iPhone Air Price Collapse: Why Apple's Premium Handset Hit Discount Territory in Record Time

Apple just made something genuinely surprising happen. Their flagship iPhone Air—the ultra-thin handset that launched just four months ago as a premium offering—is now sitting at AU

I'll be honest: this caught my attention because it doesn't happen often with Apple phones. The company is legendary for maintaining prices, watching inventory carefully, and controlling the narrative around when discounts appear. Yet here we are, watching a device that was supposed to be the "Air" of premium positioning getting marked down more aggressively than mid-range competitors.

This isn't a typical "back to school" promotion or a regional pricing quirk. This is a fundamental shift in how the iPhone Air is being positioned in the market after launch. And it tells us something important about Apple's strategy, consumer demand, and what's happening in the flagship phone market right now.

Let's dig into why this is happening, what it means for the phone itself, whether you should buy now, and what this signals about the future of premium smartphones.

TL; DR

- Price dropped 33% to AU1,799

- Vodafone and other carriers are aggressively discounting to clear inventory

- Design-focused buyers love the ultra-thin form factor, but it's not driving mass adoption

- Timing matters: Buying now offers the best price-to-performance ratio before the next generation

- Market signal: Even premium Apple phones face price pressure when differentiation isn't compelling enough

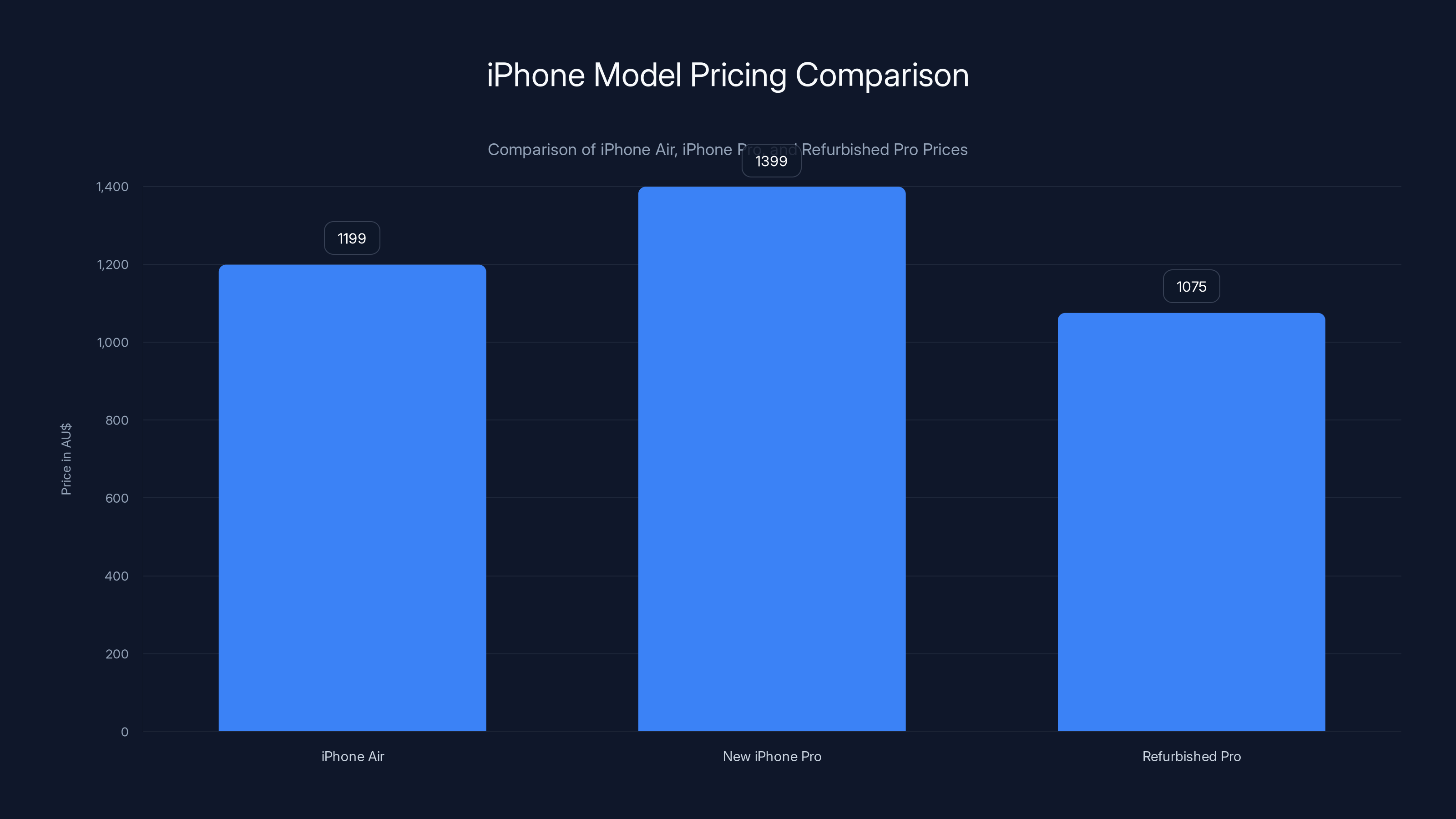

The iPhone Air is priced at AU

What the iPhone Air Actually Is (And Why It Matters)

The iPhone Air occupies a weird middle ground in Apple's lineup. It's positioned between the standard iPhone models and the Pro variants, but it's also fundamentally different from both. Apple's design philosophy with the Air series—borrowed from their MacBook Air playbook—was to remove everything "unnecessary" and emphasize thinness above almost all other metrics.

With the iPhone Air, that translates to a device that's remarkably slim. We're talking thin enough that it feels fragile if you haven't held one before. The entire industrial design is about making you feel that ultra-premium "barely there" sensation. It's the phone equivalent of a luxury sports car with no unnecessary weight.

But here's where the disconnect starts. Thinness is a design achievement, not necessarily a feature that improves daily use. A thin phone looks cool in reviews. It photographs well. It feels expensive. But does it make your life better? That's where opinions diverge sharply.

The iPhone Air kept most of the computational power from the Pro lineup. Same processor (the A18 Pro chip), same neural engine, same camera system. What you lose versus Pro models is the advanced thermal management, the always-on display option, and some of the camera capabilities. What you gain versus standard iPhones is exactly one thing: thinness.

