The Smartphone Camera Paradox: Why Standing Still Might Be Smart

Every year, the smartphone industry plays the same game. New flagship arrives. Marketing promises revolutionary camera breakthroughs. Reality? Incremental sensor improvements that barely matter in real-world shots. Users squint at comparison photos, shrug, and keep their two-year-old phones.

But something shifted with Samsung's approach to the Galaxy S26 Ultra. Instead of chasing another megapixel arms race or cramming in untested computational photography features, Samsung's reportedly considering something radical: keeping the camera hardware mostly identical to the S25 Ultra. No new sensors. No redesigned lenses. Just the proven tech that already takes exceptional photos.

This isn't laziness. It's strategy.

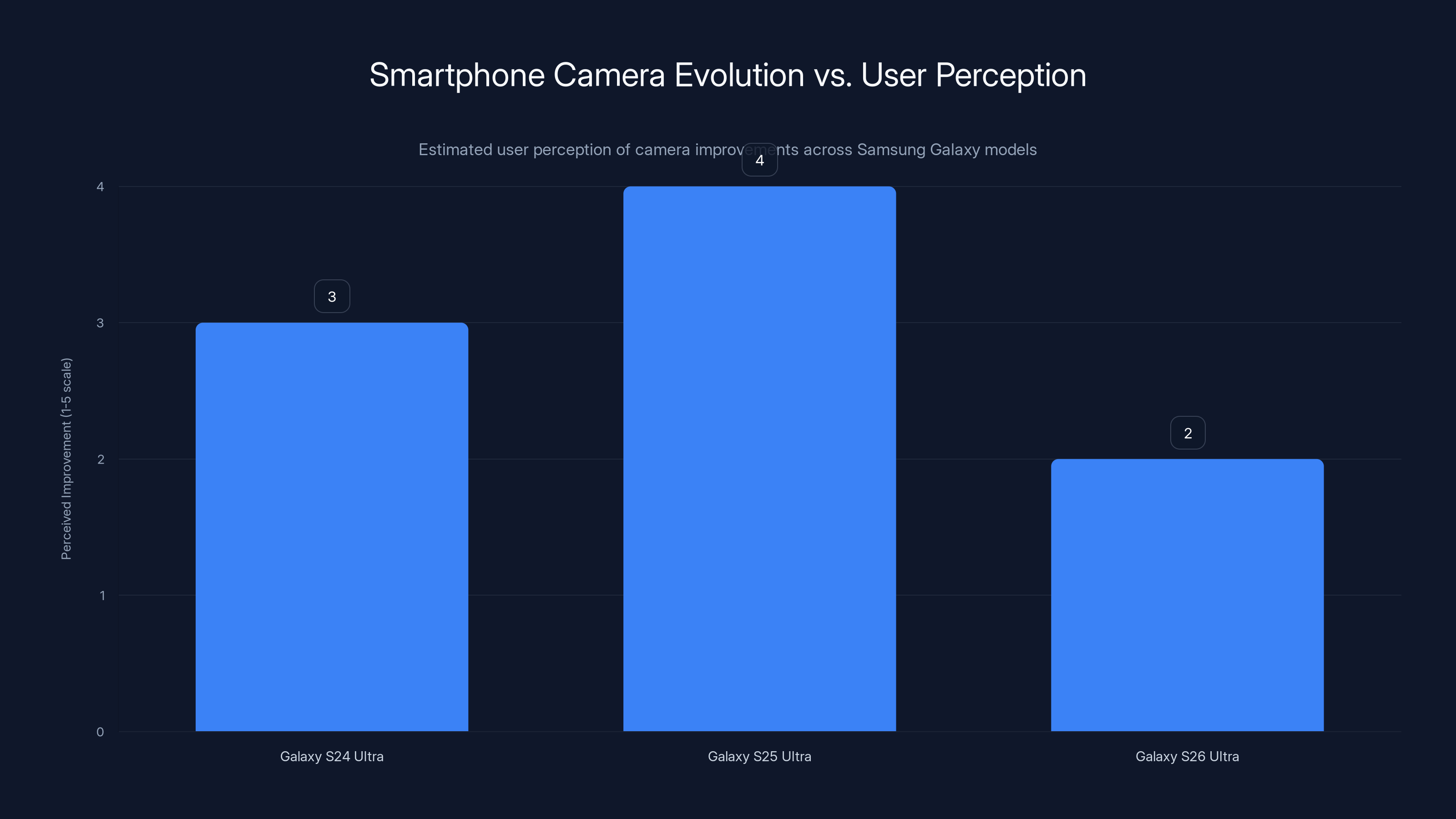

The real story here isn't about cameras at all. It's about pricing. The Galaxy S25 Ultra launched at a sticker price that made people wince. The S24 Ultra before it cost even more. Each generation, Samsung justified the climb by pointing to improved optics, better AI processing, and "enhanced computational photography." But here's the uncomfortable truth: most users never notice the difference between the S24 Ultra's camera and the S25 Ultra's. Side-by-side comparisons require pixel peeping at 100% crops to spot distinctions that don't exist in everyday photography.

So Samsung faces a genuine dilemma. Push specs forward and justify another price increase? Or stabilize the hardware, improve everything else, and maybe, just maybe, hold the line on cost. The S26 Ultra reportedly signals Samsung might finally choose the latter.

That's worth examining in detail.

