The Subscription Cost Problem: Why Users Are Looking Beyond Whoop

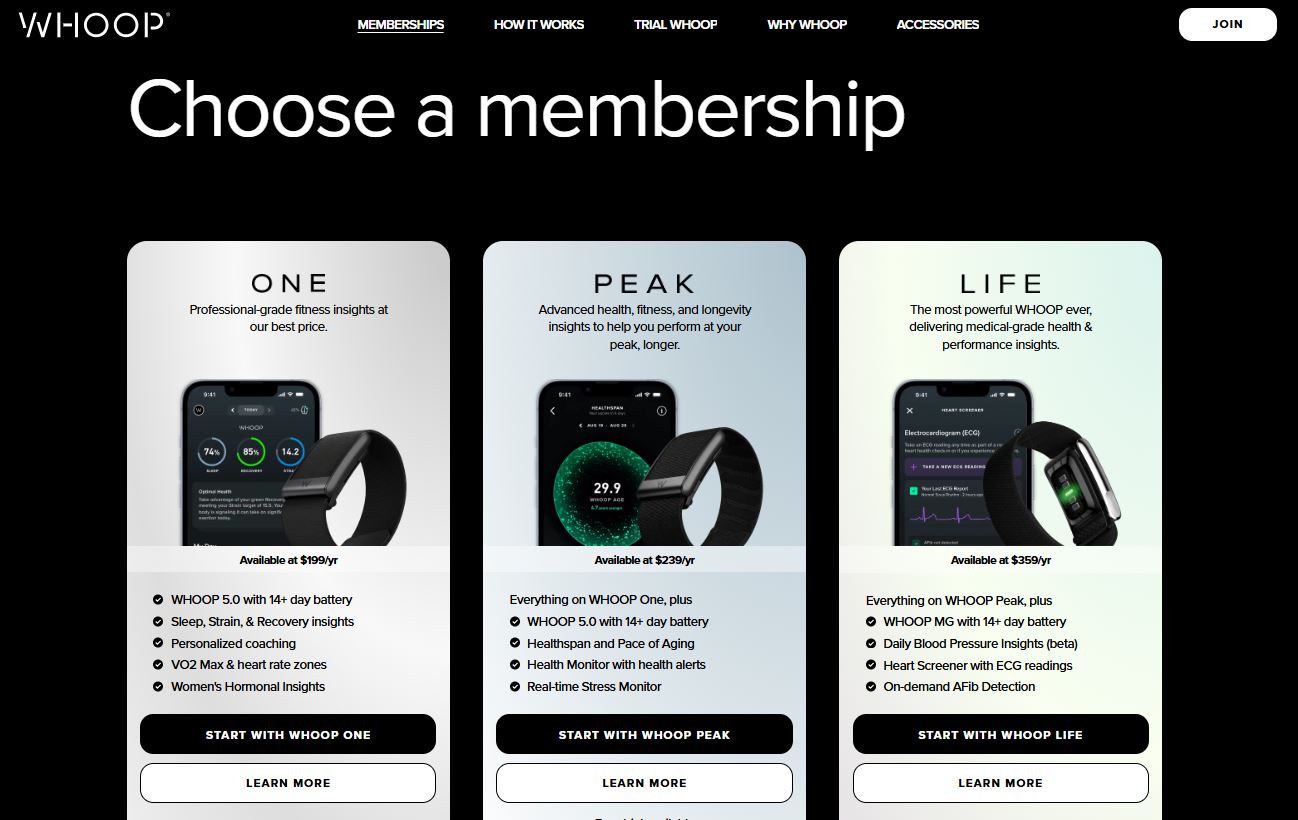

The fitness wearable market has experienced explosive growth over the past five years, with innovations in biometric sensing, AI-powered analytics, and personalized health insights transforming how athletes and fitness enthusiasts monitor their performance. However, one significant barrier has emerged that's driving consumers away from premium platforms: the subscription model. Whoop, one of the most talked-about wearables on the market, revolutionized sports performance tracking with its focus on recovery and strain metrics, but the mandatory subscription fee—ranging from

Users who invest in a Whoop band aren't just purchasing a device; they're committing to an ongoing financial relationship that can easily exceed

What's particularly interesting is that the market has evolved significantly since Whoop's launch. Modern fitness trackers now incorporate artificial intelligence, advanced biosensing capabilities, and sophisticated algorithms that were previously exclusive to premium-tier devices. Battery life has improved dramatically, form factors have become more diverse, and free software ecosystems have matured considerably. This convergence means that users no longer face a binary choice between Whoop's premium offering and basic step counters—there's now a rich middle ground of alternatives that deliver meaningful health and fitness insights without subscription barriers.

The timing of this shift is critical. As consumers become more health-conscious and wearable adoption reaches mainstream markets, the decision of whether to pay recurring subscription fees becomes increasingly important. Many users are discovering that they can achieve their fitness goals, track their recovery, monitor their sleep quality, and receive actionable insights through alternatives that charge a one-time fee or offer free services entirely. This article explores the comprehensive landscape of subscription-free wearables, with particular attention to screenless, voice-led devices that represent the cutting edge of minimalist wearable design.

Understanding Whoop's Market Position and What Made It Dominant

Whoop carved out a unique niche in the competitive fitness wearable market by focusing exclusively on recovery and strain metrics rather than trying to be an all-in-one fitness tracker. Traditional fitness trackers from companies like Fitbit and Garmin offered heart rate monitoring, step counting, and basic sleep tracking alongside their premium features. Whoop stripped away the screen, the smartphone-centric design, and the feature bloat, instead creating a minimalist band that communicated exclusively through smartphone notifications and a companion app.

This minimalist approach resonated powerfully with serious athletes and fitness enthusiasts who valued data quality over user interface novelty. Whoop's proprietary algorithms analyzed heart rate variability, sleep duration, sleep quality, respiratory rate, and skin temperature to generate recovery and strain scores that helped users understand their physiological readiness for training. The data science behind these metrics was impressive—the company invested heavily in research partnerships with elite sports teams and universities to validate their algorithms.

The subscription model, while controversial, initially seemed justified by the computational power and algorithmic sophistication powering the platform. Whoop's data scientists continuously improved their algorithms, added new metrics, and expanded their analysis capabilities. The subscription provided ongoing access to these improvements, regular coaching insights, and what Whoop positioned as premium-tier athlete analytics. For professional athletes and serious enthusiasts, the

However, several factors have eroded Whoop's competitive moat. First, the broader wearable market caught up technologically. Garmin, Apple, Fitbit, and newer entrants all incorporated similar biometric sensors and developed their own recovery metrics. Second, the rise of voice-led interfaces and AI-powered wearables created new interaction models that appealed to different user preferences. Third, and perhaps most importantly, the mandatory subscription became increasingly difficult to justify as free alternatives and one-time-purchase competitors delivered comparable insights.

