Introduction: The Agritech Company Defying Market Headwinds

Global agricultural markets are in turmoil. Commodity prices are plummeting. The World Bank has warned that extreme weather, surging input costs, trade disruptions, and shifting biofuel policies are creating unprecedented instability across agricultural commodities worldwide. For most businesses operating in this space, falling prices mean margin compression, inventory losses, and investor skepticism.

Then there's Arya.ag.

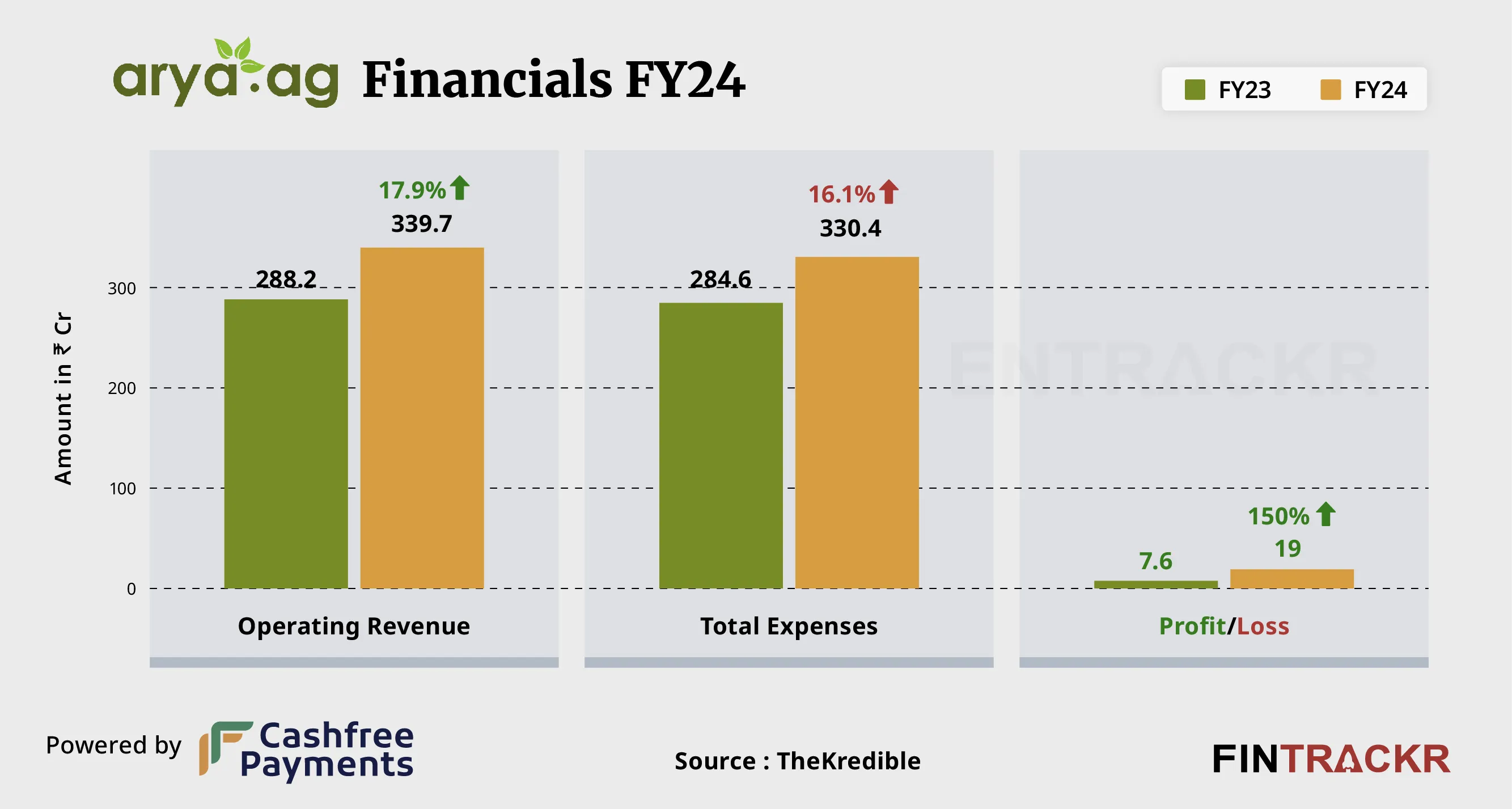

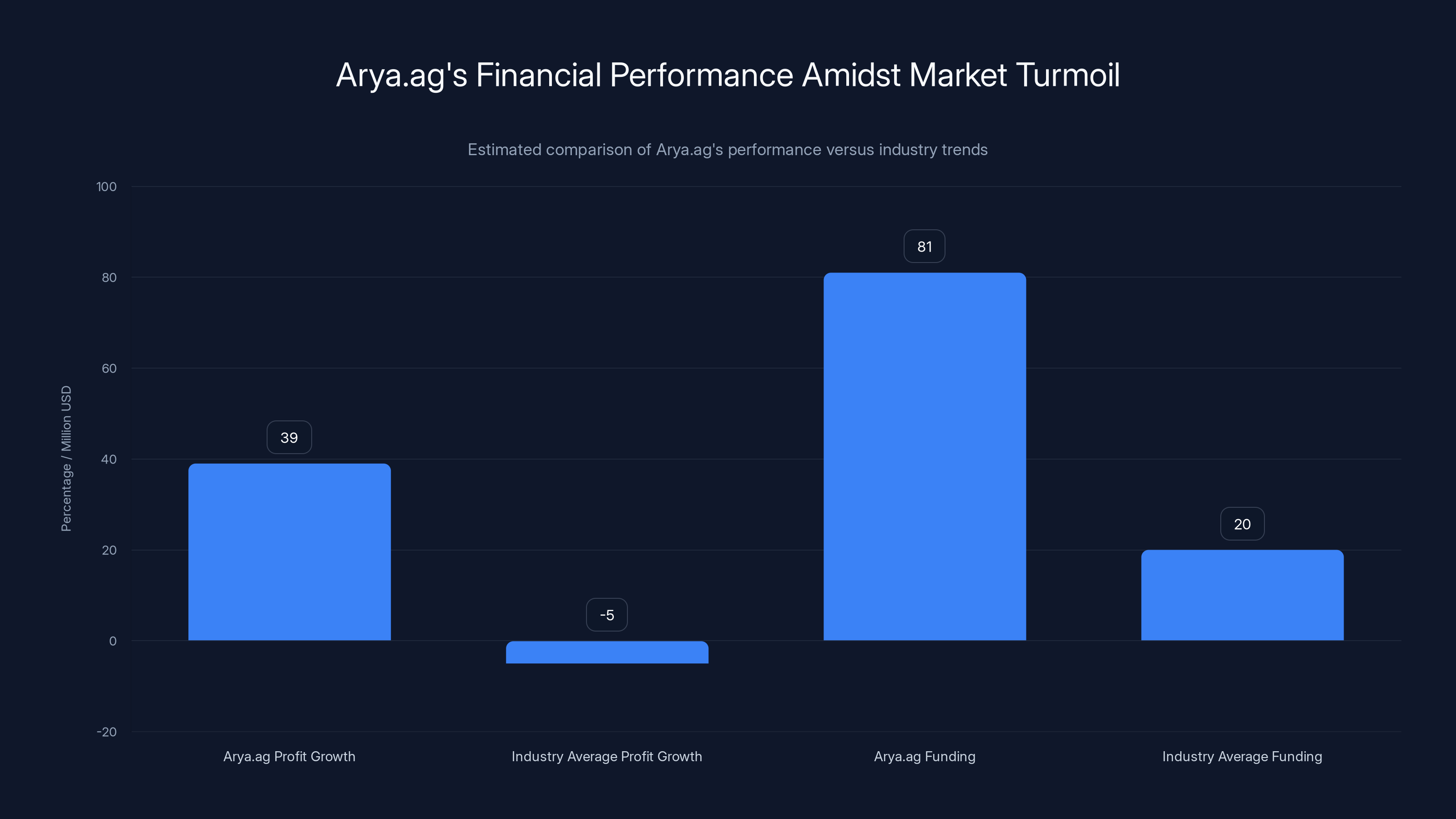

While competitors struggle and investors retreat from agriculture, this Indian agritech startup just closed an $81 million Series D funding round. More surprising still? The company is profitable. Not just slightly profitable, either. Arya.ag reported a 39% year-over-year increase in profit after tax in the first half of its current financial year, even as global commodity prices continue their downward spiral.

