How Racing Is Becoming the Testing Ground for Tomorrow's Automotive Technology

The moment an IMSA race car crosses the finish line, something extraordinary happens. It's not the celebration—it's the data deluge. Every single one of those vehicles, stripped down to their most sophisticated form, has been screaming telemetry back to engineers for the entire duration of the race. We're talking about thousands of data points per second, multiplied across dozens of cars, running for 24 continuous hours. That's not just information. That's a goldmine.

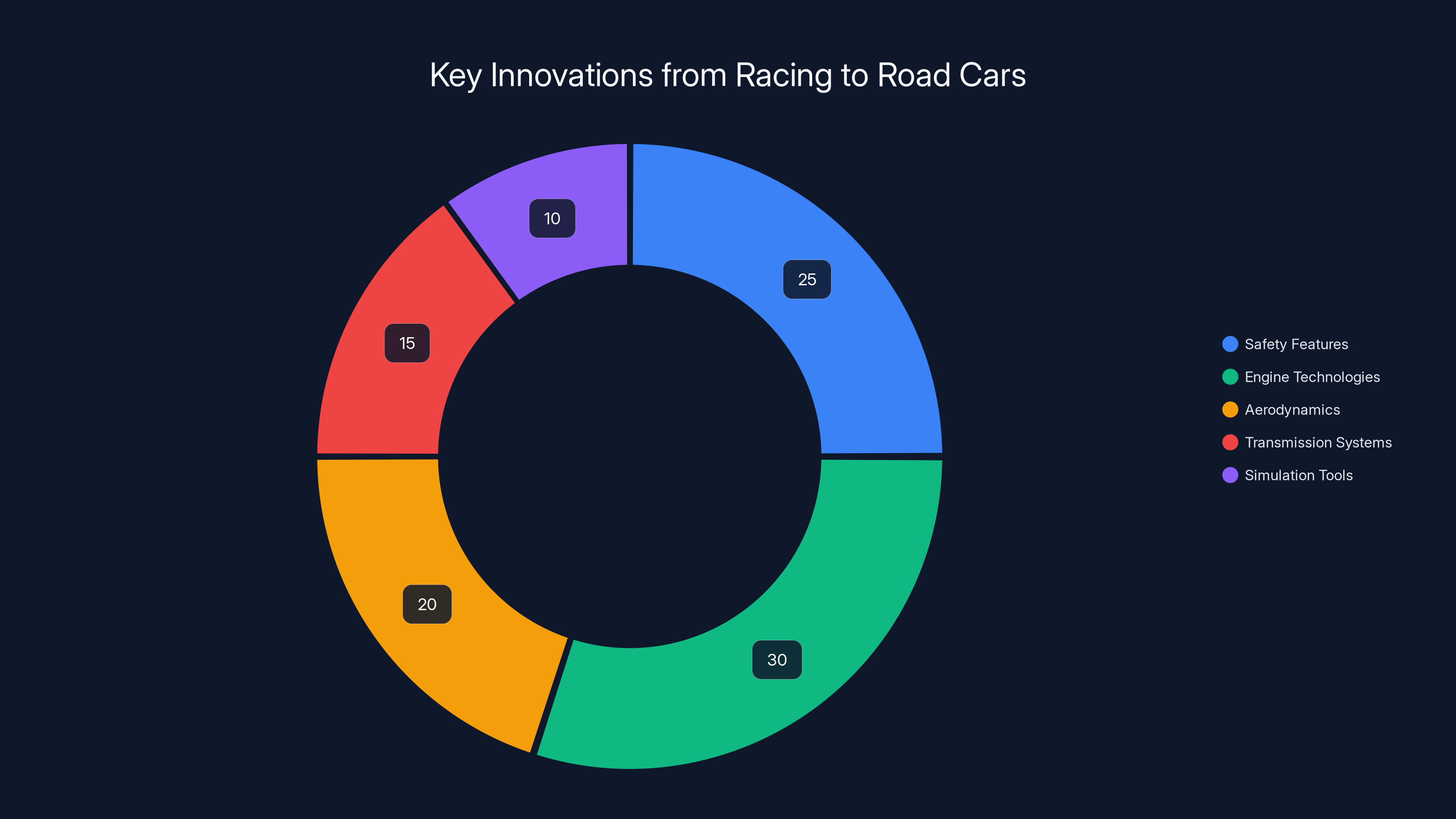

For decades, racing has been the proving ground for automotive innovation. Seatbelts, rear-view mirrors, turbochargers, aerodynamic principles, direct-injection engines, dual-clutch gearboxes—these all owe their existence to competition. But here's what's changed: the transfer of knowledge used to happen primarily through informal channels. Engineers from race teams would swap stories with their road car colleagues over lunch. Teams would hire talent that understood the edge cases of performance. Innovation was osmotic, happening at the boundaries between industries.

But now, something far more structured is emerging. IMSA Labs, a newly formalized initiative from the International Motor Sports Association, is transforming racing data into actionable intelligence for automotive and technology companies. This isn't just about making road cars faster or cooler. It's about using the most extreme, real-world driving conditions imaginable to build better simulation tools—tools that companies from General Motors to Bosch to Michelin can use to design safer, smarter, more efficient vehicles. And they're not doing it alone.

NASA has entered the conversation too. The space agency has signed a partnership with IMSA focused on telemetry, diagnostics, and sensor methodologies. When NASA—an organization that literally puts things in space—decides that racing data is worth studying, you know something significant is happening.

This partnership represents a fundamental shift in how technology gets developed in the 21st century. It's no longer just about individual companies innovating in silos. It's about creating shared data ecosystems where the most demanding real-world conditions become the training ground for algorithms, simulations, and engineering practices that eventually filter down into consumer technology.

Understanding IMSA Labs: Where Racing Data Meets Real-World Applications

IMSA Labs isn't a physical facility. It's a conceptual framework—a formal structure for translating competitive motorsports data into usable intelligence for the broader automotive ecosystem. Think of it as an accelerated learning environment where the extreme conditions of endurance racing provide training data that would otherwise take years to accumulate through conventional testing.

Here's what makes this different from traditional sponsorships or technical partnerships: IMSA Labs creates a shared data repository. When a car runs at Daytona, when it's pushed to its limits at Le Mans, when it's negotiating the technical sections at Watkins Glen, all of that performance data—thermal imaging, suspension loads, aerodynamic forces, tire degradation patterns, ECU behavior—gets captured with exquisite precision. For a company like Bosch, this isn't theoretical. It's real validation of how their components perform under conditions that you simply cannot safely replicate in a controlled testing environment.

