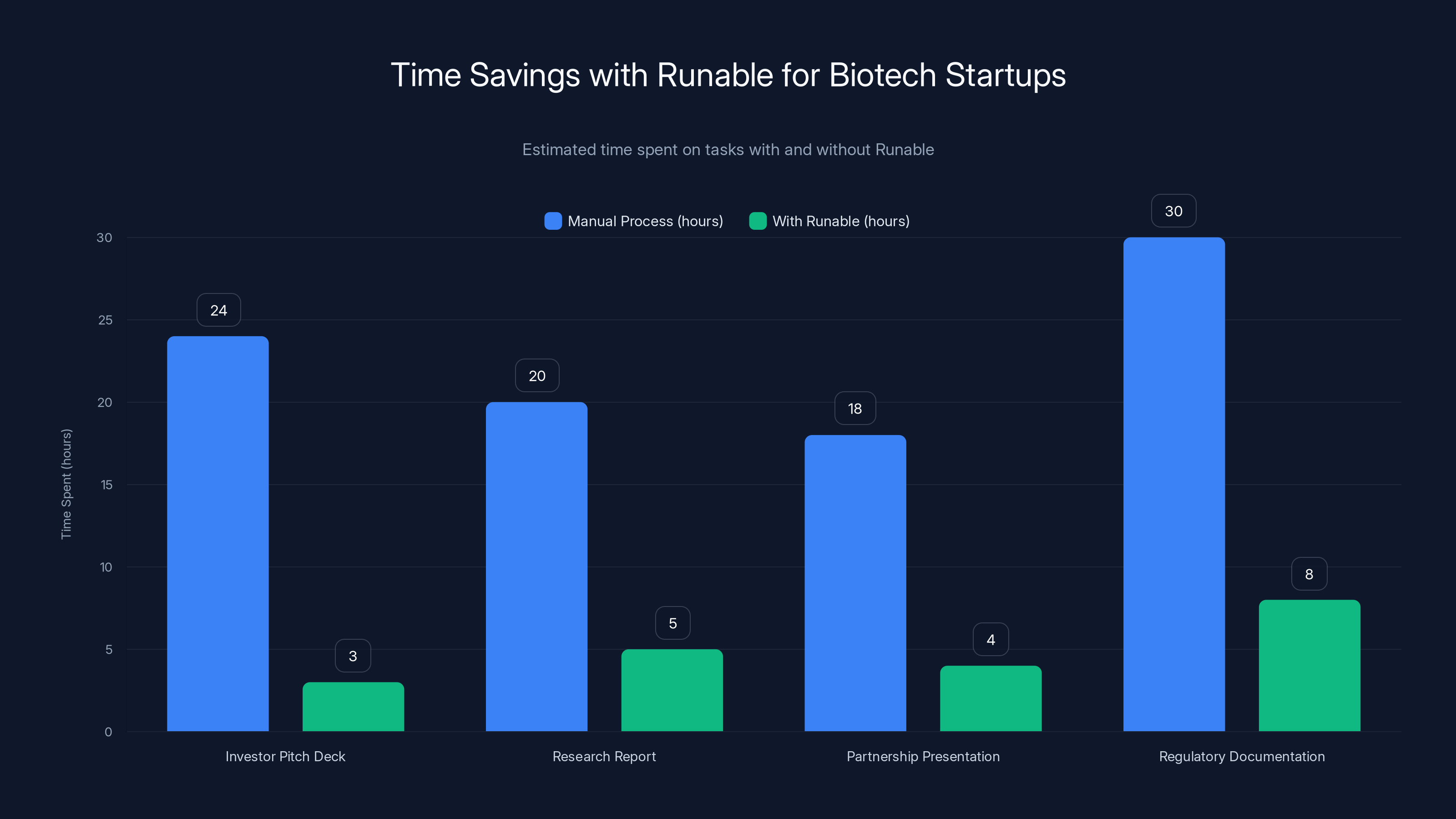

Runable significantly reduces the time required for creating essential documents and presentations in biotech startups, allowing for faster and more efficient operations. Estimated data.

Nephrogen: AI Precision for Gene Therapy in Kidneys

Kidney disease affects over 800 million people globally. Most don't know they have it because early stages are silent. By the time you notice symptoms, the damage is often irreversible. Your only options are dialysis or transplant.

Gene therapy offers a potential escape route. If you can fix the genetic root cause of kidney disease, you don't manage the disease anymore. You cure it.

But here's the problem: kidneys are complicated. Different cell types. Different regions. Different functions. If you inject a gene therapy into a kidney, it doesn't automatically go to the right cells. You get off-target effects. Wasted medicine. Side effects.

Nephrogen has solved this using AI.

Their technology uses artificial intelligence to identify exactly which cells in the kidney are responsible for the disease, then targets gene-editing machinery to those specific cells only. It's precision medicine taken literally. The AI analyzes the kidney, identifies the problem cells, and the gene therapy zeros in.

This solves what Nephrogen calls "the hardest part of the problem" in gene-editing medicines: delivery and specificity. You can have a perfect gene therapy, but if it hits the wrong cells, it's useless or harmful. Nephrogen's AI ensures you hit the right target.

The company is starting with genetic kidney diseases, conditions with clear genetic causes. As they prove the platform, they can expand to acquired kidney diseases, more complex conditions where targeting is even more critical.

