Introduction: The Smartphone Industry Is Finally Slowing Down

For over a decade, the smartphone industry ran like clockwork. Every September, Apple launched a new iPhone. Samsung followed with a Galaxy S refresh. Google, OnePlus, and others joined the ritual. Consumers anticipated these releases like tech holidays. The upgrade cycle was predictable, profitable, and relentless.

Then something changed.

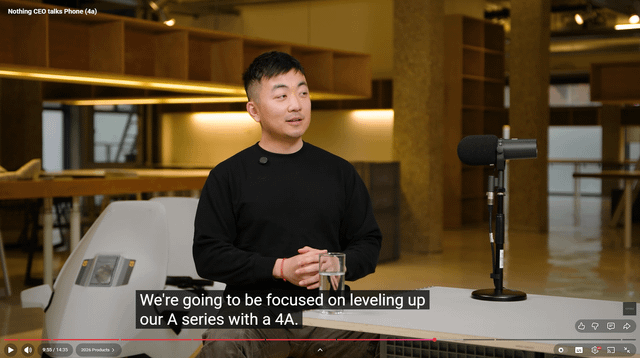

Nothing's CEO recently confirmed that the company has no plans to release a Phone 4 this year. That's not a delay. That's not caution. That's a deliberate rejection of the annual flagship cycle that's dominated the phone market for fifteen years, as noted in TechBuzz.

This announcement matters more than it sounds. Nothing isn't a legacy player trying to preserve market share. The company doesn't have massive installed bases to maintain or quarterly earnings calls to satisfy with predictable growth. Nothing is small, aggressive, and willing to do things differently. When a company like Nothing steps back from yearly flagships, it signals something deeper: the entire industry's approach to smartphone innovation might finally be unsustainable.

The question isn't really whether Phone 4 is coming this year. The question is whether the flagship era itself is ending.

This shift reflects broader changes in how phones evolve, what consumers actually want, and what makes a meaningful upgrade anymore. We're seeing this across the entire industry, from premium flagships to mid-range phones. The pace of innovation has slowed. The gaps between generations have narrowed. Phones from 2021 still work perfectly fine in 2025. And companies are starting to admit it publicly, as discussed in Omdia's report.

Nothing's decision is brave. It also might be the most honest thing any smartphone maker has said in years.

TL; DR

- No Phone 4 in 2025: Nothing's CEO confirmed the company is skipping its annual flagship release to focus on meaningful upgrades

- Why it matters: This signals the collapse of the annual flagship cycle that's dominated smartphone launches for 15 years

- Innovation slowdown: Generational improvements have become incremental; phones released 3-4 years ago still perform nearly identically to today's models

- Market shift: Consumers are keeping phones longer (averaging 4-5 years), reducing the urgency for yearly upgrades

- Industry-wide trend: Apple, Samsung, and Google are also spacing releases further apart and focusing on mid-cycle refreshes

- Bottom line: The era of guaranteed yearly flagship phones is ending, replaced by a slower, more intentional release schedule

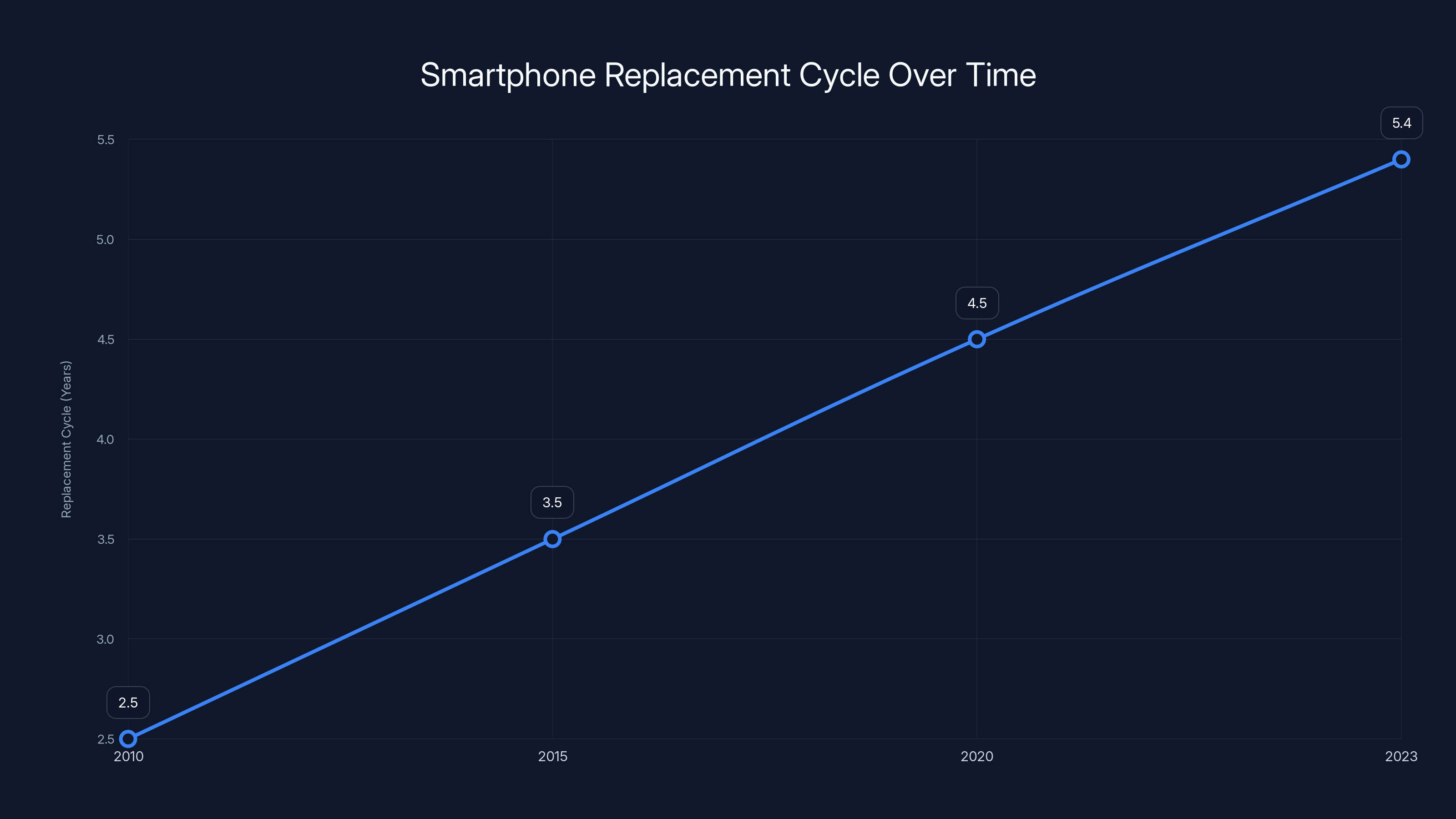

The average smartphone replacement cycle has increased from 2.5 years in 2010 to approximately 5.4 years in 2023, reflecting the slowdown in innovation and longer device longevity. Estimated data.

