Market Share Loss in SaaS: Why Revenue Growth Isn't Enough in 2025

Introduction: The Uncomfortable Truth About Growth Without Context

There's a conversation happening in board rooms across the SaaS industry that most founders don't want to have. It happens in November and December, when planning season arrives and companies prepare their annual reviews. The conversation goes something like this: "We grew 30% this year. Revenue is up. ARR increased. We're doing great."

But here's the question nobody wants to ask: Did you actually gain or lose market share?

This is fundamentally different from asking whether your company grew. Growth is straightforward—you measure it, you celebrate it, you report it to your board. Market share is messier. It requires you to honestly compare your performance against your direct competitors, not against some abstract benchmark or your own historical trajectory.

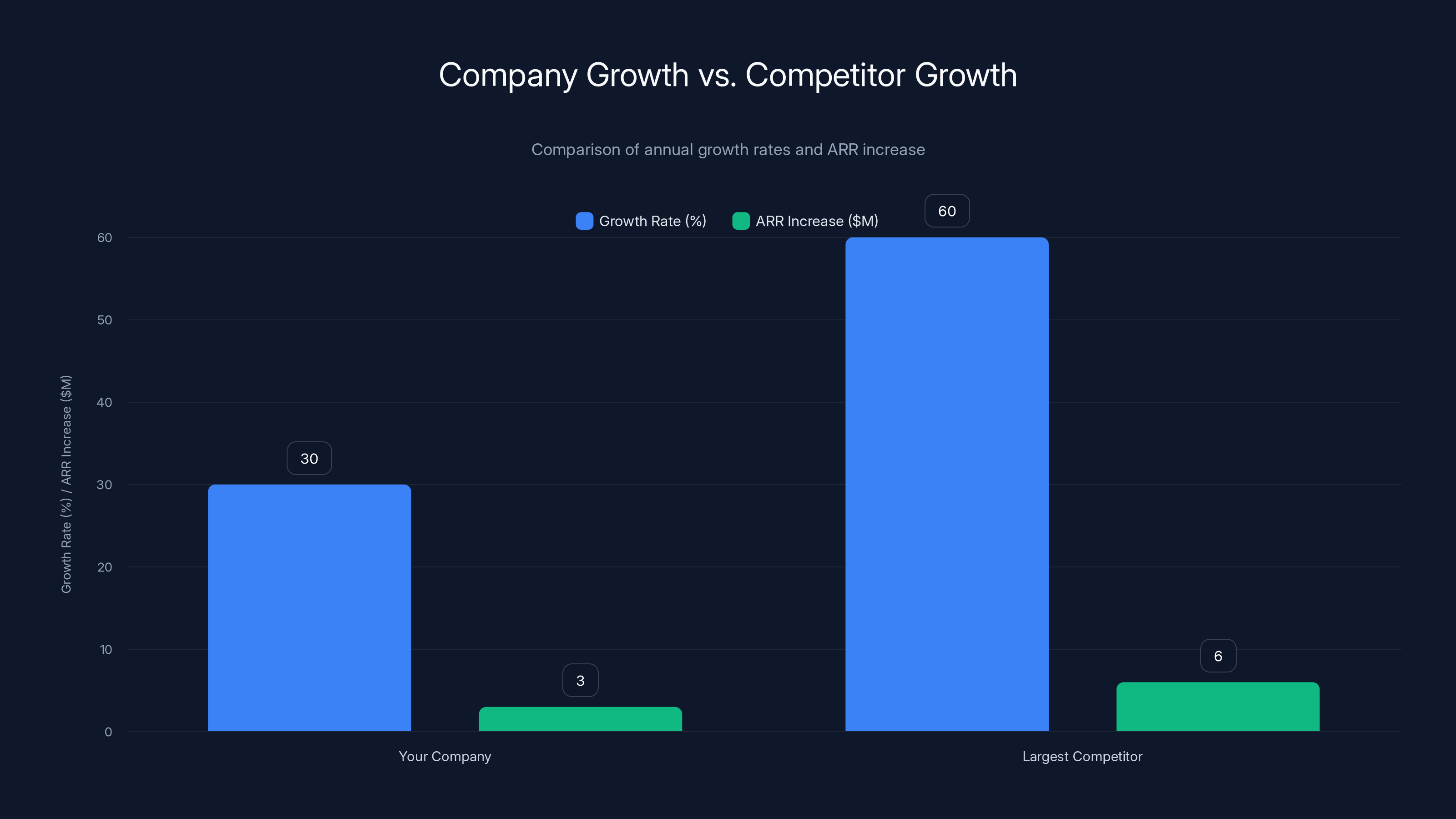

The distinction matters profoundly. Consider this scenario: You grew 30% last year, adding

This is the uncomfortable math that separates successful founders from those who slowly fade into irrelevance.

