How Nvidia Created 27,000 Millionaires: The Equity Wealth Model [2025]

You've probably heard the advice a thousand times. Start a business. Invest in crypto. Build a personal brand. Get lucky with real estate. But here's what nobody talks about: the most reliable way to create generational wealth for tens of thousands of people simultaneously isn't some secret entrepreneurship hack. It's working at Nvidia.

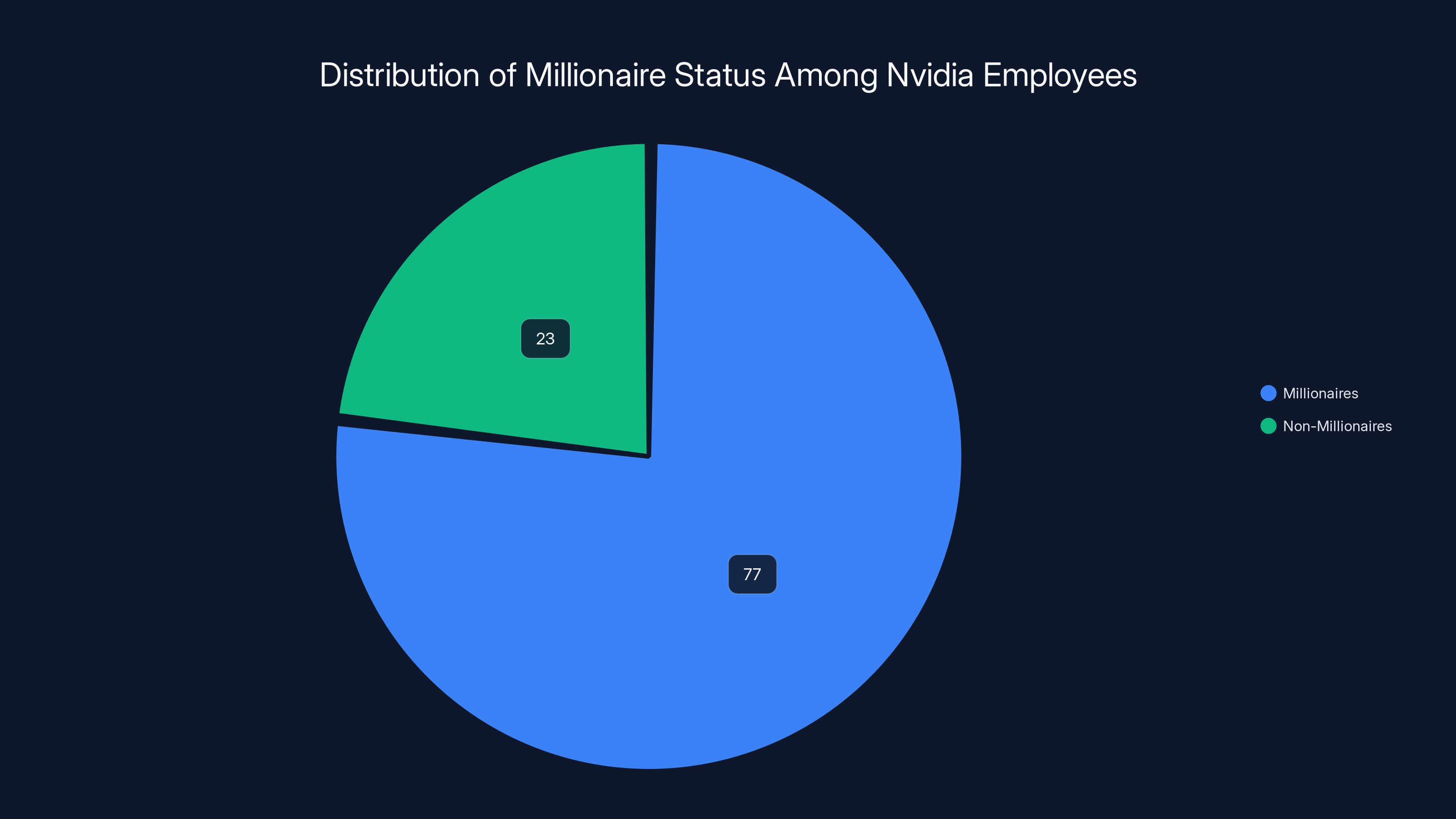

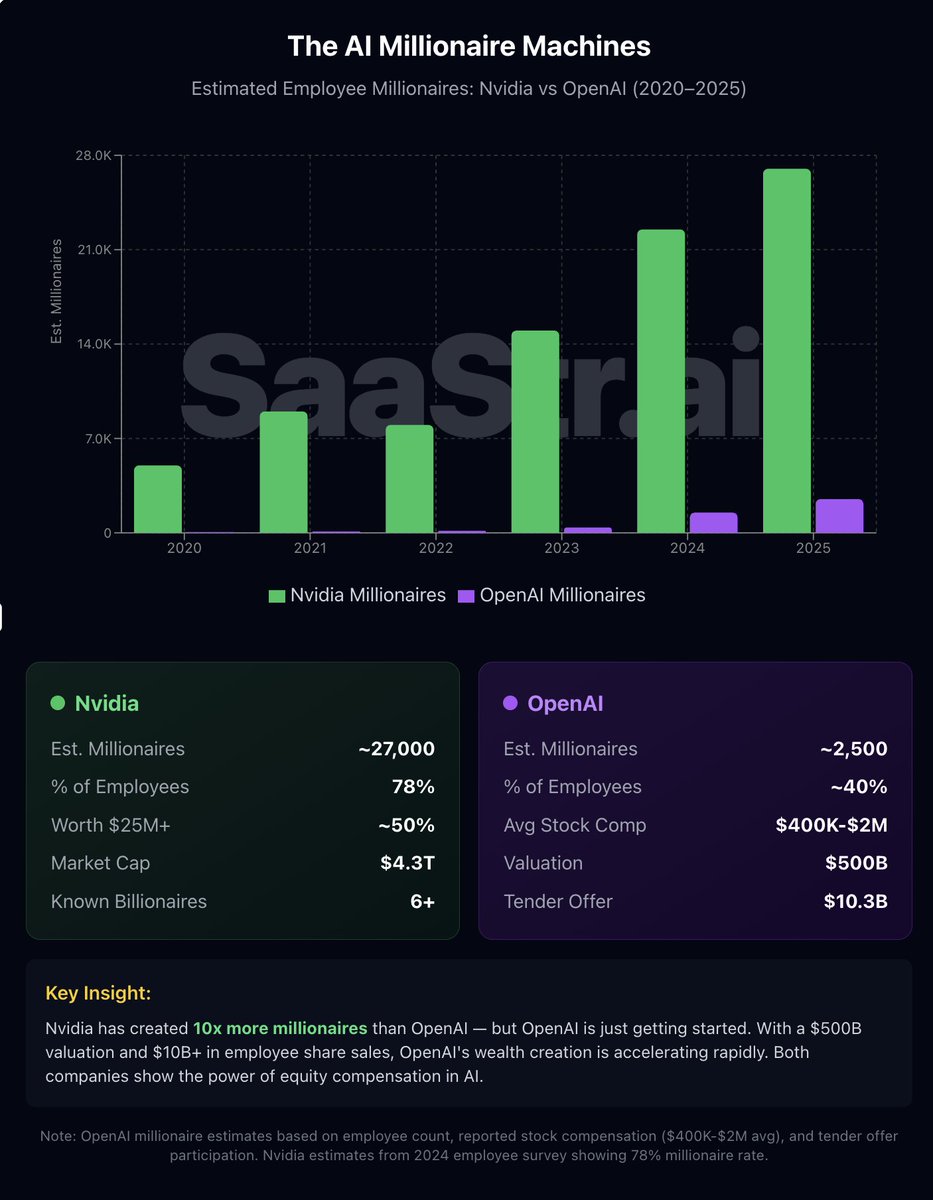

The numbers are almost impossible to wrap your head around. A company with 36,000 employees where roughly 27,000 of them are now millionaires. Where nearly half have crossed the $25 million net worth threshold. Where the CEO openly admits to creating more billionaires on his management team than any other CEO in the world.