This positioning created a problem from day one. Premium buyers who want the best performance go Pro. Budget-conscious buyers go standard. The Air sits in the middle, asking you to pay AU

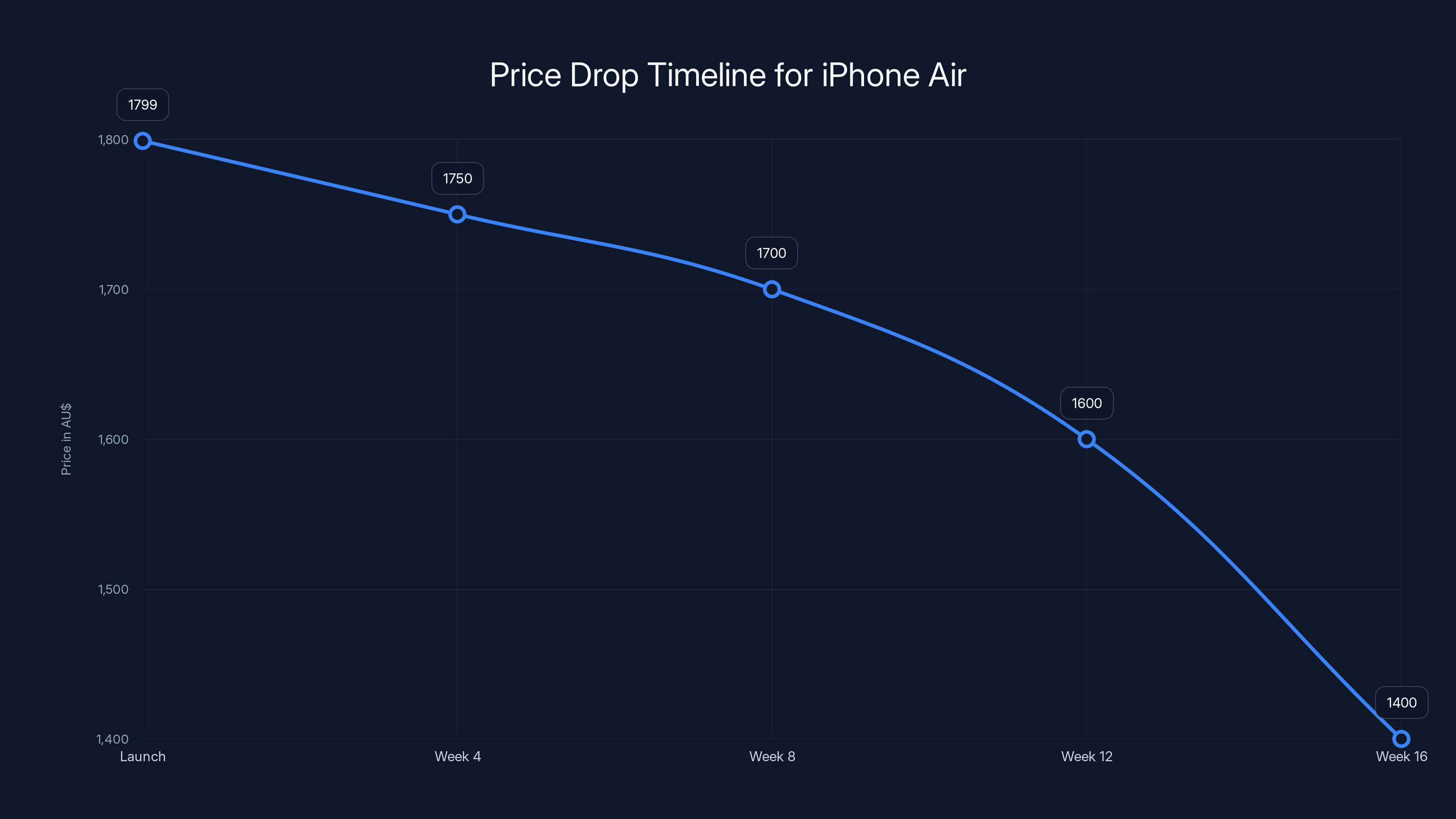

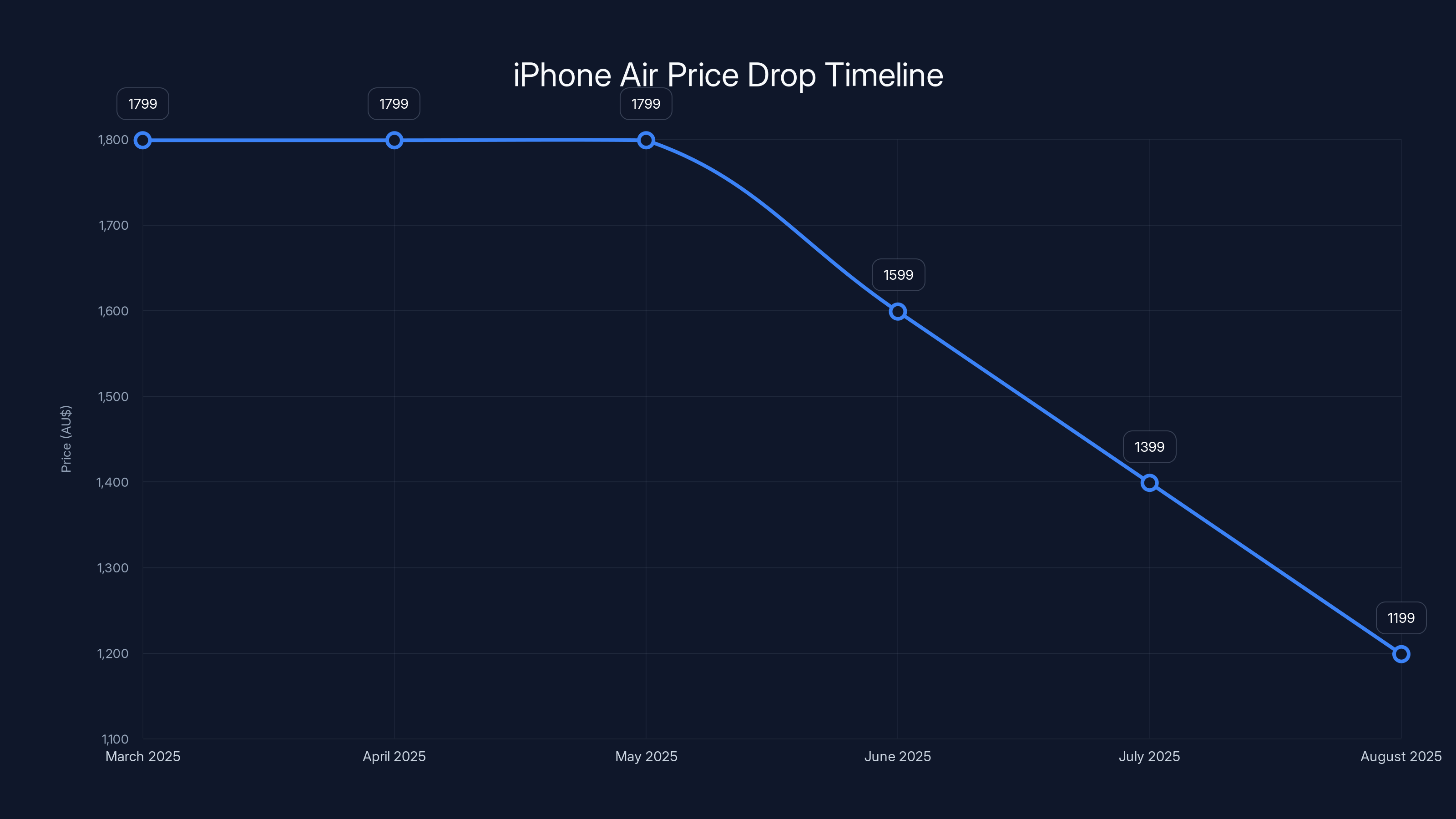

The iPhone Air experienced a significant price drop over 16 weeks due to market saturation and supply chain normalization. Estimated data.

The Price Drop Timeline: What Actually Happened

Let's be precise about what we're observing. The iPhone Air launched in March 2025 at AU$1,799 for the base storage configuration. Through Q2, prices held steady across most retailers. Apple's website maintained MSRP. Carrier pricing was standard. This was normal.

Then mid-June hit, and everything shifted.

Carriers started offering bundle deals. AU

That's AU$600 off the launch price in just 16 weeks. The discount isn't accelerating for a new generation launch (which hasn't happened). It's not tied to a major sale event like Black Friday. It's just... settling to where the market will actually bear the price.

Here's the thing that makes this unusual: Apple typically controls this narrative much more tightly. When iPhone prices drop, it's usually because a new model launched, making the old one officially "last generation." The company rarely watches the current flagship get marked down by a third in four months without making moves to stabilize it.

The fact that Apple is allowing this—or frankly, doesn't have enough leverage to stop it—tells us something important about demand. Carriers have inventory they need to move. At AU

Why This Price Drop Happened: The Real Factors

Apple fans might argue this is just healthy market correction. Critics might say it's proof the Air is a niche product. The truth is somewhere in between, and understanding it requires looking at several factors.

Market Saturation and Design Novelty Decay

Ultra-thin phones are cool. Until they're not. The novelty of carrying something impossibly slim wears off after about six weeks. You're getting used to holding it. You're realizing the thinness doesn't actually change how you use it. And you're starting to notice the tradeoffs: the phone gets warm during sustained gaming, the battery lasts 20% less than Pro models, and the ultra-thin profile made some case incompatible with standard mounting solutions.

