Garmin Cirqa Smart Band: Everything We Know About Garmin's Whoop Competitor

The fitness tracking industry has been waiting for a major shake-up, and Garmin appears ready to deliver. After years of dominating the smartwatch and GPS watch market, the company seems poised to enter the more specialized segment of health-focused wearables with a device that directly challenges Whoop's dominance in recovery tracking and advanced biometric monitoring. The leaked Cirqa smart band represents a significant strategic pivot for Garmin, moving beyond traditional activity tracking into predictive health analytics and recovery science, as detailed in the Android Authority report.

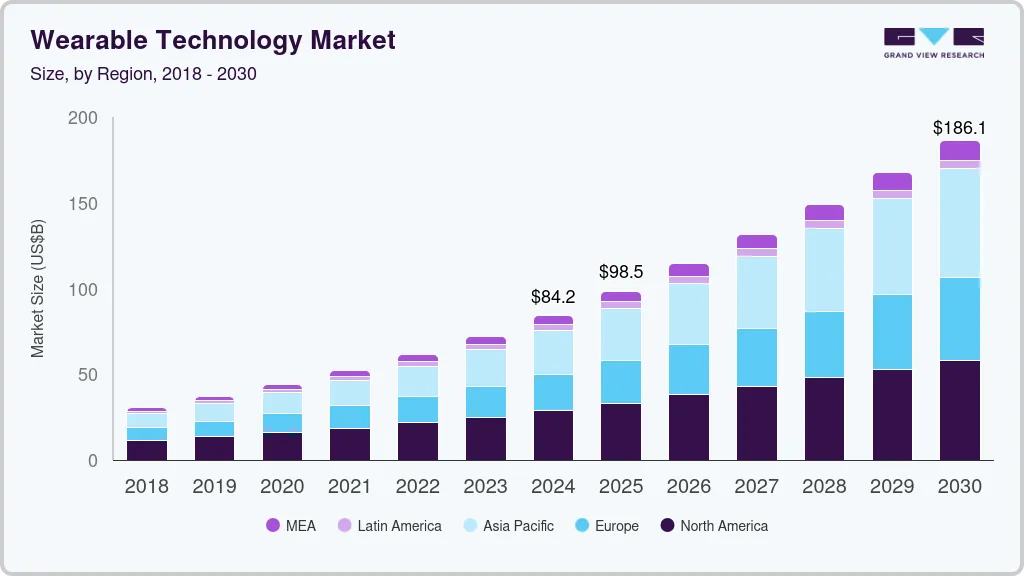

What makes this development particularly interesting is the timing. The wearable technology market has matured substantially since Whoop launched its subscription-based model in 2012. Today's consumers demand more sophisticated metrics, better integration with existing ecosystems, and transparent data ownership. Garmin, with its deep expertise in sports science data collection, GPS technology, and user interface design, appears uniquely positioned to challenge Whoop's premium positioning while leveraging its existing customer base of serious athletes and fitness enthusiasts, as noted by Live Science.

The leaked images and specifications suggest Garmin hasn't simply tried to replicate Whoop's offering. Instead, the Cirqa appears designed to integrate seamlessly with Garmin's existing Connect ecosystem while introducing proprietary algorithms for recovery analysis, strain assessment, and health metrics prediction. This strategic approach could fundamentally reshape how athletes and fitness-conscious consumers approach recovery monitoring and training optimization, as discussed in T3's coverage.

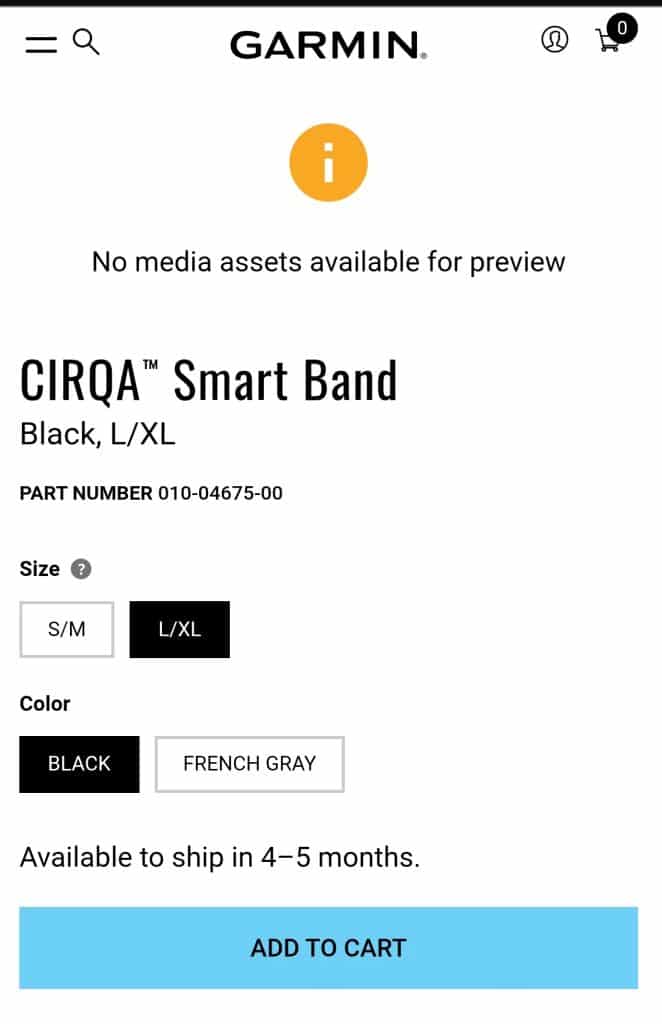

The leak itself is notable for how it occurred—eagle-eyed community members spotted the device on Garmin's own website, suggesting the company may be closer to an official announcement than previously anticipated. This accidental reveal provided the fitness tech community with crucial details about the device's design philosophy, expected capabilities, and target market positioning. Understanding what Garmin is building tells us a lot about where the entire wearables industry is headed.

The Evolution of Health-Focused Wearables: Market Context and Opportunity

The Rise of Recovery Tracking as a Premium Category

For nearly a decade, Whoop operated in a relatively uncontested market segment. The company's focus on recovery metrics rather than step counts or basic activity tracking represented a paradigm shift in how athletes approached training. By measuring heart rate variability, sleep quality, respiratory rate, and daily strain, Whoop educated consumers that recovery was just as important as exertion. This philosophical positioning created a premium market segment willing to pay $30 monthly subscriptions for data-driven insights, as highlighted in Cosmopolitan's comparison.

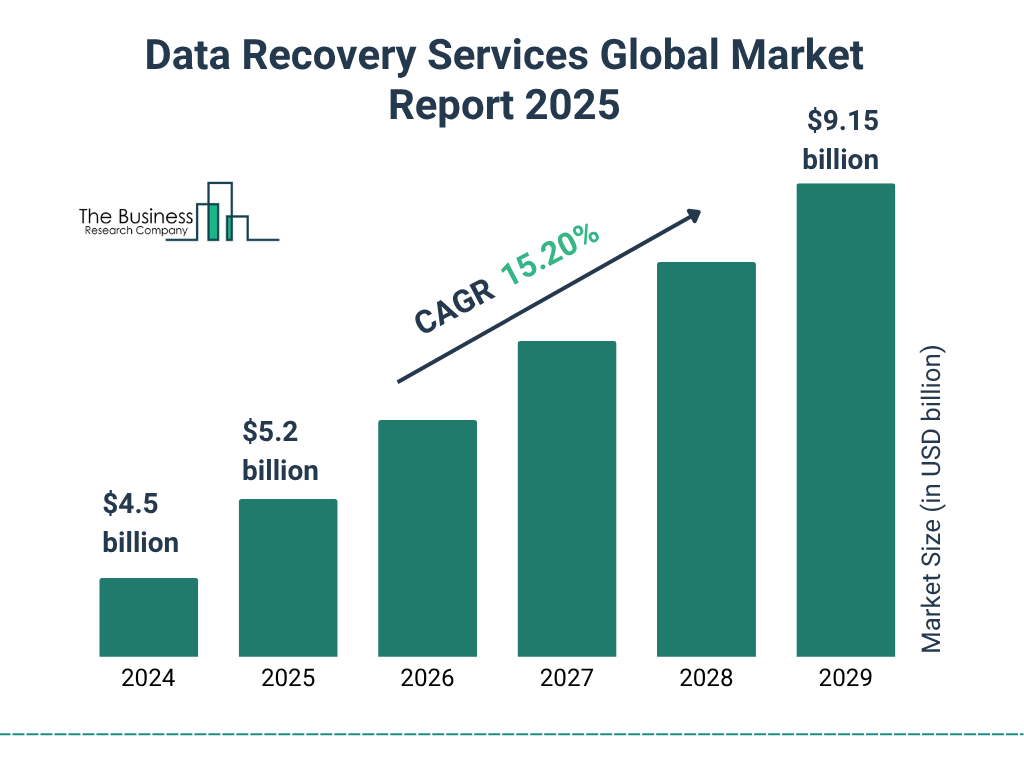

The recovery tracking category has grown exponentially as scientific understanding of athlete physiology deepened. Research increasingly demonstrates that overtraining without adequate recovery leads to performance plateaus, injury, and burnout. Professional sports teams, collegiate athletic programs, and serious amateur athletes now view recovery metrics as essential intelligence for training optimization. The global sports analytics market was valued at approximately

Garmin's entry into this market represents validation that recovery monitoring has transitioned from niche professional tool to mainstream consumer demand. The company's existing install base of over 75 million registered Garmin Connect users provides an enormous addressable market of potential Cirqa customers. Unlike Whoop, which required consumers to adopt an entirely new ecosystem, Garmin can leverage existing loyalty, established data integration partnerships, and proven user interfaces to accelerate adoption, as reported by Yahoo Finance.

Competitive Landscape: Beyond Whoop

While Whoop dominates consumer perception of premium recovery tracking, the competitive environment has evolved significantly. Apple's Apple Watch introduced Heart Rate Variability (HRV) tracking and sleep analysis to the mainstream market, though without the subscription model Whoop employs. Fitbit, acquired by Google, now offers advanced sleep insights and cardiovascular health monitoring across its product line. Oura Ring captured a significant segment with its focus on sleep quality and stress tracking through a wearable ring form factor, as noted in InsightAce Analytic's report.

Fitness-focused companies like Train Heroic and Stryd integrated recovery metrics into their training platforms, while emerging startups such as Biostrap and Whoop competitors like Hexoskin IO attempted to capture niche segments of the market. Each competitor approaches recovery tracking differently—some emphasize hardware sophistication, others focus on algorithmic analysis, and still others prioritize ecosystem integration.

