PC Industry Crisis 2026: RAM Volatility, Intel Struggles, and Market Uncertainty

TL; DR

- RAM prices are volatile and unpredictable, making 2026 expensive for PC manufacturers and consumers alike

- Intel's Core Ultra Series 3 struggles with performance gains, failing to excite the market or match AMD's trajectory

- AMD and NVIDIA continue dominant positions, leaving Intel fighting for relevance in both consumer and enterprise segments

- Dell revives XPS brand as a rare bright spot, but brand innovation alone won't save a struggling industry

- Broader tech trends (AI, foldables, wearables) are stealing mindshare from traditional PC upgrades

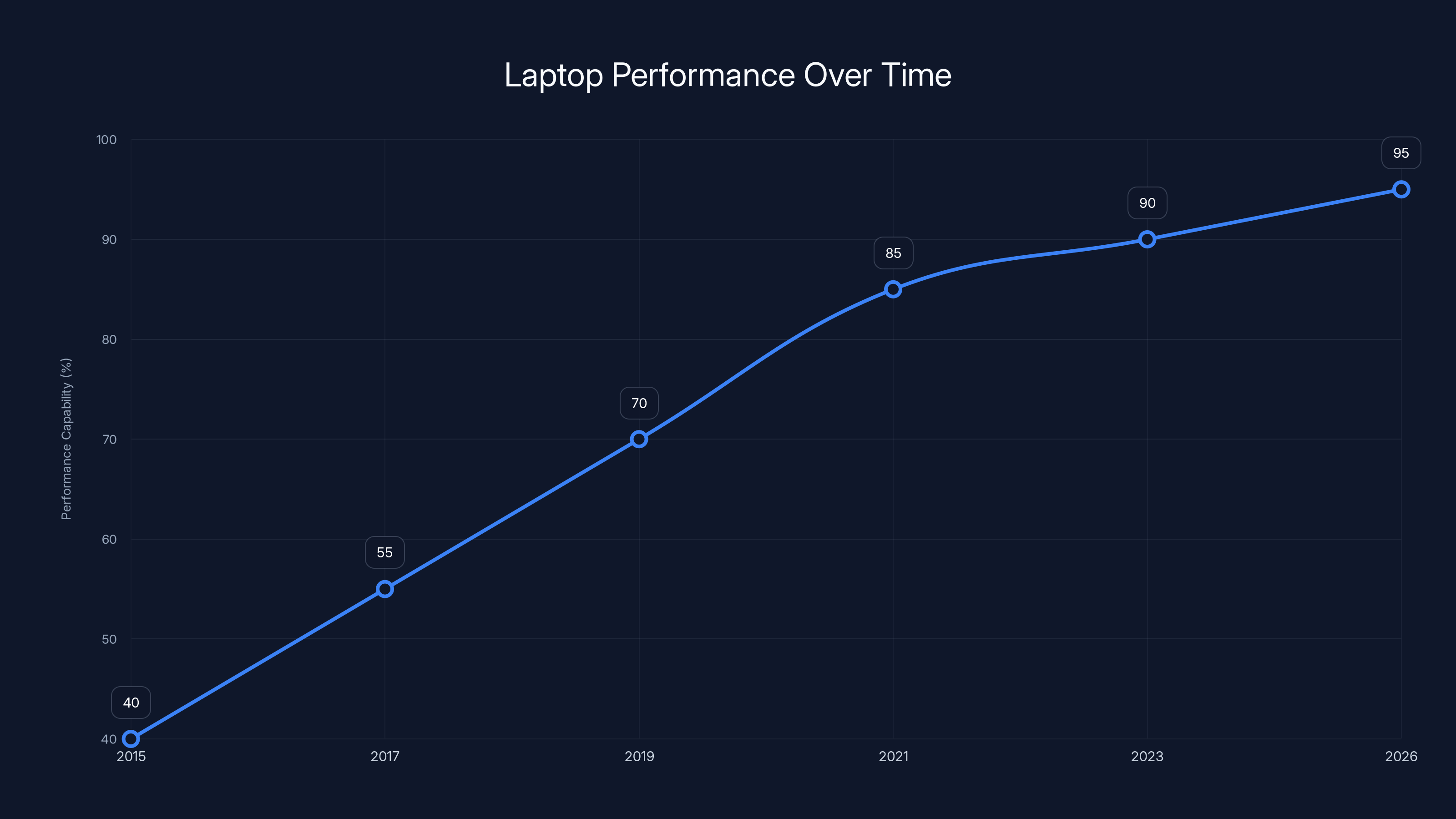

Estimated data shows that by 2021-2022, mid-range laptops reached a performance threshold where further improvements became less impactful for typical users.

Introduction: CES 2026 Exposed the PC Industry's Deepening Crisis

Walk the CES 2026 floor in Las Vegas, and you'll notice something unsettling. The PC section feels smaller, quieter, less urgent than previous years. The booths are there, sure—Intel's blue banners still fly, AMD's stands still draw crowds, Dell's refreshed XPS lineup still turns heads. But beneath the polished presentations and carefully choreographed demonstrations lies a harder truth: the personal computer industry is grinding through one of its most uncertain periods in a decade.

For most of the last fifteen years, the PC market operated with almost predictable rhythms. Every two years, a new generation of chips arrived with modest performance improvements. Refresh cycles happened on schedules manufacturers could depend on. Supply chains, while occasionally strained, generally moved in reasonably straight lines. Even during the pandemic's chaos, the fundamentals remained recognizable.

2026 is different. Really different.

What makes this year particularly rough isn't any single catastrophe. It's the convergence of multiple pressures all hitting simultaneously. Volatile RAM pricing is creating purchasing chaos. Intel, once synonymous with PC dominance, finds itself playing catch-up after years of architectural missteps. AMD continues its winning streak with better energy efficiency and performance-per-watt metrics that matter increasingly to laptop manufacturers. NVIDIA's AI acceleration dominance has shifted focus away from traditional compute metrics that defined PC competitions. Dell's XPS revival feels like rearranging deck chairs on a slowly sinking ship.

Then there's the elephant in the room nobody wants to mention at CES: consumers simply don't need new PCs as urgently as they once did. AI gadgets, foldable phones, wearables with actually useful features—these are capturing mindshare and discretionary spending. For most knowledge workers, a PC from 2022 still handles email, documents, video calls, and browser tabs just fine. The last truly compelling reason to upgrade—gaming performance—has fragmented across platforms, making high-end GPU investment less universal.

This article digs into what CES 2026 revealed about the PC industry's challenges, the specific technical and market forces reshaping the landscape, and what these trends mean for manufacturers, consumers, and anyone betting on continued PC relevance. We'll examine Intel's architectural struggles, the RAM market's destabilizing volatility, AMD's competitive positioning, and whether design-focused revivals like Dell's XPS can actually move the needle.

The PC industry isn't dying. But 2026 is the year it's finally admitting it needs to transform.

