Nintendo Switch 2 Sales: The Regional Divide That Nobody Expected

When Nintendo launched the Switch 2, everyone thought the script was written. A successful first console meant a successful successor, right? Well, not quite.

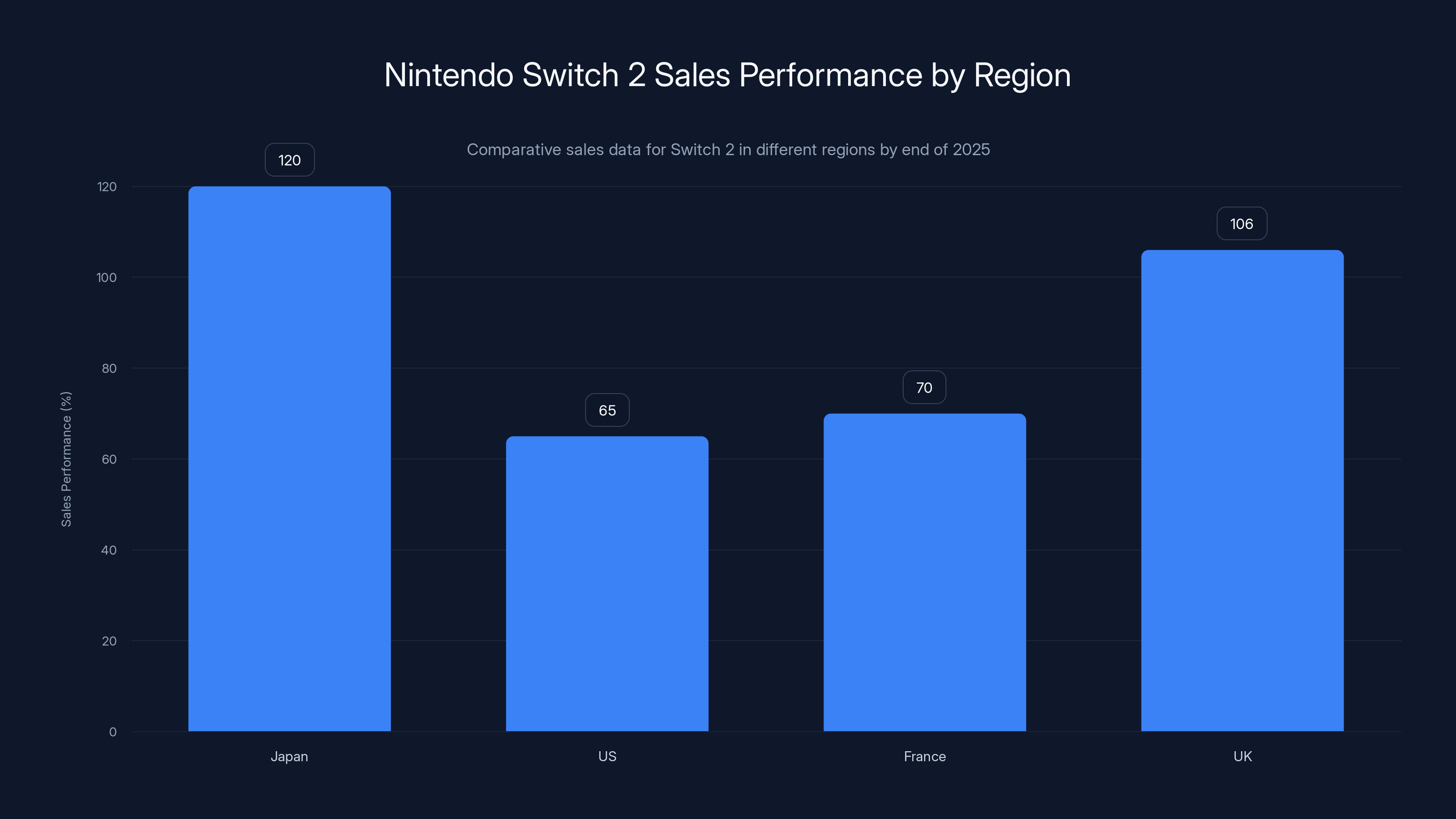

In late 2025, Nintendo president Shuntaro Furukawa dropped a bombshell during shareholder meetings: Western hardware sales for the Switch 2 were "slightly weaker than our expectations." Meanwhile, Japan? Absolutely crushing it. Sales there "exceeded our expectations" by a significant margin, as reported by The Game Business.

This isn't just a footnote in Nintendo's financial report. It's a wake-up call about global gaming markets, regional preferences, and the reality of hardware launches in 2025. The gaming industry has always been regional, sure, but this split is stark enough to demand serious examination.

Here's what happened, why it matters, and what it reveals about the future of console gaming.

TL; DR

- Switch 2 Japan sales exceeded expectations while Western markets fell short of Nintendo's forecast by the end of 2025, according to IGN.

