Introduction: Rebooting a Legacy, Rejecting the Startup Playbook

When Eric Migicovsky walked away from his previous company's exit, he took something most founders never get: a second chance. After selling Pebble to Fitbit for roughly

"We've structured this entire business around being a sustainable, profitable, and hopefully, long-running enterprise, but not a startup," he told the room. Not a startup. Those three words carry weight, especially from someone who built and sold one of the most beloved hardware brands of the 2010s.

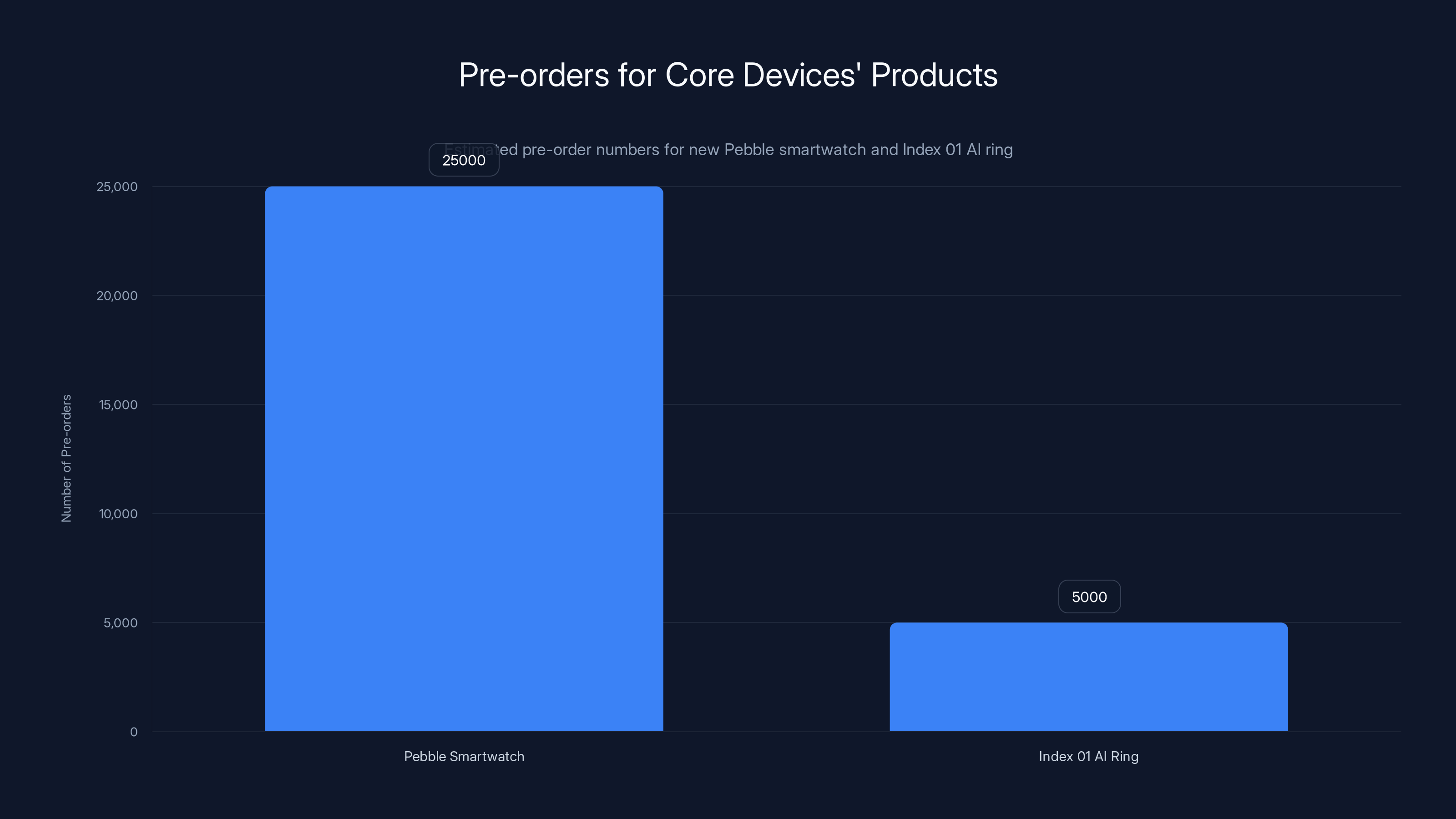

This isn't semantics. It's a fundamental rejection of the venture capital machinery that powers modern tech. No outside funding. No burn rate calculations. No venture investors demanding 10x returns. Instead, Migicovsky is building Core Devices with a team of five people, selling directly to consumers, and pre-selling products before manufacturing a single unit. Twenty-five thousand people pre-ordered the new Pebble smartwatch. Five thousand have already committed to his AI ring, the Index 01. They're shipping six months out, but the team is stable, profitable, and patient.

To understand why this matters—and why it represents a genuinely different approach to hardware—you need to understand what went wrong the first time. Pebble didn't fail because the smartwatch was a bad idea. It failed because Migicovsky lost the plot. He got caught chasing markets that weren't really his, building features that didn't fit his vision, and drowning in inventory that was supposed to save the company.

This time feels different. This time, he's learned something that most first-time founders never figure out: constraint is a feature, not a bug.

TL; DR

- Pebble's 2.0 is bootstrapped: No venture funding, no external pressure, just consumer pre-orders and sustainable unit economics

- The first company failed on execution: Migicovsky admits he chased health tracking and fitness features that didn't match the original vision

- Size matters: Five employees instead of 180, selling direct instead of through retail partners, shipping only what's already sold

- The product stays focused: Pebble Time 2, Pebble Round 2, and the Index 01 AI ring are deliberately designed for a niche (not everyone), not a mass market

- Google saved the reboot: Open-sourcing Pebble OS made the entire comeback possible—recreating that OS from scratch would've cost millions

- The metric that matters: 25,000 pre-orders for smartwatches, 5,000 for the AI ring—proof of demand before a single unit ships

