Ford's AI Assistant Revolution: What's Coming to Your Car in 2027

Forget everything you know about car infotainment systems. What Ford is building isn't just another touchscreen update or voice command upgrade. The Blue Oval is fundamentally reimagining how vehicles interact with their owners, and the shift happens starting next year.

At the 2026 Consumer Electronics Show, Ford announced a sweeping overhaul of its in-vehicle technology strategy. The company is deploying AI assistants that actually understand context—where you are, what you're doing, what your vehicle can do. Not generic machine learning bolted onto existing hardware. This is personalization built from the ground up, starting with your smartphone and extending directly into your car.

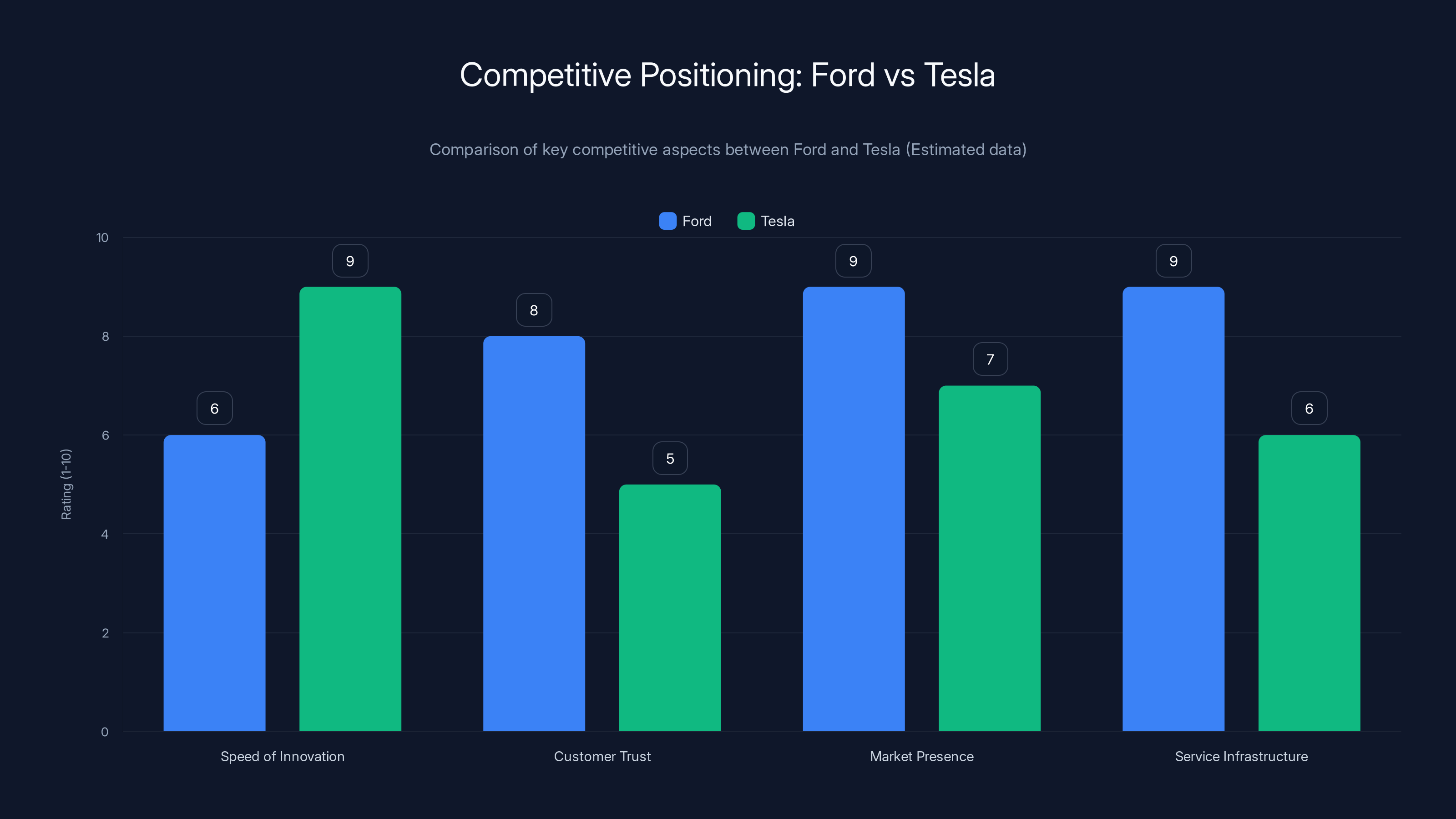

The announcement marks a critical turning point. While Tesla dominates the conversation around autonomous driving and in-car software, Ford is quietly assembling a technology stack that could reshape how traditional automakers compete in the AI era. They're not chasing full autonomy. They're solving the friction points that actually exist in daily driving.