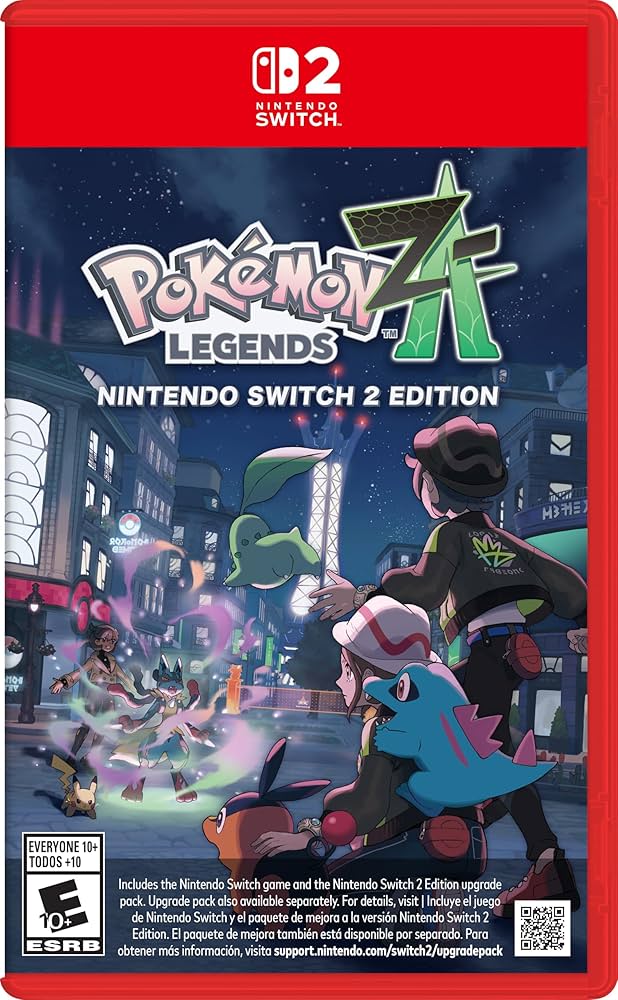

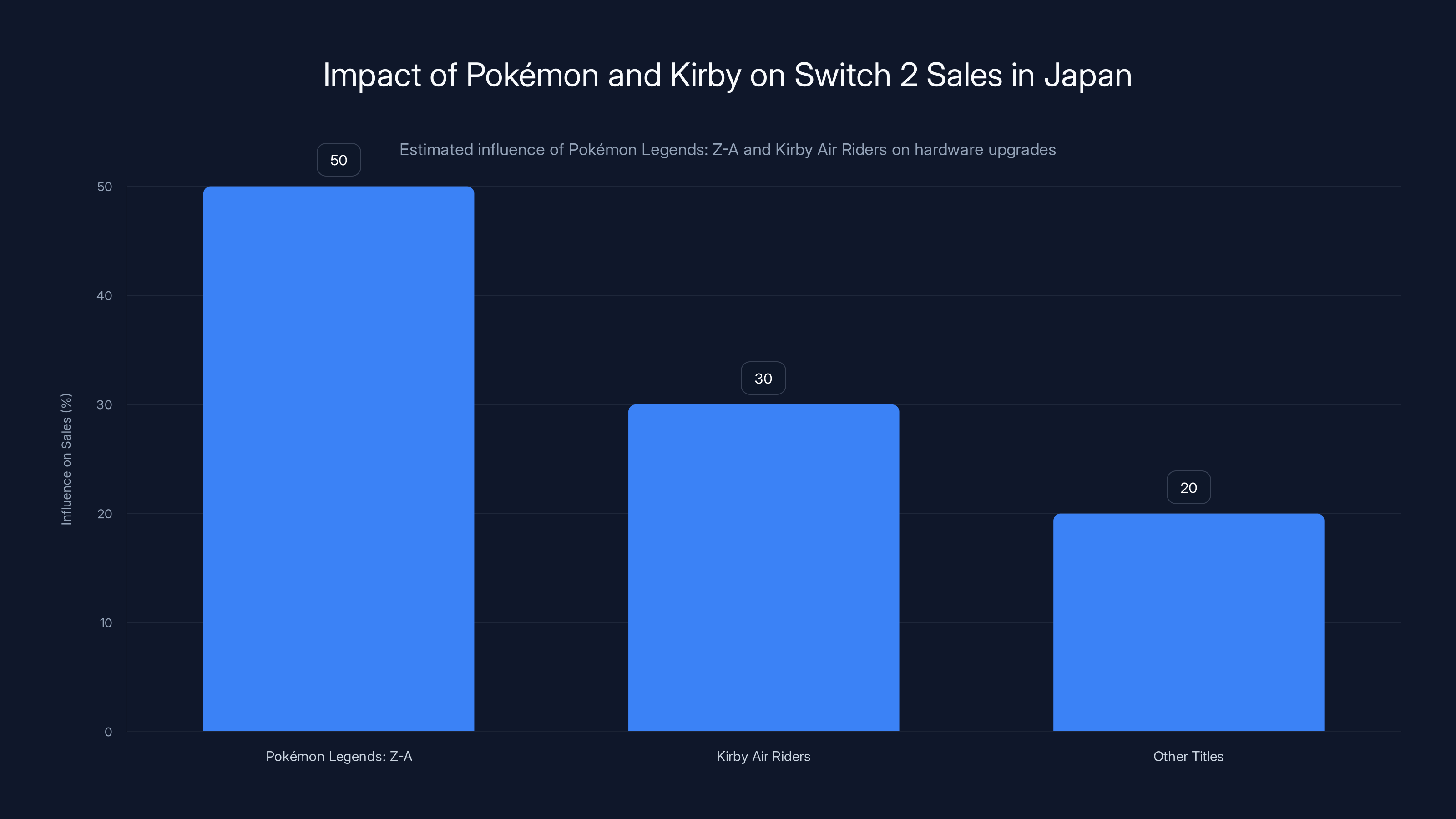

- Pokémon Legends: Z-A and Kirby Air Riders drove Japanese demand, but lacked equivalent Western impact, as noted by GameSpot.

