Google's Smartphone Pricing Gamble: Why Pixel 10 Discounts Matter Right Now

There's something unsettling happening in the smartphone market. Google is cutting prices on the Pixel 10 series harder than I've seen them do it before. And they're doing it while Samsung's Galaxy S26 is still months away from launch. That timing? It's not random.

When a company starts aggressive discounting mid-cycle, it usually means one thing: they're scared. Not of current competition, necessarily, but of what's coming. The Galaxy S26 hasn't even been officially announced yet, and Google is already reshuffling the pricing board. This isn't desperation, exactly. It's strategic positioning before the real fight begins.

I've been covering smartphone launches for years, and this pattern keeps repeating. The company with market share cuts prices to protect it. The company building hype launches something new. Google's in the first camp right now, which means they're trying to move inventory and keep customer loyalty locked in before Samsung makes its big announcement.

But here's what makes this moment interesting: it reveals something deeper about the smartphone market in 2025. Flagship phones aren't flying off shelves the way they used to. Upgrades aren't as compelling. People are keeping phones longer. And both Google and Samsung know they need to be creative to maintain momentum.

The Pixel 10 series was solid when it launched. Genuinely good cameras, solid AI integration (including features that actually matter, not just buzzwords), and a pure Android experience. But it didn't dominate the market. It didn't create that universal "everyone wants one" energy. So now Google's doing what you do when you've got a good product that isn't moving: you make the price impossible to ignore.

The Current Pixel 10 Pricing Landscape: What's Actually Happening

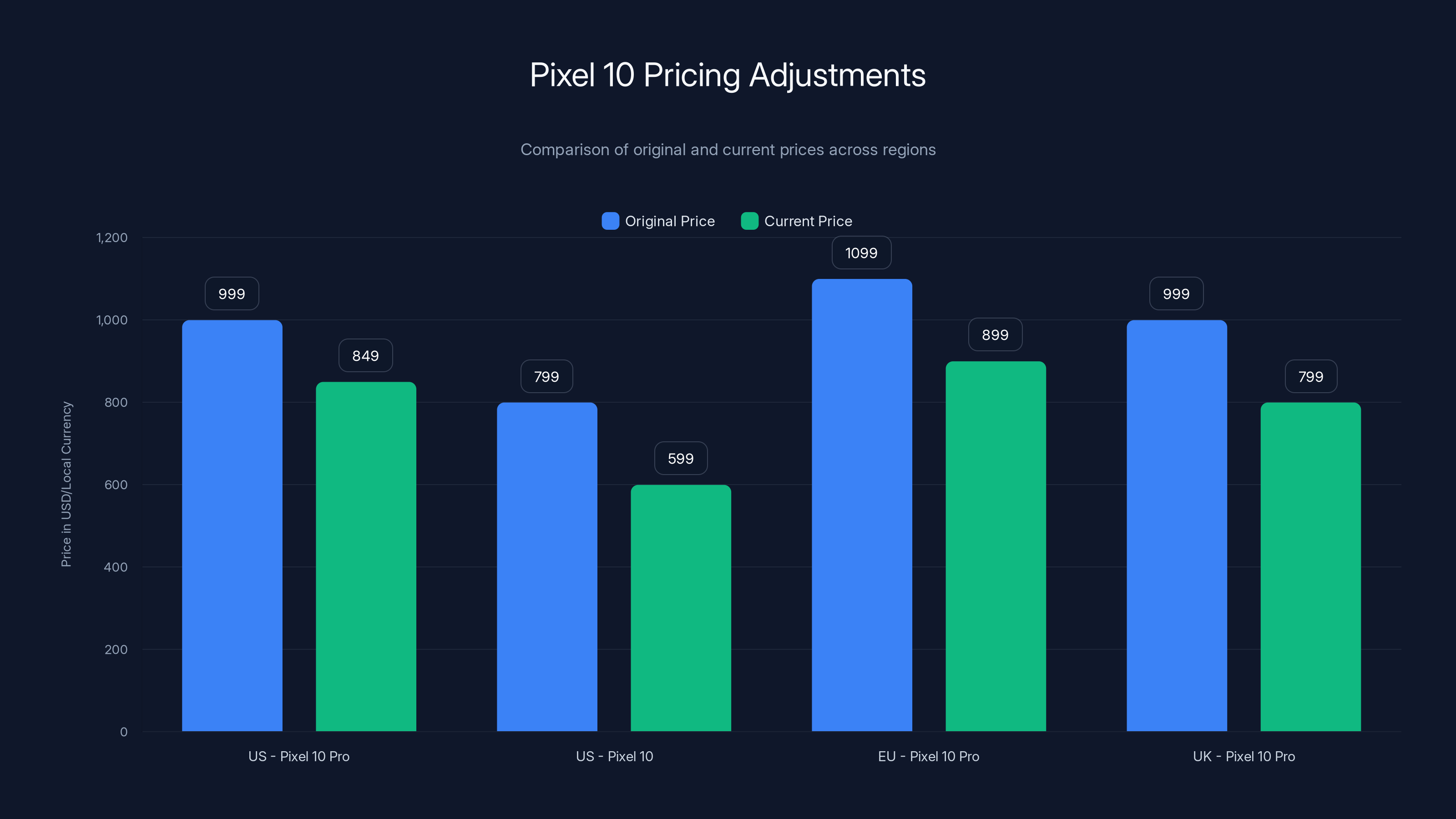

Let's talk specifics, because numbers tell the real story. Google's been running different discounts in different regions, which matters more than people think.

In the US market, the Pixel 10 Pro started at

What's interesting is how these discounts are being handled. Google isn't just running a "sale" period. They're adjusting the baseline pricing on carrier bundles, offering trade-in bonuses that exceed the phone's actual trade-in value, and running carrier-exclusive deals that make the math almost ridiculous. A new customer switching to Google Fi with a Pixel 10 Pro? You might be looking at effectively $599 after promotional credits.

The trade-in strategy is particularly worth noting. Google's offering

Carrier partnerships matter too. Verizon, T-Mobile, and AT&T are all running aggressive bundle deals. Buy a Pixel 10 Pro, get a Pixel Watch for free. That's another

International pricing tells a similar story. In European markets, the Pixel 10 Pro has dropped from €1,099 to around €799-€899 in many regions. In the UK, prices have shifted from £999 to £749-£799. These aren't small movements. They're fundamental repositioning.