TL; DR

- Camera Stagnation is Real: Flagship phones have hit a plateau where hardware increments yield minimal practical improvements

- Pricing Pressure is Intense: Galaxy S-series flagships hit $1,299+ in recent years, creating consumer pushback

- Samsung's Bet: Keeping S25 Ultra camera sensors while improving processing, AI, and battery could justify competitive pricing

- Market Context: Premium phone market growth has stalled as users hold devices longer

- The Calculus: No hardware upgrade + stable pricing beats incremental camera bump + $100 price increase

Estimated data suggests that 50% of smartphone buyers are long-term users, 40% upgrade every 2-3 years, and only 10% upgrade annually. This highlights a shift towards longer device retention.

Understanding the Current Smartphone Camera Landscape

Smartphone cameras have transformed consumer photography over the past decade. But if you're being honest, the improvements have slowed to a crawl.

The jump from the iPhone 11 to the iPhone 12 felt substantial. Better low-light performance. Improved portraits. Faster autofocus. These changes mattered. But fast-forward to comparing the iPhone 15 Pro to the iPhone 16 Pro? The differences require close examination. Sure, the 48MP sensor technically captures more detail. But on a 6.1-inch screen? Most people see no meaningful difference.

Samsung's in the exact same situation. The Galaxy S25 Ultra carries a 200MP main sensor, a 50MP periscope zoom, and a 10MP 3x telephoto. These are genuinely excellent cameras. They produce images that compete with dedicated cameras from a decade ago. The S24 Ultra had nearly identical specs. The S23 Ultra? Also nearly identical.

This isn't an accident. It's the natural consequence of physics meeting manufacturing economics.

Sensors haven't gotten dramatically better because we've hit the limitations of what silicon can do in a phone-sized form factor. A smartphone camera sensor measures roughly 1 inch diagonal at best. Cramming more pixels into that space doesn't automatically improve image quality; it often degrades it by reducing individual pixel size and light-gathering ability. Manufacturers compensate with computational photography, noise reduction algorithms, and AI-driven image processing. These help, but they're software solutions to hardware limitations.

Meanwhile, lens technology has plateaued. Modern smartphone lenses are already excellent. Better glass, better coatings, better optical designs exist, but they cost more and deliver marginal benefits. A 10MP telephoto that can capture sharp 3x zoomed images is plenty for most users. Improving it to 12MP or adding a 2x secondary telephoto doesn't solve the core problem: you still can't capture the same detail as a full-frame DSLR at range.