TL; DR

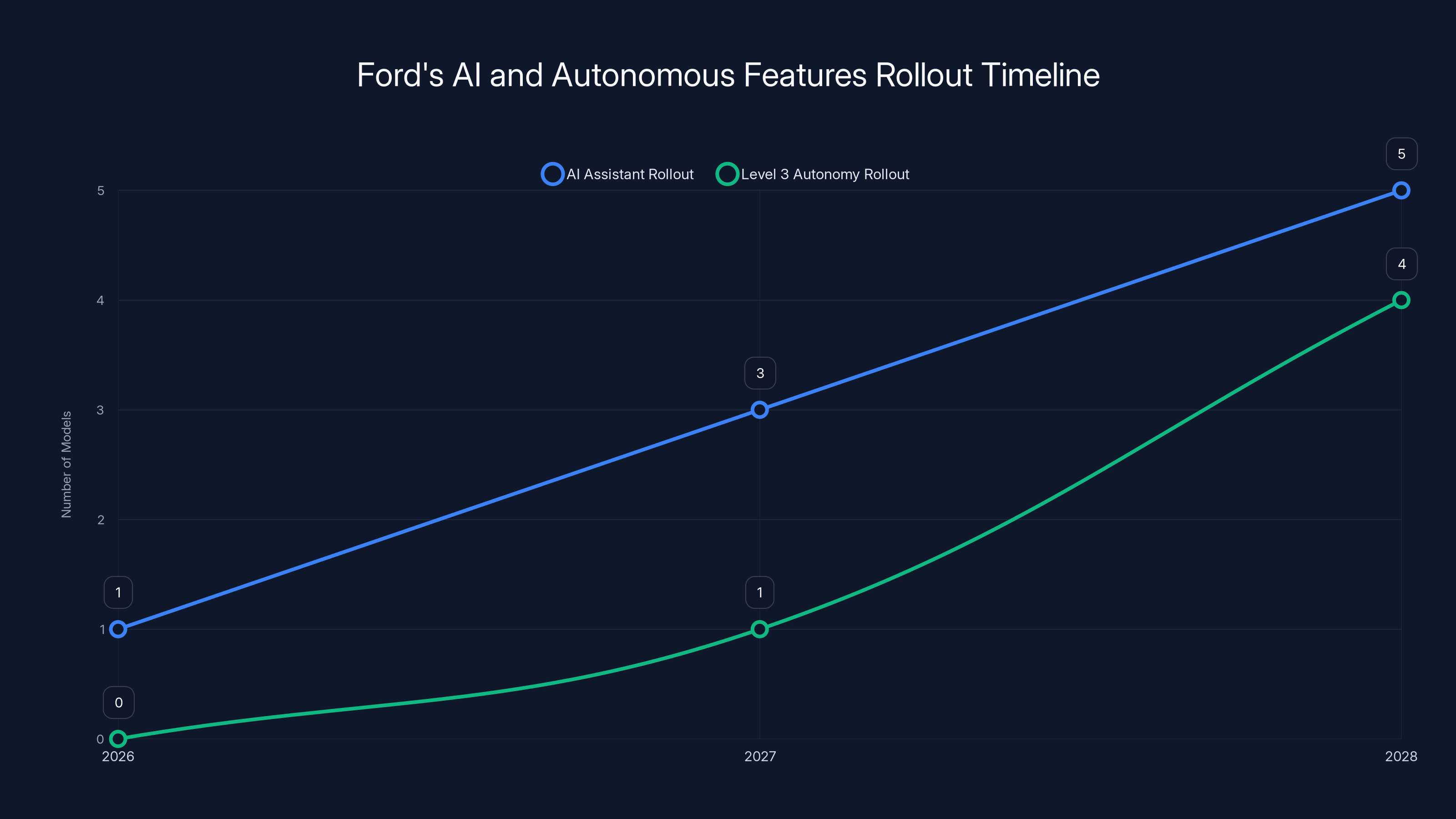

- AI assistants launch in Ford and Lincoln apps in early 2026, moving to vehicle dashboards starting in 2027

- Software-defined architecture replaces dozens of control units with fewer, more powerful computers, cutting costs while improving performance

- New Blue Cruise generation arrives in 2027 with 30% lower cost and significantly more capability

- Level 3 autonomous driving debuts in 2028, allowing drivers to relinquish situational awareness in heavy highway traffic

- Personalization happens through AI that understands context—not just commands, but intent

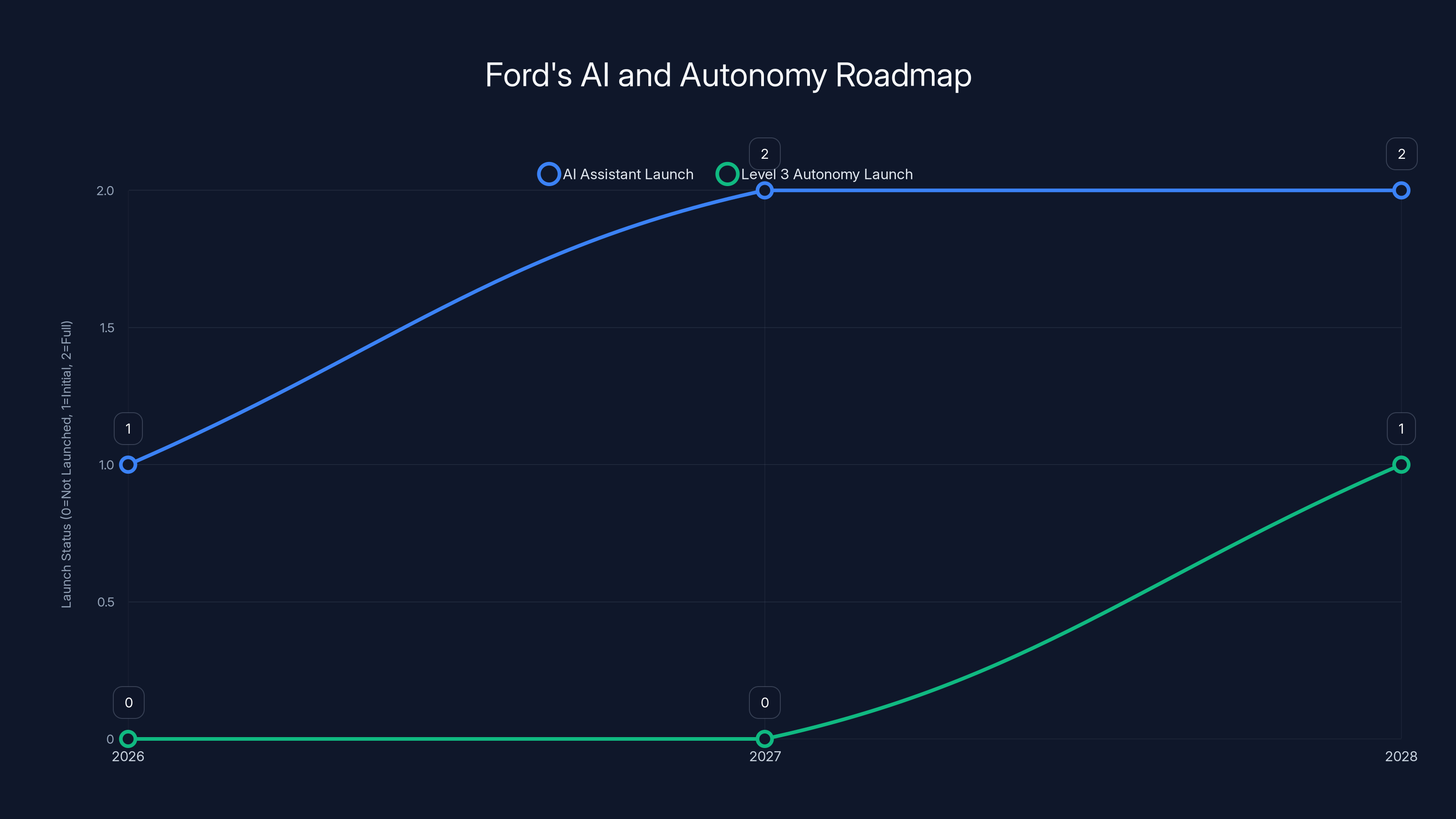

Ford's AI assistant will launch in apps by 2026 and in vehicles by 2027. Level 3 autonomy is expected by 2028, marking a significant step in vehicle automation.

The AI Assistant Ecosystem: From Your Phone to Your Dashboard

Here's what's actually happening. Ford isn't building some clunky voice assistant that recognizes thirty commands and then gives up. The AI system Doug Field, Ford's chief EV, design, and digital officer, describes is fundamentally different. It's designed to be a continuous intelligence layer that moves between your phone and your vehicle.

Think about your morning. You're planning to haul plywood to your cabin. You photograph the bundle at the hardware store. You upload that image to the Ford AI assistant. Instead of googling truck bed dimensions, the AI instantly tells you whether it fits—because it understands your truck's exact specifications, your location, and what you're trying to accomplish. That's the difference between generic intelligence and contextual intelligence.