This isn't luck. It's not randomness. It's a deliberate strategy around equity compensation, long-term stock performance, and a culture that genuinely prioritizes employee retention through financial incentive alignment. And whether you work in tech or not, there are lessons here that fundamentally reshape how we should think about building wealth.

Let's dig into what's actually happening at Nvidia, why it matters, and what it teaches us about the power of going long on the right company at the right time.

TL; DR

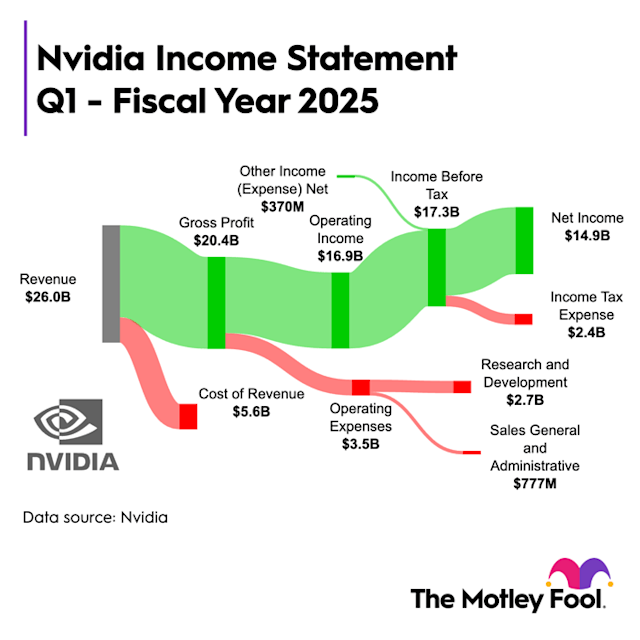

- 76-78% of Nvidia employees are millionaires: A survey of 3,000+ employees revealed that over three-quarters have crossed the 25 million

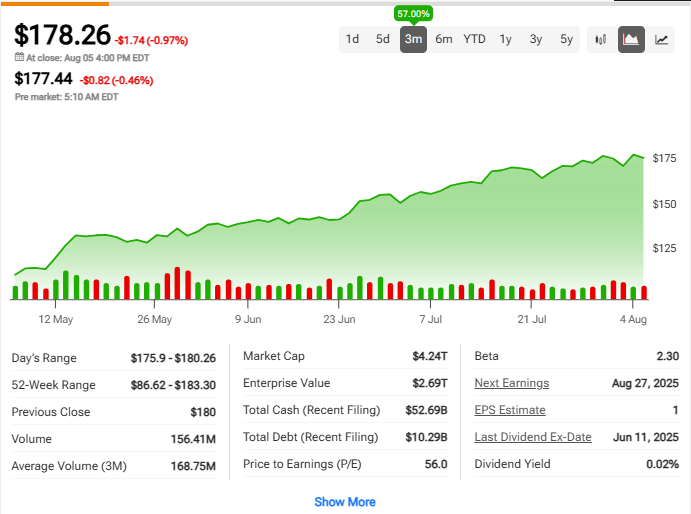

- Stock performance is the primary driver: Nvidia's stock has risen approximately 3,776% since 2019, and roughly 900% since Chat GPT launched in November 2022, creating exponential wealth multiplication

- Equity compensation at scale: Restricted Stock Units (RSUs), stock options, and an Employee Stock Purchase Program (ESPP) with 15% discounts are distributed across all levels, not just executives

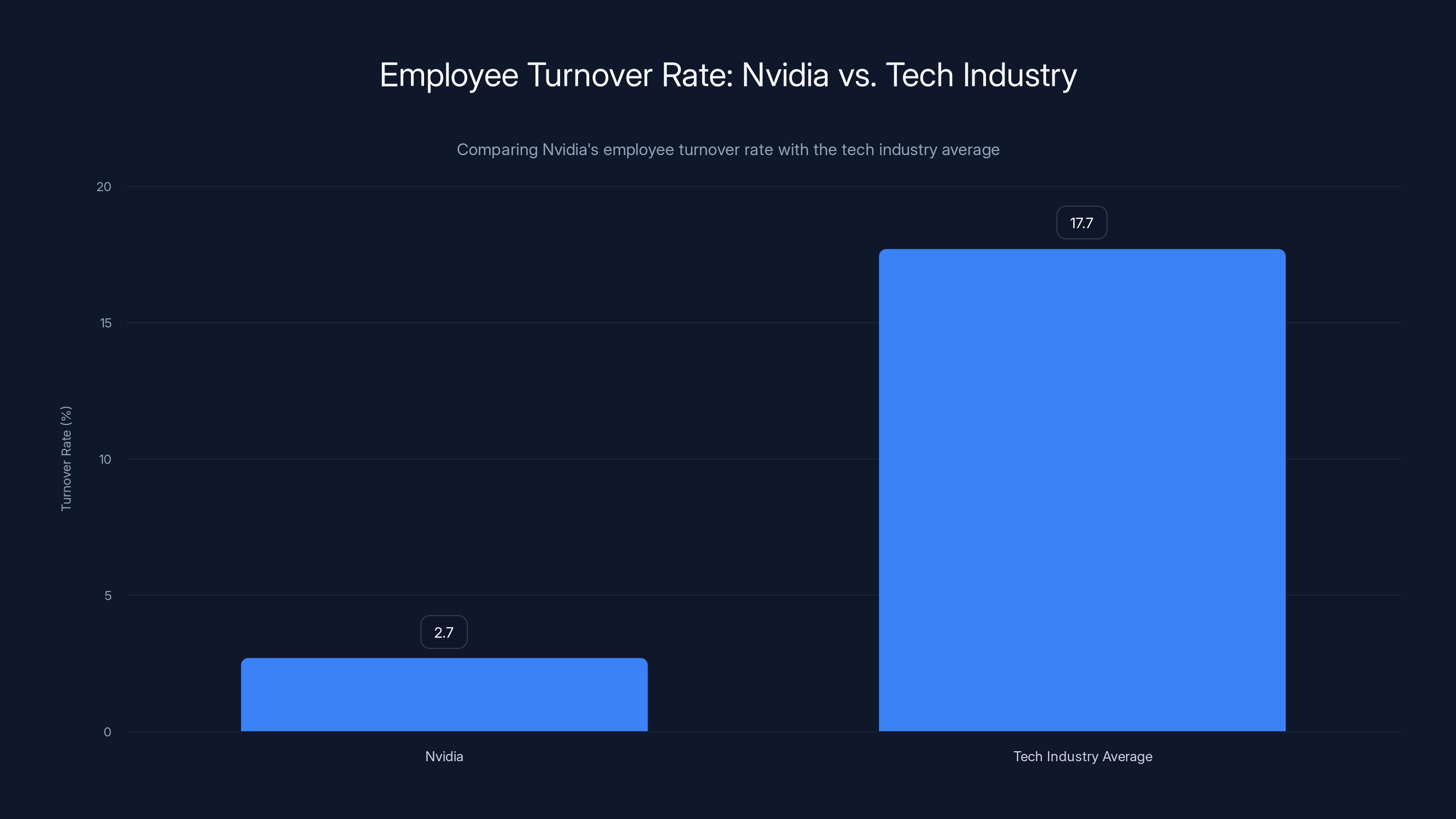

- CEO compensation philosophy: Jensen Huang personally reviews compensation for all 42,000 employees and intentionally increases spending on operating expenses, resulting in a 2.7% turnover rate (vs. 17.7% industry average)

- Historical precedent: Google's 2004 IPO created 7 billionaires and ~900 millionaires from early employees, demonstrating that generational wealth creation at tech companies is repeatable when conditions align

Approximately 77% of Nvidia employees are millionaires, highlighting significant wealth distribution within the company. Estimated data based on survey results.

The Staggering Numbers: What We're Actually Looking At

Let's establish the baseline facts, because they're genuinely remarkable.

