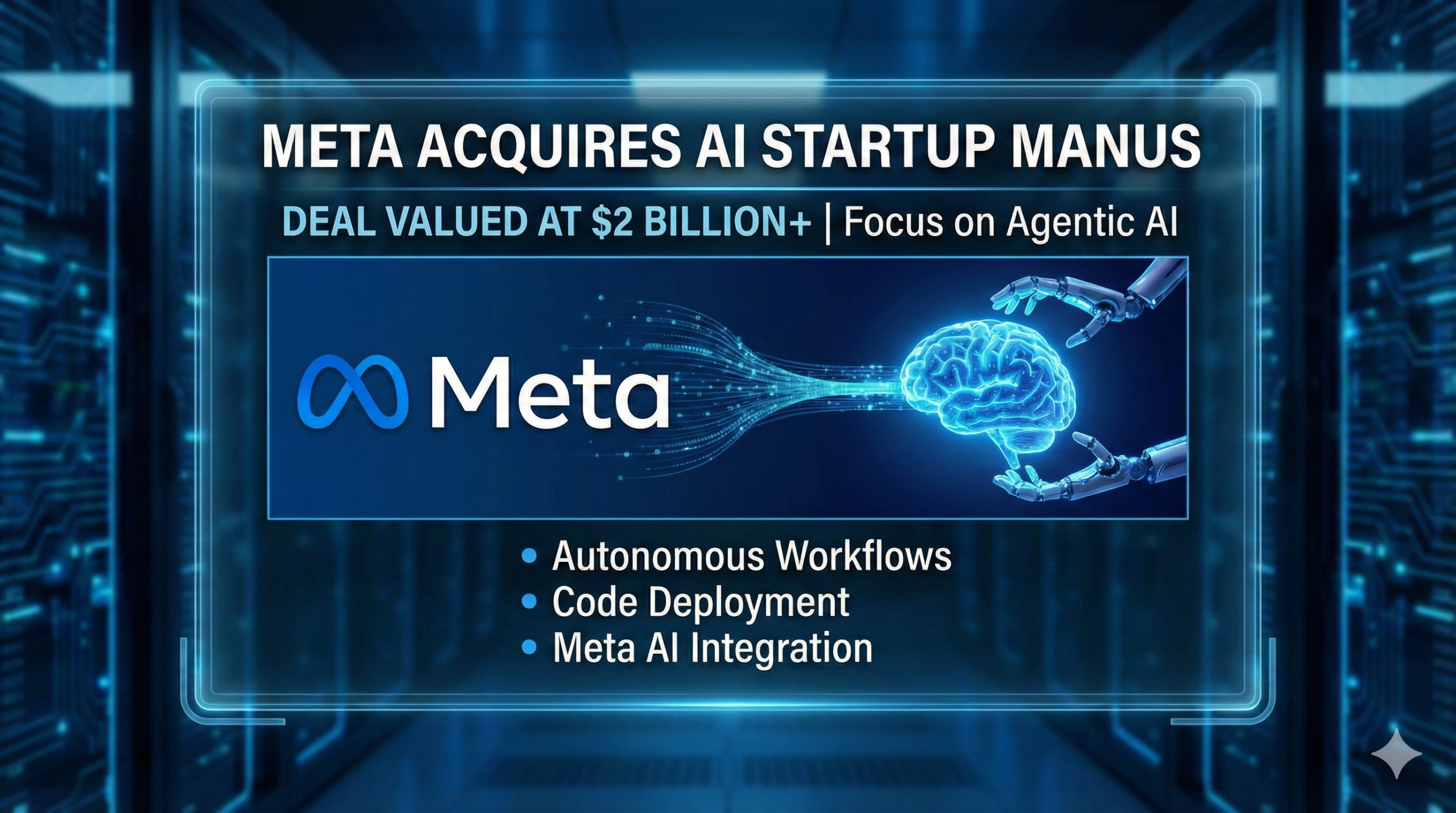

Meta's $2 Billion Manus Acquisition: The Future of AI Agents [2025]

It's not often that a single acquisition makes you rethink what an entire industry is building toward. But Meta's reported $2 billion purchase of Manus does exactly that.

For years, the narrative around AI has been straightforward: bigger models, better chat, smarter predictions. Most tech companies have poured resources into training foundational models and wrapping them in chatbot interfaces. Meta itself spent billions developing Llama, then layering Meta AI on top as a conversational tool.

But Manus represents something fundamentally different. It's not a chatbot that answers questions. It's an agent that completes tasks. Autonomously. End-to-end. Without you sitting there prompting it every step of the way.

This $2 billion price tag isn't just Meta throwing money at a trendy startup. It's a strategic pivot that tells you everything about where the tech industry is actually heading in 2025 and beyond. The winners won't be the companies with the biggest language models. They'll be the companies that can build agents that actually work in the real world.

Let's dig into what's really happening here, why it matters, and what it means for the AI landscape you're working in right now.

TL; DR

- Meta paid $2 billion for Manus, one of the largest AI acquisitions to date, signaling a massive shift toward autonomous agents

- Manus is different: It's not a chatbot but a goal-oriented system that performs complex, multi-step tasks like coding, research, and web automation

- The speed is staggering: Manus hit $125M+ revenue run rate in just 8 months and served 147 trillion tokens with 80M virtual computers created

- This is an arms race: Google's Gemini and Open AI's Chat GPT are racing to build agent capabilities, but Meta just jumped ahead by acquiring proven technology

- Enterprise automation just got real: Manus agents can integrate with other platforms, making them a threat to traditional workflow automation tools

- Data security concerns linger: Manus's Chinese origins (before relocation to Singapore) raised regulatory flags that Meta had to address explicitly

