Spotify Price Hike 2025: What You Need to Know [Analysis]

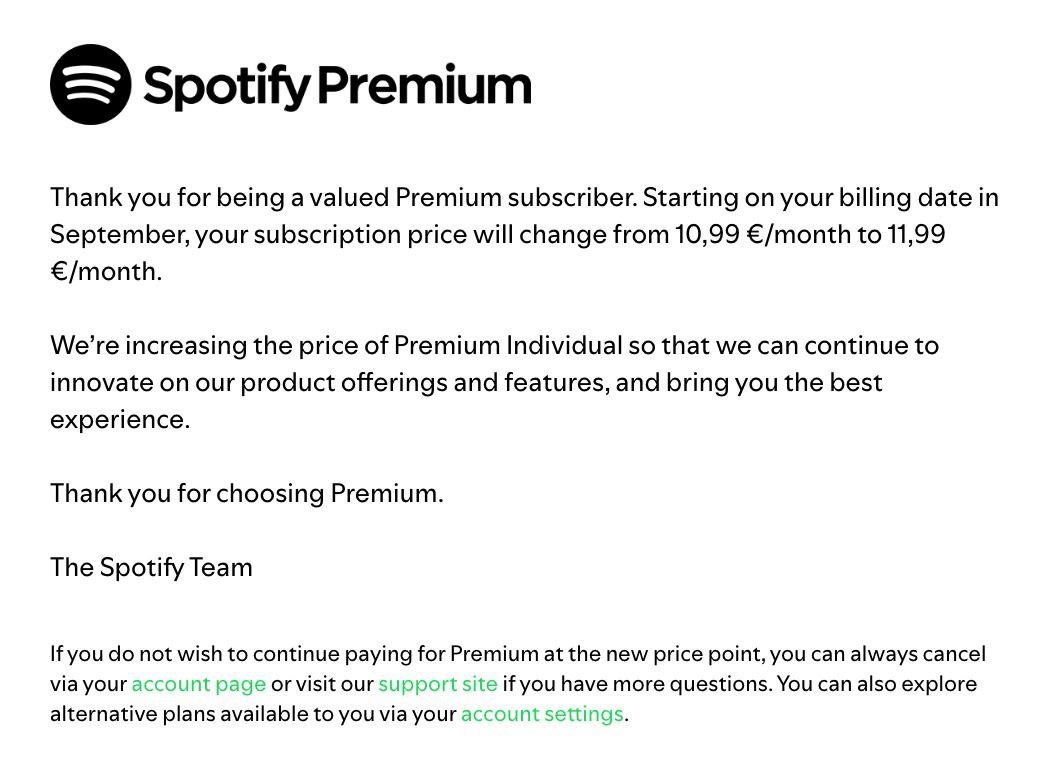

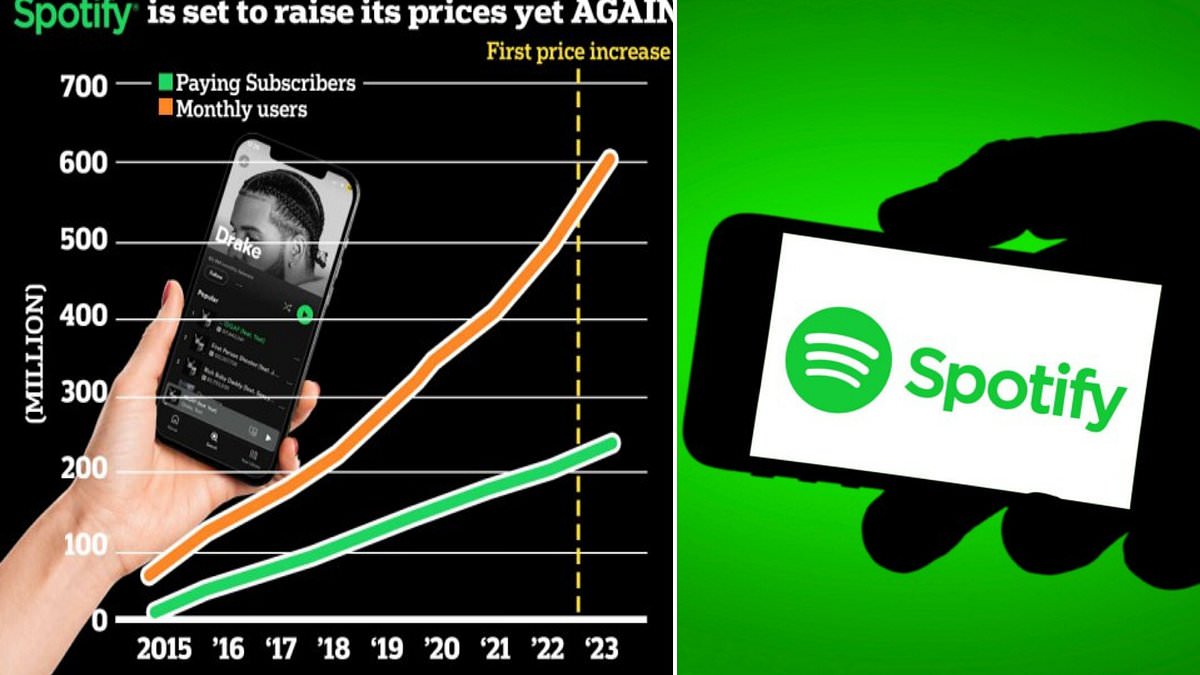

Spotify just dropped another price increase, and it's the third one in less than two and a half years. If you're paying for Premium, your bill just got more expensive—and honestly, you're probably not thrilled about it.

Here's what's happening, why the company thinks it's justified, and what it means for the streaming music landscape going forward.

TL; DR

- Premium subscriptions jump from 13/month as of February 2025

- Student plans increase from 7, Duo from19, Family from22

- This is the third price hike since July 2023, with another in July 2024

- Spotify claims improvements justify the cost: lossless audio, music videos, new messaging features

- Artist payments remain controversial despite Spotify's $10 billion royalty claim in 2024