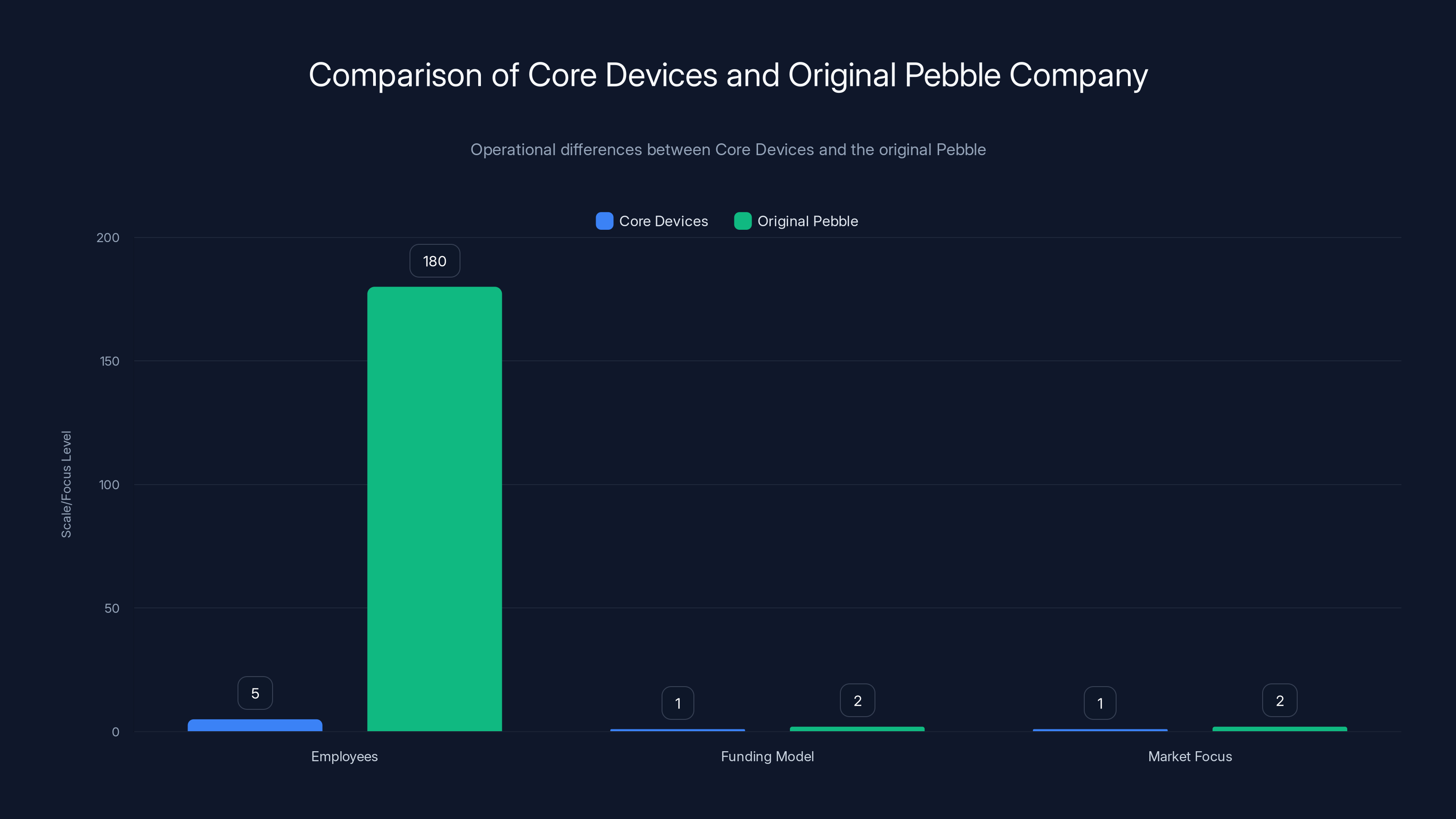

Core Devices operates with a lean team of 5, uses a pre-order funding model, and focuses on developers, contrasting with the original Pebble's larger scale and broader market approach. (Estimated data)

Why Startup Culture Failed Pebble (And How Migicovsky Learned to Spot the Trap)

