Introduction: Why NVIDIA's CES 2026 Keynote Matters

NVIDIA's presence at the Consumer Electronics Show has evolved from a graphics card company's annual checkpoint into one of the most anticipated tech events on the calendar. When NVIDIA's CEO Jensen Huang takes the stage at CES 2026, Wall Street analysts will be watching as closely as Silicon Valley engineers. This isn't just another tech demonstration—it's a narrative-setting moment for artificial intelligence, computational power, and how these technologies will reshape industries across robotics, gaming, simulation, and content creation.

The anticipation surrounding NVIDIA's CES presence reflects a fundamental shift in how technology companies communicate their vision. A decade ago, CES keynotes were primarily about showcasing consumer hardware innovations. Today, NVIDIA's presentations have become economic indicator events, where announcements about chip architecture, AI capabilities, and strategic partnerships can move markets and influence investment decisions globally.

The timing of NVIDIA's 2026 presentation is particularly significant. The company has spent the past year establishing dominance in the AI infrastructure space with its Blackwell architecture, capturing unprecedented market share in data center GPUs. Heading into 2026, the industry is watching to see whether NVIDIA can maintain this momentum, what next-generation chip architecture looks like, and how the company plans to expand AI's reach beyond data centers into consumer devices, robotics, and edge computing.

For those unable to attend in person at Las Vegas's Fontainebleau hotel, NVIDIA has made its keynote accessible through livestreaming. This comprehensive guide covers everything you need to know about watching the presentation, understanding what NVIDIA might announce, and interpreting why these announcements matter for the broader technology landscape.

Beyond the streaming logistics, understanding NVIDIA's strategy at CES 2026 requires context about the company's current market position, the competitive dynamics it faces, and the technological challenges it's working to solve. We'll explore all of these dimensions throughout this guide, providing both the practical information you need to watch the event and the analytical framework to understand its significance.

How to Watch the NVIDIA CES 2026 Keynote Live

Official Streaming Details and Timing

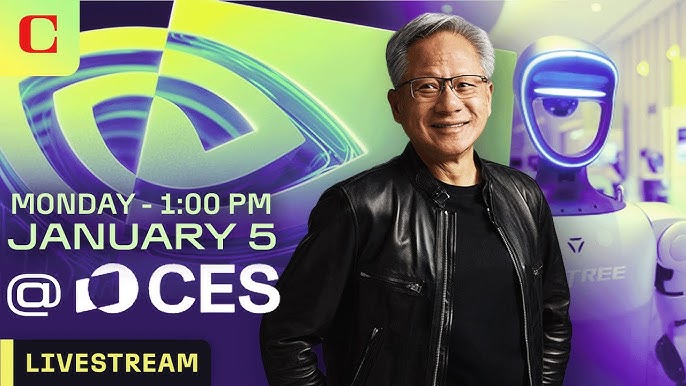

NVIDIA CEO Jensen Huang will deliver a 90-minute keynote presentation on January 5, 2026, at 4:00 PM Eastern Time. This timing is strategically chosen during CES's peak day, ensuring maximum attention from international attendees and media coverage. The presentation will be livestreamed through multiple channels, making it accessible to a global audience regardless of geographic location.

The official stream will be available directly through NVIDIA's corporate website, where the company typically hosts its major keynote presentations. Based on NVIDIA's historical patterns, the presentation will also likely stream simultaneously on YouTube, where NVIDIA maintains an official channel with millions of subscribers. Additionally, the presentation may be available through secondary streaming partnerships and major tech media outlets covering CES 2026.

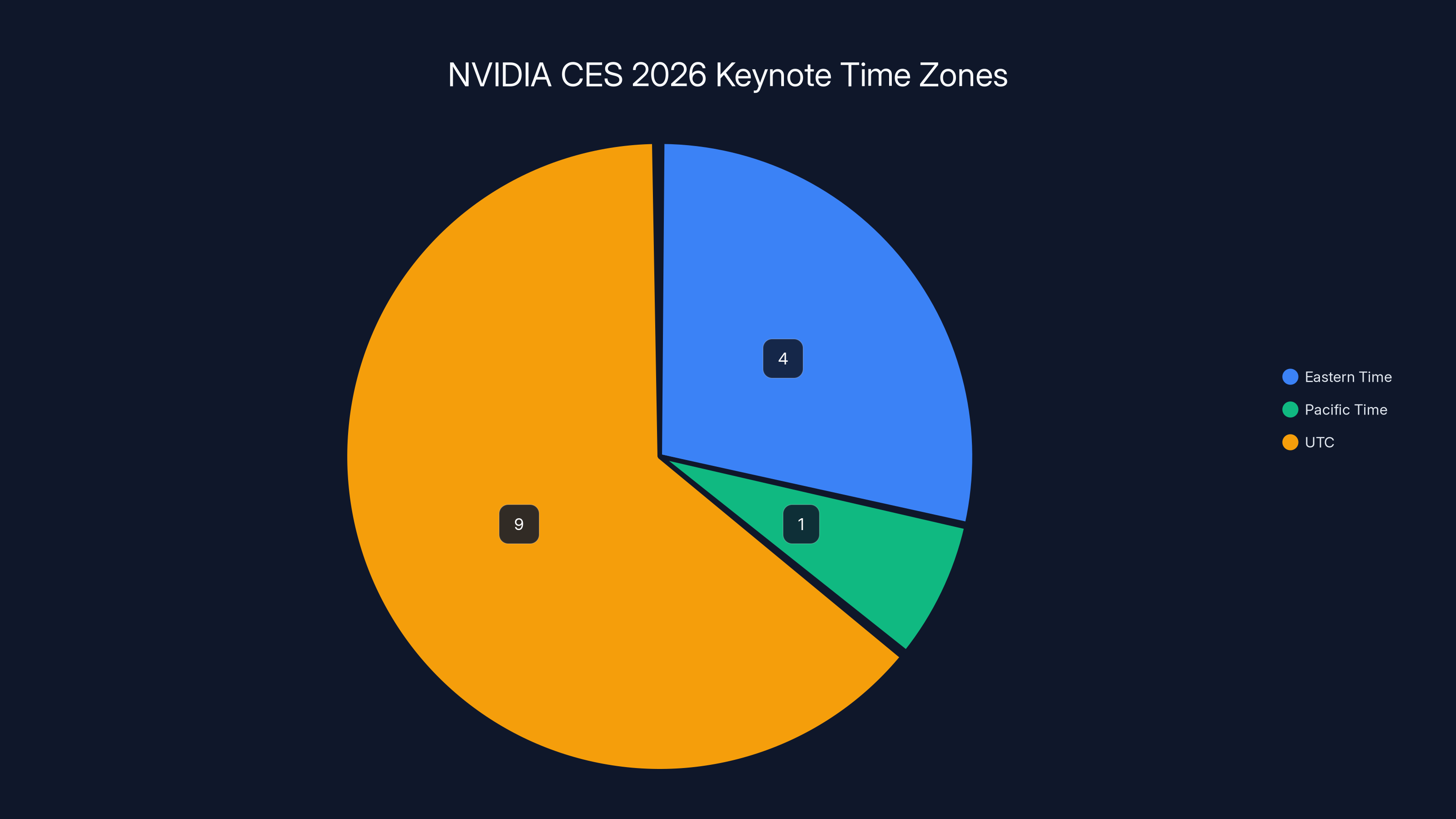

For viewers in different time zones, the 4:00 PM ET start time translates to 1:00 PM Pacific Time for West Coast viewers, 3:00 PM Central Time for the Midwest, and 9:00 PM UTC for European audiences. This scheduling decision reflects NVIDIA's global audience, balancing accessibility for US markets (where the largest investor base resides) with reasonable accessibility for international viewers.

Technical Requirements and Streaming Quality

To watch the NVIDIA keynote in optimal quality, you'll want internet connectivity capable of streaming high-definition video. NVIDIA typically provides streams at 1080p resolution at 60 frames per second, with adaptive bitrate streaming that automatically adjusts quality based on connection speed. This means even viewers with moderate internet connections can watch without significant buffering.

For the best viewing experience, a broadband connection of at least 5 Mbps download speed is recommended for 1080p streaming. Mobile viewers can access the stream through smartphones and tablets, with NVIDIA's streaming platform supporting both iOS and Android devices. The company typically provides optimized mobile experiences that adapt to varying screen sizes and connection qualities.

If you plan to watch on a larger screen, NVIDIA's streams are often compatible with Chromecast, AirPlay, and other screen mirroring technologies, allowing you to view the presentation on a television or larger monitor. This is particularly valuable for group viewing or workplace screenings, where multiple people might gather to watch NVIDIA's announcements together.

Preparing Your Viewing Setup

Since the keynote runs for 90 minutes, you'll want to ensure uninterrupted viewing without distractions. Set aside the full time block, as NVIDIA rarely provides convenient breaks during its keynotes—the entire presentation flows as a continuous narrative designed to build momentum and impact.

