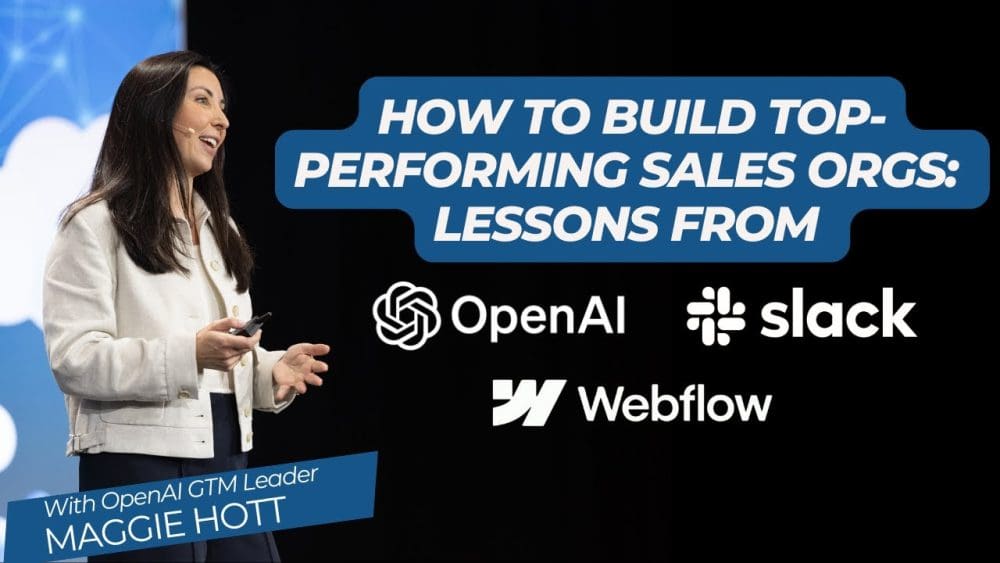

Open AI's Go-To-Market Playbook: No Commissions, 100% Pilot Wins, and Beating the Incumbents [2025]

Introduction: When Category Creators Reject Conventional Sales Wisdom

When Open AI's go-to-market leader Maggie Hott built the sales organization from scratch, she made a deliberate choice that contradicts decades of Silicon Valley sales dogma. She eliminated commissions entirely.

Not partially. Not conditionally. Completely.

This isn't a cost-cutting measure. This is culture engineering at scale. It's the kind of strategic decision that separates category creators from everyone else, and it reveals something fundamental about how companies actually win in markets where incumbents have every advantage except speed.

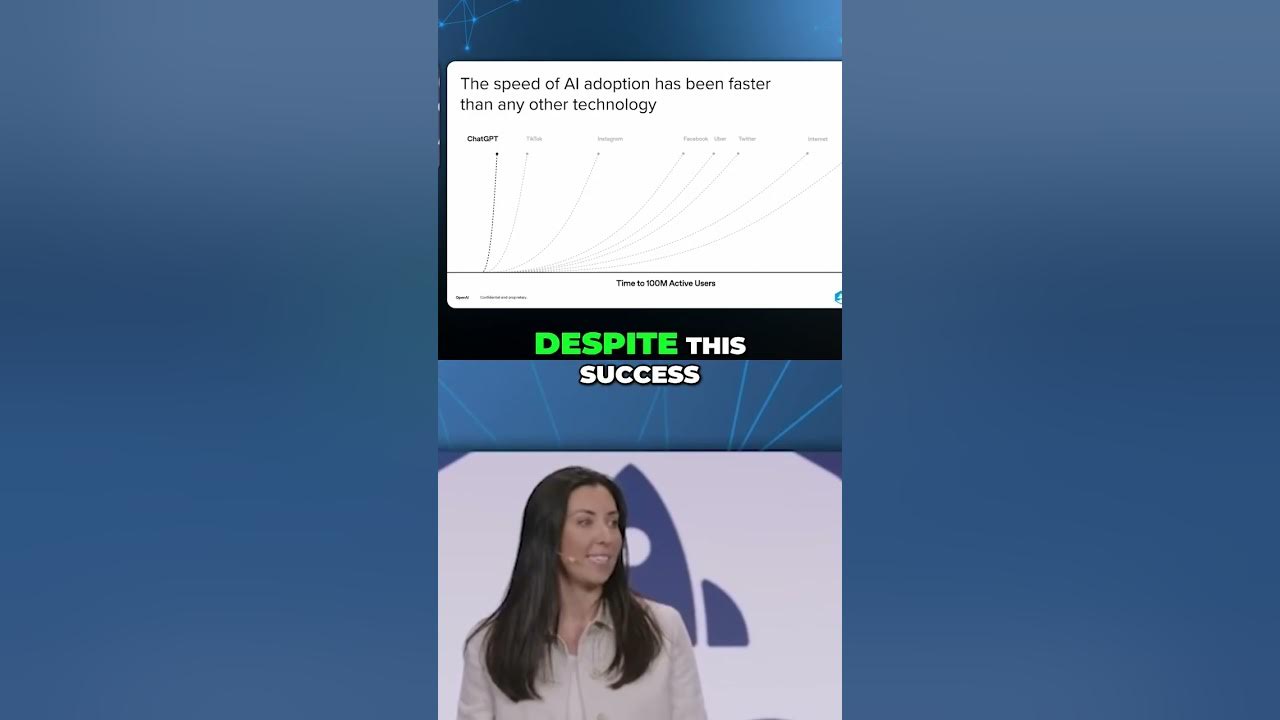

Most sales leadership advice defaults to recycled wisdom: hire for humility, avoid blamers, emphasize grit. Sound advice, certainly. Forgettable, almost certainly. But when you dig into how companies like Slack and Stripe built their go-to-market engines in the early days, and what Open AI is doing right now as it scales past 500 sales professionals, you start noticing patterns that actually matter.

These companies operate on a fundamentally different theory of how sales teams should function. They've weaponized distribution before incumbents could weaponize innovation. They've structured compensation and incentives around company velocity instead of individual deal maximization. They've treated pilots not as stalling tactics but as closing mechanisms with near-perfect conversion rates.

The stakes are enormous. Microsoft and Google aren't sitting still. The AI arms race means the window to build an unassailable customer base is finite. For Open AI, acquiring distribution before incumbents acquire genuine innovation isn't just strategy. It's existential.

Here's what separates Open AI's approach from the sales playbooks that get recycled at every SaaS company at the 10-person stage. Real talk: most of what you'll read about sales hiring and GTM strategy is either tactical minutiae or vague motivational content. This is neither. This is about fundamental structural choices that force a company to operate differently from day one.