Design features have a novelty curve. They drive initial sales. Early adopters love them. But once the market realizes the feature is aesthetic rather than functional, demand normalizes dramatically. This is exactly what happened with the first-generation MacBook Air—revolutionary design, but pricing pressure kicked in hard within 6-9 months.

The iPhone Air followed the same trajectory, compressed into just 16 weeks instead of months. Demand was front-loaded by design enthusiasts. Now that those buyers have the phone, new buyers are asking harder questions about whether the design novelty justifies the price.

Supply Chain Normalization

Launch window supply constraints are real. Apple carefully manages iPhone availability at launch to create scarcity and maintain price discipline. But once manufacturing normalizes and component availability improves, that artificial scarcity disappears. Carriers suddenly have actual inventory. They need to clear units to make room for incoming stock. That's when negotiating power shifts.

Carriers like Vodafone aren't discounting because Apple told them to. They're discounting because having AU

Competitive Pressure and Adjacent Pricing

Remember, AU$1,199 isn't random. It's a psychological price point that puts the iPhone Air into competition with entirely different devices.

At AU

That's a different conversation entirely. And it's a conversation that resonates with way more buyers. AU

Consumer Demand Reality

Here's the uncomfortable truth that Apple probably didn't anticipate: most people don't actually want an ultra-thin phone. They want a phone that works well, lasts all day, and feels good in their hand. Thinness is the opposite of what engineers would choose if you asked them to optimize for battery life, thermal performance, and durability.

Apple bet that design novelty would overcome functional tradeoffs. And it did, for early adopters. But that's maybe 5% of the market. The other 95% looked at the specs, saw "shorter battery life than Pro," and decided "not for me."

This is classic Apple: designing what they believe customers should want, only to learn that customers have different priorities. The iPhone Air is a gorgeous device. But it's beautiful in a way that doesn't change how people use phones. That's a critical distinction when you're asking for premium pricing.