The Annual Flagship Cycle Is Officially Broken

For fifteen years, the smartphone industry operated under a single assumption: release a new flagship phone every year. It was the business model. It was the marketing strategy. It was the product roadmap.

Apple proved the formula worked in 2008. Samsung duplicated it with Galaxy S. Google, OnePlus, and dozens of other brands followed. The cycle became sacred: September launches, feature announcements, marketing campaigns, quarterly earnings boosts.

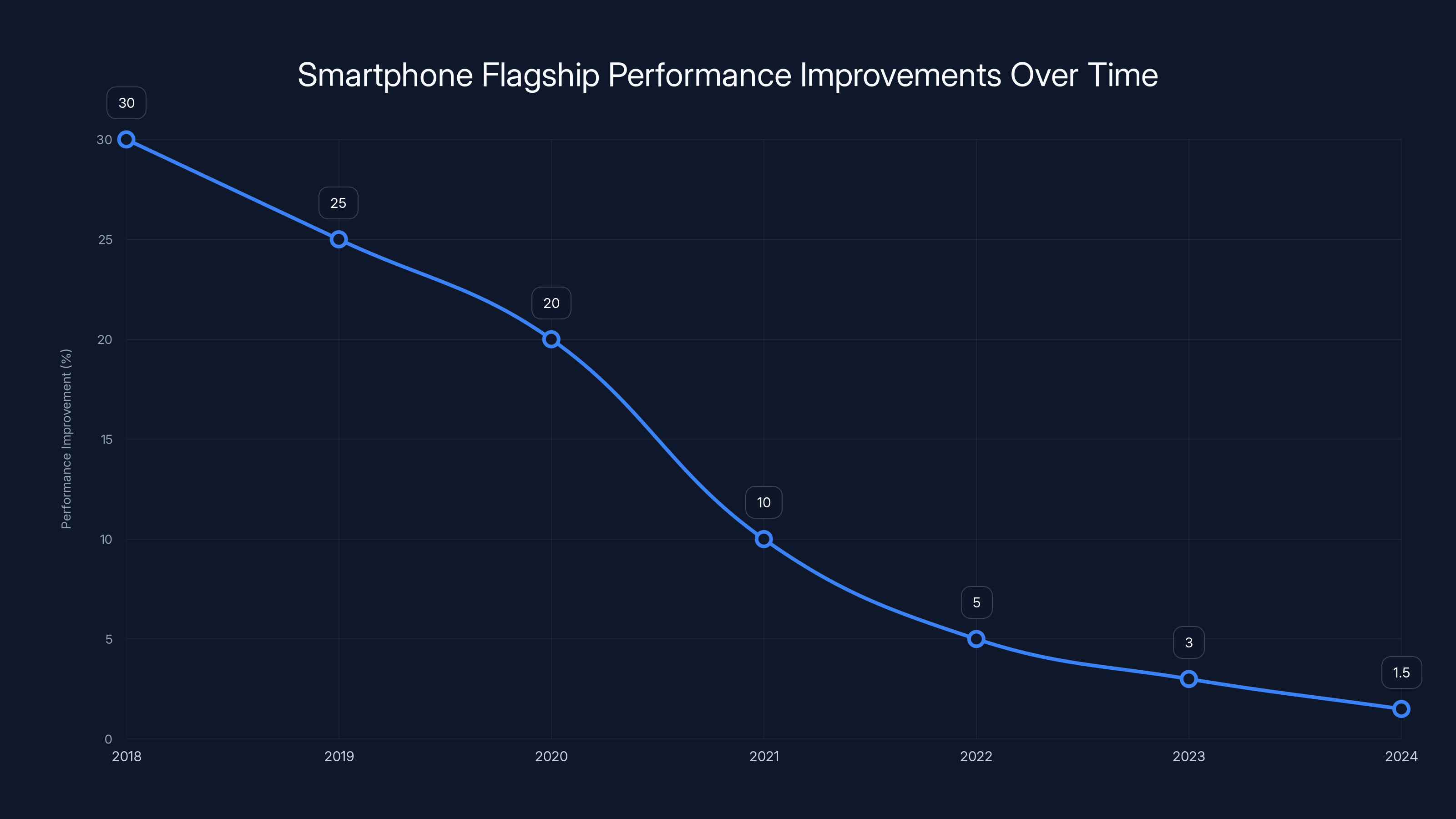

But here's what happened: the improvements stopped being meaningful.

In 2018, a processor upgrade meant 30% better performance. In 2019, cameras got noticeably sharper. In 2020, 5G arrived. These were genuine generational leaps. You could feel the difference between an iPhone 11 and an iPhone 12.

Fast forward to 2024. The difference between this year's flagship and last year's flagship? Sometimes you can't even identify it without a spec sheet. A 1-2% performance boost. Camera improvements so marginal that most people need side-by-side testing to notice. Battery life gains measured in minutes, not hours.

The marginal returns have become so small that continuing the annual cycle feels like it's for marketing purposes, not product purposes.

Nothing's admission is significant because it's public. The company's CEO explicitly said what other manufacturers have been quietly acknowledging: "we want every upgrade to feel significant." Translation: releasing a phone every year where the upgrades barely matter defeats the purpose, as highlighted in TechBuzz.

This isn't unique to Nothing. Look at Apple's roadmap: the iPhone 15 barely differentiated itself from the 14. Samsung's Galaxy S25 incremented so slightly that Samsung itself had to push AI features that don't exist yet to justify the launch, as reported by MixVale. Google's Pixel releases have become almost random in timing.

The yearly cycle is broken. Everyone knows it. Nothing just had the courage to say it.