Garmin's advantage lies in its ability to combine hardware engineering excellence with sports science data collection. The company has spent decades building trust with serious athletes through accurate GPS tracking, robust battery life, and reliable fitness metrics. This credibility transfers directly to health analytics—consumers trust Garmin's data because the company has been consistently accurate across multiple product categories.

Market Timing and Consumer Readiness

Consumer awareness of biometric data and health optimization has reached an inflection point. The global wearables market exceeded 525 million units shipped in 2023, with health and fitness tracking as the primary driver. Simultaneously, consumer skepticism about subscription services has increased, creating an opportunity for companies offering permanent hardware with optional premium subscriptions rather than mandatory recurring fees, as discussed in Discovery Alert.

The timing of Garmin's Cirqa launch also aligns with broader industry trends toward holistic health monitoring. Consumers increasingly seek integrated solutions that track not just fitness metrics but also stress, sleep quality, immune function, and recovery status. Garmin's ability to unify these data streams within its Connect ecosystem could differentiate Cirqa from single-purpose competitors.

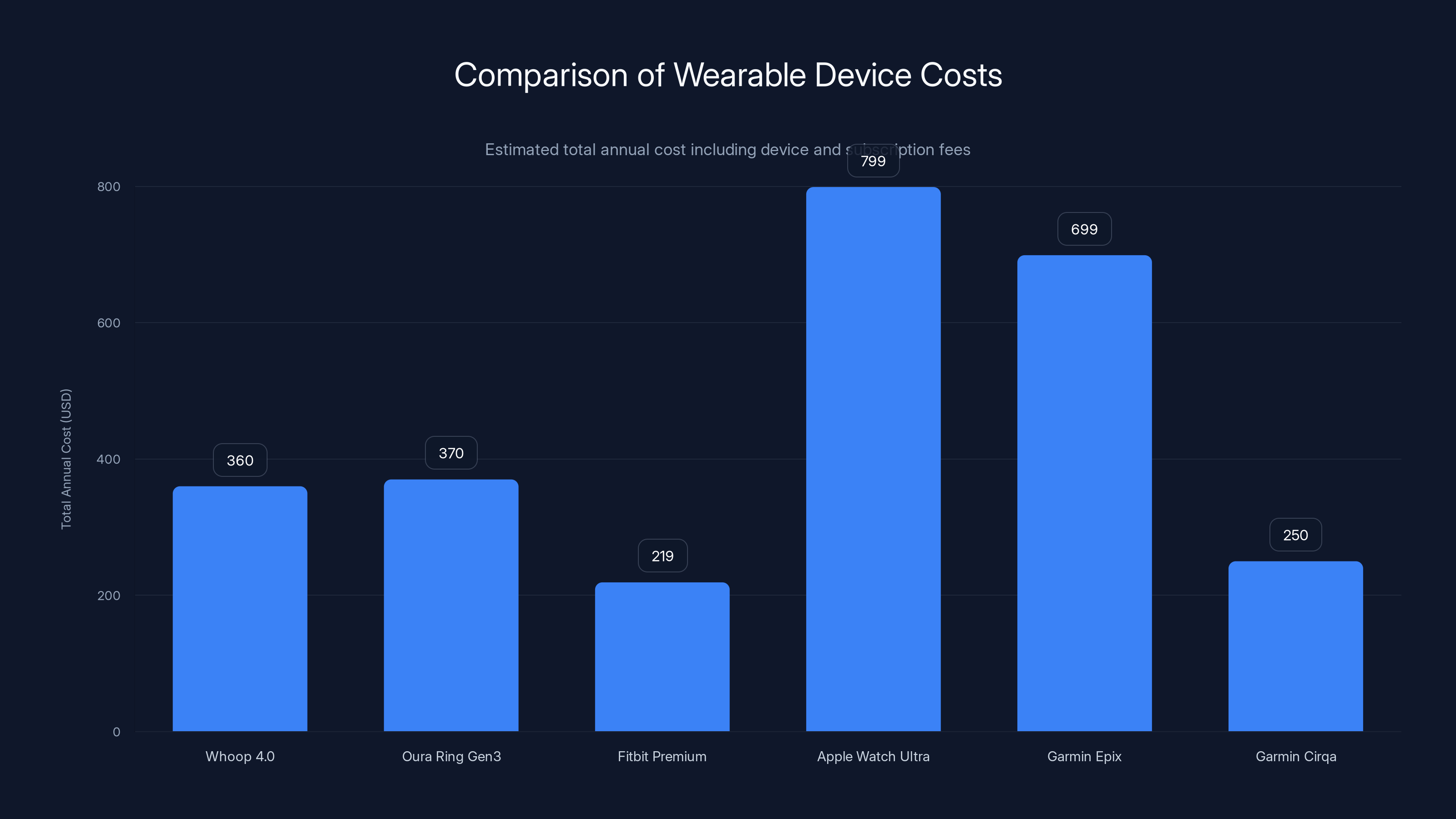

Garmin Cirqa's estimated total cost is competitive, positioned below Whoop's annual subscription model while offering premium features. Estimated data based on typical pricing.

Design and Form Factor Analysis: The Cirqa Smart Band Philosophy

Physical Design and Wearability

The leaked images reveal a device fundamentally different from Whoop's membership-based band model. The Cirqa appears to be a traditional smart band format—something between a basic fitness tracker and a smartwatch, featuring a small rectangular display similar to Fitbit's Inspire or Luxe series. This design choice reflects Garmin's philosophy of prioritizing comfort and daily wearability over extensive on-device interaction, as reported by PR Newswire.

The band form factor represents an intentional decision to optimize for continuous wear. Unlike smartwatches, which consumers might remove for certain activities or social situations, smart bands are designed to be worn 24/7 without social friction. The smaller form factor also enables lighter weight construction—crucial for accurate biometric sensing, particularly for heart rate variability calculations that require consistent optical sensor contact with skin.

Leaked specifications suggest the Cirqa will feature a circular or rectangular AMOLED display with a color screen—a significant upgrade from Whoop's minimalist monochrome band. This design choice balances Garmin's desire to provide meaningful information density with the company's understanding that excessive on-device features can drain battery life. The display enables quick metric checking without requiring smartphone connectivity, addressing one of Whoop's notable limitations.

Weight appears to be positioned around 25-35 grams, placing it firmly in the comfortable daily wear category. This weight distribution is crucial for optical heart rate sensing, which requires the sensor to maintain consistent pressure against skin for accurate readings. The lighter design also reduces fatigue during extended wear, particularly during sleep when accurate HRV measurement is most critical.

Materials and Durability

Garmin's leaked specifications suggest the Cirqa will utilize the same material philosophy as the company's other premium wearables—likely featuring a combination of advanced polymer cases with reinforced edges, silicone bands, and protected optical sensors. The company's track record suggests excellent water resistance, with expectations for 50-meter water resistance sufficient for swimming and snorkeling but not diving.

The band attachment system appears to follow Garmin's modular approach, enabling users to swap band styles and colors without requiring new hardware. This modularity addresses a significant pain point with Whoop—the limited customization options and inability to change the band's appearance. Garmin's approach acknowledges that wearables serve as fashion accessories and personal health devices simultaneously.

Durability specifications likely include military-grade material testing and extended lifespan expectations. Garmin's reputation for building devices that survive extreme conditions—from ultramarathon athletes to wilderness explorers—suggests similar engineering standards for Cirqa. The company typically designs devices with 3-5 year minimum lifespans, supported by long-term software updates and data preservation policies.

Display Technology and Information Presentation

The inclusion of a color display with AMOLED technology represents a substantial capability advancement over Whoop's approach. While Whoop relies entirely on smartphone app interaction for meaningful data visualization, the Cirqa enables glanceable metrics directly on the wrist. This design philosophy acknowledges that users want immediate access to key recovery metrics without extracting smartphones.

Expected display metrics include current strain level, recovery percentage, sleep score, and key biometric readings. The display refresh rate and brightness levels will likely follow Garmin's established standards—sufficiently bright for outdoor visibility while avoiding excessive battery drain. Most Garmin wearables employ always-on display modes with reduced information density, enabling passive metric checking without active button presses or wrist raises.

The display design likely incorporates customizable watch faces—a significant advantage over Whoop's single-purpose interface. Users can prioritize different metrics depending on context: training-focused athletes might emphasize strain and recovery percentages, while health-conscious users might prioritize sleep quality and resting heart rate data.