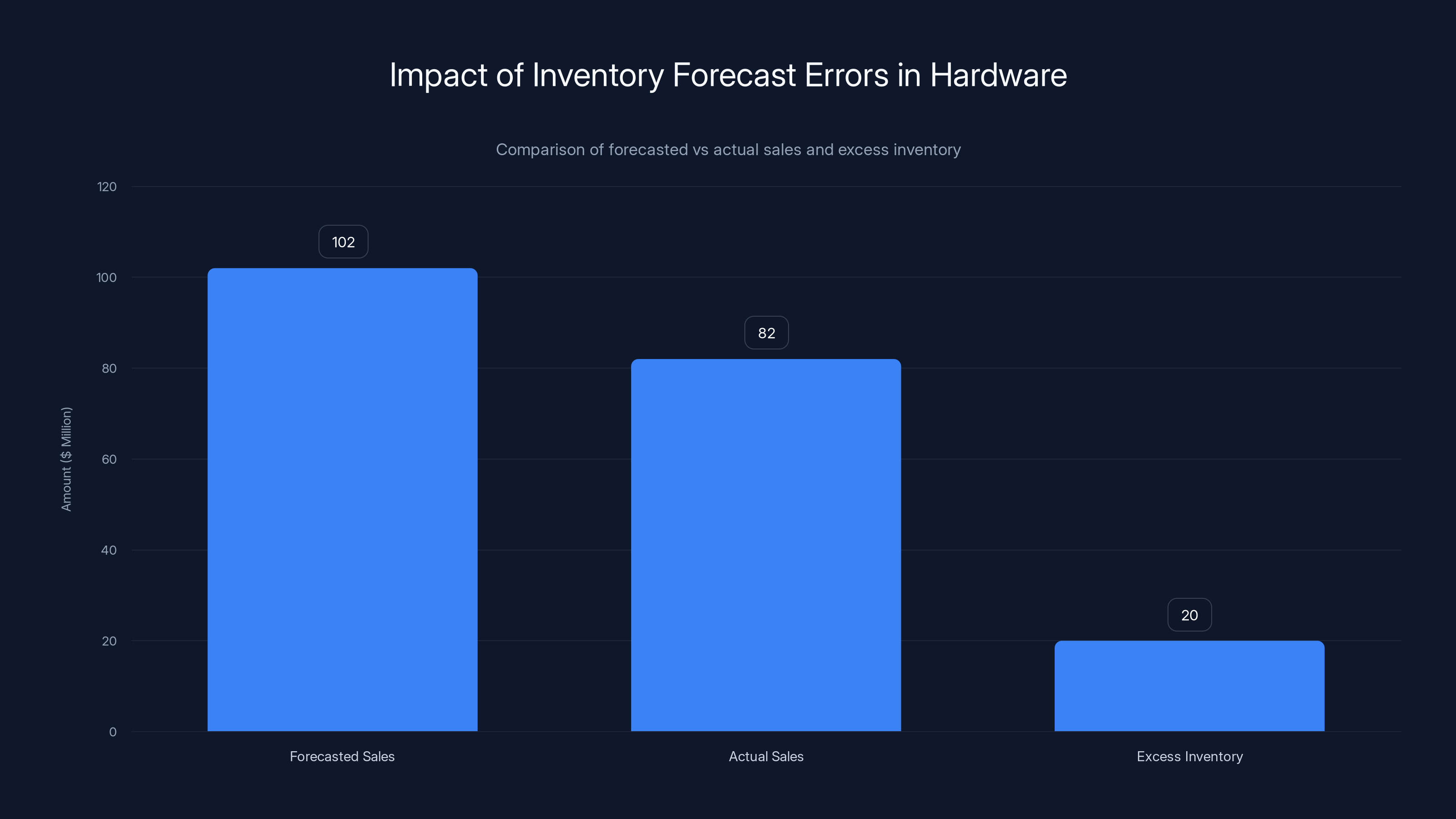

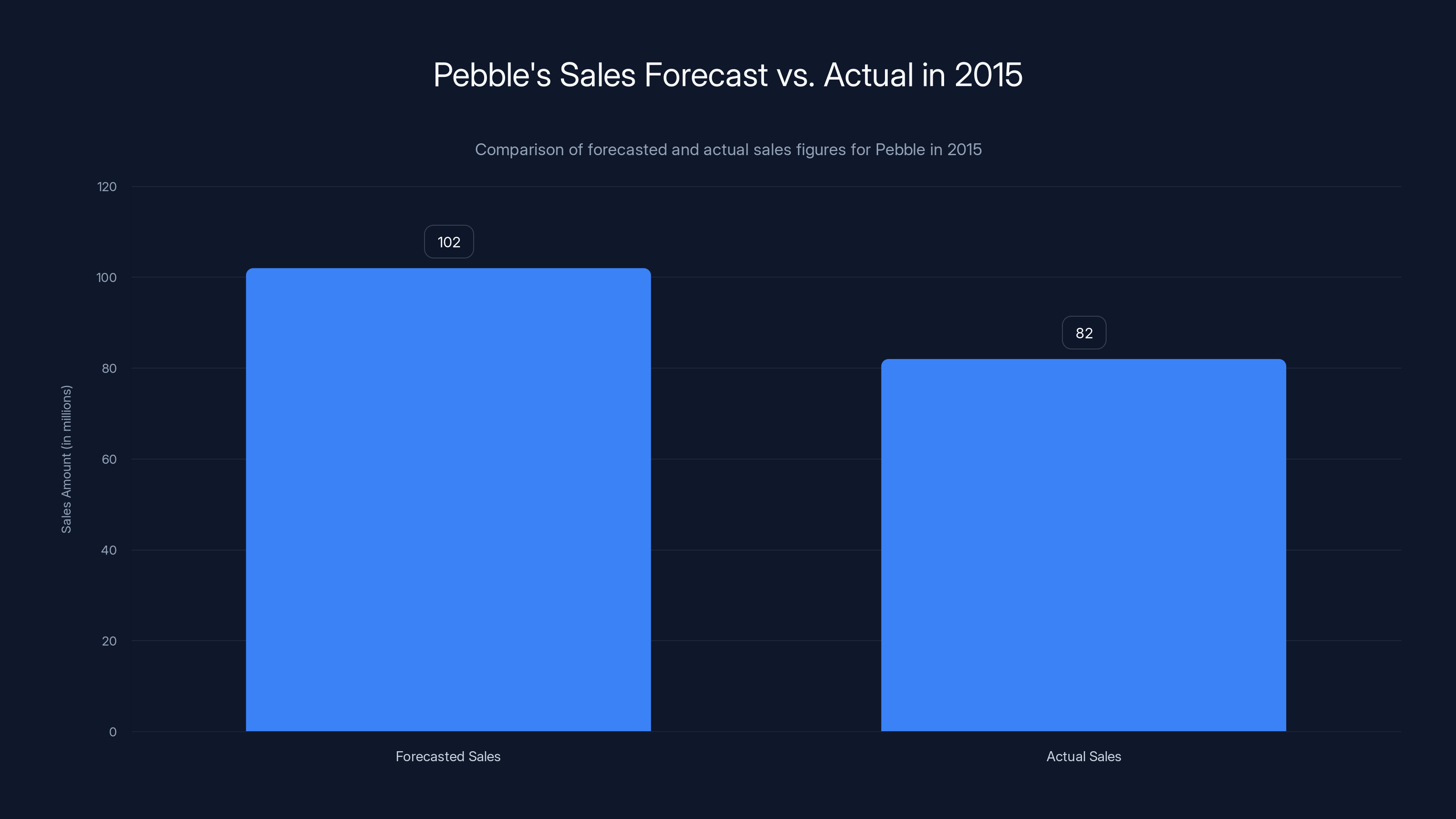

Picture this: It's Christmas 2015. Pebble's team had forecast

When you make predictions about demand and miss by 20%, the hardware world doesn't shrug. Retail partners panic because those discounted products kill their margins. Your manufacturing partners get nervous. Your cash position tightens. And if you don't have a war chest of venture capital behind you, you have to get creative fast.

Pebble got creative the worst way possible: rapid layoffs, restructuring, and a frantic search for an exit.

But here's what Migicovsky realized looking back, and this is crucial: the inventory problem wasn't the real failure. The real failure was that he'd lost sight of what Pebble was supposed to be. "I think I lost sight of the vision of why I was building Pebble," he admitted. The company started with clarity. They ran a Kickstarter campaign. They posted exactly what Pebble did, who should be interested, and what they'd build. Then something shifted.

The pressure to grow, to reach new markets, to compete with the fitness trackers and smartphone-wannabe watches pushed Pebble into health tracking, into features that didn't feel like the product anymore. Every feature the team added in pursuit of a broader market actually made the product less cohesive.

This is the startup trap. The venture capital model rewards growth at all costs. Investors need their returns, and those returns come from capturing massive markets. So you're always being pushed to expand, to build the feature that'll attract the next customer segment, to become something bigger than you actually are.

Migicovsky is now rejecting that entire premise. "I'm okay with a limited vision and a limited scope of what we're trying to accomplish," he said. These sound like small words, but they're revolutionary. In startup speak, limited scope means limited TAM (total addressable market). Limited TAM means limited venture returns. Limited returns mean no venture investors.

So Core Devices remains venture-free.

The Hardware Trap: Why Inventory Is an Existential Threat

Unlike software, where you can deploy changes instantly and don't have to predict how many copies you'll sell, hardware forces you into an impossible situation. You have to order materials, book manufacturing capacity, and commit to production months before you know if anyone actually wants the thing.

This creates a mathematical problem. If you forecast

The typical solution? Fire sales. Discount the product, blow out inventory, and hope you recover the cash. But this creates a second problem: your retail partners hate you. They bought at full price and now can't compete with your discounted units. Margins evaporate. Trust erodes. The relationship that got you distribution in the first place becomes toxic.

Pebble lived this nightmare. They had distribution through retail partners, and when they discounted, those partners got hurt. That relationship capital is hard to rebuild.

Migicovsky's solution this time: eliminate the retail layer entirely. Sell direct to consumers. No middleman, no inventory languishing in retail shops, no margin pressure from partners undercutting your pricing.

Direct-to-consumer is trendy, but for hardware companies, it's not a marketing choice. It's an existential one. It's the only way to have real-time feedback between demand and supply. If Pebble sells 5,000 units a month, they can manufacture 5,000 units a month. If demand spikes to 8,000, they slow down hiring and investment. If it drops to 3,000, they adjust.

This is the opposite of the venture model, which says: "Raise money, spend it fast, grow aggressively, and let profitability be a future problem." The venture model works for software because marginal costs are zero. Serve one more customer, it costs nothing. In hardware, serving one more customer means buying more materials, booking more manufacturing time, and carrying more inventory risk.

Hardware companies face significant challenges with inventory management, as seen in a 20% excess inventory when actual sales fall short of forecasts. Estimated data.

Who Is Pebble Actually For? Narrowing the Vision

Migicovsky is emphatic about something that startup culture trains you to avoid: specificity about who your product is not for.