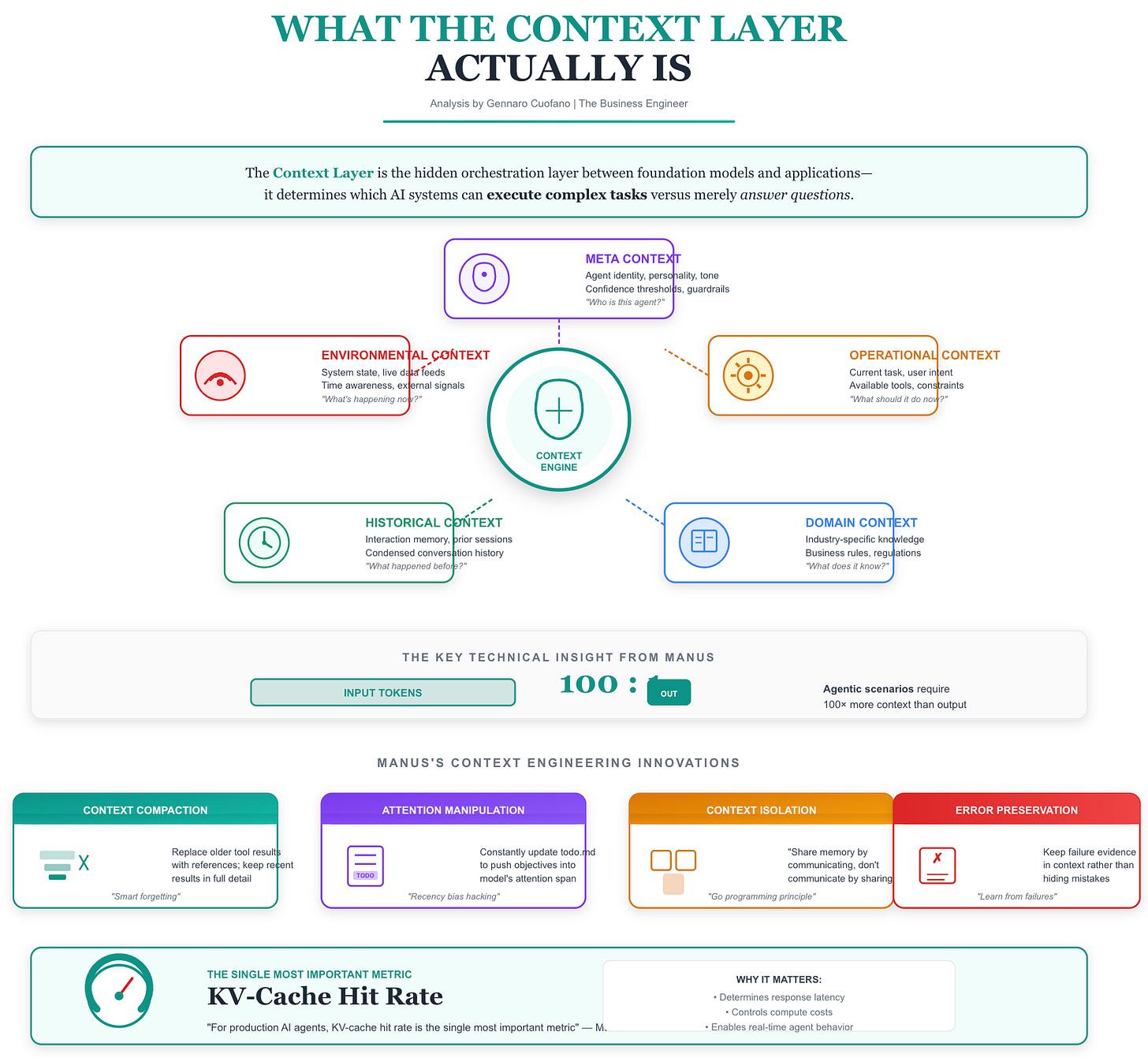

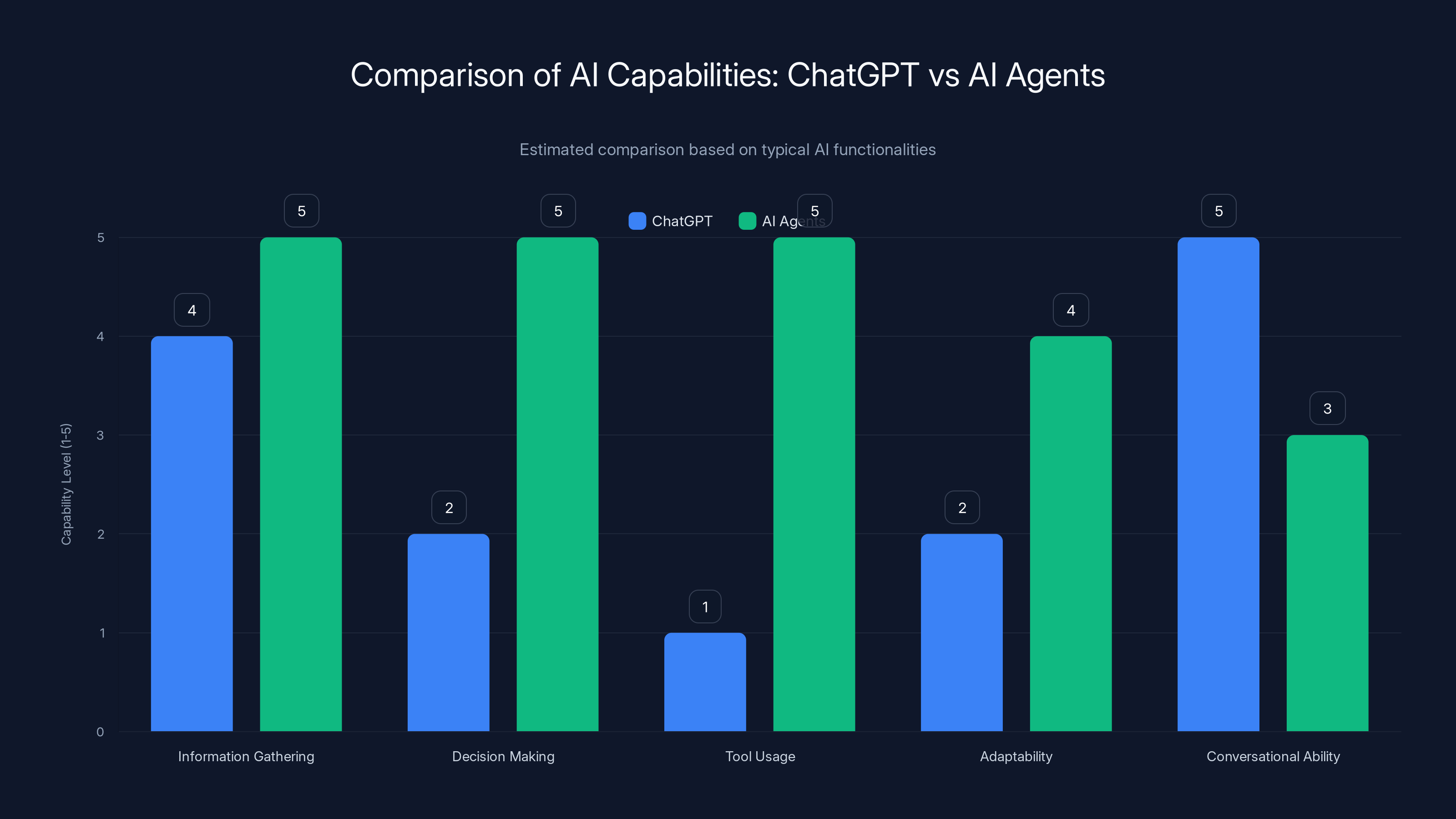

AI Agents excel in decision-making, tool usage, and adaptability compared to ChatGPT, which is stronger in conversational ability. Estimated data based on typical AI functionalities.

The Difference Between Chatbots and Autonomous Agents

Before we talk about why Meta spent $2 billion, we need to understand the fundamental difference between what everyone's been building and what Manus actually does.