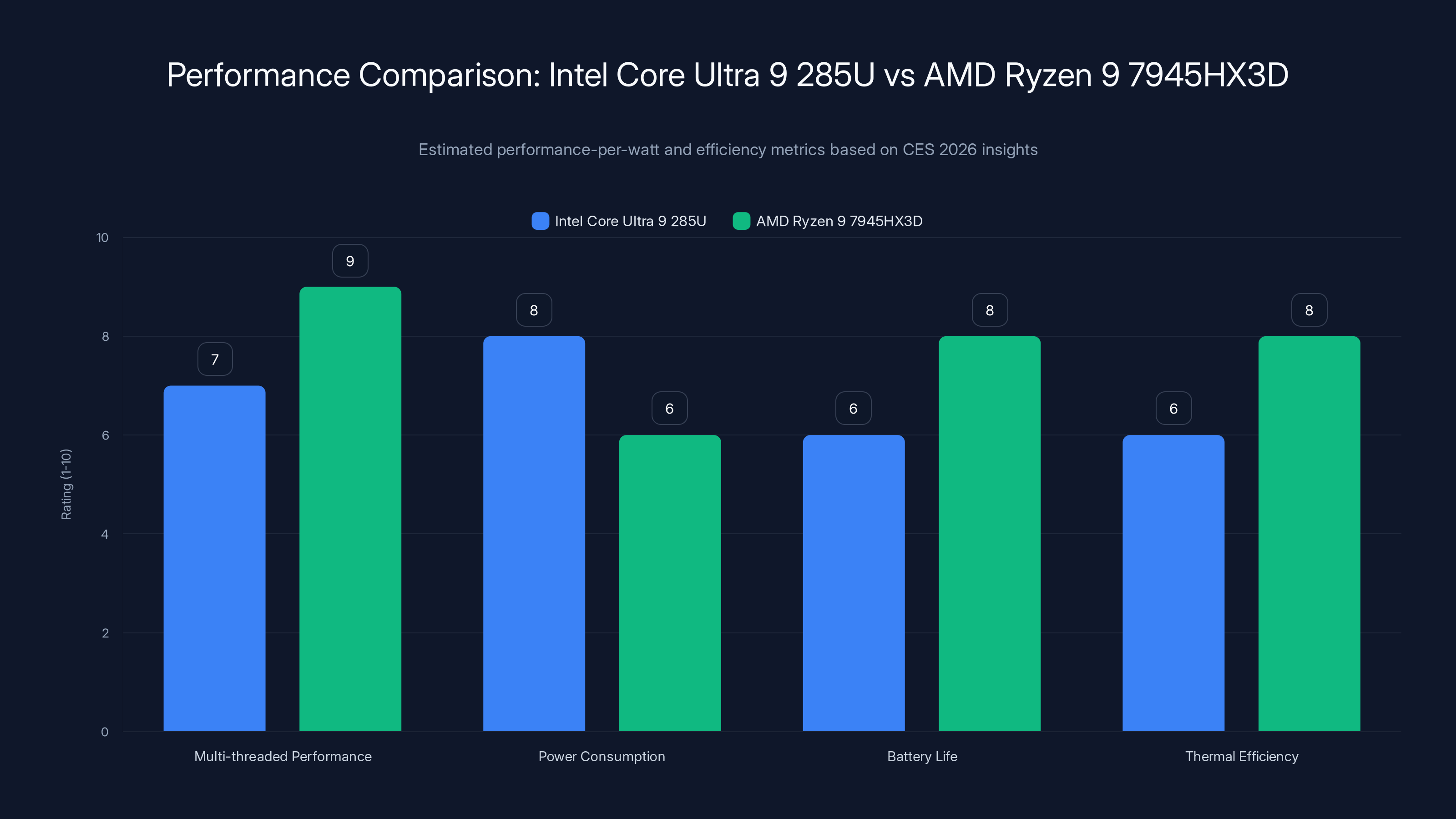

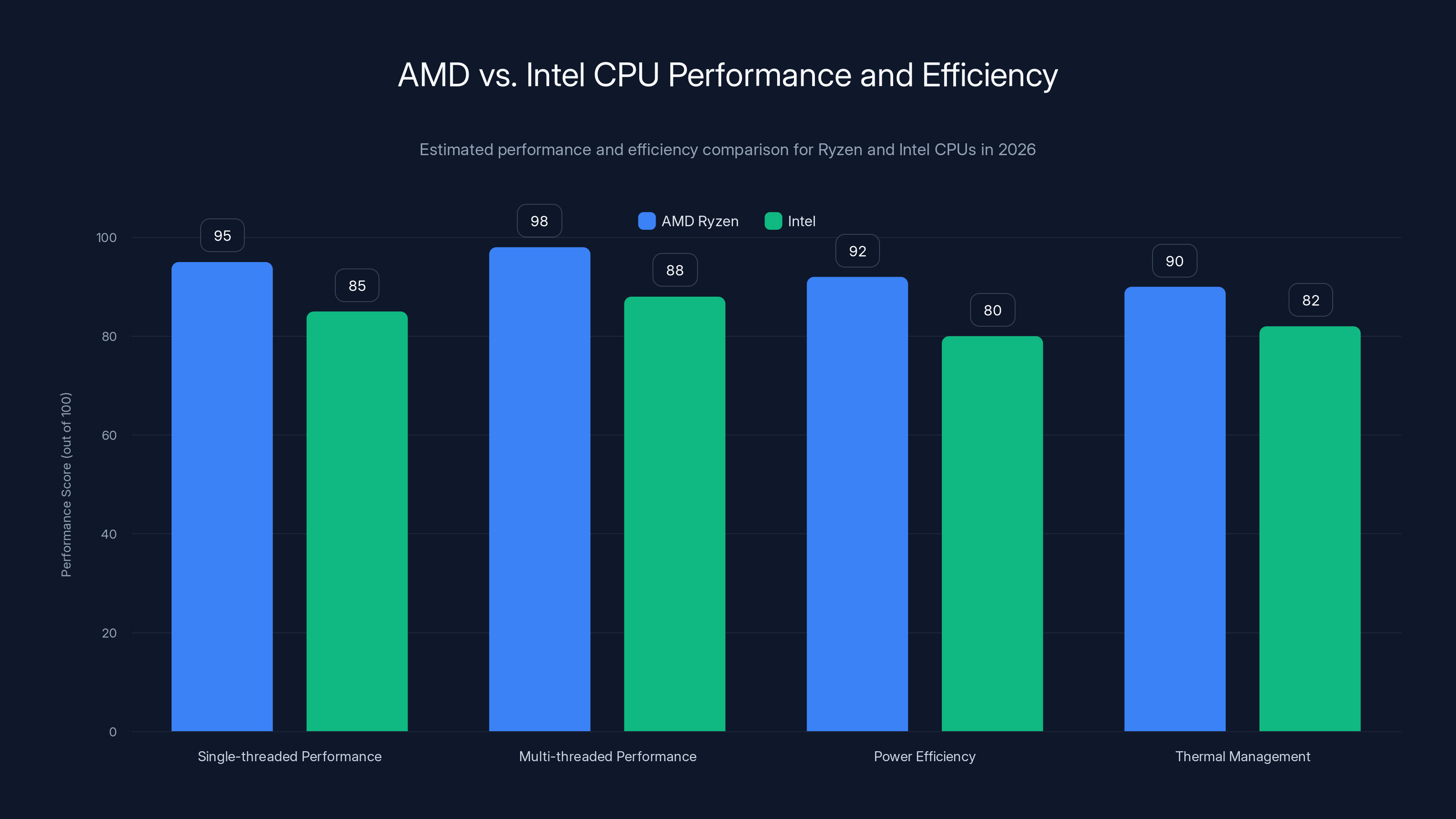

Estimated data shows AMD's Ryzen 9 7945HX3D outperforming Intel's Core Ultra 9 285U in multi-threaded performance and efficiency, offering better battery life and thermal management.

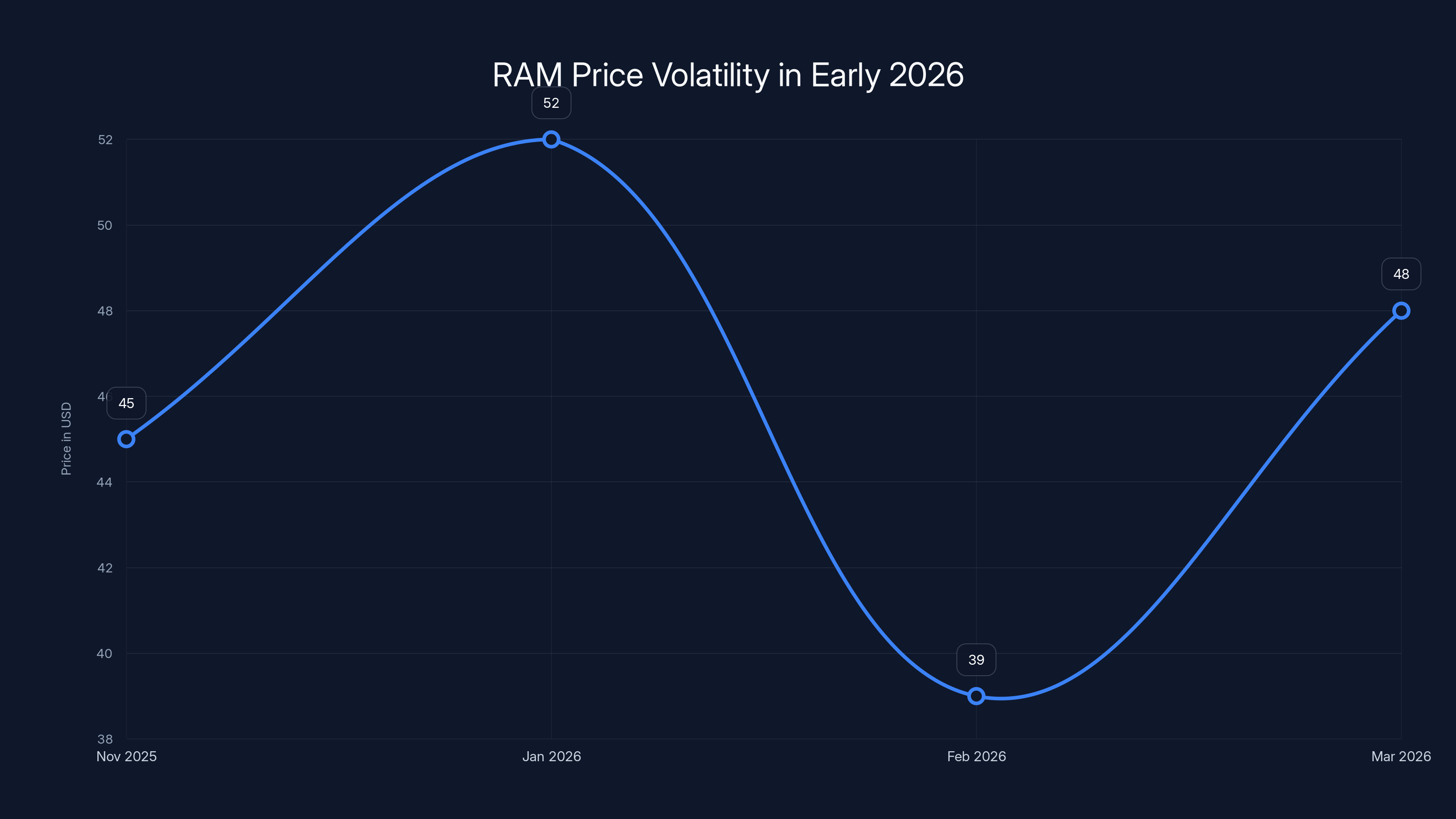

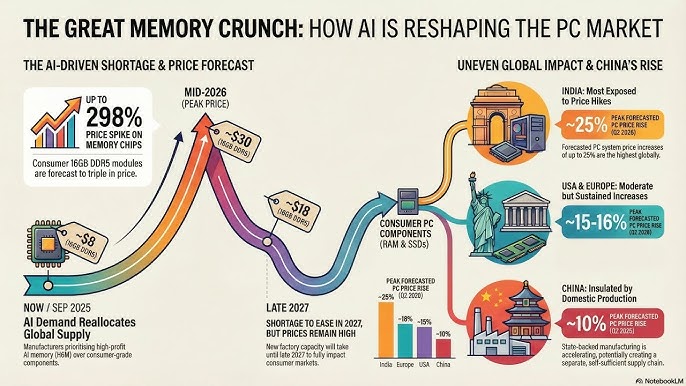

The Volatile RAM Market: The Biggest Threat to 2026 PC Pricing

Understanding RAM Price Volatility in 2026

Dynamically Random Access Memory—RAM—is one of those components that most PC shoppers never think about until they're buying a new machine. It's straightforward: more RAM means better multitasking, faster application switching, smoother performance with complex workloads. Manufacturers balance capacity, speed, and price to hit specific market segments. DDR5 has been the standard since 2022, offering faster speeds than DDR4, supporting higher clock rates, and improving power efficiency.