"The new Pebble smartwatches aren't meant to be for everyone," he said. They're not for fitness junkies. They're not for people who want a smartphone on their wrist. They're specifically for people like him: self-described nerds who like hacking, building, and tinkering.

He wants a watch that's "a companion to my phone, rather than a replacement for my phone." He wants it to feel "more like a Swatch than a Rolex." Fun. Casual. Playful. Plasticky. Not premium. Not all-in-one. Not trying to do everything.

This is radical restraint. The Apple Watch tries to be your fitness tracker, your notifications hub, your payment device, your communication center, and your health monitor. It's powerful, but it's also bloated for people who just want a nice notification display on their wrist.

The new Pebble is the anti-Apple Watch. Limited features. Limited scope. But perfect for its target user.

This matters because it directly solves the original Pebble's problem. The first iteration had clarity (watch for developers and tinkerers). The middle years added fitness, health tracking, and features designed to compete with Fitbit and Apple. By the end, it wasn't clear what Pebble was supposed to be.

Core Devices has returned to first principles. It knows exactly who it serves and what it doesn't try to do. That clarity is reflected in the product lineup: the Pebble Time 2 (rectangular face, more powerful), the Pebble Round 2 (classic circular design), and the Index 01 (a smart ring, not another watch).

Each product has a reason for existing. Each serves the same core user base. There's no feature creep, no "let's try health tracking because everyone else does."

The Five-Person Company: Why Small Teams Build Better Products

Core Devices operates with five employees. The original Pebble had 180. That's a 36x reduction in headcount.

This isn't just a cost-saving measure. It's a structural difference that fundamentally changes how the company operates.

Small teams have no room for politics. Every person has to contribute directly to the product or the customer experience. You can't hide in a large organization, waiting for someone else to solve the problem. With five people, if someone isn't pulling their weight, the entire company feels it immediately.

Small teams also have faster communication. You can't have 14 layers of approval. You can't have design arguing with engineering for months. The team meets, discusses, decides, and ships. This cadence is impossible in a 180-person company, where you need project managers to coordinate between teams, and each team has its own leadership.

There's also something psychological about building with constraints. When you have unlimited resources, you can afford to build the wrong thing. You have time to pivot. You can hire your way out of problems. With five people, every decision has to be right the first time. You build with intention.

Migicovsky is also clear about what the small team doesn't do: they don't work with distributors. They don't manage retail partnerships. They don't maintain relationships with 50 different retail partners across different regions. All of that overhead is gone. The company sells on its website. Orders come in. Manufacturing happens. Products ship. If there's an issue, customer service is direct.

This simplicity is worth gold in hardware. Every additional partner, every additional layer between the company and the customer, introduces delays, miscommunications, and margin pressure. By eliminating all of that, Core Devices keeps the feedback loop tight and the financial picture clear.

Pebble OS: The Unsung Foundation That Made Everything Possible

Here's a story that almost didn't happen. Migicovsky ran into a Google engineer, Mattieu Jeanson, at a kid's birthday party. They got to talking. Migicovsky got contact information for someone who might be able to influence a decision at Google. He sent an email requesting that the company open-source Pebble OS.

A year later, Google did it.

Without that decision, the Pebble reboot would've been impossible. The original Pebble OS took 30 to 40 engineers working for years to build. Recreating that from scratch in a five-person company? Not feasible. The engineering lift would've been massive, the timeline would've been unrealistic, and the cost would've been prohibitive.

But with Pebble OS open-sourced, Core Devices had a foundation. The team could focus on hardware, features, and user experience instead of rebuilding the operating system from zero.

Migicovsky credits Google explicitly: "What other big company in the world would do that?" It's a fair question. Open-sourcing a product that's no longer profitable is not standard practice for big tech companies. But Google recognized the Pebble community's value, understood that the OS had become an artifact of developer culture, and made the call to release it.

"I think they did it as an homage to the Pebble community," Migicovsky said. That homage became the enabling technology for the entire comeback.

This also reveals something interesting about the economics of open-source. For Google, maintaining Pebble OS was a cost center. They'd bought the company, absorbed the team, and didn't really need the OS anymore. But instead of leaving it to rot, they released it. For the community, it was priceless. For Core Devices, it was the difference between possible and impossible.

Pebble forecasted

The Pre-Order Model: Why Manufacturing Before Selling Is Insane

Core Devices has 25,000 pre-orders for smartwatches. About 5,000 pre-orders for the AI ring. These numbers tell a story that venture capital has trained us to ignore: demand can exist without massive marketing spend and without building inventory on spec.

Traditional hardware companies build first, then sell. You manufacture 100,000 units, you box them, you ship them to retailers, and you hope they sell. If they don't, you're stuck.

Core Devices flips the script. They take pre-orders. Only when the pre-orders come in do they manufacture. This means zero inventory risk. Every unit built has already been paid for.

Migicovsky admits that pre-orders are currently shipping about six months out. That's a long wait, and it suggests demand is strong. But it also indicates that manufacturing capacity is the constraint, not demand. They're deliberately capping orders so they don't overcommit.

Once the team tightens manufacturing timelines, the shipping window should compress to a couple of weeks. That's a dramatic improvement, but it's intentional. Right now, they're being conservative because they're still learning the demand pattern. Better to have customers wait than to build too much inventory.

This model also generates cash. Every pre-order is a deposit. That deposit funds the next production run. You're not borrowing money to build hardware. Your customers are funding you.

For a bootstrapped company, this is elegant. There's no burn rate. There's no venture capital requirement. The company operates on customer deposits and generates profit from day one.

The App Store Is Still Alive: 15,000 Watch Faces and Apps

One of the most underrated aspects of the original Pebble was the app ecosystem. Unlike the Apple Watch, which has a curated App Store, Pebble allowed developers to submit watch faces and apps freely. The community responded with 15,000 different options.

That ecosystem still exists. Core Devices is relaunching the SDK for developers, which means new apps and watch faces are coming.

This is significant because it aligns with Migicovsky's vision. Pebble isn't trying to be a closed ecosystem controlled by a single company. It's open. Developers can build for it. Users can customize it. The watch becomes a platform, not just a product.

This is the opposite of Apple's approach, and it's deliberate. The Apple Watch is a premium product with premium margins. Pebble is a developer-friendly platform with community-generated value. The economics are different, but so is the user relationship.

When a developer builds a watch face for Pebble, they're investing in the platform. They're creating value that extends beyond any single update that Core Devices ships. That's network effects. That's platform thinking.

For a five-person company, the app ecosystem is force multiplication. It's 15,000 developers adding value without Core Devices needing to hire and manage them.

The AI Ring Wildcard: Why Core Devices Is Diversifying

Alongside the Pebble smartwatch reboot, Core Devices is also selling the Index 01, a $75 smart ring with AI capabilities. This is interesting because it's not a Pebble product. It's a new category entirely.

But it makes sense given the team's constraints. Building a smartwatch OS and hardware is hard. Building an AI ring is also hard. But building both is only marginally harder if you've already solved manufacturing, supply chain, and direct-to-consumer distribution.

The Index 01 is getting 5,000 pre-orders, which is 20% of the smartwatch volume. That's meaningful. It suggests there's interest in smart rings, but not from the same audience. Smart ring buyers are different from smartwatch buyers.