How is this possible? The answer lies in a fundamentally different business model, one that doesn't depend on betting on commodity prices at all. Instead of playing the commodity price game, Arya.ag has built a financial services and logistics platform that abstracts away direct commodity exposure while simultaneously solving one of India's most persistent agricultural problems: farmers' inability to control when and to whom they sell their crops.

This is a story about building defensible, profitable businesses in volatile markets. It's also a masterclass in how technology, when applied correctly, can transform ancient supply chain problems into modern financial services opportunities. More importantly, it reveals why investors remain confident in agricultural technology even when commodity markets are screaming red.

Let's break down how Arya.ag achieves what seems impossible: profitability and growth in a sector that's supposed to be contracting.

TL; DR

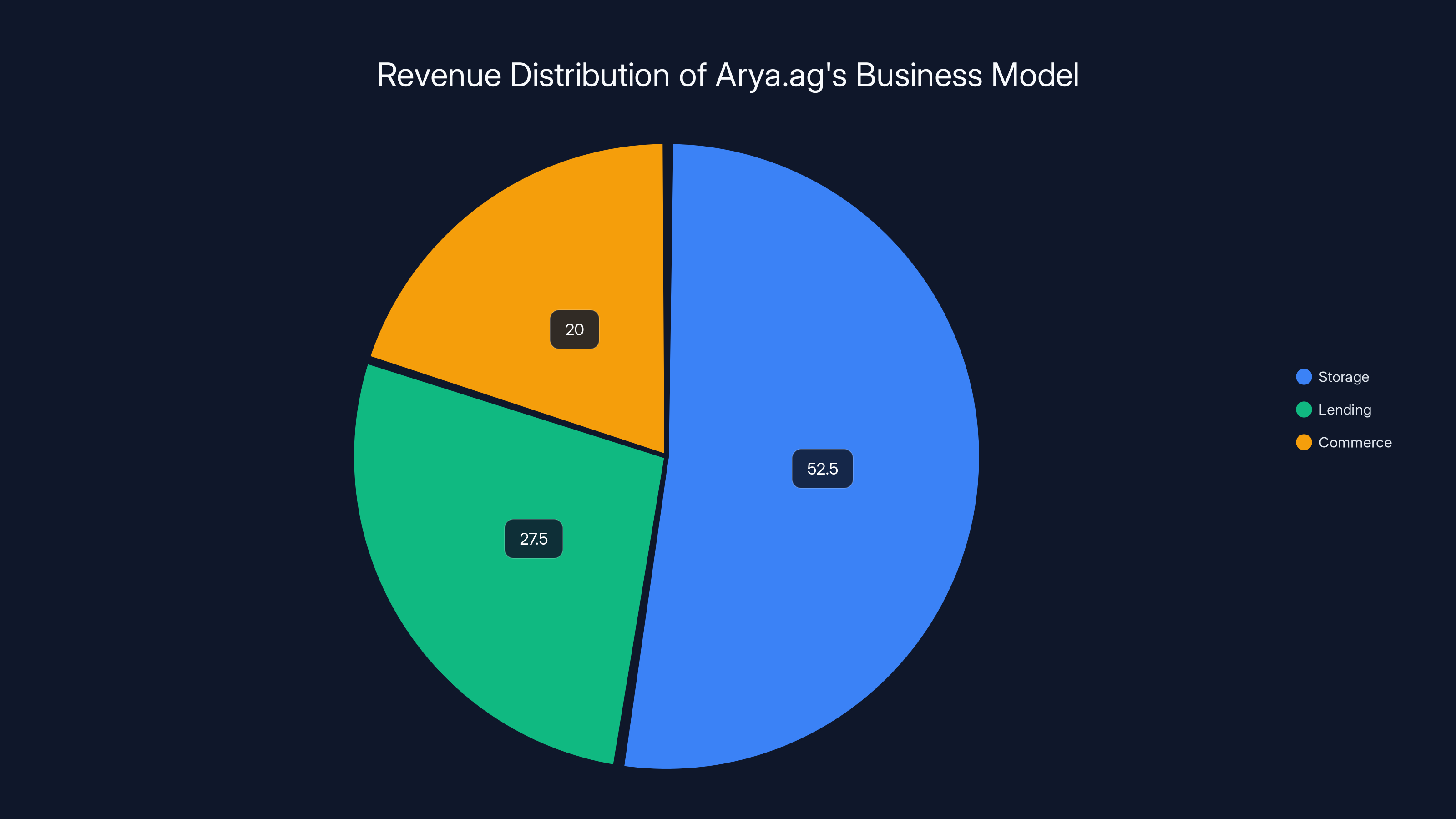

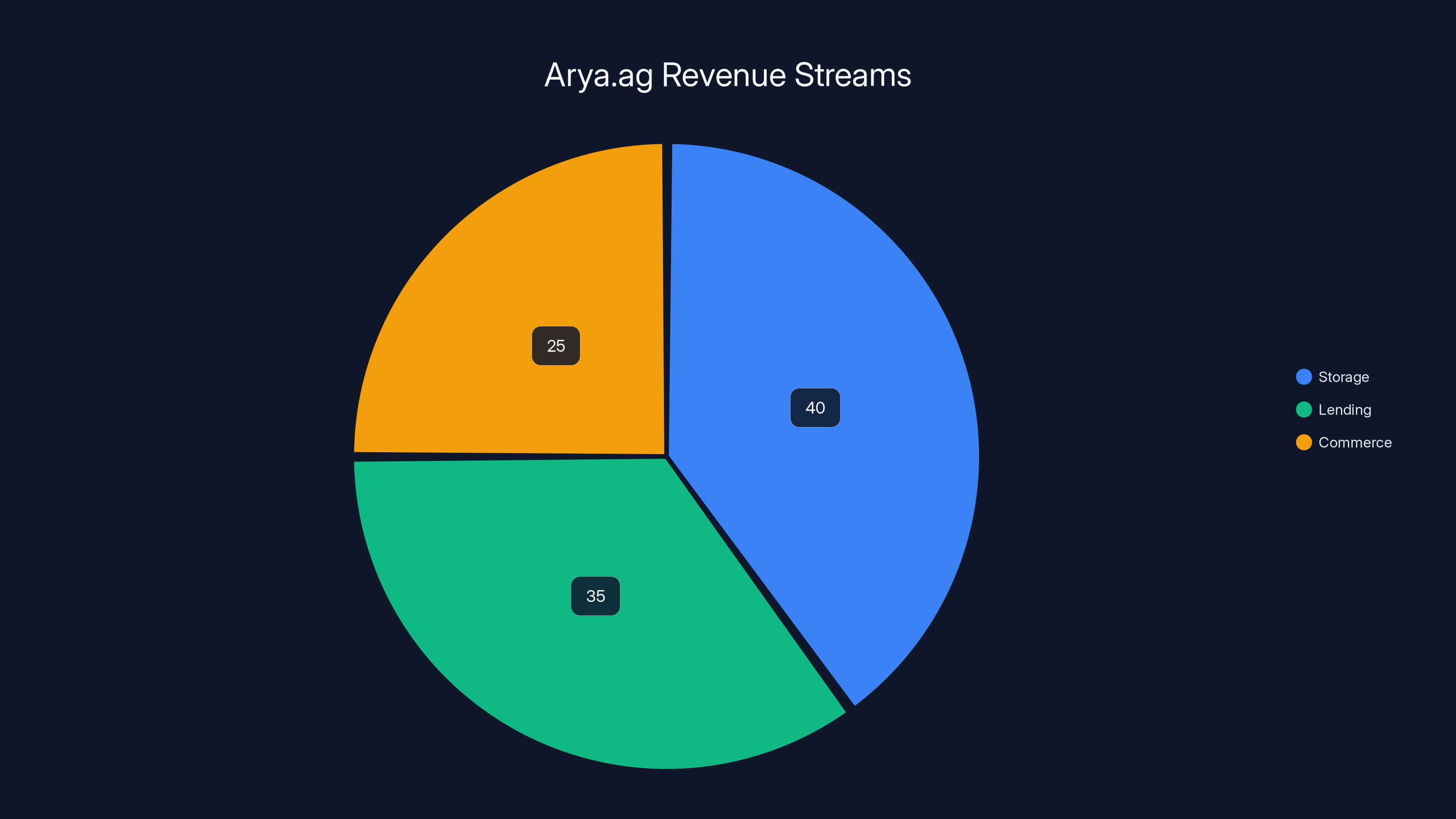

- The Business Model: Arya.ag generates revenue from three streams (storage, lending, commerce), none directly dependent on commodity prices

