How to Watch Hisense's CES 2026 Press Conference Live

The Consumer Electronics Show represents one of the most significant annual gatherings where technology companies unveil their innovations and strategic directions. For home electronics manufacturer Hisense, CES 2026 marks a turning point with fresh leadership and ambitious product announcements. If you're interested in seeing what this China-based company has planned for the coming year—particularly their advancements in display technology and smart home integration—you'll want to tune in for their official presentation.

Hisense has scheduled their main press conference for Monday, January 5, 2026, at 1:00 PM Eastern Time. The company will livestream the event directly from their official website, making it accessible to tech enthusiasts, industry professionals, and curious consumers worldwide. This timing places Hisense's presentation early in the CES week, allowing the company to command attention before the show's momentum shifts to other major announcements.

The significance of this particular presentation extends beyond typical product reveals. Hisense has undergone notable leadership changes, bringing on Chief Marketing Officer Sarah Larsen and Chief Commercial Officer James Fishler. Both executives bring extensive experience from premium consumer electronics companies, signaling Hisense's intention to elevate its brand positioning in the competitive television and appliance markets. The combination of new leadership, strategic timing, and announced focus areas suggests that CES 2026 will serve as a major milestone for the company's expansion efforts.

Understanding how to access this presentation and what to expect involves examining both the technical viewing aspects and the broader context of what Hisense plans to demonstrate. The company has already provided hints about their focus on enhanced AI capabilities, particularly through their Connect Life platform, which integrates across their entire product ecosystem. From high-end televisions to kitchen appliances and climate control systems, Hisense is positioning themselves as a comprehensive smart home solution provider.

Where and How to Watch the Livestream

Accessing the Official Livestream

Hisense will make their CES 2026 presentation available through a dedicated livestream on their corporate website. When January 5th arrives, you should navigate to Hisense's official website and look for a prominent link to their CES 2026 presentation page. The livestream typically begins a few minutes before the scheduled 1:00 PM ET start time, allowing viewers to connect and test their audio and video settings in advance.

The livestream format means you can watch from any device with internet connectivity—whether that's your computer, tablet, or smartphone. Most manufacturers optimize these streams for compatibility across different browsers and operating systems, so whether you're using Chrome, Safari, Firefox, or Edge, you should encounter minimal technical difficulties. The presentation typically runs between 45 minutes to 90 minutes, depending on the depth of announcements and demonstration time allocated for new products.

For viewers unable to watch live due to time zone differences or scheduling conflicts, Hisense typically uploads a recording to their website and YouTube channel within hours of the live presentation. This means you won't miss critical announcements even if you can't tune in during the official broadcast window. The recorded version allows you to watch at your convenience and even rewind or pause to absorb technical details about new products.

Alternative Viewing Platforms

Beyond Hisense's official website, technology news outlets frequently carry live coverage or simulcasts of major CES presentations. Major tech news sites, consumer electronics retailers with media partnerships, and streaming technology platforms may provide secondary livestream options. These alternative sources can be valuable if you experience technical issues with Hisense's primary livestream or prefer watching alongside expert commentary that contextualizes announcements in real-time.

YouTube has become a standard distribution channel for CES presentations, with both official manufacturer accounts and authorized tech media channels streaming or uploading presentations. Following Hisense's official YouTube channel or subscribing to notifications ensures you'll receive alerts when they go live. This approach also connects you to Hisense's broader content library, where you can explore product reviews, feature demonstrations, and company announcements throughout the year.

Social media platforms, particularly Twitter/X and LinkedIn, typically feature live-tweeting from tech journalists and analysts attending CES in person. Following these accounts provides real-time reaction, key quote extraction, and technical analysis as announcements unfold. While not a replacement for watching the full presentation, social media commentary helps identify which announcements carry the most significance and which product categories represent the most innovation.

Preparation Before the Event

Test your internet connection several hours before the 1:00 PM ET start time to ensure adequate bandwidth for smooth streaming. Most livestreams function well on broadband connections with speeds of 5 Mbps or higher, but if you experience buffering, consider reducing video quality settings or closing other bandwidth-consuming applications. Having your device fully charged or connected to power helps prevent interruptions during the presentation.

Consider taking notes during the presentation to capture specific product names, availability dates, and pricing information. Hisense often makes important announcements about product availability—whether items will reach specific markets, release timelines, and initial availability through specific retailers. Jotting down these details helps you follow up with retailers or decide whether announced products align with your purchase timeline and budget.

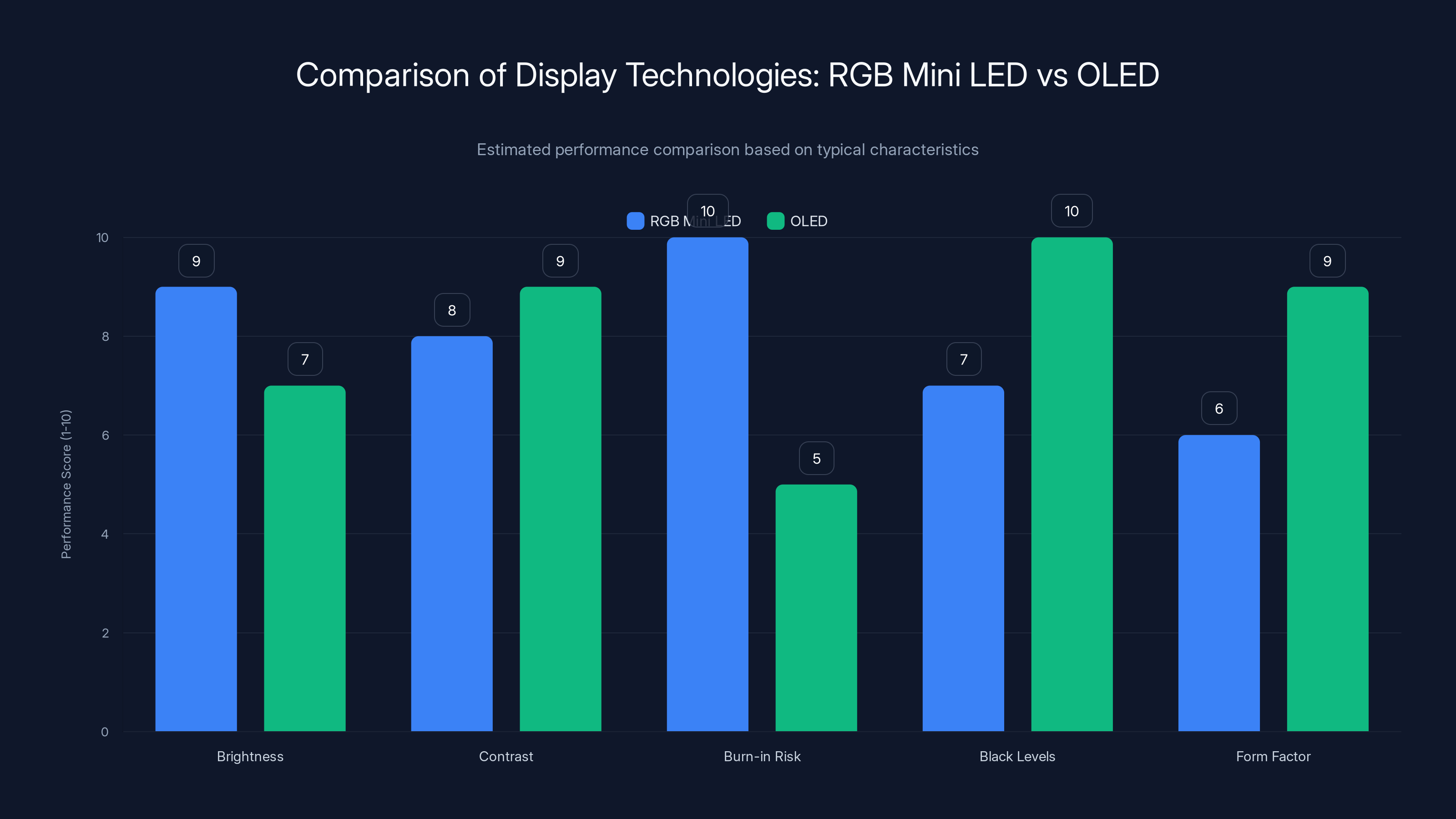

RGB Mini LED technology offers superior brightness and eliminates burn-in risk, while OLED excels in black levels and form factor. Estimated data based on typical performance.

Understanding Hisense's Brand Position and Market Strategy

From Affordable Electronics to Premium Innovation

Hisense has built its reputation primarily on affordability and value in consumer electronics. For decades, the company focused on delivering functional, dependable products at price points accessible to budget-conscious consumers. Televisions, refrigerators, washing machines, and air conditioning units bearing the Hisense name became synonymous with "good enough at low cost." This positioning served the company well in emerging markets and among price-sensitive consumer segments in developed markets.