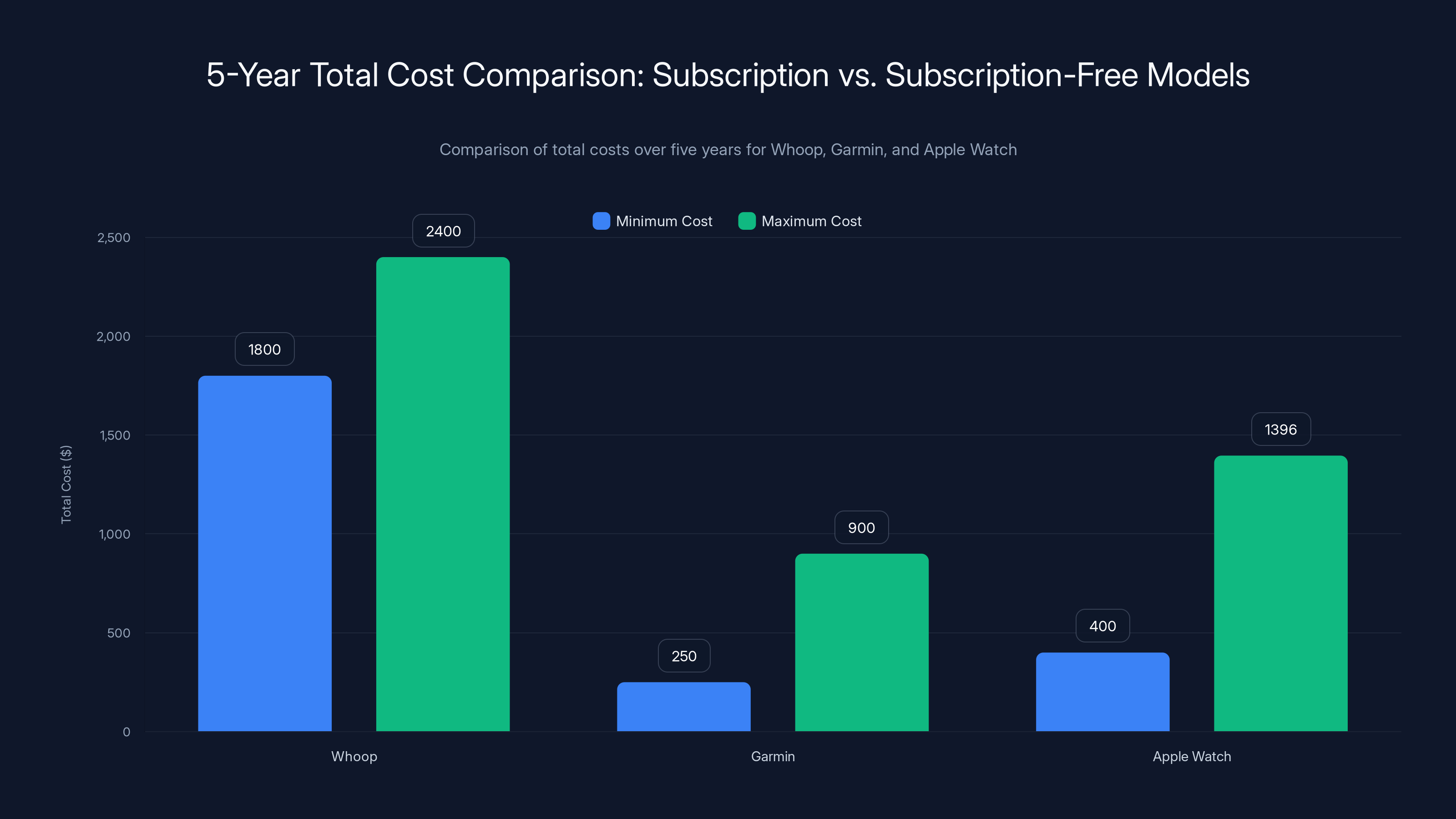

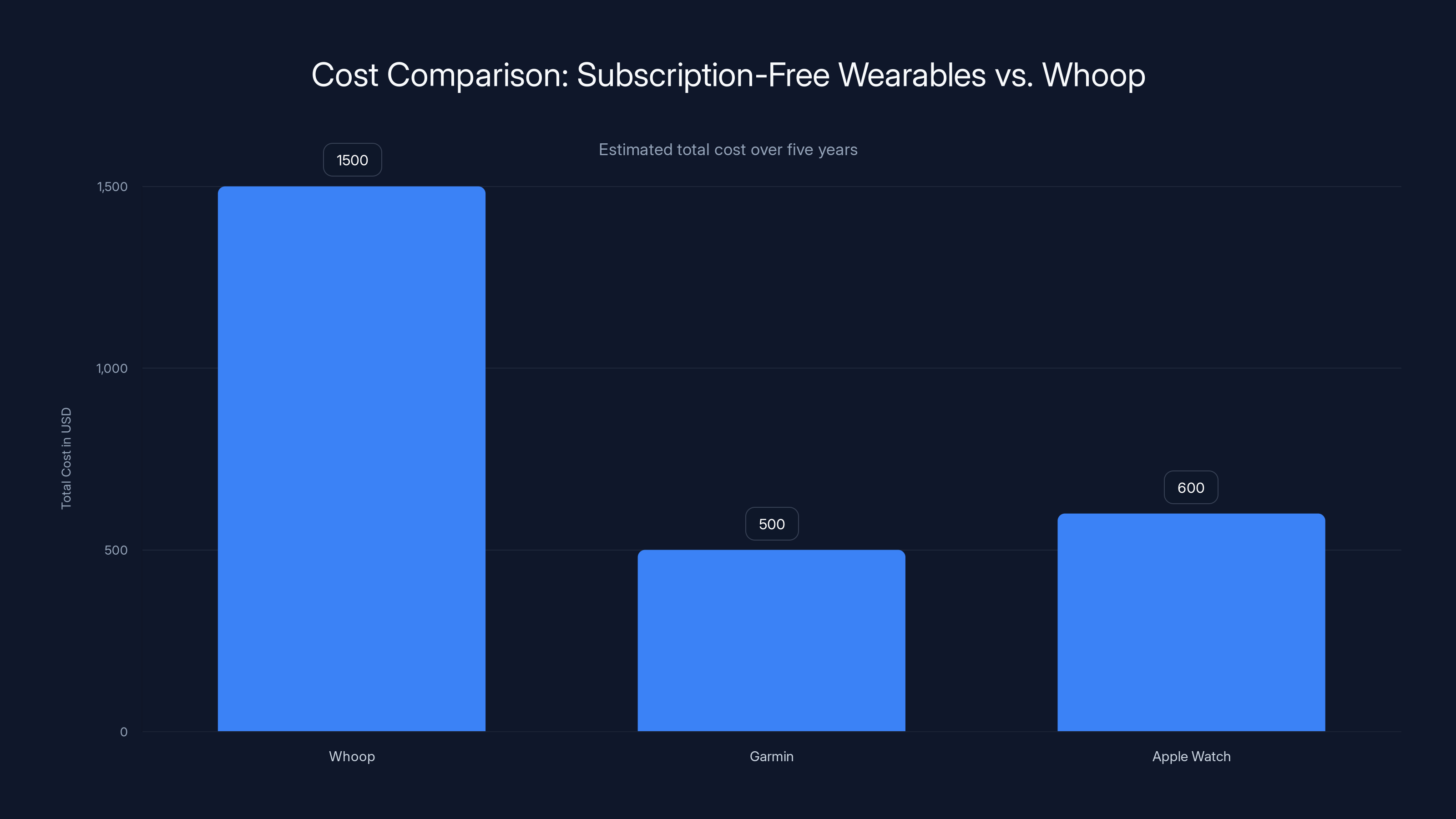

Over five years, Whoop's total cost ranges from

The Rise of Screenless Voice-Led Wearables

Screenless wearables represent a paradigm shift in how we interact with health and fitness technology. By eliminating the display, manufacturers reduce battery drain, lower manufacturing costs, simplify the user interface, and force developers to create more intuitive interaction models. Instead of checking a small screen dozens of times per day, users interact with screenless devices through voice commands, haptic feedback, and push notifications delivered to their smartphone.

The voice-led component adds another dimension to this revolution. Voice interfaces eliminate the need to remember complex menu structures or navigate through multiple app screens. Instead of swiping through options to start a workout or check your recovery score, users simply speak commands like "Start a run" or "What's my recovery status?" These devices use natural language processing to understand context and intent, making interactions more conversational and less mechanical.

Garmin's Coach, developed in partnership with several wearable manufacturers, exemplifies this trend. The device uses voice prompts and voice commands to guide training sessions, provide real-time coaching feedback, and answer health and fitness questions. Instead of looking at a watch face, runners receive audio feedback about their pace, heart rate zones, and performance metrics. This frees mental bandwidth—athletes can focus on form, breathing, and the experience of training rather than constantly checking their metrics.

The advantages of this approach are substantial. Voice interaction is faster for many tasks—speaking a command often takes less time than navigating menus. It's safer during exercise when users shouldn't be looking at a screen. It reduces the constant notification fatigue associated with smartwatch screens. And for users with visual impairments, voice-led interfaces provide accessibility benefits that traditional touchscreen devices struggle to match. Additionally, screenless voice-led wearables typically offer superior battery life, sometimes lasting 7-14 days per charge compared to smartwatches that need daily charging.

