The Pixel Paradox: A Phone Caught Between Two Strategies

Google's been playing phone roulette for years now, and 2026 might be the year they finally have to pick a lane. The Pixel lineup has always felt like a phone that doesn't quite know what it wants to be. One year it's the computational photography champion. The next, it's the AI phone that does things nobody else can. Sometimes it's both. Sometimes it's neither.

Here's the thing: everyone expects flagship phones to do flagship things. That means top-tier processors, the latest RAM, screens that don't embarrass you in bright sunlight. Apple does it. Samsung does it. Even One Plus figured it out. But Google's been walking a tightrope, betting that software magic and AI integration could compensate for slightly older chips and middling specs.

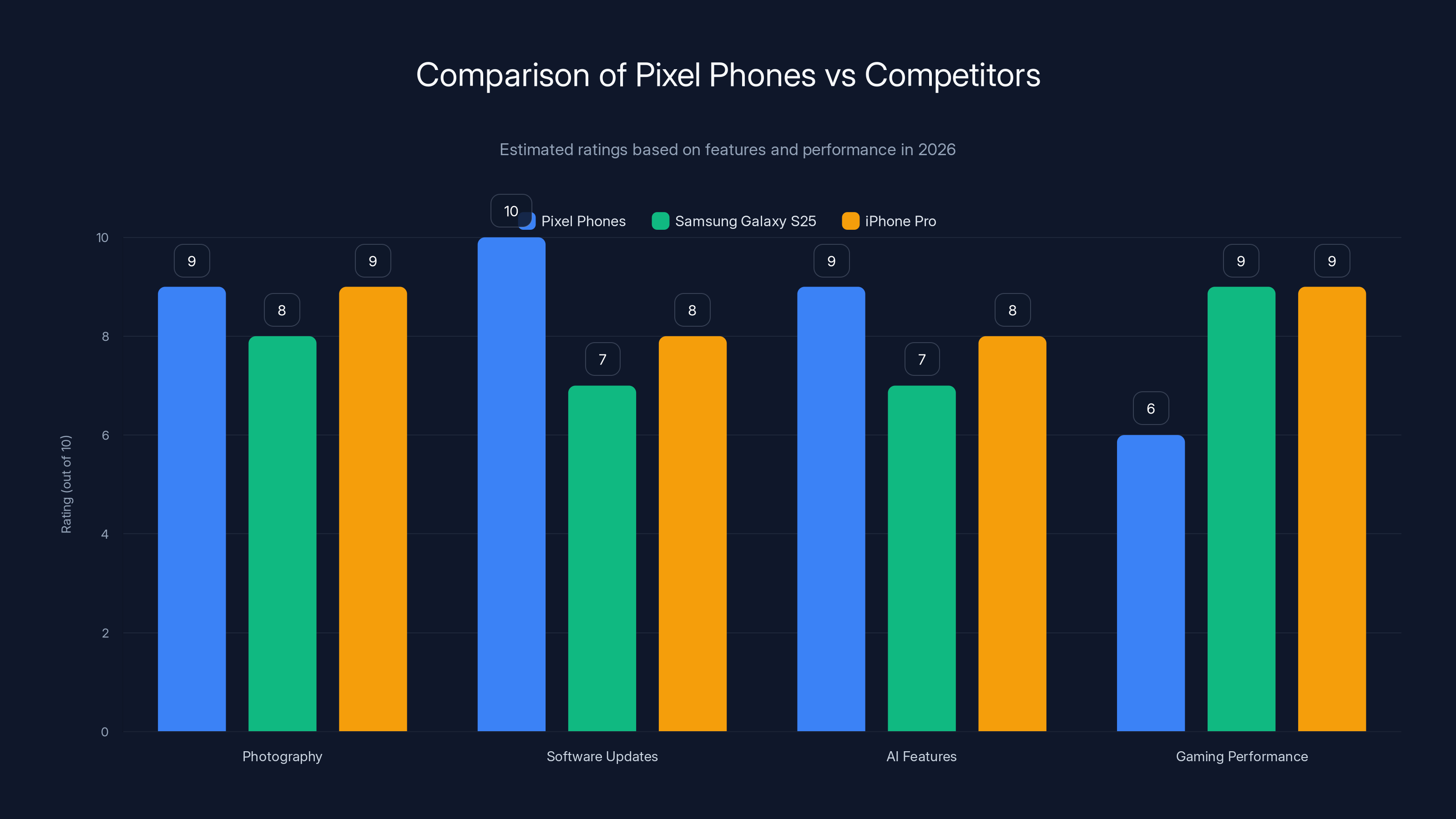

That strategy worked for a while. Really worked, actually. The Pixel 6 was revelatory. The Pixel 7 was solid. But somewhere around the Pixel 8 era, something shifted. Users started noticing the gap widening. Not in photos—Google still owns that game. But in raw speed, multitasking smoothness, and that vague feeling of "does this phone feel fast" that's hard to quantify but impossible to ignore.

The problem isn't that Pixel phones are bad. The problem is that Google's confused about what Pixel phones are supposed to be, and that confusion is trickling down to customers trying to decide whether to buy one.

