Introduction: The One-Hit Wonder Problem

Most game developers would kill for PUBG's legacy. Launched in 2017, Player Unknown's Battlegrounds became a cultural phenomenon, generating billions in revenue and cementing Krafton's place as a heavyweight in the gaming industry. But here's the problem that keeps executives awake at night: one massive hit doesn't equal sustainable success.

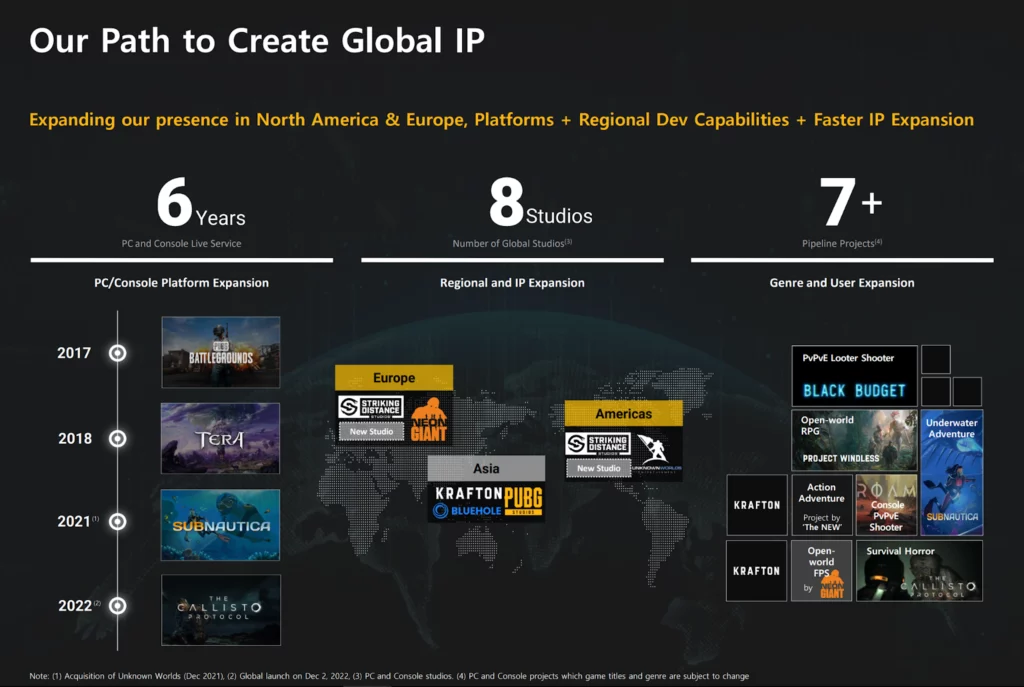

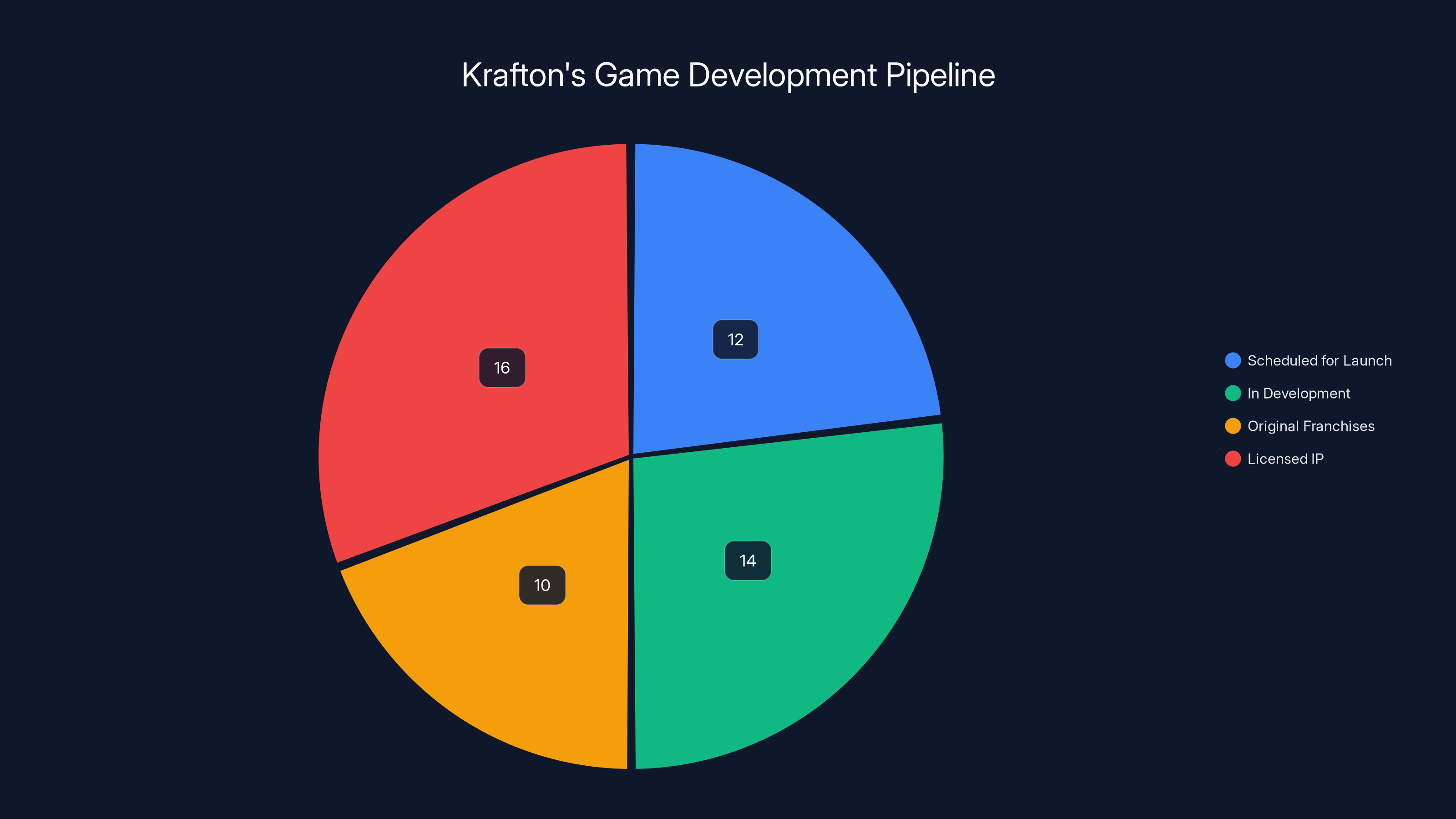

That's why Krafton is doing something increasingly rare in modern game development. Instead of milking PUBG indefinitely, the company is building an entirely new portfolio. They've got 26 games in active development right now. Twelve of those are scheduled to launch within the next two years. Some you've already heard of: Palworld Mobile, the indie phenomenon that inexplicably became a cultural moment. Subnautica 2, the underwater exploration game with a dedicated fanbase. A new original IP called No Law that hasn't gotten much press yet.

But here's what's actually interesting: Krafton isn't just throwing games at the wall to see what sticks. They're being deliberate about it. The company outlined a structured approach to franchise development, with "early validation and clear decision gates." Translation: they're testing ideas ruthlessly before committing massive budgets.

This matters because the gaming industry is in a weird spot. Live service games are increasingly unpopular with players. Development budgets for AAA titles have become genuinely insane. And finding the next PUBG, Fortnite, or Minecraft isn't something you plan for—it's something you stumble into and then capitalize on. Or at least, that's what everyone thought.

Krafton's strategy suggests a different approach: build a lot, learn fast, and scale what works. It's the startup playbook applied to a multi-billion-dollar gaming company. And if they pull it off, they'll have cracked one of the hardest problems in entertainment: repeatability. Can you find lightning in a bottle twice?