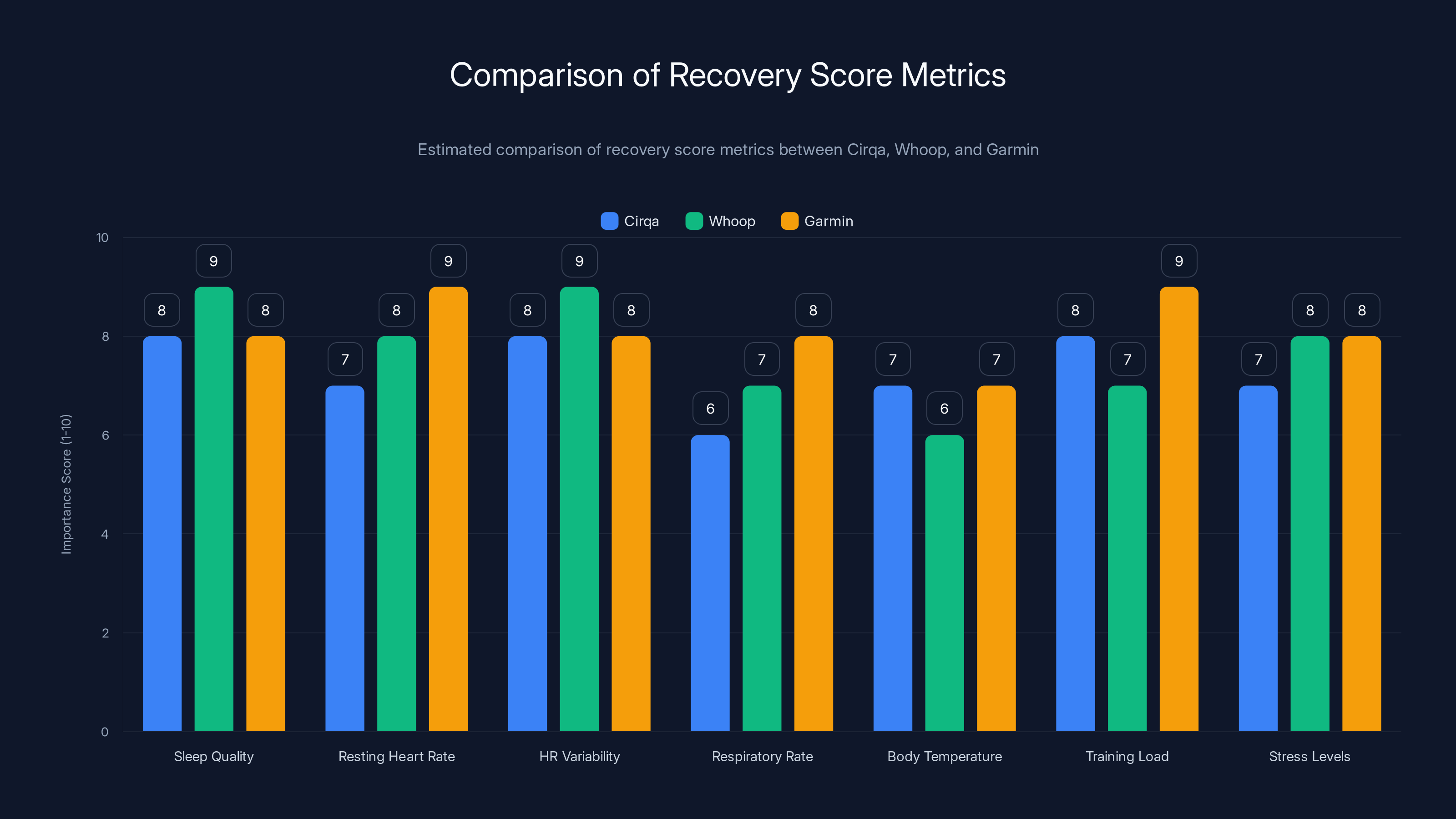

Estimated data comparing how Cirqa, Whoop, and Garmin prioritize different biometric metrics in their recovery score calculations. Garmin places a strong emphasis on resting heart rate and training load.

Expected Technical Specifications and Biometric Sensing Capabilities

Sensor Suite and Data Collection Architecture

Garmin's approach to biometric sensing draws on decades of optical heart rate sensor development. The Cirqa is expected to integrate the company's latest Elevate technology—a multi-band optical sensor capable of detecting blood flow changes with unprecedented accuracy. Unlike single-wavelength sensors that struggle with skin tone variations and motion artifacts, Garmin's multi-band approach measures light absorption across multiple wavelengths, enabling reliable readings regardless of user characteristics.

Beyond heart rate sensing, the Cirqa will likely include:

- Heart Rate Variability (HRV) measurement: Real-time tracking of beat-to-beat variations, with advanced algorithms calculating morning HRV trends

- Respiratory rate monitoring: Extraction of breathing patterns from optical sensors and accelerometer data

- Sleep architecture analysis: Differentiation between REM, light, and deep sleep stages using optical sensors combined with movement detection

- Skin temperature tracking: Recent sensor improvements enable Garmin to detect subtle temperature fluctuations indicating stress, illness, or recovery status

- Sp O2 monitoring: Blood oxygen saturation measurement using optical sensing, relevant for high-altitude athletes and altitude training assessment

- Stress measurement: Real-time stress index calculation through multiple physiological parameters

- Acceleration and motion sensing: High-sensitivity accelerometers enabling activity recognition and sleep movement analysis

The expected battery capacity suggests 8-10 days per charge with continuous sensing—a significant advantage over Whoop's 5-day battery cycle. This extended battery life reduces user friction, particularly for travelers and athletes with complex schedules.

Algorithmic Analysis Framework

Where the Cirqa will likely differentiate from Whoop is in algorithmic sophistication and integration with Garmin's broader training data ecosystem. Rather than analyzing recovery in isolation, Garmin's approach combines proprietary recovery algorithms with existing training load calculations, VO2 Max estimation, and race predictor models.

Expected analytical capabilities include:

- Body Battery technology: Garmin's proprietary energy model combining cardiovascular load, sleep quality, and stress to predict available physical capacity

- Training effect calculation: Assessment of how recent activities impact overall fitness trajectory

- Recovery time estimation: Algorithmic prediction of when body systems will return to baseline state

- Illness indicators: Pattern recognition for early symptoms of infection or overtraining syndrome

- Personalization through machine learning: Algorithms that adapt baseline metrics to individual physiology and stress responses

Garmin's advantage in this space stems from access to billions of hours of training and sleep data collected across its installed base. This data enables sophisticated machine learning models that improve prediction accuracy as the user base grows. Whoop collects comparable data but operates independently; Garmin can cross-reference training load data, GPS metrics, and historical patterns to improve algorithmic accuracy.

Integration with Garmin Connect Ecosystem

The Cirqa will integrate seamlessly with Garmin Connect, the company's comprehensive health and fitness platform. This integration enables automatic data synchronization, long-term trend analysis, and cross-device insights impossible with standalone wearables. Users with existing Garmin watches can compare metrics, identify patterns, and create holistic health profiles combining multiple data sources.

Expected integration features include:

- Unified activity calendar: View all activities, sleep, and recovery data on single timeline

- Cross-device metrics: Compare HRV, sleep quality, and training load across multiple Garmin devices

- Training plan recommendations: Automatic suggestions based on recovery status and available energy

- Social features: Team tracking, challenge participation, and group motivation

- Third-party app connectivity: Integration with Training Peaks, Strava, and other popular fitness platforms

- API access: Developers can build custom applications and integrations

Pricing Strategy and Business Model Expectations

Hardware Pricing Positioning

Leaked pricing suggests the Cirqa will launch at approximately $200-250 USD, positioning it between basic fitness trackers and premium smartwatches. This price point reflects Garmin's strategy of offering hardware at higher cost than Whoop (whose band itself is free to subscribers) while potentially undercutting total cost of ownership when subscription costs are factored in.

For comparison, the current competitive landscape shows:

- Whoop 4.0: Free band + 360 annually)

- Oura Ring Gen 3: 5.99/month optional subscription

- Fitbit Premium: 9.99/month subscription

- Apple Watch Ultra: $799+ (no subscription for health features)

- Garmin Epix: $699 (no subscription)

Garmin's $200-250 hardware pricing suggests the company is targeting consumers seeking premium recovery features without excessive upfront investment. The strategic positioning allows Garmin to undercut Whoop's lifetime subscription costs while remaining premium compared to basic trackers.

Subscription Model Strategy

While Garmin hasn't officially confirmed subscription plans for Cirqa, the company's established business model suggests optional premium subscriptions rather than mandatory fees. Garmin typically offers:

- Free tier: Core biometric tracking, activity recording, and basic analytics

- Garmin+: Premium subscription ($4.99-9.99 monthly) enabling advanced features like personalized training recommendations, detailed sleep analysis, and unlimited history access

This freemium model differs fundamentally from Whoop's mandatory subscription approach. Users get substantial value from Cirqa hardware immediately, with subscriptions enhancing functionality rather than enabling basic operation. This approach aligns with consumer preferences revealed in market research—users increasingly resist mandatory subscriptions while accepting optional premium tiers.

Expected premium features likely include:

- Advanced recovery recommendations: AI-powered suggestions for training adjustments

- Health insights: Deeper analysis of sleep quality, stress patterns, and recovery trends

- Unlimited history: Permanent data storage and unlimited historical analysis

- Premium content: Guided relaxation sessions, training programs, and educational content

- Priority support: Direct access to customer service specialists

Total Cost of Ownership Analysis

For consumers evaluating Cirqa against Whoop, total cost of ownership becomes crucial. Over a 3-year period:

- Whoop 4.0 total cost: 1,080 (subscription) = $1,080

- Garmin Cirqa estimated: 180 (optional subscription, 18 months) = $405

- Oura Ring Gen 3 total cost: 215 (optional subscription, 36 months) = $564

This comparison reveals Garmin's pricing strategy—offering roughly 60% lower total cost of ownership than Whoop while maintaining premium feature sets. This positioning particularly appeals to budget-conscious athletes, team purchasers, and consumers skeptical of mandatory subscriptions.