But here's where 2026 breaks the script. RAM pricing, historically stable once a generation of memory technology settles in, has become genuinely volatile. Prices that were predictable six months ago are swinging wildly month-to-month, sometimes week-to-week. A 16GB DDR5 module that cost

This volatility stems from multiple sources simultaneously colliding. Memory manufacturers are investing heavily in next-generation DDR5 variants and early DDR6 production capacity. Older DDR5 capacity is being repurposed or wound down. Meanwhile, demand remains choppy—some quarters see strong enterprise purchasing, other quarters see constrained consumer upgrades. Global chip manufacturing capacity continues struggling with post-pandemic rebalancing. Geopolitical tensions around semiconductor manufacturing have made supply chains less predictable. All these factors swirl together, creating an environment where buyers genuinely can't know when they're getting a good price.

How RAM Volatility Cascades Through PC Pricing

For PC manufacturers, this volatility creates genuine problems that trickle down to consumers. Building a PC involves dozens of component purchasing decisions made weeks or months before that system reaches retail shelves. A manufacturer might lock in component pricing for a planned Q1 launch in late Q4. If RAM prices spike 18% between the contract signing and production, that margin either compresses or the retail price has to increase.

Dell, Lenovo, ASUS, and HP all deal with this by building in larger price cushions than they would prefer. If a budget laptop was designed to retail for $599 with certain configurations, but RAM costs spike unpredictably, manufacturers have three bad choices: absorb the margin loss, increase the retail price (making the machine less competitive), or reduce the RAM configuration (frustrating customers who see less value). Most compromise across all three.

This affects different market segments differently. Budget laptops (sub-

Enterprise purchasing, already budget-constrained, faces particularly painful decisions. A company planning a 500-laptop refresh calculated around $650 per unit suddenly faces uncertainty about actual per-unit cost. Do you lock in expensive contracts to guarantee pricing stability? Do you wait and hope prices drop? Do you reduce specifications? These decisions ripple through entire refresh cycles.

The Supply Chain Reality Behind the Volatility

Understanding why RAM pricing is volatile in 2026 requires zooming out to supply chain fundamentals. Memory chip manufacturing is capital-intensive and operates on long cycles. Samsung, SK Hynix, and Micron—the three major DRAM manufacturers accounting for roughly 90% of global production—all made different bets about 2024-2026 demand.

Some manufacturers overestimated enterprise AI server demand, pumping capacity toward high-performance memory for data centers. Others underestimated consumer demand resilience. The post-pandemic rebalancing that everyone predicted would finish by 2024 is still settling in 2026. Manufacturing fabs that were supposed to reach stable utilization rates are running 72-85% capacity instead of the optimal 85-95% range, leading to higher per-unit costs and thinner margins.

Geopolitical factors compound the volatility. US export restrictions on advanced semiconductor technology to certain countries have reshaped global memory supply chains. Some manufacturers have delayed capacity expansions pending regulatory clarity. Others have shifted investment toward different geographies, creating temporary oversupply in some regions and undersupply in others.

Weather, labor actions, and unexpected maintenance issues at major fabs can swing global memory prices 5-10% in days. When your margin on a budget laptop is already only 8-12%, a 7% RAM cost spike can instantly flip a profitable SKU into a loss-maker.

The practical result: PC makers entering 2026 genuinely don't know whether RAM costs will remain stable, rise further, or eventually fall. This uncertainty—worse than either stable high prices or stable low prices—is paralyzing some purchasing decisions and forcing aggressive price hedging on others.

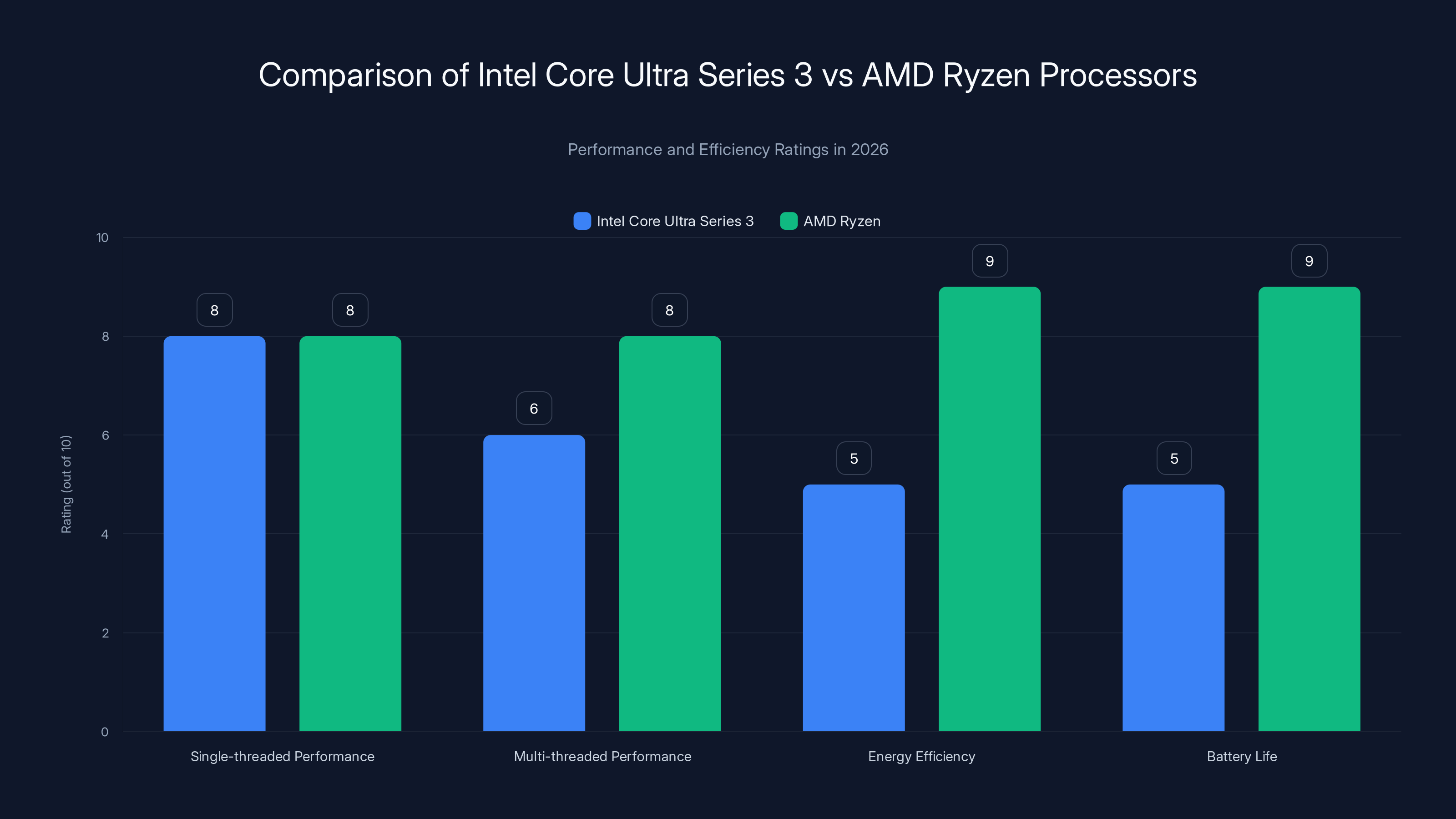

Intel's Core Ultra Series 3: Architectural Struggles and Competitive Positioning

The Performance Reality of Core Ultra Series 3

Intel arrived at CES 2026 with its Core Ultra Series 3 processors, the latest evolution of the Meteor Lake architecture that debuted in late 2023. On paper, the specifications look respectable. Increased core counts, higher clock speeds, improved efficiency metrics, and better AI acceleration through integrated NPU improvements. Intel's marketing emphasizes that these chips deliver the performance professionals need.

But here's the thing—and this is what CES 2026 made painfully clear—respectability isn't exciting anymore. The PC industry doesn't need respectable. It needs breakthrough. It needs compelling reasons for users to replace machines that are working fine. Intel's Core Ultra Series 3 is solid engineering. It's just not the kind of leap that makes someone who bought a Ryzen 7 laptop last year think, "I need to upgrade."