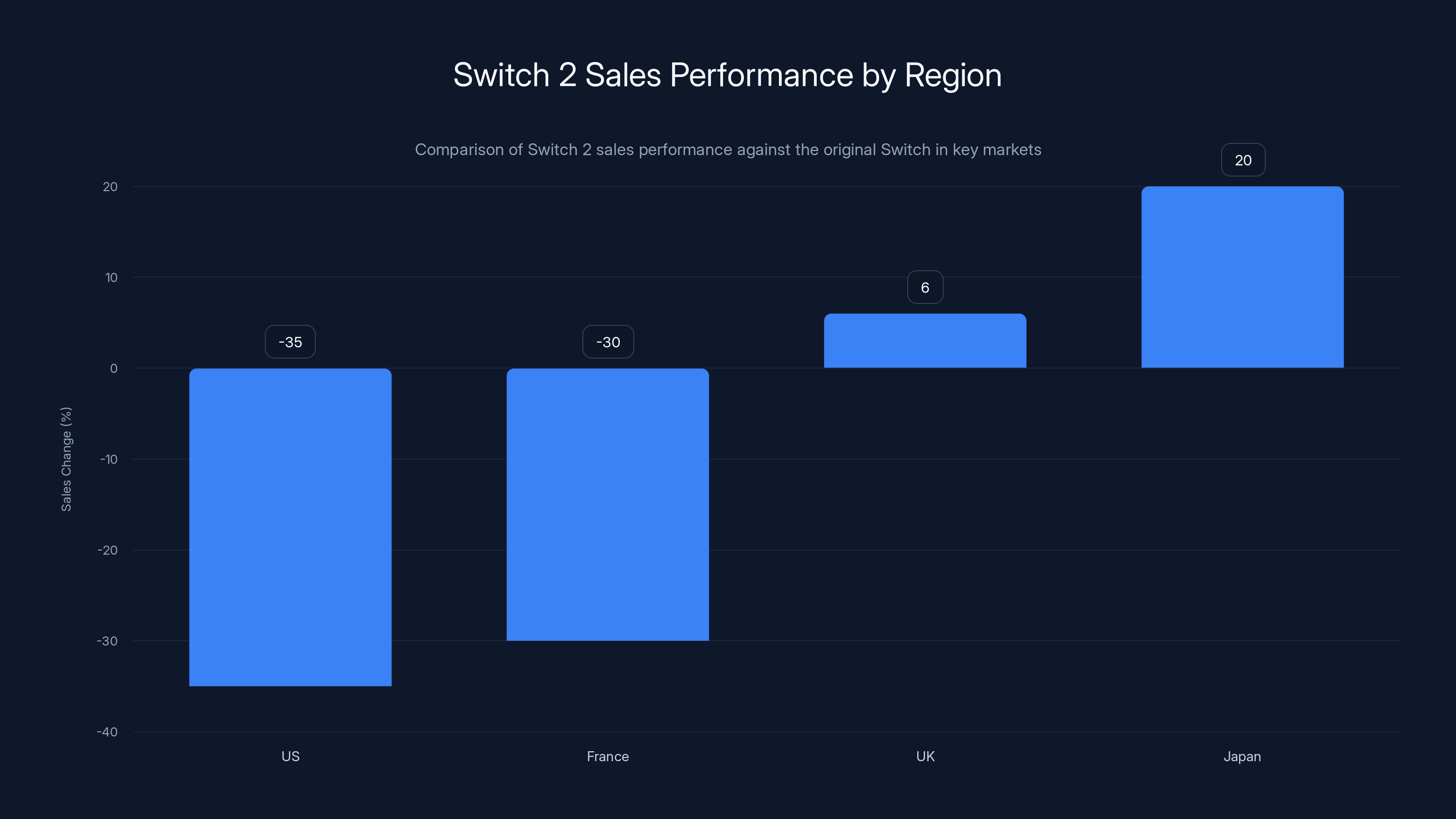

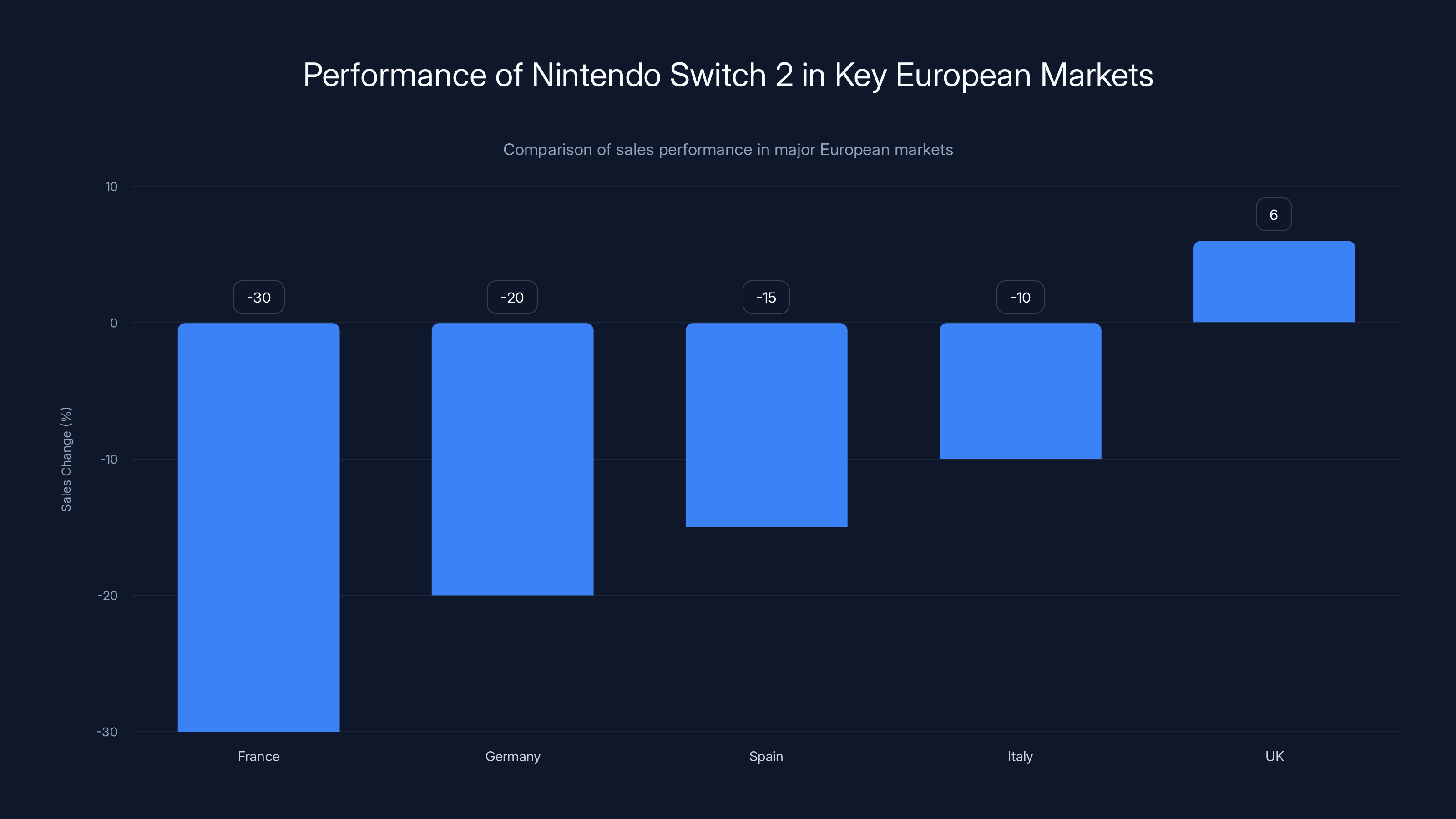

- US holiday sales dropped 35% compared to the original Switch launch, with France down over 30%, as reported by The Japan Times.

- UK only managed 6% growth, though benefiting from a longer comparison window, as detailed by VGChartz.

- "Absence of major Western games" during year-end proved critical; Metroid Prime 4 couldn't replicate Pokémon's pull, according to GoNintendo.

Japan saw a 50% increase in sales for the Switch 2 compared to the original Switch, while the US and France experienced declines of 35% and 30%, respectively. The UK had a modest 6% growth.