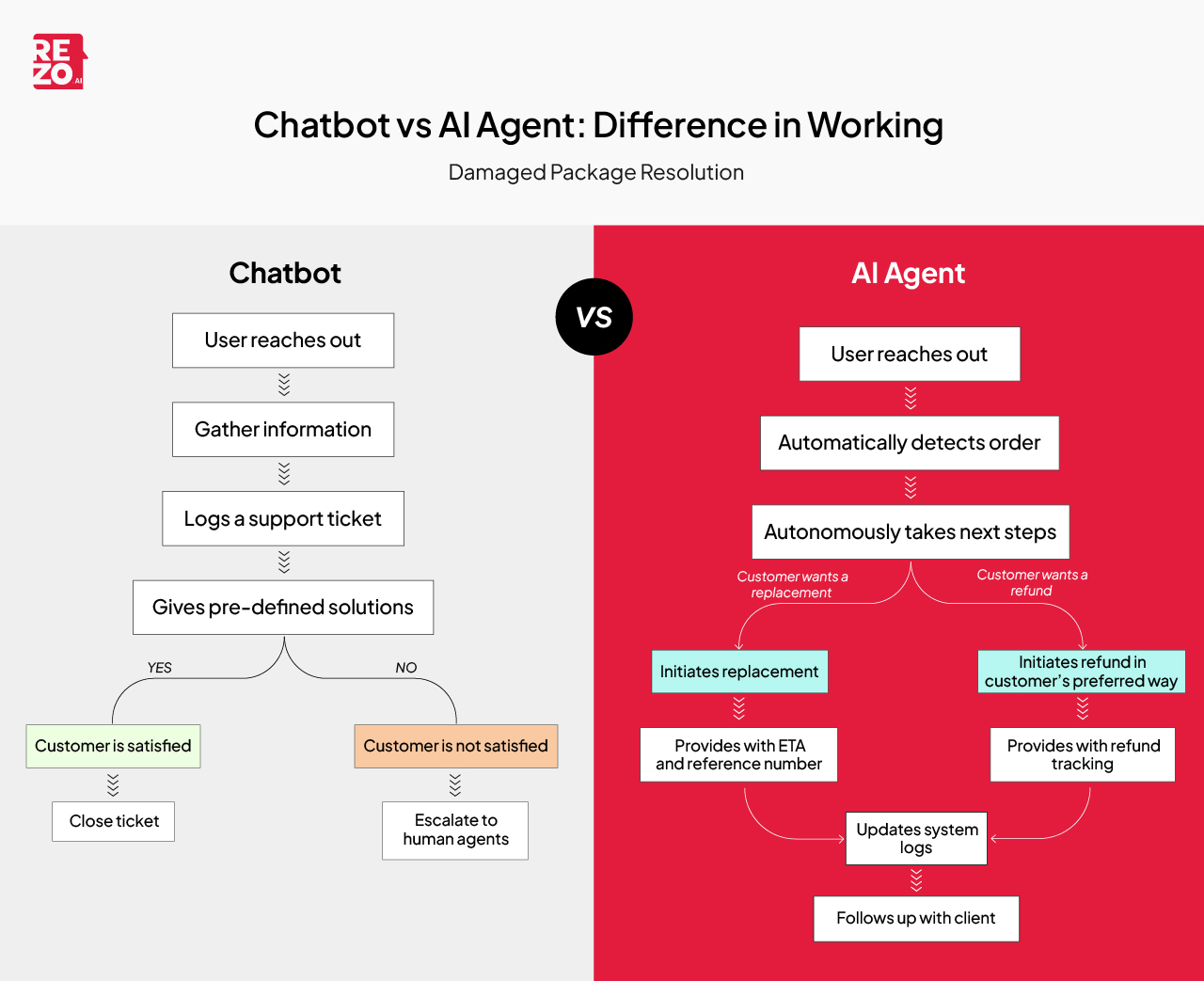

A chatbot is reactive. You ask it a question. It generates an answer. You ask another question. Repeat. It's a conversation, which is why they're called "conversational AI." Even the most advanced versions—like Chat GPT or Claude—are essentially sophisticated text prediction engines. They're incredibly smart at the next word, but they're not executing a plan.

An autonomous agent is something else entirely. It's goal-driven. You tell it what you want to accomplish, and it breaks that goal into steps, executes them, adapts when things don't work, and keeps going until the job is done. It's not waiting for you to prompt every step.

Think about the difference this way. If you ask Chat GPT to "write a market analysis for Saa S startups in the healthcare space," it'll write you something coherent. But if you ask Manus to do the same thing, it doesn't just generate text from memory. It goes out to the web, gathers current data, analyzes recent acquisitions and funding trends, cross-references industry reports, synthesizes everything, and then delivers research that's actually current.

That's the agency. That's what changes everything.

Manus achieves this through a combination of techniques that aren't particularly new individually, but are genuinely hard to implement well together: planning, memory management, tool use, and recursive reasoning. The agent needs to plan a sequence of steps, remember what it's learned so far, know which tools to use for which tasks, and be able to reconsider its approach when it hits a dead end.

Several companies have been chasing this problem for years. Anthropic has Claude with its tool-use capabilities. Open AI's Chat GPT now has browsing and code execution. Google's Gemini is adding agent features. But most of these are recent additions bolted onto conversation engines.

Manus was built from the ground up as an agent platform. That's not a trivial difference.

Estimated data shows Meta AI's post-acquisition pricing strategy maintains similar tiers but potentially undercuts competitors due to cost advantages.

Why Manus? Why Now? Why $2 Billion?

Meta wasn't desperate to buy Manus. The company had been raising new funding rounds at a $2 billion valuation before Meta made its move. Microsoft was testing Manus integration into Windows 11. Google was watching. Multiple acquirers were likely interested.

But Meta moved decisively and got the deal done. Why?

The answer is partly about timing and partly about Meta's strategic position.

First, the timing. The AI agent space exploded in 2024 and early 2025. What seemed like science fiction in 2023—AI systems that could actually automate real work—suddenly became commercially viable. Hundreds of thousands of developers, analysts, and business users started building workflows around agentic systems. The category went from "interesting research" to "companies are paying for this."

Manus proved the model works. The company launched its General AI Agent in early 2024 and hit $125 million in revenue run rate by mid-2024. That's insane growth. Not startup growth. Not "we've got a nice prototype" growth. That's "enterprise customers are betting their operations on this" growth.

The financial metrics tell you everything. Manus had served over 147 trillion tokens and created more than 80 million virtual computers across its user base. These aren't vanity metrics. They mean Manus customers were actively using the platform to handle serious workloads. The company had achieved product-market fit with both individual users and enterprises.

Meta's strategic position adds another layer. The company has been spending billions on AI infrastructure and model development. It released Llama, built Meta AI, invested in Scale AI. But Meta has consistently lagged Open AI and Google in the perception game. Open AI has Chat GPT and dominates consumer mindshare. Google has Gemini and tight integration with Search. Meta has powerful technology but struggles with differentiation.

Acquiring Manus fixes that immediately. Instead of trying to build agent capabilities from scratch, Meta instantly gains a proven, commercially successful product with millions of users and thousands of enterprise customers. It's a technology shortcut worth billions.

There's also a regulatory angle that gets glossed over. Manus started as part of a Chinese AI startup called Butterfly Effect before spinning off. The company relocated from Beijing to Singapore in 2024. Meta's acquisition explicitly requires "no continuing Chinese ownership interests." This matters because in 2025, perception of foreign influence in AI is genuinely toxic. Meta couldn't afford to be seen as dependent on Chinese-sourced technology. Acquiring Manus also neutralizes that vulnerability.

The Race for AI Agent Dominance

Meta's $2 billion bet makes sense only if we understand what's actually at stake in the AI agent race.

Open AI and Google aren't sitting still. Open AI's Chat GPT has added web browsing, code execution, and now various forms of task automation. The platform is slowly shifting from pure chat toward agentic behavior. Open AI's reasoning models are getting better at planning and multi-step problem solving.

Google's Gemini is going the same direction. Gemini is increasingly integrated across Google Workspace, Search, and Android. The company is layering agentic capabilities onto its base model. Google's advantage is integration depth—it owns the entire stack from data centers to consumer devices.

But here's the problem both companies face: retrofitting agent capabilities onto systems designed for conversation is hard. It's like trying to turn a sports car into a delivery truck. You can add features, but the architecture fights you.

Manus, by contrast, was purpose-built for autonomous task completion. The code, the data pipelines, the reasoning architecture, the memory systems—everything was designed around goal-oriented behavior. That architectural advantage is real and not easy to replicate.

Meta's acquisition short-circuits years of engineering work. Instead of building from scratch, Meta inherits a mature platform with proven real-world performance. This isn't like acquiring a research team. It's like acquiring a revenue-generating business with customers actively relying on it.

Anthropics also deserves mention. Claude has strong reasoning capabilities and tool use, but Claude remains primarily a chat interface. Anthropic has been cautious about pushing too hard into autonomous agents, partly due to safety concerns. That caution is admirable but also creates an opening for competitors.