- The Scale: The company manages approximately 1.5 billion in loans while keeping bad loans below 0.5%

- The Profitability: Arya.ag reported ₹340 million profit (about $3.78 million) last year, with 39% growth in the current year despite falling prices

- The Funding: GEF Capital Partners led an $81 million Series D round, with 70% primary capital

- The Secret: Smart use of margin calls, collateral management, and price tracking that de-couples the business from commodity price bets

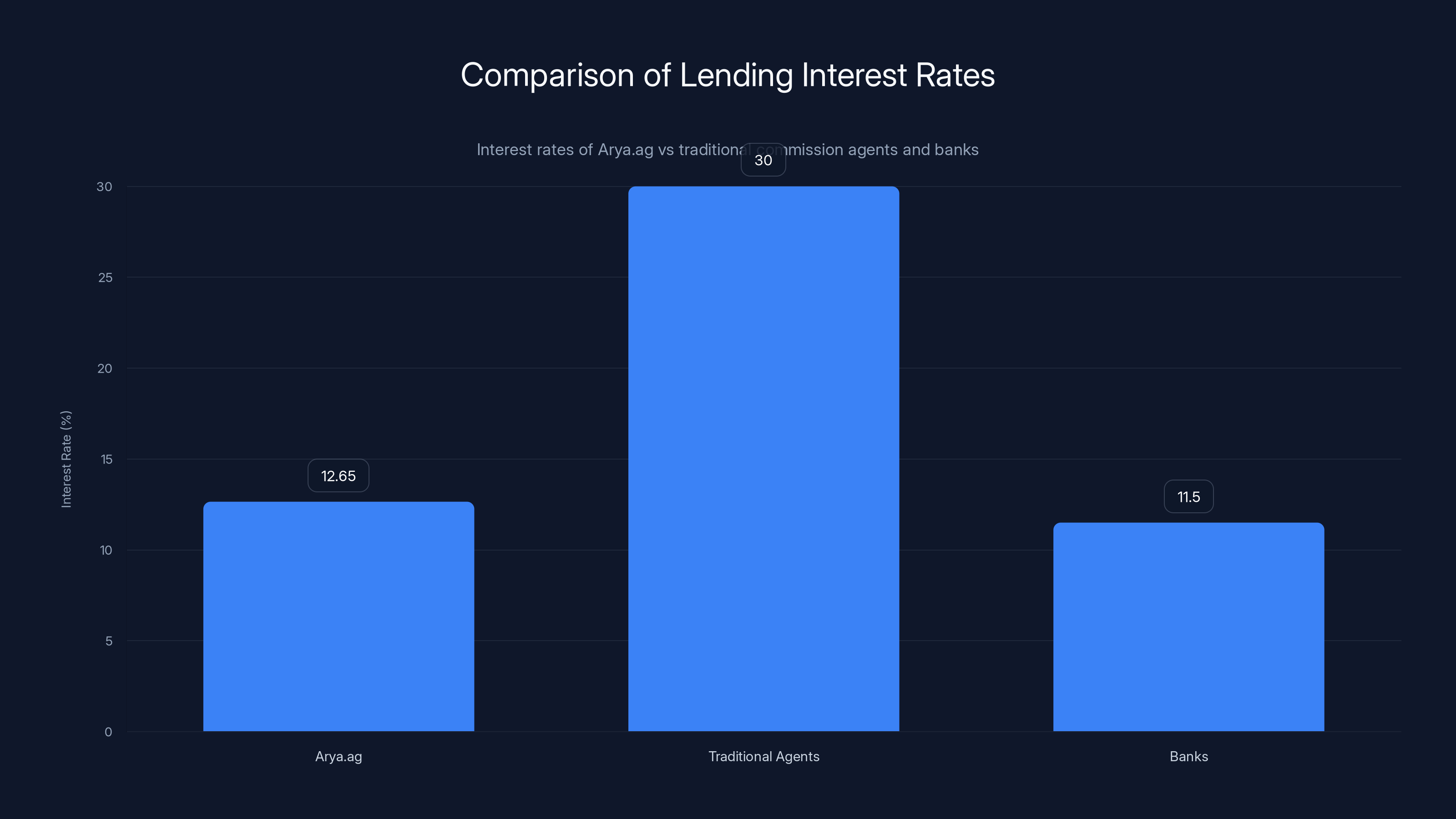

Arya.ag offers competitive interest rates at 12.5-12.8%, significantly lower than traditional agents but slightly higher than banks. Estimated data.

The Problem Arya.ag Solves: Understanding India's Agricultural Finance Crisis

Why Farmers Sell Too Early at the Worst Prices

Imagine harvesting a season's worth of work and being forced to sell everything within days. Not because you want to. Not because it makes economic sense. But because you have no other choice.

This is the reality for hundreds of millions of Indian farmers. After harvest, immediate cash needs are urgent. Farm laborers need to be paid. Debts to local moneylenders come due. Children need school fees. The pressure to convert crops to cash immediately is relentless, and that pressure creates a catastrophic economic problem: farmers sell just after harvest, when supply is highest and prices are lowest.

Commission agents in rural markets exploit this desperation. They offer rates 24% to 36% higher than formal bank lending rates because they're the only option available. Traditional banks don't operate in small, local markets close to farming areas. They don't make loans of ₹50,000 to ₹200,000 to individual farmers in remote villages. The economics don't work for them. Banks need scale, established collateral, and formal documentation. Farmers don't have any of these.

So farmers end up borrowing from commission agents at predatory rates, and then selling crops at harvest-time lows. It's a system that extracts enormous value from agriculture while leaving farmers with minimal margins.

Arya.ag saw this problem and realized it was simultaneously a finance problem, a logistics problem, and a market access problem. Solve all three, and you've built something valuable.

The Historical Context: Why Agricultural Finance Has Failed in India

India has tried to solve agricultural finance before. Government-backed cooperative banks, rural lending mandates for large banks, microcredit programs, and agricultural development banks have all attempted to bring formal finance to farmers. Most have failed or stagnated because the underlying economics don't work at small scale.

Previous attempts missed a crucial insight: you can't just apply urban banking practices to rural agriculture. You need a completely different model. You need to aggregate. You need to operate at scale. You need to use technology to manage risks that traditional banks can't control. And you need multiple revenue streams to make the unit economics work.

Arya.ag did something different. Instead of trying to be a bank, it built a platform. Instead of lending directly to individuals, it aggregated them. Instead of managing risk through traditional underwriting, it used technology to track grain quality, monitor storage conditions, watch prices in real-time, and automatically manage collateral positions.

This distinction matters because it fundamentally changes the risk profile of the business.