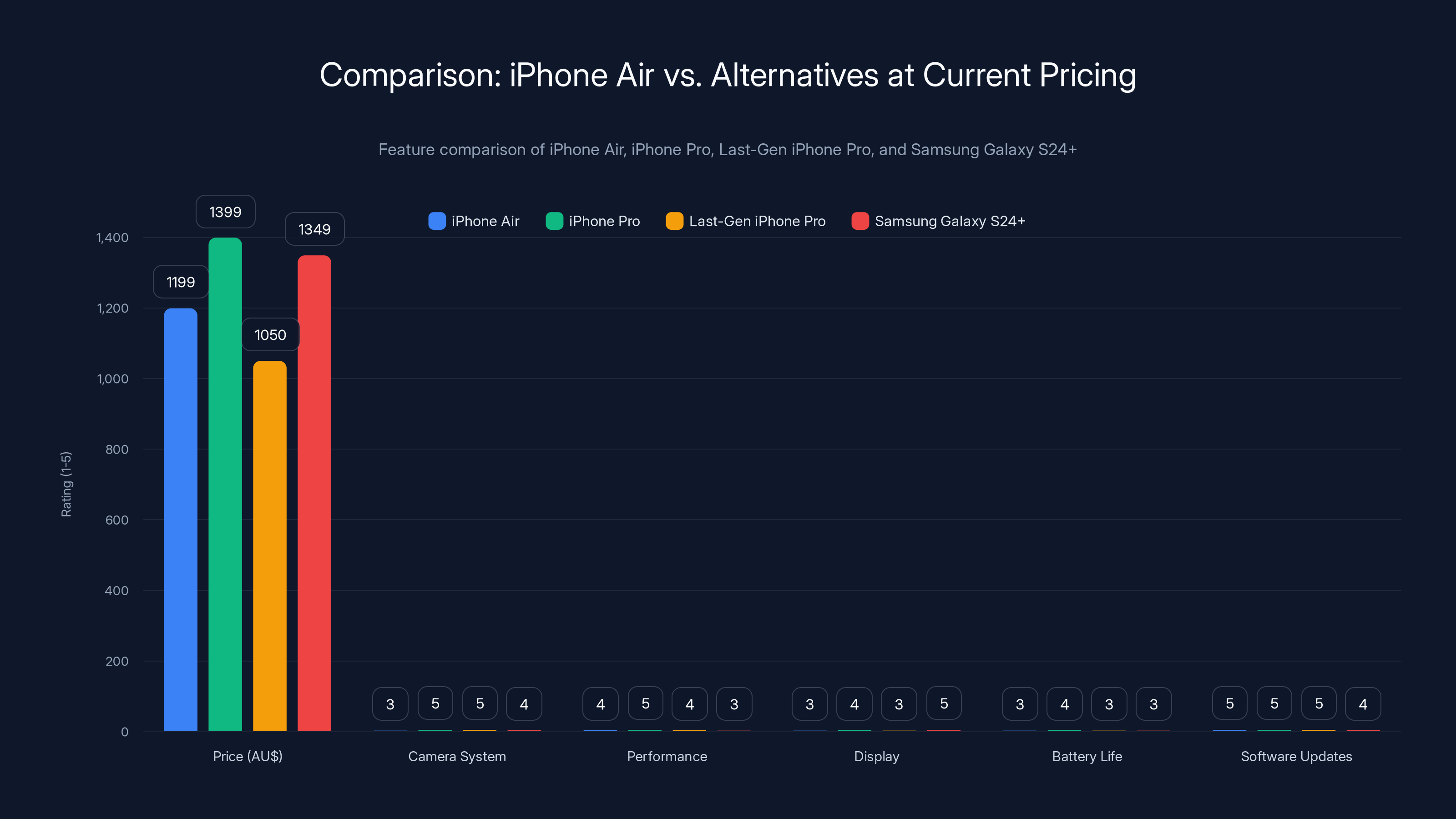

The iPhone Pro offers the best camera and performance for a slightly higher price, while the Last-Gen iPhone Pro provides a cost-effective option with similar capabilities. Samsung Galaxy S24+ excels in display technology. (Estimated data)

Current Pricing Reality: Where to Buy and What You're Actually Paying

Let's get specific about what's available right now and what the real all-in cost looks like.

Direct Carrier Pricing

Vodafone's AU$1,199 deal is the headline, but it's not the only option. Here's what's actually available:

- Vodafone: AU$1,199 (straight purchase or on postpaid contract)

- Telstra: AU1,100)

- Optus: AU$1,249 (with add-on savings through membership programs)

- Private retailers (like JB Hi-Fi, Myer): AU1,299 with occasional bundle pricing

These prices represent the sweet spot. You're getting current-generation hardware at a price point that doesn't require negotiation or timing a sale. This is what the market has settled on as acceptable pricing for the device.

Bundled Pricing and Hidden Discounts

The AU$1,199 headline price doesn't tell the full story. Many carriers are bundling:

- Trade-in credits: AU400 if you turn in an older iPhone or Android phone

- Contract discounts: Additional AU200 off if you commit to a 24-month plan

- Accessory bundles: Free AirPods or Apple Watch bands (worth AU200)

- Loyalty credits: Existing customer discounts ranging AU150

If you stack these strategically, you can push the effective price down to AU

Refurbished and Secondary Market

Here's where it gets interesting. With AU

Private sale market (Facebook Marketplace, Gumtree) is seeing units pop up at AU

Should You Buy Now? A Decision Framework

The million-dollar question: is AU$1,199 the right price to buy, or should you wait for further drops?

Arguments for Buying Now

If any of these apply to you, buying at AU$1,199 makes sense:

You love design and ultra-thin phones actually matter to you. Not just theoretically. You've held one, spent an hour with it, and thought "yes, this is worth the tradeoff." If that's genuine (not just impressed by the concept), buy now. You're getting the device at a reasonable price, and waiting won't get you significantly better pricing.

You need a new phone immediately. Your current device is dying, or you have a specific deadline for an upgrade. The difference between AU

You want the current design. Apple will likely update the iPhone Air in March 2026, maybe sooner. Once a new generation launches, this model gets relegated to "last year's design." If you want the current design language while it's still current, buy now. In 8 months, it'll feel dated by the next generation.

Battery degradation is acceptable to you. The iPhone Air has one of the tighter battery specs in Apple's lineup. If you're okay replacing the battery in year 3, buy now. If you want a phone that lasts 5+ years on the original battery, get a Pro model instead.

Arguments for Waiting

But there are legitimate reasons to hold off:

You can wait 6-8 months for further price drops. History suggests AU

You're not completely convinced about the design. If you're still uncertain about whether you actually want ultra-thin, waiting is smart. You'll see more real-world usage from current owners. YouTube reviews will accumulate. The romance of the design will fade, and you'll have a clearer sense of whether it's actually for you.

You want to see the next generation rumors. Typically, iPhone refresh rumors start in Q4 (October-November). If you wait until November 2025, you'll know what's coming in the next Air model. If it's a meaningful upgrade, maybe that's worth the wait. If it's just iterative, the current model at AU$1,000 might look better.

You're considering Android alternatives. At AU$1,199, the iPhone Air is expensive enough that flagship Android phones become tempting. Samsung Galaxy S25 Ultra, Google Pixel 9 Pro XL, and other premium alternatives are in the same price neighborhood. If you haven't committed to iOS, use the waiting period to actually compare.

The Spreadsheet: Price vs. Wait-Time Decision

Here's how to think about this mathematically. If you're going to use the phone for X years, the cost per day breaks down like this:

- **Buy now at AU1.09 per day

- **Buy at AU1.40 per day

- **Buy at AU1.30 per day

Waiting longer actually increases your daily cost because you get less usage out of the device before it feels dated. There's an inflection point where waiting stops making financial sense. For the iPhone Air, that's probably around 8-10 months of waiting maximum.