Performance-per-watt comparisons tell the real story. AMD's Ryzen 9 7945HX3D achieves better multi-threaded performance while consuming less power than Intel's Core Ultra 9 285U. That translates to tangible benefits: longer battery life, less heat, lower thermal loads on cooling systems. For laptop manufacturers trying to create thinner, lighter machines with all-day battery life, that advantage is significant. Intel is competitive on raw clock speed and single-threaded workloads, but the overall package—what actually matters to users—favors AMD.

The gaming performance story is worse for Intel. NVIDIA's dominance in discrete GPU market share means most gaming laptops pair AMD or Intel CPUs with NVIDIA graphics. But the CPU's efficiency and power management still matter for thermal design and battery life during gaming. Here too, AMD edges ahead with better efficiency metrics that translate to cooler, quieter machines—exactly what gaming laptop buyers notice.

Why Core Ultra Series 3 Feels Like Treading Water

Intel's challenge runs deeper than just falling short of AMD in efficiency metrics. The entire positioning feels reactive rather than forward-looking. AMD launched Ryzen HX series processors with significant architectural innovations in 2023. Intel responded with Core Ultra, which was good but not transformative. AMD has continued improving efficiency and performance. Intel's Series 3 update feels like catching up to where AMD was, not leapfrogging ahead to where the market needs to go.

Consider the broader trend: the PC industry's most exciting innovations in 2026 aren't happening in CPUs anymore. They're happening in AI acceleration, display technology, form factor experimentation, and battery chemistry. CPU performance has plateaued from a user perspective. A mid-range modern CPU handles everything most people do constantly: email, video calls, document editing, web browsing, even light video editing. The difference between a Core Ultra 5 and a Core Ultra 9 translates to maybe 10-15% faster project rendering, barely noticeable in real workflows for most users.

AMD recognized this shift and began repositioning Ryzen processors as "AI-ready platforms." They emphasize integrated NPUs (neural processing units), AI-accelerated features, and ecosystem partnerships that make their chips attractive in an AI-first compute world. It's not a bulletproof strategy—AI integration still feels somewhat gimmicky—but at least it's a forward-looking narrative.

Intel's messaging remains anchored in traditional compute metrics: speed, cores, threads, power efficiency. All important, all areas where Intel is competitive. But it's messaging that assumes people care about CPU performance as an end in itself. They don't. They care about whether their laptop can run what they need, whether it lasts all day, whether it stays cool and quiet. Intel's chips deliver that. But so do AMD's, usually better.

Intel's Broader Competitive Crisis Beyond Core Ultra

The Core Ultra Series 3 challenge is really just a symptom of Intel's deeper competitive problem. The company lost AI leadership to NVIDIA years ago. It's playing catch-up to AMD in energy efficiency. It missed the mobile So C revolution that NVIDIA won with Tegra and Snapdragon, leaving it nearly absent from tablets and high-end mobile devices. It's under-resourced in gaming architecture compared to AMD's RDNA GPU development.

Intel's data center business—traditionally the profit engine that funded consumer PC development—is under siege from AMD's EPYC processors and increasingly from custom silicon from hyperscalers like Google, Amazon, and Meta. When your highest-margin business is losing share, R&D spending gets constrained. Suddenly, Intel's consumer PC division is trying to compete with one hand tied behind its back.

At CES 2026, this manifested as Intel celebrating competence rather than announcing breakthroughs. The company showcased Core Ultra Series 3's improvements through benchmarks that matter mainly to performance enthusiasts, not through real-world experiences that resonate with actual users. Meanwhile, AMD's booth focused on ecosystem partnerships and AI-forward positioning that felt more aligned with where the market is heading.

The worst part? Intel's competitive situation might actually worsen before it improves. The company's next-generation Arrow Lake processors won't arrive until late 2026 at the earliest. By then, AMD will have released next-gen Ryzen processors. NVIDIA's stranglehold on AI acceleration will have tightened further. The window for Intel to reset its competitive narrative is closing.

The price of a 16GB DDR5 module fluctuated significantly, with a 15-20% swing month-to-month in early 2026. Estimated data.

AMD's Dominant Positioning and the Ryzen Advantage

How AMD Built and Maintained CPU Leadership

AMD's journey from afterthought to industry leader took a decade of disciplined execution. The company systematically improved process technology, designed more efficient architectures, and built genuine performance advantages that translated to real-world benefits. Unlike Intel, which rested on architectural dominance for years, AMD treated every generation as an opportunity to improve.

The Ryzen 9 architecture, launched in 2017, was the turning point. It delivered competitive performance at lower power consumption than Intel's equivalent chips. Consumers and OEMs noticed. System integrators could build more efficient laptops around Ryzen processors. Battery life improved. Thermal loads dropped. These weren't incremental improvements—they were the kind of generational leaps that actually change product possibilities.

AMD didn't stop there. With Ryzen 5000 series, the company pushed further. With Ryzen 7000 series (Zen 5), AMD established architectural superiority over Intel. The company's manufacturing partnerships with TSMC gave it process technology advantages that Intel's internal fabs couldn't match. While Intel struggled with transitioning to smaller processes, AMD was already optimizing at the cutting edge.

By 2024-2025, AMD had achieved something remarkable: genuine CPU leadership that translated across most workloads. Single-threaded performance, multi-threaded performance, efficiency—AMD competed at or exceeded Intel across the board. This isn't marginal advantage. It's the kind of superiority that makes OEMs choose AMD when given a choice.

Ryzen's Real-World Advantages in 2026

Performance benchmarks matter, but they tell only part of the story. What matters to actual users is how these architectural advantages translate into tangible differences in laptop experience. And here's where AMD's leadership becomes obvious.

Consider battery life. A laptop built around a Ryzen processor with equivalent specifications to an Intel system frequently achieves 2-4 hours more runtime on a single charge. That's not because Ryzen processors are magic—it's because the architecture requires less power per unit of computation, and the power gating (shutting down unused cores) works more efficiently. For someone working in coffee shops, on airplanes, or in offices with limited charging access, those extra hours transform usability.

Thermal performance follows similar logic. Ryzen laptops run cooler under sustained load, meaning less fan noise, better acoustic comfort, and more reliable sustained performance. Gaming laptops with Ryzen processors don't ramp cooling as aggressively, translating to quieter operation during gaming sessions. Professional laptops with Ryzen processors stay comfortable on laps during extended work sessions.

Multitasking performance shows AMD's advantages too. The Ryzen architecture's efficiency means more cores can run simultaneously without thermal throttling or power constraints. Video editors, 3D modelers, and developers working with complex project files notice fewer performance dips when background processes kick in. The system remains responsive even under load, a characteristic that directly impacts perceived quality.

AMD's Strategic Positioning for AI and Beyond

AMD recognized earlier than Intel that CPU supremacy alone wasn't sufficient for 2026. The company integrated NPU (neural processing unit) capabilities into Ryzen processors and began evangelizing AI-accelerated features across its ecosystem. AMD's EPYC processors in data centers started supporting more sophisticated AI workloads. The company announced ambitious plans for GPU computing through its Radeon graphics division.

This diversification matters strategically because it positions AMD as an "AI-ready" platform rather than just a "faster CPU" platform. That narrative alignment—whether or not individual AI features matter to average users—influences purchasing decisions, especially at large organizations evaluating infrastructure renewal.

AMD's partnerships with system integrators further cement leadership. Lenovo, ASUS, Dell, and HP all showcase Ryzen-powered systems prominently because they sell better and receive fewer quality complaints. Better TCO (total cost of ownership) for customers means better reputation for manufacturers. This creates a virtuous cycle where Ryzen systems accumulate positive market momentum.

The company also benefits from genuinely good execution on fundamentals. AMD's GPU development, once a joke compared to NVIDIA, has matured into respectable competition. The company's data center expansion through EPYC continues chipping away at Intel's enterprise dominance. AMD isn't just winning in consumer CPUs—it's systematically improving across the entire hardware ecosystem, making customers less dependent on Intel anywhere.

NVIDIA's Stranglehold on AI Acceleration and GPU Dominance

Why NVIDIA Owns AI Compute and What That Means for PCs

NVIDIA's position in 2026 is almost unassailable. The company's CUDA ecosystem, GPU architecture, and first-mover advantages in AI acceleration have created barriers to competition that seem permanent. Every major AI model trained at scale runs on NVIDIA GPUs. Every hyperscaler building AI infrastructure buys NVIDIA hardware. Every framework optimization, every tutorial, every piece of ecosystem infrastructure assumes NVIDIA as the primary GPU architecture.

This matters for the PC industry because it has fundamentally shifted what "PC performance" means. Five years ago, PC performance meant CPU speed and discrete GPU performance for graphics. Today, it means: will this machine run AI workloads efficiently? Does it have hardware acceleration for AI inference? Can it support local large language models?

NVIDIA wins this question definitively. NVIDIA's Ge Force RTX 40-series GPUs support CUDA with sophisticated optimization. NVIDIA's Tensor cores handle matrix operations that AI workloads depend on. NVIDIA's ecosystem—software libraries, frameworks, tutorials, best practices—is so mature that using non-NVIDIA GPUs feels risky and often impossible.

For traditional computer graphics and gaming, NVIDIA's leadership is equally dominant. NVIDIA owns roughly 80% of discrete GPU market share in laptops. AMD's RDNA architecture is improving but still trails in both performance and ecosystem support. Intel's Arc GPUs, launched with reasonable ambitions, have failed to gain meaningful traction. NVIDIA simply has too much momentum.