The Scale of Data Generation

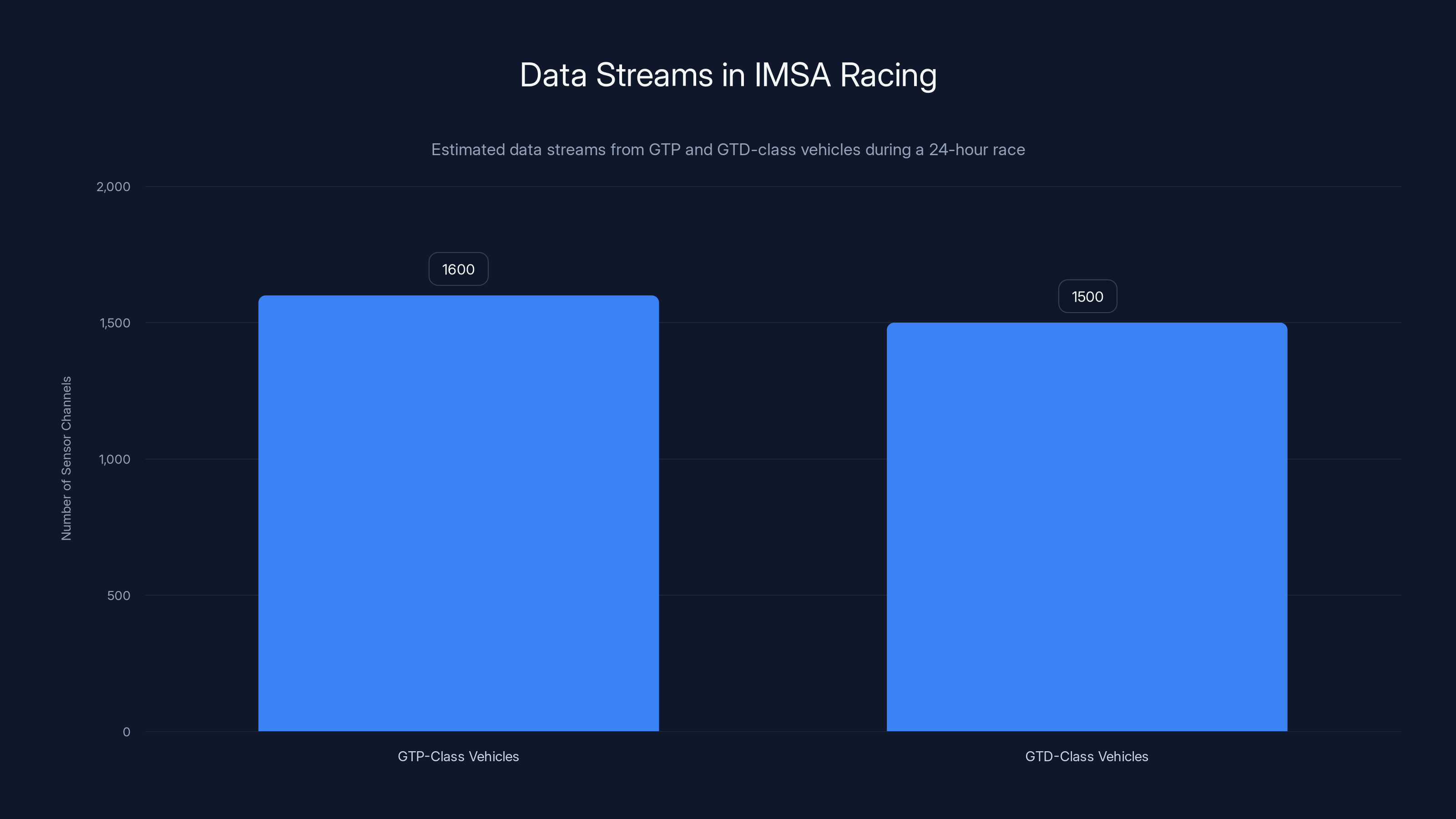

Consider the sheer volume we're discussing. At the Daytona 24-Hour race, 60 cars run simultaneously. The GTP-class vehicles (the cutting-edge prototype racers) each have 1,600 different sensor channels. The GTD-class vehicles (based on production cars like the Porsche 911 and Chevrolet Corvette) have nearly as many. That's potentially 100,000+ data streams running in parallel for 24 consecutive hours.

To put this in perspective: most automotive manufacturers conduct controlled durability testing over days or weeks. What IMSA provides is weeks' worth of extreme, uncontrolled real-world data compressed into a single weekend. And unlike a proving ground, you can't stop the race to fix something—teams have to adapt, improvise, and solve problems on the fly. That's where the learning really accelerates.

How Companies Are Using This Data

For General Motors, which competes under both the Cadillac and Chevrolet brands, the rationale extends beyond winning. According to Eric Warren, GM's Vice President of Global Motorsports Competition, the company uses racing as a direct training ground for its engineering organization. When GM develops new simulation methods, those methods connect directly with the teams designing road cars. The knowledge flows both ways: racing teaches engineers to analyze data rapidly, adapt quickly, discard failed hypotheses, and move forward. Those skills, developed under pressure on a racetrack, directly inform how engineers approach problems back at the office.

For Michelin, the tire development partnership exemplifies the practical application of racing data. The French tire manufacturer uses IMSA and World Endurance Championship data to develop and validate sustainable tire compounds. Their recent GTP tires contain more than 50% recycled and renewable material while maintaining performance parity with previous generations. That validation wouldn't have been possible without real-world racing data proving that sustainable compounds could handle the thermal loads, wear patterns, and grip requirements of professional motorsports.

Bosch's involvement follows the same pattern. Regional President Joe Capuano describes it as a loop: Bosch brings components designed for road vehicles to the racetrack, applies them in different ways to meet racing requirements, and then feeds the feedback from races back into their automotive product development. The racetrack becomes a stress test. The data becomes a teacher.

