Kodiak and Bosch Partner to Scale Autonomous Truck Technology [2025]

When Kodiak AI announced its partnership with Bosch at CES 2026, it signaled something important: the autonomous trucking industry has moved past proof-of-concept. We're now entering the scaling phase.

Here's what happened: Kodiak, which recently went public via a SPAC merger, is teaming up with one of the world's largest automotive suppliers to build hardware and software systems that can retrofit existing semi-trucks with autonomous driving capabilities. This isn't theoretical anymore. Kodiak already has trucks running driverless routes in Texas, making real deliveries for real customers. Now, with Bosch's manufacturing expertise and supply chain muscle, the company aims to do what every successful technology company must do to survive: industrialize.

But this partnership raises bigger questions. What does it take to actually scale autonomous trucking? How will standardized hardware change the economics of the industry? And why is Bosch, a $75 billion company, betting on a startup?

Let me walk you through what this partnership means, why it matters, and what happens next in the race to driverless trucks.

TL; DR

- Partnership Scale: Kodiak and Bosch are developing standardized hardware and software for retrofitting semi-trucks with autonomous capabilities.

- Commercial Proof: Kodiak already operates driverless trucks for Atlas Energy Solutions, delivering to oil and gas operations in the Permian Basin.

- Production Timeline: No official launch date announced yet, but both companies signal commercial availability within 18-36 months.

- Market Opportunity: The trucking industry moves $800+ billion in goods annually in the US alone.

- Hardware Approach: Systems can be integrated during truck manufacturing or retrofitted afterward by third-party upfitters.

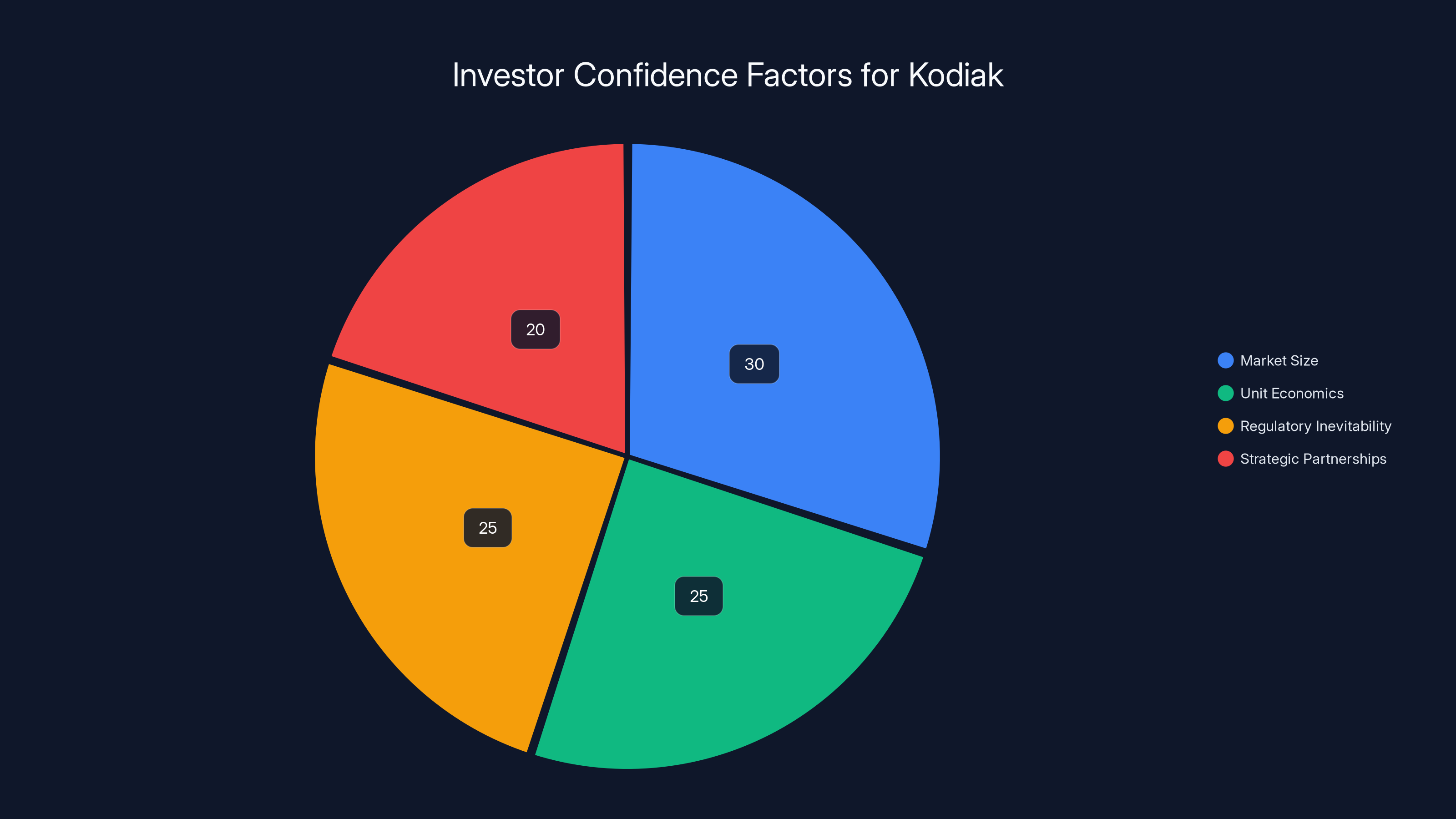

Market size and unit economics are the largest factors driving investor confidence in Kodiak, each contributing significantly to its perceived value. (Estimated data)

The Current State of Autonomous Trucking: Why This Partnership Matters Now

Autonomous trucking has been stuck in a weird middle ground for the past decade. Everyone agrees it's inevitable. Yet commercialization moves slower than a loaded semi on an icy mountain pass.

There are good reasons for this. Trucking is a regulated industry with real safety requirements. The technical challenges are substantial. Weather, construction zones, pedestrians, traffic signals—all of these require systems that work consistently, not just occasionally. And then there's the economic puzzle: when driver costs are rising but truck utilization remains unpredictable, what's the business case for expensive autonomous systems?

Kodiak entered this landscape with a specific answer: focus on highway routes. Not city driving. Not complex urban delivery. Long-haul trucking on highways, where routes are predictable, conditions are more consistent, and economics favor automation most strongly.

When Kodiak began operations with Atlas Energy Solutions in January 2025, something shifted. These weren't simulation runs. They weren't test tracks. They were actual driverless trucks making actual deliveries in one of America's most demanding logistics environments—the Permian Basin, where distances are long, routes are established, and the economics work.

But here's the catch: Kodiak built these systems custom. They worked with Roush Industries, a specialized upfitter, to install their autonomous hardware into standard semi-trucks. That works for one company, one route, one customer.

It doesn't scale.

Scaling requires modularity. It requires components that work on trucks from different manufacturers. It requires hardware that can be added to the production line or bolted on later. It requires an ecosystem.

Enter Bosch.