What you're not seeing is Google publicly announcing price cuts. They're happening through retail channels, carrier programs, and seasonal promotions. That's deliberate. It lets Google maintain the illusion of premium pricing while actually moving the needle on street price. It's a sophisticated game, and it's working. Pixel 10 sales velocity has picked up noticeably since these discounts ramped up.

The Pixel 10 series has seen significant price reductions across major markets, with discounts ranging from 15% to 25% off the original price.

Why Samsung's Galaxy S26 Terrifies Google (Even Though It Hasn't Launched)

The Galaxy S26 doesn't exist yet. No official announcement. No leaked specs that are confirmed. No confirmed release date. And Google is already running defense.

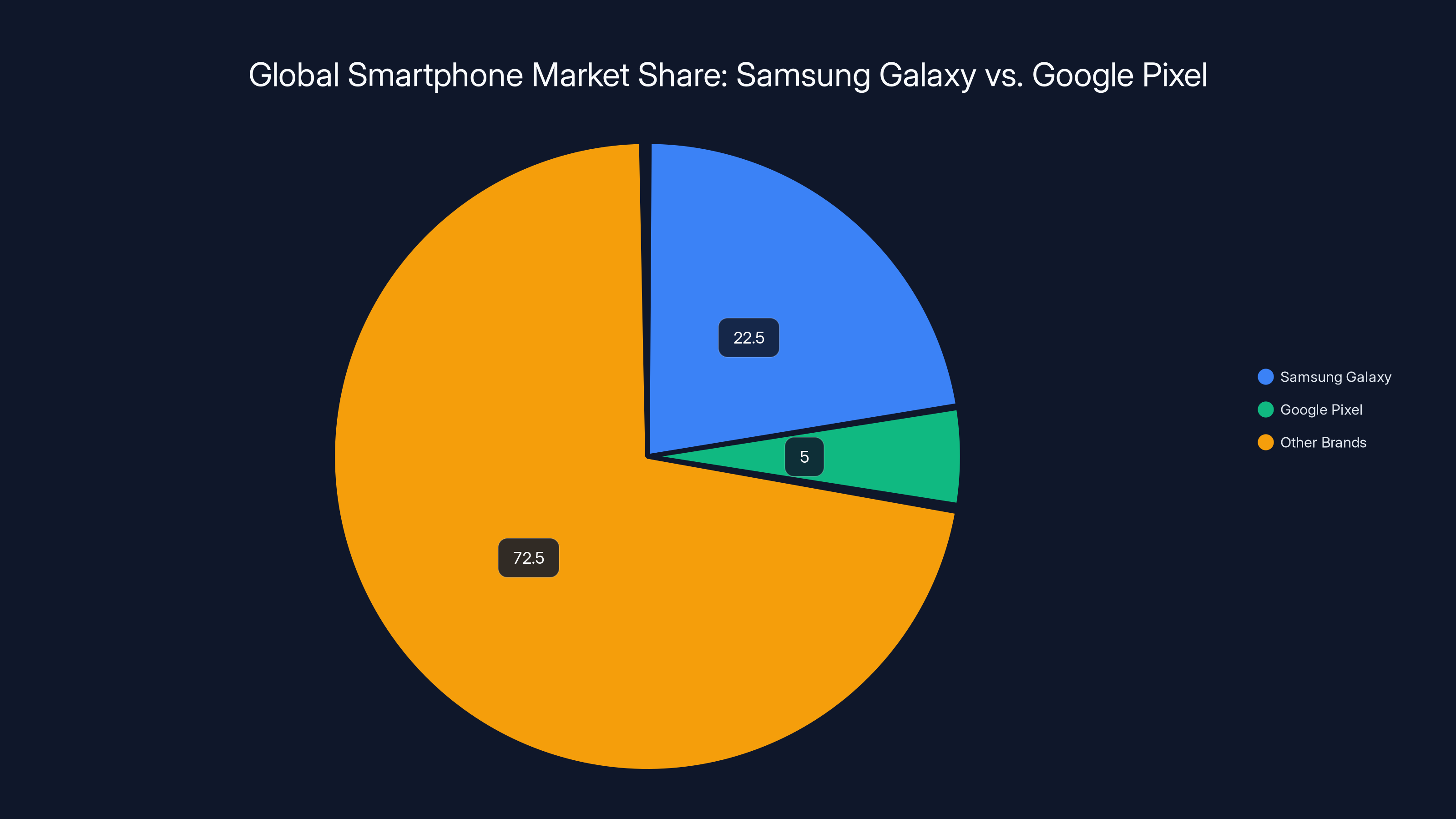

This tells you everything you need to know about how Samsung has conditioned the market. When Samsung launches a flagship Galaxy phone, it moves units. Historically, the Galaxy S series outsells Pixel phones by a significant margin. Globally, Samsung's Galaxy line represents somewhere around 20-25% of all smartphone sales. The Pixel, for context, represents somewhere in the 4-6% range. Those numbers have been relatively stable for three years.

But the gap is closing. Or more accurately, it's becoming less relevant. The Pixel 10 represented a genuine jump in software sophistication. Google's AI integration, the magic eraser, the call screening, the voice typing, the search capabilities baked into everything. These features matter. They create a reason to buy a Pixel instead of a Galaxy, even if the Galaxy specs look better on paper.

Samsung's usual response is to iterate heavily on the hardware. Better screens, faster processors, more cameras, bigger zoom ranges. The Galaxy S25 did this effectively. So Samsung has every reason to push hard on the S26. Better processor (likely the Snapdragon 8 Elite Gen 2 or whatever comes next). Better display tech. Better cameras. Better battery life. The usual Samsung playbook.

When that phone launches, it will likely be priced the same as the Pixel 10:

Google knows this. So they're preemptively making the Pixel 10 cheaper. They're building install base. They're creating a situation where by the time the S26 launches, there will be hundreds of thousands of new Pixel users who've gotten comfortable with the ecosystem, the software, the AI features. That switching cost matters.

It's actually brilliant strategy. You don't beat Samsung on specs. So you don't try. You beat them on value and ecosystem lock-in.