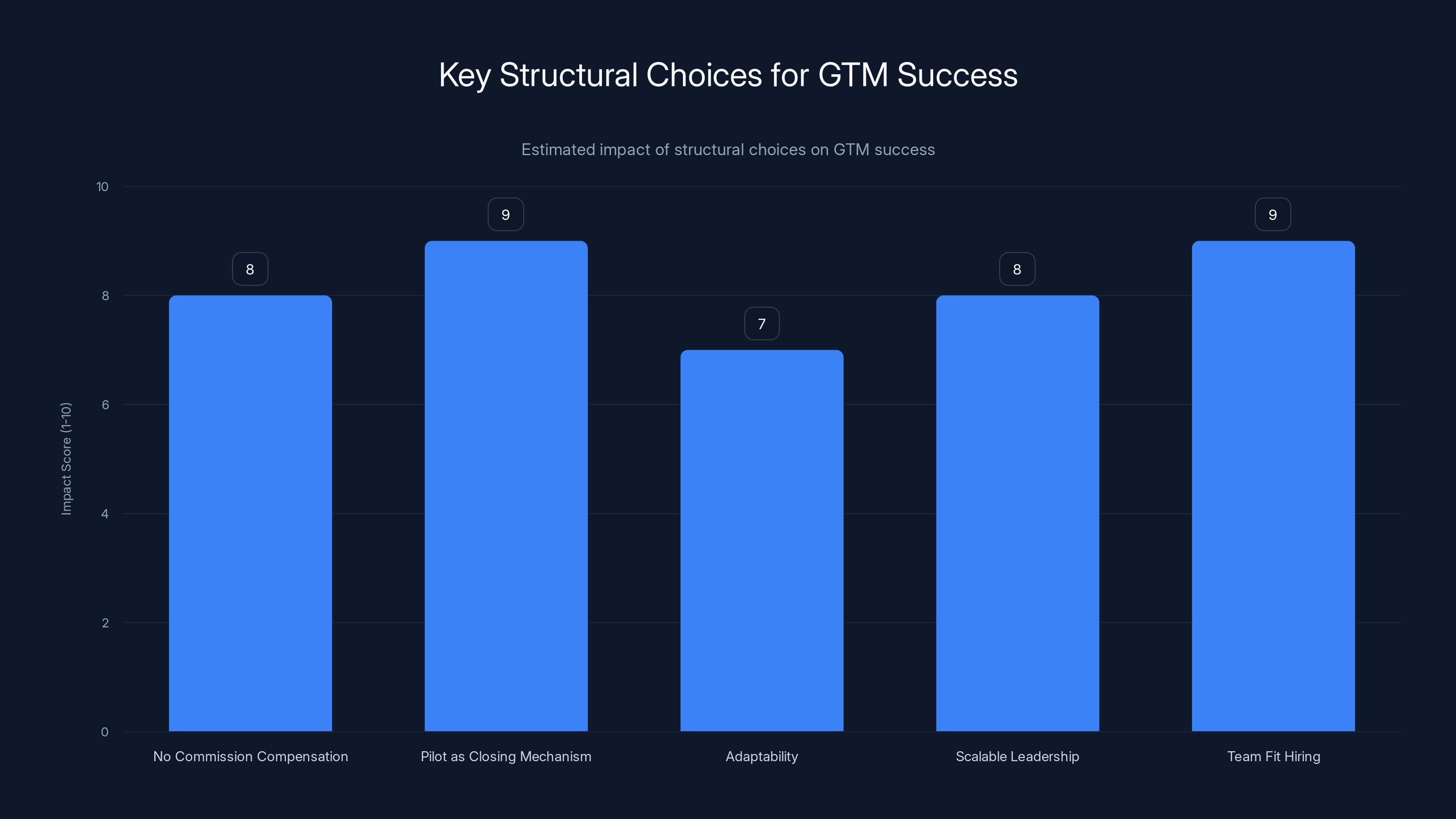

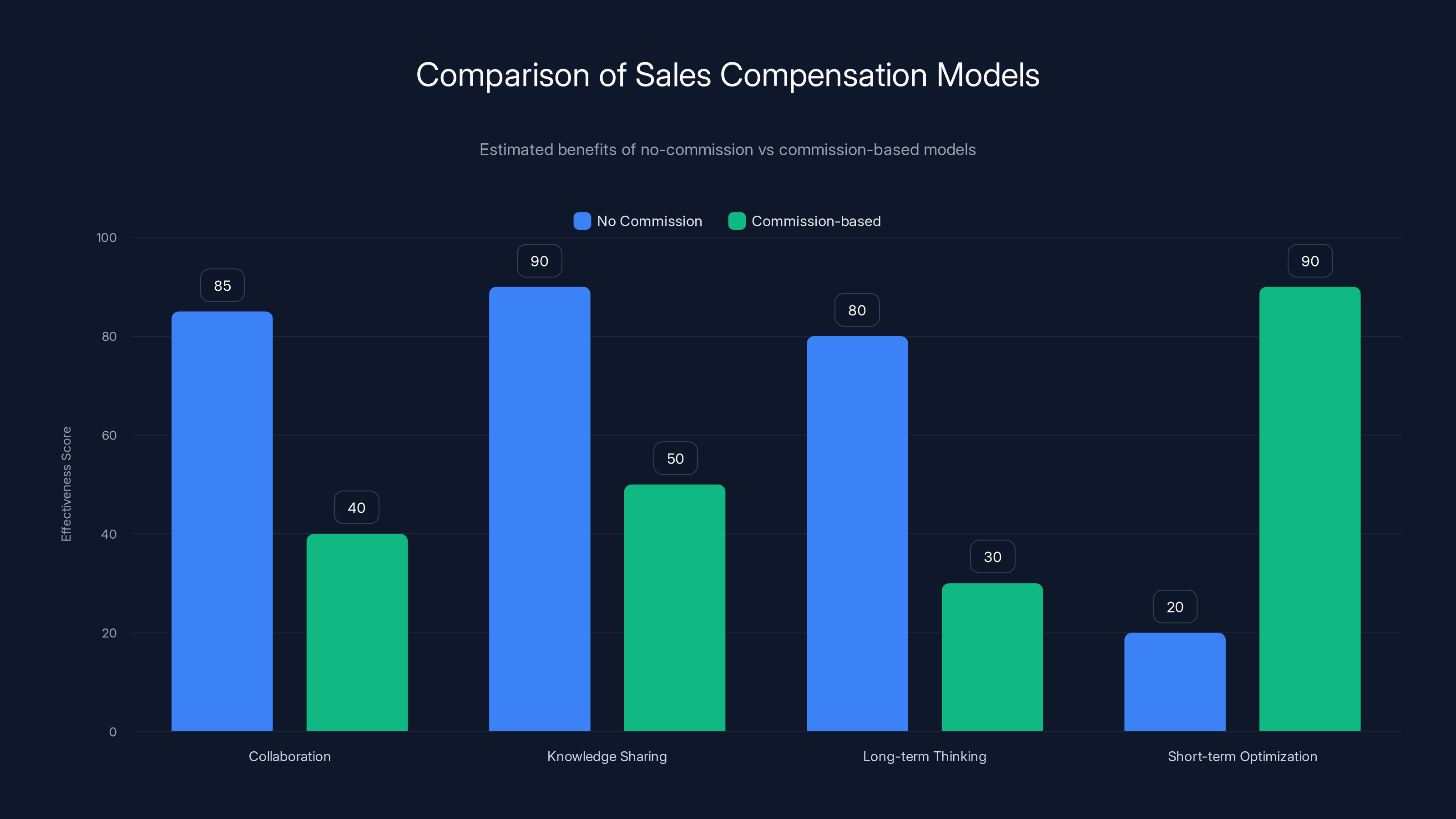

Key structural choices like no commission compensation and hiring for team fit significantly impact GTM success. Estimated data.

Why Commission-Based Pay Creates the Wrong Behaviors

When you structure compensation around commissions, you're making a game-theoretic bet. You're saying: "I want each rep to maximize personal revenue outcome, and I trust that the alignment with company interests is automatic."

It almost never is.

Here's what happens instead. Reps hoard deals because sharing means splitting commission. They defend territories aggressively, not because the territory is better served by one person but because dividing the pie reduces their take. They're reluctant to help teammates close deals because that's hours of work with no personal financial upside. They extend sales cycles for large deals because the commission bump justifies the effort, even if it delays company revenue recognition by months.

The behavior you get is perfectly rational for an individual optimizing within a system. The system itself is the problem.

Open AI chose differently. No commissions. Instead: competitive base salary plus meaningful equity, aligned with the outcome of the entire go-to-market organization, not individual deal flow.

What shifts when you remove the commission structure?

Deals flow to whoever serves the customer best. Instead of territory defense, you get specialization. If an enterprise logistics customer has a specific infrastructure requirement, the rep who knows Kubernetes inside and out handles the technical piece, even if it's not their "region." The handoff doesn't trigger compensation anxiety because there's nothing to lose.

People help each other without calculating personal upside. You'd be amazed how much sales teams suffer from knowledge hoarding. The rep who's cracked a particular vertical keeps the playbook locked in their head because sharing it creates competition for "their" deals. Without commission incentives, that playbook becomes team IP. Faster closes, better customer outcomes, systematic advantage.

The focus stays on company wins, not comp plan gaming. This is subtle but massive. A rep on commission has a personal incentive to close every deal they touch, even deals that are wrong fits. A rep on salary plus equity has an incentive to be selective. Better to lose a bad-fit deal early than win it and watch the customer churn in year two. The math changes everything.

Velocity becomes possible. When reps aren't fighting over deals, territories, and commission pools, the sales organization can move fast. Open AI scaled from 10 to 500 sales professionals. That velocity requires institutional alignment. Commission cultures fragment under that kind of growth. You need everyone rowing the same direction.

The catch is real, though. This structure only works if you have several things in place:

First, significant funding. You need to pay competitive base salaries without commissions. That's an expense line that's substantially higher than the standard "low base plus high upside" model most startups use.

Second, meaningful equity. The upside can't all come from salary. Equity creates the long-term alignment that commissions were supposed to create. But equity only feels real to employees if the company trajectory is credible and the vesting schedule is reasonable.

Third, category-defining product. This is the hidden assumption. You can only pull off a commission-free culture if you're genuinely building something valuable enough that mission-driven people self-select in. Mercenaries self-select out. That sorting happens naturally when the product is undeniably good and the market opportunity is massive.

If you're selling a "me-too" product or one that's good but not transformative, people want the commission upside because the equity might never materialize. Open AI doesn't have this problem. People want to work there.

The result: a sales culture that attracts different people and produces different behaviors. Not better or worse on an absolute scale. Different in exactly the ways that matter for a company racing against trillion-dollar incumbents.