The race is now three players: Meta (with Manus), Open AI (with Chat GPT plugins and browsing), and Google (with Gemini integration). Whoever builds the most reliable, capable, and trustworthy agent platform wins not just consumer mindshare but massive enterprise contracts.

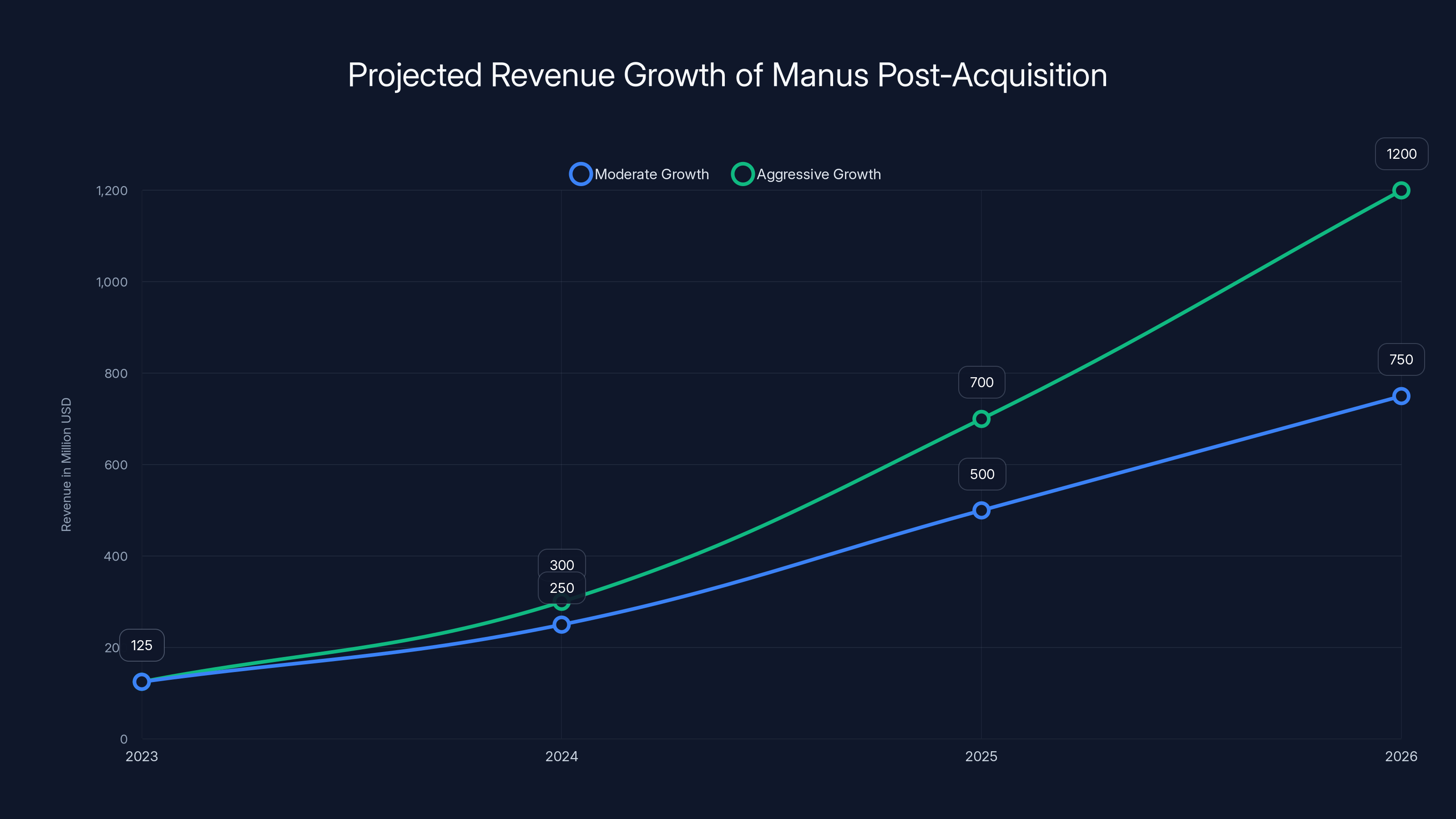

Estimated data shows that under Meta's ownership, Manus could see its revenue grow significantly, potentially reaching

What Manus Actually Does (Beyond the Hype)

Let's get specific about Manus's capabilities, because the marketing tends to oversell while the actual product is genuinely interesting.

Manus can write code. Not just generate code snippets, but actually build functioning applications. Users report giving Manus a spec and getting back a working solution. The agent doesn't just hallucinate—it tests, debugs, and iterates.

Manus can perform research. Give it a question about market trends, regulatory changes, or competitive analysis, and it goes out, aggregates information from multiple sources, synthesizes findings, and delivers a coherent report. This is dramatically different from a search engine summarizing the first few results.

Manus can automate workflows. The platform integrates with other tools and services, allowing it to orchestrate multi-step processes. Think "fetch data from database A, transform it using rule set B, upload to service C, trigger notification in service D." Automation tools have existed for years, but automating with natural language and autonomous decision-making is new.

Manus can handle web interactions. It's not just reading web pages passively. It can fill out forms, click buttons, navigate sites, and accomplish tasks that require understanding and interaction.

The technical implementation uses several key techniques:

Memory Management: The agent maintains context across long task sequences. It doesn't start fresh with every step. It remembers what it's learned, what worked, what didn't, and why.

Tool Integration: Manus can use APIs, run code, execute commands, and integrate with external services. The system knows which tool to use for which job.

Planning and Reasoning: The agent breaks complex goals into sub-goals, sequences them, and adjusts when things don't go as expected. It's not just following a fixed script.

Error Recovery: When a task fails, Manus doesn't just error out. It analyzes what went wrong and tries alternative approaches.

These capabilities combine into something genuinely useful. Early users report 60-80% task completion rates where similar automation tools would require more human oversight.