Samsung's Galaxy series holds a significant market share advantage over Google's Pixel, with Galaxy at approximately 22.5% and Pixel at 5%. Estimated data based on historical trends.

The Smartphone Market Has Fundamentally Changed

Here's something that doesn't get discussed enough: smartphones stopped being about raw capability years ago. Every flagship phone can do everything every other flagship phone can do. The Pixel 10, Galaxy S25, iPhone 16 Pro—they can all take incredible photos, run any app you want, handle gaming and video. They're all overkill for normal human tasks.

What changed is software. And specifically, AI integration. That's the actual differentiator now.

Apple put intelligence (their word for AI) into iOS 18. Google put AI into everything—photos, docs, presentations, search, calls. Samsung added Galaxy AI features but started from behind. These software layers are what make phones feel different, feel valuable, feel worth keeping.

The other thing that changed is upgrade cycles. Five years ago, phones lasted 3-4 years and then you needed a new one. Batteries degraded, performance slowed, apps required more power. Now phones last 5-7 years comfortably. The Pixel 8 from 2023 still handles 2025 apps perfectly fine. Battery degradation is slower. Software support is longer.

This creates a problem for phone manufacturers: fewer people upgrade. The upgrade market—that reliable base of customers buying a new phone every 2-3 years—is shrinking. So phone companies need to either increase the price on each phone (to make up for fewer sales) or they need to move more phones at lower prices to maintain revenue.

Google's doing the second approach right now. Move Pixels at lower prices, build the user base, and figure out monetization through services, software, and ecosystem lock-in. It's a different playbook than premium positioning, but it might be smarter in 2025.

Comparing Launch Prices: Pixel 10 vs Galaxy S25 vs iPhone 16

Let's look at the pricing picture when these phones launched:

| Phone Model | Launch Price (Standard) | Launch Price (Pro/Plus) | Current Discounted Price |

|---|---|---|---|

| Pixel 10 | $799 | $999 | |

| Galaxy S25 | $799 | $999 | |

| iPhone 16 | $799 | $999 |

The pattern is clear: Google is undercutting everyone else on street price, even though they started at the same launch MSRP. That $200+ price advantage on the Pixel 10 Pro matters. For a lot of consumers, that's the deciding factor.

Galaxy S25 pricing hasn't moved dramatically. Samsung holds its pricing power better. Carriers offer trade-in deals and bundles, sure, but Samsung isn't slashing MSRP. They're more confident in the Galaxy brand's value proposition.

iPhone 16 pricing is actually holding firm too. Apple doesn't discount much, ever. You can find deals at third-party retailers, but Apple's not pushing discounts through carriers or bundles the way Google is.

This creates an interesting dynamic: if you want the best specs at the lowest price, Galaxy S25 wins. If you want the best software experience at the lowest price, Pixel 10 wins. If you want the best ecosystem lock-in (and don't care about price), iPhone wins.

The Galaxy S26 will disrupt this balance. It'll have better specs than the Pixel 10 and probably match or beat it on price. When that happens, Google's price advantage evaporates. Unless they cut even deeper.

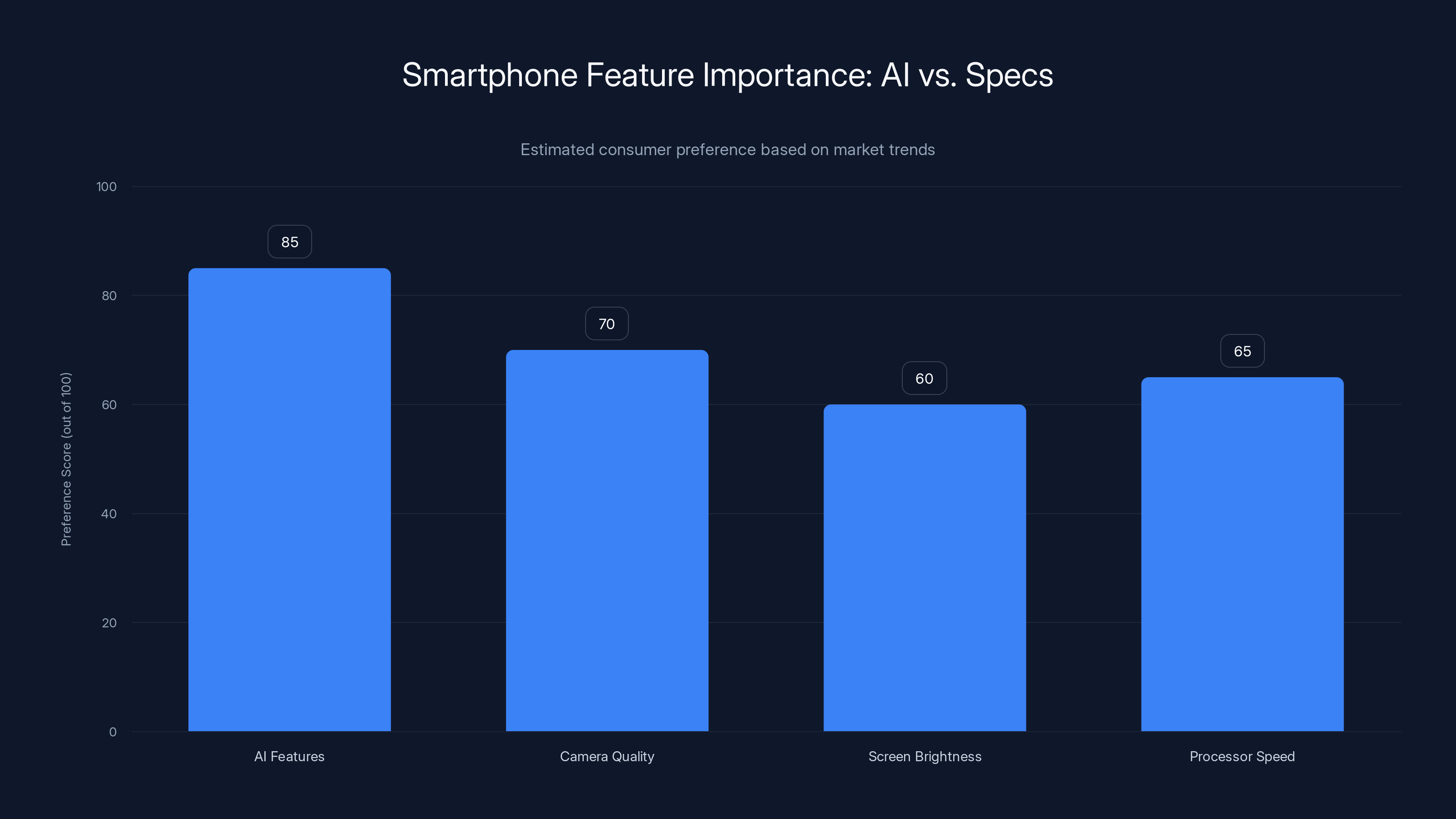

Estimated data suggests consumers prioritize AI features over traditional specs like camera quality and screen brightness. This aligns with Google's strategy focusing on AI differentiation.