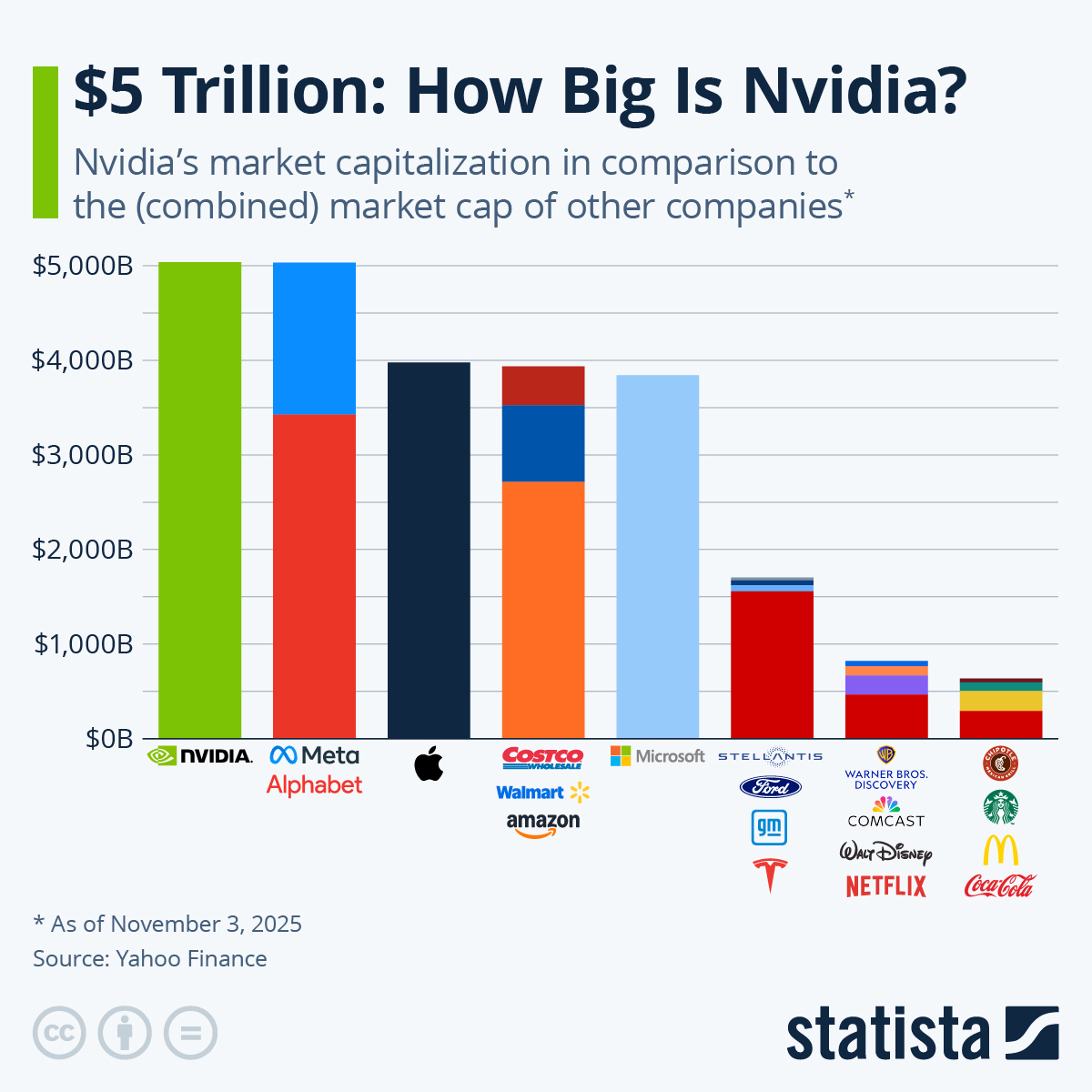

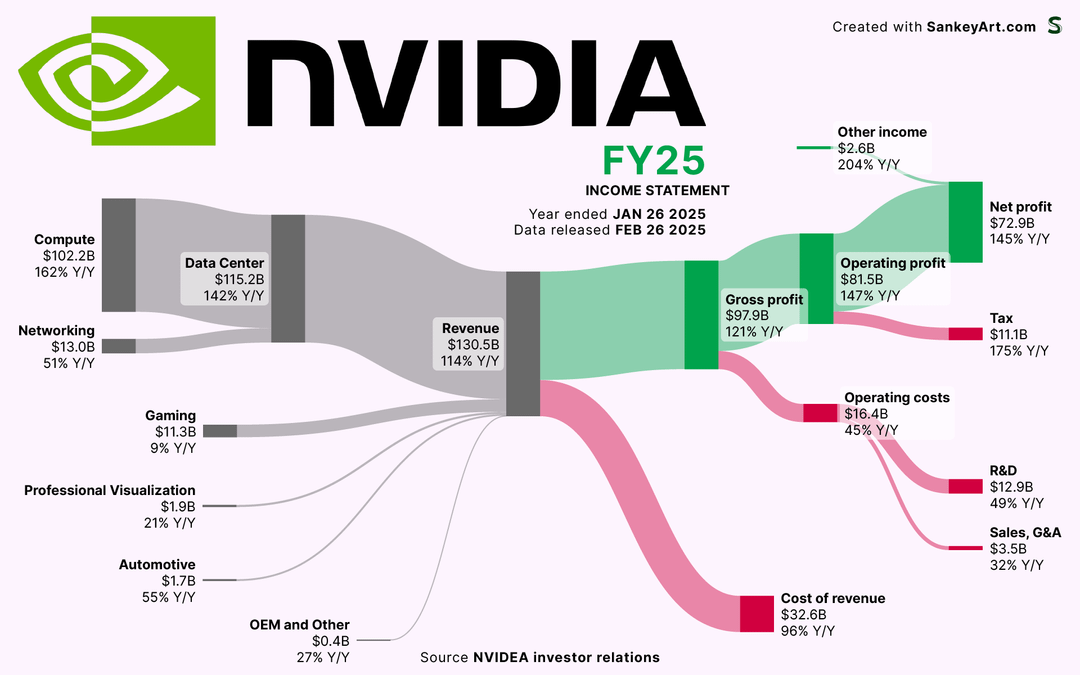

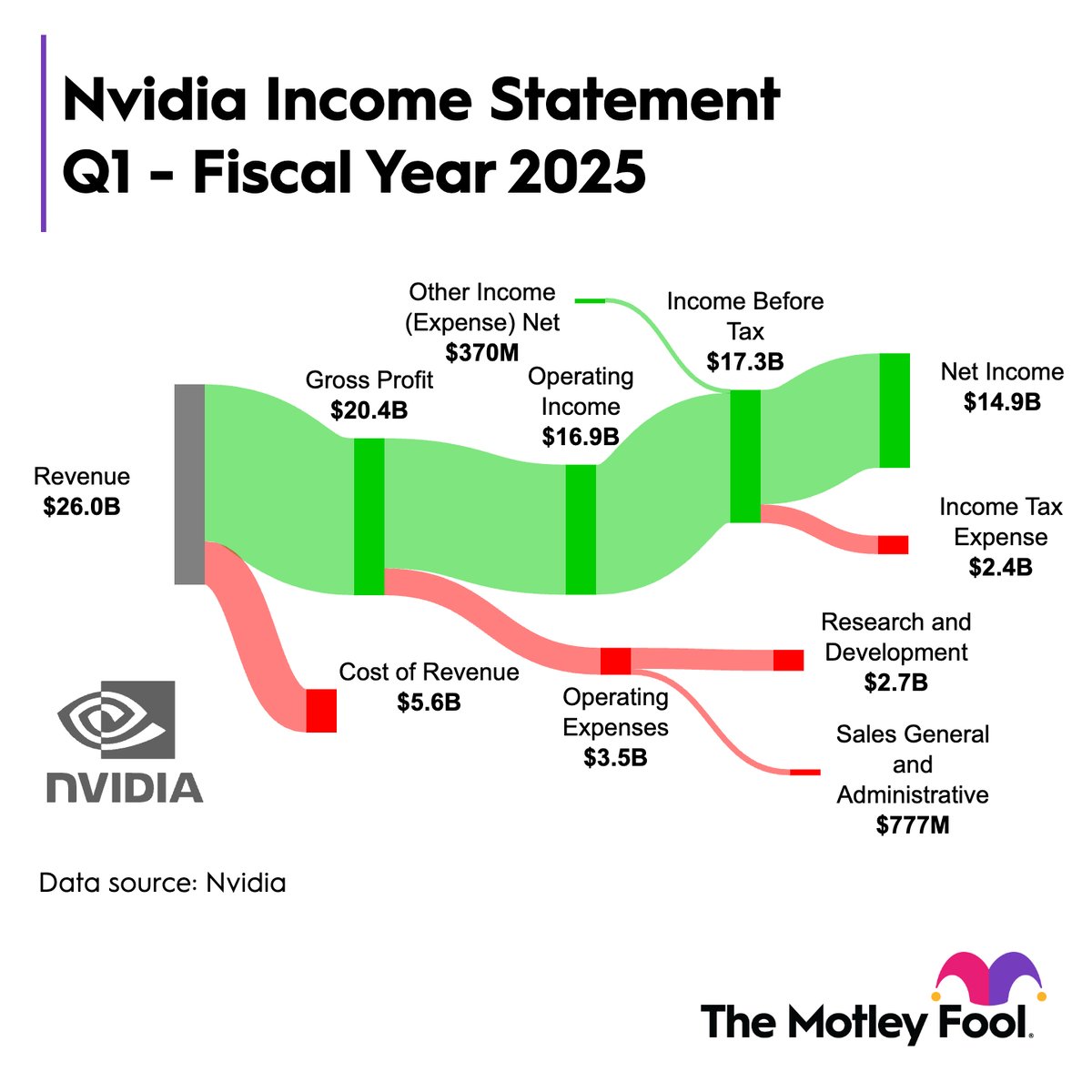

As of December 2025, Nvidia's market capitalization stands at approximately **

If you've been holding for longer than that, the numbers become almost surreal. The five-year total return sits at over 1,223%. That means if you invested

But the real inflection point came with Chat GPT. When OpenAI launched Chat GPT on November 30, 2022, the world suddenly realized that Nvidia's chips weren't just good for gaming. They were essential infrastructure for training and running large language models. Since that launch date, Nvidia's stock has climbed approximately 900%, and the company has added roughly $3 trillion in market capitalization.

A

Here's the part that most people miss: that wealth didn't just go to investors. It went to employees.

The Employee Wealth Explosion: 27,000+ Millionaires in One Company

A survey of over 3,000 Nvidia employees conducted in 2025 revealed numbers that would have seemed impossible a decade ago.

76-78% of Nvidia employees are now millionaires. Not senior executives. Not just engineers. Employees across product, sales, support, marketing, and operations. Nearly half of them have net worths exceeding

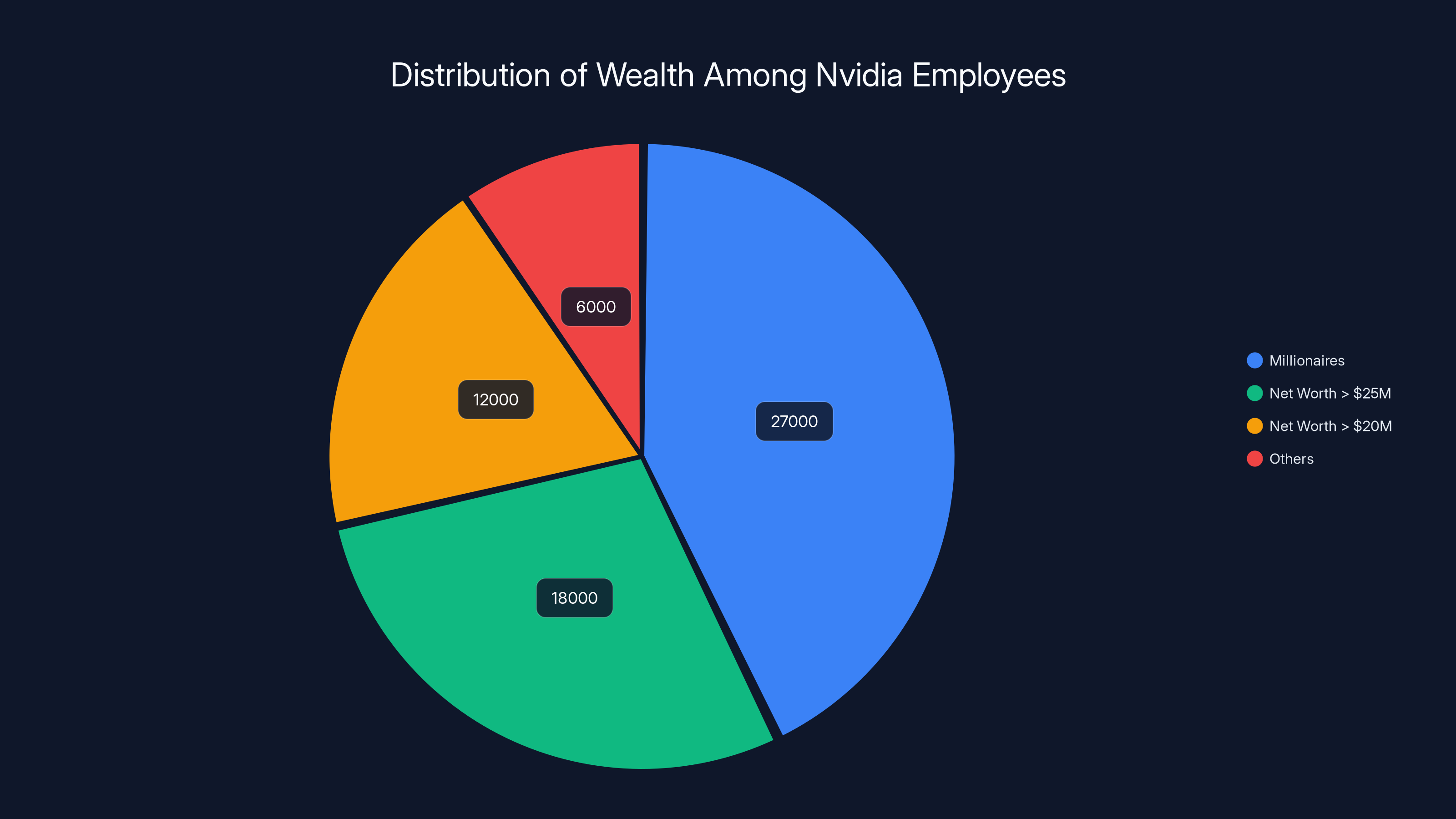

When you extrapolate those percentages across Nvidia's current workforce of 36,000 employees, the math becomes staggering:

- Approximately 27,000+ millionaires working at the company today

- Approximately 18,000 employees with net worths exceeding $25 million

- Approximately 12,000 employees with net worths exceeding $20 million

And this doesn't include the tens of thousands of former employees who accumulated wealth during their tenure and have since moved on to other ventures, often with substantial capital to deploy.

Jensen Huang, the company's founder and CEO, has been refreshingly blunt about what's happened. In a July 2025 appearance on the All-In podcast, he said: "I've created more billionaires on my management team than any CEO in the world. They're doing just fine. Don't feel sad for anybody at my layer."

He wasn't exaggerating. In 2025 alone, two more Nvidia executives joined the billionaires club: CFO Colette Kress and EVP Jay Puri. Combined with earlier executives like Huang himself, this brings the known number of billionaires at Nvidia to at least six. When you include former executives who departed with wealth, the number is likely higher.

But billionaires are the headline. The real story is the millionaires. Thousands upon thousands of ordinary technical and non-technical workers who followed a simple formula: get hired, accumulate equity over years, hold it, and watch the stock compound.

An estimated 77% of Nvidia employees have a net worth of over $1 million, showcasing the impact of stock performance and equity compensation. Estimated data.

Why This Happened: The Equity Compensation Architecture

Nvidia's wealth creation didn't happen by accident. It's the deliberate result of how the company structures employee compensation.