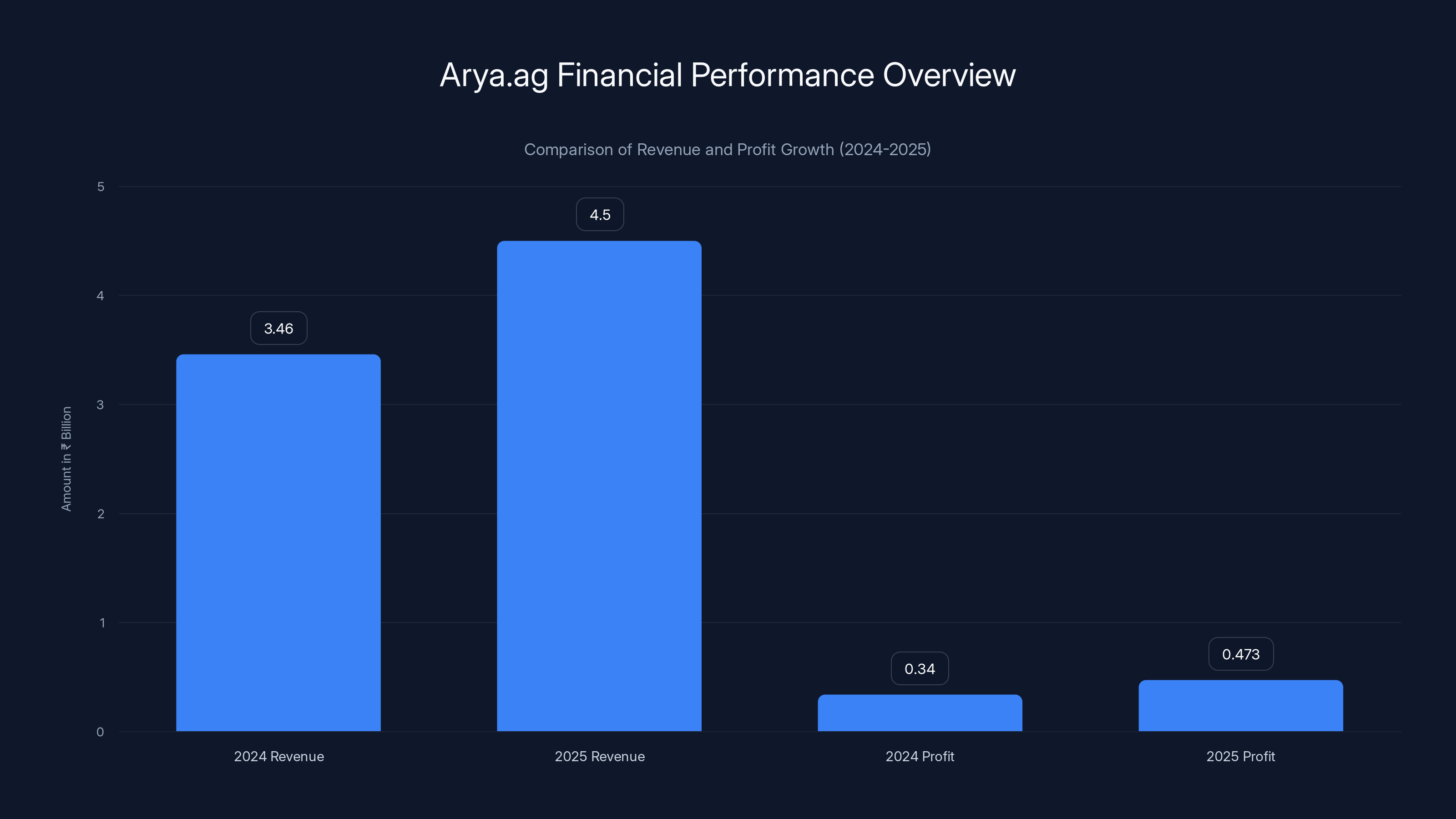

Arya.ag's revenue grew from ₹3.46 billion in 2024 to ₹4.5 billion in 2025, while profit increased from ₹340 million to ₹473 million, showcasing significant financial growth despite industry challenges.

The Three-Pillar Business Model: How Arya.ag Generates Revenue Without Taking Commodity Risk

Pillar 1: Storage (50-55% of Revenue)

Arya.ag operates roughly 12,000 agricultural warehouses across India. All of them are leased from third parties. None are owned by the company.

This is strategic. Owning warehouses would require massive capital investment, long asset depreciation timelines, and operational complexity. Instead, Arya.ag leases warehouses from farmers, agricultural cooperative societies, and private warehouse operators, then charges farmers storage fees.

The storage business generates 50-55% of total revenue. This seems like a commodity business, but it's not. Here's why: farmers need somewhere to store grain that's better than their homes or local grain dealers. Arya.ag offers secure, monitored storage with proper temperature and humidity control. For farmers who want to hold grain and wait for better prices, this is essential infrastructure.

But the genius of the model is that storage becomes the gateway to the finance and commerce pillars. Once grain is in Arya.ag's storage system, it becomes collateral for loans. Once it's stored, it can be sold through Arya.ag's buyer network at times when prices are better. Storage by itself might be a decent business. Storage plus lending plus marketplace becomes something much more valuable.

Pillar 2: Lending (25-30% of Revenue)

Arya.ag facilitates roughly ₹110 billion (about $1.2 billion) in loans to farmers annually. Of this, ₹25-30 billion comes from Arya.ag's own balance sheet through its non-banking financial company (NBFC) arm. The rest is originated for partner banks.

The critical insight here is that Arya.ag's lending operation is completely secured against stored grain. Farmers get a loan in exchange for pledging their harvest as collateral. The loan amount is always a fraction of the grain's current market value, typically 65-70%, meaning there's always a margin of safety.

Arya.ag charges interest rates of 12.5-12.8%. This is well below the 24-36% that commission agents charge, but higher than traditional bank rates of 11-12%. The premium exists because Arya.ag is taking on credit risk and operational risk that banks want to avoid.

Here's where it gets clever: Arya.ag doesn't bet on commodity prices. Instead, it tracks prices religiously. When the price of collateral grain falls, Arya.ag issues margin calls. Borrowers can respond in two ways: repay part of the loan or add more grain as collateral. This mechanism ensures that Arya.ag never takes a loss on the lending business because the company is constantly rebalancing its exposure.

The company's gross non-performing asset (NPA) rate sits below 0.5%, which is extraordinarily low for agricultural lending. For context, NPAs in Indian agricultural finance typically range from 3-8%. Arya.ag's approach manages to be 6-16 times better than the industry standard.

Pillar 3: Commerce (15-20% of Revenue)

The third pillar is the marketplace. Arya.ag connects farmers with buyers directly. These buyers include agri-corporations, food processors, millers, and other large-scale agricultural buyers.

Instead of farmers selling to the nearest middleman at harvest-time lows, they can sell through Arya.ag's platform to buyers with better offers and better timing. Arya.ag makes money on transaction fees for facilitating these sales.

This pillar benefits from the previous two pillars tremendously. Storage gives farmers the ability to hold grain. Lending gives them cash flow so they don't need to sell immediately. The marketplace then gives them access to a wider pool of buyers. Individually, each pillar is moderately valuable. Together, they're transformative.

Technology as the Competitive Moat: How Arya.ag Manages Scale and Risk

AI-Powered Grain Quality Assessment

When a farmer brings grain to an Arya.ag storage facility, the company needs to assess its quality quickly and accurately. This matters for lending decisions because grain quality affects price and storage stability. A farmer with premium-quality grain can borrow more than a farmer with lower-grade grain.

Traditional methods rely on visual inspection by trained graders. This is slow, subjective, and hard to scale. Arya.ag deployed AI-powered computer vision systems to assess grain quality automatically. The system analyzes factors like moisture content, foreign material, grain size distribution, and damage levels. The assessment takes minutes instead of hours, and it's consistent across all facilities.

This technology serves multiple functions simultaneously. First, it enables fast loan disbursal. Second, it standardizes quality assessment across thousands of warehouses. Third, it creates audit trails that reduce fraud. Fourth, it provides data that helps Arya.ag predict storage outcomes and price trends.

Satellite Monitoring of Crop Stress

Before harvest, Arya.ag uses satellite data to monitor crops for stress signals. This might seem tangential to the core business, but it's actually crucial. If satellite data indicates that a region's crops are stressed, Arya.ag can predict lower yields and adjust its lending volumes accordingly.