The rollout happens in phases, which is actually smart. The smartphone app integration comes first, starting early 2026. This lets Ford gather real usage data, understand what people actually ask for, and refine the AI's training before embedding it directly into vehicles. It's a test kitchen for a global technology rollout.

The native in-vehicle experience launches with new and refreshed models starting in 2027. Ford is being strategic about which vehicles get it first. The upcoming affordable electric truck is a likely candidate—that vehicle represents Ford's bet on capturing the next generation of truck buyers. But Lincoln models will follow, along with refreshed versions of the Expedition and Navigator. Even gas-powered vehicles will get the AI assistant, because Ford understands that most of its customer base still drives combustion engines.

The intelligence layer here is crucial. Most automotive AI today is reactive. You ask it something, it responds. Ford's system is designed to be anticipatory. It learns your patterns. Maybe you drive to the same office five days a week, then head to the gym. The AI could preemptively adjust climate control, queue your music, notify you about traffic. That's the difference between a feature and an actually useful tool.

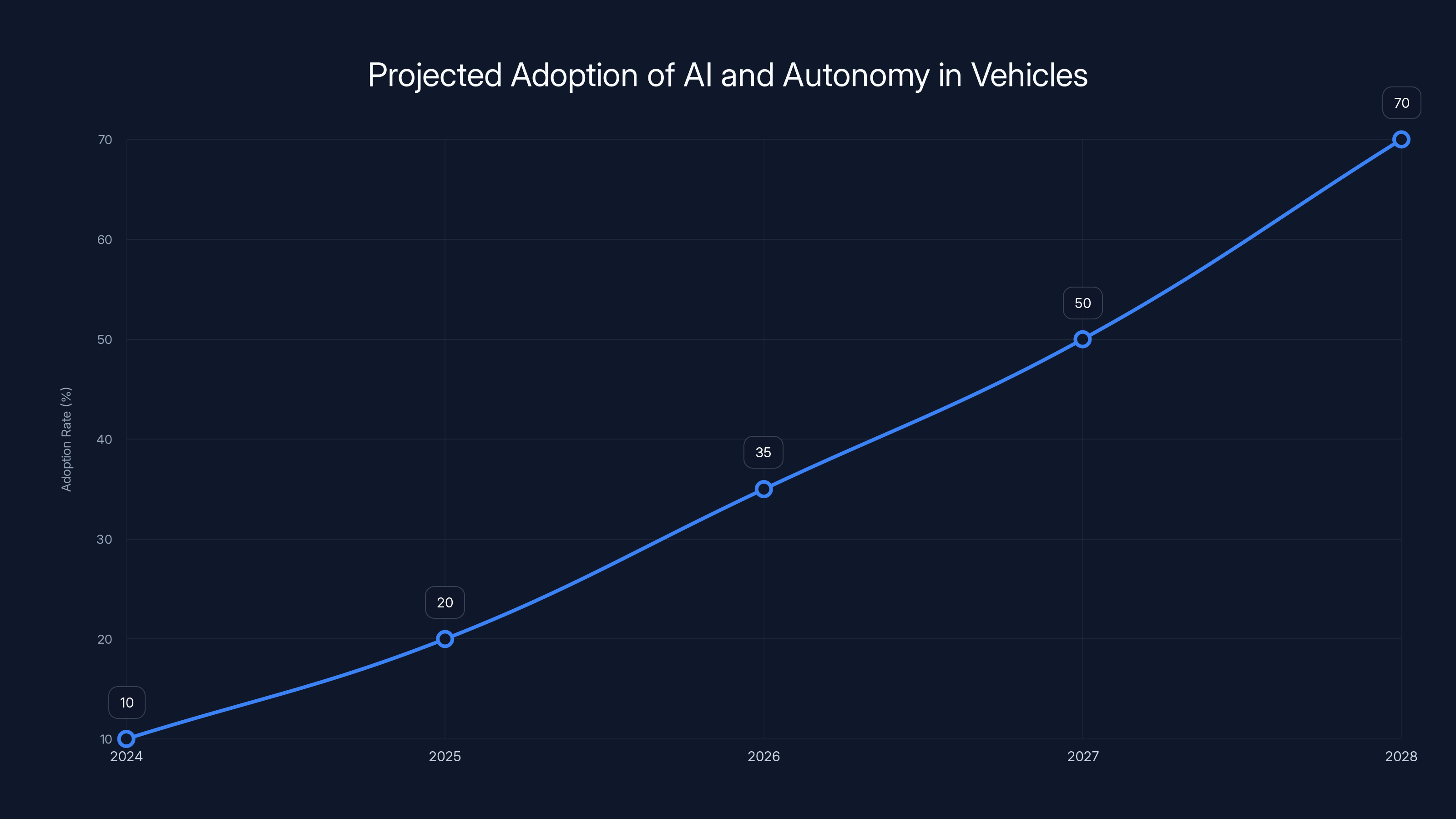

The adoption of AI and autonomy in vehicles is projected to increase significantly by 2028, driven by strategies like Ford's. Estimated data.

Software-Defined Vehicles: The Architecture Revolution

The real breakthrough isn't the AI assistant. It's what makes the AI assistant possible: a complete architectural overhaul.

Traditional cars contain dozens of electronic control units (ECUs). Your engine has one. Your transmission has another. Your infotainment system has its own. Your brakes, suspension, and lighting systems each run separate computers. They're isolated, specialized, limited. Adding new features means coordinating between systems that sometimes don't talk to each other efficiently. Updates take months or years to reach vehicles.

Ford's new approach consolidates this fragmentation. The company is introducing what it calls the "High Performance Compute Center"—a name that makes you smile because it's technically accurate and completely unnecessary. This is a powerful multitasking computer that handles infotainment, advanced driver assistance systems, audio, and networking. Instead of dozens of isolated processors arguing with each other, you have one sophisticated orchestrator managing the entire electrical ecosystem.

Paul Costa, Ford's executive director of electronics platforms, shared the technical specification: the new architecture delivers a fivefold increase in module design control. What does that actually mean? Ford can now design critical semiconductors in-house instead of relying entirely on external suppliers. That's extraordinary leverage. When your supplier controls the chips, you're dependent on their roadmap. When you design them yourself, you control the timeline, the performance, the cost.

The economics are compelling. Ford says the new computer is substantially cheaper than previous solutions while consuming half the volume and delivering significantly better performance. That's the holy trinity of hardware engineering: less costly, more compact, more capable. On a vehicle with thousands of electronics, that compounds. Cost savings add up. Weight reduction improves efficiency. Performance enables new features that weren't previously possible.

This architecture shift has cascading implications. Software updates can now deploy to the entire vehicle instead of being confined to individual systems. New features don't require hardware redesigns. When Tesla pushed a steering feel update via over-the-air firmware update, traditional car owners watched in disbelief. Software-defined vehicles make that normal. Ford's new architecture means its vehicles can improve after purchase, not just before sale.

