Meta's $2 Billion Manus Acquisition: What You Need to Know

Mark Zuckerberg just dropped a $2 billion check on a startup most people hadn't heard of six months ago. That startup is Manus, a Singapore-based AI company that went from launch to unicorn valuation in under a year. The speed is insane, but more importantly, it tells us something crucial about where AI is headed.

Meta's acquisition of Manus represents more than just another tech company getting scooped up by a larger player. This deal signals that the AI landscape has fundamentally shifted. We're no longer just talking about better language models or smarter chatbots. We're talking about AI agents that can actually work, that can handle complex multi-step tasks, and that can generate real revenue. That last part is crucial because it's the part that makes investors (and skeptics) take notice.

For years, the narrative around AI has been dominated by companies throwing massive amounts of money at infrastructure spending. Meta itself has been spending billions annually on AI capabilities. But Manus is different. This is a company that showed it could build something people actually want, pay for, and use. That's not trivial in an industry where the hype often outpaces the utility.

The deal also reveals something interesting about how tech titans acquire talent and technology. Meta isn't just buying an AI model or a piece of software. It's buying a team with a specific vision, a product that's generating real revenue (Manus reported $100 million in annual recurring revenue before the acquisition), and most importantly, an existing user base of millions. That's the kind of foundation you build a platform on.

There's also a geopolitical angle that can't be ignored. Manus was founded by engineers in Beijing before relocating to Singapore. That detail alone caught the attention of several U.S. senators, including John Cornyn from Texas, who publicly questioned why American investors were backing a company founded by Chinese entrepreneurs. Meta has already clarified that post-acquisition, Manus will have no ties to Chinese investors and will discontinue operations in China. The question of how technology, money, and national security intersect is becoming increasingly important in Silicon Valley conversations.

But let's start from the beginning. Understanding this acquisition requires understanding what Manus actually is, how it got here so quickly, and what Meta plans to do with it.

Who Is Manus and How Did They Get Here So Fast?

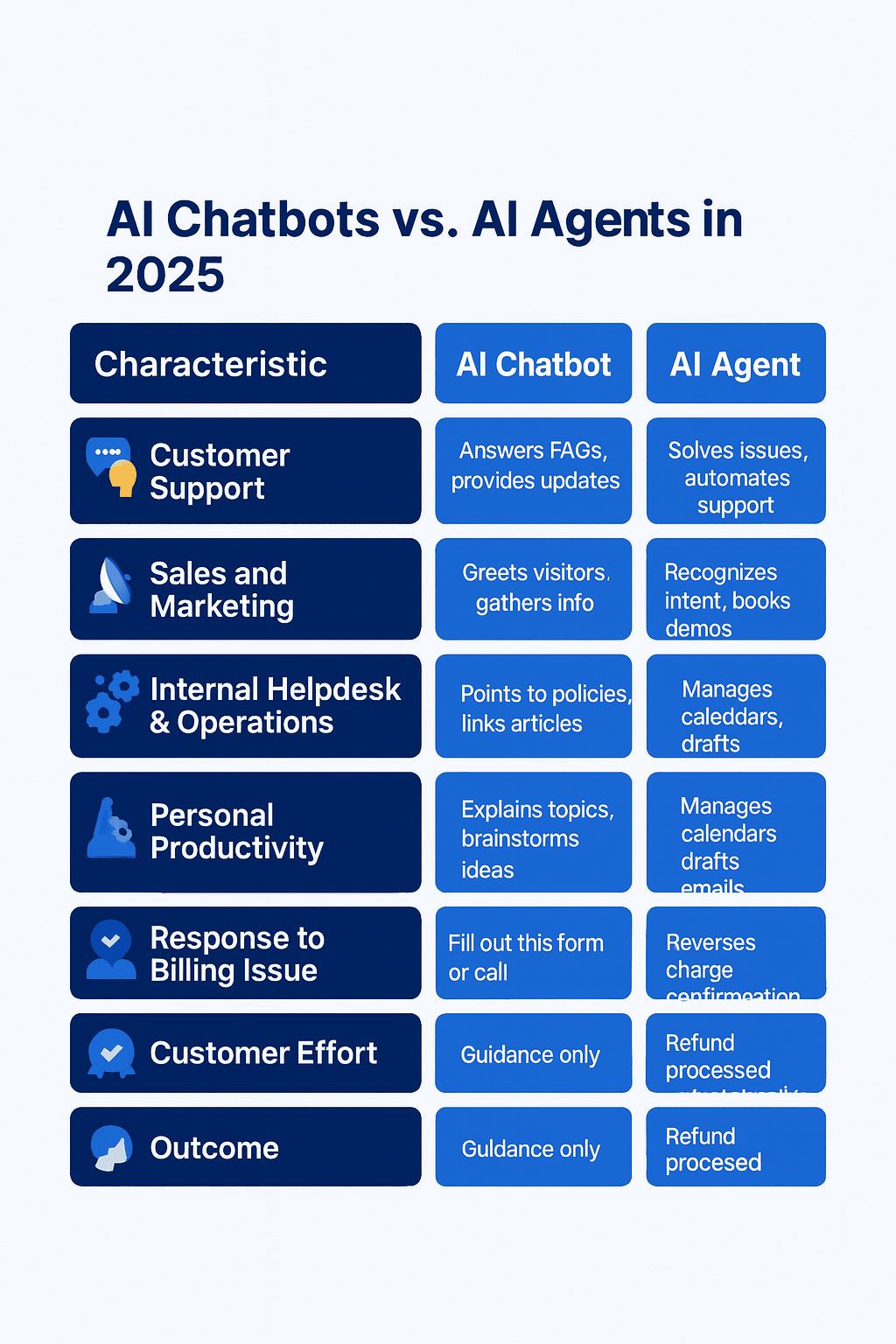

Manus launched in spring 2025 with a viral demo that showed an AI agent doing things like screening job candidates, planning vacations, and analyzing stock portfolios. The demo was polished, specific, and most importantly, it actually worked. In a landscape where AI demos often feel like theater, Manus looked like something functional.

The founders had been building AI systems in Beijing as part of a company called Butterfly Effect, which they established in 2022. They weren't newcomers to the space. They understood how to build models, how to deploy them at scale, and how to optimize for real-world use cases. When they decided to move to Singapore and launch Manus separately, they came with experience and a clear vision.

What made Manus stand out wasn't the underlying technology—there are plenty of companies building AI models. What made it stand out was positioning and execution. Manus explicitly claimed to outperform OpenAI's Deep Research tool. That's a bold claim, and it immediately positioned them as a competitor to the biggest name in AI. Whether that claim was completely accurate probably wasn't the point. The point was that they were confident enough to make it.