GPU Acceleration's Unexpected Impact on CPU Competition

Here's an interesting dynamic emerging in 2026: GPU dominance is actually reducing the importance of CPU performance in many workflows. Want to edit 4K video? GPU acceleration matters more than CPU speed. Want to run AI models locally? GPU dominance matters more than CPU. Want to accelerate data processing? GPU superiority matters more than CPU.

This subtly reduces AMD's CPU advantages. Yes, AMD processors are superior to Intel chips in many metrics. But if the workload bottleneck is GPU performance, CPU differences become secondary. The laptop with the NVIDIA RTX 4090 GPU will outperform the laptop with superior CPU but a weaker GPU for many modern workloads. This actually helps Intel somewhat—if GPU performance matters more than CPU, Intel's competitive position on CPU becomes less critical.

But NVIDIA benefits most. The company's GPU dominance means NVIDIA hardware is essential for serious compute work regardless of whether you're running an Intel or AMD CPU. NVIDIA becomes the tie that binds—the component everyone must have—regardless of CPU architecture choices.

AMD's Ryzen processors outperform Intel's Core Ultra Series 3 in energy efficiency and battery life, while both are comparable in single-threaded performance. Estimated data based on typical performance metrics.

Dell's XPS Revival: Can Design Innovation Save a Struggling Category?

The XPS Legacy and Why Dell Revived It

Dell's XPS line represented something meaningful in the PC industry during its heyday (roughly 2013-2020). The XPS 13 was compact, well-designed, and aspirational without being unattainably expensive. The XPS 15 proved that large laptops could be well-proportioned and not look like ugly bricks. The XPS line stood for thoughtful industrial design in an era when many premium laptops still looked like they were engineered by people who'd never actually used a laptop.

Then Dell got distracted. The company pivoted focus to Inspiron and Vostro lines for budget segments, and let XPS become less distinctive. By 2024, XPS's status had degraded. The brand still meant something—heritage of good design—but the current products felt less exciting relative to alternatives like the Asus Zenbook or Lenovo Think Pad.

CES 2026 marked Dell's attempt to reclaim XPS relevance. New models, refined industrial design, a return to the brand values that made XPS meaningful. The company repositioned XPS as a "design-first" platform emphasizing aesthetics, usability, and build quality rather than just raw performance specs.

What Dell Got Right with the New XPS Approach

Dell's revival strategy acknowledges a crucial truth emerging at CES 2026: CPU and GPU performance have largely converged across premium options. Most flagship laptops perform similarly for most real-world workloads. Marginal performance differences matter mainly to edge-case users. For typical users—writers, designers, engineers, students—an AMD Ryzen 7 with NVIDIA RTX 4050 performs essentially identically to an Intel Core Ultra with RTX 4050.

When performance converges, differentiation shifts to other factors. Dell realized this and doubled down on design, materials, user interface thoughtfulness, and ecosystem integration. The new XPS models feature superior keyboard layouts designed through user testing. Trackpad implementation that actually works smoothly. Display calibration out of the box rather than requiring user adjustment. Thermal performance engineered for comfort rather than just raw cooling.

These seem like small things. But accumulated across dozens of daily interactions—typing, trackpad use, visual clarity, thermal comfort—they create noticeable experiences. A user who types 1,000 words daily on a laptop with an excellent keyboard will notice the difference relative to typing on a mediocre keyboard. Multiply that across hundreds of daily interactions, and thoughtful design translates to tangible user satisfaction.

Dell's positioning also serves another purpose: it gives corporate IT departments and individuals a reasons to prefer XPS beyond spreadsheet performance metrics. When CPUs are interchangeable, "build quality" and "thoughtful design" become actual differentiators that justify price premiums. This positioning could work—if Dell executes the design vision consistently and doesn't compromise by cutting costs.

The Limits of Design Innovation in a Commoditized Market

Here's the hard truth: even excellent design has limits as a market differentiator in 2026. The laptop category has matured. Most premium laptops employ similar industrial design approaches. Trackpads across the market are good. Keyboards across the market are acceptable. Displays across the market are bright enough. The gap between "excellent" and "good enough" has narrowed to refinements that average users might not notice consciously.

Dell's revival of XPS is smart positioning for brand value and premium market positioning. But it's unlikely to reverse broader market trends. The XPS won't convince someone with a 2022 Mac Book Air or Think Pad to upgrade. It won't create urgency for customers to replace working machines. It'll appeal to people already wanting a new laptop, who might choose XPS because they appreciate design thoughtfulness. But the market for new laptop purchases in 2026 is constrained, and design alone won't expand that market.

Further, Dell's approach only works if the company maintains price discipline. Design-focused positioning demands premium pricing. But CES 2026 also revealed intense pressure on pricing from the volatile component market. Dell faces a tension: charge premium prices justified by superior design, or cut prices to remain competitive in a market where consumers already feel squeezed by RAM volatility and economic uncertainty. Most likely, the company will try to split the difference and satisfy neither strategy fully.

The Elephant in the Room: Consumers Don't Actually Need New PCs

The Durability Problem Nobody Wants to Admit

Here's the uncomfortable truth that manufacturers won't state publicly: modern laptops last long enough that most people don't need new ones as frequently as the industry prefers. A mid-range laptop purchased in 2021 is still perfectly capable in 2026. It runs applications fast enough. It has sufficient storage. The battery hasn't degraded to unusable levels. The screen is still bright. The keyboard still works.

For most users, that machine handles everything they need: email, web browsing, document editing, video calls, light photo editing, spreadsheet work. It's not the cutting edge of performance, but cutting-edge performance isn't necessary for typical workloads. A Ryzen 5 processor from 2021 is as fast as a Ryzen 7 from 2026 for everyday tasks because the bottleneck is rarely CPU anymore—it's usually application startup time, network latency, or user input response.

This wasn't always true. In earlier eras, processor capabilities genuinely limited what software could do. A 2015 laptop couldn't smoothly edit 4K video. A 2017 laptop would struggle with Photoshop on large images. A 2019 laptop couldn't comfortably run Slack plus Chrome plus multiple virtual machines simultaneously. But by 2021-2022, commodity processors reached a threshold where performance stopped being the limiting factor. Now you need a 2026 laptop mainly to get newer software features, not because older hardware actually can't work.

Manufacturers recognize this. It's why the marketing has shifted away from performance metrics toward lifestyle and design positioning. It's why AI features are being hyped despite minimal actual utility—the industry needs selling points other than performance because performance isn't actually a meaningful differentiator anymore.

The AI Feature Gimmick Problem

At CES 2026, nearly every major laptop manufacturer announced "AI features"—integrated NPUs (neural processing units), AI assistants, local language models, AI-accelerated workflows. On paper, these sound revolutionary. Imagine: run large language models locally without cloud connectivity. Process images with AI enhancement instantly. Get intelligent search across your documents.

In practice? It's largely gimmickry. The integrated NPU performance is decent but not exceptional. Most AI features work best with cloud connectivity anyway because local models are limited. The "local" AI features sound privacy-friendly until you realize they still phone home for many operations. And critically, the average user has no idea what to do with these features. The use cases exist mainly in marketing presentations and benchmark demos, not in actual daily workflows.

This matters because it reveals the industry's desperation. Manufacturers are grasping for any feature narrative—AI, design, efficiency—because the traditional differentiator (performance) no longer works. They're essentially admitting: "We can't convince you to upgrade based on speed because you don't actually need faster, so here's this other thing that sounds cool." Nobody says it that directly, but that's the subtext at CES 2026.

The AI narrative might eventually matter. Neural processing could become genuinely useful for on-device processing of sensitive data. Local language models might find real applications in specific workflows. But in 2026? Most AI features on new laptops are more marketing than substance.

The Smartphone and Tablet Competition Reality

Perhaps the biggest reason PC sales are stagnant in 2026 is that tablets and smartphones have become genuinely capable alternatives for many tasks. i Pad Pro models run powerful processors capable of serious work. Android tablets have finally matured into useful devices. Smartphones with large screens (6.5-7 inches) handle browsing, email, and document editing adequately.

Yes, these devices have limitations compared to traditional laptops. But for the specific use cases where consumers most needed devices in 2024-2025—portable video streaming, lightweight web browsing, email checking, social media—tablets and phones work fine. They're cheaper, they last longer on battery, they're instantly available.

A high school student in 2026 might legitimately choose between a

The PC market's historical response to competitive threats has been to emphasize what PCs uniquely enable: expandability, power, software selection. But those arguments weaken as tablets become more capable and as "the cloud" handles more tasks. Why expand storage if cloud storage handles everything? Why need extensive software when web apps and subscriptions cover mainstream needs?

Estimated data shows AMD Ryzen CPUs outperforming Intel in key areas like multi-threaded performance and power efficiency by 2026.

RAM Price Forecasting for Mid-2026 and Beyond

Conflicting Signals and Genuine Uncertainty

Trying to predict RAM pricing for the rest of 2026 is genuinely difficult, not because of lack of information but because of conflicting signals pulling in opposite directions. Memory manufacturers are publicly optimistic about stable pricing after mid-2026. Industry analysts are mixed, with some predicting continued volatility and others expecting stabilization. Supply chain consultants note that most planned capacity expansions should come online by Q3 2026, potentially relieving supply constraints.

But optimistic projections collide with realistic concerns. Demand forecasts could prove wrong if economic slowdown reduces PC purchasing further. Geopolitical tensions around chip manufacturing could spike unexpectedly. Environmental factors (drought in Taiwan affecting water-dependent manufacturing, for instance) could squeeze capacity. Any of these developments would reset pricing dynamics.