Unlike many tech companies that front-load cash salaries, Nvidia has always compensated employees heavily with equity. Restricted Stock Units (RSUs) and stock options form the core of compensation packages. This isn't limited to the C-suite or senior engineers. Across product managers, sales professionals, support staff, and analysts, equity makes up a meaningful portion of total compensation.

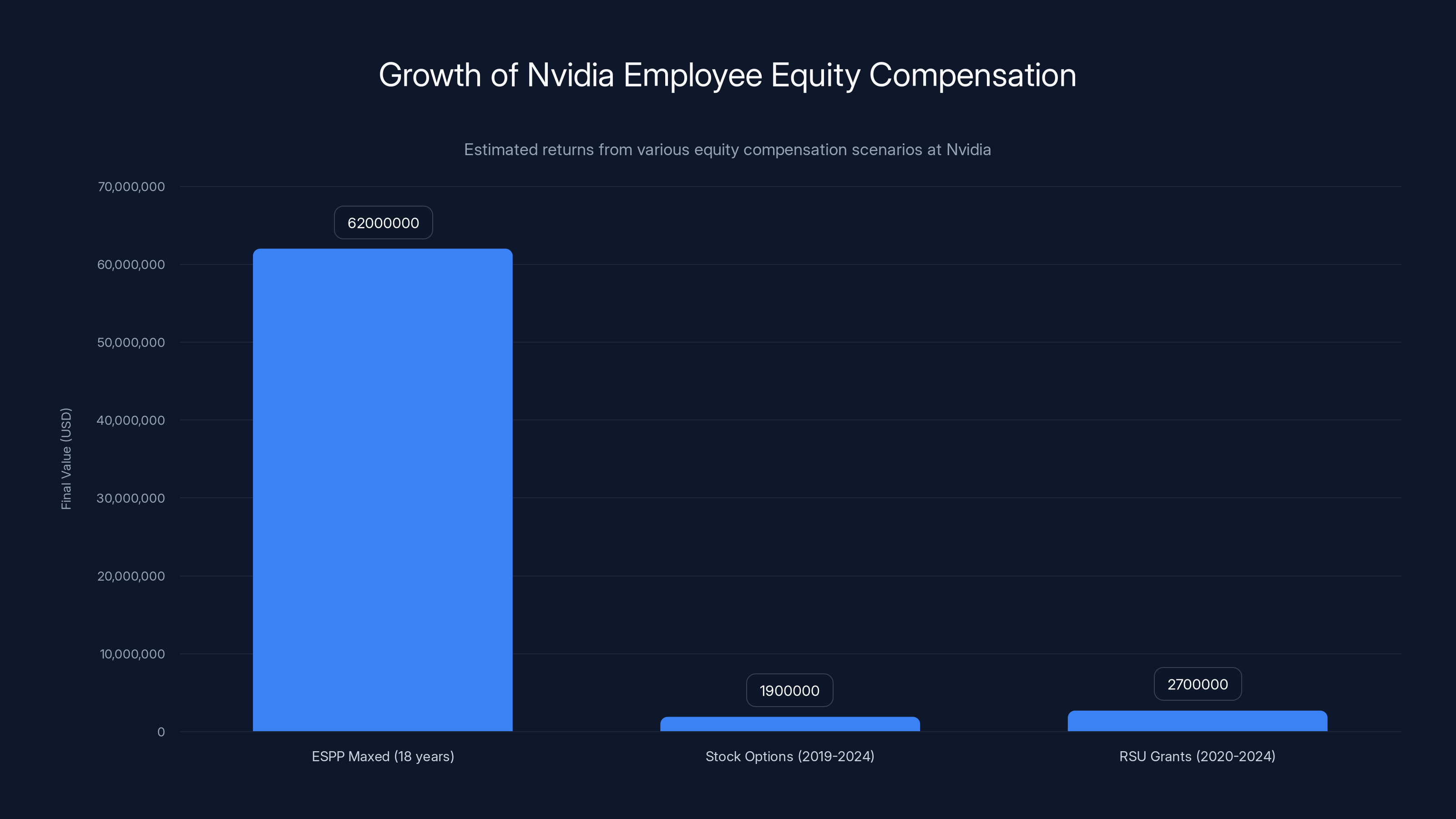

The second tool is the Employee Stock Purchase Program (ESPP). Nvidia's ESPP allows employees to purchase company stock at a 15% discount to market price. For context, the IRS maximum contribution for an ESPP is $25,000 per year. If an employee maxed out that contribution every single year for 18 years and never sold a single share, they would have accumulated significant positions in the stock.

One real example: a mid-level Nvidia employee (not an engineer) who maxed out the ESPP for 18 years and held without selling retired with approximately $62 million. That's not an outlier story. That's what the math produces when you combine disciplined saving, a 15% discount, and multi-year compounding on a stock that's risen roughly 3,776% since 2019.

Here's another concrete case study: an employee who joined Nvidia in 2019 and received stock options valued at

Or consider this calculation: the average employee who started at the end of 2020 and held all their RSU grants for four years accumulated approximately $2.7 million by 2024. For context, that's more than most people earn in a lifetime of employment at traditional companies.

The math is simple:

Where:

- Initial Grant = equity value at grant (in dollars)

- Stock Multiple = current stock price divided by grant price

- Time Factor = number of vesting periods held

At Nvidia, because the stock has multiplied roughly 40-60x for employees who joined five years ago, even modest initial grants become life-changing sums of money.

Jensen Huang's Compensation Philosophy: Taking Care of People

What separates Nvidia from other tech companies isn't just that they offer equity. It's how seriously leadership takes compensation strategy.

Jensen Huang personally reviews compensation for every single employee at Nvidia. Every. Single. One. That's 36,000+ individuals whose compensation packages get reviewed by the CEO. It's an unusual practice at scale, especially at a company of this size.

Huang has stated explicitly: "I review everybody's compensation up to this day. I sort through all 42,000 employees, and 100% of the time I increase the company's spend on operating expenses. And the reason for that is because you take care of people, everything else takes care of itself."

This philosophy has concrete results. Nvidia's employee turnover rate is just 2.7%. For context, the tech industry average is around 17.7%. That's a 6x difference. When employees are accumulating millions of dollars in unvested equity, leaving becomes genuinely difficult. Those "golden handcuffs" keep people locked in, motivated to stay for the next vesting cycle.

But here's what's interesting: employees also describe Nvidia's internal culture as intensely demanding. Seventy-hour workweeks are common. Some employees report 2 a.m. shift changes. Meetings can be brutal, with Huang known for exacting high standards. The company operates like what some describe as a "pressure cooker."

Yet people stay. Why? Because the opportunity cost of leaving has become unbearably high. A former employee, speaking anonymously, described it plainly: she endured the intense culture for two years specifically because of "the opportunity for even more wealth." By the time she considered leaving, her stock options had appreciated to the point where staying for another two years made financial sense.

This is the hidden genius of Nvidia's model: they've aligned incentives so completely that the hardest-working, most-committed employees are simultaneously the ones with the most money to lose by departing.

Historical Parallel: Google's IPO in 2004

Nvidia's story isn't unprecedented. It's actually a repeat of a moment in tech history that most people have forgotten about.

When Google went public on August 19, 2004, something extraordinary happened. The stock opened at $85 per share on the first day of trading. That single day, that single moment in time, created 7 billionaires and approximately 900 instant millionaires from early stockholders and employees.

More than half of those millionaires were worth more than $2 million immediately. They hadn't built companies. They hadn't taken enormous personal risks. Many of them were engineers, product managers, and operations professionals who had been granted stock options 4-8 years earlier when Google was still a startup.

The legendary stories circulated for years. Google's company chef, Charlie Ayers (employee #56), had 40,000 shares worth approximately $4 million at the IPO. He had joined as employee #56 and cooked for the team in the early days. His equity stake created generational wealth.

Another famous example: a Google administrative assistant who had purchased stock through the ESPP early in the company's history became a multimillionaire on IPO day.

What happened at Google in 2004 is now happening at Nvidia, but at a much larger scale. Google's IPO created wealth for roughly 900 people. Nvidia is creating wealth for 27,000+ people. The mechanism is identical: equity compensation held through exponential stock price growth.