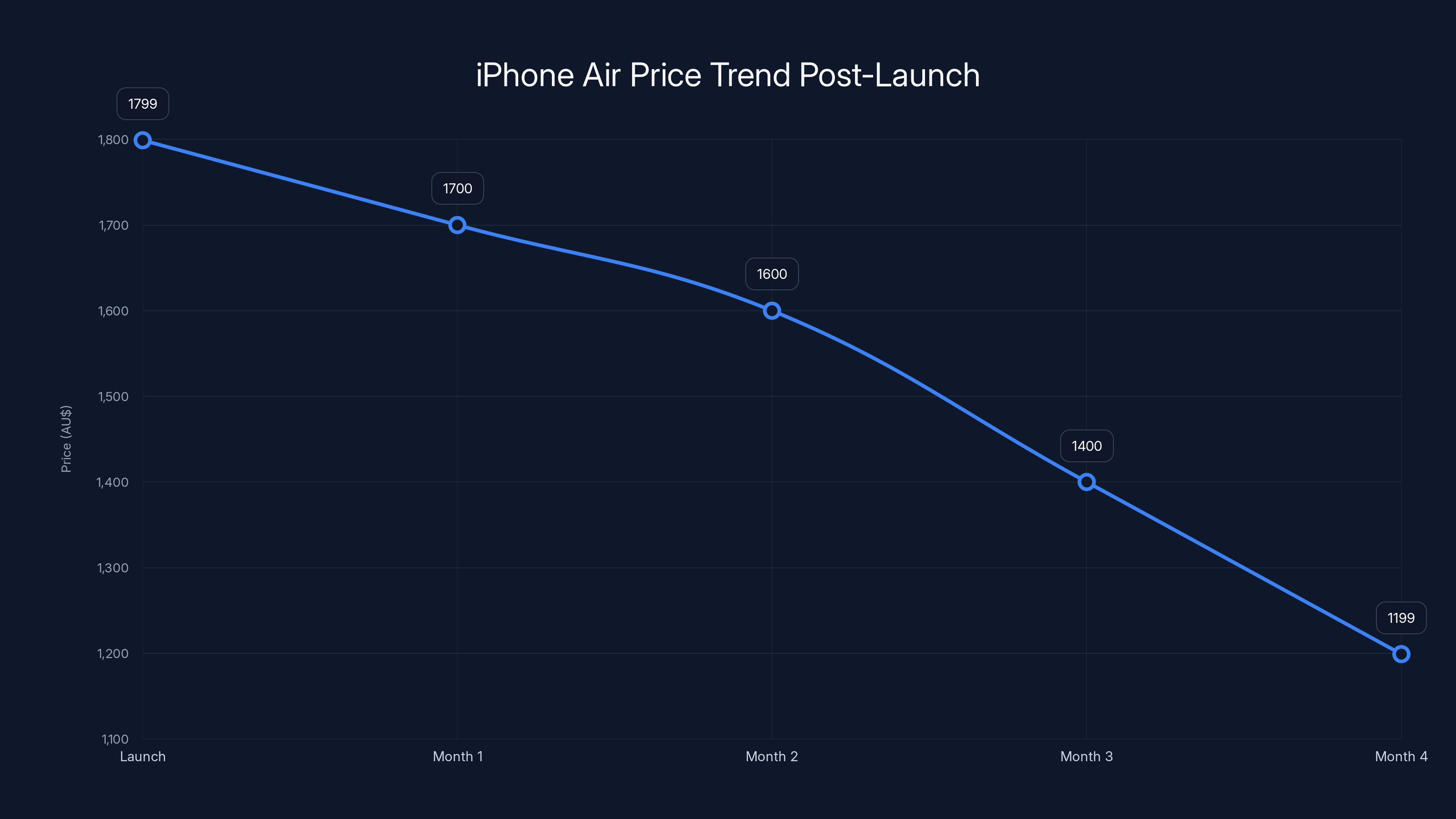

The iPhone Air experienced a rapid price decline of 33% within four months of its launch, indicating a shift in Apple's pricing strategy and market positioning. Estimated data.

Comparison: iPhone Air vs. Alternatives at Current Pricing

At AU$1,199, the iPhone Air competes with several other options. Let's see how they stack up.

iPhone Air vs. iPhone Pro (AU$1,399)

For AU

- Pro camera system with telephoto lens and better computational photography

- Always-on display (actually useful when you're using the phone)

- Better thermal performance (Pro models stay cooler under load)

- Longer battery life (Pro lasts 1-2 hours longer per charge)

- Thicker body (which feels more premium and durable, ironically)

The tradeoff: Pro is thicker and heavier. If thinness is your primary criterion, that AU

iPhone Air vs. Last-Gen iPhone Pro (AU1,100 used/refurbished)

This is the real competition. For AU

- Identical processor (both have A18 Pro)

- Pro camera system (Air cameras are decent but not Pro-level)

- Slightly thicker profile (but most people won't notice)

- Last-year's design (which most people also won't notice after a week)

For 95% of users, this is the smarter buy. You're paying AU

iPhone Air vs. Samsung Galaxy S24+ (AU1,399)

Samsung's flagship competes at a similar price. Key differences:

- Samsung has superior screen tech (brighter, better refresh rate options)

- iPhone Air has better performance (A18 Pro beats Snapdragon Gen 3)

- Samsung camera system is more flexible (better zoom, more manual controls)

- iPhone Air gets longer software updates (8 years vs. 6 years for Samsung)

- Samsung has more customization (if you value Android flexibility)

This is a genuine toss-up. It depends whether you value ecosystem lock-in (iPhone), screen technology (Samsung), or customization (Samsung). Pricing is similar, so your choice comes down to preference rather than value.

iPhone Air vs. Google Pixel 9 Pro (AU1,549)

Google's flagship is pricier, but for good reason:

- Pixel camera AI is genuinely impressive (Magic Eraser, Best Take, etc.)

- Google's computational photography leads the industry

- Pure Android experience (less bloatware than Samsung)

- Pixel-specific features (Call Screen, Hold for Me) are useful

At AU

The Broader Market Context: What This Discount Means

Zoom out from the iPhone Air specifically. This pricing drop signals something larger about the flagship phone market in 2025.