However, the CES 2025 presentation signaled a significant strategic shift. Hisense unveiled a 136-inch micro LED television priced at a staggering $100,000. This announcement represented a watershed moment—it declared that Hisense was no longer content occupying solely the mass-market segment. The company was aggressively pursuing premium positioning, competing directly with established luxury electronics brands. A television at that price point targets wealthy consumers, luxury retailers, and high-end commercial installations. It signals technological sophistication and aspirational brand status.

The arrival of Sarah Larsen as Chief Marketing Officer crystallizes this strategic pivot. Larsen brings experience from LG and Samsung, where she worked on building and refining brand perception among affluent consumers. Her appointment signals that Hisense intends to fundamentally reshape how consumers and critics perceive the brand. Rather than accepting their position as an affordable alternative, Hisense wants recognition as an innovator capable of producing premium products that justify luxury pricing through superior technology and design.

New Leadership's Vision for 2026

James Fishler's role as Chief Commercial Officer carries equally significant implications. Fishler brings extensive experience in home entertainment, appliances, and HVAC systems—the exact product categories where Hisense is expanding. His background suggests he'll oversee distribution strategy, retail partnerships, and market expansion initiatives. Fishler's appointment indicates that Hisense isn't just creating premium products; they're building the commercial infrastructure to distribute, support, and grow these offerings across multiple channels.

The timing of these leadership additions becomes crucial. Both executives joined Hisense ahead of what the company explicitly calls "a milestone 2026." This language suggests that 2026 represents a pivot year where Hisense demonstrates the fruits of its strategic repositioning. The company is betting that new leadership, combined with technological innovations and expanded product lines, will fundamentally alter perceptions of the Hisense brand. Instead of being viewed as a value brand, Hisense wants consumers to see them as an innovator creating connected smart home ecosystems and premium display technology.

Larsen emphasized in recent interviews that Hisense's rapid turnaround from concept to market serves as a key competitive differentiator. While larger competitors like Samsung and LG operate through traditional development cycles that might take years from initial concept to market availability, Hisense can move faster. This agility allows them to respond to emerging technologies, incorporate customer feedback, and capitalize on market trends more quickly than established competitors. It's a particularly valuable advantage in the fast-moving display technology space, where innovations in LED backlighting, panel design, and processor technology emerge frequently.

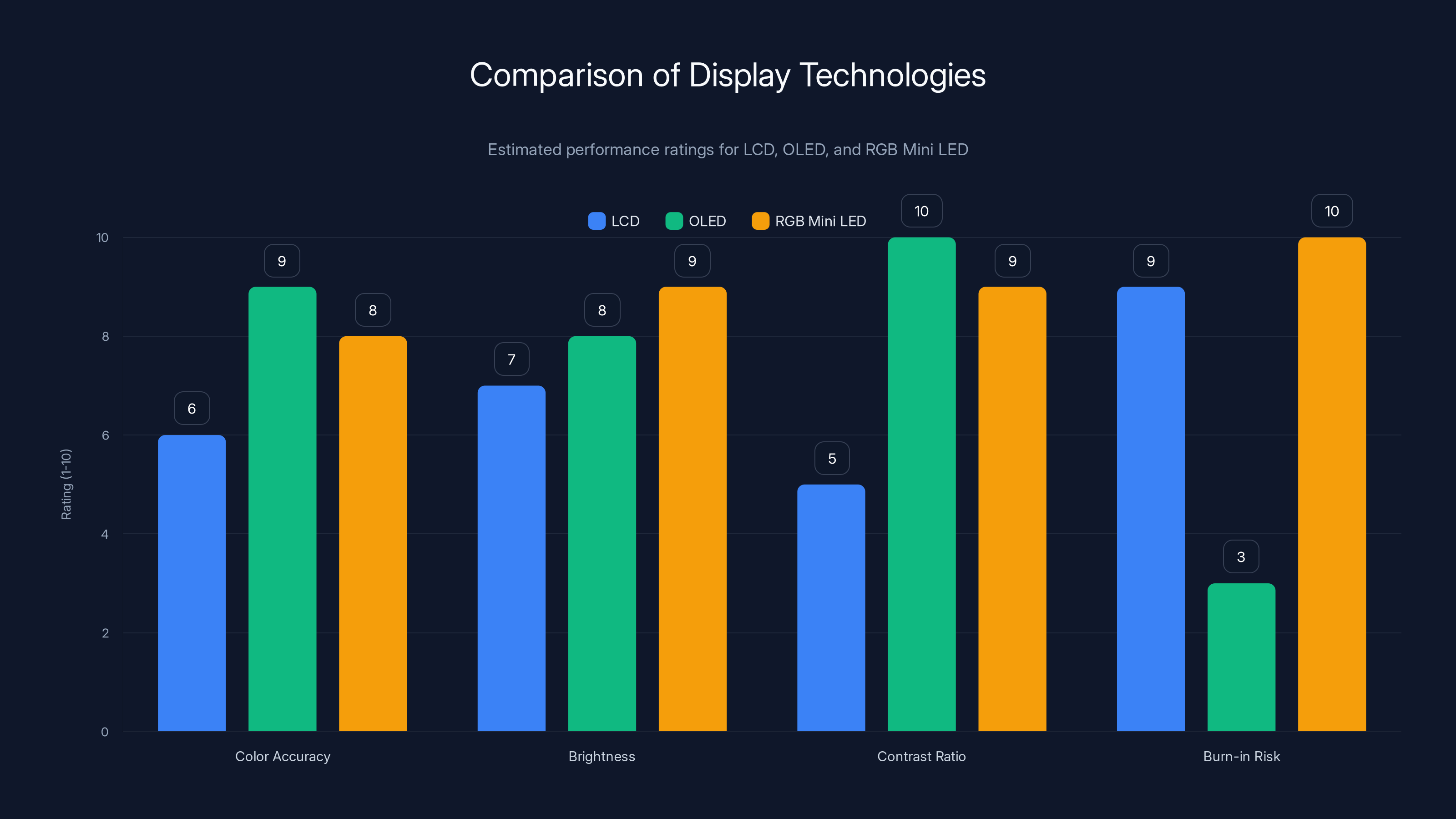

RGB Mini LED technology offers a balanced performance with high brightness and contrast, while eliminating burn-in risks, making it a strong contender against OLED and traditional LCD displays. Estimated data.

RGB Mini LED Technology and Display Innovation

What RGB Mini LED Represents in Modern Television

RGB Mini LED technology represents one of the most significant advances in television display technology since the transition from LCD to OLED displays. To understand what makes this technology important, we need to examine the fundamental challenge of modern television manufacturing: creating accurate colors and true blacks while maintaining brightness and avoiding the burn-in issues that plague OLED displays.

Traditional LCD televisions use a white LED backlight that passes through color filters to create the full color spectrum. This approach works reasonably well but has limitations—bright content can wash out dark areas, and the backlight can't be dimmed locally behind dark image elements. OLED displays solved this by making each pixel emit its own light, enabling perfect blacks (a pixel simply turns off) but introducing burn-in risks and limited brightness capabilities.

RGB Mini LED takes a different approach. Instead of using white backlights with color filters or individual pixel emitters, RGB Mini LED uses millions of tiny red, green, and blue LED elements arranged in an array behind the LCD panel. These individual RGB elements can be controlled independently, creating what's called local dimming with far more granularity than traditional LED backlighting. This means dark portions of an image can have their backlight dimmed or turned off entirely while bright areas receive full illumination.

The result? Improved contrast ratios that approach OLED performance, superior brightness that exceeds typical OLED capabilities, elimination of burn-in risk, and accurate color reproduction across the full brightness spectrum. RGB Mini LED addresses the fundamental compromise that has plagued television technology: you can have deep blacks or bright images, but achieving both simultaneously proves difficult. By utilizing separate red, green, and blue elements for each local dimming zone, RGB Mini LED theoretically achieves both.

Hisense's Implementation and Competitive Advantages

Hisense has positioned itself as a leading innovator in RGB Mini LED implementation. The company has invested substantially in the manufacturing processes and panel technology required to produce RGB Mini LED displays at scale and reasonable cost. This represents a critical advantage over competitors—while Samsung and LG have their own advanced display technologies, Hisense's focus on this specific approach gives them potential advantages in cost efficiency and manufacturing flexibility.