Consider joining community discussions on platforms like Reddit's r/nvidia, Twitter/X tech communities, or tech forums where thousands of viewers will be discussing the announcements in real-time. Having a second screen for reading along with expert commentary can enhance understanding of technical details that might be mentioned quickly during the presentation.

Download or bookmark the official NVIDIA website link before the presentation begins, as traffic to these pages typically spikes significantly once the keynote starts, potentially causing temporary slowdowns. Having the link ready ensures you won't waste viewing time searching for the stream.

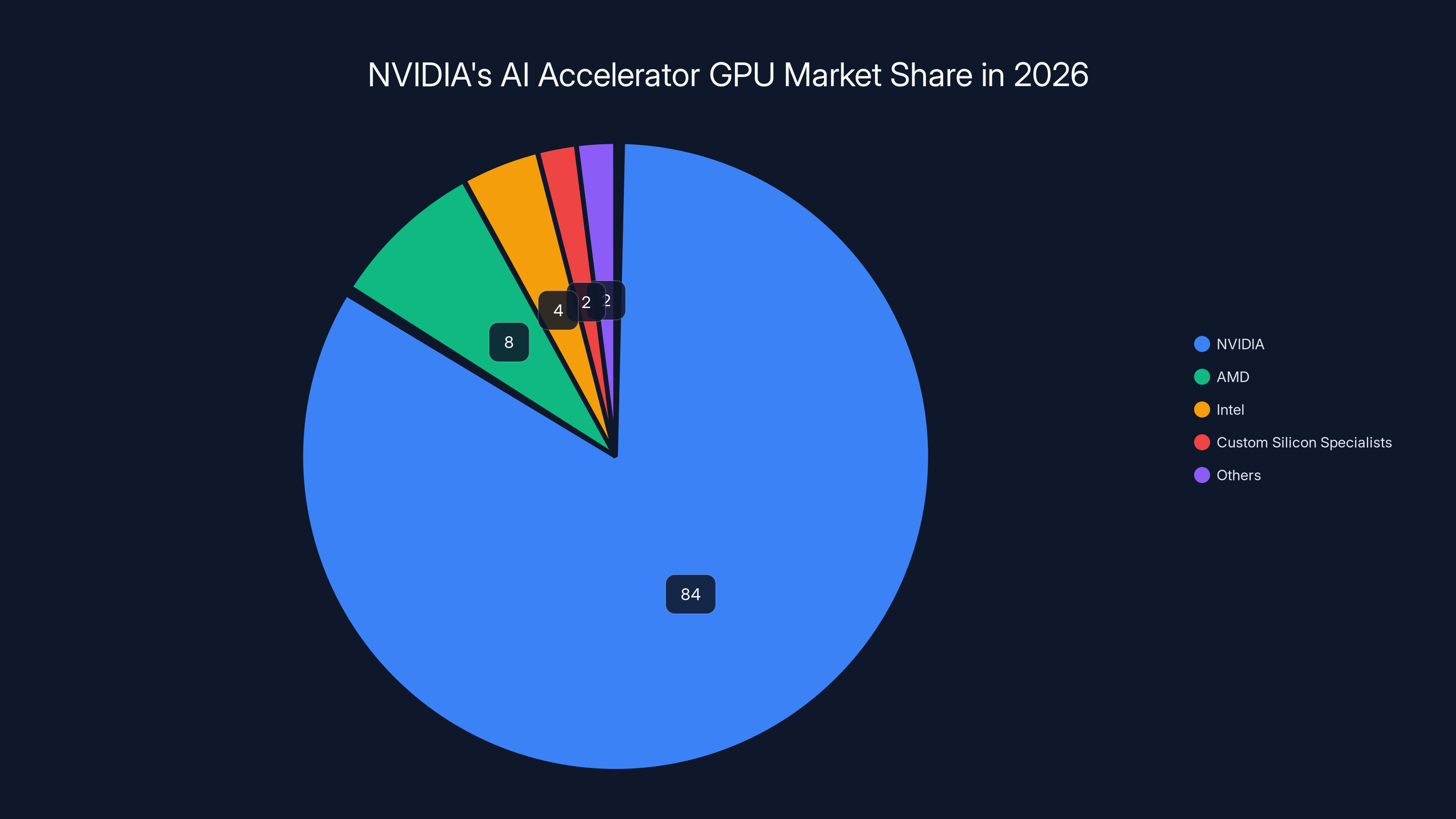

NVIDIA holds a dominant 84% market share in AI accelerator GPUs as of 2026, with AMD and Intel being notable competitors. Estimated data.

What NVIDIA Might Announce at CES 2026

Next-Generation GPU Architecture and Chip Development

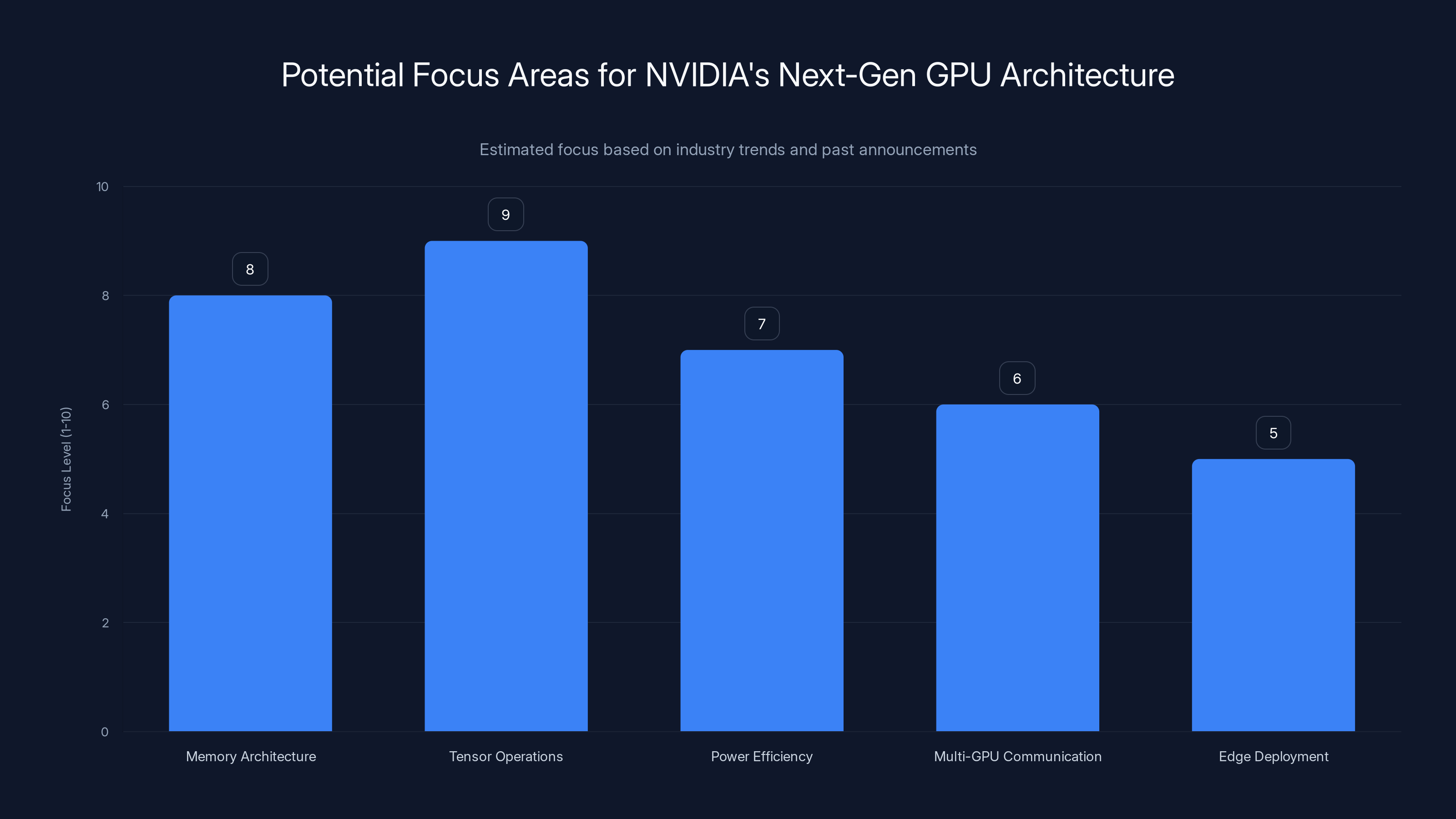

The most technically consequential announcements at CES 2026 will likely involve NVIDIA's roadmap for next-generation GPU architectures and successor products to the current Blackwell generation. While specific details remain highly confidential until announcement, industry analysts have been scrutinizing NVIDIA's patent filings and semiconductor roadmaps for clues about what's coming.

Blackwell represented a significant architectural leap, introducing innovations in tensor processing, memory bandwidth, and power efficiency that accelerated AI model training and inference substantially. The question facing NVIDIA entering 2026 is whether the next architecture can deliver comparable leaps in performance improvement while addressing emerging bottlenecks in large-scale AI systems.