Within weeks of launch, Benchmark led a

By April 2025, just months after launch, Manus had created enough buzz that VCs were racing to participate. This is how things work in AI right now. A team with a good demo, a clear value proposition, and the right positioning can raise enormous amounts of capital very quickly. The traditional startup timeline has compressed dramatically in the AI era.

The company soon announced pricing:

That $100 million ARR figure is what caught Meta's attention. In an industry obsessed with scaling and capability, Manus had done something harder—it had built something economically viable. That's rare enough that when it happens, bigger companies take notice.

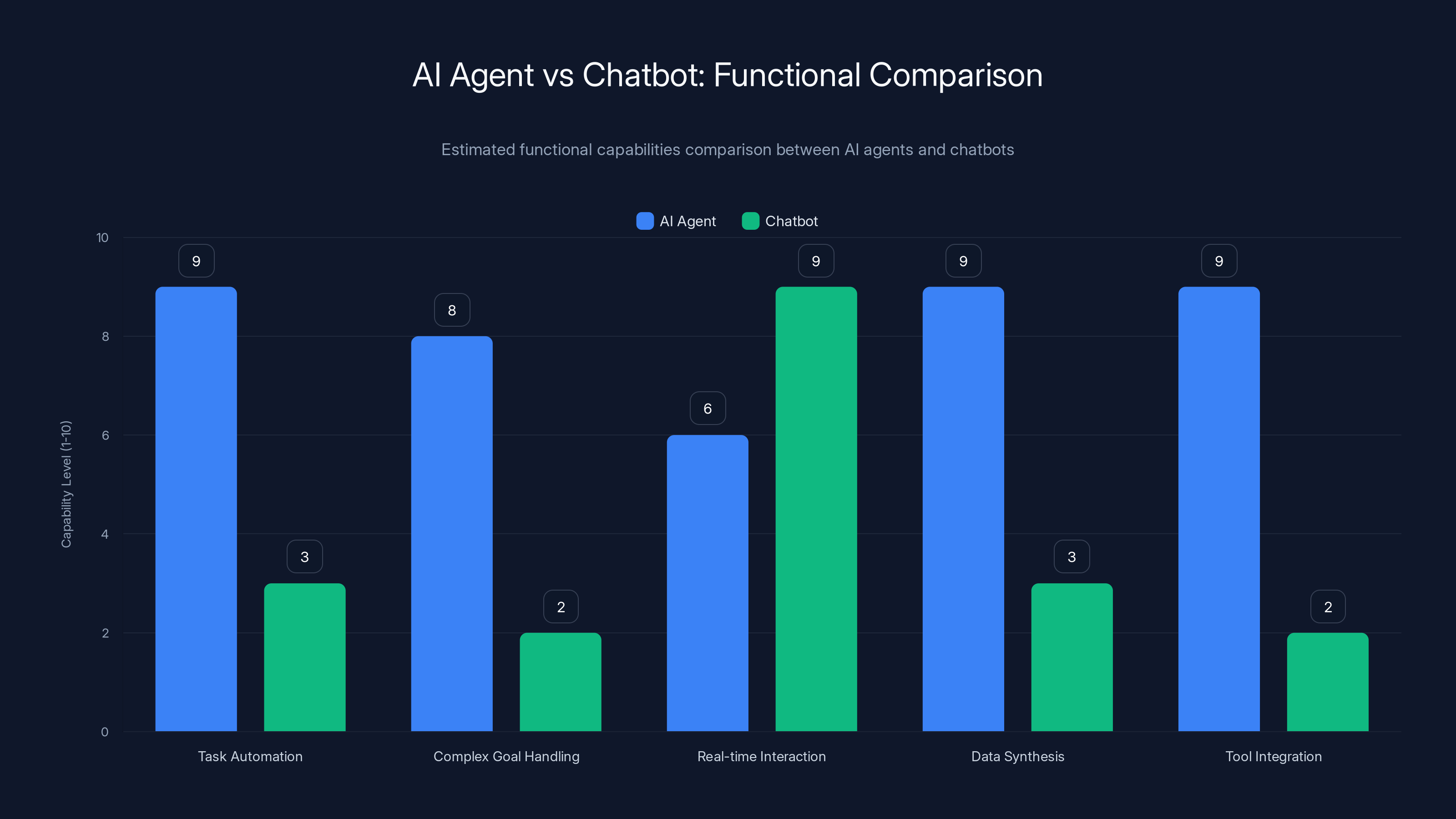

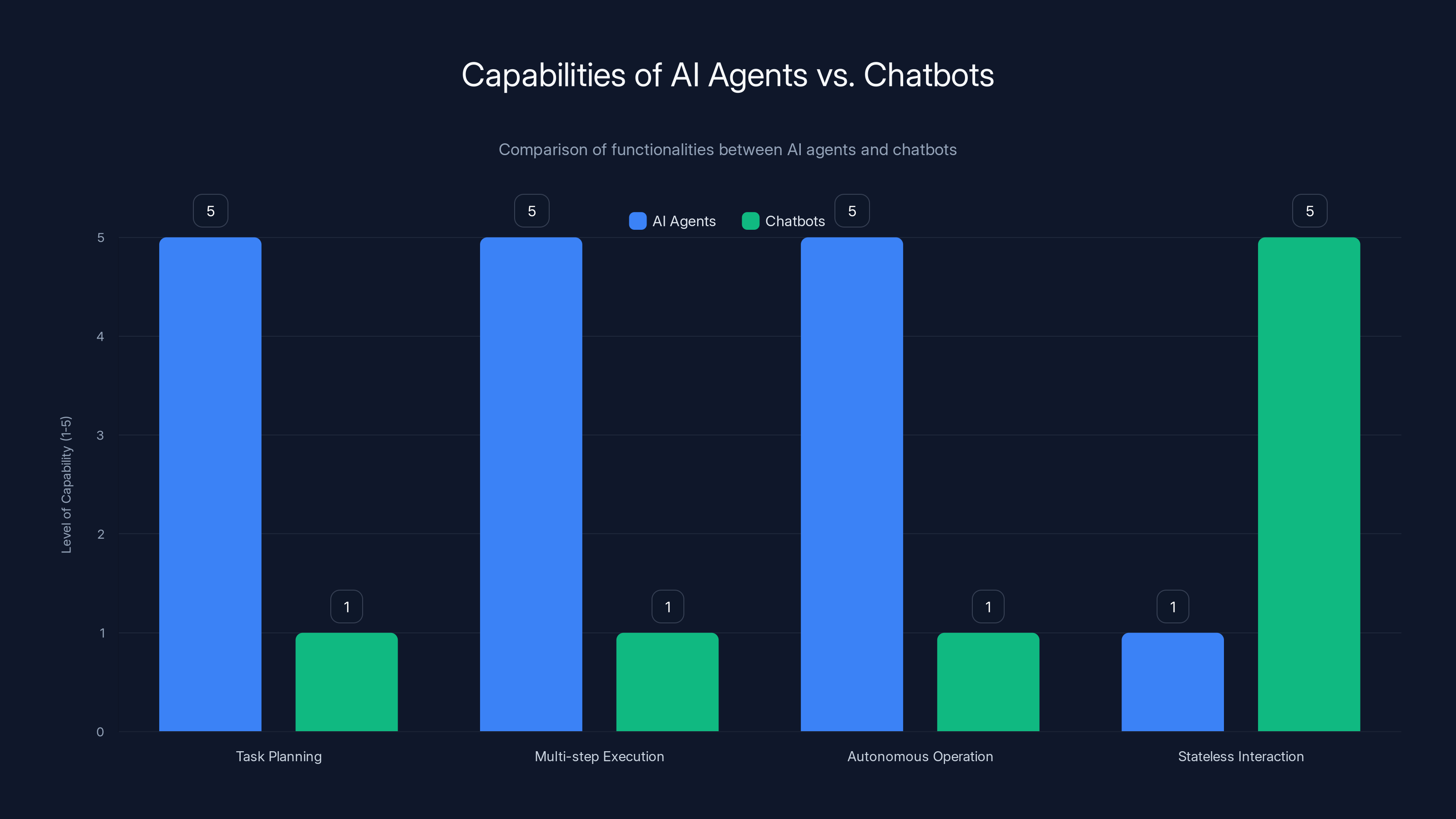

AI agents excel in task automation, complex goal handling, and data synthesis compared to chatbots, which are more focused on real-time interaction. (Estimated data)

What Is an AI Agent and Why Does Meta Care?

Before we understand why Meta paid $2 billion for Manus, we need to understand what AI agents actually are and why everyone suddenly cares about them.

An AI agent is fundamentally different from a chatbot. A chatbot takes your input and generates a response. That's it. You ask Chat GPT a question, it answers. You ask Gemini a question, it answers. The interaction is stateless and moment-to-moment.

An AI agent is designed to take on more complex responsibilities. It can plan multi-step tasks, break them down into subtasks, execute them, evaluate the results, and adjust course if something goes wrong. Imagine giving an AI agent a goal like "find me the three best flight and hotel combinations for a vacation to Japan next month within a $3,000 budget." The agent would need to search for flights, check hotel availability, compare prices, verify that the total cost fits the budget, handle edge cases, and present you with options. That's fundamentally more complex than a simple back-and-forth conversation.