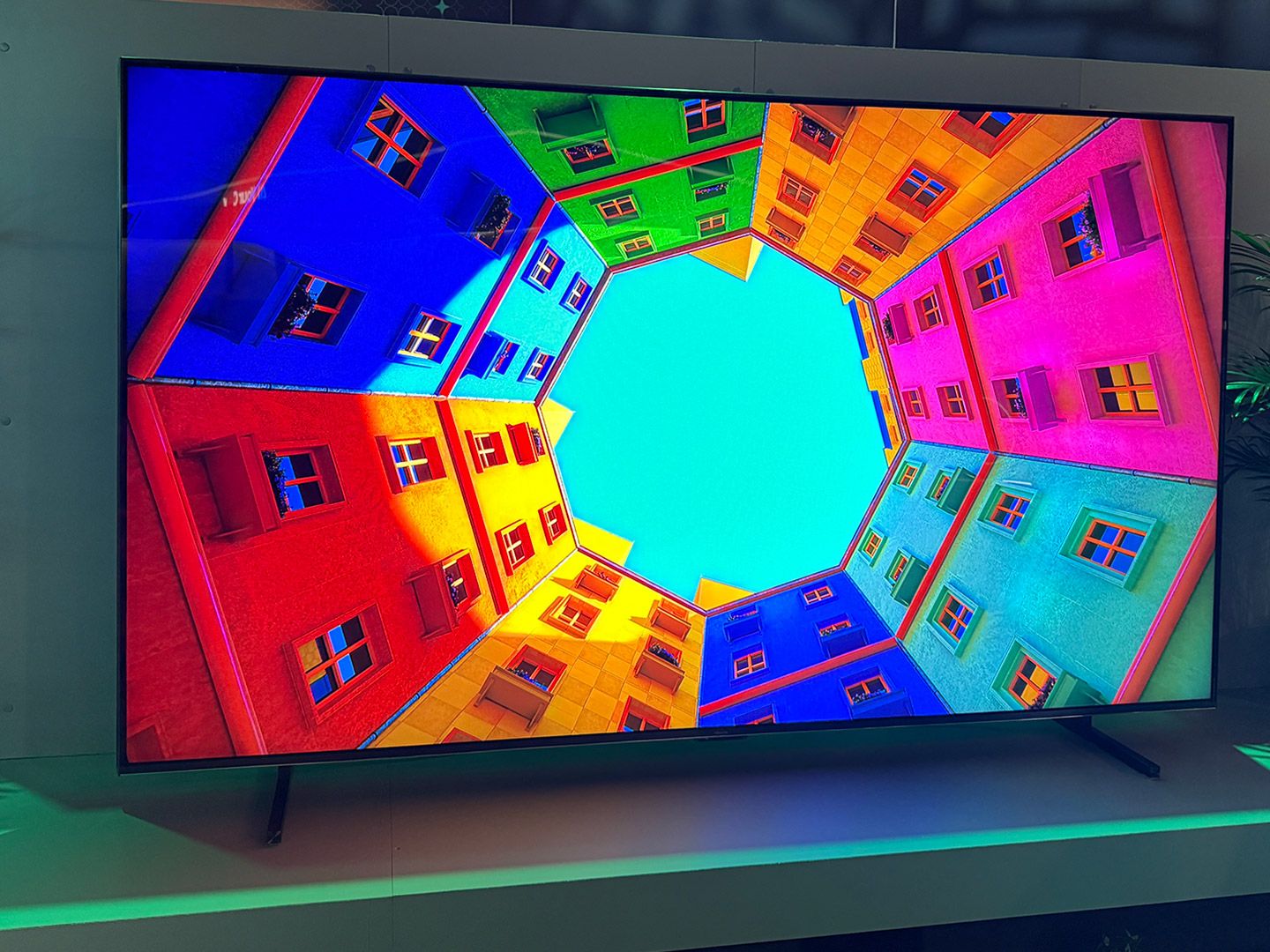

The 136-inch RGB Mini LED television that generated headlines at CES 2025 exemplifies Hisense's ambitions. At that size, achieving color accuracy, brightness uniformity, and refresh rate performance requires exceptional engineering. The fact that Hisense successfully delivered such a display and brought it to market demonstrates both technological capability and manufacturing maturity. However, at $100,000, this remains a specialty product for commercial installations and ultra-wealthy consumers.

For CES 2026, expect Hisense to announce RGB Mini LED implementations at consumer-accessible price points. The company will likely unveil 65-inch, 75-inch, and 85-inch RGB Mini LED models—sizes that represent the primary television purchasing categories. These announcements will be crucial because they determine whether RGB Mini LED becomes a mainstream technology or remains confined to ultra-premium products. If Hisense can deliver RGB Mini LED television at

Connect Life AI Platform: The Smart Home Integration Strategy

Architecture and Ecosystem Scope

Connect Life represents Hisense's comprehensive smart home platform, designed to integrate not just televisions but their entire product portfolio into a seamlessly connected ecosystem. Unlike competitors who often treat smart home features as additions to individual products, Hisense is building Connect Life as a foundational layer that underlies all their connected devices. This architectural approach offers significant advantages for consumer experience and for Hisense's ability to gather usage data and refine services across their product range.

The platform encompasses climate control systems (air conditioning units and HVAC equipment), kitchen appliances (refrigerators, ovens, cooktops), laundry equipment (washing machines and dryers), entertainment devices (televisions and soundbars), and increasingly, smart home security and energy management systems. Each device category can participate in the broader ecosystem, sharing information and coordinating actions based on user preferences and automation rules.

The AI component represents the critical differentiator. Rather than simply connecting devices and allowing manual control through an app, Connect Life uses artificial intelligence to learn user behavior patterns, anticipate needs, and optimize device operation. For example, the system might learn that users typically cook dinner at 6:00 PM, and proactively preheat the oven at 5:45 PM on weekdays. It could recognize that Tuesday mornings involve laundry and adjust washer settings based on observed soil levels and fabric types.

Enhanced AI Laundry Agent and Specific Use Cases

One particularly highlighted feature for CES 2026 is the Enhanced AI Laundry Agent, which Hisense specifically mentions in preliminary announcements. This demonstrates how Connect Life's AI capabilities extend into granular product features. The Laundry Agent uses computer vision or sensor arrays to automatically identify fabric types and soil levels, then adjusts wash cycles accordingly. Instead of users manually selecting between delicate, normal, and heavy-duty cycles, the washing machine diagnoses the load and optimizes its own behavior.

This seemingly modest feature illustrates the broader Connect Life philosophy. Traditional washing machines require users to make decisions: Is this load delicate or regular? Is it heavily soiled? Should I use hot or cold water? These decisions demand user expertise and attention. The Enhanced AI Laundry Agent removes these decisions by having the machine analyze the load and make optimal choices independently. Users benefit through time savings, improved garment longevity (since the machine won't use unnecessarily harsh cycles), and water/energy efficiency.

This type of feature integration suggests what consumers can expect across Connect Life's ecosystem. Rather than users managing individual devices through separate interfaces and manual settings, the platform moves toward automated, AI-driven operation that learns household patterns and preferences. Over time, the system becomes more personalized and anticipatory, proactively adjusting to match seasonal patterns, family composition changes, and evolving preferences.

Data Privacy, Security, and User Control Considerations

The Connect Life platform's reliance on AI and interconnected devices raises legitimate questions about data collection, privacy, and user control. For the platform to function optimally—learning patterns, anticipating needs, and providing personalized recommendations—Hisense must collect and analyze usage data. Understanding how the company handles this data, what security measures protect it, and what transparency users receive about data usage becomes critical.

Expect CES 2026 announcements to address these concerns explicitly. Leading technology companies increasingly recognize that consumers prioritize privacy and control, and that transparency about data practices builds trust. Hisense will likely emphasize any privacy protections built into Connect Life, whether data processing occurs on-device versus cloud servers, and what user controls exist for limiting data collection or sharing.

The geopolitical context also matters. As a Chinese company, Hisense faces scrutiny from consumers and governments regarding data sovereignty and potential government access. Companies including Huawei and other Chinese tech firms have faced restrictions in various markets due to security concerns. Hisense's messaging about Connect Life's security architecture and data handling practices could significantly influence adoption rates, particularly in markets like the United States where regulatory concerns about foreign technology companies remain elevated.