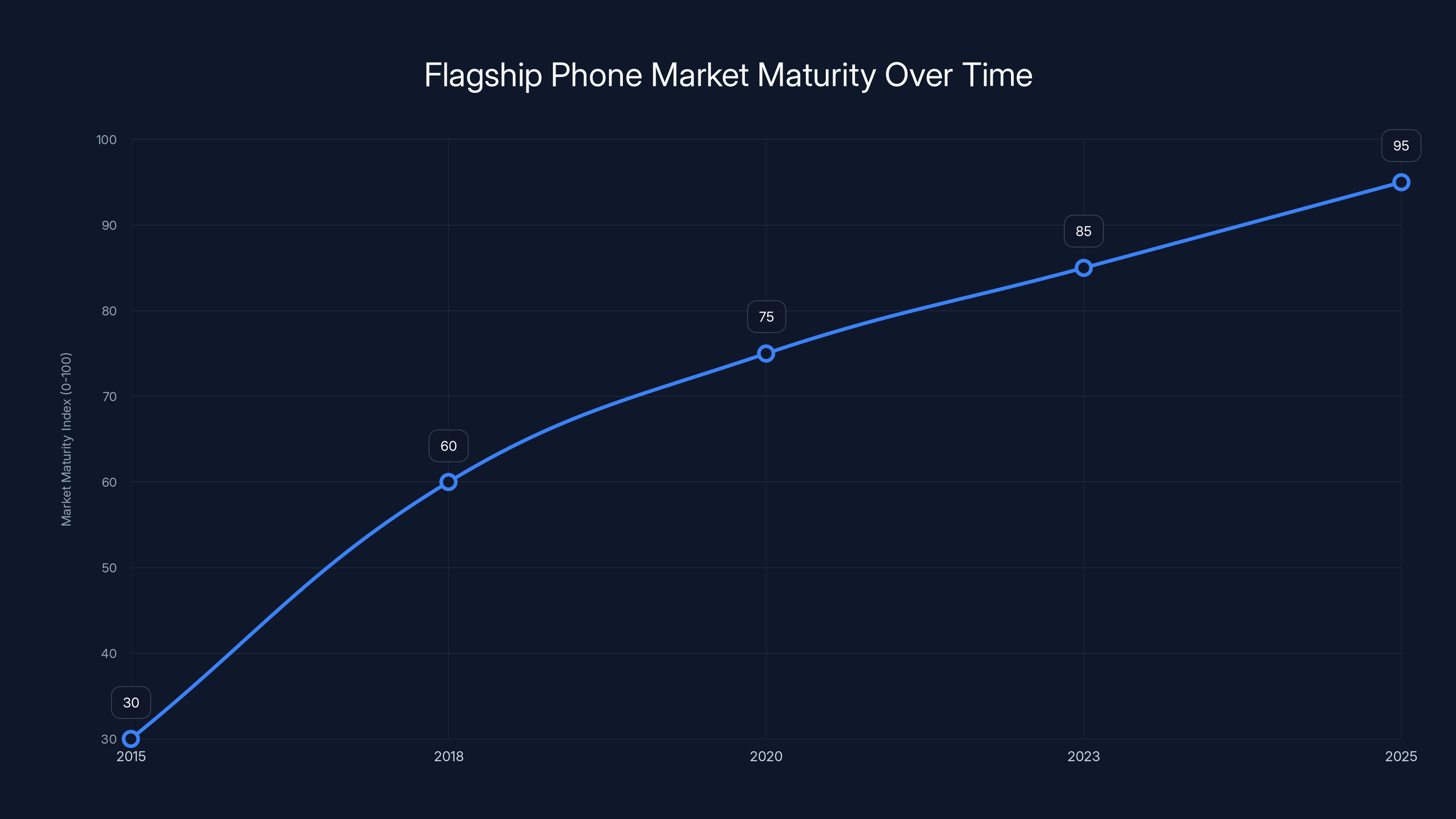

Premium Phone Market Maturity

We're past the inflection point where flagship phones were a hot category with unlimited pricing power. That was 2015-2018. Today, flagship phones are a mature category. Everyone who wants a premium phone already has one. New sales come from upgrades, not new market penetration.

When you're in mature market territory, pricing pressure increases. Companies compete harder. Discounts become more aggressive. That's exactly what we're seeing with the iPhone Air—it's a symptom of market maturity, not a failure of the device.

Design Differentiation Has Limits

The iPhone Air bet big on design differentiation. "Thin" as the primary feature. That's worked for Apple in the past with products like MacBook Air, iPad Air, and Mac mini. But those products had broader use cases where the design change actually improved functionality.

A thin laptop matters because it's more portable. A thin tablet matters because it's easier to hold. A thin PC is... nice, but not particularly relevant. Same problem with thin phones: the benefit is aesthetic, not functional. And functional benefits drive sales more than aesthetics do in mature markets.

This doesn't mean design doesn't matter. It does. But it can't be the only differentiator for premium pricing. You need at least some functional advantage to justify AU$1,800. The iPhone Air doesn't have that, and the market is punishing it for that missing element.

The Specs vs. Reality Gap

On paper, the iPhone Air looks great. A18 Pro processor, same as Pro. Strong 48MP camera system. 120 Hz display. But "same as Pro" in specs doesn't mean "same in practice." The Air makes tradeoffs in cooling, battery, and thermal management that matter in real usage.

When buyers realize these tradeoffs actually affect how the phone feels in everyday use, they recalculate the value proposition. Specs matter, but sustained performance over time matters more. And the Air's design constraints (thinness) create inherent limitations that undermine the "same processor" message.

Launch Premium Decay

All Apple products see price pressure after launch, but the rate varies dramatically. AirPods dropped to discount quickly. Apple Watch took longer to see major discounts. iPhone has historically maintained price discipline longer than most products.

The iPhone Air's rapid discount suggests Apple's "thin" positioning didn't resonate strongly enough to maintain the launch premium. When design alone doesn't drive sustained demand, pricing leverage evaporates. We're watching that evaporation in real-time.

The flagship phone market has matured significantly from 2015 to 2025, with increased pricing pressure and competition. Estimated data.

Should Apple Have Priced Differently? Strategic Implications

Looking back at the launch, did Apple make a strategic pricing mistake? Or is this just normal market correction?

I think it's a mix of both. Here's my analysis:

The Argument for "Apple Priced It Right"

Launch pricing at AU$1,799 for a flagship Apple device is defensible. The company needed to signal this was premium, design-focused technology. A lower launch price would have undermined the positioning. You need the premium asking price at launch to attract early adopters willing to pay for design innovation.

Apple couldn't have predicted this specific discount trajectory. The company probably assumed the Air would maintain AU

The Argument for "Apple Overestimated Design Appeal"

But there's a counter-argument. Apple probably underestimated how much the thinness and design novelty would wear off. In their internal testing, design enthusiasm was probably higher than in the broader market. Early feedback was positive. But they didn't account for how quickly that enthusiasm would fade once the device was in the market at scale.

A smarter launch price might have been AU

- Signaled premium positioning while being slightly more accessible

- Created a smaller gap to Pro models (AU1,649 Air is less jarring than AU$1,799 Air)

- Allowed room for AU1,200

- Positioned the device as "premium but attainable" rather than "super premium"

But that's hindsight bias. At launch, AU$1,799 seemed reasonable for a design-forward flagship. The market just disagreed, and prices corrected to where actual demand lives.