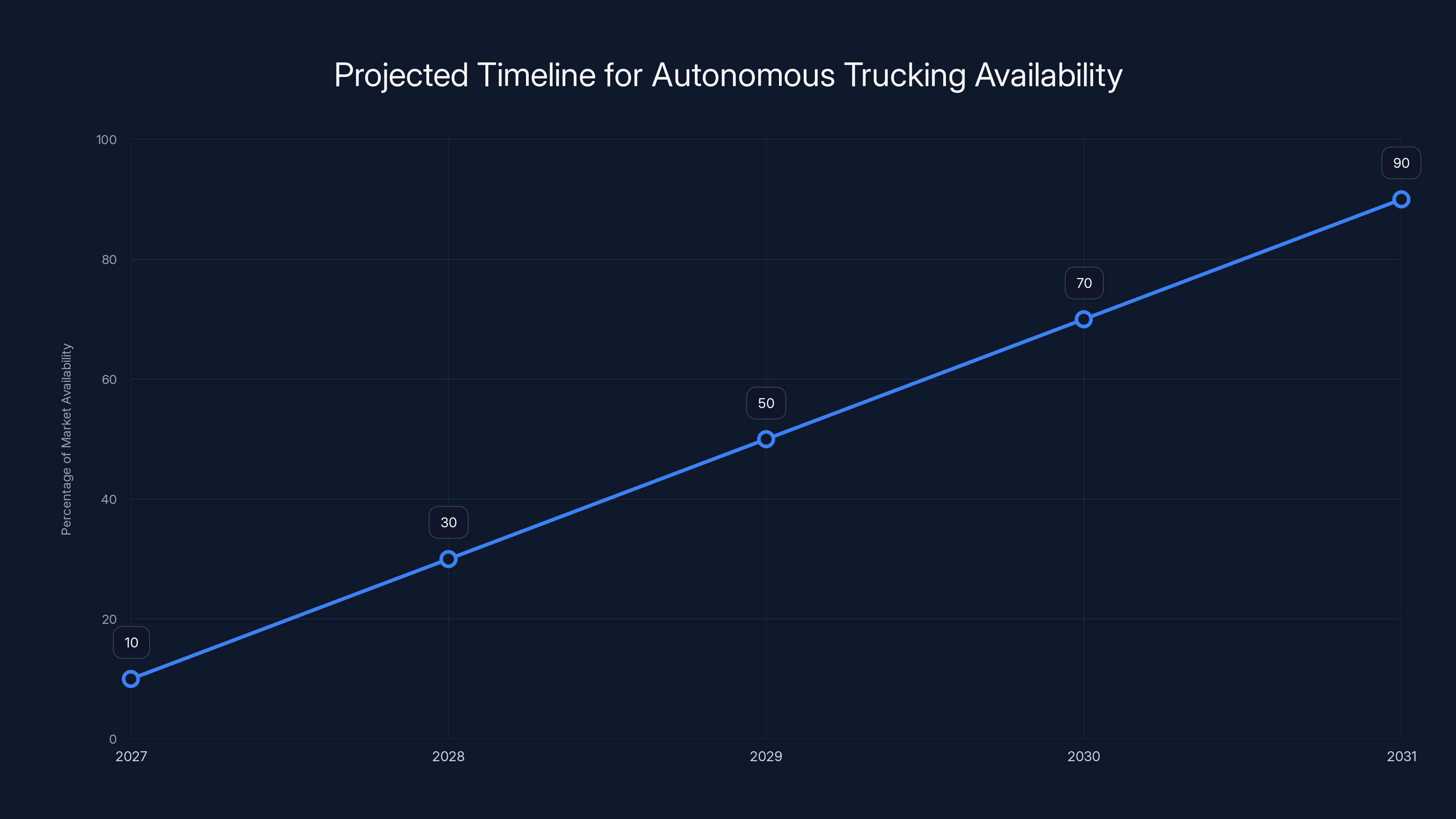

Autonomous trucks are expected to begin commercial deployment around 2028, with increasing availability through 2031. Estimated data based on industry projections.

Who Is Bosch? Why a German Automotive Supplier?

Bosch isn't a household name unless you care about car parts. But if you own a car, Bosch made something in it. Fuel injectors. Brake systems. Sensors. Electrical components. The company supplies roughly one-third of all vehicles globally with some component they manufacture.

That scale matters here.

When you're building modular autonomous systems for trucks, you need suppliers who understand vehicle integration at scale. Bosch doesn't just make parts. They make parts that integrate into production lines. They have relationships with every major truck manufacturer. They understand certifications, safety requirements, and the regulatory landscape.

Bosch also has existing autonomous driving ambitions. The company has been developing autonomous driving technology for years, including sensors, actuators, and software platforms. They've invested heavily in the infrastructure layer of autonomous vehicles—the components that other companies need but few want to build themselves.

But Bosch also knows their limits. Building complete autonomous vehicles isn't their strength. Software integration, AI, decision-making algorithms—these require different expertise. Kodiak has built these capabilities. They've already deployed working systems.

So the partnership makes sense: Kodiak brings the complete autonomous stack (sensors, computers, algorithms, orchestration). Bosch brings manufacturing, supply chain, vehicle integration, and distribution.

Paul Thomas, president of Bosch Mobility Americas, framed this as an opportunity to deepen their understanding of autonomous systems while expanding their market offerings. Translation: Bosch sees autonomous trucking as a real market and wants to be in it before competitors lock up supply relationships.

The Hardware Strategy: Modularity and Redundancy

When Kodiak describes its approach, the word that keeps appearing is "redundancy." Redundant braking. Redundant steering. Redundant sensors. Redundant computers.

This isn't overcomplicated engineering. It's safety-critical system design.

With autonomous vehicles, you can't have a single point of failure. If one sensor fails, the system needs alternative inputs. If one computer crashes, another takes over. If hydraulic brakes fail, electric brakes engage. This is the difference between a car you might have to walk home in and a truck you can't safely operate.

Kodiak has already implemented these redundancies in their existing systems. The Bosch partnership extends this by standardizing which components provide this redundancy.

Bosch will supply several categories of hardware:

Sensor systems include cameras, radar, lidar, and ultrasonic sensors. These are proven Bosch components used in conventional vehicles. Bosch knows how to manufacture them at scale, how to integrate them into vehicles, and how to ensure reliability. Rather than Kodiak custom-sourcing multiple sensor types, Bosch provides a curated selection optimized for autonomous trucking.

Vehicle actuation components include steering systems, brake systems, and throttle control hardware. These are complex electromechanical systems. A steering actuator that fails at 65 mph on a four-lane highway isn't acceptable. Bosch has decades of experience engineering these for automotive applications. They understand what it takes to certify these systems for safety.

Computing and software infrastructure includes the hardware platforms where Kodiak's autonomous driving software will run. Rather than Kodiak worrying about compute performance, heat dissipation, power management, Bosch provides integrated hardware that works reliably in the harsh environment of a truck (extreme temperatures, vibration, dust).

The modular approach means these components can integrate in two different ways:

Factory integration: When a truck rolls off the production line, autonomous hardware is installed. This requires truck manufacturers to modify their production processes. Volvo, PACCAR, Daimler—major truck manufacturers will eventually want to offer autonomous options. Factory integration makes the most sense long-term.

Aftermarket retrofitting: Existing trucks can be retrofitted with autonomous hardware by third-party upfitters like Roush. This is faster to deploy and doesn't require convincing truck manufacturers to change production. For companies with existing fleets, retrofitting is more economical than replacing trucks.

Don Burnette, Kodiak's founder and CEO, emphasized that the Bosch partnership enables "modularity, serviceability, and system-level integration." This is the language of real manufacturing. Not theoretical. Not prototype-speak. Manufacturing.

