Nintendo Switch 2 Price Hike Coming in 2026: What You Need to Know

It's the question keeping Nintendo fans up at night: how much more will the Switch 2 cost? And when?

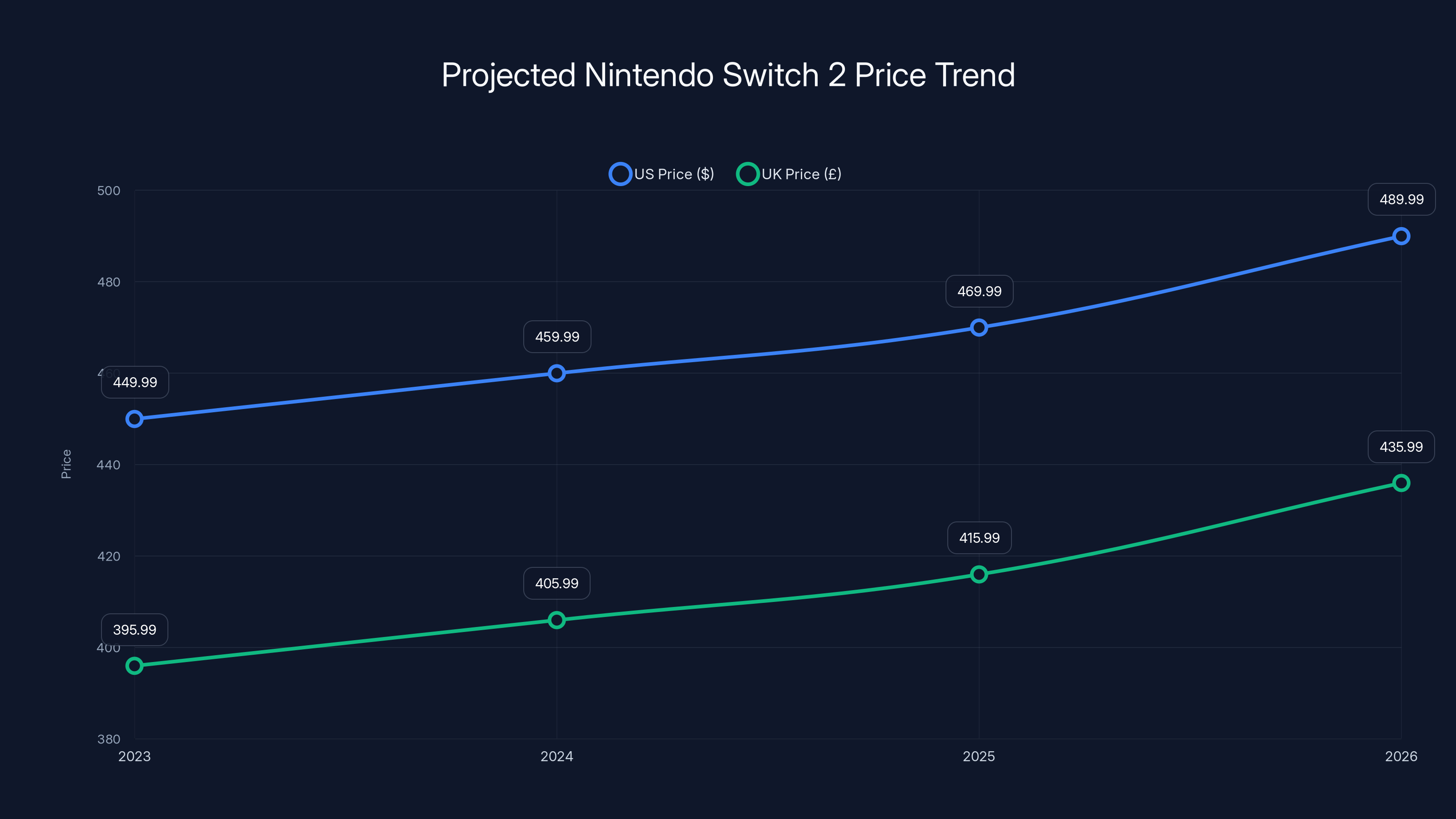

Market research firm Niko Partners just dropped a pretty significant prediction, and it's not exactly the news console enthusiasts want to hear. According to their latest report on major gaming trends heading into 2026, the Nintendo Switch 2 will likely see a "global price hike" sometime this year. The console currently sits at a comfortable $449.99 in the US and £395.99 in the UK, but don't get too attached to those numbers.

Now, here's the thing: Nintendo's been remarkably disciplined about keeping Switch 2 pricing stable despite massive cost pressures hitting the entire industry. But discipline has limits, and those limits are looking pretty close right now.

The culprits are familiar ones. Tariffs are squeezing margins. RAM prices are climbing faster than a Zelda speedrunner. Manufacturing costs across the board are ticking up. Add in broader macroeconomic headwinds, and you've got a perfect storm pushing console makers toward the inevitable: price increases.

The timing is particularly interesting. Play Station 5 and Xbox Series X/S both raised prices last year, creating a weird opportunity window where the Switch 2 actually looks like the smart buy on value. But that window is probably closing. Understanding what's coming, why it's coming, and what your options are right now is probably worth 15 minutes of your time.

Let me walk you through everything Niko Partners is predicting, what's actually driving these price pressures, and whether now really is the best time to lock in a Switch 2 at current pricing.

TL; DR

- Price hike expected in 2026: Niko Partners predicts Nintendo Switch 2 will see a global price increase due to rising manufacturing costs

- Current pricing is competitive: At $449.99 / £395.99, Switch 2 undercuts PS5 and Xbox Series consoles, but that advantage won't last

- Three cost drivers: Tariffs, RAM shortages, and broader macroeconomic conditions are squeezing Nintendo's margins

- Nintendo held strong in 2025: Despite cost pressures, Nintendo maintained Switch 2's launch price throughout 2025

- Buy now strategy: Purchasing before the price hike makes financial sense if you're considering a Switch 2 anyway

The Nintendo Switch 2 is projected to experience a price increase by 2026, with estimated prices reaching approximately $489.99 in the US and £435.99 in the UK. Estimated data based on market trends.

