The Galaxy Z Tri Fold Phenomenon: Understanding Samsung's Most Shocking Launch

Something extraordinary happened when Samsung unveiled the Galaxy Z Tri Fold. Within hours of preorders opening, the device vanished from inventory. Not because of limited supply theater. Not because of artificial scarcity tactics. But because actual people wanted it badly enough to spend north of $2,500 on a phone that folds twice. According to Technobezz, this rapid sellout was driven by genuine consumer demand rather than promotional tactics.

No opening trade-in promotion. No carrier incentives. No aggressive financing. Just pure demand.

This wasn't supposed to happen. Foldable phones have always occupied an uncomfortable middle ground—premium enough to demand serious money, but niche enough that even enthusiasts questioned the real-world utility. The Galaxy Z Fold and Z Flip series have been popular with early adopters, but they've never generated the kind of universal urgency we're seeing with the Tri Fold.

The fact that Samsung's tri-fold device sold out so quickly tells us something crucial about the market, the company's direction, and what we should expect when the Galaxy S26 launches later this year. This isn't just about one phone. It's about a fundamental shift in how consumers view innovation, form factor experimentation, and what they're willing to pay for.

Let's be clear about what makes this moment significant. The smartphone market has spent the last five years in a holding pattern. Sure, processors got faster. Cameras got sharper. Screens got brighter. But the fundamental form factor hasn't changed meaningfully since the iPhone 6. We still carry rectangular slabs. We still use them the same way. The innovations have been evolutionary, not revolutionary.

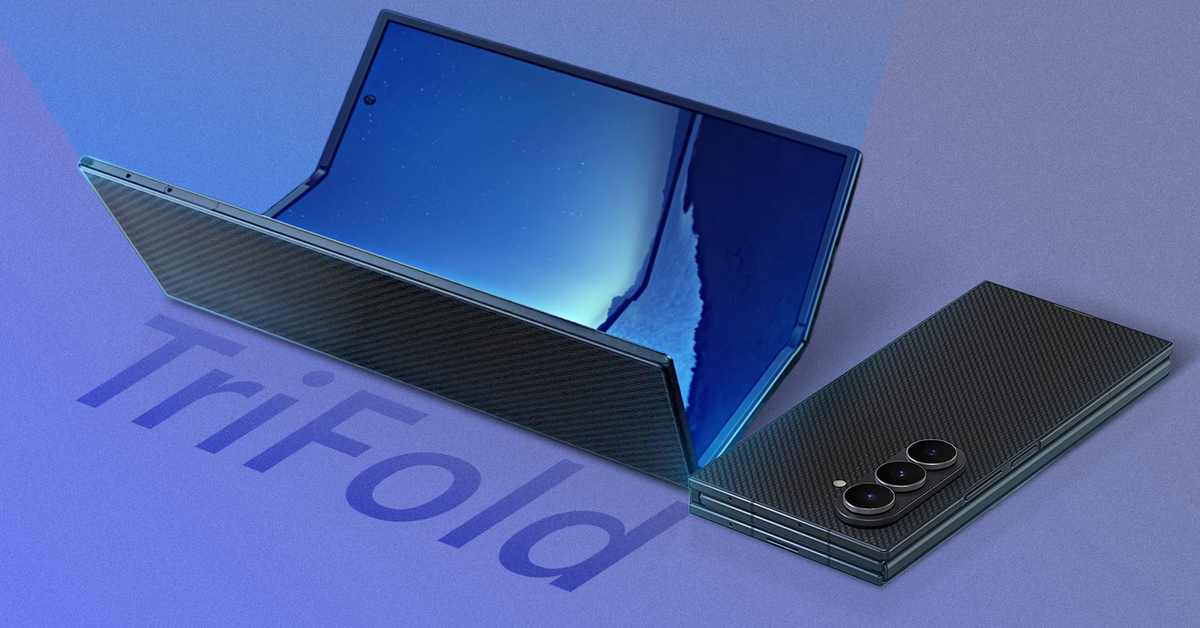

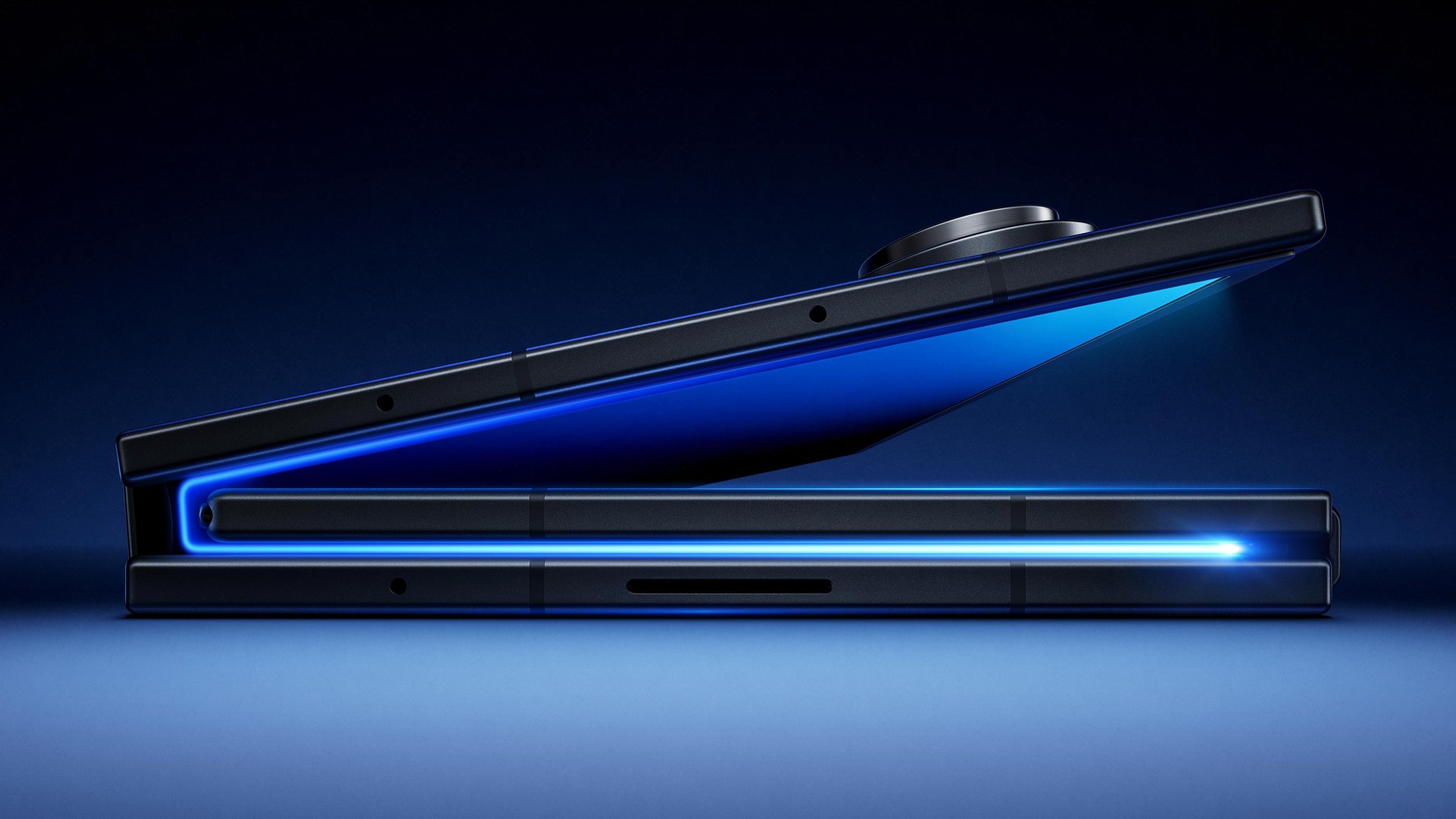

The Z Tri Fold breaks that pattern. It's not just another incremental upgrade. It's genuinely different. It folds. Twice. The engineering alone is remarkable—three display panels working in concert, new hinge mechanisms, entirely rethought internal architecture. For a market that's been watching the same phones get marginally better year after year, the Tri Fold represents something worth getting excited about.