The difference matters because agents represent a shift from AI as a tool you control to AI as something that can work more autonomously. That's a bigger deal than it might sound, both technically and commercially.

Meta cares about AI agents because they represent the next evolution of how people interact with digital platforms. Right now, if you want to book a flight on Facebook Messenger or WhatsApp, you still have to do most of the work yourself. You click links, you navigate websites, you compare options. An AI agent could do that for you. You tell it what you want, and it figures out the rest.

That's not just incrementally better from a user experience perspective. It's categorically different. It means your phone, your messaging app, your social network can become something that actively helps you accomplish things rather than just being a space where you consume content and communicate with friends.

For Meta, which owns Facebook, Instagram, WhatsApp, and Threads, that's an enormous opportunity. WhatsApp alone has nearly 2 billion users. Facebook has 3 billion. If Meta can integrate AI agents that actually work into these platforms, the potential reach is massive. Manus agents on WhatsApp could help those 2 billion users with real tasks. That's not just a nice feature—that's a fundamental shift in what these platforms do.

There's also a defensive aspect. OpenAI is building agents. Google is building agents. Anthropic is building agents. If Meta doesn't acquire or build agent capabilities quickly, it risks being left behind in what many believe will be the next major evolution of AI. Manus wasn't just a good agent company—it was a good agent company that was already operational and revenue-generating. That made it a strategic acquisition rather than a purely opportunistic one.

Manus rapidly increased its valuation and funding within months of launching in Spring 2025, highlighting the accelerated pace of AI startup growth. (Estimated data)

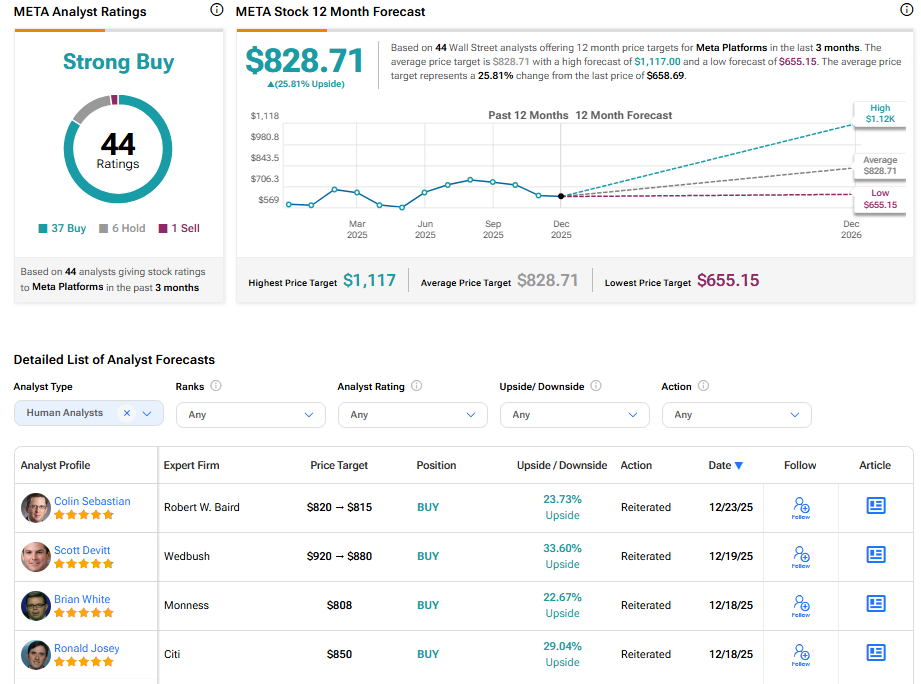

The $2 Billion Valuation: Is It Justified?

Let's talk about the elephant in the room: is a $2 billion valuation for a company that's eight months old actually reasonable?