The transition to software-defined architecture also positions Ford to compete in autonomous driving without starting from scratch. Every sensor, every camera, every lidar unit now feeds into a unified processing environment. New driver assistance systems can leverage the full computational power of the platform instead of competing with it.

The Blue Cruise Evolution: More Capability, Lower Cost

Blue Cruise is Ford's partially automated driving system. It's not Tesla Autopilot. It's not full autonomy. But it works. On highways, it handles acceleration, braking, and steering while the driver maintains situational awareness. It's genuinely useful for long drives, though the name suggests a level of sophistication that doesn't quite exist yet.

The next generation launches in 2027, and Ford is making the right engineering choices. They're not adding complexity for complexity's sake. They're reducing cost by 30 percent while simultaneously expanding capability. That's possible when you fundamentally redesign the underlying architecture instead of bolting features onto legacy systems.

What makes Blue Cruise v 2 more capable? Better perception. The new computer architecture processes camera and sensor data more efficiently, making fewer false positives about road hazards. Smoother control. With more computational headroom, the system doesn't have to compromise between response time and safety. Better handoff to driver. When the system reaches its limits, it can initiate a gentler, more controlled transition back to manual control instead of abruptly disengaging.

The 30 percent cost reduction matters enormously. Advanced driver assistance systems currently price out of the mainstream market. You see them on luxury vehicles and high-trim packages. When Ford cuts costs by a third, those systems cascade down to more affordable models. That means safer cars across the entire product line, not just vehicles purchased by wealthy buyers.

This is where Ford's strategy differs from Tesla's. Tesla optimizes for capability per dollar in expensive vehicles. Ford is optimizing for safety per customer across the entire lineup. Given that Ford sells millions of vehicles worldwide, that difference matters at scale.

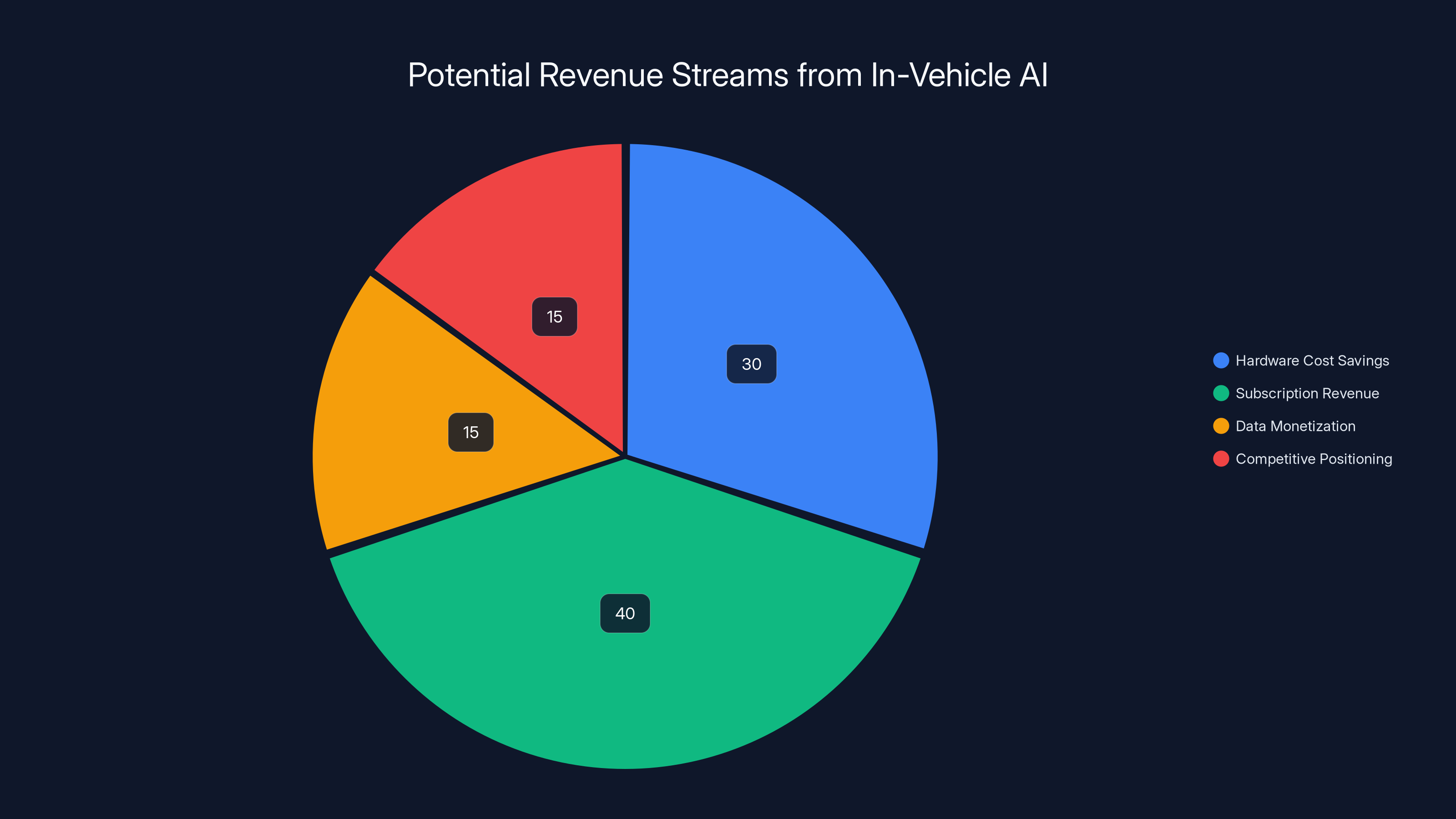

Estimated data suggests subscription revenue could be the largest contributor to Ford's AI strategy, followed by hardware cost savings. Data monetization and competitive positioning also play significant roles.

Level 3 Autonomy: The 2028 Milestone

In 2028, Ford plans to introduce Level 3 autonomous driving capability. Before you get excited, understand what Level 3 actually means and what it doesn't.

Level 3 is conditional automation. In specific circumstances—heavy highway traffic, clear road markings, decent weather—the driver can legally relinquish situational awareness. You don't need to watch the road. You don't need to keep your hands ready. You can read, work, or sleep. The vehicle handles driving completely.

The catch: the vehicle must be able to request control back within a safe transition time. If you're sleeping, the system wakes you. If you're distracted, it gets your attention. If conditions change and the system can't handle them, it takes you back to manual control in a controlled fashion.

Level 3 is not Level 5. It's not a robotaxi that drives itself everywhere in any conditions. It's not even close to that. Level 3 is specifically designed for the scenario that happens every day on American highways: you're stuck in stop-and-go traffic, and it's boring, and the car is perfectly capable of handling it without you.

Why does Ford target 2028 instead of deploying Level 3 sooner? Regulatory approval takes time. Insurance companies need to understand liability. Drivers need to build trust. Ford learned from watching Tesla's Full Self-Driving beta rollout—aggressive timelines breed backlash. Cautious rollout builds mainstream acceptance.