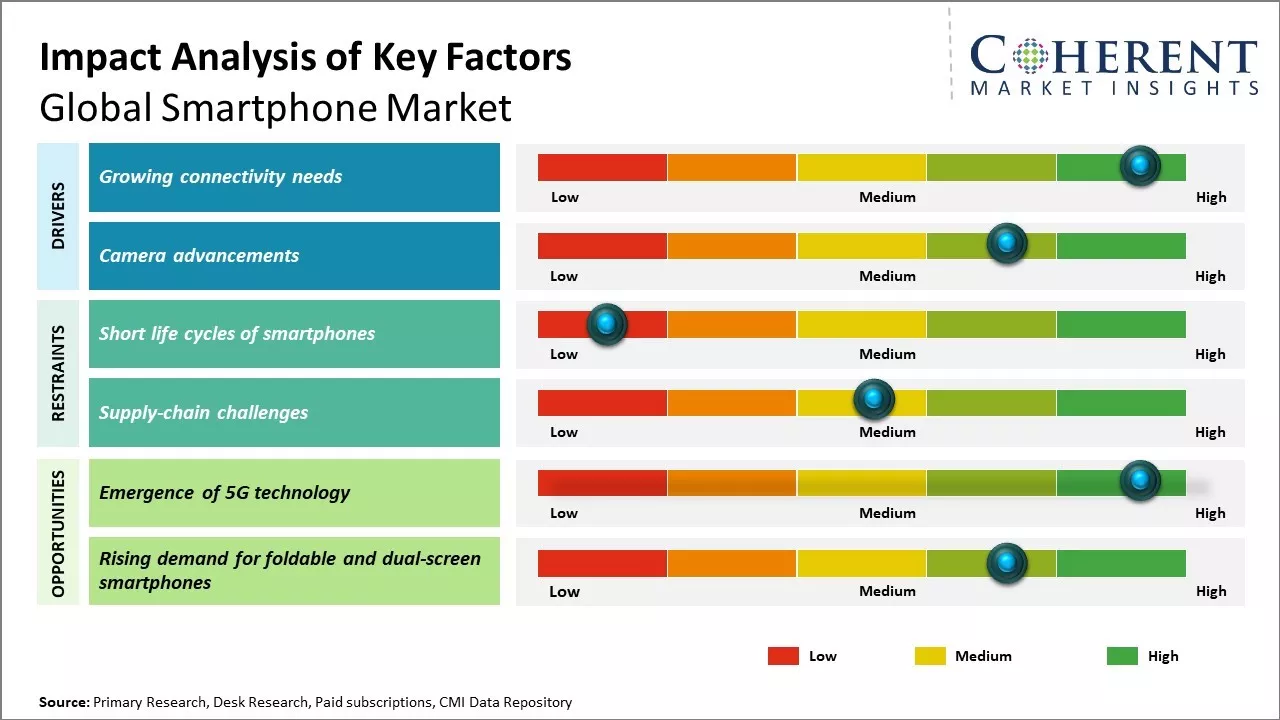

Why Innovation Has Hit a Wall

Understanding why the flagship cycle is ending requires understanding where innovation actually hits limitations.

Smartphone processors hit a wall around 2018-2019. The Snapdragon 855 could run nearly everything. The A12 Bionic could handle any mobile app. By 2022, phones had excess processing power. A 2024 flagship isn't faster because apps don't need it to be. They're faster in benchmarks that nobody runs in real life.

Camera technology has similar constraints. Smartphone cameras hit exceptional quality around 2019-2020. The Pixel 4 took extraordinary photos. The iPhone 11 Pro did the same. Night mode reached usable levels. Zoom worked without major quality loss. Since then? Improvements have been fractional. Better computational photography. Slightly sharper lenses. Marginal upgrades in already-excellent cameras, as noted in Tom's Guide.

Battery technology shows the problem most clearly. Smartphone batteries haven't fundamentally improved in a decade. A typical flagship offers 8-10 hours of screen time. A phone from 2020 offers 8-10 hours of screen time. We're not getting dramatically better batteries. Phones are just more efficient at using the same battery technology.

5G seemed revolutionary. It is, in specific use cases. But real-world 5G speeds versus 4G LTE? Most people can't tell the difference in normal browsing. The upgrade was overstated.

Screen technology has plateaued too. OLED screens are excellent. We've had excellent OLED screens for five years. A 120 Hz display is smooth. We've had smooth 120 Hz displays since the OnePlus 8 Pro in 2020. Higher refresh rates? The jump from 120 Hz to 144 Hz to 165 Hz? Virtually imperceptible to human eyes.

The physics of smartphone hardware matured faster than most people realized. You can't get dramatically better processors in the same physical space. You can't put dramatically larger batteries without making phones heavier. You can't improve camera sensors infinitely without enormous trade-offs.

Innovation didn't stop. It plateaued. And that's a fundamental difference.