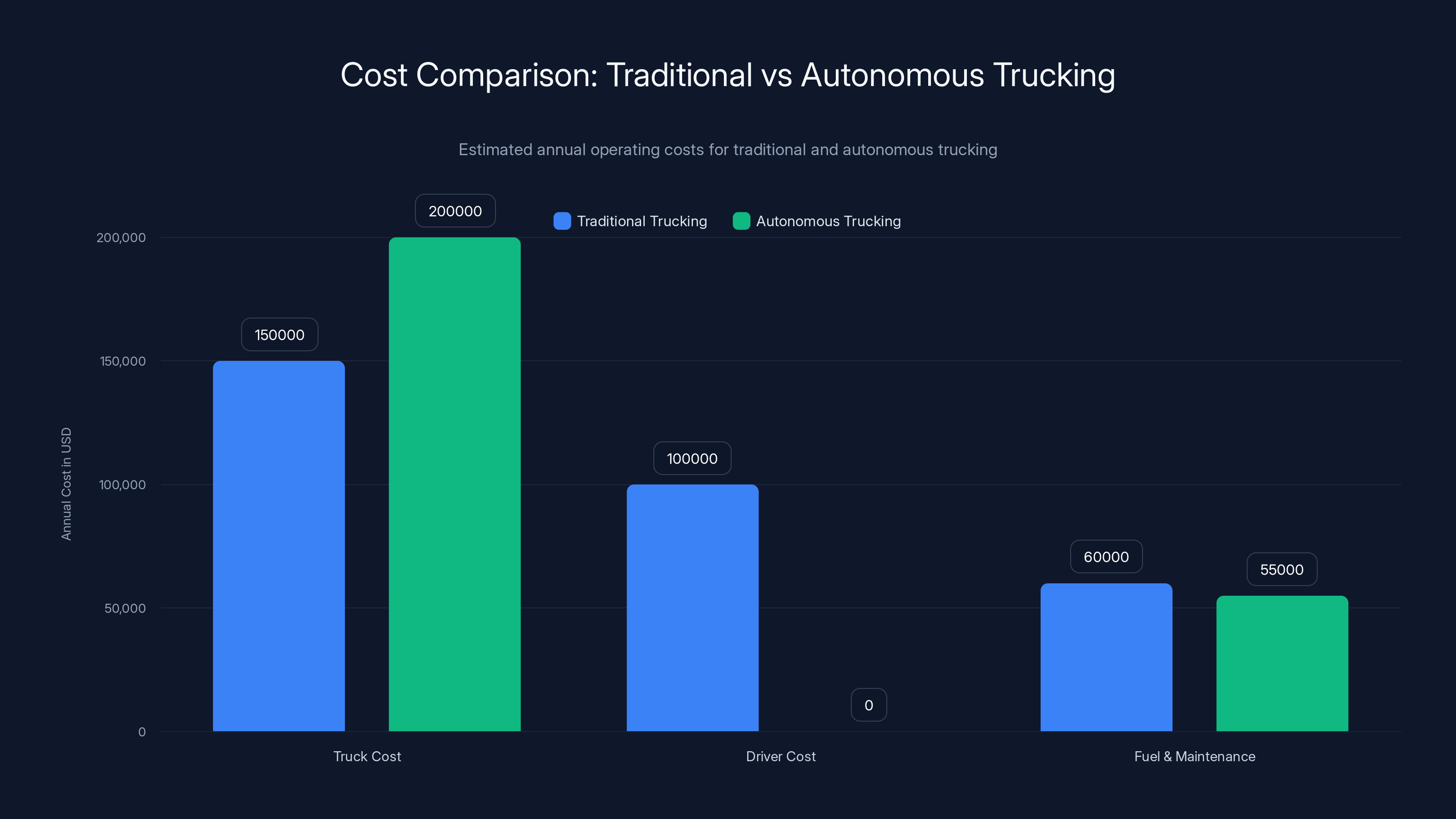

Autonomous trucking significantly reduces annual operating costs by eliminating driver expenses and optimizing fuel efficiency, despite higher initial truck costs.

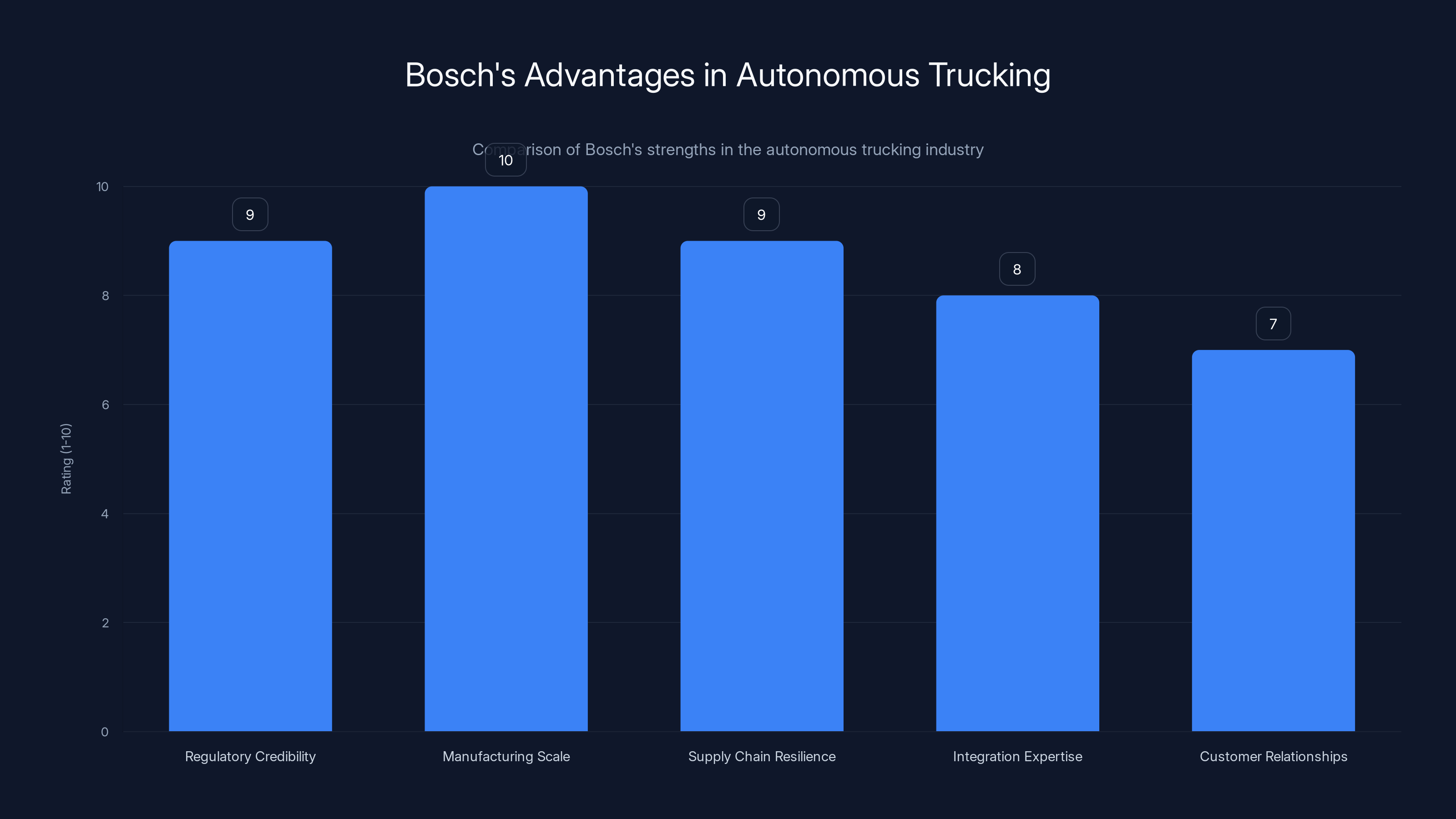

Why Bosch's Involvement Changes the Game

Let's be direct: Bosch's involvement validates autonomous trucking in ways that pure-play startups cannot.

When a startup announces autonomous vehicle progress, investors and customers watch carefully. When a $75 billion automotive supplier commits manufacturing and supply chain resources, it signals market maturity.

Here are the specific advantages Bosch brings:

Regulatory credibility: Bosch has relationships with regulatory agencies globally. They've certified thousands of automotive systems. They know how to navigate the regulatory landscape—not just for the US Department of Transportation, but for European, Chinese, and other regulatory bodies. When the time comes to certify autonomous trucking systems, Bosch's existing relationships accelerate the process.

Manufacturing scale: Bosch operates over 250 manufacturing locations worldwide. They can produce millions of components annually. For autonomous trucking to reach scale, components need to be available in volume, on time, at predictable costs. Only companies with Bosch's manufacturing footprint can guarantee this.