The Processor Problem: Why Tensor Can't Keep Up

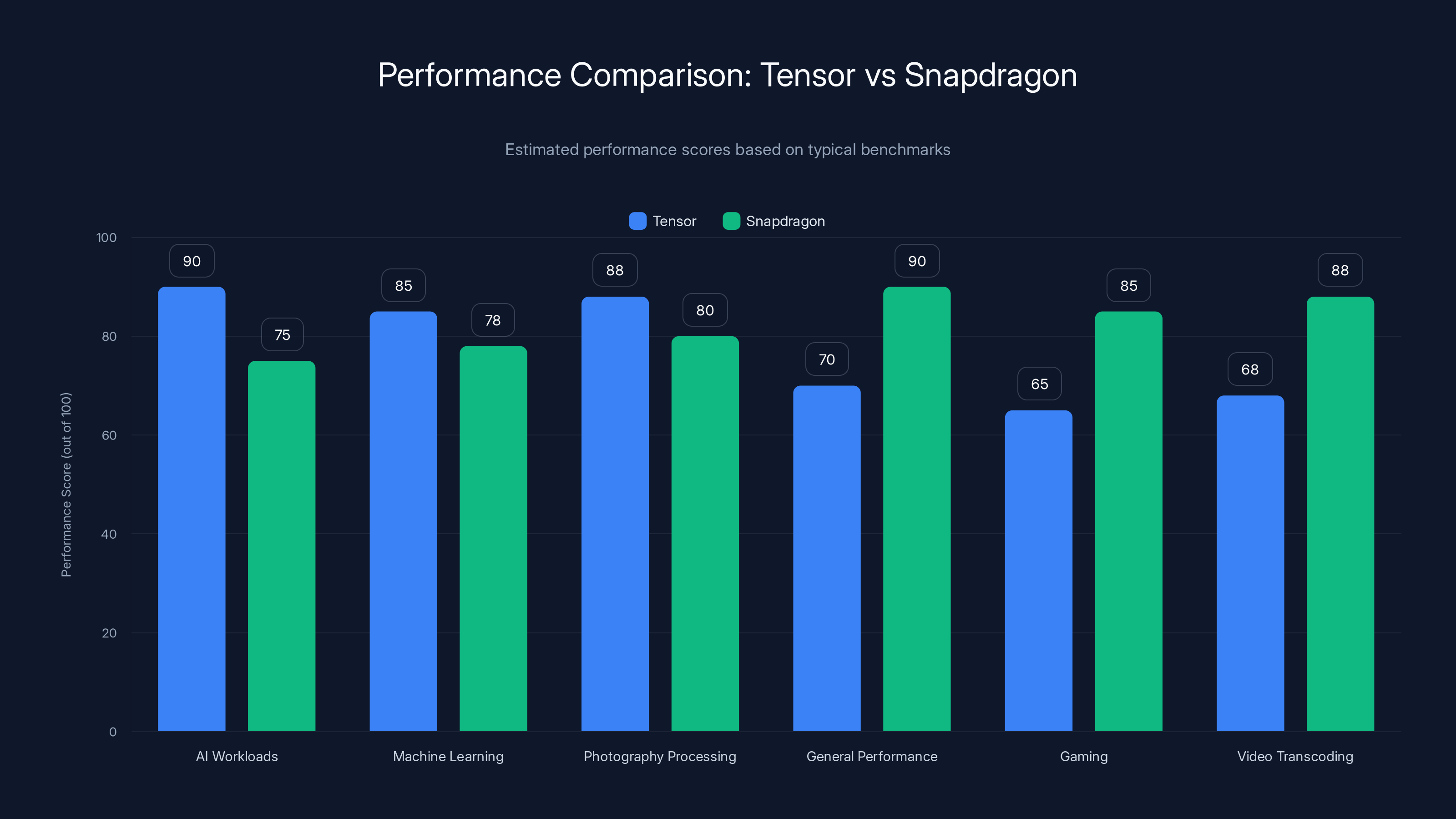

Let's talk about the elephant in the room: the Tensor chip. Google's custom silicon was supposed to be brilliant. And it is—at specific things. AI workloads. Machine learning tasks. Photography processing. That's where Tensor shines with an almost unfair advantage.