The Niko Partners Prediction: Breaking Down What's Coming

Niko Partners isn't some fringe analyst throwing darts at a board. They're a legitimate gaming market research firm that tracks hardware trends, consumer behavior, and industry economics across the gaming landscape. When they publish their annual "ten trends to watch," people in the industry actually pay attention.

Their prediction is pretty clear: the Nintendo Switch 2 "will see a global price hike" in 2026. This isn't speculation about whether a price increase might happen. This is a prediction that it will happen, across the board, globally. Not just in one region. Not just for one SKU. Globally.

What makes this prediction worth taking seriously is the reasoning behind it. Niko Partners isn't pulling this out of thin air. They're basing it on real, quantifiable cost pressures that are actually hitting Nintendo's supply chain right now.

The interesting part? Nintendo has been actively choosing not to raise prices. The company kept the Switch 2 at $449.99 throughout 2025 despite tariffs kicking in and component costs rising. That's discipline. That's Nintendo essentially absorbing costs rather than passing them to consumers. But that strategy has an expiration date.

Niko Partners suggests that while Nintendo could simply discontinue the base

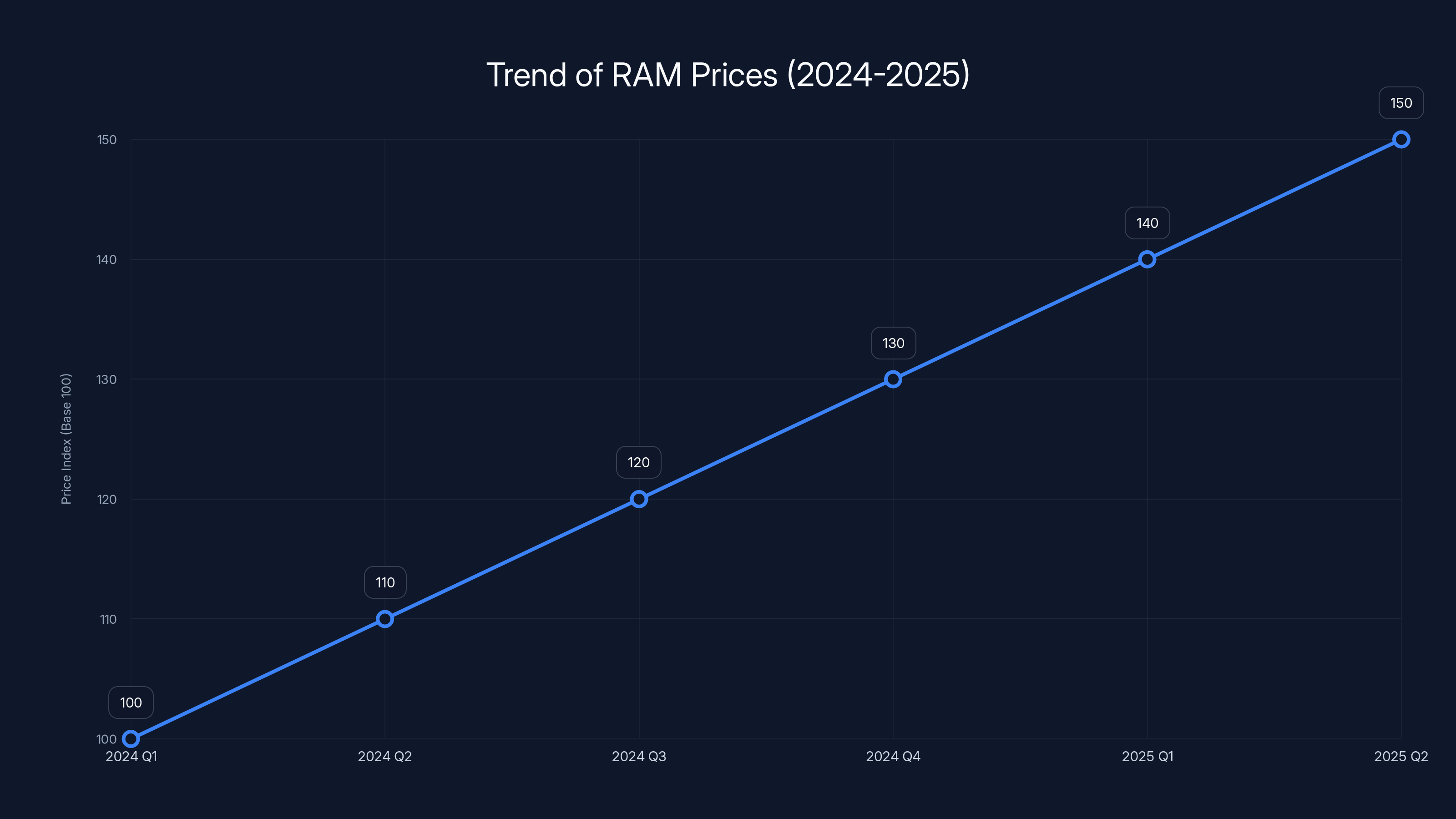

RAM prices have been steadily increasing from 2024 into 2025, driven by supply constraints and increased demand. Estimated data based on market trends.

Why Tariffs Are the Real Problem

If you've been paying attention to tech pricing over the last year or so, you've heard the word "tariffs" approximately six thousand times. Most of us tune it out. It's one of those macro policy things that supposedly affects prices but feels abstract and distant.

Except it's not abstract. It's hitting you in the wallet right now, and it's about to hit harder.