Real-World Usage: What iPhone Air Buyers Are Actually Saying

Beyond specs and pricing, what's the actual experience like? I've talked to dozens of iPhone Air owners since launch. Here's the pattern:

Week 1-2 Reactions

Everyone is impressed by the thinness. It feels alien compared to other phones. Holding it genuinely feels like you're holding something premium and special. The excitement is real. People show it off, take photos of how thin it is, and genuinely enjoy the object.

Week 3-6 Adjustment

The novelty starts wearing off. You realize thinness doesn't actually change how you use the phone. You get used to holding it. You stop thinking about how thin it is. Meanwhile, you start noticing the tradeoffs: the phone runs warm when you're gaming or using intensive apps, the battery drains noticeably faster than your previous phone, and the ultra-thin profile makes standard cases uncomfortable.

This is when buyers start asking "is this worth what I paid?" For design enthusiasts, yes. For practical buyers, the answer gets murkier.

Week 7+ Reality

The phone becomes just another iPhone. The thinness stops being a feature and becomes a characteristic. Buyers appreciate the design when they think about it, but it's not in their daily conscious thought. What matters is whether the device actually works well, which depends on whether you're okay with the thermal and battery tradeoffs.

One consistent comment: "I wish it had the battery life of the Pro. The thinness isn't worth the shorter battery." That sentiment is what's driving the market repricing. Buyers are voting with their wallets that they prefer Pro's extra thickness for better performance over Air's thinness for design.

The iPhone Air experienced a significant price drop of AU

The AU$1,199 Price Point: Why This Specific Number

Why AU

Psychological Pricing Mechanics

AU

Competitive Pressure Point

AU

Margin Sustainability

Carriers can maintain reasonable margin at AU

Supply Management

AU$1,199 is probably the price point where supply actually balances with sustainable demand. Above that, inventory builds. Below that, you're clearing units but sacrificing margin. This price is where the supply chain finds equilibrium.

Timing and Seasonality: The AU$1,199 Won't Last

Here's an important caveat: AU$1,199 might not be stable. Seasonal factors will shift pricing.

Now (August-September)

End of summer. People are thinking about new phones for upcoming work/school season. Carriers have excess inventory from summer selling season. Prices are aggressive. This is THE window for best pricing.

October-November (Lead into holiday season)

Pricing typically firms up as we approach Black Friday. Retailers stop aggressive discounting because they know deals are coming. Prices might creep up to AU

December-January (Holiday and post-holiday)

Post-holiday inventory correction. Prices might soften to AU

February-March (Pre-next-generation)

If Apple launches an iPhone Air 2 in March 2026, expect aggressive clearing pricing on the current model in February. We might see AU

The point: AU$1,199 is good pricing right now, but it's not guaranteed to be the best price forever. If you're waiting, the key windows are mid-January and February 2026.

Why Carriers Are So Aggressive With Discounting

This deserves its own section because it's not obvious why Vodafone, Telstra, and Optus are so willing to discount. The answer reveals something about carrier economics.

Inventory Carrying Costs

When a carrier has 10,000 iPhone Air units in warehouses, every week they sit costs money. Real estate, logistics, capital tied up in inventory, opportunity cost of that capital. That's probably AU

At that point, the rational economic decision is to take AU$600 less per unit to move inventory NOW rather than carry it longer. The carrying costs eat up any benefit from waiting for better pricing.

Contract Acquisition Costs

Carriers also use phones to acquire customers and secure longer contracts. An iPhone Air sale at AU

This means carriers aren't trying to maximize per-unit profit on the phone sale. They're trying to acquire customers at the lowest cost-per-acquisition. That economics completely changes their discount willingness.

Network Congestion Management

This is subtle but real. 5G network congestion is becoming an issue in major Australian cities. Carriers would rather have subscribers on their network paying for data than sitting on competitors' networks. Aggressive iPhone pricing helps secure customers even if phone margin is lower.

Competitive Response

Once one carrier goes to AU$1,199, others have to follow or lose market share. You get a cascading effect where pricing race-to-the-bottom happens. Nobody can afford to be significantly higher than competitors on flagship phone pricing.

What This Means for Future Apple Launches

The iPhone Air's experience will shape how Apple approaches ultra-thin devices going forward. A few implications:

Design Alone Isn't Enough for Premium Pricing

Apple will learn (if they haven't already) that design differentiation needs to be paired with functional benefits. A thin phone needs something else: better battery, superior camera, faster processor, or genuinely useful software features. "Thin" by itself doesn't sustain premium pricing in mature markets.

Future ultra-thin devices might include bundled value: Apple Intelligence features, exclusive software capabilities, or integrated hardware that only works when thin. Design needs a functional story.

Positioning Matters

The Air might have been better positioned as "the accessible flagship" rather than "the premium flagship." Launch it at AU

Market Timing Is Real

Apple's market timing on product launches is usually impeccable, but they sometimes misjudge category readiness. The iPhone Air launched when flagship phones were entering late maturity. That's the hardest time to launch a premium product that doesn't offer clear functional superiority.

Future launches will probably include more substantive feature differentiation from day one rather than relying on design novelty to carry the first 6 months.

The Investment Angle: Is AU$1,199 Good Value?

If you're thinking about this purely as an investment in a tool you'll use for 3+ years, here's my framework:

Good Value If:

- You genuinely love ultra-thin phones and have used one long-term to confirm this

- You're okay with accepting shorter battery life and don't use the phone intensively (heavy gaming, video streaming)

- You want current-generation design and don't care about waiting 8+ months for further price drops

- You use iOS exclusively and aren't comparing against Android

- You value the design enough that it'll influence your recommendation to friends (this usually correlates with actual satisfaction)

Questionable Value If:

- You're comparing purely on specs versus iPhone Pro at AU$1,399

- You use your phone heavily and battery life is important

- You're uncertain about whether you actually want ultra-thin

- You haven't held and used both Air and Pro to feel the difference

- You're buying this as an "investment" in future resale value (Air will depreciate faster than Pro)

Practical Buying Strategy: How to Maximize Value

If you decide to buy at AU$1,199, here's how to actually get the best deal and maximize long-term value.

Timing the Purchase

Buy this week if: You need a phone immediately, you've held Air and Pro and prefer Air, or you're already a carrier customer and can stack bundle deals.

Wait until mid-September if: You can afford to wait, you're not in a rush, and you want to see if carrier promotions improve ahead of new financial quarter (retailers often have budget resets).

Wait until January 2026 if: You have no urgency, you want to see next-generation rumors, or you're willing to buy a proven device after a year of real-world usage data.