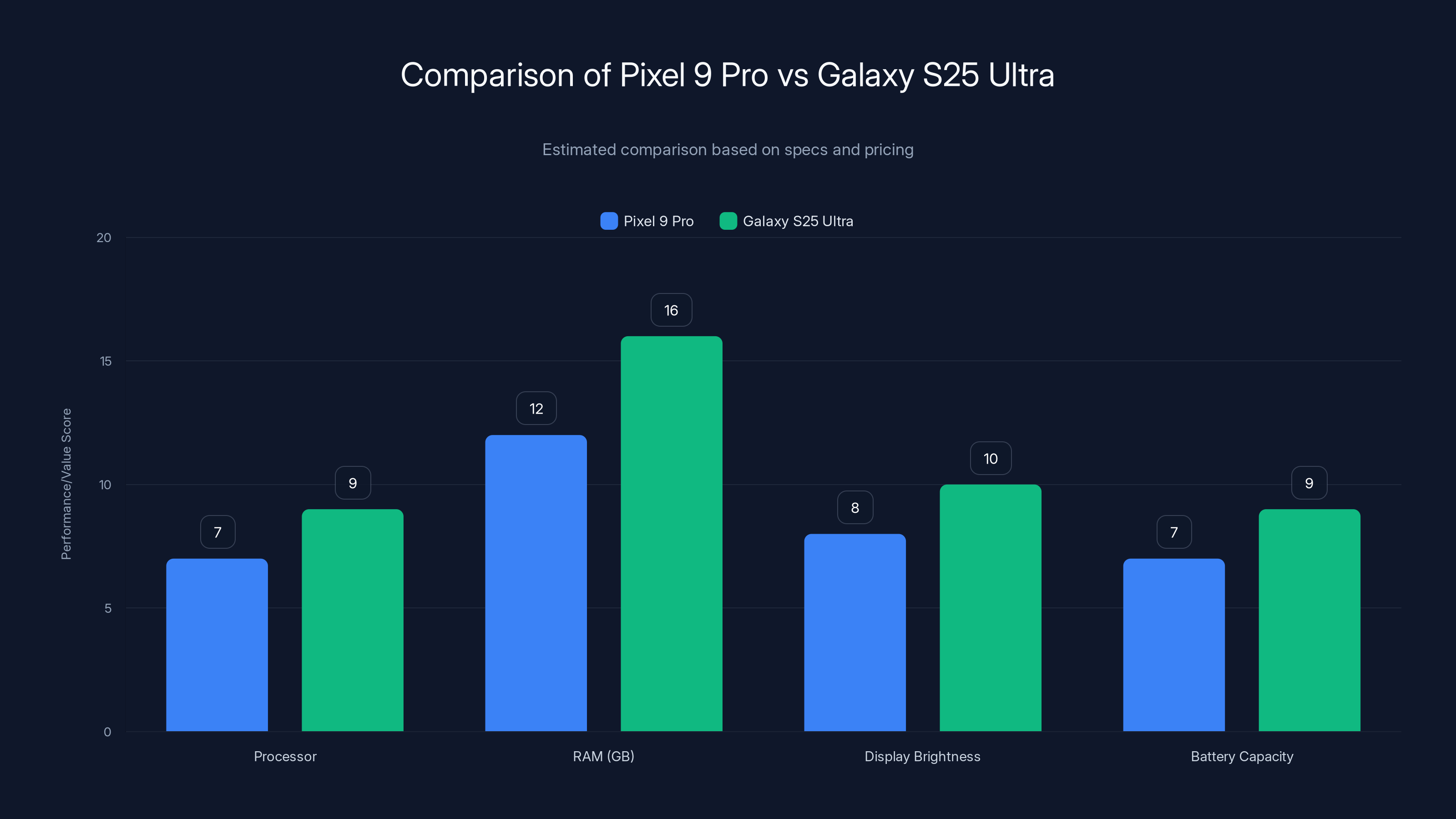

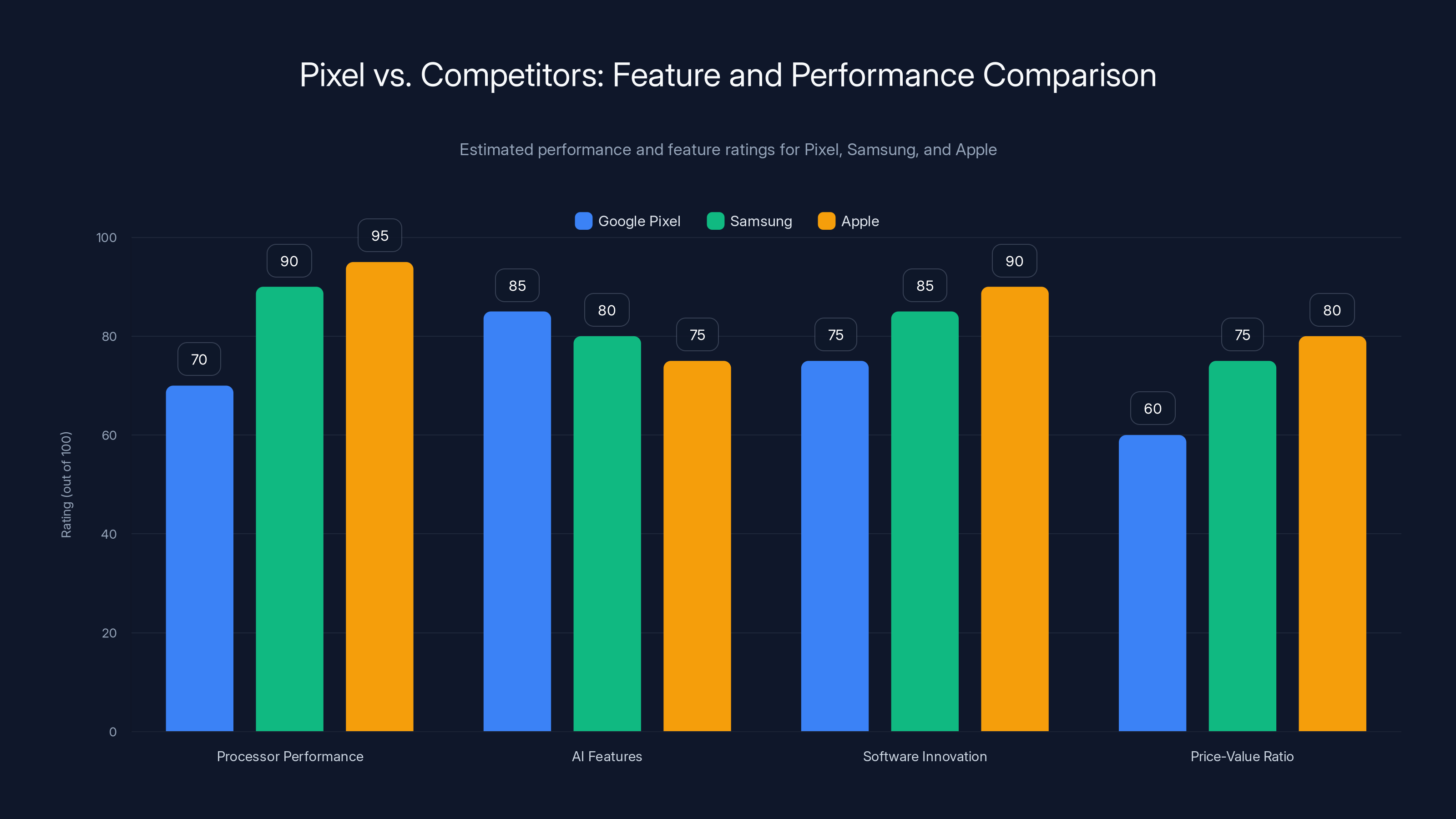

But general-purpose performance? Gaming? Video transcoding? That's where it falters. Year after year, Snapdragon processors from Qualcomm maintain a 20-30% lead in real-world speed benchmarks. The gap isn't closing. If anything, it's widening slightly with each generation.

Google's argument has always been consistent: "But our AI is better." And that's true. The Pixel's on-device AI capabilities are genuinely impressive. Magic Eraser, Best Take, Real Tone processing—these features leverage Tensor's specialized architecture in ways that matter daily.

Here's where the confusion kicks in. Most consumers don't think about AI performance when buying phones. They think about scrolling smoothness, app launch speed, gaming frame rates. They think about whether their phone feels snappy or sluggish after two years of ownership. On those metrics, Pixel phones are respectable but not dominant.

Comparison time: a Galaxy S25 Ultra with Snapdragon 8 Elite will open Instagram fractionally faster. Will switch between apps with slightly less stutter. Will handle a 4K video edit in Adobe Premiere faster. These aren't huge differences, but they're noticeable. More importantly, they matter to the people who notice them—and those people tend to be the loudest reviewers and most influential early adopters.

Google's trapped in a bind. Building a competitive general-purpose processor takes billions in R&D and years of development. Throwing a Snapdragon in a Pixel would forfeit the differentiation that Tensor provides. But keeping Tensor means accepting the performance tradeoff.

Snapdragon excels in general performance, gaming, and video transcoding, while Tensor leads in AI and machine learning tasks. Estimated data based on typical benchmarks.

The Feature Parity Crisis: When Software Can't Compete

For years, software differentiation was Google's secret weapon. Magic Eraser. Call Screen. Hold for Me. These were features nobody else had, and they felt genuinely futuristic.

Then Samsung copied them. Apple copied them. Microsoft added them to Windows. The software moat crumbled faster than anyone expected.

By 2026, the remaining exclusive features are thin. Real Tone processing is impressive but narrow (it fixes photography bias for darker skin tones—important, but not a system-wide game-changer). The AI integration is solid but Samsung's AI integration is also solid now. Apple's AI integration is also solid.

Google's stuck competing on a field that's been leveled by the very success of the original features. The "Pixel magic" that made early adopters fall in love is now industry standard. That means Pixel needs to win on specs, price, or ecosystem lock-in. And it's struggling on all three.

The ecosystem angle deserves its own paragraph. Unlike Apple, which has iPad, Watch, Mac, and AirPods creating a gravity well that pulls iPhone customers deeper, Google's ecosystem is fragmented. Pixel phones don't drive ecosystem lock-in the way iPhones do. Android users aren't chained to Google hardware. They could buy a Samsung Galaxy and have 95% of the same Google experience. That's actually great for consumers. It's terrible for Pixel's strategic position.

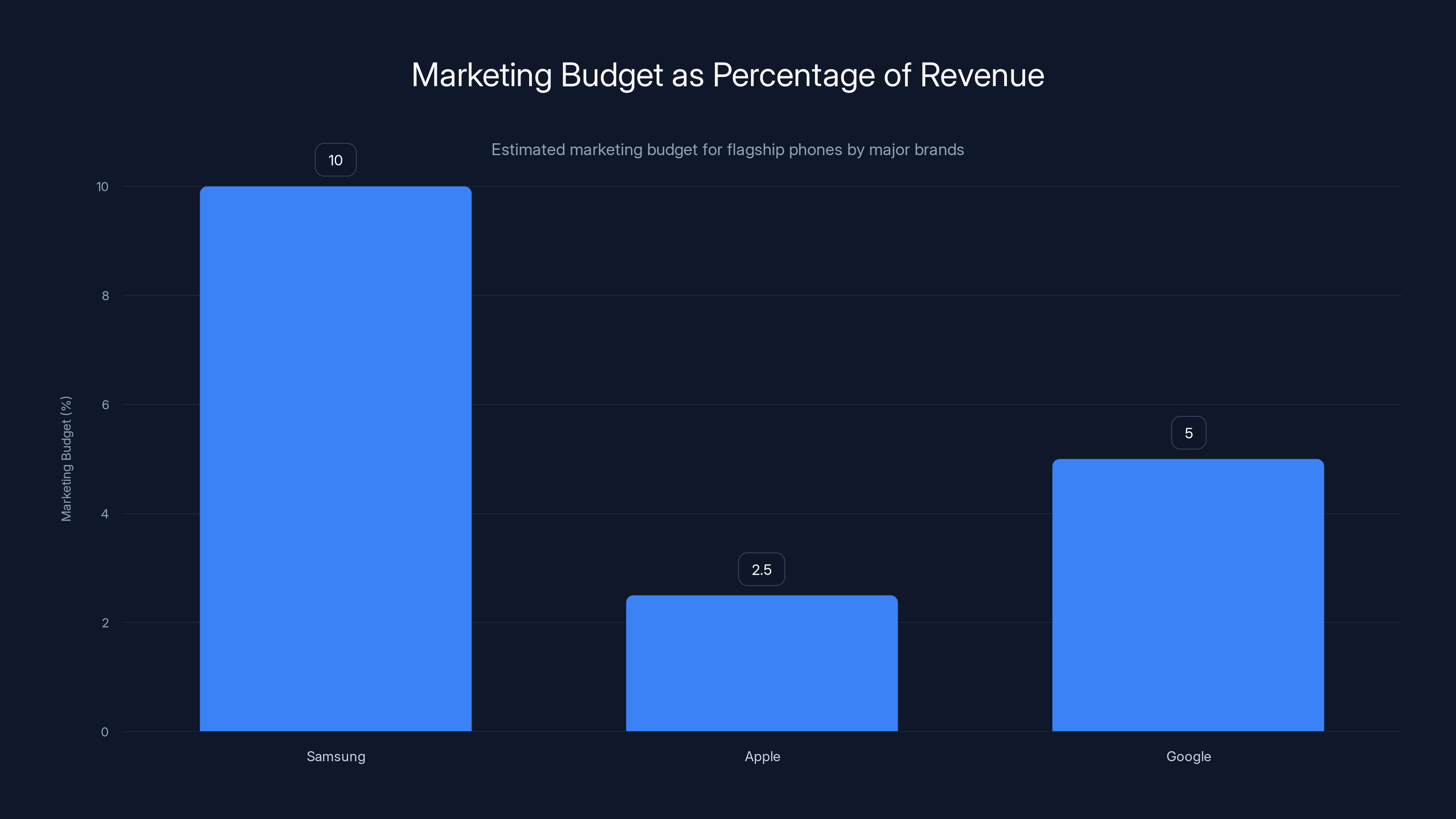

Samsung allocates a higher percentage of its revenue to marketing its flagship phones compared to Apple and Google. Estimated data based on industry insights.