The key difference is velocity. Google's wealth explosion happened over 7-8 years (from founding to IPO). Nvidia's major wealth acceleration happened in just 3 years (from Chat GPT launch to present).

Nvidia's equity compensation structure can lead to significant wealth creation. Maxing out the ESPP for 18 years could result in $62 million, while stock options and RSUs granted in recent years have also seen substantial growth.

The Role of Timing: Being Right About the Future

Here's where luck enters the equation, and it's important to be honest about it.

Nvidia's wealth creation for employees ultimately rests on one fundamental fact: the company backed the right technology at the right moment. GPUs (Graphics Processing Units) were originally designed for gaming and graphics rendering. They performed mathematical operations in parallel, making them ideal for certain types of computing.

When deep learning and large language models exploded in demand after Chat GPT's launch, it turned out that GPUs were nearly perfect for training neural networks. Nvidia's CUDA programming framework, developed over more than a decade, became the de facto standard for AI computing infrastructure.

This wasn't planned. Or rather, it was partially planned by Huang and his team, but the explosive demand was not fully predictable. Nvidia bet on the future of computing, and the future happened exactly how they hoped.

Employees who joined Nvidia in 2019 benefited from this timing accident. They joined a company that was already successful, received equity grants, and then watched the stock multiply 40-60x over five years. That's extraordinary, but it required:

- Joining the right company at the right stage

- Working there long enough to accumulate meaningful equity

- Holding the equity through volatility and vesting periods

- Staying through the chaos of an intense company culture

- Getting lucky that your industry became the center of a transformational technology shift

For most people, one or more of these elements will be missing. You might join the right company at the wrong time. You might leave before your equity fully vests. You might sell during a pullback. You might join a company that never experiences the kind of explosive growth Nvidia has.

But for those 27,000 Nvidia employees, everything aligned.

The Math of Compounding: Why Time Matters More Than You Think

Let's break down why the Nvidia story is so powerful from a pure mathematical perspective.

Consider two scenarios:

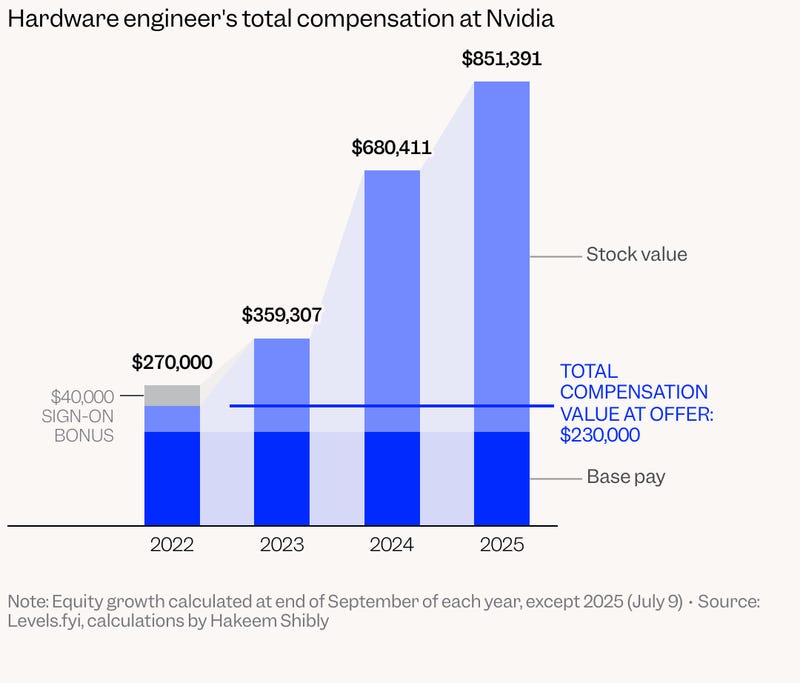

Scenario 1: Initial $50,000 grant, held for 5 years

- 2019 stock price: ~$25 per share

- 2024 stock price: ~$950 per share

- Stock multiple: 38x

- Final value: 1,900,000**

Scenario 2: Same $50,000 grant, but you sell halfway through (after 2.5 years)

- 2019 stock price: ~$25 per share

- Mid-2022 stock price: ~$220 per share

- Stock multiple: 8.8x

- Final value: 440,000**

The difference between holding and selling at the halfway point is a cool $1,460,000. That's the power of compounding and time.

But here's the truly counterintuitive part: Nvidia's 38x return over five years isn't unusual in the context of equity compensation. It's actually what you'd expect if you picked the right company. The compound annual growth rate (CAGR) needed to achieve a 38x return over five years is approximately 74% per year.

That's an extraordinarily high CAGR, but it's what happens when a company's addressable market expands 50x and the company captures enormous market share.

The lesson: if you can find a company that's going to have a CAGR of 50-100% for a sustained period, holding equity in that company for 5+ years will create transformational wealth. The challenge is picking that company in advance.

How to Think About Your Own Equity: Lessons from Nvidia

If you work at a tech company and you've received equity compensation, the Nvidia story provides some useful frameworks for thinking about your own situation.

First: Understand what you actually have. Are you holding RSUs (restricted stock units) or options? RSUs are typically worth their grant price immediately (minus taxes). Options are only valuable if the stock price rises above your strike price. Options can create outsized returns, but they're also worthless if the stock doesn't appreciate.

Second: Know your vesting schedule. Most tech companies use a four-year vesting schedule with a one-year cliff. That means you get zero equity in year one, then 25% vests each year after that. If you leave after 2.5 years, you've only captured 37.5% of your grant. The difference between staying 3 years and staying 5 years could be the difference between a few hundred thousand dollars and several million.

Third: Understand the tax implications. If you have stock options, you'll need to exercise them (pay cash to own the shares) before you can benefit from appreciation. That requires capital. RSUs are automatically converted to shares, but they trigger immediate tax events. Work with a tax advisor to optimize your approach.

Fourth: Make a conscious hold-versus-sell decision. This is psychological as much as financial. At Nvidia, employees have watched their equity appreciate to life-changing amounts. The temptation to sell is enormous. But the data shows that those who held through volatility created substantially more wealth than those who sold during pullbacks.

The hard part: knowing when to sell. If the company is struggling or your industry is declining, holding might be foolish. But if your company is growing and you believe in the long-term thesis, holding might be the single best financial decision you'll ever make.

Nvidia's employee turnover rate is significantly lower than the tech industry average, highlighting the effectiveness of its compensation strategy.

The Dark Side: The Pressure Cooker Reality

Let's be honest about something that doesn't get enough attention in the Nvidia story: the cost of that wealth.

Nvidia's culture is legendary for intensity. Seventy-hour workweeks are normal. There are stories of executives making major strategic decisions at 2 a.m. Huang himself is known for brutal, exacting standards in meetings. Mistakes are called out directly. The pace is relentless.

For some people, this culture is invigorating. They thrive on intensity and urgency. But for others, it's genuinely difficult. The stress, the long hours, the demanding meetings, the constant pressure to deliver can take a toll on mental health, relationships, and overall well-being.

One former employee described it as feeling like working in a "pressure cooker" where you're constantly at maximum effort. But here's what she also said: she stayed for two years specifically because leaving meant sacrificing millions of dollars in future equity appreciation.

This is the hidden trade-off in the Nvidia model. The company has structured incentives so that your biggest opportunities for financial gain are aligned with staying in a high-pressure environment. You can leave and take what you have. Or you can stay and accumulate more wealth while sacrificing your well-being.

For some, that trade-off is worth it. For others, it's not. The key is being intentional about the choice rather than drifting into it.

Why Equity Compensation Matters: Alignment and Retention

From a company perspective, equity compensation serves a specific purpose beyond just being generous. It aligns employee interests with shareholder interests. When your employees own pieces of the company, they have skin in the game. Their financial success is directly tied to the company's success.

This is why Nvidia's 2.7% turnover rate is so remarkable. The tech industry average is nearly 18%. That means Nvidia is retaining employees at a vastly higher rate than competitors. Why? Because losing a $2 million position by quitting would be economically irrational for most people.

But there's another benefit: it attracts a certain kind of employee. People who are willing to join startups or risky ventures in exchange for equity are typically betting on exponential growth. They're comfortable with uncertainty in exchange for potentially massive upside.