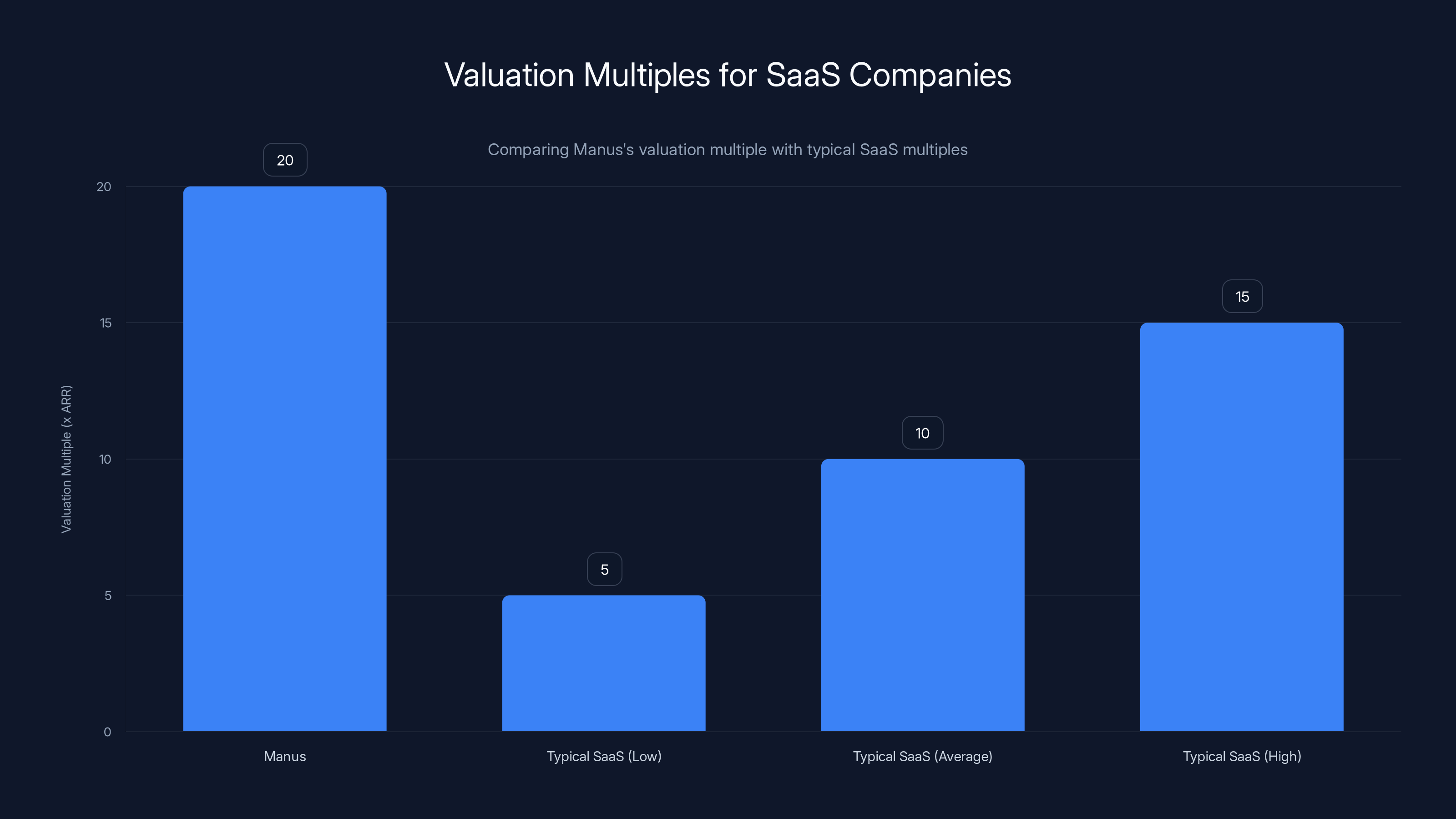

On one hand, the numbers look good. $100 million in annual recurring revenue means the company is generating real money. With the right margins, that could translate to profitability or near-profitability, which is unusual for startups at this stage. The valuation represents a 20x multiple on ARR, which is high but not insane for fast-growing SaaS companies.

On the other hand, those numbers need context. How much of that $100 million ARR is genuine, ongoing subscription revenue? How much is going toward computing costs and serving the product? What's the actual margin profile? These details matter enormously for valuation, and they're not public.

There's also the question of whether Manus had sustainable growth or growth driven by novelty and hype. New products in the AI space often see initial adoption surges followed by churn as early adopters move on or products fail to meet expectations. Without seeing the actual retention metrics, it's hard to know if Manus had built something durable or if it had caught a temporary wave.

Meta's perspective is probably different than a traditional VC's. For Meta, this isn't just a financial investment. It's a strategic acquisition to access technology, talent, and a product that's already gaining traction. The valuation takes that into account. Meta can also afford to wait longer for returns because it has enormous resources and can integrate Manus into existing profitable platforms.

From that perspective, $2 billion probably doesn't feel excessive. It's less than Meta's typical annual AI infrastructure spending. If Manus agents increase engagement on Facebook, Instagram, or WhatsApp by even a small percentage, the acquisition pays for itself many times over.

That said, valuations in this space have gotten a bit frothy. A company with

How Meta Plans to Integrate Manus Into Its Platforms

Meta has said it will keep Manus running as an independent company, which is a common approach when acquiring startups. The independent operation helps with retaining talent and maintaining momentum. But the real value comes from integration.

Meta's plan is to weave Manus agents into Facebook, Instagram, and WhatsApp. These platforms already have Meta AI, Meta's own chatbot. But Meta AI is just that—a chatbot. Manus agents could be something more functional and task-oriented.

Imagine this flow on WhatsApp: You message a Manus agent: "Help me find a birthday gift for my sister, she likes hiking, and I have a $100 budget." The agent could search for products, check prices across retailers, read reviews, and come back with specific recommendations. You could then click through to purchase directly within WhatsApp. That's a completely different experience than the current state of WhatsApp, where you might look up gift ideas but then have to manually navigate to retailer sites to complete purchases.

On Facebook and Instagram, agents could help with things like finding local restaurants, comparing services, planning events, or discovering products based on your preferences and history. For a platform that's increasingly oriented toward shopping and discovery, AI agents that can actually help with those tasks are valuable.

The technical integration probably won't be trivial. WhatsApp and Messenger run on different infrastructure. Integrating agents across all three platforms while maintaining performance and security is complex. But Meta has the engineering resources to make it happen, and Manus likely has the agent architecture expertise.