Satellite monitoring also helps Arya.ag understand which farmers are likely to have viable harvests. This improves underwriting accuracy and allows the company to better manage its credit risk portfolio.

Sensor-Enabled Storage Bags

One of Arya.ag's most innovative products is hermetically sealed, sensor-enabled storage bags. These bags maintain grain quality for extended periods, even in villages without formal warehouse infrastructure.

Why does this matter? Not all grain is stored in warehouses. Some farmers prefer keeping grain at home or in small community stores. But home storage creates problems: pests, humidity fluctuations, and theft. Arya.ag's bags solve these problems while maintaining connectivity. The sensors in the bags track temperature and humidity, sending data to Arya.ag's platform so the company can monitor grain condition in real-time.

This innovation opens up the business to farmers who can't reach warehouses easily, expanding Arya.ag's addressable market significantly.

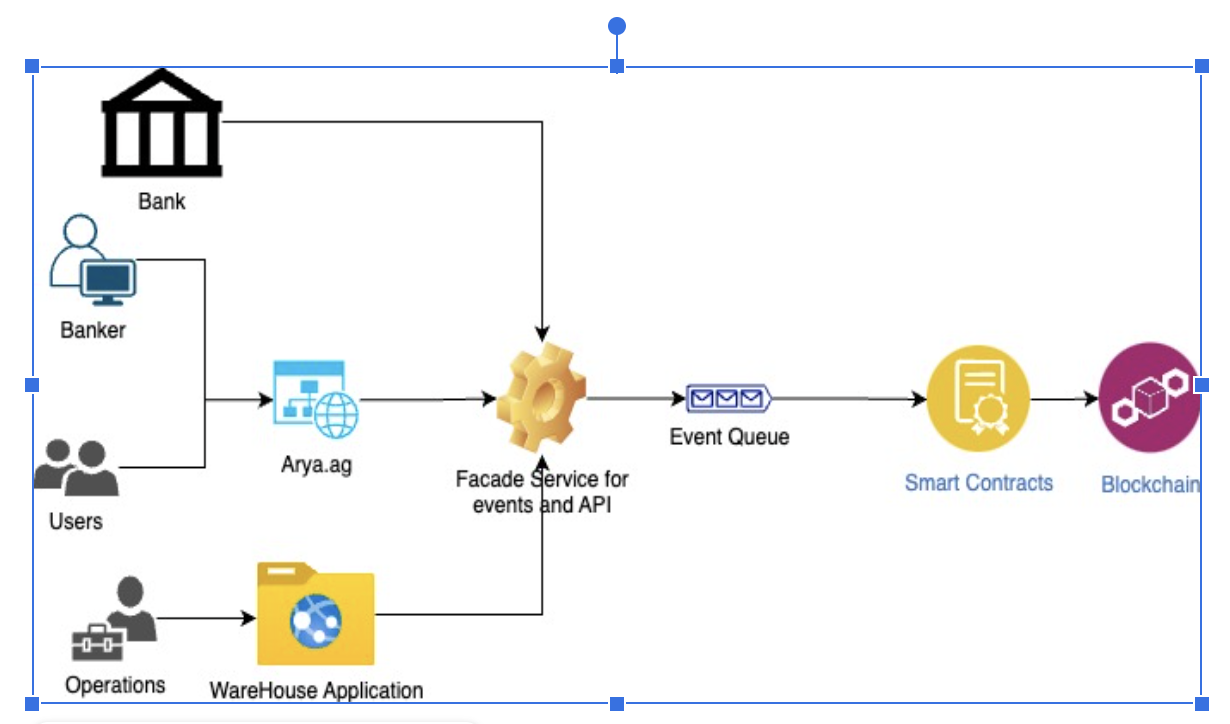

Blockchain-Based Grain Tracking

Arya.ag is building a blockchain system that digitally tracks stored grain across the entire supply chain. When a farmer's grain is used as collateral or sold through the platform, the blockchain record follows it through the transaction. This creates an immutable audit trail that reduces fraud and improves trust in the system.

For buyers, this is valuable because they can verify the origin and quality of grain. For lenders, it's valuable because it strengthens collateral verification. For farmers, it's valuable because it creates a digital record of their transactions that builds creditworthiness over time.

Arya.ag achieved a 39% profit growth and secured $81 million in funding, outperforming the industry average, which faces negative growth and lower funding. Estimated data.

Financial Performance: The Numbers Behind the Profitability

Revenue Growth Despite Market Headwinds

In the financial year ended March 2025, Arya.ag generated net revenue of ₹4.5 billion (approximately

This growth is happening while global commodity prices are falling. Most agricultural businesses in this environment are seeing revenue decline or stagnation. Arya.ag is growing at 30%. This tells you something important: the company's growth is not driven by rising commodity prices, but by increasing scale, improving customer retention, and expanding market penetration.

Profitability in an Industry That Shouldn't Be Profitable

Profit after tax last year was ₹340 million (approximately $3.78 million). In the current financial year, profit after tax has grown 39% so far. This means the company is converting more of each rupee of revenue into profit as it scales.

Let's put this in perspective. Agricultural lending businesses typically operate at 2-5% net margins because of credit losses, operational complexity, and competition. Arya.ag's margins appear significantly higher. The reasons are:

- Diversified revenue streams: No single revenue source dominates, reducing exposure to any single business risk.

- Superior credit risk management: The 0.5% NPA rate is 6-16 times better than industry averages, meaning less capital is tied up in losses.

- Operational efficiency: Technology has reduced the marginal cost of serving additional farmers. Once the AI systems and monitoring infrastructure are in place, serving farmer number 850,001 costs less than serving farmer number 850,000.

- Scale advantages: With nearly 900,000 farmers, Arya.ag has negotiating power with warehouse operators, lenders, and buyers that smaller competitors lack.

Loan Disbursement Metrics

Arya.ag disburses more than ₹110 billion in loans annually through its platform. Of this, ₹25-30 billion comes from Arya.ag's own balance sheet, and the rest is originated for partner banks.

The approval and disbursement process takes less than five minutes and is handled almost entirely digitally. This speed is a competitive advantage because farmers often need cash urgently. Traditional banks might take weeks to approve an agricultural loan. Arya.ag's digital process provides capital when farmers actually need it.

The Investment Round: Why $81 Million in Funding Matters Now

Why GEF Capital Partners Led the Round

GEF Capital Partners led Arya.ag's Series D round of $81 million. This is significant because it signals that sophisticated, globally-focused impact investors see massive opportunity in Indian agricultural infrastructure, even in a period of commodity price volatility.

GEF is not a typical venture capital firm. The fund focuses on sectors that generate both financial returns and positive environmental and social impact. The fact that GEF is willing to invest $81 million into an agricultural platform says something important: the firm believes Arya.ag's business model is durable and scalable, and that it creates genuine positive impact by improving farmer economics.

Primary vs. Secondary Capitalization

Of the $81 million raised, more than 70% was primary capital (new investment into the company) and less than 30% was secondary share sales (existing shareholders selling their stakes to new investors).

This matters because a high percentage of primary capital indicates that existing investors are confident in the company's future. If existing investors were worried, they would be trying to exit through secondary sales. Instead, they're making new bets on the company's continued growth.

The secondary portion suggests that some early investors are taking profits on their positions, which is normal and healthy. But the fact that secondaries represent less than 30% indicates that confidence in the platform remains very strong.

Valuation and Growth Trajectory

Arya.ag has raised multiple funding rounds since its 2013 founding. Each round represents increasing valuation and investor confidence. The Series D round at the company's valuation level indicates that investors believe Arya.ag is a multi-billion-dollar opportunity.

Why? Because the problem Arya.ag is solving isn't unique to India. Similar challenges exist across Southeast Asia, sub-Saharan Africa, Latin America, and other regions with large agricultural sectors. If Arya.ag can build a playbook in India, it can potentially export that model to other markets with similar agricultural structures.