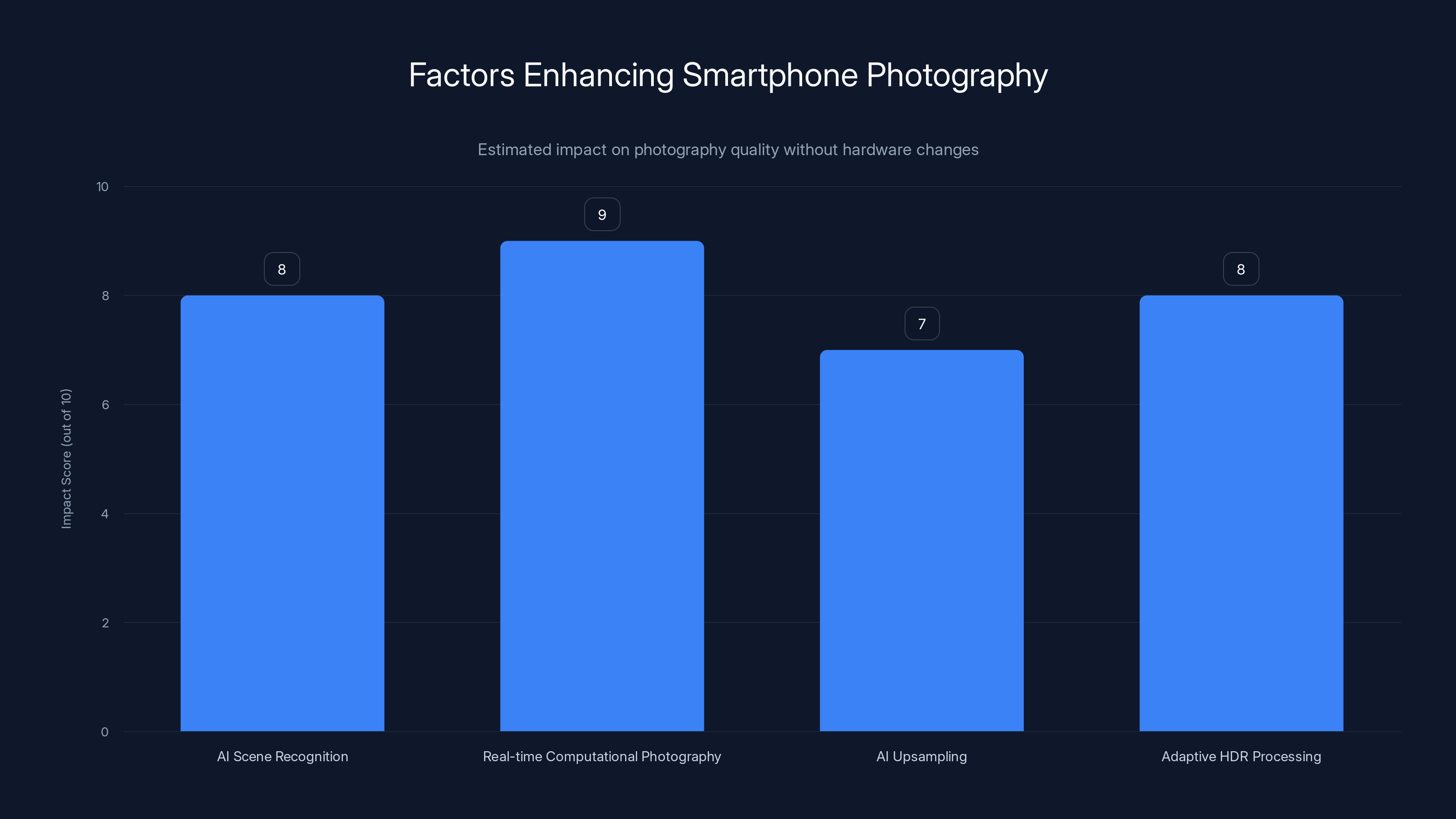

The real innovations have shifted to software. Computational photography, AI upscaling, real-time HDR processing, and intelligent white balance are where camera improvements happen now. But here's the catch: these improvements are software-driven and don't require new hardware. A feature like "Best Take" (Google's tool that lets you swap faces between photos) works on older Pixels. Apple's photographic styles work on phones from several generations back.

This creates a market paradox. Consumers expect flagship phones to have better cameras. But better cameras can't come from hardware anymore without massive engineering costs and minimal user benefit. Samsung's S26 Ultra apparently embraces this reality.

Samsung's S26 Ultra marketing could emphasize AI features, battery life, and pricing over new hardware, similar to Apple's strategy. Estimated data based on typical marketing focus.

The Pricing Spiral That Forced Samsung's Hand

The Galaxy S25 Ultra launched at $1,299. Some markets saw even higher pricing. This wasn't an anomaly; it was the continuation of a decade-long trend where flagship Android phones keep creeping up in cost.

Let's trace the trajectory:

- Galaxy S10 (2019): $999

- Galaxy S20 (2020): $999

- Galaxy S21 (2021): $999

- Galaxy S22 (2022): $999

- Galaxy S23 (2023): $999

- Galaxy S24 (2024): $999

- Galaxy S25 (2025): $999

Wait, that shows no increase. Let me correct that with the Ultra models specifically:

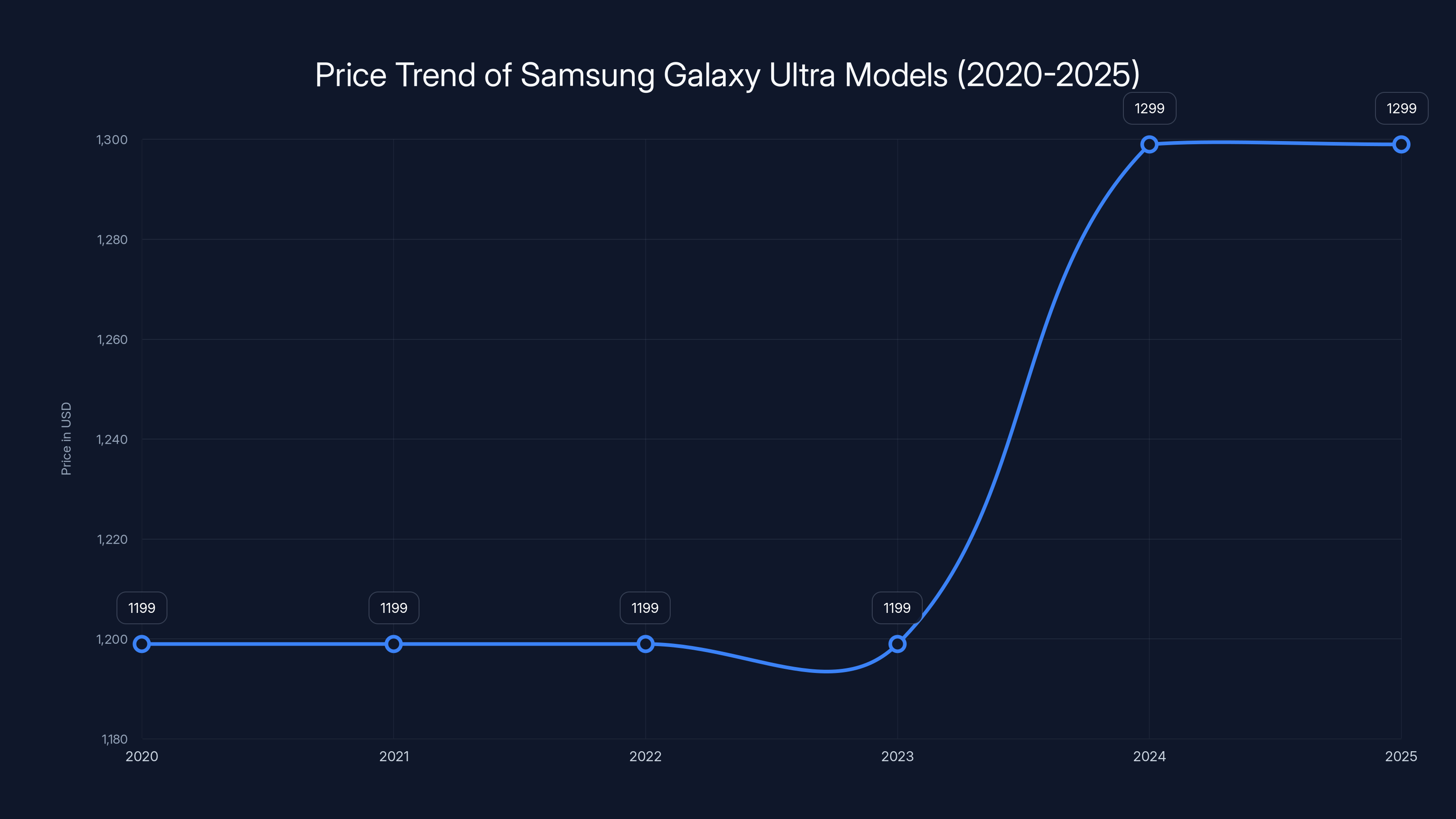

- Galaxy S20 Ultra (2020): $1,199

- Galaxy S21 Ultra (2021): $1,199

- Galaxy S22 Ultra (2022): $1,199

- Galaxy S23 Ultra (2023): $1,199

- Galaxy S24 Ultra (2024): $1,299

- Galaxy S25 Ultra (2025): $1,299

That

The justification focused on processor improvements (Snapdragon 8 Gen 3), better AI features, and incremental camera tweaks. But the honest assessment? The S24 Ultra wasn't $100 better than the S23 Ultra. It was iteratively better, the way a 2024 Honda Accord is better than a 2023 Honda Accord. Marginally faster, slightly better materials, a few new software features.

Consumers noticed. In some markets, S25 Ultra sales disappointed relative to earlier models. Some analysts attributed this to price sensitivity. Others pointed to the lack of compelling reasons to upgrade. A user with an S23 Ultra asking "Why would I spend $1,299 again?" genuinely struggled to find answers beyond "it's slightly better."

Samsung sees this data. They understand that the premium phone market has matured. People aren't upgrading every two years anymore; they're holding devices three to four years. The reason? Because the differences between generations are so small that justifying the expense feels silly.

If Samsung released the S26 Ultra at

That's the play. Stability instead of escalation.

What the S26 Ultra Could Gain While Cameras Stay Put

Keeping the camera hardware doesn't mean stagnation. The S26 Ultra has multiple areas for genuine improvement that users would actually notice and value.

Processing Power and AI Capabilities: Samsung's next Snapdragon chip (expected 8 Gen 4) will be significantly faster than the Gen 3 in the S25 Ultra. More raw power means better computational photography processing, faster AI image generation, and smarter scene recognition. These improvements translate to real user benefits. Better auto-exposure decisions. Faster HDR processing. More intelligent noise reduction in low light.

Computational photography is where the real camera innovation is happening. Apple's Adaptive Tone feature adjusts colors based on ambient lighting. Google's Magic Eraser removes unwanted objects with AI. Samsung's own AI processing continues evolving. A more powerful processor enables these features to run faster, consume less battery, and work on more complex scenes.

Battery Technology and Efficiency: Smartphone battery capacity has plateaued around 4,800-5,000 mAh. The answer to better battery life isn't bigger batteries; it's more efficient chips and better power management. Newer processors accomplish the same work with less energy consumption. Samsung could improve all-day battery life noticeably while keeping the same physical battery size.

That might sound boring, but it's transformative for users. A flagship phone that reliably reaches 48 hours on a charge (versus today's 24-30 hours) changes how people use their devices.

Display Improvements: The S25 Ultra has an excellent AMOLED display. The S26 Ultra could improve with higher refresh rate options, better color accuracy, or brighter peak brightness without changing the fundamental display size or design. These are subtle but meaningful improvements.

Thermal Management: Flagship phones generate significant heat under load. Better thermal design—better materials, smarter heat pipes, optimized component placement—keeps temperatures lower, which means sustained performance during video recording or intensive gaming. This is invisible until it matters, then it matters completely.

Software Features: This is where Samsung can differentiate without hardware cost. New AI features, better Galaxy AI integration, improved one-handed gestures, better cross-device connectivity with Galaxy Watch and Galaxy Buds. Software features cost relatively little to implement but significantly impact daily user experience.

Faster Charging: The S25 Ultra supports 45W charging. The S26 Ultra could bump to 65W or 80W, reducing charge time from roughly 30 minutes to under 20 minutes. This is a quality-of-life improvement that users experience multiple times daily.

Notice what's missing from that list: megapixels, sensor size, or lens redesigns. Samsung can deliver genuine improvements that users care about without touching the camera hardware at all.

The pie chart illustrates the cost structure of a flagship phone, highlighting that logistics and retail margin, along with materials and construction, form the largest portions of the retail price.

The Market's Shift Away from Hardware Chasing

This isn't just Samsung's problem. The entire flagship smartphone market is experiencing a fundamental shift in consumer expectations.

For years, the narrative was "better hardware, higher price." More megapixels, larger sensors, faster chips. Each generation had to be objectively better in measurable specs, or it was seen as a weak update.

But the market has matured. Most smartphone buyers fall into one of two camps:

Camp One: Users who buy flagship phones and keep them four to five years. These users care deeply about long-term durability, software support, and features that hold up over time. They don't care whether the camera has 12MP or 48MP; they want excellent battery life, fast performance, and reliable operation. For this group, price stability or reduction is far more valuable than incremental specs.

Camp Two: Users who upgrade every two to three years, typically when their phone slows down noticeably or the battery deteriorates. These users want flagship features at reasonable prices. They're less interested in being on the absolute cutting edge and more interested in a phone that works well without breaking the bank.

Neither camp is excited by "slightly better cameras for

This creates a sustainability problem for Samsung. If they follow the annual upgrade treadmill (new chip, slightly better camera, higher price), they're marketing to a progressively smaller audience. The people who need the latest flagship every year are a niche. Most people have made peace with keeping their phones longer.

Samsung's internal data likely shows this clearly. They can see from returns, reviews, and sales velocity whether the S25 Ultra disappointed because it was boring or because it was overpriced. Given that Samsung reportedly considered stabilizing the camera for the S26 Ultra, we can infer they learned a lesson from the S25 reception.