The Price Positioning Mess: Premium Cost, Premium Compromises

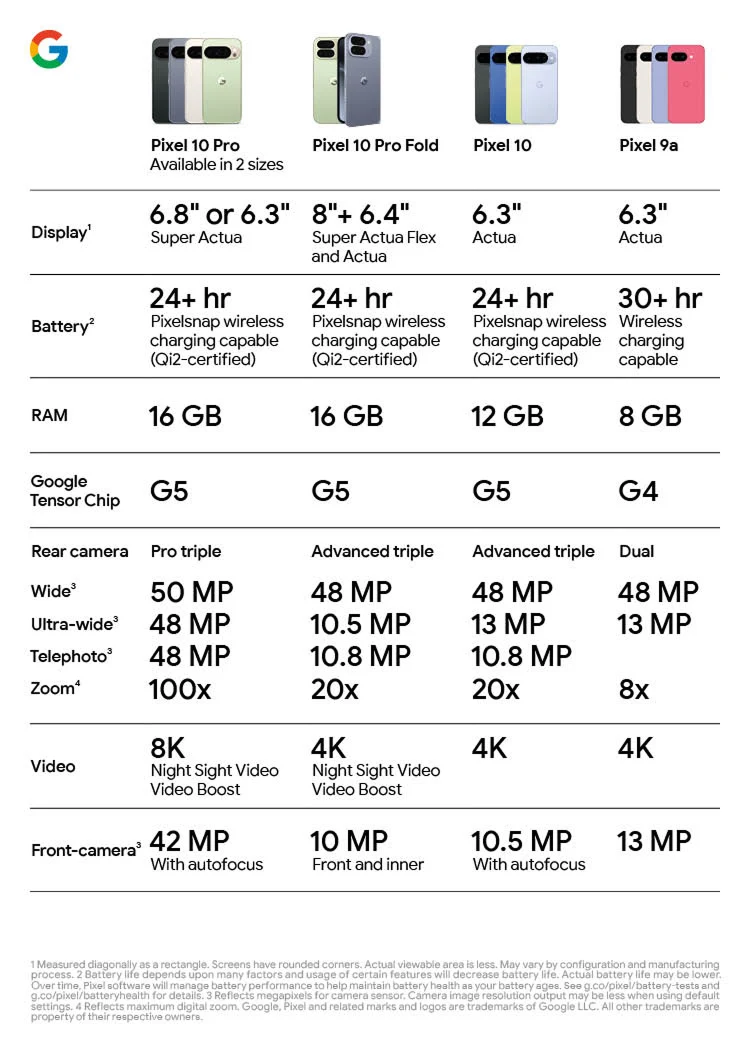

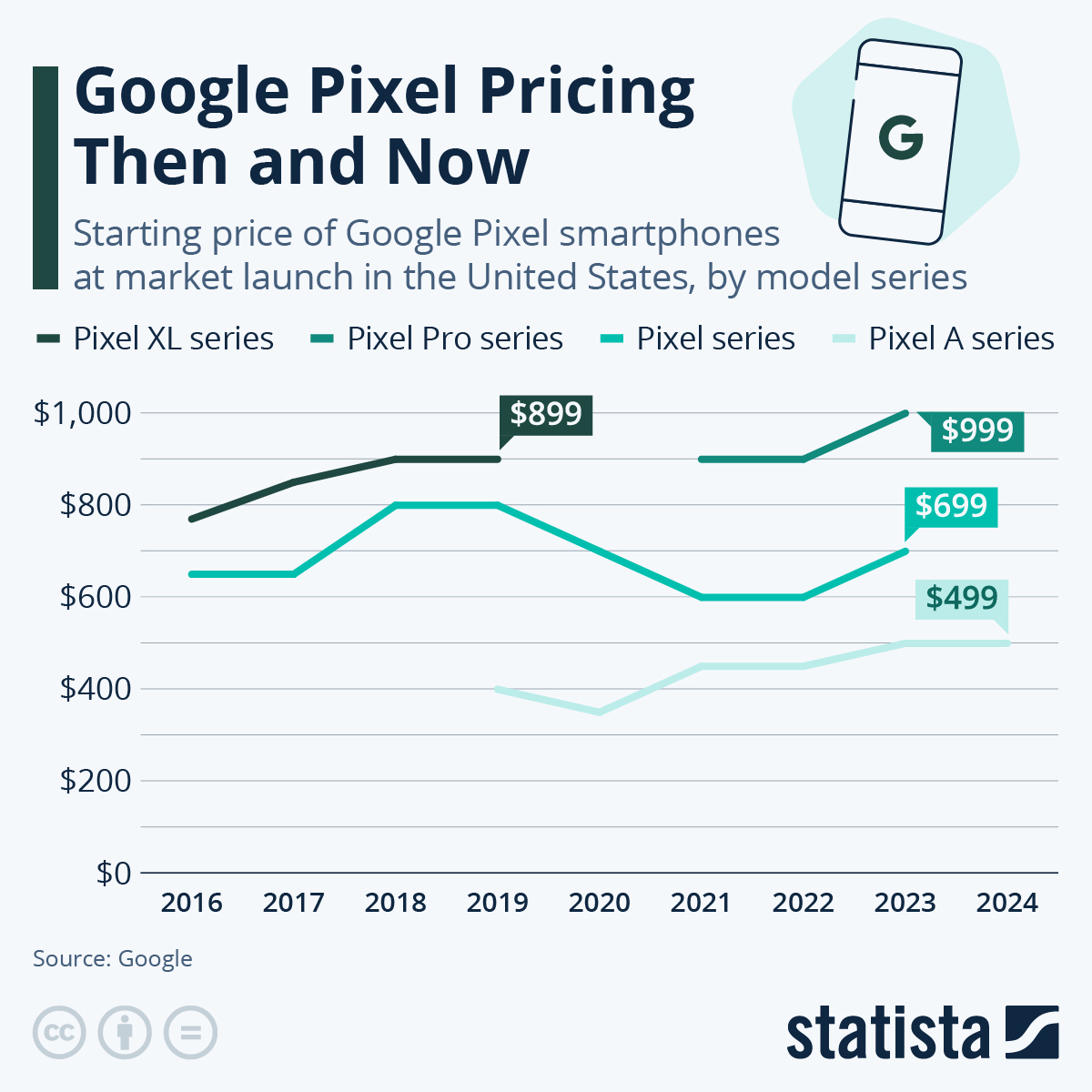

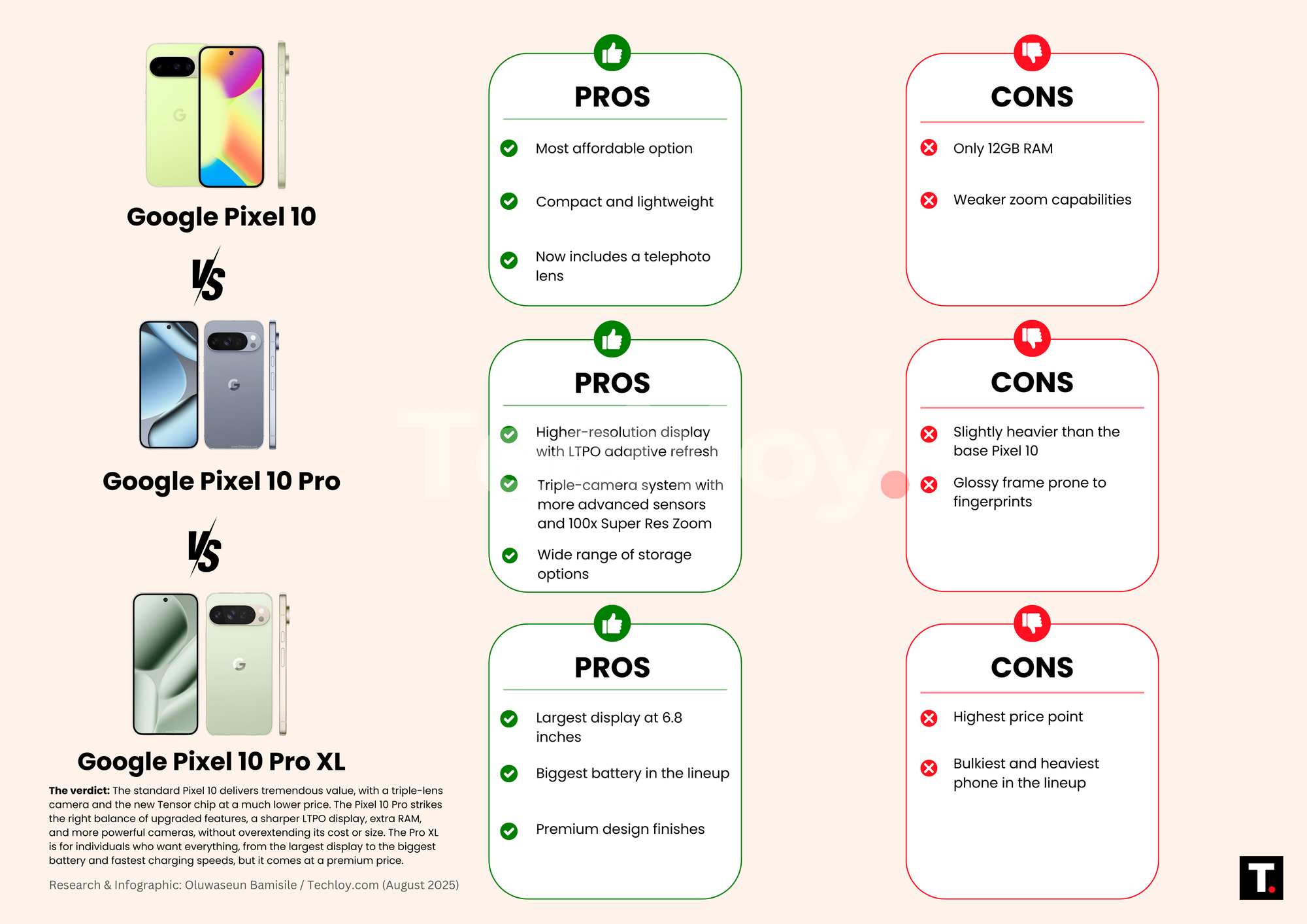

Pixel phones have crept into premium pricing territory without earning premium specs. A Pixel 9 Pro starts around $999. That's flagship pricing. But that phone uses last-generation AI chips (compared to Snapdragon 8 Gen 3), has 12GB of RAM (when competitors ship 16GB standard), and uses a display with good-but-not-class-leading brightness.

For $999, people expect the absolute best hardware. They expect specs that look amazing on a spreadsheet. They expect zero compromises. Pixel phones compromise on processor performance, RAM, display peak brightness, and often on battery capacity (compared to Galaxy S25 Ultra).

Google's counter-argument is that you're paying for software optimization and long-term support. And that's valid. Pixel phones do get 7 years of OS updates and security patches. That's genuinely strong. But when someone's looking at their phone display right now, they don't think about software support in 2031. They think about whether the display looks as bright and vibrant as a Galaxy S25's screen.

The price positioning creates a perception problem. Early adopters and tech enthusiasts—the people who drive word-of-mouth—tend to be spec-aware. They know when they're paying premium pricing for mid-tier specs. And they talk about it. A lot.

Meanwhile, the people who would benefit most from Pixel's software optimization and AI features (general consumers who just want good photos and a smooth experience) are looking at Samsung's similarly priced Galaxy S25 and seeing 50% more RAM and a faster processor for the same money. That math doesn't work.

Google's also competing with its own older stock. You can grab a Pixel 8 for $500 now. It has 90% of the capabilities of a Pixel 9. That cannibalization might be intentional (push volume), but it also suggests Google isn't confident in the Pixel 9's value proposition against recent-generation competitors.

The AI Gamble: Betting the Farm on a Feature Set Nobody Needs Yet

Google's been hammering hard on AI integration. Pixel phones have more AI features than any other hardware on the market. Some of them are clever. Some are borderline useless.

Let's be honest about what's actually useful: on-device photo editing (Magic Eraser, Best Take) and call screening. Those things work. People use them. They genuinely improve the experience.

Everything else is... fine. The AI summarization of notifications is nice if you have notification chaos. The AI writing assistance in Messages works but feels gimmicky when you're texting friends. The generative AI features in the Pixel 9's weather and clock apps are so unnecessary they feel like they exist to justify the AI marketing push.