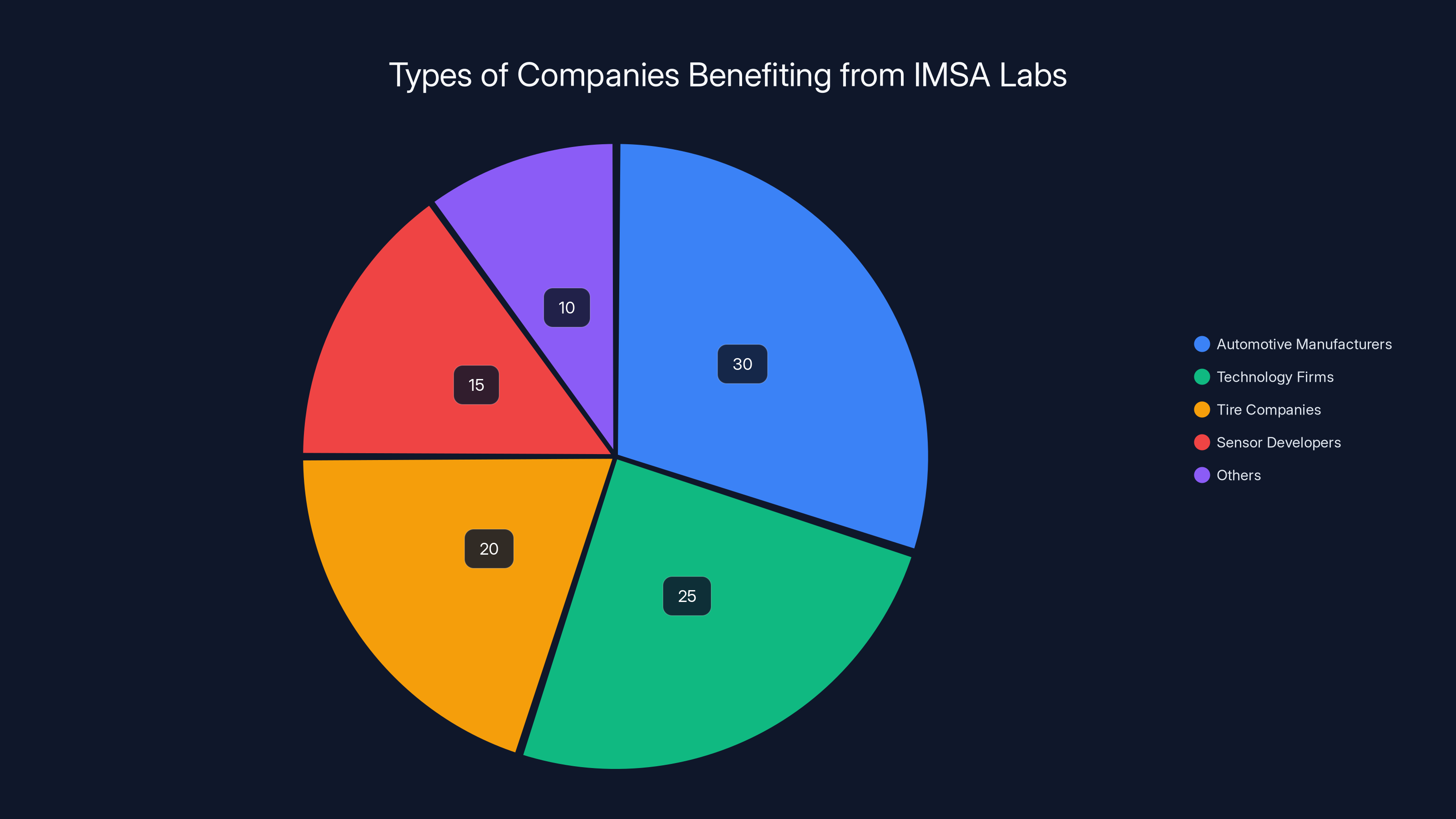

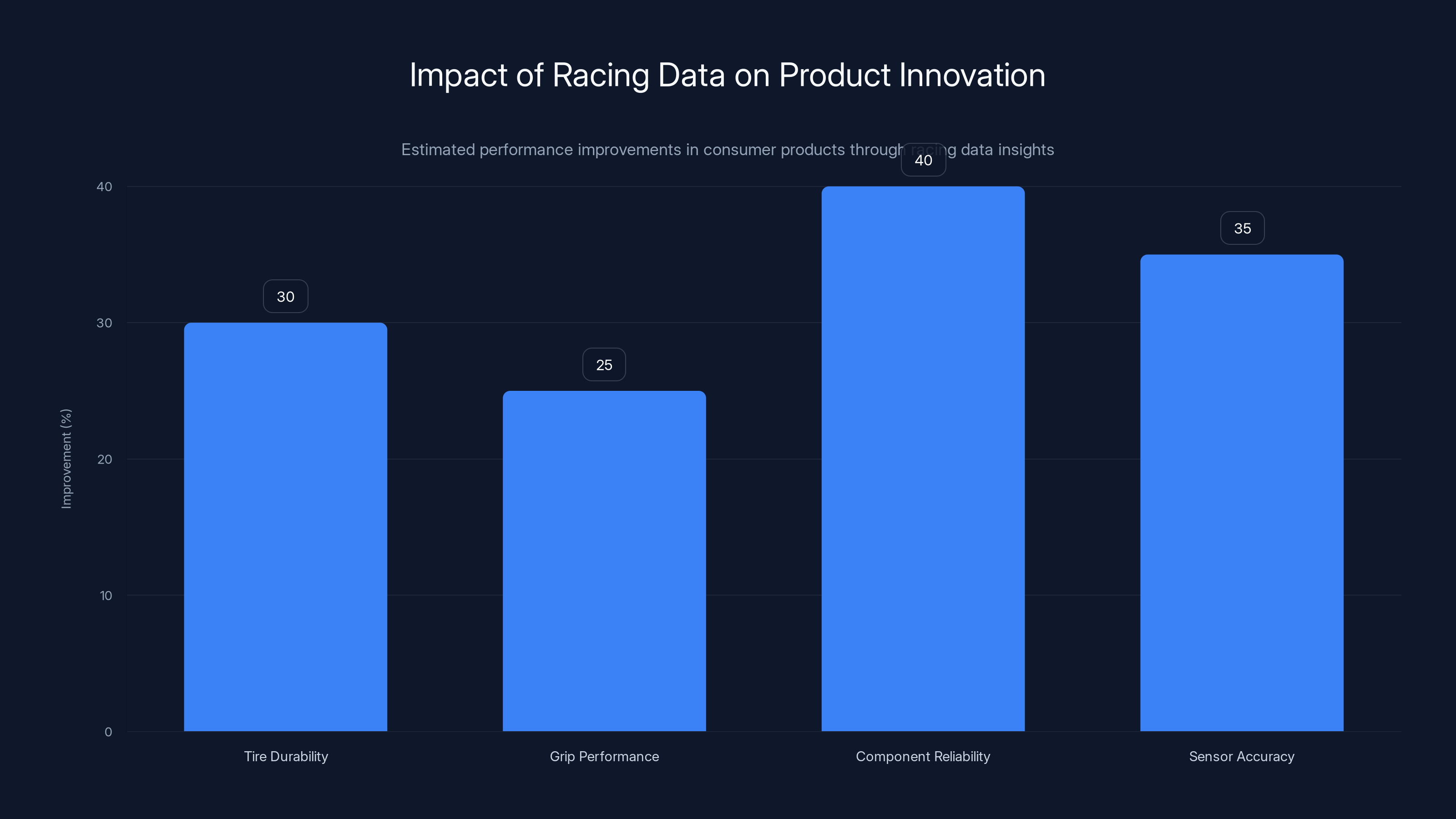

Estimated data shows automotive manufacturers and technology firms as the primary beneficiaries of IMSA Labs, followed by tire companies and sensor developers.

The NASA Partnership: What Does a Space Agency Want With Racing Data?

On the surface, the collaboration between NASA and IMSA seems unexpected. One organization operates at the edge of human spaceflight. The other operates at the edge of automotive performance. But the partnership actually makes profound sense when you understand what NASA is really good at: telemetry, diagnostics, and sensor methodologies.

NASA has been collecting, analyzing, and acting on sensor data in real-time for over six decades. The space agency has mastered the art of extracting meaningful intelligence from massive data streams under extreme conditions, where failure isn't an option. That expertise is directly applicable to motorsports, where vehicle performance data flows at extraordinary volumes and must inform split-second decisions about fuel strategy, tire management, and setup changes.

Telemetry Systems and Real-Time Analytics

When a spacecraft is in orbit, mission control doesn't just collect data—it analyzes it, predicts failure modes, and recommends actions in real-time. A similar approach now applies to racing. IMSA teams collect telemetry, but the real value comes from interpreting it correctly. NASA's involvement likely focuses on helping teams and manufacturers extract signal from noise, identify patterns before they become problems, and predict when components will fail.

Consider a tire degradation curve. A tire doesn't suddenly fail—it degrades gradually. An engineer watching raw sensor data might not catch the subtle shift in tire behavior that precedes a problem. But a system trained on NASA-grade diagnostic methodologies can predict failure patterns with remarkable accuracy. That's the kind of expertise NASA brings.

Sensor Methodologies

The other component of the NASA partnership centers on sensor technology itself. Racing cars are essentially flying laboratories with wheels. They need sensors that can withstand extreme vibration, intense heat cycling, aerodynamic stress, and electromagnetic noise. NASA has spent decades developing and validating sensors for environments far more hostile than anything on Earth. That expertise, applied to motorsports sensor design, could lead to more robust, reliable telemetry systems—which means better data, which means better insights.

Knowledge Transfer to Commercial Applications

Here's where the partnership gets interesting for industries beyond automotive. The diagnostic methodologies that NASA helps develop for racing don't stay in racing. Bosch, General Motors, Michelin—all of these companies operate across multiple industries. Sensing and diagnostic technologies developed for IMSA cars can be applied to aerospace, industrial equipment, or commercial vehicles. The racetrack becomes an innovation incubator, and NASA's involvement accelerates the development of next-generation sensing and diagnostic capabilities.

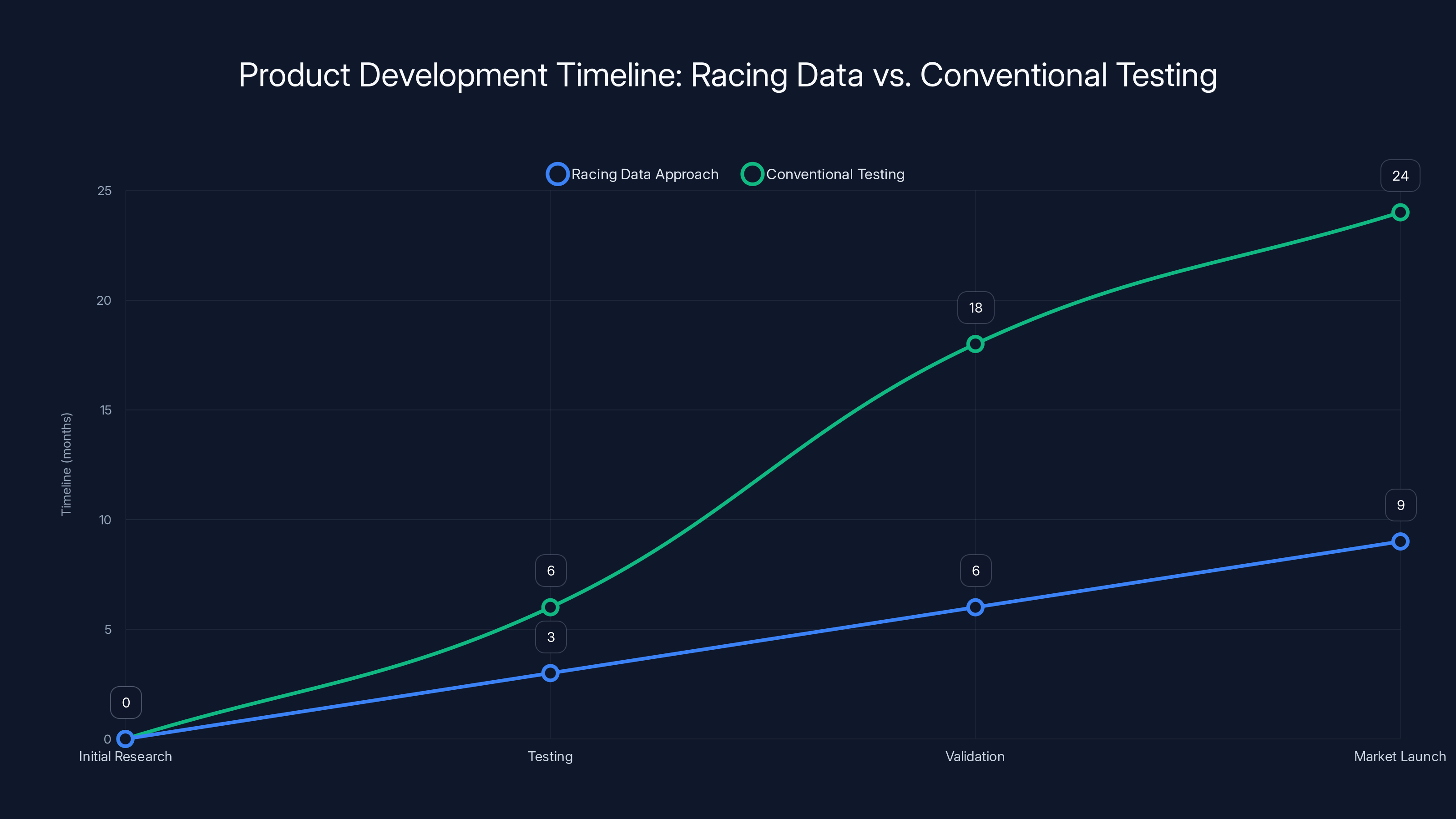

Using racing data, the supplier reduced the product development timeline from 24 months to 9 months, achieving faster market entry and improved product robustness. (Estimated data)

The Software-Defined Vehicle Revolution: Racing as the Testing Ground

One of the most significant conversations happening in automotive engineering right now centers on the software-defined vehicle (SDV). Instead of vehicles with complex, hardwired electronic systems that are locked down by manufacturers, the next generation of cars will have flexible, updatable software architectures where changes can be made over-the-air. This represents a fundamental shift in how vehicles are designed, built, and maintained.