The Numbers Behind the Disappointment

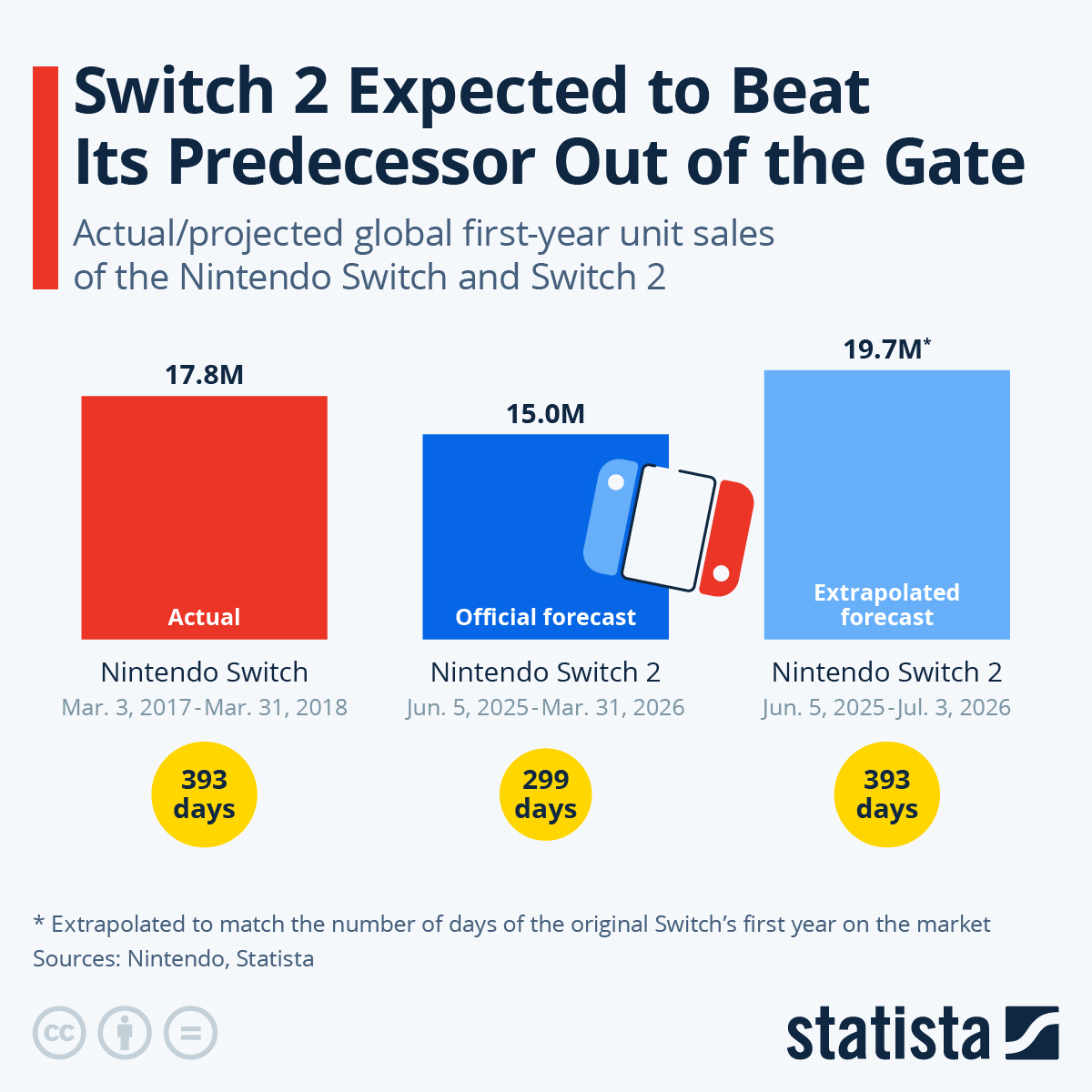

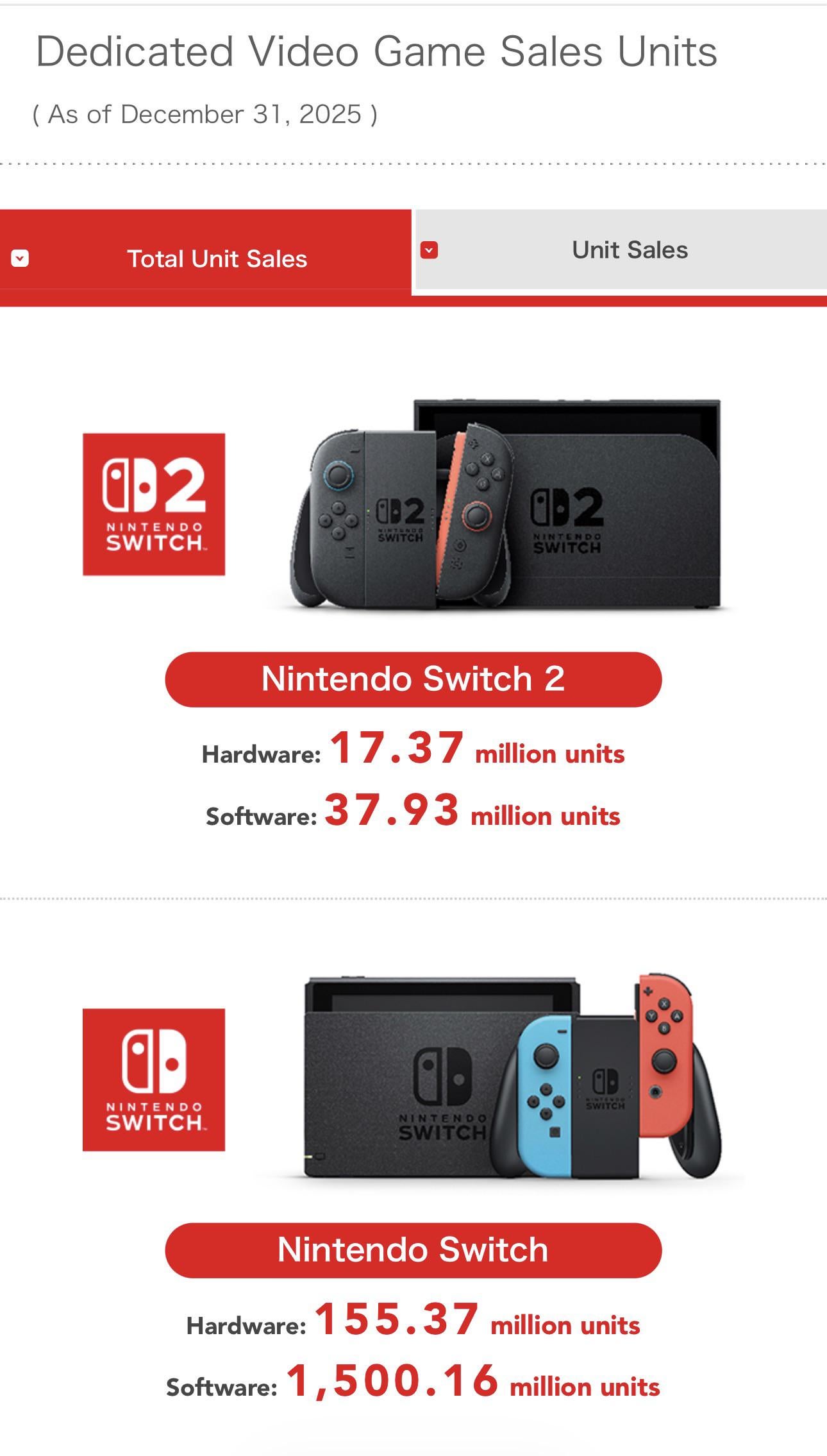

Let's start with the hard data, because numbers don't lie (even when they disappoint).

Nintendo didn't release exact sales figures, but third-party tracking revealed the scope of the problem. US Switch 2 sales during the crucial holiday period were down 35% compared to what the original Switch achieved during its launch window. Think about that for a second. The Switch was a phenomenon. The Switch 2 was supposed to build on that. Instead, Western markets pulled back significantly, as noted by The Game Business.