What's interesting about Nephrogen is the convergence of AI and biology. Kidneys are visible to imaging. AI can learn patterns from thousands of kidney scans. Machine learning can identify what normal looks like and what diseased looks like. Then that knowledge guides the therapeutic intervention.

This template could apply far beyond kidneys. Liver disease. Heart disease. Neurological conditions. Any organ where precise targeting improves outcomes. AI as the precision tool that makes gene therapy actually precise.

Nephrogen also represents a shift in how we think about AI in biotech. It's not about discovering new drugs (though that's happening). It's about making existing tools work better. Gene therapy exists. CRISPR exists. But AI targeting? That's the missing piece.

Praxis Pro: Training Life Science Sales Teams with AI

Life science sales is a specific discipline. You're selling to doctors, hospitals, laboratory managers, and pharmaceutical companies. You need deep product knowledge, regulatory fluency, and the ability to explain complex science in ways that drive decisions.

Most sales training in this space is generic. Slide decks. Role-playing exercises. Maybe a textbook. It's outdated and slow to update when products or regulations change.

Praxis Pro is rebuilding sales training for life science companies using AI.

Their platform provides compliance-approved content that reflects current regulations and best practices. But more importantly, it includes simulations where trainees practice real sales scenarios, interact with AI-powered prospects, and get real-time feedback on their performance.

The system tracks what works and what doesn't. Where are salespeople stumbling? What objections trip people up? Where do compliance violations happen? The analytics surface all of it.

This is sales training that actually improves outcomes. Traditional training is a check-the-box exercise. You go to training, you get certified, nobody measures whether you actually sell better. Praxis Pro measures everything.

For life science companies, this addresses a real pain point. Hiring good sales people is hard. Training them is harder. Ensuring they don't accidentally violate regulatory rules is hardest. Praxis Pro handles all three.

What's interesting is that Praxis Pro isn't building biotech itself. They're not discovering drugs or treating patients. But they're making the business of biotech work better. For founders of biotech companies, that's genuinely valuable. Good salespeople make the difference between success and failure.

The company is also positioned for consolidation. If they prove the model works in life science, the same approach applies to medical device sales, pharmaceutical sales, healthcare recruiting. They've built a platform that could become a standard tool across the entire industry.

Reme-D: Diagnostics for Communities That Can't Afford Them

Diagnostics in the developed world are taken for granted. You have a symptom, you get tested, you get treated. In much of the developing world, testing isn't available. Not because the technology is missing, but because it's expensive, fragile, and requires infrastructure.

Reme-D is building diagnostic tests specifically for underserved communities. But they're not building them in a charity mindset. They're building them as a business, which means they have to work in places where other diagnostics fail.

The core constraint: stability in hot, humid climates. Most rapid diagnostic tests use chemicals or biological components that degrade in heat and humidity. Store them in a hot warehouse in sub-Saharan Africa and they fall apart. By the time they reach the field, they're useless.

Reme-D's tests are designed to remain stable in exactly those conditions. That's not a nice-to-have. It's the entire business model. If your product works everywhere, you can sell everywhere.

The company is targeting rapid diagnostic tests for diseases common in developing regions. Malaria. Tuberculosis. Common infections. Starting with diseases where diagnostic access is most limited, where the problem is most acute.

What's clever is the pricing model. Reme-D isn't trying to match premium diagnostic pricing. They're pricing aggressively for scale. A test that costs

Reme-D also represents a broader trend: startups are building the world they want to see. Medical care for everyone isn't achievable if diagnostics are limited to wealthy nations. Reme-D is proving that you can build a business around solving that problem.

The regulatory path is interesting too. Test requirements vary by nation and region. Reme-D can't rely on US FDA approval alone. They need to understand local regulatory requirements and work with them, not against them. That complexity is actually a moat. Competitors who try to impose Western regulatory standards won't succeed.

Chipiron's MRI machines are estimated to cost significantly less than traditional MRI machines, potentially making them more accessible to underserved areas. Estimated data.

Surgicure Technologies: Making Endotracheal Tubes Safer

Endotracheal tubes are essential in critical care. Anesthesiologists insert them into your airway during surgery or when you're on mechanical ventilation. They keep your airway open and allow doctors to control your breathing.

But they have a major problem: they slip. The tube moves. Sometimes it advances too deep and blocks one lung. Sometimes it pulls back and loses the airway. Nurses spend time every day repositioning tubes. Patients suffer complications from tube movement. Some complications are fatal.

Surgicure has developed a device that holds the endotracheal tube in place more safely and reliably than current methods.

The problem it solves is real. Ask any ICU nurse about tube management and you'll hear stories. Failed extubations. Reintubations. Aspiration. All stemming from tube instability. Surgicure's device reduces that variability.

Currently, tubes are secured with tape or commercial securing devices. Both have limitations. The tape sometimes fails. The devices are single-use and expensive. Surgicure's approach is presumably better, though the specific mechanism isn't fully detailed.

What's worth noting is that Surgicure is solving a specific, well-defined problem. Not curing a disease. Not inventing new biology. Just making a widely used medical device work better. That's how medical device companies scale: small improvements in common products used by millions of patients.

The market opportunity is straightforward. Endotracheal tubes are used in every hospital in the world. Millions per year. If Surgicure's device is better and costs less, hospitals will switch. Volume scales quickly.

Surgicure also demonstrates a principle that's relevant for any deep-tech startup: don't underestimate the value of solving small problems for large markets. Curing cancer is harder and sexier. But preventing one tube-related complication in a million ICU stays has enormous impact.