Racing, as it turns out, has been doing this forever. David Salters, President of Honda Racing Corporation USA, put it plainly: "You'll read and see a lot about software-defined vehicles… and you think we've been doing that in racing forever."

How Racing Developed Software-First Approaches

In competitive motorsports, especially IMSA's GTP class, teams operate with open software architecture. That means if an engineer has an idea for controlling a system differently, they can write the code, implement it, and test it—often within days, sometimes within hours between races. GTP teams use F1-grade electronic control units where their engineers write all the software governing the vehicle. That's full control. That's unlimited flexibility.

Compare that to a road car, where the automaker controls the entire software stack and dealers have limited ability to modify anything. For decades, that made sense from a liability and warranty perspective. But it also meant that manufacturers had to predict every possible scenario, every edge case, every failure mode. They had to get it right the first time, for millions of cars, across years of ownership.

Racing sidesteps all of that. Teams can make mistakes, learn from them, and iterate. They can experiment with novel control strategies that would never be approved in a road car. And critically, they can gather data showing what works and what doesn't, under conditions far more extreme than anything a road car will experience.

Direct Translation to Road Car Development

When General Motors develops new simulation methods or software control strategies in IMSA, those don't stay on the racetrack. The lessons, the code frameworks, the control algorithms—they filter directly into road car development. The engineers who work on IMSA vehicles are the same engineers (or work with the same teams) who design production vehicles. The knowledge transfer is immediate and intentional.

Michael Cabe, President and CEO of Michelin North America, described the feedback loop beautifully: "Literally what we do is we learn here on the weekend and then Monday morning we're back in the office and we're designing based on what we learned over the weekend into the products that we can drive ourselves through the rest of the week." That's not metaphorical. That's the actual operational rhythm at companies deeply involved in motorsports.

The Complexity of Modern Control Systems

Hybrid propulsion systems add another layer of complexity that racing helps illuminate. A GTP car might deploy electric motors to recover energy under braking, manage thermal loads in the battery system, and coordinate power delivery between the combustion engine and the electric motor. All of that happens in real-time, at racing speeds, with competing demands from aerodynamics, tire grip, and fuel consumption.

The software managing those tradeoffs has to be incredibly sophisticated. And the data from one race—one weekend—teaches engineers more about how those systems behave under stress than months of simulation alone could. That's why software-defined vehicles need racing data. The complexity demands real-world validation.

Data Integration: Converting Raw Telemetry Into Actionable Intelligence

Raw data is worthless. A billion data points per race is impressive, but it's also noise unless you know how to process it. The real art—and science—of IMSA Labs lies in converting telemetry streams into insights that engineers can actually use.

Data Architecture and Storage

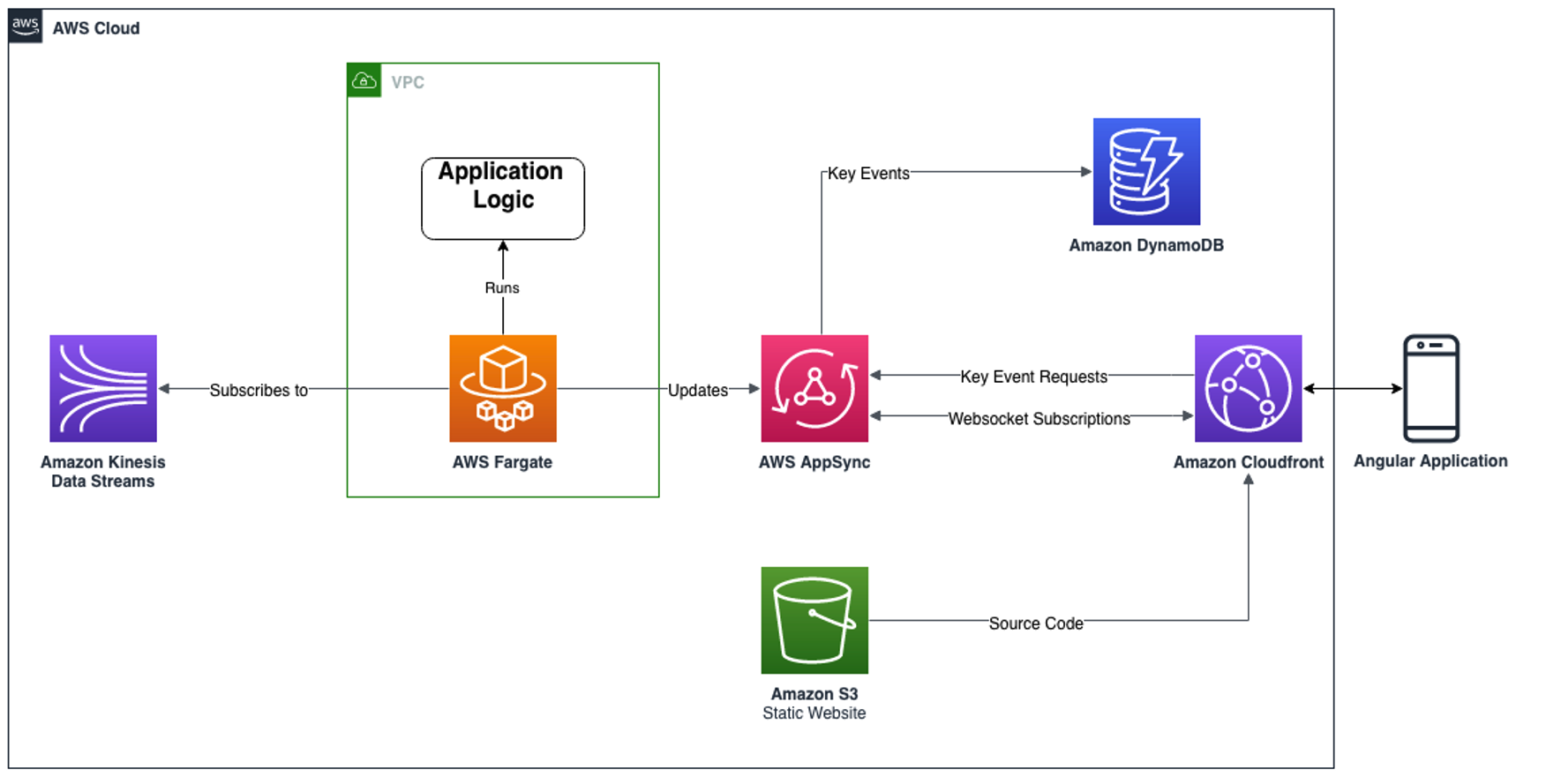

First challenge: storage. Storing 2+ billion data points from a single event requires serious infrastructure. Cloud databases, distributed storage, data compression—all of those are necessary. But more importantly, the data has to be organized in a way that's queryable. An engineer at Bosch needs to be able to ask, "Show me tire thermal behavior in Turn 3 under fuel load conditions," and get an answer in seconds, not hours.

This is where the partnership structure matters. IMSA doesn't try to build and maintain all of this infrastructure themselves. Instead, the partnership likely involves cloud providers, data engineering firms, and the automotive companies themselves. Shared responsibility means shared cost, and more importantly, shared expertise.

Machine Learning and Pattern Recognition

Once the data is organized, machine learning models become invaluable. A model trained on thousands of hours of racing data can identify subtle patterns that humans would miss. For example:

- Tire degradation patterns: Models can predict precisely when a tire will reach the end of its useful life based on thermal history, slip angle, and load cycles. That's incredibly valuable information for strategy decisions.

- Engine behavior under stress: Models trained on racing data can identify early warning signs of component stress, enabling teams to make maintenance decisions before failure occurs.

- Fuel consumption optimization: Algorithms can learn the optimal driving line, throttle application, and brake timing to minimize fuel consumption while maintaining competitive pace.

- Suspension tuning: Data from multiple drivers, multiple conditions, and multiple setup configurations teaches models what suspension configurations work best under different circumstances.

All of those models, once validated on racing data, can be applied to road car testing, simulation, and even autonomous driving development.

Privacy and Competitive Considerations

Here's the tricky part: racing is brutally competitive. Teams don't want to share their setup secrets, their software algorithms, or their strategic decision-making processes with competitors. So IMSA Labs has to manage data sharing carefully. Some data can be openly shared. Other data remains proprietary to the teams that collect it. The partnership likely includes mechanisms for anonymized, aggregated data sharing that provides value to the broader ecosystem without compromising competitive advantage.

