Why Garmin's CES 2026 Food Tracking Announcement Actually Matters

Last January, Garmin walked into the Consumer Electronics Show in Las Vegas—literally the worst possible location to announce a calorie tracking feature—and dropped something that nobody saw coming. Not another smartwatch. Not another running band. Instead, they revealed they're adding comprehensive nutrition and food tracking directly to their Connect Plus companion app. According to Engadget, this feature is set to revolutionize how users interact with their health data.

Now, I get it. The timing is hilariously ironic. You've got a tech company in Sin City, surrounded by all-you-can-eat buffets, bottomless margaritas, and deep-fried everything, announcing that you can now log every single thing you eat. But here's the thing: this move reveals something much bigger about where the fitness wearable industry is heading.

Garmin isn't building this feature in a vacuum. They've watched companies like My Fitness Pal dominate the nutrition space for over a decade. They've seen Noom turn habit tracking into a $1.3 billion business. They've noticed that serious fitness enthusiasts don't just want to know how many calories they burned—they want to understand the complete picture of calories in versus calories out. That's energy balance, and that's where real fitness progress happens.

The bold move here isn't the food tracking itself. It's Garmin's strategy to consolidate the entire fitness ecosystem into one app. If you're already wearing a Garmin watch for workouts, sleep tracking, and heart rate monitoring, why jump to a different app to log your breakfast? That's friction, and friction kills habit formation.

During the CES announcement at Yardbird restaurant (their choice of venue only makes the irony richer), I watched Garmin's AI image recognition system identify grilled salmon, roasted vegetables, and side dishes in seconds. The system didn't nail portion sizes—it guessed five kernels of corn equaled a cup—but it got the food identification right. That's the hard part. Portion accuracy? That's an adjustment you make with your thumb.

What makes this announcement worth your attention isn't just the feature itself. It's what it tells us about the convergence of wearable tech, artificial intelligence, and health data. Garmin Connect Plus already had Active Intelligence, which uses AI to give you workout recommendations. Now it's adding nutrition into that mix. Your watch knows you ran five miles yesterday. It knows your heart rate patterns. It knows your sleep quality. And now, if you log your food, it knows what you ate. That's the foundation for genuinely personalized health insights.

Let me be honest though: nutrition tracking apps aren't sexy. Nobody gets excited about logging dinner. But they work. The research is solid. People who track their food intake consume 200 to 400 fewer calories per day than those who don't. It's not magic. It's awareness. And if Garmin can make that awareness frictionless by keeping it inside the app you're already using, they solve a real problem.

Understanding the Technology Behind Garmin's AI Food Recognition

The core innovation here is the AI image recognition engine powering the food identification system. This isn't Garmin inventing something new—companies like Amazon's Rekognition and Google's Cloud Vision API have offered similar capabilities for years. But applying it specifically to food photography, in real-time, on a mobile device? That requires a specific training approach.

Food recognition AI is trickier than most people realize. A stop sign is a stop sign. A face is a face. But rice on a plate can look wildly different depending on the lighting, the plate color, the angle of the camera, and whether it's cooked separately or mixed with other ingredients. The training datasets for food recognition need to include thousands of photos of the same dish taken from different angles, under different lighting conditions, with different portion sizes.

Garmin built their system using a combination of strategies. They started with existing open-source food databases—systems like Food-101, which contains 101 different food categories with 1,000 images each. But that's just the foundation. They've likely supplemented it with proprietary data from their millions of users who've already logged food manually into their app. Every manual food entry becomes training data for the AI model.

The technical process works like this: when you snap a photo of your meal, the app analyzes the image and extracts visual features—color, texture, shape, size relative to known objects like plate diameter. These features get passed to a neural network that's been trained to recognize patterns associated with specific foods. The model outputs a prediction with a confidence score. If confidence is high, it suggests that food. If it's uncertain, it might offer multiple options.

What impressed me at the demo was the speed. The system identified a plate of salmon and vegetables in under two seconds. That's fast enough that it doesn't feel like waiting. Fast enough that the friction of using the feature stays low.

But here's where the honesty comes in: portion size detection is genuinely hard. The app struggles because it's trying to estimate three-dimensional volume from a two-dimensional photo. Computer vision can identify that you have rice on your plate. Estimating whether that's half a cup or one cup requires understanding depth, camera perspective, and the density of the food. It's why the AI thought five corn kernels equaled a cup. Different foods have different densities—a cup of corn takes up more visual space than a cup of rice.

Garmin acknowledged this limitation openly. They noted they're working on improving accuracy, which is the right answer. The good news? Users don't need perfect accuracy. They need good-enough accuracy that they can quickly adjust. The app lets you manually edit portion sizes in seconds. That's the win.

The food database powering the system matters too. Garmin says they've built out a "rich food database," which likely includes tens of thousands of food entries, each with complete nutritional data for standard portion sizes. This database needs to be comprehensive enough to handle international cuisines, restaurant dishes, packaged foods, and homemade meals. That's not trivial. My Fitness Pal works as well as it does because they've spent years building and refining their food database with crowd-sourced nutrition data.