Supply chain resilience: When you partner with Bosch, you inherit their supply chain. They've spent decades building relationships with raw material suppliers, component manufacturers, and logistics providers. This matters more than it sounds. Supply chain disruptions regularly delay vehicle launches. Bosch's scale provides insurance against localized disruptions.

Integration expertise: Bosch has integrated complex systems into millions of vehicles. They understand thermal management, electromagnetic compatibility, vibration isolation, and dozens of other engineering challenges that emerge when you squeeze autonomous hardware into an existing vehicle. This expertise compresses development timelines significantly.

Customer relationships: Bosch already supplies components to truck manufacturers. They have existing relationships, existing communication channels, and existing trust. When Bosch proposes autonomous hardware integration, truck manufacturers listen differently than when a startup makes the same proposal.

But there's a subtler benefit: Bosch's involvement signals that the autonomous trucking market is real enough for a major automotive supplier to allocate significant resources. Bosch doesn't make speculative bets. If they're committing manufacturing capacity and supply chain resources, they're betting this market will materialize.

The Economics of Autonomous Trucking: Why Now?

Autonomous trucking makes sense economically right now. It didn't five years ago. Here's why the math works:

Driver costs are rising: Long-haul trucking is a shortage occupation. Drivers are aging out of the workforce faster than new drivers enter. Wages have risen approximately 30-40% over the past five years as companies compete for limited drivers. Health insurance, benefits, workers' compensation—the fully-loaded cost of a driver is now

Fuel costs are volatile but high: Diesel prices fluctuate, but long-term trends point upward. Emissions regulations require expensive engine technology. Autonomous systems optimize route planning and driving efficiency, reducing fuel costs by approximately 10-15%.

Vehicle utilization demands improvement: A human driver can legally drive only a certain number of hours per day. A truck needs rest stops, meals, overnight accommodation. An autonomous truck can optimize routes to maximize driving hours while respecting safety requirements. This means more freight moved per truck per year.

Liability dynamics are shifting: When you deploy autonomous systems, you shift some liability from the driver to the technology provider. This is complex legally, but it creates incentives to focus on reliability and safety. Once liability frameworks stabilize, this becomes less of a concern.

Let's do some rough math on economics:

A typical long-haul trucking operation might look like this:

- Truck cost: $150,000

- Annual driver cost: $100,000

- Fuel and maintenance (annual): $60,000

- Total annual operating cost: ~$160,000 (excluding truck depreciation)

With autonomous operation:

- Truck cost: 50,000 (autonomous hardware) = $200,000

- Annual driver cost: $0

- Fuel and maintenance (annual): $55,000 (improved efficiency)

- Total annual operating cost: ~$55,000

Over 10 years of operation, the autonomous truck saves approximately $1.05 million compared to a traditional truck (accounting for hardware depreciation and annual maintenance).

These numbers are rough, but they illustrate the fundamental economics: autonomous trucking reaches profitability faster than most people expect.

This is why major trucking companies and fleet operators are suddenly interested in autonomous systems. It's not because they're tech enthusiasts. It's because the math works.

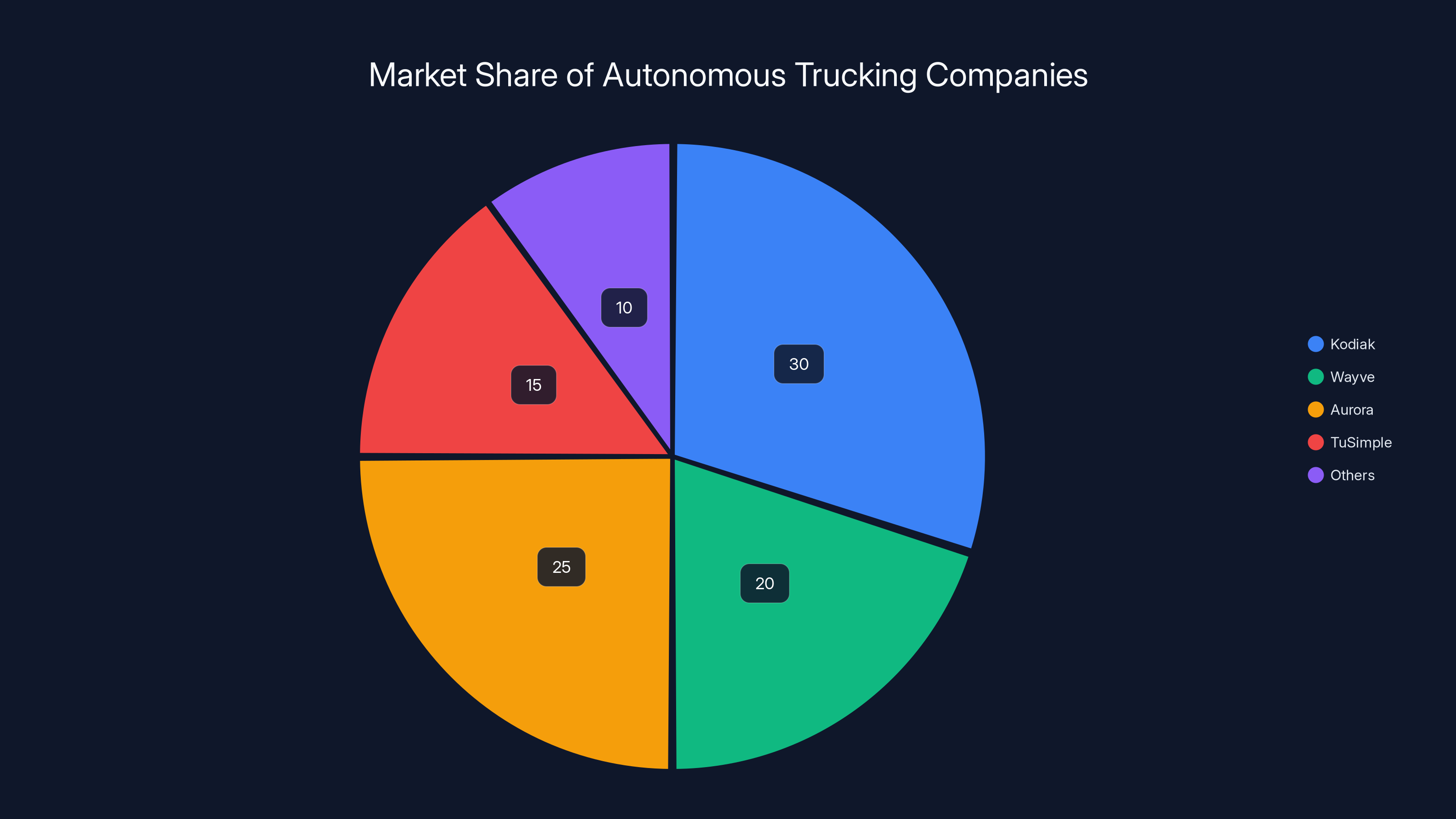

Kodiak, with Bosch's backing, is estimated to hold a significant market share advantage in the autonomous trucking industry. Estimated data.

Current Operations: What Kodiak Is Doing Today

Kodiak isn't a company talking about future possibilities. They're operating autonomous trucks today.

In January 2025, Kodiak deployed its first autonomous trucks to Atlas Energy Solutions, a company that extracts and processes minerals from oil and gas fields. Atlas operates in the Permian Basin of West Texas and eastern New Mexico—a harsh environment with long distances between facilities, consistent routes, and significant logistical demands.

Why this use case? Several factors aligned:

Predictable routes: Trucks move minerals from extraction sites to processing facilities following known routes. This reduces complexity compared to pickup-and-delivery scenarios with many stops.

Economic pressure: Oil and gas operations demand efficiency. Every hour a truck sits idle costs money. Autonomous trucks optimize loading and scheduling, improving utilization.