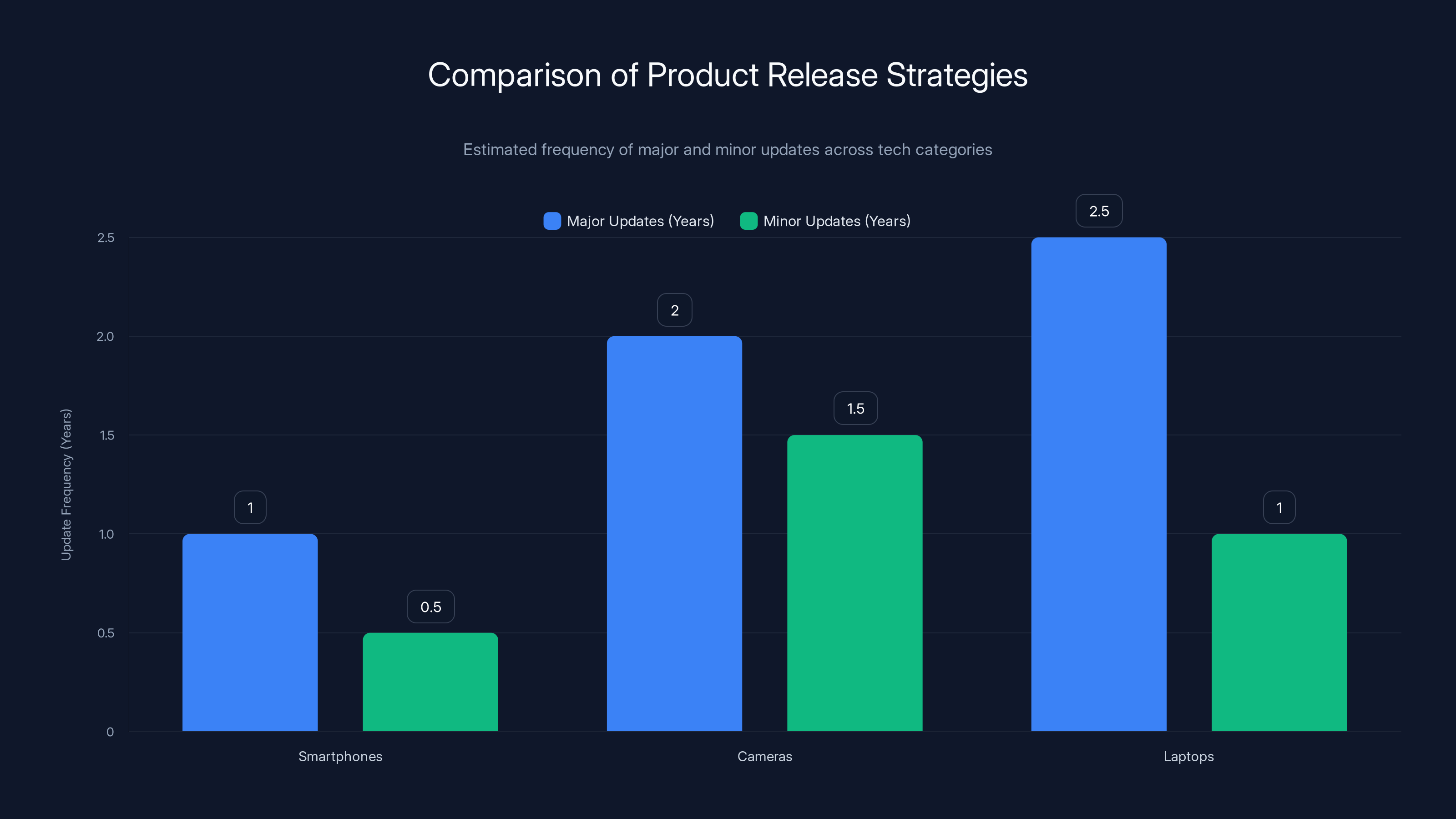

Estimated data shows that smartphones typically have more frequent major and minor updates compared to cameras and laptops. Nothing's strategy aligns more with the latter categories, focusing on meaningful updates over frequent releases.

Consumer Behavior Is Changing

Maybe the bigger issue isn't technological. Maybe it's behavioral.

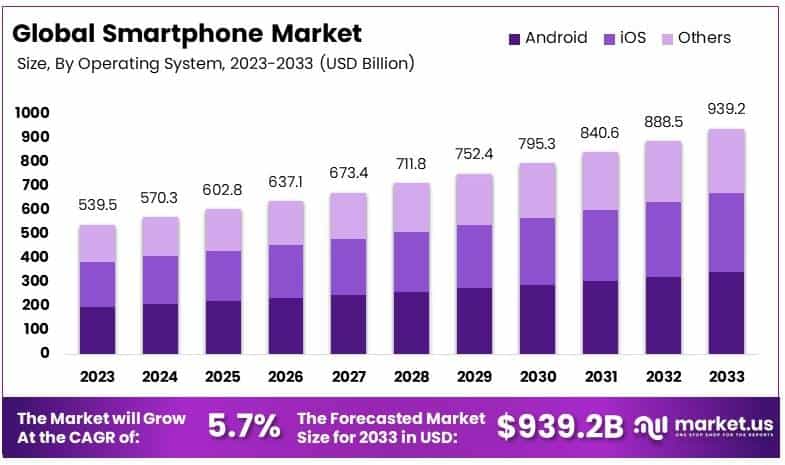

Consumers are keeping phones longer. Average phone replacement cycles have stretched from 2-3 years in the early 2010s to 4-5 years today. Some data suggests the average is now closer to 5.4 years for flagship phones, as reported by Consumer Affairs.

Why? Because phones from 2021 still work fine in 2025. A five-year-old phone runs modern apps. It gets security updates. The battery degrades, yes, but that's a known factor. The performance is sufficient for actual daily use.

Yearly upgrades assume people need better phones annually. But research shows people upgrade when their phone breaks or becomes too slow. Neither happens as frequently anymore. A flagship phone has essentially no performance ceiling for normal use. Apps don't push the limits. Phones don't become obsolete mid-cycle.

This is the opposite of the 2000s smartphone boom, when performance mattered constantly. Early Android phones were slow. Upgrade to an iPhone and things worked smoothly. Upgrade again a year later and everything was faster. The improvement was tangible.

Now? Your 2021 phone is just as fast. Loading Instagram takes the same time. Messaging is identical. Gaming performance is sufficient. There's no urgency.

Smartphone makers have been fighting this reality through marketing. New colors. Slightly thinner bezels. A camera arrangement that looks different. These aren't innovations. They're aesthetic changes. And marketing increasingly can't overcome the fundamental fact that the phone you have is still perfectly functional.