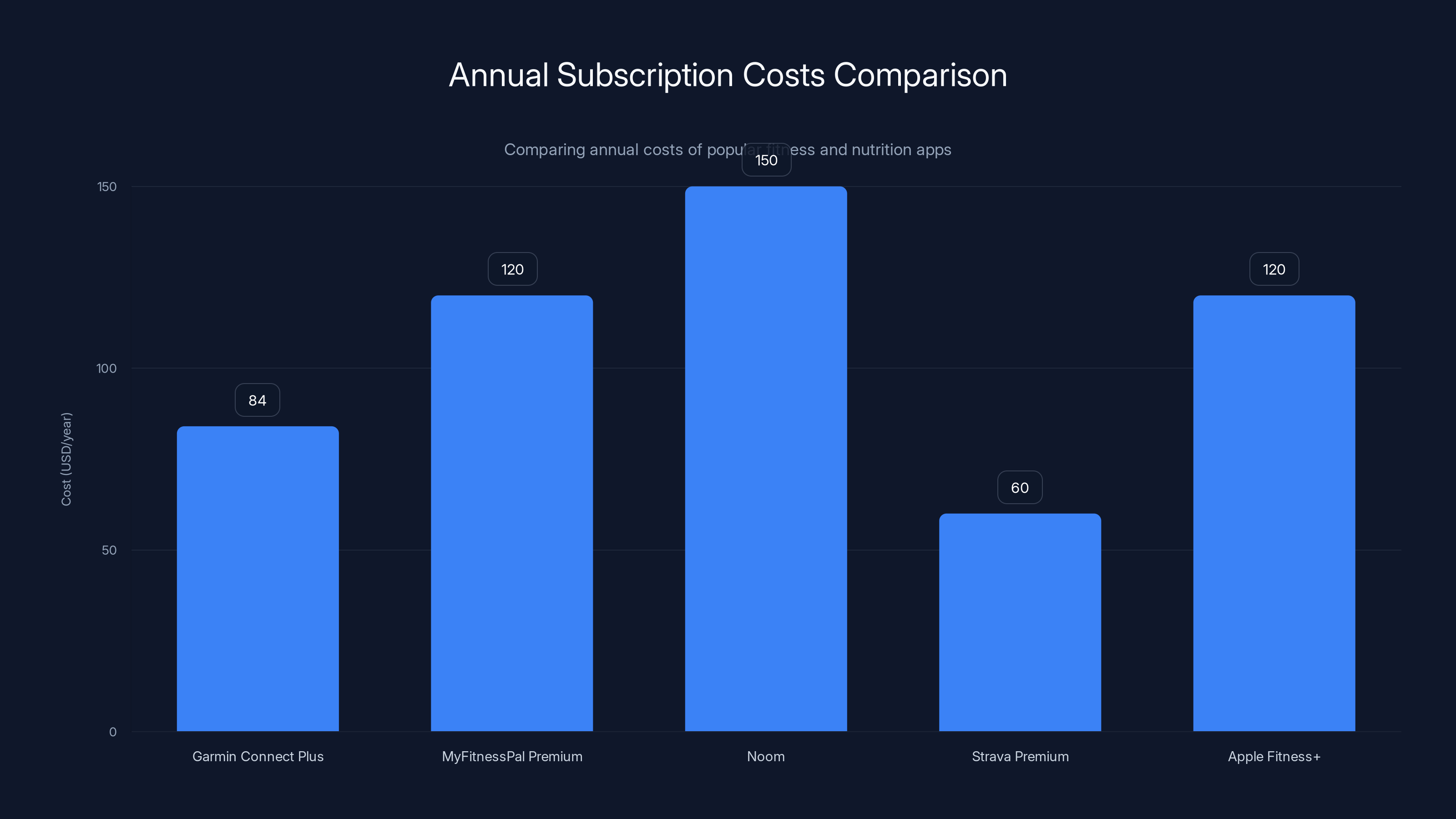

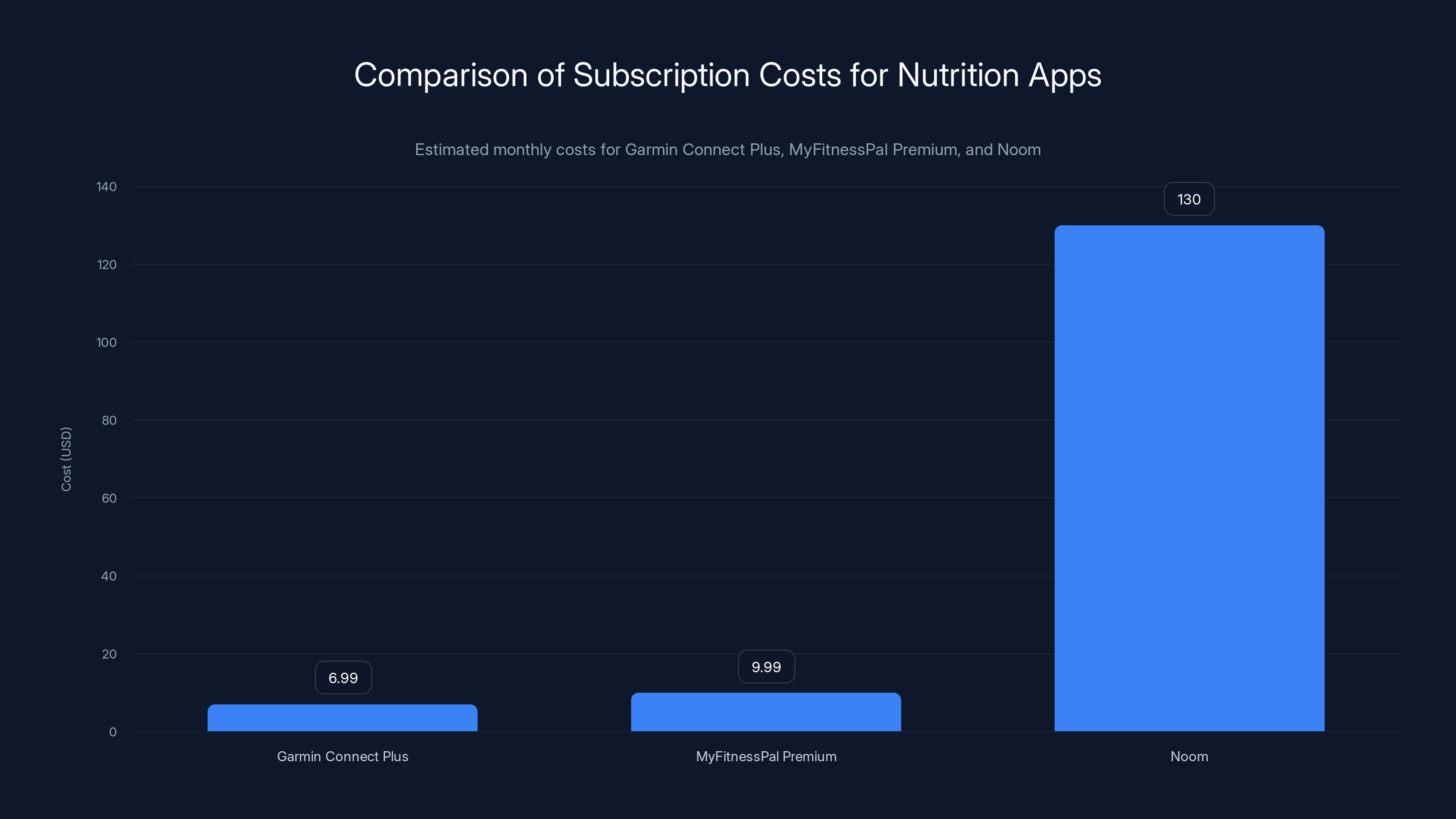

Garmin Connect Plus offers a competitive annual rate of $84, which is lower than MyFitnessPal Premium and Apple Fitness+, making it a cost-effective choice for users seeking integrated fitness and nutrition tracking.

How Garmin Connects Food Tracking to Calorie Expenditure

This is where Garmin's existing ecosystem becomes genuinely valuable. The magic doesn't happen at the moment you log food—it happens when that data combines with everything else Garmin knows about you.

When you enter food into most nutrition apps, they calculate your calorie intake based on generic databases. You log a chicken breast, they tell you it's 165 calories. That's standardized. But when Garmin logs that same chicken breast, they already know a lot more: your weight, your age, your gender, your resting heart rate, your VO2 max, your workout intensity from yesterday, your sleep quality. That context changes the equation.

Here's the core formula that nutrition science uses:

Your Garmin watch estimates calorie expenditure using what's called the Karvonen formula, which accounts for your heart rate reserve (your maximum heart rate minus your resting heart rate). It's more personalized than basic calculations because it accounts for your fitness level. A fit person burns fewer calories doing the same activity as an unfit person, because their heart doesn't have to work as hard.

Garmin Connect Plus now layers food intake data into this equation. Your watch logs that you burned 2,100 calories yesterday during your workout and daily activities. Your app shows you consumed 2,400 calories. That's a 300-calorie surplus. Over 12 days, that's a pound of body weight change. That's useful information.

But it goes deeper. The app can now provide macronutrient recommendations based on your fitness goals. If you're training for a marathon, the app might suggest a higher carbohydrate ratio (maybe 50-60% of calories from carbs) to fuel those long runs. If you're focused on strength training, it might lean toward higher protein (maybe 25-35% of calories from protein). These recommendations are personalized because Garmin knows what activities you're actually doing.