The Enterprise Implications

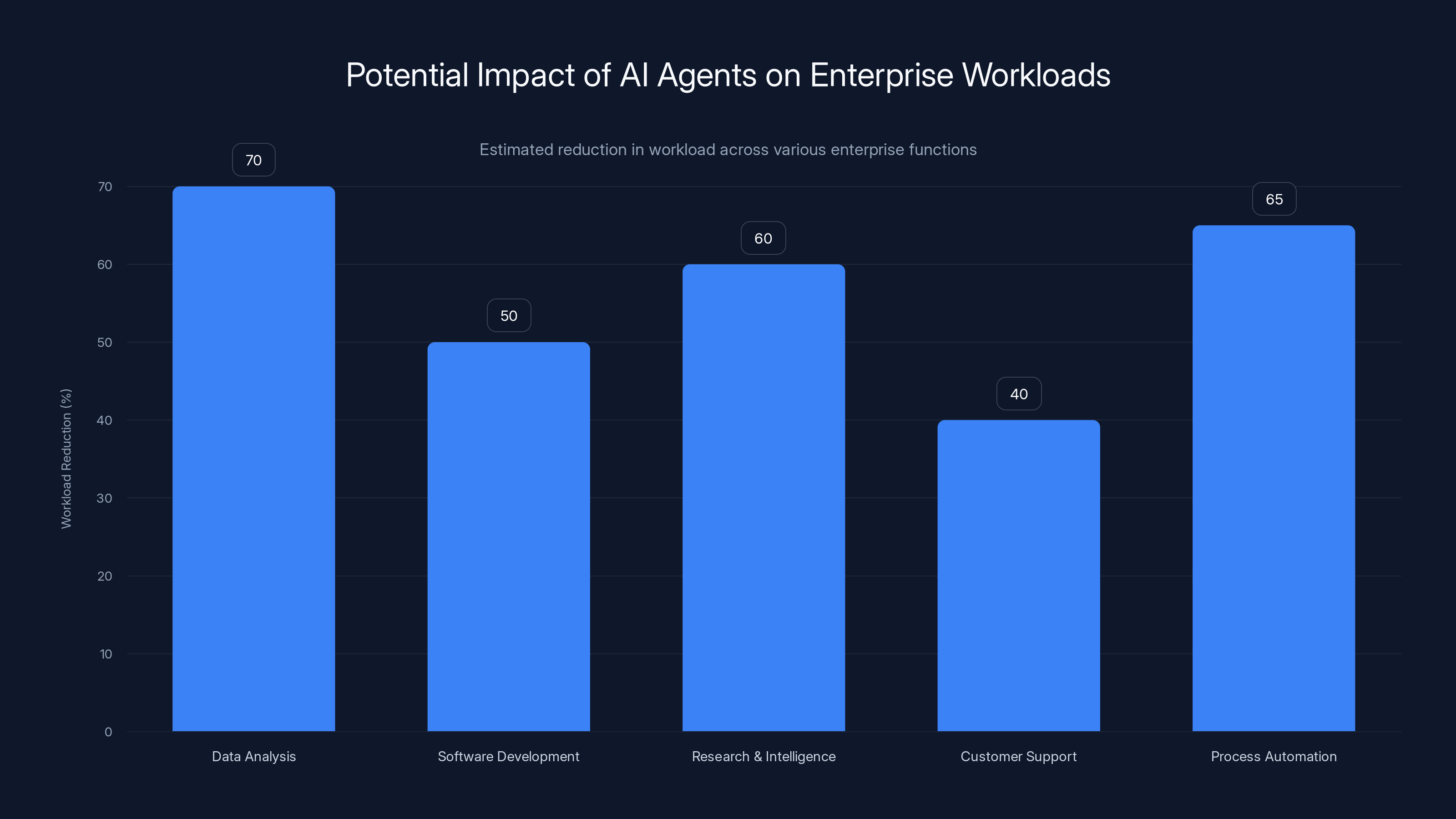

Meta's

Enterprise customers don't care about conversational AI. They care about getting work done faster, cheaper, and more reliably. If an AI agent can handle 30% of your employee's workload, that's a massive ROI conversation.

Manus is already in use at enterprises for several high-value use cases:

Data Analysis and Reporting: Agents that can gather data, analyze it, and generate reports eliminate entire categories of manual work. A data analyst might spend 10 hours per week on routine reporting that an agent could handle in minutes.

Software Development: Code generation is one thing. But agents that can architect solutions, write implementation code, run tests, and debug? That accelerates development cycles by weeks or months on complex projects.

Research and Intelligence: Competitive analysis, market research, regulatory monitoring—all tasks that currently require humans to manually aggregate information from multiple sources. Agents can automate massive portions of this.

Customer Support: While chatbots handle simple inquiries, agents could potentially handle complex multi-step customer issues that currently require escalation to senior support staff.

Business Process Automation: Companies currently use tools like Zapier, Make, and Workato to automate workflows. Agents that can understand natural language descriptions of processes and automate them with less configuration is a threat to these companies and an opportunity for whoever owns the agent platform.

Meta's acquisition puts the company in position to serve all of these markets. Meta AI can be offered to enterprise customers as a fully managed agent service. Integration with Meta's cloud infrastructure means enterprises get a complete solution from a trusted vendor.

Google will offer similar capabilities through Google Workspace. Open AI will do the same through enterprise Chat GPT. But Meta now has a proven product that works at scale, which is worth billions in credibility.

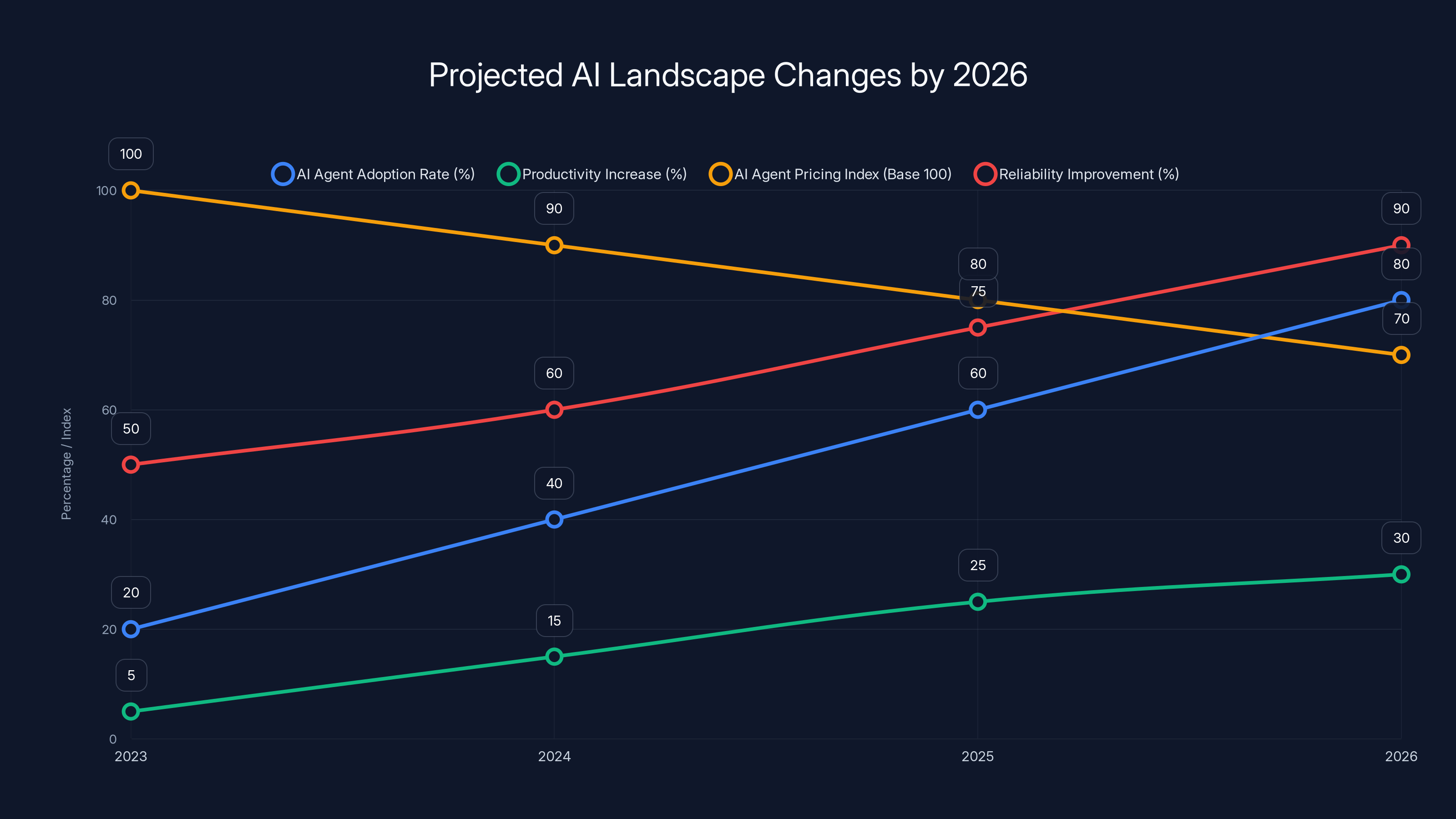

The AI landscape in 2026 is expected to see significant growth in agent adoption and productivity, with a decrease in pricing and an improvement in reliability. (Estimated data)

Revenue Models and Scaling Economics

Manus's business model offers clues about why the acquisition valuation makes sense.