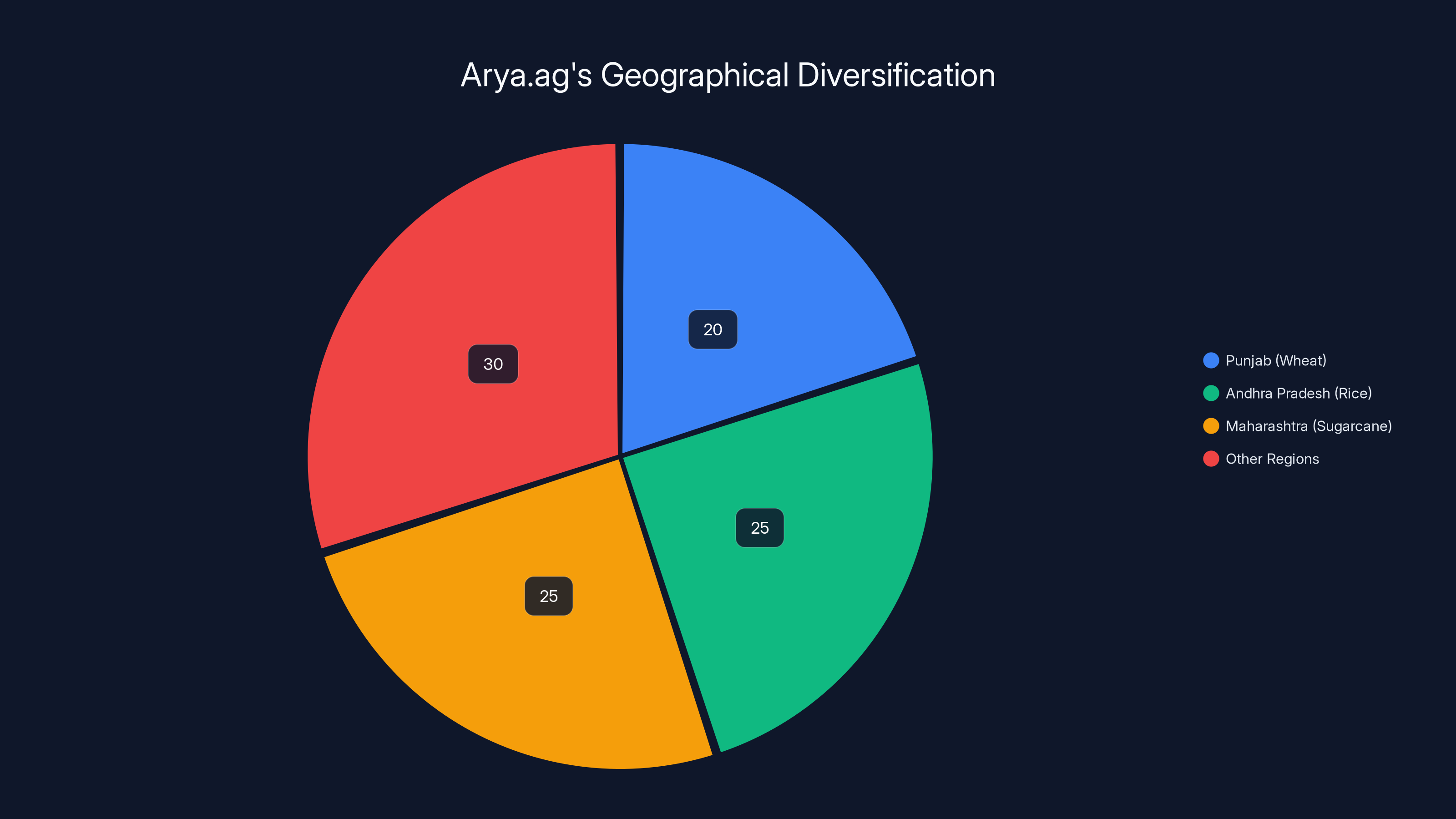

Arya.ag's diversification across various regions and crops helps mitigate risks associated with localized crop failures or price shocks. Estimated data.

The Risk Mitigation Strategy: How Arya.ag Stays Profitable When Prices Fall

The Margin Call Mechanism

When commodity prices fall, the value of collateral grain decreases. Arya.ag manages this through margin calls. The company maintains a margin of approximately 30% between the loan amount and the current market value of collateral.

Let's walk through an example. A farmer borrows ₹700,000 against 10 tons of grain worth ₹1,000,000. The margin is 30%. If grain prices fall 20%, the grain is now worth ₹800,000, but the loan is still ₹700,000. The margin is now only 12.5%. Arya.ag will issue a margin call, requiring the farmer to either repay ₹100,000 or provide another ton of grain as additional collateral.

This mechanism ensures that Arya.ag never takes a loss because the company is constantly rebalancing its exposure to match market prices. The farmer carries the price risk, not Arya.ag. This is crucial because it means the business model is resilient to commodity price volatility.

Mark-to-Market Pricing

Arya.ag prices collateral at market rates, not historical rates. This means that as soon as grain prices move, Arya.ag's systems automatically revalue the collateral. This daily revaluation ensures that loan-to-value ratios are always accurate and risk exposure is always known.

Most agricultural lending operations don't do this because it requires significant technology infrastructure to track prices across different regions and grain types in real-time. Arya.ag invested in this infrastructure, and it's paying off in the form of superior risk management.

Portfolio Diversification Across Geographies and Crops

Arya.ag operates across 60% of India's districts. This geographical diversification means that localized crop failures, weather events, or price shocks in one region don't threaten the entire business. If monsoon rains damage wheat crops in Punjab, Arya.ag still has healthy positions in rice in Andhra Pradesh and sugarcane in Maharashtra.

Crop diversification provides similar protection. Arya.ag's portfolio includes cereals, pulses, oilseeds, and spices. Different crops have different price drivers and seasonal patterns. Diversification across crops smooths out revenue and reduces the impact of any single commodity's price movement.

Competitive Advantages and Why Competitors Can't Easily Replicate Arya.ag's Model

The Network Effect and Scale

With 850,000 to 900,000 farmers on the platform, Arya.ag has achieved significant scale. This creates multiple network effects:

For farmers, more farmers mean more robust price discovery through the marketplace. When thousands of farmers are selling through the platform, prices become more representative of actual market value.

For banks and financial partners, more farmers mean lower customer acquisition cost per farmer and better credit risk pooling.

For buyers, more supply on the platform means better sourcing options and more reliable supply chains.

Competitors trying to build similar platforms today would need to spend years acquiring farmers to achieve comparable scale. By that time, Arya.ag will have moved further ahead.

Proprietary Data and AI Models

Every transaction on Arya.ag's platform generates data. Every grain quality assessment adds to the AI models. Every price prediction improves over time. This data becomes increasingly valuable and increasingly difficult for competitors to replicate.

Arya.ag's AI models for grain quality assessment and price prediction are trained on hundreds of thousands of historical transactions. A new entrant would need to either replicate this data through years of operations or acquire it somehow. Neither is easy.

Integration with Financial Institutions

Arya.ag has relationships with multiple banks and financial institutions that trust the company to originate loans. Building these relationships takes time, requires consistent performance, and involves regulatory approvals. A new competitor would need to build similar relationships from scratch.

These partnerships are sticky because banks have trained their systems around Arya.ag's processes and because Arya.ag has proven its ability to manage credit risk reliably.

Technology Infrastructure

Arya.ag has invested years building sensor networks, satellite monitoring integration, blockchain systems, and AI models. The company has likely spent tens of millions on R&D. A new competitor would need to make similar investments before they could operate at comparable efficiency or scale.

Furthermore, Arya.ag's technology is becoming more valuable as it accumulates more data and learns from more transactions. This creates a "moat" that widens over time rather than narrows.

Arya.ag's revenue is primarily driven by storage (52.5%) and lending (27.5%), with commerce contributing an estimated 20%. Estimated data.

The Founder Story: Why This Team Was Uniquely Positioned to Build This Company

Leadership Background and Expertise

Arya.ag was founded in 2013 by Prasanna Rao, Anand Chandra, and Chattanathan Devarajan, all formerly of ICICI Bank. This background is critical because ICICI is one of India's largest private banks. The founding team understood how banking works, understood credit risk management, understood regulatory requirements, and understood how to scale financial services operations.