What the Galaxy S26 Is Expected to Bring (And Why It Matters)

We don't have confirmed specs for the Galaxy S26. Samsung hasn't announced it officially. But based on Samsung's historical patterns and the roadmaps we've seen from semiconductor partners, we can make educated guesses.

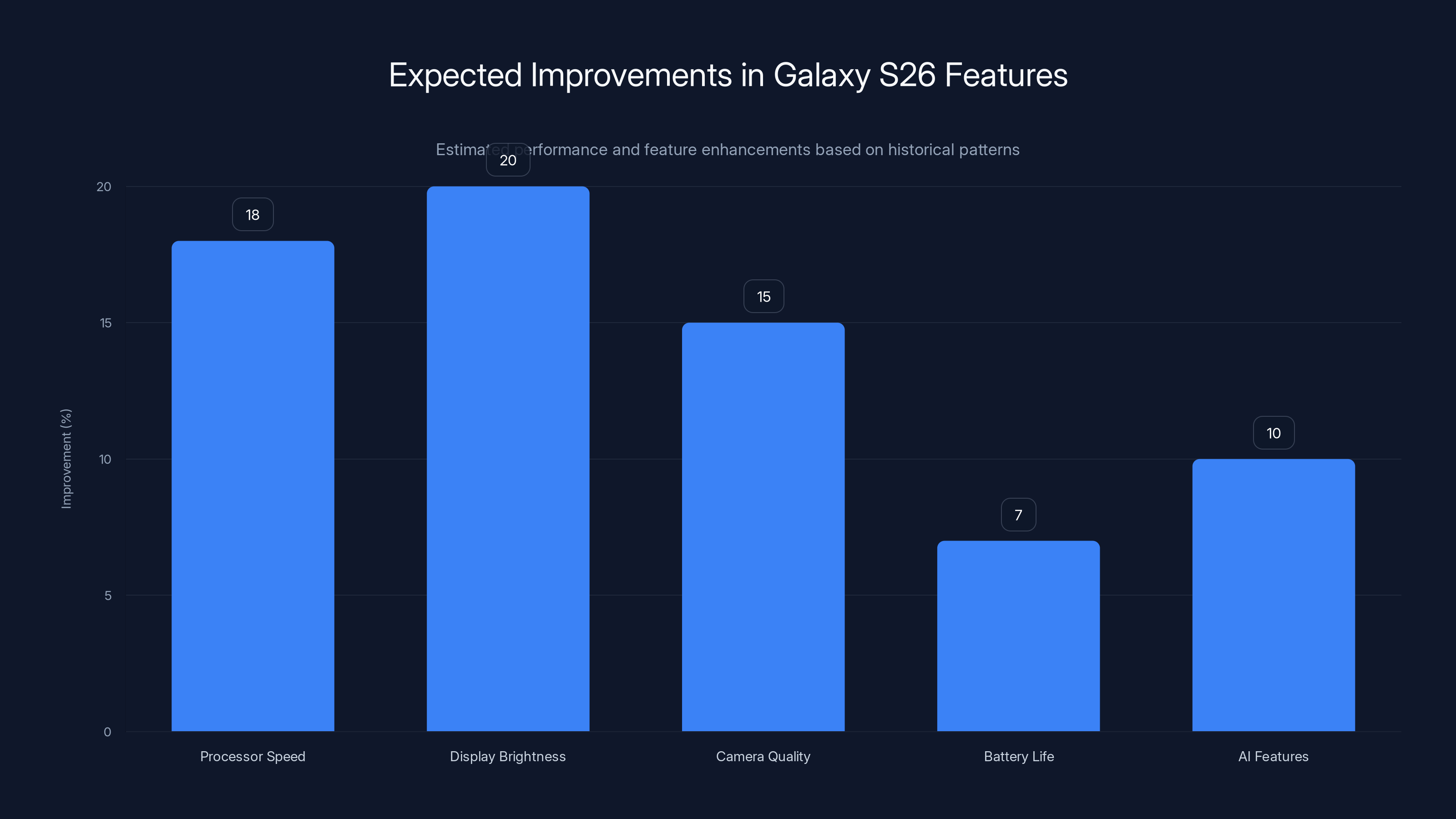

The Processor: Expect Snapdragon 8 Elite Gen 2 or the next iteration. This chip will be maybe 15-20% faster than what's in the S25, which itself was maybe 15-20% faster than the S24. These are incremental jumps, but they compound. Real-world performance will be noticeably snappier, though most people won't really feel it for normal tasks.

The Display: Samsung will probably push the brightness further. The S25 already has an incredible screen, but Samsung will likely hit 2000-2500 nits peak brightness. They might also introduce some new color tech or a higher refresh rate option. Maybe 144 Hz on the Pro model. Again, incremental, but it'll look stunning in specs.

The Camera System: This is where Samsung always differentiates. Expect a main sensor with higher megapixel count or better light-gathering ability. Better zoom capabilities. Probably a new processing pipeline that Samsung will claim makes photos sharper, colors more accurate, etc. They'll have marketing claims that sound better than Google's actual capabilities, but Google's photos will probably be indistinguishable or better in real use.

The Battery: Larger capacity, probably. The S25 was already good at battery life, so expect maybe 5-10% improvement. This will be marketed as "all-day battery" or "next-day battery," but in practice it'll be a modest bump.