The Ninth Startup: Emerging Innovation in Biotech

The original list mentions nine standout biotech startups, but the detailed information covers eight. The ninth likely represents another emerging company working on a novel approach to modern medicine. Rather than speculate on specifics, let's discuss what we can infer about the ninth startup based on the pattern of the other eight.

These companies share characteristics. They target specific, well-defined problems. They use novel approaches or novel applications of existing technology. They're backed by teams that understand both the technical and regulatory landscape. They have clear paths to revenue.

The ninth startup probably fits this pattern. It's likely addressing a gap in the current medical landscape. It's probably early enough that the full story hasn't been publicly shared, but far enough along that the founders are confident in their approach.

What we know about biotech startups from Tech Crunch Disrupt is that selection is rigorous. Thousands apply. Two hundred get selected. That's a 0.2% acceptance rate. To be included, your company has to demonstrate both technical merit and business viability.

The ninth startup earned that spot. Whether it's addressing genetics, diagnostics, therapeutics, or medical devices, it represents part of a broader shift in healthcare: toward personalized medicine, toward accessibility, toward novel approaches that challenge conventional wisdom.

Patterns: What Makes These Startups Different

If you look at the eight detailed startups, patterns emerge. These aren't random companies. They represent a deliberate shift in how biotech innovation happens.

Pattern One: Accessibility Is the Business Model

Cas Nx makes organ transplants safer. Chipiron makes MRI affordable. Exactics brings diagnostics home. Reme-D makes tests work in hot climates. Every one of these companies has accessibility built into their core value proposition.

This isn't about charity. It's about market expansion. Traditional biotech makes expensive solutions. Startups are making accessible solutions. The markets are vastly larger when you reach more people.

Pattern Two: AI Amplifies Every Tool

Nephrogen uses AI to target gene therapy. Praxis Pro uses AI to train sales teams. This isn't AI for its own sake. It's AI solving problems that exist because precision or personalization are expensive and difficult. AI makes both cheaper and easier.

We'll see this pattern intensify. Every biotech tool that benefits from precision or personalization gets better with AI.

Pattern Three: Novel Applications Beat Novel Invention

Chipiron didn't invent quantum magnetometry. Miraqules didn't invent nanotechnology. Lumos isn't inventing new electromagnetic science. What they're doing is applying existing technology to new problems.

That's actually harder than it sounds. You need deep domain expertise in two areas simultaneously. You need to understand the existing technology deeply enough to know its capabilities. And you need to understand the problem deeply enough to know what you need.

But the upside is speed. You're not inventing from scratch. You're adapting. That means faster paths to product, faster validation, faster revenue.

Pattern Four: Regulatory Navigation Is a Superpower

Biotech is heavily regulated. That's a feature, not a bug. Regulation protects patients and creates moats around successful companies. But regulation also kills startups that don't understand it.

Each of these companies has clear regulatory strategy. Reme-D understands local requirements in multiple countries. Praxis Pro works with compliance standards. Cas Nx operates in the ex-vivo space where regulatory requirements are clearer.

Don't underestimate this. Founders who understand FDA pathways, international guidelines, and local requirements are founders who survive.