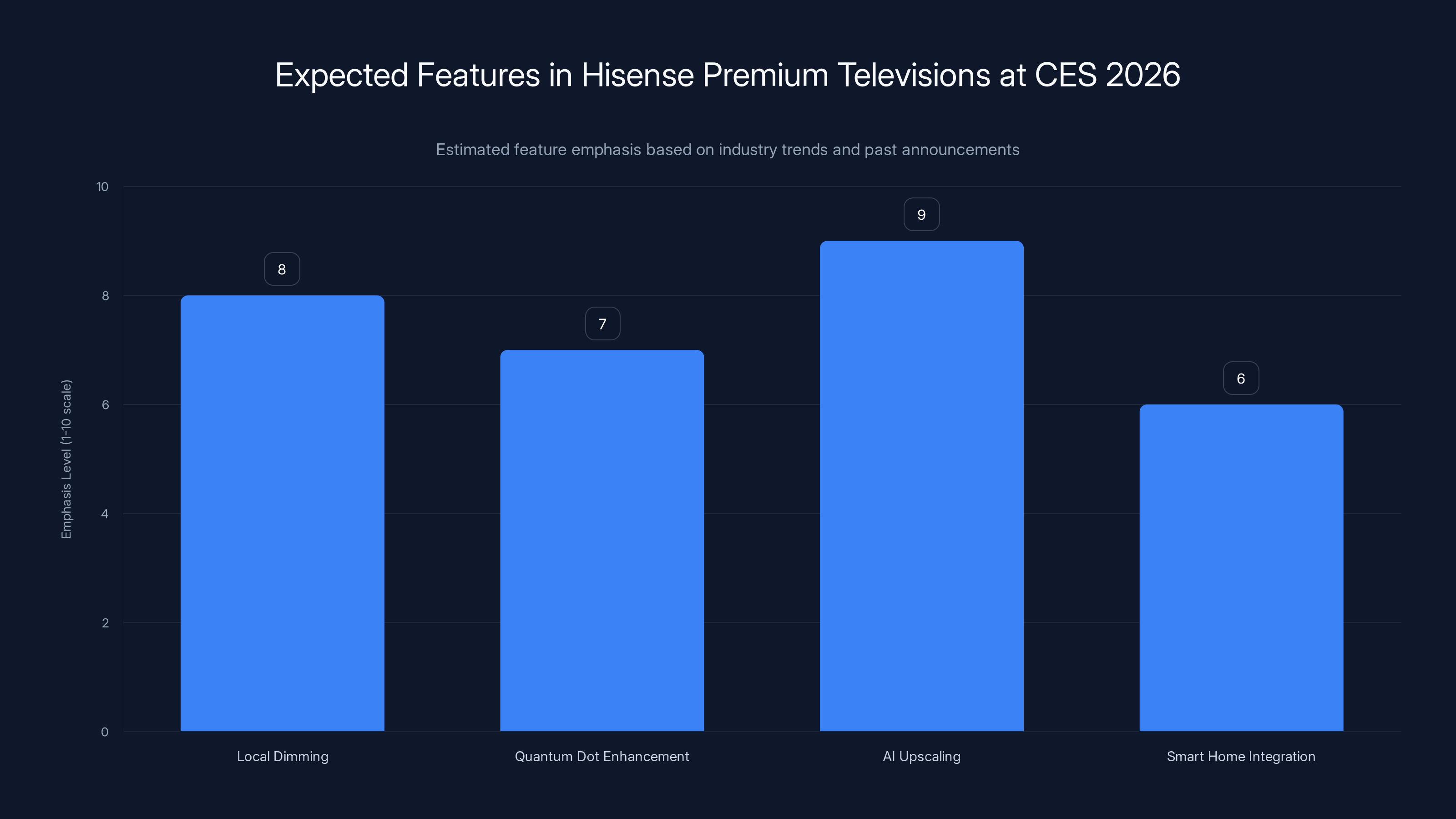

Hisense is expected to focus heavily on AI upscaling and local dimming in their premium television lineup at CES 2026, with significant attention also on quantum dot enhancements and smart home integration. Estimated data based on industry trends.

Product Categories and Announcements Expected at CES 2026

Premium Television Lineup Expansions

Following the success of their 136-inch micro LED display, Hisense will almost certainly announce expanded television lineups featuring advanced display technologies. Beyond RGB Mini LED, expect announcements regarding OLED televisions (as most major manufacturers now offer OLED options) and potential developments in their quantum dot technologies. The key question isn't whether Hisense will announce televisions—they always do at CES—but rather which price tiers will receive premium display technologies and what unique features differentiate their offerings.

Expect emphasis on local dimming capabilities, quantum dot enhancements, and AI upscaling features that improve lower-resolution content through machine learning algorithms. These features have become table stakes in premium television, but Hisense's implementation details and specific performance metrics will be worth noting. The company may also announce new television sizes, particularly in under-50-inch categories (where premium options remain limited) and extended sizes in the 95-100 inch range (commercial installation and ultra-premium consumer segments).

Smart television features will emphasize integration with Connect Life, showing how televisions serve as central hubs in smart homes. Rather than viewing TVs as isolated entertainment devices, Hisense is positioning them as command centers for managing other smart home devices, displaying information from refrigerators, washer/dryer status, and HVAC performance.

Kitchen and Laundry Appliance Innovations

Hisense's appliance divisions have expanded significantly, and CES 2026 will likely feature substantial announcements in kitchen and laundry categories. For kitchen appliances, expect the company to showcase refrigerators with advanced food management systems, including inventory tracking, expiration date monitoring, and integration with grocery shopping services. Smart refrigerators have matured to the point where basic features like internet connectivity and camera-based interior monitoring are common; differentiation now comes through sophisticated AI features that predict what users will need, suggest recipes based on available ingredients, and coordinate purchases.

Cooking appliances (ovens, cooktops, range hoods) will likely demonstrate AI-assisted cooking features—think recipe guidance, temperature monitoring, and coordinated cooking sequences where the system manages multiple cooking tasks simultaneously. These features appeal to consumers seeking convenience while maintaining flexibility for manual control when desired.

Laundry equipment announcements will build on the mentioned Enhanced AI Laundry Agent. Expect details about how washer/dryer combinations communicate, how the system handles delicate items differently, and what sustainability benefits the AI optimization provides. Water usage and energy consumption figures will be important differentiators, especially in markets with water scarcity concerns or high energy costs.

Climate Control and HVAC Integrations

James Fishler's background in HVAC systems suggests this category will receive significant attention. Traditional HVAC systems operate based on user-set thermostats, but modern connected systems can learn occupancy patterns, seasonal variations, and user comfort preferences. Hisense's HVAC offerings, integrated through Connect Life, could coordinate with other home systems—adjusting temperature when the home security system indicates nobody is present, or changing settings based on entertainment system activity (keeping the room cooler while watching action movies, for example).

Expect announcements regarding energy efficiency improvements, integration with renewable energy systems (solar panels), and potential battery storage coordination for homes with solar installations. The smart home and renewable energy trends are converging, creating opportunities for HVAC systems that optimize based not just on comfort but on available renewable energy and dynamic electricity pricing.

Market Context: CES 2026 in the Broader Technology Landscape

The State of Display Technology Competition

CES 2026 occurs at an inflection point in television technology. For years, manufacturers debated whether the future belonged to OLED (self-emissive pixels enabling perfect blacks and superior contrast) or LED-based approaches with advanced backlighting techniques. OLED matured significantly since 2020, with burn-in concerns diminishing and brightness improving. However, OLED displays remain expensive to manufacture and limited in maximum brightness compared to LED-based approaches.

RGB Mini LED and similar advanced LED backlighting technologies suggest the market isn't converging on a single technology but rather developing multiple paths serving different consumer needs. Consumers prioritizing contrast and black levels might prefer OLED; those wanting maximum brightness and burn-in resistance might choose RGB Mini LED. This fragmentation means manufacturers must offer multiple technology options, increasing complexity and capital requirements.

Hisense's strategy of emphasizing RGB Mini LED rather than competing primarily on OLED represents a differentiation choice. The company is betting that RGB Mini LED performance, combined with lower manufacturing costs and greater manufacturing capacity, can capture significant market share. If successful, this could make Hisense a major player in premium television, challenging Samsung and LG's traditional dominance.

AI Integration Across Technology Categories

Every major technology company at CES 2026 will emphasize AI—it has become the industry's dominant narrative. However, meaningful differentiation comes from how companies implement AI and what practical benefits users experience. Hisense's Connect Life approach of using AI for predictive automation and optimization across multiple devices represents one implementation philosophy. Other companies emphasize generative AI for content creation, conversational interfaces, or advanced analytics.

The key differentiator will be whether announced AI features deliver genuine utility or represent marketing additions that consume processing power without meaningful user benefits. Hisense will need to demonstrate that the AI components of Connect Life actually learn effectively, that predictions prove accurate, and that users can easily understand and control the system's automated decisions.

Smart Home Ecosystem Maturation

Smart homes have remained somewhat aspirational rather than mainstream, with adoption rates remaining modest outside early-adopter segments. However, several factors suggest CES 2026 marks a maturation point. First, broadband availability has improved globally, reducing connectivity barriers. Second, security and privacy concerns, while not eliminated, have been addressed sufficiently for mainstream adoption to proceed. Third, price points for smart devices have declined substantially, making entire-home automation more economically accessible.

Hisense's integrated ecosystem approach differs from competitors who often focus on specific categories (like Amazon's Echo-centric smart home or Apple's Home Kit integration). By offering a complete electronics ecosystem with built-in connectivity, Hisense reduces the complexity traditionally associated with smart home adoption—you don't need to purchase from multiple manufacturers or spend hours configuring compatibility. This vertical integration could prove advantageous as smart home adoption accelerates.