The core problem: Google is investing heavily in AI features that solve problems nobody has. Nobody woke up and said, "I wish my clock app could generate images." The features feel like they exist because the technology can do them, not because they're addressing genuine user pain points.

This is classic tech company behavior: shipping the coolest features the hardware enables, rather than shipping features users actually want. And it's dangerous because it positions Pixel as the "AI phone" when most people's relationship with AI is still uncertain, skeptical, or indifferent.

The Pixel 9 Pro offers less RAM and lower processor performance compared to the Galaxy S25 Ultra, despite similar pricing. Estimated data based on typical flagship expectations.

The Pro Model Confusion: Ultra or Extra?

Google's naming strategy for Pixel's high-end models has been chaotic. Pixel 8 Pro. Pixel 9 Pro. Pixel 9 Pro XL. Pixel 9 Pro Fold.

That's confusing. Is "Pro" the premium version? Is "XL" premium-er? Where does Fold fit in the hierarchy? Apple nailed this years ago: iPhone Pro, iPhone Pro Max. Singular naming convention, clear hierarchy. Even Samsung's Galaxy S25 Ultra positioning is clearer than Pixel's mess.

But the naming confusion actually points to a deeper strategic problem: Google doesn't have a clear positioning for what "Pro" means for Pixel phones. Does it mean more processing power? No, because Tensor is the same chip across all Pixels. Does it mean better display? Kind of, but Pixel's displays are good across the board. Does it mean more cameras? Yes, but Pixel's computational photography software makes the base model's cameras nearly as good.

Samsung's Galaxy S25 Ultra positioning is clear: it's the absolute top-tier phone with the best specs, newest chip, premium materials, and exclusive features. Apple's iPhone Pro positioning is clear: it's the professional-grade phone with the best performance, best display, and exclusive features. Pixel Pro positioning is muddy. It's kind of premium, but not in the ways that matter most to people shopping at that price point.

The Pro Max naming (stolen from Apple) signals that Google's given up on creating a distinct Pixel identity at the high end. They're just playing the Apple playbook, hoping the name recognition transfers. Spoiler: it doesn't.

Storage and Software: Where Google Could Actually Win

Let's talk about what Pixel actually does well, because it's not nothing.

Google Photos integration is seamless in ways that still feel magical compared to iOS or Samsung's photo handling. Upload a photo on a Pixel, it syncs to your Google account instantly, and you can access it from anywhere with the same quality. iCloud requires paid plans for unlimited backup. Samsung's cloud integration is clunky by comparison. This is a real win for Pixel, and it's barely marketed.

The call screening and spam protection on Pixel is genuinely better than competitors. Google's ML models catch spam calls that other phones miss. This is a feature that matters to people's daily experience, and it's completely taken for granted.