Nvidia benefits from this selection effect. The kind of person who joins an early-stage company because they believe in the technology and want equity is often the kind of person who will work nights and weekends to solve hard problems.

Equity compensation, done well, creates a self-reinforcing cycle: attract ambitious people → compensate with equity → align incentives → people stay and work harder → company grows faster → stock appreciates → wealth compounds.

The Broader Wealth Lesson: Passive Income Beats Active Income

Here's the meta-lesson that the Nvidia story teaches us about building wealth more broadly.

When you work for a salary, you're trading time for money. You work 2,000 hours per year, earn your salary, and the transaction is complete. Next year, you do it again. This is active income, and while it's necessary for most people, it has hard limits. You can only work so many hours per week. You can only increase your hourly rate so much before you max out your market value.

But when you own equity, your wealth grows while you sleep. The stock appreciates whether you're at your desk or on vacation. This is passive income, and it has no practical upper limit. If the company grows exponentially, your wealth grows exponentially.

The Nvidia employees who accumulated

This is why the wealthy often talk about "making money while you sleep." It's not a cute saying. It's a fundamental description of how compounding wealth works. You need some asset that appreciates over time, and you need to let it compound for extended periods.

For most tech employees, that asset is equity. For investors, it might be real estate or stocks. For entrepreneurs, it might be a business. But the principle is identical: build something valuable, own a piece of it, and let it compound.

Holding Nvidia stock for 5 years results in a final value of

The Accessibility Problem: Who Actually Gets This Wealth?

Here's the uncomfortable truth about the Nvidia story: it only applies to a tiny percentage of the world.

First, you need to work at the right company. Most companies don't create $2+ million in equity value per employee. You need to find the rare company that's operating in a booming industry with a huge addressable market and capturing significant share of it.

Second, you need to be hired in a role that includes equity compensation. Not all roles at Nvidia get equity. And at most traditional companies, only senior employees get meaningful equity grants.

Third, you need to be able to afford to hold. If you're living paycheck to paycheck, you might be forced to sell shares to pay rent. The privilege of holding for five years is actually a privilege—it requires financial security in the interim.

Fourth, you need to be comfortable with risk. Equity is volatile. You're betting that your company's stock will appreciate. If you're risk-averse, sitting on millions of dollars of illiquid equity is psychologically difficult.

Fifth, you need to be lucky. You need to join the company at the right time, in a role that will still be relevant five years later, while the industry itself is booming. That's a lot of conditions to align.

The Nvidia story is inspiring, but it's not accessible to everyone. It's a reminder that for most people, building wealth will require multiple strategies: savings, diversified investments, business ownership, real estate, or career progression. Expecting to become a multimillionaire through a single equity grant at a single company is unrealistic for most people.

But if you work in tech and you get the opportunity to join a company with strong equity compensation, the Nvidia story is a useful reminder of what's actually possible if the stars align.

The Technology Shift That Made It Possible

Underlying all of this is a fundamental technology shift that created the demand for Nvidia's products in the first place.

For decades, the semiconductor industry focused on making individual processor cores faster. The assumption was that speed mattered more than anything else. But then machine learning arrived and changed everything.

Training machine learning models requires performing the same mathematical operation millions of times on massive datasets. This is "embarrassingly parallel" work—it's the same calculation repeated over and over on different data. CPUs (central processing units) are optimized for fast sequential operations. But GPUs (graphics processing units) are optimized for parallel operations.

Suddenly, Nvidia's decade-long investment in GPU architecture and the CUDA programming ecosystem became incredibly valuable. Every company building AI systems needed access to GPU compute, and Nvidia was the dominant provider.

This is why Nvidia went from a solid but unspectacular company to the world's most valuable company in less than a decade. The technology shift created exponential demand for their products, and they were positioned to capture it.

For employees, this timing was life-changing. Those who joined in 2015-2019 got to ride the wave of this technology shift with an equity stake. They didn't need to predict the future perfectly. They just needed to be at the right company during the decade when that company's core product suddenly became essential infrastructure.

Lessons for Entrepreneurs and Founders

If you're an entrepreneur or considering starting a company, the Nvidia story offers some useful principles.

First: Focus on creating value, not just raising money. Nvidia's wealth creation is a side effect of creating incredibly valuable technology that the world needed. The focus was never "how do we make employees rich?" The focus was "how do we build the best GPU compute systems?" Wealth followed.

Second: Compensate employees with equity, not just cash. Companies that pay purely in salary are betting that they can predict future success and lock in costs. Companies that use equity are saying: "Let's align our success with yours." This creates more efficient capital structures and attracts the right talent.

Third: Play long-term games. Nvidia has operated for decades with a focus on multi-year technology development. The CUDA ecosystem took 5+ years to become dominant. The GPU architecture evolution happened over decades. Founders who are trying to hit a quick exit or optimize for short-term metrics often miss the massive opportunities that require sustained focus.

Fourth: Build for a transformational market. Nvidia got lucky (and it was partially luck) that GPU computing became central to AI infrastructure. But they didn't get lucky by accident. They were building technology for parallel computing because they believed the future would need it. Founders should study emerging technologies and bet on the ones that will reshape entire industries.

In 2025, approximately 75% of Nvidia's workforce were millionaires, with significant portions having net worths exceeding

The Role of Market Conditions and Economic Cycles

One more factor that doesn't get enough attention: Nvidia's wealth creation for employees happened during a period of sustained economic growth and tech investment.

If the 2008 financial crisis had happened in 2015 instead of 2008, Nvidia's trajectory would have been different. If AI had been less hyped or the market for AI compute had developed more slowly, the stock appreciation would have been more modest. If Nvidia had faced serious competition, the margin structure would have compressed.

None of these things happened. Instead, the company operated during:

- Low interest rates that encouraged investment in growth-oriented companies

- Massive venture capital investment in AI startups that needed Nvidia's chips

- A technology transition (AI) that played directly to Nvidia's strengths

- Strong corporate demand for cloud computing services that required Nvidia's infrastructure

These market conditions created a rising tide that lifted Nvidia's boat. Employees rode that tide.

This is important because it means the Nvidia story, while real and impressive, is not easily reproducible. You need the right company, the right technology, the right market conditions, and the right timing. Most people won't have all four.

Building Your Own Wealth: A Practical Framework

If you're inspired by the Nvidia story but recognize that you might not have the opportunity to join a company that's about to become worth $4 trillion, what should you actually do?

Here's a practical framework:

Step 1: Establish financial stability. Before you can think about wealth creation, you need to ensure you can cover your expenses and have an emergency fund. This is boring but foundational.

Step 2: Maximize your salary. Your salary is your engine for accumulating capital to invest. Prioritize increasing your income through skill development, switching companies when appropriate, and negotiating aggressively. The difference between a

Step 3: Invest in appreciating assets. This could be equity in your company (if available), index funds, real estate, or your own business. The key is finding assets that can appreciate significantly over 5+ years.

Step 4: Develop a patient time horizon. Most wealth is created through compounding over extended periods. This requires patience and the ability to tolerate volatility. If you're panicking and selling every time the market dips, you won't benefit from compounding.

Step 5: Educate yourself about what you're buying. Whether it's company equity, real estate, or stock investments, understand what you own and why you own it. Don't just accumulate assets blindly.

Step 6: Make intentional trade-offs. The Nvidia employees made a trade-off between working in a high-pressure environment and accumulating wealth. You'll need to make your own trade-offs. But make them consciously, not by accident.

Following this framework won't necessarily make you a multimillionaire like Nvidia employees. But it's a realistic path that works for ordinary people.

The Future: Can This Happen Again?

Will we see another Nvidia story? Almost certainly. The formula is clear: find a company operating in an industry that's about to experience exponential growth, the company captures significant market share, and employees hold equity through the growth phase.

Some possibilities: quantum computing companies, biotech firms that develop breakthrough treatments, renewable energy companies if climate tech becomes dominant, or companies building new categories of AI infrastructure.