The connect-the-dots insight is this: Garmin can now answer questions like "Did my nutrition support my workout intensity?" A runner who does a hard 10-mile run but doesn't eat enough afterwards won't recover well. Their watch will see elevated resting heart rate the next day. Their app can now connect those dots and suggest better nutrition timing.

That said, Garmin's estimates aren't perfect. Calorie expenditure calculators typically have a margin of error of 10-20%. Your actual metabolic rate depends on factors that wearables can't measure—your genetics, your hormonal profile, your digestive efficiency. That's why the strongest way to use this data is as a tracking tool, not as absolute truth. You track consistently for two weeks and see if your weight changes match the prediction. If actual weight loss is less than expected, you adjust intake downward. It's iterative.

Garmin excels in integration, MyFitnessPal in database size, and Noom in user focus. Estimated data based on typical app characteristics.

The Integration Across Garmin's Wearable Ecosystem

What makes this feature meaningful is that Garmin is pushing food logging onto the wearables themselves. You can log meals directly from your Garmin watch. You can use voice commands on compatible watches to log food without pulling out your phone. That's a critical detail because it addresses the #1 reason people stop tracking: friction.

Most people can sustain food logging if the effort is under 15 seconds per meal. Typing on a smartwatch keyboard would violate that. Voice commands bypass the problem. "Hey Garmin, log turkey sandwich and chips" gets parsed by the watch's voice recognition, sent to the phone, and confirmed in the app. That works.

The compatible watches include their popular fēnix line, their standard smartwatch line, and their sport-specific watches like the Epix. Older watches won't get the feature, which is a business decision. Garmin needs to incentivize upgrades. But newer hardware has the processing power to run voice recognition locally, which reduces latency.

What's interesting is where Garmin is limiting the feature. Food logging is Connect Plus only, which costs

Connect Plus already included Active Intelligence, which uses AI to analyze your workout data and suggest training adjustments. Now it's adding nutrition data into that intelligence. The app can suggest rest days based on recovery metrics. It can recommend higher calorie intake on hard training days. It can flag when you're undereating relative to your activity level. That's the value proposition justifying the subscription.

Comparing Garmin to Existing Nutrition Tracking Solutions

Garmin isn't the first to combine fitness tracking with nutrition data. Let's be real about the competitive landscape.

My Fitness Pal has owned the nutrition space for over a decade. They have the largest food database (over 12 million foods) and excellent barcode scanning. Their app integrates with virtually every fitness tracker and smartwatch. The tradeoff: the app experience feels dated, the UI is clunky, and premium pricing at $10/month limits adoption.

Noom took a different approach. Rather than focusing on absolute calorie precision, Noom uses behavioral psychology and coaches to help people make sustainable choices. Their food database is smaller, but they've built an entire coaching ecosystem around their app. Noom costs $60-200 per month and works through a subscription model where you get assigned a human coach.

Apple Health integrates nutrition tracking through a combination of apps. You can log food directly into Apple Health or through third-party apps. The advantage: if you're in Apple's ecosystem, it's frictionless. The disadvantage: Apple doesn't push nutrition tracking hard, so adoption is lower.

Strava started as a fitness community app and added nutrition tracking later. It's more of an ecosystem play for endurance athletes.

Garmin's approach is different. They're not trying to compete on food database size or coaching quality. They're competing on integration friction. If you already have a Garmin watch, adding nutrition tracking means you don't need a separate app. That's the bet.

Where Garmin might struggle: they have no existing nutrition expertise or brand equity in the space. My Fitness Pal's database is larger and more refined. Noom's coaching model creates stronger habit change than any app feature. Garmin is banking that convenience beats specialization. We'll see if that thesis holds.

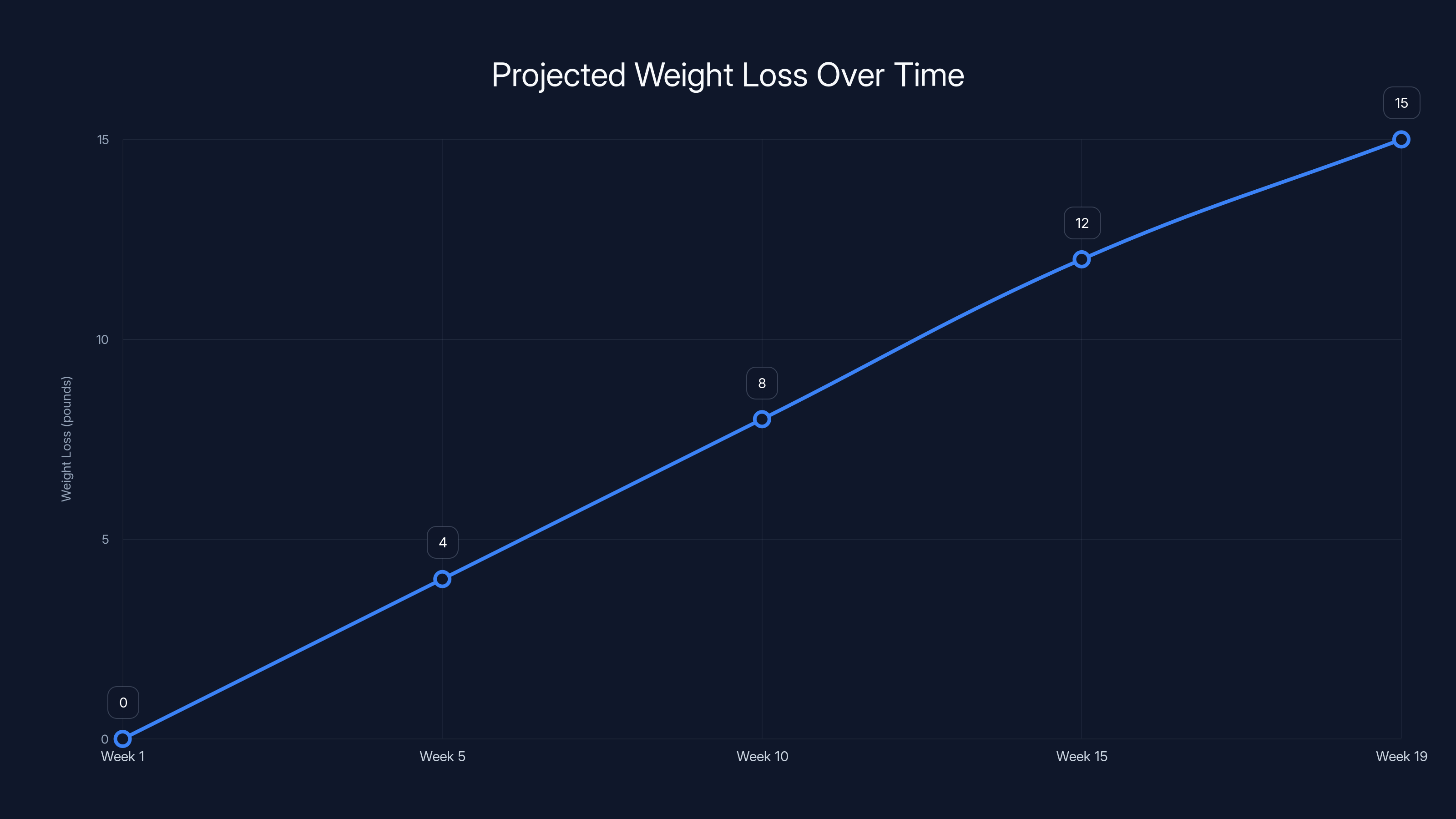

Sarah's projected weight loss follows a steady decline, reaching her goal of 15 pounds over 19 weeks with a 400-calorie daily deficit. Estimated data.