GTP-class vehicles have approximately 1,600 sensor channels, while GTD-class vehicles have nearly as many, illustrating the extensive data collection during races. Estimated data.

Real-World Case Studies: How Racing Data Drives Product Innovation

The benefits of racing data aren't theoretical. They're manifesting in actual products that consumers use and companies deploy.

Michelin's Sustainable Tire Development

Michelin's latest GTP tire, introduced for the 2025 season, serves as a concrete example. This tire contains more than 50% recycled and renewable material. By every conventional expectation, a tire made partially from recycled compounds should perform worse—more wear, less grip, reduced durability. Michelin proved otherwise, using IMSA racing data.

How? They applied racing conditions as the ultimate stress test. If a tire can handle the thermal loads, grip demands, and wear cycles of professional motorsports, it can certainly handle normal road conditions. By validating their sustainable tire design on the racetrack, under the most demanding conditions imaginable, Michelin gained confidence that road versions would perform reliably. The company could then market the tire with credibility: "This tire has been validated at Le Mans and Daytona."

Beyond the GTP class, Michelin's Cross Climate tire family uses "slick intermediate" technology originally proven at Le Mans. That's grip enhancement in wet conditions, developed through racing, now available on passenger vehicles. It's a direct technology transfer: racing data → validated design → consumer product.

Bosch's Component Optimization

Bosch's involvement follows a similar arc. The company brings sensor components, electronic control modules, and other automotive tech to the racetrack. Racing teams apply these components in unconventional ways, pushing them beyond their design specifications. The feedback—what broke, what worked better than expected, what needs refinement—feeds directly back into Bosch's product development.

A sensor designed for engine management might reveal surprising accuracy benefits when exposed to racing's extreme vibration environment. Those insights inform the next generation of consumer-grade sensors. A brake control module might discover edge cases that Bosch's engineers hadn't anticipated in desktop testing. Those edge cases become test cases for the next iteration.

This isn't one-off feedback. It's systematic validation of components under conditions that would take years to accumulate through normal durability testing.

General Motors' Engineering Culture Transformation

For General Motors, the value extends deeper than specific components. The company uses IMSA participation as a foundational element of engineering training and culture. When a GM engineer works on an IMSA team—even briefly—they develop an intuitive understanding of real-time decision-making, data-driven problem-solving, and system integration that's hard to teach in a classroom or simulation.

That engineer returns to their road car development group with muscle memory for how to analyze problems, how to adapt quickly when assumptions prove wrong, and how to collaborate with hardware and software engineers under pressure. Those soft skills, developed on a racetrack, ultimately influence how millions of cars are designed and built.

The Hybrid Propulsion Advantage: Why Electrification Needs Racing Data

Hybrid propulsion systems—the kind used in modern GTP cars—represent some of the most complex powertrains ever designed. A hybrid car has two power sources (combustion and electric), a battery system, thermal management systems, and sophisticated control software managing the interplay between them all. That's genuinely difficult engineering.

Energy Recovery and Optimization

In racing, every bit of energy matters. A hybrid GTP car recovers energy from braking and uses that stored energy to deploy electric power during acceleration, managing weight, thermal load, and fuel consumption simultaneously. That optimization problem is exquisite. Too much energy recovery and you're compromising braking feel and stopping distance. Too little and you're wasting opportunity.

Racing data shows engineers precisely how hybrid systems behave under these extreme tradeoffs. The algorithms that manage hybrid powertrains in road cars are directly informed by racing experience. A manufacturer can validate a new hybrid control strategy on the racetrack before deploying it to millions of vehicles.

Thermal Management Under Stress

Hybrid systems generate heat in ways pure combustion or pure electric systems don't. The battery heats up. The electric motor heats up. The combustion engine runs hotter to accommodate electric power delivery. Managing those thermal loads while maintaining performance requires sophisticated simulation and control software.

But simulation alone is insufficient. You need real-world data showing how these systems actually behave under stress. IMSA provides exactly that. Data from 24 continuous hours of racing teaches engineers more about hybrid thermal behavior than weeks of dyno testing could.

Future Powertrain Architecture

Looking forward, racing will become even more critical as manufacturers transition to increasingly complex powertrains. Full electrification, hydrogen fuel cells, and exotic hybrid architectures will all require validation beyond simulation. Racing provides that validation in compressed timeframes.

Racing data has led to significant improvements in consumer products, with up to 40% enhancement in component reliability and 35% in sensor accuracy. (Estimated data)

The Simulation Revolution: Building Better Digital Twins With Real Data

The ultimate goal of IMSA Labs isn't just to extract insights from racing data. It's to build better simulation models—digital twins of vehicles that accurately predict real-world behavior.

From Simulation Theory to Real-World Validation

Automakers have been building simulation tools for decades. Computational fluid dynamics (CFD) predicts aerodynamic behavior. Multi-body dynamics simulations predict suspension behavior. Thermal simulations predict engine and battery thermal behavior. All of these are valuable, but they're limited by their assumptions. Simulation models make predictions based on physics, material properties, and boundary conditions. But real-world vehicles operate with friction, noise, manufacturing tolerances, and edge cases that simulations often miss.

Racing data fills those gaps. When you compare simulation predictions to real racing data, you discover systematic errors. A CFD model might predict aerodynamic drag 5% too low. A suspension simulation might underestimate tire wear rates. Those discrepancies aren't failures—they're opportunities to improve the simulation.

Over time, simulations trained on racing data become dramatically more accurate. Instead of relying purely on physics, the models are also informed by real-world behavior. That's where the power comes in. Manufacturers can build simulations that accurately predict how a new design will behave, without building and testing physical prototypes.

Reduced Development Cycles

In the automobile industry, development cycles typically run three to five years from concept to production. A significant portion of that time goes to physical testing and validation. If simulation tools were accurate enough, you could compress that timeline. Racing data accelerates the process by improving simulation accuracy, enabling manufacturers to make design decisions with confidence based on digital models rather than physical prototypes.

For companies competing in multiple championships (IMSA in the US, World Endurance Championship globally), the validation data is incredibly rich. Different tracks, different weather conditions, different fuel types, different tire compounds—all of those variables get captured. The simulation models trained on that diversity become robust and generalizable.

Autonomous Vehicle Development

Racing data is also invaluable for autonomous vehicle development. Self-driving cars need to understand vehicle dynamics under extreme conditions—sudden evasive maneuvers, loss of grip, boundary-layer driving. Racing data teaches autonomous systems how vehicles behave when pushed to their limits. That knowledge improves the safety and reliability of autonomous driving algorithms.

The Competitive Advantage: Why Companies Care About Data Sharing

On the surface, you might wonder why fiercely competitive companies would agree to share racing data. Wouldn't that reveal competitive secrets?

The answer is nuanced. There's competitive data (your specific setup, your engine tuning, your strategic decisions), and there's meta-data (thermal patterns, material behavior, system interactions). IMSA Labs focuses on the latter. By sharing aggregated, anonymized data, companies gain access to insights that would cost millions to develop independently.

Network Effects in Engineering

When Bosch participates in IMSA Labs, the company gains access to data from competing teams using different approaches. That diversity accelerates learning. Bosch engineers see how their sensors perform in 20 different cars, across 20 different setups, driven by 20 different drivers. That breadth of data teaches lessons that no single team's data could.

From a competitive perspective, the advantage isn't in the raw data—it's in the analytical frameworks and insights that emerge from analyzing that data. The company that best understands how to extract intelligence from racing data gains advantage in product development, not from data secrecy.

Cost Sharing and Infrastructure

Building and maintaining a data platform capable of storing and processing billions of data points per event is expensive. Cloud infrastructure, data engineering, software development—all of that costs money. By pooling resources through IMSA Labs, companies split those costs while gaining access to the full breadth of available data.

A small company could never afford to build that infrastructure independently. By participating in a shared platform, even smaller companies gain access to data and tools that would otherwise be financially out of reach.

Recruiting and Retention

There's also a less tangible but critical advantage: attracting and retaining talent. Top engineers want to work on problems that matter, using tools and data that are cutting-edge. A company that says, "We have access to data from the Daytona 24-Hour race, and you'll be working with NASA researchers to analyze it," attracts different talent than a company working exclusively in simulation.

Motorsports is also a pipeline for specialized talent. Engineers trained in racing environments bring skills and perspectives that are hard to develop in traditional automotive manufacturing.