But here's what's worth noting: each time this happens, the set of people who benefit is different. Most of the people reading this probably won't have the opportunity to join the next Nvidia-like company at the right time. That's just probability.

What you can do is understand the principles: equity ownership, long-term holding, alignment with exponential growth, and patience. Then apply those principles to whatever opportunities are available to you.

Final Thoughts: Lessons from the Nvidia Millionaires

The 27,000 Nvidia millionaires didn't become wealthy because they were smarter than everyone else. They weren't necessarily harder workers (though many were). They became wealthy because they were part of an organization that:

- Compensated with equity that represented real ownership stakes

- Operated in a booming industry with expanding demand

- Captured market leadership in that industry

- Held employees long enough to benefit from the appreciation

- Let their stock compound for years without panic selling

If you can find an opportunity with three out of those five elements, you're in a good position to build substantial wealth. If you can find all five, you might be looking at the next Nvidia story.

But more important than any specific opportunity is the principle: ownership of appreciating assets, held for extended periods, in companies that are creating real value. That's not a secret. It's not even particularly complicated. It's just patience and the ability to recognize when you're on the right side of a technology shift.

The Nvidia story is remarkable not because it's impossible, but because it shows what becomes possible when you have the right combination of opportunity, strategy, and timing. For those 27,000 millionaires, the power of going long on the right company at the right time paid off beyond anyone's reasonable expectations.

FAQ

What percentage of Nvidia employees are millionaires?

According to a survey of over 3,000 Nvidia employees, approximately **76-78% of Nvidia employees have crossed the

How did Nvidia create so much wealth for its employees?

Nvidia's wealth creation for employees stems from three primary mechanisms: heavily equity-weighted compensation packages (RSUs and stock options) distributed across all employee levels, an Employee Stock Purchase Program (ESPP) that allows purchase at 15% discounts, and extraordinary stock price appreciation of approximately 3,776% since 2019. This combination of aggressive equity compensation, disciplined long-term holding, and stock price multiplication created multimillion-dollar positions even for mid-level employees who started with modest initial grants.

What is the historical precedent for this kind of employee wealth creation?

Google's 2004 IPO provides a direct parallel, creating 7 billionaires and approximately 900 instant millionaires from early employees and stockholders. Google's company chef, Charlie Ayers (employee #56), had 40,000 shares worth approximately $4 million at IPO despite not being an executive. The Nvidia story is essentially a repeat of this formula at significantly larger scale, affecting 27,000+ employees rather than roughly 900.

What makes Nvidia's equity compensation different from other tech companies?

Unlike companies that rely primarily on cash salaries, Nvidia distributes equity compensation across all employee levels, not just executives. CEO Jensen Huang personally reviews compensation for all 36,000+ employees and intentionally increases spending on equity grants. This strategy has resulted in a 2.7% employee turnover rate compared to the tech industry average of 17.7%, demonstrating the effectiveness of equity alignment for retention.

How much did Nvidia stock appreciate for employees who joined in 2019?

For employees who joined Nvidia in 2019 with initial stock grants, the stock has appreciated approximately 3,776% through 2024. This means a

What are the risks of holding company equity long-term?

Holding concentrated positions in company stock creates significant risks including company-specific risk (if Nvidia faces competition or market disruption, the stock could decline dramatically), liquidity risk (equity is illiquid during employment), tax complexity (capital gains taxes on appreciated positions can be substantial), and concentration risk (overexposure to a single company means lack of diversification). Additionally, holding provides no passive income and requires emotional discipline to resist selling during volatile periods.

Can employees realistically expect to become millionaires through company equity alone?

The Nvidia story requires specific conditions that align rarely: joining a company in an industry about to experience exponential growth, the company capturing significant market share, receiving equity grants, holding for 5+ years without panic selling, and having enough financial security to avoid forced selling during downturns. Most people won't experience all these conditions simultaneously, making Nvidia-level wealth creation through equity atypical rather than standard.

What is Jensen Huang's philosophy on employee compensation?

Jensen Huang has stated that he personally reviews compensation for all Nvidia employees and "100% of the time increase the company's spend on operating expenses." His philosophy is fundamentally that "you take care of people, everything else takes care of itself." This approach has resulted in extraordinarily low turnover and employee retention through what he calls "golden handcuffs"—unvested equity that creates incentives to stay with the company.

How does the Nvidia wealth creation compare to starting your own business?

Starting your own business offers potential for unlimited upside but requires personal capital, carries significantly higher failure risk, and demands active involvement. The Nvidia path involves less personal risk (you have a stable salary), more passive returns (your wealth grows as the company appreciates), and requires only patience and luck. For most people, joining the right company at the right time with equity compensation is more reliable than becoming an entrepreneur, though the upside potential is theoretically lower.

What should employees with company equity do to maximize wealth creation?

Employees should: understand their equity type (RSUs vs. options) and vesting schedules, hold equity through multiple vesting periods when confident in company trajectory, educate themselves on tax implications of equity sales, avoid panic selling during market downturns (if the company thesis remains intact), and consider maxing out employee stock purchase programs if available. The Nvidia data strongly suggests that holding for 5+ years creates substantially more wealth than short-term trading strategies, assuming the company remains healthy and the industry remains favorable.

Conclusion: The Power of Going Long on the Right Bet

The Nvidia millionaire story boils down to something almost embarrassingly simple: find the right company, hold equity in it for a long time, and let compounding do the work. No secret. No complex strategies. Just patience and ownership.

But here's the catch, and it's important: finding the right company is hard. You need to identify a company operating in an industry that's about to experience exponential growth. You need that company to capture significant market share in that industry. You need to join at a moment when the stock price hasn't yet reflected the future opportunity. And you need to hold through the volatility without panic selling.

For the 27,000 Nvidia millionaires, all these elements aligned. They joined a company building GPU computing infrastructure just before AI became central to every organization's technology stack. The stock price hadn't fully reflected the future opportunity when many of them joined. They held. The market caught up. Wealth compounded.

You probably won't have this exact opportunity. But the principles are replicable. If you can identify emerging technology shifts, position yourself in companies capturing those shifts, take equity compensation seriously, and have the patience to let it compound for years, you're playing the same game that turned thousands of ordinary workers into multimillionaires.

The lesson from Nvidia isn't that you should go get rich quick. It's that sustained ownership of appreciating assets, combined with patience and the right timing, creates generational wealth more reliably than any other strategy. Most people don't have the patience. They sell too early. They panic during downturns. They don't believe in the long-term thesis.

But if you can be different—if you can truly go long on the right company—the results can be extraordinary.

The 27,000 Nvidia millionaires didn't become wealthy by being exceptional traders or brilliant investors. They became wealthy by making a simple decision: hold. And then they had the discipline to stick with it.

Key Takeaways

- 76-78% of Nvidia's 36,000 employees are millionaires, with nearly 50% worth over $25 million—demonstrating the power of equity-based compensation at scale

- Nvidia's stock has appreciated 3,776% since 2019 and 900% since ChatGPT's launch, creating 38x returns for 5-year employees—a 74% compound annual growth rate

- Equity compensation (RSUs, options, ESPP at 15% discount) distributed across all employee levels, not just executives, aligns incentives and creates 2.7% turnover versus 17.7% industry average

- Google's 2004 IPO created 900 millionaires from employees; Nvidia is replicating this at 30x scale by positioning perfectly for the AI infrastructure boom

- The formula for generational wealth: find the right company in a booming industry, hold equity long-term, and let compounding do the work—most people fail at the patience part

Related Articles

- Home Audio Room EQ Kit: Fix Your Sound in Minutes [2025]

- 20 Weirdest Tech Stories of 2025: From Fungal Batteries to Upside-Down Cars

- Melatonin Dosage Guide: Safe Sleep Aid Amounts [2025]

- Apple Macs in 2025: The Best and Worst Moments [2025]

- Best PS5 Games of 2025: Complete Rankings & Reviews [2025]

- Best Plant-Based Meal Delivery Services [2025]

![How Nvidia Created 27,000 Millionaires: The Equity Wealth Model [2025]](https://tryrunable.com/blog/how-nvidia-created-27-000-millionaires-the-equity-wealth-mod/image-1-1766930758491.jpg)