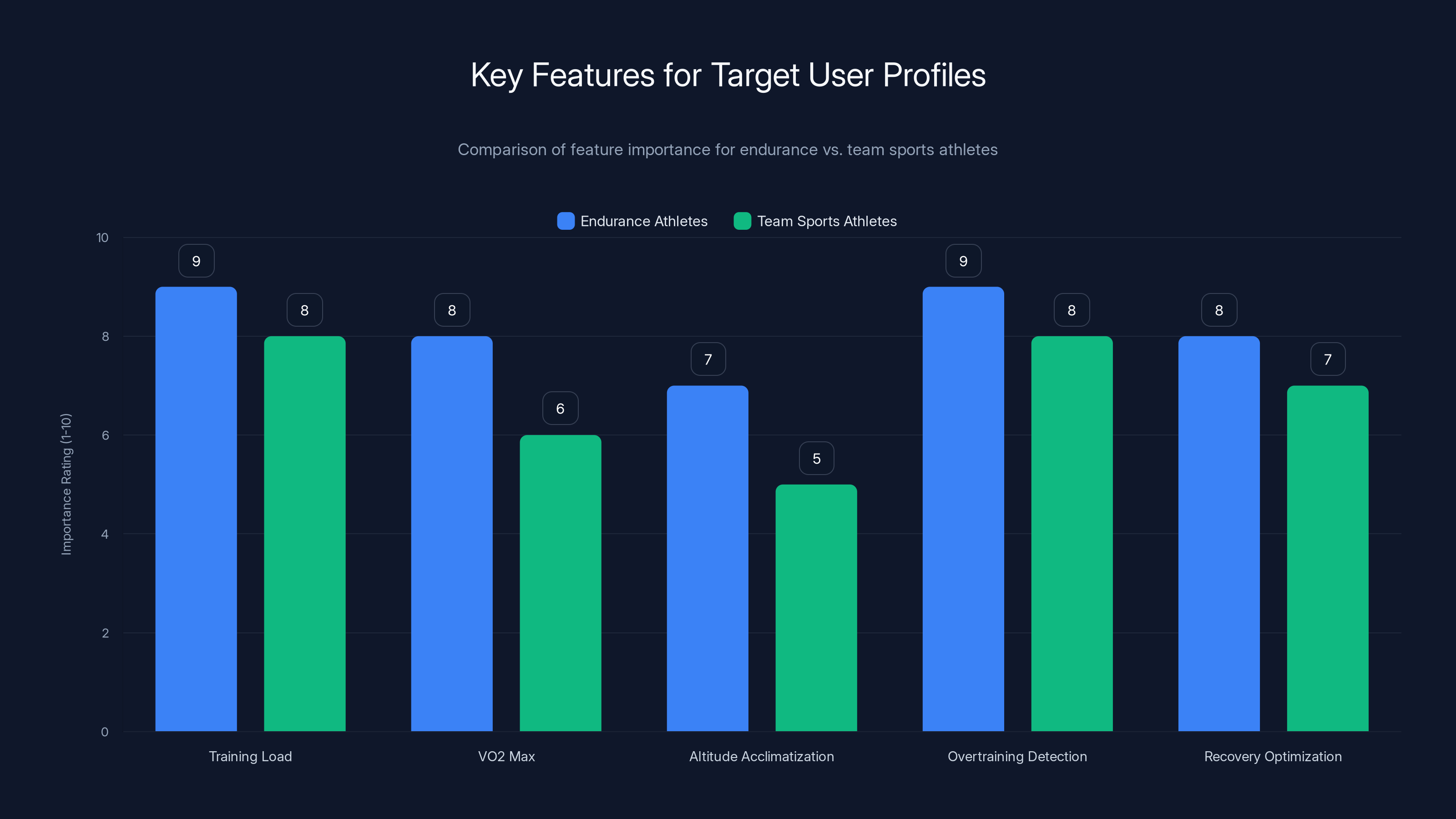

Endurance athletes prioritize training load and overtraining detection, while team sports athletes focus on load balancing and injury prevention. Estimated data.

Key Features and Biometric Metrics Explained

Recovery Score and Daily Assessment

The centerpiece of Cirqa's functionality will be a daily recovery score—a single metric synthesizing multiple physiological inputs into actionable guidance. Unlike Whoop, which presents recovery as a percentage, Garmin's approach likely incorporates color coding and contextual recommendations.

The recovery score likely combines:

- Previous night's sleep quality: Duration, sleep stages, and sleep consistency

- Resting heart rate trend: Comparison to personal baseline

- Heart rate variability: Deviation from normal patterns

- Respiratory rate: Changes indicating stress or illness

- Body temperature: Subtle fluctuations suggesting physiological stress

- Previous day's training load: Intensity and duration of physical exertion

- Stress levels: Real-time and cumulative psychological stress measurement

The algorithmic combination of these inputs produces a recovery percentage (0-100%), with contextual interpretation. A score of 70%+ typically suggests readiness for challenging training; 40-70% suggests moderate activity; and scores below 40% indicate need for active recovery. Garmin's experience with training principles enables sophisticated recommendations—not simply "you're recovered" but specific suggestions like "reduce intensity by 30% today" or "prioritize sleep tonight."

Training Load and Strain Metrics

Garmin's proprietary training load model represents one of the company's most valuable intellectual properties. The Cirqa will integrate this calculation across all activities, providing comprehensive understanding of physical stress accumulation.

Training load calculation considers:

- Intensity distribution: How much time spent in different heart rate zones

- Duration: Overall activity length weighted by intensity

- Sport-specific factors: Cycling, running, and swimming each have different physiological demands

- Personal fitness level: Training load is normalized to individual aerobic capacity

- Cumulative effect: Weekly and monthly totals revealing training volume trends

The strain metric specifically measures daily physical exertion on a 0-100 scale. High strain days (80+) represent significant physical stress; low strain days (0-20) indicate minimal physical demand. The Cirqa will track weekly strain totals, enabling users to understand if they're training appropriately for their goals. Research suggests elite athletes should maintain weekly strain totals of 300-400, with adequate recovery days providing 48-72 hour periods of reduced strain.

Sleep Cycle Analysis and Sleep Quality Scoring

One of Garmin's strongest competitive advantages is sophisticated sleep analysis derived from years of optical sensor refinement. The Cirqa will likely provide sleep stage breakdown:

- REM sleep: Rapid eye movement sleep crucial for memory consolidation and emotional processing (typically 15-25% of total sleep)

- Light sleep: Stage 1-2 NREM sleep, the entry phase of sleep (typically 50-65%)

- Deep sleep: Stage 3 NREM sleep essential for physical restoration and immune function (typically 10-20%)

The expected sleep metrics include:

- Total sleep duration: Actual hours asleep (target: 7-9 hours daily)

- Sleep efficiency: Ratio of time asleep to time in bed (target: 85%+ efficiency)

- REM percentage: Proportion of restorative REM sleep

- Deep sleep duration: Critical metric for recovery from hard training

- Sleep disruptions: Number and duration of awakenings

- Sleep schedule consistency: Variance in sleep timing across the week

Garmin's algorithms assess sleep quality holistically rather than simply counting hours. A user with 8 hours of poor-quality sleep with fragmented deep sleep receives lower sleep scores than a user with 7 hours of consolidated, deep sleep. This nuanced approach aligns with modern sleep science demonstrating that sleep quality matters more than raw duration.

Stress Measurement and Mental Resilience Tracking

Recent Garmin products introduced stress measurement through multiple physiological signals. The Cirqa will likely expand this functionality, recognizing that mental stress affects recovery as profoundly as physical exertion.

Stress measurement combines:

- Heart rate variability patterns: HRV decreases under psychological stress

- Resting heart rate elevation: Sustained stress elevates baseline heart rate

- Sleep fragmentation: Psychological stress disrupts sleep continuity

- Breathing pattern changes: Stress-induced breathing irregularity

- Physical tension indicators: Accelerometer data suggesting muscular tension

Garmin's approach recognizes that athletes face competing stressors—training stress, work stress, relationship stress, and environmental stress all accumulate. The Cirqa will contextualize recovery recommendations by acknowledging that an athlete with high work stress might need different guidance than one experiencing primarily physical fatigue.

Respiratory Rate and Oxygen Saturation

These metrics gain significance at altitude and for endurance athletes monitoring training adaptations. Respiratory rate typically ranges from 12-20 breaths per minute at rest; elevated resting rates suggest illness, overtraining, or physiological stress.

Sp O2 monitoring (blood oxygen saturation) provides particular value for:

- High-altitude training athletes: Tracking acclimatization progress

- Sleep apnea detection: Identifying nighttime oxygen desaturation events

- Illness monitoring: Early indicators of respiratory illness

- Overtraining assessment: Chronic elevation suggesting accumulated fatigue

Comparison with Whoop: Direct Feature Analysis

Hardware and Wearability

The fundamental hardware philosophy differs significantly between Cirqa and Whoop. Whoop emphasizes an unobtrusive band worn 24/7 without interface elements—the company believes health tracking shouldn't distract from daily life. This philosophy results in a minimalist band with smartphone-dependent interaction.

Garmin's Cirqa adopts the opposite philosophy: a small display enables quick metric checking without smartphone extraction. This design choice reflects different assumptions about user needs. Whoop targets consumers who want passive health tracking with deep engagement via smartphone apps; Garmin targets users who want quick wrist-glance access to key metrics.

Hardware comparison table:

| Feature | Whoop 4.0 | Garmin Cirqa (Expected) | Difference |

|---|---|---|---|

| Display | None | Color AMOLED | Cirqa enables glanceable metrics |

| Battery life | 5 days | 8-10 days | 40-100% longer duration |

| Weight | 23g | 25-35g | Negligible difference |

| Water resistance | 50m | 50m | Equivalent |

| Band customization | Limited | Modular | Cirqa offers more options |

| Form factor | Band | Smart band | Cirqa adds visual interface |

Biometric Sensing Capabilities

Both devices employ optical heart rate sensing but utilize different technological approaches. Whoop uses proprietary photonic sensors optimized for dark light conditions and skin tone variation. Garmin leverages its Elevate multi-band optical technology developed across multiple product lines.

Whoop's advantage lies in sensor optimization specifically for HRV and recovery metrics, refined through years of focus on these specific measurements. Garmin's advantage lies in broader biometric sensing—the company's optical sensors detect multiple physiological signals simultaneously, enabling richer data analysis.

Biometric comparison:

| Metric | Whoop | Cirqa (Expected) | Winner |

|---|---|---|---|

| Heart rate accuracy | Excellent | Excellent | Tie |

| HRV measurement | Specialized | Good | Whoop |

| Sleep stage detection | Good | Excellent | Cirqa |

| Respiratory rate | Basic | Advanced | Cirqa |

| Skin temperature | No | Yes | Cirqa |

| Sp O2 monitoring | No | Yes | Cirqa |

Garmin's broader sensor suite enables more comprehensive health monitoring, though Whoop's focus produces superior HRV-specific analysis. For users primarily interested in recovery optimization, Whoop remains specialized; for users seeking holistic health tracking, Cirqa offers greater capabilities.

Algorithm Quality and Recovery Recommendations

Both companies employ machine learning algorithms to synthesize raw biometric data into actionable insights. Whoop's algorithms specialize in recovery prediction and training optimization for serious athletes. Garmin's algorithms integrate training data with broader health context.

Whoop's approach:

- Recovery score synthesizes sleep, HRV, and resting heart rate changes

- Strain measurement specifically quantifies training load

- Recommendations focus on training optimization

- Specialized expertise in athlete physiology

Garmin's approach:

- Body Battery combines training load with stress and sleep

- Training effect contextualizes activity within overall fitness progression

- Recommendations address training, recovery, and general wellness

- Broader integration with fitness ecosystem

For elite athletes optimizing for specific events, Whoop's specialized algorithms provide marginal advantages. For broader populations seeking health optimization, Garmin's integrated approach may prove more valuable.

Data Ownership and Privacy

A significant differentiator emerges in data ownership philosophy. Whoop functions as a proprietary closed system—users cannot export raw data or use alternative analysis tools. This approach enables Whoop to maintain proprietary algorithmic advantages but creates lock-in concerns.

Garmin offers API access to Garmin Connect data, enabling third-party integrations and data export. Users can export raw metrics, integrate with other platforms, and build custom analyses. This openness appeals to power users and developers.

Expected Cirqa data philosophy:

- User ownership of raw biometric data

- Standard format export capabilities

- API access for developers and partners

- Privacy controls enabling selective data sharing

- No requirement to share data with third parties for basic functionality

This philosophical difference reflects broader market trends toward consumer data rights and transparency. Younger consumers increasingly value data portability and control—Garmin's open approach addresses this emerging preference.

