The Looming Copper Crisis That Nobody's Talking About

Here's the thing about copper: it's everywhere, but it won't be for long. Your smartphone has it. Your car needs it. Data centers can't function without it. And if you've paid attention to electric vehicles at all, you know they're basically copper repositories on wheels.

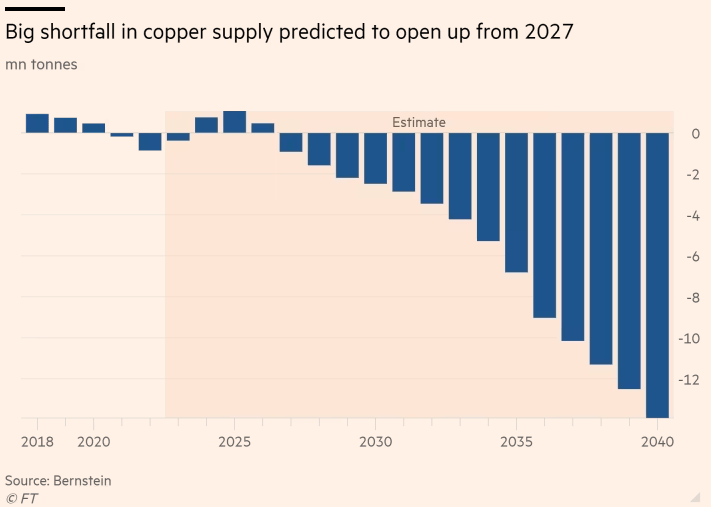

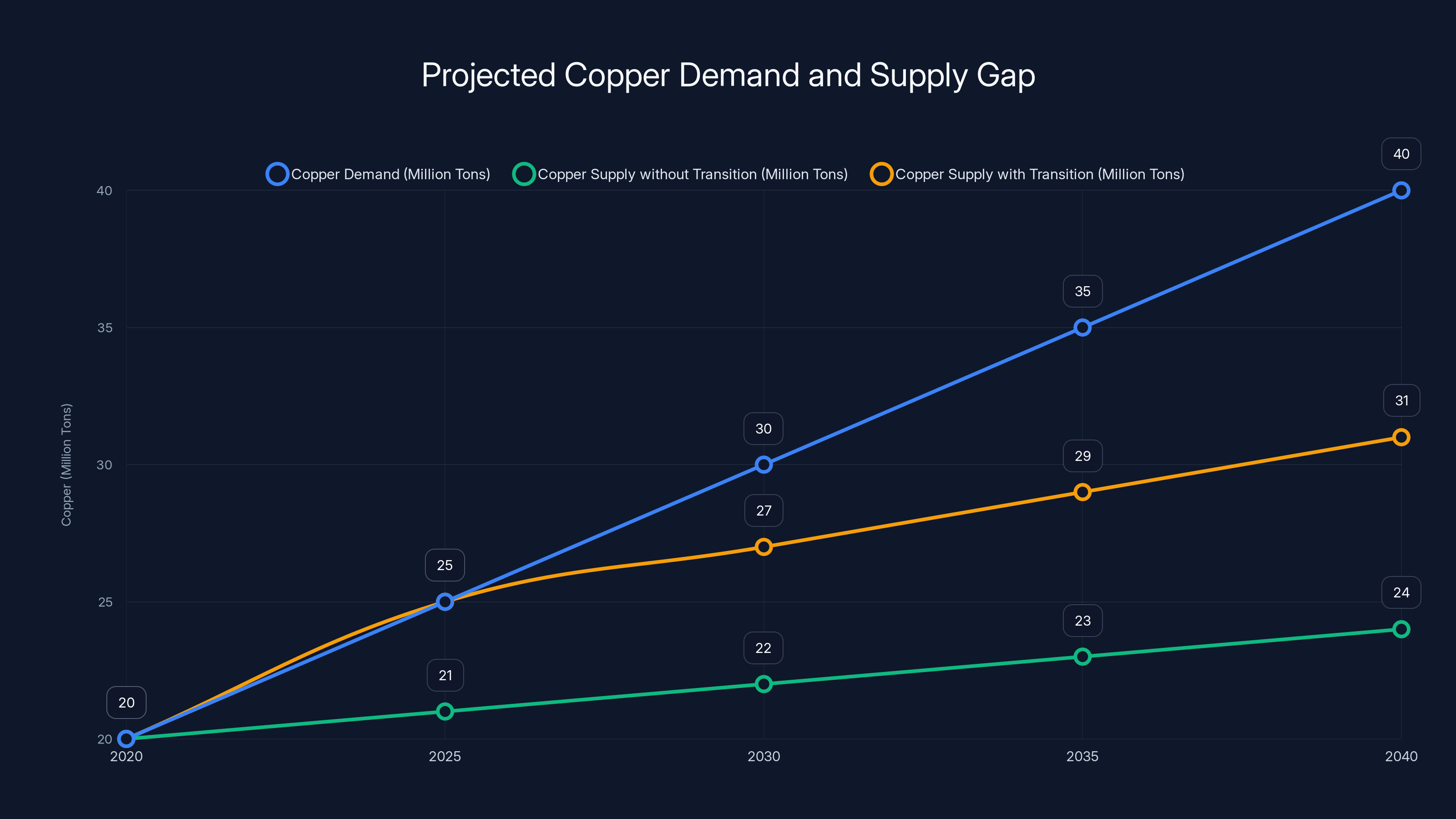

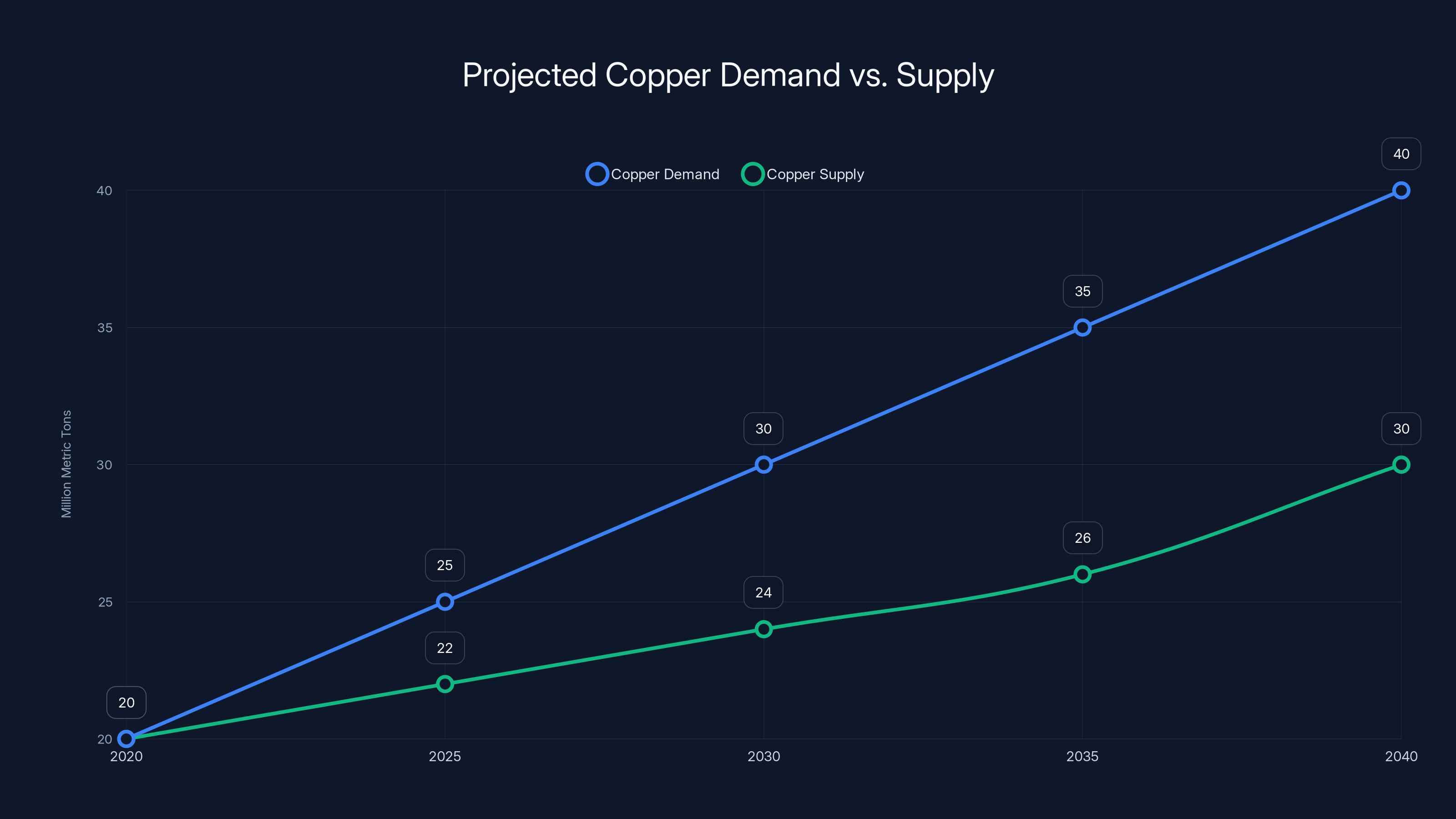

The numbers are getting scary. Within the next five to fifteen years, the world faces a potential copper shortage that could dwarf previous commodity crises. We're talking about demand exceeding supply by as much as 25% by 2040 if nothing changes. That's not a minor supply hiccup. That's a systemic problem that could ripple through every industry that depends on electricity, telecommunications, or anything remotely modern.