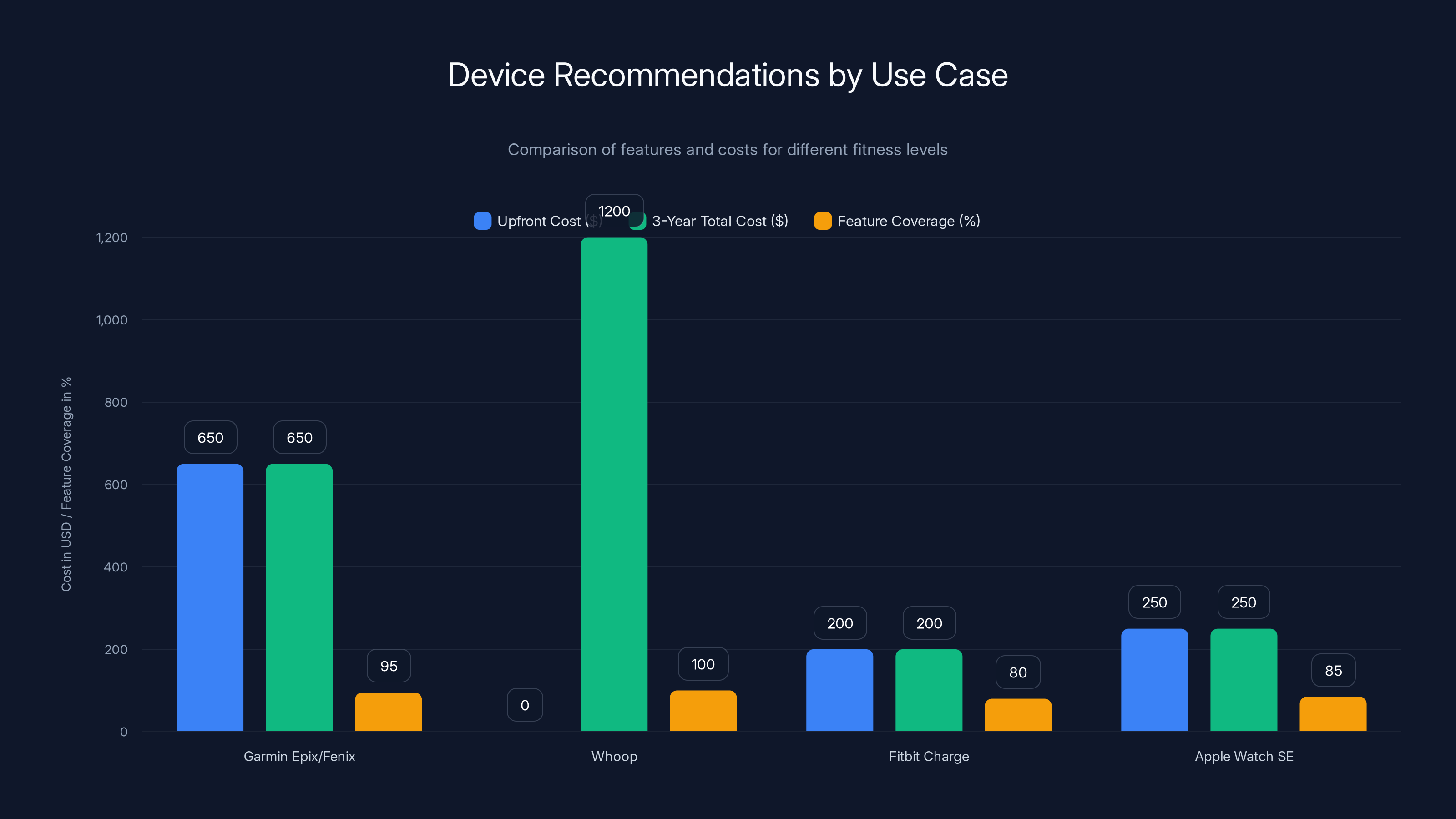

Garmin watches offer 95% of Whoop's features at 40-50% of the 3-year cost, making them ideal for serious athletes. Casual users benefit from mid-range devices like Fitbit and Apple Watch SE, which provide sufficient features at a lower cost.

How Screenless Wearables Provide Insights Without Displays

At first glance, the idea of a wearable device without a screen seems counterintuitive—how do you see your metrics and data? The answer lies in a combination of design philosophy and technological integration. Screenless wearables shift the information display paradigm from the device itself to the smartphone, where users already spend significant time looking at screens anyway.

When a screenless wearable wants to communicate information, it employs several mechanisms. Haptic feedback—subtle vibrations delivered through the band or strap—can convey different types of information through distinct vibration patterns. A certain pattern might mean "high strain today, recover well," while another might indicate "time to move, you've been sedentary for too long." Users learn to interpret these haptic signals intuitively, much like how you recognize different text message notification patterns.

Voice output is the second mechanism. Using onboard microphones and speakers (or Bluetooth connection to your smartphone's speaker), the device can speak data back to you. During a run, it might say "you're at 85 percent of maximum heart rate, maintain this pace." When you check in during the day, asking "what's my recovery?" the device responds verbally with your recovery score and recommendations.

Push notifications to your smartphone represent the third layer. When the device wants to draw your attention to something important, it sends a notification to your phone that you can read and tap to dive deeper into the data. This creates a hierarchy of information: routine updates come through haptic feedback, active questions are answered through voice, and detailed dives happen through the smartphone app.

The smartphone app itself becomes the primary data visualization tool. Instead of displaying metrics on a tiny screen inches from your face, these apps present beautifully designed dashboards on your phone's larger, higher-resolution display. Users can examine trends over time, compare metrics from different workouts, and dive deep into their physiological data whenever they want—not just when they glance at their wrist.

This approach has profound implications for user behavior. Research in human-computer interaction suggests that reducing the presence of displays decreases problematic checking behaviors and constant notification seeking. Users who previously might check their smartwatch 50+ times per day instead check their phone more intentionally, with fuller context about what they're looking for.

Comparison: Traditional Fitness Trackers vs. Screenless Alternatives vs. Subscription Services

Understanding the competitive landscape requires examining how different categories of wearables approach health and fitness tracking. The market has traditionally divided into three segments, though the boundaries are increasingly blurry.

Traditional Fitness Trackers with Screens represent the established market leaders. Products like Fitbit Charge, Apple Watch, and Garmin epix offer displays ranging from simple monochrome e-ink to vibrant AMOLED screens. These devices excel at immediate feedback, glanceability, and comprehensive fitness feature sets. Users can start a workout, see real-time metrics, and track progress without touching their phone. However, they require daily charging, the screens consume significant battery power, and many now charge subscription fees for advanced features (Fitbit+ premium analytics, Apple Fitness+, Garmin Coach).

Screenless Wearables eliminate the display entirely, relying on voice commands, haptic feedback, and smartphone apps for interaction. They offer superior battery life—often 7-14 days per charge—more durable form factors (no screen means no fragile glass), and a more minimalist interaction model. Some users find them liberating, reducing the temptation to constantly check metrics. Others find the lack of glanceable information frustrating, particularly when starting workouts or during training sessions.

Subscription-Based Services like Whoop, Apple Fitness+, and Strava Premium charge recurring monthly fees for access to premium analytics, coaching, and community features. The theory is that ongoing software development, algorithmic improvements, and personalized insights justify the recurring cost. However, many users question whether the incremental value justifies perpetual payments, especially when free alternatives provide comparable baseline functionality.

| Feature | Traditional Tracker | Screenless Voice-Led | Subscription Service | Runable Alternative* |

|---|---|---|---|---|

| One-Time Purchase Cost | $0 (device cost) | $9/month or free tier | ||

| Monthly Subscription | Often free; some premium tiers | None | Optional premium | |

| Battery Life | 1-3 days | 7-14 days | 1-3 days | N/A (app-based) |

| Display | Yes (various sizes) | No | Yes | Smartphone/web |

| Voice Commands | Limited | Comprehensive | Limited | Text-based |

| Real-Time Workout Feedback | Excellent | Good (audio) | Excellent | Moderate (app) |

| Sleep Tracking | Yes | Yes | Yes | Yes |

| Heart Rate Variability | Limited | Yes | Yes | No |

| Recovery Metrics | Basic | Advanced | Advanced | Moderate |

| Total Cost Over 3 Years |

*Note: Runable specializes in AI-powered automation and content generation for teams and developers rather than fitness tracking, though its costs are presented for general comparison purposes.