The processing power now available in the High Performance Compute Center makes Level 3 feasible. The previous architecture couldn't handle real-time sensor fusion at Level 3 performance standards. The new platform can. This is why the architectural shift matters more than the feature announcements. Features follow capability. Ford's new hardware enables capabilities that weren't computationally possible before.

When Level 3 launches, it will be limited to specific conditions. Probably limited to particular highway corridors with validated mapping. Probably limited to certain weather conditions and times of day. But it will be real, functional, and—crucially—it will let Ford gather massive amounts of real-world data about how drivers interact with Level 3 systems. That data will directly inform Level 4 development.

The Economics of In-Vehicle AI

Why is Ford betting so heavily on AI and autonomous capabilities? The economics are straightforward.

First, manufacturing margins are under pressure. Every incumbent automaker is fighting Tesla's cost structure. Adding features through software is vastly cheaper than adding features through hardware. A Tesla Autopilot-equivalent feature might cost Tesla

Second, subscription revenue. Ford's not saying this explicitly, but the infrastructure they're building enables recurring revenue streams. Premium driver assistance features. Enhanced mapping. Over-the-air software updates. Augmented reality navigation. Each of these could become a subscription service generating annual recurring revenue per vehicle. For a mature automaker, that's a fundamental business model shift.

Third, data value. Every trip your car takes generates valuable data about traffic patterns, road conditions, driving behavior, infrastructure status. Aggregated anonymously, that's valuable to insurers, city planners, and infrastructure companies. Ford doesn't need to monetize this aggressively. But having the infrastructure to capture it safely and securely means future opportunities.

Fourth, competitive positioning. Tesla has dominated the narrative around automotive AI. But narratives matter less than actual functionality. When Ford ships Level 3 autonomy that works reliably in real-world conditions, it resets perceptions. The company that ships first doesn't always win. The company that ships robust solutions does.

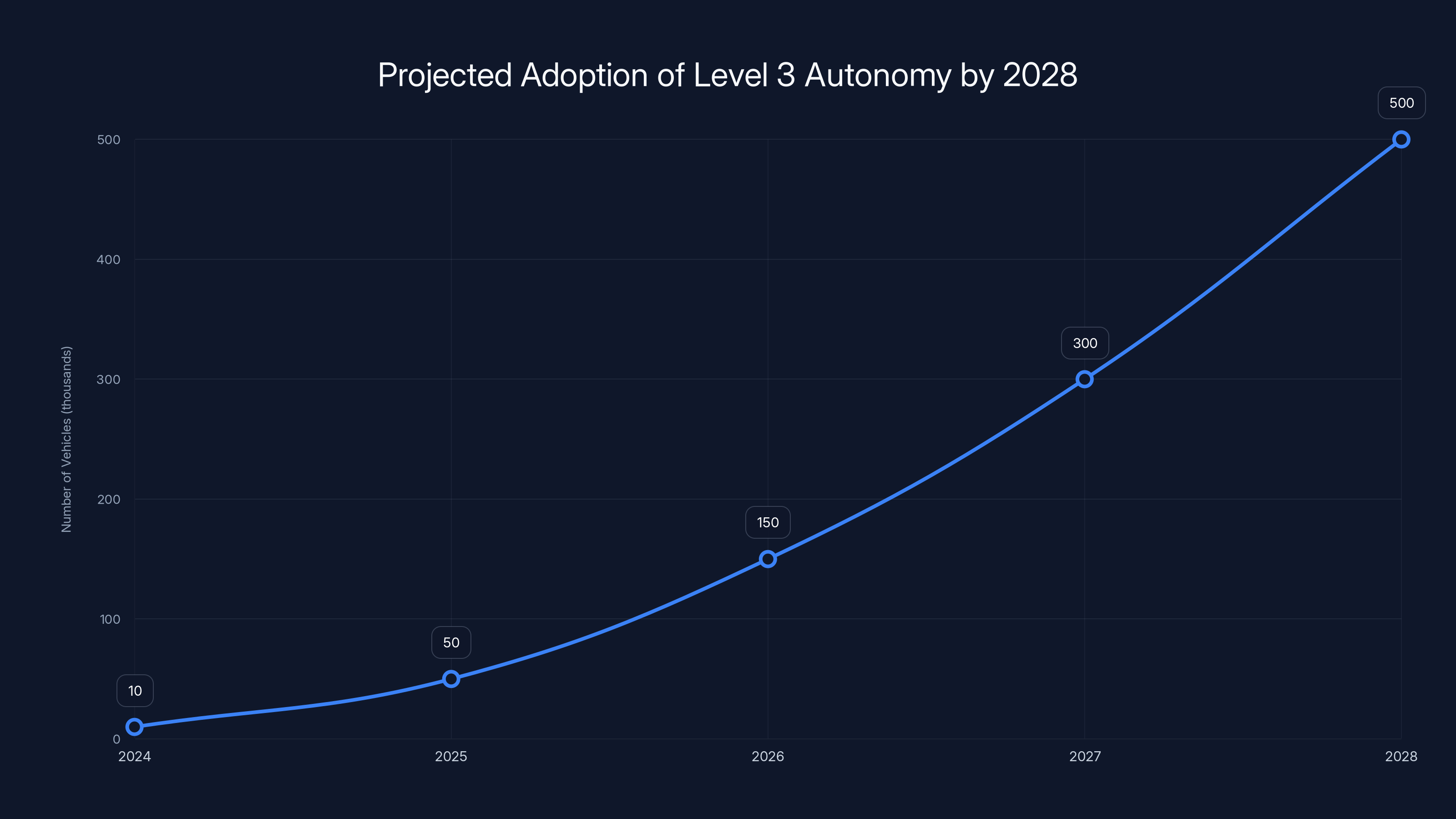

Estimated data shows a gradual increase in Level 3 autonomous vehicles, reaching 500,000 by 2028 as regulatory and technological advancements align.

Integration With Existing Ford Ecosystems

Ford's approach is interesting because it doesn't exist in isolation. The company has spent years building smartphone integration through Ford+, its connected vehicle platform. The new AI assistant layer integrates directly with that infrastructure.

Your Ford+ mobile app becomes the control interface for vehicle settings, climate, location history, and maintenance scheduling. The AI layer on top of that understands context. Maybe you're flying to Denver for a conference. The app recognizes your itinerary from your calendar. It automatically adjusts vehicle settings for high altitude. It suggests charging stops for your electric vehicle if you're renting one. It reminds you about Denver's parking regulations.

This kind of integration doesn't happen by accident. It requires engineers from multiple disciplines coordinating around a unified data model. Ford's centralizing that through the High Performance Compute Center, which acts as the single source of truth for vehicle state.

Lincoln, Ford's luxury brand, gets special treatment in the AI rollout. Lincoln owners tend to be older, wealthier, and less tech-savvy than average. The AI assistant for Lincoln will emphasize natural language conversation and contextual suggestions. Instead of requiring precise commands, Lincoln users can talk to their vehicles conversationally. "I'm tired" might trigger a transition to Level 3 on the highway, lower cabin lighting, and queue relaxing music. That's not just convenient; it's genuinely useful for drivers navigating long journeys.