The company operates a freemium model with premium subscriptions. Free users get access to basic agent capabilities with usage limits. Premium subscribers get higher token allowances, longer context windows, and priority access to new features.

Manus also sells to enterprises directly with custom contracts. These deals tend to be larger and more lucrative than individual subscriptions.

The unit economics appear extremely favorable. At $125 million in revenue run rate after 8 months, Manus was growing at a rate that would put it at unicorn status within a couple years on its own trajectory. The company had achieved product-market fit across multiple customer segments.

Meta's acquisition accelerates the scaling. Meta has infrastructure, enterprise relationships, and sales teams that took Manus years to build. Meta can bundle Manus services with Meta AI, offer it to enterprise customers at scale, and achieve much faster growth.

Looking at token economics: if Manus is serving 147 trillion tokens and making

For Meta, the $2 billion acquisition looks like it could pay for itself in 3-4 years at moderate growth rates. At aggressive growth rates (which seem likely given market momentum), the payoff timeline could be much faster.

Technical Integration: What Meta Actually Acquires

When Meta acquires Manus, it's not just paying for a product. It's acquiring specific technological capabilities that are difficult to replicate.

The Reasoning Engine: Manus's core technology is its reasoning system. This isn't just a language model. It's a system built specifically to handle planning, decomposition of complex goals, and multi-step execution. Meta gets the code, the architecture, the training approach, and the expertise to maintain and improve this system.

The Platform Architecture: Manus's infrastructure for managing virtual computers, maintaining agent state, handling concurrent requests, and scaling to millions of users. This engineering is non-trivial. Building from scratch would take Meta's engineering team years.

User Data and Feedback: Manus has millions of users providing continuous feedback on what works and what doesn't. This is incredibly valuable for training improvements. Meta inherits this data corpus and the insights it contains.

Talented Engineering Team: Manus's CEO Xiao Hong is staying on, as are the core engineering teams. Meta gets experienced engineers who understand agent architecture and have shipped a working product at scale.

Customer Relationships: Thousands of enterprise customers already using Manus, integrated into their workflows, dependent on the service. These relationships are valuable and transferable.

Integrating Manus into Meta's products creates several interesting technical opportunities:

Meta AI could shift from a pure chat interface to an agent-enabled system. Imagine asking Meta AI to "prepare my social media content strategy for next quarter" and having it actually gather competitive data, analyze engagement trends, draft content plans, and schedule posts.

Whats App Business could integrate Manus agents to help small businesses automate customer service, order processing, and inventory management through natural conversation.

Instagram could use agents to help creators analyze performance, suggest content improvements, and manage posting schedules.

Meta's Reality Labs division could use agents to manage virtual environments and handle complex interactions in mixed reality experiences.

These integrations don't happen immediately, but they're the strategic vision that justifies a $2 billion acquisition.

Agent platforms significantly reduce time spent on routine tasks, saving up to 5.75 hours per task for data analysis teams. Estimated data based on typical task durations.

The Data Security Question

Here's the part everyone's dancing around but needs to be discussed directly: Manus started in China.

Manus was initially developed under Butterfly Effect, a Chinese AI startup. The team later spun off and relocated to Singapore in 2024. Most of the original Chinese team was let go in the process.

Meta's acquisition agreement includes an explicit condition that "there will be no continuing Chinese ownership interests." This is not accidental language. This is Meta saying we've eliminated the China risk.

Why does this matter? Because in 2025, U. S. regulators care deeply about AI technology with foreign entanglements. The whole Tik Tok situation demonstrated that perceived foreign control of a platform handling U. S. user data is politically radioactive.

Meta couldn't acquire Manus without addressing this. Enterprise customers would worry about data sovereignty. Regulators would scrutinize the deal. The company couldn't afford to look complicit in transferring AI technology development to Chinese entities.

By explicitly acquiring full ownership and severing Chinese connections, Meta neutralizes this concern. It's a necessary part of making the acquisition politically palatable.

There's an interesting flipside though. Manus's technology is good enough that China would have preferred to keep developing it. By relocating the team and selling to Meta, Manus's original backers essentially exit the market. China loses access to what was probably one of its most promising AI agent projects.

This is part of the broader AI geopolitical competition. The U. S. is pulling talent and technology westward. China is being forced to rebuild from scratch. Meta's $2 billion acquisition contributes to this dynamic.

Competition Response: How Open AI and Google Might React

Meta's $2 billion move doesn't happen in isolation. Open AI and Google are watching, and they'll respond.

Open AI's likely response involves accelerating its agent roadmap. The company has been gradually adding agentic features to Chat GPT (web browsing, code execution, multimodal reasoning). Expect this acceleration to increase. Open AI might also consider its own acquisitions. There are several promising agent startups that could be targets.

Open AI's advantage is distribution. Chat GPT has hundreds of millions of users. Layering agent capabilities onto that installed base gives Open AI a massive head start. Users are already familiar with Chat GPT and willing to try new features.

Google's response is more interesting because Google has deeper enterprise relationships. Enterprises already use Google Workspace, Google Cloud, and Android. Integrating agent capabilities across these platforms gives Google inherent advantages. Google doesn't necessarily need to acquire an agent company because it can build agent features directly into products customers already depend on.

Google's challenge is legacy thinking. The company is still organized around search and advertising. Even with massive resources, shifting that organization to prioritize agent development takes time. Meta and Open AI, being smaller and more focused, might move faster.

Anthropics faces the biggest challenge. Claude has strong capabilities but remains primarily a chat product. Anthropic hasn't made major acquisition moves, focusing instead on internal development. This cautious approach is intellectually sound but might be strategically risky. If agents become the primary AI interface and Anthropics stays in the conversation space, the company could become marginalized.

Smaller agent startups now face consolidation pressure. Why build independently when Meta, Open AI, and Google are clearly willing to acquire proven technologies at enormous valuations? We'll see a wave of acquisitions in the agent space over the next 12 months.

AI agents could significantly reduce workloads in key enterprise functions, with data analysis and process automation seeing the highest potential reductions. (Estimated data)

The Hardware Angle: VR, AR, and Physical Agents

Meta has been spending billions on Reality Labs, its virtual and augmented reality division. The business is unprofitable, but Meta's long-term vision involves AI agents managing AR/VR experiences.

Manus acquisition makes more sense when you think about this vision. Imagine AR glasses that use an intelligent agent to manage information, prioritize inputs, and handle requests. "Hey, I need to understand why this customer is unhappy" could trigger an agent that gathers interaction history, analyzes sentiment, and surfaces the key issue without you having to ask follow-up questions.

Virtual reality experiences could involve AI agents as NPCs, environments, or assistants. Agents that actually understand context and respond intelligently rather than following fixed scripts create dramatically better experiences.

Meta's future involves wearable AI. Phones are becoming less important. Glasses with AI agents that understand you and your context are the next computing paradigm. Acquiring Manus is Meta preparing for that future.

Hardware integration is longer-term, but it's part of why Meta is willing to pay $2 billion for software. The hardware play justifies the software investment.

Pricing, Monetization, and the Road to Profitability

Manus's pricing model will shape how Meta monetizes this acquisition.

Current Manus pricing (pre-acquisition) works roughly like this:

Free Tier: Limited agent usage, suitable for individuals and small experiments

Premium Individual: ~$20-40/month, higher token limits, access to advanced models

Enterprise: Custom pricing based on usage, dedicated support, SLA guarantees

Post-acquisition, Meta will likely keep this structure but integrate it with Meta's existing AI offerings. Meta AI currently operates on advertising-supported free tier plus premium subscription tiers for access to advanced features.