Let's dig into what Krafton is actually building, why the gaming industry desperately needs companies like this to succeed, and what it means for players that one of the world's biggest game publishers is fundamentally rethinking how to create franchise IP.

TL; DR

- The Scale: Krafton has 26 games in development, with 12 launching in the next two years, representing the most ambitious portfolio expansion in the company's history.

- The Strategy: The company is using "early validation and clear decision gates" to test concepts before committing major resources, reducing risk in an industry plagued by expensive failures.

- The Mix: Projects range from established IPs like Subnautica 2 and Palworld Mobile to original franchises like No Law, creating multiple paths to blockbuster success.

- PUBG Evolution: Rather than abandoning their flagship, Krafton is expanding PUBG's user-generated content ecosystem, positioning it as a platform rather than just a game.

- The AI Angle: Krafton is simultaneously investing in exploring AI applications in gaming, robotics, and physical AI, treating these as long-term strategic bets alongside their game development.

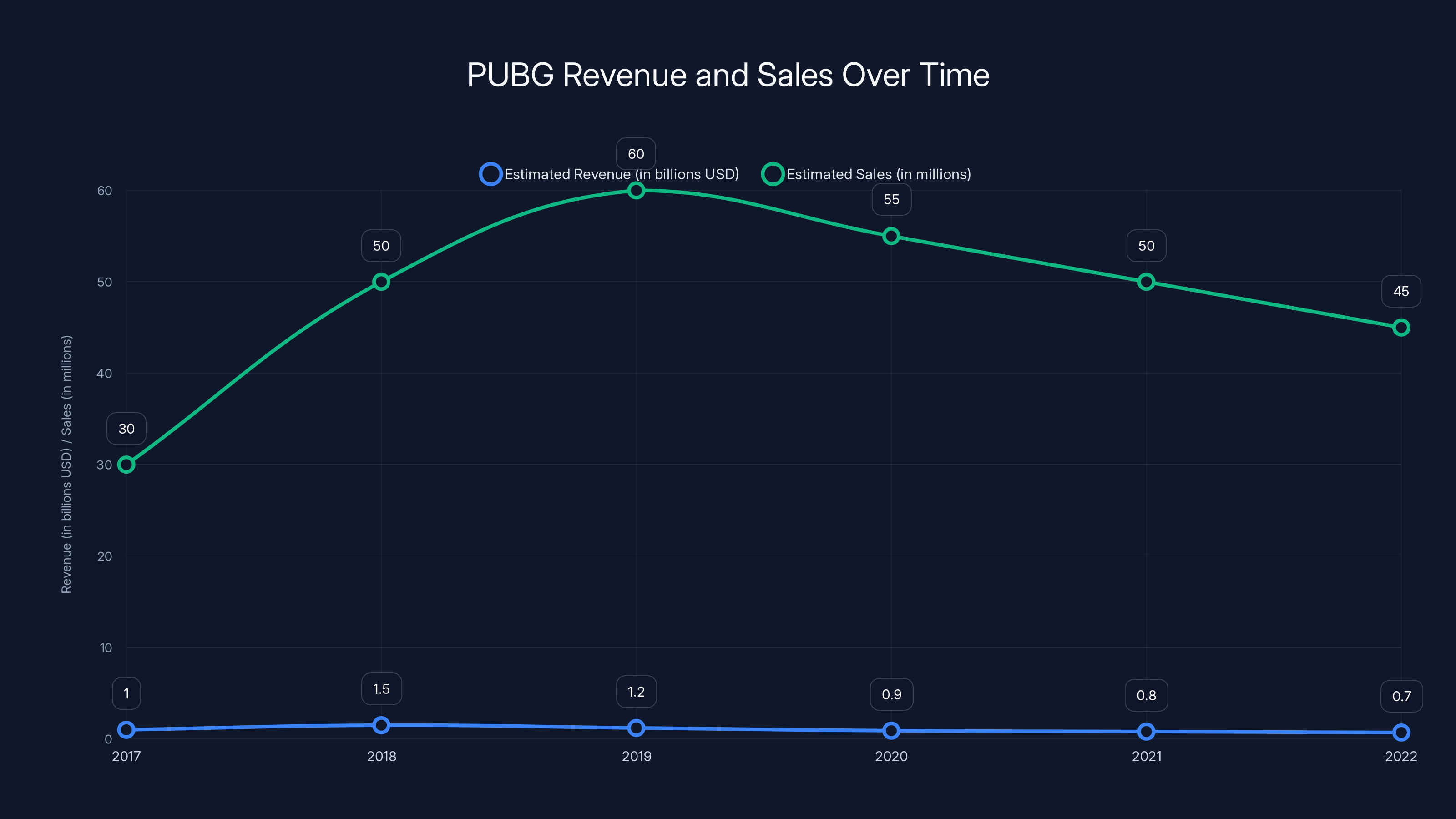

PUBG's initial success in 2017 with over 30 million copies sold and $1 billion in revenue was followed by a decline due to market saturation and competition. Estimated data shows a strategic pivot with free-to-play and platform expansion in 2022.

The PUBG Paradox: One Hit Isn't Enough

Let's be honest about what PUBG actually did for Krafton. When the game launched in early access on PC in March 2017, it didn't have fancy cinematics or a Hollywood marketing campaign. It had something rarer: it tapped into something players didn't know they wanted.

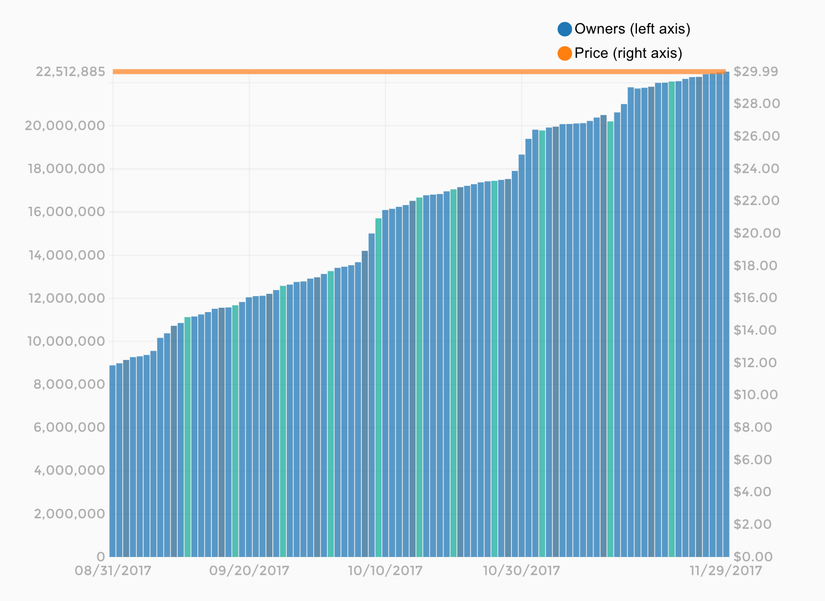

Battle royale wasn't invented by Player Unknown. The concept existed in mods, in other games, in the cultural consciousness. But PUBG brought it to the mainstream with just the right mix of tension, accessibility, and social gameplay. Within a year, the game had sold over 30 million copies and was generating an estimated $1 billion in quarterly revenue.

That's the kind of success that makes shareholders happy and executives confident. It's also the kind of success that creates serious strategic problems. When you've got one game generating the vast majority of your revenue and player attention, you're vulnerable. What happens when the playerbase gets bored? What happens when a competitor releases a better battle royale? What happens when trends shift and everyone moves on?