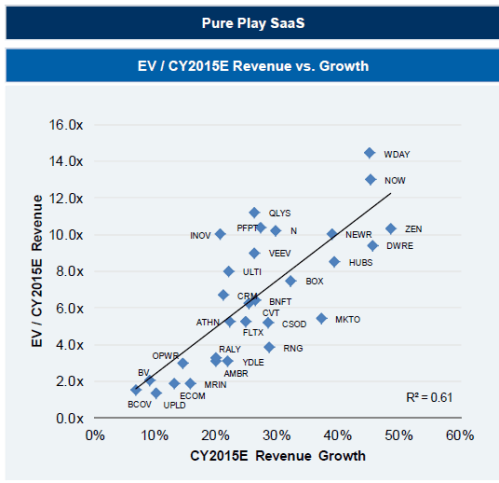

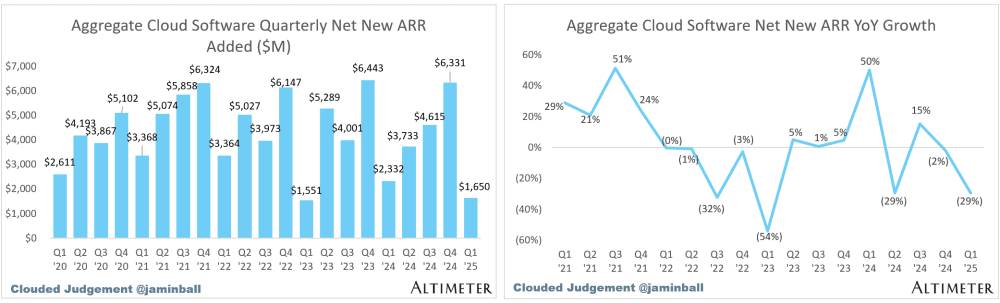

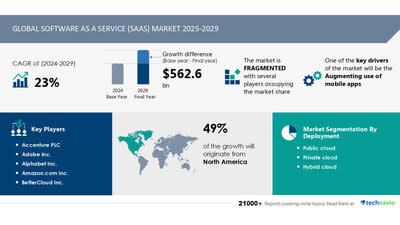

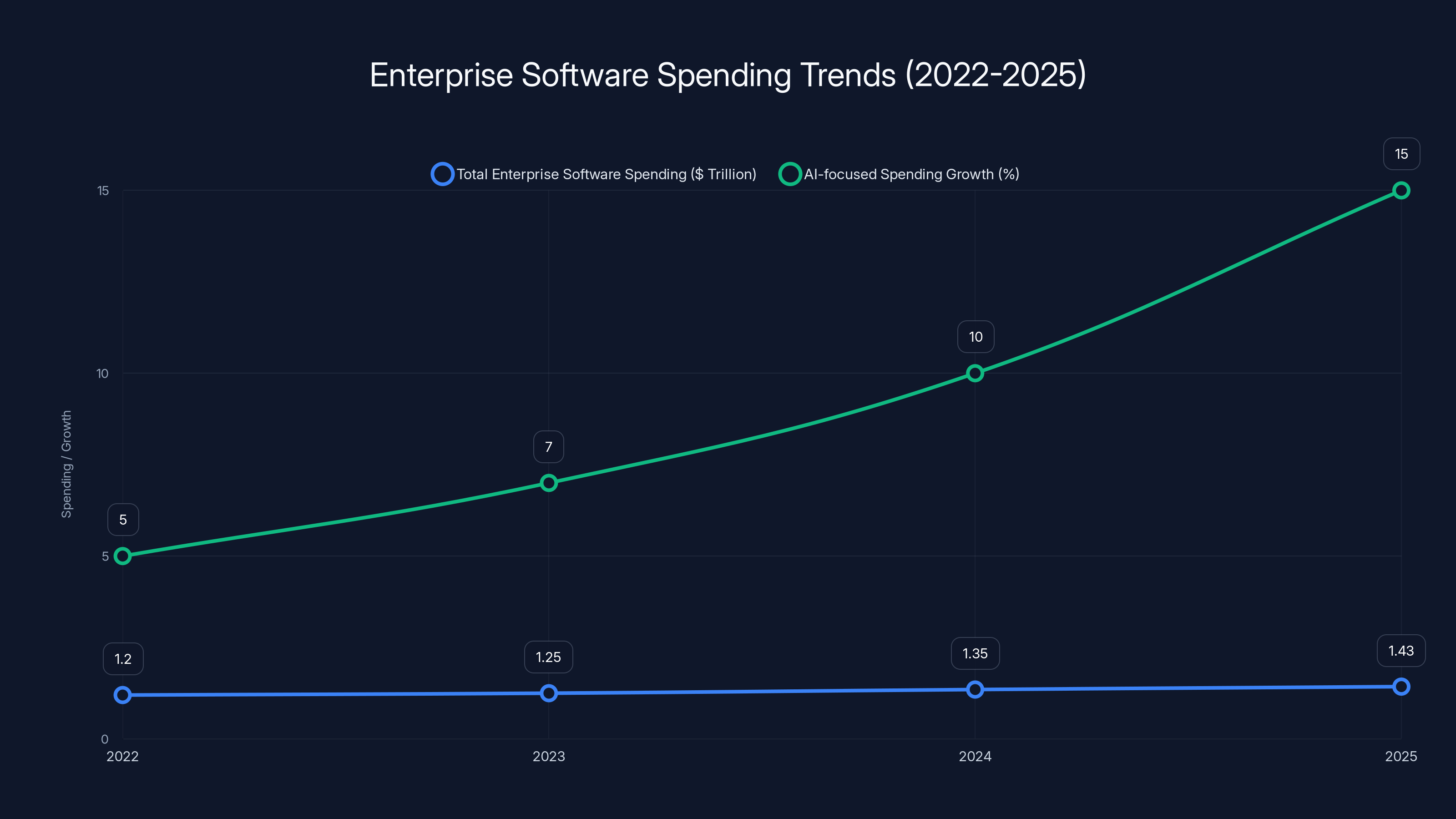

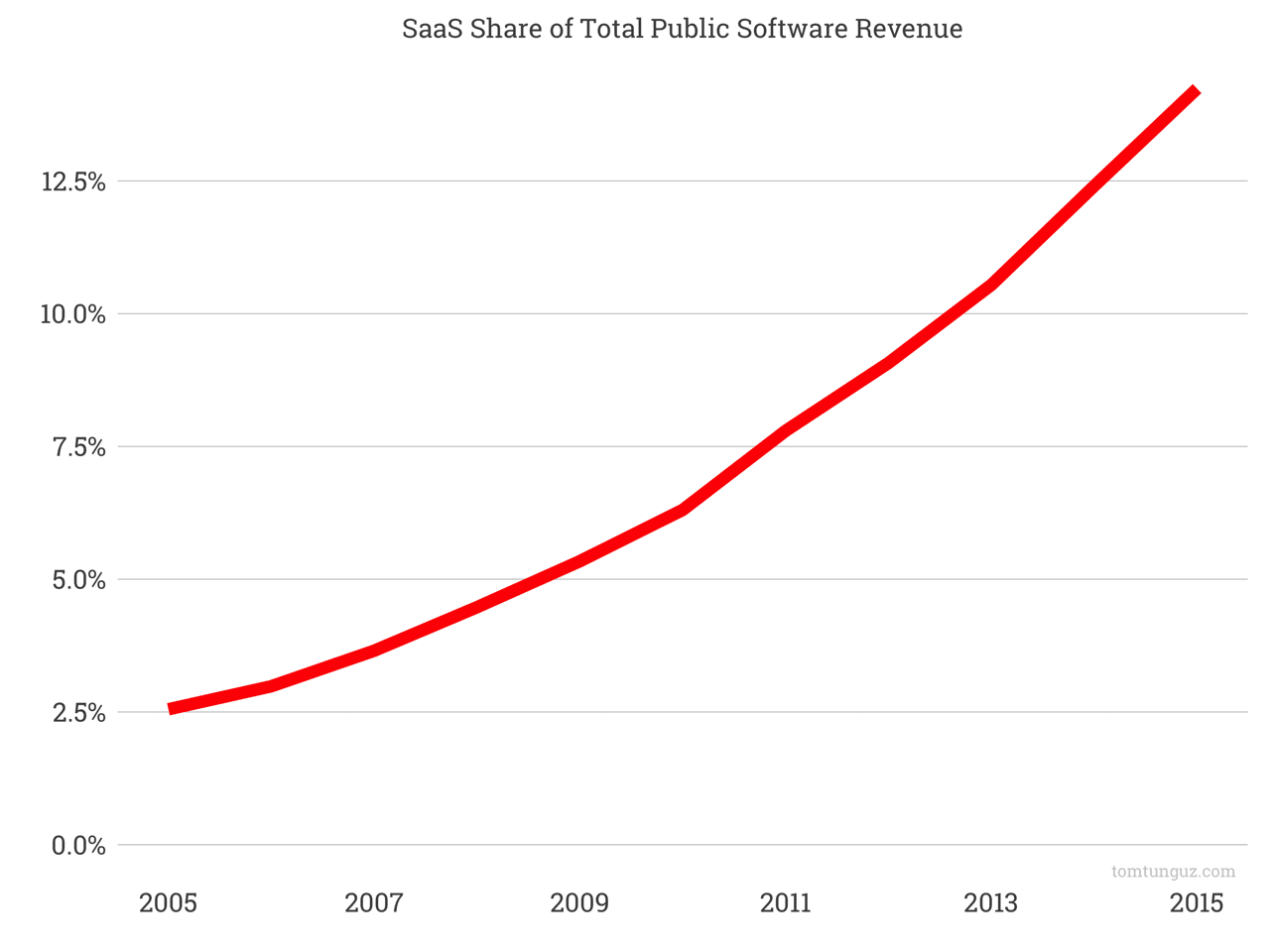

The current market environment makes this assessment even more critical. We're no longer in a downturn—if we ever truly were one. Venture capital is flowing at record rates into AI-powered companies. Enterprise software spending is accelerating at 15.2% annually, with the largest portion allocated specifically to AI initiatives. Hypergrowth is back. The question isn't whether growth is possible in your category—it's whether your company is capturing its fair share of that growth.

This article cuts through the noise and examines why traditional growth metrics are insufficient, how to honestly assess your market position, what it means to be an "NRR zombie," and most importantly, how to reclaim or establish real product-market fit in a competitive landscape. By the end, you'll have a framework for the difficult conversations you need to have with your team about your actual competitive position.

While your company grew by 30% adding

Section 1: Understanding Market Share Versus Revenue Growth

The Mathematical Reality of Market Share

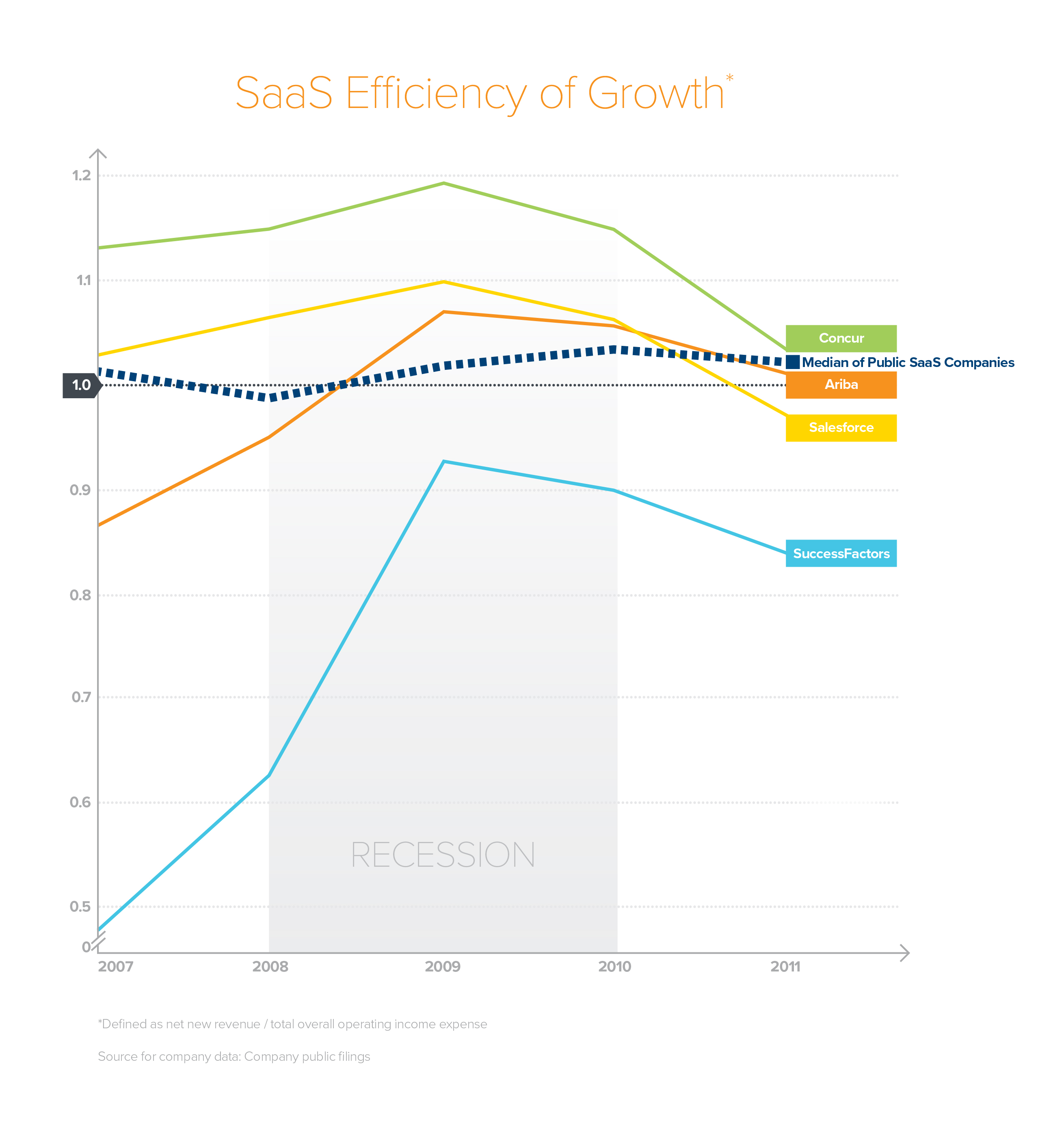

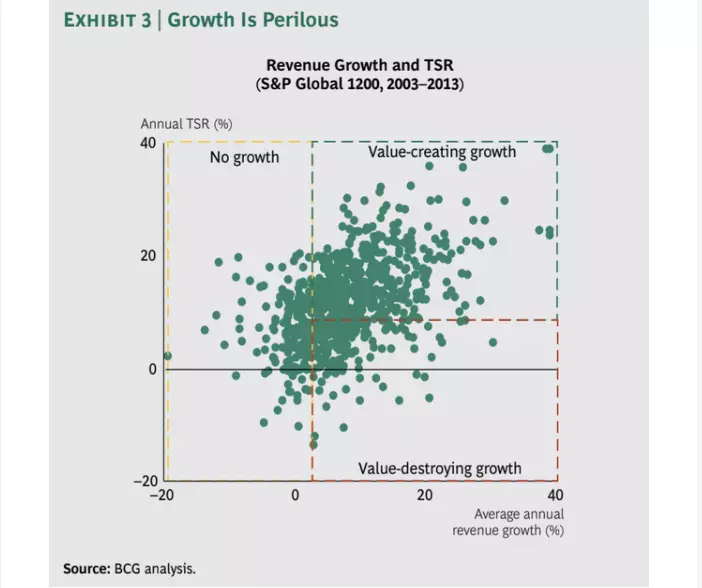

Market share isn't an opinion—it's a mathematical fact. If your total addressable market is growing at 10% annually, and you're growing at 8%, you're losing market share by definition. Conversely, if the market is flat and you're growing at 5%, you're gaining share. The relationship is straightforward, but the emotional reaction is not.

Most founders optimize for absolute growth because it's easier to celebrate. Increasing ARR from

This psychological gap creates dangerous blind spots. A company that's growing 30% might be gradually losing its market position, but the positive headline allows leadership to avoid the harder questions: Why aren't we growing faster? What have our competitors done differently? Have we fallen behind technologically? Is our sales motion broken? Have we lost product-market fit?