France took the biggest hit. Sales there dropped over 30% compared to the original Switch's first year. That's not a minor fluctuation. That's a market correction, as detailed by IGN.

The UK told a different story, barely. Switch 2 managed 6% growth compared to the original Switch's first year, but here's the catch: the original Switch was on sale for an extra 14 weeks during that comparison period. So UK's "growth" is actually smaller when you normalize for selling time, according to VGChartz.

The regional breakdown gets worse the more you dig. Individual markets across Europe showed the same downward trend. Some markets exceeded expectations (hello, Japan). Others faced what can only be called underperformance.

What's crucial to understand is that Nintendo wasn't wrong about global hardware sales volume. The forecasted global numbers remained unchanged. But the regional mix? That shifted dramatically. Japan picked up the slack that the West couldn't deliver, as reported by The Game Business.

The Switch 2 experienced a significant sales decline in the US and France, while Japan showed a positive growth trend. Estimated data for Japan.

Why Japan Dominated: The Pokémon and Kirby Effect

Japan's outperformance came down to one thing: franchises that actually matter in that market.

Pokémon Legends: Z-A Nintendo Switch 2 Edition and Kirby Air Riders launched during the holiday shopping season in Japan. Both are enormous franchises, but their reach differs drastically by region. In Japan? These are cultural institutions. Kids want them. Parents buy them. Existing Switch owners upgrade to Switch 2 to play them, as explained by GameSpot.

Furukawa explained this directly: "New titles such as Pokémon Legends: Z-A Nintendo Switch 2 Edition and Kirby Air Riders, released during the holiday shopping season, led to a relatively high trend of existing Switch owners switching to the Switch 2 compared to overseas."

That's the operative word: "existing." Pokémon and Kirby weren't attracting new players to the ecosystem. They were converting current Switch owners into Switch 2 owners. This upgrade cycle accelerated because Japanese gamers had a compelling reason to switch hardware immediately.

Pokémon, specifically, is an event franchise in Japan. New Pokémon releases drive hardware sales, console purchases, and ecosystem engagement in ways that Western publishers struggle to replicate. When you launch a major Pokémon title for a new console, you're not just releasing a game. You're creating a cultural moment, as noted by The Game Business.

Kirby Air Riders added to this momentum. It's a character-driven game in a franchise that dominates Nintendo's Japanese audience. The combination was potent: a major Pokémon title plus a beloved character-action game during peak holiday shopping.

Nintendo's domestic hardware sales beat expectations because these titles created immediate demand for Switch 2 hardware specifically. The company didn't just sell consoles. It created upgrade urgency.

The Western Problem: Where Were the Games?

The West faced a different reality: the absence of a major game launch that could drive hardware sales.

Metroid Prime 4: Beyond released in December 2025. On paper, that's a flagship. Metroid is a storied franchise with hardcore fans. The original Metroid Prime trilogy defined a generation of first-person action games.

But here's the uncomfortable truth: Metroid Prime 4 doesn't pull hardware the way Pokémon does. Dedicated fans? Absolutely. They want it. But casual buyers? People making gift-purchasing decisions for the holidays? Metroid didn't register with them the same way, as reported by GoNintendo.

Furukawa acknowledged this directly: "An unnamed senior Nintendo source blamed the 'complicated' economic climate and the 'absence of a major Western game' during the end-of-year period on the lagging sales."

Notice what he's saying. It's not that Metroid Prime 4 was bad. It's that it wasn't "major" in the cultural sense. Pokémon is a multi-generational franchise that spans toys, trading cards, anime, and more. Kirby is recognizable to every demographic. Metroid? It's a respected series with a passionate community, but it doesn't have the same broad appeal.

The economic climate that was mentioned likely mattered too. Holiday 2025 saw consumer spending patterns shift. People were more selective. Without a game that absolutely demanded new hardware, many Western consumers either waited for a sale or skipped the upgrade entirely.

This created a cascading effect: fewer hardware sales meant fewer players for third-party games, which meant less software revenue, which affects the overall ecosystem momentum.

France experienced the steepest decline at over 30%, while the UK saw a modest growth of 6%. Estimated data based on narrative.

The US Holiday Season Collapse: 35% Down

The US number demands its own examination because it's the largest Western gaming market.

Down 35% compared to the original Switch's launch period is catastrophic. The Switch was one of the most successful hardware launches in gaming history. It's not an unfair baseline. It's the minimum expectation when you're launching a successor to a cultural phenomenon, as noted by The Japan Times.

The US represents about 30-35% of Nintendo's global hardware revenue. When the largest market underperforms by that magnitude, it fundamentally changes the company's year and damages momentum heading into 2026.

US consumers had several options during the holiday season:

- Skip the upgrade and play Switch 1 games

- Wait for a price drop on Switch 2

- Buy Switch 2 but with lower enthusiasm due to software selection

- Investigate competitor hardware (Steam Deck, Play Station, etc.)

Many chose option one or two. Without a game that screamed "upgrade now," the incentive wasn't there.

The economic headwinds the industry cited matter here. US consumer spending on gaming hardware shifted. People prioritized essential upgrades over enthusiast purchases. Without that killer game, Switch 2 fell into the "nice to have" category rather than "must have."

This is how hardware launches fail, even when the hardware is solid. The Switch 2 is by all accounts a capable device with real improvements over its predecessor. But capability doesn't sell consoles. Software does. Experiences do. Reasons do.

European Markets: The Forgotten Story

Western underperformance wasn't just a US phenomenon. It was pan-European.

France got hit hardest, down over 30% compared to the original Switch's first year. That's the worst performance in any major market. France represents significant gaming revenue for Nintendo, and a 30%+ decline is genuinely concerning, as reported by VGChartz.

Other European markets showed similar patterns. Germany, Spain, Italy, and other key territories didn't surge the way Nintendo expected. The Switch 2 was positioned as an incremental upgrade, and many European consumers treated it as such: interesting, but not urgent.

Some of this relates to the economic climate. Europe faced higher inflation and more cautious consumer spending than the US during the same period. Holiday purchasing decisions were more conservative.

But software selection also played a role. European gamers care about different franchises than Japanese consumers. The absence of major Western game launches meant the Switch 2 had to stand on the strength of its hardware alone. And while the hardware is good, it's not different enough from the Switch 1 to justify an immediate purchase for everyone.

The UK's 6% growth is actually the best European story, but context matters. If the original Switch was on sale for 14 additional weeks, the Switch 2 still underperformed on a normalized basis.

Europe's underperformance signals that Nintendo's Western strategy needs adjustment. Relying on Metroid to drive hardware sales didn't work. Pokémon Legends: Z-A is a major franchise, but it launched before the critical holiday shopping window in the West (it released in December, but momentum was already slowing), as noted by The Game Business.