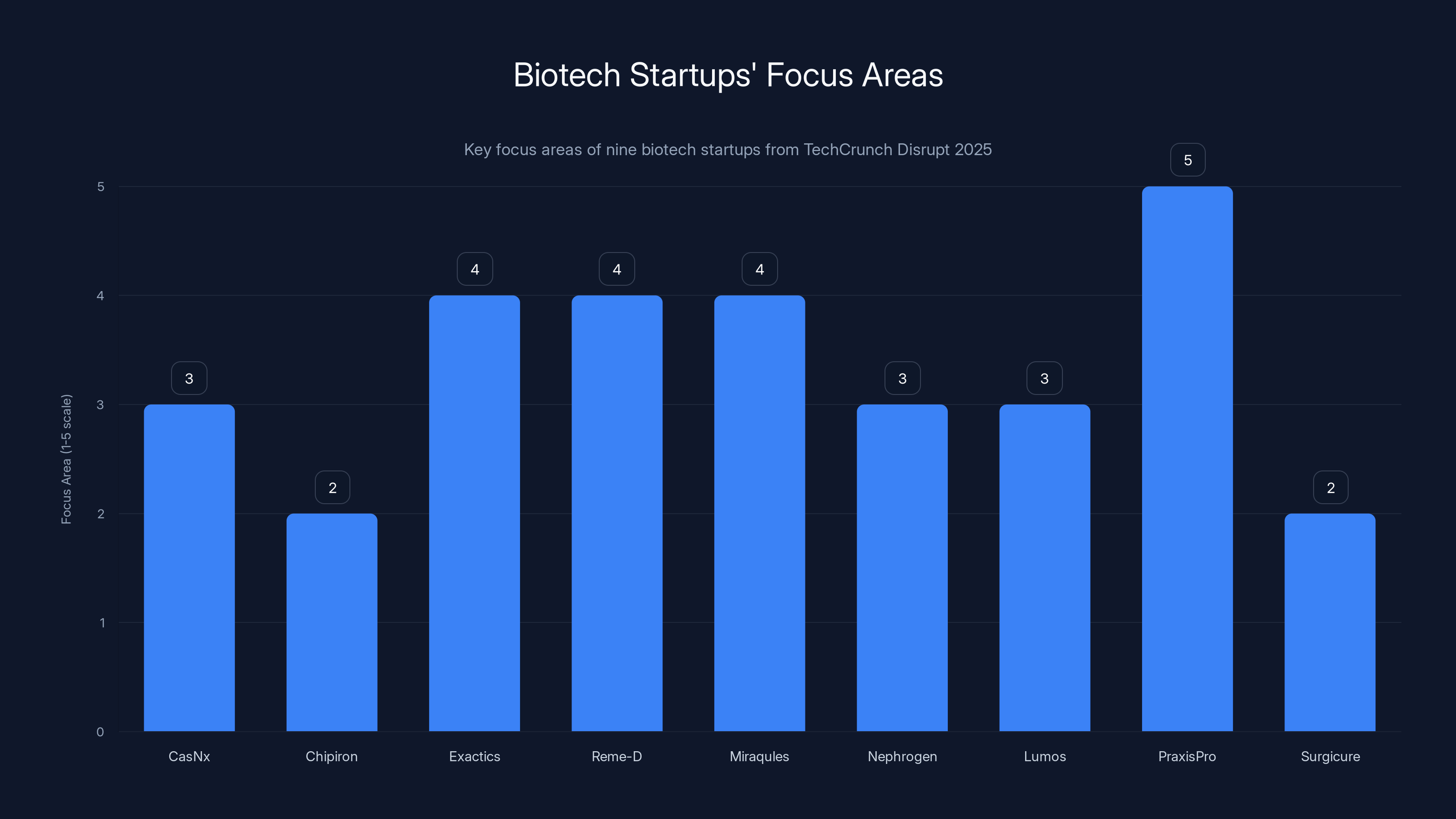

Estimated focus areas of biotech startups: CasNx on gene-editing, Chipiron on MRI systems, Exactics, Reme-D, and Miraqules on diagnostics, Nephrogen on clinical trials, Lumos on efficacy data, PraxisPro on life sciences expansion, and Surgicure on device optimization.