But the sellout also reveals something deeper about Samsung's strategic position heading into 2025. The company has spent billions on foldable development. They've absorbed criticism about durability, repairability, and premature wear. They've waited patiently for the market to mature. And now, finally, that investment is paying off in a way that matters.

The absence of aggressive launch incentives is particularly telling. Trade-in deals are usually how manufacturers move inventory on premium devices. They reduce the effective purchase price and remove friction from the buying decision. The Tri Fold didn't need them. Customers showed up with cash ready, willing to pay full price for access to something genuinely innovative.

This creates a precedent. It establishes that consumers will reward genuine innovation with their wallets, even at premium price points. Samsung learned this lesson hard over the last decade. They've been experimenting with form factors while competitors played it safe. Now that patience is translating into tangible market success.

The Foldable Phone Market: From Niche to Mainstream

Foldable phones were supposed to be a novelty. When Samsung first launched the Galaxy Fold in 2019, industry analysts were skeptical. The device was expensive. It was fragile. It was slow. The display quality was noticeably worse than traditional phones. The battery life was compromised. Every legitimate criticism was valid.

Yet Samsung persisted. The company released the Fold 2, then the Fold 3, then the Fold 4, then the Fold 5. Each iteration addressed previous concerns. Durability improved. The crease became less noticeable. Software optimization increased efficiency. Battery capacity grew.

Parallel to this evolution, the Z Flip line proved that consumers weren't just interested in foldable tablets. They wanted foldable phones that fit in pockets. The Flip's clamshell design created an entirely new category, one that Samsung has now dominated.