Regulatory environment: Texas and New Mexico have relatively permissive autonomous vehicle regulations, especially for private land operations. Kodiak could focus on technology rather than regulatory battles.

Safety criticality: Operating in remote areas with established infrastructure meant fewer edge cases and external variables. This is where autonomous systems perform most reliably.

Under the initial agreement with Atlas, Kodiak delivered approximately eight autonomous trucks as part of a 100-truck order. This isn't a pilot anymore. This is a multi-year commercial deployment.

What makes these trucks autonomous?

Hardware stack: Kodiak integrated multiple redundant sensor systems (cameras, radar, lidar), computing platforms running proprietary autonomous software, and actuators for steering, braking, and throttle. Roush Industries handled the physical integration.

Software stack: This is where Kodiak differentiates. Their proprietary software handles perception (understanding the environment), prediction (anticipating what other vehicles will do), planning (deciding what route to take), and control (actually steering and accelerating the truck). This is the AI layer that standard automotive suppliers typically can't provide.

Operational layer: Kodiak doesn't just deploy trucks and walk away. They maintain a 24/7 operations center where human operators can intervene if needed. They monitor every autonomous truck in real-time. They collect data from every trip to improve the autonomous system.

The result? Trucks running fully autonomous routes with no safety driver. This is the threshold of viability. You're not testing anymore. You're delivering freight.

The Bosch Partnership: What Happens Next?

The announcement at CES 2026 provided limited detail about timelines. Neither company committed to specific launch dates. But we can infer what happens based on how these partnerships typically evolve:

Phase 1 (Current through Q3 2026): Design and specification

Engineer teams from Kodiak and Bosch are defining exactly which Bosch components integrate with Kodiak's autonomous system. This isn't trivial. Sensor characteristics must match Kodiak's software algorithms. Computing platforms must have sufficient performance. Actuators must respond with precise timing.

Phase 2 (Mid-2026 through Q4 2026): Integration and testing

Engineer teams build integrated systems and test them in controlled environments. They validate that Bosch hardware works correctly with Kodiak software. They identify incompatibilities and resolve them. By end of 2026, they'll likely have functioning prototypes.

Phase 3 (Q1 2027 through Q4 2027): Field testing and validation

Real trucks running real routes. Not just Atlas Energy's routes anymore. Expanding to other customer environments, other geographic regions, other weather conditions. This phase is about proving the systems work in diverse conditions.

Phase 4 (Q1 2028 onward): Production and deployment

Assuming field testing validates the systems, Bosch begins manufacturing autonomous hardware components at scale. Kodiak begins deploying trucks more aggressively. Truck manufacturers begin integrating the systems into production vehicles.

This timeline is speculative, but it's realistic. Enterprise software deployments move faster. Automotive hardware deployments move slower. 18-36 months from announcement to production availability is reasonable for this type of partnership.

The partnership agreement likely includes exclusivity provisions—probably worldwide exclusive for autonomous trucking, with carve-outs for Bosch's own autonomous vehicle programs. This means Kodiak becomes Bosch's primary partner for autonomous trucking systems. Competitors won't have access to Bosch's truck-specific hardware.

This creates asymmetry in the market. Kodiak gets Bosch's hardware advantage. Other autonomous trucking companies must either build their own hardware (expensive) or partner with other suppliers (more limited options).

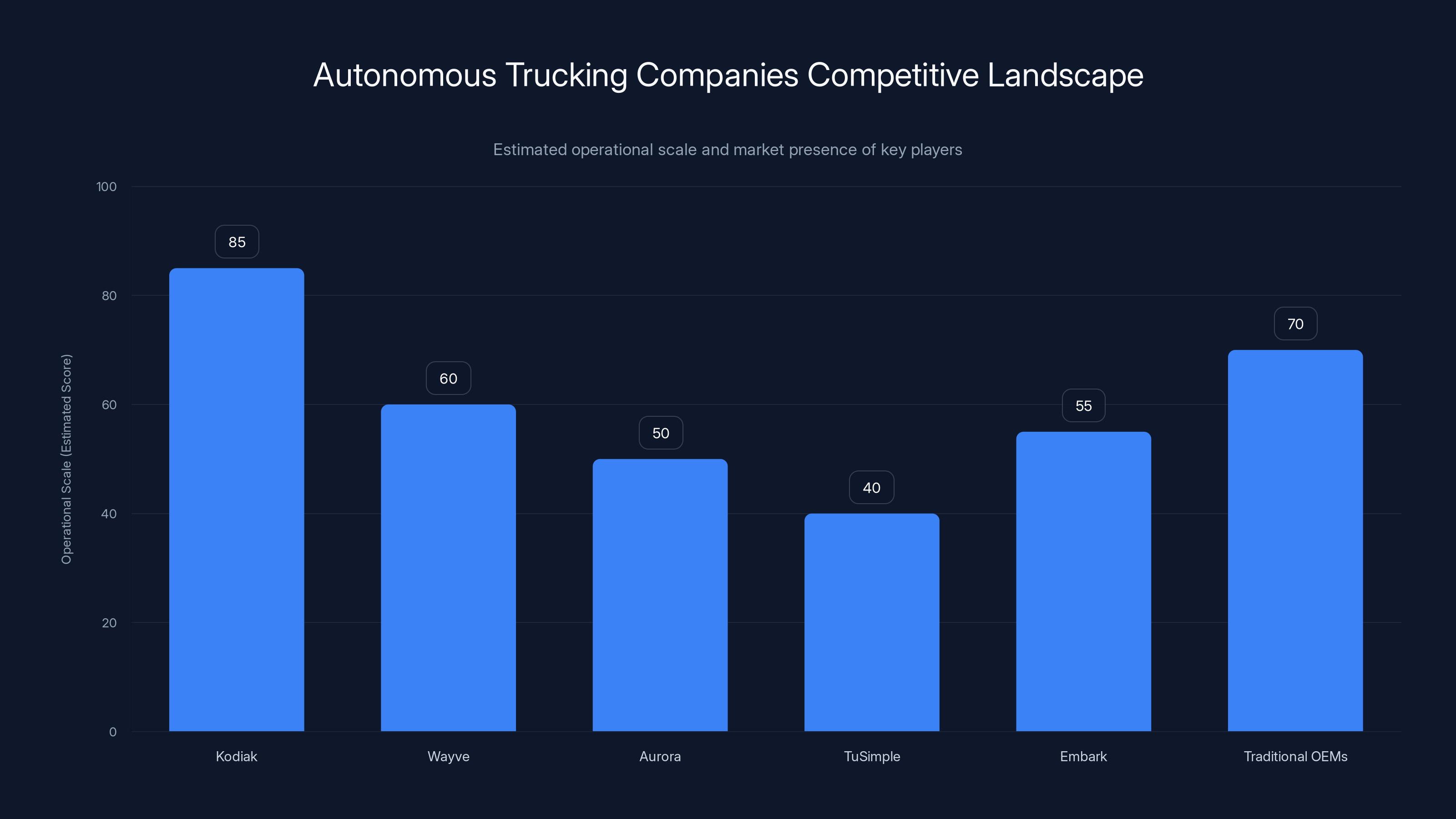

Kodiak leads in operational scale among autonomous trucking companies, followed by traditional OEMs and Wayve. Estimated data based on market insights.

Market Implications: What This Means for the Trucking Industry

The Kodiak-Bosch partnership signals that autonomous trucking is transitioning from startup phase to industrialization phase. This has several implications for the broader market:

Competitive pressure on other autonomous trucking companies

Kodiak isn't the only autonomous trucking company. Wayve operates in the UK and is expanding. Aurora is testing systems. Tu Simple was operating but faced challenges. Plus, there are well-funded stealth startups nobody has heard of yet.