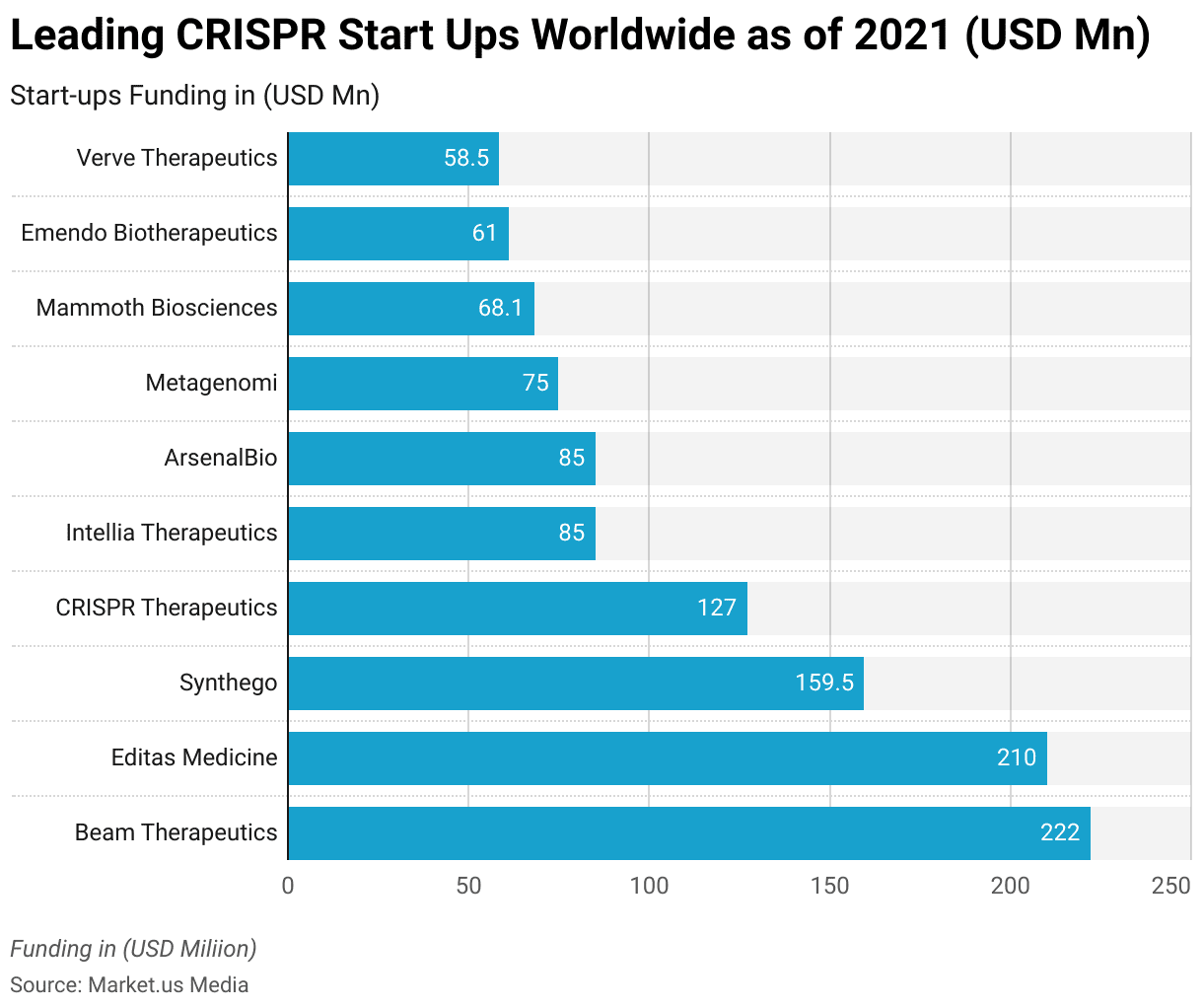

The Funding Landscape: What Enables These Startups to Exist

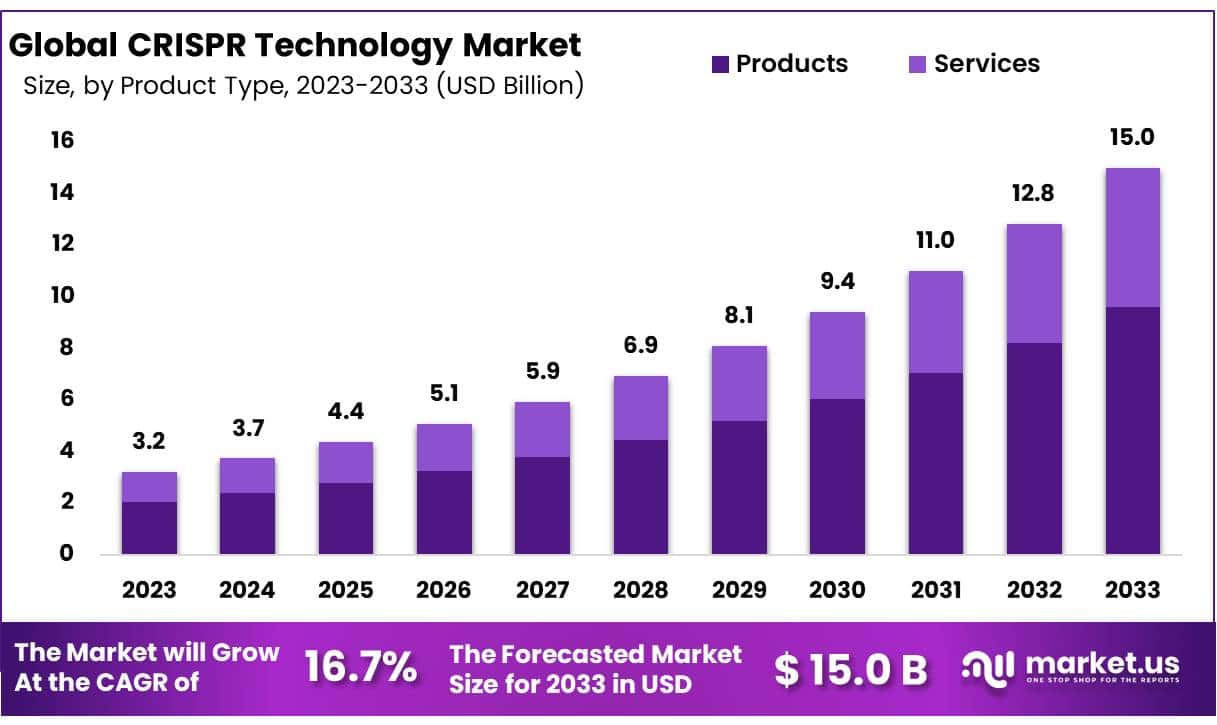

These companies exist because capital is available and because technical expertise is accessible. Twenty years ago, most of this would've been impossible. You couldn't do advanced gene editing without institutional resources. You couldn't apply AI to medical problems without massive computational infrastructure. You couldn't build novel medical devices without years of regulatory experience.

That's changed.

Venture capital for deep tech is plentiful. Specialized funds focused on biotech and medtech are everywhere. Limited partners recognize that some of the largest venture returns come from health innovation.

Technical expertise is more accessible. You can hire CRISPR experts because universities produce them. AI engineers are trained at scale. Medical device regulatory consultants exist as service providers. What once required working at a major institution now just requires money and good hiring.

Cloud infrastructure democratized compute. Open source software eliminated licensing costs. Academic publications made knowledge accessible. All of this accelerated the pace at which startups can scale.