Specific areas where next-generation architectures might focus include:

- Memory architecture improvements: Increasing memory bandwidth and capacity to support increasingly large AI models without proportional increases in latency

- Tensor operation optimization: Further specialization of hardware accelerators for specific AI operations like transformer inference, sparse tensor operations, and fine-tuning workloads

- Power efficiency gains: Reducing power consumption per computational operation, a critical metric for data center operators facing energy constraints

- Multi-GPU communication: Enhanced interconnect technology for seamless scaling across thousands of GPUs in distributed training scenarios

- Edge deployment variants: Chips optimized for deployment outside data centers, in robotics platforms, autonomous vehicles, and consumer devices

Historically, NVIDIA announces architectural details during major keynotes but restricts specific product availability announcements to later in the year. Don't expect immediate availability for next-generation products announced at CES 2026, but rather an announcement of roadmap timing and architectural philosophy.

Robotics and Autonomous Systems Solutions

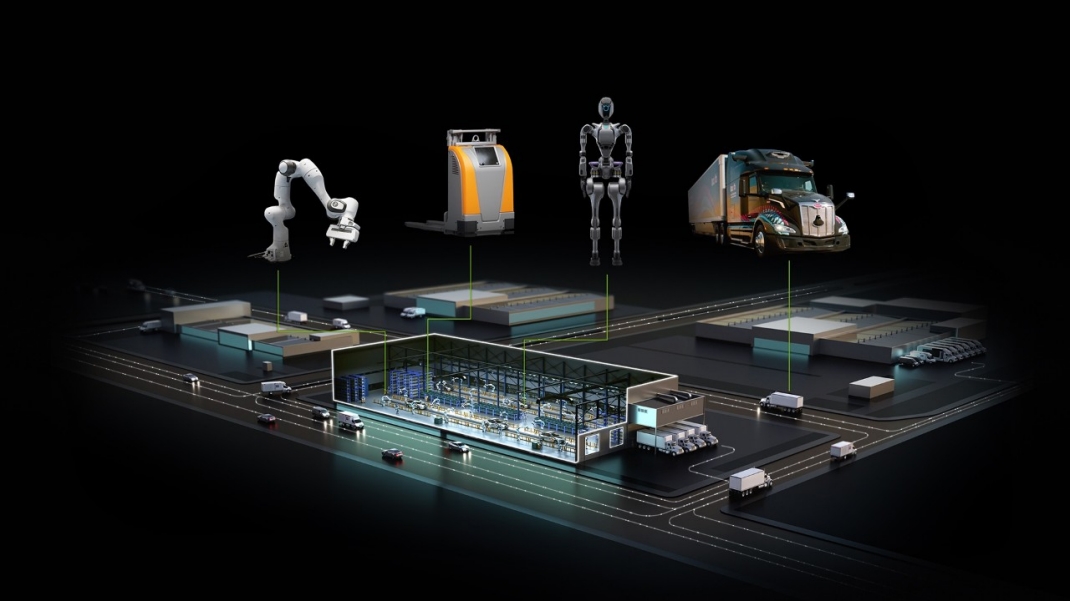

NVIDIA has invested heavily in robotics software platforms, particularly through its NVIDIA Isaac robotics platform, which provides simulation tools, development environments, and acceleration libraries for robotics companies. CES 2026 presents an ideal venue for NVIDIA to showcase how its AI infrastructure translates into practical robotics applications.

The robotics demonstrations will likely highlight NVIDIA's Isaac platform in action with physical robot demonstrations, showing real-world applications of AI-powered robotics in manufacturing, logistics, healthcare, and consumer contexts. These demos serve both to educate the market about what's possible and to inspire robotics companies and startups to build on NVIDIA's platform.

Key robotics announcements might include:

- Humanoid robot capabilities: Demonstrations of advanced bipedal robots performing complex manipulation tasks using AI-powered perception and control systems

- Autonomous vehicle progress: Updates on self-driving car technology and the computational platforms powering autonomous vehicle perception and decision-making

- Industrial robot autonomy: Robots capable of adapting to unstructured environments without explicit programming for every scenario

- Robot simulation acceleration: Faster physics simulation enabling accelerated training of robot control policies through digital twins

- Multimodal AI for robotics: Integration of vision, language, and sensor fusion enabling robots to understand natural language commands and visual descriptions

Simulation and Digital Twin Technology

NVIDIA's Omniverse platform has emerged as the company's strategic bet for digital simulation and digital twin technology. Unlike traditional CAD software, Omniverse enables real-time physics simulation, AI-driven autonomous agents, and collaborative environments. At CES 2026, expect substantial announcements about Omniverse's evolution and expanding use cases.

Digital twins—virtual representations of physical systems that simulate their behavior—are becoming increasingly critical across industries. NVIDIA's simulation capabilities matter because training AI systems requires vast amounts of data; simulation allows companies to generate training data synthetically, potentially reducing the need for real-world data collection.

Omniverse demonstrations might showcase:

- Industrial plant simulation: Digital twins of manufacturing facilities enabling optimization and troubleshooting without physical disruption

- Urban planning and smart city: Simulation of traffic patterns, infrastructure systems, and city-scale logistics

- Scientific simulation: Physics-based simulation for material science, climate modeling, and drug discovery

- Entertainment and content creation: Real-time rendering and physics simulation for games, films, and interactive experiences

- Collaborative design: Teams across geographies working simultaneously in shared 3D environments

Gaming and Consumer Graphics Innovations

While NVIDIA's enterprise AI business dominates investor attention, consumer gaming remains strategically important and a significant revenue driver. CES 2026 will likely feature announcements about next-generation consumer GPUs in the RTX series, following the RTX 50 series expected to launch around the CES timeframe.

Expect gaming announcements to emphasize:

- DLSS evolution: Advancements to NVIDIA's Deep Learning Super Sampling technology, which uses AI to upscale lower-resolution images to higher resolution while maintaining visual quality

- Real-time ray tracing improvements: Faster ray-traced rendering enabling photorealistic graphics at higher frame rates

- AI-powered game features: In-game AI systems that generate dynamic content, improve NPC behavior, and enhance player experience

- VR and metaverse readiness: Graphics capabilities optimized for virtual reality and immersive online worlds

- Frame rate scaling: Technologies enabling games to run smoothly across a broader range of hardware configurations

Gaming announcements also serve a strategic purpose beyond consumer interest: they demonstrate NVIDIA's consumer brand strength, showing that the company isn't solely dependent on enterprise AI infrastructure. This brand diversity matters for investor perception and for attracting engineering talent.

Content Creation and Professional Tools

NVIDIA's professional GPU line serves architects, engineers, designers, and content creators. CES 2026 will likely feature announcements about accelerating content creation workflows using AI, building on tools like NVIDIA Canvas (which uses AI to generate environment art) and expanding to video editing, 3D modeling, and other creative domains.

AI-accelerated content creation matters increasingly as content demands (particularly for personalized video, dynamic advertisements, and high-resolution media) continue growing. NVIDIA will likely emphasize how its GPUs enable creators to work faster, iterate more quickly, and produce higher-quality output.

Expected announcements might include:

- AI video editing tools: Automatic scene detection, subtitle generation, and visual effect application

- Generative image and video: AI models running on NVIDIA hardware generating visual content from text descriptions

- 3D asset generation: AI systems rapidly creating 3D models from photographs or descriptions

- Collaborative content platforms: Cloud-based tools leveraging NVIDIA's infrastructure for distributed creative work

- Real-time rendering: Preview and editing capabilities that previously required rendering time now possible in real-time