The product itself is positioned as an AI interface. Press a button, get an AI response. It's not trying to replace your phone or be a full computer on your finger. It's augmentation.

Migicovsky hasn't given extensive details about the Index 01, but the fact that Core Devices can develop, manufacture, and sell multiple hardware products simultaneously with five employees suggests the company has figured out something about the hardware development process that most hardware companies miss. They're not reinventing the manufacturing process for each product. They're building a platform for hardware development.

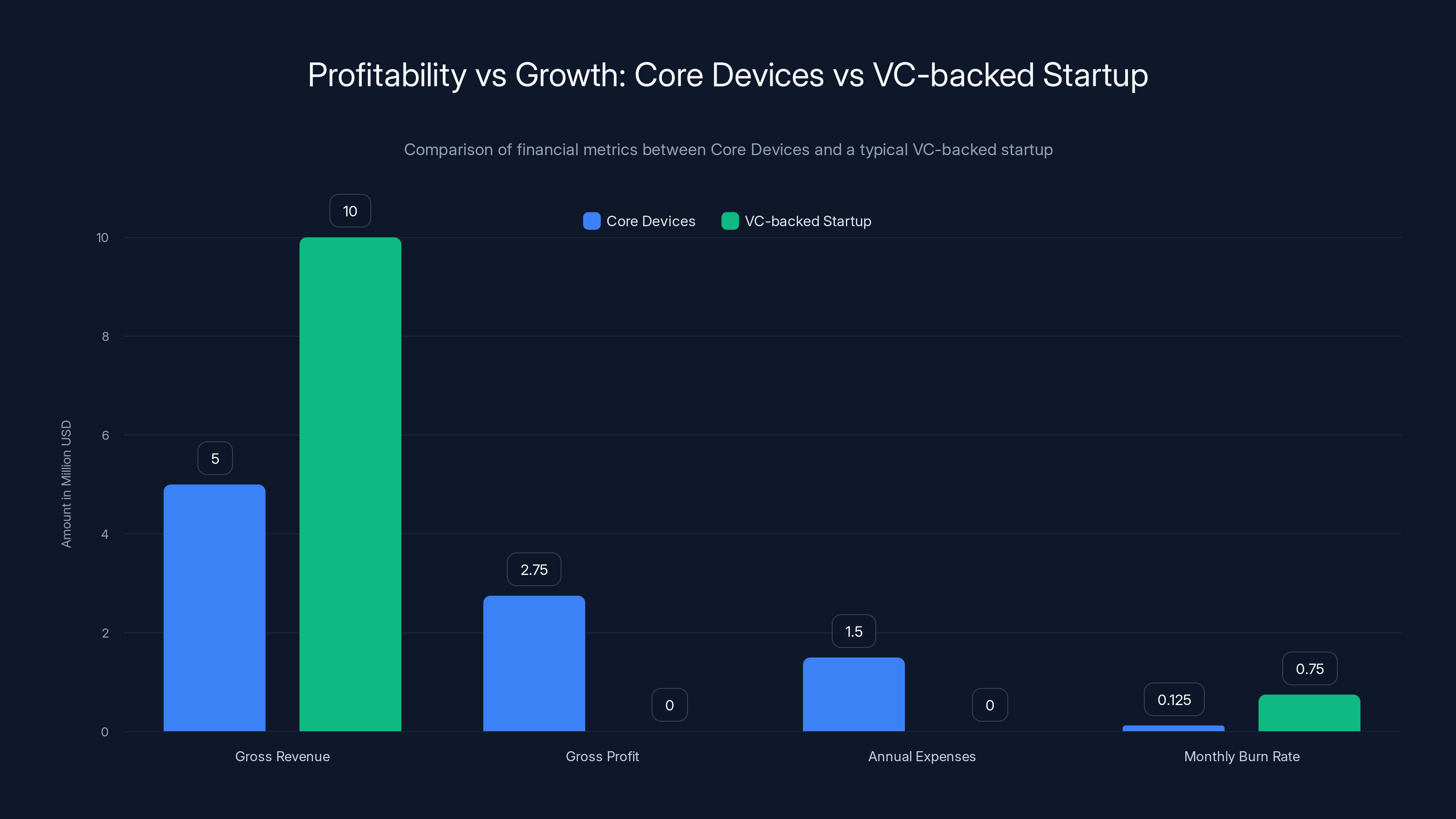

Core Devices achieves profitability with a

Profitability From Day One: The Unsexy Path to Sustainability

Core Devices is profitable from day one. Not projecting to be profitable. Actually profitable.

This is unusual enough that it's worth examining what this means. The company took pre-orders, collected payments, and hasn't spent more than it's earning. Expenses are covered. The team is paid. Operations are sustainable.