AI Features: This is where it gets interesting. Samsung's Galaxy AI is currently behind Google's offerings. Samsung will try to catch up with new features, but Google's advantage here is substantial. Google's been doing AI in phones longer and more comprehensively. Samsung will add features, but they'll likely be: 1) Late to market, 2) Not as well integrated, 3) Requiring more processing power.

The Price: Here's my prediction: Samsung launches the S26 at

When that happens, the Pixel 10's primary advantage (price) disappears. Google will need to either cut further or pivot to software/AI value. This is the moment the real competition starts.

The AI Factor: Software Differentiation in 2025

Here's what's actually important when choosing a flagship phone in 2025: what AI features come built-in, and how well do they work?

Google has advantages here that are hard for competitors to copy quickly:

Search Integration: Google's Pixel phones can search across all your files, photos, emails, and messages through a unified interface. This is genuinely useful for people who take a lot of photos or have lots of files on their phone. Samsung and Apple are trying to match this, but Google's integration is deeper.

Photo Magic: The magic eraser has been on Pixel phones for years, and it's gotten progressively better. The new version can handle complex scenes—removing people while keeping backgrounds intact—in ways competitors still can't match. This single feature justifies a Pixel for some people.

Call Screening and Call Assist: Google's AI can screen calls, respond to texts with AI-suggested replies, and even transcribe voicemails in real-time. It's the most practical AI feature on any phone. Apple doesn't have the equivalent. Samsung is catching up but not there yet.

Smart Compose and Writing Tools: Google's AI writing assistance is built into messages, emails, and docs across the Pixel ecosystem. You can ask it to make text more casual, more formal, shorter, longer, etc. It's practical and works well.

Generative Photos: This one is newer. Google's Pixel can now generate variations of photos—different sky, different time of day, etc. It's creative and fun, if not incredibly practical.

Samsung's Galaxy AI includes:

Circle to Search: Samsung's answer to visual search. You circle something in any app and search for it. Works well and is becoming standard across Android.

AI Photo Editing: Samsung's AI can enhance photos, adjust lighting, change backgrounds, etc. Good tech, but not as polished as Google's magic eraser.

Generative Rewrite and Compose: Similar to Google's writing tools, but less comprehensive across the ecosystem.

Apple's Intelligence is still rolling out, but includes:

Writing Tools: Similar to Google and Samsung, helps with tone and clarity.

Photo Cleanup: Similar to Google's magic eraser, but less powerful.

Visual Intelligence: Similar to Samsung's circle to search.

The gap here is significant. Google's AI integration is deeper, broader, and more useful in daily life. This is Google's moat against Samsung. And Samsung knows it. The S26 will likely introduce new AI features in an attempt to close this gap. But Google won't stand still either. By the time the S26 launches, Google will probably have pushed new AI features to Pixel phones.

This is the real competition: not specs, but software capabilities. And in that department, Google has momentum.

The Galaxy S26 is expected to feature up to 20% brighter displays and 18% faster processors. Camera and AI improvements are anticipated but may not surpass competitors. Estimated data.

Carrier Strategies and Why They Matter

Most people don't think about it, but your carrier (Verizon, T-Mobile, AT&T) has enormous influence on which phone you buy. And right now, carriers are pushing Pixel 10 hard.

Why? Because carriers make money on multiple vectors: the phone subsidy, the monthly service, the add-ons. If Google's cutting prices and offering trade-ins, carriers get excited because it moves customers. New customers (especially switchers from other carriers) are valuable. They sign multi-year contracts, add family lines, buy protection plans.

T-Mobile has been particularly aggressive with Pixel deals. They've offered things like "buy a Pixel 10, get a Pixel Watch free." Verizon is running "switch to Verizon and get $500 off a Pixel 10 Pro." AT&T is running similar plays.

Samsung gets carrier support too, but it's different. Samsung commands more retail shelf space and marketing prominence, even with aggressive discounting. Carriers treat Samsung as a flagship brand. They treat Pixel as a value option. That positioning could shift if Google's AI capabilities become the flagship story instead of specs.

When the Galaxy S26 launches, watch where carriers put marketing emphasis. If they push it hard, Samsung's got momentum. If they play it cool and emphasize the Pixel's AI advantages, Google maintains control.

Carrier positioning is actually one of the less-discussed factors in smartphone success. Marketing budgets matter. Retail placement matters. Which phone the sales rep pushes when you come in matters. Right now, the carrier ecosystem is tilted toward Pixel. That could be a huge advantage when S26 launches.

Regional Variations: Why Your Market Matters

Smartphone pricing and positioning isn't uniform globally. Markets have different dynamics, different preferences, different carrier ecosystems.

North America: This is where the competition is fiercest. Pixel, Galaxy S, and iPhone are all competing aggressively. Google's discounts are deepest here. This is the reference market for most tech coverage.

Europe: Samsung is stronger here. Europeans tend to prefer Samsung's ecosystem integration and camera tech. Pixel is growing but isn't dominant. Google's discounts in Europe are real but not as aggressive as North America.

Asia: This is complicated. In some Asian markets (Japan, Korea), Samsung is extremely strong. In others (China, India), local brands compete heavily. Google's Pixel presence is weaker in Asia generally. The Galaxy S25 and S26 will dominate specs conversations in Asia more than Pixel will.

Rest of World: Varies significantly. In some markets, iPhone dominates. In others, Samsung or local brands lead.

For evaluating Google's price cuts, the North American market is most important. That's where the strategy is being executed most aggressively and where the impact is most visible.