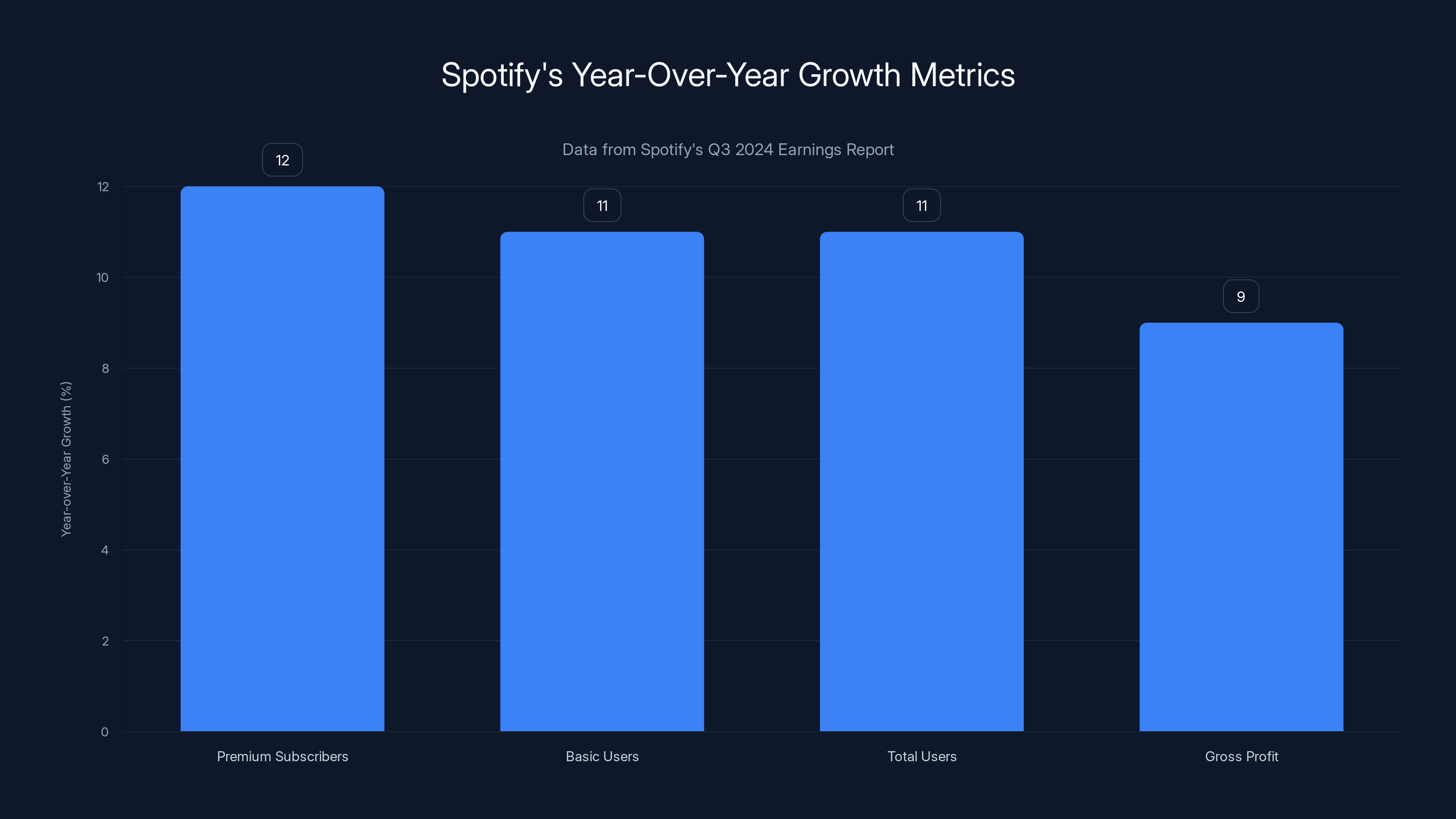

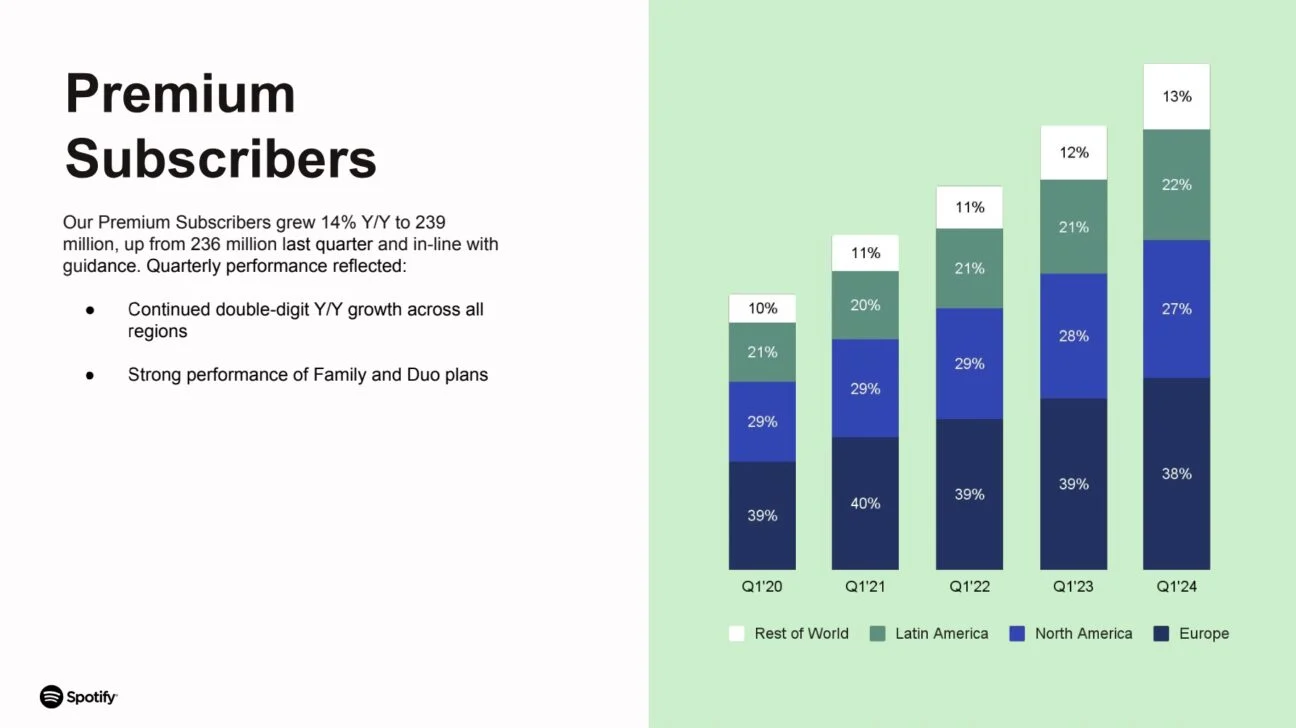

- User growth suggests the strategy is working: 12% Yo Y growth in Premium subscribers as of Q3 2024

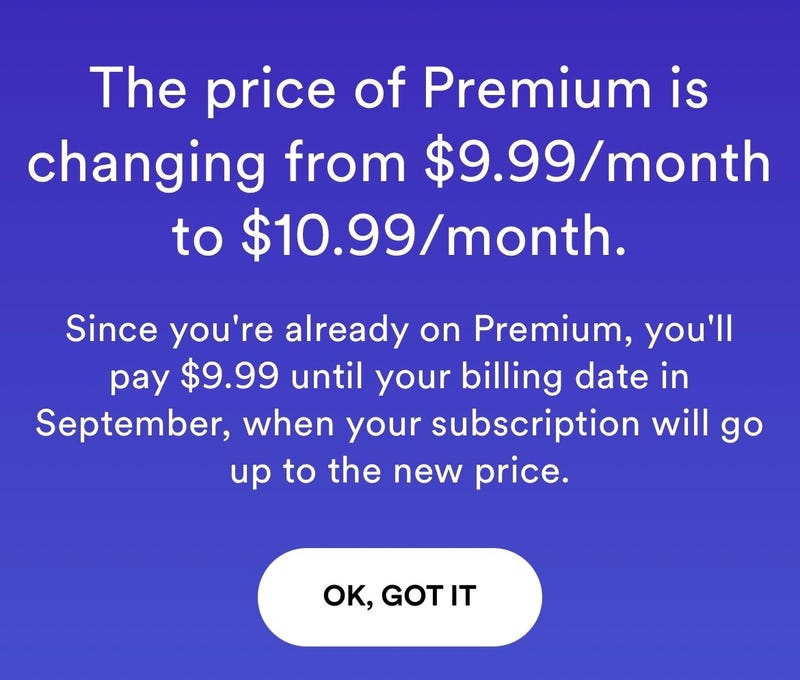

Spotify's Premium price increased from

Why Spotify Keeps Raising Prices (And Why They Think They Can)