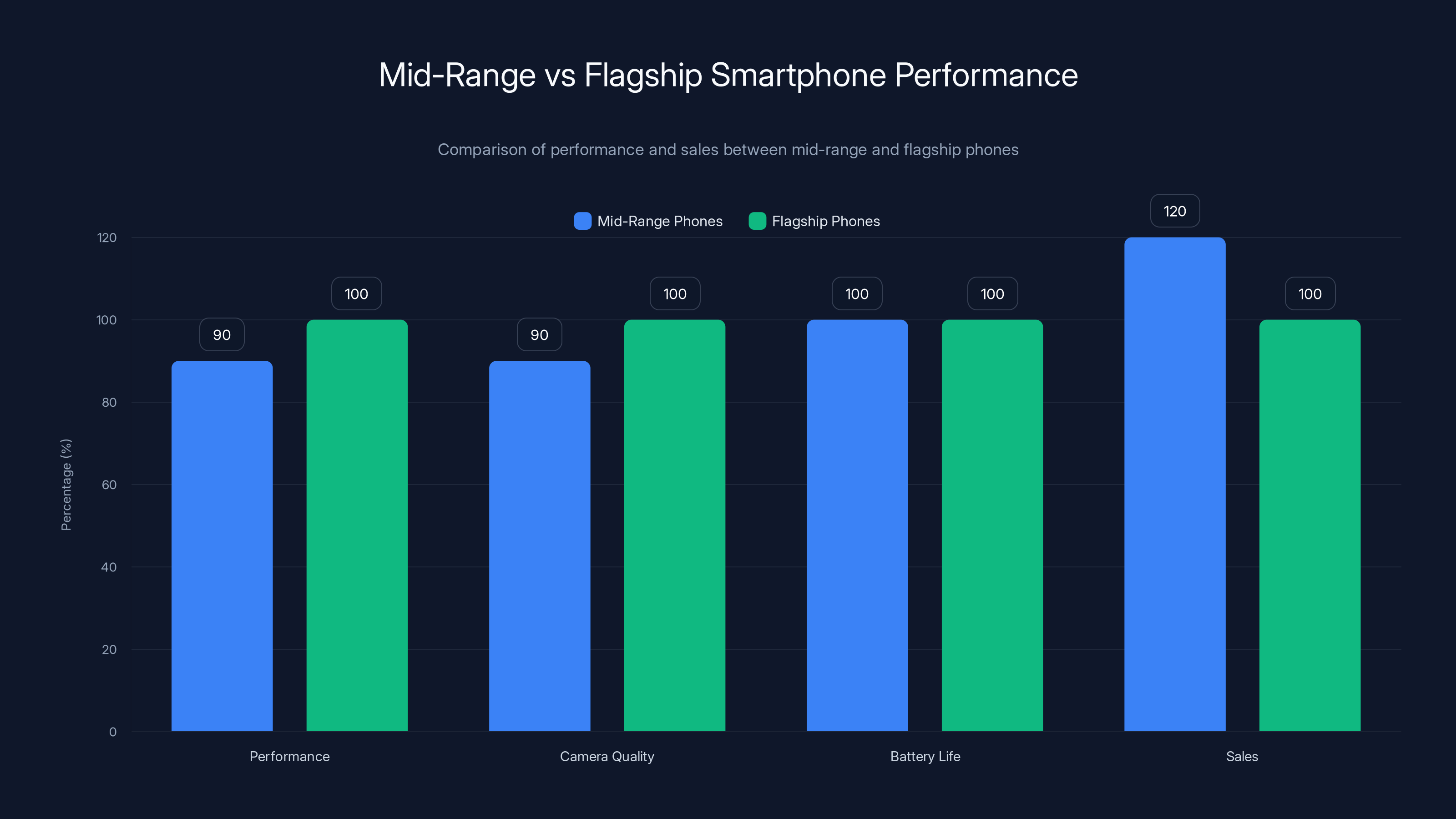

The Mid-Range Revolution Is Real

While flagships have stagnated, something unexpected happened in the mid-range market.

A $400-600 phone now offers 85-90% of flagship performance. Samsung's Galaxy A series phones, Google's Pixel 6a, OnePlus's regular models—they compete directly with flagships on everyday tasks. The processor is the same or one generation behind. The camera is nearly identical. Battery life is equivalent, as highlighted by CNET.

The only real difference? Build quality and edge-case performance.

This creates a paradox: why spend

Notable smartphone makers have quietly acknowledged this. They've stopped releasing as many flagship models and invested more in mid-range variants. Samsung's Galaxy A line outsells the flagship S line. Google's Pixel 6a sales exceeded the flagship Pixel 6 sales. This isn't accidental. It's market response, as reported by Apfelpatient.

Nothing itself entered the market in the mid-range space, then moved upmarket. But even Nothing's flagships—the Phone 2 and Phone 3—weren't positioning against iPhones and Galaxy S models. They were positioned against OnePlus flagships and Pixel phones at slightly lower price points.

When the mid-range phones are 90% as good as flagships, the flagship's value proposition vanishes. That's not a Nothing problem. That's an entire industry problem.

What Nothing Is Actually Doing Instead

Nothing isn't abandoning the phone business. The company is changing strategy, and understanding the new approach reveals where the industry is headed.

Instead of chasing yearly flagships, Nothing is focusing on refinements to existing models. The Phone 3 got an update with camera improvements. The Phone 3a arrived as a mid-range variant. These aren't major releases. They're iterations.

This mirrors what mature tech categories do. Think about camera manufacturers. Canon doesn't release a new EOS flagship every year. They release iterative updates every 18-24 months. Laptops? Dell and HP release major refreshes every 2-3 years with annual minor updates.

Smartphones are maturing into this model.

Nothing is also investing heavily in software. The Nothing OS is distinct from stock Android. The company is differentiating through OS features, not just hardware specs. This is smarter than the spec race, which favors massive manufacturers with supply chain advantages, as discussed in ThomasNet.

The company is also reportedly working on non-phone hardware—potentially smartwatches, earbuds, or IoT devices. This ecosystem play is more valuable long-term than fighting the flagship cycle against companies like Apple and Samsung that have massive advantages.

Nothing's decision to skip Phone 4 this year gives the company room to genuinely improve the next flagship instead of iterating slightly for marketing purposes. That's actually pro-consumer. It's saying: "we'll release a phone when we have something meaningful to announce."

Compare that to the industry norm, where phones get announced with features that won't work for six months, with marginal spec improvements, with marketing hype inflated to justify $1000+ price tags.

Nothing's approach is honest. It might also be a competitive advantage if consumers start valuing substance over novelty.