The most likely scenario—and this is important for consumers making purchasing decisions—is that RAM prices stabilize in the

Implications for Laptop Pricing Through 2026 and Into 2027

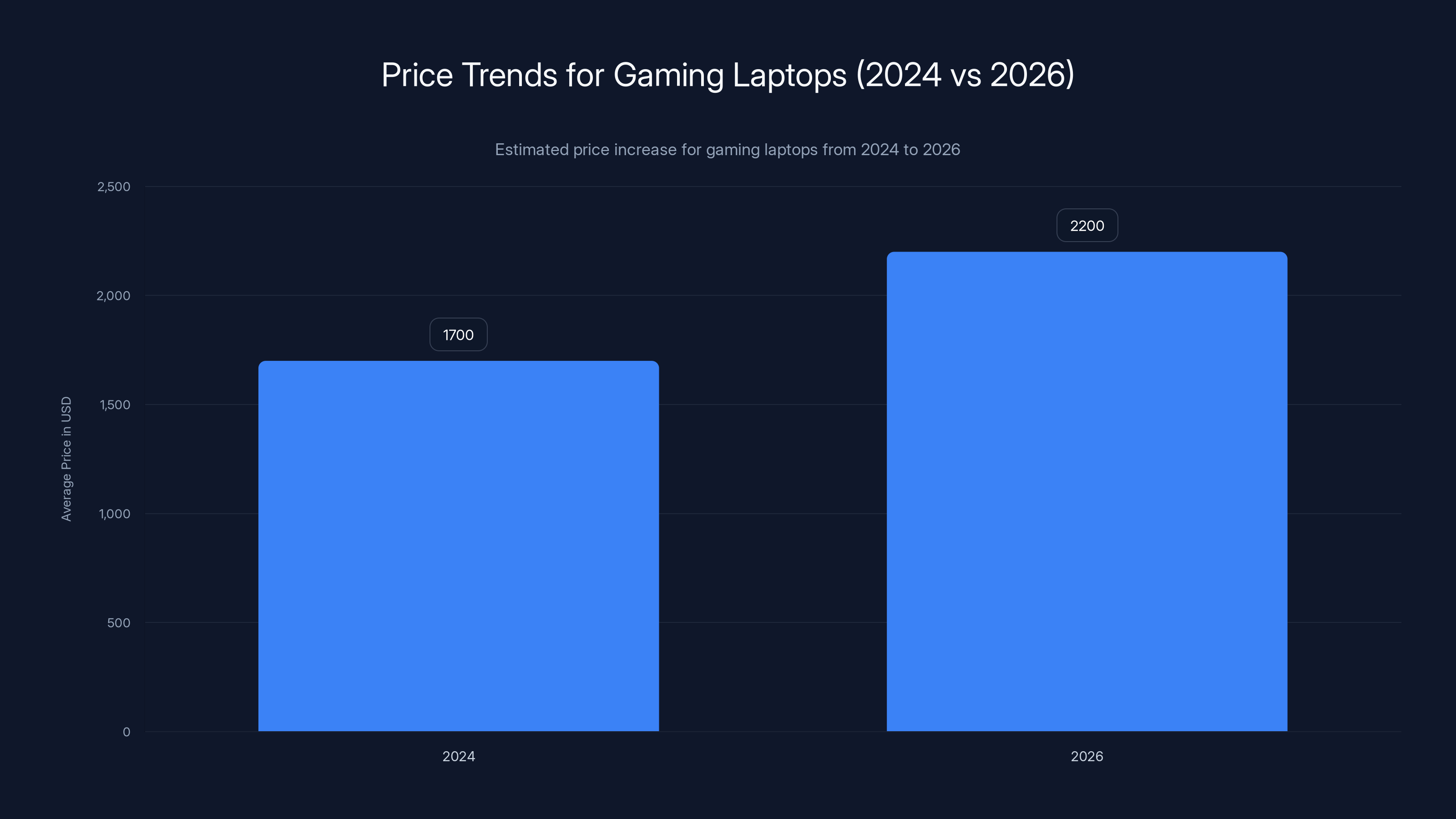

If RAM prices stabilize in the forecasted range, expect laptop pricing to stabilize around 5-8% higher than comparable 2022-2023 models. A

This potentially accelerates a consolidation at both ends of the market—growing budget segment, growing premium segment, shrinking mainstream middle. That's bad for mainstream laptop manufacturers because margin is lower at both extremes. Budget is low-margin, high-volume; premium is high-margin, lower-volume. Manufacturers would prefer mainstream where they balance both factors.

Gaming Laptops and Professional Workstations: Diverging Paths in 2026

Gaming Laptops: Premium Performance Reaching Price Ceiling

Gaming laptops represent an interesting category at CES 2026. High-end gaming requires powerful CPUs, powerful discrete GPUs, excellent cooling, and premium components. This creates inherent cost floors—you can't build a good gaming laptop cheaply. The market has generally accepted $1,500-2,500 price points for serious gaming machines.

But even this premium segment faces pricing pressure in 2026. Add volatile RAM costs, power-hungry GPUs that require beefier power supplies and cooling solutions, and component inflation across the board, and gaming laptops are creeping into

This creates a buyer perception problem. Gaming laptops feel genuinely expensive for what you get. A console plus portable device often costs less than a gaming laptop and covers gaming needs for many consumers. Game Pass subscriptions reduce the need to own specific games. Cloud gaming, while still imperfect, offers gaming experiences without high-end local hardware.

Gaming laptop manufacturers are responding by emphasizing exotic features—high refresh rates (360 Hz, 540 Hz displays), premium audio, superior cooling—anything to justify premium pricing. But these refinements matter mainly to hardcore enthusiasts. Average gaming laptops are expensive enough that only serious gamers justify the purchase.

Professional Workstations: Specialization as Competitive Refuge

Professional workstation laptops (for video editors, 3D artists, engineers, architects) face different dynamics. These machines serve specific professional needs where performance directly affects productivity and deliverables. A video editor who renders footage for 2 hours daily cares intensely about rendering speed. A 3D modeler who waits for geometry calculations values processing power. An engineer running simulations needs sustained performance.

For these users, price elasticity is different. They buy machines based on professional requirements, with ROI calculation built in. A $2,000 workstation laptop that saves 5 hours weekly on processing time pays for itself in productivity gains. Professional buyers are less price-sensitive than consumers because the machine is an investment in their livelihood.

At CES 2026, workstation laptops are holding up better than gaming or mainstream categories. Manufacturers can charge premium prices and still see strong sales because the value proposition is clear: professional capability justifies the cost. AMD's superior energy efficiency appeals to professional buyers who want cooler, quieter machines. NVIDIA's GPU dominance appeals to graphics-intensive workflows. Intel's positioning is less relevant here—professional buyers care about total system capability, not CPU championship.

Workstation manufacturers are also leveraging design and specialization more effectively. Lenovo's Think Pad P-series, Dell's Precision line, and ASUS Pro Art all emphasize hardware configured specifically for professional workflows. They're not trying to compete on mainstream appeal but on professional suitability. This narrower positioning protects margin and allows premium pricing.

Estimated data shows gaming laptop prices increasing from an average of

The Supply Chain Residue: How 2020-2023 Manufacturing Shifts Still Impact 2026

The Post-Pandemic Rebalancing That Never Fully Stabilized

Pandemic-era supply chain disruptions—chip shortages, transportation bottlenecks, manufacturing reallocations—were supposed to normalize by 2024. But in 2026, we're still seeing aftereffects. Manufacturing capacity that was supposed to rebalance toward normal levels never quite stabilized. Some manufacturers over-invested in capacity (leading to low utilization rates and lower profitability). Others under-invested, maintaining production constraints.

Geopolitical pressures aggravated the rebalancing problem. Restrictions on advanced semiconductor manufacturing in certain geographies led some manufacturers to relocate or duplicate capacity in politically safer regions. This created temporarily stranded capacity and new supply networks that haven't fully optimized.

The result: computer components costs haven't returned to pre-shortage levels. Manufacturing is more expensive, supply chains are more fragmented, and pricing reflects genuine cost increases rather than shortage-driven premiums. PC makers hoping that supply chains would normalize and enable return to 2019 pricing are disappointed.

Manufacturing Automation and Labor Costs

One underappreciated factor in 2026 component costs is that manufacturers have invested heavily in automation to reduce labor dependency and increase resilience. This automation is expensive to implement but was strategically necessary after pandemic supply chain chaos demonstrated vulnerability to labor disruptions.

These automation investments increase per-unit costs in the short term (depreciation and capital amortization) but should decrease costs long-term (labor and operation efficiency). We're in the middle phase—paying for the automation without yet seeing full cost reductions. By 2027-2028, the investments should start delivering savings, but 2026 still bears the investment costs.

Emerging Technology Categories Stealing PC Mindshare and Dollars

AI Assistants and Dedicated AI Hardware

One notable theme at CES 2026 is the explosion of dedicated AI devices. Dedicated chatbot hardware, AI-accelerated smartwatches, AI-powered home devices—all designed to handle specific AI tasks without requiring general-purpose computers. This is shifting consumer interest and discretionary spending away from PC upgrades toward these specialized devices.

A consumer with

Foldable Devices and Form Factor Innovation

Foldable phones and tablets—One Plus Pad-style devices, Samsung Galaxy Z Fold-style phones—are capturing genuine consumer interest in ways that traditional laptops aren't. A foldable phone that becomes a tablet when you need bigger screen real estate offers genuine utility innovation. Foldable tablets offer larger effective screens than traditional tablets.