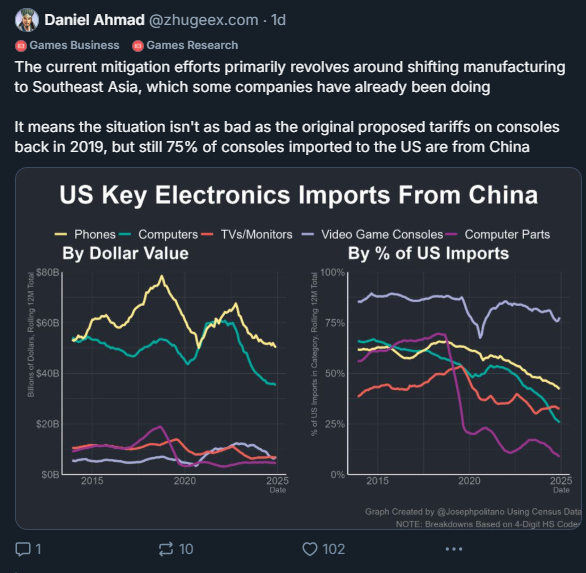

Here's the actual mechanism: the US imposed new tariffs on imports from China, Vietnam, and other countries where gaming hardware gets manufactured. These tariffs apply to Nintendo Switch units and components. What that means in practice is that it costs more to get products from the factory to store shelves in North America. Someone has to absorb that cost. Either Nintendo does, or consumers do.

Nintendo chose to absorb it in 2025. They took the tariff hit and kept prices flat. That was noble. That was also not sustainable.

The tariff situation isn't getting better. If anything, there's a decent chance it gets worse depending on how various trade negotiations play out. Nintendo can't absorb escalating tariff costs forever. At some point, you have to pass those costs along.

This is different from other market pressures because it's essentially a government-imposed cost that Nintendo has zero control over. They can't negotiate their way out of tariffs. They can't suddenly manufacture more efficiently to offset them. They just have to deal with them.

Console manufacturers in other sectors know this pain intimately. Everyone from smartphone makers to laptop manufacturers has been dealing with tariff uncertainty for years now. Nintendo got to stay relatively insulated for a while. That window is closing.

The RAM Shortage Factor

Random access memory (RAM) shortages sound like a technical problem. In reality, they're an economic problem that's directly impacting your wallet.

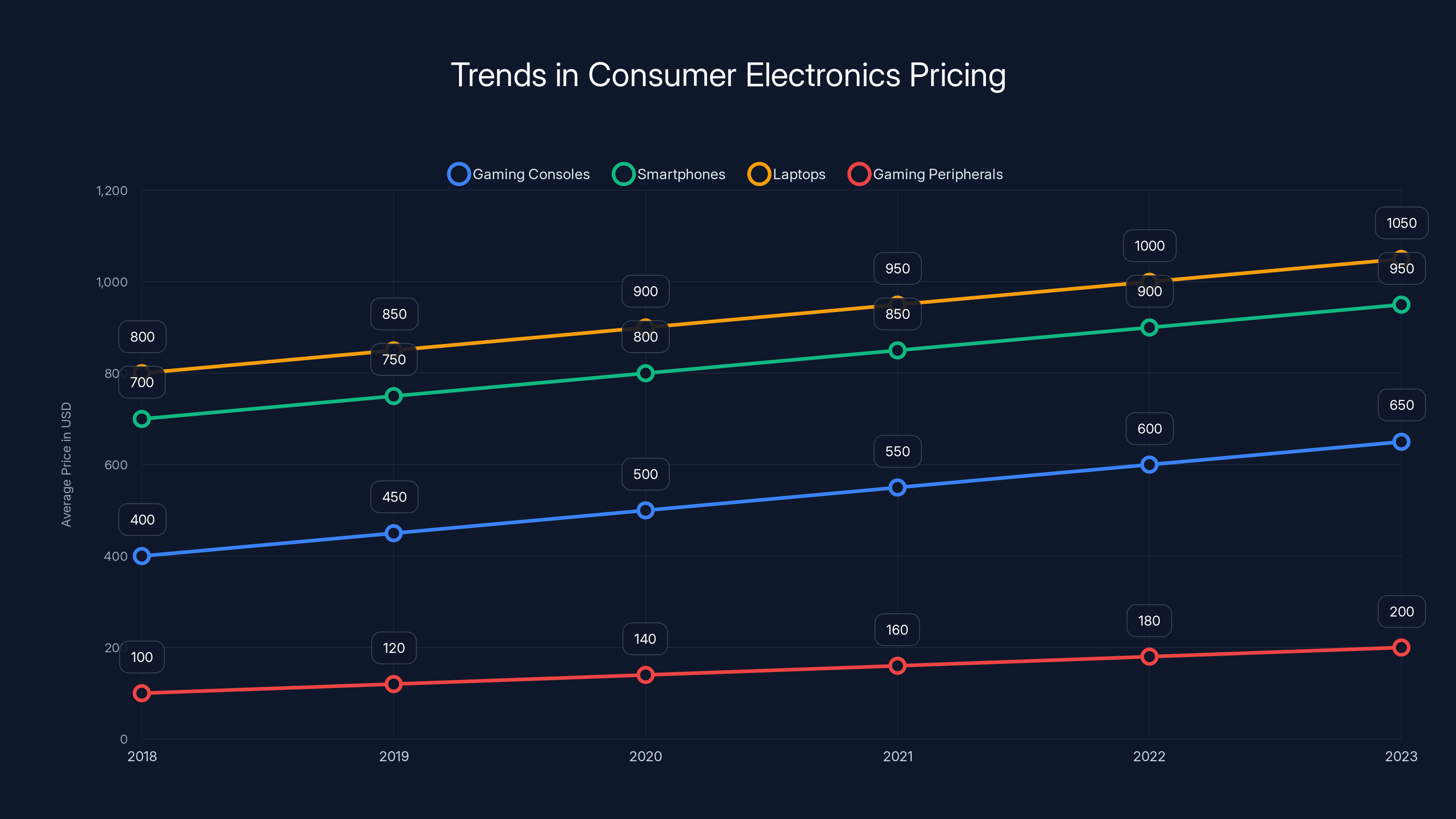

Here's what's happening: RAM prices have been trending upward throughout 2024 and into 2025. This isn't accidental market chaos. The NAND and DRAM markets are concentrated. A handful of companies control most of the global production capacity. When those companies restrict supply or prioritize higher-margin applications, prices go up for everyone else.