The financial calculation becomes striking when you factor in the total cost of ownership over multiple years. A traditional fitness tracker might cost

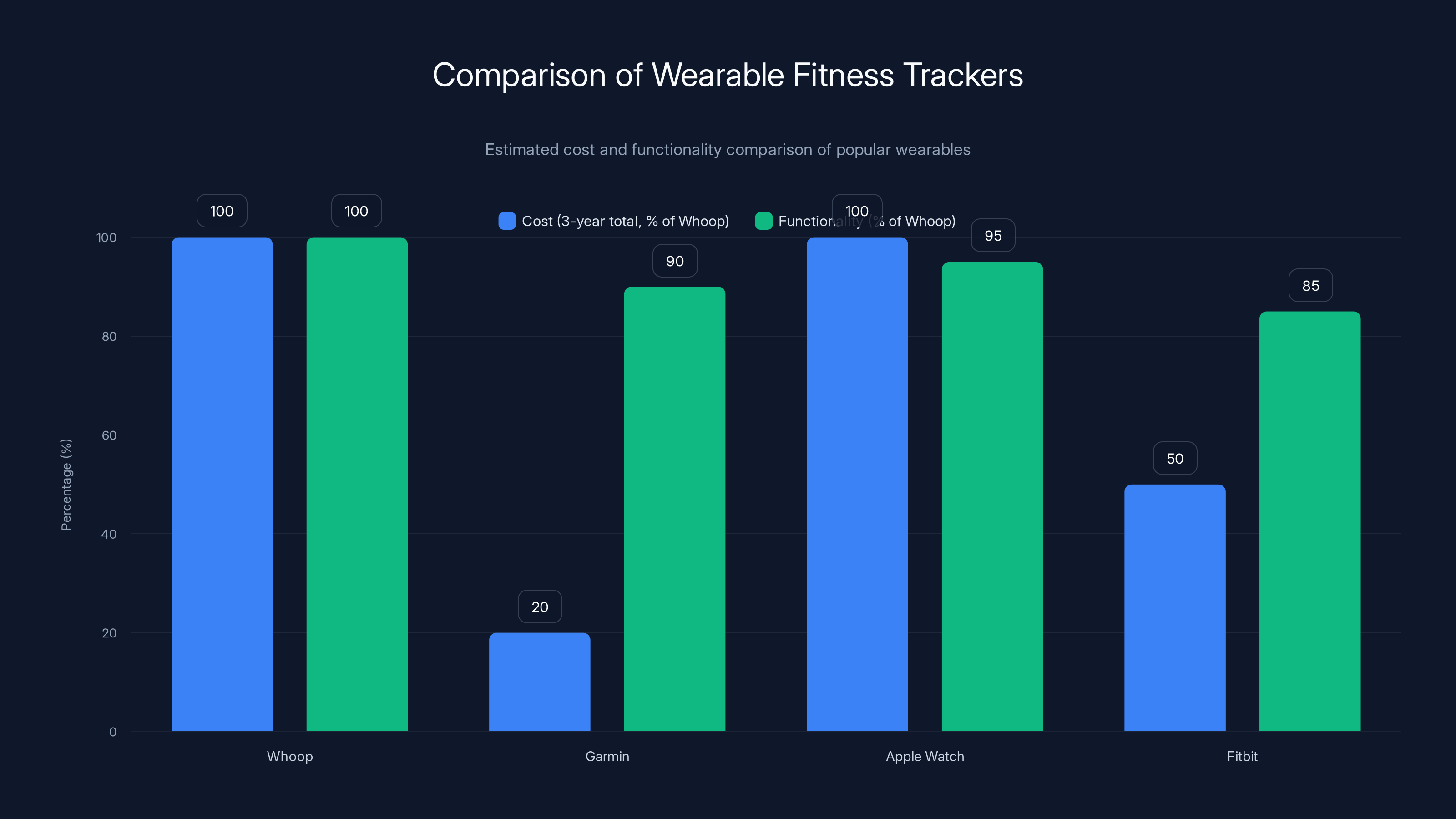

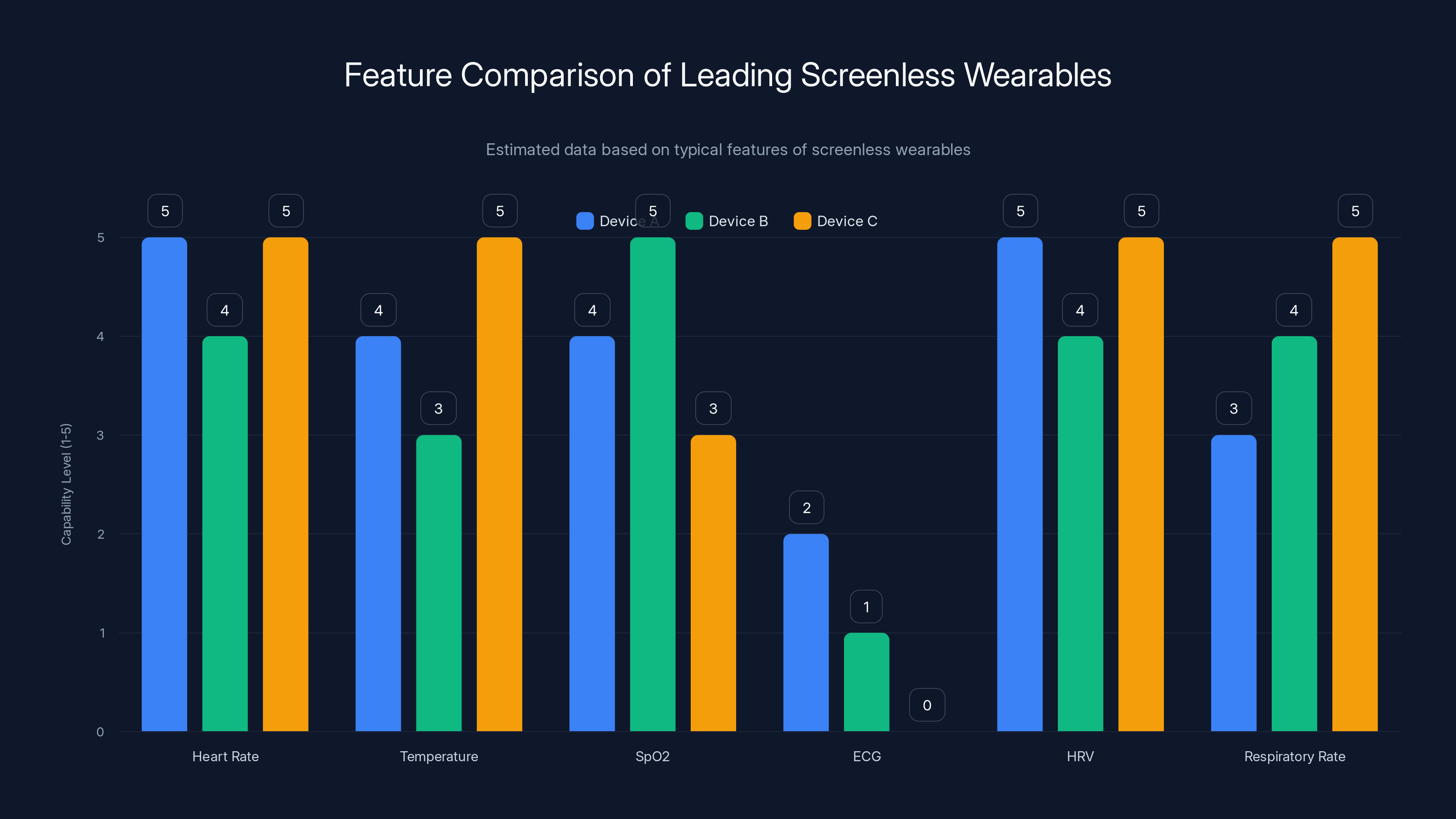

Estimated data shows that while Whoop offers unique features, alternatives like Garmin and Apple Watch provide similar functionality at a fraction of the cost.

Key Features of Leading Screenless Wearable Alternatives

Biometric Tracking Capabilities

Modern screenless wearables incorporate sophisticated sensors that continuously monitor multiple physiological parameters. At minimum, they track heart rate using optical sensors (similar to smartwatches), but many add additional sensors for more comprehensive data collection. Temperature sensors monitor skin temperature, which fluctuates with circadian rhythm and training load. Some devices add blood oxygen saturation (Sp O2) monitoring, which helps identify respiratory issues and sleep apnea. A few even include electrocardiogram (ECG) capabilities, though this is more common in screened devices.

Heart rate variability—the variation in milliseconds between successive heartbeats—is perhaps the most important metric for recovery assessment. It's a more sophisticated measure than raw heart rate because it reflects parasympathetic nervous system activity, which relates directly to recovery status. Unlike Whoop's proprietary algorithm, many alternatives now provide HRV tracking with transparent methodologies. Garmin devices calculate HRV through their Garmin 4VO (VO2 max equivalent) metric. Apple Watch provides a daily average HRV measurement. This democratization of HRV analysis has reduced Whoop's competitive advantage significantly.