The Role of AI Image Recognition in Reducing Tracking Friction

This feature lives or dies on AI reliability. Manual food logging kills habit formation. People do it for three weeks, then stop. The barrier to entry has to be low, or the system doesn't work.

Image recognition reduces that barrier. Instead of typing "grilled salmon, 6 oz" and "roasted asparagus, 1 cup," you point your camera at the plate and let the AI figure it out. The time difference is huge. Photography takes 10 seconds. Typing takes 60 seconds. Over a year, that's 180 minutes saved. That matters psychologically.

The challenge, as Garmin acknowledged, is accuracy. AI can identify that you're eating corn. AI struggles to know whether that's a quarter cup or a full cup. This is solvable, but it requires either better computer vision or more user input.

Garmin's approach—make a good guess, let the user adjust—is pragmatic. You take a photo, the app suggests "roasted corn, 1 cup." You look at the photo and your plate and mentally adjust: "Actually, that's more like three-quarters cup." You tap the slider, adjust to 0.75, and move on. That's still faster than typing from scratch.

The food database integration matters here too. When you photograph a plate from a restaurant, the app doesn't just see "chicken." It might recognize "fried chicken, restaurant-style, with breading." That specificity matters because the calorie content of fried chicken varies wildly from baked chicken. A restaurant fried chicken breast might be 350 calories. A baked one might be 165. That difference compounds over days.

Long-term, I'd expect Garmin to improve accuracy by incorporating depth sensors. Many newer phones have LiDAR sensors that measure distance to objects. A LiDAR measurement plus a photo would let the AI better estimate volume. That's likely where this feature heads in 2-3 years.

For now, though, the UI handles imperfection well. You see a photo of your food with Garmin's best guess at the calories and macros. If it looks wrong, you adjust. Simple.

Nutritional Insights: Macros, Micros, and Personalized Recommendations

Tracking calories is table stakes. Garmin's real advantage is that it can now track macronutrients (protein, carbs, fat) and integrate that with your training data.

Here's why that matters: two people could eat the exact same number of calories but with very different macronutrient ratios, and get completely different results.

Let's say Person A eats 2,000 calories per day with 50g protein, 250g carbs, 85g fat. Person B eats 2,000 calories per day with 150g protein, 150g carbs, 70g fat. Same calories, totally different body composition outcomes. Person B, with higher protein intake, will preserve muscle mass better during a deficit and recover faster from strength training.

Garmin's app, combined with Active Intelligence, can now detect your training style and recommend macros accordingly. Detect a lot of running workouts? Suggest higher carbs. Detect strength training? Suggest higher protein. That's the personalization angle.

Most food tracking apps show macros, but they don't contextualize them against your activity. Garmin is trying to. The question is whether they execute well or if it ends up as generic suggestions that most users ignore.

Micronutrients are trickier. Garmin says the app can track nutrients beyond the big three macros. That means minerals like sodium, potassium, magnesium. That means vitamins like B12, iron, calcium. Getting those right requires an exceptionally detailed food database, because the micronutrient content of food varies significantly based on cooking method and source.

A homemade spinach salad with fresh spinach (raw) has different iron content than cooked spinach. A grass-fed beef steak has more omega-3s than grain-fed beef. Most nutrition apps don't capture these nuances. They'll show you iron content based on standard USDA data, which is an average. If Garmin actually gets this right, it's a meaningful differentiation.

But here's the honesty: most people don't need to track micronutrients obsessively if they eat reasonably varied foods. You hit macros right and eat a diverse diet (vegetables, fruits, whole grains, protein sources), micronutrients typically follow. Micronutrient tracking is valuable for athletes with specific needs or people with dietary restrictions. For everyone else, it's nice-to-have.

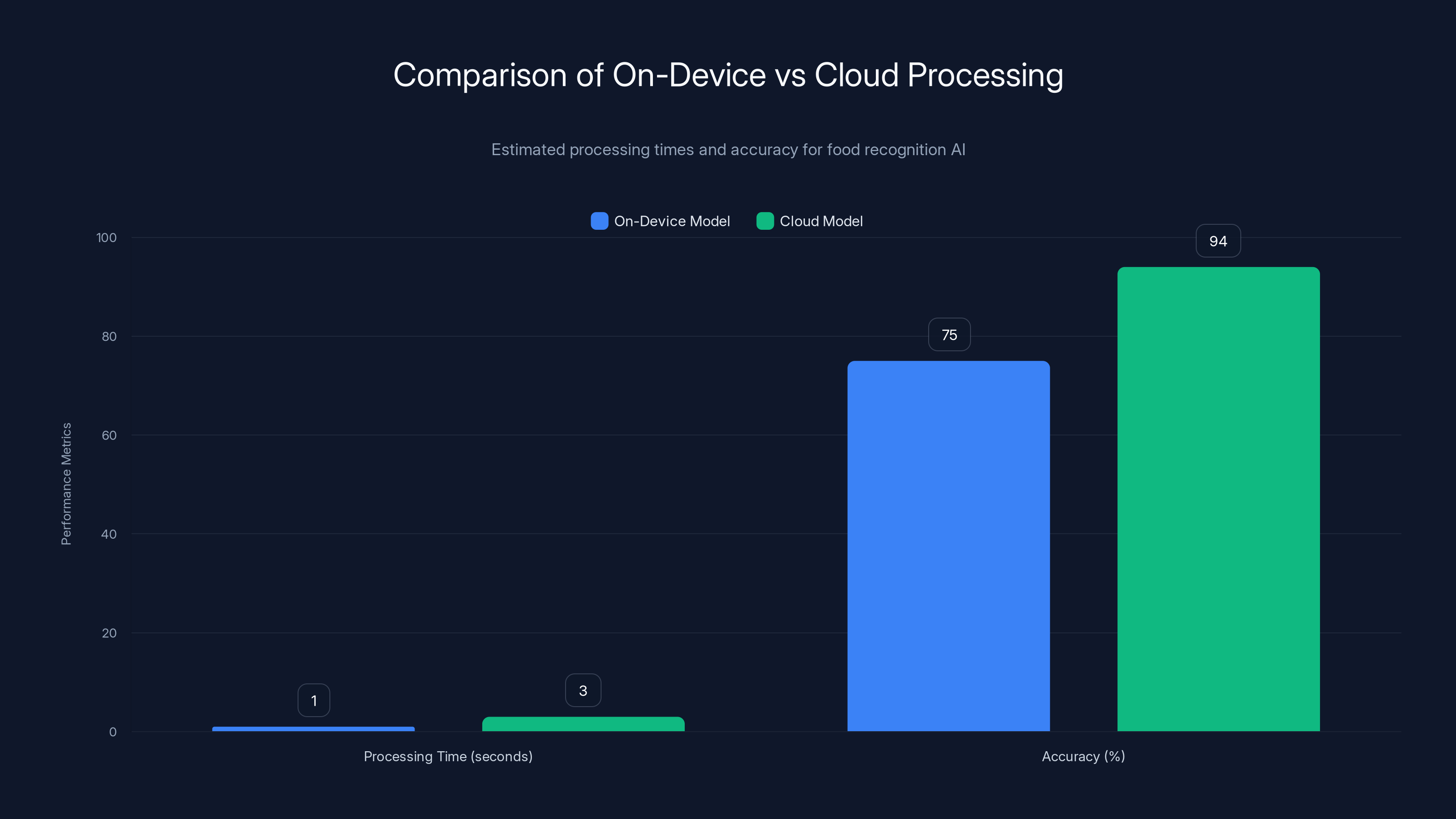

The on-device model processes images faster but with lower accuracy compared to the cloud model, which takes longer but provides more accurate results. (Estimated data)

Understanding Calorie Deficits and the Energy Balance Equation

The entire reason Garmin is building food tracking is that it enables one core equation: to lose weight, you need calorie expenditure to exceed calorie intake. To gain muscle, you need the opposite.