There's also a monetization angle. If Manus agents become a key part of how people use these platforms, Meta could eventually monetize that in various ways: taking a cut of transactions, offering premium agent versions, or using the engagement data to improve ad targeting. This is speculative, but the commercial potential is clear.

Manus's valuation multiple of 20x ARR is high compared to typical SaaS companies, which range from 5x to 15x. Estimated data based on industry norms.

The Chinese Ownership Question and National Security

Here's where things get complicated. Manus was founded by engineers in Beijing. Its parent company, Butterfly Effect, was established in Beijing in 2022. The company had investors from China, including Tencent and HSG (formerly Sequoia China). That's relevant because it immediately caught the attention of lawmakers who are very concerned about AI technology and Chinese competition.

Senator John Cornyn, a Texas Republican and senior member of the Senate Intelligence Committee, went on X (formerly Twitter) in May 2025 questioning who thought it was "a good idea for American investors to subsidize our biggest adversary in AI, only to have the CCP use that technology to challenge us economically and militarily." Cornyn is one of Congress's most vocal hawks on China and technology competition, but he's not alone. Being tough on China has become genuinely bipartisan in Congress.

The concern, broadly, is that if American investors fund companies with Chinese founders, and if that technology could eventually benefit China's AI capabilities, that's a national security issue. It's not an unreasonable concern. The technology landscape has become intertwined with geopolitical competition, and AI is arguably the most strategically important technology in that competition.

Meta's response was to commit that post-acquisition, Manus will have no ties to Chinese investors and will discontinue operations in China. A Meta spokesperson told Nikkei Asia: "There will be no continuing Chinese ownership interests in Manus AI following the transaction, and Manus AI will discontinue its services and operations in China." That's a clear signal that Meta is aware of the political sensitivities and is acting to address them.

This raises an interesting dynamic in venture capital and startup funding. If you're a startup founded by engineers with Chinese origins, raising capital from American VCs, you're now potentially political. Your investors might face scrutiny. An acquisition by an American tech giant might be pursued as much for national security reasons as for commercial ones.

It's not clear whether this particular acquisition faced regulatory review or political pressure beyond public criticism. But it's clear that in future acquisitions involving AI companies, especially those with international founders or investors, these questions will be on the table.

What This Means for the AI Startup Landscape

Manus's acquisition by Meta tells us a few things about where the AI startup world is heading.

First, the era of funding startups on the basis of impressive technology alone is ending. Investors and acquirers want to see business models that work. Manus had users, revenue, and clear commercial traction. That matters more now than another clever algorithm or another model that's marginally better on benchmarks.

Second, speed matters enormously. Manus went from launch to acquisition in less than a year. In that timeframe, they attracted

Third, talent acquisition through acquisitions is becoming a primary strategy for large AI companies. Meta didn't just buy Manus's technology or its users. It bought a team that knows how to build agents, that has demonstrated success, and that has the confidence to compete with incumbents. In a space where talent is scarce and crucial, that's often worth more than the technology itself.

Fourth, there's still significant investment flowing toward AI companies because the belief in the technology's importance remains strong. Despite skepticism about some AI applications and concerns about hype, the venture capital and corporate acquisition market is functioning as if AI is the priority. Money continues to flow toward companies that can credibly claim to be advancing the space.

Finally, this signals that agents are the direction the industry is moving. If Meta thought the future of AI was just better language models or better chatbots, it probably wouldn't have paid $2 billion for Manus. But if Meta believes the future is task-oriented agents that can accomplish goals across platforms and products, then buying the best agent team available makes strategic sense. That belief is now more credible because of major venture capital and corporate backing.

The acquisition of Manus by Meta highlights key success factors in the AI startup landscape: effective business models, rapid market entry, strategic talent acquisition, continued investment flow, and a focus on task-oriented agents. Estimated data.

What Manus Actually Does: The Technical Reality

It's important to separate the hype around Manus from what it actually does. The company has been coy about technical details, which is normal for competitive reasons. But based on available information and demos, here's what Manus appears to do.

Manus agents are trained to break down complex goals into subtasks, then execute those subtasks using various tools and APIs. If you ask an agent to find job candidates for a specific role, it might: search job boards, filter results based on criteria, extract relevant information, score candidates based on a rubric, and present summaries. Each of these steps involves calling different tools or APIs and combining information.

This is somewhat different from pure language model capability. A language model can understand your request and generate relevant text. An agent takes that understanding and translates it into concrete actions. It's more orchestration and automation than pure generation.

For this to work well, agents need several capabilities: the ability to understand natural language requests, the ability to break down requests into subtasks (sometimes called "planning"), the ability to call external APIs and tools, the ability to handle errors or unexpected results, and the ability to present information back to users in a useful form.

Manus likely combines a large language model (probably built on an open-source or licensing foundation like Llama or their own training) with additional scaffolding for planning and tool integration. There's nothing proprietary about this architecture at a high level—other companies are building similar systems. But the specific execution, the training data, the optimization for particular tasks, and the user experience design are what differentiate products.

What made Manus's demo impressive wasn't that it was doing something technically impossible. It was that it looked polished and worked reliably for the tasks shown. In a space where many AI products feel like research projects, Manus felt like a product. That's not a trivial distinction.

Comparing Manus to Other AI Agent Companies

Manus isn't the only company building AI agents. Understanding how it compares to alternatives helps contextualize the $2 billion valuation.

OpenAI is building agents, though they've been somewhat cautious about how much they're emphasizing this. Their approach is to make agents a capability within their existing products rather than a standalone offering. That gives them distribution but potentially makes their agents less specialized.

Anthropic, the company behind Claude, has been experimenting with agents as well. Claude's training and architecture make it well-suited for reasoning through complex tasks, which is important for agent planning. But Anthropic, like OpenAI, seems to view agents as one capability among many rather than the core product.

Google is building agents as part of its broader AI strategy, likely to be integrated into Google's vast ecosystem of products and services. The distribution advantage is enormous, but it's also why an independent company like Manus was valuable—it could move faster and specialize more.

There are also smaller companies like Gumloop, Langchain, and others building tools and infrastructure for agent development. But these are more developer tools than end-user products.

What makes Manus different from most of these is that it's a consumer-facing AI agent product with reported millions of users and significant revenue. Most competitors are either building agents as part of larger products or building infrastructure for others to build agents. Manus built an agent product that consumers were willing to pay for and actually use. That's the rare part.

The comparison also highlights why large companies are acquiring agent startups. If you're OpenAI or Google, you can afford to develop agents in-house. But if you're Meta, and you've been somewhat behind the curve on consumer-facing AI products, acquiring a startup that already has users and traction is faster than building from scratch. Speed, in this case, was worth $2 billion.