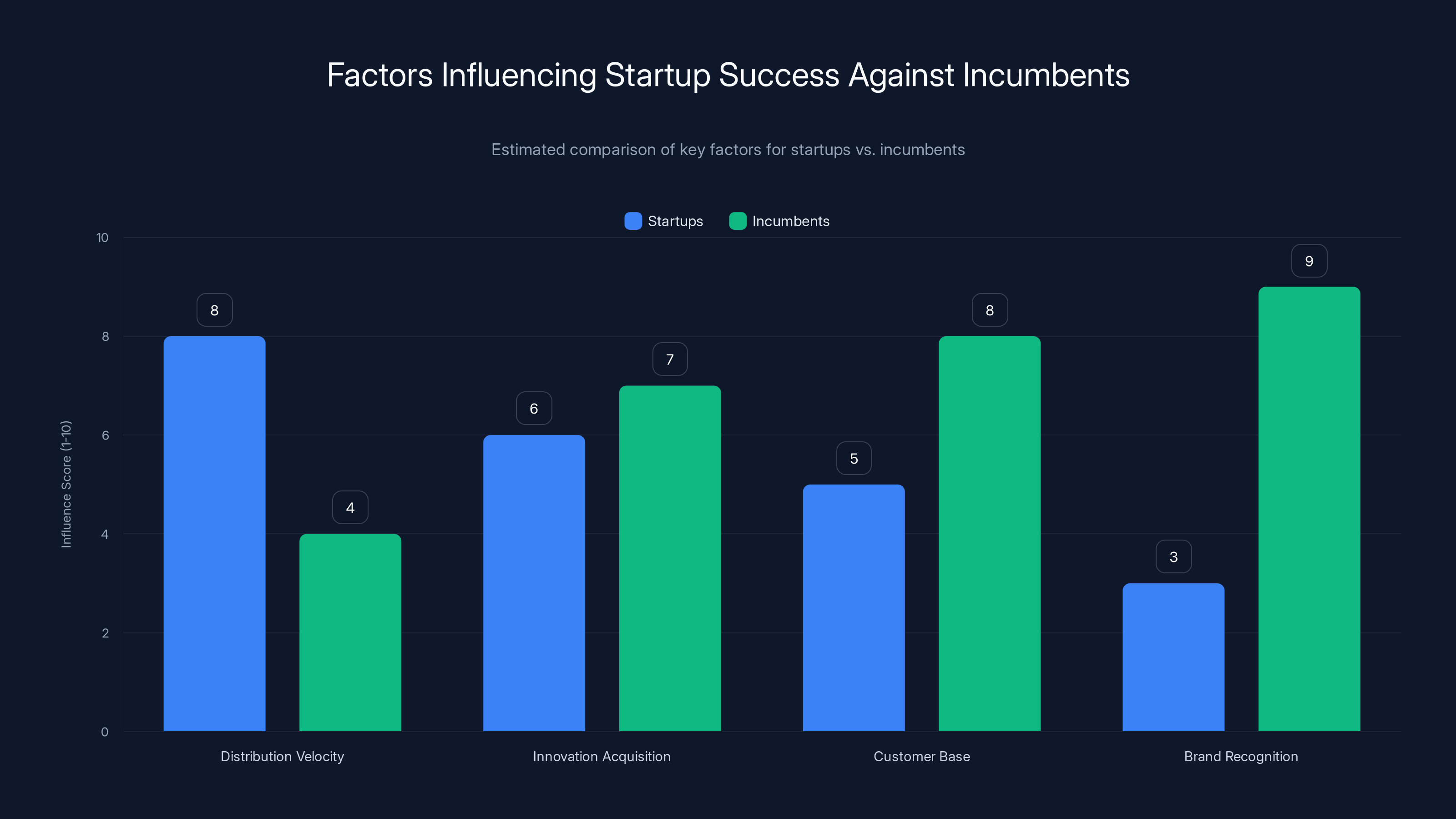

Startups excel in distribution velocity, while incumbents have stronger brand recognition and customer bases. Estimated data highlights strategic focus areas.

The Pilot Win Rate Strategy: 100% or You're Doing It Wrong

Most companies treat pilots as a necessary evil. The customer wants to "test things out" before committing. The sales team agrees because it advances the deal forward, even if it extends the cycle by weeks or months.

Open AI inverted this dynamic. Pilots aren't stalling tactics. They're closing mechanisms. And if you're losing them regularly, the problem isn't the customer. The problem is your process.

Target win rate on pilots: 100%. Not "very high." Not "respectable." 100%.

This requires thinking about pilots completely differently. Most companies run pilots backward. They say: "Okay, you've got 30 days. Try the product. See if it works for you. Let us know." Then they disappear. The customer runs the pilot in a vacuum, with minimal support, no clear success metrics, and no accountability from either side. Of course these fail. The customer doesn't fail because the product doesn't work. They fail because there's no structure.

Open AI's approach has three layers:

Executive buy-in before the pilot starts. This is non-negotiable. Before a single line of code runs, you need the customer's executive sponsor to say: "Yes, we've committed to evaluating this for a real business outcome." That commitment means budget, team allocation, and cultural permission to succeed. If the executive isn't committed before day one, no pilot playbook will rescue you.

The sales team's job isn't to run the pilot. It's to ensure that the customer has made the internal commitments required for a successful outcome. That's radically different from "getting the deal moving."

A repeatable playbook with clear success metrics defined upfront. Every pilot runs the same way. Same structure, same timeline, same success criteria. Both sides know what success looks like before the pilot starts. Not "does the customer like it?" but "does the customer achieve X measurable business outcome?" This makes the pilot a scientific process, not a hope-driven experiment.

The metrics matter because they're not aspirational. They're based on the customer's current state and what they're trying to solve. If a customer is losing 20% of applicants in their hiring workflow due to friction, the success metric isn't "improve hiring." It's "reduce applicant drop-off to under 10%." Concrete. Measurable. Clear.

The pilot IS the sales process. This might be the most counterintuitive insight. Most companies think of the sales process as "get to pilot." Then once the pilot starts, the sales team disappears. Open AI flips this: the pilot is where the customer experiences what it actually feels like to work with the company. It's where trust gets built. It's where the customer starts understanding how to extract value.

When you run the pilot correctly, the transition from "evaluation" to "paying customer" is a formality. The customer already knows they need it because they've lived the outcome.

This changes how you staff pilots. The same people who ran the sales process should be involved in ensuring the pilot succeeds. Not because they're doing the technical implementation. But because they're ensuring that success criteria are being met, that the customer's team is engaged, and that obstacles are being removed.

When pilots have a 100% win rate, it means you're running them well. When you're losing them regularly, the first question isn't "why didn't the customer like it?" It's "where did we fail to set this up for success?"

Often the answer is one of these:

The executive never actually committed. They let a mid-level manager run the pilot without real accountability.

The success metrics were vague. "See if it works" isn't a metric. "Reduce processing time from four hours to one hour" is.

The customer's team wasn't properly resourced. Pilots fail when they're treated as a side project.

The sales team disappeared. Pilots need active management to stay on track.

You picked the wrong use case. Pilots should be on the customer's highest-priority problem, not a nice-to-have.

When these things are in place, pilots become a forcing function for customer success. And closing rates move toward 100% because the customer has already decided, psychologically and operationally. The contract is just paperwork.

The Real Race: Distribution Velocity vs. Incumbent Innovation

Alex Rampell's famous framework sits at the center of Open AI's entire go-to-market strategy. Startups win by acquiring distribution before incumbents acquire innovation.

In other words: you need to build an unassailable customer base before the big guys figure out how to do what you do.

For Open AI, this isn't abstract strategy. It's a literal race against time.

Microsoft is building AI. Google is building AI. Every enterprise software company is integrating AI. The window where Open AI has "novel and irreplaceable" as a competitive position is finite. The moment Gemini or Claude or whatever comes next is "good enough," the incumbents' distribution advantage becomes the decisive factor.

But here's the thing: incumbents have profound distribution advantages. They have enterprise relationships spanning decades. They have sales teams with deep customer relationships. They have budgets and brand recognition that startups can't match. On a symmetric playing field, they win.

Open AI's asymmetric advantage is velocity. They can make decisions faster. They can run sales processes differently. They can optimize for company wins instead of deal-by-deal performance. And they can do that at scale because they've structured the entire go-to-market operation to enable it.

This explains why eliminating commissions isn't penny-pinching. It's a structural choice that enables velocity. It explains why pilots have a 100% win rate target. It's a structural choice that compresses the sales cycle. It explains why the team has grown to 500 people so quickly. It's about locking in distribution before the incumbents start seriously trying to compete.