Android OS updates are a non-trivial advantage. Pixel phones get updates immediately. Samsung phones wait 2-3 months. iPhone updates are simultaneous, but only for current and previous-year models. Pixel's commitment to 7 years of updates is a huge win for long-term value.

But Google barely talks about this stuff. Instead, they're hammering on AI features that feel like marketing theater. It's a strategic mistake.

Pixel phones excel in photography and software updates but lag in gaming performance compared to Samsung Galaxy S25 and iPhone Pro. Estimated data for 2026.

The Competition Landscape: Samsung and Apple Aren't Standing Still

Samsung's Galaxy S series has gotten aggressively good. The S25 Ultra is a beast: Snapdragon 8 Elite processor, 16GB RAM standard, 6.8-inch display with 3000 nits peak brightness (compared to Pixel's 3000, but achieved more efficiently). It's a legitimate flagship that outspecs Pixel in almost every way that spreadsheet watchers care about.

More importantly, Samsung's also serious about software differentiation now. Their Galaxy AI features aren't as polished as Pixel's, but they're real and improving. Samsung's ecosystem integration (Galaxy Watch, Galaxy Buds, Galaxy Tab) is now competitive with Apple's in terms of lock-in.

Apple's iPhone Pro is still the undisputed king of overall refinement and speed. The A19 Pro processor—while smaller in die size than Snapdragon—is still the fastest mobile processor available. The display is good (not best-in-class, but good). The ecosystem lock-in is unbeatable. iPhone Pro is more expensive than Pixel, but it justifies the price with better overall execution.

Meanwhile, Xiaomi and Oppo are breathing down everyone's necks with phones that have better specs than Pixel for 40% less money. In markets outside the US, this competition is absolutely crushing Pixel's market share.

Google's in the uncomfortable middle: premium pricing without premium specs (in most categories), innovative software (but copied by competitors), and strong services integration (but less lock-in than Apple).

The Innovation Velocity Problem: Moving Slower Than Competitors

Here's an uncomfortable truth: Google's moving slower than Samsung and Apple when it comes to hardware innovation. The last Pixel feature that felt truly revolutionary was the Tensor chip itself, three years ago. Everything since has been iterative.

Samsung's folding phones? Genuinely innovative, even if the execution is imperfect. Apple's Dynamic Island? Simple idea, but it changed how people think about notches and always-on displays. Google's most recent innovations? AI features that are neat but not transformative.

The folding phone is probably where Pixel could have dominated. But the Pixel Fold launch was messy—it had durability issues, was priced absurdly high ($1799), and Google clearly wasn't ready to push the technology. Samsung took that opening and made the Galaxy Z Fold a legitimate alternative to traditional flagship phones.

Google's moving like a hardware company that accidentally became successful in hardware, not like a company passionate about hardware innovation. Samsung and Apple move like companies that are obsessed with hardware and willing to bet the company on new form factors and capabilities. That difference shows up in execution speed and ambition.

Estimated data shows Pixel lagging in processor performance and price-value ratio compared to Samsung and Apple, despite strong AI features.

The Developer Experience Angle: A Missed Opportunity

Pixel phones have historically been the best for Android developers. Pure Android, latest versions, instant updates. It's the "Nexus" legacy—a phone built for people who tinker and develop.

But Google's never leaned into this positioning. They don't market Pixel as the developer phone. They don't have special programs or pricing for developers. They don't create content or communities around the developer experience on Pixel. It's like they're leaving money and market position on the table.

Samsung markets to enterprise. Apple markets to creatives. Google could own developers and tech enthusiasts—a highly influential segment that drives word-of-mouth and reviews. Instead, Pixel positioning is confused between mainstream appeal and premium features and AI storytelling.

If Google positioned Pixel as the developer's phone, committed to pure Android, open bootloaders, and developer-friendly features, they could own a meaningful niche and build a community that actually advocates for the brand. That's worth billions in marketing value.

Regional Strategy Disaster: Why Pixel Struggles Globally

In the US, Pixel has decent market share and brand awareness. But globally, Pixel is invisible compared to Samsung and Apple. In India, China, Southeast Asia, Japan—Pixel barely registers.

There are structural reasons for this. Google's business model (ad targeting, data collection) is hindered in some markets by local regulations. Pixel's software features (Google Photos integration, Google Play services) don't work as seamlessly in markets where Google's services are restricted. The supply chain and distribution for Pixel is fragmented globally.

But there's also a strategic failure. Google acts like Pixel is a prestige product for early adopters, not a phone for the global mainstream. Samsung and Apple both have global strategies with multiple price points and distribution networks in every market. Pixel's mostly available through carrier partnerships and Google's own channels, which severely limits reach in price-sensitive markets.

This is a massive missed opportunity. The global smartphone market is growing fastest in emerging economies. Pixel isn't competing there at all. Even in mature markets, regional brands are stealing share by offering better value and distribution than Pixel.

If Google took Pixel seriously as a global product—not a US prestige project—they could be shipping 200+ million phones annually. Instead, they're shipping maybe 20-25 million in a good year.