AI agents excel in planning, executing multi-step tasks, and operating autonomously, unlike chatbots which are limited to stateless interactions. Estimated data.

Meta's AI Strategy and Where Manus Fits

To understand this acquisition, you need to understand Meta's broader AI strategy.

Meta has been investing heavily in AI for years. The company has large research labs, significant computing infrastructure, and talent. They've developed their own large language models and have been exploring various AI applications. But they've also had some stumbles. Meta AI, their chatbot, hasn't achieved Chat GPT-level adoption or cultural relevance.

Meta's challenge is distribution. It has massive platforms—Facebook, Instagram, WhatsApp—but these platforms haven't necessarily been the best distribution channels for pure AI capabilities. Chatbots work, but they're not differentiating. Users go to Chat GPT or Gemini for sophisticated AI conversations, not to Facebook Messenger.

That's where agents could be different. If agents can actually help users accomplish things within Meta's ecosystem, that's valuable. It's not about having a cool AI feature—it's about making the platforms more useful and sticky. That's a business-relevant improvement.

The Manus acquisition fits into this strategy by giving Meta a team that knows how to build consumer-facing agent products, a product that's already gaining traction, and the ability to integrate those agents across platforms. Rather than developing agents entirely in-house (which would take time), Meta is buying proven capability.

It's also worth noting that Meta is not just betting on agents. The company continues to invest in foundational models, safety research, and infrastructure. Manus is one piece of a larger AI strategy. But it's a significant piece because it represents the consumer-facing front end of that strategy.

The Competitive Implications for OpenAI and Google

When Meta acquired Manus, it sent signals to every other major tech company. The message was clear: AI agents are important, and they're worth paying premium prices to acquire.

For OpenAI, the acquisition suggests that they should probably accelerate their own agent capabilities and think about how to distribute them more effectively. OpenAI has been somewhat cautious about emphasizing agents, focusing instead on general-purpose language models. But if Meta is willing to pay $2 billion for agent capability, OpenAI might reconsider that strategy.

For Google, the acquisition is less immediately concerning because Google already has enormous distribution and its own research capabilities. But it does signal that integrating agents effectively across products is becoming a priority. Google has been moving in that direction already, but the Manus acquisition might accelerate those efforts.

The broader competitive dynamic is this: the next wave of AI products will likely be agent-based rather than chatbot-based. Companies that can build agents effectively and integrate them into products that millions of people use will have significant advantages. That's why Meta paid $2 billion, and that's why other major companies will be thinking about similar investments.

Manus stands out with high specialization and consumer focus, while Google excels in distribution. Estimated data based on company strategies.

Regulatory and Political Considerations

The acquisition happened without apparent regulatory blockage, but that doesn't mean there won't be considerations going forward.

The primary concern, as we discussed, was around Chinese ownership and founders. That's been addressed by Meta's commitment to cut all Chinese ties and discontinue operations in China. But it raises the question of whether future acquisitions involving Chinese founders or Chinese investors will face regulatory scrutiny.

There's also the broader question of whether major tech acquisitions in the AI space face regulatory review. Historically, acquisitions have been reviewed by the FTC and other regulators, but acquisitions of startups by large tech companies have generally been approved without major concerns unless there were specific antitrust issues. In the AI space, there's less precedent.

We haven't seen major antitrust actions against AI acquisitions, but that could change. If regulators become concerned that large tech companies are acquiring all the promising startups and preventing competition, they might become more skeptical. But from a regulatory standpoint, as of early 2025, acquisitions like this are happening with relatively little friction.

There's also the question of whether the FTC might want to look at Meta's acquisition strategy more broadly. Meta has been quite acquisitive over the years, and there might be concerns about whether those acquisitions are anticompetitive. But the Manus acquisition seems more likely to be viewed as vertical integration (acquiring a product to integrate into existing platforms) rather than horizontal consolidation (acquiring a direct competitor).

What This Means for Startup Founders and Investors

If you're a startup founder or investor in the AI space, the Manus acquisition tells you several things.

First, being in the right category at the right time matters enormously. Agents were becoming a priority for major companies, and Manus was positioned as the leading consumer-facing agent product. That positioning alone probably multiplied the company's valuation multiple times over.

Second, revenue and traction matter more than ever. Startups that can show real user adoption and revenue growth will attract acquirers willing to pay premium prices. The era of funding startups on pure vision and technology is giving way to an era where business metrics matter.

Third, speed matters. Manus went from launch to acquisition in less than a year. In that time, they proved their concept, built a user base, and achieved a significant valuation. For founders, this suggests that moving fast and capturing market opportunity quickly has enormous value.

Fourth, being on the radar of major tech companies is valuable. Whether through acquisition offers, partnership opportunities, or strategic investments, large companies are actively looking for promising AI startups. If you're building something in this space, there's interest from potential acquirers and partners.

Finally, the geopolitical dimension matters. If you're a founder with international background or if your company has investors from multiple countries, be aware that national security and geopolitical concerns are increasingly relevant to funding and acquisition decisions.

The Future of AI Agents in Consumer Products

Assuming the Manus acquisition is successful and agents get integrated into Meta's platforms, what's the likely trajectory?

Initially, we'll probably see agents focused on high-friction, high-value tasks. Shopping, reservations, customer service, and planning are good candidates. These are areas where agents can demonstrably improve the user experience and provide value.

As agents improve and users get comfortable with them, the scope will probably expand. Agents could help with more complex tasks like financial planning, research, or analysis. Over time, the distinction between using an agent to accomplish a task and using a traditional application might blur.

For Meta specifically, agents could be a key part of the company's strategy to remain relevant as consumer behaviors and technologies evolve. If agents become an expected part of digital products, Meta's platforms need to have competitive agent capabilities. Manus helps accelerate that.

There's also the question of what users will actually use these agents for. It's easy to imagine ideal scenarios, but actual user behavior often diverges from predictions. We'll learn a lot more once agents start getting rolled out at scale on WhatsApp, Facebook, and Instagram.

The technology will also continue to improve. Current AI models, even advanced ones, still make mistakes and have limitations. As models improve and as the scaffolding around agents (planning, error handling, tool integration) becomes more sophisticated, agents will become more capable and more trusted.

Comparing This Acquisition to Other Major AI Deals

To contextualize the Manus acquisition, it's worth comparing it to other significant AI deals in recent years.

Microsoft's $10 billion investment in OpenAI (announced in 2023) dwarfs the Manus deal in dollar terms. But that's for an ongoing investment and partnership, not a full acquisition. If we're comparing acquisitions, the dynamics are different.