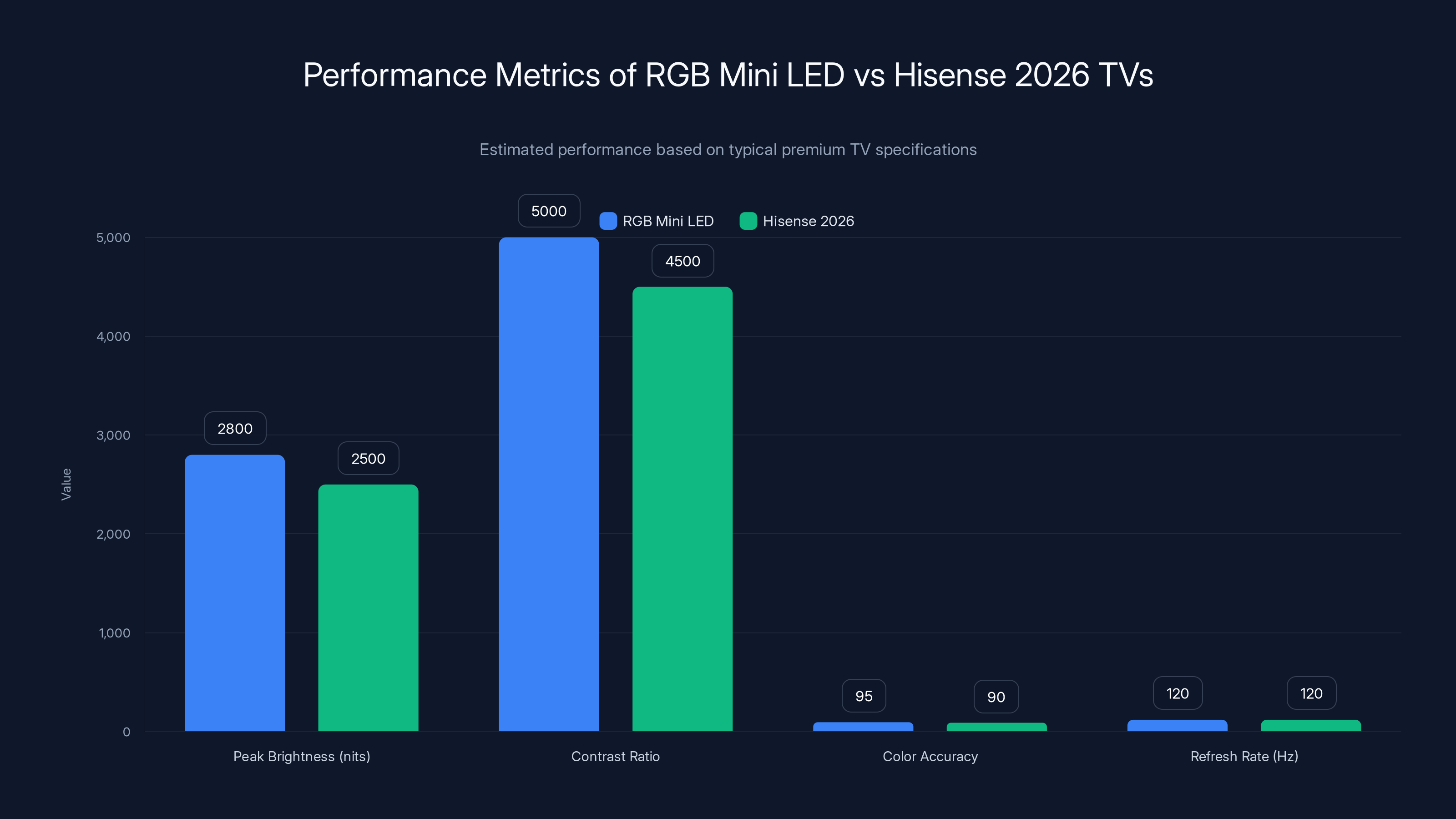

RGB Mini LED TVs are estimated to outperform Hisense 2026 models in peak brightness and contrast ratio, while both offer similar refresh rates. Estimated data.

Leadership Changes and Organizational Implications

Sarah Larsen's Marketing Vision

Sarah Larsen's appointment as Chief Marketing Officer signals that Hisense takes brand perception seriously. Previous Hisense leadership didn't always prioritize brand messaging in the same way premium competitors do. Larsen's background at LG and Samsung—companies that have invested heavily in brand prestige and consumer perception—suggests she'll implement more sophisticated marketing strategies. This likely includes partnerships with luxury retailers, sponsorships of premium events, targeted advertising in affluent consumer publications, and social media strategies emphasizing innovation and quality.

Larsen's recent comments about Hisense's rapid concept-to-market advantage provide insight into the marketing narratives we'll likely hear. Rather than trying to compete with Samsung or LG's century-long histories or their established premium brand associations, Hisense wants to differentiate as the "innovator's innovator"—a company that moves faster, takes more risks, and brings breakthrough technologies to market more quickly. This positioning appeals to tech-savvy consumers who value innovation over tradition.

Marketing strategy will likely extend to distribution channel choices. Premium brands carefully control where their products are sold, avoiding channels that might diminish brand prestige. Hisense may introduce exclusive retail partnerships, limited distribution through high-end electronics retailers, and strategic placement in home automation and luxury home design showrooms. These distribution decisions, combined with premium pricing, reinforce brand positioning.

James Fishler's Commercial Strategy

Fishler's role as Chief Commercial Officer encompasses distribution, partnership development, and market expansion strategy. His experience across multiple product categories (home entertainment, appliances, HVAC) positions him to oversee coherent go-to-market strategies across Hisense's diverse product lines. Rather than having separate sales organizations for televisions, refrigerators, and air conditioning units, Fishler likely envisions integrated sales approaches where retailers and distributors represent the full Hisense ecosystem.

This approach creates operational efficiencies and better supports the Connect Life narrative. Sales teams can position Hisense as a comprehensive smart home solution rather than selling televisions to one set of customers and appliances to another. For commercial customers (contract manufacturers, hotel chains, office building management companies), offering integrated solutions across multiple product categories creates switching costs that benefit Hisense long-term.

Fishler's appointment also suggests expansion into new channels and markets. Companies like LG and Samsung have strong relationships across professional channels—hospitality, commercial real estate, workplace design. Hisense will likely aggressively pursue these channels, leveraging their integrated product offerings to convince commercial customers to consolidate vendors. This approach works particularly well in markets where customers previously fragmented purchases across multiple suppliers.

Competitive Landscape: How Hisense Stacks Against Major Rivals

Samsung and LG's Responses to Premium Positioning

Samsung and LG have dominated premium television and appliances for decades, building strong brand recognition and commanding premium pricing. However, both companies face challenges: their legacy products and manufacturing processes sometimes feel dated compared to innovative startups, and their organizational complexity can slow decision-making. Hisense's aggressive push into premium segments threatens market share if consumers believe Hisense offers comparable technology at lower prices or better feature sets for equivalent pricing.

Samsung has been diversifying its display technology portfolio, offering OLED, Mini LED (their own advanced backlighting approach), and traditional LED options across price tiers. This diversification protects Samsung from technological disruption—if RGB Mini LED becomes dominant, Samsung has development programs underway. However, it also creates complexity in consumer messaging and potential channel conflict.

LG remains committed to OLED technology, which they've invested heavily in manufacturing and developing. LG's OLED TV business has profitability challenges despite strong performance, as the high manufacturing costs limit margin expansion. If RGB Mini LED proves sufficiently compelling while carrying lower manufacturing costs, LG's strategic commitment to OLED could prove disadvantageous.

Emerging Competitors and Technology Startups

Beyond traditional appliance manufacturers, several companies are entering smart home spaces. Amazon has built the Echo ecosystem and expanded into home energy management. Google offers Nest products for climate control and security. Apple, through Home Kit, provides premium smart home integration. These technology companies approach smart homes differently—emphasizing software platforms and ecosystems rather than manufacturing end-user appliances.

Hisense's vertical integration—designing and manufacturing actual products rather than just providing platforms—represents a different approach. The company can ensure hardware and software integration that platform-only companies cannot match. However, technology companies have massive software engineering resources and established consumer ecosystems that hardware manufacturers must compete against.

Startups focused on specific categories (like smart kitchen companies or advanced refrigeration startups) also pose indirect competition, though they currently lack the breadth Hisense offers. As smart home adoption accelerates, niche players may gain traction with specific consumer segments before being acquired by larger companies or squeezed out by integrated players.