Respiratory rate—breaths per minute—is another advanced metric increasingly available in mainstream wearables. Normal resting respiratory rate ranges from 12-20 breaths per minute; elevated resting respiratory rate can indicate overtraining, illness, or stress. Devices measure this through sophisticated algorithms analyzing heart rate patterns and movement data, as they don't directly measure breathing.

Sleep Analysis and Recovery Scoring

Sleep analysis represents one of the most valuable features of premium wearables. Devices categorize sleep into stages: light sleep, deep sleep, and REM sleep, using heart rate, heart rate variability, movement data, and sometimes additional sensors like actigraphy. The science behind sleep staging in consumer devices is less precise than laboratory polysomnography, but it provides meaningful trends and insights.

Recovery scoring—the distillation of all these biometric signals into a single meaningful number—is where algorithmic sophistication matters most. Whoop pioneered the idea of a recovery score (0-100) based on sleep quality, sleep duration, heart rate variability, and resting heart rate. But alternative devices now offer similar metrics with different names: Garmin's "Body Battery" (0-100 scale), Apple's sleep stage categorization with trend data, and others.

The key question is whether proprietary algorithms that analyze these metrics daily provide meaningfully better insights than transparent, open-source methodologies. Research published in sports medicine journals suggests that the general accuracy of consumer-grade sleep and recovery tracking is comparable across major brands, with most devices correctly categorizing sleep stages 80-85% of the time (compared to 95%+ for laboratory-grade equipment). The difference between brands at the consumer level is often more about how clearly they communicate results than about raw algorithmic superiority.

Training Load and Strain Analysis

Strain tracking quantifies the physiological stress imposed by exercise, enabling athletes to understand whether they're training hard enough or need to reduce volume to prevent overtraining. Heart rate zones provide the basis for most strain calculations: harder workouts push heart rate higher, requiring more cardiovascular effort and creating greater strain.

Screenless wearables calculate strain by analyzing the cumulative time spent in different heart rate zones during each workout, combined with intensity metrics like VO2 max effort and threshold pace work. Some devices add additional factors like movement data (accelerometers detect impact-heavy sports), GPS pace/speed data (particularly important for runners), and even environmental factors like altitude and temperature.

The advantage of voice-led interaction for strain data is significant. A device can tell you "your strain today was 85, which is high for you," providing context in a single sentence. Checking the same metric on a smartwatch requires multiple taps through menus. Over time, small friction reductions in data access compound to encourage more frequent check-ins and better adherence to insight integration.

Menstrual Cycle Tracking and Biometric Data

Many women specifically seek wearables that track menstrual cycle and related biometric patterns. Traditional fitness trackers and Whoop provide basic cycle tracking (period timing and predicted windows), but newer screenless alternatives add nuance by tracking how metrics fluctuate across different cycle phases. Heart rate patterns change measurably across the menstrual cycle, as do recovery needs, workout performance, and sleep patterns.

Several research institutions have demonstrated that menstrual cycle awareness improves training planning, particularly for female athletes. Training intensity and volume during the follicular phase (first half of cycle) typically yields better performance adaptation than identical training during the luteal phase (second half). Wearables that track cycle phase and correlate it with biometric changes enable more sophisticated training personalization.

Social and Community Features

Unlike Whoop, which emphasizes individual metrics and doesn't include social features, some screenless alternatives prioritize community engagement. Strava, while primarily a running and cycling app rather than a wearable-specific platform, has integrated community leaderboards, achievement badges, and social sharing that many users find motivating. The psychological power of friendly competition and community validation shouldn't be underestimated—research shows that social sharing and community features significantly improve exercise adherence.

Screenless wearables that integrate with existing apps like Strava, My Fitness Pal, or All Trails inherit community features without needing to build duplicate social infrastructure. This reduces development costs and redirects resources toward core biometric analysis and user experience improvements.

Subscription-Free Models: How They Make Economics Work

The most common question about subscription-free alternatives is: "If Whoop charges

One-Time Purchase Model

Many screenless wearable manufacturers—particularly Garmin—generate revenue through device sales rather than subscriptions. A

Garmin's approach has evolved into a hybrid where basic features are free, while premium services like Garmin Coach (personalized training plans) require subscriptions. However, the core Garmin fitness tracking experience remains fully functional without any subscription—you can sync your workouts, analyze your training, and access recovery metrics entirely through free features.

Ad-Supported and Freemium Models

Some platforms (notably Strava in its free tier) generate revenue through advertising and premium upsells rather than mandatory subscriptions. Free users see ads, experience feature limitations, but retain core functionality. Premium subscribers pay for an ad-free experience and additional analysis tools. This model incentivizes broadening the user base since more free users eventually convert to premium, and all users generate valuable behavioral data and engagement metrics.

Spotify pioneered this model at massive scale—free users experience ads and skips limitations, while premium users enjoy ad-free streaming and offline downloads. Applied to fitness wearables, the logic is similar: capture a large user base through free tiers, monetize through premium features, advertising partnerships, and enterprise sales to gyms and fitness facilities.

Data Monetization and B2B Integration

Most of the leading free fitness platforms generate substantial revenue from business partnerships and data insights rather than direct consumer payments. Garmin sells enterprise licenses to gyms, fitness facilities, and corporate wellness programs. They also partner with insurance companies and health providers who are willing to pay for aggregated, anonymized fitness data. Fitbit, before its acquisition by Google, monetized through similar channels.

This model requires a very different approach to data privacy and user trust. Companies pursuing data monetization must be transparent about what data is being collected and shared (in anonymized form), and they must be compliant with regulations like HIPAA and GDPR. Users must actively consent to their data being included in research or insights. Most transparent fitness companies publish annual reports documenting exactly what data they share and how they protect individual privacy.

Open-Source and Community-Driven Models

A smaller but growing segment of wearable platforms rely on open-source development and community contributions. These projects maintain minimal operations costs by leveraging volunteer developers, distributing across distributed networks, and focusing on interoperability rather than proprietary lock-in. The medical device regulation environment has prevented most such projects from offering full medical-grade analytics, but they serve well for fitness enthusiasts who prioritize data ownership and control over algorithmic sophistication.

Openxlab and similar projects allow users to analyze their fitness data without sending it to cloud servers—data stays on the user's device or personal servers. This appeals to privacy-conscious athletes and those who distrust corporate data handling.

Traditional trackers excel in feature set but have lower battery life. Screenless wearables offer superior battery life but limited features. Subscription services provide ease of use but at a higher cost. (Estimated data)

How Voice Interaction Changes the User Experience

Voice commands in wearables might seem like a small interaction change, but they fundamentally alter how users engage with their fitness data throughout the day. Traditional wearables require opening the corresponding app on your phone or checking a watch face—both activities that interrupt whatever you're doing. Voice commands enable information access during activities where your hands or eyes are occupied.

During Exercise: Hands-Free Coaching

While running, cycling, or swimming, you can't safely check a watch or look at your phone. Voice-led wearables enable real-time coaching: "You're currently in zone 3, your pace is 7:45 per mile, maintain this effort for two more minutes to complete your tempo interval." This guidance helps runners maintain their target effort level without the constant checking behavior that distracts from running economy and form.

The same applies to strength training: "Your last set averaged 8 reps at 225 pounds. Try to match that on your next set" provides real-time feedback in a format optimized for the context. Contrast this with traditional watches where you'd need to constantly look down, breaking focus and potentially risking form degradation.

Ambient Health Check-Ins

Throughout the day, you might casually ask your device "Am I recovered?" or "How's my sleep looking?" and receive a voice response. This creates a fundamentally different relationship with your health data—more conversational, less mechanical. Over time, users develop an intuitive sense of what their metrics are doing because they're checking them more naturally through speech.

Research in user experience design suggests that voice interaction reduces the "cost" of information access, increasing the likelihood that users will check in regularly. Since fitness insights compound over time as you recognize patterns and trends, more frequent casual check-ins actually improve outcomes relative to infrequent deep dives into the app.

Context-Aware Prompts and Guidance

Sophisticated voice-led wearables use context to provide relevant guidance proactively. If your strain is consistently high and recovery is low, the device might prompt you during the day: "Your recovery is lower than usual. Would you like to change today's workout from running to easy cycling?" If you're approaching your target weekly volume, it might warn "Be careful about increasing this workout—you're already at 90% of your weekly target."

This proactive guidance moves beyond passive data presentation toward active coaching. The device uses your data and its understanding of training principles to nudge you toward better decisions—something that requires your engagement through voice interaction to feel natural rather than intrusive.