Krafton faced exactly this problem. PUBG started to decline in relevance around 2019-2020, partly because Fortnite was doing the same thing but with better polish and cultural cache, partly because the market became oversaturated with battle royale knockoffs. Meanwhile, Krafton had invested heavily in the game but hadn't developed a deep bench of franchises to fall back on.

The company's response to PUBG's plateau was instructive. Instead of abandoning the game, they pivoted. They made PUBG free-to-play in 2022. They expanded to console and mobile platforms. They licensed the IP to mobile developers for spinoffs. They kept the core game alive with seasonal content and balance updates. And importantly, they started thinking about PUBG not as a finite game but as a platform.

But platform games are only valuable if they have strong network effects and an active community. Steam charts show PUBG still has serious staying power—nearly 200,000 concurrent players at any given moment makes it consistently one of the top games on the platform. But that's maintenance mode success, not growth mode.

This context explains why Krafton is being so aggressive with its current portfolio expansion. They can't afford to put all their chips on PUBG forever. The company needs new franchises that can grow into the PUBG-sized phenomenon. That's the difference between being a publisher with one hit and being a real game company with multiple revenue streams.

Inside the 26-Game Portfolio: What's Actually Getting Built

Krafton's development pipeline breaks down into three distinct categories, and understanding the mix tells you a lot about their strategic thinking.

Category 1: Licensed and Acquired IP

The easiest games to make are the ones you don't have to invent from scratch. Krafton acquired Unknown Worlds Entertainment in 2021, which gave them ownership of the Subnautica franchise. That underwater survival game has a passionate, dedicated playerbase. It's not the scale of PUBG, but it's sustainable. A successful Subnautica 2 could mean tens of millions in revenue.

Palworld is a different kind of acquisition story. The game was developed by Pocket Pair, a small Japanese studio. Palworld launched in early access in January 2024 and became a phenomenon almost overnight. The game combines creature-collecting mechanics (very Pokemon-like) with survival gameplay. It sold over 25 million copies in its first few months and generated hundreds of millions in revenue. Now Krafton is building a mobile version, which could be even more lucrative than the PC original.

What's smart about these moves is that both games already have proof of concept. You're not betting on an unproven idea. You're scaling something players already love. The risk is execution—can the teams deliver quality sequels and spinoffs—but the market demand is already validated.

Category 2: Internal Original IP

Then there's the scary category: games Krafton is developing with no guaranteed audience. Projects like No Law fall into this bucket. Without much public information, we don't know exactly what No Law is, but it's being positioned as a major title in Krafton's portfolio.

Developing original IP is where the real money is if you hit. Original franchises have infinite licensing potential. You can make merchandise, adapt to other media, create sequels and spinoffs. But they're also where most game studios lose the most money.

Krafton's approach here seems to be structured around what they call "early validation and clear decision gates." That's corporate speak for "we're going to test this constantly and kill projects that aren't working." In practice, that probably means a lot of prototyping, extensive playtesting with external audiences, and hard decisions about which concepts actually resonate.

The gaming industry is littered with stories of studios that fell in love with an idea internally, spent millions developing it, and then released it to crickets. Krafton seems committed to avoiding that trap by validating ideas before they become full productions.

Category 3: PUBG Ecosystem Extensions

Here's where it gets interesting. Krafton isn't just maintaining PUBG; they're actively expanding it. The company is building out user-generated content capabilities that "leverage PUBG's core gunplay, mechanics, and physics engine."

This is crucial. The most successful games in the last decade—Roblox, Minecraft, even Fortnite to some extent—succeeded because they became platforms. They gave players tools to create and share their own content. Players then spent thousands of hours (and real dollars) engaging with player-created experiences.

Krafton is essentially trying to turn PUBG into a platform like that. If successful, this approach could extend PUBG's lifecycle by years while creating entirely new revenue streams. Player-created battle royale variants, training modes, creative challenges—all of these become possible.

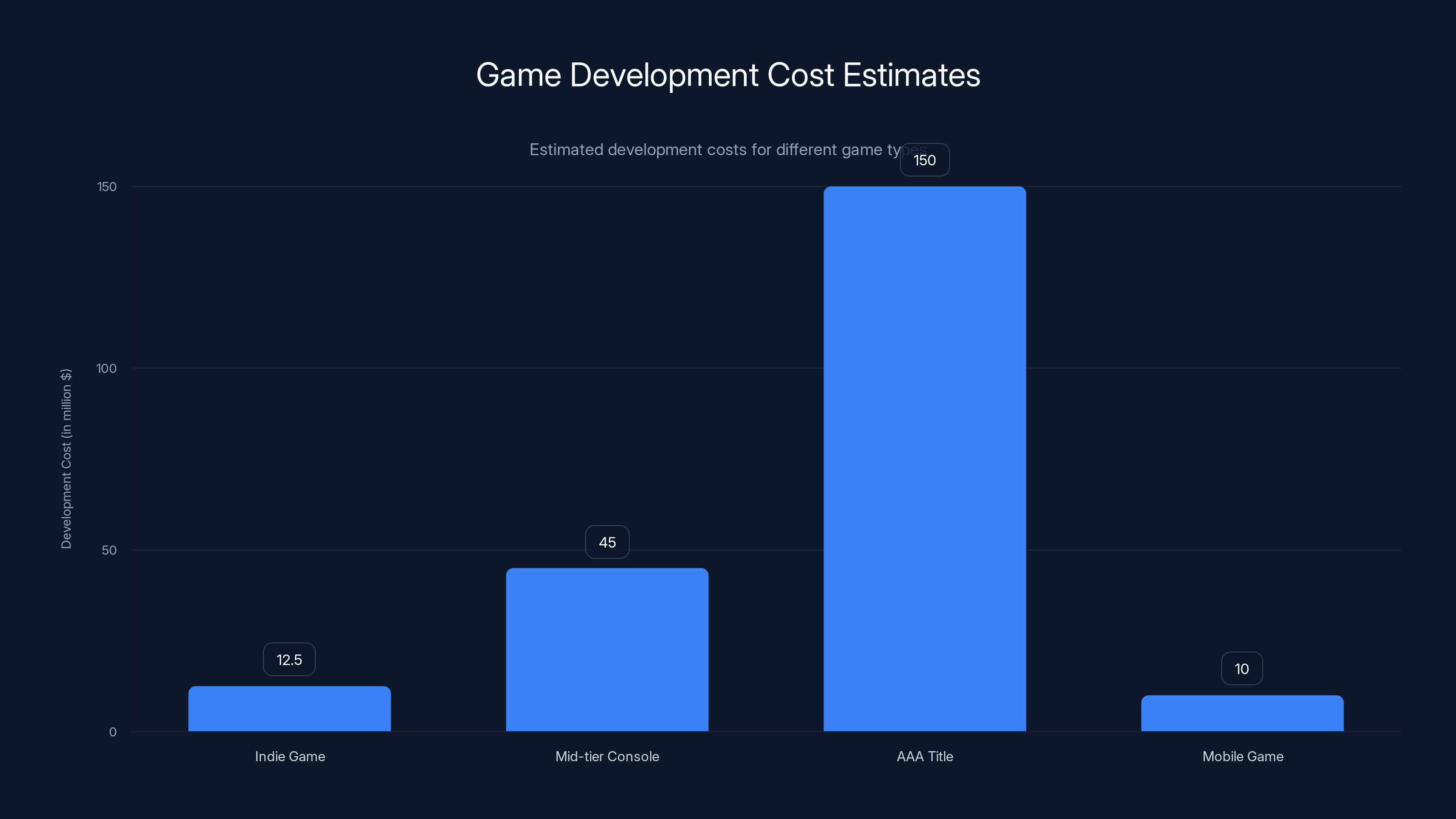

Estimated data shows indie games cost

The Risk Mitigation Strategy: Early Validation and Decision Gates

Here's the thing about building 26 games simultaneously: it's incredibly risky. The natural instinct is to kill the risk by investing less in each project. But Krafton seems to be taking a different approach.