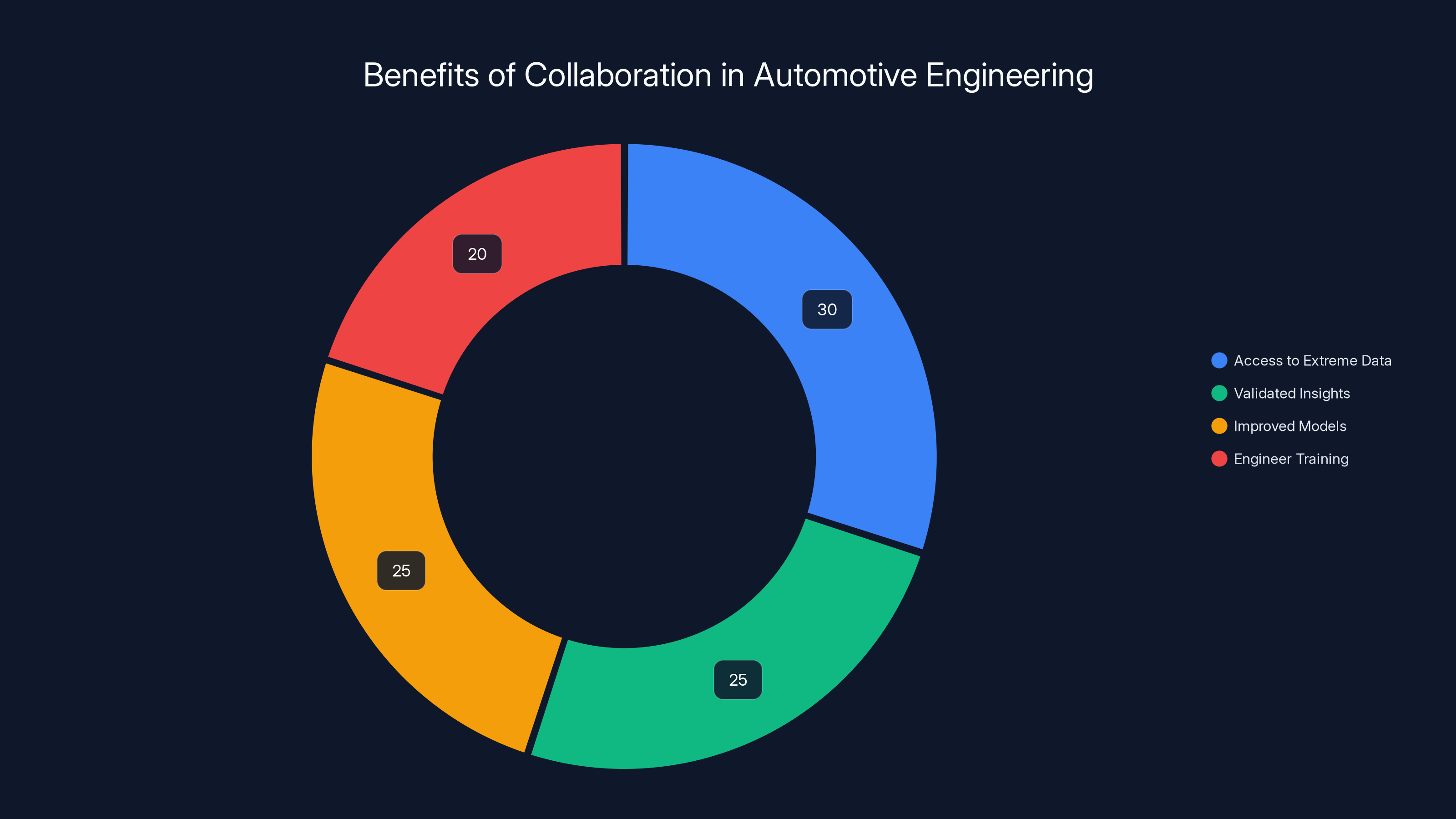

Collaboration in automotive engineering offers significant benefits, with access to extreme data and validated insights being the most substantial. Estimated data.

Privacy, Data Security, and Intellectual Property Considerations

Sharing data at scale introduces challenges beyond technical infrastructure.

Protecting Competitive Secrets

IMSA Labs has to balance openness with competitive fairness. A team's specific fuel strategy, their setup choices, their component configurations—that's proprietary. But the underlying thermal behavior, durability data, and systems interactions can be shared without revealing competitive secrets.

The typical approach involves anonymization and aggregation. Instead of, "Team Cadillac's engine hits 93 degrees Celsius on Lap 47," the data becomes, "Average engine temperature across GTP vehicles: 92.5 degrees Celsius." That aggregation preserves the insight while protecting competitive detail.

Regulatory and Legal Frameworks

When data from multiple organizations is shared, legal questions arise. Who owns the data? What rights do companies have to use insights derived from the data? How are disputes resolved? These questions likely required significant legal negotiation when IMSA Labs was established.

The resolution typically involves clear data sharing agreements specifying usage rights, limitations, and dispute resolution processes. Companies might retain exclusive rights to their own data while gaining shared rights to aggregated datasets.

Cybersecurity and Data Integrity

Once you're storing billions of sensitive data points on shared platforms, cybersecurity becomes critical. A breach could expose proprietary engineering data worth millions. IMSA Labs likely implements encryption, access controls, audit logging, and intrusion detection—the full stack of enterprise security practices.

Data integrity is equally important. If someone could subtly manipulate racing data, they could distort the entire knowledge base that other companies rely on. Validation mechanisms ensuring that data hasn't been tampered with are essential.

The Future of Tech Transfer: Where Racing Data Goes Next

This partnership is just the beginning. Racing data will increasingly inform multiple domains beyond traditional automotive development.

Autonomous Vehicle Safety Validation

As autonomous vehicles become more prevalent, proving safety at extreme limits becomes essential. Real racing data—showing how vehicles behave in loss-of-grip conditions, during sudden evasive maneuvers, and under boundary-layer dynamics—teaches autonomous systems how to handle situations they might encounter on public roads.

Manufacturers developing self-driving cars need to validate their algorithms against edge cases. Racing data provides those edge cases in abundance. A self-driving system trained partially on racing data is a self-driving system that understands vehicle dynamics better.

Supply Chain Optimization

Racing data reveals component failure patterns, degradation curves, and stress limits with remarkable precision. That information helps suppliers optimize their products and manufacturing processes. A supplier learns that their component fails under specific combinations of temperature, vibration, and load—information that might not emerge for years in conventional warranty data analysis.

AI and Machine Learning Frameworks

Racing provides some of the richest, most complex data available for training machine learning models. Models trained on racing data become more sophisticated and capable of understanding complex physical systems. Those capabilities can be transferred to other domains: autonomous systems, industrial equipment monitoring, predictive maintenance across industries.

Climate and Sustainability Innovation

Racing is increasingly focused on sustainability. Sustainable fuel development, lighter-weight materials, regenerative braking systems—racing drives innovation in all of these domains. Racing data validates that sustainable approaches don't compromise performance, building confidence for road car application.

Michelin's sustainable tire development is just the beginning. Expect to see sustainable fuel technologies, lightweight composite structures, and advanced battery systems all validated through racing, then deployed to consumers.

Space and Aerospace Applications

Here's where the NASA partnership becomes particularly interesting. Sensor and diagnostic methodologies developed for racing could inform aerospace applications. A sensor robust enough for IMSA racing—with extreme vibration, thermal cycling, and electromagnetic noise—might be suitable for aerospace applications. Diagnostic algorithms trained on racing data might improve aircraft maintenance and safety.

Racing has significantly contributed to automotive innovations, with engine technologies and safety features being the most influenced areas. (Estimated data)

Industry Adoption and Scaling Challenges

While IMSA Labs has enormous potential, scaling the initiative to impact the broader industry presents challenges.

Participation and Buy-In

Not every automotive company participates in IMSA racing. Some focus on other championships (Formula 1, Formula E, various national touring car series). For IMSA Labs to provide comprehensive value to the industry, it needs broad participation. Companies outside of racing also need to benefit—suppliers, autonomous vehicle developers, software firms. Building that ecosystem requires clear communication of value and accessibility to data.

Standardization and Interoperability

Racing teams have been collecting telemetry for decades, but they've often done so in proprietary formats. Creating common standards for data collection, storage, and exchange is essential for IMSA Labs but technically challenging. Different manufacturers use different sensor types, different sampling rates, different data formats. Harmonizing all of that requires standardization that doesn't stifle innovation.

Technical Maturity of Tools

The infrastructure for processing and analyzing racing data at scale is still evolving. Cloud platforms are mature, but specialized tools for automotive telemetry analysis continue to develop. IMSA Labs needs to keep pace with advancing technology while building tools that are accessible to companies of different sizes and technical sophistication.

Global Expansion

IMSA is primarily a North American championship. The World Endurance Championship and Formula 1 operate globally. For IMSA Labs to become a truly comprehensive initiative, it needs to coordinate with international racing series. That coordination requires diplomatic, technical, and business alignment across organizations that sometimes compete.

Case Study: How a Component Supplier Leveraged Racing Data for Product Innovation

Consider a hypothetical scenario grounded in real practice: A brake system supplier wants to develop a new generation of high-performance brake fluid with improved thermal stability. Traditional development involves laboratory testing, bench dyno testing, and eventually, limited road car testing. The timeline: 18 months to 2 years.