The strategic implication for any startup is worth understanding. Your real competition isn't other startups in your space. It's how fast the big guys can copy or acquire what you've built. You have maybe 18-36 months to build an entrenched position before the copies arrive. After that, the game is about features, relationships, and operational excellence. But the window to be truly unreplaceable is brief.

Open AI is racing against that clock. That's why everything in their GTM strategy is optimized for velocity over everything else. They're acquiring distribution at an aggressive pace because they have to.

The question every startup should ask itself: what would our go-to-market look like if we had 12 months instead of 18? What would we cut? What would we optimize? What structural changes would make that timeline possible?

Often the answer reveals that you're carrying overhead you don't need. Commission structures that slow decision-making. Sales processes that are longer than they have to be. Middle managers that add more friction than value. Teams optimized for performance at scale, not for velocity during the window when it matters most.

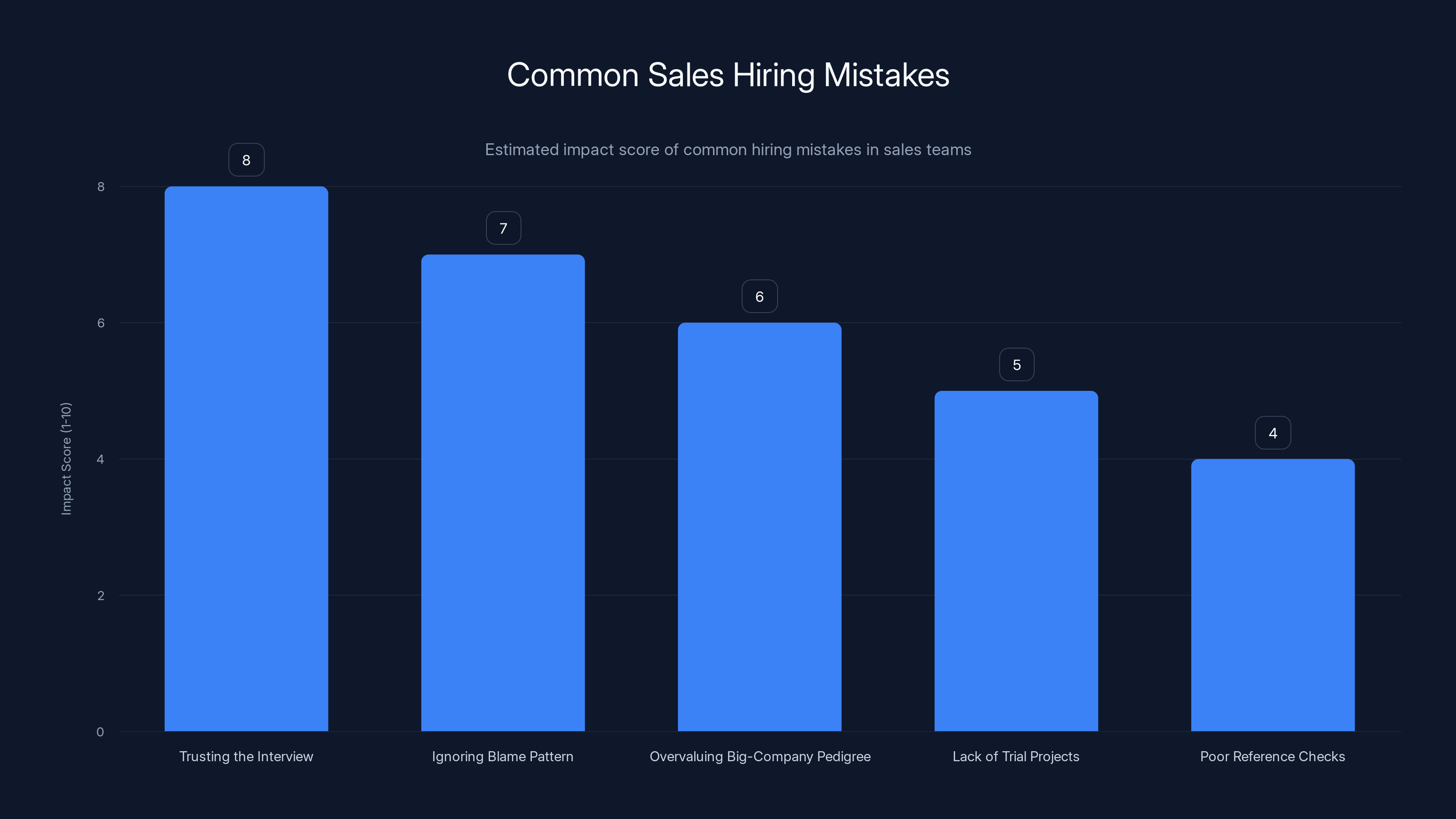

Trusting the interview too much is the most impactful mistake, with an estimated score of 8 out of 10, indicating its significant potential to lead to poor hiring decisions. Estimated data.

Building Irreplaceability Through Replaceability: A Leadership Paradox

Maggie Hott went through a health crisis that fundamentally shifted how she thinks about leadership. The lens changed when she realized: what if something happened to me? What would break?

Most leaders cling to being indispensable. They're the bottleneck where critical decisions happen. They're the person who really understands how things work. They're the one who relationships flow through. Being indispensable feels like job security. It's actually a fragility.

The counterintuitive insight: the best leaders make themselves replaceable. The goal is to set people up for success and then get out of the way.

This has three implications for how you build a sales organization:

Build systems, not dependencies. When your top performer is irreplaceable, that's a system failure. Every deal, every customer, every process should work whether a specific person is present or not. This means documentation. It means process. It means that knowledge is embedded in the organization, not in someone's head.

The moment you accept that your best rep is irreplaceable, you've capped the size of your organization. You can only grow to the point where that person's time becomes the bottleneck. That's not a strategy. That's a constraint.

Distributed decision-making over centralized approval. If every important decision requires the sales leader's sign-off, the organization moves at that person's processing speed. If decisions are distributed to the reps and managers closest to the customer, the organization moves at the speed of market reality.

This requires trust, clarity about authority boundaries, and a strong culture. But when it works, it compounds. Decisions get made faster. Information about what's working flows back to the organization quicker. Adaptations happen before they need to.

Succession planning as ongoing practice, not crisis response. Every role should have a documented handoff procedure. Every critical relationship should have multiple people involved. Every strategic decision should be made with the question: "If this person left tomorrow, could the next person continue executing?"

This feels inefficient in the moment. It's actually the opposite. When succession planning is integrated into how you run things day-to-day, you don't lose anything when people leave. You actually gain organizational resilience.

For Open AI, the implication is massive. You can't scale a 500-person sales organization if the entire culture depends on a few irreplaceable people. You have to build a system that works regardless of who's in which role. That's liberating for the leaders (they're not trapped in their roles) and liberating for the organization (it can grow without being constrained by individual capacity).

The paradox: the only way to become truly indispensable as a leader is to make yourself replaceable.

The Thermo Fisher Case Study: Where AI Meets Real Healthcare Outcomes

Buried in the broader conversation about Open AI's GTM strategy was a concrete application worth unpacking. Partnership with Thermo Fisher on clinical trials.

The problem: drug approval takes 5-10 years and costs billions. The trial process is slow, inefficient, and involves massive amounts of manual coordination. Patients wait years for treatments that could work. Companies spend resources that could go toward research instead going toward administrative processes.

Open AI's approach: rethink the entire trial architecture. Use AI to optimize patient matching. Use AI to streamline data collection and analysis. Use AI to predict outcomes and identify problems earlier in the trial process.

The stakes are enormous. If they can compress a seven-year trial into four years, that's massive value creation. Not just for the biotech company. For patients waiting for treatment. For regulators. For society.

For sales strategy, the lesson is broader: the best opportunities are in industries where the status quo is genuinely broken. That's where startups can win against entrenched players, even when those players have more resources.

Thermo Fisher isn't a startup. It's a massive, successful company. But they're constrained by legacy processes and regulatory requirements. An AI company that can prove it reduces clinical trial time by a meaningful percentage doesn't have to convince Thermo Fisher that AI is valuable. They already know. They just need proof that this particular approach works.

When you're in a market where the incumbent knows their current process is broken, the sales cycle shortens dramatically. You don't need to change minds. You need to prove efficacy.

This is why Open AI's approach to pilots matters. In a space like AI-assisted healthcare, you can't sell based on promises. You have to demonstrate measurable outcomes. That's exactly what a well-run pilot does.

The strategic implication: look for markets where the incumbent is desperate for a better way. They're easier to convert because the pain is undeniable. The sales process is about reducing risk and proving that your solution works, not about convincing them that a problem exists.