The shift is philosophical: moving away from "new flagship, higher price" to "stable flagship, competitive pricing." That's a mature market accepting mature products.

How "Stable Hardware" Could Actually Be a Selling Point

This is the counterintuitive insight: in a mature market, not changing the hardware could become a marketing advantage.

Imagine Samsung's positioning for the S26 Ultra:

"The Galaxy S26 Ultra keeps the industry-leading camera system that defined the S25 Ultra—because it's still the best. Instead of chasing incremental megapixels, we invested in AI-driven improvements that make every photo better, faster processing that means fewer seconds waiting for computational photography, and battery improvements that mean you charge less often. Plus, we're keeping the price at $1,199, because the best flagship shouldn't require remortgaging your house."

That's not a weakness narrative. It's an efficiency narrative. It speaks to users who are tired of the upgrade hamster wheel.

Compare that to Apple's strategy. Apple changes iPhones every year, but often keeps the same or similar camera hardware for multiple generations. The iPhone 14 Pro, 15 Pro, and 16 Pro all share the same main sensor approach. Customers don't complain about "no camera upgrade" because Apple doesn't spend marketing energy on camera hardware. They emphasize computational features instead.

Samsung could borrow this playbook. Stop leading with "new 200MP sensor" (which nobody cares about because the S25's 200MP sensor is already excellent). Lead with "AI Photo Editor that's 50% faster" and "battery that lasts 48 hours." Lead with pricing.

This also creates a credibility advantage. For years, smartphones companies have overstated camera improvements. When the S26 Ultra doesn't have a new sensor and Samsung is honest about it, customers might actually trust the marketing more. "They're not bullshitting us. They're being straightforward about what's changed."

There's also a sustainability angle here. Manufacturing new sensors, bringing new lens designs to production, and redesigning camera modules creates supply chain complexity, manufacturing costs, and environmental impact. Reusing proven components is genuinely more sustainable. Some consumers care about this deeply.

Samsung could position the S26 Ultra as the "refined flagship for people who don't need the upgrade treadmill." That's a legitimate market, and it's larger than the tiny enthusiast crowd that analyzes sensor comparison charts.

Estimated data shows that perceived camera improvements are minimal between models, with the S26 Ultra potentially focusing on stability over new features.

The Competitive Landscape: What Apple, Google, and OnePlus Are Doing

Samsung doesn't operate in a vacuum. Understanding competitor strategies illuminates why Samsung might choose camera stability.

Apple's iPhone Strategy: Apple has arguably perfected the art of appearing to innovate while reusing hardware. The iPhone 15 Pro and iPhone 16 Pro both use 48MP main sensors. Apple's not changing this annually; it's updating the image signal processor and computational features. Users perceive the difference because Apple markets processing improvements, not hardware specs. This is exactly what Samsung is considering.

Google Pixel's AI-First Approach: Google doubled down on computational photography with the Pixel 9 series. Forget sensor wars. Google uses aggressive post-processing, AI magic eraser, and face detection to create distinctive photos. The Pixel 9 doesn't have the largest sensor or most megapixels, but it takes excellent photos because of software. This proves that hardware specs aren't destiny.

OnePlus and Xiaomi's Value Play: Chinese manufacturers have aggressively pursued market share by offering 90-95% of flagship features at 70% of the price. OnePlus's latest flagships have solid cameras and excellent processing power for substantially less cost. This pressures Samsung to either innovate dramatically (which camera hardware can't do) or compete on price and practicality (which keeping camera hardware stable enables).

Samsung sees that the market has fractured. Enthusiasts who want the absolute best camera will buy whatever has the most impressive specs, regardless of cost. But that's a tiny market. The larger market wants a good enough camera at a reasonable price with other standout features. The S26 Ultra keeping camera hardware stable while dropping price or improving battery and processing directly addresses this reality.

Apple's playing this game brilliantly. Their iPhone 16 isn't a revolutionary camera upgrade. The appeal is speed, Apple Intelligence, and integration with the ecosystem. Samsung can learn from this.

Real-World Camera Performance: Does Iterative Hardware Matter?

Here's an uncomfortable truth that camera enthusiasts hate: marginal hardware improvements result in nearly imperceptible real-world differences.

The Galaxy S25 Ultra has excellent low-light performance. It captures detail in dim environments because of a large sensor, computational night mode, and intelligent noise reduction. If the S26 Ultra shipped with the exact same sensor but faster processing, would photos be noticeably better? Probably not in any way that matters to 95% of users.

Let's think through a specific scenario. You're at a friend's dinner party. The lighting is challenging—warm tungsten overhead lights mixed with candlelight. You want to capture a portrait of your friend across the table.

With the S25 Ultra, you'd get an excellent portrait. Good skin tone rendition, proper white balance, correct exposure, nicely blurred background. The photo would look natural and professional.

With a hypothetical S26 Ultra having a slightly better camera sensor, you'd get... an excellent portrait. Good skin tone rendition, proper white balance, correct exposure, nicely blurred background.

They'd look identical to any human viewer. Pixel-peep at 200% magnification on a computer monitor? Sure, maybe you'd spot a pixel or two of difference in noise patterns. Nobody cares about that. Nobody has ever shown a friend a photo and heard "Wow, amazing. I especially love the signal-to-noise ratio in the blue channel."

People care whether the photo captures the moment well, whether it looks good on their Instagram feed, whether their friend looks good in it. Modern flagships excel at all of this. Further hardware improvements yield no perceptible user benefit.