Copper prices have already started climbing. In 2020, the metal traded around $2.50 per pound. By early 2025, it had nearly tripled. That trend will only accelerate as the supply tightens. But here's what most people don't realize: the problem isn't that we lack copper deposits. The problem is that we're not extracting it efficiently enough.

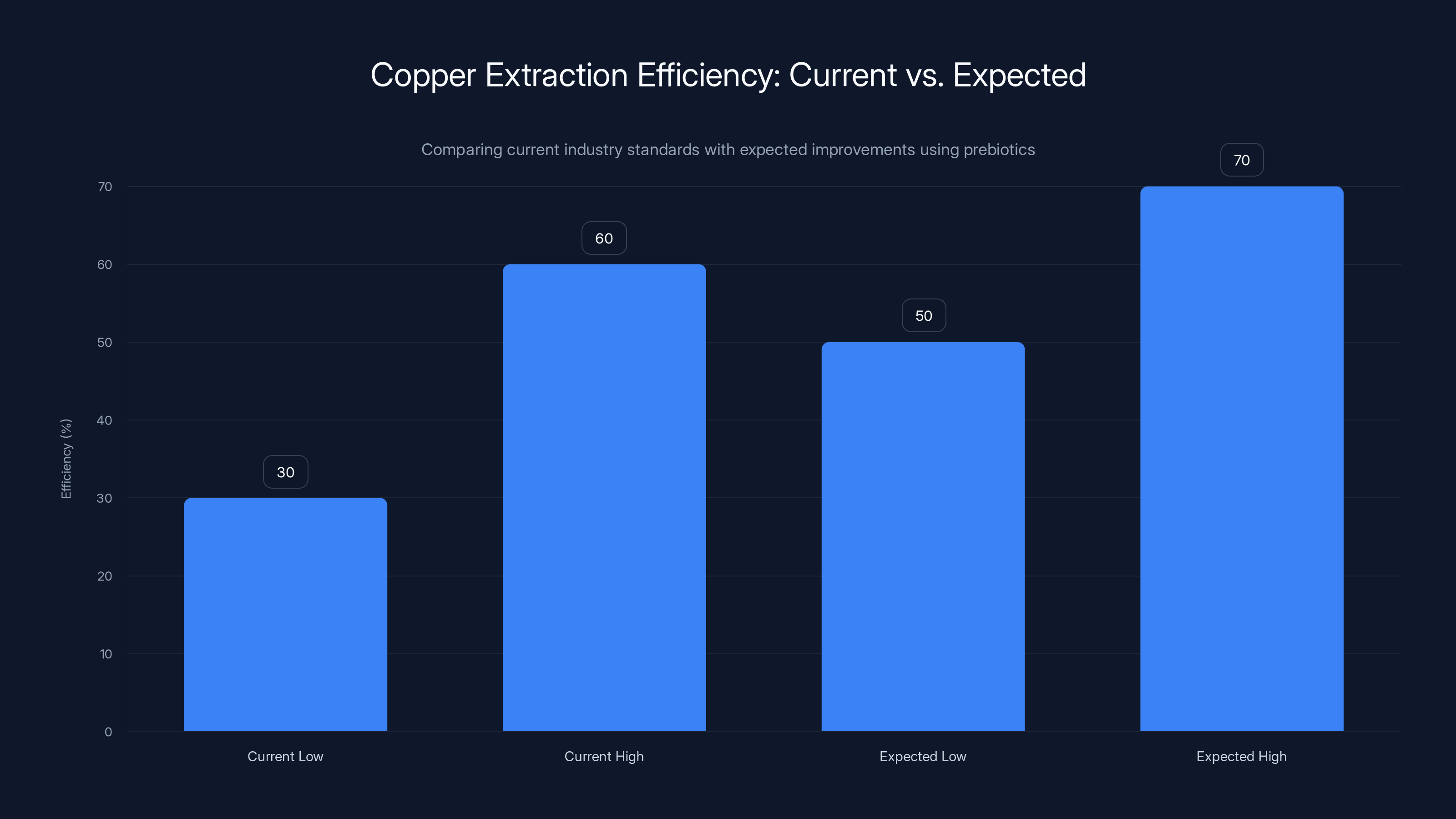

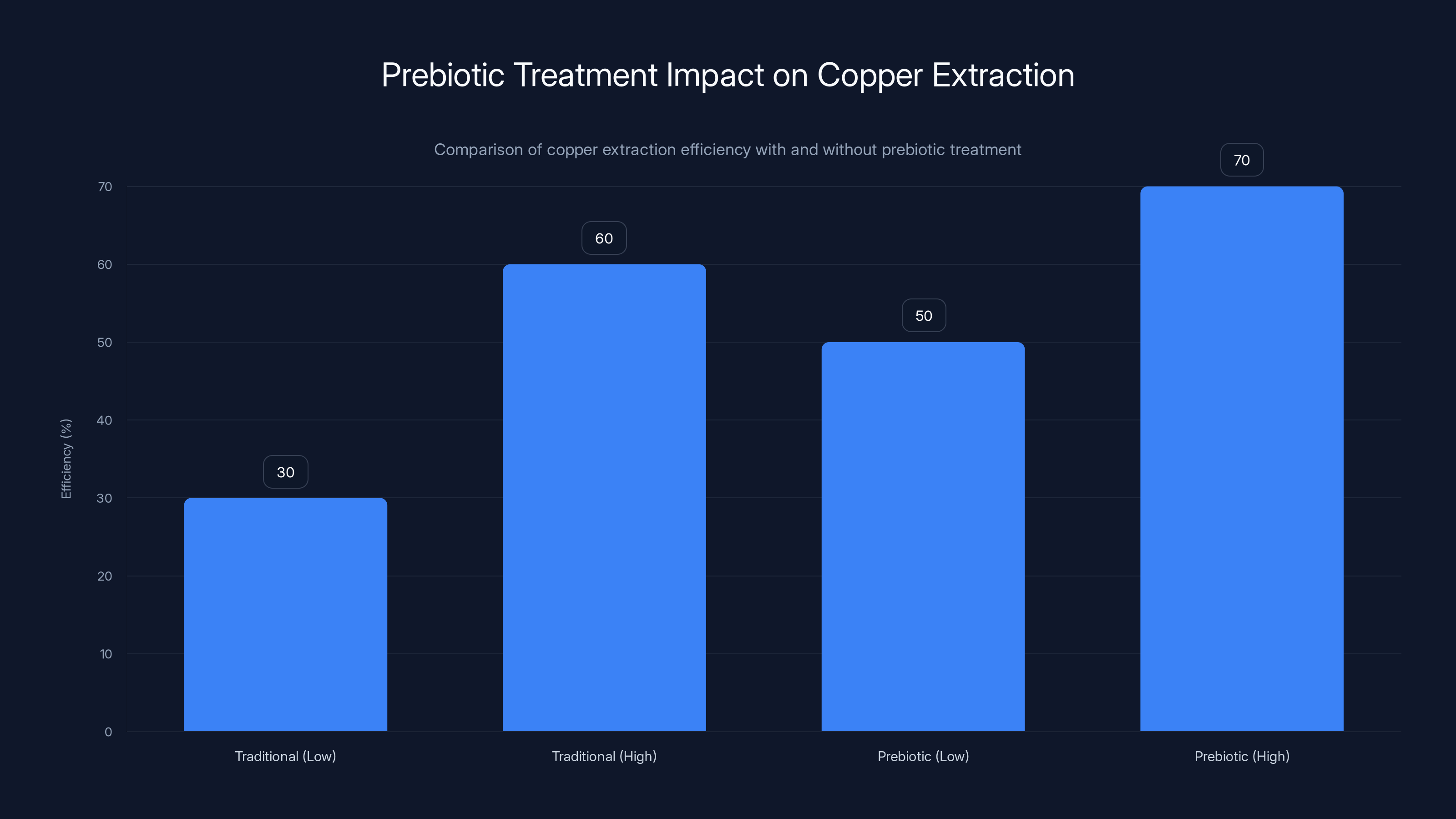

Traditional copper mining methods recover only about 30% to 60% of the copper actually present in the ore. That means we're literally leaving billions of dollars worth of metal behind in tailings piles. For decades, mining companies have accepted this as inevitable. The economics didn't support trying to squeeze more out of marginal ores. But when you're facing a potential global shortage, suddenly that math changes dramatically.