Physical Design: The Case for Minimal Form Factors

Screenless wearables enable radically different physical designs than traditional smartwatches. Without a display, there's no need for bezels, protective glass, or careful screen-to-form factor balancing. Manufacturers can create ultra-thin bands, minimize wearable weight, and prioritize comfort over form factor constraints imposed by displays.

Durability and Material Science

Without screens, screenless wearables can use materials that would be unsuitable for smartwatches. Silicone bands without protective cases, fabric straps that can handle submersion without protecting electronics, and minimal protective bezels all reduce weight and improve comfort during sleep and extended wear. The absence of a screen also eliminates one of the most common failure points—cracked or malfunctioning displays account for the majority of smartwatch repairs and replacements.

This durability advantage compounds over years of use. A screenless wearable that lasts 5 years without screen degradation outperforms a smartwatch that might develop screen issues after 2-3 years, even if they started at similar price points.

Comfort and Wearability

Many users report that traditional smartwatches feel bulky, particularly during sleep. Wearing a chunky device with a rigid screen on your wrist throughout the night compromises sleep quality for some individuals. Screenless wearables, by contrast, can be designed with minimal thickness and soft materials, making them barely noticeable during sleep. Some users report that they forget they're wearing the device, which paradoxically encourages 24/7 wearing patterns that generate better data.

Aesthetic considerations also matter—while not everyone cares about watch appearance, some users prefer the minimalist look of a simple band over the tech-gadget appearance of a smartwatch. Screenless wearables can be styled to look more like traditional watches or fashion accessories than computing devices.

Battery Longevity and Charging Cycles

Battery life improvements enabled by screenless design have meaningful downstream effects. A device that charges every 3 days requires 122 charging cycles per year. One that charges every 10 days requires only 37 charging cycles. Since lithium-ion battery degradation correlates directly with charge cycles, the screenless device will maintain greater battery capacity over the same 5-year period. A device that charges weekly rather than daily experiences 2.5x fewer charging cycles annually, potentially extending its useful lifespan by 1-2 years.

This becomes economically significant. If a

Estimated data shows that while all devices excel in heart rate and HRV tracking, ECG capabilities are less common in screenless wearables.

Syncing and Integration with the Smartphone Ecosystem

Screenless wearables' dependence on smartphone apps for data visualization might initially seem like a limitation, but it creates unexpected advantages through integration with the broader mobile ecosystem. Most smartphone users already have apps for music, productivity, navigation, and communication—wearables that integrate smoothly with these existing tools enhance overall experience more effectively than standalone apps.

Health App Ecosystem Integration

Apple Health and Google Fit provide centralized repositories for health data from multiple sources. Wearables that sync with these platforms (rather than maintaining proprietary silos) allow users to correlate fitness data with medical information from their healthcare providers, nutrition data from food tracking apps, and mental health data from meditation or mental wellness apps. This interoperability creates a more holistic health picture than any single wearable company can provide.

Screenless wearables from Garmin, Fitbit, and others integrate deeply with Health and Fit, while Whoop maintains a proprietary approach where data remains siloed in the Whoop app. For users tracking multiple health dimensions, the integration advantages of mainstream wearables are substantial.

Third-Party App Ecosystem

Smartphone app stores contain hundreds of fitness and health applications that integrate with standard health data formats. Wearables that export to Apple Health or Google Fit automatically become compatible with training apps like Strava, nutrition apps like My Fitness Pal, and coaching apps like Trainerize. This creates a modular ecosystem where users assemble their perfect health stack from best-of-breed tools rather than committing to a single company's interpretation of what fitness tracking should be.

Whoop's proprietary approach means the wearable is less useful without the Whoop app, whereas a Garmin device becomes more valuable as users add complementary apps to their ecosystem.

Calendar and Notification Integration

Screenless wearables can integrate with smartphone notifications more intelligently than traditional smartwatches. Instead of all notifications flowing to the watch (which creates chaos), users can route only specific notification types to the wearable. Recovery alerts flow through, but random social media notifications don't. Training suggestions appear, but email updates don't. This selective notification routing creates a more peaceful experience than smartwatches that often become dumping grounds for every notification your phone receives.

Advanced Analytics: Comparing Whoop's Proprietary Algorithms to Open Standards

A significant portion of Whoop's subscription value proposition rests on the claim that their proprietary algorithms provide superior insights compared to standard calculations. However, examining the actual science reveals more complexity than marketing suggests.

The Science of Heart Rate Variability

Heart rate variability analysis involves measuring the time intervals between successive heartbeats using sophisticated statistical methods. The field has standardized methodologies: root mean square of successive differences (RMSSD), standard deviation of normal-to-normal intervals (SDNN), and other metrics that are calculated identically across devices. The "proprietary" algorithms come in how these numbers are then interpreted and contextualized.

Whoop's approach involves collecting years of individual baseline data to personalize recovery scores—your recovery score of 70 means something different than someone else's score of 70 because your baselines are different. This is valuable, but it's not unique to Whoop. Garmin's Body Battery, Apple's Health Trends, and others implement similar individualization. The distinction is more subtle than "proprietary is better"—it's that each company has slightly different interpretations of what the metrics mean.

Recovery Score Validation and Limitations

Multiple peer-reviewed research studies have examined whether Whoop's recovery scores predict athletic performance, injury risk, or training outcomes better than alternative metrics. The research is mixed. Some studies find that recovery scores correlate with performance changes, while others find that simpler metrics (sleep duration, resting heart rate) are comparably predictive. Very few find that the increased complexity of proprietary algorithms substantially outperforms transparent open calculations.

One critical limitation of any recovery score is that physiology is highly individual and context-dependent. Two athletes with identical recovery scores might respond completely differently to the same training because of different genetics, different life stressors, and different training history. The best recovery metric isn't a proprietary score—it's an athlete learning to understand their own patterns through careful self-observation, which wearables should facilitate rather than obscure through black-box scoring.

Transparency and Trust

Whoop's approach of not publicly disclosing exactly how their algorithms work makes it impossible for independent researchers to evaluate whether the algorithms are actually more accurate than open alternatives. In contrast, Garmin publishes detailed documentation of how Body Battery is calculated. Apple explains how they determine sleep stages. This transparency enables independent verification and continuous improvement as researchers identify gaps.

There's a legitimate debate in data science about whether proprietary algorithms justified greater trust. Some argue that companies naturally want to protect competitive advantages. Others argue that transparent methodologies allow broader scientific scrutiny and ultimately lead to better outcomes. In the field of sports science and medicine, transparency is increasingly expected by professional organizations and regulatory bodies.

Choosing subscription-free wearables like Garmin or Apple Watch can save users

Cost-Benefit Analysis: The Real Value of Subscription vs. Subscription-Free

Creating a detailed cost-benefit comparison requires moving beyond just price to consider what each model actually delivers and what users actually use.

Direct Financial Comparison

Whoop Model:

- Device: $300 (one-time)

- Subscription: 40/month (480/year)

- 3-year total: 1,440

- 5-year total: 2,400

Screenless Alternative (Garmin):

- Device: $250 (one-time)

- Subscription: 10-$15/month for premium coaching

- 3-year total: 540 (with optional premium)

- 5-year total: 900 (with optional premium)

Traditional Smartwatch (Apple Watch Series 9):

- Device: $400 (one-time)

- Subscription: 10.99/month for Fitness+ coaching

- 3-year total: 796

- 5-year total: 1,396

The financial difference compounds dramatically. Across five years, Whoop costs 2-4x more than alternatives even before considering opportunity costs of that capital.

Feature Completeness and Actual Use

However, cost alone doesn't determine value. If Whoop's premium insights lead to genuinely better training decisions and superior performance outcomes, the investment might be justified. But research suggests that most users benefit equally from freely available metrics:

- Sleep tracking: Available free on Garmin, Apple Watch, most mainstream wearables

- Heart rate variability: Available free on some Garmin devices and calculable from exported Apple Watch data

- Recovery scoring: Garmin Body Battery provides similar scoring free; Apple doesn't score recovery but provides raw data for independent calculation

- Training load/strain: Calculable from free metrics available on virtually all wearables

- Personalized coaching: Optional add-on subscriptions on Garmin and Apple; not unique to Whoop

The honest assessment is that 80-90% of what Whoop provides is available through free or low-cost alternatives. The subscription premium buys the remaining 10-20%, which consists of optimized user experience, proprietary coaching frameworks, and the Whoop community. Whether that 10-20% is worth 4-6x the device cost is a deeply personal calculation.