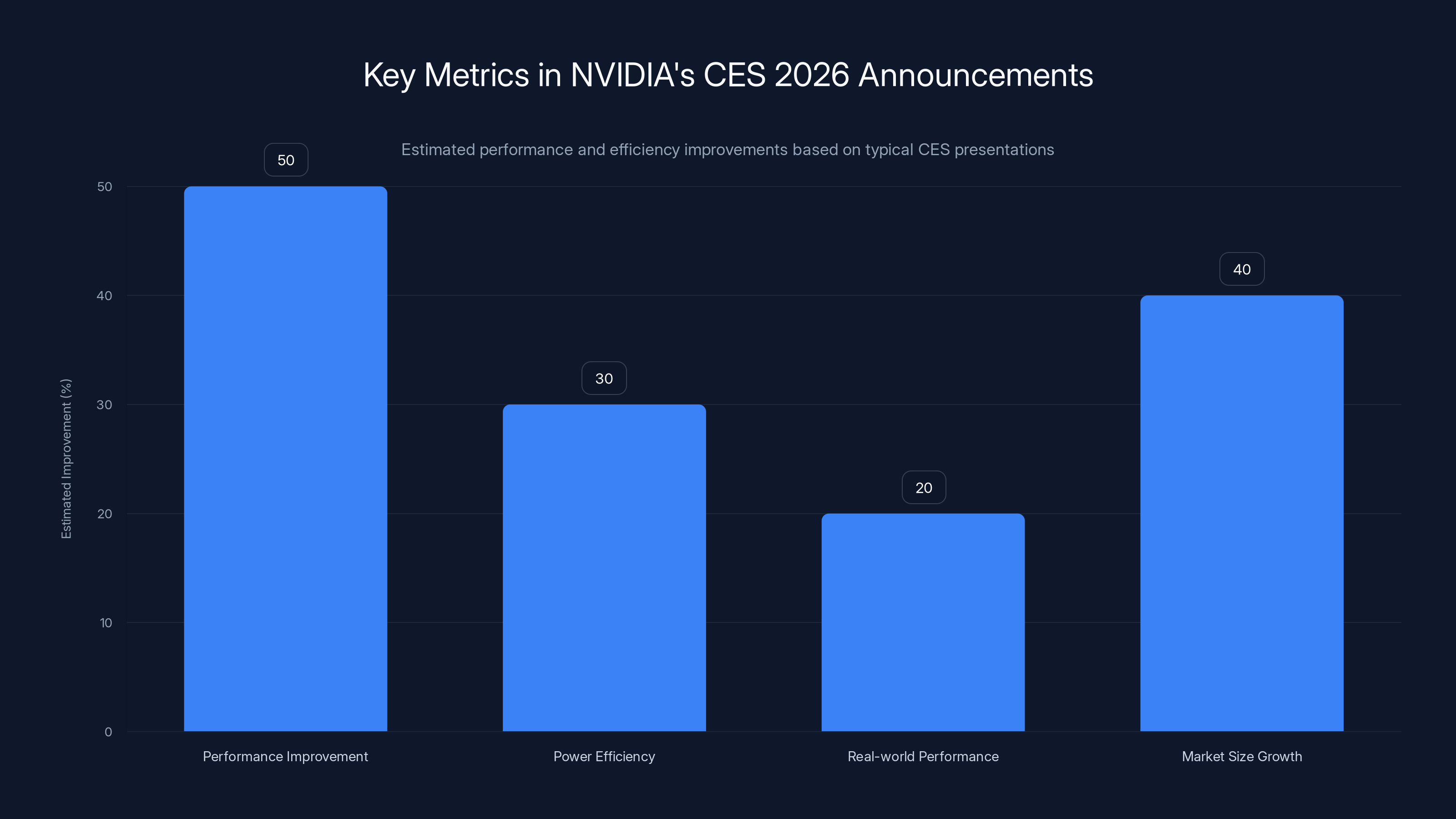

Estimated data suggests NVIDIA may claim up to 50% performance improvement and 30% power efficiency gains at CES 2026. These metrics are crucial for understanding their competitive edge.

Understanding NVIDIA's Market Position and Strategic Context

Competitive Landscape and Market Dominance

Entering 2026, NVIDIA maintains overwhelming market dominance in AI accelerator GPUs, controlling approximately 80-88% of the global market for AI infrastructure processing. This dominance stems from several factors: early mover advantage, superior software ecosystems, architectural innovations, and massive investments in developer relations.

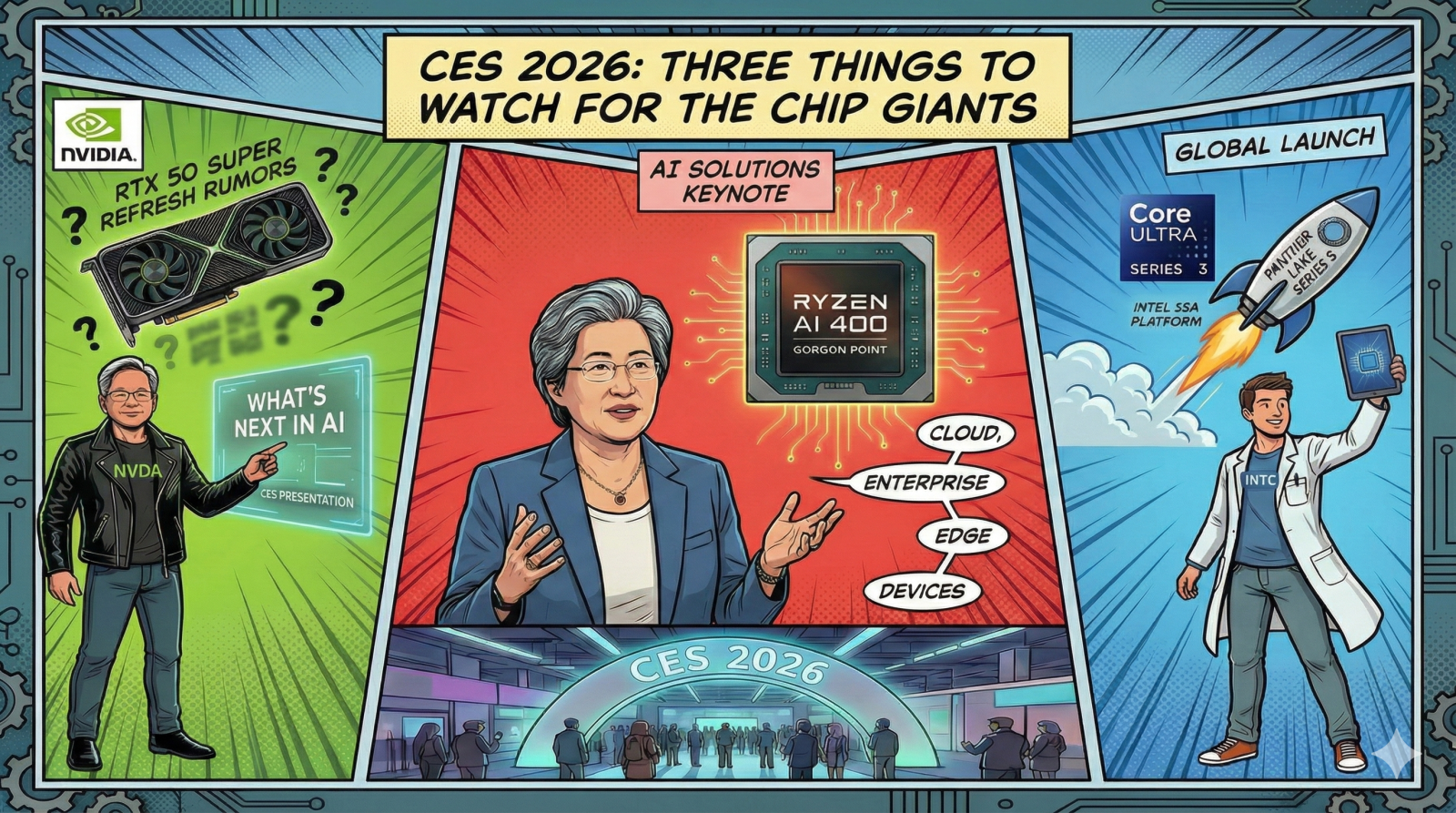

However, this dominance faces increasing challenges. Advanced Micro Devices (AMD) has significantly improved its MI-series GPUs, offering competitive performance at lower price points. Intel is investing heavily in data center GPUs through its Gaudi and upcoming products. Custom silicon specialists like Cerebras, Graphcore, and others are targeting specific AI workloads where custom hardware can offer superior economics compared to general-purpose GPUs.

International competitors also matter strategically. China's Huawei and other local chipmakers are developing indigenous AI acceleration technology, potentially reducing dependency on US exports. European companies are pursuing alternatives, driven partly by geopolitical considerations and the EU's semiconductor independence initiatives.

NVIDIA's CES 2026 presentation occurs in this competitive context, where maintaining architectural superiority and developer ecosystem leadership is essential to preserving market position. Any significant architectural innovations announced will immediately face scrutiny from competitors and analyst evaluations about whether the advantages are defensible or likely to be narrowed.

Supply Chain and Manufacturing Realities

NVIDIA doesn't manufacture its own chips—the company relies on TSMC (Taiwan Semiconductor Manufacturing Company) for production. This outsourced manufacturing model offers flexibility but creates dependencies. NVIDIA's ability to rapidly scale production of new chips depends on TSMC's capacity availability and geopolitical stability of the Taiwan Strait.

Supply chain announcements at CES 2026 might include commitments regarding production capacity for next-generation products, addressing customer concerns about availability and delivery timelines. During the AI boom's peak in 2023-2024, NVIDIA customers faced extended lead times; any ability to demonstrate improved supply chain resilience would be welcome news to the market.

The manufacturing relationship also influences NVIDIA's architectural choices. TSMC's process node capabilities (current state-of-the-art being 3 nanometer in 2026) determine what's technically feasible. NVIDIA's engineers design with specific manufacturing constraints in mind, and any announcements about next-generation products implicitly reference specific manufacturing nodes and timelines.

Financial and Investor Implications

NVIDIA has achieved a market capitalization exceeding $3 trillion as of late 2025, making it among the world's most valuable companies. This valuation reflects investor beliefs about NVIDIA's ability to maintain dominance in AI infrastructure, but also creates enormous expectations for continued growth and innovation.

CES 2026 announcements directly influence investor sentiment and stock valuation. Presentations that suggest architectural advantages, expanded addressable markets, or improved competitive positioning typically result in stock price appreciation, while presentations perceived as incremental or facing increased competition can trigger sell-offs.