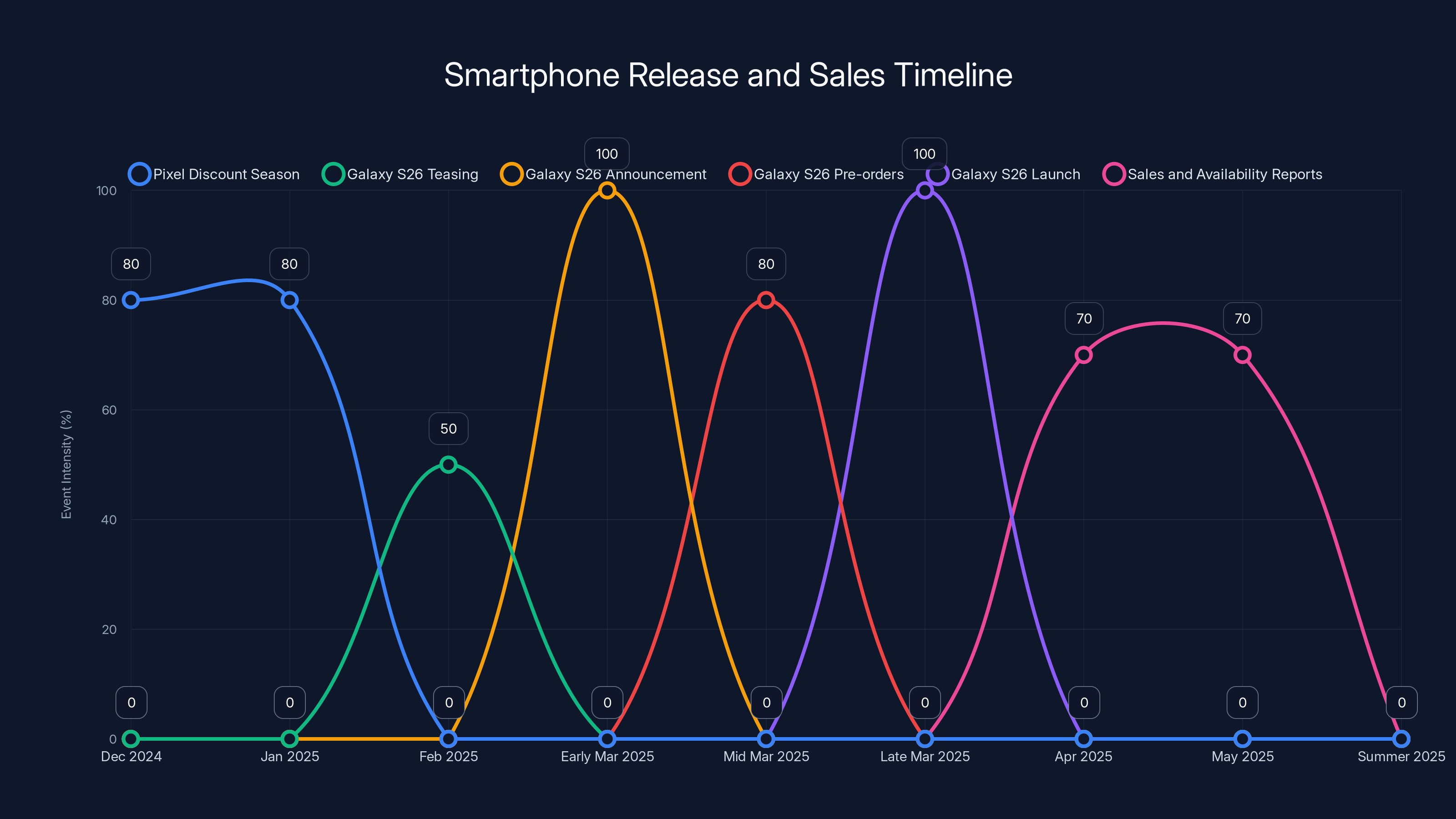

The timeline shows key events for Pixel discounts and Galaxy S26 launch. Peak Pixel discounts occur in Dec 2024-Jan 2025, while Galaxy S26 activities intensify from Feb 2025 onwards. (Estimated data)

Timeline: When Things Actually Happen

Here's what the smartphone calendar looks like:

December 2024 - January 2025: This is peak Pixel discount season. Google's maximizing sales before S26 hype builds.

February 2025: Samsung starts teasing the Galaxy S26. No official announcement yet, but rumors intensify, leaks multiply.

Early March 2025: Samsung officially announces the Galaxy S26. Full specs, full pricing. The comparison game begins in earnest.

Mid-March 2025: Galaxy S26 pre-orders open. Carriers start running promotional campaigns. Marketing battles heat up.

Late March / Early April 2025: Galaxy S26 launches for real. This is when the market sees actual customer preference data.

April-May 2025: First availability reports and initial sales data. By this point, we'll know whether the S26 is a hit or not. We'll also know whether Google's Pixel pricing strategy worked.

Summer 2025: Typically quieter period, but phones that sell well in March-April stay on promotional calendars longer.

If you're in the market for a flagship Android phone right now, understand this timeline. Buy a Pixel 10 before S26 launches, and you get the best price on a genuinely good phone. Wait until S26 launches, and you'll be comparing at true MSRP, unless Google cuts prices further.

The Longer Game: What This Pricing War Signals

Google's aggressive Pixel 10 discounts aren't just tactical. They signal something bigger about where the smartphone market is heading.