This is where the innovation comes in. While venture capitalists have been flooding money into companies hunting for new copper deposits (we're talking half-billion-dollar raises), a different approach is emerging from the lab. What if, instead of finding more copper, we just got better at extracting what's already there?

One startup thinks it has cracked the code. And the method sounds almost absurd when you first hear about it: they're feeding copper-eating microbes. Not with regular food. With prebiotics.

What Are Prebiotics (And Why Do Copper Mines Need Them)?

Before we get into the tech, let's establish something fundamental: copper doesn't just sit in ore waiting for you to pick it up. It's locked in mineral structures, chemically bonded to other elements. Getting it out requires chemistry, heat, or biology. Mining companies have been using chemistry and heat for centuries. Transition Metal Solutions is betting on biology.

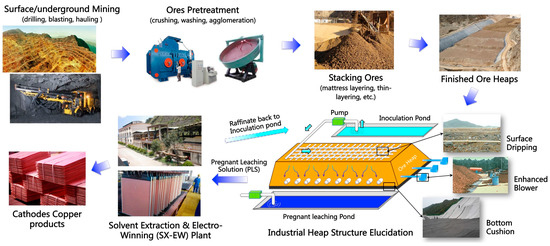

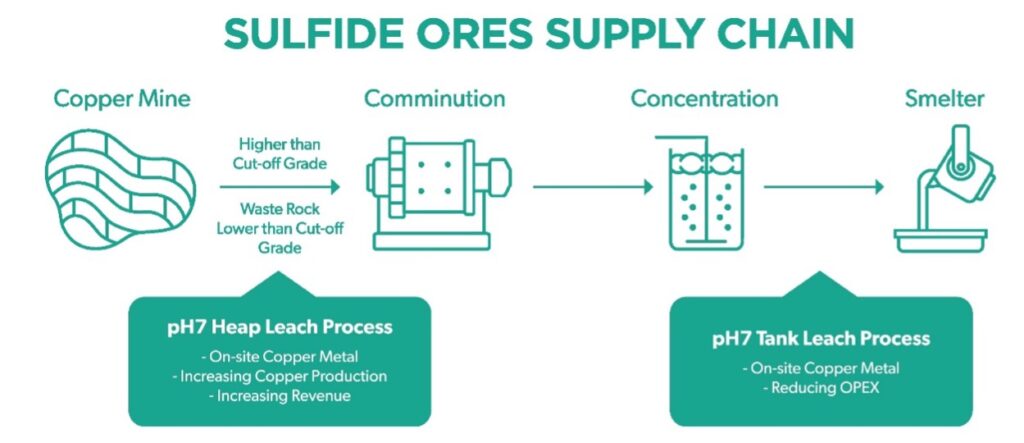

Microorganisms have actually been part of copper mining for longer than most people realize. Bacteria and other microbes naturally exist in ore deposits. When mining companies create heap leaches (enormous piles of crushed ore that they irrigate with acidic water), these microbes get to work. They oxidize minerals, breaking chemical bonds and releasing copper that can then be extracted with standard leaching processes.

The process works, but it's inefficient. Historically, mining companies have tried to improve it the obvious way: isolate the best-performing bacterial strains, grow massive quantities of them in fermentation tanks, and dump them onto ore heaps. The logic is sound. More of the good bacteria should mean more copper extraction.

Except it doesn't work that way. And here's why: bacteria don't live as solo performers. In nature, microbial communities are complex ecosystems. A strain that performs spectacularly in isolation often fails in the wild because it lacks the supporting cast. It's like casting a blockbuster movie with a huge star but forgetting to hire the supporting actors, cinematographer, and sound engineer. The star can't carry the whole film alone.

This is where prebiotics come in. In human nutrition, prebiotics are compounds that feed beneficial bacteria in your gut without feeding the harmful ones. They selectively stimulate the growth and activity of good microbes while leaving others alone. Transition Metal Solutions applied this same principle to copper mine microbial communities.

Instead of trying to introduce new strains or engineer superior bacteria, the company developed a proprietary cocktail of mostly inorganic compounds. These compounds are already present at mining sites in small quantities. But the startup found that by adding them in specific ratios and concentrations, they could nudge the entire microbial ecosystem toward higher productivity.

The additives don't create new bacteria. They don't eliminate competing strains. They change the environment in ways that naturally favor the most copper-productive microbes already living in the ore. It's elegant. It's low-tech in some ways and high-tech in others. And it works.

Estimated data shows a significant supply-demand gap in copper by 2040. Transition Metal Solutions' technology could potentially close this gap by improving extraction efficiency, adding millions of tons to supply.

The Numbers Behind the Prebiotic Advantage

Let's talk about what these additives actually accomplish. In laboratory conditions, Transition's solution is remarkable. When the company applied its prebiotic cocktail to ore samples, extraction efficiency jumped from 60% to 90%. That's a 50% relative improvement. That's the kind of number that makes geologists sit up straight.

Of course, laboratory conditions are controlled. Temperature is stable. Microbial composition is known. Variables are isolated. The real world is messier. Inside a heap leach, conditions are brutal. The pH drops to around 2 (extremely acidic). Various metals and clay minerals float around, creating a chaotic chemical environment. Temperature fluctuates. The microbial community is wildly diverse, with over 90% of species never formally identified or cultured.

When asked about real-world performance expectations, CEO Sasha Milshteyn was honest about the gap between lab and field. The company expects efficacy to drop somewhat from that laboratory baseline. But not dramatically. Milshteyn estimates that traditional heap leaches, which currently recover 30% to 60% of available copper, could be pushed to 50% to 70% or potentially higher with Transition's prebiotic treatment.

Let's put that in economic terms. The average copper mine processes millions of tons of ore annually. If a mine is currently extracting 30% of available copper from its ore, and the prebiotic treatment could boost that to 50%, that mine just increased its output by 67% without digging a single additional ton of ore. Without building new infrastructure. Without the years of environmental permitting. Without the massive capital expenditure.

That's the economic power of this approach. And it explains why major mining companies are starting to pay attention.

But beyond the pure economics, there's an environmental angle that deserves attention. Mining is resource-intensive and generates massive tailings piles. Leaving 40% to 70% of copper behind in those tailings isn't just economically wasteful. It's environmentally problematic. Those tailings take up land, require perpetual management, and can leach contaminants for decades or centuries after mining stops.

By increasing extraction efficiency, Transition's technology could reduce the volume of tailings generated per unit of copper produced. It's not a solution to mining's environmental challenges. But it's an improvement. And in an industry that's already under pressure to justify its existence, improvements matter.

Prebiotic enhancement is expected to increase copper extraction efficiency from the current 30-60% to 50-70%, potentially boosting copper supply significantly.

Why Previous Approaches to Microbial Enhancement Failed

To understand why Transition's prebiotic approach is genuinely novel, you need to understand why the industry's previous attempts flopped so spectacularly.

For decades, mining companies and research institutions have been trying to improve copper extraction using microorganisms. The fundamental insight was sound: bacteria are already doing this work, so why not optimize it? But the execution was flawed from the beginning.