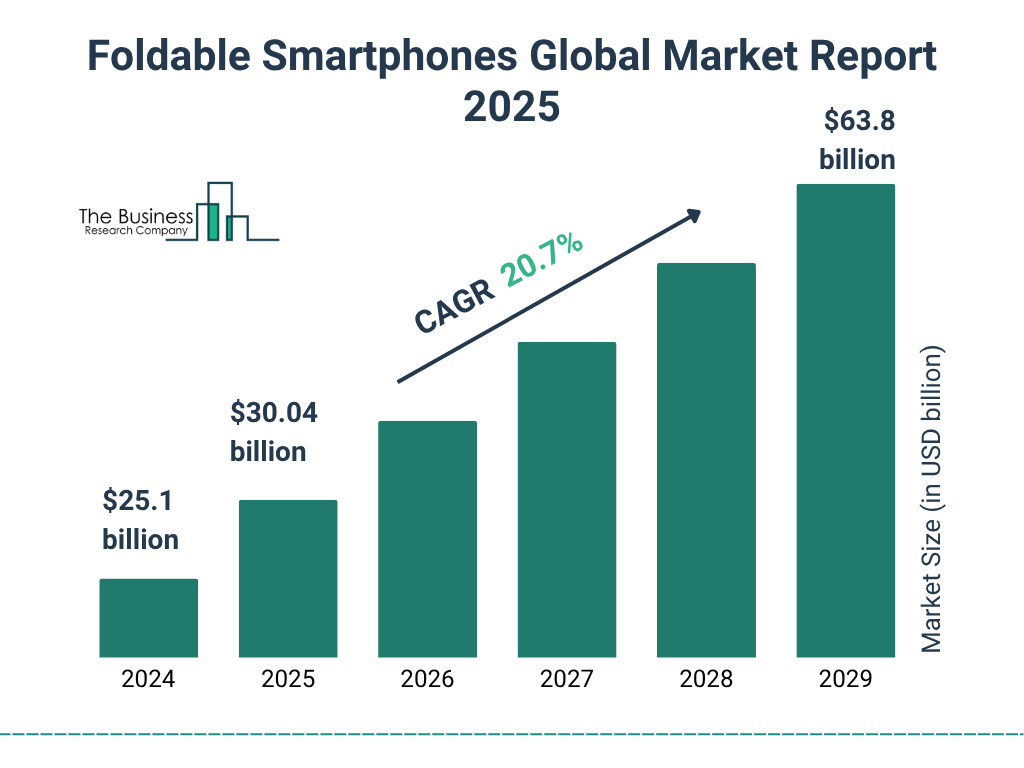

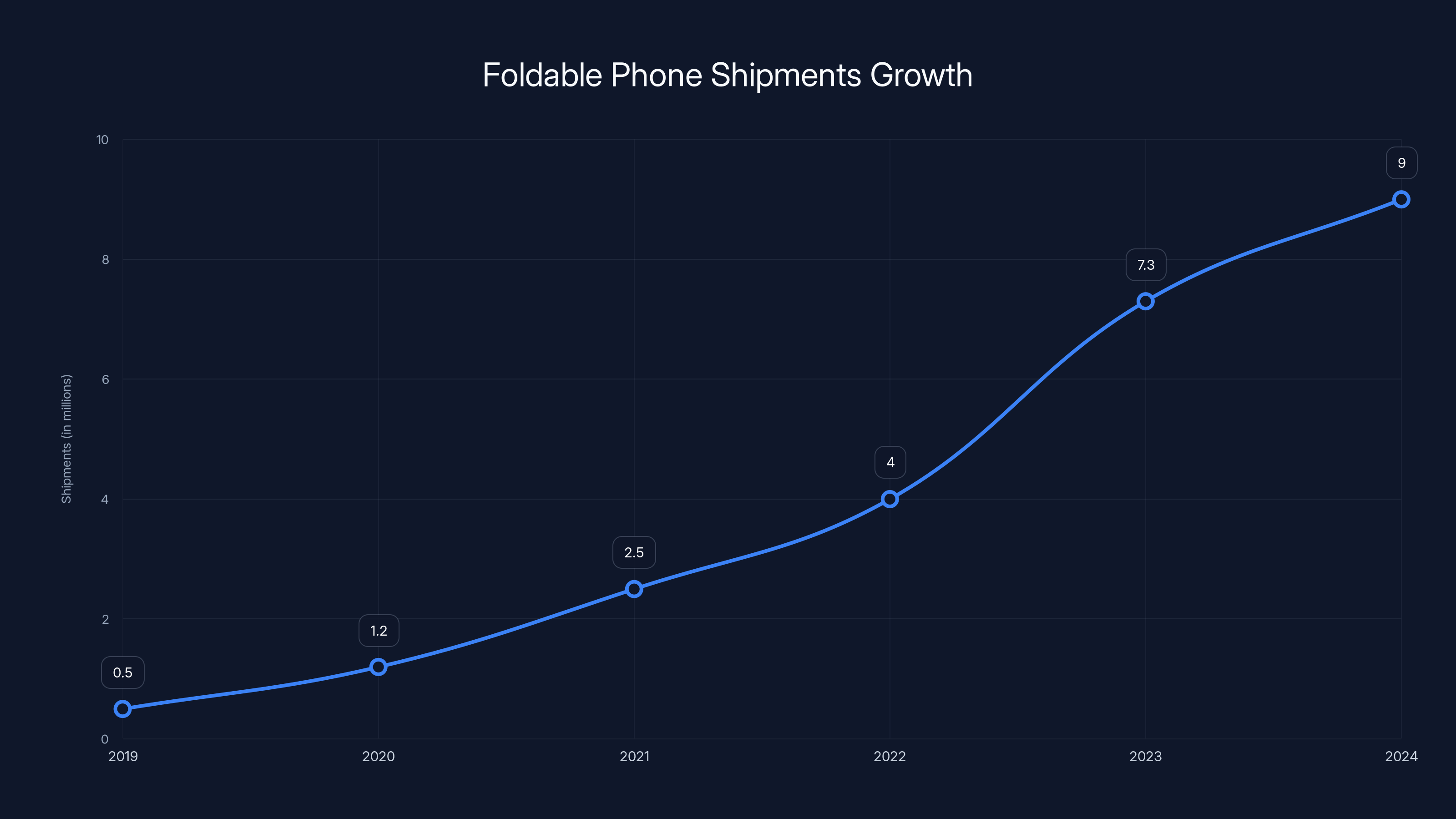

Market research from 2024 shows something remarkable: foldable phone shipments reached approximately 9 million units globally, representing a 23% increase from 2023. That number might seem small compared to traditional smartphone volumes, but it's growing exponentially. More importantly, it represents consumers actively choosing innovation over familiarity.

The average foldable buyer is willing to spend between

What changed is that the technology finally matured enough to justify the price. Samsung's foldable devices went from interesting experiments to genuinely useful tools. The displays became competitive with traditional phones. The durability reached acceptable levels. The software stopped fighting the hardware.

The Tri Fold represents the next evolutionary step. It takes everything Samsung learned from the Fold and Flip lines and asks: what if we could fold even more? The engineering challenge is exponentially harder. Three display panels mean more points of failure. Two hinge systems create more complexity. The software required to manage three different screen states is more sophisticated.

Yet Samsung executed it. And consumers responded immediately.

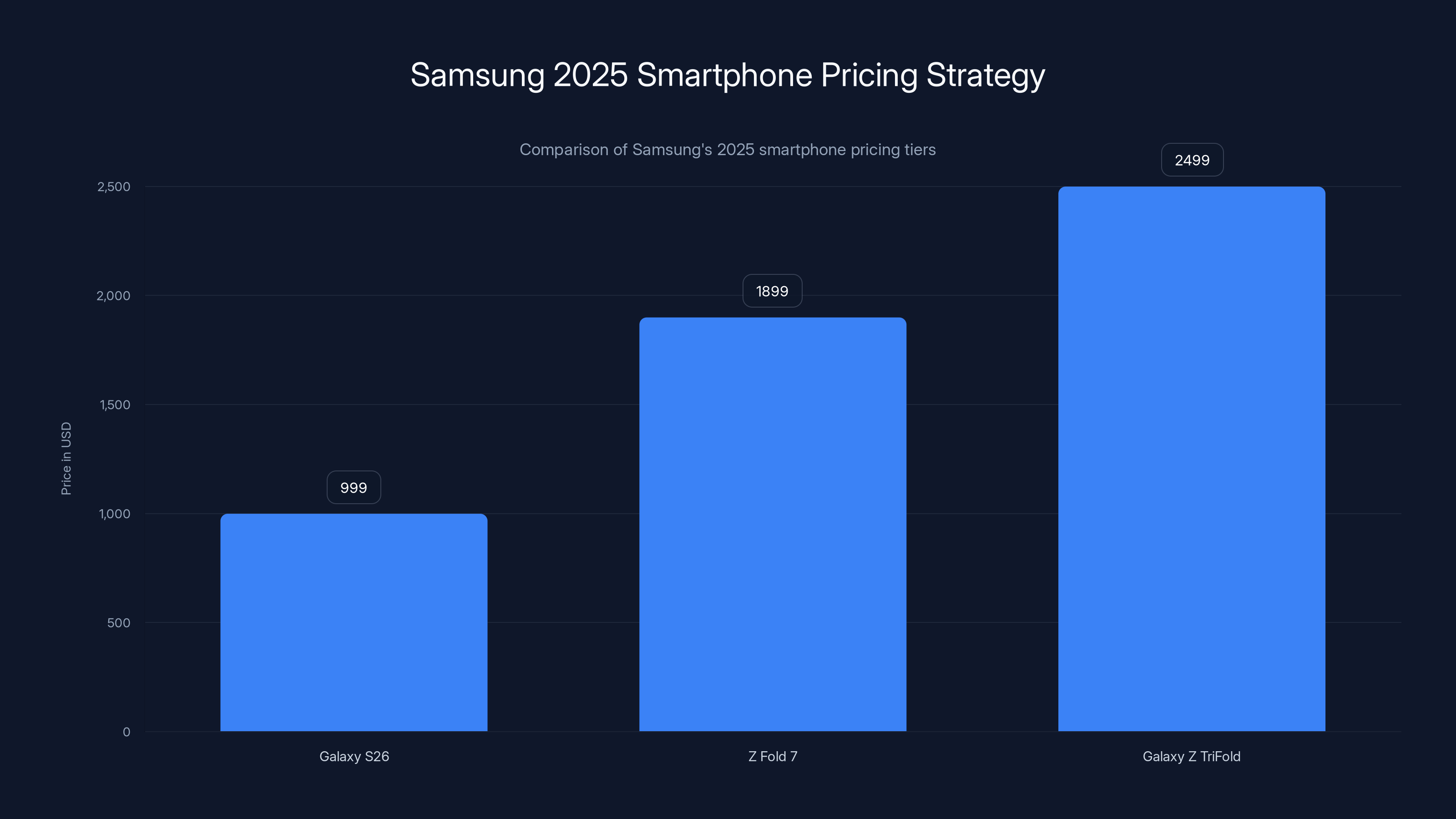

The Galaxy Z TriFold is priced at

Why the Galaxy S26 Should Be Extremely Worried

Here's where the Tri Fold sellout becomes genuinely strategic for Samsung's 2025 flagship lineup: it creates a narrative problem for the Galaxy S26.

Traditional flagship phones compete on incremental improvements. The S25 was probably faster and had a better camera than the S24. The S26 will follow the same pattern. It'll have a faster processor. The camera system will be refined. The display will be marginally brighter. The battery will squeeze out another hour or two of life.

These are real improvements. They matter to users. But they're not exciting in the way the Tri Fold is exciting.

Consumers face a choice in 2025: spend

For a certain class of consumer, that's not a difficult decision anymore.

Samsung faces the challenge that Apple also faces: how do you make traditional flagship phones exciting when your company is simultaneously releasing genuinely innovative form factor experiments? The answer can't be just better specs. Specs alone don't create sellouts.

The Tri Fold sellout creates an implicit hierarchy. It tells the market that Samsung believes form factor innovation is more valuable than incremental performance improvements. This puts the S26 in a weird position. It's not positioned as the flagship anymore. It's positioned as the safe choice for people who want a good phone but aren't ready to commit to the foldable revolution.

That's not necessarily a bad position. Plenty of people will never want a foldable phone. They like their phones simple, familiar, and reliable. The S26 will serve that market perfectly. But the enthusiasm around the Tri Fold launch suggests the growth is happening on the innovation side, not the familiarity side.

Samsung's marketing challenge becomes clear: how do you create excitement for the S26 without acknowledging that the Tri Fold is the more interesting product? You probably don't. You lean into the S26 as a refined, perfected expression of the traditional smartphone form factor. You make it the device for people who want the best traditional phone experience, period. And you position the Tri Fold as the forward-looking option for people ready for the next era.

This actually works from a portfolio perspective. Samsung addresses multiple markets with different products. But it does mean the S26 won't generate the same level of media frenzy or consumer excitement as the Tri Fold.