"Early validation and clear decision gates" sounds dry, but it's actually a radical approach to game development. Traditionally, studios develop games in isolation, behind closed doors, with periodic milestone checkpoints. Months or years of development happen before external audiences see anything.

Krafton appears to be compressing that timeline aggressively. Projects probably go through rapid prototyping phases where internal teams and external playtesters evaluate the core concepts. The data from these playtests informs major decisions: does this core mechanic feel fun? Are players engaging with the intended systems? Is there a clear path to monetization?

Based on the answers, projects either move forward to full production, get repositioned around new concepts, or get canceled entirely. This is the "clear decision gates" part.

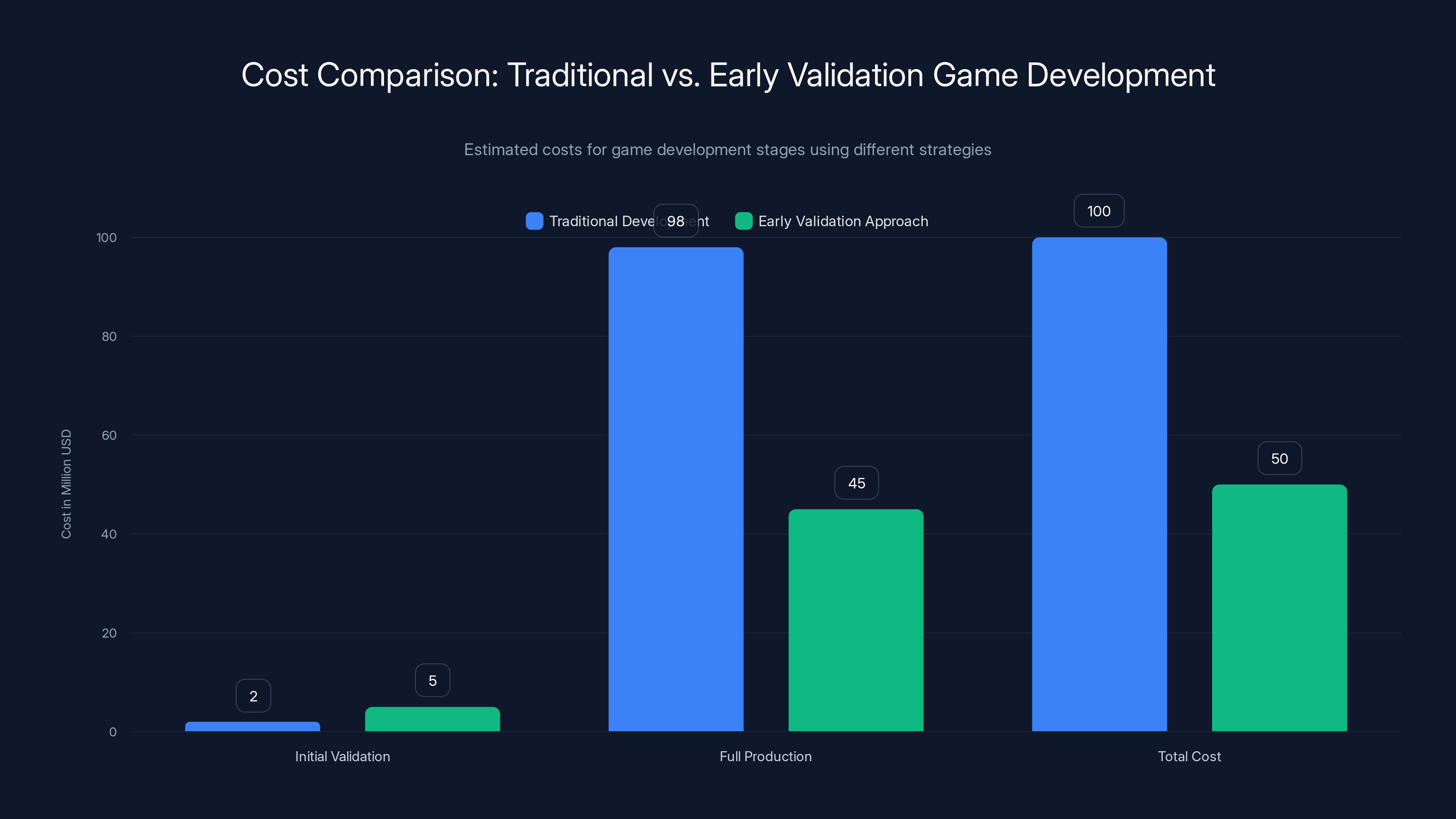

Why does this matter? Because it dramatically reduces the risk of catastrophic failure. Instead of spending

The game industry is slowly adopting this approach, but most AAA studios are still trapped in old patterns. Development timelines stretch to 5-7 years. Publishing decisions get made based on internal politics rather than player data. By the time a game reaches launch, it's often too late to address fundamental design flaws.

Krafton's approach suggests they've learned from past mistakes and are applying lessons from the technology sector more broadly. And given that the company has a $3+ billion market cap and the capital to fund this kind of experimentation, they're in a rare position to actually execute on this strategy.

The 12-Game Launch Timeline: Which Projects Matter Most

Of the 26 games in development, 12 are scheduled to launch within the next two years. That's an aggressive pace. For context, most AAA publishers launch maybe 2-3 major titles per year. Krafton is talking about essentially launching a major publisher's worth of games while still maintaining their existing portfolio.

Not all 12 launches are equal in strategic importance. Some will be small-budget experiments. Others will be major franchise bets. Here's what we know about the most important ones:

Subnautica 2 is the most proven of the bunch. The original game built a cult following. The sequel has expectations to meet, but it also has a clear audience. If executed well, this is almost a guaranteed revenue generator.

Palworld Mobile is potentially the highest ceiling. The original game became a cultural moment in 2024. Mobile versions of popular games often outperform their originals because the addressable market is so much larger. If the mobile version captures even a fraction of Palworld's success, it could be a multi-hundred-million-dollar franchise.

No Law and other unannounced projects are the real wildcards. These are the bets on finding the next PUBG or Palworld. Success here would transform Krafton's future. Failure is expensive but survivable because of the portfolio approach.

The rest of the 12 are probably smaller projects, mobile titles, and console ports of existing games. They're revenue generators and audience builders but not franchise pillars.

PUBG as a Platform: The Long-Term Play

While everyone's focused on the new games, Krafton is quietly building something potentially more valuable: PUBG as a platform.

For most of its lifecycle, PUBG was essentially a closed game. You downloaded it, you played the maps Krafton created, you competed in events Krafton organized. It was a great game, but it was also a static experience.

Krafton's pivot toward user-generated content changes that fundamentally. Imagine if PUBG had the creative tools of Fortnite Creative Mode. Players could design custom battle royale maps, create training scenarios, or build entirely different game modes using PUBG's gunplay mechanics. They'd share these creations with the community. Popular creators would build audiences. Some would find ways to monetize their content.

This is how Fortnite sustains itself. The base game is fun, sure, but the platform layer—where players can be creators—is what keeps it relevant year after year. Epic Games gets a cut of the economics, but they're also delegating content creation to millions of players, which is far more efficient than any internal team could be.

If Krafton successfully executes this for PUBG, the game's lifecycle could extend indefinitely. PUBG would stop being a product and start being an infrastructure. That's the difference between a game that declines in 3-5 years and a game that remains relevant for a decade or more.

The tricky part is implementation. Fortnite's creative tools took Epic Games years to develop and refine. They required significant investment in engine improvements and tooling. Krafton has the technical capability—the company uses Unreal Engine for many projects—but execution is where most companies stumble.