Nintendo's not just buying RAM for Switch 2 units. They're buying it in massive quantities. The Switch 2 requires memory to function. The handheld screen needs it. The docking station's internals need it. The controllers need it. All of that RAM costs money, and that money is getting more expensive.

Nintendo's president actually acknowledged this in recent earnings calls, noting that increasing RAM costs are "something we must monitor closely." Translation: we're watching our component costs and they're trending the wrong direction.

The RAM shortage isn't a binary thing where supply suddenly drops to zero. It's a gradual tightening that creates price pressure. Manufacturers with guaranteed long-term contracts get better rates. Spot market purchases get expensive. Nintendo has long-term contracts, sure, but those contracts renew. When they do, prices will be higher.

This isn't unique to Nintendo. Every console manufacturer, every PC builder, every device maker dealing with RAM-dependent hardware is facing this. But Nintendo faces a specific challenge: they're operating at massive scale with the Switch 2. Every $1 increase in component costs across millions of units adds up to hundreds of millions of dollars in gross margin pressure.

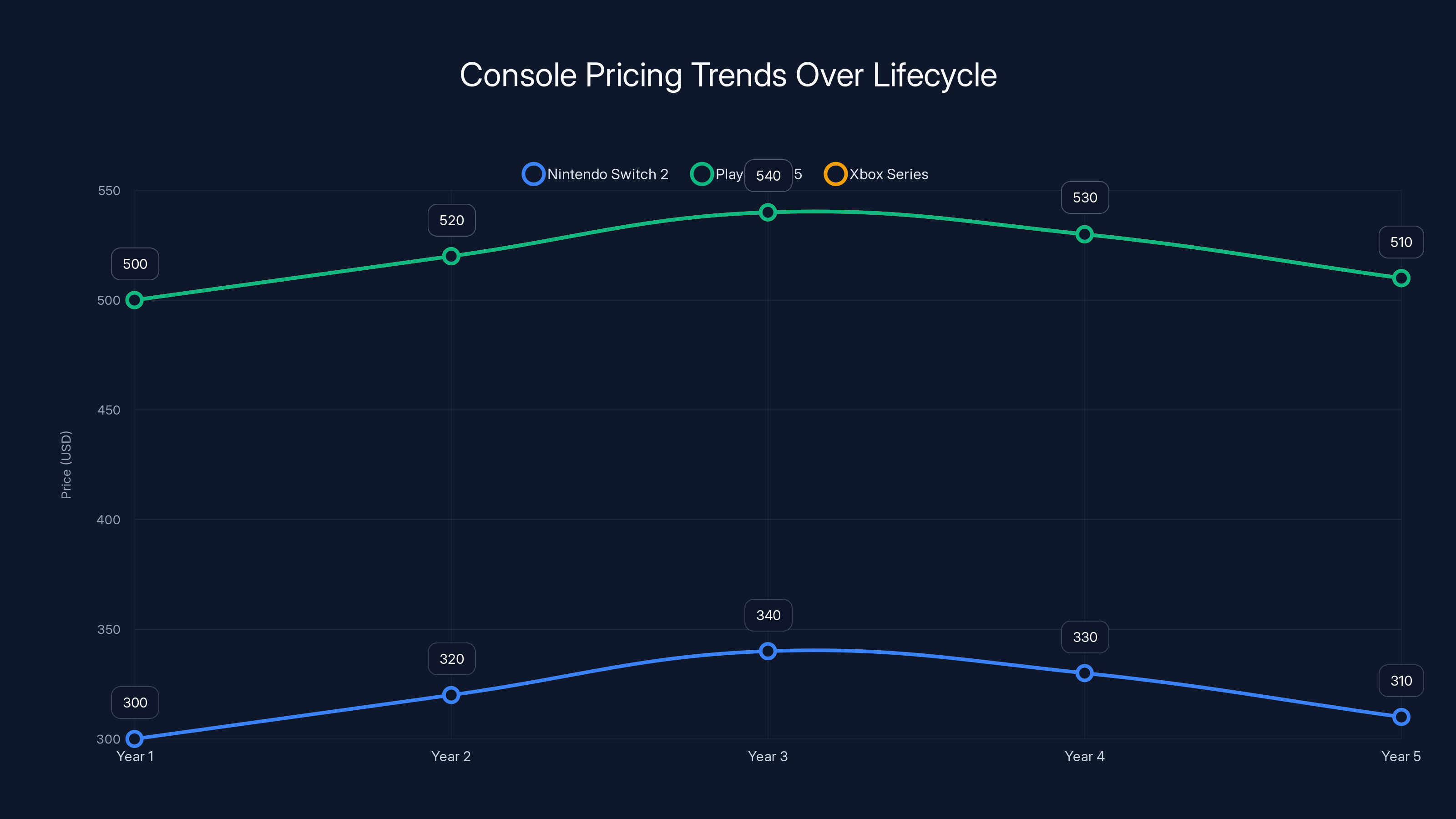

Estimated data shows that console prices peak around Year 3, capturing premium pricing before market maturation leads to price reductions.

The Macroeconomic Context

Beyond tariffs and component costs, there's a broader economic backdrop that matters. Global inflation, manufacturing costs, logistics, and consumer spending patterns are all shifting.

Niko Partners mentions "broader macroeconomic conditions" as a contributing factor, which is analyst-speak for "everything's getting more expensive and consumers have less discretionary income." That might sound like a reason Nintendo should lower prices, not raise them. But it's actually the opposite.

When consumers have less money to spend, console makers need to maintain (or improve) margins because they're selling fewer units. You can't sustain operations on volume alone anymore. You need better per-unit economics.

Also, the console market itself is shifting. The Switch 2 is selling incredibly well, but growth is moderating. Nintendo needs to transition from explosive growth phase to mature profitability phase. Price increases are part of that transition. You move from "sell as many as possible" to "sell at the most profitable price point."

This economic context also explains why Play Station 5 and Xbox Series raised prices. They weren't doing it because they were desperate. They were doing it because the window for premium device pricing is actually shorter than people think. You have maybe 3-4 years into a console's lifecycle to establish premium pricing. After that, the market matures, supply increases, and prices trend down. Sony and Microsoft realized they needed to capture margin during the premium pricing window. Nintendo will do the same.