Investor expectations for the keynote include:

- Clear articulation of future market opportunities: How large is the market NVIDIA is targeting? What are the growth rates? What is NVIDIA's share?

- Technological roadmap confidence: Evidence that NVIDIA can continue delivering superior performance-per-watt and architectural advantages

- Margin sustainability: Indication that NVIDIA's profitability (gross margins currently exceeding 70%) can be maintained despite competition and scale

- New market development: Signals that NVIDIA isn't dependent solely on data center AI chips, but can expand into adjacencies

These financial dimensions don't appear explicitly in keynotes but form the subtext underlying Jensen Huang's remarks and the announcements' strategic framing.

The Importance of Jensen Huang's Leadership and Communication Style

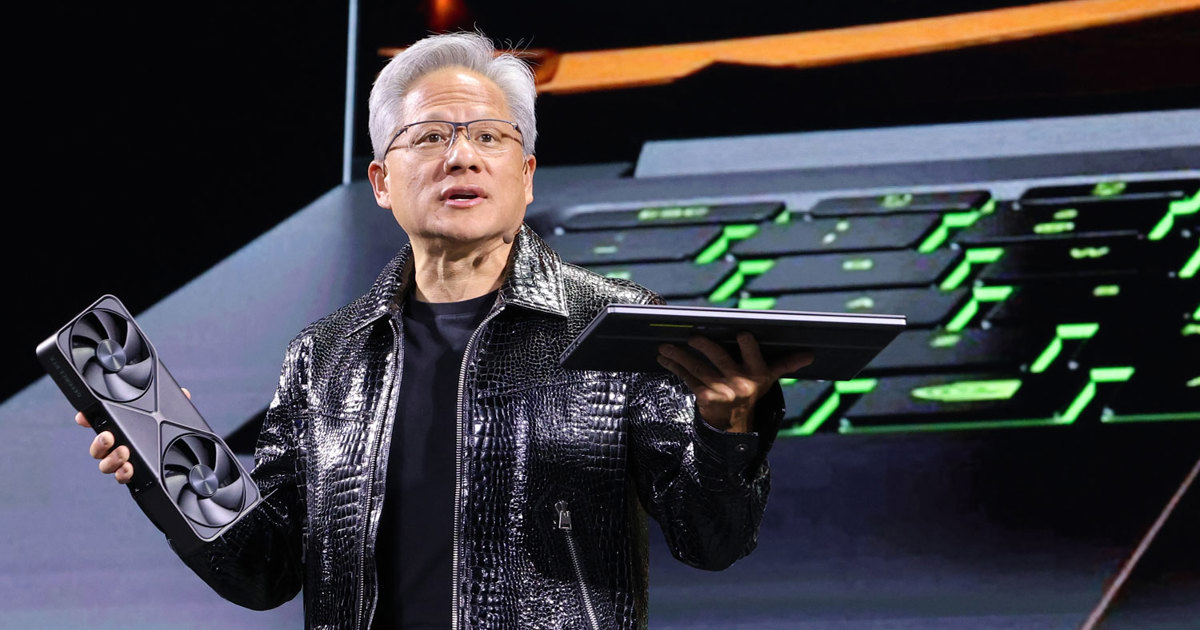

Huang's Track Record of Strategic Foresight

Jensen Huang has led NVIDIA since its 1993 founding, and his strategic decisions have defined the company's evolution across multiple major technology transitions. From early graphics processing dominance through the CUDA revolution to current AI infrastructure leadership, Huang has demonstrated consistent ability to identify emerging computing paradigm shifts and position NVIDIA to lead them.

Huang's keynote presentations are renowned for their ambitious vision combined with specific technical insights. He doesn't simply announce features; he contextualizes technological advances within larger narratives about computing's future direction. This narrative-driven approach has become increasingly influential as technology leaders and investors look for strategic direction in an uncertain landscape.

Key strategic decisions Huang has championed include:

- Investing in CUDA development environment: Creating an ecosystem lock-in advantage that remains NVIDIA's most defensible competitive moat

- Pivoting to AI acceleration: Recognizing that AI workloads represented a massive opportunity before widespread AI adoption

- Acquiring ARM and merging with Mellanox: Expanding beyond GPU manufacturing into broader data center infrastructure (though the ARM acquisition ultimately faced regulatory obstacles)

- Building software stack: Moving beyond hardware into complete platform solutions with Omniverse and Isaac platforms

Communication Strategy and Public Messaging

Huang's presentations typically emphasize a few core themes that transcend specific product announcements. These themes include the transformative power of technology, NVIDIA's commitment to enabling innovation, and specific applications of computational power solving real-world problems.

His presentations often feature dramatic demonstrations, celebrity appearances, and storytelling elements that make technical content accessible to broad audiences. At CES 2026, expect Huang to use similar techniques—possibly including live robot demonstrations, simulations running in real-time, and applications showing AI in action—rather than simply presenting slides of specifications and benchmark numbers.

The emotional arc of NVIDIA keynotes typically follows a pattern:

- Opening framing: Establish a big question or challenge the world faces

- Technical foundation: Explain NVIDIA's approach to solving this challenge

- Demonstration: Show the technology working in real-world contexts

- Scaling narrative: Explain how this technology will transform industries and society

- Call to action: Invite developers, partners, and customers to build with NVIDIA's platform

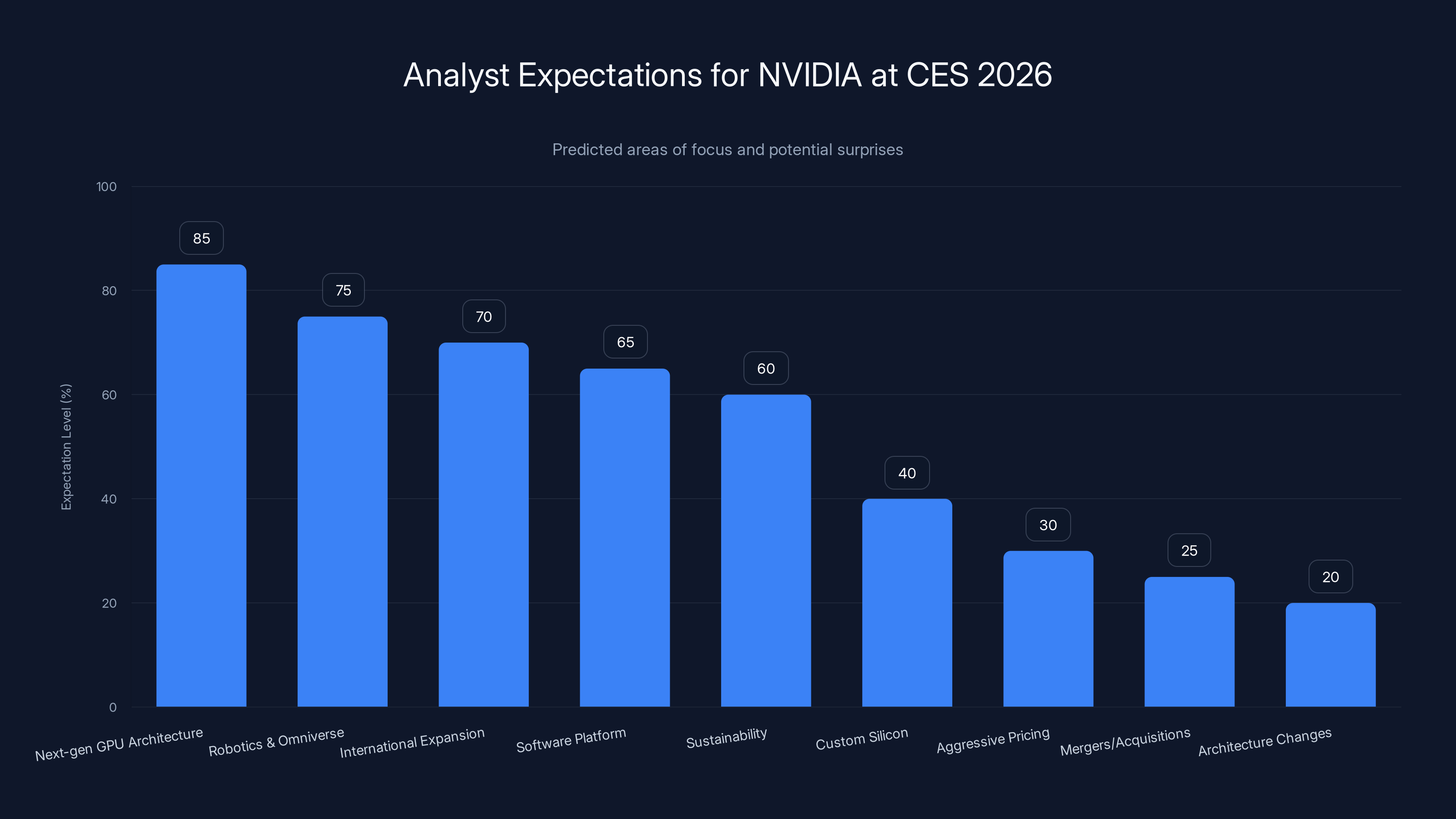

Analysts expect NVIDIA to focus on next-gen GPU architecture and robotics at CES 2026. Surprises could include custom silicon or aggressive pricing strategies. Estimated data.