Japan's sales exceeded expectations at 120%, while the US and France saw significant declines compared to the original Switch launch. The UK experienced modest growth at 6%. Estimated data.

The Software Drought Problem: A Strategic Misstep

Here's the fundamental issue: Nintendo didn't align software launches with hardware momentum in the West.

In Japan, the company understood the formula. New console? Release major franchises. Pokémon and Kirby both hit at the right time, creating urgency for Switch 2 hardware.

In the West, this didn't happen. Metroid Prime 4 was the marquee launch, and while it's a solid game, it's not Pokémon. It's not the kind of franchise that drives parents to buy new hardware during the holidays, as reported by IGN.

Looking at software release calendars, Nintendo had major releases spread across 2025, but not concentrated during the critical launch window. This is a planning failure, not a market failure. Nintendo could have aligned major software with hardware momentum but didn't.

The "absence of a major Western game" wasn't inevitable. It was a choice. Perhaps budget constraints forced this. Perhaps development timelines shifted. Regardless, the result was that Switch 2's Western launch lacked the software anchor that could have driven hardware sales to expectations.

Compare this to successful hardware launches: Play Station 5 had Demon's Souls and Spider-Man: Miles Morales at launch. Xbox Series X had Game Pass and Halo Infinite. The Switch had Zelda: Breath of the Wild. Great hardware matters, but it needs great software that's available immediately.

Switch 2's Western launch had solid games eventually, but not the cultural moment-maker that drives hardware upgrades.

Economic Headwinds: The Macro Picture

Nintendo blamed "complicated economic climate" for Western underperformance. That's not just corporate speak. It's real.

Late 2025 saw consumer spending patterns shift across North America and Europe. Inflation remained sticky. Interest rates were elevated. Holiday spending was more selective than in previous years, as noted by Morningstar.

Under these conditions, hardware upgrades become discretionary. A

This affected all console makers, not just Nintendo. But Nintendo felt it most acutely because the Switch 2 didn't have that killer software moment that would have overridden economic hesitation.

If Pokémon Legends: Z-A had launched in North America during the holiday window with the same cultural impact it had in Japan, economic headwinds might not have mattered as much. Parents still buy major gifts for kids even when budgets are tight.

But without that software anchor, the Switch 2 became optional. And in a complicated economic climate, optional purchases get deferred.

This is important context for understanding why regional performance diverged. Japan's stronger economy and higher disposable income (particularly for gaming) meant that hardware purchases were less discretionary. In the West, they were more price-sensitive and timing-dependent.

Japan saw a 20% increase in sales due to strong software alignment, while US and France experienced declines of 35% and 30% respectively, highlighting regional strategy differences. (Estimated data)

The Upgrade Cycle Reality: Existing Owners vs. New Players

Furukawa's comment about "existing Switch owners switching to the Switch 2" reveals something crucial: this wasn't about market expansion. It was about cannibalization.

In Japan, the Switch 2 succeeded by converting Switch 1 owners into Switch 2 owners. That's not growth. That's upgrade penetration. The existing installed base is being skimmed for hardware revenue, as reported by The Game Business.

In the West, even that conversion didn't happen at expected rates. The Switch 1 is still a viable platform. Major games still launch for it. Existing Switch owners had less urgency to upgrade because their current hardware still plays the games they want.

This matters because it reveals Nintendo's fundamental challenge: the Switch 2 isn't a generational leap. It's an iterative upgrade. In Japan, where Pokémon and Kirby titles were exclusive to Switch 2, that was enough to drive upgrades. In the West, where those franchises had less cultural weight, the lack of exclusive software made the upgrade feel optional.

The real game for Nintendo is getting new players into the Switch ecosystem, not just upgrading existing owners. But Switch 2's Western launch didn't accomplish that. It relied on existing fans to upgrade, and many of them decided to wait or skip the upgrade entirely.

Pokémon: The Franchise That Actually Moves Hardware

Pokémon is unique in Nintendo's portfolio because it genuinely moves hardware across all regions, not just Japan.

When you look at console sales data historically, Pokémon launches create measurable hardware spikes. People buy consoles specifically to play new Pokémon games. It's the most reliable franchise Nintendo has for driving hardware revenue.

So why didn't Pokémon Legends: Z-A Western Edition create the same momentum in North America and Europe as it did in Japan?

The answer is timing. In Japan, the game released perfectly aligned with holiday shopping season. The momentum built, the urgency was real, and hardware sales followed, as noted by The Game Business.

In the West, while Pokémon Legends: Z-A eventually released, it didn't have the same pre-launch buildup or the same cultural saturation. Marketing efforts likely differed. Release timing was different. The game existed, but it didn't create the same moment.

This suggests Nintendo's marketing and release planning differed by region, with Japan getting a more coordinated hardware-software launch while the West got a more staggered approach.

If Nintendo had launched Pokémon Legends: Z-A Western Edition during the holiday window in North America and Europe with the same cultural positioning as the Japanese version, the sales story would likely be different. Hardware and software would have been tightly aligned. Consumer urgency would have been higher.

Instead, the franchise that's most reliable for hardware sales wasn't leveraged effectively in the region where it matters most for revenue.

Pokémon Legends: Z-A and Kirby Air Riders significantly influenced Switch 2 sales, with Pokémon driving 50% of the upgrades. (Estimated data)

Kirby Air Riders: A Smaller Piece of the Puzzle

Kirby Air Riders contributed to Japanese success but barely registered in Western markets.

Kirby is beloved, but it's not Pokémon. It doesn't have the same cross-generational appeal or merchandising ecosystem. It's a great character-action franchise, but it's not the kind of game that drives hardware purchases for casual consumers.

In Japan, Kirby has stronger cultural resonance. New Kirby games are events. The character is ubiquitous. A new Kirby title during the holiday season adds to momentum created by Pokémon.

In the West, Kirby is respected and liked, but it's not essential. A new Kirby game is a nice thing to have, not a reason to buy new hardware.

Kirby Air Riders is proof that not all first-party franchises drive hardware sales equally. Nintendo's performance varies dramatically by franchise and by region. Pokémon, Mario, and Zelda are universal movers. Kirby, Fire Emblem, and others are more niche.

When you're launching new hardware, you need franchises with universal appeal. Kirby, while solid, isn't that franchise in Western markets.

Metroid Prime 4: The Wrong Game at the Right Time

Metroid Prime 4: Beyond represents a strategic miscalculation.

The game released in December 2025, which is the right timing. December is peak hardware shopping. But Metroid isn't the right franchise to drive that shopping.

Metroid has a passionate fanbase, but it's a hardcore/mid-core franchise. People who care deeply about Metroid will buy it and buy the hardware. But casual buyers? Holiday gift-givers? People making hardware purchasing decisions? They don't know Metroid or care about it, as noted by GoNintendo.