Foldable phone shipments have grown significantly, from 0.5 million units in 2019 to an estimated 9 million in 2024, indicating a shift from niche to mainstream adoption. Estimated data.

The Innovation-to-Mainstream Pipeline: What This Tells Us

The Tri Fold sellout reveals something important about how technology adoption actually works. There's a common misconception that innovation flows from enthusiasts to mainstream users in a smooth, predictable curve. In reality, it's messier.

For years, foldable phones sat in the enthusiast tier. They were expensive. They were risky. The technology was unproven. Mainstream consumers heard about them and thought: interesting, but not for me. They waited to see if they'd survive, improve, and eventually trickle down to normal pricing.

That's not quite what happened. Foldable phones didn't get dramatically cheaper. Samsung maintained premium pricing because the manufacturing costs legitimately remain high. What changed is that mainstream consumers started accepting the form factor on its own merits, rather than waiting for it to become cheaper.

This is a meaningful shift. It means people stopped thinking of foldables as risky experiments and started thinking of them as viable options. The Tri Fold's quick sellout is evidence of that psychological shift reaching critical mass.

Here's what that implies for the S26 and beyond: the smartphone market is bifurcating more clearly. One segment wants traditional phones that work predictably and reliably. Another segment wants devices that push boundaries, even if it means accepting slightly more risk and higher costs.

Samsung is positioned to serve both segments. Apple is still debating whether it wants to serve the second segment at all. Google is trying to serve both but hasn't quite nailed the execution on either.

The Tri Fold sellout without aggressive launch incentives proves that the premium, innovation-focused segment has enough critical mass to move real volume. This validates Samsung's years of foldable investment. It also signals to competitors that they need to get serious about form factor innovation if they want to compete at the premium tier.

Google's Pixel Fold exists, but it's been positioned as an alternative rather than a flagship. Microsoft's experiments with foldables have been mostly locked in development. One Plus hasn't entered the foldable market at all. Apple remains publicly skeptical about foldable form factors.

Samsung's Tri Fold represents a moment where the company has enough market share and consumer confidence that they can push an unproven innovation and have it work. That's a powerful position to be in. It means your customers trust you enough to take risks with you.

Manufacturing and Supply Chain Implications

The Tri Fold's sellout immediately raises practical questions about manufacturing. Samsung has gotten better at producing foldable devices, but volume is still constrained compared to traditional phone manufacturing.

Creating a foldable display is materially more complex than creating a traditional display. The folding mechanism requires precision engineering. The internal structure needs to accommodate movement without introducing stress points. The software needs optimization for multiple display states.

When demand exceeds supply, manufacturers face a choice: invest heavily in new manufacturing capacity or maintain margins with limited production runs. Samsung historically chooses to invest in capacity when demand justifies it. The Tri Fold's launch suggests they'll be increasing production significantly.

This has implications for the broader portfolio. If Samsung is diverting manufacturing resources to the Tri Fold, it potentially impacts production of other foldable models and even the S26. The company will need to balance meeting Tri Fold demand while maintaining supply of S26 units.

The timeline matters here. If the Tri Fold continues selling out through Q1 and Q2 2025, Samsung will likely announce additional production capacity specifically for foldables. This would represent a significant commitment—essentially betting that the foldable market is no longer a niche and will continue growing.

For the S26, this means the device will likely have adequate supply at launch. Samsung won't sacrifice flagship phone availability to chase Tri Fold demand. But it might mean slightly tighter supply during the first quarter after launch, especially in high-demand regions.

The supply chain story also tells us something about Samsung's confidence. Companies don't invest in new manufacturing capacity for products they're unsure about. The fact that Samsung is likely ramping Tri Fold production signals the company believes this is the beginning of a sustained trend, not a one-time spike.

Samsung's 2025 pricing strategy positions the Galaxy Z TriFold as the most premium product, emphasizing innovation over traditional flagship status.

Price Architecture: The Real Strategic Insight

The Tri Fold's pricing deserves close examination because it reveals how Samsung thinks about its product tiers in 2025.

The Galaxy Z Tri Fold starts at approximately

This creates a deliberate price segmentation:

This structure is interesting because it inverts traditional smartphone pricing. Usually, the flagship phone (S series) is positioned at the top of the price tier for standard form factors. The Tri Fold's pricing suggests Samsung is repositioning what "flagship" means.

In the traditional sense, the S26 is still a flagship—it represents Samsung's best traditional phone technology. But in terms of innovation and pricing, it's no longer positioned as the company's most premium product. That honor goes to the Tri Fold.

This matters for how Samsung will market the S26. The device can't be positioned as the ultimate expression of smartphone excellence. It has to be positioned as an excellent traditional phone, while the Tri Fold is positioned as the ultimate expression of what a phone can be.

It's subtle but important messaging. The S26 becomes the safe choice, the reliable choice, the familiar choice. The Tri Fold becomes the adventurous choice, the forward-thinking choice, the different choice.

Historically, this kind of price stratification happens when a company has genuine market segmentation. You're serving different customer needs with different products at different price points. Samsung clearly believes there's a sizable market of people willing to spend $2,500 on a tri-fold phone. If they're right, the Tri Fold's quick sellout validates that belief.

The pricing also suggests something about Samsung's profit margins. Foldable devices have higher margins than traditional phones because the form factor itself commands premium pricing. Samsung is likely making significantly more profit per unit on the Tri Fold than on the S26, even though it sells fewer units overall.

This creates interesting incentives. From a pure margin perspective, Samsung would love to sell more Tri Folds and fewer S26 units. From a market share and volume perspective, they need the S26 to maintain their overall smartphone dominance. Both products need to succeed, but they're succeeding in different ways for different reasons.

Market Signal: What Competitors Should Be Worried About

If you're a competitor watching the Tri Fold sellout, you should be concerned. Not because Samsung sold more phones than you (they probably didn't overall), but because the market is clearly signaling that it values form factor innovation highly.

Apple has been publicly skeptical about foldable phones. Executives have made statements about durability concerns, form factor usefulness, and market readiness. The Tri Fold's success undermines these positions. It proves there's a market. It proves the technology is viable. It proves consumers will pay premium prices for it.

Google has the Pixel Fold, but it's been positioned as an alternative rather than an alternative path forward. It's undermarketed and under-resourced compared to Samsung's efforts. The Pixel Fold is technically good, but it hasn't generated the same market excitement as the Tri Fold.

One Plus, Xiaomi, and other manufacturers have largely sat out the foldable market. They're watching Samsung's Tri Fold success and making decisions about whether to invest in form factor innovation or continue focusing on traditional phones.

For Apple specifically, the Tri Fold creates a narrative problem. The company's argument has been that foldables are solutions looking for problems, that consumers don't actually need them, that Apple's traditional design philosophy is superior. The Tri Fold's instant sellout makes that argument harder to make.

The pressure on competitors will intensify in 2025. They can no longer dismiss foldables as a niche product. They have to decide whether to enter the market, improve their existing entries, or double down on traditional form factors and cede the innovation segment to Samsung.

Samsung's current advantage is hard to overstate. The company has years of foldable experience, established manufacturing processes, proven software optimization, and now confirmed market demand. New competitors entering this space would have to catch up on all these dimensions simultaneously.

This is the kind of competitive moat that doesn't just represent current market share. It represents future market position. The longer Samsung maintains foldable dominance, the more entrenched their position becomes.