That equation isn't complicated. What's hard is executing it consistently, and that's where Garmin's integrated approach becomes valuable.

Let's work through an example. Sarah is a Garmin watch user who wants to lose 15 pounds. Here's what the system can now track:

Calorie Expenditure Tracking:

- Resting metabolic rate: 1,400 calories/day (estimated from age, weight, activity history)

- Exercise calories: 500 calories/day (average from her workouts)

- Total daily expenditure: 1,900 calories/day

She sets a goal of 1,500 calories intake per day, creating a 400-calorie deficit.

At 400 calories per day deficit, she'd lose roughly 0.8 pounds per week. Over 19 weeks, that's the 15-pound goal.

But here's where tracking matters: in week 3, Sarah's Garmin notices something. Her resting heart rate is elevated. Her sleep quality is degraded. Her recovery metrics are declining. The AI could flag: "You might be undereating. Consider increasing intake by 200 calories." That's not just a nutrition thing. It's preventing overtraining syndrome and hormonal disruption.

The reverse scenario works too. Sarah might overestimate her workout calories. Her watch says she burned 600 calories, but she actually burned 450. If she logs food to hit her "earned back" 600 calories, she's overeating by 150 calories per day. That adds up to 1,050 calories per week, or 0.3 pounds of unwanted weight gain per week. Over 19 weeks, that's 5.7 pounds of lost progress.

Garmin's system can't eliminate those estimation errors perfectly. But by integrating food intake data with calorie expenditure data, it can at least flag discrepancies. If Sarah's logging 1,500 calories daily but her scale weight isn't moving, the app can ask: "Are portion estimates accurate? Is the scale measurement reliable?" That debugging is useful.

The energy balance equation sounds simple. The execution is where 99% of people fail, because it requires consistent tracking and adjustment. Garmin's trying to make that easier.

Real-World Accuracy: What the AI Got Right and Wrong at CES

During the demo at Yardbird restaurant, I watched the AI in action. The results were mixed, which is honest feedback.

What it got right:

- Identified grilled salmon instantly and accurately

- Recognized roasted asparagus and other vegetables

- Distinguished between different cooking methods (grilled vs fried)

- Parsed a plate with multiple components

- Processing speed was sub-2 seconds for complex plates

What it missed or struggled with:

- Portion size estimation was off. Five corn kernels registered as one cup.

- Didn't account for sauce or oil added during cooking

- Struggled with foods that blend together (like a grain-based salad)

- Would need manual adjustment for most real-world meals

The portion size problem is the real limitation. Garmin was honest about it. They said they're working on accuracy improvements. That's the right approach—acknowledge the gap, commit to closing it.

Here's the thing though: portion estimation being imperfect is actually okay. If you're tracking consistently and adjusting based on real-world results (scale weight, body measurements), the AI estimates converge to accuracy over time. Week one, you might be off by 20%. Week four, the system learns your typical portion sizes and gets much closer.

The bigger insight from the demo: AI image recognition solved the hard problem (identifying food) and partially solved the medium problem (estimating calories). It completely failed at one problem (portion accuracy), but that's a problem you can brute-force with manual adjustment.

Compare that to manual food logging, where you have to solve all three problems yourself. You have to identify the food. You have to estimate calories. You have to eyeball portion size. Most people fail at all three, which is why manual tracking has such high dropout rates.