The typical approach involved isolating promising bacterial strains from existing mine sites. Researchers would collect samples from successful heap leaches, identify bacteria that seemed to correlate with good copper extraction, and try to culture them in the lab. Once they had a pure culture, they'd scale it up in fermentation tanks, growing millions of liters of bacterial broth.

Then they'd dump it onto a new ore heap. And... nothing. Or something worse than nothing: an initial burst of activity followed by rapid decline. The bacteria would fail to establish themselves. Or they'd do a little work and then peter out. Or their productivity would never match what they'd demonstrated in controlled laboratory conditions.

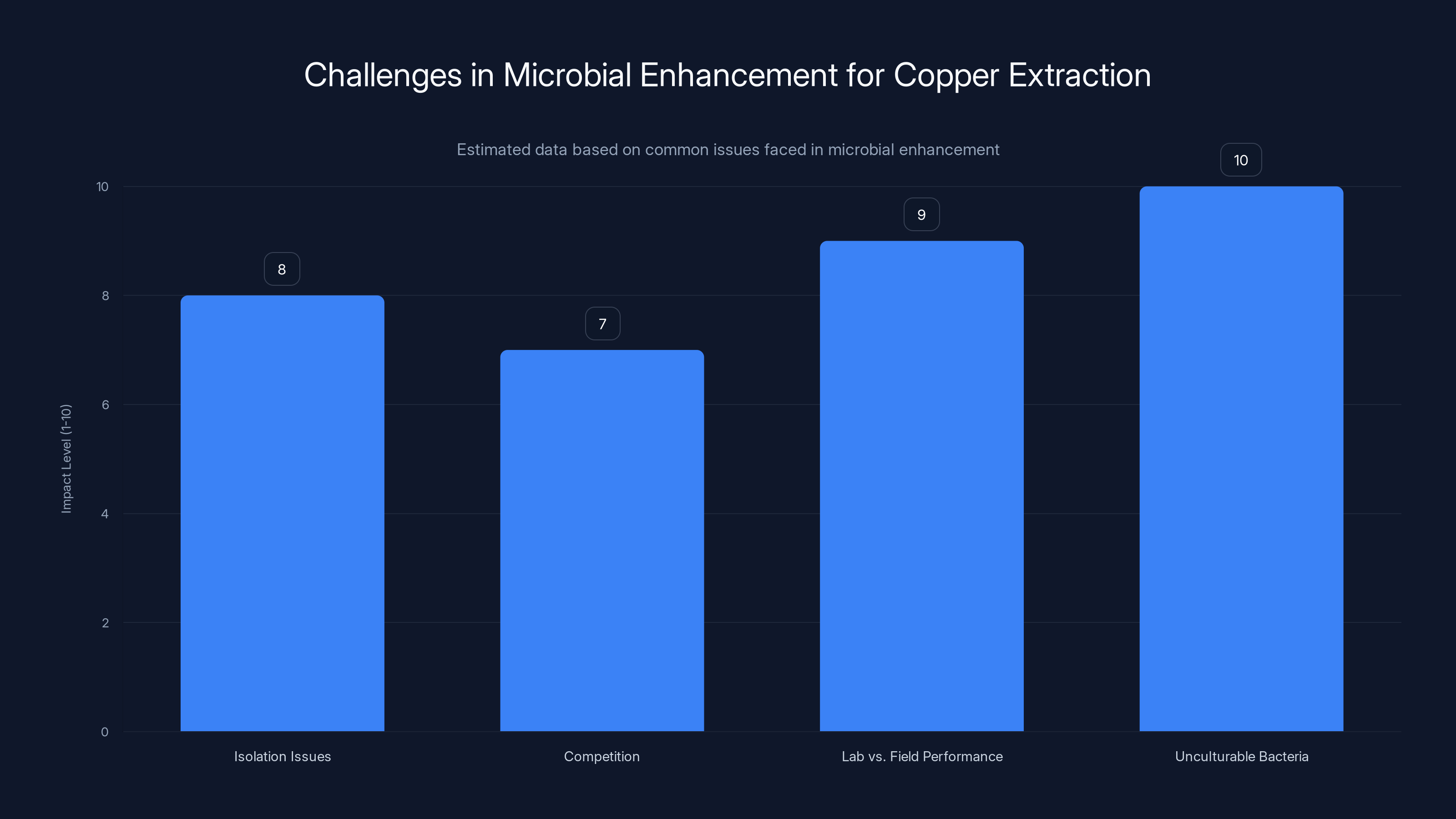

Why? The fundamental problem is that microbes don't exist in isolation. They're not individuals playing a solo role. They're members of communities. A bacterial strain that dominates in a pure lab culture is often a specialist, optimized for narrow conditions. Put it into the chaos of a heap leach, and it faces competition from thousands of other microbial species, all fighting for resources.

Moreover, many of the most productive microbes in ore heaps can't be cultured in the lab at all. This is actually a huge problem in microbiology. It's estimated that 99% of bacteria in natural environments can't be grown in laboratory conditions. We don't fully understand why. Maybe it's because they need specific consortia of other microbes to survive. Maybe they need rare nutrients that labs don't provide. Maybe they're obligate symbionts that can't function alone.

Milshteyn explained it clearly: typically, only about 5% of the microbial community in an ore heap can be cultured in the lab. The other 95%? Total mystery. And it's quite possible that some of the most copper-productive bacteria are hidden in that mysterious 95%.

So the old approach was fundamentally limited. It was like trying to improve an orchestra by recruiting only the musicians you can find easily, while ignoring the majority of the ensemble.

The Microbial Ecosystem Insight That Changed Everything

What Transition Metal Solutions did was fundamentally different. Instead of trying to engineer or control the microbial community, the company decided to understand and enhance it. This required a shift in thinking from microbiology to ecology.

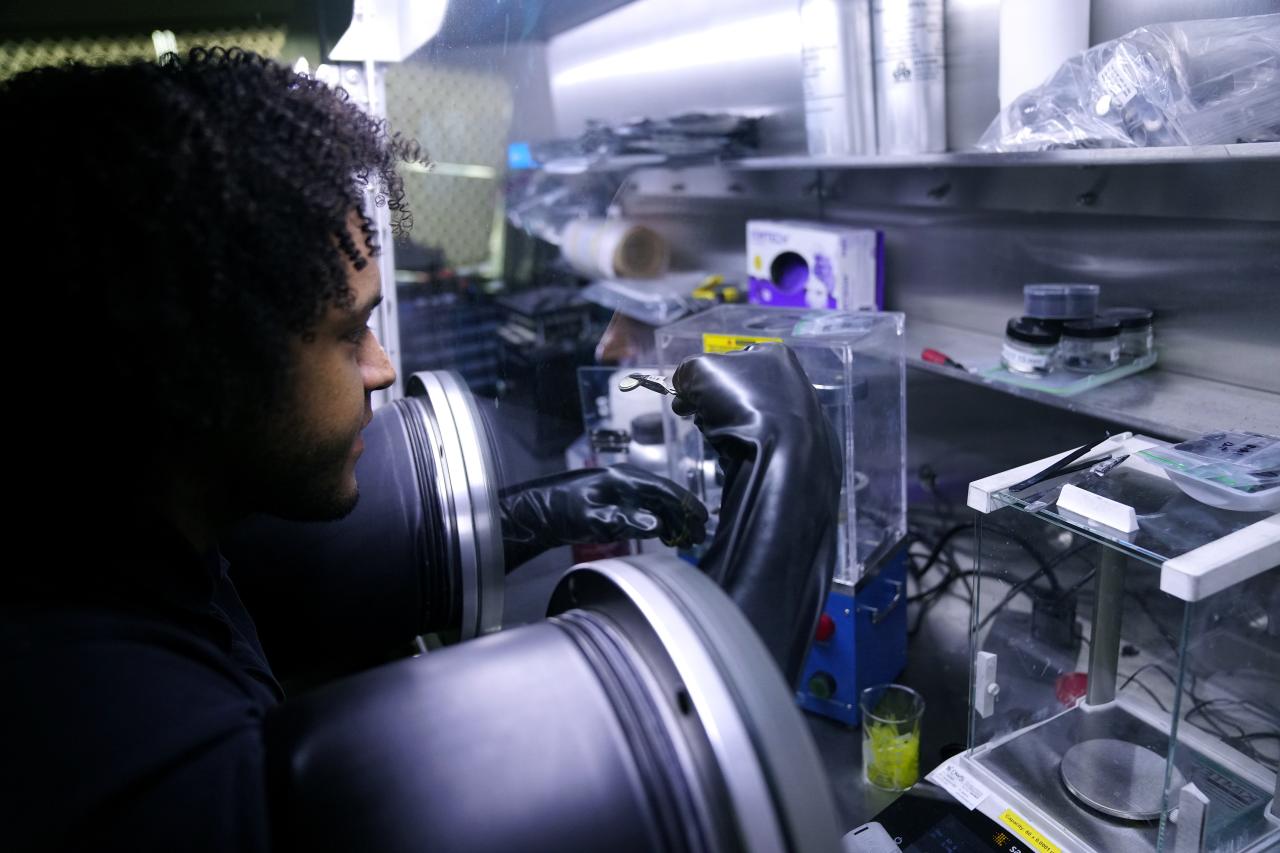

Milshteyn and his team studied the microbial communities present in successful copper heaps. They analyzed samples not just using traditional culturing techniques, but also using modern genomic approaches like metagenomics, which allow researchers to identify microbial species even if they can't grow them in labs. They looked at what compounds were present in the ore. They examined what physicochemical conditions correlated with high copper extraction.