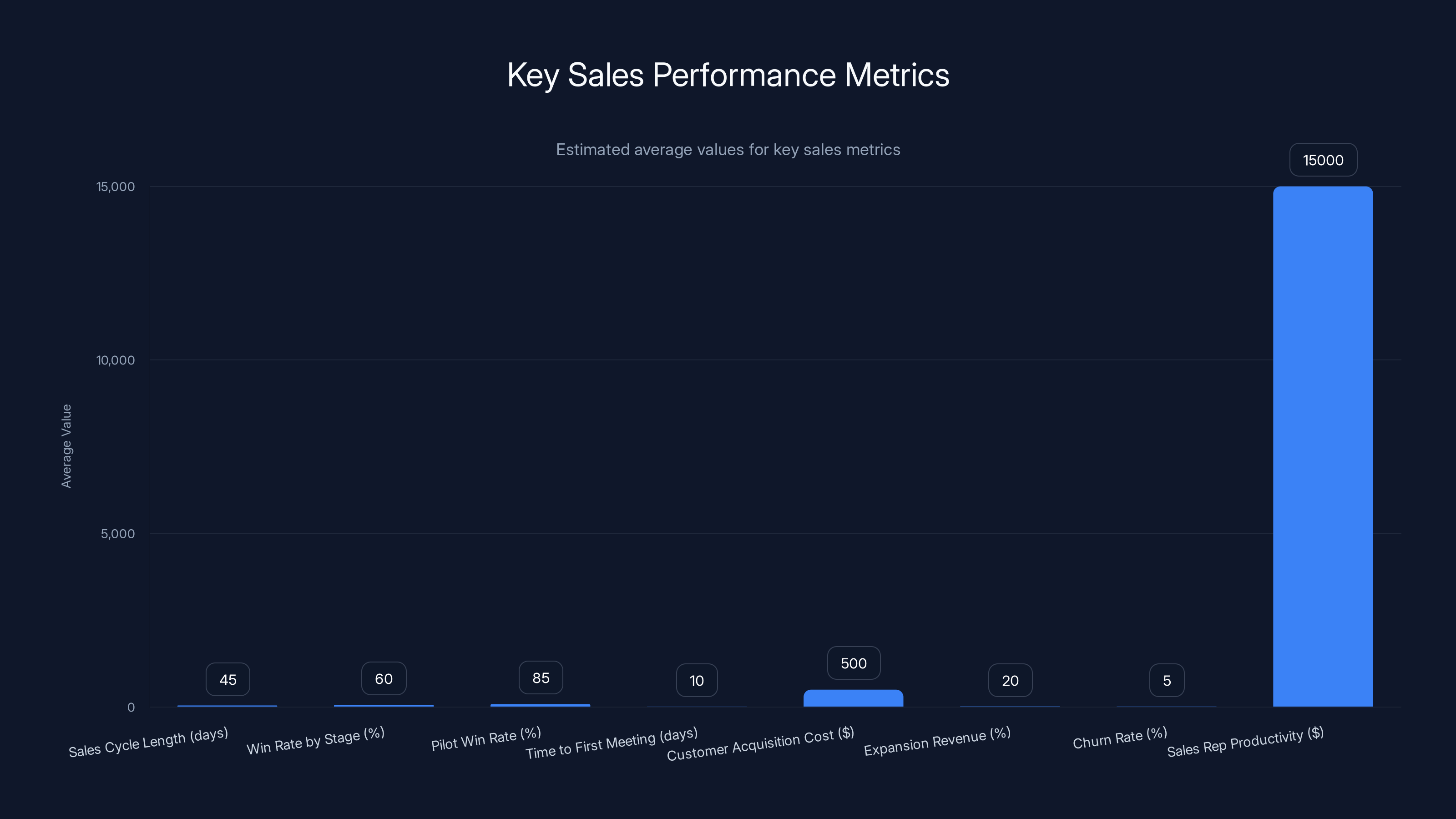

This bar chart provides estimated average values for key sales performance metrics. Monitoring these metrics can help identify areas for improvement and ensure a successful sales process. Estimated data.

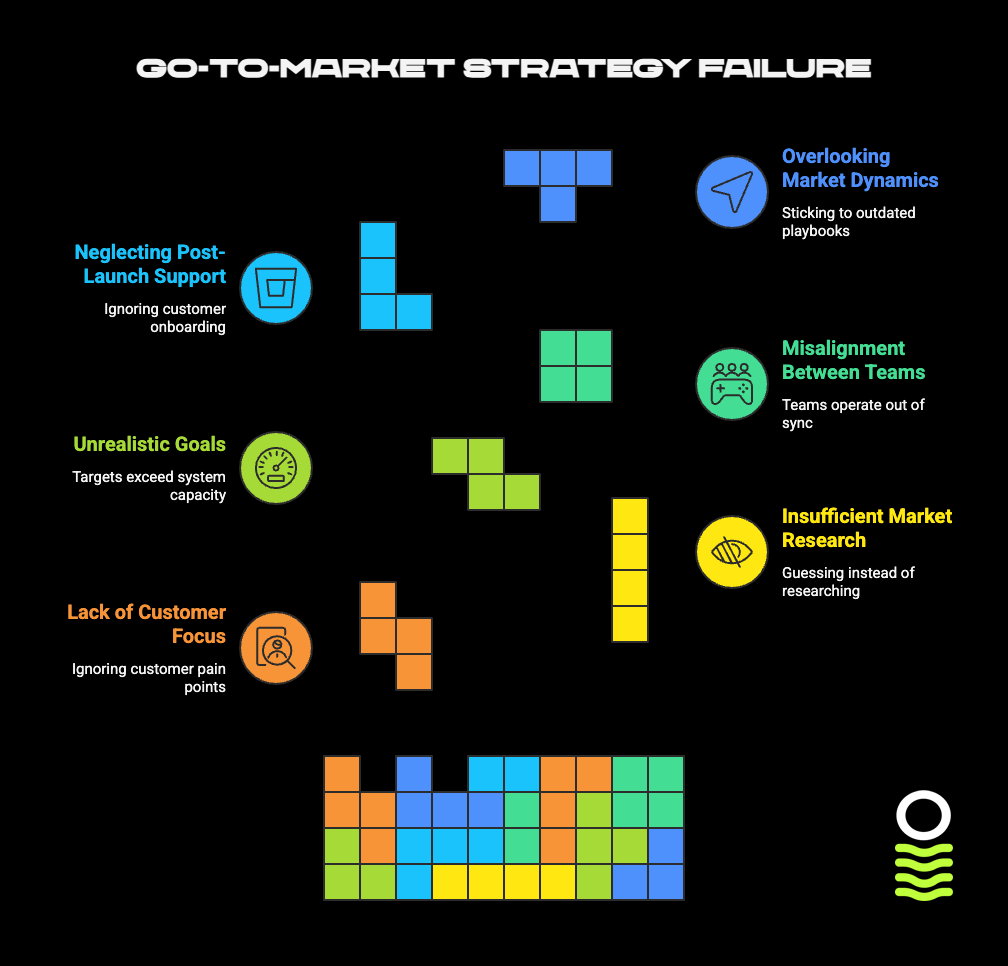

The Five Most Common Sales Hiring Mistakes (And How to Avoid Them)

When you're building a sales team, hiring is everything. Get it wrong early, and those mistakes compound for years. Maggie's perspective on hiring, drawn from building a 500-person organization, reveals five patterns that most companies get wrong.

1. Trusting the interview too much. Salespeople are, by definition, good at selling. Of course they interview well. They're selling themselves. The interview is the worst possible data point for whether someone will actually execute.

Instead: verify through work samples, reference calls that are actually substantive, and if possible, a short contract or trial project. See how they actually work before making a full-time commitment.

2. Ignoring blame pattern. If every failure in a candidate's previous role was someone else's fault, that continues at your company. This is one of the few personality traits that's highly predictive of future behavior.

Listen carefully for how candidates talk about things that didn't work. "The product wasn't good" is different from "the product wasn't good and here's what I did to work around that limitation." "The team wasn't aligned" is different from "the team wasn't aligned and here's how I helped surface that and solve it."

Blame patterns are one of the few things an interview actually reveals.

3. Overvaluing big-company pedigree. "I built a $100 million sales team at Salesforce" is impressive. But it's not predictive of startup success. Big companies have infrastructure, resources, and organizational support that startups don't. A rep who crushes it at a Fortune 500 company might completely fail in a 50-person startup because the constraints are totally different.

Probe specifically for scrappiness. How have they succeeded when things were broken? How do they perform when they have to do multiple jobs because there's nobody else to do them? Startups success requires adaptability in ways that large-company success doesn't.

4. Hiring for individual performance over team fit. The best individual performer can be terrible for team culture, especially early on. If your first three sales hires are all individual contributors who hoard information and optimize for personal deals, you've baked a certain culture into the organization from day one. Changing that later is exponentially harder.