Google's acquisition of DeepMind for around $500 million in 2014 was a significant deal, though that was before the current era of AI investment. Adjusted for inflation and the changed market dynamics, the Manus deal is in a similar ballpark proportionally.

Meta's own acquisition history includes the purchase of Instagram for

The comparison to other high-profile acquisitions suggests that $2 billion is expensive for an eight-month-old company, but not so expensive as to be completely out of line with how tech companies value strategic acquisitions. It reflects the premium that major companies are willing to pay for proven products in hot categories.

What Could Go Wrong?

Acquisitions don't always work out. It's worth thinking about the risks here.

Integration risk is real. Manus is a lean startup with its own culture and way of working. Integrating it into Meta's much larger organization could cause friction. Key engineers might leave. The product vision might get diluted by corporate priorities. The timeline for integration might be longer than expected.

Product-market fit risk exists, even though Manus has shown traction. Maybe the $100 million ARR was driven by hype and early adopter interest, and the company will see churn as the novelty wears off. Maybe the specific capabilities that made Manus valuable don't translate well when integrated into other platforms.

Competition risk is significant. Other companies are building agents. OpenAI, Google, and others will continue improving their own capabilities. Manus's advantage might narrow over time. What seems like leading-edge technology today might feel commonplace in a few years.

Regulatory risk, while mitigated, still exists. New regulations around AI could affect how agents can operate. Privacy regulations could limit the data that agents can access. Labor regulations could affect how agents are trained or what tasks they can perform.

User adoption risk is real. Meta has struggled to make some of its AI products sticky and widely used. Manus agents will face similar challenges. Building something technically impressive is different from building something that millions of people actually use regularly.

None of these risks are deal-killers, but they're real enough that the acquisition could underperform expectations.

The Broader Context: Why AI Acquisition and Investment Are Accelerating

Step back from the Manus deal specifically, and the broader context is clear: there's an acceleration in AI-related acquisitions and investments.

This is happening for several reasons. First, there's genuine belief that AI represents a fundamental technological shift with enormous potential. That belief is driving capital allocation across the industry.

Second, there's fear of missing out. If AI is truly transformative, companies that don't acquire or develop AI capabilities might be left behind. That fear is rational and powerful, and it drives acquisition decisions.

Third, the talent war is real. There are relatively few people who can build advanced AI systems effectively. Acquiring startups is a way to acquire that talent at scale. It's expensive but faster than trying to recruit and build in-house.

Fourth, there's path dependency. Once a few major deals happen at high prices, it creates a precedent. When Meta paid $2 billion for Manus, it sends a signal to every other tech company: this is what AI startups are worth in this environment. That drives up acquisition prices across the board.

Finally, the venture capital machine continues to feed money into AI startups, which creates companies that are then available for acquisition. The ecosystem is functioning as a kind of pipeline: VC funding creates startups, successful startups get acquired by large tech companies, and the cycle continues.

Whether this level of investment is sustainable is a different question. If AI delivery doesn't keep pace with investment and acquisition prices, valuations might contract. But for now, the acceleration continues.

Lessons for Building and Evaluating AI Products

What can we learn from Manus's success that applies more broadly?

First, focus on real use cases that solve real problems. Manus didn't just build a general-purpose AI product—it built agents designed to accomplish specific tasks. That focus is valuable because it makes the product more useful and easier to evaluate.

Second, build for end users, not just for B2B or enterprise. Consumer products that people want to pay for have different economics and dynamics than enterprise software. Manus managed to find consumer adoption early, which increased the company's value in ways that pure B2B companies might not achieve.

Third, speed matters. Manus moved from launch to $2 billion valuation in less than a year. That speed is partially luck and timing, but it's also execution. The company made decisions fast, shipped products, and captured market attention quickly.

Fourth, positioning and narrative matter. Manus explicitly positioned itself as outperforming OpenAI. That bold positioning attracted attention and investment that a more conservative framing might not have. In a crowded market, differentiated positioning is valuable.

Fifth, show the work. Manus's viral demo was specific and credible-looking. It didn't make vague claims—it showed concrete examples of the product working. That transparency built trust and interest.

Finally, understand your market moment. Manus arrived when the market was hungry for agent capabilities and skeptical of legacy AI companies. If Manus had launched two years earlier or two years later, the reception might have been different. Understanding where you are in the market cycle is important.

TL; DR

-

**Meta's

2 billion, signaling that task-oriented AI agents are now a major priority for tech giants and that revenue-generating AI products command premium valuations. -

Manus's Rapid Rise: In less than 8 months, Manus went from launch to unicorn status, raising

100 million in annual recurring revenue** with millions of users—proving that AI agents could be commercially viable. -

Agents vs. Chatbots: AI agents are fundamentally different from chatbots because they can break down complex goals into subtasks, execute them autonomously, and handle multi-step workflows—this represents the next evolution of AI interaction.

-

Strategic Positioning for Meta: Meta plans to integrate Manus agents into Facebook, Instagram, and WhatsApp to help 5+ billion users accomplish tasks like shopping, reservations, and research, transforming these platforms from content destinations to task-completion tools.

-

Geopolitical Complexity: The acquisition raised questions about Chinese founders and investors, leading Meta to commit to cutting all Chinese ties and discontinuing operations in China post-acquisition—highlighting how national security is now a factor in AI M&A.

-

Market Implications: The deal signals that agents are the next AI battleground, intensifies competition between OpenAI, Google, and Meta, and sets a precedent that high-revenue AI startups can command billion-dollar valuations.

FAQ

What is an AI agent and how is it different from a chatbot?

An AI agent is a system designed to autonomously break down complex goals into subtasks, execute them using various tools and APIs, and then synthesize the results back to you. A chatbot simply takes your input and generates a response—the interaction is stateless and moment-to-moment. Imagine asking a chatbot "find me a flight to Japan for under $1,000" versus asking an agent the same thing. The chatbot might give you general advice; the agent would actually search flight databases, filter results, check hotel availability, calculate total costs, and present you with specific options. That's why agents represent a fundamental shift in how people interact with AI.

Why did Meta pay $2 billion for Manus when it could have built agents in-house?

Meta has the capability to build agents internally, but speed and distribution were crucial. Manus already had millions of users,

What are AI agents actually used for, and what real-world value do they provide?

Current AI agents are most useful for high-friction tasks that involve research, planning, and decision-making. Real-world applications include job candidate screening, vacation planning, stock portfolio analysis, product recommendations, travel booking, customer service handling, and research synthesis. The value comes from automating the legwork—instead of you manually visiting five websites, comparing options, and synthesizing information, an agent does that work and presents you with evaluated results. For Meta, the commercial opportunity is enormous: integrating agents into WhatsApp and Facebook means helping billions of users accomplish everyday tasks more efficiently, which increases platform stickiness and engagement.