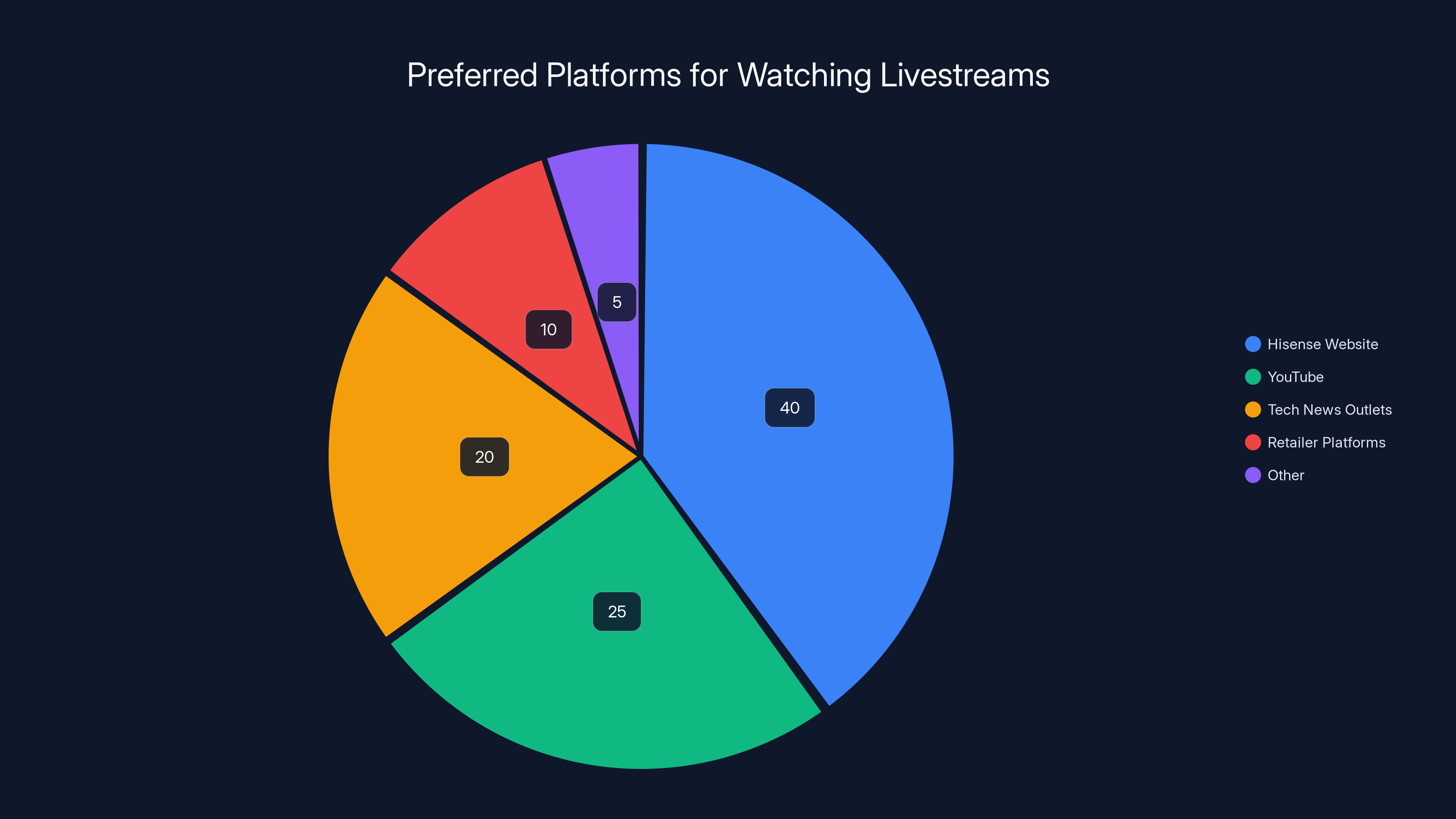

Estimated data suggests that most viewers prefer watching the CES 2026 livestream directly on the Hisense website, followed by YouTube and tech news outlets.

Technical Specifications and Performance Benchmarking

Display Performance Metrics

When evaluating RGB Mini LED televisions and Hisense's 2026 announcements, several technical metrics deserve attention. Peak brightness measurements (typically quoted in nits) indicate maximum luminosity—higher values provide better visibility in bright rooms and more impressive HDR content performance. Current premium televisions range from 1,500–3,000 nits peak brightness, with RGB Mini LED claiming advantages in this category.

Contrast ratio compares the brightest whites to the darkest blacks the display can produce. Traditional specifications sometimes misrepresent this through static measurements, but dynamic contrast (how rapidly and smoothly the display transitions between brightness levels) matters more for real-world performance. RGB Mini LED's local dimming capability should provide superior dynamic contrast compared to traditional LED backlighting.

Color accuracy and gamut coverage (the range of colors the display can reproduce) determine whether the television faithfully represents content creator intent. Professional displays require extremely high color accuracy; consumer displays prioritize visually pleasing color balance, which sometimes diverges from perfect accuracy. Hisense will likely emphasize color science improvements enabled by RGB backlighting.

Refresh rate (typically 60 Hz or 120 Hz) and response time (how quickly pixels change states) matter primarily for gaming and sports viewing. Recent Hisense televisions have increasingly targeted gamers through gaming-specific features, and we can expect CES 2026 announcements to emphasize gaming performance.

Smart Home Integration Specifications

For Connect Life and broader smart home capabilities, technical specifications include communication protocols (Wi-Fi 6, Bluetooth, Zigbee, Z-Wave), response latencies (how quickly devices react to commands), and database synchronization capabilities (ensuring multiple devices share current information). The most seamlessly integrated smart homes utilize consistent protocols across all devices; when different products use different standards, integration becomes friction-filled.

Expect Hisense to announce standardized connectivity across their ecosystem, likely emphasizing modern protocols like Wi-Fi 6 and emerging standards. The company may also highlight integration with major smart home platforms—whether Connect Life works smoothly with Amazon Alexa, Google Home, or Apple Siri. Cross-platform compatibility increases utility significantly, as it lets users control Hisense devices through whatever smart home platform they've already adopted.

Regional Market Strategy and Availability

North American Market Focus

With Larsen and Fishler's extensive North American market experience, expect CES 2026 announcements emphasizing North American availability. Hisense has historically found greater acceptance in Asian, European, and Middle Eastern markets than in North America, where Samsung, LG, and Sony maintain stronger brand recognition. The strategic hiring of executives with North American experience signals that the company views this market as critical to 2026 ambitions.

Product availability in North America often follows a phased rollout—premium products launching first through select retailers and online channels before expanding to broader distribution. Hisense will likely announce which retailers will carry which products, with initial focus on major electronics retailers (Best Buy, Amazon) and online channels where Hisense can reach price-conscious consumers.

Pricing strategy for North American markets deserves particular attention. Hisense has traditionally competed on value—offering good specifications at lower prices than established brands. However, the company can't simultaneously pursue premium positioning and budget pricing. Expect CES 2026 announcements to include different price tiers, with premium RGB Mini LED models at elevated price points and continued value offerings in standard LED categories. This multi-tier approach allows Hisense to preserve premium positioning while maintaining accessibility for budget-conscious segments.

International Market Expansion

While North America commands attention, Hisense's largest markets remain in Asia, Middle East, and Africa. The company has established manufacturing presence in multiple countries and maintains strong distribution networks. CES 2026 announcements will likely address how new products roll out across these regions, timelines for availability, and any region-specific variations.

Globally, Hisense faces challenges around brand perception that vary by market. In some regions, Hisense is already perceived as innovative and quality-focused. In others, negative associations with budget products persist. Leadership appointments and product announcements provide opportunities to reinforce positive perceptions globally.