Ecosystem Integration

Whoop operates independently from other fitness platforms. Data integration exists through partnerships with Training Peaks and other platforms, but Whoop maintains strict control over its core data.

Garmin Connect integrates with hundreds of third-party services through official partnerships and API access:

- Training platforms: Training Peaks, Zwift, My Fitness Pal

- Recovery tools: Stryd, Whoop (ironically), Apple Health

- Social networks: Strava, Facebook

- Health platforms: Google Fit, Samsung Health

- Smart home: Control of smart speakers and home automation through Garmin devices

This ecosystem integration creates network effects—users with existing Garmin watches gain additional value from Cirqa through unified data visualization and cross-device insights. Users without Garmin devices face no disadvantage but miss optimization opportunities.

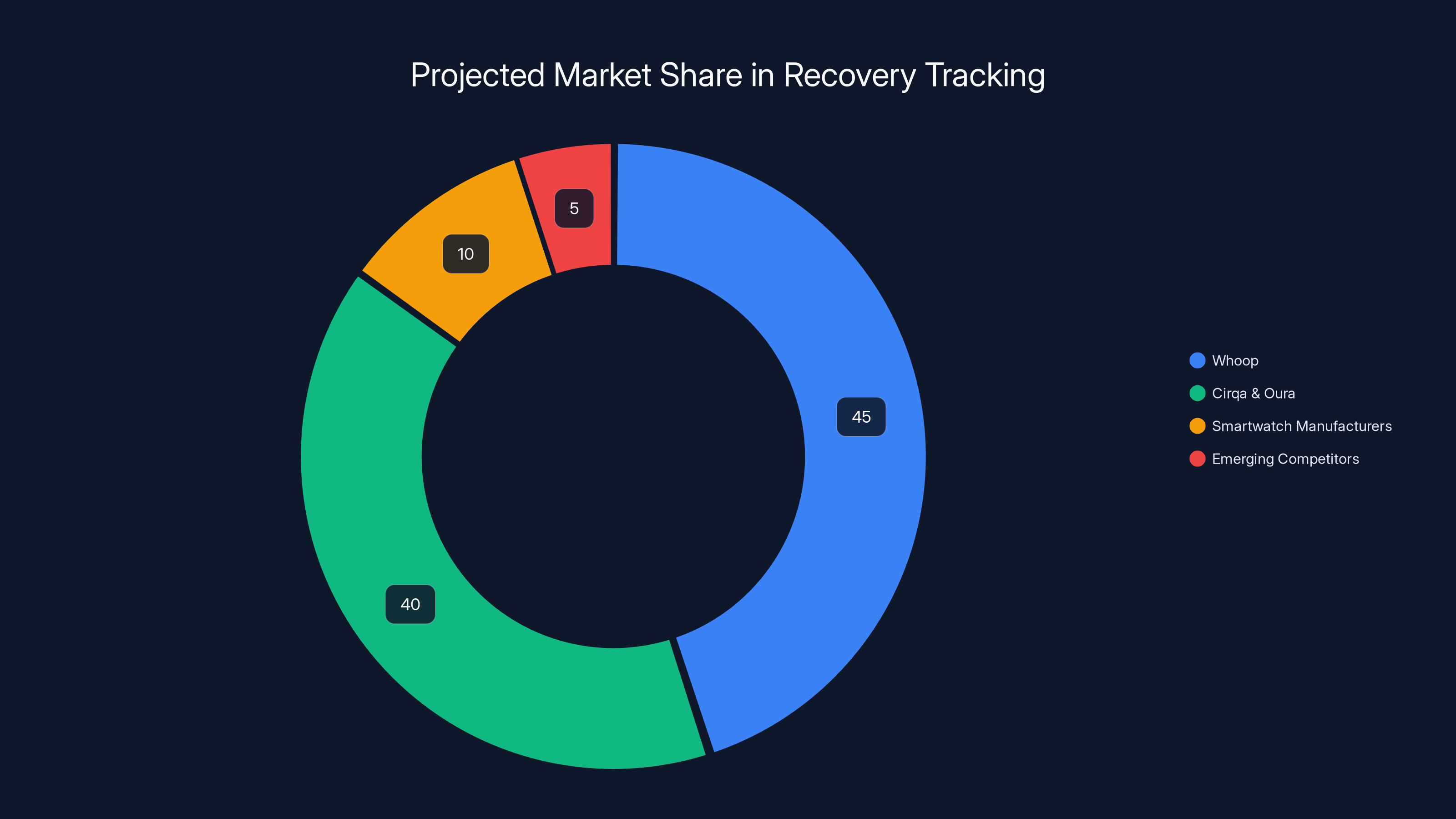

Estimated data suggests Whoop will maintain a leading position with 45% market share, while Cirqa and Oura capture 40%. Smartwatch manufacturers and emerging competitors fill the remaining 15%.

Target User Profiles and Ideal Use Cases

Serious Endurance Athletes

Endurance athletes—runners, cyclists, triathletes, and trail runners—represent the natural target market for Cirqa. These athletes already understand training load, recovery, and periodization. They actively use training platforms like Training Peaks and value data-driven optimization.

For endurance athletes, Cirqa delivers:

- Training load quantification: Precise metrics for balancing training intensity and recovery

- VO2 Max tracking: Progressive improvement monitoring across training cycles

- Altitude acclimatization: Sp O2 and respiratory rate changes tracking adaptation

- Overtraining detection: Early warning systems for accumulated fatigue

- Recovery optimization: Training adjustment recommendations preventing injury

- Multi-day event preparation: Race-specific training load management

The typical endurance athlete profile expects to spend

Team Sports and Collegiate Athletes

Team sports environments increasingly adopt wearable monitoring for injury prevention and performance optimization. Cirqa's ability to aggregate team data within Garmin Connect enables coaching staff to monitor athlete readiness, manage training loads, and detect overtraining.

For team environments:

- Load balancing: Distribute athletes across different recovery states

- Injury prevention: Identify athletes at elevated injury risk

- Return-to-play monitoring: Track readiness following injury rehabilitation

- Training periodization: Align team training intensity with competition schedules

- Compliance tracking: Verify athletes completing prescribed recovery activities

Collegiate athletic budgets typically allocate

General Health and Wellness Consumers

Beyond athletic applications, Cirqa appeals to health-conscious consumers prioritizing sleep quality, stress management, and general wellness. These users may not follow formal training plans but value understanding their physiological responses to life stress.

For wellness-focused users:

- Sleep quality optimization: Understanding sleep architecture and improvement strategies

- Stress monitoring: Tracking daily stress levels and identifying stressors

- Activity balance: Ensuring appropriate exercise without overexertion

- Recovery insights: Understanding individual recovery patterns

- Health trend tracking: Monitoring changes in resting heart rate, HRV, and sleep quality

This segment values simplicity and actionable insights over raw data granularity. Garmin's strength in translating metrics into comprehensible guidance makes Cirqa appealing. Users in this category might pay $200 for a device but likely won't adopt paid subscriptions—Garmin's freemium model serves this segment well.

Personal Trainers and Fitness Coaches

Fitness professionals increasingly use wearable data to optimize client programming. Cirqa enables coaches to access client recovery metrics, adjust programming based on readiness, and demonstrate effectiveness to clients.

Coach-relevant features:

- Client readiness assessment: Adjust training intensity based on recovery metrics

- Training compliance: Verify clients completing prescribed activities

- Progress visualization: Demonstrate fitness improvements through objective metrics

- Injury prevention: Early detection of overtraining or inadequate recovery

- Accountability enhancement: Clients more committed when tracking comprehensive metrics

Personal trainers represent a high-value customer segment willing to invest in client monitoring tools. A trainer managing 20 clients could justify purchasing Cirqa units for each, creating a $4,000+ investment generating additional revenue through improved retention and pricing justification.

Market Reception Predictions and Competitive Dynamics

Whoop's Potential Response Strategies

Whoop holds several advantages in the face of Garmin's entry. The company has invested heavily in athlete partnerships, branded training resources, and professional sports integration. Whoop athletes and teams create network effects encouraging others to adopt the platform. In response to Cirqa's launch, Whoop might:

- Reduce subscription pricing: Currently 20/month to improve value positioning

- Expand hardware offerings: Develop a smart band product similar to Cirqa

- Strengthen ecosystem partnerships: Deepen integrations with Training Peaks, Strava, and other platforms

- Emphasize data specialization: Market HRV and recovery expertise as distinct from broad health monitoring

- Accelerate feature development: Introduce new analytics and recommendation capabilities

Whoop's greatest strength is brand loyalty—the company has cultivated a community of professionals and serious athletes who view Whoop as the recovery standard. Switching costs extend beyond data export to abandoning community participation and peer validation.

Market Fragmentation Scenarios

Cirqa's arrival likely won't eliminate Whoop but will fragment the recovery tracking market into distinct segments. Potential market structure:

- Specialist recovery focus (Whoop): 40-50% of market share; athletes prioritizing maximum recovery optimization

- Integrated health monitoring (Cirqa, Oura): 35-45% of market share; users seeking comprehensive biometric tracking

- Smartwatch manufacturers (Apple, Samsung): 10-20% of market share; users accepting moderate recovery features within broader smartwatch functionality

- Emerging competitors: 5-10% of market share; specialized niches and regional players

This fragmentation reflects maturation of the wearables market—no single product serves all needs, and consumer preference diversifies as features reach parity.

Pricing War Potential and Industry Impact

Garmin's $200-250 hardware pricing combined with optional subscriptions initiates a pricing rationalization across the industry. Current pricing structures appear vulnerable:

- Whoop's $360 annual subscription seems excessive when Garmin offers comparable features through lower hardware cost and optional subscriptions

- Apple Watch's $399+ pricing justified through computing capabilities beyond health tracking

- Oura Ring's $349 pricing positioned between Cirqa and smartwatches

Industry pressure will likely drive:

- Subscription pricing consolidation: Moving toward 30+ mandatory subscriptions

- Free tier expansion: All major players offering basic metrics without subscription requirements

- Hardware cost reduction: Competition driving manufacturing optimization

- Feature commoditization: Advanced metrics (HRV, sleep staging) becoming standard rather than premium

These dynamics benefit consumers through lower pricing and greater feature access. Garmin's entry effectively democratizes recovery tracking, making sophisticated health monitoring accessible beyond premium price points.