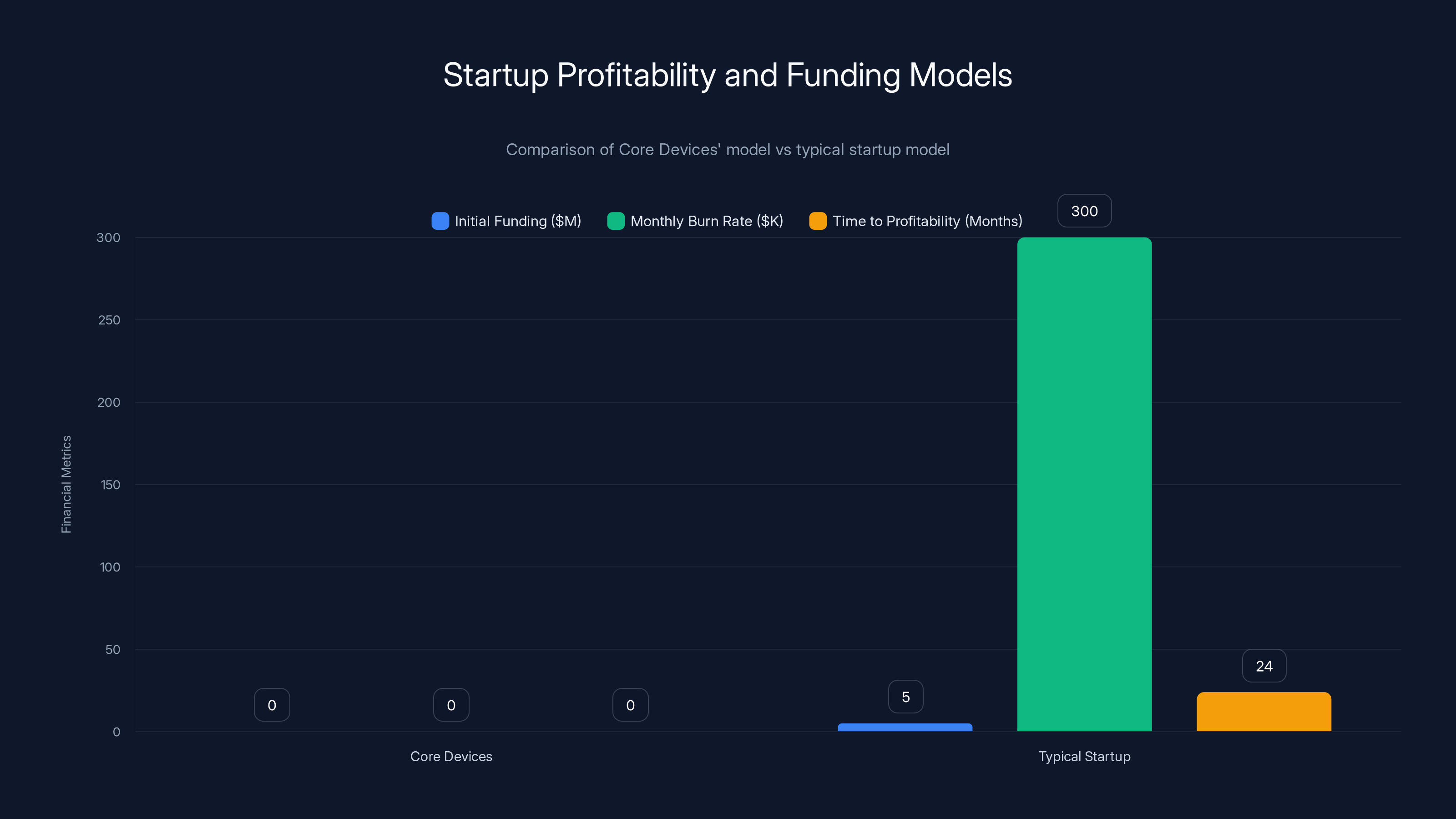

Compare this to a typical startup playbook: raise

Core Devices rejected that playbook entirely. No raise. No burn. No runway. Just customer demand and careful spending.

Migicovsky described the team as being in a "comfortable spot," where their expenses are paid, and they can finance new product development from operations. That's not venture language. That's sustainable business language.

It's also less glamorous. There's no Series A announcement. No headline about closing a mega-round. No valuation. The company isn't building for a big exit. It's building to last.

But there's a strategic advantage here that venture capital hasn't figured out yet: if you're not dependent on outside capital, you're not beholden to investors. You can make decisions based on product quality and user happiness instead of growth metrics and market share. You can say no to features that don't fit the vision. You can wait for the right moment to expand instead of scaling before you're ready.

The Shipping Cadence: Six Months Out, But Getting Tighter

Core Devices is currently shipping pre-orders about six months after purchase. That's a long wait by consumer standards. But Migicovsky is confident this will compress to a couple of weeks as manufacturing efficiency improves.

This timeline tells a story about demand vs. capacity. If demand is so strong that it's six months out, the company could theoretically raise prices, attract more investment, or hire aggressively to shorten the timeline. But Migicovsky isn't doing any of those things.

Instead, the team is optimizing manufacturing and supply chain to naturally improve throughput. Every production run teaches them something. Lead times will improve. Efficiency will increase. The six-month backlog becomes three months, then eight weeks, then a couple of weeks.

But importantly, there's no panic. The company isn't sacrificing quality to speed up delivery. It's not overcommitting to promises it can't keep. It's taking its time to build right.

This is a patient approach, and it's only possible because the company isn't under investor pressure. A VC-backed hardware startup would be raising prices or cutting corners to hit shipping targets. Core Devices can afford to be methodical.

Why Open-Source OS Matters More Than Proprietary Innovation

Pebble's OS being open-source isn't just nice for the community. It's a strategic advantage for Core Devices.

A proprietary OS would mean the company is locked into supporting a single platform. Updates would come from the company alone. Security patches would depend on internal resources. Features would be limited to what the company can build.

With open-source, security patches can come from the community. Features can be contributed by external developers. The OS improves through collective effort rather than the effort of a single company.

For a five-person team, this is essential. They can't possibly maintain an OS, ship hardware, manage a website, handle customer support, and develop new features all at the same time. But with an open-source OS, the community shares the maintenance burden.

This is also why Google's decision to open-source Pebble OS was so valuable. It wasn't just generous. It was strategically smart for anyone who wanted to keep Pebble alive.

Core Devices has received 25,000 pre-orders for the new Pebble smartwatch and 5,000 for the Index 01 AI ring, indicating strong consumer interest in their direct-to-consumer model.

The Supply Chain Advantage: DTC Eliminates Friction

Direct-to-consumer doesn't just mean better margins. It means direct feedback about what's working and what isn't.

If a retail partner's store gets 10 units of Pebble Time 2 and they sell 8, the feedback gets filtered through the distributor, then the company, and by the time anyone internal knows about it, the data is stale. With DTC, Core Devices sees real-time sales. They know which product is moving, which configuration people prefer, which color is popular.

This information is gold for a small team. They can adjust production mix immediately. If everyone is ordering the rose gold variant and ignoring black, they can shift manufacturing to make more rose gold units. No inventory of unwanted colors. No discounting to clear stock.

The supply chain is also shorter. No retail markup. No distributor margin. No layoffs in the distribution chain. Just customer to company to manufacturer. That simplicity reduces complexity and reduces cost.

It also means the company controls the entire customer experience. If there's a defect, Core Devices handles it directly. If a customer has a question, they contact Core Devices directly. The company builds a relationship with its users, not through retail partners, but directly.

Community as Strategy: Pebble's Underrated Competitive Advantage

Pebble has always had a fiercely loyal community. The original Pebble Kickstarter raised $10.3 million from 68,929 backers. That's not typical venture capital numbers. That's a community that believed in the product.

Even after Fitbit and Google acquired Pebble, the community never really left. They kept using the watches. They kept developing apps and watch faces. They kept hoping for a comeback.

Migicovsky tapped into that community to relaunch Core Devices. The pre-order numbers (25,000 smartwatches, 5,000 AI rings) suggest the community came back.

But a community isn't just a marketing asset. It's a product development asset. The community tells you what features matter. They tell you what's broken. They contribute directly to the product (watch faces, apps). They evangelize to potential users.

Venture-backed companies have user bases. Pebble has a community. That's a different thing.

For a five-person company, the community is force multiplication. It's thousands of people investing time and energy in the platform because they believe in it, not because they were paid to.

The Smartwatch Wars: Pebble's Niche in the Apple Watch Dominated Landscape

The smartwatch market today is dominated by Apple. The Apple Watch is the best smartwatch. It has the most features. It has the best integration with iPhone. It's the default choice for most people.

But there's a reason the Apple Watch doesn't appeal to everyone. It's expensive. It tries to do too much. It's designed to keep you looking at your wrist, not to stay out of your way.

Pebble's reboot is the anti-Apple Watch. It's cheap (

Google's Wear OS is also in this space, but it's fragmented and clunky. Samsung's Galaxy Watch is better, but it's still expensive and still trying to be too much.

There's a gap in the market for a simple, affordable, developer-friendly smartwatch. That's the gap Pebble is filling.

It's not going to dethrone the Apple Watch. It's not trying to. It's capturing the people who like the Apple Watch's idea but hate its execution. People who want a watch that tells time, shows notifications, and gets out of the way. People who want to hack and tinker. People who value an open ecosystem over a walled garden.