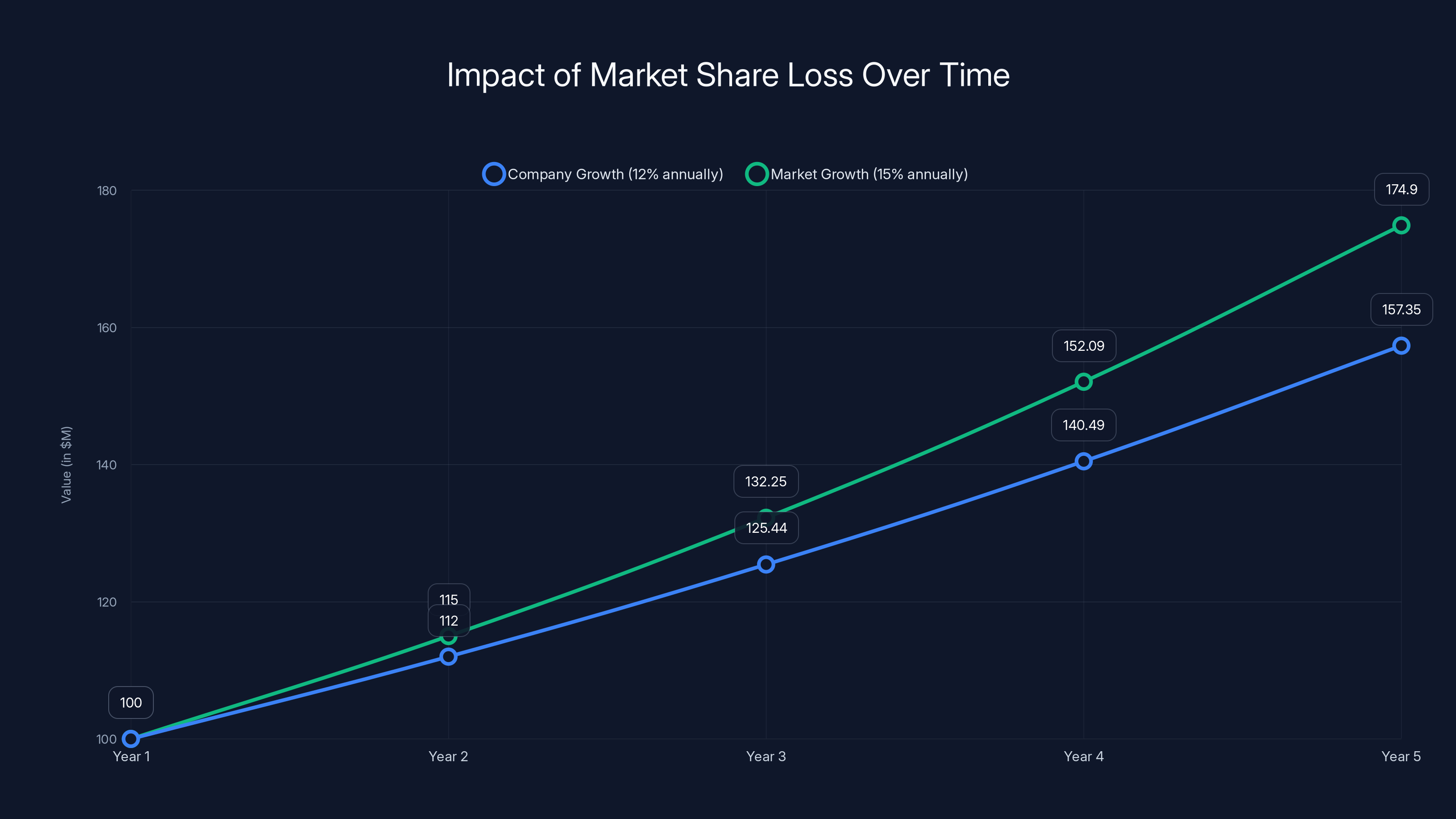

The mathematics of market share compound over time. If you're losing 2% of market share annually—which sounds minor—and your market is

Why Context Matters More Than Absolute Numbers

A 50% growth rate is genuinely impressive—unless your market is growing 75%. A 15% decline is concerning—unless your entire market is contracting 40%. This is why founders must stop looking at their own numbers in isolation.

The exercise of competitive benchmarking is uncomfortable precisely because it removes the ability to hide behind positive absolute metrics. If you search LinkedIn for your competitors' sales team sizes and multiply by the roughly $500K in average annual quota productivity, you can estimate their annual growth targets. If your growth rate is substantially lower, you're losing share. This isn't speculation; it's market mathematics.

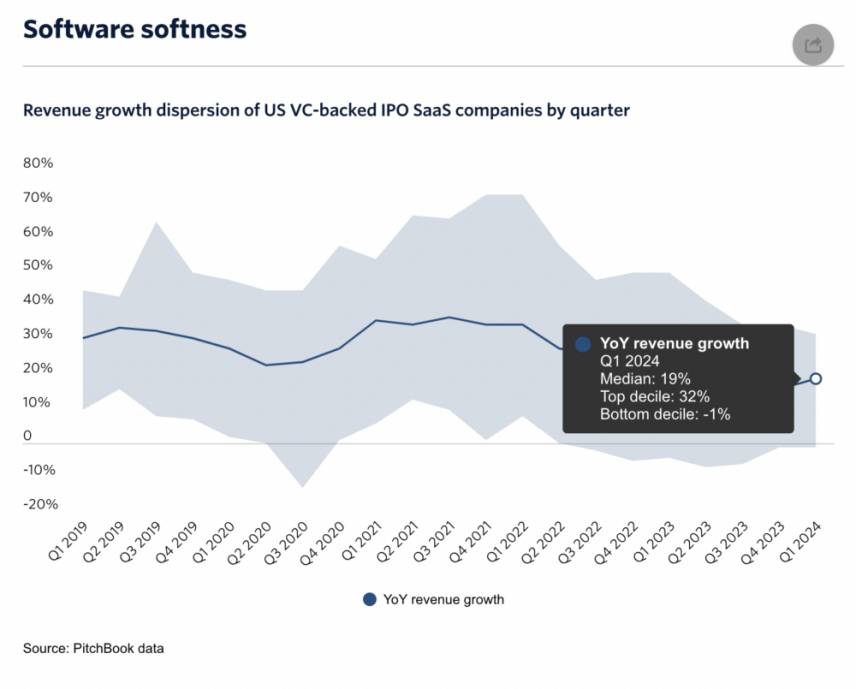

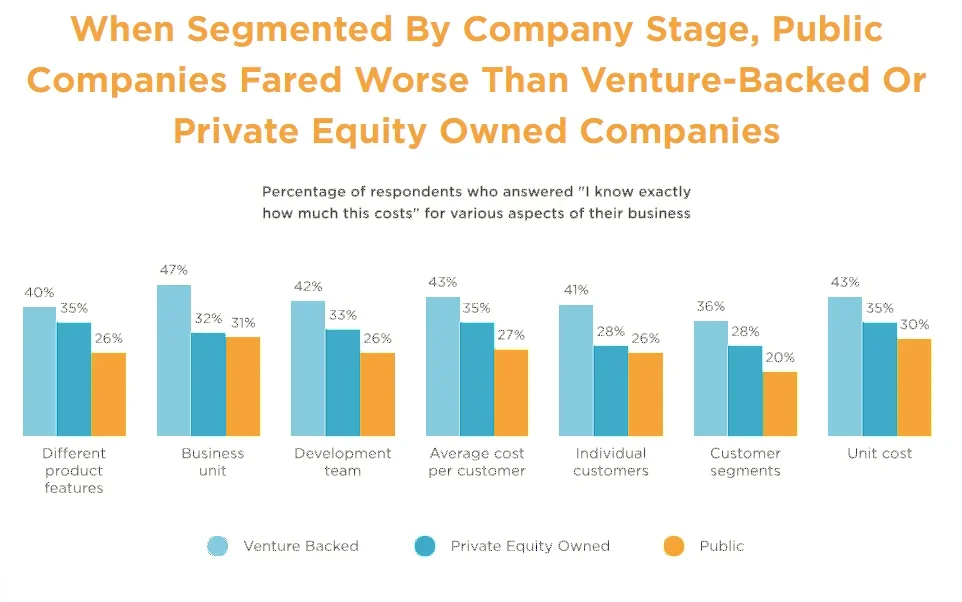

Companies that have fallen out of product-market fit often maintain stable or even growing revenue through existing customer relationships, which masks a more serious problem: they're no longer winning new deals at a competitive rate. High net revenue retention (NRR) can hide this issue for 2-3 years until it becomes unavoidable.