What emerged was a picture of complex, interdependent communities. Certain bacteria oxidized minerals. Others created conditions that made it easier for the first group to work. Still others broke down byproducts that would otherwise accumulate and inhibit the process. It was a finely tuned ecosystem.

The breakthrough came when Transition realized that the bottleneck wasn't the presence of good bacteria. It was the conditions for them to thrive. In suboptimal conditions, less efficient microbes dominated. But by changing the chemical environment in specific ways, you could shift the ecosystem toward more productive members.

This is where the prebiotic cocktail came in. By understanding what specific compounds stimulated the most productive copper-eating microbes, Transition could add small amounts of these compounds to enhance their performance without introducing foreign bacteria.

It's worth emphasizing how elegant this approach is. The additives don't contain living organisms. They're not genetically modified. They're mostly inorganic compounds already present at mining sites. The technology is regulatory-light because it doesn't introduce novel organisms or genetic modifications. It's just smart chemistry applied to microbial ecology.

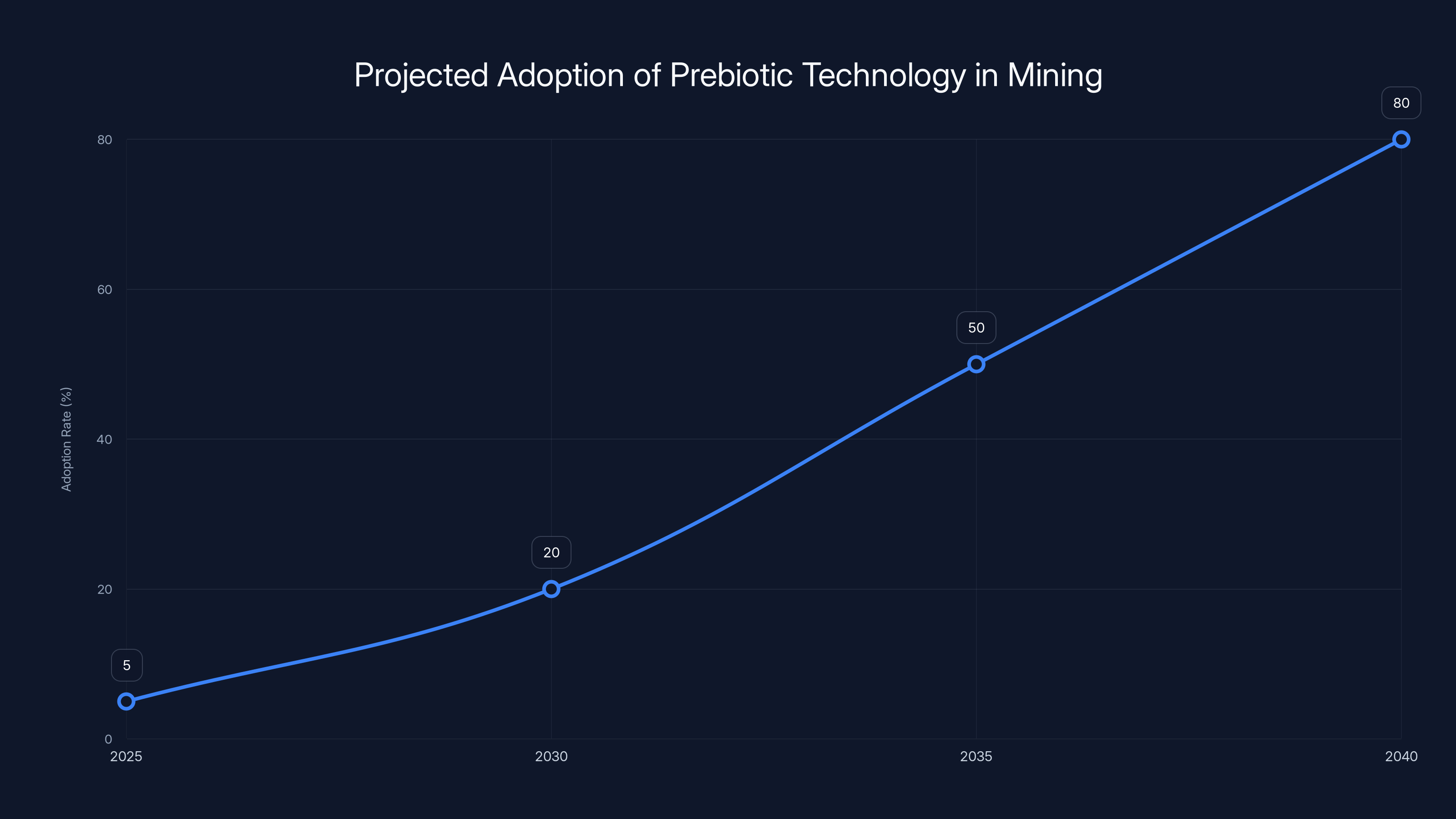

Estimated data shows a gradual increase in the adoption of prebiotic technology in mining, with significant acceleration expected between 2030 and 2040 due to competitive advantages and supply constraints.

From Concept to $6 Million in Funding

The startup emerged from stealth with solid science, a proof-of-concept in laboratory settings, and a compelling pitch. And the market for compelling pitches in the critical minerals space is hot right now.

Climate change, electrification, and the clean energy transition have created unprecedented demand for copper and other critical minerals. Every renewable energy installation, every electric vehicle, every data center upgrade requires more copper than the generation before. This has attracted venture capital attention at levels rarely seen in the commodities space.

Companies like Ko Bold Metals raised over half a billion dollars to explore new copper deposits using AI-powered geological analysis. But Transition's approach is different. Rather than finding new ore bodies, the company is improving extraction from existing ones. From a venture perspective, that's actually more attractive in some ways. New deposits take years to develop. Improved extraction can be deployed at existing mines with minimal capital expenditure.

Transition's seed round came together quickly. The lead was Transition Ventures (no relation to the company name), a fund focused on climate and cleantech. The co-investors read like a checklist of who's who in the critical minerals and cleantech venture space: Climate Capital, SOSV, New Climate Ventures, and others. In total, the round brought in $6 million.

That's not a huge amount by venture standards. Major enterprise software rounds dwarf it. But for a deep-tech company that's still in early demonstration phases, it's substantial enough to fund the next 18 to 24 months of work.

The money will primarily go toward validation. Transition plans to work with third-party metallurgy laboratories known and respected within the mining industry. This is crucial. Mining companies won't adopt a new technology based on a startup's lab results. They need independent verification from institutions they trust.

After lab validation, Transition will move to demonstration scale. The company will apply its prebiotic treatment to a test heap containing tens of thousands of tons of ore. This is a critical step because it bridges the gap between controlled laboratory conditions and full commercial deployment. If the technology performs as expected at demonstration scale, actual deployment at real mines should follow.

The Path to Commercial Deployment and Mine Partnerships

For Transition Metal Solutions, the real test comes when they have to convince mine operators to use their technology. Mining is conservative. Companies don't adopt new technologies without extensive proof. But they're also desperate enough to improve extraction efficiency that they'll listen to promising approaches.

The typical sales cycle will likely involve several stages. First, a mine operator agrees to a small test. Transition applies the prebiotic cocktail to a limited section of an existing ore heap. The company monitors results, compares them to control sections, and generates data. If results are positive, the conversation escalates.