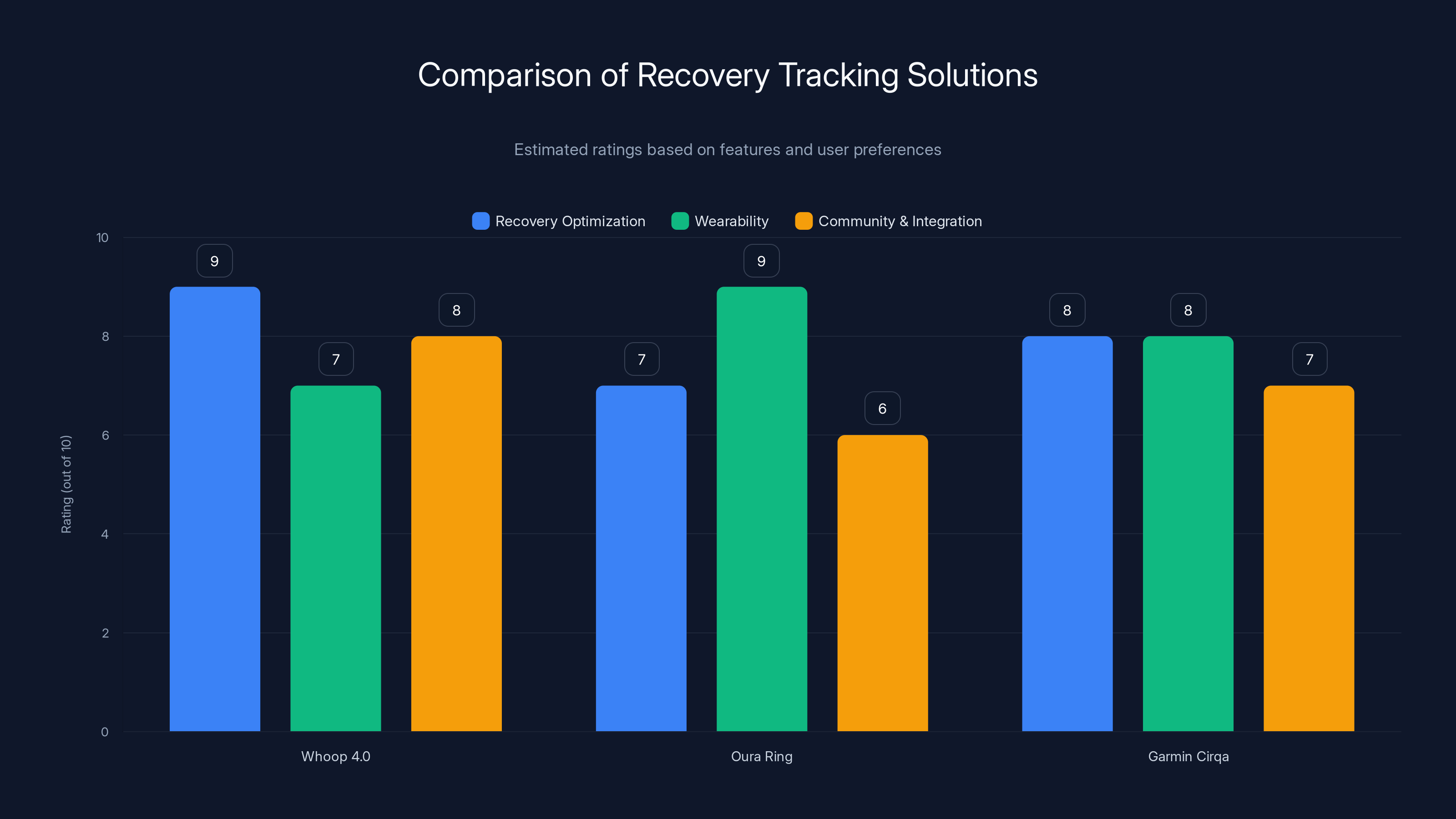

Whoop 4.0 excels in recovery optimization, while Oura Ring leads in wearability. Garmin Cirqa offers balanced features. Estimated data based on typical user preferences.

Technical Implementation: How Cirqa Works Behind the Scenes

Data Collection and Synchronization Architecture

The Cirqa employs sophisticated data collection methodology balancing accuracy with battery efficiency. Continuous monitoring throughout the day records:

- Every heartbeat detection: Optical sensors sample at 512 Hz during the day, detecting individual heartbeats

- Movement data: Accelerometers recording 3D motion at 20-100 Hz depending on activity type

- Periodic biometric updates: Respiratory rate and temperature measured during motion-stable periods

- Sleep-specific monitoring: Enhanced sampling during sleep when user is stationary

Data synchronization leverages Bluetooth Low Energy (BLE) technology, enabling constant wireless connectivity with paired smartphones. The Cirqa likely employs intelligent sync strategies:

- Automatic sync: When smartphone is nearby and battery is adequate

- Scheduled sync: Overnight syncing to minimize battery drain during daytime

- On-demand sync: Manual triggering through app interface for immediate data refresh

- Differential sync: Only updated metrics synchronized; unchanged data cached locally

This architecture enables offline functionality—the Cirqa operates independently during periods without smartphone connectivity, storing data locally until connection restoration.

Machine Learning Model Architecture for Recovery Prediction

The algorithmic complexity underlying Cirqa's recovery recommendations reflects years of Garmin's machine learning development. Expected model structure includes:

Ensemble learning approach: Multiple specialized models combine predictions

- HRV prediction model: Forecasts next-day HRV based on historical patterns

- Sleep quality model: Predicts sleep duration and quality given current stress levels

- Recovery rate model: Estimates physiological recovery progression throughout the day

- Strain impact model: Projects training load effects on recovery timeline

These models likely employ gradient boosting (XGBoost) or neural network architectures trained on Garmin's historical data. Training data includes billions of days of real-world user data with known outcomes—if a user had high strain and low sleep, what was the recovery outcome 48 hours later?

Personalization layer: Raw model predictions are adjusted for individual physiological characteristics

- Baseline establishment: Initial 1-2 weeks collecting data to establish personal norms

- Sensitivity factors: Individual physiological responsiveness to training stress

- Chronotype adjustment: Morning people versus night owls show different patterns

- Age and fitness level normalization: Baselines adjust for demographic factors

This personalized approach enables the Cirqa to provide accurate guidance despite physiological variation across the user base.

Real-Time Data Processing and On-Device Computation

The Cirqa executes sophisticated analysis on the device itself rather than relying entirely on cloud processing. This on-device computation enables:

- Immediate metric availability: Users see current metrics without cloud dependency

- Privacy protection: Sensitive health data can be processed locally

- Battery efficiency: Reduces wireless transmission requirements

- Offline functionality: Metrics remain available without connectivity

Expected on-device processing includes:

- Beat detection algorithms: Converting raw optical sensor data into individual heartbeat detection

- HRV calculation: Computing beat-to-beat variability metrics

- Sleep stage classification: Real-time determination of sleep stage through movement and heart rate analysis

- Activity recognition: Identifying activity types (running, cycling, swimming, etc.) without explicit user input

More complex algorithms (recovery prediction, long-term trend analysis) execute on cloud servers, enabling continuous model updates and sophisticated computations that would drain device batteries.

Cloud-Based Analytics and Trend Analysis

Garmin Connect servers execute sophisticated analysis on aggregated data:

- Long-term trend detection: Identifying gradual changes in HRV, sleep quality, or resting heart rate indicating fitness progress or declining health

- Predictive modeling: Forecasting future metrics based on historical patterns

- Anomaly detection: Identifying unusual physiological events warranting user attention

- Competitive analysis: (Optional) Comparing personal metrics to population benchmarks

- Recommendation generation: Creating personalized guidance based on analysis

Potential Challenges and Limitations

Optical Heart Rate Sensing Accuracy Limitations

Optical heart rate sensing, while sophisticated, faces inherent limitations. Tattoos, darker skin tones, and different vascular patterns affect sensor accuracy. Garmin's multi-band approach mitigates these issues but doesn't eliminate them entirely. Users with heavily tattooed wrists or unusual vascular patterns may experience reduced accuracy.

Motion artifacts present another challenge—during intense activities, motion-induced sensor displacement increases false beat detection. Garmin's algorithms filter motion artifacts, but extremely vigorous activities sometimes produce less accurate metrics. Wrist-mounted sensors also miss chest-mounted accuracy, relevant for athletes requiring clinical-grade measurements.

Sleep Stage Detection Methodology Questions

Sleep stage classification (REM versus light versus deep) relies on movement patterns and heart rate variability—algorithms lack the EEG data used in clinical sleep studies. This methodology produces good accuracy for sleep staging but cannot match medical-grade polysomnography. Users seeking clinical sleep apnea evaluation require professional sleep studies, not wearable assessment.

Battery Life Trade-offs

Extended battery life (8-10 days) requires compromises in sampling frequency, display functionality, or computing capability. Garmin's 8-10 day estimate might prove optimistic with continuous color display usage and real-time processing. Actual battery life likely ranges 5-8 days depending on use patterns—still superior to Whoop but requiring more frequent charging than claimed.

Subscription Value Proposition Ambiguity

Garmin hasn't clearly specified what premium features warrant subscription payment. If core recovery analysis remains free, what justifies premium subscriptions? This positioning differs fundamentally from Whoop's mandatory subscription model—if Cirqa doesn't require subscriptions for basic operation, the value exchange becomes murky. Consumers may resist optional subscriptions if base functionality already provides sufficient insights.

Ecosystem Dependency and Fragmentation Risk

Circa's value increases substantially with Garmin Connect integration. Users without existing Garmin devices receive less benefit—the device becomes another standalone tracker rather than part of comprehensive ecosystem. This creates ecosystem dependency, potentially disadvantaging new Garmin customers compared to existing users.