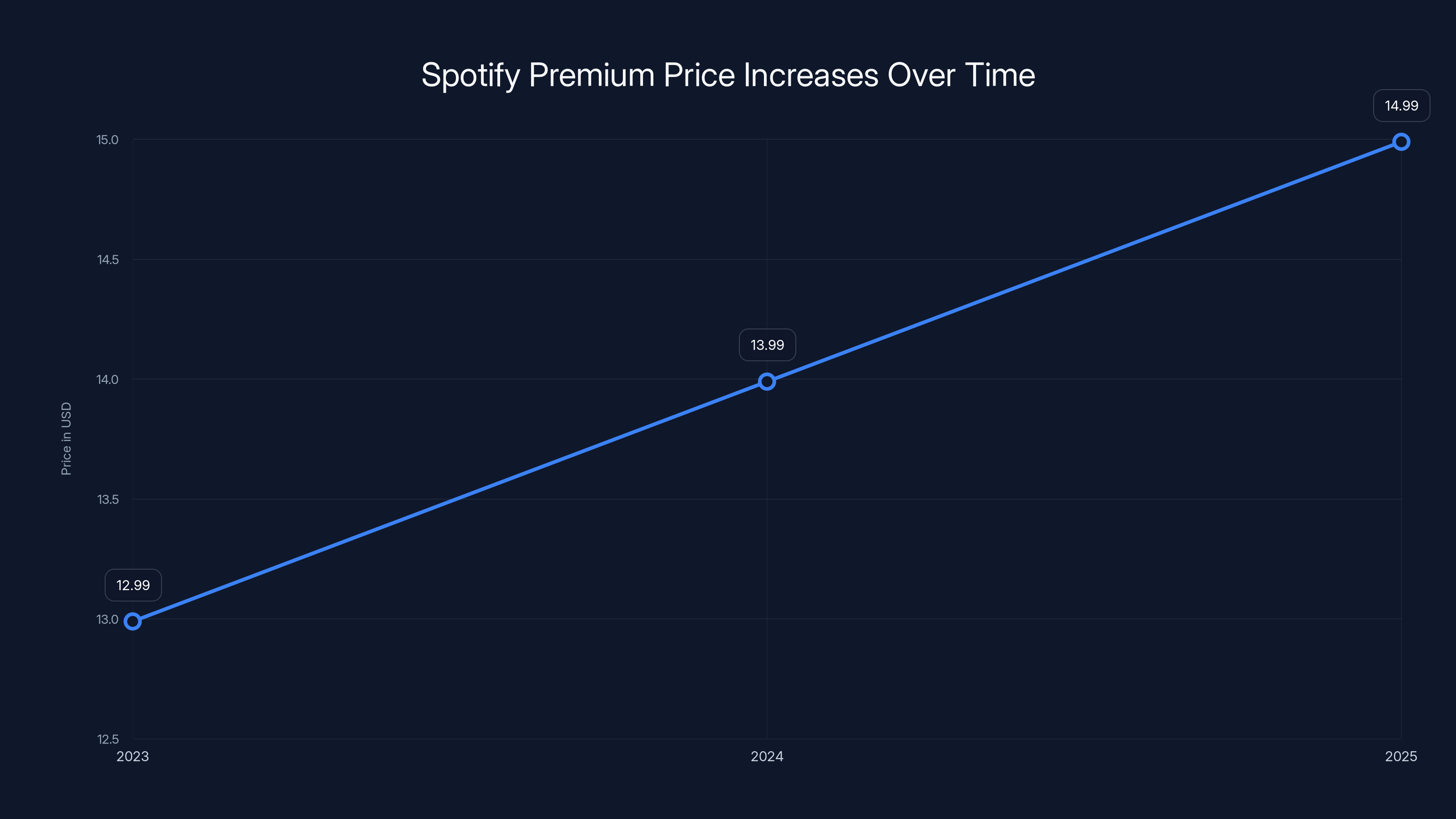

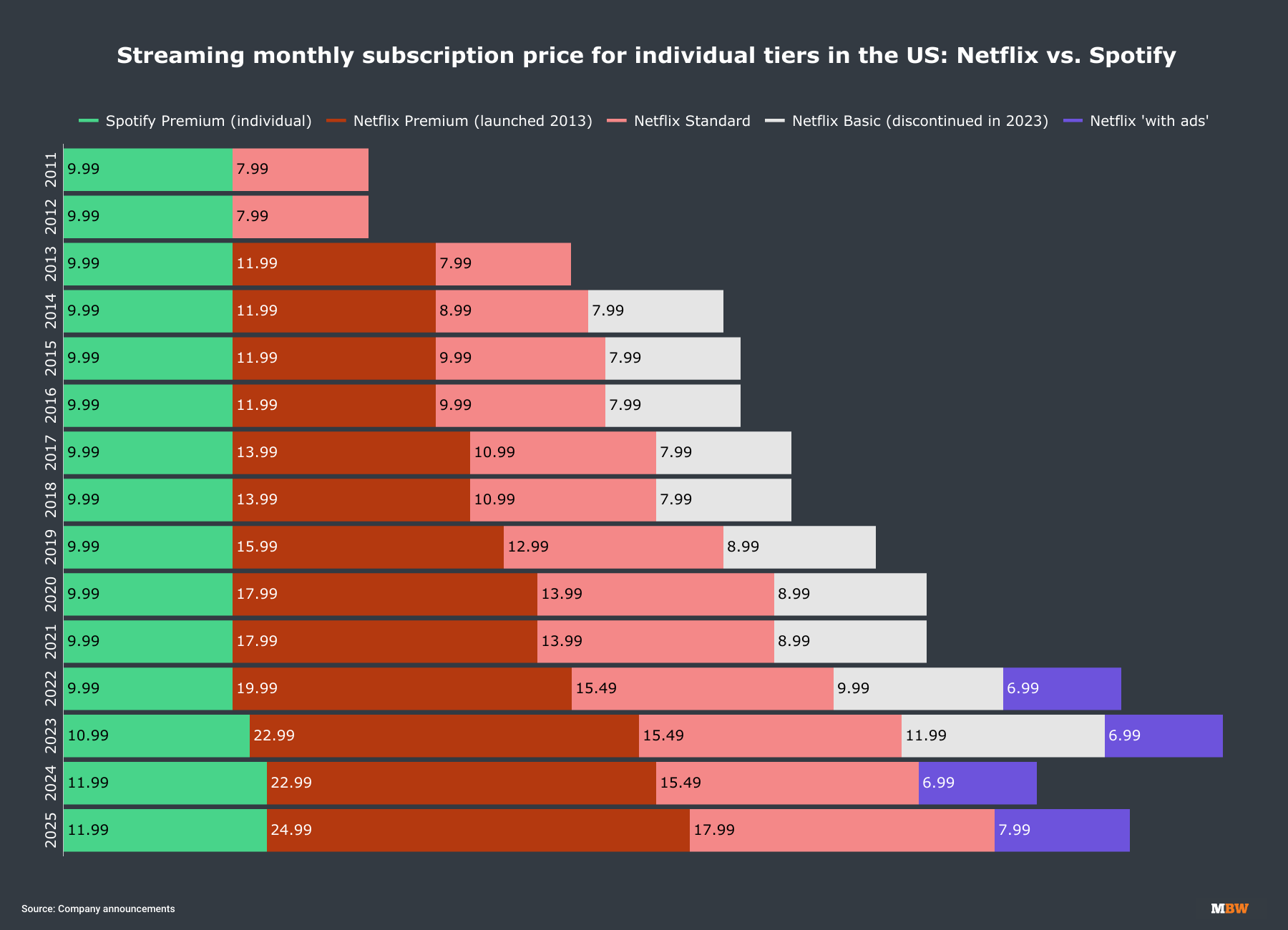

Spotify's pricing strategy has shifted dramatically. For over a decade, the company kept its $12.99 Premium price point stable. Then something changed.

In July 2023, they raised prices for the first time in years. Another hike came in July 2024. Now, less than a year later, here's another one in February 2025. That's three increases in 30 months.

The company's rationale is consistent: they need the money for product innovation, artist compensation, and platform improvements. But the frequency tells you something important—Spotify has moved from a "keep prices stable indefinitely" strategy to a "regular, incremental increases" approach, similar to how Netflix, Hulu, and Disney+ operate.

Why now? Several factors:

First, subscription platforms have realized that gradual price increases cause less churn than one massive jump. If you raise prices

Second, Spotify's growth metrics show they're winning. In their Q3 2024 earnings, they reported 12% year-over-year Premium subscriber growth. That's healthy enough that a $1 price increase won't tank the user base. The math is simple: lose 2% of subscribers, gain 10% in revenue per user. That's a net win.

Third, the streaming music industry has matured. Artists aren't leaving Spotify for Apple Music or Amazon Music in significant numbers, so the company has leverage. Listeners are sticky. Most people have Spotify accounts, integrated into their daily routines, connected to friends, and embedded in their cars and smart speakers. Switching costs are real—not in money, but in convenience.

Spotify's framing always emphasizes artist benefits. They point to the $10 billion in music royalties they paid in 2024, an increase from previous years. But that's a misleading stat. Higher total payments don't mean individual artists make more per stream. In fact, Billboard reported in 2024 that changes in how Spotify calculates payments would result in musicians receiving millions less in royalties. The company pays more total royalties because they have more subscribers and more streams, not because per-stream rates went up.

Spotify reported strong year-over-year growth across key metrics, supporting their confidence in price increases. Estimated data.

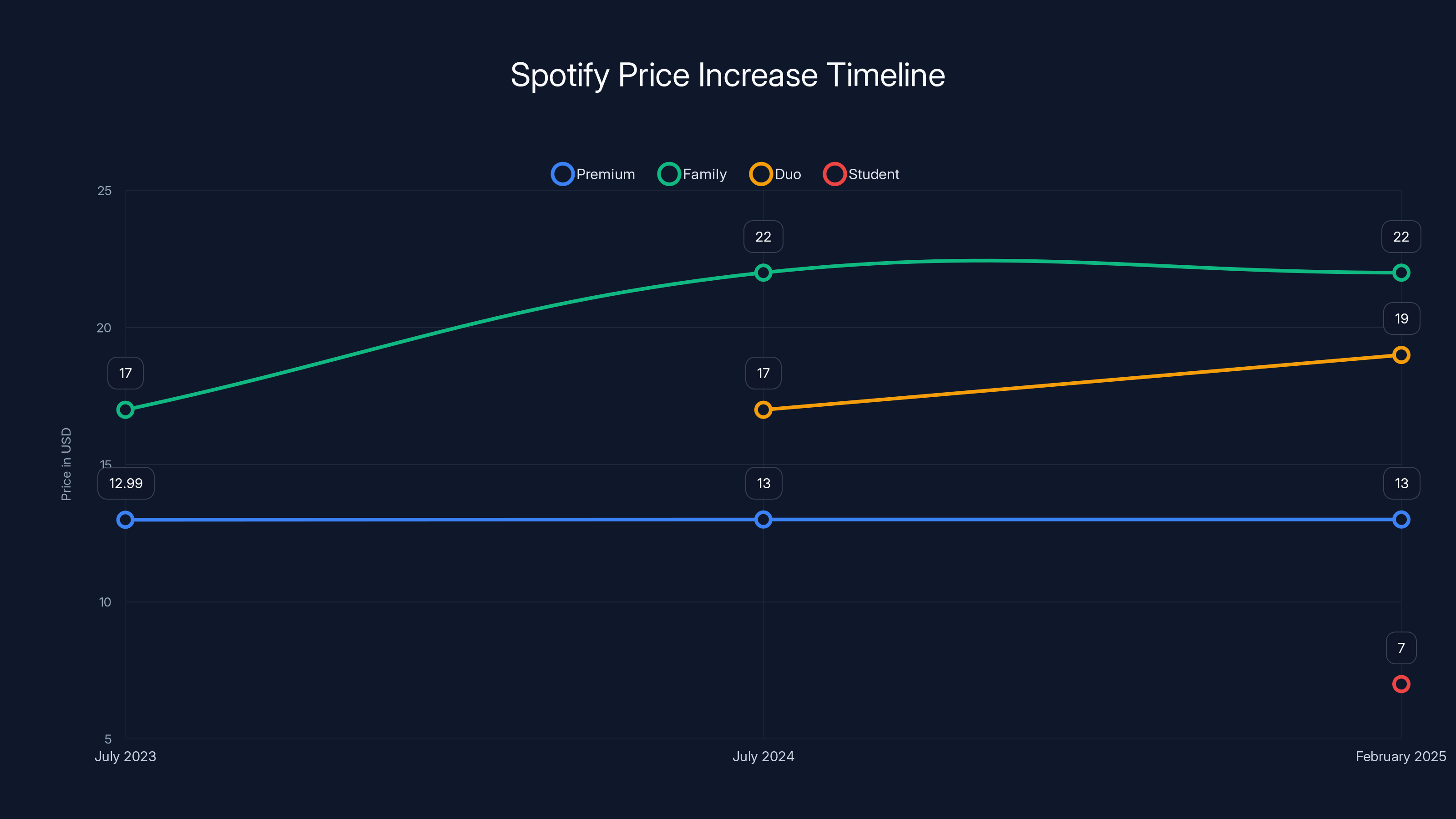

The Full Breakdown of What Changed

Let's talk specifics. Here's what each plan costs as of February 2025.

Premium Individual:

Student Plan:

Duo Plan (two accounts, same household):

Family Plan (up to six accounts):

Basic Plan: $11 per month, unchanged. Basic is the ad-supported tier, but it's only available as a downgrade for existing Premium subscribers. New sign-ups don't get access to it.