Next comes a larger pilot. Maybe treatment of an entire heap containing thousands of tons of ore. This costs real money for the mine but remains manageable. It generates commercially relevant data because conditions in a full-scale heap more closely resemble real mining operations than laboratory samples.

Once a mine is convinced, scaling to full deployment is relatively straightforward. The company doesn't need to build new facilities. Mine operators don't need to retool their operations. They just add the prebiotic compounds to their standard heap leaching process. Implementation friction is low compared to most industrial technologies.

Geography will matter. Some regions have more developed mining infrastructure, better relationships with technology vendors, and more willing early adopters. Others are more conservative. Transition will likely start in regions where mining is economically competitive and companies are motivated to improve margins. Zambia, Peru, Chile, and other major copper-producing regions are obvious targets.

The company also has to think about competition. Other research teams are undoubtedly working on similar problems. Microbiological enhancement of mining processes is a logical focus for research institutions with mining industry connections. The prebiotic approach might remain somewhat proprietary if Transition can keep the exact composition of its additives confidential. But the general concept will eventually become obvious to competitors.

This creates a race. Transition needs to deploy the technology widely and establish partnerships before competitors catch up. The $6 million seed round should give them that runway if they execute efficiently.

The introduction of prebiotic treatment can potentially increase copper extraction efficiency from 30-60% to 50-70%, representing a significant improvement in output.

The Copper Supply Chain Implications

If Transition Metal Solutions succeeds, the implications ripple through the entire copper supply chain.

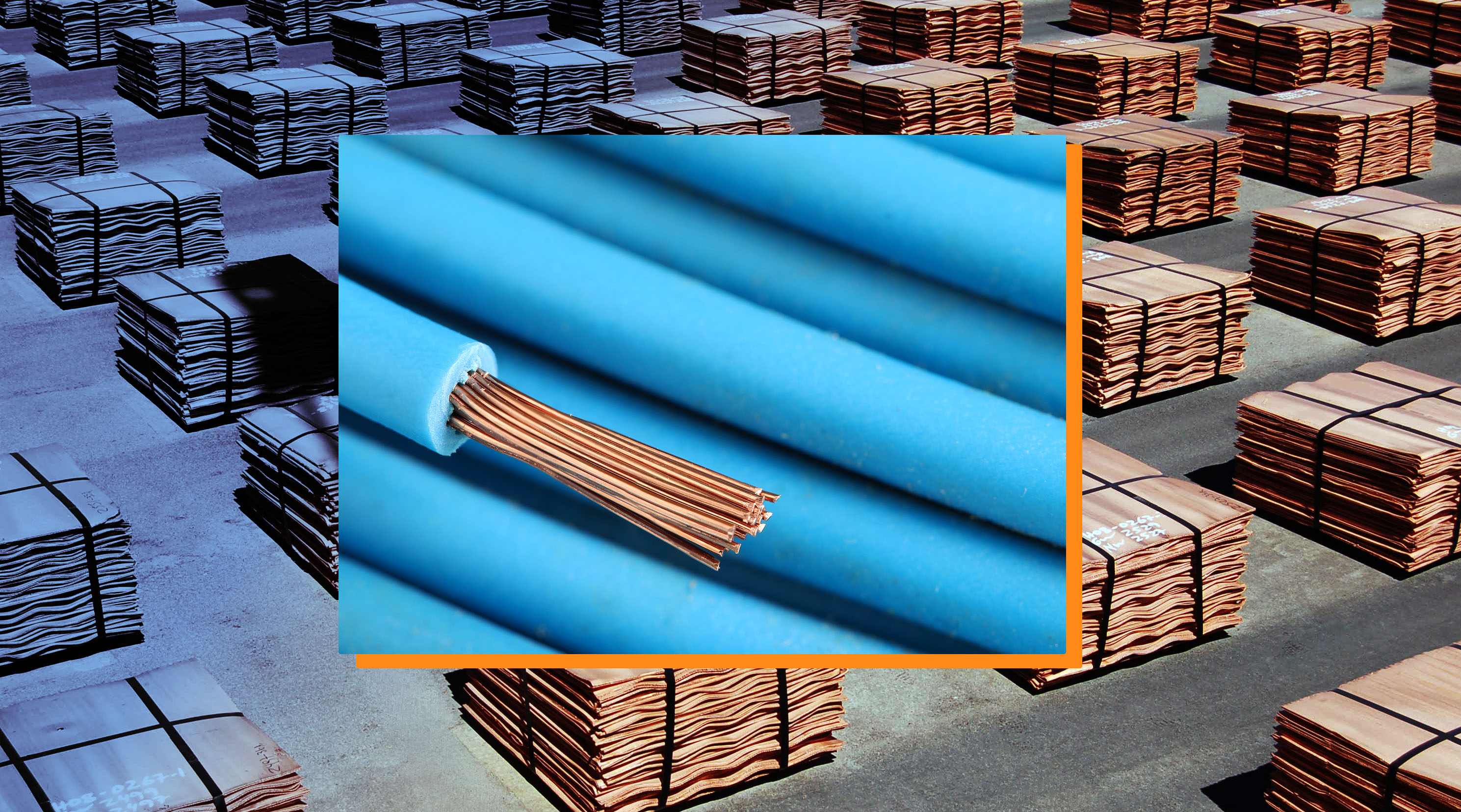

Copper is a choke point for multiple global trends. Renewable energy deployment depends on copper. Electric vehicle manufacturing is copper-intensive. Data centers have exploded demand for the metal. And demand is only growing. Every electric vehicle sold requires about 150 pounds of copper. Every megawatt of renewable energy capacity requires several tons of copper in transmission and distribution infrastructure. The math is relentless.

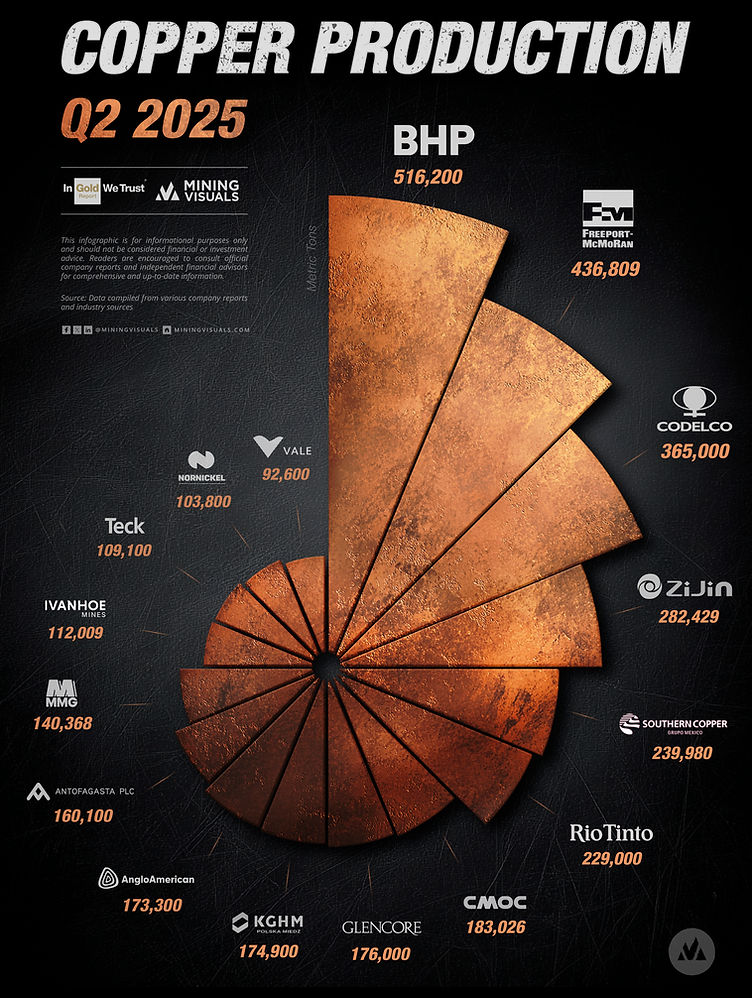

Some projections show copper demand growing 50% between 2020 and 2040 even under conservative electrification scenarios. Supply growth is much slower. New major copper deposits are increasingly rare and difficult to develop. Permitting takes years. Construction takes additional years. And copper is becoming more challenging to extract as remaining deposits are lower-grade ore bodies that require more processing.