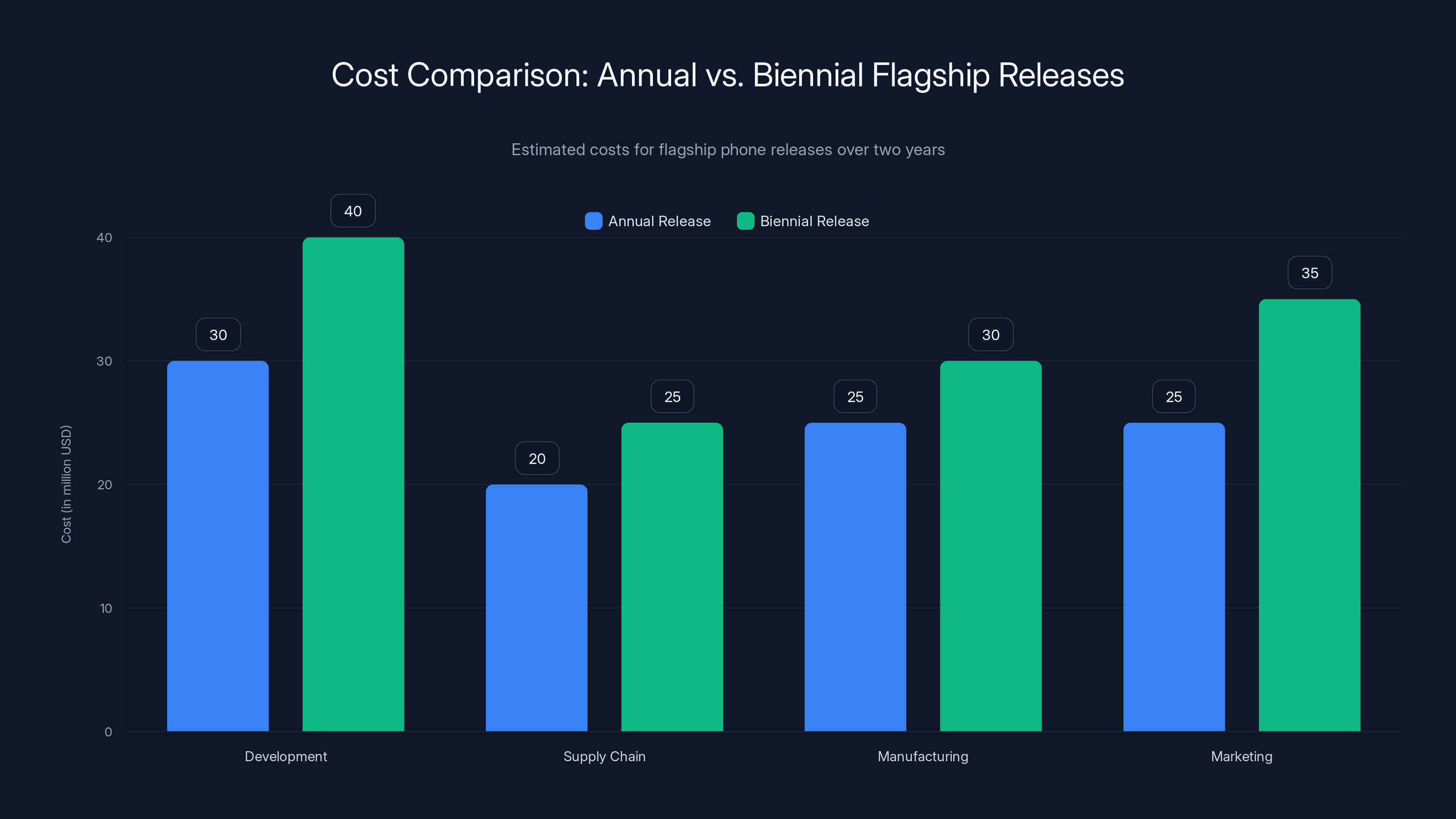

Estimated data suggests that biennial releases can save smaller manufacturers significant costs in development, supply chain, and marketing, allowing for more impactful upgrades.

Apple's Quiet Acceptance of the Reality

Apple pioneered the annual flagship cycle. The company has released an iPhone every September for fifteen years. You could set a calendar by it.

But look at what Apple actually did with the iPhone 15. The upgrade from 14 to 15 was so minor that Apple had to bundle features that still don't work with the iPhone 16 to justify it. USB-C connectivity? That should have happened in 2020. A slightly faster processor? The 14 was already overkill.

Apple's keynote presentation lasted over two hours. The actual iPhone changes took eight minutes. The company spent most of the time talking about AI features (that don't exist yet), talking about camera improvements (that are marginal), and emphasizing colors, as noted in TechRadar.

That's the death rattle of the annual cycle. When the keynote is mostly theater because the product improvements are insufficient.

Apple hasn't explicitly abandoned the yearly release schedule. But the company is clearly stretching out meaningful upgrades. Look at the performance gap between iPhone 13 and iPhone 15. It's almost nothing. Then look at the wait for iPhone 16 Pro with actual AI features that might matter—presumably requiring entirely new hardware.

Apple is managing the transition differently than Nothing. Apple can't skip a year without alarming investors and disrupting the upgrade machine. But Apple is clearly moving toward longer cycles between meaningful upgrades, with annual refresh variants to maintain the release cadence.

It's a compromise. It's not ideal. But it's what happens when you can't innovate annually anymore but have committed shareholders expecting yearly events.

Nothing doesn't have those constraints. So Nothing is being honest about it.