Safety Implications and Regulatory Framework

Adding autonomy to vehicles raises safety questions that regulators and the public take seriously. Ford's approach here is conservative in the right ways.

The progression from Blue Cruise v 2 to Level 3 to eventual Level 4 is carefully structured to generate safety data at each stage. You don't jump to Level 4 without understanding how Level 3 performs across millions of miles. You don't deploy Level 3 without validating that handoff scenarios work predictably. Ford is building this staircase deliberately.

The AI assistant itself has safety implications beyond autonomous driving. Voice-controlled systems in vehicles have caused accidents when drivers became overly distracted trying to get the system to understand them. Ford's approach, with context awareness and predictive behavior, should reduce that risk. If the AI anticipates your needs, you don't need to interact with it as much.

Cyber security is non-trivial. A software-defined vehicle is substantially more vulnerable to hacking than a vehicle with isolated ECUs. Ford's architecture includes security layers designed to prevent unauthorized access to critical systems. The company is collaborating with cybersecurity firms and following industry standards for automotive security. But the risk is real and ongoing.

Data privacy is equally important. Your vehicle will know everywhere you drive, how fast you drive, when you brake hard, where you idle. That data is valuable and sensitive. Ford is legally required to protect it, but requirements change slowly while hacking evolves quickly. The company needs to be proactive about privacy, not just compliant with existing regulations.

Tesla excels in speed of innovation, while Ford leads in customer trust and service infrastructure. Estimated data reflects perceived strengths.

Competitive Positioning Against Tesla

Tesla's advantage has been speed and integration. Tesla designs hardware and software together from the start. Traditional automakers design vehicles five years in advance, then bolt software onto the results. Tesla's approach is demonstrably superior for in-vehicle software experiences.

Ford's new architecture partially equalizes that disadvantage. Software-defined vehicles let Ford iterate faster than legacy architecture permits. But Ford still has a fundamental disadvantage: it sells to traditional dealers with traditional economics. Tesla sells directly, controls the customer experience end-to-end, and owns the software pipeline completely.

Where Ford might win is in trust and acceptance. Many people distrust Tesla. Elon Musk's polarizing public presence creates hesitation among some buyers. Ford, by contrast, is a legacy brand that's been navigating regulatory and consumer expectations for over a century. When Ford says a system is safe, some people believe it more readily than Tesla's claims. That's not technology advantage; that's brand trust. But in automotive, brand trust drives purchasing decisions as much as features do.

Ford also has a geographic advantage. The company has presence in markets where Tesla struggles. Strong dealer networks in rural America, solid relationships with fleet operators, established service infrastructure globally. As autonomous and AI features become mainstream, support and service matter more. Tesla can't service vehicles with the same density as Ford in many regions.

The real competition isn't Ford versus Tesla. It's traditional automotive software stacks versus Tesla's approach. If Ford's new architecture proves its capabilities in market, it validates the model that other legacy automakers (Volkswagen, General Motors, Stellantis) are pursuing. If it fails, it shows that Tesla's integrated approach is required for modern automotive software.

The Role of Semiconductors and Supply Chain

The "fivefold increase in module design control" that Paul Costa mentioned sounds abstract. It's actually a massive deal for Ford's supply chain.

Automotive semiconductors are custom-designed for specific vehicles. Traditionally, automakers work with suppliers like Qualcomm, NVidia, or NVIDIA to design chips for their vehicles. The automaker specifies requirements, the supplier designs the chip, the supplier manufactures or contracts manufacturing, and the automaker integrates it. That process takes years.

Ford's new approach means more design happens in-house. The company contracts manufacturing at foundries like TSMC but owns the intellectual property and the design decisions. That's crucial for several reasons.

First, it reduces dependency on any single supplier. If NVIDIA's production is constrained, Tesla suffers. If Qualcomm can't meet your specifications, you wait. When Ford designs its own chips, it has flexibility. It can source production from multiple foundries. It can adjust specifications if a supplier can't deliver.

Second, it enables custom optimization. A chip designed specifically for Ford's architecture will be more efficient than a general-purpose automotive computing platform. Better efficiency means less power consumption, less heat generation, smaller cooling systems. On an electric vehicle, that translates directly to range.

Third, it accelerates innovation. When you own the design, you control the timeline. Want to add neural accelerators for machine learning? Add them. Want to improve real-time responsiveness for autonomous driving algorithms? Change the architecture. General-purpose chips force compromise. Custom designs force alignment with your actual needs.

The downside is complexity. Ford needs strong semiconductor engineering talent. The company is clearly investing in that—the announcement wouldn't happen if the capability didn't exist internally. It's a bet that vertical integration in semiconductors will pay off. For a company of Ford's scale, making that bet makes sense.

Ford plans a phased rollout of AI and Level 3 autonomy, starting with phones in 2026 and expanding to vehicles by 2028. Estimated data.

Launch Timeline and Model Coverage

Ford's rollout schedule is actually conservative. The AI assistant reaches phones first—early 2026. That gives the company months to refine and stabilize before vehicles ship.

The affordable electric truck gets the native in-vehicle AI first in 2027. That's strategically smart. Truck buyers are relatively tech-forward compared to sedan buyers. The truck market is Ford's stronghold. Early adopters in a product category where Ford dominates creates goodwill and generates useful data.

Lincoln models follow. Lincoln targets affluent buyers who expect premium technology. Positioning Level 3 and advanced AI as a luxury feature makes sense. Charge a premium for it. That premium finances further development. Meanwhile, traditional Ford models get the technology cascade down as it matures.

Gas-powered models get the treatment alongside electric vehicles. The Expedition and Navigator both get the AI assistant and potentially Level 3 capability. Full-size trucks and SUVs make sense for autonomous features—they're highway vehicles purchased by people who value convenience.

The timeline gives competitors two to three years to prepare. That's meaningful. General Motors is rolling out its software-defined vehicle architecture. Volkswagen is pursuing similar goals. Stellantis is investing in autonomous technologies. None of them are months away. Ford having real Level 3 capability on the road in 2028 puts market pressure on them to accelerate their own programs.

Customer Experience Implications

Ford's vision focuses on the driver's actual experience, which is refreshing. Most automotive technology marketing focuses on impressive capability that drivers rarely need. Ford is targeting friction points that drivers encounter daily.

Let's think through a real scenario. You're driving to the airport for a business trip. Your luggage is oversized and you're wondering if it fits your truck. Instead of guessing or making an extra trip home, you photograph it at the curb, send the image to the Ford AI, and get an answer in seconds. That's solving a real problem.

Or you're driving in heavy highway traffic. You're tired, your shoulders hurt, you'd like to close your eyes for twenty minutes. Blue Cruise v 2 handles the driving, but you're still responsible. Level 3 launches and suddenly the drive is genuinely restful. That's transforming an unpleasant experience into a tolerable one.