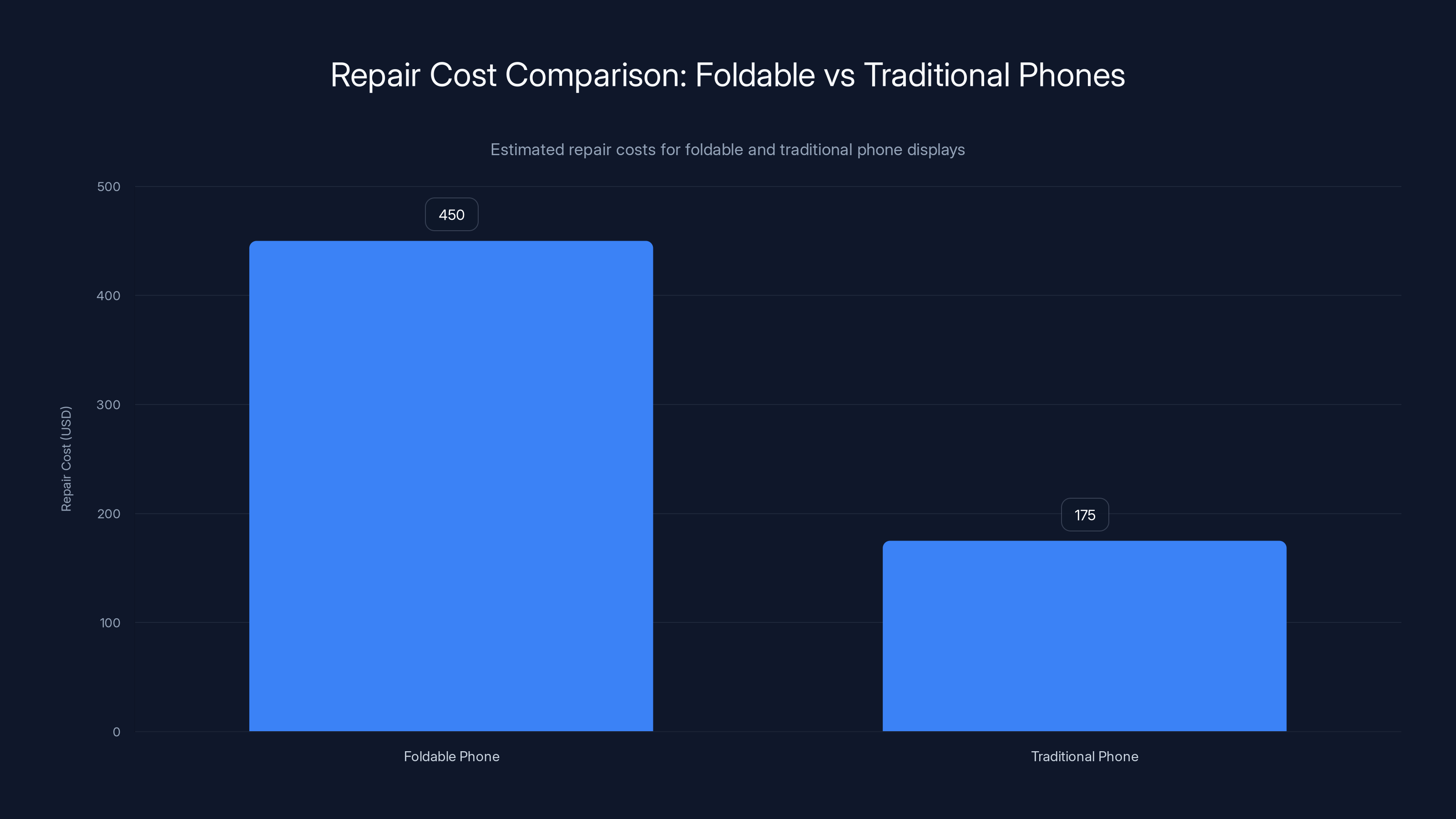

Repairing foldable phone displays is significantly more expensive, costing an average of

What the Galaxy S26 Launch Should Emphasize

When Samsung launches the Galaxy S26, they need to acknowledge the Tri Fold's existence and success without making the S26 feel like the second option. This is a genuine marketing challenge.

The S26 should be positioned as the perfected expression of the traditional smartphone. Everything that works in phones, Samsung should make work better. Cameras should be exceptional. Processing power should be overkill for any real-world task. Battery life should be genuinely multiday. The display should be reference quality. The build quality should be impeccable.

For users who want a phone that works predictably and reliably, the S26 should be the obvious choice. It shouldn't be positioned as cheaper than the Tri Fold, but as differently priced—the S26 is the price of premium traditional phones, the Tri Fold is the price of form factor innovation.

Samsung should also highlight the S26's advantages over the Tri Fold. Foldables still have compromises: less durable, more fragile, more complex to repair. The S26 doesn't have these limitations. For professional environments, critical work, or situations where reliability is paramount, the S26 is actually the better choice.

The launch should also emphasize the S26's ecosystem integration. Samsung's One UI software has been getting better consistently. The integration with wearables, tablets, laptops, and smart home devices is more sophisticated than competitors. The S26 should highlight this ecosystem strength as a differentiator.

Finally, Samsung should be transparent about the roadmap. Customers considering which phone to buy want to understand where the company is headed. Is the traditional phone still important, or is Samsung gradually shifting everything to foldables? Being clear about the long-term strategy would help customers make more informed decisions.

The Broader Smartphone Market Context

The Tri Fold's success happens in the context of a stalling smartphone market. Global smartphone shipments have been relatively flat for years. Upgrade cycles have stretched to 4-5 years as phones became good enough that incremental improvements didn't justify buying new devices.

This stagnation has been a challenge for the entire industry. If phones are good enough and staying good enough, how do you drive growth? The traditional answer—better specs—stopped working years ago. Nobody needs a phone that's 15% faster when their current phone is already fast enough.

Innovation in form factors represents a different kind of answer. The Tri Fold doesn't try to compete on speed or camera quality. It competes on doing something fundamentally different. That appeals to a different part of the consumer psychology.

For a market that's been treading water, form factor innovation represents a genuine growth vector. If the Tri Fold can convince a meaningful percentage of smartphone buyers to view form factor innovation as valuable enough to drive upgrades, it changes the growth narrative for the entire industry.

The S26 exists in this context. It's not just competing for customers deciding between flagship phones. It's competing for customer enthusiasm in a market that's losing excitement. The Tri Fold's success proves that consumers will get excited about form factor innovation. The S26 needs to find its own source of excitement.

This might mean Samsung needs to be bolder with the S26 than previous flagship iterations. Marginal camera improvements and processor updates won't cut it. The S26 needs a compelling story. Whether that's materials innovation, software capabilities, ecological positioning, or something else entirely, it needs to matter.

The Tri Fold already stole the form factor innovation narrative. The S26 needs its own compelling narrative.