Why the Switch 2 Is Still Underpriced Right Now

Here's a fact that might surprise you: at $449.99, the Nintendo Switch 2 is actually a better value than the Play Station 5 or Xbox Series X, even today.

The PS5 currently costs

But here's the thing: the Switch 2 is a newer product. It launched more recently. From a pure hardware capability standpoint, it's competitive with last-generation consoles but not current ones. The PS5 and Xbox Series X are more powerful. They have larger game libraries. They have different exclusives.

Yet despite being newer and technically less powerful, the Switch 2 is cheaper. Why? Because Nintendo has maintained aggressive pricing to drive adoption. They wanted to maximize install base. They wanted to make the Switch 2 the obvious choice for console buyers. And they wanted to protect against competitors who might try to price-undercut them.

But that strategy only works for so long. Once you've captured sufficient market share, you start optimizing for margin instead of volume. That's where Nintendo is headed.

Niko Partners specifically highlights this dynamic. They note that Switch 2's competitive pricing advantage over PS5 and Xbox is "unlikely to last." That's analyst-speak for "Nintendo's about to raise prices." The current window where you can get a Switch 2 for less than a Play Station 5 is probably closing in 2026.

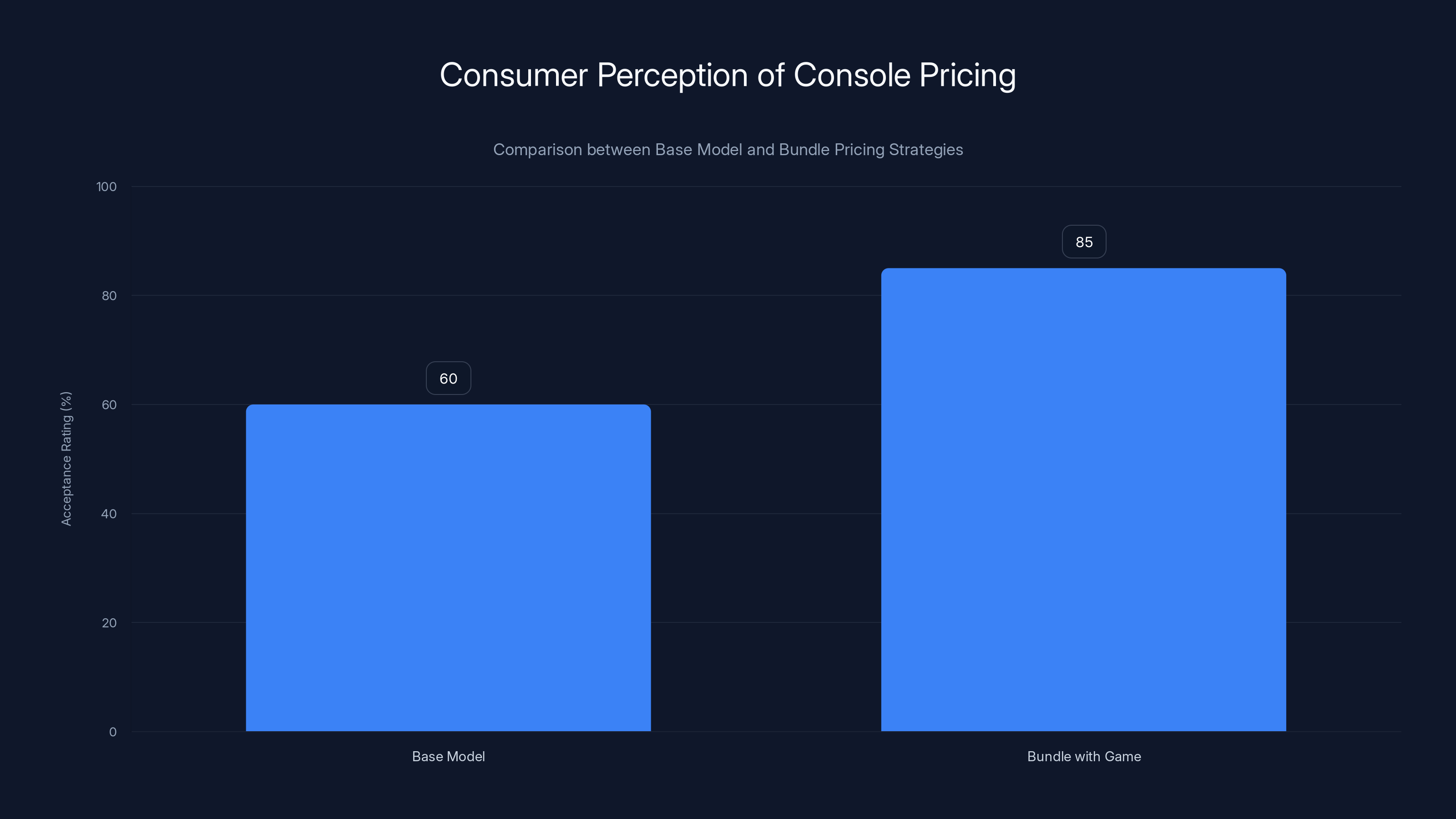

Estimated data shows that consumers are more likely to accept a $499.99 price for a console bundled with a game (85% acceptance) than for the console alone (60% acceptance). This highlights the psychological impact of bundling.

What Could Actually Happen: The Base Model Discontinuation Scenario

Niko Partners offers an interesting alternative to a straight price increase: Nintendo could simply discontinue the

This is actually a clever move from a marketing perspective. It's not a "price increase." Technically, you're buying a bundle. You're getting Mario Kart 9 included. The value narrative is different. Consumers might accept

In practice, though, it's the same thing. You're paying more. You're getting Mario Kart whether you want it or not. But the psychological framing is different, and psychology matters in consumer electronics pricing.

The bundle approach also has another advantage: it solves inventory management. Retailers have a cleaner SKU lineup. Nintendo doesn't have to maintain multiple price points. Marketing becomes simpler. Margins become more predictable.