Industry Predictions and Analyst Expectations for CES 2026

Analyst Consensus and Market Forecasts

Industry analysts covering NVIDIA heading into CES 2026 have developed consensus expectations about what the company should announce, allowing us to understand what might surprise markets versus what's priced into current expectations.

Broad analyst consensus suggests CES 2026 will feature:

- Next-generation GPU architecture announcement: Most analysts expect some details about the architecture succeeding Blackwell, though specifics remain unclear

- Robotics and Omniverse expansion: Continued investment in these strategic areas beyond core data center business

- International expansion: Particularly regarding how NVIDIA serves non-US markets amid geopolitical tensions

- Software platform expansion: Additional layers of software abstraction making NVIDIA's hardware easier to program and deploy

- Sustainability focus: Emphasis on power efficiency and environmental responsibility as data center energy consumption becomes increasingly scrutinized

Announcements that would surprise analysts (and potentially trigger significant stock movements) might include:

- Custom silicon for enterprise customers: NVIDIA moving into the business of designing chips with AWS, Google, or Microsoft (following the latter companies' moves into custom silicon)

- Aggressive pricing strategy: Reducing GPU prices significantly to accelerate market adoption and outcompete emerging competitors

- Merger or acquisition announcements: Major strategic deals reshaping NVIDIA's business scope

- Fundamental architecture changes: Revolutionary rather than evolutionary improvements to computational approaches

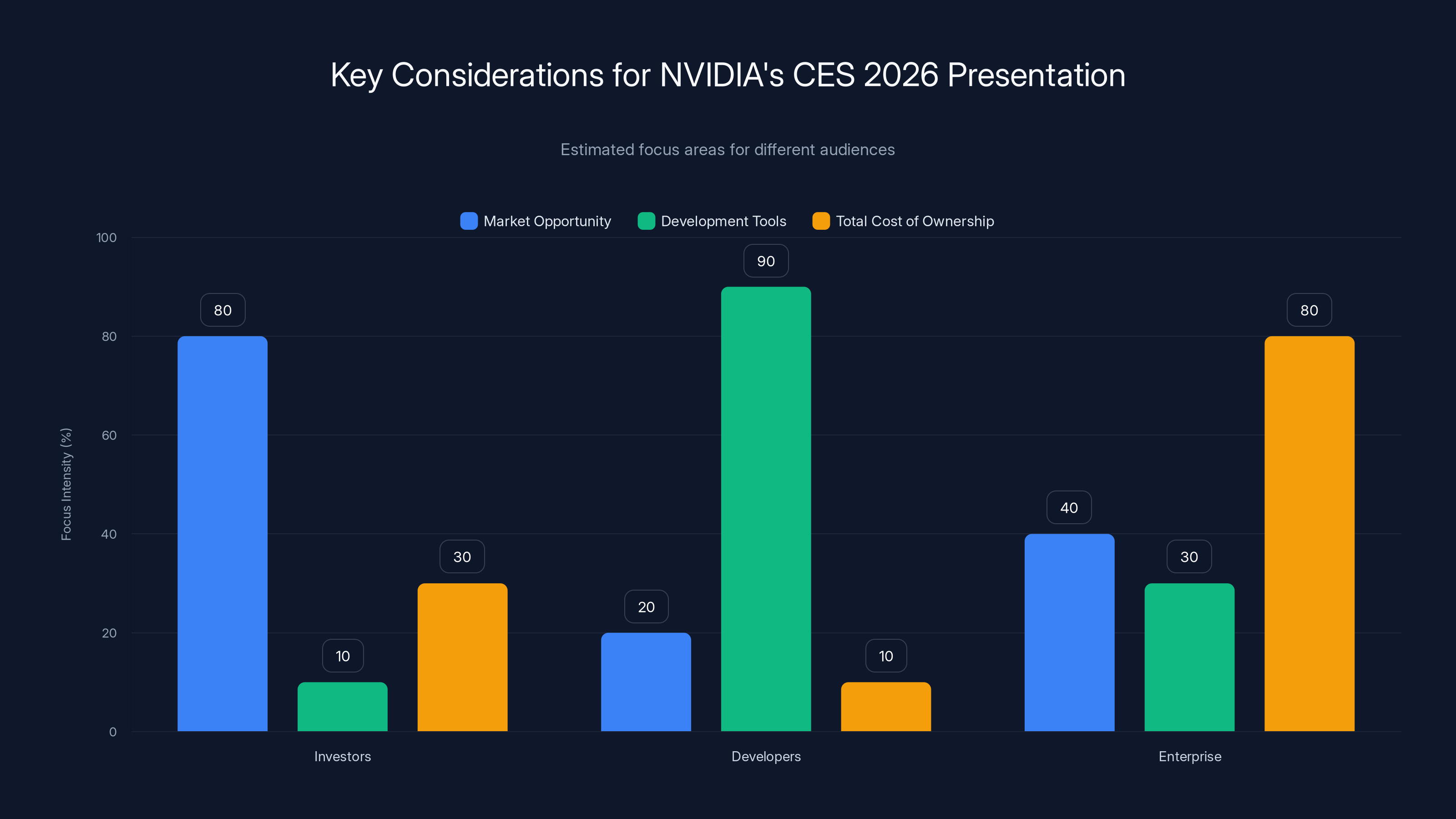

Implications for Different Market Segments

Different market participants care about different aspects of NVIDIA's announcements. Understanding whose interests align with particular announcements helps interpret significance:

Data Center Operators and Cloud Providers: These companies want signals about performance improvements, power efficiency gains, and supply availability that help them plan capital expenditures and pricing strategies for AI services.

AI Software Companies and Startups: These companies depend on NVIDIA hardware but want to see improvements in ease of programming, developer tools, and performance on their specific workloads.

Semiconductor and Component Suppliers: Companies selling memory, networking, interconnect, and other components to data center builders want to understand NVIDIA's architectural direction to plan compatible products.

Consumer Electronics Manufacturers: Companies making laptops, desktops, and consumer devices want consumer GPU roadmap information to plan product launches and AI features.

Enterprise Customers: Manufacturing, finance, healthcare, and other sectors implementing AI want to understand how NVIDIA's technologies address their specific industry requirements.

Investors and Financial Markets: This broad group cares about market opportunity sizing, competitive sustainability, growth trajectories, and margin implications—fundamentals driving investment decisions.

Historical Context: How NVIDIA's CES Presentations Have Evolved

Previous CES Keynote Themes and Announcements

Examining NVIDIA's previous CES presentations provides context for understanding what CES 2026 might deliver and how the company has evolved its messaging.

In recent years, NVIDIA's CES presentations have shifted from focusing primarily on consumer gaming and graphics to emphasizing AI infrastructure and enterprise applications. This evolution reflects both genuine shifts in the company's business (data center now exceeds consumer gaming in revenue) and strategic positioning toward investor expectations.

Thematic progression in recent years:

- 2023 CES: Positioned NVIDIA as the AI infrastructure company, emphasizing CUDA ecosystem and developer tools. Huang appeared in his now-famous leather jacket, becoming a cultural icon of tech leadership.

- 2024 CES: Expanded narrative from pure data center focus to robotics and Omniverse, showing applications beyond cloud infrastructure. Emphasized how AI would touch every industry.

- 2025 CES: Showcased RTX 5000 series consumer GPUs and Project Digits (later Spark), expanding AI beyond data centers to individual developers and smaller organizations.

The progression shows NVIDIA increasingly positioning itself not as a pure hardware company but as an AI platform enabling countless applications.

Patterns in Product Announcements and Marketing

Historical patterns in NVIDIA's CES presentations suggest:

- Architectural announcements arrive before product availability: NVIDIA typically announces next-generation architecture at major events but delays product availability 3-6 months, allowing for manufacturing ramp and software optimization

- Demonstrations precede real-world deployment: Many CES demonstrations showcase applications still in development or early pilot stages, requiring 12-24 months before broad availability

- Software announcements receive less headlines but drive greater value: While GPU announcements generate headlines, software framework and tool announcements often have greater long-term impact on developer productivity and ecosystem lock-in

- Enterprise focus dominates presentation time: Despite being held at a consumer electronics show, recent NVIDIA CES presentations have devoted 60-70% of time to enterprise applications rather than consumer products

NVIDIA's next-gen GPU architecture is expected to focus on optimizing tensor operations and memory architecture, with significant attention also on power efficiency and multi-GPU communication. (Estimated data)

Key Technologies Likely to Feature Prominently

Artificial Intelligence and Large Language Model Computing

AI and large language models have become the dominant workload driving GPU demand. NVIDIA's announcements will likely emphasize AI compute efficiency, focusing on metrics like:

- Tokens per second: How quickly a GPU can generate tokens (words) in language model inference

- Inference cost per token: The computational cost of running pre-trained AI models on input data

- Fine-tuning efficiency: How quickly GPUs can adapt pre-trained models to specific domains or tasks

- Mixture of Experts (MoE) optimization: How efficiently hardware handles sparse model architectures where only portions of the model activate for each input

These metrics matter because the economics of AI deployment increasingly revolve around inference costs. A 10% improvement in inference efficiency translates to significant operational cost savings for companies running large-scale AI services.