They also understood the limitations of traditional banking when applied to rural agriculture. They saw the gap between farmer needs and bank capabilities. They recognized that no existing organization had both the incentive and the capability to solve the problem.

Instead of trying to change banks from within, they started a new company to do what banks couldn't. This entrepreneurial path has proven far more effective than waiting for incumbent institutions to adapt.

Domain Expertise Combined with Financial Services Knowledge

What makes this founding team exceptional is that they brought both financial services expertise and agricultural domain knowledge. Many agritech founders are technologists without agricultural experience. Many agricultural entrepreneurs lack financial services expertise. Arya.ag's founders had both.

This combination is rare and valuable. It allowed them to understand not just what the problem was, but how to build a financially sustainable business model to solve it.

Challenges and Limitations: The Realities Arya.ag Still Faces

Commodity Price Volatility Remains a Farmer Problem

While Arya.ag's business model is protected from commodity price volatility, farmers still bear the risk. When prices fall, farmers' incomes fall. The company helps by allowing farmers to hold grain longer and find better buyers, but it doesn't eliminate the underlying economic challenge.

This creates a ceiling on how much farmers can borrow and how much they're willing to pay for storage and financial services. In a severely depressed market, some farmers might forgo storage and financing altogether, reducing Arya.ag's addressable market.

Warehouse Capacity Constraints

Arya.ag operates roughly 12,000 warehouses, all of which are leased. This model is capital-efficient but creates constraints. Warehouse capacity is finite, and adding more capacity requires negotiating leases with additional warehouse operators. Rapid growth might require Arya.ag to either own more warehouses (capital-intensive) or accept that some farmers can't be served.

During peak harvest seasons, warehouses may operate at near-full capacity, limiting the company's ability to take on new customers.

Regulatory and Policy Risks

Agriculture in India is heavily regulated. Government policies around minimum support prices, agricultural trade, and financial regulations can change. Changes to these policies could affect Arya.ag's business model.

For example, if the government drastically changed minimum support price policies or imposed new restrictions on agricultural trade, it could affect how farmers use Arya.ag's storage and lending services.

Credit Risk in Severe Market Downturns

While Arya.ag's risk management is exceptional, it's not foolproof. In a severe market downturn where commodity prices fall 40-50%, even the company's margin of safety might be tested. Farmers might struggle to repay or add collateral, potentially pushing NPAs above the company's historical 0.5% level.

The margin call mechanism assumes farmers can add collateral or repay loans. In severe economic stress, they might not be able to do either, forcing Arya.ag to take losses.

Arya.ag's revenue is generated from three main streams: storage, lending, and commerce. Estimated data suggests storage contributes the largest share.

Expansion Opportunities: How Arya.ag Could Grow Beyond Current Scope

Geographic Expansion Within India

Arya.ag currently operates across 60% of India's districts. The remaining 40% represents expansion opportunity. Extending operations to less developed agricultural regions would require relationship-building with local warehouse operators and regulatory approvals, but the playbook is proven.

Geographic expansion is also valuable because it further diversifies risk across more regions and reduces exposure to any single agricultural zone.

Additional Financial Services Products

Beyond lending secured by stored grain, Arya.ag could offer insurance products, commodity futures contracts, or forward contracts. These products would help farmers manage price risk more directly while generating additional revenue for Arya.ag.

Insurance against crop failure or price decline could be particularly valuable in a volatile market, though it would require understanding actuarial modeling and insurance regulations.

International Expansion

Arya.ag's model could potentially be exported to other countries with similar agricultural structures: Southeast Asian nations, parts of Africa, and Latin America. The core problem Arya.ag solves exists globally wherever farmers face cash flow pressure and lack market access.

International expansion would be complex because regulatory environments, agricultural practices, and market structures vary significantly by country. But the core business model could likely be adapted.

Vertical Integration into Processing and Distribution

Arya.ag could expand backward into processing or forward into distribution. If the company processed grain into higher-value products, it could capture more margin. If it handled distribution to retail markets, it could serve more customers across the value chain.

Vertical integration would increase capital requirements and operational complexity, but it could also increase margins and customer stickiness.

Industry Context: Where Does Arya.ag Fit in the Broader Agritech Landscape?

The Agritech Boom and Consolidation

India has seen an agritech boom over the past decade, with hundreds of startups launching to solve different agricultural problems. Some focused on agricultural inputs (seeds, fertilizers), others on output sales (marketplaces), others on technology (farm management software).

Many of these startups have faced challenges. The agricultural sector's low margins, high operational complexity, and regulatory constraints have proven difficult to navigate. Several agritech startups have failed or been acquired for far less than their funding amounts.

Arya.ag, by contrast, has remained independent, profitable, and well-capitalized. This makes the company exceptional in a crowded field.

The Shift Toward Financial Services

Arya.ag's success has demonstrated that agricultural technology + financial services is a more durable combination than agricultural technology alone. Several newer agritech startups are now emphasizing lending, insurance, and financial products alongside their core offerings.

This trend suggests that Arya.ag has identified a winning formula that others are now copying. But Arya.ag's first-mover advantages in scale, data, and relationships will be difficult to overcome.

The Role of Impact Investing

The fact that an impact fund like GEF Capital Partners is willing to lead an $81 million round speaks to a broader trend in venture capital. Impact investing is becoming mainstream, and investors increasingly believe that profitable businesses can also generate social and environmental benefits.

Arya.ag fits this profile perfectly. The company is profitable, growing, and generating genuine economic benefits for hundreds of thousands of farmers. This combination of financial returns and social impact makes Arya.ag attractive to a wide range of investors, not just traditional venture capitalists.

The Broader Lesson: Building Durable Businesses in Volatile Markets

Volatility as a Feature, Not a Bug

Most companies try to avoid volatility. Arya.ag's model actually benefits from volatility in commodity prices because it creates more demand for Arya.ag's services. When prices are stable and predictable, farmers have less need to store grain or borrow against it. When prices are volatile, farmers desperately need tools to manage that volatility.

This counter-intuitive insight suggests that building services around volatility, rather than assuming it away, can be a path to building more durable businesses.

Revenue Diversification as Risk Management

By generating revenue from three different sources (storage, lending, commerce), Arya.ag ensures that no single business driver dominates. If lending margins compress, storage and commerce can compensate. If commodity prices make farmers risk-averse about borrowing, storage and marketplace services remain valuable.

Many startups focus on optimizing a single revenue stream. Arya.ag's success suggests that diversification across complementary revenue streams can be more important than optimization within any single stream.

Technology as De-Risk Tool

Arya.ag uses technology not to replace human judgment, but to enable better decision-making at scale. AI assesses grain quality, allowing faster lending. Satellite monitoring predicts crop stress, enabling better risk management. Blockchain creates audit trails, reducing fraud and improving trust.

In each case, technology is solving a specific problem that limits scale or increases risk. This is different from technology as a cost-cutting tool, which often creates quality or trust problems.

What's Next for Arya.ag: Future Growth and Evolution

Deepening Financial Services

With $81 million in fresh capital, Arya.ag will almost certainly deepen its financial services offerings. The company might expand its NBFC operations, increase the volume of loans it originates on its own balance sheet, or launch insurance products.

Financial services generate higher margins than storage or commerce, so increasing the proportion of revenue from lending could improve overall profitability.

Expanding Smart Farm Centers

Arya.ag plans to deploy more smart farm centers, which are physical locations where farmers can access technology, training, and services. These centers serve as touchpoints for the company's technology and services, making it easier for farmers to engage with the platform.

Expanding these centers requires capital for infrastructure and personnel, which the Series D funding provides.

Scaling Digital Tools and Infrastructure

The company will continue deploying digital tools closer to farms. This might include additional sensor networks, expanded satellite monitoring, or new blockchain applications. Each of these investments makes Arya.ag's platform more valuable to farmers and more defensible against competition.

Building the Next Generation of Agricultural Infrastructure

Longer-term, Arya.ag might position itself as a critical piece of India's agricultural infrastructure. If the company becomes the default platform for agricultural finance and commodity trading, it would have significant leverage with governments, regulators, and other institutions.