Historically, Nintendo has used bundling as a pricing mechanism. The original Switch had various bundle configurations at different price points. Bundles move the conversation away from "what does the hardware cost" to "what does this package offer." It's a subtle but effective psychological shift.

Will Nintendo actually do this? Probably depends on how quickly they need to address margin pressure. If costs escalate slowly, they might do a straight price increase. If they need margin relief faster, bundling could be the move.

The Timing Question: When Will Prices Actually Rise?

Niko Partners says 2026, but what does that mean exactly? January? Q1? Q4? There's a big difference between "January 1st" and "December 31st" when you're trying to time your purchase.

Usually, console price increases happen at specific trigger points. Back-to-school season (August/September). Holiday season prep (October). Spring refresh periods (March/April). Nintendo tends to time significant pricing or product announcements around Direct presentations or earnings calls.

If I had to guess—and this is speculation, not prediction—I'd expect a mid-year announcement, probably around March or April 2026. That gives Nintendo time to let early-year data inform the decision. It also lets them announce the increase, give retailers time to adjust, and implement it before summer seasonality hits.

But here's the thing: you don't need to be precisely right about timing to make a smart purchase decision. If you think prices are going up sometime in 2026, and you want a Switch 2 anyway, buying now makes sense. Even if the increase doesn't happen until November, you've locked in current pricing by purchasing today.

The only scenario where waiting makes sense is if you think the increase will be minor (like

Consumer electronics prices have steadily increased across various categories, reflecting broader market trends. Estimated data based on industry observations.

How This Compares to Previous Console Cycle Pricing Patterns

Is a price increase in year two of a console's lifecycle unusual? Not really. Let's look at history.

The original Switch launched at $299.99 in March 2017. By 2018, Nintendo had already released variants (the Switch Lite, for example) and was considering pricing adjustments. Within three years, you had multiple SKUs at different price points.

The Play Station 4 launched at $399.99 in 2013. Sony never raised the base PS4 price. But they did introduce higher-SKU variants (Pro, for example). The PS4 generation ran longer than expected, which dampened pricing pressure.

The Xbox One launched at $499.99 in 2013 (notably more expensive than PS4). Microsoft quickly dropped prices to match Sony and maintain competitiveness. Then they released variants and higher-end models.

The pattern is clear: console price dynamics are complex. Straight price increases are less common than SKU expansion or variant introduction. But they do happen. And when they do, it's usually driven by manufacturing cost pressures or margin optimization.

What's different this time is the global nature of the prediction. Niko Partners isn't predicting a US-only increase or a region-specific adjustment. They're predicting a global, coordinated price increase. That's rarer. That signals serious underlying cost pressure that can't be contained to one region.

When you see global price increases, it's usually because costs are global. Tariffs affect all regions. RAM prices affect all regions. Logistics and supply chain costs affect all regions. Nintendo has to address the problem everywhere simultaneously.

The Current Buyer's Advantage: Why Now Might Actually Be the Time

Let's be direct: if you've been on the fence about buying a Switch 2, this prediction is a pretty strong signal to stop procrastinating.

Here's the math: let's say the price goes from

Now, you might argue that $50 isn't worth rushing to buy something you're not entirely sure you want. Fair point. But if you've already decided you want a Switch 2, and you're just procrastinating on the purchase, this is actually useful information.

There's another angle: used market dynamics. Once prices increase, trade-in values and used Switch 2 prices might actually go up (or stay higher than they would have otherwise). If you buy new now and decide later you want to sell, you're not necessarily better off. But if you buy used after a price increase, you might pay slightly more.

The real advantage is for committed buyers. If you're planning to own a Switch 2 for multiple years, you want to lock in the lowest possible price point now. The longer you wait, the less likely you are to get current pricing.