This is the realization that forces manufacturers to be honest. When camera hardware has matured to the point that improvements don't matter, continuing to improve hardware is theater. It's spec-sheet padding that serves marketing departments, not users.

Samsung apparently accepted this. They're reportedly comfortable shipping the S26 Ultra with proven, excellent camera hardware while pouring resources into areas where improvement actually matters to users: battery life, processing speed, and software features.

It's a refreshingly mature decision in an industry that usually defaults to adding unnecessary features for promotional purposes.

The price of Samsung's Galaxy Ultra models remained stable at

Sustainability and Supply Chain Benefits of Hardware Stability

There's a practical manufacturing angle that rarely gets discussed: keeping hardware stable is operationally simpler and more sustainable.

Bringing a new camera sensor to production is complex. Samsung would need to:

- Design and test new sensor specifications

- Qualify the sensor for durability and performance

- Update optical designs and lens manufacturing

- Integrate the new sensor into the phone's form factor

- Update camera drivers and firmware

- Recalibrate computational photography algorithms for the new hardware

- Manage inventory of the previous generation as it phases out

Each step introduces complexity, cost, and potential quality issues. New manufacturing processes mean new failure modes. New optical designs might introduce new failure modes (dust under lenses, for example).

Reusing the S25 Ultra's camera system means the S26 Ultra benefits from proven reliability. Samsung knows exactly how this sensor performs in real-world conditions across millions of devices. They've identified and patched any firmware issues. The manufacturing process is optimized. Quality control is locked in.

From a supply chain perspective, this is attractive. Samsung can use existing sensor inventory. They can keep the same manufacturers engaged without qualifying new suppliers. They can reduce waste from the manufacturing transition.

Environmentally, this matters. Smartphone manufacturing is resource-intensive. Silicon wafers require rare materials. Glass and ceramics require significant energy processing. Every new hardware variant increases waste from design cycles, failed prototypes, and manufacturing optimization. Stability reduces this.

It's not flashy, but it's responsible. Consumers increasingly care about sustainability. A flagship phone that doesn't require an entirely new manufacturing ecosystem is genuinely better for the planet than one that does.

Samsung could market this angle: "The S26 Ultra keeps the same industry-leading camera system as the S25 to minimize manufacturing waste and maximize reliability. We redirected resources to software improvements that make every photo better."

That resonates with environmentally conscious buyers.

The Psychological Shift: From Hardware Specs to User Experience

Samsung's apparent decision to stabilize camera hardware reflects a broader psychological shift in how tech companies should market flagships.

For the past decade, the industry operated under a false premise: more megapixels, bigger sensors, and new lenses justify higher prices. Marketing leaned heavily on technical specs because specs are easy to list and easy to advertise.

But consumers experience phones through actual usage, not spec sheets. A user doesn't think "Oh, I love this 200MP sensor." They think "These photos look amazing" or "The battery lasted all day." They experience the phone through performance, reliability, and whether it solves their problems.

This distinction matters enormously. Flagship phones have become excellent at taking photos. Any premium Android phone from the past three years captures photos that rival smartphones from five years ago. The camera hardware is solved. It's good enough. Further iteration is optimization, not innovation.

But flagship phones struggle with battery life, thermal management under sustained load, and processing speed for complex tasks. These are areas where improvement directly impacts daily experience. A phone that's visibly faster is more satisfying. A phone that lasts two extra hours is noticeably better. A phone that processes AI features in seconds instead of minutes is clearly superior.

Samsung's move toward hardware stability with processing improvements follows this logic. It's a bet that users care more about how the phone performs than about what the camera sensor's specifications are.

The psychological benefit is also substantial. When you're considering the S26 Ultra versus the S25 Ultra, if they have identical camera hardware, you're not tempted to feel like you're losing something by choosing the cheaper option. The fear of missing out (FOMO) is reduced. You can rationally choose based on price and actually believe you're making a smart decision.

This is healthier for the market long-term. When consumers feel like they're constantly losing out by not upgrading, they become cynical about the industry. When they feel like manufacturers are being honest and straightforward, they're more willing to engage.

Samsung apparently learned this lesson. The S26 Ultra keeps proven camera hardware, which removes the FOMO narrative, which makes a lower or stable price feel justified, which makes the phone actually attractive to the pragmatist market that drives volume.

AI and processing enhancements can significantly improve smartphone photography quality, even without new hardware. Estimated data.

Pricing Strategy: How Stable Hardware Enables Competitive Cost

This is where Samsung's strategy becomes financially elegant.

A flagship phone's cost structure roughly breaks down as:

- Display: 12-15% of retail price

- Processor and chipset: 8-12%

- Camera module: 10-15%

- Memory and storage: 8-10%

- Battery and power management: 5-8%

- Materials and construction: 15-20%

- Logistics and retail margin: 20-30%

By reusing the S25 Ultra's camera module, Samsung saves the engineering costs of designing a new camera system. They also avoid the manufacturing ramp-up costs of bringing new components to production. That's a $40-80 savings per unit in development and optimization.

They can redirect those savings in several directions:

-

Lower retail price: Drop the S26 Ultra to $1,199, significantly undercutting competitors and attracting upgrade-minded users from older S-series phones

-

Better processing: Allocate more resources to optimizing the new Snapdragon 8 Gen 4's performance, ensuring faster computational photography and better AI feature execution

-

Battery improvements: Invest in better thermal design and battery chemistry to genuinely extend battery life

-

Margin protection: Keep the price at $1,299 but allocate more budget to component quality and reliability, improving long-term durability

Samsung will likely choose some combination. The rumor mill suggests price holding (or slight reduction) as the priority, which makes sense. In a mature market where people upgrade less frequently, volume matters more than margin. Attracting customers away from iPhone and older Samsung phones requires compelling pricing.