Look for people who want to be part of something bigger than their personal number. People who care about the team's win rate, not just their own. People who get energy from helping others succeed.

5. Skipping the ego test. The best sales reps believe in themselves deeply. But there's a difference between confidence and insecurity masquerading as confidence. Insecure people need constant external validation. They need to be right. They need to win every argument.

Confident people are comfortable being wrong. They're comfortable learning from failure. They don't need to prove themselves in every interaction.

You can gauge this by introducing a situation where the candidate's approach might not be optimal. See whether they defend it aggressively or whether they're curious about alternative approaches. Watch whether they ask clarifying questions or whether they assume they already understand.

The best reps believe in themselves without needing to prove it constantly.

How to Build a Repeatable Sales Playbook That Actually Scales

Open AI's sales organization scaled from 10 to 500 people. That's not possible without a repeatable playbook. Here's how to build one:

Start with your best customer. Look at your current customer base and identify which one had the smoothest, fastest sales process and the highest expansion potential. That customer's journey is your playbook template.

Document everything about that process. How did you get introduced? Who was the champion? What meetings happened in what order? What content did you share? What objections came up and how were they addressed? What was the timeline from first meeting to contract?

Identify the three to five moments that matter most. In a sales process, not every meeting is equally important. Some moments are inflection points. Someone decides to explore further, or they decide they're done. Someone says "yes" or "no." Map out what those moments are and what needs to happen at each one.

Build the success metrics for each stage. Once you know the critical moments, define what success looks like at each stage. What percentage of prospects should move from stage one to stage two? How many buyers need to be involved? How much discovery needs to happen before you move forward?

These aren't targets. They're minimum viability criteria. If deals are moving forward without meeting these criteria, you're not running the playbook. You're hoping.

Create repeatable content and conversation frameworks. Don't script the sales rep. Scripting kills discovery and makes conversations feel robotic. But do provide frameworks. How do you structure the initial conversation? What questions do you ask? What problems are you specifically listening for?

Make it easy to do it right. The best playbooks are ones where the default path is the right path. If it takes effort and discipline to follow the playbook, people won't. If the playbook is the path of least resistance, people do.

This means: templates that people use, not processes they memorize. CRM fields that remind people what to do next, not organizational rules. Tools that support the playbook, not bureaucracy that gets in the way.

Measure rigorously and iterate quickly. Once you have a playbook, measure how it's working. Are deals moving through the stages at expected velocities? Are success metrics being hit? Where are deals getting stuck?

The playbook isn't sacred. It's a hypothesis. When you see it failing at a specific stage, investigate. Either the playbook is wrong, or the rep isn't executing it. Usually it's a combination.

Institutionalize the wins. When a rep discovers a new approach that works better, that becomes part of the playbook for everyone. Institutional learning is how playbooks improve over time.

Without this step, you end up with pockets of excellence. One rep is crushing it, but their approach never gets shared. The organization stays fragmented. Scaling becomes harder.

A repeatable playbook is the only way to scale sales without losing quality. Every new rep should be able to start at 70% effectiveness because the playbook handles the hard structural work. Their job is to add personality and relationship-building on top of a solid foundation.

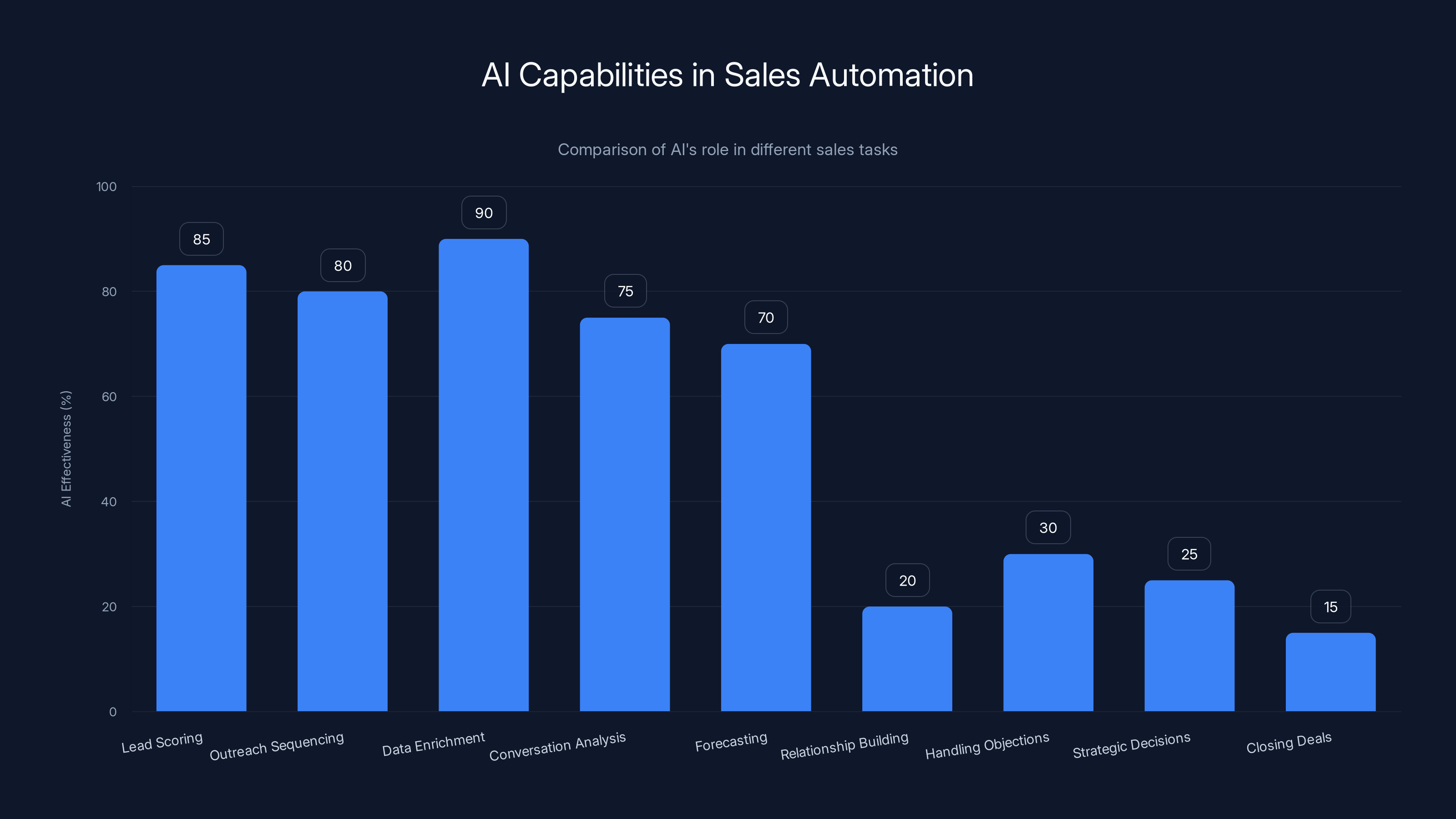

AI is most effective in automating tasks like lead scoring and data enrichment, while human skills are crucial for relationship building and closing deals. Estimated data.

The Enterprise Sales Lens: Who Actually Makes the Decision?

One of the most underrated aspects of enterprise sales is understanding who actually has decision-making power. Most sales processes fail because they're talking to the wrong person.

Here's the reality: there's rarely a single decision-maker. Instead, there are multiple people with different incentives and concerns:

The champion is the person who recognizes the problem and wants it solved. They're typically mid-level management or an individual contributor who's frustrated with the status quo. They care about solving their specific problem.

The economic buyer controls budget and can say yes or no to the expense. This is often someone several levels higher than the champion. They care about ROI, risk, and whether it competes with other budget priorities.

The technical evaluator needs to confirm that the solution works technically and integrates with existing infrastructure. This is often the CTO or infrastructure team. They care about implementation burden and technical debt.

The procurement person handles the actual contracting and ensures the terms are acceptable. They care about legal risk, vendor viability, and compliance.

A common sales mistake is treating these as sequential. You win over the champion, then you move to the economic buyer, then the technical evaluator. In reality, they're often happening in parallel. And sometimes they're the same person (in smaller organizations) or more people (in larger ones).

The best sales reps figure out who these people are early and orchestrate their involvement throughout the process. The champion provides cover and context. The economic buyer provides budget and permission. The technical evaluator confirms viability. Procurement ensures the contract is acceptable.

If you lose any of these people along the way, the deal stalls. Understanding this early in the sales process is why pilots matter. Pilots force these people to be involved and engaged throughout the evaluation.