If you do the math across a year, a Premium subscriber now pays

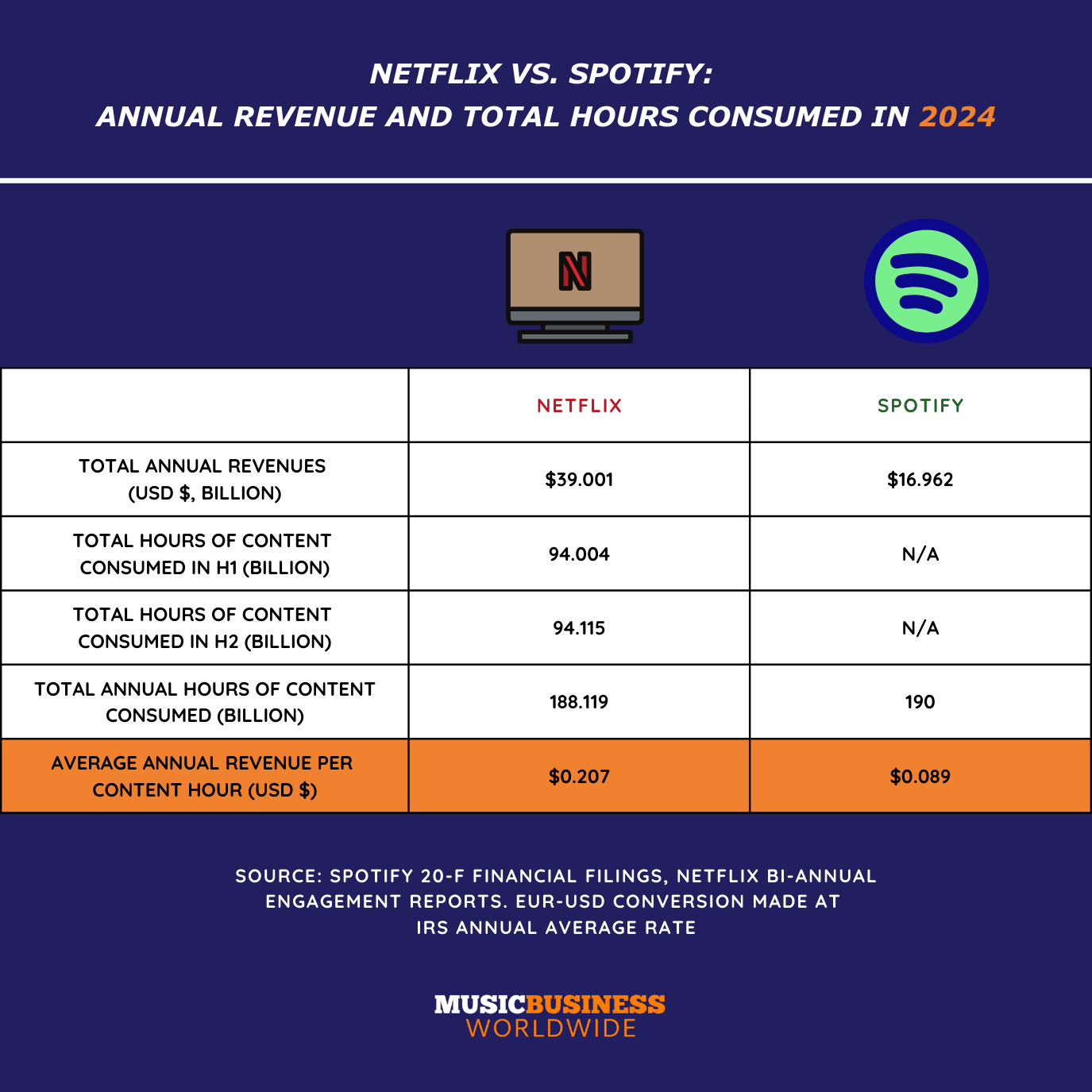

This matters because Spotify accounts for a growing portion of household entertainment budgets. You've also got Netflix (

Spotify's strategy assumes that music streaming is worth the increase relative to other entertainment costs. For many people, it probably is. Spotify is often the cheapest premium entertainment subscription available. But that calculus changes when you're paying for five or six streaming services simultaneously.

What Features Justify the Price Increase?

Spotify's official statement is vague: "Occasional updates to pricing reflect the value that Spotify delivers." But what value, specifically?

The company has actually rolled out several features recently that they're leveraging to justify the price hike.

Lossless Audio arrived in November 2024, though it's only available on some devices and isn't truly "lossless" in the audiophile sense—it's higher quality than standard streaming but not CD-quality. Still, it's a differentiator that Apple Music also offers.

Music Videos launched in December 2024. Spotify started letting users watch music videos from artists directly in the app. This is a genuinely new offering that competes with You Tube Music's music video integration.

Messaging Features arrived this month. Spotify added the ability to share what you're listening to with friends (similar to existing features) and a new feature called "Jams," which lets you request collaborative listening sessions. It's basically a way to socialize music listening in real-time.

Podcast Studio is the biggest investment on Spotify's side. In January 2025, they opened an 11,000-square-foot podcast studio in Hollywood. This is corporate real estate, infrastructure for podcast production. It signals that Spotify sees podcasts and music as equally important to the platform's future.

These features are real. They represent product investment. But here's the honest take: most casual Spotify users won't notice or care about lossless audio. Music videos are nice but not revolutionary—people can watch those on You Tube. Messaging features are mildly useful for friends. The podcast studio is invisible to most subscribers.

The underlying value proposition is the same as it's always been: millions of songs, good recommendations, offline downloads, ad-free listening. The price increase isn't really about the features. It's about Spotify's transition from a growth company to a profit-optimization company.

A

Why This Matters for the Music Streaming Industry

Spotify's pricing strategy doesn't exist in a vacuum. It signals where the entire industry is heading.

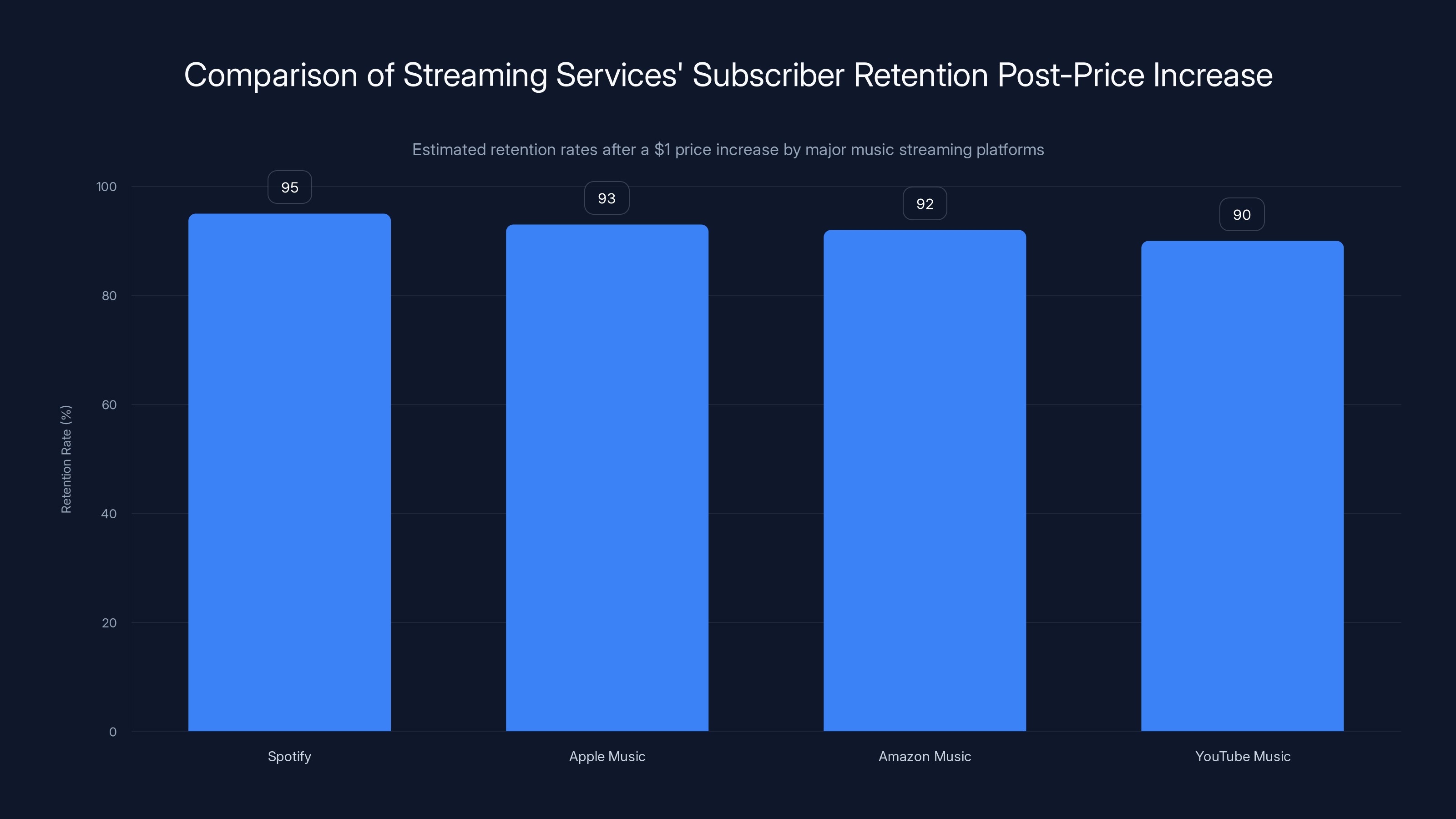

When Spotify raises prices, Apple Music and Amazon Music watch closely. If Spotify retains 95% of subscribers after a $1 increase, that's permission for competitors to test their own increases. Pricing power flows through the market like water finding cracks.