None of these companies has Bosch backing. Access to Bosch's manufacturing capacity and supply chain gives Kodiak a significant scaling advantage. Competitors either need to secure their own manufacturing partnerships or differentiate in software and AI.

Truck manufacturers will eventually make autonomous vehicles standard offerings

Volvo, PACCAR (owns Peterbilt and Kenworth), and Daimler (owns Freightliner) will eventually offer autonomous options as standard configurations. This might not happen until 2029-2031, but it will happen. When it does, ordering an autonomous-capable truck will be as common as ordering power windows.

Fleet operators face a binary decision

Either upgrade to autonomous trucks, or stay stuck with rising driver costs. This timeline is longer than it seems—truck replacement cycles typically span 5-7 years, so even companies deploying autonomous trucks today won't have fully autonomous fleets until the early 2030s. But the direction is clear.

Regional variations in deployment

Autonomous trucking will deploy fastest in regions with:

- High driver costs (expensive labor markets)

- Regulatory environment that permits autonomous operations

- Long-haul routes (where economics favor automation)

- Mature supply chain infrastructure

The Midwest and Great Plains are likely early adopters. Dense urban areas will lag (more complex driving scenarios). Rural mountain regions will be mixed (good for autonomous operation, but lower freight volumes).

Insurance and liability frameworks will solidify

Today, liability for autonomous vehicle accidents is murky. Insurance companies aren't sure how to price autonomous truck coverage. But as companies like Kodiak operate more trucks and accumulate more safety data, insurance will become more predictable. This will unlock fleet operator adoption at scale.

Technical Deep Dive: Redundancy and Safety Systems

Let's get into the technical details of why redundancy matters so much in autonomous trucking.

When you're piloting a car, your brain constantly performs sensor fusion. Your eyes see a red light. Your ears hear a siren. Your proprioception tells you if the car is tilting. Your brain integrates all this information to make decisions.

Autonomous systems must do the same, but with pure engineering. They can't have human intuition as backup.

Sensor redundancy is the foundation. Kodiak trucks use:

- Multiple cameras providing overlapping fields of view. If one camera fails, others continue providing visual information.

- Radar that provides range and velocity information independent of lighting conditions. Radar works in fog, rain, and darkness when cameras struggle.

- Lidar that creates a 3D map of the environment through laser pulses. Lidar is immune to lighting conditions and provides depth information cameras cannot.

- Ultrasonic sensors for close-range detection around the truck.

These sensors provide redundancy not just in quantity, but in principle. If one sensor type fails, others provide independent information. The autonomous system votes on what it observes. If cameras see an obstacle but radar doesn't confirm it, the system waits for resolution.

Computing redundancy ensures the system can still function if one computer fails. Kodiak likely runs the same software stack on multiple independent computing platforms. If primary compute fails, backup compute takes over within milliseconds. This is standard practice in safety-critical systems (aircraft autopilot, industrial control systems) but uncommon in commercial vehicles.

Actuation redundancy is critical. The autonomous system must be able to:

- Brake using independent systems (air brakes and electric brakes on heavy trucks)

- Steer using independent actuators

- Control throttle independently

If one braking system fails, the other engages. If steering fails one direction, the system compensates. This requires hardware that's more complex than a traditional truck but is manageable with proper engineering.

Software voting takes all this sensor and compute redundancy and makes it useful. The software doesn't just trust one sensor or one computer. It:

- Collects data from all sensors simultaneously

- Compares observations for consistency

- Weights each sensor's input based on confidence

- Makes decisions based on consensus

- Monitors for sensor/compute failures

If multiple sensors disagree, the system triggers a safe state (typically reducing speed and moving to shoulder).

This architecture is why Kodiak emphasizes redundancy so heavily in their messaging. It's not complexity for its own sake. It's the difference between a vehicle you can trust with millions of miles and one that occasionally surprises you.

Bosch scores highly across key areas critical for autonomous trucking, particularly in manufacturing scale and regulatory credibility. Estimated data.

Competitive Landscape: Who Else Is Building Autonomous Trucks?

Kodiak isn't operating in a vacuum, even if they're ahead of the pack.

Wayve is the UK-based autonomous vehicle company backed by Soft Bank and others. They've taken a different approach than Kodiak—focusing on generalist autonomous systems rather than trucking-specific. They've tested in the UK, Europe, and recently began US testing. They're well-funded but haven't achieved the operational scale Kodiak has. Wayve likely needs similar hardware partnerships to scale.

Aurora took a hardware-agnostic approach, focusing on software that works with existing vehicle platforms. They've operated trucks with PACCAR and others. But Aurora has been relatively quiet recently, suggesting challenges in achieving operational scale or economic viability.

Tu Simple was well-funded and was testing autonomous trucks but faced significant challenges and restructuring. Recent reports suggest the company is struggling with commercialization. They're still operating but aren't currently the threat they were perceived as a few years ago.

Embark is another autonomous trucking company, smaller than Kodiak but still operational. They focus on similar use cases (hub-to-hub, predictable routes) but haven't announced significant partnerships.

Traditional OEMs (Volvo, PACCAR, Daimler) are investing in autonomous driving but moving slowly. They're cautious about cannibilizing existing sales and prefer to move at a pace their entire supply chain can support. This creates an opportunity window for pure-play autonomous trucking companies.

Where does Kodiak stand relative to competitors?

Advantages:

- Largest operational fleet (8+ trucks in daily operation)

- Commercial customer (Atlas Energy) generating real revenue

- Public company (SPAC merger gives capital for scaling)

- Partnership with major automotive supplier (Bosch)

- Focused strategy (long-haul trucking, not trying to solve general autonomy)

Challenges:

- Limited geographic diversification (primarily one region)

- Small total fleet (still early stage despite being ahead of peers)

- Unproven economics at scale (current operation is small)

- Regulatory uncertainty (self-driving rules still evolving)

Overall, Kodiak is in the strongest position among pure-play autonomous trucking companies. The Bosch partnership solidifies this advantage.

Regulatory Environment: The Legal Landscape for Autonomous Trucking

Autonomous trucks can't just roll across the country without regulatory approval. The regulatory landscape is actually more favorable than most people realize, but it's also fragmented.

Federal level (United States):

The National Highway Traffic Safety Administration (NHTSA) oversees vehicle safety. They've issued guidance on autonomous vehicles but haven't finalized comprehensive rules specifically for autonomous trucks. This actually works in Kodiak's favor—it means they can operate under existing rules without needing new federal approval.

The Department of Transportation has announced plans to create rules for autonomous vehicles, but this process moves slowly. Most experts expect final rules in 2026-2027 timeframe.

State level:

Most states allow autonomous vehicle testing with proper permits. California is famous for autonomous vehicle permits but Texas and others have similar frameworks. Kodiak's initial operations in Texas took advantage of permissive state regulations.

Safety driver requirements:

Different states have different requirements. Some require a safety driver in the vehicle. Others allow fully autonomous operation with remote monitoring. Kodiak's current operations use remote monitoring rather than onboard safety drivers, reducing operational costs significantly.

Insurance:

This is where things get complicated. Insurance companies aren't sure how to underwrite autonomous vehicles. They don't have sufficient claims data. Standard insurance policies may not cover autonomous operation. This is gradually changing as data accumulates.

Liability frameworks:

If an autonomous truck causes an accident, who's liable? The truck manufacturer? The software company? The fleet operator? The answer depends on where the accident occurred and what caused it. These frameworks are still being established. As they clarify, it will reduce liability uncertainty for fleet operators considering autonomous adoption.

Platooning regulations:

One technology Kodiak hasn't focused on but others are exploring is truck platooning (multiple trucks driving very close together, with one human driver controlling the group). This has different regulatory implications than full autonomy and might provide near-term benefits (aerodynamic efficiency, reduced driver workload).