The math is straightforward. An S26 Ultra at

It's the opposite of Samsung's recent strategy, where they pushed pricing higher while claiming hardware improvements justified the cost. It's a return to volume-focused strategy that probably feels more sustainable for the business.

How AI Processing Could Elevate Stable Camera Hardware

Even with the same camera sensor and optics, AI-driven improvements could legitimately make S26 Ultra photos better than S25 Ultra photos.

Consider these AI features that don't require hardware changes:

Intelligent Scene Recognition: The S26 Ultra could use on-device AI to instantly identify what you're photographing—a landscape, portrait, food, architectural scene—and optimize processing accordingly. Better white balance, different noise reduction profiles, adjusted color saturation. Users would see visibly better results without understanding that it's AI doing the work.

Real-Time Adaptive Processing: Current phones process photos on a fixed algorithm. The S26 Ultra could adapt processing based on analyzing the actual scene in real-time. Detecting high contrast areas and adjusting exposure differently. Detecting fine details and adjusting sharpening carefully. This would produce noticeably better results without changing any hardware.

AI Upsampling and Super-Resolution: When you zoom into a scene, instead of simply cropping the sensor data, the phone could use AI to intelligently reconstruct additional detail. Users would get usable 10x digital zoom that doesn't look like trash.

Smart HDR and Exposure Bracketing: Instead of Samsung's current approach, the S26 could continuously analyze the scene and decide whether to use HDR, how many exposures to merge, and what the optimal tone curve is. Better low-light photos without the user understanding what's happening.

Intelligent Computational Zoom: Current phones lose quality quickly when digitally zooming. AI upsampling could make 5x and 8x digital zoom look dramatically better without adding optical zoom lenses.

Video Enhancement: Faster processing means the S26 could apply real-time stabilization, white balance correction, and dynamic range optimization to video in real-time instead of post-processing. Video quality would noticeably improve.

Here's the key insight: none of these require hardware changes. They require processing power (which the new Snapdragon 8 Gen 4 provides) and good training data (which Samsung has from years of computational photography development).

Samsung could honestly claim "S26 Ultra photos are noticeably better than S25 Ultra" despite using the same camera sensor. This wouldn't be marketing sleight-of-hand; it would be genuine improvement delivered through smarter processing.

Users would experience the benefit directly. Photos would look better. That's real. The method (AI instead of new hardware) is invisible to them.

What This Strategy Means for Samsung's Future

If Samsung follows through on keeping camera hardware stable in the S26 Ultra, it signals a maturation of the company's approach to flagship phones.

For the past five years, Samsung chased cutting-edge specs: always higher megapixel counts, always new sensor designs, always pushing optical zooming further. This approach generated marketing headlines but didn't translate to market-leading innovation. Google and Apple took the spotlight with computational photography breakthroughs, not hardware breakthroughs.

The S26 Ultra strategy says: "We're stopping the hardware chase and competing on what matters: software, processing, integration, and price."

This doesn't mean Samsung abandons innovation. It means innovation shifts away from camera hardware toward:

- Faster processing and responsiveness

- Better battery management and longevity

- Smarter software features and integration

- Improved thermal management

- Better cooling solutions for sustained performance

- More intelligent computational photography

- Integration with Samsung's ecosystem

These are areas where Samsung can genuinely lead. They can build better One UI. They can optimize hardware-software integration better than competitors. They can create unique features that Apple and Google can't match because of ecosystem advantages.

Long-term, this positions Samsung as a mature company that understands its market. Not a company chasing arbitrary specs, but a company building phones that users actually want to own and use.

The risk is that competitors follow the same path, leading to stagnation. But stagnation in flagship hardware isn't necessarily bad if processing, features, and ecosystem value continue improving. Most users would happily accept "same camera hardware, $200 cheaper, much faster processing, week-long battery." That's an upgrade in experience even if hardware is stable.

Consumer Perspectives: Who Benefits Most from This Strategy

Not all smartphone buyers benefit equally from hardware stability and price control.

Camera enthusiasts lose out. People who carefully evaluate sensor specifications, test cameras extensively, and care deeply about optical quality wanted marginal camera improvements. They're disappointed by stable hardware. But this group is tiny—maybe 3% of the market—and they'll grumble but still buy because the S26 Ultra's camera is still excellent.

Value-conscious buyers win significantly. People looking for flagship features at reasonable cost love "same great camera, lower price." This is probably 40% of the market. Samsung's move directly appeals to them.

Upgrade-cycle buyers win. People upgrading from S23 or older phones see meaningful improvements in processing, battery, and features even with stable camera hardware. For them, the S26 Ultra is a clear upgrade without requiring a larger expenditure.

Long-term keepers win. People planning to own their phone for four years benefit from stable, proven hardware (more reliable than bleeding-edge designs that might have issues) and better battery management (critical for phones kept long-term).

Ecosystem users win. If Samsung improves integration with Galaxy Watch, Galaxy Buds, and tablets, owning multiple Samsung devices becomes more valuable. This creates stickiness and raises switching costs.

Early adopters lose slightly. People who want the absolute newest technology might perceive stable hardware as a cop-out. But they probably weren't the target market anyway.

Overall, this strategy serves the majority market (pragmatists) much better than the enthusiast minority. That's a mature market decision.

The Broader Industry Implication: Is Hardware Maturity Acceptable?

If Samsung succeeds with the S26 Ultra (assuming the rumors are true and that's what actually happens), other manufacturers will take notice.