The second thing that matters is the normalization of regular price increases. For years, tech companies faced a choice: raise prices all at once and risk backlash, or keep them stable and accept lower margins. Netflix proved that incremental increases work better. Spotify is following the same playbook.

Third, there's a strategic message here about podcasting. By investing in an 11,000-square-foot studio and integrating podcasts more deeply into the platform, Spotify is telling users: we're not just a music company anymore. We're an audio company. And audio companies need more revenue to operate.

Finally, the price increase matters because it reflects Spotify's business model priorities. In 2024, Spotify reported that podcast revenue is growing faster than music revenue. But podcasts have lower margins than music (because Spotify has to split revenue with podcast networks and creators differently). To offset lower margins, Spotify needs higher prices across the board.

The artist payment controversy adds another layer. Spotify has been criticized for years over how much (or how little) it pays musicians per stream. Current rates are estimated at

When Spotify claims that price increases "benefit artists," they mean that higher subscriber counts = more total streams = more total royalties. But per-stream rates remain low. Artists don't get a piece of the $1 price increase directly. The money goes to Spotify, which keeps most of it as profit.

The Price Increase Timeline: A Trend Emerges

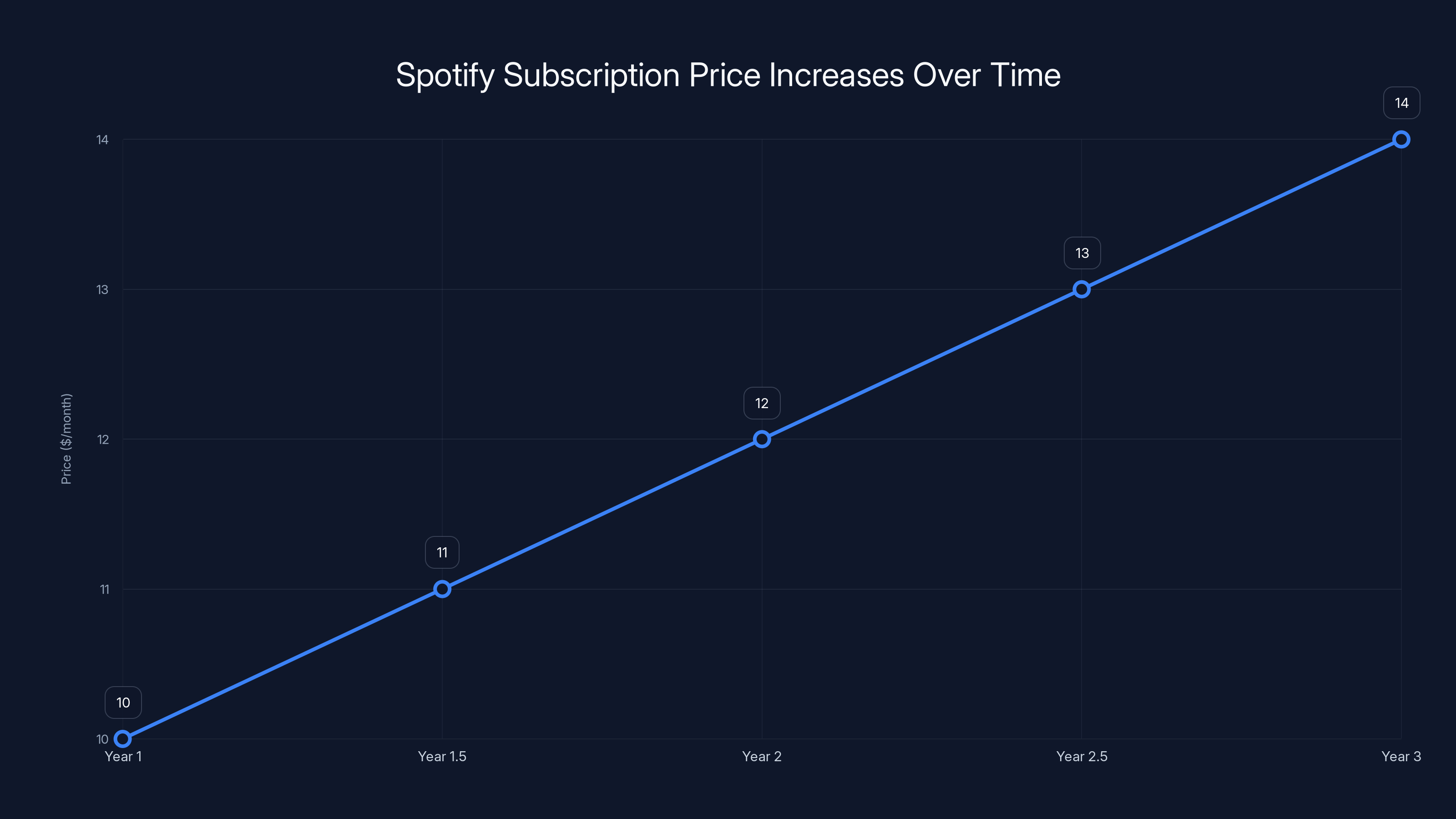

Looking at Spotify's pricing history over the past 24 months reveals a clear pattern.

July 2023: First price increase in over a decade.

- Premium: 13 (technically flat, but they had been at $12.99)

- Family: 19

July 2024 (one year later): Second price increase.

- Premium: 13 (wait, didn't we just do this? They're consolidating to $13)

- Duo: 17

- Family: 22 (this was raised again, not from22)

February 2025 (seven months later): Third price increase.

- Premium: 13 (again)

- Student: 7

- Duo: 19

- Family: 22

Wait, some of these numbers are confusing because Spotify has been consolidating regional pricing and adjusting different tiers at different times. But the pattern is clear: increases are happening more frequently, and they affect multiple plans simultaneously.

A decade ago, Spotify could point to pricing stability as a competitive advantage. Now, that stability is gone. The company is using the playbook perfected by Netflix: get users hooked at a low price, then incrementally raise rates as their dependence grows.

The question is whether customers will accept this new normal. Early data suggests yes. Spotify's subscriber growth remains strong. But there's a psychological threshold where price increases start causing real churn. Spotify is testing where that threshold is.

Estimated data suggests Spotify retains 95% of subscribers after a $1 price increase, setting a benchmark for competitors. Estimated data.

Why Spotify Thinks It Can Get Away With This

Spotify's confidence in these price increases is backed by real data.

In their Q3 2024 earnings report (released in November 2024), Spotify reported:

- 12% year-over-year growth in Premium subscribers

- 11% Yo Y growth in Basic (ad-supported) active users

- 11% Yo Y growth in total monthly active users

- 9% Yo Y increase in gross profit, reaching $1.56 billion

These are strong numbers. If a company loses subscribers, they report lower numbers. But Spotify's numbers are going up. That suggests the previous price increases didn't cause major churn.

Add to this the stickiness factor. Spotify doesn't just offer music—it's integrated into people's lives. Your playlists are there. Your saved songs. Your listening history. Friends are on Spotify. Your car's infotainment system connects to Spotify. Your smart speakers play Spotify. Switching costs aren't financial; they're psychological and logistical.

Apple Music charges $11/month for individuals, basically the same as Spotify's old price. Amazon Music is cheaper. You Tube Music is comparable to Spotify. But network effects matter. Most people's friends are on Spotify, so there's a social cost to leaving.

Moreover, Spotify has become a utility in people's lives, like Netflix or an internet subscription. People think of it as essential, not discretionary. That's when companies can raise prices—when they're seen as necessities rather than luxuries.

There's also the international pricing strategy. Spotify doesn't raise prices everywhere at the same time or to the same degree. In developing markets, where purchasing power is lower, they keep prices cheaper or grow the ad-supported Basic tier. In wealthy markets like the US, Western Europe, and Australia, they're more aggressive.

For Spotify, the math is simple: lose 5% of US subscribers, gain 10% in revenue per user, and you come out ahead. And the data shows they're losing far fewer than 5%.

The Artist Payment Angle: Reality vs. Marketing

Every time Spotify raises prices, they claim it benefits artists. Let's dig into that claim.

Spotify paid $10 billion in music royalties in 2024, more than ever before. On its surface, that sounds great for artists. More money for musicians, right?

Here's the problem: royalty payments are based on stream count and per-stream rates. Spotify's per-stream rate has been relatively stable at $0.003–0.005 for years. The only reason total royalties increased is because Spotify now has more subscribers and more streams.

Individual artists didn't get richer. The pie got bigger, but their slice stayed roughly the same size.

In 2024, Billboard analyzed changes in how Spotify calculates payments and found that these changes would result in millions of dollars less in royalties for musicians. That's not a headline Spotify likes to share.