Compare this to what happened with other Nintendo hardware launches. The Switch launched with Zelda: Breath of the Wild, a franchise that transcends gaming. Everyone knows Zelda. Grandparents know Zelda.

Metroid Prime 4 didn't have that cultural saturation. It's a great game for people who already care about Metroid, but it's not the kind of franchise that creates new hardware demand.

Nintendo had an opportunity to align a major franchise with hardware launch timing but chose the wrong franchise. Pokémon existed but wasn't positioned the same way in Western markets. Mario games existed but didn't launch during the critical window. The result was that the biggest hardware shopping season had a game that appealed to dedicated fans but not to the broader market.

This is a lesson in franchise positioning. Not all games are equally capable of driving hardware sales. Metroid is respected. It's well-made. But it's not Pokémon. And without Pokémon or Mario, hardware launches in the West struggle.

The Broader Western Gaming Market: What's Changing?

Switch 2's Western underperformance reflects broader shifts in the gaming market.

Consumers are more selective about hardware upgrades. The distinction between generations is blurring. Games exist across multiple platforms. The urgency to upgrade hardware is lower than it was historically, as noted by Morningstar.

This is a long-term trend. The jump from PS3 to PS4 felt essential. The jump from Switch 1 to Switch 2 feels optional. The hardware differences are real, but they're incremental. Developers can still make great games for Switch 1. Existing owners aren't forced to upgrade.

Consumers recognize this. They wait longer before upgrading. They ask harder questions about whether new hardware is necessary. They compare prices and features more carefully.

Nintendo's challenge is that the Switch 2 is a good upgrade but not a must-upgrade. In this environment, software becomes even more critical. You need games that absolutely require new hardware or that are so culturally significant that people want them immediately.

Metroid Prime 4 didn't meet that threshold. Pokémon Legends: Z-A does, but it wasn't positioned the same way in Western markets.

This dynamic will persist. Future hardware launches that rely on software traction will struggle if that software isn't positioned correctly. Casual consumers need clear reasons to upgrade. Without them, they'll stick with current hardware longer.

Regional Strategy: Why One Size Doesn't Fit All

Nintendo's experience with Switch 2 proves that regional strategy matters enormously.

What works in Japan doesn't automatically work in the West. Franchises have different cultural weight. Timing matters differently. Economic conditions vary. Consumer psychology differs.

Yet Nintendo treated Switch 2's launch somewhat uniformly across regions. The hardware was the same (mostly). The launch window was the same. But the software strategy wasn't coordinated the same way.

A more sophisticated approach would have recognized that the West needed Pokémon positioned as a hardware launch title, not as a follow-up game. It would have understood that Metroid couldn't carry the hardware sales load alone, regardless of when it released.

Regional strategy requires regional thinking. What drives hardware sales in Tokyo won't drive them in New York the same way. Astute publishers recognize this and adjust.

Nintendo did this in Japan successfully. The same rigor wasn't applied to Western markets. The result was predictable: Western markets underperformed, as reported by The Game Business.

This is a template for future launches. Hardware success requires not just good hardware and good software, but good alignment between them. And that alignment must be region-specific, recognizing local preferences and market dynamics.

What This Means for Gaming's Future

Switch 2's regional split tells us something important about the future of console gaming.

Hardware is becoming more commoditized. The differences between generations are smaller. The ability to differentiate via hardware alone is diminishing. Software and services are the real differentiators.

Companies that can create software events—cultural moments that people want to participate in immediately—will succeed. Companies that can't will struggle, regardless of hardware quality.

Nintendo has proven it can do this in Japan. Pokémon Legends: Z-A and Kirby Air Riders created that moment. But in the West, the company failed to create equivalent moments. The result is predictable hardware underperformance.

This pattern will repeat unless Nintendo adjusts. Future hardware launches require better regional software strategy. Major franchises must be positioned as launch anchors, not follow-ups. Marketing must create cultural momentum, not just announce availability.

For the broader industry, it's a reminder that hardware specs don't sell consoles. Experiences do. Franchises do. Cultural moments do. Companies that recognize this and plan accordingly will win. Companies that treat hardware and software as separate concerns will struggle.

Looking Ahead: Can Nintendo Course-Correct?

Switch 2 has years ahead of it. The first-year sales miss is notable, but it's not determinative of the platform's long-term success.

Nintendo has already announced major franchises coming to Switch 2 in 2026 and beyond. Metroid Prime 4 is out. New Mario games are in development. More Pokémon titles are coming. Zelda eventually returns.

The question is whether Nintendo will learn from the Switch 2 launch and better align software and hardware timing going forward.

The Japanese success proves that Nintendo knows how to execute this. Pokémon and Kirby were positioned correctly as hardware drivers. That success wasn't accidental. It was strategic.

For Western markets to reach expectations, similar strategies are needed. Major franchises must be timed to hardware momentum. Marketing must build cultural urgency. Exclusives must be positioned as reasons to upgrade.

If Nintendo executes this in 2026, the regional gap might narrow. If the company makes similar mistakes, Western markets will continue to underperform relative to expectations.

The hardware is good. The franchises are there. What's missing is the strategic coordination that turns those ingredients into sales momentum.

The Broader Lesson: Hardware Launches Require Ecosystem Alignment

Switch 2's experience teaches a universally applicable lesson: successful hardware launches aren't just about the hardware.

They require alignment of multiple factors: hardware quality (check for Switch 2), software availability (partial success), franchise positioning (regional inconsistency), marketing (inconsistent by region), timing (missed in the West), and cultural relevance (strong in Japan, weak in the West).

Missing any single element undermines the whole launch. Miss the software, and hardware sales suffer. Miss the timing, and momentum stalls. Miss the cultural positioning, and people don't see why they should care.

Nintendo nailed this in Japan. The company's execution was methodical: new hardware arrives, major franchises line up, marketing builds momentum, holidays hit, sales follow.

In the West, execution was uneven. Hardware arrived, software came later or in the wrong sequence, cultural positioning was unclear, holidays came, and sales underperformed.

The irony is that Nintendo has the infrastructure and expertise to execute perfectly everywhere. The company proved it in Japan. But that same rigor wasn't applied consistently across regions.

This is an execution failure, not a market failure. The West didn't reject Switch 2. Consumers just didn't have compelling reasons to buy it immediately. That's a strategic miscalculation, not a fundamental market problem.

Conclusion: The Switch 2 Story Continues

Switch 2's first year revealed a stark regional divide that challenges assumptions about global hardware launches.

Japan exceeded expectations because Nintendo aligned software and hardware perfectly. Pokémon Legends: Z-A and Kirby Air Riders created urgency for Switch 2 hardware. Existing Switch owners upgraded. The franchise ecosystem aligned with hardware momentum. The result was sales that surprised on the upside.