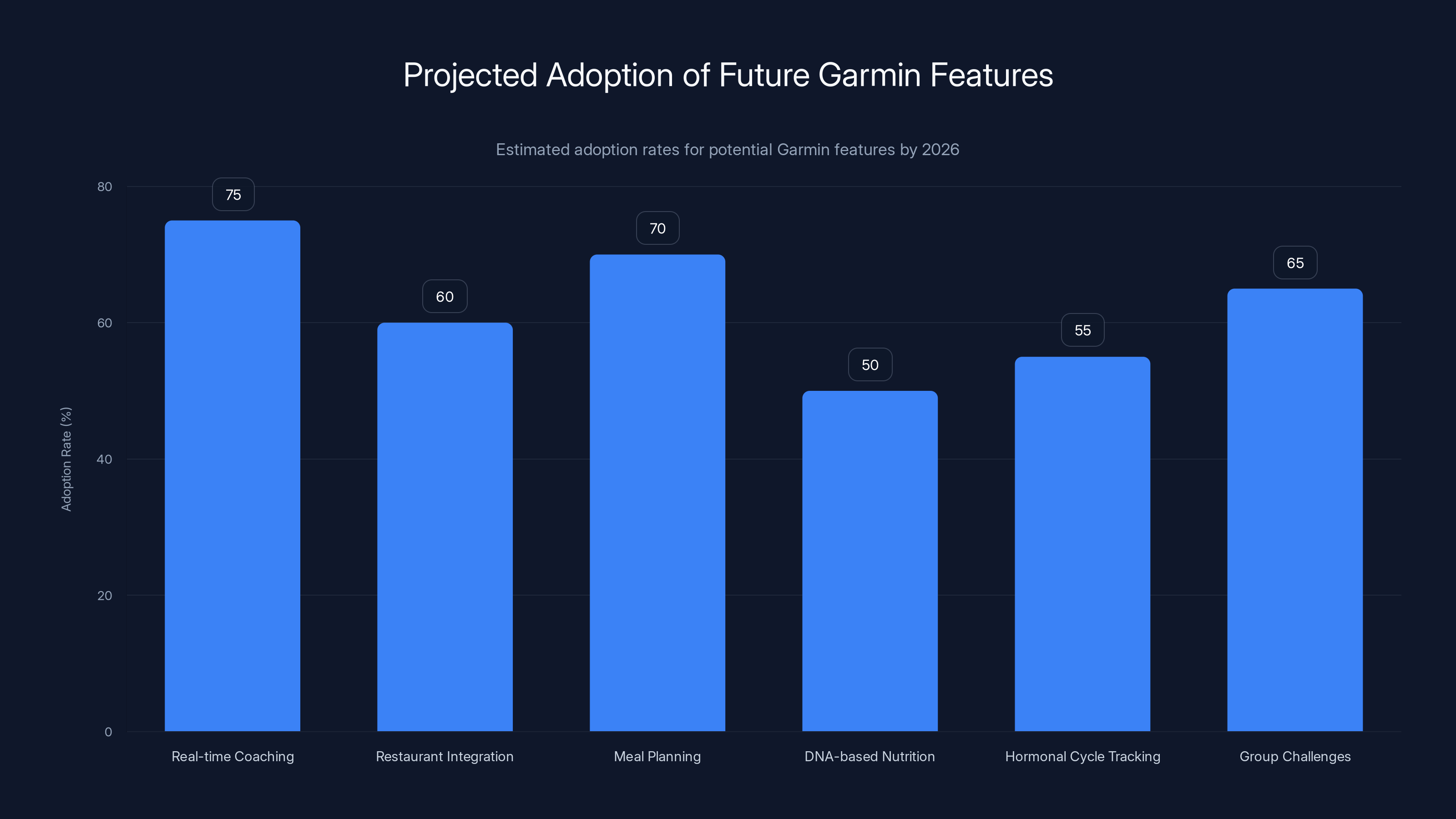

Real-time coaching and meal planning are expected to have the highest adoption rates by 2026, reflecting user demand for personalized nutrition guidance. (Estimated data)

Why CES in Las Vegas Was the Perfect Troll (And Why It Actually Works)

Let's acknowledge the elephant in the room: Garmin announced food tracking at one of the most indulgent events on Earth. In a city famous for excess, they launched a calorie tracking app.

It's either genius marketing or the worst possible timing. Possibly both.

On one level, it's hilarious. The timing highlights the reality that Garmin's target market isn't the general consumer. It's health-conscious people who are already tracking workouts. Those people understand that tracking happens in the real world, including Las Vegas. The announcement in Vegas—surrounded by temptation—actually proves the point: you need to track especially when you're in environments like this.

But more strategically, the CES venue matters because that's where tech industry leaders pay attention. CES announcements move product reviews, analyst coverage, and retail shelf placement. By announcing food tracking at CES rather than a fitness conference, Garmin positioned this as a tech story, not just a fitness story. That's smart.

Yardbird as the venue was specifically chosen. The restaurant is known for Southern food, which is calorie-dense and indulgent. Garmin's statement was essentially: "We built this feature so that even when you're eating incredible fried chicken and waffles, you can still track and make informed decisions." That's more relatable than announcing it at a kale salad bar.

The irony works as a marketing mechanism. It's memorable. People will remember "Garmin announced food tracking in Vegas" longer than they'd remember "Garmin announced food tracking at a fitness conference."

From a product perspective, the CES timing also matters because Garmin can get media coverage right now, at the start of the year, when people are making fitness resolutions. That's when they're motivated to buy new tracking tools. By June, that moment passes.

Subscription Strategy: Is $6.99/Month Worth It?

Garmin Connect Plus costs

Worth it? Depends on what else comes with Connect Plus.

Before this announcement, Connect Plus included Active Intelligence, which analyzes your workouts and gives AI-powered training suggestions. That feature alone has real value. If you're paying $7/month for Active Intelligence and food tracking makes that 20% more valuable (because you now understand nutrition alongside training), the price becomes easier to justify.

Let's do the math: active runners often spend

My Fitness Pal Premium is

Garmin's pricing is competitive, not premium. That's a positioning choice. They're not competing on features; they're competing on convenience. If you already have a Garmin watch, paying $7/month to stay inside one app instead of juggling five apps makes sense.

The risk for Garmin: the feature has to actually work well, or $7/month becomes hard to justify. If the food database is tiny, portion estimates are constantly wrong, or the AI recognition is flaky, people will switch to My Fitness Pal despite the extra friction.

Garmin's bet is that "good enough" combined with convenience beats "better" from a specialist. That bet has a lot of historical precedent—integration kills specialization in consumer software. But it's not guaranteed.

Garmin Connect Plus offers a competitive monthly subscription cost of

The Broader Fitness Trend: From Tracking to Actionable Intelligence

What Garmin's doing with Connect Plus reflects a bigger industry trend: moving from passive data collection to active recommendations.

Five years ago, fitness apps were data recorders. You ran a mile, the app recorded your time and pace. That's it. No intelligence, no insight, no action. The user had to interpret the data.

Now, apps are intelligence layers. Apple Watch detects an irregular heartbeat and alerts you to see a doctor. Strava shows you that your FTP (functional threshold power) is increasing based on climbing performance. Whoop analyzes sleep and strain to tell you whether you're overtraining. Garmin's adding nutrition data so it can say: "Your protein intake is low relative to your training volume; consider increasing it."

That shift requires more sophisticated machine learning and larger, more diverse training datasets. Garmin has the training data from millions of users. They have heart rate patterns, workout data, sleep records. Now they're adding nutrition data to that training set. Each data point you log makes their AI models smarter.

The end game, five years out, might look like this: your Garmin Watch knows what workout you're about to do. It predicts how many calories you'll burn within 10% accuracy. It recommends eating strategy before the workout (timing, macros). It monitors performance during the workout. It recommends recovery nutrition afterwards. It optimizes the next day's training based on whether you followed those recommendations and how you recovered.

That's closing the loop from data → intelligence → action → outcome measurement.

Garmin's food tracking is the missing piece. Without food data, the loop was incomplete. Now they can close it.

Technical Infrastructure: How This Scales to Millions of Users

Food recognition AI requires serious computational infrastructure. Every photo needs to be processed, ideally in real-time or near-real-time. Scaling that to millions of Garmin users creates infrastructure challenges.

Garmin likely uses a hybrid approach. Basic image recognition happens on-device (on your phone), to reduce latency. More complex analysis happens in the cloud. The on-device model is smaller and faster but less accurate. The cloud model is larger and more accurate but takes 3-5 seconds.

The flow probably looks like: you take a photo on your phone. The device runs a quick AI model: "This is probably food. It's probably protein and vegetables." That's sent to Garmin's servers with the full-resolution image. The server runs a bigger, more sophisticated model: "This is specifically grilled salmon, roasted asparagus, wild rice. Confidence: 94%." That detailed prediction comes back to your phone within 2-3 seconds.

Food database queries also require backend infrastructure. When the app suggests a food, it needs to look up the nutritional data from the database and serve it fast. With millions of users logging food, you need database replication, caching layers, and load balancing to avoid slowdowns.

Garmin's already operating infrastructure at that scale—they handle millions of users' workout data daily. Food tracking adds another data stream but shouldn't require architectural redesign. It's more data, more storage, more processing, but the scaling patterns are similar.

Privacy considerations matter too. Food photos are sensitive. Garmin says they're only using photos to train their models (with user consent), but they could delete them immediately after processing. That's an important detail because you probably don't want your food photos stored forever on Garmin's servers.

Data Privacy and Security Concerns

Foods logs reveal intimate information about your life: dietary restrictions, eating disorders, health conditions, schedule patterns. That data needs protection.

Garmin's existing privacy policy covers fitness data, but food data is different. If you log food consistently, the company knows what you're eating. They know if you're vegetarian. They know if you're eating more on stress days. They know your eating schedule. That's predictive data about behavior.

The key question: what does Garmin do with that data? Do they use it to train better AI models? Do they sell it to health insurers? Do they keep it aggregated and anonymous, or tied to your individual account?