The Early Validation approach significantly reduces total development costs by investing more in initial validation, thereby minimizing risks and avoiding large expenditures on unproven concepts. Estimated data.

The "AI First" Bet: Exploring Physical AI and Robotics

Here's where Krafton gets weird. The company announced a commitment to being "AI First," and it's not just about using AI to generate content or improve game balance. They're explicitly exploring how game technology might apply to physical AI and robotics.

This sounds like science fiction, but it's actually strategically smart. Game engines are among the most sophisticated simulation software in the world. They can model physics, collisions, complex behaviors, and realistic environments in real-time. These same capabilities are useful for training AI systems in virtual environments before deploying them to physical robots.

Companies like NVIDIA and Open AI are exploring similar concepts. NVIDIA's Phys X engine (which powers many games) is also used for robotics simulation. The technical overlap is genuine.

What Krafton is doing is hedging against the possibility that generative AI and robotics become huge industries. If they position themselves as a potential supplier of simulation tools and technology to that sector, they're creating optionality. It's a long-term bet, but it's smart optionality to have.

For game players, this probably doesn't change anything in the near term. But it signals that Krafton is thinking beyond pure game development. They see their technical capabilities as potentially valuable in adjacent markets. That kind of strategic flexibility is rare among gaming companies, which tend to be narrowly focused on games.

Market Context: Why This Strategy Now

Krafton's aggressive portfolio expansion isn't happening in a vacuum. There are specific market forces that make this moment right for this strategy.

The Live Service Backlash

First, there's growing player dissatisfaction with live service games. For the past decade, the industry bet heavily on online multiplayer games that you play forever with constant updates. EA's Anthem flopped spectacularly. Blizzard's Overwatch 2 disappointed many fans. Even Microsoft's Redfall and other live service experiments have failed.

Players are tired of live service promises. They want complete games they can own and play whenever they want, not perpetual updates with aggressive monetization. Krafton's approach—developing multiple standalone games alongside platform extensions—positions them better for this market shift.

Budget Insanity in AAA Development

Second, AAA game development budgets have gotten genuinely insane. Major studios are spending $200+ million on single games. These massive budgets create massive pressure to hit huge numbers, which often leads to risk-averse design and safe sequels rather than innovation.

Krafton's portfolio approach spreads risk. Instead of betting

This is the playbook that Take Interactive uses. They publish a lot of games, most of which are modest successes, while occasionally hitting massive franchises like Grand Theft Auto. Krafton is essentially copying this model.

Mobile Gaming Market Expansion

Third, mobile gaming is bigger than console and PC gaming combined, but many Western publishers treat it as a secondary market. Krafton is making mobile a core part of the strategy with projects like Palworld Mobile and presumably other titles.

Mobile games have higher addressable markets, faster iteration cycles, and often better unit economics than console games. They're also less culturally prestigious, which means less pressure and less risk.

Competitive Positioning: How Krafton Compares

To understand the significance of Krafton's strategy, it helps to compare how they're approaching game development versus other major publishers.

Krafton vs. Tencent

Tencent is the world's largest gaming company by revenue, but they're more of a publisher and investor than a developer. Tencent has stakes in Riot Games, Supercell, and dozens of other studios. They succeed by identifying winners and scaling them. Krafton is trying to be the developer that Tencent invests in, which is actually a stronger position long-term.

Krafton vs. Electronic Arts

EA is structured around major franchises: FIFA/FC, Madden, Battlefield, The Sims, Apex Legends. They're incredibly profitable but vulnerable if any of those franchises falters. Krafton's approach is more defensive. By spreading bets across 26 projects, they're less dependent on any single franchise succeeding.

Krafton vs. Activision Blizzard

Activision Blizzard has been stuck in decline for years, unable to launch successful new IPs while milking older franchises like Call of Duty. Krafton's willingness to invest in new franchises and let some games fail is almost a direct contrast to Activision's risk-averse culture.

Krafton vs. Embracer Group

Embracer Group is attempting a similar portfolio-based approach by acquiring numerous studios, but their strategy is more about consolidation than coherent creative direction. Krafton's approach seems more coordinated and strategically thoughtful.

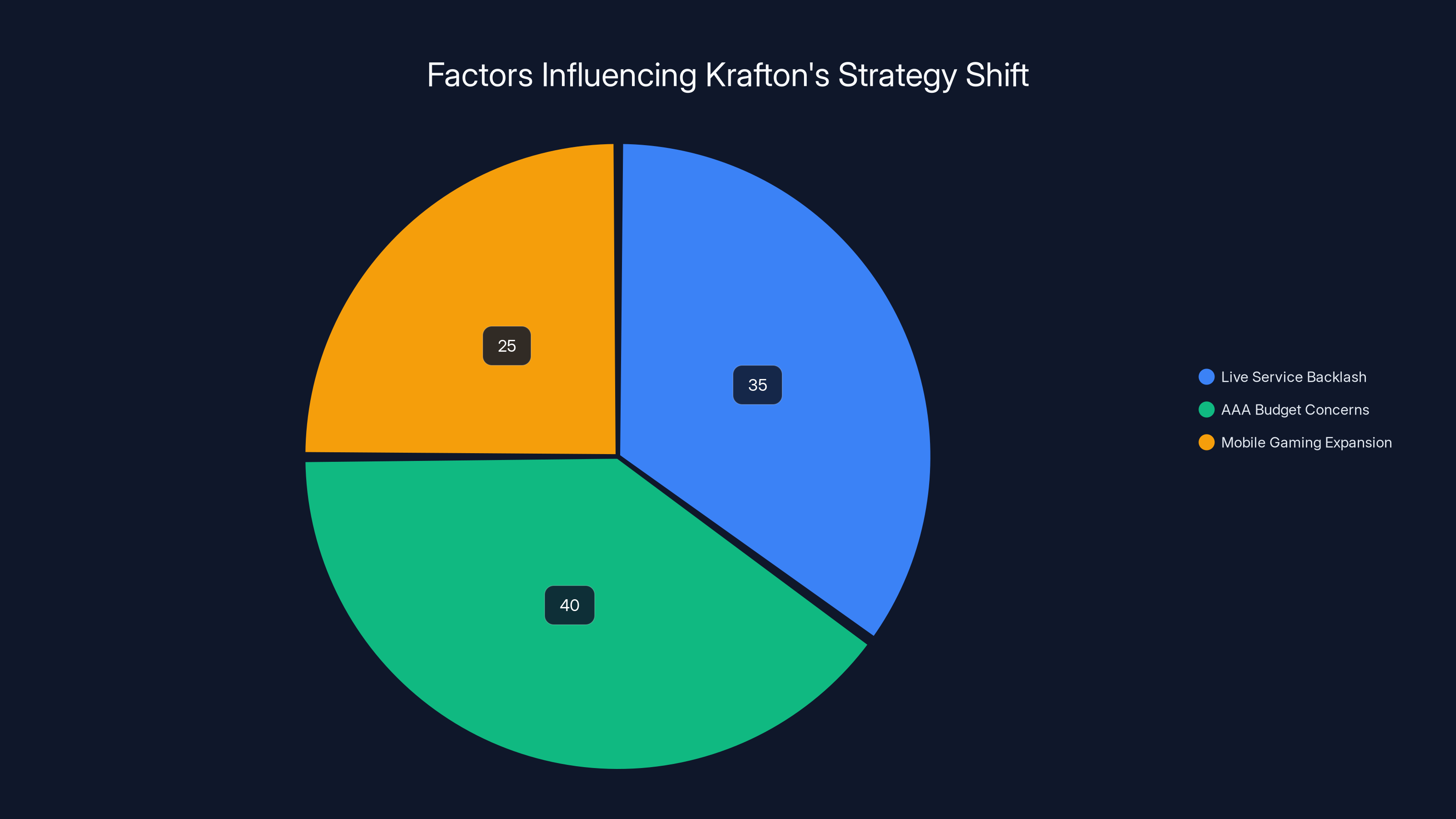

Krafton's strategy shift is influenced by a backlash against live service games (35%), concerns over AAA budget risks (40%), and the expansion of mobile gaming (25%). Estimated data.