Section 2: The Downturn is Dead—And So Are Your Excuses

The 2022-2024 Excuse Cycle

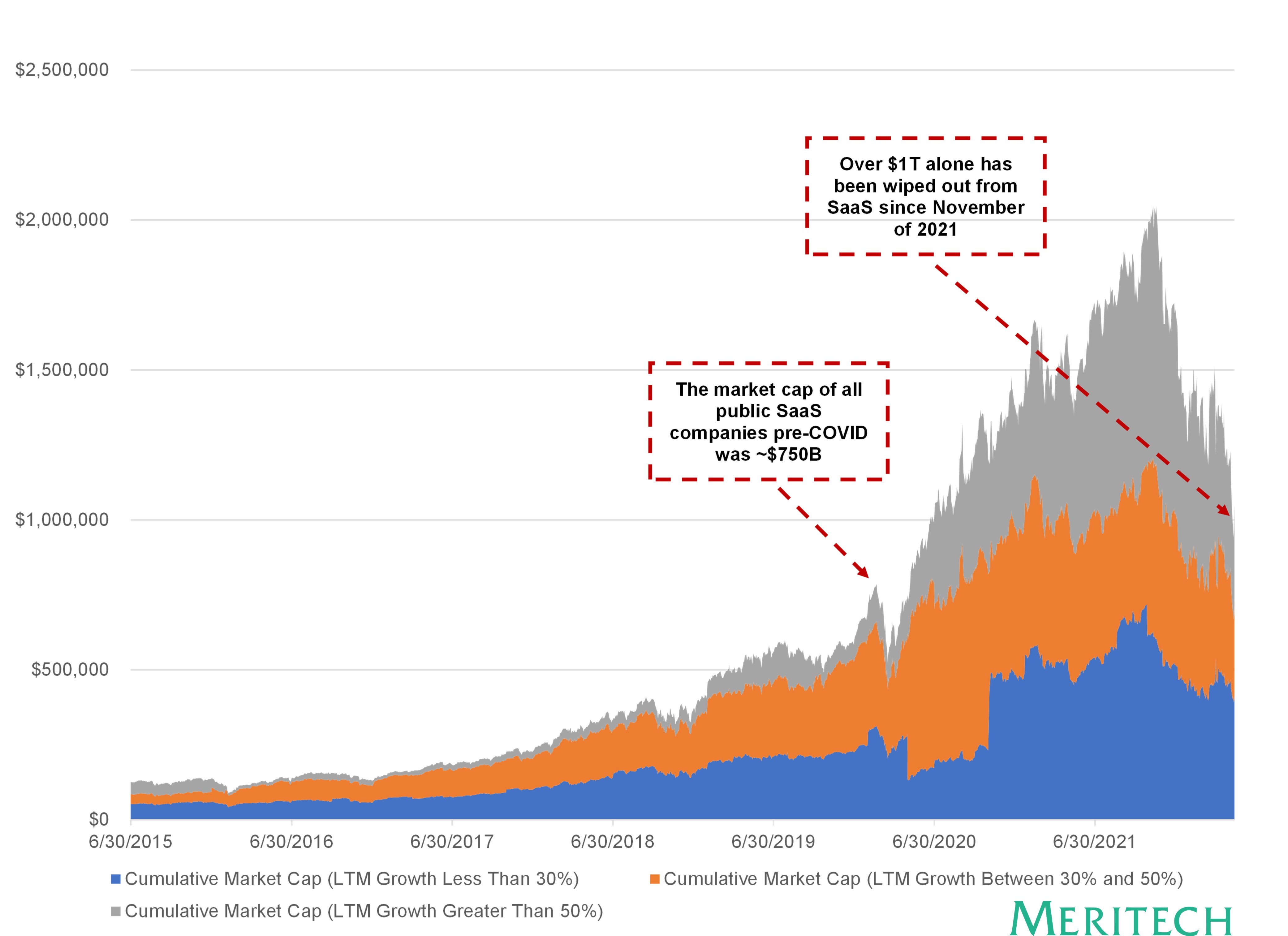

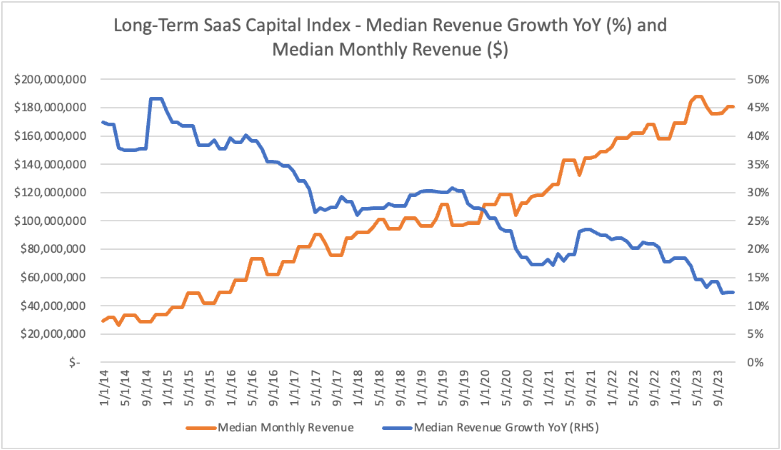

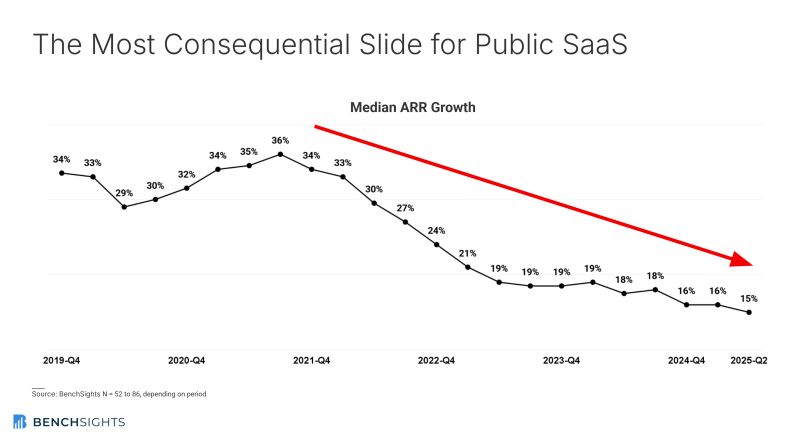

For three years, the SaaS industry had a collective excuse: the downturn. In 2022, when venture capital dried up and growth companies stopped hiring, founders could blame market conditions. In 2023, when the contraction persisted, the "macro environment" became the universal justification for mediocre performance. In 2024, when some companies continued to struggle, the recession narrative continued to provide cover.

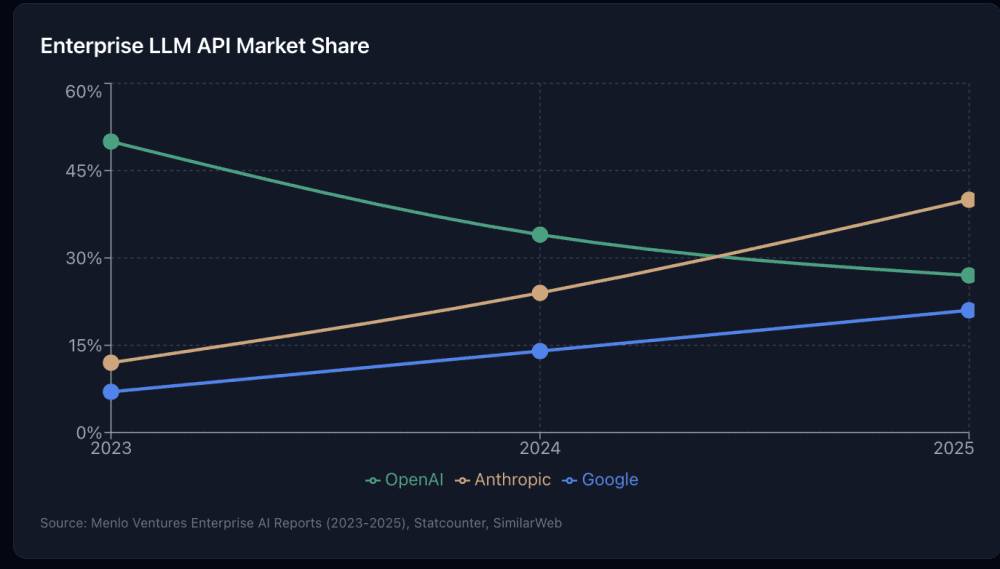

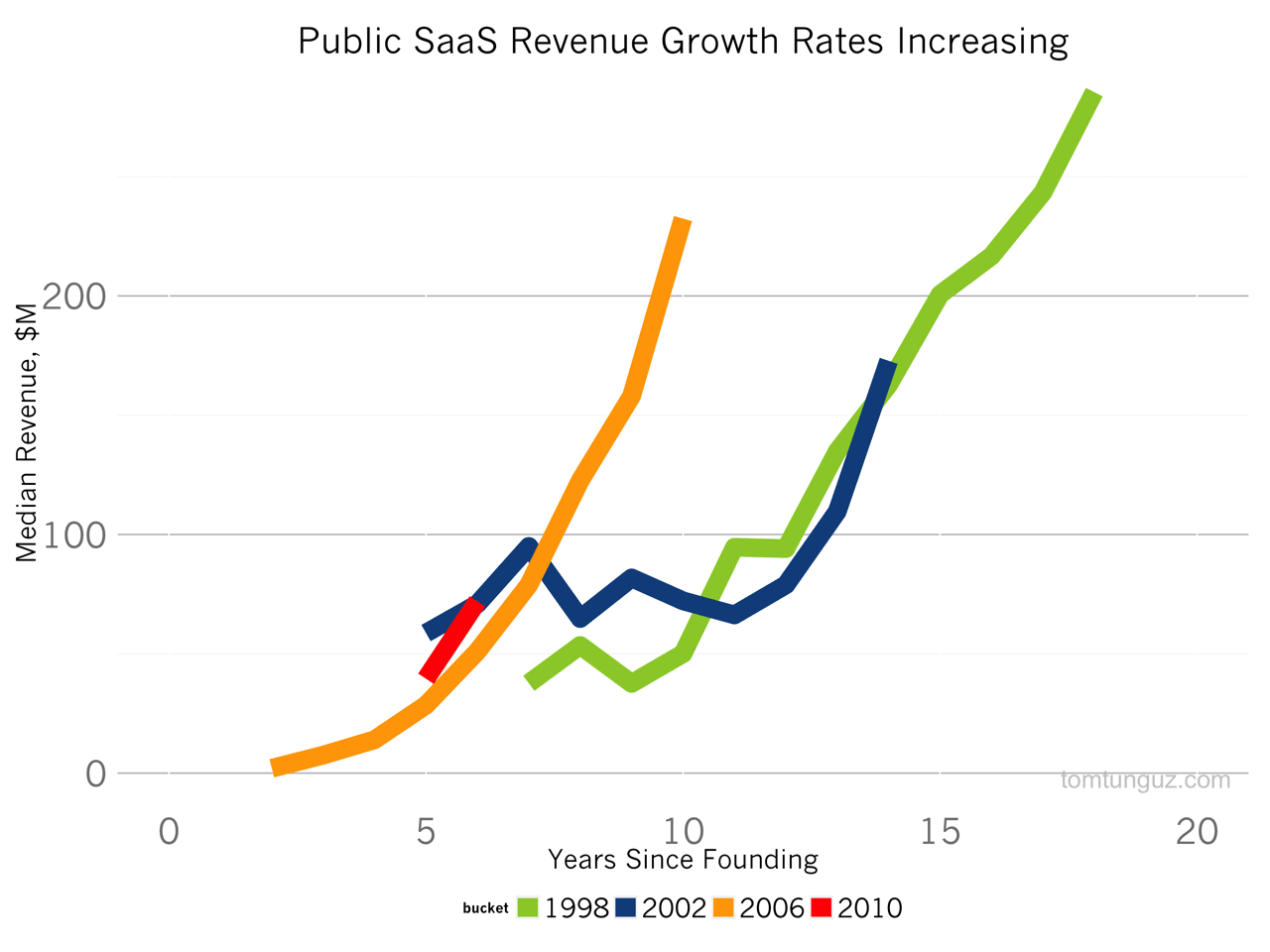

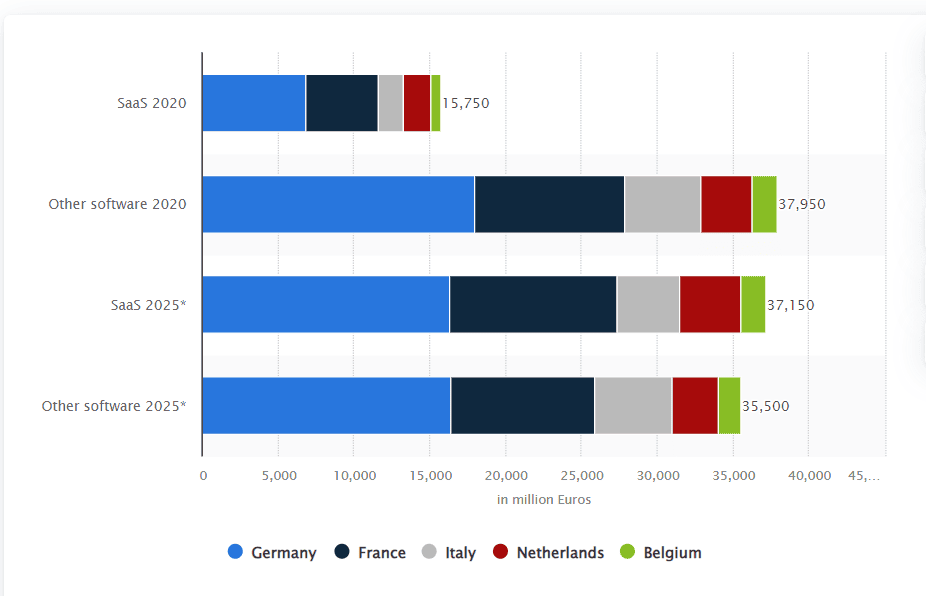

But something shifted in 2024 and accelerated into 2025: the downturn either never happened in most categories, or it's definitively over. You can measure this shift in multiple ways. Venture capital deployment is back to 2021 levels. AI-focused startups are raising at multiples that haven't been seen since the late 2010s. Enterprise software spending is accelerating, projected to reach $1.43 trillion annually. Public B2B SaaS companies are posting their strongest growth quarters in years.

Most importantly, the next generation of companies—Databricks, Cursor, Anthropic, and others—are growing at paces that have never been seen before in the industry. These aren't anomalies; they're proof that the downturn excuse no longer applies.

Enterprise Software Spend is Reshaping Itself

Here's where the situation becomes particularly challenging for companies that didn't evolve: of the projected 15.2% growth in enterprise software spending, roughly 9% represents price increases on existing software. CIOs have budgeted for these increases; they're automatic. The remaining 6% is genuine new spending, and the majority of that is allocated to AI capabilities.

This reshaping creates a zero-sum game for non-AI software. If your product doesn't have meaningful AI features or can't demonstrate clear ROI in an AI context, you're competing for the declining portion of budgets. Buyers are reallocating spend from "nice to have" tools toward AI-powered solutions that promise competitive advantage or efficiency gains.

This shift explains why some companies are growing at 80%+ annually while others in supposedly healthy categories are struggling to hit 20%. The winners captured the AI wave early. The losers are fighting for the shrinking allocation of non-AI budgets.