Garmin's privacy policy for health data is relatively consumer-friendly—they don't sell individual health data to third parties without consent. But that can change, especially if Garmin faces financial pressure or acquisition from a larger company with different privacy standards.

The practical security concern: if someone gains access to your Garmin account, they see your workout history, sleep patterns, and now your eating habits. That's enough data to paint a detailed picture of your life. Account security becomes more important.

Garmin should (and probably does) use encryption for food data in transit and at rest. They should implement strong authentication (two-factor auth) to prevent account takeover. Users should enable those features.

Long-term, the industry might need privacy regulations around health data. HIPAA governs medical data. GDPR governs personal data in Europe. The U.S. has no equivalent privacy law yet, so Garmin can be more restrictive than required by law. That's actually in their interest—stronger privacy practices are a competitive advantage when consumers increasingly care about data privacy.

How Food Tracking Integrates with Active Intelligence and Training Plans

Here's where Garmin's strategy gets sophisticated. Active Intelligence, their AI training system, already recommends rest days, intensity levels, and recovery activities based on your workout patterns. Adding nutrition into that mix creates a feedback loop.

Scenario: Active Intelligence suggests you take an easy day or rest because your heart rate variability is low and your sleep was poor. That's telling you that you're not recovered. If you've also logged your food, the app might now add context: "Your protein intake is low. Improving that could help recovery. Consider adding 20g more protein today."

Reverse scenario: Active Intelligence suggests a hard workout because your recovery looks good. If your nutrition is also being tracked, the app can ask: "Do you have enough carbs and protein to fuel a hard workout?" If you've only logged 1,200 calories so far and a hard workout burns 600 more, you might end up in too deep a deficit. The app could suggest eating before the workout or scaling back intensity.

This integration is powerful because it moves from "here's data" to "here's what to do about it." Users don't have to be nutritionists or coaches. They follow recommendations and see results.

Training plans are where this gets really interesting. Garmin offers adaptive training plans that adjust weekly based on your performance. With nutrition data, those plans could also adjust nutrition recommendations. Week 1, you did harder workouts than planned, so the system recommends more calories and carbs. Week 2, you missed workouts due to illness, so the system recommends fewer calories.

That's not just useful; it's the kind of functionality that justifies a $7/month subscription. It's personalized coaching without a human coach.

The catch: executing this well requires sophisticated algorithms and careful validation. Garmin needs to make sure their recommendations are evidence-based, not just algorithmically confident. Bad nutrition advice at scale creates problems.

The Competitive Threat: Why My Fitness Pal and Noom Are Watching

Garmin's announcement is a direct challenge to nutrition app incumbents. Let's look at why they should be concerned.

My Fitness Pal has been coasting on their database advantage for years. They have the largest food database and the most established user base (over 150 million users). But the app experience is aging. The UI feels dated. Performance is sluggish on older phones. User retention has been declining.

Garmin's threat is integration. If Garmin's app is faster, more modern, and doesn't require switching apps, users will migrate. Garmin has the installed base (millions of smartwatch owners) to bootstrap initial adoption.

Noom's threat is different. Noom sells transformation, not data collection. Users pay $60+ per month for coaching and behavioral psychology. Garmin is selling convenience. These are different value propositions serving different markets. But if Noom's results aren't significantly better than Garmin + diligent tracking, that price gap becomes hard to justify.

Apple Health's threat is vertical integration. Apple could upgrade their nutrition tracking to be competitive with what Garmin is building. They have the scale and the user base. If they do, Garmin is out. Apple's just choosing not to prioritize nutrition tracking right now.

Garmin's competitive advantage is specificity. They're not trying to be the best overall health app. They're trying to be the best app for people who already own Garmin wearables and care about fitness. In that specific niche, they can win.

The timeline matters. If Garmin launches food tracking and it's buggy or inaccurate, they lose credibility. Users will stick with My Fitness Pal or migrate to Noom. If Garmin's version is genuinely good, they could take meaningful market share from both.

Future Features and the Roadmap Beyond 2026

Garmin's statement that they're "looking into" improving portion size accuracy is coded language for "we're working on better algorithms." That's the obvious next step.

Further out, here are features I'd expect:

Real-time coaching during eating. Your watch vibrates before a meal suggesting hydration or suggesting you eat more protein. Based on your goals and current day's macros, it proactively guides eating decisions.

Restaurant integration. Scanning a restaurant menu and having the app pre-populate nutritional info for dishes you're considering. Some apps have this, but integrating it with real-time portion estimation would be valuable.

Meal planning based on workouts. The app plans your week's meals based on the planned workouts that week. Hard training days get higher calorie recommendations.

Integration with DNA-based nutrition science. Companies are starting to offer genetic testing that shows how you metabolize different macronutrients. Garmin could integrate that data to personalize macro recommendations.

Hormonal cycle tracking. For menstruating users, nutrition needs vary across the cycle. Integration with cycle tracking could optimize nutrition timing.

Group challenges and social comparison. Garmin's ecosystem already has social features. Nutrition could be gamified—team challenges where groups compete on nutrition consistency.

Most of these are natural extensions. Some require partnerships (with genetic testing companies, restaurants, nutrition researchers). Garmin has the infrastructure to add them incrementally.

The bigger question: does Garmin invest in food tracking as a core product or as a nice-to-have attachment to Connect Plus? If they treat it as a nice-to-have and Noom or My Fitness Pal launches a competing smartwatch app, Garmin could lose the battle they just entered.

Lessons from My Fitness Pal's Dominance and Why Garmin Needed This

My Fitness Pal owns the nutrition tracking space, but ownership is fragile. They've made a series of decisions that hurt their position.

First, they were acquired by Under Armour, then sold to Apollo Global Management, then sold again to Accendo Markets. Through those acquisitions and sales, the app quality declined. Every acquisition brought a new management team with different priorities. No consistent vision.

Second, they made the free tier less useful to push more users toward premium. That worked short-term, but it meant free users had a worse experience. If a competitor offered a better free experience, those users would switch.

Third, they didn't deeply integrate with fitness wearables. Users had to log into My Fitness Pal separately from their smartwatch app. That friction matters. If you're already in the Garmin app, pulling out to go to My Fitness Pal requires extra effort.

Garmin learned from that. They're not trying to dominate the nutrition space independently. They're integrating nutrition into an existing dominant product (their wearables and Connect app). That's defensive moat strategy—it's much harder to unseat nutrition tracking if you have to replace the whole ecosystem, not just one app.

Where Garmin is vulnerable: they have no history in nutrition. They're starting from scratch on food database and AI model quality. My Fitness Pal's database is larger and more refined. Garmin has to execute better in every other way (speed, UX, integration) to overcome that database deficit.

They also have no existing nutrition brand. When people think food tracking, they think My Fitness Pal. That brand perception takes years to shift. Garmin's betting that convenience and integration beat brand perception.

Why This Matters for Your Fitness Goals

If you're a Garmin user, this feature legitimately changes your options. You can now stay in one ecosystem for training and nutrition. That's valuable because it eliminates app switching and enables better AI recommendations that integrate both data sources.

If you're undecided on a fitness tracker, Garmin's food tracking capability might swing the decision. Instead of buying a Garmin and also paying for My Fitness Pal, you pay for Garmin and get nutrition data included in Connect Plus.