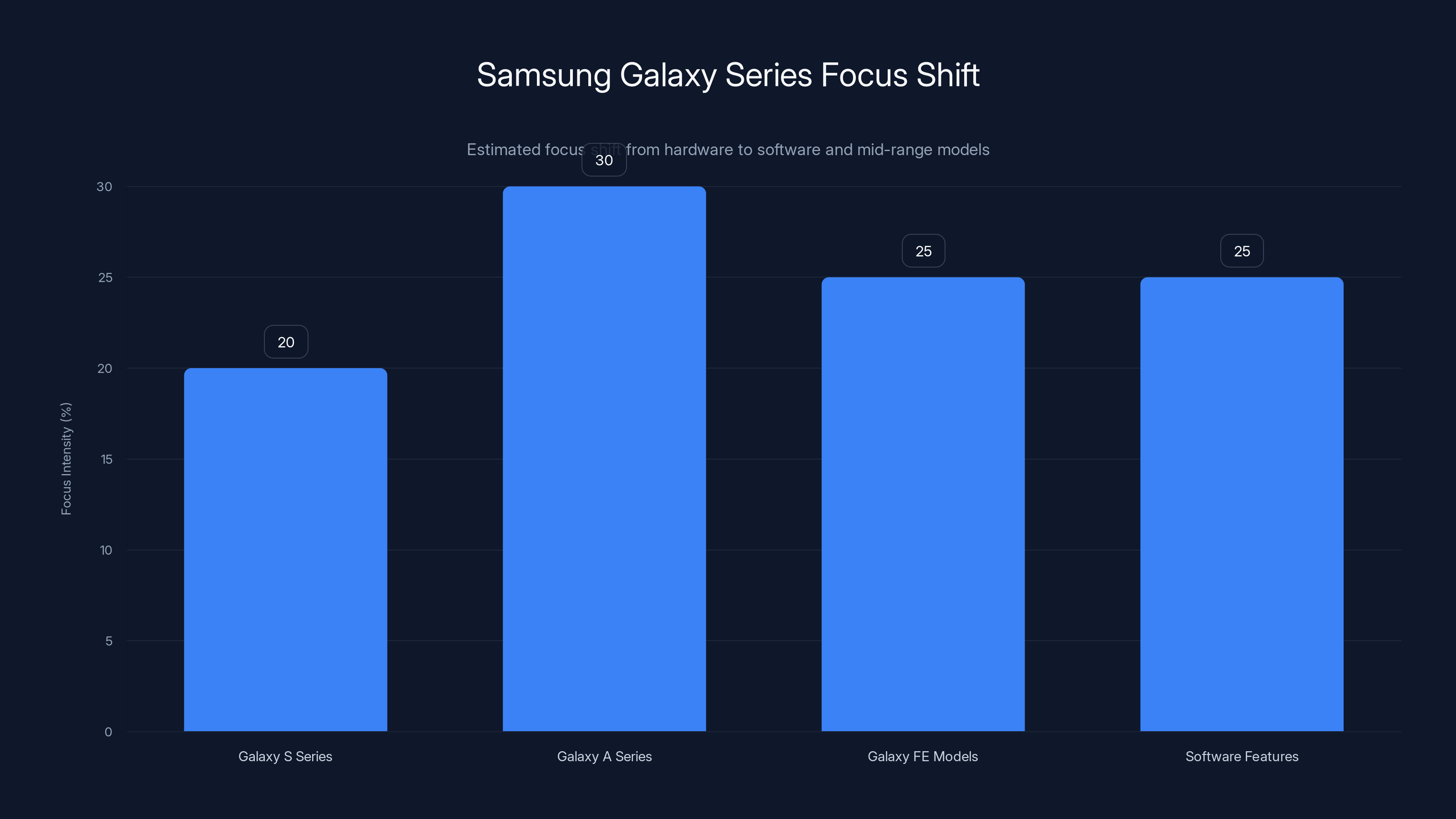

Samsung's Galaxy Strategy Shift

Samsung's approach reveals the same reality wrapped in different marketing.

The Galaxy S25 arrived with incremental improvements. The Galaxy S24 existed recently enough that comparing them directly shows how marginal the differences are. Camera improvements? Measured in processing. Performance? Benchmark gains that don't translate to real-world use. Design? Nearly identical.

Yet Samsung continued the yearly release. The company did this because Samsung, like Apple, has stakeholder expectations and massive supply chains that need to justify annual product cycles.

But look at Samsung's pivot: the company is emphasizing software features over hardware. Galaxy AI became the marketing focus because hardware improvements couldn't justify the release, as highlighted in MixVale.

This is the same shift Nothing is making, just at a different scale. When hardware improvements stop mattering, marketing pivots to software.

Samsung is also releasing more mid-range variants—Galaxy A phones, Galaxy FE models—because those phones are crushing flagship sales. The company is essentially admitting that most consumers don't need Galaxy S phones anymore.

If Samsung truly believed in yearly flagship cycles, the company would focus everything on the S line. Instead, Samsung invests resources in phones that compete with flagships at lower prices. Because that's where the market actually wants to be.

Google's Pixel Strategy Shows the Path Forward

Google's approach is most interesting because the company never committed to strict yearly releases.

Google released Pixel phones when they had something meaningful to announce. Pixel 6 took years to arrive because Google was building custom silicon. Pixel 7 came sooner because the team had momentum. Pixel 8 had an even longer gap.

Google's next release doesn't follow a calendar. It follows when Google has something to say.

This is the model Nothing is adopting. Release when the upgrade matters. Not because the calendar demands it.

Google's strategy is also interesting because it emphasizes computational photography and AI processing—advantages that last longer than hardware specs. A Pixel phone from 2021 still takes better photos than competitors in some scenarios because of the software, as noted in Tom's Guide.

This is smarter than the spec race. Hardware converges. Everyone gets access to the same processors, the same camera sensors, the same battery technology. Software and AI differentiate longer.

Nothing could follow Google's path more closely. Focus on software differentiation. Release hardware when the improvements are significant. Build an ecosystem. Let the phone be one device among many.

That's not the explosive growth path. It's not the quarterly earnings driver. But it's honest about where the market actually is.

The chart shows a decline in the percentage of performance improvements in flagship smartphones from 2018 to 2024, highlighting the diminishing returns of the annual upgrade cycle. Estimated data.

The Business Case Against Annual Flagships

Let's talk about the actual financial incentive to break the yearly cycle.

Releasing an annual flagship is expensive. Development costs are enormous. Supply chain coordination is complex. Manufacturing scale requires volume. Marketing costs are massive. And the payoff per unit has shrunk dramatically.

When a flagship upgrade provides 20% performance gain, consumers feel compelled to upgrade. The marketing message is clear. When the upgrade is 1-2% performance gain, consumers need convincing. Marketing budgets swell to compensate.

Nothing's decision to skip a year saves significant development costs. No design iteration. No new manufacturing tooling. No massive marketing campaign. The engineering team works on the next significant upgrade instead.

From a cash flow perspective, this actually makes sense for smaller manufacturers. Why spend $50-100 million annually on phones with marginal improvements when you could spend it once every two years on phones with meaningful improvements?

Larger manufacturers face shareholder pressure. Apple and Samsung are expected to deliver consistent revenue. Skipping a year would spook investors. But for smaller players like Nothing, the business case for spacing out releases is stronger than the business case for annual cycles.

This creates an interesting incentive structure: smaller, more agile manufacturers might actually be better positioned to make better products because they can skip the annual treadmill. They can take real time between releases.

Large manufacturers might be locked into yearly cycles not because it's optimal for products, but because investor expectations demand it.

Nothing just flipped that on its head.