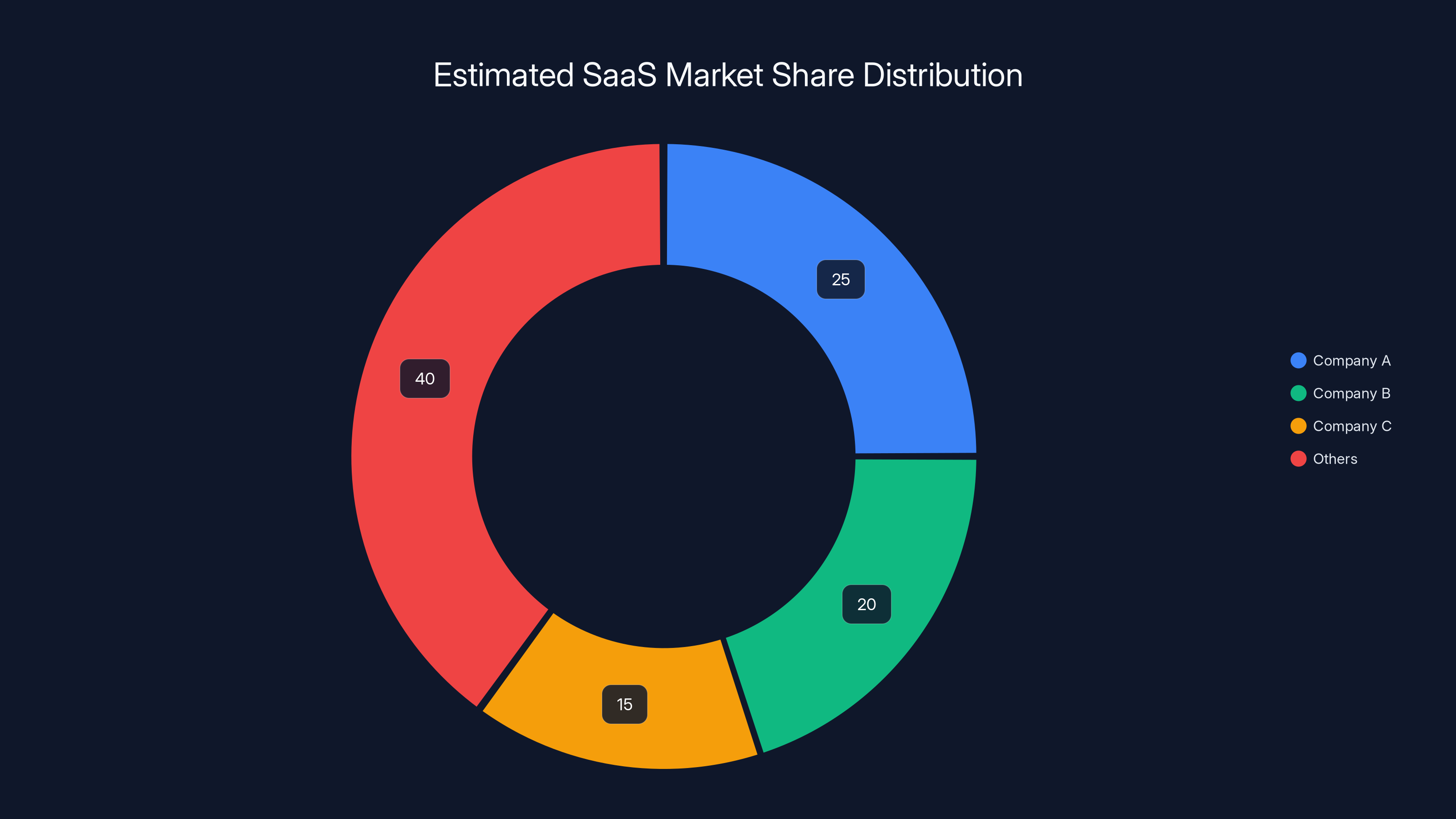

This doughnut chart illustrates a typical distribution of market share in a SaaS category, highlighting how a few companies often dominate the market. Estimated data.

Section 3: Growth Rate as a Vanity Metric

The Problem With Celebrating Growth in Isolation

When a founder tells you they grew 40% last year, your response should be immediate: "What did your competitors do?" Everything else is context.

Consider two scenarios:

Scenario A: Company X grew from

Scenario B: Company Y grew from

Both companies grew 40%. One is winning; one is losing. The growth rate alone tells you nothing.

The Compounding Effect of Relative Performance

When one company outgrows another consistently, the mathematics become devastating over time. If Company A grows 20% annually and Company B grows 40% annually, and they both start at $10M ARR, here's what happens over five years:

- Year 1: Company A = 14M (Company B leads by $2M)

- Year 2: Company A = 19.6M (Company B leads by $5.2M)

- Year 3: Company A = 27.4M (Company B leads by $10.1M)

- Year 4: Company A = 38.4M (Company B leads by $17.7M)

- Year 5: Company A = 53.7M (Company B leads by $28.9M)

In five years, the faster-growing company is more than 2x larger. This gap affects every aspect of the business: engineering resources, sales capacity, marketing budget, product velocity, and ability to acquire talent. The larger company can outbid smaller competitors on hiring, invest more in R&D, weather downturns better, and dominate market narratives.

This is why founders obsessed with absolute growth while ignoring relative performance are playing a losing game. They're not just competing for customers; they're competing for resources and market position. Losing the latter eventually makes winning the former impossible.

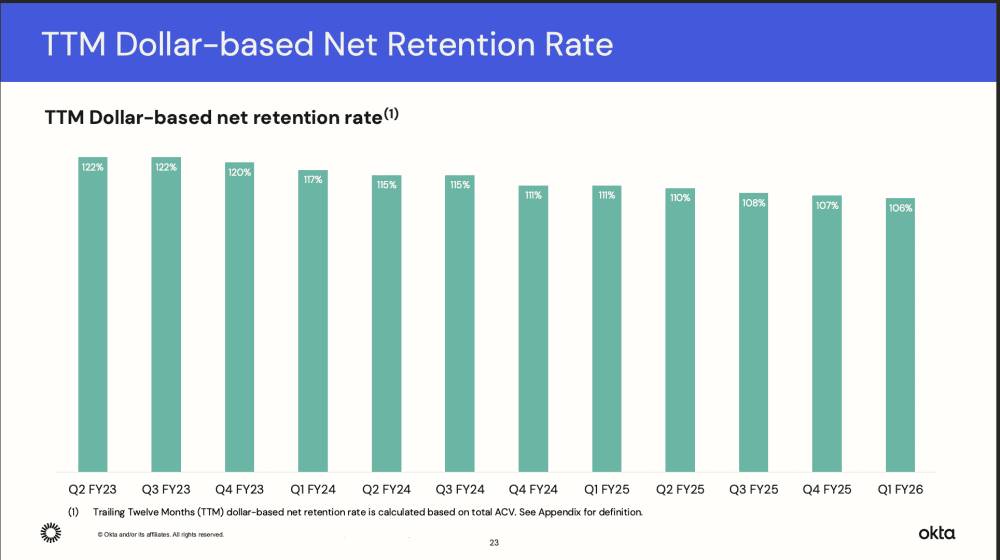

Section 4: The NRR Zombie Phenomenon

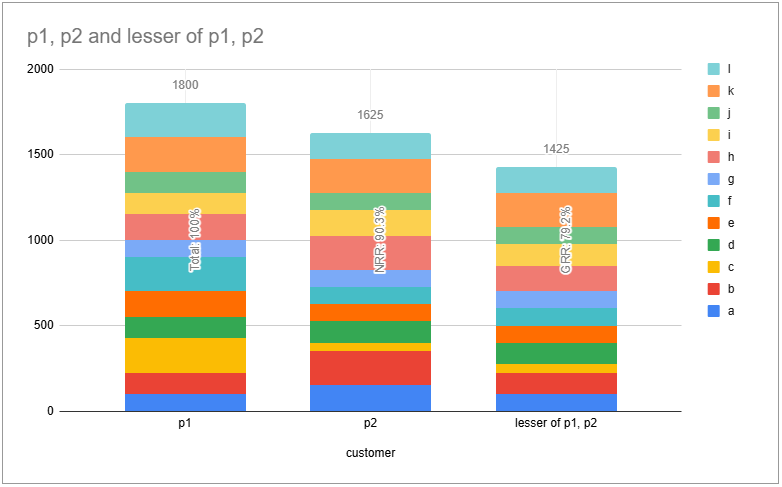

Defining the NRR Zombie

An NRR Zombie is a specific category of SaaS company that represents one of the most dangerous positions in the industry. These are companies that:

- Operate at 20M+ ARR (sometimes higher)

- Maintain 90%-100%+ net revenue retention

- Aren't losing money (often breaking even or modestly profitable)

- Show stable or slightly growing revenue

- Appear to be functioning normally from a financial perspective

- But have essentially stopped winning new customers

These companies "died" in the sense of losing product-market fit during or after the 2021 boom, but the high retention of existing customers masks the underlying problem. With 150% NRR, a company can add virtually zero new customers and still grow revenue. A customer base generating

But it's not. It's a zombie.

How High NRR Enables Dangerous Denial

The insidiousness of the NRR zombie is that all the traditional metrics point toward health. Customers aren't leaving. Revenue is stable. In fact, it's growing—just not growing as fast as the market, as new entrants, or as the company needs to defend its position.

Let's examine the math. If you're an NRR zombie with $10M ARR, 125% NRR, and 5% new customer growth:

- Expansion revenue: 10M base at 25% expansion)

- Retention (existing cohorts): $10M (unchanged customer base)

- New customer revenue: ~$0.5M (5% growth on a declining base as customers churn)

- Total: $13M ARR

Your board deck shows 30% growth. You're hiring. You're spending on marketing. Everyone feels like they're working hard. But you're acquiring 5% fewer customers than you did last year. You're winning fewer deals. You're losing competitive positioning.

Meanwhile, your competitors without the NRR benefit are forced to focus obsessively on new customer acquisition. They're more painful and stressful companies to work at. But they're also fighting, adapting, innovating, and moving faster. In three years, they'll be substantially larger than you.

The Trap: Exhaustion and Organizational Decay

NRR zombies face a particular organizational challenge. The team is often exhausted from the 2021 boom, then the subsequent contraction, then the slow grind of maintaining existing revenue. There's no energy for bold innovation. The product development cycles stretch because the company isn't being pressured by losing deals. Sales teams become complacent because expansion revenue is easier than new customer acquisition.

Meanwhile, the product itself becomes outdated relative to new entrants who have the freedom to build from scratch without legacy customer constraints. Technical debt accumulates. The codebase was built for a different era. New technologies and approaches pass the company by.

By the time leadership recognizes the problem, the organizational gap is substantial. You can't simply decide to win again—you have to rebuild the organization's hunger, velocity, and focus. That's a multi-year project.

Section 5: The AI Budget Shift and Why You Need 10x Features

New AI Spend vs. Reallocated Budgets

According to market analysis, approximately 50% of enterprise AI spending represents genuinely new budget allocation—not reallocation from existing categories. This means $7B+ in new annual spending is entering the market for AI-powered solutions. This isn't subject to normal budget cycles. CIOs have explicit approval from CFOs and boards to spend this money on AI.

The question for every SaaS company is: Did you capture any of it? Or did you sit on the sidelines waiting to see how the market evolved?

Companies that moved early—integrating AI into their core product, building AI-native features, or positioning as AI-first solutions—tapped into this new spending pool. Companies that waited are now forced to retrofit AI into legacy architectures or rebuild from scratch. The relative position matters enormously.

The 10x Feature Requirement

In a competitive market with established players, undifferentiated product improvements don't win. You can make your product 10% better—faster, more reliable, more user-friendly—but that doesn't capture market share from entrenched competitors. Customers have switching costs. They have training invested. They have integrations built.

To overcome that, you need a 10x feature—something your competitors don't have that provides dramatically different value. For many AI-powered companies, that feature is AI itself. Not AI as a bolt-on enhancement, but AI as the core architecture that enables fundamentally different workflows or outcomes.

The problem is that 10x features are rare. Most product improvements are 10% better at best. This is why so many founders, when pressed, can't articulate what makes their product fundamentally different from competitors. They can list 15 features that are marginally better, but they can't identify a single feature that's 10x better.