Becoming infrastructure is the path to durable, multi-decade business creation. It's what Arya.ag appears to be building toward.

Conclusion: Why Arya.ag Matters Beyond Agriculture

On the surface, Arya.ag is a company solving agricultural finance problems in India. But the company's significance extends far beyond agriculture.

Arya.ag demonstrates that you can build profitable, growing businesses in volatile markets if you design your business model correctly. It shows that solving real problems for underserved populations can be economically attractive, not just socially valuable. It proves that technology, when properly applied, can manage complexity and risk at scale.

The company's ability to remain profitable while commodity prices fall is particularly instructive. Most businesses fail in adverse market conditions because they're betting on favorable conditions. Arya.ag has designed its business to be antifragile, meaning it benefits from volatility rather than suffering from it.

Moreover, Arya.ag's success challenges the assumption that emerging markets are high-risk, low-return investment opportunities. Sophisticated investors like GEF Capital Partners are committing massive capital because they recognize that emerging market companies solving real problems can generate exceptional returns.

For entrepreneurs, the lesson is clear: focus on solving genuine problems, design business models that work in adversity, build networks and scale that create defensible advantages, and use technology to extend your reach without destroying your margins.

For investors, Arya.ag shows that impact investing and financial returns aren't mutually exclusive. Companies that generate genuine social impact while remaining highly profitable attract capital from increasingly sophisticated sources.

For policymakers and institutions in developing countries, Arya.ag demonstrates that private sector companies can solve problems that governments have struggled with for decades. Agricultural finance is a critical challenge in India, yet private capital is solving it faster and more effectively than government initiatives.

The biggest lesson, though, might be this: in a world of increasing volatility and disruption, the companies that thrive are often those that stop trying to eliminate volatility and instead build business models that survive and flourish within it. Arya.ag has done exactly that, and that's why it's attracting billions in investor interest while competitors are struggling.

FAQ

What is Arya.ag and what does it do?

Arya.ag is an Indian agritech company that provides storage facilities, lending services, and marketplace access to hundreds of thousands of farmers. The company operates approximately 12,000 leased warehouses across 60% of India's districts, manages about

How does Arya.ag remain profitable when global commodity prices fall?

Arya.ag's business model isolates the company from direct commodity price risk through its three-pillar revenue structure (storage, lending, commerce). Critically, the company's lending is fully secured against stored grain with a 30% margin of safety. When commodity prices fall, Arya.ag issues margin calls to borrowers, requiring them to either repay loans or add collateral. This mark-to-market approach ensures the company never absorbs losses from price declines. Additionally, Arya.ag's diversified revenue streams mean that declines in any single business area are offset by stability in other areas.

What are the key features of Arya.ag's lending operations?

Arya.ag disburses over ₹110 billion ($1.2 billion) in loans annually, with approval and disbursement completed in under five minutes through a fully digital process. Interest rates are 12.5-12.8%, significantly lower than the 24-36% charged by traditional commission agents but higher than standard bank rates of 11-12%. The company maintains an exceptionally low non-performing asset (NPA) rate below 0.5%, which is 6-16 times better than industry averages. This superior credit performance is achieved through sophisticated risk management including AI grain quality assessment, real-time price monitoring, and collateral rebalancing.

Why did GEF Capital Partners invest $81 million in Arya.ag?

GEF Capital Partners, an impact-focused investment fund, led the Series D round because it recognized that Arya.ag combines exceptional financial returns with genuine social impact. The company is highly profitable, growing at approximately 30% year-over-year, and serving nearly 900,000 farmers across India. Moreover, Arya.ag's business model is demonstrably resilient to adverse market conditions, making it an attractive long-term investment. The fund's participation signals that impact investing is becoming mainstream and that investors increasingly believe profitable businesses can generate significant positive social outcomes simultaneously.

What technology does Arya.ag use to manage risk at scale?

Arya.ag employs multiple layers of technology including AI-powered grain quality assessment using computer vision, satellite monitoring to track crop stress before harvest, sensor-enabled storage bags for remote grain monitoring, and blockchain systems for supply chain tracking. These technologies enable the company to manage credit risk across hundreds of thousands of farmers, approve loans in under five minutes, assess collateral consistently across thousands of warehouses, and maintain detailed audit trails for regulatory compliance. The technology infrastructure creates a defensible competitive advantage that would take competitors years to replicate.

Can Arya.ag's business model be expanded to other countries?

Yes, potentially. Arya.ag's core problem (farmers facing cash flow pressure and lacking market access) exists globally in agricultural regions across Southeast Asia, Africa, Latin America, and South Asia. The company's technology and financial services framework could theoretically be adapted to other countries, though this would require navigating different regulatory environments, agricultural practices, and market structures. International expansion would be complex and capital-intensive, but represents a significant long-term opportunity if Arya.ag can prove the model works outside India.

What is the relationship between Arya.ag's profitability and its ability to attract investors?

Arya.ag's profitability is the primary reason it attracts institutional investors. Most agritech startups lose money for years, betting on eventual scale to drive profitability. Arya.ag is profitable now while growing rapidly, which is exceptionally rare. This profitability demonstrates that the business model is fundamentally sound, that the company has successfully navigated operational challenges that typically plague emerging market startups, and that the company can reinvest profits into growth and innovation. Profitable growth attracts investors because it reduces risk and demonstrates management capability.

How does Arya.ag's business model differ from traditional agricultural lending?

Traditional agricultural lending (through banks or commission agents) requires farmers to either sell immediately after harvest or borrow at predatory rates without better market access. Arya.ag's model allows farmers to store grain in secure facilities, borrow against stored grain at reasonable rates, and access a wider network of buyers. Crucially, Arya.ag's lending doesn't depend on farmer creditworthiness assessments. Instead, lending is fully collateralized by stored grain with automatic rebalancing through margin calls. This approach eliminates the underwriting burden that prevents traditional banks from serving small-scale farmers in remote areas.

What are the main risks to Arya.ag's business model?

Key risks include extreme commodity price volatility (where prices fall 40%+ and farmers cannot meet margin calls), warehouse capacity constraints during peak harvests, regulatory changes to agricultural policy or financial services rules, and the possibility that farmers in severe economic stress default on obligations despite collateral. Additionally, while Arya.ag's model is profitable today, rapid expansion or competitive pressure could compress margins. Geographic concentration in India also creates country-specific regulatory and economic risks.

How has Arya.ag achieved such a low NPA rate compared to competitors?

Arya.ag's below-0.5% NPA rate compared to industry averages of 3-8% results from multiple factors. First, all lending is fully collateralized by stored grain, eliminating unsecured credit risk. Second, the company uses AI to assess grain quality and value accurately, ensuring collateral valuations are precise. Third, real-time price monitoring enables rapid identification of concentration risk. Fourth, the margin call mechanism allows proactive risk rebalancing before losses occur. Fifth, fast digital loan disbursal and approval reduces fraud and borrower default. Together, these create a substantially lower-risk lending operation than competitors face.

Key Takeaways

- Arya.ag has built a three-pillar revenue model (storage, lending, commerce) that generates over $50 million annually while remaining highly profitable despite falling global commodity prices

- The company's genius is structural: by securing all lending with stored grain and using margin calls to manage collateral, Arya.ag transfers commodity price risk to borrowers while protecting its own balance sheet

- Technology is the competitive moat: AI grain assessment, satellite monitoring, sensor-enabled storage, and blockchain tracking create defensible advantages that would take competitors years to replicate

- $81 million in Series D funding validates the model: impact investors recognize that Arya.ag generates both financial returns and genuine social impact by serving nearly 900,000 farmers at scale

- The business is antifragile: commodity price volatility actually increases demand for Arya.ag's services, making the company stronger as markets become more unstable

![How Arya.ag Stays Profitable While Commodity Prices Fall [2025]](https://tryrunable.com/blog/how-arya-ag-stays-profitable-while-commodity-prices-fall-202/image-1-1767339356948.jpg)