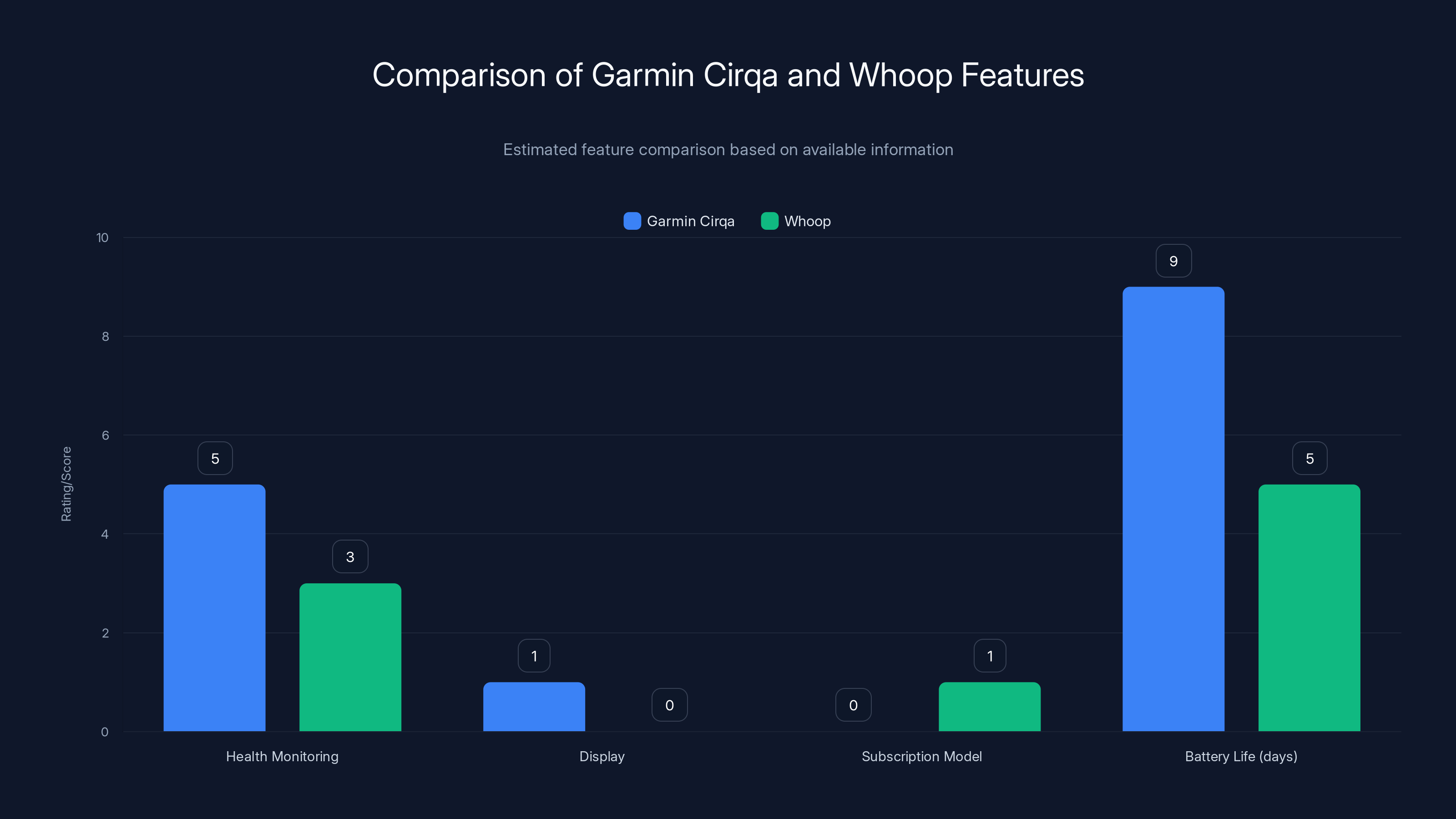

Garmin Cirqa offers broader health monitoring and longer battery life compared to Whoop. Cirqa's hardware-first pricing model is more flexible than Whoop's subscription model. Estimated data based on feature descriptions.

Alternative Solutions and Competitive Consideration: Exploring Your Options

While Garmin's Cirqa presents compelling features, several alternative solutions address recovery tracking and health monitoring from different angles. For teams evaluating recovery tracking solutions, the competitive landscape offers distinct value propositions.

Whoop 4.0: The Established Specialist

Whoop remains the gold standard for athletes prioritizing maximum recovery optimization. The platform's specialized focus on HRV, strain, and recovery metrics delivers unmatched depth in these specific domains. Whoop's community features, athlete partnerships, and professional sports integration create network effects that persist despite competitive entry.

Whoop's ideal for:

- Elite endurance athletes optimizing for specific events

- Teams with substantial budgets for comprehensive monitoring

- Athletes committed to data-driven training optimization

- Users prioritizing recovery specialization over general health monitoring

Current pricing ($30/month) remains premium but reflects specialized expertise. For users willing to pay subscription costs, Whoop delivers unmatched value despite Cirqa's comparable general health metrics.

Oura Ring: Form Factor Innovation

Oura Ring offers recovery tracking through a novel wearable form factor—a lightweight ring rather than band or watch. This design choice appeals to users for whom visible wearables present social friction. Rings integrate seamlessly into daily life without requiring visible technology.

Oura Ring strengths:

- Exceptional comfort and discrete wearability

- Strong sleep architecture analysis

- Optional subscription model similar to Cirqa's expected approach

- Growing third-party integrations

Oura limitations:

- Smaller display screen limits real-time metric access

- Slightly shorter battery life (3-4 days)

- Smaller user community than Whoop or Garmin

- Ring sizing complexity and potential fit issues

For users prioritizing discrete wearables and sleep analysis, Oura Ring presents compelling alternative with midpoint pricing ($299-399) between Cirqa and Apple Watch.

Apple Watch: Comprehensive Platform Integration

Apple Watch doesn't specialize in recovery tracking but offers comprehensive health monitoring integrated throughout iOS ecosystem. Watch Series 9 and Ultra models provide:

- Heart rate variability tracking

- Advanced sleep analysis (with third-party apps)

- Activity tracking with move, stand, exercise rings

- Health integration with iPhone and iPad

- Seamless payments, communication, and control

Apple Watch ideal for:

- Apple ecosystem users seeking unified experience

- Users valuing computing capabilities beyond health monitoring

- Consumers prioritizing social acceptability and fashion

- Users wanting comprehensive notifications and communication

Apple Watch limitations in recovery context:

- HRV and recovery metrics less sophisticated than specialized devices

- Sleep analysis less detailed than Whoop or Cirqa

- Limited export capabilities compared to Garmin

- $399+ pricing reflects computing capabilities beyond health

For Apple users already invested in the ecosystem, Apple Watch delivers adequate recovery tracking without additional device investment. For pure health focus, specialized devices provide superior functionality.

Fitbit: Affordable Gateway to Health Tracking

Google's Fitbit maintains strong market position through affordability and simplicity. Fitbit Sense 2 and Charge 6 offer basic recovery features at lower price points ($99-299).

Fitbit strengths:

- Affordable entry point to wearable health tracking

- Excellent sleep and activity tracking

- Simple, intuitive user interface

- Integration with Google ecosystem

- Extensive app library and third-party partnerships

Fitbit limitations:

- Less sophisticated recovery algorithms than Whoop or Cirqa

- Limited HRV-specific analysis

- Smaller athlete community

- Recovery recommendations less detailed

Fitbit serves budget-conscious consumers and those seeking basic health tracking without specialization. For serious athletes requiring advanced metrics, Fitbit provides insufficient analytical depth.

Runable AI Platform: Workflow Automation for Teams

For organizations managing multiple athletes or building custom recovery tracking systems, Runable offers a complementary approach through AI-powered automation tools starting at $9/month. Rather than replacing specialized wearables, Runable enables teams to:

- Automate recovery data aggregation: Pull metrics from multiple devices (Whoop, Cirqa, Apple Watch) into unified dashboards

- Generate automated athlete reports: AI-powered document generation summarizing recovery trends and recommendations

- Create workflow automations: Trigger notifications and actions based on recovery metrics crossing thresholds

- Build custom analyses: Develop personalized recovery assessment tools through automation

- Manage team communication: Automate coaching recommendations based on athlete recovery status

Runable's value lies not in replacing wearable devices but in amplifying value through intelligent automation. Teams could use Cirqa hardware while Runable processes and acts on that data at scale. For organizations with multiple athletes, Runable's $9/month cost becomes negligible against the efficiency gains from automating recovery data workflows.

Runable particularly appeals to:

- Coaching teams managing 20+ athletes

- University athletic departments

- Sports science researchers analyzing multiple data sources

- Fitness facilities coordinating member training programs

Launch Timeline and Industry Impact Assessment

Expected Launch Timeline and Market Availability

Based on the website leak and typical product development cycles, Garmin likely prepares Cirqa for launch in Q2-Q3 2025. The company typically provides 2-3 weeks advance notice before major product announcements, followed by immediate retail availability.

Expected timeline:

- January-February 2025: Official announcement with detailed specifications

- March-April 2025: Initial product reviews and influencer partnerships

- May 2025: Retail launch at Best Buy, Amazon, REI, and official Garmin channels

- June-July 2025: Production ramp-up to meet demand

- August 2025+: Software updates adding features and optimization

Garmin typically stocks products adequately to avoid shortages seen with Apple Watch and other premium launches. Consumers should expect reasonable availability throughout 2025.

Broader Industry Implications

Circa's launch initiates significant industry shifts beyond simple competition with Whoop:

Pricing normalization: Hardware-first pricing with optional subscriptions becomes industry standard, reducing Whoop's pricing advantage.

Feature commoditization: Advanced metrics (HRV, sleep staging) become standard across premium wearables rather than specialist differentiators.

Ecosystem integration: Wearables increasingly integrate within broader technology ecosystems (Apple, Google, Garmin) rather than functioning independently.

Data accessibility: Consumer expectations for data export and API access increase, forcing competitors to reduce lock-in mechanisms.

Specialization narrowing: Competitors must demonstrate clear differentiation; generalist health tracking insufficient for premium pricing.

Garmin's entry accelerates the maturation of wearables from novelty to commodity, ultimately benefiting consumers through choice, competition, and innovation.

Making Your Decision: Cirqa vs. Whoop vs. Alternatives

Decision Framework: Evaluating Your Priorities

Choosing between recovery tracking solutions requires clear prioritization of values. Different users prioritize different aspects:

Priority 1: Maximum Recovery Optimization → Choose Whoop; its specialized algorithms and HRV focus deliver maximum recovery insights despite premium pricing

Priority 2: Overall Health Monitoring + Recovery Tracking → Choose Cirqa; broader sensor suite and integrated health analysis serve diverse needs

Priority 3: Discrete Wearable and Sleep Focus → Choose Oura Ring; form factor and sleep analysis differentiate clearly

Priority 4: Ecosystem Integration and Notifications → Choose Apple Watch; computing capabilities and ecosystem integration justify premium pricing

Priority 5: Budget Constraints and Accessibility → Choose Fitbit; affordable entry point to wearable health tracking

Total Cost of Ownership Calculation

Beyond purchase price, consider three-year ownership costs:

Whoop investment:

Price alone shouldn't drive decisions, but true TCO reveals real value differences.