Or you're moving to a new city and you don't know the parking regulations. Your AI assistant handles that. You don't need to research or remember. Just tell the car you've arrived, and it understands the local rules.

These aren't flashy features. They don't make headlines. But they're the features that actually improve daily life. That's where Ford might have an advantage over companies chasing headline-generating technology.

The personalization layer matters too. After a few months, your AI assistant knows your preferences. It learns that you like the cabin heated to 71 degrees. It learns that you hate harsh lighting. It learns that you prefer podcast audiobooks to music during commutes. The system doesn't need you to configure these manually. It observes and adapts.

That's the difference between a feature and a product. A feature is something the car can do. A product is something the car does for you automatically, correctly, without intervention.

Future Development Roadmap

Ford hasn't detailed the roadmap beyond 2028, but we can infer where the company is heading based on the architecture foundation they're building.

Level 4 autonomy in specific geographic regions is probably a 2029-2030 target. Geofenced autonomous robotaxi service in partnership with fleet operators is potentially closer. Ford could announce a robotaxi service using Level 4-capable vehicles before those vehicles are available for consumer purchase.

Vehicle-to-vehicle communication is enabled by the new architecture. Vehicles can share information about road conditions, traffic, hazards. That's Level 4-adjacent technology but simpler to deploy. Ford might launch V2V in a limited way before Level 4 is broadly available.

Augmented reality navigation is probably coming. The processing power now available makes rendering AR navigation overlays feasible. Imagine real-world directions appearing on your windshield, not just on a display. That's enabled by the new computer architecture.

Personalized infotainment will get increasingly sophisticated. Your vehicle knowing your preferences isn't futuristic. Your vehicle predicting what you want to listen to, read, or watch without being asked is standard. That's maybe two years away.

Integration with smart home systems is plausible. Your car arrives home and automatically opens the garage, starts climate control in the house, and queues music for the evening. That's not complex technology—it's straightforward Io T integration that the architecture supports.

Industry-Wide Implications

Ford's announcement matters beyond Ford customers. It signals that software-defined vehicles are moving from theory to reality. When a company of Ford's scale and conservatism commits to a technology shift, the industry responds.

Vehicle architectures developed today will ship until 2035 or later. If Ford's new architecture proves superior—cheaper, more capable, more updateable—competitors will be forced to redesign their own platforms. That's a multi-billion-dollar decision. It cascades through engineering organizations, supply chains, dealer networks.

For suppliers, this is a transition point. Companies that have sold isolated automotive control units are competing with integrated computer platforms. Companies that provide general-purpose automotive computing are competing with custom designs. The supplier landscape for automotive electronics is about to consolidate and transform.

For consumers, the implication is significant. Within a few years, vehicles will be meaningfully more capable and safer through software than they are today. Cost curves will improve. Features that are expensive and rare in 2025 will be standard in 2030. The vehicle you buy in 2027 will be substantively different from the vehicle you buy in 2032.

For regulations, this forces standards development. If vehicles can update themselves wirelessly, cybersecurity regulations become critical. If vehicles can drive themselves in certain conditions, liability frameworks need adjustment. Ford's timeline puts pressure on regulators to establish rules before the technology is already widespread.

Challenges and Realistic Constraints

Ford's announcing ambitious plans. That's marketing and reality simultaneously. The company genuinely intends to hit these timelines. But things go wrong in automotive technology development. Let's be realistic about what could delay or change these plans.

Software complexity is the biggest risk. Coordinating dozens of teams across multiple systems is hard. The new architecture centralizes computation but also centralizes risk. If the core system has a critical bug, it affects infotainment, driving assistance, and safety simultaneously. Testing burden increases exponentially.

Regulatory approval for Level 3 could be slower than anticipated. Different countries have different standards. A system validated in the US might require different testing for European approval. Level 3 rules are still being written in many jurisdictions. Ford could ship Level 3 capable vehicles that can't legally use Level 3 in some markets.

Semiconductor supply could constrain rollout. Designing custom chips is great. Manufacturing them at scale is different. If TSMC or Samsung have capacity constraints, Level 3 deployment might get delayed. Custom chips can't pull from multiple sources easily if the design is proprietary.

Integration complexity increases with each system connected to the central computer. The safety implications are non-trivial. A bug in one subsystem could potentially affect another. Ford's testing processes will be scrutinized heavily, especially after any incident.

Driver acceptance of Level 3 could be slower than expected. Handing control to the vehicle in highway traffic is conceptually simple. Actually trusting it with your life is different. Ford's rollout will need to manage anxiety carefully. One viral video of Level 3 failing could set adoption back years.

Cost reduction timelines could slip. Ford claims 30 percent cost reduction for Blue Cruise v 2. In automotive, new technology usually costs more initially, not less. Manufacturing processes need optimization, supply chains need stabilization. If costs don't drop as planned, Level 3 features could become premium-only, limiting adoption.

None of these are show-stoppers. But they're real constraints. Ford's timeline is ambitious. It's achievable, but it requires execution excellence across multiple complex domains. That's rare but possible.

FAQ

What is Ford's new AI assistant for vehicles?

Ford's AI assistant is a context-aware intelligent system that understands where you are, what you're doing, and what your vehicle can do. Unlike generic voice assistants, it learns your preferences and provides intelligent suggestions without requiring explicit commands. The system will initially launch in Ford and Lincoln smartphone apps in early 2026, then migrate to vehicle dashboards starting in 2027. It can handle complex tasks like determining whether cargo fits in your truck by analyzing photos, or automatically adjusting climate control based on your calendar and location.

How does the software-defined vehicle architecture improve performance?

Traditional vehicles contain dozens of isolated electronic control units (ECUs), each running independently. Ford's new "High Performance Compute Center" consolidates this into a unified, powerful computing platform that handles infotainment, driver assistance systems, audio, and networking. This centralized architecture provides better real-time processing, faster communication between systems, and simpler software updates. The system costs substantially less than previous solutions while consuming half the physical space and delivering significantly superior performance. The architecture also enables fivefold increased control over critical semiconductors through Ford's in-house chip design.

What is Level 3 autonomy and when will Ford offer it?

Level 3 autonomy, arriving in 2028, allows drivers to legally relinquish complete situational awareness in specific conditions, typically heavy highway traffic. Unlike Level 2 systems like Blue Cruise that require constant driver monitoring, Level 3 permits you to read, work, or sleep while the vehicle handles driving. The vehicle maintains the ability to request control back within a safe transition time if conditions change beyond its capabilities. Level 3 will initially operate under specific constraints—particular highway corridors, validated weather conditions, and times of day—but represents a significant step toward fuller autonomous capability.

How much will Ford's new AI assistant and autonomous features cost?

Ford hasn't revealed specific pricing for the AI assistant or Level 3 capabilities. However, the company claims Blue Cruise v 2, launching in 2027, will cost 30 percent less than current Blue Cruise systems while delivering significantly more capability. Given Ford's goal to make advanced safety features broadly accessible rather than premium-only, expect these technologies to cascade down to more affordable Ford models over time rather than remaining exclusive to luxury vehicles. Subscription components for enhanced features are likely but not yet confirmed.