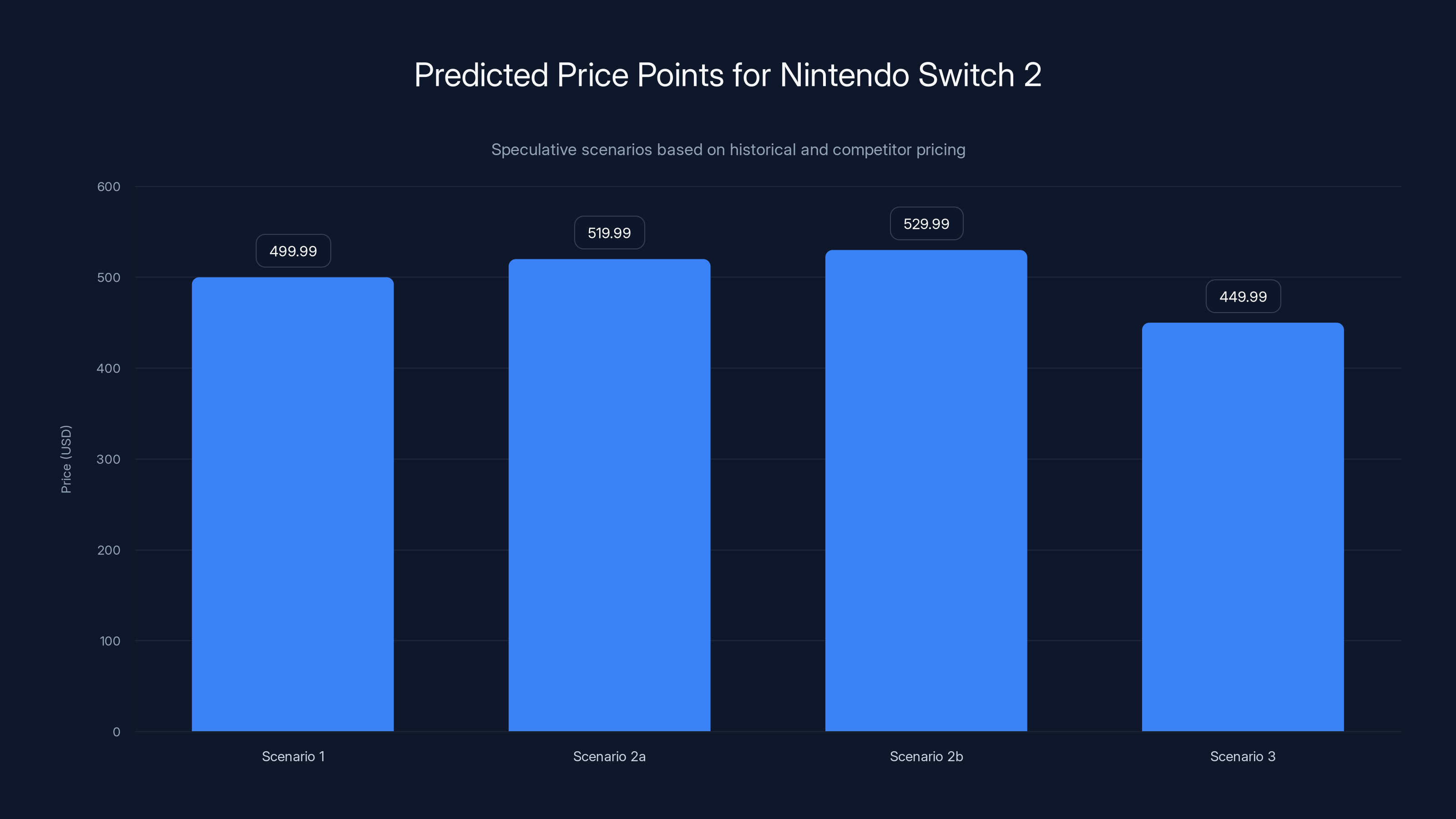

Estimated data suggests Scenario 1 ($499.99) is most likely, aligning with competitor pricing and historical patterns.

What Gamers Should Actually Do Right Now

Okay, so you've read all this. What's the actionable takeaway? What should you actually do?

First, if you want a Switch 2 and you were considering buying one, buy it now. Don't wait. The prediction of a 2026 price increase is credible enough that locked-in current pricing is valuable.

Second, if you're not sure whether you want a Switch 2, use this as a decision point. Does the current library of games excite you? Are there upcoming exclusives you're interested in? If yes, buy now. If you're lukewarm, wait until the price increase actually happens and then decide if the higher price point changes your calculus.

Third, if you're a hardcore Nintendo fan with disposable income, consider whether multiple Switch 2 units make sense. If you have family members who might want one, this is the time to coordinate purchases before prices rise. You can save $50 per unit across multiple purchases.

Fourth, if you're price-sensitive and Nintendo raising prices would genuinely push you out of the market, start looking at alternatives now. Maybe a Play Station 5 at

Fifth, if you were considering selling a Switch 2 later and buying something else, the timing math might have just changed. If you're thinking about a resale a year or two out, current used prices will probably stay relatively stable even as new prices rise. That's actually good news for your resale value.

Beyond Nintendo: How This Reflects Broader Hardware Pricing Trends

The Switch 2 price increase prediction isn't happening in a vacuum. It's part of a much broader trend in consumer electronics pricing.

Console prices have been rising for years. The PS5 Pro costs

What's driving all of this? Roughly the same factors affecting Nintendo: component costs, tariffs, supply chain complexity, and margin optimization.

We're seeing this across industries. Smartphones haven't gotten cheaper. Laptops have gotten more expensive. Even gaming peripherals—monitors, headsets, controllers—have trended upward in pricing over the last few years.

This suggests we're in a phase where consumer electronics are getting more expensive across the board. The days of steady-as-she-goes pricing are over. Expect adjustments. Expect volatility. Expect price increases to become more common.

Nintendo raising Switch 2 prices isn't a warning sign that Nintendo's in trouble. It's a signal that the entire industry is shifting toward higher price points and margin-focused rather than volume-focused strategies. That's actually a sign of a mature market, not a troubled one.

What If You're Already a Switch 2 Owner?

If you already bought a Switch 2, this doesn't directly affect you unless you're planning to buy another one or you were hoping to sell it eventually.

For existing owners: your device's value might actually go up if supply becomes constrained after the price increase. If Nintendo is selling fewer units at higher prices, and people want to switch from old hardware, used market demand could push prices up. Not guaranteed, but possible.

For potential second-device buyers (let's say you want a Switch 2 for a family member): this makes a strong case to buy now at current pricing rather than waiting.

For trade-in scenarios: if you were considering trading your current console for credit toward a Switch 2, know that trade-in values are usually locked into current hardware pricing. Once the Switch 2 price increases, trade-in offers might increase too, but that's not guaranteed. Best to figure out your trade-in situation before any increase hits.

The Nintendo Response: Why They're Holding Strong Until They Can't

Why hasn't Nintendo already raised prices if costs are so high? That's a fair question.

Probably because Nintendo is playing a different game than competitors. Nintendo cares about install base. They want as many people as possible to own a Switch 2. That drives software sales, digital store revenue, and online subscription revenue. The margin on the hardware itself is almost secondary.

When you optimize for install base instead of hardware margin, you keep prices competitive and stable. You absorb cost pressures because you're making your money elsewhere.

But that strategy works best when you're trying to capture market share. Once you've captured it—and the Switch 2 is selling incredibly well—you can shift to margin optimization. That's probably where we are now. Nintendo's captured the market. Now they're optimizing for profitability.

Nintendo's actual statement about this (from their president) is interesting. They said the increasing RAM costs are "something we must monitor closely" but there's no "immediate impact on earnings" from the Switch 2. Translation: we see it coming, we're not panicking yet, but we're watching it closely.

That's a company that knows a price increase is probably coming but hasn't decided exactly when to pull the trigger. Once they finalize component contracts for next year, or once tariff situations clarify, they'll probably announce. Until then, they're holding steady.

Predicting the Actual Price Point: What We Might See

Let's speculate a bit on what the new price might actually be. I'm not predicting this with high confidence, but we can make educated guesses based on history and competitor pricing.