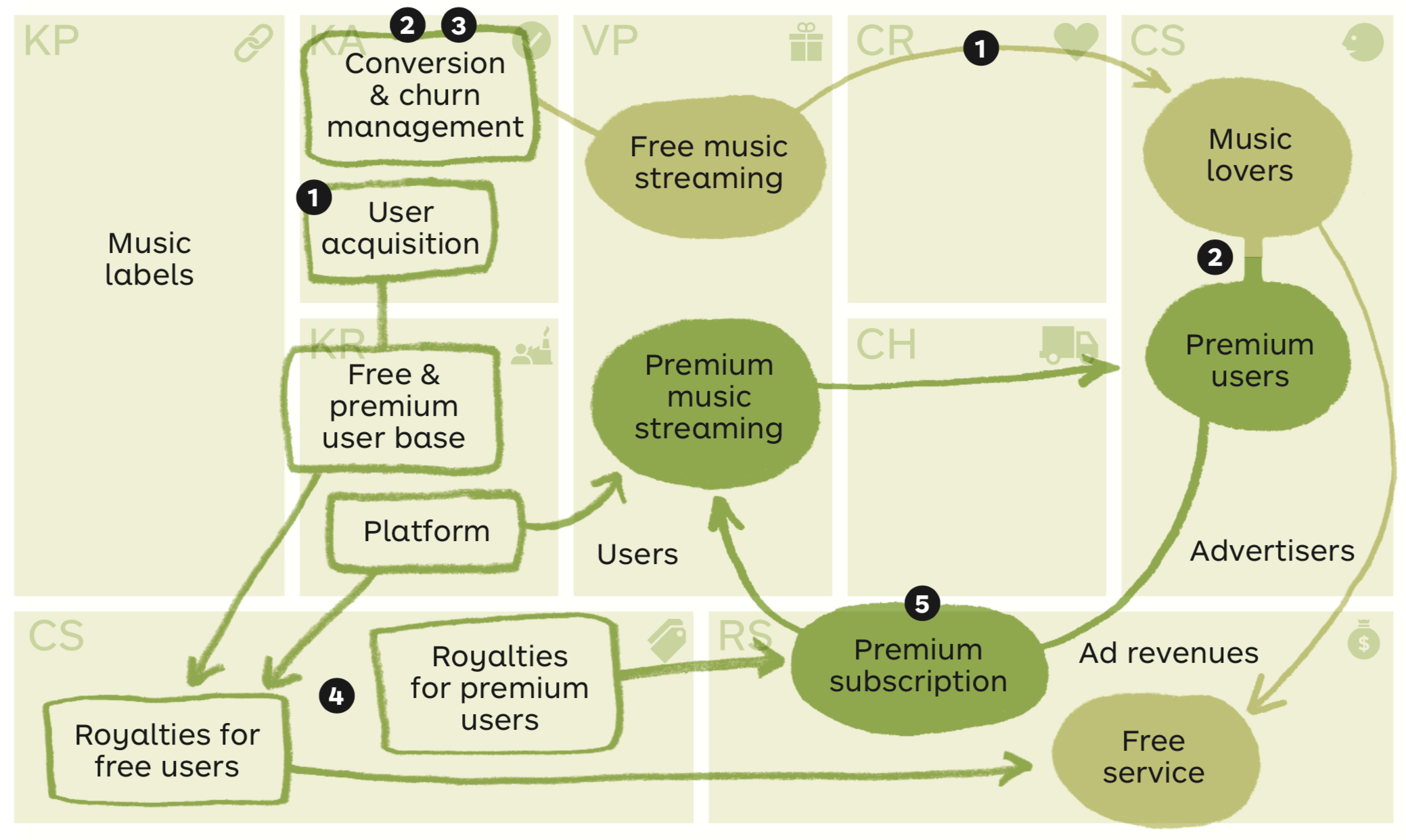

Here's how the system actually works:

Spotify takes subscriber revenue and allocates a percentage to the artist pool. That pool is divided based on the proportion of streams each artist received. So if an artist gets 1% of all Spotify streams that month, they get 1% of the artist royalty pool.

The problem is obvious: big artists get most of the streams, so they get most of the money. Independent artists and niche musicians make almost nothing. An unsigned artist might get $100 per month from Spotify despite having thousands of monthly listeners. That's unsustainable as a full-time career.

When Spotify raises prices by $1, that doesn't directly increase artist payouts. It increases Spotify's revenue. Some of that revenue goes to artists, but most goes to Spotify shareholders and operating costs.

The company's claim that "price increases benefit artists" is marketing. More subscribers benefit artists. Price increases benefit Spotify's profit margins. These are not the same thing.

Spotify's subscription price has increased steadily over the past 2.5 years, reflecting a common trend among subscription services. Estimated data.

Customer Backlash and Recent Controversies

Spotify's 2024 wasn't all smooth sailing. The company faced multiple controversies that affected its brand reputation.

The Helsing Investment Controversy

In early 2025, it emerged that Spotify's then-CEO Daniel Ek had heavily invested in Helsing, a Germany-based military defense AI company. The revelation triggered backlash from users and musicians who didn't want their subscription fees supporting weapons development.

Users and artists called for boycotts. The controversy raised a larger question: where does Spotify's revenue actually go? Even if you trust their artist payment claims, knowing that profits flow to military AI investments can make the purchase feel uncomfortable.

Spotify's response was muted. The company didn't defend the investment aggressively or explain why Ek's personal investments should matter to users. They let the story blow over, which worked because most people have short attention spans for corporate drama.

The ICE Recruitment Ad Campaign

In October 2024, Spotify ran recruitment ads for US Immigration and Customs Enforcement (ICE). The non-profit Indivisible called for a boycott, arguing that Spotify shouldn't profit from enforcement agencies associated with family separations and immigrant detention.

The criticism was swift and sharp. Immigration advocates pushed back hard. By late 2025, Spotify confirmed the ad campaign had ended. A November Rolling Stone report cited an anonymous industry source claiming the Department of Homeland Security had paid Spotify $74,000 to run the ads.

That's a relatively small amount of money for Spotify's scale, but it symbolizes something larger: the company will accept money from controversial sources if the check clears. That damages trust with progressive users who care about ethical consumption.

The Frequency of These Controversies

What's notable is that both controversies emerged within months of price increase announcements. This creates a problematic narrative: Spotify raises prices to fund military AI investments and immigration enforcement ads.

In reality, these things are separate. But in the court of public opinion, narrative beats facts. When you raise prices and then users learn your CEO invested in defense AI and your company took ICE money, the price increase feels less like product investment and more like funding a system they morally object to.

Spotify could have handled this better with transparent communication about where revenue goes. Instead, they took the approach of denial and delay.

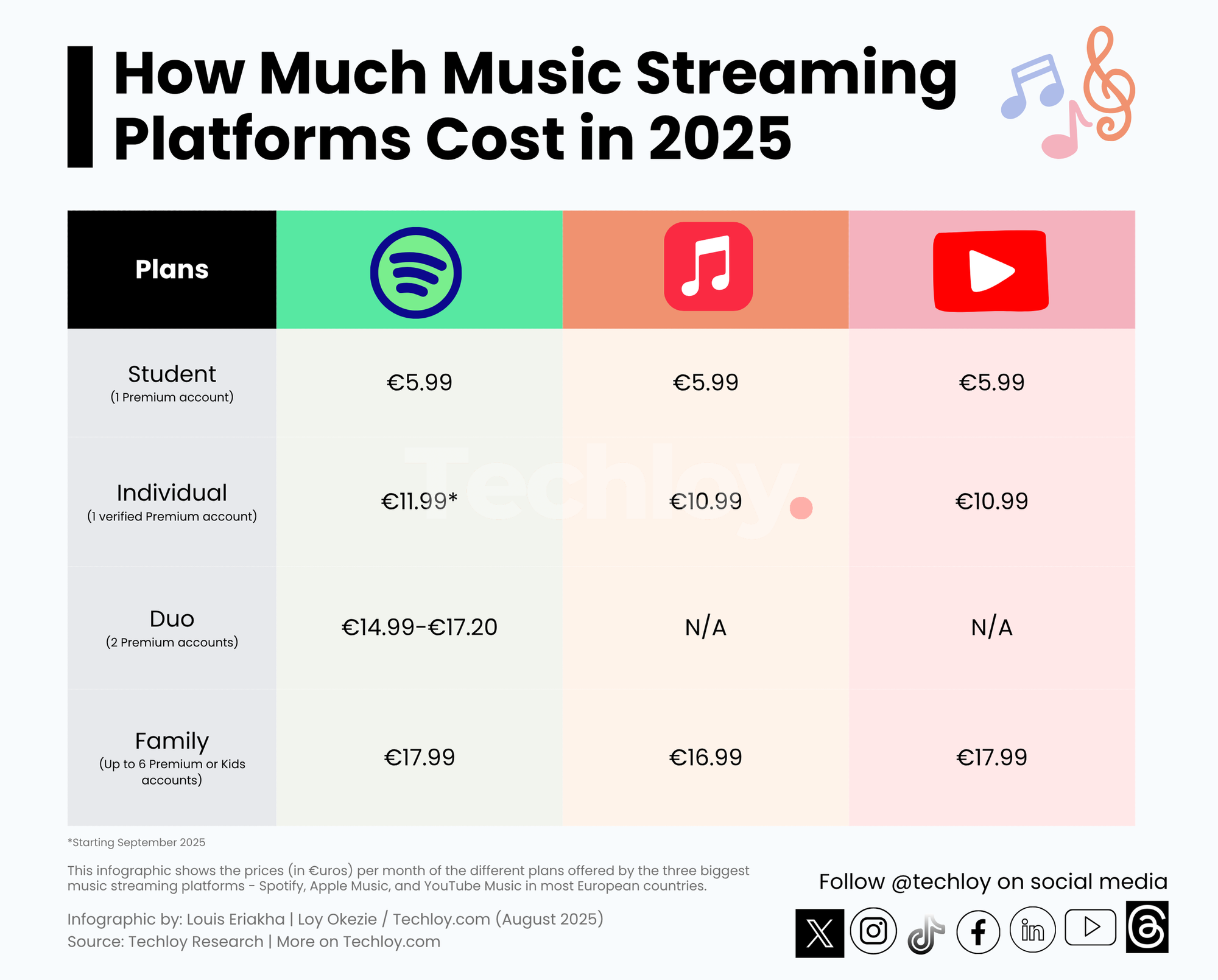

How Other Streaming Services Are Pricing (The Competitive Landscape)

Spotify isn't raising prices in isolation. Understanding how competitors are positioned helps explain why Spotify feels confident.