Overall, the regulatory environment is moving toward supporting autonomous trucking, but at a frustratingly slow pace. This actually benefits companies like Kodiak that are already operating—they'll be grandfathered into existing frameworks.

The Human Element: Driver Job Displacement and Retraining

Let's address the elephant in the room: autonomous trucking will displace truck drivers.

There are approximately 3.5 million commercial truck drivers in the United States. They collectively earn roughly $45-75K annually depending on region and experience. This is a substantial workforce and livelihood.

When will displacement happen?

Timeline reality check: Autonomous trucking will NOT replace all truck drivers overnight. It won't even replace most truck drivers in the next 10 years. Why?

- Current technology works best on long-haul highway routes. Short-haul and last-mile delivery (majority of trucking) remain challenging.

- Fleet replacement cycles take 5-7 years. Even as autonomous trucks become available, adoption will be gradual.

- Regulatory uncertainty means some jurisdictions will restrict autonomous operations longer.

- Economic transition takes time. Companies optimize gradually, not all at once.

Most realistic estimates suggest that autonomous long-haul trucking becomes standard by mid-2030s, creating gradual displacement of drivers over a 10-15 year period rather than sudden upheaval.

What happens to displaced drivers?

Best case scenario: Retraining programs help drivers transition to other roles (truck maintenance, remote monitoring of autonomous systems, local/short-haul delivery where autonomy is harder). Aging out of the workforce naturally reduces workforce size without sudden layoffs.

Reality: Some drivers will transition. Some will be displaced. Policy responses (retraining programs, displaced worker benefits) are inadequate in most states.

Kodiak's position:

Kodiak hasn't publicly addressed driver displacement (not surprising—it's bad PR). But long-term, the company has incentives to support transition programs. Negative public sentiment about autonomous trucks displacing drivers could invite regulatory backlash or public pressure that slows deployment.

This is a legitimate social issue that deserves attention beyond the scope of this article. The point relevant here: autonomous trucking will displace some workers eventually, but not immediately, and the timeline is slow enough for policy responses to theoretically be developed.

Financial Implications: Stock, Funding, and Investment Thesis

Let's talk money. Kodiak going public via SPAC in September 2025 valued the company at approximately $1.2-1.5 billion (estimates vary). This gives us a sense of investor confidence in the company and the market.

What investors are betting on:

-

Market size: The trucking industry is $800+ billion annually in the US alone. Even capturing a small percentage is massive opportunity.

-

Unit economics: Autonomous trucks have strong unit economics. You save $80-100K in driver costs annually per truck. With 8+ million trucks on US roads, the addressable market is huge.

-

Regulatory inevitability: Most investors believe autonomous trucks will eventually be approved for widespread operation. It's just a matter of when, not if.

-

Strategic partnerships: The Bosch partnership de-risks the scaling phase. Kodiak doesn't have to build manufacturing capacity or figure out supply chains alone.

What could go wrong:

-

Regulatory rejection: If a major accident blamed on autonomous systems triggers regulatory backlash, deployment could be delayed years.

-

Economic slowdown: If a recession reduces trucking demand, the business case for autonomous trucks weakens (you need utilization to achieve ROI).

-

Technology disappointment: If autonomous systems underperform in field conditions or safety issues emerge, confidence collapses.

-

Competition: Traditional OEMs (Volvo, Daimler) deploying their own autonomous systems could commoditize the market faster than expected, pressuring margins.

Stock price dynamics:

Kodiak's stock price will likely be volatile. Major catalysts:

- New customer announcements (each successful contract is positive)

- Regulatory approvals (each new jurisdiction opened is positive)

- Accident or incident (could be very negative)

- Bosch partnership progress updates (keep stock moving)

- Competitive announcements (if competitors advance faster, could be negative)

Long-term, if autonomous trucking materializes as expected, Kodiak could be worth multiples of current valuation. If it doesn't materialize, stock could go to near zero. It's high risk, high reward.

Future Outlook: What Comes After This Partnership?

Where does autonomous trucking go after the Bosch partnership launches?

Phase 1 (2026-2028): Consolidation and standardization

Once Kodiak and Bosch's hardware platform is available, other competitors face a choice: build their own hardware or find other suppliers. Expect consolidation. Smaller autonomous trucking companies either get acquired, merge with competitors, or partner with other suppliers (if options exist). The market probably consolidates to 2-3 major players in autonomous trucking.

Phase 2 (2028-2031): OEM integration

Truck manufacturers begin offering autonomous options as standard configurations. This is when the market really expands. Rather than retrofitting existing trucks, autonomous systems come from the factory. Adoption accelerates dramatically.

Phase 3 (2031+): Market maturity

Autonomous trucking becomes standard for long-haul applications. The competitive battle shifts from "can we do this" to "who can do it most efficiently." Margins compress. Market becomes mature and predictable.

Parallel development:

Beyond long-haul highway trucking, other applications will develop:

- Autonomous short-haul delivery: More challenging but profitable. Expect progress 2-3 years after long-haul matures.

- Last-mile autonomous delivery: Hardest problem. Urban environments, pedestrians, complex scenarios. This will take longest to crack (probably late 2030s).

- Autonomous logistics hubs: Trucks connecting distribution centers without human drivers. This might be the first fully autonomous trucking application.

Technology developments to watch:

- V2X communication: Trucks communicating with each other and infrastructure. Could dramatically improve safety and efficiency.

- Advanced AI: Better perception, better prediction, better decision-making. Current AI is good enough for controlled scenarios. Future AI will handle edge cases better.

- Sensor fusion improvements: Lidar, radar, camera technology continues improving. Future sensors will be more reliable, cheaper, and smaller.

The Bosch partnership positions Kodiak to lead through this transition. But there's no guarantee they'll maintain leadership. Technology changes fast. Market dynamics shift. The company that's ahead today might be overtaken by a more innovative competitor or a large OEM that decides to prioritize autonomous trucks.

Broader Industry Impact: Beyond Kodiak

When Kodiak and Bosch succeed with autonomous trucking (and they likely will), it reverberates across multiple industries:

Logistics and supply chain

Autonomous trucks improve supply chain efficiency immediately. Routes optimize better. Trucks run more hours. Delivery times become more predictable. Companies that adapt quickly gain competitive advantage over those that don't. Expect consolidation in logistics—smaller players can't afford autonomous systems, so they'll be acquired or become obsolete.

Fuel and energy

Autonomous trucks improve fuel efficiency through better route planning and driving optimization. This reduces energy demand. Fuel companies face lower demand. But energy infrastructure companies benefit from the need to provide charging (if electrification accompanies automation).

Insurance

The insurance industry will transform. Autonomous trucks will eventually be safer than human drivers (fewer accidents). Insurance rates will drop. Insurance companies that rely on premium prices will face pressure. Insurance companies that adapt to autonomous vehicles thrive.

Trucking industry employment

As discussed, driver displacement will eventually happen. But other jobs emerge: remote monitoring of autonomous systems, maintenance of more complex vehicles, coordination of autonomous fleets. Net job losses likely, but not every driver is displaced.

Technology sector

Autonomous trucking validates several technology approaches: sensor fusion, real-time processing, distributed systems, remote monitoring. This creates demand for engineers and technologies across multiple domains. Companies providing tools for autonomous vehicles (simulation, testing, monitoring) will grow significantly.

Real estate and urban planning

Autonomous trucks could enable different logistics strategies. Consolidation centers could be farther from cities (cheaper land) since autonomous trucks don't need driver amenities. But remote operations require better infrastructure. Long-term urban planning implications are significant but not immediately obvious.

The broader point: successful autonomous trucking isn't just a transportation story. It's a systemic transformation affecting multiple industries and the broader economy.

Key Takeaways and Critical Insights

Let's synthesize what the Kodiak-Bosch partnership means:

1. Autonomous trucking is transitioning from startup phase to industrialization phase

When major automotive suppliers like Bosch commit resources, the technology moves from "interesting startup" to "real business." This signals that autonomous trucking has achieved sufficient maturity to attract serious capital and expertise.