Scenario 1: Conservative increase to $499.99. This gets Nintendo to parity with PS5 and Xbox Series X. Simple, clean, easy to market. Most likely scenario based on historical patterns.

Scenario 2: Aggressive increase to

Scenario 3: Bundle-based pricing where the base

My gut says Scenario 1 ($499.99) is most likely. It's clean, it's defensible to consumers, it gets Nintendo to strategic pricing parity with competitors, and it doesn't alienate the market. But watch what competitors do in 2026. If console makers are coordinating (informally or otherwise), they might move at the same time to avoid undercutting each other.

The Bottom Line: Lock In Current Pricing

Niko Partners' prediction isn't earth-shattering. The analysis is fairly straightforward: costs are up, and companies eventually pass those costs to consumers. It's economics 101.

But the clarity of the prediction is useful. It's not "prices might go up someday." It's "prices will go up in 2026." That's specific enough to act on.

If you want a Switch 2, buy one now. If you were on the fence, this is a reasonable data point to tip the decision toward purchasing sooner rather than later. If you were planning to buy one in 2026, consider moving that purchase to now and locking in current pricing.

The financial impact is real but not catastrophic. We're probably talking about a

Nintendo's been remarkably disciplined about keeping Switch 2 prices stable in a hostile cost environment. That discipline is commendable. But it can't last forever. Take advantage of it while it does.

FAQ

What is the Nintendo Switch 2 price hike prediction?

Market research firm Niko Partners has predicted that Nintendo Switch 2 will see a global price increase in 2026. The console currently costs $449.99 in the US and £395.99 in the UK, but this prediction suggests those prices won't hold much longer due to rising manufacturing costs, tariffs, and component shortages.

Why is Nintendo planning a price increase for the Switch 2?

Three major factors are driving the predicted price increase: US tariffs on imports from manufacturing-heavy regions like China, rising RAM component costs industry-wide, and broader macroeconomic pressures on manufacturing and logistics. Nintendo held prices stable throughout 2025 despite these pressures, but that strategy is becoming unsustainable as costs continue climbing.

How much will the Nintendo Switch 2 price increase by?

Niko Partners hasn't specified an exact amount, but based on competitor pricing and historical patterns, the increase is likely to be

When exactly will the Nintendo Switch 2 price increase happen?

Niko Partners predicts the increase will occur sometime in 2026, but they haven't specified a month. Based on typical console pricing announcement patterns, expect an announcement in Q1 or Q2 2026, with actual implementation following shortly after. Nintendo typically times price announcements around earnings calls or Direct presentations.

Should I buy a Nintendo Switch 2 now before the price increase?

If you're already considering a Switch 2 purchase and you're confident you want one, buying now makes financial sense. Locking in current

How does the Nintendo Switch 2 price compare to Play Station 5 and Xbox Series consoles?

Currently, the Switch 2 at

Could Nintendo avoid raising prices through other strategies?

Yes. Nintendo could discontinue the base

What does this price increase mean for the used Nintendo Switch 2 market?

Once new Switch 2 prices increase, used market prices typically increase or hold steady rather than declining further. Trade-in values will likely improve for existing owners. If you're planning to sell a Switch 2 later, the downstream impact of higher new prices could actually benefit you.

Are other gaming consoles and hardware facing similar price increases?

Yes. The industry-wide trend toward higher consumer electronics prices is driven by the same factors affecting Nintendo: tariffs, component shortages, and supply chain complexity. Play Station 5 already increased prices in 2024. Other gaming hardware makers are likely following similar pricing strategies.

What are the best alternatives if the Switch 2 price increase makes it unaffordable?

If the higher Switch 2 price puts it outside your budget, alternatives include purchasing a Play Station 5 at similar pricing, an Xbox Series console (sometimes available at discount), or waiting for used Switch 2 units to become more widely available as current owners upgrade. Handheld gaming devices from other manufacturers offer different experiences at various price points.

The prediction from Niko Partners isn't a surprise twist in an industry thriller. It's a straightforward consequence of economic forces playing out as they should. Costs go up, prices follow. It's happened before, it's happening now, and it'll happen again.

What matters is that you know it's coming and you can act accordingly. The window for current Switch 2 pricing is closing. It's not slammed shut yet, but the hinges are moving. If you want in at $449.99, now's actually the time to stop thinking about it and start buying.

The console wars have never been about the hardware alone. They're about the ecosystem, the games, the community, the value proposition. For Nintendo, that value proposition is currently unmatched at the current price point. Once prices increase, that calculus changes. Everything shifts. Better to lock in current pricing before that shift happens.

Don't overthink it. Don't wait for perfect timing. If you want a Switch 2 and you're worried about prices going up—and you should be, based on credible analyst prediction—just buy the thing. Future you will thank you.

Key Takeaways

- Niko Partners predicts Nintendo Switch 2 will see a global price increase in 2026 due to tariffs, RAM shortages, and macroeconomic pressures

- Current 50, but this competitive advantage won't survive into 2026

- Nintendo maintained stable pricing throughout 2025 despite cost pressures, suggesting they're absorbing losses and will eventually pass costs to consumers

- Smart buyers should purchase Switch 2 now at current pricing to lock in savings before predicted price increase

- Price increase likely to be 75, bringing Switch 2 to519.99, or Nintendo could discontinue base model and push consumers toward $499.99 bundle

Related Articles

- Google Stadia's Final Death: How Developers Rescued the Bluetooth Controller [2025]

- Samsung P9 microSD Express Card for Switch 2: Complete Storage Guide [2025]

- Sony Marathon DualSense & Pulse Elite: Limited Edition PS5 Gear [2025]

- Seagate FireCuda 530R PS5 SSD Review: Performance vs. Price [2025]

- Hori Adventure Pack Nintendo Switch 2 Review [2025]

- 9 Hidden Nintendo Switch 2 Features That Save Money & Last Longer [2025]

![Nintendo Switch 2 Price Hike Coming in 2026: What You Need to Know [2025]](https://tryrunable.com/blog/nintendo-switch-2-price-hike-coming-in-2026-what-you-need-to/image-1-1768997535535.jpg)