Apple Music:

Amazon Music Unlimited:

You Tube Music:

Tidal:

Amazon Music Unlimited (ad-free): Some services offer ad-supported tiers at

What's interesting is that Spotify's new $13/month Premium price is now matched or undercut by competitors. Spotify used to have a price advantage. That's gone. The company is now betting on features, UI, recommendation quality, and ecosystem integration rather than price.

For budget-conscious users, the calculus has shifted. You Tube Music or Amazon Music Unlimited might be better value, especially if you already use Prime or You Tube.

Spotify's pricing shows a clear trend of increasing rates across multiple plans over the past 24 months, with more frequent adjustments starting from July 2023.

What This Means for the Streaming Industry's Future

Spotify's aggressive pricing strategy is a signal about the future of streaming services. Here's what it tells us:

1. Streaming is consolidating into utilities

When a service becomes essential, pricing power increases. Spotify is treating music streaming as a utility, like electricity or internet. You'll pay what they charge because the alternative (going without music streaming) is unacceptable.

2. Incremental increases are now the norm

Instead of massive one-time price hikes, expect regular

3. Bundling is becoming strategic

Spotify's podcast investment signals that bundling music + podcasts + possibly other audio content will be the future. Apple did this with Apple Music + Apple TV+. Spotify might do it with music + podcasts + audiobooks.

4. Ad-supported tiers are less important than Spotify thought

Spotify initially pushed the ad-supported Basic tier aggressively. Now they're restricting it to existing users. The company prefers paid Premium subscribers because they pay reliably. Ad-supported revenue is volatile and depends on advertiser demand.

5. Per-stream rates for artists will stay low

Despite price increases, don't expect musician payouts to improve significantly. Spotify's economics don't support it. The company operates on thin margins (profit margins around 18–22%), and most of that margin comes from Premium subscribers.

6. Price increases will continue

If Spotify retains 95%+ of subscribers after price increases, the company has zero incentive to stop. Expect another

The Psychology of Price Increases and User Retention

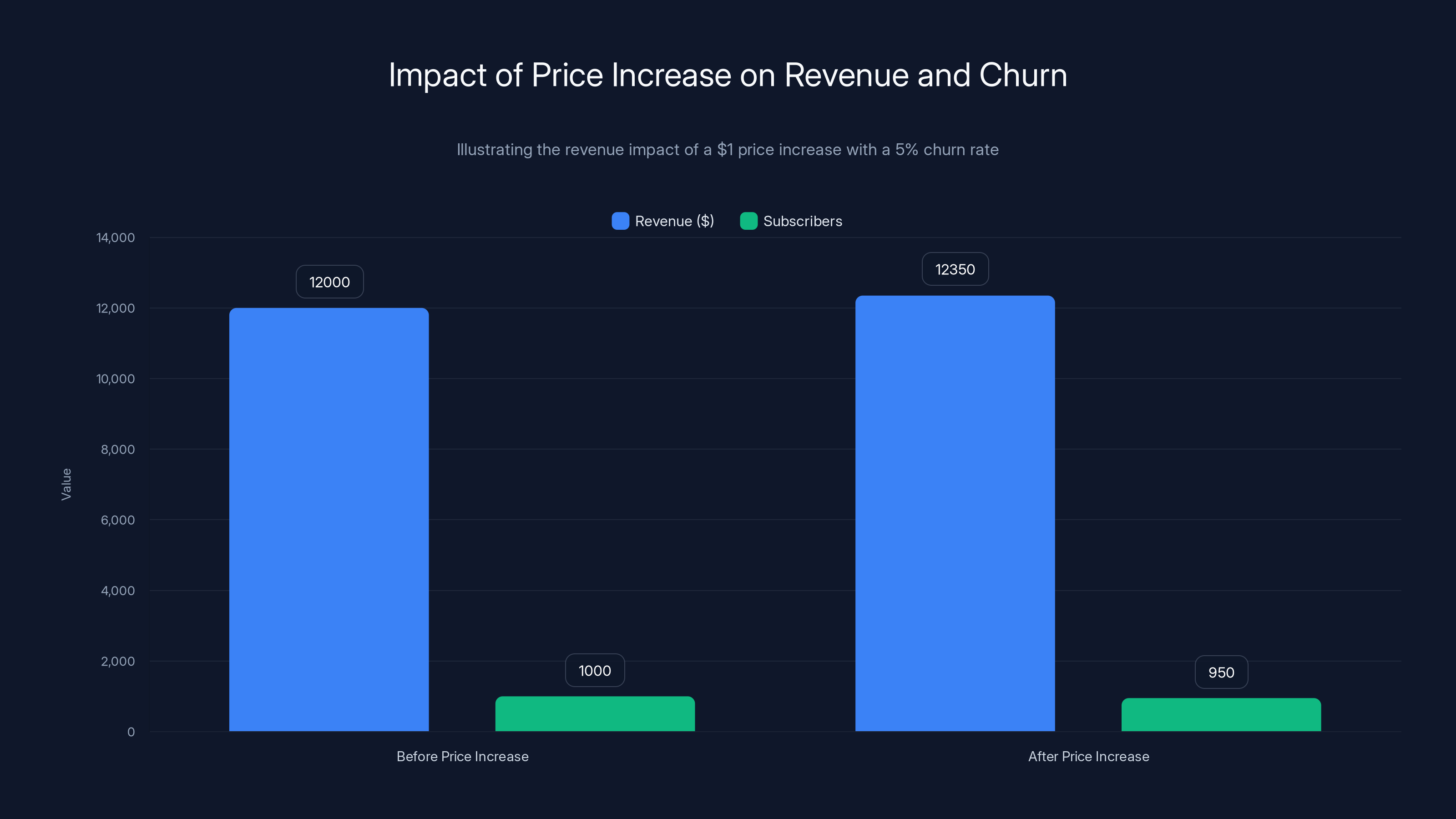

Why do companies like Spotify, Netflix, and Apple confidently raise prices knowing it might cause some churn? The answer lies in subscription economics.

When you raise prices by $1, the 5% of users who cancel due to the price increase represent a net gain if the 95% who stay generate additional revenue.

Math: 1000 subscribers ×

After price increase: 950 subscribers ×

You lose

This math assumes a 5% churn rate from price increases. Spotify's actual churn rate is likely lower. Their Q3 2024 data showed subscriber growth despite recent price increases, which suggests churn from pricing was minimal.

There's also the psychological factor: people are more likely to tolerate price increases from services they use daily and consider essential. If Spotify is part of your daily routine—during your commute, at the gym, while working—you're unlikely to cancel because of a $1 increase.

But there's a saturation point. If Spotify keeps raising prices without equivalent feature improvements, churn will eventually accelerate. Competitors will capitalize by positioning themselves as cheaper alternatives.

Right now, Spotify is betting that people won't hit that saturation point. They might be right.

Should You Accept the Price Increase or Switch?

This is the practical question. Here's a framework for deciding.

Stay with Spotify if:

- You use features like collaborative playlists, song radio, or Spotify's recommendation algorithm, which are genuinely better than competitors

- You have a large library of saved songs and playlists you don't want to lose

- Your friends are on Spotify and you value the social features

- 156/year)

- You use offline downloads frequently when traveling or in low-connectivity areas

- The new features (lossless audio, music videos) genuinely matter to you

Switch to a competitor if:

- You primarily listen to specific genres and value curation quality (Tidal or Apple Music might have better playlists in your genre)

- You care about artist compensation and are willing to pay more for higher per-stream rates

- You're price-sensitive and prefer You Tube Music, Amazon Music, or Apple Music at similar or lower prices

- You want lossless audio and already have Apple devices (Apple Music is cheaper and more integrated)

- You barely use your Spotify library and can tolerate starting fresh with playlists

- You're already subscribed to Amazon Prime (making Amazon Music essentially free)

Consider hybrid usage:

- Subscribe to Spotify's free tier with ads and use the paid tier for Apple Music or You Tube Music

- Subscribe to one paid service and use free tiers of others for specific use cases

- Share a Family Plan with friends or family to reduce per-person cost to $3.67/month

The last option is often overlooked. If you split a Family Plan (

What Spotify Should Have Done Differently

Here's an honest take: Spotify's communication around price increases has been poor.

Instead of vague statements about "ongoing product investment," Spotify should have been transparent about specific improvements tied to price increases. They should have said: "The $1 increase funds X feature for Y users, improves Z infrastructure, and increases artist royalties by W%."

Instead, they've been coy, which makes users feel like the company is just extracting more money without providing commensurate value.

Second, Spotify could have offered opt-outs or grandfathering for long-term subscribers. Netflix did this to some extent—they let some users keep old pricing longer if they switched to ad-supported tiers. Spotify could have offered a choice: stay at

Third, they should have addressed the artist payment controversy directly instead of letting it simmer. A transparent breakdown of where subscription revenue goes—how much goes to artists, how much to infrastructure, how much to profit—would have built trust.

Finally, the timing of price increases relative to controversies like the Helsing investment and ICE ads was terrible. It gave users the impression that price increases were funding controversial activities. Better communication and greater separation between these events would have mitigated backlash.