That's a smaller market than "everyone," but Migicovsky is okay with that. "I'm okay with a limited vision and a limited scope." That limitation is the product's strength, not its weakness.

Core Devices achieves profitability from day one with no initial funding or monthly burn, contrasting with typical startups that often require $5M in funding and 24 months to reach profitability. Estimated data.

Manufacturing Reality: Lead Times, Constraints, and Realistic Scaling

Migicovsky's comment that they're shipping six months out tells you something important about hardware manufacturing. Lead times are real. They're not negotiable.

You can't just decide to make more watches. You have to book manufacturing capacity with your contract manufacturer, order components from suppliers who have their own lead times, and wait for the production run to complete. Then there's quality assurance, packing, and logistics.

Six months is actually not that long in hardware terms. Apple's iPhone has even longer waits for premium models. Samsung manages similar timelines. But the difference is that Apple and Samsung spread demand across 50 different SKUs and have massive manufacturing capacity.

Core Devices is dealing with limited SKUs (a few watch models, the AI ring) and learning manufacturing as they go. The team is also deliberately not rushing. Better to have a six-month backlog and happy customers than to rush production and deliver defective units.

As manufacturing efficiency improves, that timeline will naturally compress. Migicovsky's goal of a couple of weeks is realistic but probably 12-18 months out. In the meantime, the backlog is a feature, not a bug. It proves demand is real.

The Business Model Math: Why Profitability Beats Growth

Let's do some math on the Core Devices model.

Assuming 25,000 smartwatch pre-orders at an average price of

So the company is cash-positive from the first production run.

Compare this to a typical VC-backed hardware startup raising

Core Devices doesn't have that stress. Every unit sold is profit. Every additional sale is reinvestment capital.

This also changes the company's financial decisions. They don't need to hit aggressive growth targets. They don't need to capture market share at any cost. They can be selective about which markets to enter, which products to build, and which customers to serve.

The flip side is that the company will grow more slowly. Without aggressive capital investment, scaling will take time. But the company will also be more stable. Recessions won't sink it. Market downturns won't require layoffs. There's no investor pressure to pivot or shut down.

Lessons for Other Hardware Founders: The Core Devices Playbook

Migicovsky's approach offers a blueprint for hardware founders who want to avoid the pitfalls he experienced at Pebble.

First: Know your niche. Don't try to build the watch for everyone. Build the watch for your people. For Pebble, that's developers and tinkerers. Stay focused. Say no to features that don't fit.

Second: Manage inventory ruthlessly. Pre-sell before manufacturing. Don't build on speculation. Every unit you build should already be paid for. This eliminates the inventory risk that killed the original Pebble.

Third: Go direct to consumer. Eliminate retail partners, distributors, and middlemen. Sell on your website. Control the customer relationship. Collect real-time feedback. Adjust quickly.

Fourth: Stay small as long as possible. Five people can move faster than 50. Don't hire just to hire. Make sure every person adds direct value to the product or customer experience.

Fifth: Embrace constraints. Limited budget means every decision matters. Limited team means clear priorities. Limited scope means focused execution. Constraints are features, not bugs.

Sixth: Avoid venture capital if you can. VC is useful if you're building something that requires massive upfront capital or if you need money to scale faster than your competitors. If you can bootstrap, do it. You'll be happier.

Seventh: Build platform thinking into the product. Pebble OS being open-source and the App Store having 15,000 entries means the community creates value. Enable that. Don't try to own everything.

Looking Forward: What's Next for Core Devices

Migicovsky hasn't announced long-term plans, but the structure of the company suggests a path forward.

The smartwatch and AI ring are the foundation. The 25,000 and 5,000 pre-orders respectively prove the market exists. As manufacturing efficiency improves and shipping times compress, the company can probably handle higher order volumes without expanding the team significantly.

There's room for new products. The technology that powers the smartwatch and AI ring could power other devices. A smart glasses frame? A smart wallet? The platform thinking means new hardware categories could be added without completely reinventing the company.

But Migicovsky will be selective. The company won't chase every market. It'll focus on products that fit the core vision and serve the core audience.

There's also the question of scale. Can a five-person company sustainably ship 100,000+ units per year? Probably not without additional headcount. But that expansion can come from operational cash flow, not venture capital. As the company grows to 10-15 people, it's still bootstrapped.

The long-term vision isn't to become the next Apple. It's to become the alternative to Apple. A company that serves people who don't want the premium, closed-ecosystem experience. A company that lasts for decades because it's profitable and customer-focused, not because it's chasing venture returns.

That's a different kind of success metric. It won't make investors rich overnight. But it might make founders rich slowly, and it'll definitely create products that people love for a long time.

The Pebble Community Is Proof of Concept

The real proof that this model works isn't in the financial projections. It's in the fact that people pre-ordered 25,000 smartwatches sight unseen.

These aren't speculative pre-orders from venture capital types hoping for a 10x exit. These are people who used Pebble before, loved it, wanted it back, and were willing to put money down to make it happen.

That's not hype. That's authentic demand. That's a market that actually exists.

Migicovsky tapped into something that venture capital often misses: nostalgia for products that did one thing well instead of trying to do everything. Nostalgia for companies that respected their users' time instead of trying to occupy their wrists. Nostalgia for open ecosystems that welcomed tinkering.

The Pebble community never really left. They were waiting for the company to come back. Now it has. And they're voting with their wallets.

That's the real story here. Not that Eric Migicovsky started a new company. It's that he figured out how to resurrect a beloved product by rejecting everything venture capital taught him about building startups. And it's working.

Sustainable Business vs. Growth At Any Cost

The fundamental difference between Core Devices and a typical tech startup is the goal. A startup's goal is growth. Rapid growth. Venture growth. The goal is to reach billion-dollar valuation and then either go public or sell to a big tech company.

Core Devices's goal is sustainability. Make great products. Keep customers happy. Make enough money to pay the team and fund the next product. Repeat.

These are not the same thing. They require different decisions, different timelines, and different metrics.

A startup would look at 25,000 pre-orders and think: "How do we get to 250,000? How do we expand to new markets? How do we build a $100 million company?" The growth mindset is baked in.

Migicovsky looks at 25,000 pre-orders and thinks: "How do we make this sustainable? How do we deliver a great product to these people? How do we keep the team happy and the company profitable?" The sustainability mindset is different.

Both approaches have merit. Growth-focused companies create jobs, drive innovation, and build massive products. Sustainable companies create stability, generate steady value, and last longer.

Neither is wrong. But most startup culture only celebrates growth. Migicovsky is betting on sustainability instead.

The Future of Hardware: Rethinking What "Success" Means

Core Devices might be the proof of concept for a different model of hardware company. Not venture-backed. Not targeting massive TAM. Not obsessed with growth at all costs.

Instead: bootstrapped, focused, profitable, and built to last.

This model won't work for every hardware category. If you're building a technology that requires massive upfront R&D investment (like a new battery chemistry or a novel manufacturing process), you probably need venture capital. But for hardware that uses existing technology in new ways, or for hardware that serves a specific niche, the Core Devices model might be the blueprint.