The Execution Challenge: Why This Is Actually Hard

So far, everything about Krafton's strategy sounds smart. But here's where things get difficult: execution at scale.

Managing 26 concurrent game development projects requires exceptional organizational capability. You need strong creative leadership across multiple teams. You need transparent metrics for evaluating project health. You need decision-making processes that can kill projects without causing organizational trauma.

Most game studios aren't structured this way. They tend to be creator-focused, where senior designers or directors have a lot of autonomy. That creates great art but terrible risk management. When multiple projects fail, there's often finger-pointing and political dysfunction.

Krafton seems aware of this. They explicitly mentioned "strengthening creative leadership" as part of their 2025 strategy. That probably means hiring experienced game directors and building management infrastructure.

But there's also a cultural risk. Game developers care deeply about their work and the games they're building. Knowing that your project might be canceled at any time based on playtesting metrics can be demoralizing. If Krafton doesn't handle the human side of this strategy well, they could end up with talented people leaving for studios that feel less disposable.

Financial Implications: The Math Behind the Madness

Let's talk about the actual financial picture. Game development budgets vary wildly depending on project scope.

A small indie-style game might cost

If Krafton has 26 games in development at an average cost of

The key financial assumption is that some of these games will be huge hits. If even one project becomes a PUBG-sized franchise, it could generate billions in revenue over its lifetime. If Subnautica 2 and Palworld Mobile both succeed, that's potentially

Of course, if most of the new games fail, this becomes a giant waste of money. That's the risk. But the portfolio approach is designed to mitigate that risk by spreading bets and testing concepts early.

What Success Actually Looks Like

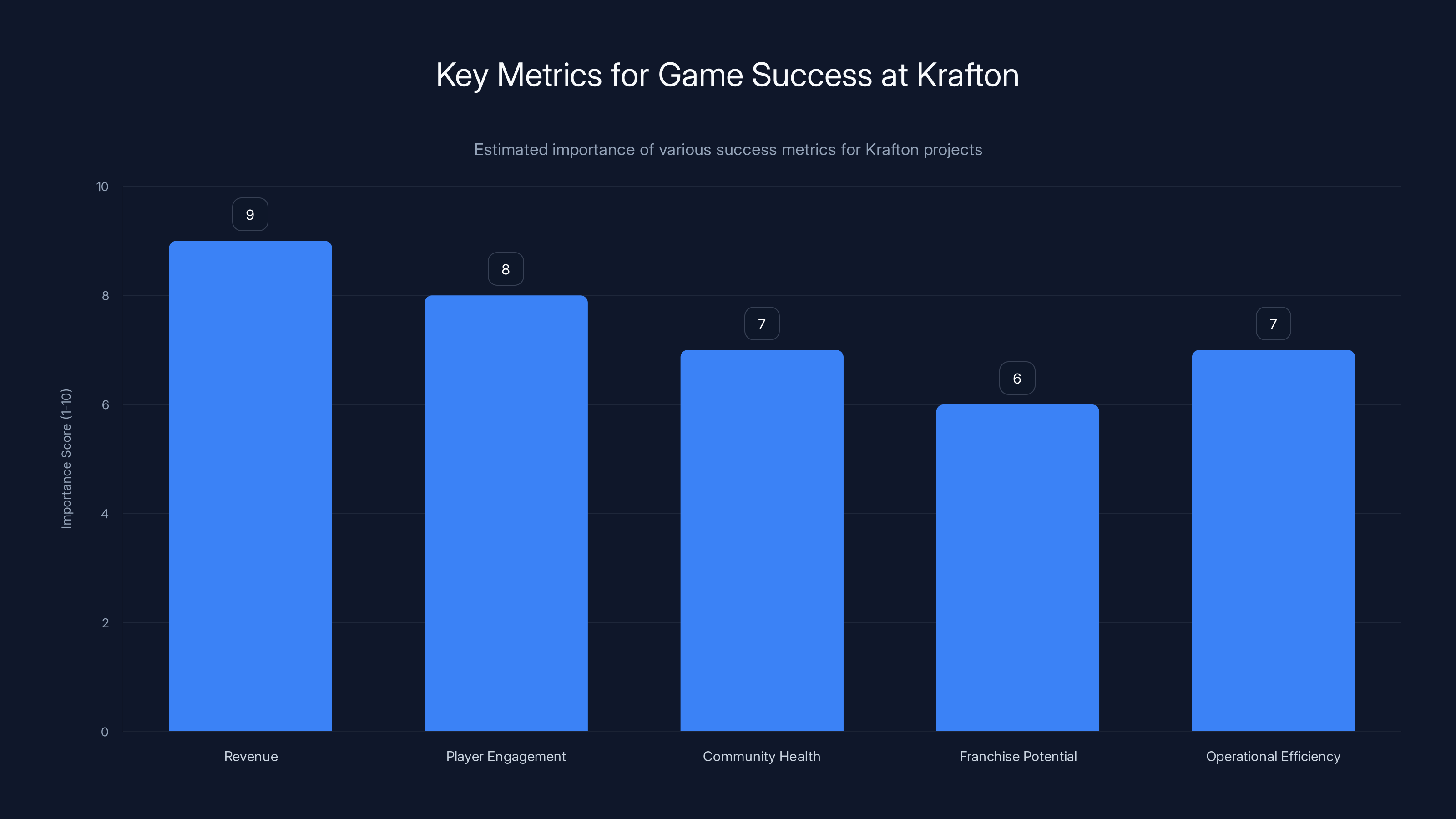

When Krafton measures success, what are they looking for? Probably a mix of metrics:

Revenue: Games need to hit commercial targets. What those targets are varies by project—a mobile game might need to generate

Player Engagement: How much time do players spend with the game? How often do they return? Engagement metrics predict monetization potential.

Community Health: Do players spend time in the community? Are content creators interested in making content? Strong communities are self-sustaining and generate word-of-mouth.

Franchise Potential: Can this game become more than just a game? Are there licensing opportunities? Merchandise potential? Narrative richness that could support other media adaptations?

Operational Efficiency: Can this game be maintained and updated profitably by a relatively small team? Or does it require constant expensive content creation?

Success means having 2-3 projects that hit these metrics strongly across the portfolio. Failure means having 4-5 projects that all underperform and become cash drains.

Revenue and player engagement are the most critical metrics for Krafton's game success, followed by community health and operational efficiency. Estimated data based on typical industry priorities.

The Next Two Years: Critical Timeline

Everything hinges on execution in the next 24 months. The 12 games scheduled to launch are real commitments. Marketing budgets have probably been allocated. Development timelines are fixed. This is where theory meets reality.

If Krafton successfully launches Subnautica 2, Palworld Mobile, and several other quality titles, they'll have proven the portfolio approach works. They'll have shifted from "one-hit company" to "multi-franchise publisher." That's a significant strategic achievement.

If launches are delayed, quality suffers, or games underperform commercially, investors will lose confidence in the strategy. There could be pressure to refocus on proven IP and abandon the portfolio approach.

This is probably the most critical business period Krafton will face in the next five years. They're essentially trying to transform their company identity. That's always risky.

The Player Perspective: What This Means for You

All of this corporate strategy talk is interesting, but what does it mean for actual players?