Physics Simulation and Digital Twins

NVIDIA's investments in physics simulation through its PhysX engine and Omniverse platform represent strategic expansion beyond compute acceleration into simulation infrastructure. CES 2026 might showcase:

- Real-time physics at scale: Simulating complex physical systems with thousands of interacting elements in real-time

- AI-guided simulation: Using machine learning to predict physical system behavior without explicit physics calculations

- Multi-agent simulation: Simultaneously simulating behavior of thousands of agents (robots, vehicles, people) interacting in shared environments

Quantum Computing Integration

While quantum computing remains nascent, NVIDIA has been positioning itself as enabling quantum computing integration with classical systems. This might manifest in CES announcements about how GPUs accelerate quantum simulation or how quantum processors could integrate with GPU-accelerated computing architectures.

Market Opportunities NVIDIA Might Address

Emerging Verticals and Industry Applications

Beyond the core data center AI market, NVIDIA has been expanding into several new industries where GPU-accelerated computing provides significant advantages:

Healthcare and Life Sciences: Drug discovery, protein folding prediction, medical imaging analysis, and genomics analysis all benefit from GPU acceleration. NVIDIA might announce partnerships with pharmaceutical companies or healthcare systems.

Climate Science and Environmental Modeling: Scientific computing for climate modeling, weather prediction, and environmental monitoring represents a massive computational opportunity.

Financial Services: Risk modeling, algorithmic trading, fraud detection, and portfolio optimization benefit from GPU acceleration. Expect announcements about NVIDIA's financial services applications.

Energy and Utilities: Power grid optimization, renewable energy forecasting, and energy trading systems all rely on sophisticated computational models.

Autonomous Systems: Beyond robots and vehicles, autonomous systems in agriculture, mining, construction, and other industries represent emerging NVIDIA markets.

Geographic Expansion and International Markets

NVIDIA has faced challenges in international markets due to export restrictions and competitive alternatives. CES 2026 announcements might address:

- Regional partnerships: Collaborations with local companies in Asia, Europe, and other regions to serve markets where direct sales face obstacles

- Export-compliant product lines: Potentially announcing products specifically designed to comply with export restrictions to certain countries

- International developer initiatives: Programs to grow NVIDIA's developer community outside the US

Estimated data shows that investors focus on market opportunities, developers on tools, and enterprises on TCO. Estimated data.

How to Interpret CES 2026 Announcements

Key Metrics and Benchmarks to Watch

When NVIDIA presents performance benchmarks, understanding the context is crucial:

Performance improvements: When NVIDIA claims X% performance improvement, verify whether this is measured against the previous generation, against competitors, or against some baseline. A 2x performance improvement sounds dramatic but means different things depending on the comparison point.

Power efficiency: Measured in FLOPS per watt (floating point operations per second per watt) or similar metrics. Improvements here matter significantly for data center operators facing power constraints and electricity costs.

Real-world versus theoretical performance: NVIDIA's presentations often emphasize peak theoretical performance. Real-world performance depends on how effectively software can utilize available hardware resources.

Benchmark selection bias: Presentations typically highlight benchmarks where NVIDIA performs well. Look for which benchmarks are conspicuously absent from presentations—these often indicate areas where competitors maintain advantages.

Reading Between the Lines

NVIDIA's presentations contain strategic messaging layered beneath technical announcements:

Competitive positioning language: How NVIDIA talks about competitors (whether named explicitly or referenced obliquely) signals competitive concerns and differentiation strategies.

Market size claims: NVIDIA's estimates of addressable market sizes indicate where the company believes future growth will come from. Expansions to previous market size estimates signal growth optimism.

Partner announcements: Which companies are highlighted as partners or customers indicates strategic partnerships and validates market demand.

Investment signals: How much time and emphasis NVIDIA devotes to particular areas (like robotics or Omniverse) signals investment priority and expected growth.

Preparing for Post-Announcement Analysis

Where to Find Expert Commentary

Immediately following NVIDIA's CES 2026 keynote, expert analysis and investor commentary will proliferate across multiple platforms:

Financial analyst notes: Equity research analysts at investment banks and research firms will publish immediate reactions, typically within hours of the keynote conclusion. These analyses focus on financial implications and market impact.

Technology media outlets: Tech publications will publish detailed breakdowns of technical announcements, explaining implications for different technology domains.

Investor conference calls: NVIDIA executives will discuss the keynote on investor calls, providing opportunity to ask clarifying questions and explore implications.

Social media and forums: Real-time discussion on Twitter/X, Reddit, and dedicated tech forums provides diverse perspectives from industry professionals, investors, and enthusiasts.

Evaluating Announcement Significance

Not all announcements carry equal significance. Consider these factors when evaluating importance:

Time allocation: Announcements receiving more presentation time signal greater importance to NVIDIA's strategic vision.

Product specificity: Concrete product announcements with pricing and availability dates matter more than vague roadmap statements.

Market impact: Announcements addressing massive markets or dramatically superior technology generate greater significance than niche or incremental improvements.

Competitive implications: Announcements that clearly differentiate NVIDIA from competitors or address competitive threats carry greater significance.

The NVIDIA CES 2026 keynote starts at 4:00 PM ET, 1:00 PM PT, and 9:00 PM UTC, accommodating a global audience.

What CES 2026 Means for NVIDIA's Future

Strategic Positioning for 2026-2030

NVIDIA's CES 2026 presentation will establish strategic direction for the next several years. Key questions the presentation should answer include:

How will NVIDIA respond to emerging competition from custom silicon, AMD improvements, and international competitors? NVIDIA's current strategy focuses on software ecosystem lock-in through CUDA, but this advantage erodes if competitors' software stacks mature.

Where does NVIDIA see the next major computing paradigm shift, and how is the company positioning to lead it? The company successfully pivoted from graphics to AI; the next shift might involve quantum computing, neuromorphic computing, or other emerging paradigms.

How will NVIDIA balance enormous data center demand against other markets? As data center demand potentially plateaus, can NVIDIA successfully expand into robotics, edge computing, automotive, and consumer applications?

How will geopolitical and regulatory changes affect NVIDIA's business? Export restrictions, semiconductor sovereignty initiatives, and antitrust scrutiny all pose challenges NVIDIA's strategy must address.

Long-term Competitive Positioning

CES 2026 announcements will influence NVIDIA's competitive position for years afterward. Strong announcements that clearly demonstrate architectural advantages and strategic vision strengthen NVIDIA's ability to:

- Attract top engineering talent

- Maintain pricing power and margins

- Retain customer relationships against competitive alternatives

- Justify premium valuation to investors

Conversely, presentations perceived as incremental or not clearly addressing competitive challenges can trigger erosion of market position and valuation multiple compression.

Considerations for Different Audiences

For Investors and Financial Professionals

Investors watching NVIDIA's CES 2026 presentation should focus on financial implications:

- Market opportunity quantification: What's the total addressable market NVIDIA is targeting, and what growth rates does management project?

- Gross margin trajectories: Will new products maintain current gross margins (60-70%) or face margin pressure from competition or product mix shifts?

- Capital intensity: How much additional manufacturing capacity investment will be required to meet demand for new products?

- Competitive moat sustainability: What durable advantages will NVIDIA maintain against competitors, and how defensible are these advantages?

- Multiple expansion or contraction signals: Do announcements suggest future growth acceleration or deceleration?

For Software Developers and Engineers

Developers watching the keynote should focus on:

- Development tools and frameworks: What improvements to CUDA, deep learning frameworks, and other development tools does NVIDIA offer?

- Hardware programming difficulty: Do new architectures become easier or harder to program effectively?

- Performance optimization guidance: What specific optimization strategies work best on new hardware?

- Educational resources and documentation: Will NVIDIA invest in helping developers learn new technologies?

- Community support: How active are NVIDIA's developer communities, and what support channels exist?

For Enterprise Decision-Makers

Corporate IT and technology leaders should focus on:

- Total cost of ownership implications: How do new products affect TCO for AI infrastructure deployments?

- Compatibility with existing infrastructure: Can new products integrate with existing on-premise and cloud systems?

- Vendor lock-in risks: How dependent will our organization become on NVIDIA's ecosystem, and is this acceptable?

- Support and services availability: What support options exist, and what's the vendor's commitment to long-term support?

- Roadmap alignment: Does NVIDIA's technology roadmap align with our organization's 3-5 year computing needs?

Competitive Alternatives and Emerging Options

AMD's Competitive Response and MI Series

Advanced Micro Devices has been rapidly improving its AI accelerator offerings, particularly through its MI series GPUs. While AMD maintains roughly 12-15% market share in AI accelerators (compared to NVIDIA's dominance), the company is steadily gaining ground among customers frustrated with NVIDIA's pricing and supply limitations.