How does Manus make money, and is the $100 million ARR figure reliable?

Manus generates revenue through subscription tiers:

Why does the Chinese founder background matter, and how did Meta address it?

Manus was founded by engineers in Beijing who previously worked on Butterfly Effect, a Beijing-based company established in 2022. The startup also had investors from China, including Tencent and HSG (formerly Sequoia China). Senator John Cornyn and other lawmakers raised concerns about American investors funding AI technology developed by Chinese founders, particularly given the geopolitical competition between the U.S. and China over AI leadership. Meta addressed these concerns by publicly committing that post-acquisition, Manus would have no Chinese ownership interests and would discontinue all operations in China. This demonstrates how geopolitical considerations now influence AI M&A decisions and startup funding.

What does this acquisition mean for OpenAI, Google, and other AI competitors?

The Manus acquisition sends a clear signal to every major tech company: AI agents are the next critical technology, and they're worth paying premium prices for. For OpenAI, it suggests they should accelerate agent capabilities and think about distribution more strategically. For Google, it reinforces the importance of integrating agents across products but is less immediately threatening because Google already has enormous distribution. For smaller AI companies and startups, it demonstrates that building high-revenue consumer AI products can lead to lucrative exits, attracting more capital and talent to the space. The deal effectively raises the stakes for AI development priorities across the industry.

Will Manus agents actually get used by billions of Meta users, or will this acquisition underperform?

That's the biggest open question. Manus has proven that consumers will adopt AI agents voluntarily (they've already attracted millions of users). The challenge is whether that adoption translates when integrated into Meta's platforms. Meta has a track record of successfully acquiring startups and integrating them (Instagram, WhatsApp), but has also had failures with consumer AI products like some social features. Success will depend on whether agents provide enough utility to justify platform real estate, whether users trust agents enough to use them for important tasks, and whether Meta can maintain the product quality during integration. The acquisition doesn't guarantee success, but the early traction and Meta's resources give it a reasonable chance.

How does the Manus deal compare to other major AI acquisitions and investments?

The Manus acquisition at

What could go wrong with this acquisition from Meta's perspective?

Several risks exist: integration challenges could cause key talent to leave, the

What do founders and investors need to learn from Manus's success?

Key lessons include: focus on real use cases that solve genuine problems, build for consumer adoption if possible (it attracts higher valuations than pure B2B), move fast and make decisions quickly, use bold but credible positioning to differentiate in crowded markets, show concrete examples of your product working rather than making vague claims, understand where you are in your market's hype cycle, and achieve product-market fit with real revenue metrics—these signal real traction to acquirers. Manus executed on all of these, which is why it attracted a $2 billion acquisition offer in less than a year despite being an early-stage company.

What's the next evolution after AI agents, and what should we expect from Meta going forward?

Once agents become baseline capabilities across platforms, the evolution will likely be toward more autonomous, proactive agents that don't just react to requests but anticipate user needs and suggest actions. We'll also see specialization—agents optimized for specific domains like finance, health, shopping, or creative work. Meta will probably focus initially on high-friction, high-value tasks like shopping and reservations where agent utility is clearest. As adoption grows and trust builds, agents might handle more complex and sensitive tasks. The company will also need to address trust, privacy, and reliability concerns to ensure users are comfortable giving agents increasing autonomy. Expect that integration and rollout will take longer than optimistic timelines suggest.

Conclusion: The Inflection Point for AI in Consumer Products

Meta's $2 billion acquisition of Manus marks something significant. It's not just a company acquiring another company—it's a signal that the AI industry has reached an inflection point where task-oriented agents are moving from research projects and demos to products that people actually use and pay for.

For years, the AI narrative was dominated by large language models, generative capabilities, and what machines could theoretically do. Manus forced a different conversation: what can AI agents actually accomplish, how do people want to use them, and how much are they willing to pay? The company answered those questions convincingly enough to attract a $2 billion offer.

That has ripple effects across the entire tech industry. Major companies now know that AI agents are a priority. They're allocating capital, talent, and strategic focus accordingly. For startups, it demonstrates that building consumer AI products with real revenue and traction can lead to enormous exits. For venture investors, it shows that AI companies that achieve business metrics—revenue, users, retention—command premium valuations.

There are still real questions about whether this level of investment is sustainable, whether agent adoption at scale will match the hype, and whether these acquisitions will deliver the expected returns. But from the perspective of where the industry thinks the puck is going, agents are clearly it.

For Meta specifically, this acquisition is a bet that the future of its platforms isn't just about content consumption and social connection, but about accomplishing tasks. If that bet is right, agents are going to become as fundamental to Meta's platforms as the feed, the like button, and messaging. That's why $2 billion doesn't seem crazy—it's an investment in the future of the platforms themselves.

The real test will come when agents get integrated into WhatsApp, Facebook, and Instagram at scale. That's when we'll find out if Manus agents can maintain their momentum and user engagement in Meta's ecosystem, or if they'll become just another feature that doesn't drive the needle. For now, though, Meta has made a clear statement about where it believes the future of AI is heading. The next eighteen months will tell us whether that bet was prescient or expensive.

For anyone building AI products, investing in AI startups, or trying to understand where the industry is going, the Manus acquisition is worth studying. It's a masterclass in how to build momentum quickly, how to position a product in a crowded market, and how to create enough evidence of commercial viability that major acquirers will pay premium prices. Whether the acquisition itself turns out to be a success or a cautionary tale, the playbook is now visible.

Key Takeaways

- Meta paid 100 million in annual recurring revenue with millions of users—proving AI agents can be commercially viable

- AI agents are fundamentally different from chatbots because they can break complex goals into subtasks and execute them autonomously, representing the next evolution of AI interaction

- The acquisition signals that major tech companies now prioritize task-oriented agents over general-purpose language models, intensifying competition between Meta, OpenAI, and Google

- Meta plans to integrate Manus agents into WhatsApp, Facebook, and Instagram to help billions of users accomplish tasks like shopping and reservations, transforming these platforms from content to utility

- Manus's Chinese founders and early Chinese investors raised national security concerns with U.S. lawmakers, leading Meta to commit to cutting all Chinese ties post-acquisition, demonstrating how geopolitics now shapes tech M&A

![Meta Acquires Manus: The $2 Billion AI Agent Deal Explained [2025]](https://tryrunable.com/blog/meta-acquires-manus-the-2-billion-ai-agent-deal-explained-20/image-1-1767075004916.jpg)