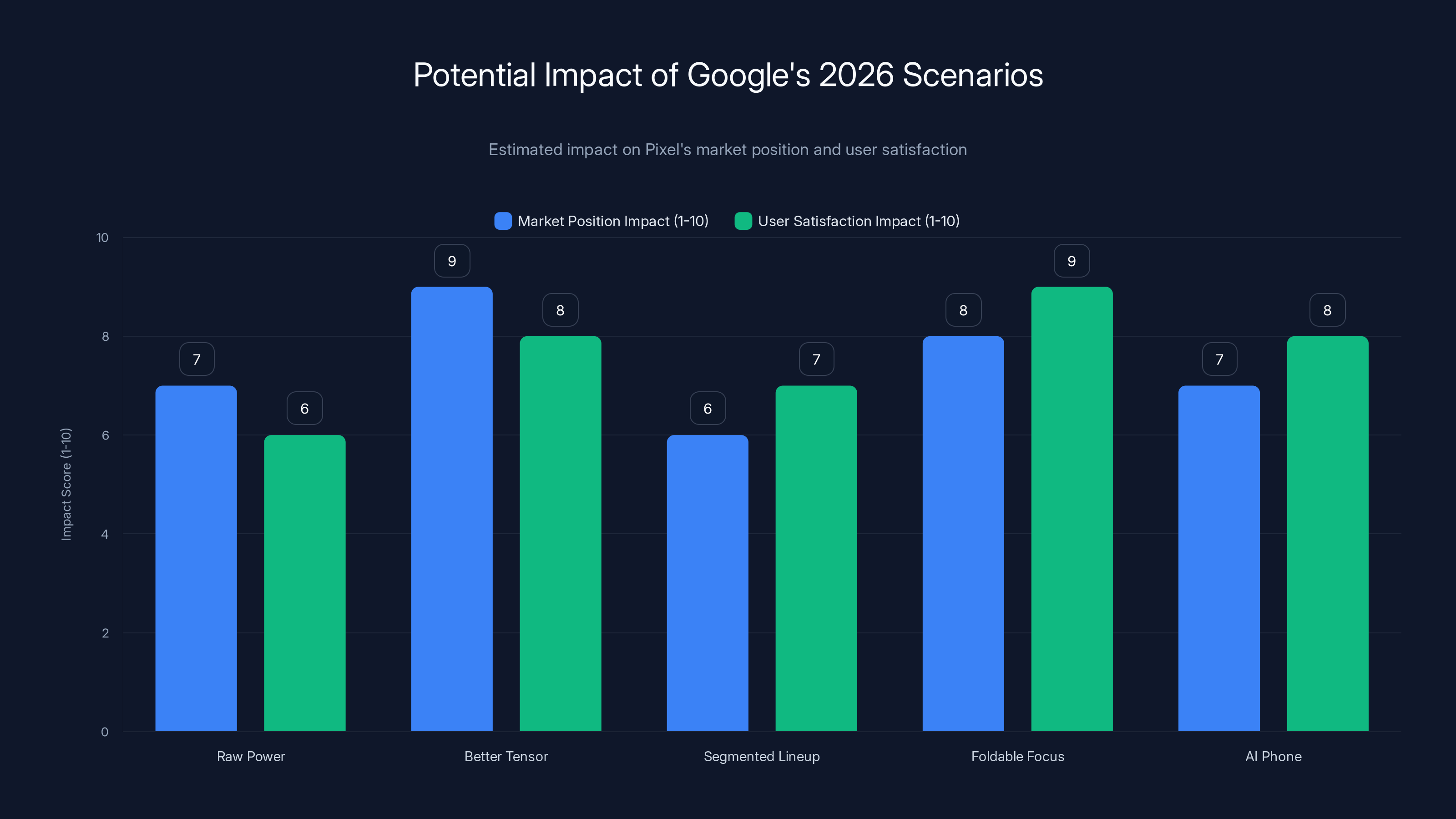

Estimated data suggests that 'Build a Better Tensor' could have the highest impact on both market position and user satisfaction, making it a potentially ideal strategy for Google.

2026 Scenarios: What Could Actually Fix This

So what does Google need to do in 2026? There are a few paths:

Scenario 1: Double Down on Raw Power Google abandons Tensor and ships Snapdragon 8 Elite in all Pixel phones. This immediately puts Pixel on equal hardware footing with Galaxy S series. Performance complaints evaporate. Pixel becomes a pure software/ecosystem play, competing on optimization, updates, and Google services integration.

This could work. The tradeoff is losing the AI performance advantage that Tensor provides. Google's computational photography might become slightly less responsive. On-device AI features might be slower. But for 95% of users, nobody would notice.

Scenario 2: Build a Better Tensor Google goes all-in on Tensor, designing a chip that's genuinely competitive on general-purpose performance while maintaining AI advantages. Basically, Tensor 4 or 5 finally achieves feature parity with Snapdragon on CPU and GPU while maintaining AI acceleration advantage.

This takes 2-3 years of heavy investment and is risky. But if successful, it's the dream scenario: best of both worlds. Pixel becomes truly premium.

Scenario 3: Segment the Lineup Clearly Google ships a budget Pixel with older Tensor, a mainstream Pixel with current Tensor, and a Pro Pixel with Snapdragon (custom variant). This creates a clear value ladder and lets Pixel compete at multiple price points.

This is complex and confusing but might be necessary. It's basically what Samsung and Apple do.

Scenario 4: Embrace Folding as the Hero Form Factor Google pushes the Pixel Fold as the flagship instead of traditional phones. Invest heavily in making folding phones work better than Samsung's. Make it the innovation focus.

This is risky but differentiating. Nobody else is seriously competing in foldables except Samsung. If Google could make a genuinely better foldable, it's defensible and could drive premium pricing.

Scenario 5: Reposition as the AI Phone for Normies Google stops trying to compete on specs and leans all the way into "your AI assistant that happens to be a phone." Pixel 10 is marketed as the phone where AI doesn't feel like a gimmick because Google controls both the hardware and software and can actually make it work smoothly.

This means shipping AI features that are genuinely useful (more photo editing, assistant improvements, better voice commands) rather than gimmicky weather app image generation. And it means being honest about what AI can and can't do.

The Cultural Problem: Why Pixel Feels Unfocused

Here's a theory about why Pixel strategy feels confused: Google's hardware division is the bastard stepchild of a company obsessed with software and services. Google makes obscene amounts of money from search, ads, and cloud services. Hardware makes billions but is peanuts compared to core business. Hardware teams fight for priority and get product decisions overruled by commercial teams focused on short-term revenue.

Meanwhile, Samsung is a hardware-first company. iPhone is Apple's entire identity. When Samsung decides on a strategy, they commit for years and back it with billions in R&D. When Apple commits, the entire company aligns around it.

Google's Pixel team seems to be making decisions on a 1-year horizon, constantly pivoting as market dynamics change. It's like watching someone simultaneously try to be an Apple competitor and a Samsung competitor and a value competitor and an AI leader. You can't win by trying to be everything.

The fix is cultural: Google leadership needs to make a genuine commitment to Pixel, publicly and with resources, and stick with a strategy for 3-5 years. Not constantly second-guessing. Not treating hardware like an experiment. Not optimizing for short-term quarterly results.

That's not how successful hardware companies work. That's not how Apple works. That's not how Samsung works.

The Battery and Heat Problem: Silent Killer

One thing Pixel phones have struggled with—that reviewers don't talk about enough—is battery life and thermal performance under load. Tensor chips run hot. Pixel 9 models have reported throttling issues when gaming or doing sustained processing.

Samsung's Galaxy S25 Ultra runs cooler and manages thermal performance better. iPhone Pro runs noticeably cooler. This matters for battery life, for sustained performance, and for user experience. A phone that gets hot in your hand feels broken, even if it's technically fine.

Google's never clearly addressed this problem. You see occasional acknowledgments that Tensor runs warm, but no real solution. If Tensor 4 or 5 doesn't solve thermals, it's going to keep dragging Pixel's real-world performance perception down.

This is one of those sneaky issues that doesn't show up in benchmarks but absolutely shows up in everyday use. People notice when their phone throttles during a game or gets hot during a video call. They remember it. They talk about it.

What 2026 Needs to Look Like: The Real Opportunity

Okay, here's what Google actually needs to do, not theory but practical roadmap:

On Processors: Commit to Snapdragon 8 Elite or later in flagship Pixel phones. Design a custom variant if you want (like One Plus does), but stop acting like Tensor is competitive on general performance. It's not. Everyone knows it. Stop pretending.

On Pricing: If you're shipping premium hardware and premium software, charge premium prices (

On Software: Stop shipping AI features for the sake of AI. Ship features users actually want. Better notifications. Better widgets. Better integration with Google services (Photos, Drive, Gmail). Make software the actual differentiator, not a marketing checkbox.

On Design: The Pixel look is nice but boring now. Samsung S25 Ultra looks premium. iPhone Pro looks premium. Pixel looks... fine. Spend some money on industrial design, materials, and finishes that feel genuinely premium at the price point.

On Positioning: Pick who this phone is for. Developers? Mainstream consumers? Photographers? Google services users? Enterprise? You can't be everything. Apple owns creative professionals and green-bubble status. Samsung owns specs-aware enthusiasts and enterprise. Pixel should own... something specific.

On Communication: Stop confusing marketing teams, reviewers, and consumers with unclear messaging. Every Pixel announcement should have one clear story, not five competing narratives about AI and photos and software and hardware and ecosystem.

The Ecosystem Question: Can Pixel Ever Lock People In?

This is probably the hardest problem. Apple's ecosystem works because you can be entirely in the Apple world: iPhone, Mac, iPad, Watch, AirPods, HomePod. That interconnectedness creates genuine value.

Google's ecosystem is all software: Gmail, Workspace, Google One, Chromebook (which is niche). But unlike Apple's ecosystem, you can get Google services on any phone. That's great for Google's services business, terrible for Pixel's position.

Samsung's ecosystem (S25, Galaxy Watch, Galaxy Buds, Galaxy Tab) is better than Pixel's but still inferior to Apple's because Google (not Samsung) controls the underlying services.

Google can't easily fix this without breaking the open nature of Android. But they could at least lean into it: "This is the phone that works best with your Google account, Google services, and Google hardware." Market it to Google users, not generic "everyone."

That's actually a sizable addressable market. Anyone with a Gmail account, Google Drive, Google Photos, Chromebook, or Google Home could benefit from tighter integration on a Pixel phone. But Google's barely marketing that.