The Role of Product in Go-To-Market Strategy

There's a false assumption that GTM strategy is purely sales and marketing. In reality, product strategy is part of GTM. How you build the product affects how easily it sells.

Open AI's product has certain characteristics that make it easier to sell at enterprise scale:

It solves a problem that's hard for incumbents to solve. This matters because it means the customer is genuinely motivated to evaluate. They're not choosing between marginal improvements. They're choosing between the broken status quo and a genuinely better way.

It's defensible. There's genuine technical moat because of the model, the data, and the team. This matters in sales because it means you're not asking customers to bet on a long shot. The product is likely to still be good next year and in five years.

It works with incumbents' infrastructure. This is subtle but important. If your product requires ripping out existing systems, the friction is enormous. If it integrates with what they already have, adoption becomes possible.

It has clear, measurable value. You can point to before-and-after numbers. This matters because it makes pilots work. You can define success objectively.

These are all product decisions, but they're GTM decisions too. When you're building a product, ask yourself: will this be easy to sell? Will customers be able to measure its value? Will it integrate with their existing infrastructure? Can we defend it against copies?

GTM and product strategy are intertwined.

Estimated data suggests no-commission models promote collaboration, knowledge sharing, and long-term thinking, while commission-based models focus on short-term optimization.

Velocity as a Competitive Advantage: Why Speed Matters More Than Size

When you're racing against larger, better-resourced incumbents, velocity is your asymmetric advantage. You can move faster. You can make decisions quicker. You can adapt based on market feedback before the incumbents even notice.

But velocity isn't free. It requires structural choices:

Flatter decision-making. Every layer of approval slows things down. Open AI has layers because they're a 500-person organization. But the decision authority is distributed. Reps can make tactical decisions without waiting for manager approval. Managers can make strategic decisions without waiting for the executive team.

Clear principles over detailed rules. When you have detailed rules, every exception requires a decision. When you have clear principles, people can make decisions themselves. "Close deals with good-fit customers" is a principle. "You can only give discounts within these ranges" is a rule. Principles scale better.

Fast feedback loops. When you make a decision, you need to know quickly whether it's working. This means metrics, measurement, and honest assessment. If something isn't working, you need to know fast enough to change it before too much damage is done.

Willingness to be wrong. The fastest organizations make decisions with imperfect information. They know they'll need to adjust. The slowest organizations try to gather perfect information before deciding. That takes months.

Compensation that's not transactional. When people are optimizing for individual deals, decision-making slows down because everyone's trying to extract personal upside. When people are optimizing for company outcomes, decisions can be made on company logic, not personal finance.

Velocity compounds. Each fast decision enables faster decision-making downstream. Each month you move faster than competitors builds a lead that's hard to close.

Sales Culture and the Behaviors You're Actually Creating

When you make structural decisions about your sales organization, you're not just making financial choices. You're creating a culture.

Commission cultures create certain behaviors: individual optimization, information hoarding, territory defense, short-term thinking. These aren't moral failures. They're rational responses to incentives.

Salary plus equity cultures create different behaviors: team optimization, knowledge sharing, collaborative problem-solving, long-term thinking. Again, rational responses to incentives.

The choice between these isn't "one is good and one is bad." It's "which behaviors do I need right now?"

For a company racing to build distribution before incumbents copy them, the salary plus equity culture is better. You need collaborative problem-solving more than you need individual deal maximization.

But here's the thing: if you put someone who's built their entire career in a commission culture into a no-commission organization, they'll be miserable. They'll feel like they're being punished. The compensation might be higher, but the psychological reward is lower.

This is why hiring matters so much. You need to hire for the culture you're building, not the culture you inherited. For Open AI, that means hiring people who are motivated by mission and impact, not by personal upside.

Culture is created through structure, not through speeches. You can't talk your way into a different culture. You have to build it through systems, incentives, and hiring choices.

Preparing for the Incumbents' Response

Open AI is winning right now because they're faster and more innovative. But incumbents aren't standing still. The question worth asking: what's your competitive position going to look like when the incumbents get serious?

Microsoft has distribution. Google has distribution. Every major tech company will eventually have a viable AI offering. The moment they do, the game changes.

Open AI is aware of this. That's why the race for distribution is urgent. You need to be embedded in enough customer workflows and decision-making processes that switching costs become real.

For any startup in a market where incumbents can eventually compete, this is the critical question: what makes you irreplaceable once they have feature parity?

The answer is usually some combination of:

Data and network effects. The longer you operate, the more data you collect and the more you understand your customers. That becomes hard to replicate.

Integration and workflow lock-in. The deeper you're woven into customer operations, the harder you are to replace.

Relationships. The people who've built trust with your teams will continue advocating for you, even when alternatives exist.

Switching costs. If moving to a competitor requires significant organizational effort, that's protection.

Specialized capabilities. If you develop something that's genuinely better or harder to copy, that buys time.

Open AI is probably betting on some combination of all of these. They want to be so embedded in customer operations that even if Google AI becomes feature-equivalent, the switching costs are too high.

That's a long-term strategy. But it's necessary when you're racing against incumbents.

The Future of AI GTM: What Comes Next

Open AI's approach to go-to-market is working today. But markets change. Here's what's likely to shift:

Self-serve becomes more important. Right now, Open AI is focused on enterprise direct sales because that's where the biggest deals are. But eventually, self-serve will unlock a larger market. The GTM strategy will need to include product-led growth, not just sales-led growth.

Vertical specialization becomes necessary. Gen AI is broadly applicable. But the most defensible positions will be vertical-specific. The company that owns "AI for clinical trials" is more valuable than "we sell AI to lots of verticals." This will require specialized sales teams with vertical expertise.

Compliance and governance become sales criteria. Enterprise customers are increasingly concerned about AI governance, bias, explainability, and regulatory compliance. This will become a major sales criterion, especially in regulated industries.

Pricing models will evolve. Usage-based pricing is common for API businesses. But enterprise customers want predictability. Expect hybrid models that balance both.

Partnerships become critical. The largest deals will likely involve partnerships with system integrators and consulting firms. Open AI's GTM strategy will need to include partner management, not just direct sales.

The fundamentals don't change. Velocity matters. Distribution matters. Product fit matters. But the specific tactics will evolve as the market matures.

How to Apply These Lessons to Your Own Organization

You probably don't have the resources Open AI has. You probably can't afford to eliminate commissions entirely and pay purely salary plus equity.

But you can borrow from the principles:

Ask what behaviors your compensation structure creates. If it's creating information hoarding and territory defense, what would it take to change that? What behaviors do you actually need?

Run pilots like they're closing mechanisms, not stalling tactics. Define success metrics upfront. Ensure executive buy-in. Make the pilot repeatable. Use it to build trust and prove value.

Hire for team fit, not just individual performance. Your first three sales hires will bake a culture into the organization. Choose carefully.

Build systems and playbooks, not dependencies. Document your best sales process. Make it repeatable. Make it easy to do it right.

Optimize for velocity during the window when it matters. You probably have 12-36 months before larger competitors start seriously competing. What would you cut to move twice as fast? What's carrying you down?

Distribute decision-making authority. Every approval layer slows you down. Push decisions down to the people closest to customers.

Make yourself replaceable. Build organizational resilience through systems, not through individual heroics.

These aren't specific to Open AI. They're principles that apply to any startup that's trying to outrun larger competitors.

Key Metrics to Track for Sales Performance

If you're going to build a repeatable sales process, you need metrics to know whether it's working.

Here are the ones that matter most:

Sales cycle length. How long from first conversation to contract? This is your velocity metric. Longer is slower. You want to compress this over time.

Win rate by stage. What percentage of deals move from stage one to stage two? Stage two to stage three? Where do you lose deals? That tells you where your process is broken.

Pilot win rate. This is your indicator of deal quality and process quality. If this is below 85%, your pilot process needs work.

Time to first meeting. How long from initial contact to first conversation? This indicates your responsiveness and how engaged your market is.

Customer acquisition cost. Total sales and marketing spend divided by new customers. This needs to be sustainable relative to customer lifetime value.

Expansion revenue. How much additional revenue comes from existing customers? This indicates product stickiness and customer success.

Churn rate. What percentage of customers leave each year? This determines whether your growth is real or if you're leaking the bucket as fast as you're filling it.

Sales rep productivity. Revenue per rep, typically measured quarterly. This indicates whether your playbook and support systems are working.

These metrics should be reviewed weekly or bi-weekly for early-stage companies, monthly for later-stage. The point isn't to obsess over them. The point is to know whether your process is working and where to focus your attention.

Common Sales Process Failures and How to Fix Them

Most sales organizations struggle with a few common failure modes. Here's how to diagnose and fix them:

Deals stall in the middle. Deals move fast initially, then get stuck for weeks. Usually means you haven't involved the right stakeholders. You need to map who the decision-makers are and ensure they're engaged early.