Apple could feel emboldened to stabilize iPhone camera hardware further. Google could accept that the Pixel's camera advantage doesn't require annual hardware refreshes. OnePlus could compete even more aggressively on price knowing that flagship camera hardware has converged.

The industry could shift from "annual hardware race" to "converged hardware, differentiated software." This is actually how the PC industry evolved. Processors and GPUs improved annually but weren't considered revolutionary. Differentiation shifted to design, reliability, software, and ecosystem.

Smartphone cameras could follow the same trajectory. Everyone converges on excellent "good enough" hardware. Innovation becomes marginal or software-driven. Differentiation comes from processing, features, price, and reliability.

This is actually healthier for consumers. It slows the disposable electronics cycle. It reduces environmental impact. It reduces pressure to upgrade constantly. It focuses innovation on areas that actually improve daily experience.

But it's also challenging for manufacturers. Revenue depends partly on upgrades. When hardware matures, upgrade cycles lengthen. Customers hold phones longer. Annual replacement rates drop. The market becomes more competitive on price and software quality rather than specs.

Samsung apparently decided this is the future and is preparing now. That's a bold strategic bet.

FAQ

Why would Samsung keep the same camera hardware for two generations?

Smartphone camera sensors have reached a maturity point where incremental hardware improvements yield minimal real-world benefits. Instead of chasing diminishing returns on hardware, Samsung can deliver better value by keeping proven camera hardware while improving processing, battery life, and software features. This approach allows for competitive pricing while maintaining excellent photography quality.

Will the S26 Ultra take noticeably worse photos than the S25 Ultra?

No. The camera hardware would be identical, so photo quality would be nearly identical in real-world conditions. Any perceived improvements would come from faster processing and smarter AI-driven optimization, not from different sensors or optics. For 95% of users, photos would look identical.

How could the S26 Ultra improve photography without new camera hardware?

AI and processing power enable substantial improvements without hardware changes. Intelligent scene recognition could optimize settings per shot. Faster processors enable real-time computational photography adjustments. AI upsampling could improve digital zoom. Adaptive HDR processing could optimize exposure merging. These improvements are invisible to the user but produce noticeably better results.

Would this strategy hurt Samsung's competitiveness with iPhone and Google Pixel?

No. Apple's iPhone already reuses camera hardware across generations, focusing on computational improvements. Google's Pixel succeeds through software rather than hardware specs. Samsung keeping camera hardware stable while competing on price and processing would align them with successful strategies from competitors and potentially attract budget-conscious customers from competing platforms.

What would happen to the price of the S26 Ultra with stable camera hardware?

Rumors suggest Samsung could lower the S26 Ultra price to

Is it possible Samsung is actually planning major camera upgrades and the rumors are wrong?

Absolutely. These are rumors, not confirmed specifications. Samsung could introduce new camera hardware despite discussions about stability. However, the strategic logic behind keeping hardware stable is sound, so whether or not these specific rumors prove true, the industry trend is clearly moving toward hardware convergence and software differentiation.

How would users actually perceive a camera-stable S26 Ultra?

Most users would likely appreciate the lower price and faster processing more than they'd miss marginal camera improvements they'd never notice. Photography enthusiasts might complain about spec stagnation, but the broader market would probably see the S26 Ultra as a smarter, more pragmatic flagship. Sales data would ultimately determine if this strategy works.

Could other smartphone makers follow Samsung's lead with stable camera hardware?

Yes. If the S26 Ultra succeeds commercially, competitors would take notice. Apple could stabilize iPhone cameras further. Google could extend Pixel's hardware refresh cycle. This could fundamentally shift the industry away from annual hardware races and toward longer hardware cycles with annual software improvements. The precedent exists in other tech categories like laptops and desktops.

The Bottom Line

Samsung's apparent decision to keep the Galaxy S26 Ultra's camera hardware identical to the S25 Ultra represents more than a skipped camera upgrade. It signals acceptance of a fundamental market reality: smartphone camera hardware has matured to the point where further iteration provides negligible real-world benefits.

Instead of chasing phantom improvements through expensive sensor redesigns, Samsung can deliver genuine value by holding the line on price while investing in processing speed, battery life, and software features that users actually notice. This is a pragmatic, mature approach to a commodifying market.

It's also honest. For years, the industry justified price increases through marginal camera improvements that looked impressive on spec sheets but meant nothing in actual photos. Stabilizing hardware forces manufacturers to compete on price, reliability, and software quality. These are harder fights than spec-sheet wars, but they're more meaningful.

The real winners are consumers. A flagship phone at

Samsung apparently understands this. Whether the S26 Ultra actually follows through remains to be seen, but the strategic logic is sound. The smartphone industry is growing up, moving beyond hardware arms races toward sustainable, mature products that prioritize practical user value over chasing specs.

That's the future worth paying attention to.

Key Takeaways

- Smartphone camera hardware has matured to a point where annual incremental improvements yield minimal real-world benefits

- Reusing the S25 Ultra's proven camera system allows Samsung to lower prices or improve other components without sacrificing photography quality

- AI-driven computational photography can produce noticeably better photos without requiring new sensors, optics, or hardware

- Market data shows consumers prioritize battery life, processing speed, and pricing over marginal camera spec improvements

- Stabilizing hardware reflects broader industry maturation where software differentiation matters more than hardware specifications

![Samsung Galaxy S26 Ultra: No Camera Upgrade, Better Pricing [2025]](https://tryrunable.com/blog/samsung-galaxy-s26-ultra-no-camera-upgrade-better-pricing-20/image-1-1767650943032.jpg)