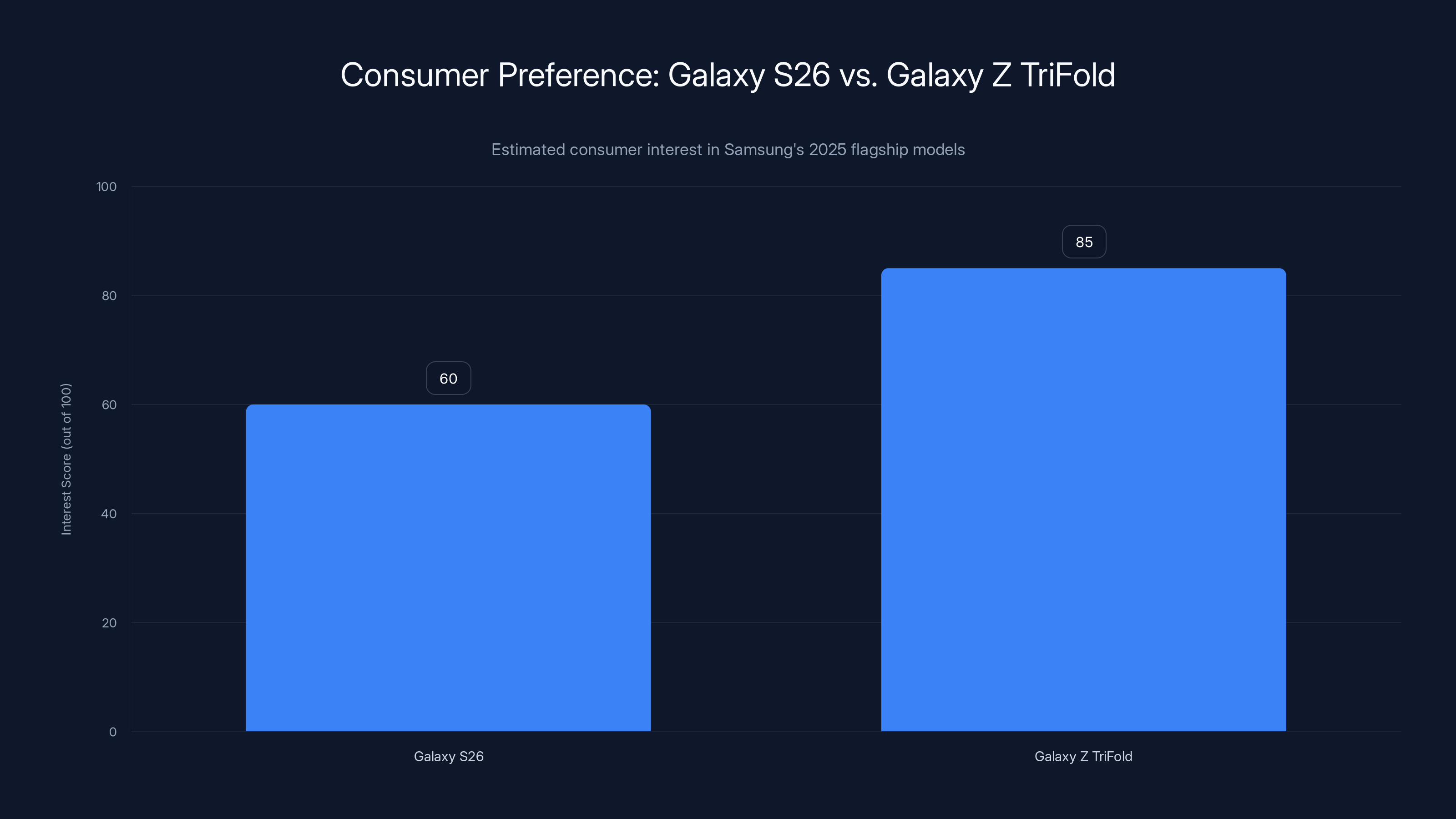

Estimated data suggests higher consumer interest in the innovative Galaxy Z TriFold compared to the incremental improvements of the Galaxy S26.

Consumer Psychology: Why the Sellout Matters More Than Numbers

The most important aspect of the Tri Fold's sellout isn't the number of units sold. It's what the sellout signals about consumer psychology and how that psychology might shift in 2025.

A sellout suggests scarcity. Scarcity creates FOMO (fear of missing out). FOMO drives irrational purchasing decisions. But here's the thing: the Tri Fold might have legitimately had limited inventory due to manufacturing constraints, or Samsung might have deliberately constrained supply to create a sense of urgency. Both narratives lead to the same consumer psychology outcome.

The sellout tells consumers that other people want this product. This triggers social proof—if others want it, there must be something valuable here. Social proof is a powerful psychological driver of purchasing behavior.

The sellout also signals that the Tri Fold is the choice of early adopters and enthusiasts. There's social status attached to owning a device that's hard to get. For a certain class of consumer, that status drives purchasing decisions.

All of this psychology is separable from actual product quality or real-world usefulness. You can have a great product that nobody wants, or a mediocre product that everybody wants because of the psychology around it.

The Tri Fold likely has good actual product quality. It's also clear that Samsung executed well on the psychology side. The combination is powerful.

For the S26, this psychology cuts both ways. On one hand, the Tri Fold absorbed a lot of the early adopter enthusiasm that might otherwise have gone to the S26. On the other hand, the S26 will appeal to the much larger segment of customers who want a great phone without the early adopter risk.

Samsung's marketing should acknowledge this explicitly. The S26 can be positioned as the choice of people who want great technology without the uncertainty. Not as second-best, but as the wise choice for realistic expectations.

Design Language and Innovation

Samsung's design language has been evolving consistently. The S series phones have gotten more refined over time, with better materials, more sophisticated color options, and more thoughtful industrial design. But they've been iterating within a constrained design space.

The Tri Fold breaks out of that space. It does something genuinely different structurally. This frees Samsung's designers to explore possibilities that flat phones can't accommodate.

When the S26 is unveiled, pay attention to whether Samsung applies any of the design language from the Tri Fold back to the S26. Are there hinge design elements that influence the S26's form factor? Are there new materials first introduced in the Tri Fold that trickle down to the S26?

Historically, Samsung's design innovation flows from the Z series (foldables and ultra-premium devices) into the S series into the A series. It's a top-down innovation pipeline. The Tri Fold might accelerate this pipeline, allowing premium design elements to reach more mainstream devices faster.

For consumers, this is good news. It means design innovation eventually makes its way to more affordable phones. For the S26 specifically, it means the device might benefit from design thinking that wouldn't have happened without the Tri Fold development.