Feature Matching Exercise

Create a decision matrix weighting your priorities:

| Feature | Weight | Whoop | Cirqa | Oura | Apple Watch |

|---|---|---|---|---|---|

| Recovery optimization | 25% | 5/5 | 4/5 | 3/5 | 3/5 |

| Sleep analysis | 20% | 4/5 | 5/5 | 5/5 | 3/5 |

| Real-time metric access | 15% | 2/5 | 5/5 | 3/5 | 5/5 |

| Data portability | 15% | 2/5 | 5/5 | 4/5 | 3/5 |

| Ecosystem integration | 10% | 3/5 | 5/5 | 3/5 | 5/5 |

| Price value | 15% | 2/5 | 5/5 | 3/5 | 3/5 |

Score devices 1-5 per category, multiply by weight, sum totals. This exercise personalizes decision-making beyond generic recommendations.

FAQ

What is the Garmin Cirqa smart band?

The Garmin Cirqa is an upcoming health and recovery tracking smart band designed to compete with Whoop by providing sophisticated biometric analysis and recovery recommendations. The device combines optical heart rate sensing with advanced algorithms to measure sleep quality, stress levels, training load, and recovery status, delivering metrics through a small AMOLED display with Garmin Connect integration.

How does the Cirqa differ from Whoop in terms of features?

While both devices track recovery metrics, Cirqa offers broader health monitoring through additional sensors (skin temperature, Sp O2, respiratory rate) that Whoop lacks, plus a color display enabling on-device metric viewing without smartphone extraction. Whoop specializes in HRV-specific analysis and recovery optimization, while Cirqa integrates recovery tracking within comprehensive health monitoring and its broader Garmin ecosystem. The fundamental difference lies in Cirqa's hardware-first pricing model versus Whoop's mandatory subscription approach.

What is the expected price for the Garmin Cirqa?

Leaked specifications suggest Cirqa will launch at approximately

What battery life can I expect from Cirqa?

Garmin's specifications indicate 8-10 days of battery life between charges, substantially exceeding Whoop's 5-day cycle. This extended duration reduces charging friction, particularly for travelers and athletes with complex schedules. Actual battery life varies based on display usage frequency and continuous processing demands, with real-world performance likely ranging 5-8 days.

How does Cirqa integrate with other fitness platforms and apps?

Circa will integrate with Garmin Connect, which connects to hundreds of third-party fitness services including Training Peaks, Zwift, Strava, My Fitness Pal, and Apple Health. This ecosystem integration enables comprehensive fitness tracking across multiple platforms, whereas Whoop operates as a standalone system with limited partnerships. API access enables developers to build custom integrations and analyses.

Should I choose Cirqa or Whoop for serious athletic training?

The choice depends on prioritization: choose Whoop if maximum recovery optimization and specialized HRV analysis are paramount, or Cirqa if you want broader health monitoring combined with recovery insights at lower cost. Elite endurance athletes optimizing for specific events often prefer Whoop's specialization, while recreational athletes and multi-sport participants may prefer Cirqa's integrated approach. Consider trying both platforms' trials before committing to longer-term investment.

Can the Cirqa replace my current smartwatch?

Circa functions as a dedicated health and recovery tracking device rather than a comprehensive smartwatch. It provides limited notifications and communication features compared to Apple Watch or Samsung Galaxy Watch. If you need smartwatch capabilities (calls, texts, payment, extensive app support), maintaining a separate watch alongside Cirqa makes sense. However, if you prioritize health metrics over smartwatch features, Cirqa eliminates the need for separate devices.

What happens if I'm not in the Garmin ecosystem already?

Circa operates independently of other Garmin devices—you don't need existing Garmin watches or fitness trackers to benefit from Cirqa. However, ecosystem value increases significantly if you own other Garmin devices, as unified data visualization and cross-device insights optimize analysis. New users can still derive substantial value from Cirqa's standalone functionality, missing only the additional insights available through ecosystem integration.

How does Garmin's approach to data privacy differ from Whoop?

Garmin offers greater data transparency and control compared to Whoop's closed ecosystem. Users can export biometric data, integrate with third-party services through APIs, and maintain ownership of health information. Garmin's privacy policies enable selective data sharing rather than requiring wholesale company access. For privacy-conscious consumers, Garmin's open approach provides significant advantages over Whoop's proprietary data model.

Is Cirqa waterproof enough for swimming and water sports?

Expected specifications indicate 50-meter water resistance, adequate for swimming and snorkeling but insufficient for diving. This standard matches Whoop's rating and most premium fitness trackers. Resistance to chlorine and saltwater varies—fresh water swimming presents no issues, while frequent saltwater immersion may accelerate sensor degradation. Rinse devices with fresh water after saltwater exposure to maximize longevity.

When will the Garmin Cirqa officially launch?

Based on Garmin's typical product cycles and the website leak, official announcement likely occurs in early 2025, with retail availability expected in May-June 2025. Garmin typically provides adequate inventory at launch, avoiding the shortages common with other premium wearables. Interested consumers should monitor Garmin's official website and major retailers for announcement details and pre-order opportunities.

Conclusion: Navigating the Evolution of Recovery Tracking

Garmin's Cirqa smart band represents a watershed moment for the recovery tracking industry. For nearly a decade, Whoop operated with minimal direct competition, establishing premium pricing and mandatory subscription models. Cirqa's arrival signals that recovery tracking has transitioned from specialized niche to mainstream fitness category, with established technology companies deploying significant resources to serve this market segment.

The leaked specifications reveal a device built not to replicate Whoop's approach but to offer distinct philosophy: comprehensive health monitoring integrated within broader fitness ecosystem, optional rather than mandatory subscriptions, and data ownership transparency rather than proprietary lock-in. This positioning doesn't invalidate Whoop's value proposition—the company's specialization in HRV and recovery optimization remains unmatched—but it democratizes access to sophisticated health metrics previously available only through premium subscriptions.

For consumers evaluating recovery tracking solutions in 2025, the expanded choice improves outcomes. Budget-conscious athletes can now access advanced biometric analysis without $360 annual subscription commitments. Casual fitness enthusiasts benefit from Fitbit's affordability and Apple Watch integration. Elite athletes requiring maximum optimization still find Whoop's specialization valuable despite new competition. Oura Ring users benefit from expanded feature development driven by competitive pressure. The rising tide of competition lifts all boats through innovation acceleration and pricing rationalization.

The broader implications extend beyond device selection. Garmin's entry validates recovery tracking as essential rather than optional for serious athletes. Coaching programs, athletic departments, and professional teams will increasingly adopt recovery monitoring as standard practice. The next decade will see recovery science transition from specialized protocol to routine athletic practice, with wearable devices serving as primary data collection mechanisms.

Technology integration will accelerate. Expect Cirqa's successors to incorporate advanced sensing (continuous glucose monitoring, lactate measurement, core body temperature) currently available only through professional sports labs. Machine learning algorithms will improve through competitive data collection and model refinement. Ecosystem integration will deepen, with recovery data informing everything from training recommendations to dietary guidance.

Yet beneath technological advancement lies fundamental truth: understanding your body's recovery status enables better training decisions, injury prevention, and performance optimization. Whether you choose Cirqa, Whoop, Oura Ring, or an alternative solution, the act of measuring and monitoring recovery improves outcomes. No device or algorithm replaces proper sleep, appropriate training loads, and adequate nutrition—recovery tracking amplifies these fundamentals through data-driven insights.

As you evaluate solutions, remember that optimal choice depends on personal priorities rather than universal superiority. Professional endurance athletes pursuing marginal gains may justify Whoop's specialization and premium pricing. Casual fitness enthusiasts may find Fitbit's affordability and simplicity more appropriate. Health-conscious professionals may value Cirqa's comprehensive monitoring within Garmin's ecosystem. Discrete wearable advocates may prefer Oura Ring's unique form factor. Technology enthusiasts may choose Apple Watch for ecosystem integration.

The convergence of sophisticated sensors, machine learning algorithms, and consumer awareness has democratized access to health intelligence. Garmin's Cirqa represents the next chapter in this evolution—not the final destination, but a significant step toward making advanced recovery science accessible to anyone pursuing improved health and performance. Whatever device you choose, the opportunity to optimize recovery through data-driven insights has never been more available or more valuable.

Start your evaluation today by clarifying your priorities, calculating total cost of ownership, and considering how each solution integrates with your existing technology ecosystem. Test competing devices if possible through trial programs or store demonstrations. Remember that no device perfectly suits every user—optimal choice reflects your unique values, goals, and constraints. The competitive landscape now offers genuine alternatives at multiple price points. Choose wisely, measure consistently, and let data inform your training decisions. The future of athletic performance lies not in harder training but in smarter recovery—and the tools to enable that intelligence now exist within reach.

Key Takeaways

- Garmin's Cirqa represents major competitive entry into recovery tracking market previously dominated by Whoop

- Expected 30/month mandatory model

- Cirqa integrates broader health monitoring (temperature, SpO2) beyond Whoop's HRV specialization within comprehensive Garmin ecosystem

- Device includes color AMOLED display enabling on-wrist metric viewing, addressing Whoop's smartphone dependency limitation

- 8-10 day battery life substantially exceeds Whoop's 5-day cycle, reducing charging friction for athletes and travelers

- Garmin's open data philosophy with API access contrasts with Whoop's proprietary ecosystem and lock-in model

- Competitive alternatives including Oura Ring, Apple Watch, and Fitbit serve distinct market segments with different priorities

- Recovery tracking market experiencing transition from specialist niche to mainstream fitness category through competitive pressure

- Feature commoditization drives industry pricing normalization toward lower-cost hardware with optional premium subscriptions

- Choice between recovery trackers depends on individual prioritization of specialization, ecosystem integration, form factor, and budget constraints

Related Articles

- Subscription-Free Whoop Alternatives: Complete Guide to Screenless Wearables 2025

- Apple's AI Pin Strategy: Why It Misses the Mark [2025]

- Mentra Live Smart Glasses: Open-Source AR & App Store Guide [2025]

- Amazon Bee AI Wearable: Complete Guide & Alternatives [2025]

- Motorola Moto Watch 2026: 13-Day Battery, Polar Health Tracking Explained

- Vocci AI Note-Taking Ring: Complete Guide & Alternatives 2025

![Garmin Cirqa Smart Band: Complete Analysis & Alternatives [2025]](https://tryrunable.com/blog/garmin-cirqa-smart-band-complete-analysis-alternatives-2025/image-1-1769519264207.jpg)