The Bigger Picture: Why Subscription Prices Keep Rising

Spotify isn't alone in raising prices. This is happening across the entire subscription economy.

Netflix has raised prices multiple times. Disney+ has raised prices and introduced ad-supported tiers. Adobe increased Creative Cloud prices. Hulu, HBO Max, and Paramount+ have all gotten more expensive. Even Costco raised membership fees in 2024.

Why is this happening everywhere?

The underlying cause is that early-stage subscription services underpriced their offerings to gain market share. They were trading current profit for future dominance. Netflix did this brilliantly—they kept prices low while building a massive subscriber base.

Now that these services have dominant positions, they've entered the "profit optimization" phase. The growth phase is over; it's time to maximize shareholder returns.

Inflation is also a factor. Streaming services have real costs: servers, licensing fees for music or content, customer support, marketing. Inflation increases these costs. Passing costs to consumers through price increases is the standard approach.

There's also the reality of slowing growth. Streaming markets are maturing. Netflix has penetrated most developed markets. Spotify has captured the majority of willing music streaming subscribers. Growth is slowing, and the only way to increase revenue per shareholder is to raise prices on existing customers.

This dynamic creates a ceiling. At some point, prices become so high that churn accelerates and new market entry becomes viable for competitors. We're not there yet for Spotify—but the direction is clear.

Will the Price Increases Eventually Stop?

This is the million-dollar question. Will Spotify eventually stabilize prices, or will they keep rising indefinitely?

Most likely scenario: prices will continue rising, but at a slower rate as they approach a saturation point. Spotify will probably raise prices every 18–24 months by

For reference, Netflix is now at

However, if competitors gain significant share by positioning themselves as cheaper alternatives, Spotify would be forced to stabilize or even lower prices. Market competition is the only real brake on price increases.

The wild card is AI-driven music generation. If AI-generated music becomes indistinguishable from human-created music and gains widespread acceptance, it could disrupt Spotify's entire business model. At that point, artist royalties might plummet, pressuring Spotify to lower prices to remain competitive.

But that's speculative. For now, Spotify's price increases will continue as long as subscriber retention remains strong.

Key Metrics to Watch Going Forward

If you want to understand whether Spotify's pricing strategy is sustainable, pay attention to these metrics in future earnings reports:

Premium Subscriber Growth Rate: Currently 12% Yo Y. If this drops below 8%, it signals that price increases are causing churn.

Churn Rate: Spotify doesn't disclose this explicitly, but you can estimate it from growth trends. If growth slows sharply after price increases, churn is rising.

Average Revenue Per User (ARPU): This is the key metric. If ARPU is growing faster than subscriber count, price increases are working. If they're decoupling, price increases are causing retention problems.

Competitive Subscriber Share: Does Spotify's market share grow or shrink relative to Apple Music, Amazon Music, and You Tube Music? If market share is steady while growth is strong, pricing power is confirmed.

Family Plan Adoption: As individual plans get expensive, families might shift to Family Plans to reduce per-person cost. Tracking this ratio shows whether users are price-sensitive.

Free Tier Usage: If more users migrate from Basic (ad-supported) to free, it signals price sensitivity. Higher free tier usage dilutes premium revenue.

Spotify will report these metrics quarterly. Tracking them will give you early signals of whether the pricing strategy is sustainable or approaching its limits.

Conclusion: Accepting a New Reality

Spotify's price increase is part of a broader shift in how subscription services operate. The days of stable pricing are over. Expect regular increases across every subscription service you use.

For Spotify specifically, the $13/month price point is still competitive with alternatives. The service is worth the cost for most users. But the frequency of increases—three in 2.5 years—signals that Spotify is testing how high prices can go before churn becomes unacceptable.

Your decision is simple: Is Spotify worth $156/year to you? If yes, pay the increase. If no, explore alternatives like You Tube Music, Amazon Music Unlimited, or Apple Music, which offer similar features at comparable prices.

The bigger lesson is that subscription services will keep pushing prices upward until market forces push back. The only leverage consumers have is to switch when prices exceed perceived value. So far, that hasn't happened at scale for Spotify. But if price increases continue without equivalent feature improvements, that dynamic could change.

For now, Spotify's strategy is working. But nothing works forever. Eventually, price increases hit a ceiling, and the company will have to make a choice: stabilize prices and accept lower profit growth, or keep pushing and accept slower subscriber growth.

Based on Spotify's recent history, they'll choose the latter. They'll keep raising prices and accept single-digit subscriber growth rather than stabilizing prices for double-digit growth. That's the choice every mature subscription service faces, and most of them make the same decision.

The question isn't whether Spotify will raise prices again. The question is when—and how much your tolerance for increases will be tested before you switch.

FAQ

Why is Spotify raising prices again?

Spotify is raising prices to fund product innovation, podcast studio operations, and artist royalties. The company claims lossless audio, music videos, and new messaging features justify the increase. In reality, the main driver is profit optimization—Spotify has matured beyond the growth phase and is now maximizing revenue per user, a strategy proven successful by Netflix and other subscription services.

How much is the price increase for each plan?

Premium Individual rises from

When does the price increase take effect?

The price increase takes effect in February 2025 starting on users' next billing date. Spotify has already begun notifying subscribers via email. New subscribers are being offered plans at the higher prices immediately, while existing subscribers get until their next billing cycle.

Should I switch to a different music streaming service?

Switch if you're primarily price-sensitive and prefer competitors like You Tube Music or Amazon Music Unlimited, which offer similar features at comparable or lower prices. Stay if you value Spotify's superior recommendation algorithm, collaborative playlists, or if your friends and social circle are on the platform. A Family Plan shared among six people costs $3.67/month per person, which is significantly cheaper than any individual plan.

Does the price increase benefit artists?

Not directly. While Spotify paid

What features justify the $1 price increase?

Spotify points to lossless audio (launched November 2024), music videos (launched December 2024), new messaging and "Jams" collaborative listening features, and infrastructure improvements. These features are real but incremental—most casual users won't notice a significant difference. The primary justification is platform maturity and profit optimization rather than revolutionary new features.

Can I keep my old price if I don't change anything?

No. Once your billing date arrives in February 2025 or later, you'll automatically be charged the new price. Spotify doesn't granfather existing users at old rates. Some promotions or retention offers might apply if you threaten to cancel, but these are handled on a case-by-case basis.

Is Spotify still the best music streaming service?

Spotify remains strong in recommendation quality and user experience, but it's no longer the clear value leader on price. Apple Music, You Tube Music, and Amazon Music Unlimited are now competitive or cheaper. Best choice depends on your priorities: if you want recommendations and social features, Spotify is excellent; if you want lossless audio or artists paid better, alternatives might suit you better.

Will Spotify raise prices again soon?

Based on the pattern of three increases in 2.5 years, expect another price increase in 18–24 months. Spotify has shifted from stable pricing to regular incremental increases, following Netflix's model. Expect

How does Spotify's price compare to competitors?

Spotify Premium at

Related Considerations for Your Music Streaming Choice

Beyond Spotify's price increase, several broader factors deserve consideration when evaluating your music streaming subscription.

Ecosystem Lock-In: Consider which ecosystem you're invested in. Apple Music integrates seamlessly with i Phones, Mac Books, and Home Pods. Spotify integrates everywhere. Amazon Music integrates with Alexa and Prime. You Tube Music integrates with You Tube. Choose a service that aligns with your devices.

Audio Quality: If you have a good audio system (quality headphones, home speakers), lossless audio matters. Spotify offers lossless, but Apple Music offers it cheaper (

Social Features: Spotify's social integration is superior—collaborative playlists, friend activity feeds, and now Jams. If you care about music as a social activity, Spotify's features justify the cost.

Podcast Integration: Spotify is heavily integrating podcasts. If you listen to podcasts, Spotify offers a bundled experience. Competitors don't compete in this space yet.

Family Considerations: If you have a family, Family Plans (6 users) are cheaper per person than individual plans. Spotify's Family Plan at

Trial Before Switching: Most services offer free trials or free tiers. Use these to test whether switching is worthwhile before canceling Spotify.

The music streaming market is mature enough that quality is table stakes. All major services have 100+ million songs and capable apps. Your choice boils down to price, features, ecosystem integration, and personal preference. Spotify is still excellent, but it's no longer the obvious default choice for everyone.

Key Takeaways

- Spotify raises Premium from 13/month in February 2025, marking the third price increase in 2.5 years

- Student plans increase 7, Duo19, Family22, signaling a shift to regular incremental increases like Netflix

- Spotify's Q3 2024 data showed strong 12% YoY subscriber growth, validating the pricing strategy despite previous increases

- Per-stream rates for artists remain at $0.003–0.005 despite higher total royalties, meaning price increases primarily benefit Spotify, not musicians

- Spotify's positioning is weakening on price compared to Apple Music, YouTube Music, and Amazon Music Unlimited, which now offer similar features at lower costs

- Family Plan sharing across 6 users reduces per-person cost to $3.67/month, making it the best value option despite the price increase

Related Articles

- Spotify Price Increase to $13: What You Need to Know [2025]

- Spotify's Price Hike to $12.99 in 2026: What It Means for Subscribers [2025]

- Spotify Price Hike February 2025: What Changed & Your Options [2025]

- Netflix Dominates Golden Globes 2026: Seven Awards for Adolescence and KPop Demon Hunters [2026]

![Spotify Price Hike 2025: What You Need to Know [Analysis]](https://tryrunable.com/blog/spotify-price-hike-2025-what-you-need-to-know-analysis/image-1-1768505828507.jpg)