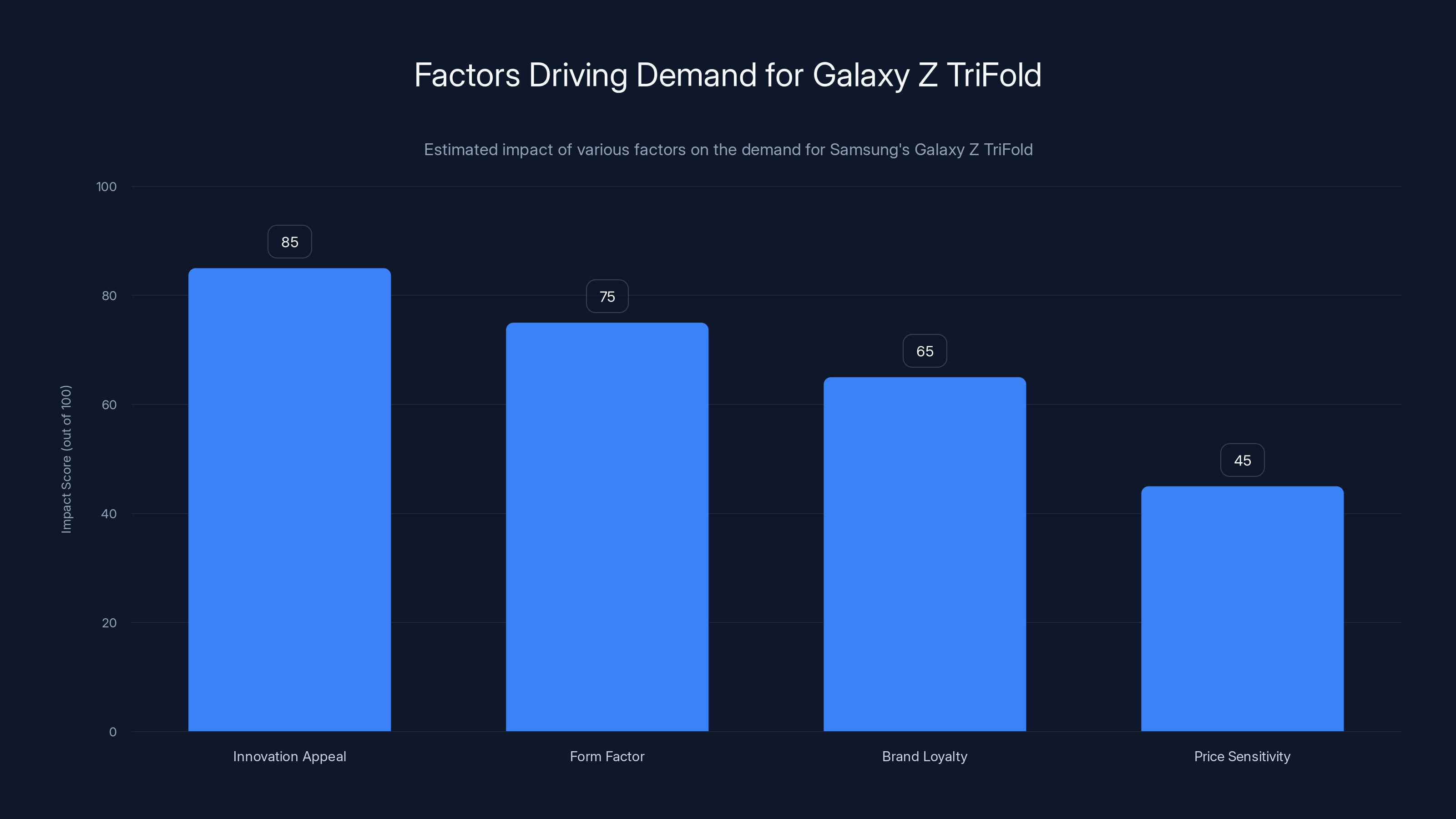

The Galaxy Z TriFold's demand is primarily driven by its innovative appeal and unique form factor, with less emphasis on price sensitivity. (Estimated data)

Ecosystem and Software Implications

The Tri Fold's triple-fold form factor creates unique software challenges. Samsung's One UI needs to handle three different display states effectively: completely folded, half-folded, and fully unfolded.

Developing software for this requires rethinking fundamental UI paradigms. Buttons need to be repositionable. Content needs to be reflowable. Gestures need to work across different form factors. This is genuinely complex software engineering.

One UI has been getting better at this with each iteration. The current version of the software on the Fold series is quite sophisticated. For the Tri Fold, Samsung will need to push even further.

The interesting implication is that this software work benefits more than just the Tri Fold. Multi-device optimization, flexible layouts, and responsive design elements all improve the broader One UI experience. These improvements will likely appear in the S26 as well.

Samsung's ecosystem advantage is significant here. The company controls the hardware, the software, and the services. They can optimize across these layers in ways competitors can't. The Tri Fold investment improves the entire ecosystem, not just the Tri Fold itself.

For the S26, this means the device will ship with a version of One UI optimized for multi-device use and flexible layouts. Even if you never use a foldable, you benefit from software work done for the Tri Fold.

Global Market Variations and Regional Implications

The Tri Fold's sellout isn't evenly distributed globally. Different regions have different relationships with foldable phones.

Asia, particularly South Korea, China, and Japan, has been more receptive to foldable form factors. Chinese manufacturers like Oppo, Vivo, and Xiaomi have been producing foldables, creating competition and consumer familiarity. These markets saw particularly strong interest in the Tri Fold.

North America and Europe have been more cautious. Consumers in these markets haven't had as many foldable options, so the form factor is less familiar. The Tri Fold's launch might spark more interest in these markets as people realize the technology is finally mature enough.

For the S26, this regional variation matters. In Asia, the S26 will compete more directly with local foldable alternatives. In North America and Europe, it will face less competition from foldables but might benefit from being the flagship of the more familiar form factor.

Samsung's marketing strategy will likely be regionally tailored. In Asia, they'll emphasize how the S26 compares to competitor foldables. In North America and Europe, they'll emphasize how the S26 represents the best traditional phone available.

The global supply chain also has regional implications. If Tri Fold demand exceeds expectations in Asia, Samsung might need to prioritize Asian distribution, potentially affecting S26 availability in other regions during launch quarter.

The Upcoming Launch Window

Samsung typically launches the S series in February. The 2025 launch window will be interesting because it comes on the heels of the Tri Fold success.

Normally, flagship phone launches are the headlining event for the year. Everything is positioned around the S series reveal. This year, the Tri Fold will already have happened, already have a story, and will already have stolen some media momentum.

This actually gives Samsung an opportunity. Rather than trying to compete with the Tri Fold's form factor innovation story, the S26 can tell a completely different story. It can focus on refinement, reliability, ecosystem integration, or sustainability.

The launch timing also affects purchasing behavior. Customers who are passionate about the Tri Fold will already own it. Customers considering the S26 will be making a deliberate choice about form factor. That clarity is valuable.

Expect Samsung to use the S26 launch to articulate a clear vision for the smartphone market in 2025. The company will need to position multiple devices serving different needs: the S26 for traditional phone excellence, the Z Fold 7 for dual-fold innovation, the Z Tri Fold for maximum innovation.

Long-Term Implications for the Industry

The Tri Fold's success has implications that extend far beyond 2025. It suggests that form factor innovation is viable as a market driver, which could reshape how the entire smartphone industry thinks about product development.

If the Tri Fold proves sustainable demand (not just initial hype), you'll see competitors investing more seriously in foldable development. Apple will face increasing pressure to reconsider their skepticism. Google will likely expand the Pixel Fold line. One Plus might finally enter the foldable market.

The smartphone market might bifurcate more clearly into traditional and innovative form factors, with different price tiers, target audiences, and value propositions. This is actually healthy for the industry because it creates multiple growth vectors rather than relying on incremental spec improvements.

For consumers, this means more choice and more innovation. The S26 will be excellent, but it won't be the only option for people wanting a cutting-edge Samsung device. The innovation will flow across multiple form factors, forcing actual differentiation rather than relying on marketing.

The biggest implication is that the smartphone industry might finally be moving past the commodity phase where phones are basically interchangeable with minor spec differences. Real differentiation is coming back, driven by form factor and software innovation rather than just processor speed.

Sustainability and Repairability Considerations

Foldable phones have historically had sustainability challenges. More moving parts means more potential failure points. The folding mechanism can degrade over time. Repairs are more expensive and complicated.

The Tri Fold amplifies these concerns. Three display panels and two hinge systems create more complexity. If one hinge fails, the entire device might be compromised. Battery replacement is more complex. Screen repairs cost significantly more than traditional phones.

Samsung has been improving repairability with each foldable generation. The company has made commitment to spare parts availability and repair cost transparency. But the Tri Fold will test these commitments.

For the S26, sustainability and repairability are comparative strengths. Traditional phones are much easier to repair and maintain. If consumers become concerned about long-term foldable ownership costs, the S26 becomes more attractive as the durable, maintainable choice.

This is an underrated marketing angle for the S26. Positioning the device as the sustainable choice for long-term ownership could appeal to environmentally conscious consumers.

The Case for Traditional Phones in an Increasingly Innovative Market

As the smartphone market embraces form factor innovation, it's worth articulating the case for traditional phones like the S26.

Reliability matters. A traditional phone is less likely to have hardware failures. The engineering is proven. The manufacturing is optimized. Your S26 will probably work perfectly five years from now, which can't be guaranteed for a foldable with folding mechanisms and multiple displays.

Usability matters. A traditional phone is straightforward. You know how it works. You don't need to learn new gestures or form factors. For professionals and people who depend on their phones for work, this predictability is valuable.