Looking Ahead: The 2026 Catalyst Moment

Pixel is at a decision point. Google needs to commit to a clear strategy and execute flawlessly, or accept that Pixel will always be a niche player competing with better-executed flagships from Apple and Samsung.

The company has the resources, the technology, and the talent to win. They have search advertising funding a $3 trillion market cap company. They can invest whatever they want in phones. The problem isn't capability. It's focus and commitment.

2026 is the year this gets decided. If Google ships another confused lineup with unclear positioning and marginal hardware improvements, Pixel stays in the same uncomfortable middle ground. If they make a real commitment—better chips, clearer positioning, genuine differentiation—they could build something genuinely competitive again.

The clock is ticking. Samsung's getting better. Apple's getting smarter. Other manufacturers are moving faster. Google's runway is finite.

FAQ

What makes Pixel phones different from other Android phones?

Pixel phones run pure Android (no manufacturer customizations) and ship with exclusive Google software features like Magic Eraser, Best Take, Call Screen, and tighter integration with Google services like Photos and Gmail. They also receive system updates immediately when Google releases them, rather than waiting for manufacturer customization. However, many exclusive features have been adopted by competitors, narrowing the differentiation gap.

Why does Google use Tensor chips instead of Snapdragon?

Google designed Tensor specifically to accelerate machine learning and AI workloads, which powers computational photography and on-device AI features. Tensor excels at these specialized tasks, but trades general-purpose performance (CPU/GPU speed for regular apps and games) for this AI specialization. This is a deliberate choice that makes Pixel phones optimized for photography and AI but less competitive on gaming and app performance compared to Snapdragon-based phones.

Should I buy a Pixel phone in 2026 if I care about performance?

If raw performance and gaming matter to you, a Samsung Galaxy S25 or iPhone Pro will deliver better results at comparable prices. Pixel phones are respectable but not class-leading on performance. However, if you prioritize photography, long-term software updates, and Google services integration, Pixel remains a strong choice despite performance compromises. Test both side-by-side to see which matters more to your daily use.

What is Pixel's biggest competitive weakness?

Pixel's biggest weakness is lack of strategic focus. The company hasn't clearly committed to whether it's a premium flagship (competing on specs and performance), a software-differentiated device (competing on exclusive features), or an AI-first phone (competing on smart features). This confusion makes it hard for consumers to understand Pixel's value proposition compared to clearly-positioned alternatives from Apple and Samsung. The processor performance gap with competitors is also a constant disadvantage for gaming and heavy multitasking.

How long does Google support Pixel phones with updates?

Google commits to 7 years of OS updates and security patches for Pixel phones, which is among the longest in the industry. This is longer than Samsung's 5-6 years or Apple's typically 5-6 years. Long-term support is one of Pixel's genuine advantages for people who keep phones for many years, though it's rarely discussed in marketing.

Will Pixel phones ever compete on raw specs with Samsung and Apple?

This depends on Google's commitment level. If Google invests heavily in a next-generation Tensor chip designed to compete on general-purpose performance while maintaining AI advantages, Pixel could eventually match or exceed competitors on specs by 2026-2027. Alternatively, Google could license higher-performance Snapdragon variants for flagship Pixel models. However, this requires sustained investment and a clear commitment from Google leadership, which has been inconsistent to date.

Is the Pixel Fold worth buying compared to Galaxy Z Fold?

The Pixel Fold is a respectable folding phone but behind Samsung's Galaxy Z Fold in execution, durability, and ecosystem support. The Galaxy Z Fold has a more mature design, better display quality, and stronger ecosystem integration with other Samsung devices. Pixel Fold is worth considering if you prefer pure Android and Google services integration, but Galaxy Z Fold is the more reliable choice at the same price point. Both are expensive ($1700+) and represent a niche form factor.

What should Google focus on for Pixel in 2026?

Google should focus on three things: (1) Close the performance gap by upgrading the processor and chipset to be truly competitive, (2) Create one clear positioning (either premium flagship, software-optimized, or AI-focused) instead of trying to be everything, and (3) Commit to global expansion beyond the US market with localized distribution and pricing strategies. Without fixing these three issues, Pixel will continue to be a confused middle-market player.

TL; DR

-

Pixel's Strategy Problem: Google's confused messaging positions Pixel as premium-priced but mid-tier-specced, trying to be all things to all people without excelling in any category.

-

The Processor Gap: Tensor chips excel at AI but lag 20-30% behind Snapdragon on general performance, putting Pixel at a disadvantage for gaming and heavy multitasking despite premium pricing.

-

Feature Parity Erosion: Software features that once differentiated Pixel (Magic Eraser, call screening, computational photography) have been copied by Samsung and Apple, eliminating the innovation moat.

-

Price Positioning Failure: At $999+, Pixel lacks the specs (RAM, processor, brightness) that justify premium pricing, while older Pixel models cannibalize sales at better value points.

-

AI Gimmickry: Most of Pixel's AI features are marketing theater rather than solving real user problems, positioning the phone as "the AI phone" when most users are still skeptical about AI's value.

-

Clear Roadmap Needed: For 2026 to matter, Google must commit to either matching flagship specs with premium pricing, clearly owning the software-optimization category, or building a genuine ecosystem moat. Confused strategy will keep Pixel in the uncomfortable middle.

The Best Android Flagships at a Glance

| Phone | Best For | Standout Feature | Starting Price |

|---|---|---|---|

| Pixel 9 Pro | Google services users | Computational photography, 7-year updates | $999 |

| Galaxy S25 Ultra | Performance enthusiasts | Snapdragon 8 Elite, 16GB RAM standard | $1,299 |

| iPhone Pro | Professionals | Apple A19 processor, ecosystem lock-in | $999 |

| Pixel Fold | Foldable enthusiasts | Pure Android folding, Google integration | $1,799 |

| Galaxy Z Fold 6 | Premium foldable buyers | Mature folding design, 6.8" main display | $1,899 |

Quick Navigation:

- Pixel 9 Pro (#best-for-google-services) for photographers and Google ecosystem users

- Galaxy S25 Ultra (#best-for-performance) for gamers and spec-focused buyers

- iPhone Pro (#best-for-ecosystem) for creative professionals and Apple users

- Pixel Fold (#best-for-foldables) for early adopters wanting pure Android

- Galaxy Z Fold 6 (#best-for-folding-maturity) for reliable folding phone experience

Key Takeaways

- Pixel phones are priced as flagships ($999+) but compromise on processor speed, RAM, and display brightness that competitors offer at equal price points

- Google's Tensor chip excels at AI and computational photography but trails Snapdragon 20-30% on general performance, creating constant competitive disadvantage for gaming and apps

- Software features that once differentiated Pixel (Magic Eraser, call screening, computational photography) have been copied by Samsung and Apple, eroding the innovation moat

- Google's confused positioning (AI phone? Premium flagship? Software-optimized device?) makes it difficult for consumers to understand Pixel's value proposition versus clear alternatives

- Pixel's 7-year software update commitment and Google services integration are genuine advantages rarely discussed in marketing, suggesting a communication failure rather than technical shortcoming

- For 2026 to matter, Google must commit to a single clear strategy: either match flagship specs, own the software-optimization category, or build genuine ecosystem lock-in—not attempt all three simultaneously

Related Articles

- How to Redeem Game Codes on Nintendo Switch 2 [2025]

- The Best TV Shows of 2025: Complete Streaming Guide [2025]

- AI Gross Margins & Compute Costs: The Real Math Behind 70% Margins

- Best Netflix Shows & Movies to Stream in 2025: Complete Guide

- How to Track Santa Claus on Christmas Eve with AI [2025]

- SPEED Act: How Permitting Reform Reshapes Clean Energy [2025]