When will the AI assistant be available to purchase?

The AI assistant launches in Ford+ smartphone apps in early 2026 for existing and new Ford and Lincoln owners. Native integration into vehicle dashboards begins in 2027, starting with new and refreshed models. The affordable electric truck that Ford announced is a likely early candidate for the in-vehicle AI. Gas-powered models like the Expedition and Navigator will receive the technology as they go through refresh cycles. This phased rollout approach allows Ford to refine the system and gather real-world usage data before wider deployment.

What vehicles will receive the new software-defined architecture?

All new Ford and Lincoln vehicles launching from 2027 forward will be designed around the new software-defined architecture. This includes the upcoming affordable electric truck, refreshed versions of the Expedition and Navigator, and new Lincoln models. The company is taking a measured approach, integrating the technology as new platform generations launch rather than retrofitting existing models. This ensures the architecture's benefits are realized through optimized vehicle design rather than adaptation of legacy platforms.

How does Ford's approach compare to Tesla's autonomous driving technology?

Ford's strategy differs fundamentally from Tesla's. Tesla optimizes for autonomous capability in expensive vehicles, integrating software and hardware design from inception. Ford is building a foundational architecture that enables rapid software iteration while prioritizing accessibility across its product line. Tesla owns the entire customer experience through direct sales; Ford works through dealerships, which involves different support ecosystems. Both approaches have advantages—Tesla achieves faster innovation cycles, while Ford leverages broader service infrastructure and established brand trust. Ford's conservative rollout minimizes risk of public incidents that could damage trust, while Tesla's aggressive approach generates faster market learning.

Is my personal driving data safe with Ford's AI systems?

Ford has committed to protecting driver privacy and vehicle data, though specific mechanisms haven't been detailed publicly. Your vehicle will track location history, driving patterns, braking behavior, and other telemetry. The company must comply with emerging automotive data privacy regulations and security standards. As with any connected vehicle, understanding Ford's privacy policy and data handling practices before purchase is wise. The architecture supports encrypted data transmission and local processing, which can enhance privacy relative to systems that transmit all data to cloud servers.

Will Level 3 autonomy work everywhere or only certain roads?

Ford's Level 3 deployment will initially be geofenced and conditional. It will function on specific highway corridors with validated mapping and optimal conditions. It will likely have restrictions based on weather—clear conditions first, rain and snow later. Time-of-day restrictions are possible. This phased, limited deployment gathers data about real-world performance and builds public confidence before broader availability. Expect Level 3 capability to expand geographically and conditionally as the company gains confidence in the system's reliability.

What happens if Ford's Level 3 system fails or hands control back to the driver?

Ford's Level 3 system is designed to manage handoffs carefully. If road conditions change beyond the system's capability, it initiates a controlled request for driver attention. You'll have several seconds of warning, sufficient for a safe transition from autonomous to manual control. The system won't suddenly disengage like some earlier driver assistance systems. Safety validation for these handoff scenarios is extensive before public deployment. If you're asleep during a handoff request, the vehicle has mechanisms (sound, light, steering) to wake you appropriately. If you don't respond, the vehicle can safely maneuver to a stop.

What Ford's AI Strategy Means for the Broader Automotive Landscape

Ford's announcements at CES 2026 mark a critical inflection point for traditional automotive companies competing against Tesla. The company is betting billions on a specific architectural approach: software-defined vehicles with centralized computing, custom semiconductors, and AI-native design.

If this strategy succeeds—if Level 3 autonomy works reliably in 2028, if costs drop as promised, if customers embrace in-vehicle AI—then Ford has a roadmap that other legacy automakers can adapt. The company is demonstrating that you don't need to start from scratch like Tesla did. You can evolve from traditional architecture to software-first vehicles through deliberate architectural redesign. That's genuinely valuable for an industry where hundreds of billions in assets exist in older designs.

If the strategy stumbles—if software development delays extend timelines, if regulatory approval doesn't materialize, if customer adoption lags—then Ford's competitors might conclude that legacy architecture is incompatible with modern automotive software expectations. That would force more radical redesigns across the industry.

For vehicle buyers, the timing is interesting. The 2027-2028 window is likely the last generation before in-vehicle AI and autonomy become normalized features rather than cutting-edge technology. Buying a vehicle in that window means understanding that tomorrow's vehicles will be significantly more capable. That affects resale value, feature expectations, and how you evaluate what matters in a car.

The real test begins in 2027 when vehicles with the new architecture start shipping. Not press releases. Not prototypes. Actual vehicles in customers' hands, accumulating real-world data. That's when we'll learn whether Ford's architectural vision is a genuine competitive advantage or an interesting technical exercise.

Until then, the company's announcements are credible but unproven. Ford has a history of shipping on ambitious timelines in some domains and missing them in others. The company's being transparent about constraints and realistic about the multi-year deployment. That's encouraging. But software development has a way of humbling even well-resourced teams with clear vision.

What's clear is that 2027 marks the year when traditional automotive software assumptions fully break down. Vehicles will have more processing power than many computers. They'll update themselves wirelessly. They'll learn from driving patterns and optimize their own behavior. They'll understand context and anticipate needs. That's a fundamental shift from the vehicles that dominated the market for the previous century.

Ford's committing substantial resources to that shift. The company isn't guessing. This is a calculated bet that the future of automotive is software-first, AI-enabled, and personally relevant to each driver. Whether that bet pays off will reshape the automotive industry for the next decade.

Key Takeaways

- Ford launches AI assistant in smartphone apps early 2026, integrating into vehicles by 2027 with contextual personalization features

- Software-defined architecture consolidates dozens of isolated control units into unified computing platform at 30% cost reduction

- BlueCruise v2 (2027) improves capability significantly while cutting costs 30%; Level 3 autonomy arrives in 2028 for conditional automation

- Ford designs custom semiconductors in-house, gaining control over critical components and enabling faster innovation cycles

- Conservative, phased rollout generates real-world data and builds trust before broad Level 3 deployment, differentiating from Tesla's aggressive approach

Related Articles

- CES 2026: Why EVs Lost to Robotaxis & AI – Industry Shift Explained

- Sony Honda's Afeela 1 EV: Why It Feels Outdated at CES 2026 [Review]

- Sony Honda Afeela CES 2026 Press Conference: Complete Watch Guide [2025]

- Kodiak and Bosch Partner to Scale Autonomous Truck Technology [2025]

- Sony Honda Afeela CES 2026: How to Watch & What to Expect [2025]

- How to Watch Hyundai's CES 2026 Presentation Live [2025]

![Ford's AI Assistant Revolution: What's Coming to Your Car in 2027 [2025]](https://tryrunable.com/blog/ford-s-ai-assistant-revolution-what-s-coming-to-your-car-in-/image-1-1767832608672.jpg)