Pilots fail to convert. You're running pilots but deals don't close. Usually means either the success metrics weren't clear, or the customer wasn't actually ready to commit. Strengthen your pilot criteria and ensure executive buy-in upfront.

Sales reps aren't following the playbook. You have a process but people aren't using it. Usually means either the process is too complicated, the tools don't support it, or the reps don't understand why it matters. Simplify the process. Make the tools easier. Explain the why.

Turnover is high. You're hiring good people but they leave after a few months. Usually means compensation is off, you're hiring the wrong fit, or the culture is misaligned. Review hiring criteria. Review comp strategy. Talk to people who've left.

Sales cycle is too long. Taking months to close deals that should close in weeks. Usually means too many approval layers, unclear success criteria, or not enough executive involvement. Flatten decision-making. Define success metrics. Get executives involved early.

What About Automation and AI in Sales?

There's a lot of hype about AI automating sales. Here's the reality: AI can automate parts of sales. It can't automate the whole thing.

Where AI helps:

Lead scoring. AI can identify which leads are most likely to convert.

Outreach sequencing. AI can determine the optimal timing and messaging for outreach.

Data enrichment. AI can gather information about prospects and accounts.

Conversation analysis. AI can analyze sales conversations and identify what works.

Forecasting. AI can predict which deals are likely to close and when.

What AI can't do:

Build relationships. Trust still requires human connection.

Handle complex objections. Responding to sophisticated buyer concerns requires judgment and expertise.

Make strategic decisions. Should we pursue this account? How should we position against this competitor? These require strategic thinking.

Close deals. The final commitment is still a human decision made by a human.

The best use of AI in sales is augmentation, not replacement. Use AI to handle the repetitive parts so your reps can focus on relationship-building and strategic conversations.

Looking to reduce manual work in your sales process or automate reporting? Runable helps teams automate document generation, create data-driven reports, and build AI-powered workflows. Starting at $9/month, it's an affordable way to free up time for what matters most.

FAQ

What does it mean for a sales organization to have "no commissions"?

No-commission compensation means sales reps are paid a base salary plus equity, with no additional commission based on deals closed. This aligns incentives toward company outcomes rather than individual deal maximization. Open AI uses this model, as did Slack and Stripe early on. The approach works best when you have significant funding, competitive base salaries, and a product that attracts mission-driven talent.

How can you achieve a 100% pilot win rate?

A 100% pilot win rate requires three elements: executive commitment before the pilot starts, clear success metrics defined upfront, and treating the pilot as the sales process itself, not as a separate evaluation. This means ensuring leadership is invested, the customer's team is resourced properly, and the sales team remains engaged throughout. When pilots are structured this way, the conversion to paying customer becomes a formality rather than a gamble.

Why would a startup choose not to pay sales commission?

Eliminating commission changes the behaviors your sales team exhibits. Commission-based pay creates information hoarding, territory defense, and short-term optimization. Salary-plus-equity creates collaboration, knowledge sharing, and long-term thinking. When you're racing to acquire distribution before incumbents catch up, the second set of behaviors is more valuable. This only works if you can pay competitive salaries without commissions, which requires significant funding.

What is the race between distribution and innovation that Maggie Hott references?

The concept, popularized by Alex Rampell, is that startups win by acquiring an unassailable customer base before incumbents figure out how to compete. For Open AI, this means locking in customers before Microsoft, Google, and other tech giants develop competitive AI offerings. The window is finite, which is why velocity in sales and distribution is critical.

How do you build a repeatable sales playbook?

Start by documenting your best customer's journey. Identify the three to five critical moments in the sales process where decisions get made. Define success metrics for each stage. Create repeatable content and conversation frameworks that support the process. Make it easy to do the right thing by default through templates and tools. Finally, measure rigorously and iterate when you see failures at specific stages. The playbook isn't sacred; it's a hypothesis that should improve over time based on what you learn.

What are the most important sales metrics to track?

The critical metrics are: sales cycle length, win rate by stage, pilot win rate, customer acquisition cost relative to lifetime value, expansion revenue, churn rate, and sales rep productivity. These should be reviewed frequently (weekly or bi-weekly for early-stage companies) to identify where your process is working and where it needs adjustment. The goal is to spot problems early before they compound into major issues.

Can smaller companies implement Open AI's sales strategy?

The core principles can be applied at any scale, though the specific execution might differ. You might not be able to eliminate commissions entirely, but you can structure compensation to reward collaboration over individual optimization. You can run pilots as closing mechanisms. You can build repeatable playbooks. You can hire for team fit. The underlying logic applies to any company trying to outrun larger competitors. The key is being intentional about which behaviors your structure is creating.

How does AI fit into modern sales strategy?

AI can automate parts of the sales process: lead scoring, outreach sequencing, data enrichment, conversation analysis, and forecasting. However, AI cannot replace the human elements: building relationships, handling complex objections, making strategic decisions, and closing deals. The best approach is augmentation, using AI to handle repetitive work so your reps can focus on relationship-building and strategic conversations. Runable can automate reporting and documentation generation, freeing up time for higher-value activities.

Why does being replaceable matter for a sales leader?

If a sales leader is irreplaceable, the organization can only grow to the point where that person's time becomes the bottleneck. By building systems, distributing decision-making, and ensuring succession planning is part of daily operations, you create organizational resilience. The paradox is that the only way to become truly indispensable is to make yourself replaceable, because the organization becomes stronger and more valuable as a result.

What should you do if you're regularly losing pilots?

If pilots are failing, the problem isn't usually the product. The problem is process. Start by asking whether you had executive commitment before the pilot started. Did you define clear success metrics upfront? Was the customer's team properly resourced? Did your sales team stay engaged throughout? If pilots have a 100% win rate target and you're missing it, investigate these areas systematically rather than assuming the product doesn't work.

Conclusion: The Structural Choices That Drive GTM Success

When you boil down Open AI's go-to-market strategy, it's not about secret tactics or clever closing techniques. It's about structural choices that cascade throughout the entire organization.

No commission compensation eliminates the incentive for individual optimization and creates alignment around company velocity. This requires confident leadership, significant funding, and a product that attracts mission-driven people. But when these conditions exist, the payoff is enormous.

One-hundred-percent pilot win rates aren't about magical sales skills. They're about treating pilots as closing mechanisms instead of stalling tactics, defining success upfront, and ensuring the customer is set up to win. This compresses sales cycles and builds trust.

The race against incumbents is real. The window to build distribution before copies arrive is finite. Every structural choice you make should be evaluated through that lens. Does it make you faster? Does it make you more adaptable? Does it enable velocity?

Being replaceable as a leader seems counterintuitive until you realize that it's the only way to scale without being constrained by individual capacity. Building systems beats building dependencies.

The hiring decisions you make early on bake culture into the organization. Hire for team fit, not just individual performance. Hire for the culture you're building, not the culture you inherited.

For most startups, you can't copy Open AI's structure exactly. But you can borrow the principles. You can be intentional about the behaviors your compensation structure creates. You can treat pilots as closing mechanisms. You can build repeatable playbooks. You can hire for team fit. You can optimize for velocity during the window when it matters.

The companies that win aren't the ones with the best sales tactics. They're the ones that made the right structural choices early and have been optimizing around them ever since.

Open AI is winning because they made those choices deliberately and are executing consistently. That's replicable. Not the specific decisions, but the approach: be intentional about structure, optimize for the right behaviors, and execute with discipline.

That's how you build go-to-market momentum that compounds.

Ready to accelerate your team's productivity? Runable helps teams automate document creation, generate reports with AI, and build presentation slides from data—all starting at $9/month. Less time on admin work means more time for what actually drives revenue.

Use Case: Automate your weekly sales reports and customer success summaries in under 5 minutes using AI, freeing up time for strategic deals.

Try Runable For Free

Key Takeaways

- Commission-free compensation structures enable team collaboration and company velocity over individual deal optimization, critical for competing against larger incumbents.

- Pilots achieve near-perfect win rates when structured with executive commitment, clear metrics, and treated as closing mechanisms rather than evaluation periods.

- The race between startups and incumbents is about acquiring distribution before competitors acquire innovation—with a finite window to lock in market position.

- Distributed decision-making authority accelerates sales velocity by removing approval bottlenecks and empowering teams closest to customers.

- Sales hiring mistakes compound over time; early hire quality bakes culture into organization, making team fit assessment more important than individual performer metrics.

![OpenAI's Go-To-Market Playbook: No Commissions, 100% Pilot Wins [2025]](https://tryrunable.com/blog/openai-s-go-to-market-playbook-no-commissions-100-pilot-wins/image-1-1767096498200.jpg)