We might start seeing more companies take this approach. More hardware founders who've been through the venture cycle before saying: "This time, I'm doing it differently." More companies that reject the growth-at-all-costs mentality and bet on building something sustainable.

Migicovsky's biggest contribution might not be the smartwatch. It might be showing that there's an alternative to the venture capital playbook. An alternative that's profitable, sustainable, and genuinely customer-focused.

That's the real comeback story here.

Conclusion: Why "Not a Startup" Might Be the Future

When Eric Migicovsky said, "We've structured this entire business around being a sustainable, profitable, and hopefully, long-running enterprise, but not a startup," he made a quiet, radical statement.

It's radical because startupism has become synonymous with ambition, innovation, and success in tech. To say you're "not a startup" is to reject that entire cultural narrative. It's to say that growth isn't the only goal. That profitability from day one is better than profitability in 24 months if you can make it happen. That a small, stable team that makes great products is better than a large, chaotic team that's burning millions to reach some arbitrary market cap.

Migicovsky learned this the hard way at the original Pebble. He got caught up in growth, in chasing bigger markets, in trying to be everything to everyone. The company failed not because the smartwatch was a bad product, but because he lost focus.

This time, he's not losing focus. The vision is clear. Pebble is for developers and tinkerers. The product lineup is defined. The team is small. The economics are transparent. The company is profitable. The path forward is clear.

Will this model scale to massive size? Probably not with just five people. But it'll scale. Sustainably. Profitably. In a way that doesn't require venture capital or an exit to a big tech company.

The pre-orders prove the market is there. The profitability proves the model works. The community proves the product is loved. All of that without venture capital. Without a burn rate. Without the chaos and pressure that most startups live under.

Migicovsky's comeback isn't just about smartwatches. It's about proving that there's a different way to build technology companies. A way that's more focused, more stable, and more genuinely customer-centric than the venture capital playbook.

That might be the most important innovation here. Not the hardware. The business model.

FAQ

What exactly is Core Devices, and how is it different from the original Pebble company?

Core Devices is Eric Migicovsky's relaunch of the Pebble brand, but it's structured completely differently from the original company. The original Pebble had 180 employees, worked with retail distributors, and took venture capital. Core Devices operates with just five people, sells directly to consumers through its website, and is entirely bootstrapped without outside funding. The new company is also deliberately narrower in scope—focused specifically on developers and tinkerers rather than trying to capture the entire smartwatch market.

How is Core Devices funding its operations without venture capital?

Core Devices uses a pre-order model: customers pay upfront for products before manufacturing begins. Those deposits fund the production run, which means the company doesn't need external capital to build inventory. Once products ship and customers receive them, the company captures revenue. With a small team of five people and lean operations, the company is profitable from day one with no burn rate.

What happened to the original Pebble company, and why did it fail?

The original Pebble was sold to Fitbit in 2016 for approximately

Why did Google open-source Pebble OS, and how does that help the reboot?

Google made the decision to open-source Pebble OS as an homage to the Pebble community. This decision was crucial for the reboot because the original OS took 30 to 40 engineers working for years to develop. Rebuilding it from scratch would have been impossible for a five-person company. By open-sourcing it, Google essentially gave Core Devices a foundation to build on. The company could focus on hardware and features instead of rebuilding the operating system.

What products is Core Devices launching, and who are they designed for?

Core Devices is launching two smartwatch models (the Pebble Time 2 with a rectangular face and the Pebble Round 2 with a circular face) and a smart ring called the Index 01 priced at $75. These products are specifically designed for developers, tinkerers, and people who want a smartwatch that's a "companion to my phone" rather than a replacement. They're not targeting fitness enthusiasts or people who want a smartphone on their wrist. The positioning is intentionally narrow.

How many pre-orders has Core Devices received, and what do those numbers mean?

Core Devices has received approximately 25,000 pre-orders for smartwatches and 5,000 pre-orders for the AI ring. These numbers prove authentic market demand exists before any significant marketing spend. The pre-orders also fund production directly, eliminating inventory risk. The fact that pre-orders are shipping six months out indicates demand is strong and manufacturing capacity is the constraint.

What role does the Pebble community play in the reboot's success?

The Pebble community is foundational to the reboot. The original Pebble Kickstarter raised $10.3 million from 68,929 backers, creating a fiercely loyal user base that never really left even after the company was acquired by Fitbit and Google. This community came back to pre-order the new products, and they continue to drive the ecosystem through the Pebble App Store (which has 15,000 watch faces and apps) and by developing for the open-source OS. The community is essentially providing free product development and marketing.

Is Core Devices planning to scale and eventually become a "normal" startup?

Migicovsky has been explicit that Core Devices is not trying to become a venture-backed startup. The goal is sustainable, long-term profitability, not aggressive growth or a massive exit. The company may hire more people as operations scale, but that growth will be funded from operational cash flow, not venture capital. The company is intentionally rejecting the venture playbook in favor of a sustainable business model.

What can other hardware founders learn from the Core Devices model?

The Core Devices playbook suggests several lessons: know your specific niche and stick to it, pre-sell before manufacturing to eliminate inventory risk, sell directly to consumers to control the customer relationship, keep the team small initially to maintain focus and speed, embrace constraints as features rather than bugs, avoid venture capital if possible, and build platform thinking into the product by enabling community contribution. This model won't work for every hardware category, but it's proven effective for Pebble's reboot.

How does the direct-to-consumer approach benefit Core Devices compared to retail distribution?

Direct-to-consumer sales eliminate middlemen (distributors and retail partners), which improves margins and simplifies the supply chain. More importantly, it gives Core Devices real-time feedback on demand, customer preferences, and product quality. The company can adjust manufacturing, product mix, and features quickly based on direct customer data rather than filtered feedback from retail partners. It also lets the company build a direct relationship with users and provide better customer support.

Key Takeaways

- Core Devices operates with five employees, no venture capital, and day-one profitability through pre-order funding model

- Original Pebble failed not from bad products but from lost focus: chasing health tracking and features that diluted the vision

- Google's open-source release of Pebble OS was essential—rebuilding the OS from scratch would have been impossible for a small team

- 25,000 smartwatch pre-orders and 5,000 AI ring pre-orders prove authentic market demand exists for focused, niche hardware products

- Direct-to-consumer sales eliminate retail margins, provide real-time customer feedback, and strengthen company control over user experience

- Sustainable business model eliminates investor pressure to pursue growth-at-any-cost and enables focus on product quality and customer happiness

Related Articles

- CES 2026 Best Products: Pebble's Comeback and Game-Changing Tech [2025]

- Trump Phone Release Date Delays: Why It May Never Arrive [2025]

- Best Buy Winter Sale 2025: The Complete Deal Guide [Up to 50% Off]

- The Complete History of TiVo: How It Changed TV Forever [2025]

- Best Tech Deals This Week: Fitness Trackers, Chargers, Blu-rays [2025]

- Best CES 2026 Gadgets Worth Actually Buying [2025]

![Pebble's Comeback: Why Eric Migicovsky Says His New Company Isn't a Startup [2025]](https://tryrunable.com/blog/pebble-s-comeback-why-eric-migicovsky-says-his-new-company-i/image-1-1768252031187.jpg)