Specific Device Recommendations by Use Case

For Distance Runners and Endurance Athletes

Endurance athletes particularly benefit from advanced strain and recovery metrics because training load management is crucial—overtraining leads to performance plateaus and injury. Garmin's advanced running watches like the Epix or Fenix series provide phenomenal running-specific features: advanced VO2 max estimates, lactate threshold detection, ground contact time analysis, and cadence optimization recommendations.

These devices cost

For Casual Fitness Enthusiasts

Casual exercisers (3-4 workouts per week, no specific performance goals) benefit less from advanced metrics. A mid-range smartwatch like Fitbit Charge or Apple Watch SE provides excellent step tracking, heart rate monitoring, and basic sleep analysis at

At this fitness level, the behavioral motivation of having any tracker often outweighs differences between devices. The best tracker is the one you'll actually wear consistently, which usually means the one that's most comfortable and integrates best with your phone. Cost difference rarely exceeds

For Sleep-Focused Health Optimization

Users primarily interested in sleep quality optimization should prioritize wearables with excellent sleep tracking and algorithms that correlate sleep with daytime recovery metrics. Whoop excels here because the entire platform is built around the sleep-recovery connection. However, Oura Ring (a smart ring, not a band) also provides exceptional sleep tracking, circadian rhythm analysis, and generates recovery recommendations. Oura Ring costs

Garmin devices also provide good sleep tracking with free analysis. For sleep optimization, the key question isn't which wearable provides the most metrics but which one helps you actually improve your sleep through actionable insights. Any platform that clearly shows you that your sleep duration drops when you exercise after 7 PM, or that your deep sleep percentage improves when you keep your bedroom at 65-68 degrees, has delivered value regardless of which brand you choose.

For Women's Health and Cycle Tracking

Women athletes increasingly want wearables that understand menstrual cycle physiology and help optimize training around cycle phases. Specialized women's fitness platforms like Dailyo and Clue provide cycle tracking with excellent science, though they're apps rather than wearables. Several wearable companies have added menstrual tracking, including Whoop, Fitbit, and Garmin.

For comprehensive cycle-aware training optimization, Whoop's approach of integrating cycle tracking directly into recovery scores is thoughtful. However, this is becoming increasingly available in alternatives. Oura Ring recently added cycle tracking. Several Garmin devices support cycle tracking in their apps. For women seeking this specifically, the device choice should hinge on which brand's implementation matches your preferences, not on assumption that only premium subscribers get menstrual tracking.

For Competitive Athletes and Professional Development

Competitive athletes training with coaches or pursuing professional development might justify Whoop's premium cost. The combination of precise metrics, coaching integration, and proprietary insights might provide marginal performance gains (1-3%) that compound meaningfully in competitive contexts. For someone whose livelihood depends on athletic performance, spending

However, even competitive athletes should evaluate whether Whoop specifically, or any wearable, is the optimal investment relative to coaching, training facilities, nutrition support, and other performance factors. Many professional teams now prefer athlete biometric monitoring through systems that allow them to integrate wearable data with coaching platforms like Training Peaks, Athletica, or Wearable Sports Tech—often using standard Garmin or Apple Watch devices rather than proprietary platforms.

Alternative Software Solutions for DIY Enthusiasts

For technically minded users willing to invest time in setup, several open-source and DIY solutions provide wearable analytics without proprietary lock-in.

Exporting and Analyzing Your Own Data

Apple Watch and Garmin devices allow data export in standard formats (CSV, FIT files, Health Kit exports). Tools like Python with libraries like pandas and numpy, or dedicated analytics platforms like Training Peaks, enable sophisticated analysis without subscription fees. Athletes who write SQL queries and build their own analysis dashboards often discover insights more relevant to their specific goals than any commercial platform provides.

This approach requires significant technical skill—you need to be comfortable with data manipulation, potentially with coding, and with building your own visualizations. But for software engineers and data scientists, it's liberating to escape proprietary analytics and build custom tools that match your exact needs.

Open-Source Fitness Platforms

Projects like Fit Trackee (self-hosted fitness tracking), Quantified Self projects, and various open-source wearable tools allow athletes to maintain complete control over their data. These platforms often export data in open formats (ISO 8601 timestamps, standard metrics definitions) that remain useful long-term even if the platform becomes unmaintained.

The tradeoff is clear: comprehensive features and polished user experience from commercial platforms versus data ownership and customization from open-source tools. Most users find the polish of commercial platforms worth the cost, but power users increasingly choose open-source alternatives.

The Future of Wearable Technology and Subscription Models

Looking forward, several trends suggest the wearable market will continue moving away from mandatory subscriptions.

Edge Computing and On-Device Processing

As processors become more powerful and power-efficient, wearable devices can handle increasingly sophisticated analysis locally without uploading data to cloud servers. This reduces infrastructure costs for manufacturers and improves privacy for users. If a wearable can calculate recovery scores, strain metrics, and coaching recommendations entirely on the device using local algorithms, there's no longer a technical justification for continuous cloud connections and subscription fees.

Apple's approach of processing health data on-device represents this trend. Your iPhone analyzes sleep, calculates trends, and generates insights entirely locally—your data never flows to Apple servers unless you explicitly share health data with medical apps or enable iCloud syncing.

Integration with Healthcare Systems

As wearables move beyond fitness enthusiasm into legitimate medical applications, regulatory frameworks and insurance company interest will drive transparency. Insurance companies considering whether to reimburse for wearable-guided interventions will demand open validation of efficacy. This transparency requirement will make proprietary black-box algorithms less viable—regulators will want to understand exactly how recommendations are generated.

Wearables that integrate with electronic health records, communicate with healthcare providers, and support clinical decision-making will increasingly need to operate on open standards and transparent methodologies. Proprietary, non-validated algorithms will become less relevant in this context.

Unbundling and Modularity

The current trend toward unbundling is likely to continue—users will choose best-of-breed components (device from one manufacturer, analysis software from another, coaching from a third) and expect them to integrate through open data standards. Rather than choosing a single ecosystem like Whoop that handles everything, users will assemble modular stacks optimized for their specific needs.

For runners, this might mean a Garmin watch for training, Apple Watch for everyday wear and integration with health data, and a separate coaching platform like Athletica for personalized training adjustments. For cyclists, it might mean a Garmin Edge for bike computing, a Whoop band for recovery (if they value it), and Integration with Training Peaks. This unbundling reduces the lock-in power of any single subscription service.

Making Your Decision: Questions to Ask Yourself

Choosing between Whoop and alternatives requires honest self-assessment about what you actually need and value.

Necessity Assessment

Do you have a specific training goal where marginal performance gains matter? If you're training for a competitive event where 1-2% improvements matter financially or for personal achievement, premium analytics might be justified. If you're training for health maintenance or general fitness, the incremental value is likely minimal.

Do you struggle with consistency and adherence without accountability? If you're likely to stop training without external motivation and coaching support, investing in Whoop's coaching framework might improve outcomes sufficiently to justify the cost. If you have strong self-motivation, the accountability features are less valuable.

Are you collecting biometric data that you'll actually use to make training decisions? Some people track extensively but ignore the data—if that's you, spending

Financial Reality Check

What's your monthly discretionary budget for fitness investments? If

What's your device replacement timeline? If you keep fitness watches 3-4 years, screenless alternatives or traditional smartwatches that last without screen degradation might deliver better value. If you upgrade every 18-24 months anyway, the difference in upfront device cost is less meaningful.

Integration Preference Assessment

How important is integration with your broader health ecosystem? If you use multiple health apps and want data flowing between them, Whoop's proprietary approach is increasingly limiting. If you're comfortable staying entirely within the Whoop ecosystem, the closed platform is less problematic.

Do you value minimalism and simple interfaces? Screenless devices and Whoop both offer minimal interfaces, but Whoop forces data interpretation through its proprietary app. Traditional smartwatches offer more glanceability. Choose based on what interaction pattern feels natural to you.

FAQ

What is a screenless wearable device?

A screenless wearable is a fitness tracking device that lacks a display, instead communicating information through voice commands, haptic feedback (vibrations), and smartphone app integration. These devices prioritize battery life, durability, and comfort over the glanceability offered by smartwatch screens. Screenless wearables represent a design philosophy that information consumption is better handled by your smartphone than by a tiny wrist-mounted display, enabling longer battery life and more durable form factors.

How does voice-led fitness tracking work compared to traditional smartwatch tracking?