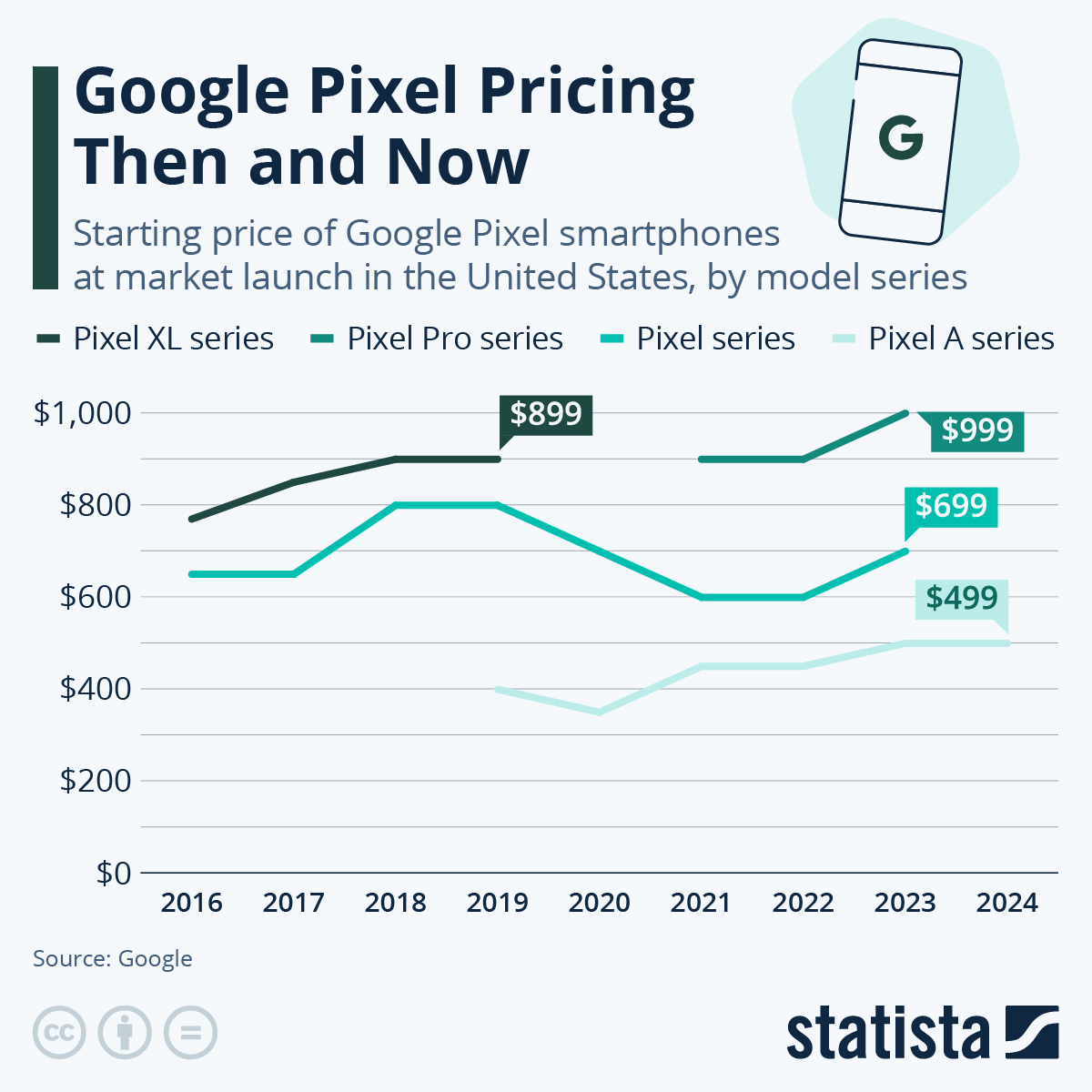

Premium pricing on smartphones is eroding. For years, $999 was acceptable for a flagship. Consumers paid it without question. Now, they question it. The value proposition has to be clearer. The differentiation has to be real.

Google's bet is that software differentiation (AI, specifically) matters more than hardware specs. They're betting that people care more about their photos coming out better, calls being screened automatically, and text being rewritten by AI than they care about having an extra 50 megapixels or 500 nits of brightness.

If Google wins that bet, their strategy of undercutting Samsung on price while matching them on features is brilliant. They build market share, establish the Pixel as the thinking person's choice, and create ecosystem lock-in through software.

If Google loses that bet, they're just competing on price. And competing on price is not a good strategy for a company trying to maintain premium positioning and profit margins.

Samsung's bet is the opposite: that specs still matter, that design and build quality matter, that the Galaxy brand is strong enough to justify premium pricing. If that's true, Samsung will launch S26 at the same price as Pixel 10, undercut it on specs, and the market will choose Samsung.

One of these narratives will be proven right in the next few months. The market data will tell us. Pre-order numbers will matter. Early sales numbers will matter. Customer retention will matter. Carrier support will matter.

My read: Google wins this round. Pixel 10's AI capabilities are genuinely useful. The price advantage is substantial. And most consumers care more about AI that actually works than about having the absolute latest processor or brightest screen. But it's not certain. Samsung's a formidable competitor, and the S26 could be a genuine flagship that justifies its price.

We'll know in 90 days.

What Buyers Should Actually Do Right Now

If you're thinking about buying a flagship phone, here's my honest assessment:

Buy a Pixel 10 if: You care about software, AI features, and value. The discounts available right now are genuinely good. You're getting a great phone for

Wait for Galaxy S26 if: You want the best hardware specs available. You're willing to pay premium price for it. You prefer Samsung's design and ecosystem. You want to see how Samsung's new AI features compare. If specs matter more to you than price, wait 60 days and compare at launch.

Buy an iPhone if: You care about the ecosystem and integration with other Apple products. Price is less important to you. You want the guarantee of software support and updates for 6+ years. iPhone is the lock-in choice.

Buy a previous-generation Galaxy S25 if: You want Galaxy specs but don't want to spend new-model money. The S25 is still an incredible phone and will be heavily discounted once S26 launches. It'll perform better than a Pixel 10 on paper. You'll save money compared to either new-generation option.

My personal recommendation: If you need a phone now and care about value, Pixel 10. If you can wait 60 days and want the absolute best hardware, wait for S26. If you're a specs optimizer, Galaxy. If you care about the ecosystem and don't mind paying, iPhone.

The Broader Implications: Where Smartphones Go From Here

What's happening with Pixel 10 pricing and Galaxy S26 competition tells us something important about the smartphone market's future.

First: spec competition is becoming less important. When every phone has a 7nm processor, 8GB+ of RAM, and a 120 Hz display, incremental improvements matter less. They still matter, but they're not the reason people choose phones anymore.

Second: software and AI are becoming the primary differentiator. Google understands this. Apple understands this. Samsung is trying to understand it. The company that builds the most useful, most integrated, most intuitive AI experience wins the market.

Third: pricing is becoming more flexible and more aggressive. Gone are the days of rigid $999 flagships. Pricing will be dynamic, carrier-dependent, region-specific, and constantly optimized. You'll see deals based on timing, location, trade-in, carrier, and bundle eligibility.

Fourth: ecosystem lock-in is becoming more important. People don't just buy phones anymore; they buy into ecosystems. iPhone ecosystem, Google ecosystem (Pixel, Docs, Drive, Gmail, etc.), Samsung ecosystem. Switching costs matter because you're switching out of an entire ecosystem, not just a device.

Fifth: upgrade cycles are getting longer. People are keeping phones for 5-7 years instead of 3-4 years. This means manufacturers need to either increase revenue per phone or find new revenue sources. Google's betting on services. Samsung's betting on design and specs. Apple's betting on ecosystem.