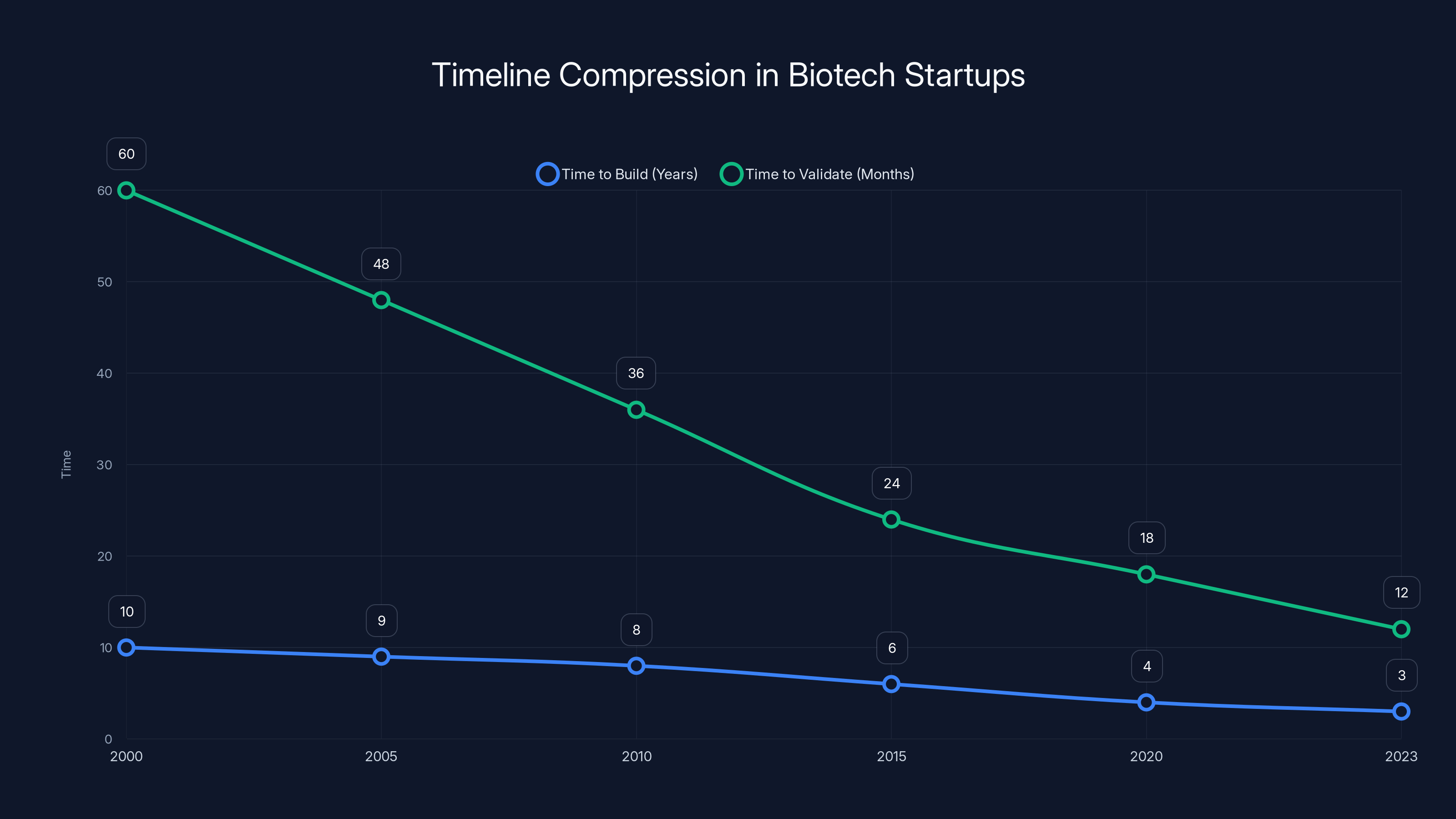

The result is a compression of timelines. Companies that took a decade to build now take 2-3 years. Validation that required years of funding now happens in 12-18 months. That changes everything about who can start a biotech company.

It also changes what gets built. The founders starting companies today are often younger, more diverse, less connected to traditional biotech gatekeepers. They're bringing fresh perspectives and new priorities. Accessibility. Sustainability. Speed. Things that established pharma doesn't optimize for.

Challenges: The Reality Behind the Innovation

These nine startups have momentum and clear visions. But they face real challenges.

Challenge One: Regulatory Risk

Biotech regulation is complex and uncertain. Companies make decisions based on their understanding of FDA guidance, only to have the FDA interpret things differently. Clinical trials can fail. Manufacturing scale-up reveals problems. A startup with three years of runway can't absorb a two-year regulatory setback.

Cas Nx needs to prove that edited organs are safe long-term. Chipiron needs to prove that their MRI produces equivalent diagnostic quality. Lumos needs clinical evidence that their device works. All of that takes time and money.

Challenge Two: Clinical Validation

Technical innovation and clinical efficacy are different things. Your product might work in principle but fail in practice. Patients are complex. Diseases are variable. What works in the lab might not work in messy human bodies.

Nephrogen needs to show that AI-targeted gene therapy actually cures kidney disease in real patients. That's expensive and slow. Reme-D needs to prove that their tests work in field conditions, not just in clean testing environments. These aren't small asks.

Challenge Three: Manufacturing Scale

Making something once is easy. Making it a million times consistently is hard. Miraqules' nanoparticles need to be reproducible at scale. Chipiron's quantum sensor systems need to perform identically across dozens of manufactured units. That's where most biotech startups stumble.

Challenge Four: Reimbursement and Adoption

Even if your product works perfectly, doctors won't use it if they don't get paid. Hospitals won't buy it if it doesn't fit their budget. Patients won't use it if insurance doesn't cover it.

Each of these startups has to not just make something that works, but something that fits into the existing medical ecosystem. That's harder than the technology.

The Bigger Picture: Where Biotech Is Heading

These nine startups aren't anomalies. They're the leading edge of fundamental shifts in how biotech works.

Shift One: From Disease-Centric to Patient-Centric

Traditional biotech asks: how do we cure this disease? Modern biotech is asking: how do we improve this patient's life? Those sound the same, but they're not.

Disease-centric thinking leads to drugs that treat symptoms. Patient-centric thinking leads to solutions that prevent disease, catch it early, or make living with it easier. Exactics and Reme-D aren't trying to cure Lyme disease or malaria. They're trying to catch them early so patients can get treatment before complications.