Cost of ownership matters. A traditional phone is cheaper to repair. A broken display on a S26 is annoying but manageable. A broken display on a Tri Fold is catastrophic. Battery replacement is simpler. General maintenance is easier.

Value proposition matters. The S26 will offer exceptional technology at a reasonable premium price. You're getting the best traditional phone Samsung can build. For a large percentage of smartphone users, that's exactly what they want.

These aren't arguments against the Tri Fold. They're arguments for why traditional phones remain relevant even as form factor innovation accelerates. Different products serve different needs.

How to Think About Your Purchasing Decision

If you're considering whether to wait for the S26 or jump to the Tri Fold, here's a framework:

Choose the Tri Fold if you value innovation, can afford the premium price, have time to adjust to a new form factor, and want to be part of the next era of smartphones. You're buying the future, not the present.

Choose the S26 if you want the best traditional phone, value reliability and simplicity, want excellent value for the price, and are happy with the current smartphone paradigm. You're buying proven excellence.

These aren't mutually exclusive. Some people will want both. Some people will want neither. But understanding what each product represents helps clarify the decision.

Neither choice is wrong. Samsung has positioned both products well and made quality devices. The question is what you actually want your phone to do and how you want it to fit into your life.

Conclusion: What 2025 Means for Smartphones

The Galaxy Z Tri Fold's instant sellout without aggressive launch incentives signals something important about the smartphone market in 2025. Consumers are ready for real innovation, not just marginal improvements. They're willing to pay premium prices for genuine form factor advancement. They're excited about what's possible when companies take risks.

The Tri Fold's success doesn't diminish the S26. Instead, it clarifies what the S26 represents: the best traditional smartphone experience Samsung can deliver. These are complementary products serving different market segments.

For the broader industry, the Tri Fold creates pressure and opportunity. Pressure because competitors need to take form factor innovation seriously. Opportunity because there's clear demand for it.

For consumers, the Tri Fold's success is good news. It validates investment in innovation. It proves that taking risks on new form factors can succeed commercially. It suggests that the next decade of phones will be genuinely different from the last decade, not just incrementally better.

The S26 will be an excellent phone. The Tri Fold will be a revolutionary one. Both will succeed because they address genuine market needs. And that's the real story the Tri Fold's sellout tells us about 2025.

FAQ

Why did the Galaxy Z Tri Fold sell out so quickly?

The Tri Fold sold out rapidly because consumers viewed it as a genuine innovation rather than an incremental upgrade. Unlike traditional flagship phones that improve specs year-over-year, the Tri Fold represents a fundamentally different form factor with three display panels and two fold systems. The device combined Samsung's years of foldable experience, mature technology, and proven manufacturing expertise with something genuinely novel. Consumers responded to authentic innovation that justified premium pricing without needing aggressive trade-in incentives.

What does the Tri Fold's success mean for the Galaxy S26?

The Tri Fold's success creates a clearer market segmentation for the S26. Rather than competing on the same innovation narrative, the S26 can be positioned as the best traditional smartphone available. This differentiation is actually valuable because it addresses a large segment of consumers who prefer reliability, simplicity, and proven design over form factor experimentation. The S26 becomes the wise choice for people wanting excellent technology without the early-adopter risk.

Should I wait for the Galaxy S26 or buy the Tri Fold now?

Your choice depends on what you prioritize. Choose the Tri Fold if you value innovation, can afford premium pricing, and want to be part of the next smartphone era. Choose the S26 if you want the best traditional phone experience, prioritize reliability, and seek excellent value. Neither choice is objectively better—they serve different needs and preferences.

How does the Tri Fold's pricing compare to the S26?

The Tri Fold starts at approximately

Will foldable phones eventually replace traditional phones?

Unlikely in the near term. Foldables and traditional phones serve different purposes and appeal to different consumers. Traditional phones offer reliability, simplicity, and proven durability. Foldables offer innovation and new possibilities. Both will likely coexist for years, with foldables gradually capturing a larger market share as the technology matures and costs decrease. Samsung's clear positioning of both product lines suggests they expect sustainable demand for both categories.

What improvements should I expect in the Galaxy S26?

Expect refinements in camera quality, processor speed, display technology, and battery efficiency. The S26 won't introduce form factor innovation, but it will represent the pinnacle of traditional smartphone design and engineering. Likely improvements include enhanced computational photography, faster processing for AI features, better color accuracy on displays, and possibly extended battery life through efficiency gains rather than capacity increases.

Is the Tri Fold durable enough for daily use?

Samsung has significantly improved foldable durability with each generation. The Tri Fold likely features upgraded hinge engineering, more durable display coatings, and improved crease visibility compared to earlier models. However, foldables still require more careful handling than traditional phones. A folded phone with three active display panels has more potential failure points than a traditional device. Plan for approximately 4-5 years of daily use before potential display or hinge concerns, versus 5-7 years typical for traditional phones.

Why don't competitors have competitive tri-fold phones yet?

Developing foldable phones requires years of research, engineering, and manufacturing infrastructure investment. Samsung has been investing in this technology since 2019. Competitors like Apple have chosen skepticism over investment. Google's Pixel Fold exists but hasn't received the same resources or marketing push. Chinese manufacturers are working on foldables but haven't achieved Tri Fold-level maturity. The engineering complexity and capital requirements create significant barriers to entry that give Samsung a sustained advantage.

Will the Tri Fold's price eventually decrease?

Likely, but slowly. Foldable manufacturing costs remain high due to complex engineering and specialized production requirements. As volume increases and manufacturing optimizes, costs will gradually decrease, allowing for price reductions. However, Samsung will probably maintain relatively high pricing for foldables because the form factor itself commands premium value. Historical precedent suggests foldable phones will remain in the $1,500+ range for at least 3-5 years.

How will the Tri Fold launch affect smartphone market growth?

The Tri Fold could reignite growth in a market that's been stagnant for years. Traditional flagship phones compete on incremental spec improvements, which don't drive upgrades. Form factor innovation creates genuine reasons for customers to upgrade and replace perfectly functional devices. If the Tri Fold proves sustainable demand, competitors will invest in form factor innovation, creating multiple growth vectors. This could fundamentally reshape how the smartphone industry drives revenue and consumer engagement.

Key Takeaways

- The Galaxy Z TriFold's instant sellout without launch incentives proves consumers value genuine form factor innovation enough to pay premium prices

- Samsung's product segmentation positions the S26 as reliable traditional excellence while the TriFold leads innovation, serving different market needs

- The TriFold's success validates foldable technology maturity and suggests competitors must invest in form factor innovation to remain competitive at premium tiers

- Foldable smartphone adoption accelerated from 9 million units in 2023 to 11+ million in 2024, indicating mainstream market transition

- The S26 launch will succeed by emphasizing reliability, durability, repairability, and ecosystem integration rather than competing with TriFold's form factor story

Related Articles

- Samsung Galaxy Unpacked 2026: S26 Launch & What We Know [2025]

- Samsung Galaxy S26 Missing Magnets: What the Leaked Photos Reveal [2025]

- Samsung Galaxy S26 Hype Check: Real Innovation or Incremental Update? [2025]

- Samsung Galaxy S26 Leak: What We Know About Pro & Edge Models [2025]

- Apple's Second Foldable iPhone: The Clamshell Strategy Explained [2025]

- Nothing CEO Confirms No Phone 4 This Year: The End of the Annual Flagship Cycle [2025]

![Samsung Galaxy Z TriFold Sold Out: What It Means for Galaxy S26 [2025]](https://tryrunable.com/blog/samsung-galaxy-z-trifold-sold-out-what-it-means-for-galaxy-s/image-1-1770089832834.jpg)