First, more games. Krafton's strategy is specifically designed to put more games in front of players. Some will be trash. Some will be brilliant. Most will be somewhere in between. But more diversity in the types of games being made is generally good for the industry.

Second, potentially more original IP. Sequels and franchises are safe. Original IP is risky. But the original IP is where innovation happens. Krafton's willingness to bet on original franchises means more genuinely new games, not just the thousandth sequel to an existing property.

Third, longer game lifespans for successful titles. If Krafton invests in platform features like user-generated content, games stick around longer. PUBG could theoretically remain relevant for another decade if the platform features are executed well.

Fourth, risk of lower average quality. When studios are spreading development resources across 26 projects, something's got to give. Some games might feel rushed or incomplete. Portfolio approaches often mean accepting that not every game will be a masterpiece.

Fifth, better alignment between what publishers make and what players actually want. Playtesting and early validation means games are shaped by player feedback, not just internal assumptions.

Industry Implications: A Shift in Game Development

If Krafton's strategy works, it could ripple through the entire industry. We might see other major publishers abandon the "fewer, bigger games" approach in favor of portfolio strategies.

That would be genuinely significant. The current approach—betting huge budgets on tentpole releases—leads to conservatism. Publishers greenlight sequels and safe bets because the downside of failure is massive. But if you're betting

Portfolio approaches also create different incentive structures. Individual game success becomes less about hitting a specific commercial target and more about learning what players actually want. That shifts the industry from "maximize revenue on this game" to "learn and iterate."

Of course, this assumes players prefer a future where there are more smaller bets rather than fewer massive bets. That's not universally true. Some players love huge budget productions. Some prefer indie games. There's room for both approaches.

But the current AAA development model is clearly breaking. Budget inflation, longer development cycles, and higher failure rates suggest the system is unsustainable. Krafton's portfolio approach is one potential solution. If it works, others will copy it.

Krafton is developing 26 games, with 12 scheduled for launch within two years. The pipeline includes a mix of original franchises and licensed IP. Estimated data.

Potential Failure Scenarios: What Could Go Wrong

Let's be realistic about downside scenarios. Krafton's strategy is bold, but it's also risky in ways that deserve acknowledgment.

Execution Failure: The most straightforward risk is that Krafton simply can't execute at this scale. Managing 26 concurrent projects is genuinely difficult. Teams might cannibalize each other for talent. Project managers might miss deadlines. Quality might suffer across the board.

Market Saturation: Launching 12 games in two years floods the market with Krafton products competing against each other. Some are cannibalizing audience from others. Marketing becomes less effective because there's competition for players' attention within Krafton's own portfolio.

No Breakout Hits: The worst-case scenario is that none of the 12 games become major successes. Maybe they're all fine, modestly successful games that generate some revenue but don't become franchise pillars. That's still a waste of the development investment and strategic opportunity.

Talent Drain: If people feel like projects are being canceled arbitrarily or that there's no long-term stability, talented developers leave. Brain drain at scale can cripple a studio.

Investor Patience: Investors are funding this strategy based on projections of multiple blockbuster hits. If early launches disappoint, there could be pressure to abandon the approach and refocus on proven franchises.

Market Timing: Games succeed or fail based partly on timing and trends. Launching 12 games over two years means some inevitably land in bad windows, competing against bigger titles or failing to capture trend momentum.

These aren't theoretical risks. They're genuinely possible outcomes. Krafton is betting that their execution capability, financial resources, and strategic thinking can overcome these challenges. That's a big bet.

The PUBG Evolution: Maintaining Relevance

While Krafton builds the new portfolio, they can't afford to let PUBG decline further. The game still generates significant revenue and player engagement. But it's no longer the cultural phenomenon it was.

Krafton's strategy for PUBG seems to be evolution rather than revolution. They're not completely reimagining the game. Instead, they're:

Expanding platform capabilities: User-generated content, custom match creation, and editor tools that give players more agency.

Maintaining live service cadence: Seasonal content, balance updates, and events keep the game fresh without requiring expensive new development.

Licensing and spinoffs: Official and unofficial PUBG mobile games, console ports, and licensed merchandise keep the brand visible.

Competitive infrastructure: Supporting esports and competitive play builds prestige and community around PUBG.

This is the right approach for a declining but still valuable franchise. You're not trying to reverse decline—that's rarely possible. Instead, you're maximizing the value extraction while accepting gradual player decline over time.

PUBG will probably be profitable for another 5-10 years at least. That's not nothing. But Krafton needs new franchises to grow, which is why the portfolio expansion is so important.

Comparing Game Development Strategies

To put Krafton's approach in context, here's how it compares to other major publishers:

| Company | Strategy | Strengths | Weaknesses |

|---|---|---|---|

| Krafton | Portfolio approach: 26 games, 12 in 2 years | Risk distribution, portfolio upside, innovation incentive | Execution complexity, quality risk, cannibalization |

| Tencent | Investment-based: Stake in many studios | Massive capital, diverse portfolio, network effects | Less direct control, slower decision-making |

| EA | Franchise consolidation: FIFA/FC, Madden, Sims, Apex | Predictable revenue, brand recognition, loyal players | Vulnerable if franchise falters, risk-averse |

| Activision Blizzard | Milking franchises: Call of Duty, Overwatch, World of Warcraft | Proven IP with huge install bases | Stagnation, inability to launch new IP, declining cultural relevance |

| Embracer Group | Acquisition strategy: Buy many studios | Low-cost portfolio building through consolidation | Less strategic coordination, integration challenges |

| Indie studios | Lean, focused development | Creative freedom, lower overhead, viral potential | Limited resources, marketing challenges, feast/famine cycles |

Krafton's strategy is unique because it combines scale with risk-taking. Most publishers at their size are conservative. Most risk-takers are small studios. Krafton is trying to be both simultaneously.

The AI Dimension: Future-Proofing

Krafton's commitment to being "AI First" deserves more analysis. The company isn't just talking about using AI to help develop games faster (though that's happening too). They're exploring how game technology could eventually apply to physical AI and robotics.

This is speculative, but it makes sense strategically. Game engines are sophisticated simulation environments. They model physics, collisions, complex behaviors. These same capabilities are useful for training AI systems.

NVIDIA's Phys X, for example, started as a gaming physics engine and is now used for robotics simulation. There's genuine technical overlap. If Krafton positions their game engine and simulation technology as potentially useful for AI and robotics applications, they create optionality in a high-growth sector.

Will this actually happen? Unknown. It's a long-term exploratory bet. But having optionality is valuable. If AI and robotics become massive industries in the next 10 years, Krafton might be able to monetize their technical capabilities in those sectors, not just in gaming.

For now, it's mostly talk. But it signals that Krafton is thinking beyond games. That kind of strategic flexibility is rare in entertainment companies.

Investment Thesis: Why This Matters to Stockholders

If you own Krafton stock, what does all this mean?

The portfolio approach is explicitly designed to reduce risk and increase optionality. Instead of betting the company on 2-3 major releases, Krafton is spreading bets across 26 projects. From a financial perspective, that's smart. Probability of at least some successes is higher with more bets.

But it also signals that management expects the traditional PUBG revenue stream to decline. Otherwise, why invest so heavily in new franchises? This is essentially management saying: "We can't count on PUBG forever, so we're building new revenue streams."

That's simultaneously bullish (they're taking proactive action) and bearish (they're admitting current franchise is under pressure).

Key metrics to watch:

Q1-Q2 2025: Early indicators of whether playtest-to-launch pipeline is working. Do projects stay on schedule? Early player feedback on launched titles.

Q3-Q4 2025: First major launches. Do Subnautica 2 and Palworld Mobile hit commercial targets? Do they generate sustainable engagement?

2026: Full-year results of 12-game launch strategy. Revenue contribution from new franchises. Evidence of whether portfolio approach is working.