2. Modularity and standardization are the path to scale

Kodiak can't scale by custom-building systems for each customer. The partnership enables modular, standardized hardware that can be mass-manufactured. This is the bridge between pilots and commercial scale.

3. Economics strongly favor autonomous trucking

The math works. Autonomous systems cost more upfront but save enough on driver costs to achieve strong ROI within 5-7 years. With driver costs rising and truck utilization demands increasing, autonomous trucking becomes increasingly economical over time.

4. Regulatory environment is becoming supportive, not restrictive

While there's legitimate concern about safety and job displacement, the regulatory trend is toward enabling autonomous trucks, not blocking them. States that embrace autonomous trucking gain economic advantage. Federal regulations, while slow to develop, are unlikely to prevent autonomous trucking entirely.

5. Competitive advantage is temporary but meaningful

Kodiak's partnership with Bosch gives them significant advantages: access to manufacturing, supply chain, integration expertise, customer relationships. But this advantage erodes over time. Competitors will find other suppliers. OEMs will build their own systems. Long-term, Kodiak must compete on software quality, customer service, and continuous innovation.

6. Deployment timelines are realistic but not imminent

Expect production-ready systems in late 2027 or early 2028. Widespread deployment across the industry by early 2030s. This is fast enough to justify investment in autonomous trucking companies, but slow enough that truck drivers have time to adapt or retire naturally.

7. Long-haul highway trucking is the obvious first application

This is the low-hanging fruit. Predictable routes, consistent conditions, strong economics. Other applications (short-haul, last-mile, urban delivery) will follow but take longer. Companies focused on easy applications first (like Kodiak) are making smart strategic choices.

FAQ

What exactly is autonomous trucking?

Autonomous trucking refers to trucks that can drive themselves on roads without human drivers. These trucks use combinations of sensors (cameras, radar, lidar), computing systems, and AI software to perceive their environment, make driving decisions, and control acceleration, braking, and steering. Kodiak's trucks represent true autonomy—no safety driver required, operating 24/7 on commercial routes.

How does the Kodiak-Bosch partnership work?

Bosch will supply hardware components (sensors, actuators, computing platforms) specifically designed for autonomous trucking. Kodiak provides the autonomous driving software and system integration. Together, they're building a complete, modular platform that can be integrated into trucks during manufacturing or retrofitted afterward. Kodiak retains exclusive access to Bosch's autonomous trucking-specific hardware.

When will autonomous trucks be available for commercial purchase?

Neither company has announced official timelines, but industry estimates suggest late 2027 or 2028 for production-ready systems. Early adopters could begin deploying systems in 2028, with broader availability expanding through 2029-2031. This is faster than most people expect but slower than optimistic startup claims.

Is autonomous trucking safe?

Current data suggests Kodiak's systems are safer than human drivers in controlled highway environments. They've operated thousands of driverless miles without serious incidents. However, autonomous systems still have edge cases and fail modes (extreme weather, unusual road conditions, unprecedented scenarios). Safety is improving continuously as data accumulates, but complete elimination of risk is impossible.

How much will autonomous trucks cost?

Estimates suggest autonomous hardware adds $40-60K to a truck's cost. This seems expensive, but when you calculate cost per mile of operation (including driver costs), autonomous trucks become economical. For fleet operators running high-utilization routes (like Atlas Energy does), ROI occurs within 5-7 years.

Will autonomous trucking eliminate truck driver jobs?

Eventually, yes. But the timeline is long—probably 10-15 years before significant displacement occurs. Most displacement will happen through natural workforce attrition (aging drivers retiring) rather than sudden mass layoffs. Short-haul and last-mile delivery will continue requiring human drivers for years longer than long-haul trucking. Policy responses (retraining programs, income support) are inadequate but could improve.

What about truck platooning—is that different from autonomous trucking?

Yes. Platooning is when multiple trucks drive very close together with reduced spacing, improving aerodynamic efficiency and potentially reducing driver workload. Platooning doesn't require full autonomy—a lead vehicle (human driver) controls a group of following vehicles. Kodiak is focused on full autonomy rather than platooning, but both technologies could eventually coexist or combine.

Who are Kodiak's competitors in autonomous trucking?

Wayve (UK-based, well-funded), Aurora (US-based, hardware-agnostic approach), Tu Simple (currently struggling), and others. But Kodiak has the most impressive operational deployment and the most strategic partnership. Competition is real but Kodiak currently leads.

What role will traditional truck manufacturers play?

Eventually significant. Volvo, PACCAR, and Daimler will offer autonomous options as standard configurations. They're moving slower than startups but they have manufacturing capacity, supply chain relationships, and customer relationships that pure-play autonomous trucking companies lack. Long-term, OEMs will dominate autonomous trucking like they dominate conventional trucking.

Should I invest in Kodiak AI stock?

That depends on your risk tolerance and investment thesis. Kodiak is betting on a large market (autonomous trucking) that's likely to materialize. The company has strong operational metrics (real trucks, real deployments) and strategic partnerships (Bosch). But execution risk remains high, competition is fierce, and regulatory uncertainty persists. If you believe autonomous trucking reaches scale by early 2030s, Kodiak is well-positioned to benefit. If you doubt the timeline or think competitors will win, avoid the stock.

Conclusion: What This Partnership Signals

When Kodiak announced its partnership with Bosch at CES 2026, most people missed the real significance. It wasn't about a new feature or capability. It was about a market transition.

Autonomous trucking is moving from the startup phase (where everything is custom-built and expensive) to the industrialization phase (where major suppliers commit manufacturing and scale). This transition is the single most important indicator that a technology is about to enter mainstream adoption.

We've seen this pattern before. When major manufacturers partnered with electric vehicle startups, EV adoption accelerated dramatically. When cloud infrastructure companies partnered with AI startups, AI adoption exploded. When automotive suppliers partnered with autonomous vehicle startups, deployment followed.

The Bosch partnership doesn't guarantee success. Kodiak could stumble. Competitors could leapfrog them. Regulatory changes could slow deployment. Safety incidents could trigger backlash.

But if things break roughly as expected, the partnership signals that autonomous long-haul trucking will be commercially available within 18-36 months and will begin widespread deployment by 2030.

This has implications:

- For fleet operators: You'll need to make decisions about autonomous adoption within the next 2-3 years. Early adopters gain economic advantage.

- For truck drivers: Your career trajectory is being rewritten. Plan accordingly.

- For technology investors: Autonomous trucking represents one of the largest addressable markets in automation today. The race to capture this market is heating up.

- For the logistics industry: Supply chains will transform. Companies that adapt to autonomous trucking thrive. Those that don't face disruption.

- For society: Autonomous trucking will eventually unlock substantial economic value (safer roads, more efficient logistics, lower costs) but creates real displacement challenges that policy needs to address.

The Bosch partnership isn't the end of the autonomous trucking story. It's the beginning of the chapters that actually matter.

The startup phase is over. The scaling phase is beginning. And now, the race truly is on.

Related Articles

- Rivian's Survival Plan Goes Way Beyond Cars [2025]

- Tesla Loses EV Crown to BYD: Market Shift Explained [2025]

- Trump Phone T1 Missed Another Release Date: What's Really Happening [2025]

- Sony Honda Afeela CES 2026 Press Conference: Complete Watch Guide [2025]

- NVIDIA CES 2026 Keynote: Live Stream Guide & What to Expect

- The 7 Top Space and Defense Tech Startups from Disrupt Startup Battlefield [2025]

![Kodiak and Bosch Partner to Scale Autonomous Truck Technology [2025]](https://tryrunable.com/blog/kodiak-and-bosch-partner-to-scale-autonomous-truck-technolog/image-1-1767609551633.jpg)