Voice-led wearables use onboard microphones and natural language processing to understand spoken commands, allowing users to ask questions like "What's my recovery?" or "Start a run" without touching their phone or watch screen. Traditional smartwatches require visual navigation through menus and on-screen confirmation. Voice interaction is particularly valuable during exercise when users can't safely look at screens, enabling hands-free coaching and real-time metric feedback without distraction or interruption.

What are the benefits of choosing a subscription-free wearable over Whoop?

Subscription-free alternatives offer significantly lower total cost of ownership—saving

How does a screenless wearable track sleep without a display?

Screenless wearables use the same sensors as traditional smartwatches—heart rate monitors, accelerometers for movement detection, sometimes skin temperature sensors—to classify sleep stages based on physiological patterns. Heart rate dropping and becoming more variable, minimal wrist movement, and skin temperature changes all indicate sleep. The device processes this information locally and stores results that sync to your smartphone app, where you view detailed sleep stage breakdowns. The visualization happens on your phone's larger screen rather than a tiny watch display, actually providing better clarity than smartwatch sleep displays.

What's the difference between heart rate variability and resting heart rate as recovery metrics?

Resting heart rate (measured when completely still, typically first thing in the morning) indicates overall cardiovascular fitness and recovery status—lower resting heart rate generally means better recovery and fitness. Heart rate variability measures the variation in milliseconds between successive heartbeats, reflecting parasympathetic nervous system activity and stress response. Elevated resting heart rate combined with low HRV is a reliable indicator of inadequate recovery or overtraining, while low resting heart rate with high HRV indicates strong recovery status. Together, they provide complementary information that's more informative than either metric alone.

Can I use Garmin, Apple Watch, or Fitbit data without paying for premium subscriptions?

Yes—all three offer comprehensive free fitness tracking without mandatory subscriptions. Garmin devices provide Body Battery recovery scoring, advanced sleep analysis, and training load metrics entirely free. Apple Watch provides sleep stage categorization, activity rings, and health trends without subscription requirements. Fitbit provides comprehensive activity tracking and sleep analysis free with basic accounts. Optional premium subscriptions (Garmin Coach, Apple Fitness+, Fitbit+) add personalized coaching and advanced features, but base functionality is entirely free—significantly more generous than Whoop's mandatory subscription model.

How do I decide between a screenless wearable, traditional smartwatch, and subscription-based services like Whoop?

Consider three primary factors: your specific fitness goals and whether marginal performance improvements justify extra costs; your personal interaction preferences (some people prefer glanceable information on a watch, others prefer screenless simplicity); and your integration needs (whether you want data flowing to multiple health apps or staying in one proprietary platform). For competitive athletes pursuing performance gains where 1-2% improvements matter, Whoop's premium analytics might be justified. For fitness enthusiasts, screenless alternatives or traditional smartwatches usually provide comparable functionality at lower cost. Test different form factors if possible—wearable preference is highly personal and often surprising when you actually wear the devices for several days.

Are there open-source alternatives to commercial fitness trackers?

Yes—projects like Fit Trackee, Quantified Self communities, and various open-source health platforms allow athletes to maintain complete control over their data and analysis. These require more technical setup than commercial products but offer customization and data ownership advantages. Additionally, many commercial devices now support data export in standard formats (FIT files, CSV, Health Kit exports) that power users can analyze independently with tools like Python, Excel, or dedicated analytics platforms. The tradeoff is clear: commercial platforms offer polish and ease of use, while open-source solutions offer control and customization.

How does menstrual cycle tracking in wearables improve training outcomes?

Research demonstrates that athletic performance, recovery needs, and training responsiveness fluctuate significantly across the menstrual cycle, with follicular phases typically supporting better performance adaptation to high-intensity training. Wearables tracking menstrual cycle phases enable athletes to align training intensity and volume with cycle physiology—scheduling harder workouts during follicular phases and focusing on technique work during luteal phases. This optimization can improve performance adaptations by 5-10% for some athletes. Whoop integrates cycle tracking into recovery scoring, though Fitbit, Oura, and other platforms now offer similar functionality.

What's the realistic total cost of ownership comparing Whoop to alternatives over five years?

Whoop's total five-year cost is approximately

How often do wearable algorithms update, and do subscriptions guarantee access to improvements?

Both subscription-based services like Whoop and free platforms like Garmin continuously improve their algorithms, typically releasing updates monthly to quarterly. Whoop's subscription model theoretically incentivizes continuous algorithm improvement for paying subscribers. However, Garmin and Apple release algorithm improvements at similar or faster rates to all users regardless of subscription status, suggesting that proprietary algorithms may not improve faster than open, transparent approaches. Regular algorithm updates improve insights for all users regardless of which platform they choose, making "continuous improvement" somewhat generic as a subscription value proposition.

Conclusion: Finding the Right Wearable for Your Needs

The wearable technology market has matured dramatically since Whoop's launch, moving beyond a landscape where "premium = proprietary subscription" toward a more nuanced ecosystem where excellent fitness tracking is available at multiple price points and through various business models. The decision between Whoop and alternatives ultimately reflects your personal priorities rather than objective quality differences.

If you value simplicity above all else and want a single, integrated platform handling all your fitness metrics and coaching, Whoop delivers an excellent experience that justifies its investment for some users—particularly competitive athletes pursuing marginal performance gains and those who find Whoop's specific coaching frameworks particularly valuable. The screenless design is genuinely excellent, battery life is impressive, and the focus on recovery-first training philosophy resonates with many athletes.

However, for the majority of fitness enthusiasts, the subscription cost becomes difficult to justify once you understand what's available through alternatives. A mid-range Garmin screenless wearable provides 90%+ of Whoop's core functionality at 15-20% of the three-year cost. Apple Watch provides excellent integration with the smartphone ecosystem at comparable cost. Traditional smartwatches from Fitbit and others deliver comprehensive tracking at even lower prices. The free analytics provided by these platforms have improved to the point where they're not secondary to Whoop's proprietary algorithms—they're genuinely comparable in most practical applications.

Screenless wearables specifically represent an underrated design approach that deserves more consideration than they typically receive. The combination of superior battery life (7-14 days vs. 1-3 days), reduced screen durability issues, voice-led interaction models, and minimalist design appeals to users prioritizing substance over glanceability. If you've been considering Whoop primarily because it's the most well-known screenless option, exploring Garmin's screenless alternatives or even Oura Ring might reveal a product that better matches your preferences.

The broader trend in wearables—whether from Whoop, Garmin, Apple, Fitbit, or others—is toward subscription-free or optional-subscription models. Market competition, regulatory pressure for transparency, and improving on-device processing power all reduce the viability of mandatory subscriptions. The next three to five years will likely see wearable manufacturers increasingly moving toward device-based pricing with optional premium features, similar to how Apple and Garmin have already shifted.

As you evaluate your options, honestly assess what you actually need, what metrics you'll use to make training decisions, and what price you're willing to pay for that functionality. Test devices in person if possible—wearable comfort and interaction preferences are deeply personal, and "best" is always context-specific. Then recognize that the best wearable is ultimately the one you'll actually wear consistently, regardless of whether it's the most feature-rich option available.

Your fitness journey doesn't require a $1,500+ three-year investment in a proprietary platform. It requires consistency, sound training principles, adequate recovery, and whatever measurement tool helps you stay accountable to those fundamentals. For most people, that tool is available at significantly lower cost than Whoop's premium price point—and increasingly, the free or low-cost alternatives are sophisticated and elegant enough that the premium pricing is becoming difficult to defend on any basis except brand preference or specific coaching framework alignment.

Choose based on your actual needs, test before committing, and remember that wearable data is only valuable if you use it to make better training decisions. The platform that best facilitates that decision-making for you is the right choice—and it might surprise you that it doesn't have to be the most expensive option.

Key Takeaways

- Subscription-free alternatives provide 90%+ of Whoop's functionality at 15-20% of three-year cost

- Screenless voice-led wearables offer superior battery life (7-14 days) and more durable form factors than smartwatches

- Advanced metrics like HRV, sleep staging, and recovery scoring are increasingly available free from mainstream brands

- Total five-year cost: Whoop (2,400) vs. Garmin screenless (430) vs. Apple Watch (~1,060)

- Voice interaction enables hands-free coaching during exercise, addressing smartwatch screen limitations

- Market consolidation and regulatory transparency requirements are reducing viability of proprietary subscription models

- Best wearable depends on personal priorities, not objective quality differences between platforms

- Ecosystem integration through Apple Health and Google Fit makes traditional brands more flexible than proprietary platforms