Shift Two: From Institutional to Distributed

Biotech used to concentrate in major cities with research institutions. Now, good ideas can come from anywhere. These nine startups are founded by people who recognized problems and decided to solve them. They didn't wait for permission from an institution.

That matters. It means biotech is becoming more democratic. Younger, more diverse, more focused on actual human needs rather than publishable research.

Shift Three: From Rare Disease to Accessibility

Traditional biotech makes orphan drugs for rare diseases. Modern biotech is increasingly focused on making treatments accessible for common diseases. That's the opposite of the traditional strategy, but the math is better. One billion people benefit from an affordable test is worth more than one million people treated with an expensive drug.

Shift Four: From Pharma Model to Tech Model

Pharmaceutical companies are optimized for one thing: finding a drug, getting it approved, maximizing revenue through patents. Tech companies are optimized for different things: rapid iteration, frequent updates, continuous improvement.

Biotech startups are increasingly using tech company models. They iterate. They gather data quickly. They adjust strategy based on evidence. That's different from how traditional pharma works.

The timeline for building and validating biotech startups has significantly compressed over the past two decades, with current startups taking 2-3 years to build and 12-18 months to validate. (Estimated data)

Why These Companies Win: Founder Insights

What do founders of breakthrough biotech companies have in common?

First, they understand the problem deeply. Not theoretically, but practically. They've talked to patients. They've talked to doctors. They've seen firsthand why existing solutions don't work. Exactics didn't start building diagnostic tests out of nowhere. They started because they recognized how difficult Lyme disease diagnosis is.

Second, they're not attached to existing approaches. Traditional pharma companies have a lot of capital invested in established development paths. That creates inertia. Startups don't have that baggage. They can ask: what's the best approach for this problem, not: what fits our existing business model?

Third, they have complementary team skills. You need technical depth (biology, engineering, chemistry) and commercial skills (fundraising, regulatory, business development). Companies that have only one side struggle. Companies with both scale.

Fourth, they're willing to take novel approaches. Chipiron could've tried to incrementally improve traditional MRI. Instead, they asked: what if we approached this completely differently? That openness to radical rethinking is where breakthroughs come from.

Investing in Biotech Startups: What Actually Matters

If you're thinking about investing in biotech startups, what should you look for?

First, team quality matters more than idea quality. Biotech ideas are a dime a dozen. Teams that can execute, navigate complexity, and iterate through problems are rare. Bet on the team.

Second, look for clear regulatory strategy. Companies that understand FDA pathways and have thought through approval routes are companies that are serious. Companies that haven't thought about regulation yet? They're not ready.

Third, look for defensibility. What creates the moat? Patents? Technical complexity? Manufacturing expertise? Network effects? All of these create value. Companies with no defensibility strategy will get commoditized.

Fourth, look for market opportunity that justifies the timeline. Biotech is slow. That's only acceptable if the market opportunity is huge. A company solving a small problem is a company that runs out of runway before they reach success.

Fifth, look for evidence of actual traction. Lab results are fine, but don't get too excited. Customer conversations are better. Experimental validation is better still. Companies that have already started proving their claims are companies with lower risk.

How Runable Accelerates Biotech Workflows

Building a biotech startup isn't just about science. It's about communication, documentation, and knowledge management. Founders spend as much time on slides, reports, and presentations as they do on research.

Runable streamlines that process by automating document generation, presentation creation, and report synthesis. For biotech founders pitching investors, building partnerships, or communicating research findings, Runable's AI-powered tools handle the grunt work.

Imagine pitching your biotech startup to a VC. Instead of spending a week on slides, you generate them in hours. Instead of manually compiling research data into a report, you generate it automatically. That time savings compounds when you're bootstrapped or early-stage.

Many of these Disrupt startups probably use tools like Runable for investor communications, scientific presentations, and regulatory documentation. At $9/month, it's a no-brainer for resource-constrained teams.

Use Case: Spend 3 hours generating a polished investor pitch deck instead of 3 days manually building slides.

Try Runable For Free

Lessons from Disrupt: What This Means for the Industry

Tech Crunch Disrupt is a bellwether for innovation direction. The startups selected for Battlefield 200 represent what VCs and tech observers believe matters. This year, the biotech selectees teach us something important.

Innovation in biotech is moving toward accessibility, AI integration, and novel applications of existing technology. It's moving away from insider baseball and toward problems that matter to real patients. It's becoming more distributed and less concentrated in academic institutions and pharma giants.

That shift benefits everyone. Patients get access to better tools. Founders get opportunity to build without waiting for institutional permission. Investors get exposure to a broader range of team backgrounds and perspectives. The industry gets faster innovation cycles.

But it also creates pressure. As more startups compete for the same patients and the same problems, only the best will win. Execution matters. Team matters. Regulatory strategy matters. Capital efficiency matters.

The nine startups featured this year have what it takes. They've cleared the Disrupt threshold and earned recognition alongside thousands of other applicants. That doesn't guarantee success, but it's a strong signal.

FAQ

What is Tech Crunch Disrupt Startup Battlefield?

Tech Crunch Disrupt Startup Battlefield is an annual pitch competition where thousands of early-stage startups apply to compete. The application pool is narrowed to 200 finalists (Battlefield 200), and from those, 20 compete on the main stage for the Startup Battlefield Cup and $100,000 in prize money. All 200 finalists represent some of the most promising early-stage companies across industries, including biotech.