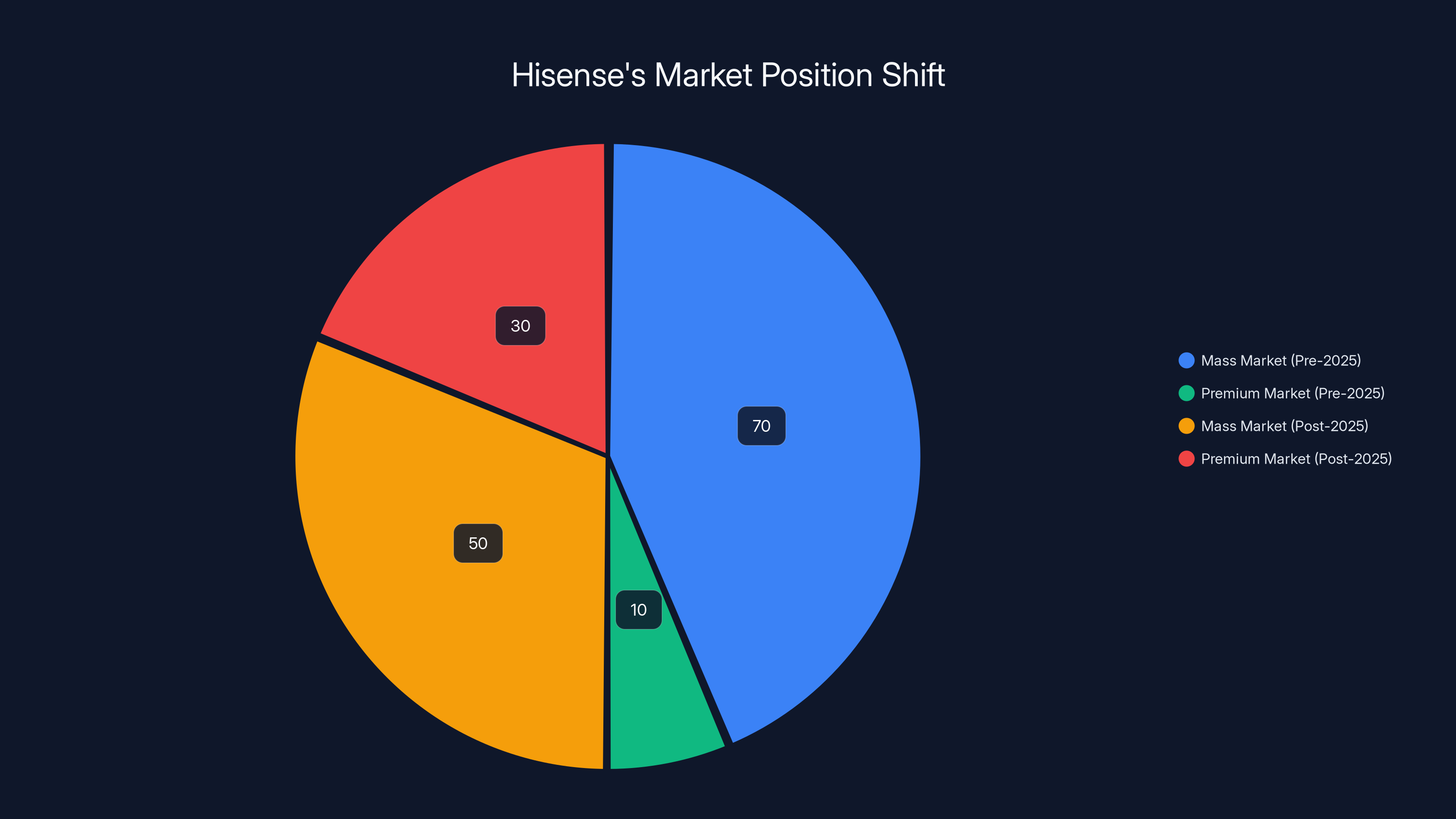

Hisense's strategic shift is evident in its increased focus on the premium market, growing from an estimated 10% to 30% of their market focus post-2025. Estimated data.

Consumer Considerations and Purchase Decision Frameworks

Evaluating RGB Mini LED Televisions

For consumers considering new television purchases, RGB Mini LED technology offers compelling advantages but introduces complexity. The technology delivers superior contrast and brightness compared to traditional LED backlighting while avoiding OLED burn-in concerns and achieving lower manufacturing costs than OLED displays. However, RGB Mini LED remains expensive, price points exceed many consumers' budgets, and the technology remains less established than OLED or traditional LED options.

Potential buyers should evaluate their specific priorities. If maximizing brightness (for bright living rooms) and avoiding burn-in risk matters more than absolute contrast performance, RGB Mini LED deserves serious consideration. If existing viewing conditions already accommodate darker environments and burn-in risk seems minimal, OLED might provide superior contrast at potentially lower price points.

The timing of Hisense's CES 2026 announcements creates an opportunity—waiting to hear exact specifications, available sizes, and confirmed pricing allows more informed purchasing decisions. Consumers planning 2026 television purchases would be wise to wait for CES coverage before making final decisions.

Smart Home Integration Evaluation

For consumers considering smart home investments, Hisense's integrated ecosystem approach offers genuine advantages. Rather than purchasing individual smart devices from different manufacturers and struggling with compatibility and integration, buying most products from a single manufacturer with unified ecosystems simplifies implementation significantly. Users can set up automation rules once and have them work reliably across all devices.

However, integration benefits only accrue if your specific appliance needs align with Hisense's product offerings. If you require a specialized refrigerator without Hisense alternatives, or prefer specific televisions models Hisense doesn't manufacture, the ecosystem advantage disappears. Consumers should assess whether Hisense's complete product portfolio meets their needs before committing to their ecosystem.

Data privacy remains worth considering. Integrated smart homes collect more usage data than traditional homes, and this data's security and management becomes critical. Consumers uncomfortable with data collection should carefully review Hisense's privacy policies and data handling practices before integration.

Industry Trends Shaping 2026 Announcements

Sustainability and Energy Efficiency Imperatives

Environmental concerns increasingly influence consumer purchasing decisions, particularly among affluent segments that can afford premium products. Hisense will likely emphasize energy efficiency improvements in their 2026 products, including more efficient display technologies, smart power management that reduces standby consumption, and appliances that use water and energy more efficiently through AI optimization.

RGB Mini LED technology itself offers sustainability advantages—the approach uses more electricity during peak luminosity compared to OLED, but overall power consumption metrics may favor RGB Mini LED in typical viewing conditions. If local dimming effectively dims backlight for dark image portions, total power consumption could decrease compared to always-on OLED backlights.

Manufacturing sustainability, recycling programs, and supply chain ethics represent additional dimensions where premium brands differentiate themselves. Expect announcements addressing these topics, as competitors increasingly highlight responsible sourcing and manufacturing practices.

Generative AI Integration Opportunities

Generative AI—the technology behind Chat GPT and image generation tools—has captured public imagination and driven investment across technology companies. While Hisense hasn't emphasized generative AI in early Connect Life descriptions, expect CES 2026 to explore opportunities. Television interfaces could incorporate conversational AI letting users control devices through natural language. Appliances might generate recipes based on available ingredients. Smart home systems could create summaries of daily activities or predictive insights.

Generative AI integration carries risks beyond technical challenges—public concern about AI-generated misinformation and job displacement could make some consumers skeptical of AI-heavy product positioning. Hisense will need to articulate clear user benefits and address legitimate concerns about AI in their marketing messaging.

Timing and Strategic Implications of CES 2026 Positioning

Why January 2026 Matters for Hisense

CES timing is strategic. January represents the beginning of retail's retail cycle, when consumers make fresh-year purchasing decisions and retailers stock new inventory. Major announcements at CES 2026 give Hisense the entire retail year to build momentum, generate sales, and establish new product categories' market presence. Missing 2026 or conducting half-hearted launches would squander this opportunity.

The company explicitly references 2026 as a "milestone year," suggesting internal ambitions exceed normal product launch cycles. This language typically indicates that Hisense has set internal targets for market share gains, revenue growth, or brand perception improvements that rely on 2026 execution.

New leadership timing reinforces this interpretation. Companies typically onboard new executives during transition periods when strategic shifts are planned. The fact that both Larsen and Fishler joined before CES 2026 rather than after suggests they've been involved in product planning, marketing strategy development, and go-to-market execution.

Announcements Beyond Hardware Specifications

While display technology and connected appliance features generate excitement, expect equally significant announcements regarding service plans, warranty structures, and support offerings. Premium positioning requires premium customer experience. Hisense will likely announce extended warranties, white-glove delivery and installation services, and dedicated customer support channels that compete with established premium brands' service offerings.

Retail partnership announcements also matter. Which stores will carry Hisense premium products? Will specialized showrooms open in major metropolitan areas? Will online sales receive priority? These commercial decisions shape consumer accessibility and brand positioning as much as product specifications.

Alternative Smart Home Platforms and Competitive Solutions

While Hisense focuses on integrated hardware-centric smart home platforms, other approaches merit consideration. If you're evaluating smart home solutions broadly, understanding Hisense's position relative to alternatives helps contextualize their CES 2026 announcements.

Amazon's Alexa ecosystem dominates the current smart home market through aggressive pricing, wide device selection, and integration with countless third-party products. Alexa-compatible devices span hundreds of manufacturers, offering flexibility but potentially lacking the integration depth that proprietary ecosystems provide.

Google Home and Nest products emphasize AI capabilities and integration with Google's broader service ecosystem. The approach works well for consumers already embedded in Google services (email, calendar, photos). Nest's acquisition by Google added professional-grade smart home hardware to their platform.

Apple Home Kit appeals to premium consumers within the Apple ecosystem, emphasizing privacy and on-device processing. Home Kit's integration with iPhone, iPad, and Mac appeals to Apple users, though the limited device selection constrains flexibility.

Samsung Smart Things represents a manufacturer-driven approach similar to Hisense's, leveraging Samsung's extensive appliance and electronics portfolio. Smart Things has matured into a capable platform, though its integration with Samsung products works more smoothly than with competitors' devices.

Hisense's Connect Life approach sits between these categories. Rather than serving as an open platform accessible to numerous manufacturers, Connect Life prioritizes deep integration with Hisense's own products. This delivers superior integration for Hisense ecosystem users but reduces flexibility compared to open platforms. The trade-off depends entirely on whether Hisense's complete product portfolio aligns with your household needs.

Looking Forward: Post-CES 2026 Expectations

Product Availability Timeline

Announcements at CES frequently precede actual availability by weeks or months. Hisense will need to communicate clearly about when products reach retail shelves, which models launch first, and any region-specific availability variations. Savvy consumers should take announcement dates with healthy skepticism—many CES products take months reaching consumers despite enthusiastic January reveals.

The first product availability windows typically indicate Hisense's manufacturing priorities. Premium RGB Mini LED televisions may launch immediately to capitalize on high-end consumer demand and generate positive reviews. Value-oriented products might arrive later as manufacturing scales up. Connect Life features might roll out gradually through firmware updates rather than waiting for complete availability.

Market Reception and Industry Response

How the industry and consumers respond to Hisense's CES 2026 announcements will significantly shape the company's strategic trajectory. Overwhelmingly positive reception validates the premium positioning, generates manufacturing investment confidence, and supports the brand narrative Larsen and Fishler are building. Lukewarm or skeptical response forces recalibration.