Integrating Manus could look like:

Meta AI Free: Basic conversational AI with limited agent capabilities

Meta AI Premium: $20/month for advanced reasoning, agent capabilities, higher usage limits

Meta Business Suite: Enterprise agents for workflow automation, reporting, analysis

The enterprise segment is where the real money is. A company paying $10K-100K per month for AI agents that automate significant operational work is extremely common in the Saa S market. Slack sells for thousands per month to enterprises. Salesforce sells for tens of thousands. High-capability AI agents operating on behalf of the company should command similar pricing.

Meta's infrastructure cost advantage (lower per-token cost than competitors due to vertical integration) means Meta can undercut competitors on pricing while maintaining higher margins. This is how Meta typically wins in software markets—superior margins allowing aggressive pricing.

Looking at the math: if Meta can keep token costs below

Implementation Challenges and Realistic Expectations

Let's be honest about the hard parts. Acquiring Manus doesn't automatically make Meta an agent leader. Several challenges exist.

Integration Complexity: Manus has its own independent platform, customer base, and product roadmap. Integrating it with Meta AI while maintaining backward compatibility and not losing customers is genuinely difficult. Companies do this poorly all the time.

Talent Retention: Acquisitions lose key talent when acquired employees realize they're now working in a 60,000-person company instead of a focused startup. Meta will need to retain Manus's core team and give them autonomy to continue development. This requires executive commitment.

Regulatory Scrutiny: Meta already faces regulatory pressure regarding privacy and data practices. Combining Meta's data collection capabilities with agent technology that actively interacts with user systems could trigger regulatory concern. Meta will need to be proactive about addressing privacy and security.

Competitive Parity: Manus is ahead today, but Open AI and Google have enormous resources. Within 12-18 months, these companies could achieve feature parity through internal development. Meta needs to keep innovating to maintain its advantage.

Reliability at Scale: Manus works well for millions of users. But scaling to hundreds of millions while maintaining reliability is a different challenge. Infrastructure scaling is harder than it looks.

User Adoption: Even with Meta's distribution, getting users to trust agents with real work is slow. Education and trust-building take time. Meta can't just flip a switch and activate agents across its billion-user base.

What This Means for the Broader AI Industry

Meta's acquisition signals something important about where the industry is actually heading, which often differs from where the hype suggests.

First, model size is becoming less important. The narrative around GPT-4, Claude, and Llama has been about scale—bigger models, more parameters, higher compute. But what actually wins in the market might be better architecture for specific use cases. Manus doesn't have the largest model. It has the best agent implementation. That matters more.

Second, autonomous behavior is becoming table stakes. Companies that can only do chat are increasingly behind. Agents that can complete tasks autonomously are the future. Every major AI company will have to move in this direction.

Third, the integrated stack wins. Open AI is building Chat GPT. Google is building Gemini with Workspace integration. Meta is acquiring Manus to integrate into its ecosystem. The winner will be the company that owns the entire stack—models, agents, applications, and distribution. Standalone AI products have a harder path.

Fourth, international competition is real. Meta's explicit requirement to eliminate Chinese ownership interests shows that geopolitics matter in AI development. Countries and companies are increasingly thinking about AI as a strategic asset, not just a commercial product.

Fifth, enterprise is where the money is. Consumer AI is exciting but unprofitable. Enterprise AI automation is where revenue and profitability live. Every major company is pivoting toward enterprise.

Looking Ahead: The AI Landscape in 2026

If Meta successfully integrates Manus and executes on its roadmap, 2026 looks like this:

AI Agents as Default: Instead of chatting with AI, you'll mostly interact with agents that complete tasks. Chat will be one tool agents use, not the primary interface.

Enterprise AI Scaling: Thousands of companies will have deployed AI agents handling data analysis, reporting, customer service, and workflow automation. The 30% productivity lift becomes real and measurable.

Competitive Consolidation: Several small agent startups will be acquired by major platforms. The number of independent agent vendors will decline as integration becomes more important than innovation.

Pricing Competition: Initial high pricing for AI agents will decline as competition increases. The per-token cost will keep dropping. Access to agent capabilities becomes cheaper.

Regulatory Clarity: Governments will have established clearer rules about AI agents, data privacy, and autonomous systems. Some overhyped capabilities won't be allowed. Others will be mandated for certain industries.

Safety Maturation: Agents that sometimes fail (current state) become agents that rarely fail (2026 target). Reliability improvements matter more than capability improvements.

Meta's $2 billion bet positions the company to lead this shift, but execution matters more than acquisition price. Many tech companies have paid billions for acquisitions that didn't work out. Meta's success depends on integration, innovation, and maintaining Manus's culture while scaling it within Meta's organization.

The fundamental question in 2026 will be: Which company's agents do you trust most? Meta is betting that the answer is Meta.

How Teams Are Actually Using Agent Platforms Today

Theory is interesting, but practice is what matters. How are actual teams using Manus and similar agent platforms?

Data Analysis Teams: A common workflow is handing Manus a business question ("Why did churn increase in the northeast region last quarter?") and having it pull data from multiple sources, identify correlations, and surface the likely root cause. Previously, this took an analyst 4-6 hours. Agents handle it in 15 minutes with 80% accuracy.

Software Development Teams: Junior developers use agents as pair programmers. Give an agent a feature spec and it generates functioning code. Seniors review and refine. This dramatically accelerates development velocity while maintaining code quality.

Marketing and Content Teams: Agents help analyze campaign performance, suggest content optimizations, and draft social media posts. The team reviews and publishes. This replaces several hours of manual work per week.

Customer Success Teams: Rather than manually researching customer issues, agents pull context from multiple systems and identify solutions. The agent becomes a research assistant that makes customer service faster and more effective.

Finance Teams: Monthly closing involves massive manual data aggregation and reporting. Agents automate 60-70% of this work, freeing finance people for actual analysis rather than data entry.

These aren't hypothetical use cases. Thousands of teams are using Manus (and similar platforms) in exactly these ways. The ROI is clear: significant time savings on routine work, allowing humans to focus on judgment calls and strategy.

The Path Forward: What Comes After Acquisition

Meta's acquisition is the beginning, not the end. The real work starts now.

Immediate focus (next 3-6 months): Integrating Manus into Meta's existing infrastructure while maintaining product stability. Retaining Manus's team and preserving the product's independence within Meta's organization. Communicating clearly to Manus customers that the service will continue unchanged.

Medium-term (6-18 months): Integrating Manus agents into Meta AI, allowing Meta's billion-plus users to access agent capabilities. Launching enterprise packages that bundle agents with Meta Cloud services. Iterating on agent reliability and expanding capabilities.

Long-term (18+ months): Making agents a core feature across Meta's products. Using agent capabilities to drive adoption in AR/VR. Becoming the default platform for enterprise AI automation.

Success looks like this in 2026: Meta AI agents are handling 20-30% of routine work for enterprise customers. The service generates $1-2 billion in annual revenue. Competitors are playing catch-up. Meta has clear leadership in the agent space.

Failure looks like this: Integration struggles, key talent leaves, customers migrate to alternatives, agent capabilities lag behind Open AI and Google. Meta spends $2 billion and gets minimal return on investment.

Meta's track record suggests success. The company has successfully integrated Instagram, Whats App, and Oculus into its portfolio while maintaining their independence. But integrating a core technology product is harder than integrating social platforms. The execution challenge is real.

FAQ

What is an AI agent and how is it different from Chat GPT?