If you're a My Fitness Pal user on an Android phone, you might find Garmin Connect's experience compelling enough to switch if you buy a Garmin watch. That's the real competitive threat.

If you're a serious athlete, the integration of training data and nutrition data is genuinely useful. It enables the kind of personalized coaching that previously required hiring an actual coach.

The honest take: Garmin's feature isn't revolutionary. Food tracking has existed for years. But integrating it into their ecosystem in a frictionless way is a meaningful quality-of-life improvement if you're already using Garmin. And improving adoption and consistency of nutrition tracking, even incremental improvements, has real health outcomes. People who track food lose more weight. That's not magic; it's accountability.

Conclusion: The Broader Vision Behind the CES Announcement

Garmin's food tracking announcement at CES 2026 isn't just about adding a feature to their app. It's a statement about the direction of the fitness industry: consolidation and integration are winning over specialization.

Fitness companies used to be specialized. Strava was for endurance athletes. My Fitness Pal was for nutrition. Training Peaks was for coaching. Users had to juggle five apps to get complete picture. That was friction. It was also opportunity for platforms to build lock-in by moving "other guy's job" into their app.

Garmin's saying: we already know your heart rate, your workouts, your sleep. If we also know what you eat, we can give you holistic, personalized feedback. That's the advantage of integration. The question is whether they execute better than point solutions, and that's unresolved.

What's not unresolved: people need to track their nutrition better. Two-thirds of American adults are overweight or obese. Chronic disease burden is enormous. Most of that is driven by poor nutrition decisions, many of which happen unconsciously. Awareness, even imperfect awareness through food tracking, moves the needle.

If Garmin's tool makes food tracking 5-10% easier, and that improvement pushes even 10% more Garmin users to track consistently, that's meaningful public health impact. Scaled across millions of users, that's millions of better nutrition decisions.

The irony of announcing this in Las Vegas, surrounded by indulgence, wasn't accidental. It's a reminder that tracking happens in the real world, including hard moments. If the tool works when you're tempted to overindulge, it works everywhere.

That's the bet. We'll see if Garmin pulls it off.

FAQ

What exactly is Garmin's food tracking feature?

Garmin's food tracking system uses AI image recognition to identify foods from photos and log them directly in the Connect Plus app. You snap a picture of your meal, the AI recognizes the foods and estimates calories and macronutrients, and you can adjust portion sizes if needed. You can also log food manually and use voice commands on compatible Garmin watches to add meals without pulling out your phone.

How does the AI image recognition work for food identification?

The system uses neural networks trained on large datasets of food photos to identify foods from images. When you photograph a meal, the app analyzes visual features like color, texture, and shape, compares them to known food patterns in the training dataset, and suggests what you're eating with a confidence score. For portion size, it attempts to estimate volume based on visual cues, though accuracy in this area remains a work-in-progress that Garmin is actively improving.

What's the difference between Garmin's approach and My Fitness Pal or Noom?

Garmin's strategy is integration and convenience rather than specialization. Instead of requiring a separate nutrition app, the food tracking lives inside your existing Garmin Connect app where your workout and sleep data already exist. This enables more personalized recommendations since the AI can see your complete fitness picture. My Fitness Pal has a larger food database with more accuracy from years of refinement, while Noom focuses on behavioral psychology and coaching. Garmin is betting that convenience and integration beat specialization for most users.

Is food tracking accurate enough to rely on for weight loss?

Food tracking is accurate enough to be useful, even if not perfectly precise. Research shows that people who track food intake, regardless of app accuracy, lose 200-400 more calories daily than those who don't. That awareness and consistency matter more than perfect accuracy. Garmin's AI estimates are generally good for food identification but imperfect for portion sizes, which you can manually adjust. Tracking consistently for several weeks allows you to calibrate estimates against real weight changes.

What does Connect Plus cost and is it worth the price?

Garmin Connect Plus costs

Can I log food directly from my Garmin watch?

Yes, compatible Garmin watches let you log food directly from the wrist. You can use voice commands to say "Log chicken sandwich and fries" and the watch will parse that, send it to your phone, and log it in the app. You can also manually select foods from a list on your watch. This reduces friction compared to pulling out your phone for every meal, though voice accuracy varies depending on background noise and pronunciation.

How does Garmin use food data to improve training recommendations?

Garmin's Active Intelligence system already recommends rest days and training intensity based on recovery metrics. By adding food intake data, the system can now determine whether your nutrition is supporting your training volume. If you're doing hard workouts but undereating, the app might recommend increasing calorie intake or scaling back intensity. Conversely, if you're eating well and recovering properly, it might recommend pushing training harder. This integration creates a feedback loop that previous systems couldn't achieve.

Is my food data private and secure?

Garmin's privacy policy for health data is relatively strong—they don't sell individual health data to third parties without consent. Food photos are used for AI training only, and many are likely deleted after processing. However, account security remains important since someone with access to your account can see detailed food logs that reveal personal habits and dietary patterns. Enable two-factor authentication on your Garmin account for added protection.

How accurate are portion size estimates?

Portion estimation is the weakest part of food tracking AI. During the CES demo, Garmin's system struggled with accurate volume estimation—it guessed five corn kernels equaled a full cup. This is a known limitation because estimating three-dimensional volume from a two-dimensional photo requires sophisticated depth perception. Garmin acknowledged this limitation and said they're working on improvements. For now, you manually adjust portion sizes after the AI makes its initial guess, which takes only seconds but is an extra step.

What's the timeline for improvements to the food tracking feature?

Garmin indicated they're actively working on improving portion size accuracy, but didn't announce a specific timeline. Typical product development cycles suggest 6-12 months for meaningful improvements, though phased rollouts could bring incremental improvements faster. As users log food consistently, they also generate training data that helps the AI models improve over time, so accuracy should naturally increase as more people use the feature.

Did you find this breakdown helpful? If you're already in the Garmin ecosystem or considering switching, the food tracking integration is worth testing. The feature won't solve your nutrition problems for you, but it removes enough friction that you might actually stick with tracking long enough to see results.

Key Takeaways

- Garmin integrated food tracking into Connect Plus ($6.99/month) using AI image recognition, not building a standalone nutrition app, which is a consolidation play, not an innovation play.

- The AI identifies foods accurately but struggles with portion size estimation, which users adjust manually—a pragmatic approach that reduces friction compared to manual food logging.

- By combining food intake data with workout, heart rate, and sleep data, Garmin can personalize recommendations in ways standalone nutrition apps cannot, enabling integrated training and nutrition coaching.

- Food tracking adoption directly correlates with weight loss outcomes (200-400 calorie daily reduction), making even imperfect tracking valuable through increased awareness and accountability.

- Garmin's competitive strategy is convenience and integration over specialization, betting that staying in one app beats jumping between Garmin wearables, MyFitnessPal, and training apps separately.

Related Articles

- Garmin Nutrition Tracking: Complete Guide to Connect Plus [2025]

- Alienware's 2026 Gaming Laptop Lineup: Covert, Budget, and OLED [2025]

- Rokid Style AI Smartglasses: Everything You Need to Know [2026]

- HP's HyperX Omen Rebrand: A Gaming Laptop Strategy Gone Wrong [2025]

- MSI Prestige Laptops 2025: The Most Beautiful Business Laptops Yet [CES]

- How to Watch Hyundai's CES 2026 Press Conference Live [2026]