This matters because it explains market share loss. Without a 10x differentiator, you're competing on price, relationships, and brand. Those are vulnerable positions in a market with better-funded competitors.

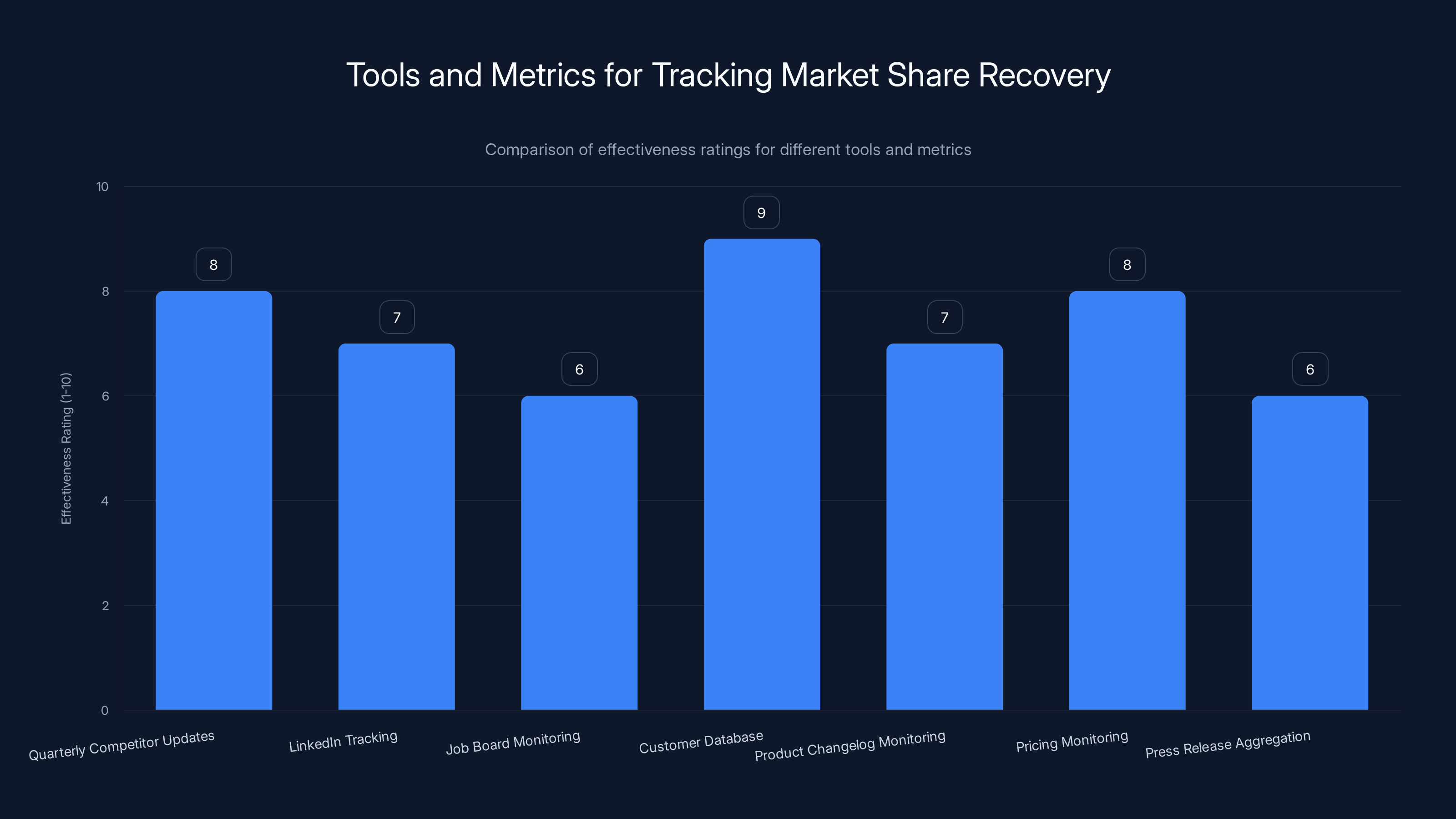

The chart estimates the effectiveness of various tools and metrics for tracking market share recovery, with Customer Database and Quarterly Competitor Updates rated highest. Estimated data.

Section 6: Diagnosing Product-Market Fit Loss

The Hidden Signal of Falling out of PMF

Product-market fit loss doesn't always announce itself. A company can lose PMF gradually while maintaining healthy financial metrics. The primary signal is deal win rate degradation combined with longer sales cycles.

When you have strong PMF, salespeople win at high rates because the product is clearly solving a critical problem in a way competitors don't. Sales cycles are short because buyers are eager to implement. When you've fallen out of PMF, sales cycles extend and win rates decline—but only when compared to competitors.

This is why understanding relative performance matters so much. You might have a 40% win rate that appears stable year-over-year. But if your competitors are achieving 60% win rates, you've fallen out of PMF relative to the market. You're still winning deals, but you're losing too many to competitors. The market has evolved, and you haven't kept pace.

Customer Satisfaction Masks Deeper Problems

Many companies that have fallen out of PMF maintain high customer satisfaction scores. Existing customers are happy with the solution they've implemented. But happiness with existing solutions doesn't translate to being the first choice for new customers evaluating solutions.

This is the critical distinction: Your customers might love you. But the broader market might have moved on to solutions that solve their problems differently, more efficiently, or with emerging technologies you haven't incorporated.

High NRR combined with declining new customer acquisition is the pattern that indicates PMF loss. If you're losing 20% of new customer growth opportunities year-over-year while maintaining stable expansion revenue, you've lost competitive advantage with new buyers. The market shifted, and you didn't.

Section 7: Honest Assessment Framework

Question 1: Are You Gaining or Losing Market Share?

Begin with direct competitors. Identify your top three competitors by revenue or market presence. Then determine how they're growing. If you can't find this information publicly:

- Search LinkedIn for their sales team size and use $500K per rep as a proxy for quota

- Monitor job postings to identify whether they're hiring or cutting

- Analyze their G2 review growth and customer count trends

- Track their funding and spending based on announced capital raises

- Monitor their feature releases and product velocity

- Assess their customer logos at major companies

Compile a simple chart:

| Metric | Your Company | Competitor 1 | Competitor 2 | Competitor 3 |

|---|---|---|---|---|

| Estimated ARR | $15M | $25M | $12M | $8M |

| Estimated Growth | 35% | 60% | 28% | 45% |

| Share of Growth | Low | High | Low | High |

| Trajectory | Declining | Rising | Flat | Rising |

If you're not in the top growth column, you're losing share. This is the honest assessment that enables real strategic decisions.

Question 2: Where Is Your 10x Feature?

This requires brutal honesty. Ask your sales team: "What do we do that competitors don't?" If the answer is a list of marginal improvements, you don't have a 10x feature.

Genuine 10x features enable different outcomes:

- Speed: Your tool works 10x faster than alternatives, changing how users interact with the problem

- Cost: Your solution costs 90% less, making previously uneconomical use cases viable

- Capability: Your tool enables workflows that weren't possible before

- Accuracy: Your solution is 10x more accurate, changing outcomes

- Integration: Your platform integrates with 10x more tools seamlessly

If you can't identify a 10x differentiator, you're a feature competitor. Feature competitors lose market share to better-funded or better-executed competitors.

Question 3: Have You Fallen Out of Product-Market Fit?

This is diagnosed by comparing your new customer acquisition rates over time while controlling for sales and marketing effort. If you're acquiring 20% fewer new customers despite flat or increased sales spending, you've fallen out of PMF.

Additional signals include:

- Sales cycles extending by 50%+ over two years

- Win rates declining against specific competitors

- Price discounting increasing to close deals

- Lower-quality leads from marketing (fewer hand-raisers, more dials required)

- Sales team churn (experienced reps leaving)

- Increased customer implementation challenges

PMF loss is recoverable, but only if you commit to rebuilding it. That means product changes, potentially repositioning, and definitely more investment in the sales motion.

Question 4: Did You Grab New AI Budgets?

Simple assessment: Did your company release meaningful AI capabilities in 2024-2025? Did you allocate R&D resources to AI? Did your sales team specifically pursue AI-related budget conversations with prospects?

If the answer to any of these is "no," you missed an opportunity that won't come again. The companies that tapped into the new AI spending pool early are now solidly ahead. Catching up requires substantial effort.

For companies with products that benefit from AI but haven't implemented it yet, the challenge is one of urgency. Waiting another year means your competitors will have built distribution channels, mind share, and product advantage in the AI category.

Section 8: Why Founders Avoid This Assessment

The Psychological Weight of Losing Share

The honest assessment of market share loss carries emotional weight that absolute growth metrics don't. Telling your board you grew 35% feels good. Telling your board you grew 35% while your competitors grew 70% feels terrible.

This psychological barrier creates a powerful incentive to avoid the assessment entirely. As long as you don't calculate market share explicitly, you can maintain the narrative that everything is fine. The moment you quantify it, denial becomes impossible.

This is why many founders never have this conversation with their teams. It's uncomfortable. It might force strategic decisions they'd rather avoid. It might require admitting that previous strategic bets didn't pay off. It might necessitate major organizational changes.

The Difficulty of Admitting Previous Errors

Most companies that have lost market share did so through a series of decisions—some active, some passive—that seemed reasonable at the time. Maybe you moved upmarket too early, losing touch with the core market. Maybe you waited too long to add AI. Maybe you over-hired and built too much organizational bloat. Maybe you promoted the wrong person to VP of Product.

Orange individual decision is defensible. Collectively, they resulted in market share loss. Assessing this honestly requires acknowledging that the company's leadership made mistakes. That's difficult for founders, especially ones with substantial ego investment in their decisions.

Yet this acknowledgment is necessary. Without it, the same mistakes repeat. Strategic decisions continue to be made from a position of partial information and self-protective reasoning rather than honest assessment.

Enterprise software spending is projected to grow significantly, reaching $1.43 trillion by 2025, with AI-focused spending showing the highest growth. Estimated data.

Section 9: Strategies for Regaining Market Share

Strategy 1: Build or Reposition Around a 10x Feature

If you've lost market share, you must reestablish a competitive advantage. The most sustainable path is through product innovation that creates genuine differentiation.

This means identifying a problem your competitors are solving poorly or not at all, and solving it 10x better. This might be performance, cost, capability, or user experience. The dimension matters less than the magnitude of the improvement.

Repositioning around this feature requires coordinated changes:

- Product roadmap: Commit 12-18 months of engineering resources to the 10x feature

- Go-to-market messaging: Center all sales and marketing on this single differentiator

- Organizational alignment: Sales, marketing, product, and customer success must all reinforce the same positioning

- Customer communication: Existing customers need to understand why you've shifted focus

This is risky because it requires bet-the-company focus. But the alternative—incrementally improving across all dimensions while competitors build deeper moats—is slower death.

Strategy 2: Aggressive TAM Expansion

If your current market is saturated with entrenched competitors, you can gain relative market share by expanding into adjacent markets where your differentiators provide advantage.

This doesn't mean abandoning your core product—it means building flanking products or expanding use cases in new verticals or company sizes.

Successful TAM expansion requires:

- Adjacent market research: Identify markets where your product has advantage and customers have acute pain

- Product adaptation: Modify your product to address the specific needs of the new market

- Separate go-to-market: Launch with dedicated sales and marketing teams rather than trying to sell the new solution through existing channels

- Honest assessment of fit: Not all adjacencies are viable; be willing to abandon those that aren't gaining traction

The advantage of TAM expansion is that you're not directly competing with established players in their core market. You're creating new categories where you can establish leadership.