This supply-demand gap is what makes Transition's technology potentially transformative. Even a 20% to 30% improvement in extraction efficiency from existing mines could shift the supply-demand balance significantly. Over the next 15 years, that improvement applied across the global copper mining industry could represent billions of pounds of additional copper.

Let's put actual numbers on it. Global copper production is around 20 million tons annually. If Transition's technology boosted extraction efficiency by an average of 20% across existing operations, that's an additional 4 million tons of copper per year. At current prices, that's worth over $40 billion annually.

Even if the company achieves only 10% adoption across global copper mining, the economic value is enormous. And that's without accounting for reduced mining expansion required to meet growing demand. Fewer new mines need to be developed. Less land needs to be disturbed. Less environmental cost is incurred.

This is why major mining companies will pay attention. This is why the venture investors who backed Transition believe in the opportunity. Better extraction efficiency is economically valuable, environmentally preferable, and strategically important for the clean energy transition.

How Prebiotics Compare to Other Copper Enhancement Technologies

Transition's approach isn't the only way researchers are trying to improve copper extraction. Understanding the alternatives shows why the prebiotic angle is compelling.

Genetic engineering of microbes is one approach being explored. The idea is to take known copper-productive bacteria and engineer them with enhanced capabilities. Maybe more efficient metabolic pathways. Maybe better survival in harsh heap conditions. Maybe faster reproduction.

The problem? Regulatory barriers are significant. Mining companies don't want to introduce genetically modified organisms at scale. It creates permitting challenges and public relations headaches. And there's the fundamental issue Milshteyn mentioned: engineered strains often fail in real-world conditions where their engineered advantages don't matter if they can't establish themselves in the existing microbial ecosystem.

Chemical enhancement is another angle. Instead of relying on microbes, some researchers are looking at ways to accelerate chemical leaching using additives. These approaches sidestep biological complexity entirely.

The downside is cost and environmental impact. Chemical accelerators typically require more aggressive compounds, which increases operational costs and creates more hazardous waste streams. Microbiological approaches are inherently lower-cost and lower-impact because they leverage processes that already exist naturally.

Physically improving ore preparation is a third approach. Maybe grinding ore finer before leaching improves extraction. Maybe improving heap permeability helps.

This works to some extent. But it requires significant capital investment in new equipment and more energy input. Transition's approach requires neither.

Combining approaches is increasingly common. Some operations might combine prebiotic enhancement with modest chemical additives and improved ore preparation. This is probably the future: using multiple levers to squeeze more copper from existing ore bodies.

But Transition's purely biological approach is elegant because it minimizes complexity and cost while working with natural microbial processes.

Estimated data shows copper demand could exceed supply by up to 25% by 2040, highlighting a potential crisis in the industry.

The Long Game: Scaling Prebiotics Globally

Assume Transition Metal Solutions succeeds with its first deployments. Assume mining companies adopt the technology enthusiastically. What does scaling actually look like?

It's different from scaling a software company. There's no viral growth. There's no doubling of users every quarter. Instead, there's methodical expansion from one mine to the next, one region to another. Each new deployment requires some customization because each mine has a unique microbial community.

This is where Transition's long-term vision becomes clear. Milshteyn mentioned that eventually, the company expects to predict what additives a mine needs based on initial testing. As they accumulate more data from deployed mines, machine learning and statistical analysis could identify patterns. They might eventually have a diagnostic process: sample the microbial community, run some tests, prescribe the specific prebiotic cocktail that mine needs.

This is classic deep tech strategy. The first deployments are tough, expensive, and somewhat custom. But each one generates data and learning. Eventually, the process becomes systematized. The economics improve. Growth accelerates.

The timeline matters. Mining industry adoption is slow. But copper scarcity is becoming urgent. By 2030, copper supply constraints will likely be real and visible. By 2040, they could be severe. Mines that have already adopted Transition's technology will have a competitive advantage. They'll be producing more copper from the same ore. Their per-unit costs will be lower. They'll be more profitable.

This creates a pull-through effect for technology adoption. As the first movers see improved economics, others rush to follow. The adoption curve accelerates.

Transition also has an option on a much larger business. If the prebiotic approach works for copper, it probably works for other metals. Nickel. Cobalt. Lithium. All of these are critical minerals with supply constraints. Mining companies extract them using broadly similar processes. The microbial enhancement approach could apply to many of them.

But first, Transition needs to prove itself in copper. That's the immediate focus. And that's where the $6 million seed round comes in.

The Regulatory and Environmental Considerations

One advantage Transition's approach has is regulatory simplicity. Because the technology doesn't introduce novel organisms or genetically modified microbes, it dodges a lot of regulatory complexity.

Mining is heavily regulated, but the regulations typically focus on environmental impacts, waste handling, and mine closure. Introducing additives that enhance existing natural processes fits neatly into existing frameworks. It's an operational improvement, not something fundamentally new.

That said, mining regulations vary by jurisdiction. Some countries are more permissive of new mining technologies. Others are more skeptical. Transition will likely encounter different regulatory environments in different regions. But generally, the approach should be easier to deploy than alternatives requiring genetically modified organisms.

The environmental angle is also favorable. Improving extraction efficiency reduces environmental impact per unit of copper produced. It means smaller tailings piles. It means less mining expansion needed to meet demand. These are genuine environmental benefits, not just greenwashing.

Mining will never be environmentally neutral. The industry generates massive environmental disruption. But incremental improvements matter. If Transition's technology reduces the mining footprint required for a given amount of copper, that's a legitimate win for the environment.

The primary challenges in microbial enhancement for copper extraction include the inability to culture bacteria in labs and the difference in performance between lab and field conditions. Estimated data.

Why This Matters Beyond Just Copper

There's a broader pattern here worth noting. The clean energy transition depends on critical minerals. And our current extraction methodologies for those minerals are inefficient. This creates a huge opportunity space for companies that can improve extraction, reduce costs, and lower environmental impact.

Transition Metal Solutions is addressing one specific chokepoint: copper extraction efficiency. But the broader opportunity is improving the entire critical minerals supply chain. Ore preparation, concentration, leaching, refining. Huge amounts of waste. Huge amounts of inefficiency. Huge amounts of opportunity for improvement.

Venture capital is waking up to this. Instead of just funding companies that find new deposits, investors are funding companies that improve extraction from existing deposits. This is a more mature recognition that supply constraints are about efficiency and processes, not just about discovering new ore bodies.

For the clean energy transition to work at scale, we need both: new deposits and better extraction. Companies like Transition are the better extraction piece. They're less glamorous than prospecting companies. But they might be more important.

The Challenges Ahead

Despite the compelling story, Transition faces real challenges. The first is execution risk. Laboratory results don't always translate to real-world deployment. Mining sites are variable. Weather affects operations. Equipment breaks. Supply chains have hiccups. Getting a technology to work reliably across dozens of different mines is harder than getting it to work in one laboratory.

The second is mining company conservatism. These are huge operations running on thin margins. Executives are risk-averse. They'll adopt new technologies slowly, carefully, with extensive proof. This is good for Transition in that it creates defensibility (once adopted, switching costs are high), but it's bad for growth speed. Scaling won't be fast.

The third is competition. As Transition's approach gains attention, other companies and research institutions will pursue similar strategies. The prebiotic concept isn't proprietary. The specific formulations are, but the general approach will become obvious. First-mover advantage matters, but it's not permanent.

The fourth is dependency on commodity prices. If copper prices collapse due to economic slowdown, mining companies become less interested in efficiency improvements. They're surviving on thin margins already. Adopting new technologies requires capital that becomes harder to justify in downturns. Transition's success is somewhat correlated with commodity cycle timing.

Thinking Through the Long-Term Vision

If everything goes right, Transition Metal Solutions becomes a critical infrastructure company. Not in the sense of data centers or telecommunications, but in the sense of enabling the supply chains those industries depend on.

The company could be acquired by a major mining company once proven. Or it could remain independent and build direct partnerships with operators globally. Either path makes sense depending on how the technology evolves and what Transition's founders want.

More ambitiously, Transition could expand beyond copper into other metals. The playbook works: understand the microbial ecology, develop prebiotics tailored to that ecology, deploy globally. Same approach, different metals. Different problems, broadly similar solutions.