These devices aren't replacing laptops entirely, but they're capturing incremental computing moments that might previously have driven laptop usage. Someone who would have purchased a 2-in-1 laptop might now buy a foldable tablet instead. Someone considering a secondary tablet might instead buy a foldable phone that serves the function.

Laptop manufacturers haven't figured out how to innovate form factors in comparable ways. Some experiments with rollable screens exist (mentioned at CES 2026), but practical implementations don't yet exceed traditional form factors in utility. Until laptops offer genuine form factor breakthroughs comparable to foldables, they're at a disadvantage in capturing innovation-hungry buyers.

Wearable Computing and Always-On Devices

Smartwatch technology is genuinely improving. Garmin's latest offerings include health metrics that rival dedicated medical devices. Apple Watch capabilities expand yearly. Third-party developers build increasingly sophisticated apps for wearables. For specific use cases—fitness tracking, health monitoring, notifications, quick tasks—wearables are becoming genuine computing platforms rather than just notifications devices.

This doesn't directly replace laptop functionality, but it does reduce the perceived need for constant device connectivity. Someone with an excellent smartwatch can handle notifications, quick messages, and health data without touching a laptop. That reduces daily laptop usage and potentially delays upgrade cycles.

Wearables also attract tech spending. Someone who might spend

What Analysts and Industry Experts Are Saying About 2026

Research Firm Consensus on PC Market Outlook

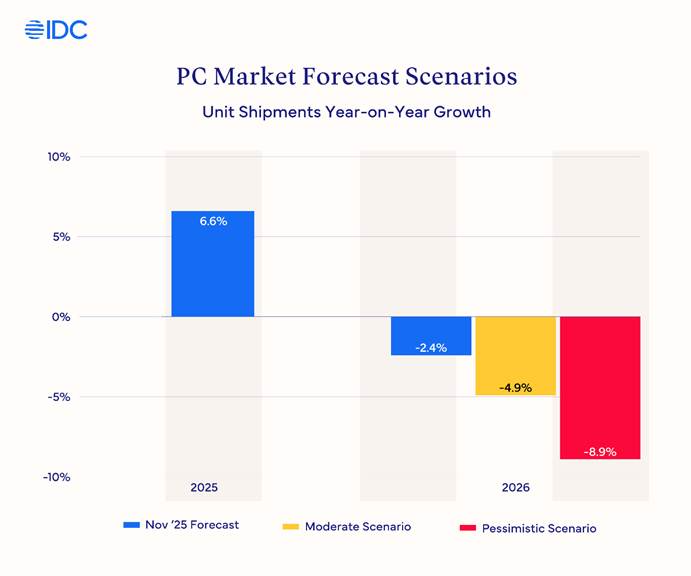

Gartner, IDC, and Counterpoint Research have all published reports on the 2026 PC market. The consensus is decidedly pessimistic relative to historical trends. PC shipment forecasts remain essentially flat or declining slightly compared to 2025. This is in a market that expects overall PC TAM (total addressable market) to grow incrementally, meaning premium segments grow while mainstream and budget segments shrink or stagnate.

Analysts cite RAM volatility, subdued consumer demand, competition from smartphones and tablets, and lack of compelling upgrade drivers as primary headwinds. Few analysts expect 2026 to be a recovery year. Most position it as a transition year where the industry adjusts to lower growth rates than historical norms.

The one bright spot in analyst forecasts is gaming and professional segments, which are expected to maintain reasonable growth even as mainstream segments struggle. Workstations and specialized systems are seen as defensive plays that maintain demand even when consumer demand weakens.

Industry Executive Commentary from CES 2026

At CES 2026, company executives from Intel, AMD, NVIDIA, Dell, HP, and Lenovo offered carefully worded optimism. Intel's leadership emphasized "strong execution" on Core Ultra while acknowledging competitive pressure. AMD's executives highlighted Ryzen momentum and ecosystem partnerships. NVIDIA's leadership emphasized AI opportunity even while noting that AI adoption is uneven across markets.

What's telling is what they didn't say. Nobody predicted acceleration. Nobody claimed breakthrough innovation. Nobody announced major new initiatives that would reshape the market. The tenor was defensive—protecting market position, managing margins, and hoping for stabilization.

The Opportunity Within the Crisis: Where Innovation Might Actually Emerge

Battery and Thermal Innovation as Real Differentiators

If traditional compute performance is commoditized, what can actually differentiate machines? Battery technology and thermal management. Better batteries that truly deliver 3+ days of runtime between charges would be transformative. Batteries that don't degrade over two years would reduce replacement cycle pressure. Innovative cooling that enables passively cooled high-performance systems would transform design possibilities.

At CES 2026, we saw incremental improvements in these areas but no breakthroughs. A few promising technologies exist (solid-state batteries, liquid cooling innovations) but none have reached consumer product maturity. This is actually opportunity—the first manufacturer to deliver genuine battery or thermal breakthroughs will have clear competitive advantage.

Software and Ecosystem Innovation

PC manufacturers are increasingly recognizing that hardware alone is insufficient. The software experience, ecosystem integration, and service layers matter more. Companies investing in software quality, user experience refinement, and service ecosystems are finding better market reception than those competing solely on hardware specs.

This represents opportunity for companies willing to invest in software and services at scales that purely hardware-focused manufacturers won't. Better system software, more thoughtful configuration tools, superior ecosystem integration—these aren't sexy, but they're differentiating.

Sustainability and Repairability as Market Drivers

One emerging consideration at CES 2026 is sustainability and repairability. As consumers question throwaway culture, some are valuing machines they can repair, upgrade, and keep longer. This directly opposes industry interests in frequent upgrades, but it's growing as a consumer priority.

Manufacturers offering truly repairable machines (modular components, readily available parts, repair documentation) might find unexpected market advantage. This is early-stage trend, but it's real. Right to repair advocacy is pushing regulation and consumer expectations. Getting ahead of this trend rather than resisting it could provide competitive advantage.

Predictions for the Rest of 2026 and Into 2027

Q2-Q3 2026: Continued Stagnation with Margin Pressure

The first half of 2026 will likely see continued flat or declining PC shipment trends. New processors from Intel, AMD, and others will launch throughout the year, but marketing them will remain challenging without compelling reasons for users to upgrade. RAM pricing should stabilize mid-year, allowing manufacturers to finalize pricing structures, but at higher-than-2024 levels.

Margin pressure will intensify as manufacturers compete for constrained demand. Price wars will likely break out in specific segments (gaming, budget, education), particularly around back-to-school season (August-September). Premium segments will hold margin better as design differentiation provides defensive positioning.

Holiday 2026: Modest Recovery on Expected Seasonal Demand

Holiday season (October-December) traditionally drives PC demand due to gift giving and educational purchasing. 2026 will likely see modest recovery during this period, but year-over-year growth will be minimal. Gift-givers might select $500-700 mainstream laptops for students or professionals, but less likely to upgrade existing machines.

Integration of AI features (even if gimmicky) will receive heavy marketing focus during holidays, potentially driving some purchase interest among early adopters. Gaming laptop promotions will likely be aggressive to move inventory.

2027 Outlook: Inflection Point Approaching

By late 2026 and into 2027, several factors could shift dynamics. Next-generation processors (Arrow Lake for Intel, next-gen Ryzen) will launch with genuine architectural improvements. Manufacturing capacity should stabilize, potentially enabling more competitive pricing. AI features might mature into something genuinely useful (or be abandoned as gimmicks, clearing the way for new differentiators).

The question for 2027 is whether any of these changes create compelling reasons for users to upgrade. If they don't—if 2027 CPUs are 12-15% faster but don't enable genuinely new capabilities—then the market continues stagnating. If they do—if architectural changes enable new AI applications or meaningful new workflows—then growth could resume.

The most likely scenario is continued stagnation through 2027 with modest growth returning 2028-2029 when new form factors (rollable screens, significantly more durable batteries, or breakthrough designs) create genuine innovation excitement.

Runable: Automating Your Productivity Despite PC Industry Uncertainty

While the PC industry grapples with stagnation and commoditization, your productivity tools don't have to stay stuck in the past. Runable offers AI-powered automation for creating presentations, documents, reports, and slides without wrestling with traditional software limitations.

When your PC hardware feels dated or your software feels slow, Runable's AI agents handle the heavy lifting. Generate comprehensive reports from raw data, create professional presentations from talking points, or draft documents with AI assistance—all at a fraction of traditional software friction.

Use Case: Create a weekly business report in under 5 minutes instead of spending an hour formatting and writing manually.

Try Runable For FreeUnlike new hardware that might not deliver compelling improvements, Runable at $9/month immediately improves your actual productivity. Your PC hardware doesn't matter much if your software lets you accomplish more, faster. That's the approach that actually works in 2026's uncertain PC landscape.

Conclusion: A Rough Year Ahead, But Not a Crisis

What CES 2026 Really Revealed

Stepping back from all the individual challenges, what CES 2026 fundamentally revealed is that the PC industry is entering a maturity phase. Not a decline—maturity. The difference is important. A mature market isn't exciting because the category stops experiencing growth and breakthrough innovation. It still serves essential functions for billions of people, but it's no longer where the cutting edge of technology development happens.