Strategy 3: Ruthless Cost Structure Rebuilding

If you can't win on features, you might be able to win on cost. This requires rebuilding your entire business model and cost structure.

Comparable to startups that deploy AI automation to reduce sales and customer success costs by 40-60%, established companies can sometimes gain market share through superior unit economics. Lower cost of customer acquisition and serving customers means you can undercut competitors on price while maintaining margins—or maintain price while building superior margins.

This strategy requires:

- Automation: Identify every manual process and automate it where possible

- Operational discipline: Cut any spending that doesn't directly contribute to customer acquisition or delivery

- Engineering efficiency: Rebuild technical architecture for efficiency rather than feature velocity

- Ruthless prioritization: Say no to 95% of feature requests

Companies like Stripe, Twilio, and Datadog have gained market share partly through superior unit economics that allow aggressive pricing. Not every company can achieve this, but it's a viable path if your product is commoditized.

Strategy 4: Vertical Market Dominance

Instead of competing horizontally across all potential customers, dominate a vertical. Build specific, deep integrations and features for one industry. Market aggressively in that vertical. Hire sales reps with domain expertise.

Vertical dominance requires:

- Industry selection: Choose a vertical where your product has specific advantage

- Deep customization: Build features specifically for that industry's workflow

- Industry partnerships: Partner with consultants, resellers, and complementary vendors serving the vertical

- Thought leadership: Become the recognized expert in how your category serves that industry

- Customer concentration: Build a reference-able base of customers in the vertical

This strategy sacrifices breadth for depth. You might only serve 20% of your potential market. But within that 20%, you achieve 70%+ market share and defensible competitive position.

Section 10: Organizational Changes Required for Market Share Recovery

Restructuring Sales Organization

If you've lost market share, your sales organization likely needs restructuring. Sales team structure that worked when you were winning might not work when you're losing.

Specific changes to consider:

- Sales rep quality: High-performing reps leave losing companies. You might need to restructure compensation to attract hungry talent

- Sales process: If win rates are declining, your sales process is likely outdated. Rebuild it around the problems your competitors are solving better

- Sales territory: Reallocate territories to put your best reps against your best opportunities

- Competitive training: Sales teams need detailed training on how to compete against specific rivals

- Sales leadership: If sales are declining under current leadership, change leadership

Product Organization Changes

Product-market fit loss indicates a product organization problem. Changes required:

- Product leadership: If the chief product officer led strategy into a ditch, it's time for change

- Customer feedback loops: Establish direct feedback from winning and losing deals back to product

- Engineering velocity: Increase the pace of product releases and iterations

- Technical debt: Allocate engineering resources to reducing technical debt and improving velocity

- Product positioning: Realign product strategy around competitive differentiation

Marketing and Brand Reestablishment

Lost market share often reflects lost brand perception. Rebuilding requires:

- Brand repositioning: If your brand is associated with the old positioning, rebuild it around new differentiation

- Customer stories: Develop 5-10 detailed case studies showing specific customer outcomes

- Industry visibility: Sponsor conferences, speak at events, publish research in your category

- Paid demand generation: Shift from organic marketing to aggressive paid campaigns capturing buyers actively searching for solutions

- Thought leadership: Establish company leadership as experts through speaking, publishing, and media presence

Section 11: Tools and Metrics for Tracking Market Share Recovery

Building a Competitive Intelligence System

Stop guessing at competitor performance. Build a system for tracking it:

- Quarterly competitor updates: Document each competitor's estimated ARR, growth rate, hiring, funding, and product releases

- LinkedIn tracking: Follow 20-30 employees at each major competitor and monitor hiring and promotions

- Job board monitoring: Track open positions at competitor companies (indicates growth areas and hiring)

- Customer database: Maintain a list of competitor customers and monitor departures and additions

- Product changelog monitoring: Subscribe to competitor product updates and release notes

- Pricing monitoring: Track competitor pricing and packaging changes monthly

- Press release aggregation: Set alerts for competitor press releases and funding announcements

Win-Loss Analysis Program

Implement a systematic program to analyze why you win and lose deals:

- Post-deal interviews: For every lost deal over $100K, conduct a structured interview with the buyer about why they chose a competitor

- Win quantification: For wins, document specifically what differentiated you in the buyer's mind

- Competitive themes: Look for patterns in win-loss data (e.g., "We lose to Company X on price but win on integration breadth")

- Strategy implications: Use themes to inform product roadmap, sales process, and go-to-market decisions

- Quarterly reporting: Report win-loss insights to leadership and tie them to strategic decisions

Market Share Estimation

While precise market share requires industry analyst reports, you can estimate it:

Market size can be estimated through:

- Gartner market sizing reports

- Industry analyst firms

- Customer research (surveying 50-100 customers on total software spend in your category)

- Competitor ARR × estimated market share ratios from analyst reports

Estimate your market share and your competitors' shares quarterly. Track the trend.

Competitor 1 shows the highest growth and ARR, indicating a strong market position. Your company has a moderate growth rate but lower ARR compared to Competitor 1. Estimated data.

Section 12: Special Consideration—Enterprise vs. Mid-Market Positioning

The Upmarket Trap

Many companies that lost market share made a strategic decision to move upmarket—targeting larger enterprises with larger deals. The logic was sound: larger contracts improve unit economics and lower CAC ratios.

But there's a trap. Upmarket motion requires different sales skills, longer sales cycles, and deeper integrations. You're also competing against entrenched enterprise solutions. If you haven't built a 10x product feature, you're unlikely to win these deals—you're likely to get stuck in endless cycles against superior competitors.

Meanwhile, the mid-market and SMB segments—where you potentially had competitive advantage—were abandoned. New competitors entered and captured that market share.

A more sustainable approach: Dominate your core market first. Build a 10x solution for the customers who care most about what you do. Then expand upmarket from a position of strength.

The Technology Pivot Decision

Some market share loss is driven by technology changes that made existing products less competitive. The shift from on-premises to SaaS, from native to web, from monolithic to microservices, from traditional to AI-powered—these transitions create opportunities for new entrants and threaten incumbents.

If your product is built on legacy technology, you face a decision: rebuild on modern architecture, or accept declining market share. Some companies choose the latter because they still have enough revenue to remain viable. But that's a strategic decision to become a declining business.

Companies choosing to rebuild face 18-36 months of painful transition where they're operating two products (legacy and new). This is expensive and diverts resources. But it's the only path to remaining competitive.

Section 13: The Role of External Capital and M&A

When Bootstrap Companies Lose to Well-Funded Competitors

All else being equal, better-funded companies outpace bootstrapped ones. More resources mean faster product development, more aggressive sales hiring, more brand building, more customer success investment.

If you're a bootstrapped company losing market share to well-funded competitors, you have two options: raise capital to match resources, or differentiate on something capital can't buy (deep customer relationships, unique domain expertise, superior product architecture).

Most bootstrapped founders wait too long to raise capital. By the time they do, competitors are 2-3 years ahead. Catching up from behind is dramatically harder than maintaining leadership from ahead.

For bootstrapped companies that want to remain competitive, the decision to raise institutional capital should come earlier rather than later, specifically during periods of market share loss when capital can be deployed to recover position.

Acquisition as a Market Share Recovery Strategy

Some companies recover market share through acquisition. They identify companies that serve complementary segments or have valuable customer bases, and acquire them.

This strategy works if:

- The acquired company has a valuable customer base with high switching costs

- The products complement each other rather than cannibalizing

- The acquisition closes a feature gap or extends market reach

- Integration challenges are manageable

It fails if:

- The acquisition is a desperate grab for growth without strategic fit

- Integration distracts from core business and product execution

- The acquired company's customers churn post-acquisition

- It's used as a substitute for building competitive product

M&A can accelerate market share recovery, but only if it's complementary to strong core product strategy, not a replacement for it.

Section 14: Communication and Board Dynamics

Having the Honest Conversation with Your Board

If you've lost market share, your board needs to know before it's unavoidable. Hiding the problem creates credibility issues when it eventually emerges.

Structure the conversation:

- Present the honest assessment: Show market share data alongside growth metrics

- Explain what happened: What strategic decisions led to this position?

- Acknowledge the problem: Don't minimize or excuse it

- Present options: What are the realistic paths to recovery?

- Request support: What do you need from the board to execute the recovery plan?

Boards respect founders who identify and address problems. They disrespect founders who hide problems and then claim surprise when conditions deteriorate.

Managing Internal Messaging

Your team will sense whether you're being honest about market position. Consistently downplaying market share loss while emphasizing growth creates cognitive dissonance that erodes trust.

Instead:

- Be transparent: Tell your team the honest assessment of market share and competitive position

- Explain the strategy: Share the specific plan for recovering share

- Rally around the mission: Frame market share recovery as a concrete, achievable goal

- Celebrate progress: As you implement changes and gain traction, celebrate the wins

Teams are motivated by clear missions and honest communication. They're demoralized by dishonesty and unclear strategy.

Over five years, a company growing at 12% annually in a market growing at 15% loses significant market share, transitioning from a leader to a secondary player. Estimated data.

Section 15: Timelines and Realistic Expectations for Recovery

Phase 1: Assessment and Planning (1-3 Months)

The first phase is understanding exactly what happened and creating a recovery strategy. This requires:

- Competitive intelligence gathering

- Win-loss analysis on 20-50 deals

- Product differentiation assessment

- Market research on customer needs and competitor positioning

- Leadership alignment on strategy

Expect this phase to be uncomfortable. You'll learn things you didn't want to know. Push through it.

Phase 2: Product Repositioning and Development (6-18 Months)

The second phase is building the differentiator. If you need to build a 10x feature, budget 12-18 months of engineering effort. If you're repositioning existing products, budget 3-6 months for refinement and validation.

During this phase:

- Beta test with 5-10 strategic customers

- Refine based on feedback

- Build sales tools and messaging

- Train your sales team

- Gather case studies and success metrics

Phase 3: Market Share Capture (12-36 Months)

Once you've repositioned or rebuilt, the capture phase involves aggressive go-to-market execution. Expect:

- Year 1: Growth rate beginning to exceed competitors (visible inflection)

- Year 2: Market share stabilization or early gains

- Year 3: Consistent market share growth

Some companies accelerate this timeline through aggressive hiring and spending. Others take a more measured approach. The timeline depends on your resources and competitive intensity.

Overall Timeline to Recovery

For a company that's lost significant market share, expect 2-4 years to full recovery. This assumes:

- Strong execution on product strategy

- Successful sales organization changes

- Customer and market willingness to re-evaluate your solution

- Adequate resources and capital

If any of these factors are weak, the timeline extends. Some companies never recover; they're acquired or wind down.

Section 16: Automation and Operational Efficiency in Share Recovery

Using Automation to Improve Economics

During a market share recovery, improving unit economics allows you to invest more aggressively in growth. Automation—particularly AI-powered automation—is a key lever.

Consider these automation opportunities:

- Sales process automation: Use AI to qualify leads, schedule demos, and handle initial discovery conversations. This allows smaller sales teams to handle larger pipelines

- Customer success automation: Deploy AI-powered onboarding and support bots to reduce time per customer

- Product development acceleration: Use AI code generation tools to reduce development time and cost

- Marketing automation: Use AI to personalize outreach at scale and improve conversion

- Data analysis: Use AI to analyze customer data, win-loss data, and competitive intelligence faster

Companies like Runable offer AI-powered automation tools specifically designed for teams looking to improve operational efficiency. For developers and teams in growth mode, these tools can accelerate product development and reduce operational drag, freeing resources for market share recovery efforts.