All of this is visible in Google's Pixel 10 strategy right now. They're executing a software-first, value-conscious, ecosystem-focused approach that's fundamentally different from Samsung's spec-first, design-focused strategy.

One approach will prove smarter than the other. The next few months will tell us which.

FAQ

Why is Google cutting Pixel 10 prices before the Galaxy S26 even launches?

Google's preemptively moving inventory and building install base before Samsung's flagship arrives. It's a defensive strategy to establish user loyalty and create switching costs through ecosystem integration. When you've owned a Pixel for a few months and you're comfortable with the software and AI features, switching to Galaxy becomes more difficult, even if it has better specs. Google's betting they can win on software and ecosystem, so they're reducing friction for customers to try Pixel first.

Will the Galaxy S26 have better specs than the Pixel 10?

Most likely yes. Samsung historically wins the spec battle: faster processor, brighter display, better cameras on paper, longer battery life in marketing claims. But "better specs" doesn't always translate to better real-world experience. Google's software optimization often makes the Pixel feel faster, and its AI features often deliver more practical value than Samsung's hardware advantages. The S26 will impress on specs; whether it impresses in actual daily use depends on Samsung's software execution.

Should I buy a Pixel 10 now or wait for the Galaxy S26?

It depends on your priorities. If you care about value and software features, buy now while discounts are deepest. The Pixel 10 is a genuinely good phone, and prices won't be this low again. If you care about having the absolute latest hardware or prefer Samsung's ecosystem, wait 60 days for S26 launch so you can compare at equivalent pricing. The cost difference between buying now and buying in 60 days is probably

What AI features does the Pixel 10 have that the Galaxy S25 doesn't?

Pixel 10 has deeper integration of generative AI across the system. Magic eraser is more sophisticated. Call screening actually prevents scam calls from ringing. Writing tools work across emails, messages, and documents. Photo generation and variations are more advanced. Search integration is smarter. These aren't single features; they're systemic AI advantages that matter in daily use. Samsung's Galaxy AI is good and improving, but it's not as comprehensive or as well-integrated.

Will Google drop Pixel 10 prices even further once Galaxy S26 launches?

Probably not dramatically. Google will likely maintain current discount levels through carrier bundles and trade-in promotions, but won't slash MSRP further. That would hurt margins and signal weakness. Instead, Google will emphasize AI capabilities and value proposition to justify pricing against the Galaxy S26's spec advantages. If Galaxy S26 doesn't sell as well as expected, then prices might stay where they are. If it's a hit, Google might cut deeper 90 days after launch.

Is the Pixel 10 still worth buying in late 2024 / early 2025?

Yes, absolutely. The Pixel 10 is an excellent phone. The current pricing makes it a great value. You'll get at least 3-4 years of software support, excellent AI features, a great camera, and a pure Android experience. The discounts available right now reflect inventory management, not product problems. If the Pixel 10 meets your needs and you need a phone now, the current pricing makes it an easy recommendation. You're getting a flagship phone for mid-range pricing.

What carrier has the best Pixel 10 deals right now?

T-Mobile generally has the most aggressive Pixel promotions, followed by Verizon and AT&T. The specific best deal depends on your situation (new customer vs. existing, trade-in eligibility, financing options, bundle interest). Check all three carriers' websites directly because deals rotate monthly and vary by region. Also check unlocked pricing on Google's website and third-party retailers like Best Buy, as those sometimes beat carrier prices once you factor in taxes and financing.

Conclusion: The Market Has Spoken, But the Game Isn't Over

Google's aggressive Pixel 10 price cuts are a calculated response to Samsung's Galaxy dominance and a bet on software differentiation over hardware specs. They're signaling that in 2025, AI capabilities and user experience matter more than raw processor power or megapixel counts.

Is that the right bet? Probably. But Samsung's not helpless. The Galaxy S26 will be a genuinely good phone with specs that look impressive on paper. Samsung knows the game. They'll run marketing that emphasizes hardware advantages. They'll position the S26 as the "ultimate flagship" for specs obsessives.

For most consumers, the choice boils down to preference: Do you want the best software experience and AI features at a great price (Pixel 10)? Or do you want the best hardware specs available and Samsung's proven ecosystem (Galaxy S26)?

Both are excellent phones. Both will handle everything you throw at them. Both have their strengths. The fact that Google's willing to cut prices to convince you their strengths matter more than Samsung's is actually healthy for the market. It means innovation is being driven by something other than just adding specs.

The next few months will show us which strategy worked better. But right now, in December 2024, if you're looking for a flagship Android phone, you've got genuine options at reasonable prices. That's not a given in the smartphone market. Use that advantage.

Buy what works for you. Don't buy what you think you're supposed to want. And if you're on the fence between Pixel and Galaxy, understand that your decision signals to both companies what matters. Google's betting you care about software. Samsung's betting you care about specs. The winner will determine what flagship phones look like in 2026.

The game is on.

Key Takeaways

- Google's Pixel 10 price cuts reflect strategic positioning ahead of Samsung's Galaxy S26 launch, designed to build install base and ecosystem lock-in

- AI capabilities have become the primary smartphone differentiator, with Pixel's integrated AI features (magic eraser, call screening, generative writing) providing more practical value than hardware specs alone

- The smartphone market is shifting from spec-based competition to software and AI differentiation, signaling that processor power and megapixels matter less than user experience

- Current Pixel 10 discounts of 15-25% represent historically deep pricing that will likely not return after Galaxy S26 launches, making now an optimal buying window for value-conscious consumers

- Carrier partnerships and regional pricing variations create complex dynamics where street prices diverge significantly from MSRP, requiring strategic timing for optimal purchasing decisions

Related Articles

- Samsung Galaxy S26 Launch Date and Expected Discounts [2025]

- Verizon's iPhone 17 Pro Free Deal: Complete Guide & Expiration Timeline [2025]

- Samsung Galaxy S26 Leak: Full Specs and Why It Might Disappoint [2025]

- Samsung Galaxy S26: What Customers Really Want [2025]

- AirPods Pro 3 Hit Record Low Price: $65 Discount Explained [2025]

- Metro by T-Mobile Free iPhone 16e Deal: Is It Worth It? [2025]