The PC industry's golden age—2000-2015, roughly—coincided with rapid performance improvements enabling new capabilities and experiences. Faster processors enabled video editing on consumer machines. Better GPUs enabled gaming. Larger, brighter displays enabled creative work. Each generation created genuine reasons for upgrades because hardware improvements translated to new user capabilities.

By 2016-2020, the pace of meaningful improvement slowed. Processors got faster, but not faster enough to enable fundamentally new workflows. GPUs improved, but not in ways that shifted what was possible on consumer machines. By 2020-2025, the plateau was obvious—mainstream processors were "good enough" for virtually everything ordinary people do. Upgrades continued happening on replacement cycles, not on compelling feature demand.

2026 represents the transition to full-on maturity. The PC industry is accepting that it's not driving innovation anymore. The exciting work is in other categories: AI, robotics, wearables, foldables, AR/VR. The PC remains essential but no longer revolutionary. This maturity is actually healthy—markets need stable, reliable platforms. It's just less exciting than the growth phase.

The Challenges Are Real, But Manageable

Volatile RAM pricing is genuinely problematic, but it's a near-term volatility. Manufacturing will stabilize. Component costs will normalize. Pricing pressure will ease. This isn't a structural crisis—it's a supply chain adjustment period. By late 2026 or early 2027, this will feel like a bump in hindsight, not a rupture.

Intel's competitive struggles are more structural. The company faces real challenges: process technology disadvantages, architecture execution issues, competitive pressure across multiple fronts. But Intel still has resources, still has customers, still has capabilities. The company will either execute a turnaround or accept reduced market share in specific segments. Neither outcome kills the company or creates industry-wide crisis.

AMD's lead in consumer CPUs is real and substantial. But it's a technical lead, not insurmountable. Intel's engineering organization is still excellent. Architectural improvements in Arrow Lake could be significant. NVIDIA's dominance in GPUs is more concerning because barriers to entry are higher, but even there, AMD's GPU improvements and Intel's Arc trajectory suggest competition will intensify.

Dell's XPS revival is positioning not brilliant but reasonable. Design differentiation is real if executed well. The brand still means something. Whether this strategy actually drives sales meaningfully remains to be seen, but it's not a desperate move—it's a calculated repositioning.

What Comes After the Rough Year

The immediate forecast is indeed rough: stagnant demand, margin pressure, constrained innovation excitement. That's 2026 and likely extending through early 2027. But rough doesn't mean permanent. The fundamentals of computing—that people need devices for productivity, communication, and creativity—aren't changing.

What will change is how those needs get satisfied. Form factors will evolve. Software and AI integration will improve. Battery and display technologies will improve. Eventually, one of these improvements will feel sufficiently meaningful that upgrade cycles accelerate again. It might take 2-3 years, but industry cycles eventually turn.

The PC manufacturers understanding this transition best will manage it best. Those that panic and cut all R&D investment will emerge weak. Those that maintain investment despite margin pressure will have advantages when the upturn comes. Those that invest in software and services, not just hardware, will find revenue sources beyond traditional hardware sales.

For consumers, the rough year isn't catastrophic. It means prices might be higher than hoped. It means new products might not feel revolutionary. It means your PC from 2022 is still perfectly viable, probably better than fine. But it also means you'll eventually upgrade to something genuinely better in some meaningful way. The industry will figure out what that meaningful improvement looks like.

CES 2026 was rough. It was honest. It showed an industry in transition, grappling with maturity, struggling to find the next compelling narrative. But struggle during transition isn't unusual. It's necessary. The PC industry will emerge from this rough period. It'll just look different than before.

FAQ

What are the main challenges facing the PC industry in 2026?

The PC industry faces multiple interconnected challenges: volatile RAM pricing creating cost uncertainty and margin pressure, Intel's failure to gain meaningful performance advantage over AMD, commoditized hardware performance removing traditional upgrade drivers, competition from smartphones and tablets reducing PC relevance for many tasks, and lackuster consumer demand despite new product launches at CES. These challenges combine to create a rough year characterized by stagnant sales, margin pressure, and reduced innovation excitement.

Why are RAM prices so volatile in 2026?

RAM pricing volatility stems from multiple supply chain pressures: memory manufacturers simultaneously investing in next-generation technology while winding down current-generation capacity, uneven demand patterns across consumer and enterprise segments, global capacity utilization issues with manufacturers operating below optimal efficiency, and geopolitical tensions affecting semiconductor supply chains. These factors create genuine uncertainty about supply and demand balance, leading to prices that swing 15-20% month-to-month.

How does Intel's Core Ultra Series 3 compare to AMD's Ryzen processors?

Intel's Core Ultra Series 3 is competitive but not superior. AMD's Ryzen processors deliver better energy efficiency (performance-per-watt), translating to longer battery life and cooler operation. Intel achieves comparable single-threaded performance but falls behind on multi-threaded and sustained-load scenarios. For most users, the practical difference manifests as better battery life and quieter operation on AMD systems. Intel remains competitive enough for specific workloads but lacks the leap-ahead advantage needed to inspire upgrades.

Should I upgrade my existing PC in 2026?

Most users should not prioritize upgrading in 2026. If your PC handles your typical workflows—email, document editing, web browsing, light creative work—without significant slowdowns, upgrading won't provide meaningful benefits. The exception is if you do specialized work (video editing, 3D modeling, professional coding) where newer hardware might measurably improve your productivity. For typical users, waiting until 2027 or 2028 when new form factors or breakthrough capabilities emerge makes more sense financially and practically.

Is the PC market actually in decline or just maturing?

The PC market is maturing, not declining. Maturity means the category stops experiencing rapid growth and breakthrough innovation but continues serving essential functions for billions of users. Think of it like the automobile market—cars remain necessary and important, but the industry isn't experiencing the revolutionary changes of the 1900s-1960s growth phase. PC maturity means stable, reliable platforms for essential computing, just without the excitement of growth phases.

What innovations might actually revive PC market excitement?

Potential drivers of renewed interest include battery technology breakthroughs enabling 3+ days of runtime, thermal innovations enabling passively cooled high-performance systems, significant form factor changes (rollable or foldable displays with practical advantages), artificial intelligence capabilities that genuinely improve productivity, and sustainability/repairability features appealing to environmentally conscious buyers. None of these are imminent, but any could emerge in 2027-2028 to restart upgrade cycles.

How should manufacturers respond to this challenging 2026 environment?

Manufacturers best positioned for 2026 success will: focus on design quality and user experience differentiation rather than performance metrics, invest in software and services beyond hardware, maintain R&D spending despite margin pressure to be ready for the next cycle, target premium segments where margin is higher and design matters most, and build resilient supply chains that handle volatility. Companies cutting R&D or focusing exclusively on cost-cutting will emerge weak when market conditions improve.

The Path Forward

CES 2026 painted an honest picture of an industry in transition. It's not a catastrophic picture—the PC remains essential for billions—but it's undeniably a rough one. Volatile component costs, commoditized performance, intense competition, and lack of compelling upgrade drivers all converge to create challenging conditions.

But rough years are temporary. They're transitions. The manufacturers, developers, and ecosystem partners that navigate 2026 well will emerge stronger. The consumers who understand that upgrading now offers minimal benefits will save money waiting for genuinely better options. The innovators who figure out what's next after performance-based competition will define the next phase.

The PC industry's golden age of rapid improvement and explosive innovation is over. But its era of mature, essential computing is just beginning. That might be less exciting, but it's far from finished.

Key Takeaways

- RAM price volatility in 2026 creates genuine cost uncertainty for manufacturers and consumers, with 15-20% monthly swings making component purchasing unpredictable.

- Intel's Core Ultra Series 3 represents competent engineering but fails to excite the market, as it doesn't achieve meaningful performance leaps over AMD's superior efficiency-focused architecture.

- AMD has achieved sustained CPU leadership through better energy efficiency, longer battery life, and cooler operation than Intel equivalents, becoming the default choice for laptop manufacturers.

- The PC market is entering mature stagnation phase where users no longer see compelling reasons to upgrade, as hardware from 2021-2022 remains perfectly adequate for typical workloads.

- Dell's XPS revival and other design-focused strategies represent defensive repositioning rather than market-driving innovation, unable to create meaningful upgrade demand.

- Gaming laptops and professional workstations maintain stronger demand than mainstream segments, with specialized use cases justifying premium pricing despite broader market stagnation.

- Competition from smartphones, tablets, and foldable devices is fragmenting consumer tech spending away from traditional PC upgrades, reducing overall market addressable opportunity.

- NVIDIA's GPU dominance extends beyond graphics into essential AI acceleration, making discrete graphics cards critical for modern computing regardless of CPU choice.

- The PC industry will likely remain stagnant through early 2027 before potential recovery driven by breakthrough battery technology, form factor innovation, or AI capabilities that offer genuine utility.

Related Articles

- Best Dell Laptop Deals in 2025: Save Up to $500 on Top Models

- CES 2026 Day 1: The Biggest Tech Announcements and Gadgets [2025]

- CES 2026: Every Major Tech Announcement & What It Means [2026]

- Intel Core Ultra Series 3: The 18A Process Game Changer [2025]

- Alienware's New Slim and Budget Gaming Laptops [2025]

- Dell XPS Revival: Why the Rebranding Disaster Led to Redemption [2025]

![PC Industry Crisis 2026: RAM Volatility, Intel Struggles, and Market Uncertainty [2026]](https://tryrunable.com/blog/pc-industry-crisis-2026-ram-volatility-intel-struggles-and-m/image-1-1767825474146.jpg)