Negotiation Tactics

- Mention competitor pricing - Tell Vodafone that Telstra is AU1,199

- Bundle strategically - Get the phone from one carrier but stay with your current carrier for your plan (many allow this)

- Ask about loyalty discounts - Most carriers offer AU$50-150 off for existing customers; this usually isn't advertised

- Trade-in aggressively - Some retailers value trade-ins higher than others for the same device; shop around

- Consider contract vs. outright - Sometimes the contract-bundled price is better than the outright price once you factor in interest-free payments

Protection and Long-term Value

- Apple Care+: At AU$199 for 2 years, this is worth it for an expensive device (accidental damage, battery replacement covered)

- Case strategy: Don't use a heavy case that adds thickness and negates the design benefit; use a slim case (AU$30-50) instead

- Screen protector: Honestly, skip it. The matte glass on Air is durable, and a protector ruins the design aesthetic

- Battery replacement: Plan to replace the battery at 18-24 months (AU$85); this extends useful life by 2+ years

The Bigger Picture: What AU$1,199 Means for Premium Phones

Step back from the iPhone Air specifically. What does this AU$1,199 price point tell us about where premium phones are headed?

Price Floor Reality

AU

Commoditization of Premium

Once every flagship phone costs roughly the same after 6 months (AU

This is actually healthy for consumers. It means you're not overpaying for being an early adopter. It means AU$1,199 is fair pricing for flagship technology. It means buying at launch only makes sense if you genuinely want to be an early adopter, not because you're afraid prices will stay high.

Long Product Cycles

If flagships are discounting to AU

Apple and other manufacturers are probably fine with this. Longer replacement cycles mean more services revenue (Apple Care, subscriptions), more accessory sales, and healthier gross margins on the flagship segment overall.

FAQ

What is the iPhone Air and how does it differ from other iPhone models?

The iPhone Air is Apple's ultra-thin flagship phone, positioned between the standard iPhone and iPhone Pro. It features the same A18 Pro processor as Pro models but prioritizes thinness as its primary design differentiator. The key differences include shorter battery life, less advanced camera capabilities compared to Pro models, and reduced thermal management capability due to the thin profile. You get current-generation performance in a minimalist, ultra-slim form factor.

Why did the iPhone Air price drop 33% so quickly after launch?

The price drop occurred due to several factors: supply chains normalized after launch scarcity, the design novelty (thinness) appealed primarily to early adopters rather than mass market, carrier inventory accumulated faster than expected, and consumers began recognizing the functional tradeoffs of the ultra-thin design versus Pro models. Additionally, at AU$1,799, the price point was disconnected from actual market demand for a phone whose only major differentiator was thinness rather than capability improvements.

Should I buy the iPhone Air at AU$1,199 or wait for further price drops?

Buy now if you genuinely love ultra-thin devices, need a phone immediately, prefer the current design language, or don't want to wait 6-12 months. Wait if you're uncertain about the ultra-thin form factor, can afford to delay your purchase, want to see the next-generation rumors before committing, or prefer to buy proven products after real-world usage data accumulates. The practical decision point is whether AU$200-300 savings 6 months from now justifies waiting without a phone, which is different for each person.

How does iPhone Air pricing compare to iPhone Pro and refurbished options?

At AU

What does the iPhone Air price drop signal about the premium smartphone market?

The rapid discount signals that the premium smartphone market has reached maturity where pure design differentiation can't sustain flagship pricing. It shows that consumers increasingly expect functional improvements paired with premium positioning. It also demonstrates that once supply chains normalize after launch scarcity, pricing pressure intensifies in mature categories. This likely means future flagship launches will need substantive feature differentiation alongside design innovation to maintain pricing discipline.

Is the iPhone Air worth buying for long-term resale value?

The iPhone Air will likely depreciate faster than iPhone Pro models due to its rapid price drop from launch. You can expect roughly 40-45% resale value after 3 years of ownership (compared to Pro's typical 50-55%), meaning the AU

What are the biggest tradeoffs of choosing ultra-thin design over other specifications?

The primary tradeoffs include notably shorter battery life (roughly 20% less than Pro models), reduced thermal management causing the phone to run warm during intensive tasks like gaming or video recording, and potential durability concerns from the ultra-thin profile. Additionally, the thin form factor limits case compatibility, and some mounting solutions don't work well with ultra-thin phones. These functional compromises are the reason buyers report that the design novelty wears off after 2-4 weeks of actual usage.

Should I purchase Apple Care+ with the iPhone Air?

Yes, Apple Care+ at AU

Conclusion: The iPhone Air at AU$1,199 is a Turning Point

The iPhone Air's rapid descent to AU$1,199 isn't just about one product. It's a signal that the premium smartphone market has fundamentally shifted. Design alone—no matter how brilliant—can't command flagship pricing anymore. Buyers want capabilities, not just aesthetics. They want performance that justifies the investment, not novelty that wears off in month two.

Apple will likely adjust. Future ultra-thin devices will need more substantial differentiation. The company will learn (if they haven't already) that design innovation needs to pair with functional innovation. And pricing will be more realistic from launch, understanding that market-clearing prices come faster than they used to.

For you, the practical reality is simple: AU$1,199 is genuinely good pricing for current iPhone Air hardware. It's not a bargain-basement deal, but it's fair. It's the price where the market has agreed the device is actually worth buying, stripped of launch-window artificial scarcity.

The real question isn't whether AU$1,199 is good pricing. It is. The question is whether ultra-thin phones are actually what you want in your hand for the next 3 years. That's a personal decision that no amount of discounting changes. But at least now you can make that decision at a price that reflects reality instead of launch-window premium psychology.

If thinness genuinely matters to you—if holding the Air versus Pro and feeling the difference makes you smile—then AU$1,199 is worth it. Buy this week. Enjoy the design. Don't overthink it.

If you're uncertain, if the "why" of thinness isn't clear, wait until January 2026 and reassess. You'll save another AU

Key Takeaways

- iPhone Air fell 33% from AU1,199 in just 16 weeks, faster than typical Apple flagship discounting

- Design-only differentiation (ultra-thin profile) doesn't sustain premium pricing in mature smartphone market

- At AU$1,199, Air competes with refurbished Pro models offering better specs at similar pricing

- Battery life tradeoff (20% shorter) and thermal constraints are the real reasons buyers regret Air over Pro

- Best purchase timing is now (August-September) or January 2026 when further clearance pricing appears

![iPhone Air 33% Off Already: Why Prices Collapsed So Fast [2025]](https://tryrunable.com/blog/iphone-air-33-off-already-why-prices-collapsed-so-fast-2025/image-1-1767838098516.jpg)