Western markets fell short because that same alignment didn't exist. Metroid Prime 4 released during the right window but couldn't carry hardware sales on its own. Pokémon existed but wasn't positioned the same way. The absence of a clear "must-have" software moment meant that upgrading to Switch 2 was optional, and many consumers chose to wait.

The numbers tell the story: US sales down 35%, France down over 30%, UK growth of just 6%. These aren't catastrophic failures, but they're significant misses that Nintendo didn't forecast.

What's important now is whether Nintendo learns from this divergence. The company has proven it can execute perfectly—it did in Japan. The question is whether Western markets will receive the same strategic attention going forward.

Switch 2 isn't struggling. It's a solid console with a bright future. But it could have launched stronger in the West, and understanding why is crucial for what comes next.

The hardware is good. The problem was strategy. And strategy is something Nintendo can absolutely fix.

FAQ

Why did Nintendo Switch 2 sales differ so dramatically between Japan and the West?

The primary difference came down to software availability and franchise positioning. In Japan, Pokémon Legends: Z-A Nintendo Switch 2 Edition and Kirby Air Riders released during the critical holiday shopping season, creating urgency for existing Switch owners to upgrade to Switch 2. In the West, these franchises weren't positioned with the same coordinated timing, and Metroid Prime 4, while a solid release, lacked the broad appeal needed to drive hardware sales. Additionally, the economic climate in Western markets during late 2025 made consumers more selective about discretionary hardware purchases, as noted by The Game Business.

What specific sales figures did Nintendo report for Switch 2 in each region?

Nintendo didn't release exact sales numbers, but third-party tracking data revealed that US holiday sales were down 35% compared to the original Switch's launch period, France was down over 30%, and the UK managed only 6% growth compared to the original Switch's first year. These figures underscore the regional divergence in market reception, with Japan significantly outperforming expectations while Western markets fell short, as reported by IGN.

How did Pokémon Legends: Z-A contribute to Japanese success versus Western underperformance?

Pokémon Legends: Z-A is one of the most universally appealing franchises in gaming, with particular cultural strength in Japan. In Japan, the game released perfectly timed with hardware momentum during the holiday season, creating urgency for upgrade purchases. In the West, while the game eventually released, it lacked the same coordinated positioning and cultural saturation, so it didn't drive the same hardware upgrade cycle. This demonstrates that even major franchises require region-specific marketing and timing strategies to maximize impact, as noted by The Game Business.

Why wasn't Metroid Prime 4: Beyond positioned as a hardware launch title?

Metroid Prime 4 is a respected and well-made game, but Metroid is a mid-core franchise with a passionate but narrower audience compared to Pokémon or Mario. While the game released during the right window (December 2025), it couldn't generate the broad consumer appeal needed to drive hardware sales among casual buyers and holiday gift-givers. Nintendo likely underestimated how much the West needed a franchise with universal appeal to match the sales performance achieved in Japan with Pokémon and Kirby, as reported by GoNintendo.

What role did economic conditions play in Switch 2's Western underperformance?

Nintendo explicitly cited a "complicated" economic climate as a factor in Western hardware underperformance. Late 2025 saw elevated inflation, higher interest rates, and more cautious consumer spending across North America and Europe. Under these economic conditions, hardware upgrades become discretionary rather than essential. Without a software moment compelling enough to override budget constraints, many consumers deferred Switch 2 purchases or chose not to upgrade from their original Switch, which continued to offer excellent games and value, as noted by Morningstar.

Could Nintendo have prevented this regional divergence with different launch planning?

Yes. The company proved in Japan that coordinated software-hardware launches drive sales. A similar strategy in the West, with Pokémon Legends: Z-A positioned as a hardware launch title rather than a follow-up, combined with aggressive marketing to build cultural momentum, likely would have yielded significantly stronger Western sales. This suggests the underperformance was primarily a strategic execution issue rather than a fundamental market rejection of Switch 2, as reported by The Game Business.

How does Switch 2's first-year performance compare to the original Switch's launch?

The original Switch had one of the most successful hardware launches in gaming history, creating an extremely high bar for its successor. Switch 2, while capable hardware, was positioned as an incremental upgrade rather than a generational leap. In markets like Japan with strong software positioning, Switch 2 exceeded expectations. In the West, where software positioning was weaker, the hardware struggled to inspire the same immediate upgrade demand, resulting in significant year-over-year sales declines in most Western markets, as noted by IGN.

What does this teach the gaming industry about hardware launches in 2025 and beyond?

Switch 2's experience demonstrates that successful hardware launches require more than good technology. They demand perfect alignment between hardware, software, marketing, and cultural positioning. Franchise selection matters enormously—not all games drive hardware sales equally. Regional strategy is critical; one-size-fits-all approaches fail. Finally, in a market where hardware differences are increasingly incremental, software and cultural moments are the true differentiators that convince consumers to upgrade, as reported by Morningstar.

Will this first-year performance impact Switch 2's long-term success?

First-year performance matters for momentum, but it's not determinative. Switch 2 has years ahead and a major software pipeline including new Mario, Zelda, and Pokémon titles. If Nintendo learns from Western underperformance and applies the strategic rigor shown in Japan to all regions going forward, the platform can recover and grow throughout its lifecycle. Long-term success depends on whether Nintendo course-corrects regional strategy and better aligns major franchises with hardware momentum, as noted by The Game Business.

How did the UK's 6% growth stand out from the rest of Western Europe?

The UK's 6% growth looks better in isolation but requires context. The comparison period favored Switch 2 because the original Switch had sold for an additional 14 weeks during its first year. When normalized for selling time, UK's actual growth was lower. Still, the UK outperformed every other Western market, though it remained below Nintendo's expectations. This suggests some market-specific factors in the UK, possibly related to different software positioning or marketing effectiveness compared to continental Europe, as reported by VGChartz.

Key Takeaways

- Sales there "exceeded our expectations" by a significant margin

- Instead, Western markets pulled back significantly

- The forecasted global numbers remained unchanged

- Png)

*The Switch 2 experienced a significant sales decline in the US and France, while Japan showed a positive growth trend

- When you launch a major Pokémon title for a new console, you're not just releasing a game

Related Articles

- Best Dystopian Shows on Prime Video After Fallout [2025]

- Who will win Super Bowl LX? Predictions and how to watch Patriots vs Seahawks | TechRadar

- Here are my 4 most anticipated 4K Blu-rays of February 2026 | TechRadar

- Amazon's Melania Documentary: Box Office Reality & Media Economics [2025]

- NYT Connections Game #966: Complete Hints, Answers & Strategy Guide [2025]

- GTA 6 Delays Risk Killing Hype Forever: Why Rockstar Can't Win [2025]

![Nintendo Switch 2 Sales Reveal: Why Japan Crushed Western Markets [2025]](https://tryrunable.com/blog/nintendo-switch-2-sales-reveal-why-japan-crushed-western-mar/image-1-1770291245994.jpg)