If Krafton hits these milestones strongly, stock could outperform because investors will gain confidence in the franchise expansion strategy. If they miss, stock could underperform because it signals the strategy isn't working.

For a mid-cap game publisher, Krafton is taking a significant strategic bet. That's either brilliant or foolish. The next 24 months will determine which.

Conclusion: The Franchise Roulette

Krafton is essentially playing franchise roulette with a loaded gun instead of a revolver. They've got 26 spins instead of 1, which dramatically improves their odds of hitting a jackpot. But the stakes are still enormous, the execution challenges are real, and there's no guarantee this strategy actually works.

What makes it interesting is that Krafton is being disciplined about the risk. Early validation, clear decision gates, and willingness to kill projects that aren't working—these are how you reduce the downside of portfolio-based development. It's not random. It's structured.

The broader gaming industry is watching closely. If Krafton succeeds, this becomes the model everyone else tries to copy. Publishers abandon their current risk-averse conservative structures and embrace portfolio-based innovation. That would be genuinely transformative for gaming.

If Krafton fails, we'll probably see the opposite: publishers become even more conservative, betting even more heavily on proven franchises and sequels. The industry will double down on what works rather than experimenting with what might work.

For game players, Krafton's success means more new IPs, more diversity, and more innovation in the games being made. Krafton's failure means fewer risks, fewer new franchises, and more sequels. The stakes aren't just financial. They're about the kind of games the industry makes.

It's been a few years since the gaming industry felt like it was genuinely innovating at scale. Most AAA releases are sequels or refinements of existing franchises. Krafton's bet on 26 new projects, with clear commitment to franchise innovation, is a bet that the industry can recapture that innovative spirit.

Will it work? The next two years will tell us. But the fact that Krafton is even trying is noteworthy. The company is literally betting billions that you can find lightning in a bottle twice. And they're building organizational structures and decision-making processes specifically designed to increase the odds.

That's either the smartest strategic move in gaming right now, or it's spectacular hubris. We'll know by 2027. Until then, we watch, we wait, and we see what 26 games in development actually produces.

FAQ

What is Krafton's 26-game development pipeline?

Krafton is actively developing 26 games simultaneously across multiple genres and platforms, with 12 scheduled to launch within the next two years. This portfolio approach is designed to reduce risk by spreading development resources across multiple projects rather than betting everything on a single franchise. The pipeline includes both licensed IP like Subnautica 2 and Palworld Mobile, as well as original franchises like No Law.

How does Krafton's "early validation and decision gates" strategy work?

Krafton uses rapid prototyping and external playtesting to validate game concepts before committing to full production. Projects go through structured evaluation phases where playtesters and internal teams assess whether the core mechanics are fun, engaging, and commercially viable. Based on this feedback, projects either move forward to full development, get repositioned around new concepts, or get canceled. This approach dramatically reduces the risk of expensive failures by identifying problems early when they're cheaper to fix.

What are the key games in Krafton's launch pipeline?

The most significant projects include Subnautica 2 (a proven franchise sequel), Palworld Mobile (expanding the blockbuster 2024 phenomenon to mobile platforms), and No Law (an original IP with substantial development resources). Additional projects span console games, mobile titles, and PC releases across multiple genres. The specific launch dates and details for many projects remain under development, but the company has committed to delivering 12 major releases within two years.

How is Krafton planning to evolve PUBG beyond the base game?

Krafton is expanding PUBG from a static game into a platform by building user-generated content capabilities that leverage PUBG's core gunplay mechanics and physics engine. This allows players to create and share custom battle royale maps, training scenarios, and game mode variations. By turning PUBG into a platform like Fortnite Creative or Minecraft, Krafton hopes to extend the game's lifecycle and create new revenue streams through player-created content ecosystems.

Why is Krafton pursuing an "AI First" strategy, and what does it involve?

Krafton's AI-first commitment includes both practical applications in game development (using AI to help with content creation and game balance) and exploratory long-term research into how game simulation technology could apply to robotics and physical AI systems. The company views game engines as sophisticated simulation environments that could eventually have applications beyond gaming. This is a strategic bet on future market opportunities in adjacent sectors like robotics and autonomous systems.

How does Krafton's strategy compare to other major game publishers?

Unlike EA's franchise consolidation model or Activision's reliance on legacy franchises, Krafton is explicitly embracing a portfolio approach that spreads risk across 26 projects. This is similar to how Take Interactive operates, but with more structured validation processes. Tencent uses an investment-based approach by staking companies, while Krafton is combining internal development with selective acquisitions and licenses. The approach is unique in balancing scale with innovation and risk-taking.

What does success look like for Krafton's 2026 strategy?

Success means having multiple games in the 12-launch pipeline achieve strong commercial performance and sustainable player engagement. Key metrics include hitting revenue targets (which vary by project scope), maintaining healthy player communities, building competitive/esports infrastructure where applicable, and establishing franchise potential for long-term expansion. The real success marker is whether any of these projects grows into a PUBG-sized phenomenon. Even 1-2 major successes would validate the entire portfolio approach.

What are the main risks of Krafton's portfolio development approach?

Key risks include execution complexity at scale, potential cannibalization between Krafton's own games for player attention and marketing budgets, quality variability when spreading teams across 26 projects, talent drain if developers feel projects are canceled arbitrarily, and the possibility that none of the major launches meet commercial expectations. There's also investor patience risk—if early 2025-2026 launches disappoint, shareholder pressure could force strategy abandonment. The approach requires exceptional organizational capability to manage effectively.

Wrapping Up

Krafton's journey from one-hit wonder to multi-franchise publisher is one of the most important experiments happening in gaming right now. The company is taking risks that most publishers at their scale would never consider. They're betting billions that the right organizational structure, validation processes, and creative leadership can produce multiple successful franchises.

For game players, this matters because it affects the kind of games the industry makes. For investors, it matters because it's a high-risk, high-reward strategic bet. For the broader gaming industry, it matters because success here could reshape how major publishers approach game development entirely.

The next two years are critical. Twelve games launching, dozens more in development, and a company trying to prove that finding lightning in a bottle twice isn't just possible—it's systematic. That's worth paying attention to.

Whether Krafton succeeds or fails, they're asking the right questions and building the right structures to attempt something genuinely difficult. That alone deserves respect, even if the execution doesn't work out perfectly.

Key Takeaways

- Krafton has 26 games in active development with 12 scheduled launches within two years, representing the company's most ambitious portfolio expansion strategy

- The company uses 'early validation and decision gates' to test game concepts before full production, reducing risk of expensive failures that plague AAA development

- Portfolio approach distributes financial risk across multiple projects, improving odds of finding franchise hits while accepting that some games will fail

- PUBG remains a revenue pillar with 200,000 concurrent Steam players, but Krafton's expansion signals recognition that single-franchise dependency is unsustainable

- Major launches like Palworld Mobile and Subnautica 2 represent both proven IP expansion and test cases for the broader portfolio methodology

Related Articles

- Battlefield 6 Season 2 Delay: What It Means for Players [2025]

- Battlefield 6 Season One Extension: New Rewards & Strategy [2025]

- Most Played Games 2025: Why Roblox, Fortnite, and Call of Duty Dominate [2025]

- Amazon's New World: Aeternum Shutting Down 2027 [Complete Guide]

- Subway Surfers City Launch Guide: Release Date, Features, Gameplay [2025]

- Bully Online Mod Shutdown: Why Rockstar Killed the Viral Game [2025]

![Krafton's Quest for the Next PUBG: Inside 26 Games in Development [2025]](https://tryrunable.com/blog/krafton-s-quest-for-the-next-pubg-inside-26-games-in-develop/image-1-1768511224912.jpg)