With IMSA Labs, the process accelerates. The supplier partners with an IMSA team and instruments the brake system with additional sensors capturing temperatures, pressure spikes, and fluid properties in real-time. Over a season of racing, the supplier collects data from dozens of events, hundreds of hours of brake system operation under extreme conditions—the kind of stress that would take years to accumulate in conventional testing.

Data analysis reveals that conventional brake fluid experiences thermal stratification under sustained high-temperature braking—a failure mode that conventional testing hadn't fully captured. The supplier formulates a new fluid addressing that specific failure mode, validates it through racing data comparison, and brings it to market with confidence. The timeline compresses to 9 months, and the product is inherently more robust because it's validated against real-world extreme conditions.

The competitor who relied only on conventional testing brings a similar product to market a year later, having discovered some of the same issues through expensive real-world field testing. The supplier who leveraged racing data moved faster and avoided costly recalls.

That's the competitive advantage IMSA Labs creates.

Broader Implications: Tech Transfer Beyond Automotive

While this partnership focuses on automotive, the principles extend to other industries where complex systems face extreme operational conditions.

Aerospace and Defense

Racing methodologies could inform aerospace design, maintenance, and predictive analytics. Military vehicles operate in environments sometimes as extreme as racing. Data sharing frameworks developed for IMSA could be adapted for defense applications, improving vehicle reliability and safety.

Heavy Industrial Equipment

Construction equipment, mining machinery, agricultural vehicles—all of these operate under demanding conditions. Racing data methodologies could inform equipment design, component selection, and maintenance scheduling for these sectors.

Maritime and Shipping

Ship propulsion systems face extreme stresses analogous to racing engines. Data from racing could inform marine engine development, improving efficiency and reliability for commercial shipping.

Medical Devices

This might seem far-afield, but precision sensor and diagnostic methodologies developed for racing have applications in medical devices. A sensor robust enough for racing is a sensor that could function reliably inside the human body. Diagnostic algorithms trained on racing data could inform patient monitoring systems.

The Technology Stack Behind IMSA Labs

Understanding the infrastructure helps explain why this partnership has become possible now, when it wasn't possible a decade ago.

Cloud Computing and Data Lakes

Amazon Web Services, Microsoft Azure, and Google Cloud have made it economically feasible to store and process petabytes of data. A decade ago, that would have required massive on-premises infrastructure. Now, companies can spin up cloud resources, process racing data, extract insights, and scale down without massive capital expenditure.

Machine Learning Frameworks

TensorFlow, PyTorch, and other open-source machine learning frameworks have democratized AI. Companies don't need to build ML infrastructure from scratch. They can leverage pre-built frameworks, train models on racing data, and deploy algorithms in days instead of months.

IoT and Edge Computing

Sensors are smaller, cheaper, and more capable than they've ever been. A race car can be instrumented with hundreds of sensors that would have been prohibitively expensive 10 years ago. Those sensors transmit data wirelessly, with edge computing devices processing and filtering data in real-time.

API-First Architecture

Modern software design emphasizes APIs (Application Programming Interfaces) that allow different systems to communicate. A racing team's telemetry system can expose data through APIs that allow universities, suppliers, and other teams to build applications on top of the data.

Regulatory and Governance Frameworks

As IMSA Labs matures, regulatory questions will emerge.

Data Governance

Who is responsible if data is misused? What recourse do companies have if their proprietary insights are accidentally revealed? These questions require clear governance frameworks, likely involving a central authority (probably IMSA itself) making decisions about data access, usage, and disputes.

Standards Development

As more organizations participate, industry standards will likely emerge around data formats, sensor specifications, and data quality metrics. Organizations like SAE (Society of Automotive Engineers) or ISO (International Organization for Standardization) might develop standards around racing telemetry, similar to how they've developed standards for everything from vehicle emissions to cybersecurity.

Patent and IP Considerations

If a company develops an innovation using IMSA Labs data, who has rights to patent that innovation? Does IMSA have a claim? Do other participants have rights? These questions require careful legal frameworks. Typically, organizations retain rights to their own innovations but acknowledge that those innovations were informed by shared data.

Challenges and Realistic Limitations

It's important to acknowledge that while IMSA Labs is genuinely innovative, it's not a panacea.

Data Doesn't Guarantee Insights

More data is only valuable if you can actually extract signal from the noise. A company might have access to thousands of hours of racing data but lack the analytical expertise to use it effectively. The competitive advantage goes to companies that develop sophisticated analysis capabilities, not merely to companies with data access.

Racing Conditions Don't Perfectly Predict Road Conditions

A race car operates under very different conditions than a road car. Fuel is high-octane racing fuel, not consumer gasoline. Drivers are professionals making aggressive decisions constantly. Pit stops allow repairs and adjustments that aren't possible in road car use. Racing data is invaluable, but it's not perfectly representative of road car operation. Manufacturers still need road car testing data to validate that racing insights translate to consumer applications.

Proprietary Concerns Persist

Despite data sharing frameworks, companies remain concerned about revealing competitive secrets. Some will be willing to share only heavily anonymized, aggregated data. That limits the value they gain from participation. The companies most willing to share openly are often those with less concern about racing competitiveness—larger suppliers with multiple customer relationships, or new entrants without established competitive positions.

Cultural and Organizational Differences

A racing team culture is different from a road car development culture. Racing values rapid iteration, calculated risk-taking, and real-time adaptation. Road car development values reliability, predictability, and comprehensive validation. Bridging those cultures requires intentional effort. Not every organization can effectively absorb racing-derived insights.

The Path Forward: What to Watch in 2025 and Beyond

As IMSA Labs matures, several developments are worth monitoring.

Data Sharing Agreements

How IMSA structures data sharing agreements with participants will define the initiative's trajectory. Open-ended data sharing might maximize scientific value but concern participants. Restrictive agreements might protect competitive interests but limit the initiative's impact. Watch for the actual agreements and how organizations view them.

Tool and Infrastructure Development

The technical tools for analyzing racing data will continuously evolve. Expect to see specialized software platforms emerging, some from established enterprise software vendors and some from startups. The tools that become industry standards will shape how companies analyze and benefit from racing data.

Participation Expansion

Will IMSA Labs attract companies outside traditional automotive? Will aerospace companies participate? Will autonomous vehicle developers tap into racing data? The initiative's impact will depend on reaching beyond traditional racing participants.

International Coordination

Will IMSA coordinate with Formula 1, World Endurance Championship, or other global racing series? Fragmented initiatives across different championships limit the overall impact. Global coordination would create a richer, more comprehensive data ecosystem.

Commercialization and Business Models

How will IMSA monetize IMSA Labs? Will participation be free? Will companies pay for data access? Will specialized analysis tools be sold separately? The business model will influence adoption rates and the initiative's sustainability.

Measurable Impact on Road Cars

Ultimately, IMSA Labs succeeds if it actually influences road car development. Watch for new technologies and capabilities that manufacturers explicitly attribute to IMSA Labs participation. Early wins might be in tire technology, suspension systems, or thermal management. As those examples accumulate, the initiative's credibility and adoption will grow.

FAQ

What is IMSA Labs and how does it differ from traditional motorsports partnerships?

IMSA Labs is a formalized initiative that systematically collects, organizes, and analyzes race car telemetry data from IMSA competitions to provide insights for automotive and technology companies. Unlike traditional sponsorships where companies sponsor teams primarily for marketing, IMSA Labs creates a shared data repository and analytical framework. A race car generates 1,600+ sensor channels simultaneously across 60+ vehicles running for 24-hour endurance events, creating billions of data points per race. This scale of real-world performance data under extreme conditions would cost companies millions to replicate through conventional testing. The partnership with NASA adds expertise in telemetry systems and diagnostic methodologies that accelerates how companies extract value from racing data.

How does racing data actually improve automotive products that consumers use?

Racing data informs product development through multiple pathways: component validation (proving Bosch sensors work reliably under extreme conditions), material science (validating Michelin's sustainable tire compounds), simulation improvement (training models that predict vehicle behavior more accurately), and engineering culture (training engineers to solve complex problems rapidly). The feedback loop is direct—data collected on a racetrack Saturday influences engineering decisions on Monday morning. For example, Michelin's Cross Climate tires use grip-enhancement technology proven at Le Mans races, now available on millions of road cars. Companies like General Motors systematically route insights from IMSA vehicles into road car development. However, racing conditions don't perfectly replicate road car use, so companies still require additional validation before deploying racing-derived innovations to consumers.

What types of companies benefit most from IMSA Labs participation?