An AI agent is a system that accepts a goal, breaks it into sub-tasks, executes those tasks using available tools, and completes the objective with minimal human intervention. Chat GPT is a conversational AI—you ask it questions and it generates responses based on patterns in training data. Agents actually do things: they gather information, make decisions, use tools, and adapt based on outcomes. Think of Chat GPT as a highly informed advisor who answers your questions, while Manus is more like a competent employee who you assign work to and trusts to get it done correctly.

Why did Meta pay $2 billion for Manus specifically?

Manus hit profitability and rapid growth ($125M revenue run rate in 8 months) while most AI startups are still burning money. The company has proven agent architecture that works at scale, with millions of users and thousands of enterprise customers already relying on the platform. Rather than Meta spending 2-3 years building equivalent technology internally, acquiring Manus provided immediate capabilities, customer relationships, and a talented team. The acquisition also positioned Meta ahead of competitors in the agent race just as the market was accelerating.

How is Meta likely to use Manus technology?

Meta plans to integrate Manus agents into its Meta AI assistant and enterprise products, allowing Meta's billion-plus users and enterprise customers to access agent capabilities. This could enable agents to automate tasks across Whats App, Instagram, Facebook, and Meta's productivity tools. Enterprise customers could use agents to handle data analysis, reporting, customer service automation, and workflow optimization. Over time, agents could also be integrated into Meta's augmented and virtual reality products to power more intelligent interactions.

What are the risks with this acquisition?

Integration challenges could cause customer defection if Manus loses its independence or product quality suffers. Regulatory scrutiny of Meta's data practices could intensify when the company controls an autonomous AI agent platform that interacts with user data and systems. Competitive advances by Open AI and Google could erode Manus's technological advantage within 12-18 months. Talent retention is critical—if key Manus engineers leave, the technical advantage diminishes. There's also uncertainty about enterprise adoption of autonomous agents, which remains relatively low despite hype.

What should enterprises consider before adopting AI agents?

Start with a pilot focused on your most routine, time-consuming task. Test agent reliability before depending on it for critical workflows. Verify data security and privacy practices align with your requirements. Understand your exit options if the vendor relationship doesn't work out. Consider integration complexity with your existing systems. Invest in training teams to work effectively with agents, since the workflow is different from previous automation tools. Monitor agent outputs rather than assuming accuracy, especially in early deployments.

How does Manus pricing compare to other automation platforms?

Manus uses a freemium model with premium subscriptions around $20-40 per month for individuals and custom enterprise pricing. This is cheaper than traditional enterprise automation tools (Zapier Enterprise can cost thousands monthly) but more expensive than free automation tools. The value proposition is agent autonomy—Manus handles multi-step tasks with minimal configuration, whereas tools like Zapier require more manual setup for complex workflows. For enterprises, the time savings usually justifies the cost compared to previous automation approaches.

Will this acquisition make AI agents accessible to smaller companies?

Yes, likely. Meta's strategy involves scaling Manus agents across its massive user base. While enterprise-grade features will command premium pricing, basic agent capabilities will eventually be available to small businesses and individual users through Meta AI's free and low-cost tiers. This mirrors Meta's approach to other technologies—develop at enterprise level, then democratize to SMBs and consumers. By 2026, small business owners should be able to use AI agents for basic marketing, customer service, and operations tasks without specialized technical knowledge.

What does this mean for companies building competing agent platforms?

Competition just got much harder. Meta has distribution (1.2B+ users globally), infrastructure (massive data centers and AI expertise), and deep resources. Smaller competitors need to either find a niche that Meta won't dominate (healthcare, finance, legal) or get acquired by another platform player (Open AI, Google, Anthropic). Standalone agent platforms may struggle unless they have defensible intellectual property or such strong positioning that acquisition by a major player is inevitable. We'll likely see a wave of M&A in the agent space as companies accept they can't compete long-term independently.

How quickly can Meta integrate Manus and make it useful to users?

The integration likely happens in phases. Maintaining Manus as an independent service for 6-12 months keeps customers satisfied while integration planning happens. Rolling out agent features to Meta AI users probably starts in 2025 with limited capabilities, expanding through 2026. Full integration across Meta's product suite (Whats App, Instagram, Workplace) could take 18-24 months. Real-world AI implementations are typically slower than people expect due to testing, compatibility requirements, and user adoption curves. Meta should have meaningful agent capabilities available to users by late 2025, with broader rollout continuing through 2026.

Conclusion: The Future is Agents, and Meta Just Bought a Ticket

Meta's $2 billion acquisition of Manus represents a strategic inflection point for the company and the AI industry at large.

The narrative around AI has dominated tech for the past two years, but most of it has been about chatbots and language models. Chat GPT, Claude, Gemini—all sophisticated conversation engines. But conversation engines don't actually get work done. Humans still need to take the output and do something with it.

Agents change this equation. Agents complete tasks. Autonomously. End-to-end. This is the inflection point. The next phase of AI isn't about better chat. It's about actual automation that frees people from routine work so they can focus on judgment, creativity, and strategy.

Mana's technology isn't revolutionary in isolation. The individual components (planning, memory, tool use, reasoning) exist in various forms across the industry. But implementing them well together is genuinely hard. Manus has done it. The company has customers relying on this technology, revenue proving the value, and growth showing the market is ready.

Meta's acquisition makes strategic sense for several reasons. First, it's cheaper than building from scratch. Second, it provides immediate market leadership in agents while competitors scramble to catch up. Third, it gives Meta a proven revenue stream in a new category. Fourth, it positions Meta for the next computing paradigm where agents manage information and tasks for wearable AR/VR devices.

Open AI and Google will respond with their own advances, acquisitions, and integrations. But Meta just moved first and moved decisively. That matters.

For enterprise customers, this is genuinely good news. Competition drives innovation and drives prices down. More vendors offering agent capabilities means better products, lower costs, and more options. The companies that can effectively use AI agents to automate routine work will have significant competitive advantages. Those that don't will struggle to keep pace.

For Manus employees and customers, the acquisition is bittersweet. Joining Meta provides resources and distribution they couldn't achieve independently. But there's always risk that a successful startup loses its culture or focus when absorbed into a much larger organization. Manus's success in the next 18 months depends largely on Meta's leadership respecting the team's autonomy and commitment.

For the AI industry, Meta's move signals that the agent era has arrived. This is no longer speculative. Companies are willing to pay billions for proven agent technology. The market for autonomous AI agents is real. The race is on.

Meta bet $2 billion that it can integrate Manus, maintain momentum, and build agents into core products across its portfolio. If the company executes well, that investment could generate returns many times over. If execution falters, it becomes a cautionary tale about acquisition integration.

Either way, we're watching a fundamental shift in how AI gets built and deployed. The next few years will determine whether Meta's bet was genius or just expensive. But the bet itself tells you everything about where the industry is heading.

Agents are the future. Meta just bought a significant piece of that future. Now comes the hard part: making it work.

Key Takeaways

- Meta's $2 billion acquisition of Manus represents a strategic pivot toward autonomous AI agents that complete tasks rather than just chat

- Manus achieved $125M revenue run rate in 8 months and serves as proof that enterprise agent adoption is real and scalable

- Autonomous agents differ fundamentally from chatbots: they plan ahead, use tools, maintain context, and complete multi-step tasks without human intervention

- The agent arms race is now actively competitive with OpenAI, Google, and Meta racing to build capabilities while smaller players face consolidation pressure

- Enterprise customers can achieve significant ROI by automating routine tasks like data analysis, reporting, and workflow automation with agent platforms

![Meta's $2 Billion Manus Acquisition: The Future of AI Agents [2025]](https://tryrunable.com/blog/meta-s-2-billion-manus-acquisition-the-future-of-ai-agents-2/image-1-1767209937006.png)