The financial impact can be substantial. A sales team 20% more efficient through automation can handle 20% more pipeline with the same headcount. That compounds across a recovery timeline.

Section 17: Industry-Specific Market Share Dynamics

Vertical SaaS and Market Dominance

In vertical SaaS markets (software targeted at specific industries), market share dynamics differ from horizontal markets. Vertical markets have less competition, higher switching costs, and deeper customer relationships.

If you've lost market share in a vertical market, recovery is often faster because there are fewer competitors. Focus on deepening relationships and industry specialization. Market share recovery in vertical SaaS often takes 12-24 months rather than 3-4 years.

Infrastructure and Developer Tools

Market share in developer tools and infrastructure is often driven by developer mind-share, community, and integration depth rather than sales and marketing. If you've lost market share in this category:

- Increase developer engagement (conferences, communities, open source)

- Build robust APIs and integrations

- Improve documentation and developer experience

- Consider open-sourcing core components

Recovery timeline is often longer (3-5 years) because developer preference changes slowly, but once recovered, the defensibility is high.

Enterprise SaaS

Enterprise SaaS market share loss is often tied to vendor consolidation and platform dominance. If you've lost share to platform players:

- Consider vertical specialization

- Build deep integrations with the platform ecosystem

- Focus on adjacent use cases and expansion within accounts

Direct recovery is often difficult; most non-platform companies accept secondary positioning or pursue vertical dominance strategies.

Section 18: Future-Proofing Against Future Market Share Loss

Building Sustainable Competitive Advantage

Once you've recovered market share, the goal is to prevent future loss. This requires:

Continuous product innovation: Don't rest on a 10x feature; build a culture of continuous innovation. Allocate 20-30% of engineering resources to exploring new capabilities

Customer obsession: Maintain direct relationships with customers. Know their evolving needs. Move faster than competitors to address them

Technical excellence: Invest in technical architecture, engineering culture, and code quality. Technical debt compounds and eventually impedes competitiveness

Talent attraction: Build a culture that attracts top talent. Better engineers build better products. Better product teams win market share

Capital efficiency: Maintain unit economics that allow you to invest in growth without dependency on constant capital raises. This provides flexibility competitors might not have

Market Monitoring Systems

Build permanent systems for monitoring competitive position:

- Quarterly competitive intelligence updates

- Annual win-loss analysis programs

- Ongoing customer feedback loops

- Market research investments

- Analyst relationship management

The founders and leaders who avoid market share assessment are the ones who eventually lose it. Continuous, honest assessment enables responsive strategy.

Conclusion: Moving from Denial to Action

The uncomfortable question at the beginning of this article—"Did you gain or lose market share?"—is difficult precisely because it removes the ability to hide behind positive absolute metrics. It forces honest assessment. And honest assessment, while painful, is the foundation for recovery.

Here's what we've covered:

Market share is different from growth. Revenue growth of 30% might represent market share loss if competitors grow 60%. This mathematical reality compounds over time, creating gaps that become increasingly difficult to close.

The downturn excuse is dead. Venture capital is flowing, enterprise software spending is accelerating, and AI-powered hypergrowth is real. If you're not growing competitively, it's not market conditions—it's your company.

NRR zombies are trapped. Companies with high retention but low new customer acquisition are masking deeper problems. High retention can hide falling out of product-market fit for 2-3 years, but eventually the math catches up.

You need a 10x differentiator. Without a feature that's 10x better than competitors, you're competing on price, relationships, and brand. Those are weak positions against better-funded rivals.

Product-market fit loss is the core problem. When new customer acquisition declines while expansion revenue stays stable, you've fallen out of PMF. This is recoverable, but only with deliberate product strategy and organizational change.

Recovery is a 2-4 year project. Market share recovery isn't quick. It requires sustained effort through product development, go-to-market change, sales restructuring, and cultural shifts. Companies that expect faster results typically give up mid-way.

Honest assessment is the first step. Use the framework in this article to assess your actual market position. Calculate estimated market share. Determine growth rates versus competitors. Identify your 10x differentiator (or lack thereof).

Action follows assessment. Once you've honestly assessed your position, you can choose a path forward: build a 10x feature, pursue vertical dominance, expand TAM, rebuild cost structure, or raise capital to match better-funded competitors.

The companies winning in 2025 are those that honestly assessed their market position in 2023-2024 and took aggressive action. The companies struggling are those that celebrated 20-30% growth while ignoring that competitors were growing 50-80%.

As you head into planning season, push your leadership team to have the uncomfortable conversation. Ask the questions nobody wants to ask. Calculate your market share. Assess your competitive position. Then commit to the hard work of recovery.

Denial is comfortable. Action is difficult. But action is the only path to winning market share in 2025 and beyond.

FAQ

What exactly is market share in SaaS?

Market share in SaaS represents your company's revenue or customer count as a percentage of the total addressable market (TAM) in your category. Unlike growth rate (which measures year-over-year improvement), market share measures your competitive position relative to the total market. A 30% growth rate is only meaningful if the total market is growing slower than 30%; otherwise, you're losing relative position. Market share is calculated as: Your ARR ÷ Total Market ARR × 100 = Market Share %.

How do I calculate my estimated market share if I don't have access to analyst reports?

You can estimate market share through several methods: First, multiply your top three competitors' estimated ARR by their known market share percentages (from available analyst reports) to triangulate total market size. Second, conduct customer research—survey 50-100 customers in your category about total software spending and extrapolate. Third, use Gartner or Forrester reports which publish category-level spending projections. Once you have estimated TAM, divide your ARR by that number to get approximate market share percentage.

What is an NRR zombie and why should I care?

An NRR zombie is a SaaS company operating at

Why is a 10x feature necessary for market share growth?

Market share competition requires overcoming switching costs. Customers have training invested, integrations built, and relationships established with current solutions. Marginal product improvements (10% better) are insufficient to justify switching—the friction outweighs the benefit. A 10x feature—whether speed, cost, capability, or integration breadth—is sufficiently valuable that it overcomes switching friction. Without 10x differentiation, you're competing on price or relationships, both vulnerable positions.

How can I tell if we've fallen out of product-market fit?

Product-market fit loss manifests primarily through declining new customer win rates combined with stable or growing expansion revenue. Specific diagnostic signals include: sales cycles extending 50%+ over 2 years, win rates declining against specific competitors, increased price discounting required to close deals, and high-quality lead generation declining despite stable or increased marketing spend. Your existing customers might be very happy (high NRR), but the broader market prefers competitors' solutions. This is diagnosed through win-loss analysis on 20-50 deals.

What percentage of enterprise software spending is going to AI, and why does it matter?

Approximately 50% of enterprise AI spending represents new budget allocation (not reallocation from existing categories), totaling $7B+ annually. The remaining portion comes from reallocating budgets from non-AI software. This matters because if your product doesn't have meaningful AI capabilities or can't demonstrate clear ROI in an AI context, you're competing for the shrinking allocation of non-AI budgets. Companies that captured new AI spending early established leadership; catching up now requires substantial product and go-to-market effort.

How long does it take to recover market share after identifying loss?

Market share recovery typically requires 2-4 years assuming strong execution. Timeline breaks down as: Phase 1 (Assessment) - 1-3 months; Phase 2 (Product Development/Repositioning) - 6-18 months; Phase 3 (Market Share Capture) - 12-36 months. Companies with more resources or faster execution can compress this timeline. Companies that take a measured approach or face strong competitor resistance might extend it to 4-5 years. Most companies that don't commit fully to recovery over 18-24 months eventually surrender market position to competitors.

Should we raise capital to recover market share?

Capital enables faster market share recovery through accelerated hiring, product development, and market expansion. If you're losing market share to better-funded competitors, raising capital can help level the playing field and fund recovery efforts. However, capital is not sufficient alone—you also need clear strategy (10x differentiator, TAM expansion, or cost structure advantage) and strong execution. Raising capital without clear strategy is likely to delay difficult decisions rather than solve underlying problems.

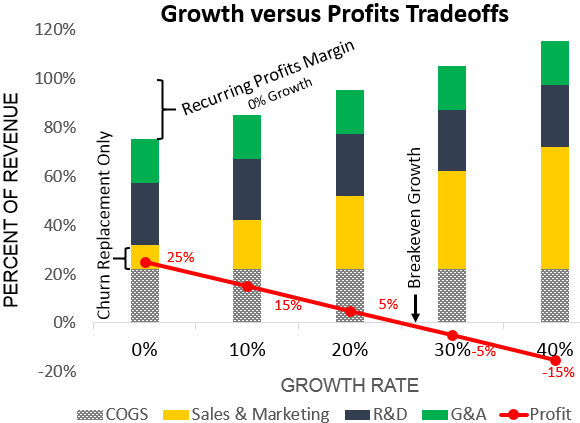

How do we balance market share recovery with profitability?

Market share recovery and profitability are often in tension. Aggressive recovery typically requires increased spending on product development, sales, and marketing, which pressures near-term profitability. The strategic question is whether market share position is worth the profitability trade-off. For growing markets with long-term expansion potential, sacrificing 1-2 years of profitability to establish market leadership often creates more long-term value than maintaining profitability while losing share. This calculation is unique to each business, competitive situation, and market condition.

Can automation help with market share recovery?

Yes, automation—particularly AI-powered automation—can improve unit economics by increasing sales team efficiency, reducing customer success costs, and accelerating product development. A 20% efficiency gain through automation allows the same team to handle 20% more pipeline or customers. This compounds across a recovery timeline, freeing resources for growth investment. For teams looking to recover share efficiently, platforms offering AI-powered workflow automation and content generation can reduce operational drag that otherwise slows execution.

Key Takeaways:

- Market share loss is distinct from revenue growth and compounds over time

- NRR zombies mask falling market position through expansion revenue

- 10x features are required to overcome switching costs and win market share

- Recovery requires 2-4 years of sustained effort across product, sales, and marketing

- Honest competitive assessment is the foundation for strategic decision-making

Key Takeaways

- Market share loss compounds exponentially over time—losing 2% annually for 5 years means losing ~15-20% cumulative opportunity

- Revenue growth without comparative analysis is a vanity metric; 30% growth while competitors grow 60% means you're losing position

- NRR zombies mask product-market fit loss through expansion revenue; high retention can hide declining new customer acquisition for 2-3 years

- A 10x feature is required to overcome switching costs; marginal improvements don't justify competitive switching

- Market share recovery requires 2-4 years of sustained effort across product, sales, and organizational change—there are no quick fixes

- Enterprise software spending is shifting toward AI; companies without AI capabilities are losing budget allocation to AI-focused competitors

- Win-loss analysis on competitive deals reveals pattern gaps between your product positioning and market perception

- Honest competitive assessment is emotionally difficult but strategically necessary; denial prevents strategic evolution

- TAM expansion, vertical dominance, and aggressive cost restructuring are viable paths to share recovery without matching all competitor capabilities

- Automation and AI-powered tools can improve operational efficiency during recovery, freeing resources for growth investment

Related Articles

- LG CLOiD Home Robot: The Future of Household Automation [2025]

- LG's CLOiD Humanoid Robot: The Future of Home Automation [2026]

- Samsung's S Pen for Foldables: The Game-Changer Against iPhone Fold [2025]

- Best Cybersecurity Journalism 2025: Stories That Defined the Year

- Best Buy's Post-Christmas Sale: 55% Off Tech Explained [2025]

- Spartacus: House of Ashur Episode 5 Disturbing Scene Breakdown [2025]