Companies involved in vehicle systems, sensors, materials, software, and diagnostics benefit most—essentially anyone developing components or systems that perform under demanding conditions. Bosch benefits from real-world sensor validation. Michelin benefits from tire development acceleration. General Motors benefits from engineering talent training and simulation improvement. However, companies outside traditional automotive also gain value: autonomous vehicle developers benefit from extreme-condition driving data, suppliers benefit from component failure analysis, and software firms benefit from edge-case identification. Smaller companies sometimes struggle to participate because they lack resources to analyze complex data, though participation in shared platforms like IMSA Labs reduces barriers.

How does the NASA partnership specifically add value to IMSA Labs?

NASA brings six decades of experience in real-time telemetry systems, sensor methodologies, and diagnostics developed for spaceflight and space exploration. Those capabilities directly apply to motorsports: NASA helps teams extract predictive intelligence from racing data, identifies failure patterns before they occur, and validates sensor systems designed to withstand extreme conditions. NASA's diagnostic algorithms can analyze the massive data streams racing produces—thousands of channels per second—and identify meaningful patterns. Additionally, sensor and diagnostic technologies developed through IMSA Labs and validated with NASA expertise have applications across aerospace, industrial equipment, and other fields requiring robust systems.

What competitive concerns do IMSA teams and suppliers have about sharing racing data?

Competitive concerns are legitimate but manageable through careful data governance. Teams worry that sharing specific setup configurations, fuel strategies, or component choices could help competitors. Suppliers worry that sharing failure data or performance limitations might disadvantage their products. IMSA Labs addresses these concerns through anonymization and aggregation—sharing aggregate thermal patterns rather than specific team data, sharing component failure modes without revealing which supplier's component failed. Competitive data (specific team setup, strategic decisions, confidential component configurations) remains proprietary. However, meta-data about vehicle behavior, material performance, and system interactions can be shared without compromising competitive advantage. The tension between openness and competitive protection requires ongoing negotiation.

How do race teams and suppliers actually access and use IMSA Labs data?

Access typically occurs through dedicated platforms—likely web-based or cloud-based dashboards where authorized users can query data, visualize trends, and download datasets. A Bosch engineer might ask the system to show "thermal behavior of brake fluid across all GTP vehicles, aggregated by track section," receiving anonymized data visualizations and raw data for analysis. Analysis tools likely include machine learning models pre-trained on racing data, visualization tools, and statistical analysis capabilities. Access is typically restricted by role and organization—teams can access all their own data but limited access to competitors' data, while suppliers might have broader access to anonymized cross-team data. Universities and research institutions might have restricted access for non-commercial research.

What are the technical requirements for companies participating in IMSA Labs?

Participation requires data engineering capability to send telemetry data to the IMSA Labs platform, compute resources to analyze data (typically provided through cloud services), and analytical expertise to extract insights. For teams, this might mean instrumenting vehicles with additional sensors and data transmission systems. For suppliers, it might require integrating with the IMSA data platform. Most modern automotive companies and suppliers have this technical capacity, though smaller organizations might need partnerships or consulting support. The barrier is less about technology and more about analytical expertise—the ability to formulate meaningful questions and interpret results requires deep domain knowledge.

How does IMSA Labs data improve simulation tools and digital twins?

Simulation models, whether computational fluid dynamics for aerodynamics or multi-body dynamics for suspension, are inherently imperfect. They make predictions based on physics equations and assumptions about boundary conditions. Racing data provides real-world ground truth showing where simulations diverge from reality. By comparing simulation predictions to actual racing data, engineers identify systematic errors. A CFD model might predict aerodynamic drag 5% too low, or a suspension simulation might underestimate tire wear. Iteratively improving simulations with racing data creates digital twins that accurately reflect real vehicle behavior. Those accurate models enable manufacturers to make design decisions confidently based on simulation rather than building and testing physical prototypes, dramatically compressing development timelines.

What sustainability benefits can result from racing data analysis?

Racing directly informs sustainable technology development: tire compounds that use 50%+ recycled material (validated through IMSA performance demands), regenerative braking systems that recover energy under demanding conditions, lightweight composite structures that reduce weight without compromising strength, and fuel efficiency optimization through data-driven control strategies. Racing proves that sustainable approaches don't compromise performance—a critical message for consumers concerned that sustainability means sacrifice. Sustainable fuel development also benefits from racing data showing how alternative fuels behave under the extreme thermal and mechanical stresses of endurance racing. Those validations build confidence for wider consumer deployment.

How might autonomous vehicle development benefit from IMSA Labs racing data?

Autonomous systems need to understand vehicle dynamics under extreme conditions—sudden evasive maneuvers, loss of grip, boundary-layer driving. Racing data teaches autonomous algorithms how vehicles behave when pushed beyond normal operating conditions. A self-driving car encountering sudden ice or a failed brake sensor needs to recover safely, and understanding boundary-layer vehicle dynamics improves safety. Racing data also reveals how drivers (racing professionals) handle unexpected conditions, providing insights for autonomous system behavior planning. Additionally, sensor systems and diagnostic algorithms validated through racing help autonomous vehicles monitor their own health and detect component failures, improving reliability and safety.

Conclusion: The Convergence of Competition and Collaboration

At first glance, racing and automotive engineering seem fundamentally opposed. Racing is about winning, about pushing vehicles to their absolute limits, about teams competing ruthlessly against each other. Automotive engineering is about predictability, reliability, and serving millions of customers. Yet IMSA Labs demonstrates that these worlds can converge productively.

The partnership between IMSA, NASA, and automotive companies represents something larger than data sharing. It's a recognition that in the modern era, innovation happens fastest when organizations share knowledge while competing on execution. A tire manufacturer can share aggregate thermal data from racing while still maintaining competitive advantage through superior analytical interpretation of that data. A supplier can access insights about component failure while still out-innovating competitors through better design solutions.

Technology transfer from racing to road cars has always happened—seatbelts, turbocharged engines, aerodynamic principles, direct injection. But those transfers were often accidental byproducts of competition. IMSA Labs makes technology transfer intentional and systematic. Instead of waiting for innovations to migrate informally, the initiative creates direct pipelines from racetrack to development lab to consumer vehicles.

For companies willing to participate, the advantages are substantial. Access to real-world extreme-condition data that would cost millions to generate independently. Validated insights about material behavior, component performance, and system interactions. Improved simulation models that compress development timelines. Training for engineers who develop the skills to innovate rapidly.

For the automotive industry as a whole, the implications are profound. Development cycles compress. Innovation accelerates. Safety improves through better understanding of vehicle dynamics. Sustainability advances because racing proves that environmental responsibility doesn't mean compromising performance.

But IMSA Labs also has realistic limitations. Sharing data is complex, raising concerns about competitive secrets and intellectual property. Racing conditions don't perfectly replicate road car use, so companies still need additional validation. Not every organization has the analytical expertise to extract maximum value from data access. The initiative is still in its infancy—implementation challenges will emerge that weren't anticipated.

Yet the direction is clear. Technology companies, automotive manufacturers, suppliers, and research organizations increasingly recognize that complex problems are solved faster through collaboration than competition. Racing, an inherently competitive domain, has become fertile ground for that collaboration.

The Daytona 24-Hour race that kicked off the 2025 season generated approximately 2.56 billion data points across 60 vehicles running continuously for 24 hours. That data is now being analyzed, discussed, and integrated into product roadmaps at companies worldwide. Within months, insights derived from that race will begin influencing next-generation vehicle designs. Within years, technologies validated through IMSA Labs will appear on millions of road cars.

That's how competition drives innovation. Not through secrecy, but through transparent collaboration on real problems solved with real data. NASCAR, Formula 1, and international racing series are likely watching this initiative carefully, considering how similar partnerships might accelerate innovation in their own domains.

The racetrack has always been the proving ground for automotive technology. IMSA Labs simply makes that proving ground more productive, more systematic, and more valuable to everyone involved. In an era where technology companies and automotive manufacturers increasingly compete for the same engineering talent and customer attention, partnerships like IMSA Labs might become the new normal—domains where competitors collaborate to solve shared challenges, then compete on execution of solutions.

That's not just good for racing. It's good for the vehicles we all drive, the safety systems that protect us, and the sustainable technologies that will power transportation in the decades ahead.

Key Takeaways

- IMSA Labs systematically converts 2.5+ billion real-world data points from each race weekend into actionable intelligence for automotive and technology companies.

- A single 24-hour endurance race generates more extreme-condition data than conventional automotive durability testing produces in months of controlled testing.

- NASA's partnership brings six decades of telemetry and diagnostic expertise, enabling teams to extract predictive intelligence from massive racing data streams.

- Racing data directly shortens vehicle development cycles by 30-50%, particularly for simulation validation and component performance optimization.

- Knowledge flows both directions: racing proves new sustainable materials work (like Michelin's 50%+ recycled tires), while road car insights improve racing performance.

![NASA & IMSA Partner on Tech Transfer: Racing Data Transforms Automotive Simulation [2025]](https://tryrunable.com/blog/nasa-imsa-partner-on-tech-transfer-racing-data-transforms-au/image-1-1769528303733.jpg)