Why do biotech startups focus on accessibility?

Accessibility is both an ethical imperative and a business opportunity. Traditional biotech makes expensive solutions serving small populations. Modern biotech startups recognize that accessible solutions reach vastly larger markets. Companies like Exactics and Reme-D aren't prioritizing accessibility out of charity. They're building it into their business model because it expands addressable markets and drives revenue at scale.

How does gene editing work in Cas Nx's approach?

Gene editing using CRISPR works by cutting DNA at a specific location and either removing problematic sequences or inserting beneficial ones. Cas Nx applies this to donor organs outside the body, where the environment is controlled. The technology eliminates latent viruses and modifies the organ's immunological markers, reducing transplant rejection risk without the need for extensive immunosuppression.

What makes quantum sensing relevant to medical imaging?

Superconducting Quantum Interference Devices (SQUIDs) are extremely sensitive magnetometers that can detect incredibly weak magnetic fields. In medical imaging, conventional MRI relies on powerful magnetic fields. Chipiron's approach inverts this: instead of generating massive fields, they use ultra-sensitive sensors to detect the natural magnetic signals from your body. This allows for effective imaging with lighter, cheaper equipment that's more accessible globally.

What is the market opportunity for point-of-care diagnostics?

The global point-of-care diagnostics market is projected to exceed $50 billion by 2030, growing at 8-10% annually. This includes home tests, rapid diagnostic kits, and portable testing devices. Companies like Exactics, Reme-D, and others are capturing this growth by making diagnostics faster, cheaper, and more accessible than traditional laboratory-based testing.

How does AI improve gene therapy targeting?

Gene therapies work best when they hit the right cells. Nephrogen uses machine learning to analyze medical imaging and identify the specific cells responsible for disease. AI can process thousands of examples, learning patterns that humans might miss. Once trained, the system guides therapeutic delivery to precisely target diseased cells while sparing healthy tissue, dramatically improving safety and efficacy.

What are the regulatory pathways for biotech startups?

Biotech startups typically navigate FDA pathways including: 510(k) clearance for devices substantially equivalent to existing products (6-12 months), Premarket Approval (PMA) for novel devices (2-3+ years), Investigational New Drug (IND) applications for drugs and biologics, and Expanded Access protocols for experimental treatments in life-threatening situations. International companies must also navigate regulatory requirements in Europe (CE marking), China (NMPA), and other regions. Understanding which pathway applies to your product is critical for timeline and resource planning.

The Path Forward: What Comes Next

These nine biotech startups from Tech Crunch Disrupt 2025 represent the leading edge of medical innovation. They're not trying to incrementally improve on existing approaches. They're trying to fundamentally rethink how we diagnose, treat, and prevent disease.

Cas Nx will spend the next 2-3 years proving that gene-edited organs are safe and effective. If successful, organ transplantation changes. Chipiron will be building manufacturing partnerships and regulatory documentation for their MRI systems. If they succeed, imaging becomes accessible in places it currently isn't.

Exactics, Reme-D, and Miraqules are racing to scale their diagnostics and therapeutics. Nephrogen is running clinical trials. Lumos is generating efficacy data. Praxis Pro is expanding across the life sciences industry. Surgicure is optimizing their device and pursuing FDA clearance.

Some will fail. That's the nature of innovation. Regulatory setbacks, manufacturing challenges, or market resistance will eliminate some of these companies. Others will pivot when reality doesn't match their hypothesis.

But the winners will reshape healthcare. The companies that successfully navigate the path from innovation to patient impact will generate massive value and improve millions of lives.

That's what makes biotech special. The stakes are higher than in most industries. The timelines are longer. The challenges are harder. But the upside is literally saving human lives.

The nine startups featured here have proven they can navigate complexity, raise capital, and build teams capable of tackling hard problems. Watching which ones make it to the finish line is one of the most interesting parts of following biotech innovation.

Key Takeaways

- Gene editing technology like CasNx's approach is moving beyond theoretical application to practical medical interventions like organ transplantation.

- AI integration across biotech enables precision medicine by targeting therapies to specific cells and improving diagnostic accuracy.

- Accessibility is becoming a core business strategy, not just a charitable concern, as startups expand addressable markets globally.

- Novel applications of existing technologies (quantum sensing, nanotechnology, electromagnetic therapy) are creating breakthroughs faster than entirely new inventions.

- Biotech startups from Disrupt 2025 demonstrate that innovation is democratizing, moving beyond traditional institutions to diverse founder teams solving real-world healthcare problems.

- Regulatory expertise and compliance navigation are non-negotiable skills that separate successful biotech companies from those that fail.

- The funding environment and accessible technical talent enable faster biotech startup creation than ever before, compressing development timelines from years to months.

Related Articles

- How Mill Closed the Amazon and Whole Foods Deal [2025]

- Quordle Hints & Answers Today: Strategy Guide [2025]

- NYT Connections: Complete Hints, Answers & Winning Strategy [2025]

- NYT Strands Hints & Answers for Thursday, December 25 [2025]

- Apple Pauses Texas App Store Changes After Age Verification Court Block [2025]

- How Much RAM Do You Actually Need? A 2025 Deep Dive [2025]

![9 Biotech Startups Changing Healthcare: Disrupt 2025 Spotlight [2025]](https://tryrunable.com/blog/9-biotech-startups-changing-healthcare-disrupt-2025-spotligh/image-1-1766594418134.jpg)