Or Transition could remain focused on copper but expand into different extraction methodologies. Not just heap leaching, but in-situ leaching, pressure leaching, and other approaches where microbes play a role.

The point is that Transition has identified a real problem (inefficient extraction), developed a novel approach (prebiotic enhancement of microbial communities), and is now moving toward proof at scale. The next 18 to 24 months will be crucial. If the company succeeds at demonstration scale, adoption should follow. If deployment stalls or shows disappointing results, the whole thesis collapses.

But assuming execution goes well, this is exactly the kind of deep tech company that should exist. It's addressing a real constraint on the clean energy transition. It's using underutilized natural processes. It's economically compelling. And it's raising the right amount of capital to move from proof of concept to real deployment.

The Bigger Picture: Critical Minerals and the Energy Transition

To understand why Transition's technology matters, you need to see it in context. The clean energy transition isn't just about renewable energy and electric vehicles. It's about the supply chains that enable them.

Every solar panel requires aluminum frames, glass, silicon. Every wind turbine requires steel, rare earth elements, copper. Every battery requires cobalt, nickel, lithium. Every electric vehicle multiplies these requirements.

The mineral constraints are real. Some estimates suggest that to meet 2050 net-zero targets, mineral production would need to triple or quadruple from current levels. That's not happening. New deposits aren't being found fast enough. Permitting is slow. Production capacity is limited.

This creates urgency for anything that improves extraction efficiency. Transition Metal Solutions is one response to that urgency. There are others: companies improving ore concentration, refining methods, waste recovery. Together, they're trying to squeeze more useful minerals from the mining processes we already have.

It's not a complete solution. Behavioral change matters too (using fewer minerals through efficiency). Circular economy and recycling matter. New extraction technologies that reduce environmental impact matter. But incremental improvements to existing mining operations are low-hanging fruit that nobody should ignore.

FAQ

What are prebiotics and how do they work in mining?

Prebiotics are compounds that selectively stimulate the growth and activity of beneficial microorganisms without introducing new species. In copper mining, prebiotics work by feeding and enhancing the natural microbial communities already present in ore heaps, shifting the ecosystem toward more efficient copper-extracting bacteria without genetic engineering or foreign organism introduction.

Why is copper extraction efficiency such a critical problem?

Current mining operations extract only 30% to 60% of the copper present in ore, leaving the rest behind in tailings. With global copper demand projected to exceed supply by 25% by 2040, improving extraction from existing operations is faster and cheaper than developing new mines. A 20% efficiency improvement across global operations would represent billions of pounds of additional annual copper supply.

How does Transition Metal Solutions' approach differ from previous microbial enhancement attempts?

Previous approaches tried isolating and introducing superior bacterial strains, which typically failed because engineered microbes couldn't compete in the complex natural ecosystem of ore heaps. Transition instead uses prebiotics to enhance the productivity of the existing microbial community as a whole, working with nature rather than against it. This ecological approach addresses why 95% of beneficial microbes in ore heaps can't even be cultured in laboratories.

What are the real-world performance expectations for prebiotic copper enhancement?

Laboratory results showed 90% extraction efficiency compared to 60% baseline, but real-world conditions are harsher. Transition expects deployment to achieve 50% to 70% extraction efficiency, up from the current industry standard of 30% to 60%. The exact improvement varies by mine because each has a unique microbial community composition.

What's the timeline for commercial deployment of this technology?

Transition is currently in the validation phase using third-party metallurgical laboratories. Following successful lab validation, the company will conduct demonstration-scale tests on tens of thousands of tons of ore. After proving viability at demonstration scale, actual deployment at active mining operations should follow. The entire process typically takes 18 to 36 months from seed funding to first commercial deployments in mining industry timelines.

Why would mining companies adopt this new technology given their conservative industry culture?

Mining margins are tight, making even small efficiency improvements economically attractive. A 20% increase in extraction translates to enormous revenue increases for major operations. As copper becomes scarcer and more expensive, the economic case for efficiency improvements strengthens. Early adopters gain competitive advantages in profitability and cost per unit of copper. Additionally, Transition's approach requires minimal capital investment and operational disruption compared to alternatives.

Could this prebiotic approach work for other metals besides copper?

Yes, the fundamental principle applies to any metal extracted using heap leaching or similar biological processes. Nickel, cobalt, and other critical minerals extracted through similar microbial processes could potentially benefit. However, Transition is initially focused on copper because it's the most critical bottleneck for clean energy transition and the company needs to prove the approach thoroughly in one metal before expanding.

What regulatory challenges might Transition face in deploying this technology?

The approach has relatively few regulatory barriers compared to alternatives using genetically modified organisms because it enhances natural processes without introducing novel species. Mining regulations focus primarily on environmental protection and waste management, areas where this technology has advantages. However, deployment varies by jurisdiction, with some countries more permissive than others regarding new mining additives and operational methods.

How does this technology address environmental concerns about mining?

By improving extraction efficiency from existing ore bodies, fewer new mines need development, reducing overall environmental disruption. The technology also reduces tailings volume per unit of copper produced, lowering perpetual waste management costs and environmental risks. While mining remains disruptive, incremental efficiency improvements represent genuine environmental benefits compared to expanding mining operations.

What's the biggest risk that could prevent this technology from succeeding?

Execution risk is substantial. Laboratory results don't always translate reliably to diverse mining environments. The technology must work consistently across dozens of different mines with varying geology, climate, and existing microbial communities. Additionally, mining industry conservatism means adoption will be slow even if technology works perfectly. Commodity price cycles also matter; low copper prices reduce mining company incentive to invest in efficiency improvements.

Conclusion

The copper shortage looming in the 2030s and 2040s isn't inevitable. It's a problem that technology can help solve. And Transition Metal Solutions represents exactly the kind of innovative approach needed to address it.

The company isn't trying to revolutionize mining overnight. It's not pursuing fundamental breakthroughs in extraction chemistry. Instead, it's applying ecological thinking to an old problem. The microbes are already there. The extraction processes are already proven. The opportunity is in optimization.

That's less flashy than discovering a new copper deposit or engineering designer bacteria. But it might be more important. Optimization is how you squeeze value out of existing systems. Optimization is how you prepare for coming constraints. Optimization is how you accelerate the clean energy transition without waiting decades for new infrastructure.

With $6 million in seed capital and validation starting now, Transition is on a path to prove whether prebiotics for copper mines actually work at scale. If they do, the implications are substantial. If they don't, the company becomes an interesting failure and someone else pursues the same insight.

But the economic logic is too compelling, and the supply problem too urgent, for this approach to remain unexplored. Transition is betting that working with nature is smarter than fighting it. That enhancing existing microbial ecosystems is better than engineering new ones. That incremental improvements applied globally matter more than breakthrough innovations in one place.

Those bets might be right. And if they are, we might thank this startup quietly, years from now, when copper supply doesn't become the constraint that blocks the clean energy transition. The most important innovations are often invisible, woven into supply chains and operational processes. This could be one of them.

Key Takeaways

- Transition Metal Solutions uses prebiotic compounds to enhance existing microbial communities in copper ore heaps, boosting extraction efficiency from 30-60% to projected 50-70%

- Global copper demand is projected to exceed supply by 25% by 2040, making extraction efficiency improvements critical to the clean energy transition

- The company raised $6 million in seed funding and plans third-party validation followed by demonstration-scale testing before commercial mining deployment

- Prebiotic enhancement works by nudging microbial ecosystems toward higher productivity rather than isolating or engineering new strains, a fundamentally different ecological approach

- A 20% global efficiency improvement would yield 4 million additional tons of copper annually, worth over $40 billion, without requiring new mine development

Related Articles

- Sophie Turner as Lara Croft: Amazon's Tomb Raider Series Casting Breakdown [2025]

- Sony FE 100mm f/2.8 Macro GM OSS: Complete Review, Testing & Alternatives [2025]

- Subway Surfers City Launch Guide: Release Date, Features, Gameplay [2025]

- Microsoft Copilot Prompt Injection Attack: What You Need to Know [2025]

- Sesame Street Classics on YouTube: Complete Guide [2025]

- NVIDIA RTX 5070 Ti and 5060 Ti 16GB Discontinued: What It Means [2025]

![Prebiotics for Copper Mines: How One Startup is Solving a Critical Shortage [2025]](https://tryrunable.com/blog/prebiotics-for-copper-mines-how-one-startup-is-solving-a-cri/image-1-1768495374478.jpg)