AMD's strategy emphasizes open-source software ecosystems and compatibility with broader industry standards. Where NVIDIA locks developers into CUDA, AMD's ROCm stack aims to be more portable and less vendor-specific. For organizations concerned about vendor lock-in, AMD's alternatives deserve consideration.

For teams evaluating infrastructure automation and looking to optimize how they manage multi-vendor environments, platforms like Runable offer workflow automation capabilities that abstract away specific hardware vendor details. Runable's AI-powered automation can help teams rapidly deploy, configure, and optimize infrastructure across different accelerator types, reducing the operational complexity of managing heterogeneous hardware environments.

Intel's Data Center GPU Strategy

Intel is investing substantially in data center GPUs through its Gaudi architecture and upcoming products. Intel's approach emphasizes integration with existing Intel server infrastructure and competitive pricing. However, Intel faces significant challenges competing against NVIDIA's software ecosystem advantages and established market position.

Custom Silicon and Specialized Approaches

Technology companies like Google, Amazon, and Meta are increasingly developing custom silicon optimized for their specific AI workloads rather than relying solely on general-purpose NVIDIA GPUs. This trend toward customization reflects growing sophistication in AI workload analysis and the realization that general-purpose solutions often waste computational resources on underutilized capabilities.

For organizations developing custom AI infrastructure, Runable's automation capabilities become particularly valuable, enabling efficient orchestration and optimization of heterogeneous hardware environments combining general-purpose and specialized accelerators.

FAQ

What time does the NVIDIA CES 2026 keynote start?

The NVIDIA CES 2026 keynote begins at 4:00 PM Eastern Time on January 5, 2026. This translates to 1:00 PM Pacific Time for West Coast viewers and 9:00 PM UTC for European audiences. The presentation is scheduled for 90 minutes, running until approximately 5:30 PM ET.

Where can I watch the NVIDIA CES 2026 presentation live?

The NVIDIA CES 2026 keynote will be livestreamed on NVIDIA's official corporate website and likely on NVIDIA's YouTube channel. You can access the official stream directly through NVIDIA.com once the event begins. Major tech media outlets covering CES 2026 will also likely provide streaming links and embedded players on their sites.

What will NVIDIA announce at CES 2026?

While specific announcements remain confidential until the keynote, industry analysts expect NVIDIA to announce next-generation GPU architecture details, expand its robotics and Omniverse applications, showcase AI-powered innovation across industries, and potentially discuss new consumer gaming GPUs in the RTX series. The presentation will likely emphasize AI, robotics, simulation, gaming, and content creation applications.

Do I need special software or subscriptions to watch the livestream?

No, NVIDIA's livestream is publicly accessible through a web browser without requiring subscriptions, accounts, or special software. Any device with internet connectivity and a web browser can access the stream. You may want to test your internet connection beforehand to ensure smooth streaming at 1080p resolution.

How long is Jensen Huang's keynote presentation?

The NVIDIA CES 2026 keynote is scheduled for 90 minutes. This extended format allows Jensen Huang to present comprehensive material covering multiple product categories, demonstrate technologies in action, and provide strategic context for NVIDIA's technology roadmap. Plan for uninterrupted viewing throughout the full 90-minute duration.

What is the significance of NVIDIA's CES presentation for investors?

NVIDIA's CES 2026 keynote carries significant importance for investors because it establishes the company's technology roadmap, articulates future market opportunities, addresses competitive challenges, and signals investment priorities. Announcements can influence investor sentiment, affect stock valuation, and shape market expectations for the company's financial performance. The presentation addresses questions about NVIDIA's ability to maintain market dominance and growth trajectory in increasingly competitive markets.

Will there be demonstrations or hands-on experiences at NVIDIA's CES 2026 booth?

Yes, NVIDIA is hosting a showcase at the Fontainebleau hotel in Las Vegas featuring more than 20 demonstrations of the company's latest solutions across AI, robotics, simulation, gaming, and content creation. These hands-on experiences provide detailed exploration of NVIDIA's technologies beyond what's covered in the keynote. Demonstrations will be available throughout the CES 2026 event week for attendees visiting NVIDIA's physical booth.

How should I prepare to watch the CES 2026 keynote?

To prepare for watching the NVIDIA CES 2026 keynote, ensure you have a stable internet connection capable of streaming 1080p video (5+ Mbps recommended), set aside the full 90-minute time block, and consider having a second screen available for researching topics or reading expert commentary. Bookmark the official NVIDIA livestream link before the event begins, as traffic typically spikes during major announcements. You might also review NVIDIA's previous CES presentations to understand the company's communication style and typical announcement themes.

What should I watch for to understand NVIDIA's future strategy?

Focus on how NVIDIA allocates presentation time across different technology areas (AI, robotics, gaming, Omniverse)—this indicates strategic priorities. Pay attention to competitive positioning language and how Huang addresses market challenges. Notice which new markets or applications NVIDIA emphasizes, as these signal expansion opportunities. Listen for specific performance benchmarks and technical details that demonstrate architectural advantages. Finally, observe which companies NVIDIA highlights as partners, as these partnerships validate market demand and indicate strategic relationships.

Conclusion: Making Sense of NVIDIA's 2026 Vision

NVIDIA's CES 2026 keynote represents far more than a technology product announcement event. It constitutes a strategic positioning moment for one of the world's most consequential technology companies at a pivotal period where artificial intelligence transitions from emerging technology to foundational infrastructure. Jensen Huang's 90-minute presentation on January 5, 2026, will offer insights into how NVIDIA plans to maintain its dominant market position, where the company believes the next major computing paradigm shifts will occur, and how the company plans to expand AI's reach beyond data centers into robotics, consumer devices, simulation, and countless other applications.

For technology enthusiasts simply wanting to stay informed about the latest innovations, the keynote provides a window into the future of computing, robotics, gaming, and AI applications. The demonstration of cutting-edge technology, showcased both during the keynote and throughout NVIDIA's CES 2026 booth, illustrates what becomes technically possible when enormous computational power and artificial intelligence combine to solve previously intractable problems.

For investors and financial professionals, the keynote serves as essential intelligence for understanding NVIDIA's competitive positioning, growth trajectory, and ability to justify a multi-trillion-dollar valuation in an increasingly competitive landscape. Market reactions to announced products, partnerships, and strategic positioning will immediately influence NVIDIA's stock price and investor sentiment toward the broader semiconductor and AI infrastructure industries.

For software developers and engineers, the keynote provides crucial information about the development tools, frameworks, and hardware capabilities that will shape their work for the next several years. Understanding NVIDIA's architectural direction, software investments, and developer community initiatives helps engineers make technology decisions affecting their careers and organizations.

For enterprise decision-makers evaluating AI infrastructure investments, the presentation offers guidance regarding NVIDIA's long-term viability as a strategic partner and the trajectory of technology that will impact their organizations' competitive positions in an AI-driven world.

As you prepare to watch the January 5 livestream, remember that the true value of CES keynotes often lies not in individual announcement details but in understanding the strategic narrative underlying those announcements. NVIDIA doesn't simply sell products; the company articulates a vision of how technology will transform human capability, solve important problems, and create new opportunities. That visionary narrative, delivered by one of technology's most influential leaders, makes NVIDIA's CES 2026 keynote an event worth watching regardless of your specific interest in the company or its products.

Whether you're watching to understand the future of AI, robotics, and simulation; evaluating investment opportunities; planning technology infrastructure; or simply staying informed about technological progress, NVIDIA's CES 2026 presentation will provide substantial material for analysis and discussion. Set aside the time on January 5 at 4:00 PM ET, tune in to NVIDIA's livestream, and witness how one of technology's most important companies is shaping the future of computing.

Key Takeaways

- NVIDIA's CES 2026 keynote streams January 5 at 4 PM ET via NVIDIA.com and YouTube for 90 minutes

- Expect announcements on next-generation GPU architecture, robotics applications, Omniverse expansion, and consumer gaming innovations

- NVIDIA commands 80-88% market share in AI accelerators but faces increasing competition from AMD, Intel, and custom silicon

- The presentation holds significance for investors as it establishes technological roadmap and addresses competitive challenges

- Key areas to watch include performance benchmarks, strategic partnerships, market expansion signals, and software ecosystem investments

- Demonstrations across AI, robotics, simulation, gaming, and content creation will showcase applications beyond data center infrastructure

- Jensen Huang's communication style emphasizes visionary narrative alongside technical details, appealing to both engineers and investors

- CES 2026 keynote will help determine NVIDIA's ability to maintain market dominance amid emerging competition and geopolitical challenges

Related Articles

- NVIDIA CES 2026 Keynote: Live Stream Guide & What to Expect

- LG's CLOiD Humanoid Robot: The Future of Home Automation [2026]

- AI Predictions 2026: What's Next for ChatGPT, Gemini & You [2025]

- Sony Honda Afeela CES 2026 Press Conference: Complete Watch Guide [2025]

- LG xBoom Speakers 2026: AI EQ, Smart Lighting, and Design Innovation [CES]

- LG Gallery TV: The Ultimate Art Display Solution [2026]