Competitor responses also matter. If Samsung and LG introduce aggressive RGB Mini LED or superior alternative technologies shortly after Hisense's announcements, it suggests competitors view Hisense's approach as threatening. If competitors largely ignore Hisense's announcements, it might indicate they view them as niche offerings unlikely to significantly impact market share.

For consumers and industry observers, CES 2026 becomes a pivotal moment to assess whether Hisense's strategic pivot toward premium positioning succeeds or whether the company's traditional value-brand associations prove difficult to overcome.

FAQ

What time does Hisense's CES 2026 press conference begin?

Hisense's main press conference is scheduled for Monday, January 5, 2026, at 1:00 PM Eastern Time. The company will livestream the event on their official website, with recordings typically made available within hours of the live presentation concluding.

Where can I watch the Hisense CES 2026 presentation?

The official livestream will be available on Hisense's corporate website. Additionally, tech news outlets, YouTube (through Hisense's official channel and authorized media partners), and social media platforms will likely provide coverage or simulcasts. Recorded versions become available shortly after the live event concludes.

What is RGB Mini LED technology and how does it differ from OLED?

RGB Mini LED uses millions of independently controlled red, green, and blue LED elements behind an LCD panel, enabling precise local dimming for improved contrast. Unlike OLED displays where individual pixels emit light (creating perfect blacks but risking burn-in), RGB Mini LED provides exceptional brightness and contrast without burn-in risk. OLED excels at perfect blacks and thin form factors; RGB Mini LED typically offers superior peak brightness and eliminates degradation concerns.

What is Connect Life and how does it function?

Connect Life is Hisense's AI-powered smart home platform integrating televisions, appliances, climate control systems, and other devices into a unified ecosystem. The platform learns user behavior patterns and automates device operation—for example, automatically selecting optimal washer cycles based on fabric type, or adjusting temperature settings based on occupancy patterns. Devices communicate through Connect Life to coordinate actions and share information.

What new products can I expect Hisense to announce at CES 2026?

Expect announcements across televisions (particularly RGB Mini LED models at consumer price points), kitchen appliances with enhanced AI features, laundry equipment with the Advanced AI Laundry Agent, and HVAC systems integrated with Connect Life. The company has emphasized smart home integration and premium display technology as key focus areas, suggesting significant announcements in both categories.

Who are Sarah Larsen and James Fishler, and why are their appointments significant?

Sarah Larsen serves as Hisense's new Chief Marketing Officer, bringing experience from Samsung and LG in premium brand positioning. James Fishler is Chief Commercial Officer, with background in home entertainment, appliances, and HVAC from major manufacturers. Their appointments signal Hisense's strategic pivot toward premium positioning—these executives bring expertise in building and maintaining premium brand perception and managing complex commercial operations across multiple product categories.

How does Hisense's pricing strategy align with their premium positioning?

Hisense is adopting a multi-tier approach: premium RGB Mini LED televisions and integrated Connect Life products at elevated price points (competing with Samsung and LG premium offerings), while maintaining value-oriented products at traditional Hisense price levels. This allows brand elevation without abandoning budget-conscious customer segments who contributed to historical growth.

What advantages does an integrated smart home ecosystem provide over open platforms like Alexa or Google Home?

Integrated ecosystems like Hisense's Connect Life offer deeper device integration, more sophisticated automation rules, and reduced compatibility issues compared to open platforms supporting numerous manufacturers. However, they provide less flexibility—if Hisense doesn't manufacture a specific appliance type you need, you're limited. Open platforms offer broader device selection but potentially shallower integration and more setup complexity.

How does Hisense's positioning compare to Samsung and LG in the premium television market?

Hisense is aggressively pursuing premium positioning through technological innovation (RGB Mini LED), strategic pricing below Samsung and LG premium models, and rapid product development cycles. However, Samsung and LG maintain advantages through established brand recognition, legacy customer loyalty, and broader distribution networks. Hisense's success depends on delivering comparable performance at lower prices while building brand perception matching premium positioning.

When will RGB Mini LED televisions be available for purchase?

While Hisense will announce RGB Mini LED models at CES 2026, specific availability dates depend on company announcements during the presentation. Historically, premium products announced at CES reach retail channels within weeks, while broader availability across price tiers extends over several months. Consumers should wait for official announcements to determine exactly when specific models they're interested in will be purchasable.

Conclusion: The Significance of Hisense's 2026 Strategic Pivot

Hisense's CES 2026 presentation represents far more than a routine product announcement cycle. The combination of new leadership, strategic emphasis on premium positioning, technological innovations in display and smart home integration, and explicit messaging about a transformative milestone year suggest that the company is fundamentally repositioning itself in global markets. For decades, Hisense built its business on affordability and accessible quality. The company is now attempting a strategic transition toward premium brand positioning—a shift that many technology companies have attempted but few have successfully executed.

The appointment of Sarah Larsen and James Fishler crystallizes this ambition. These executives don't join mid-tier companies for routine product management responsibilities. Their presence signals that Hisense's board and executive leadership have committed resources and strategic focus to elevating brand perception and expanding market share in premium segments. The timing—positioning them to launch 2026 products rather than arriving afterward—suggests they've already influenced product strategy and go-to-market planning.

RGB Mini LED technology provides technical justification for premium positioning. If Hisense successfully delivers RGB Mini LED televisions at price points below established premium brands while matching or exceeding performance specifications, they've created a compelling value proposition. Early adoption of RGB Mini LED, combined with manufacturing advantages potentially providing cost efficiency, could establish Hisense as the innovation leader in display technology—an enviable position currently owned by Samsung and LG.

Connect Life represents the strategic broadening of Hisense's value proposition. Rather than asking consumers to choose between premium televisions and smart home integration, Hisense is offering integrated ecosystems spanning entertainment, appliances, and climate control. For consumers frustrated with compatibility headaches associated with multi-manufacturer smart homes, this integration appeals significantly. For Hisense, it creates ecosystem lock-in—once you've invested in multiple Hisense products, switching becomes increasingly inconvenient.

However, execution risks remain substantial. Technology companies attempting brand repositioning face challenges overcoming existing perceptions. Consumers accustomed to viewing Hisense as a budget brand must be convinced that the company has truly elevated quality and innovation. This requires not just better marketing but sustained product performance and customer experience that justifies premium pricing. A single product failure or customer service failure could undermine the entire strategic pivot.

Manufacturing challenges also deserve consideration. Premium RGB Mini LED television production requires sophisticated manufacturing capabilities and quality control processes. Scaling production while maintaining consistency across multiple product categories challenges even experienced manufacturers. If Hisense struggles with quality consistency, premium positioning becomes untenable.

Geopolitical factors introduce additional uncertainties. Trade tensions between the United States and China have previously affected Chinese technology companies' market access. While Hisense hasn't faced the restrictions placed on companies like Huawei, a changing geopolitical landscape could create unexpected headwinds. Transparent communication about data privacy and security practices becomes even more critical for Chinese companies pursuing premium positioning in Western markets.

For consumers, CES 2026 provides an invaluable window into Hisense's strategic direction and the products they're prioritizing. Those considering premium television purchases in 2026 should absolutely tune in to understand what RGB Mini LED offerings will be available and at what price points. Consumers interested in comprehensive smart home solutions should evaluate whether Connect Life's approach and specific product offerings align with their needs. Early adopters can track the success of first-wave products and make purchasing decisions accordingly.

For the broader technology industry, Hisense's CES 2026 presentation will be worth monitoring as a case study in brand repositioning and premium market entry. If Hisense successfully executes their strategic vision, they'll become a major competitor threatening Samsung and LG's traditional dominance. If they falter, it will serve as a cautionary tale about the difficulty of simultaneously maintaining value positioning while pursuing premium status.

Ultimately, CES 2026 marks a critical juncture where Hisense's strategic ambitions become concrete reality. The announcements, product specifications, pricing, and available channels will reveal how seriously the company takes this transformation and whether they've allocated sufficient resources to succeed. For anyone interested in the future of display technology, smart home integration, or the competitive dynamics of consumer electronics, Hisense's January 5th presentation deserves your attention.

Key Takeaways

- Hisense's CES 2026 presentation on January 5, 1PM ET marks a strategic pivot toward premium positioning with new leadership Sarah Larsen and James Fishler

- RGB Mini LED technology offers superior brightness and contrast while avoiding OLED burn-in concerns, potentially disrupting the premium TV market

- ConnectLife AI platform integrates televisions, appliances, and HVAC systems into a unified smart home ecosystem using predictive automation

- The company is pursuing multi-tier pricing strategy balancing premium positioning with value offerings across their product portfolio

- Hisense's rapid concept-to-market advantage differentiates them from slower-moving established competitors like Samsung and LG

- New product announcements across display technology, kitchen appliances, laundry equipment, and climate control systems expected at CES 2026

- The livestream will be available on Hisense's official website with recordings available shortly after the live event

- Hisense faces execution challenges in brand repositioning and premium market entry despite strong technological foundation