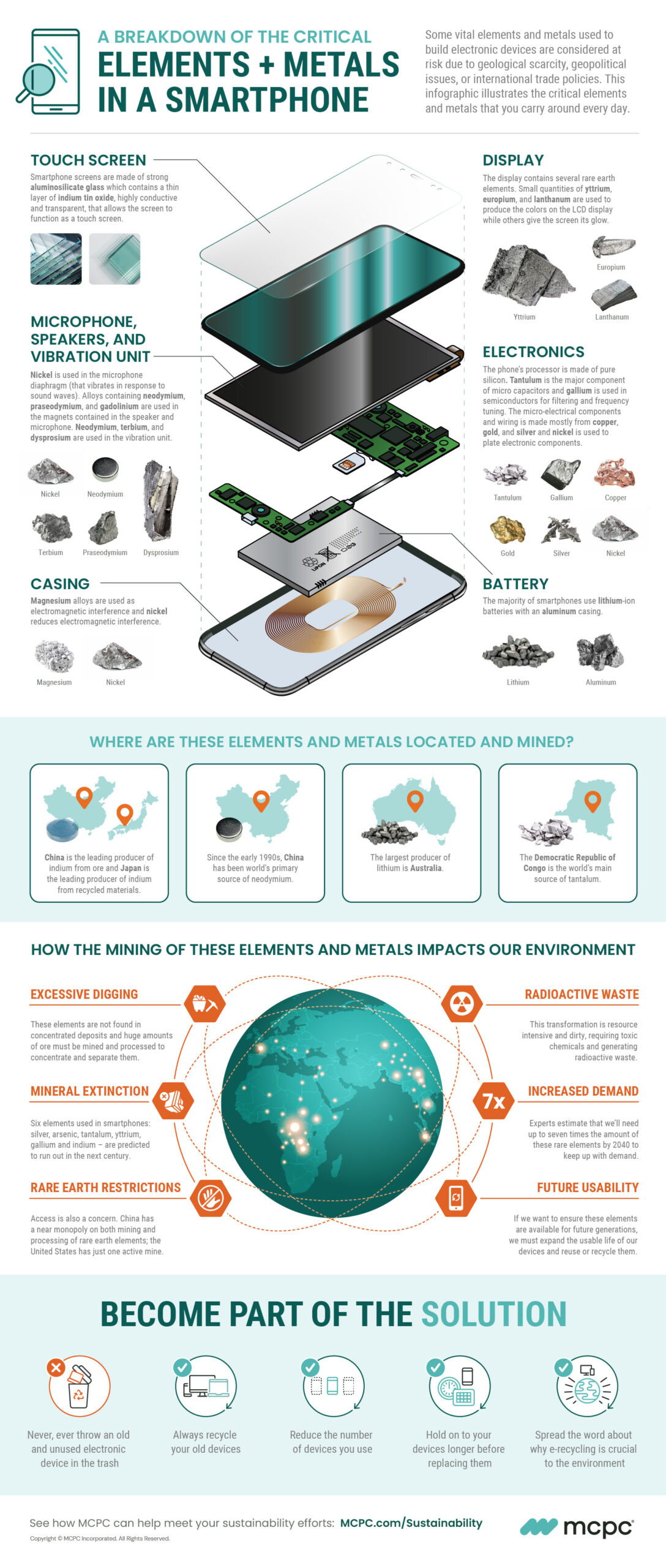

Environmental Impact and E-Waste Reduction

There's another argument for spacing out flagship releases: environmental impact.

Smartphone manufacturing is resource-intensive. Mining rare earth elements. Manufacturing processors. Building batteries. Transporting phones globally. And when a phone is replaced every year instead of every four years, that environmental cost multiplies.

A person who upgrades every four years instead of annually generates 75% less electronic waste from phones over a sixteen-year period. The environmental impact compounds across millions of users.

This hasn't been Nothing's primary stated reason for the decision. The company's CEO focused on meaningful upgrades. But the environmental case for longer cycles is substantial.

Some smartphone manufacturers have started highlighting this. Fairphone emphasizes repairability and longevity. Apple has pushed longer OS support to extend phone lifespan. But the industry as a whole still optimizes for upgrade cycles, not sustainability.

If the flagship cycle genuinely ends, reduced e-waste would be one significant benefit. Fewer unnecessary phones entering recycling streams. Lower manufacturing emissions annually.

This might become a marketing angle eventually. "This phone is designed to last five years, not one." That's a compelling message in an era where climate consciousness matters to consumers.

The Revival of Mid-Cycle Refreshes

With annual flagships possibly ending, we're seeing the rise of mid-cycle refreshes.

Apple used to do this with the iPhone 6s (released mid-way through the 6's cycle), the iPhone XS, and the iPhone 11. The company released phones between major design cycles to give people an upgrade path.

Then Apple abandoned this strategy. The company went to strict annual releases, even when designs stayed mostly the same.

Now we might see mid-cycle refreshes return. Nothing mentioned this indirectly: the company has room for significant updates to existing products like the Phone 3 between major releases.

Mid-cycle refreshes serve a real purpose. Consumers who bought a flagship two years ago have a meaningful upgrade path without waiting another year or two. The refresh doesn't require full redesign. Camera upgrades. Performance bumps. Software maturity. These matter more than they sound.

This model works better for manufacturers and consumers. Manufacturers maintain product momentum without full redesign costs. Consumers get upgrade options on their schedule, not the calendar.

We might see this pattern emerge across the industry. Annual refreshes of existing models instead of entirely new flagships every year.

Mid-range smartphones offer 85-90% of flagship performance at a lower price, with sales surpassing flagship models. Estimated data.

What This Means for Consumers

The end of the annual flagship cycle is actually good news for consumers, even if it doesn't feel like it immediately.

First, it means less marketing hype and more real product improvements. When a company skips a year, the next release better matter. Companies can't get away with marginal upgrades sold with premium marketing if the previous phone is still current.

Second, it gives consumers permission to not upgrade. The industry's entire messaging for fifteen years was: "new phone every year." That narrative created artificial urgency. If manufacturers stop pretending they've improved things dramatically, consumers stop feeling obligated to upgrade annually.

Third, it could drive prices down or at least stabilize them. Annual releases create pricing pressure. If phones release every 18-24 months instead of annually, manufacturers face less pressure to keep flagship prices escalating.

Fourth, it creates longer OS support expectations. If a phone is expected to be current for two years instead of one, manufacturers need to commit to longer software support. This is already happening—Apple's iPhones get six years of updates, Samsung's flagships get similar support.

Fifth, it shifts focus to sustainability. Longer cycles mean fewer environmental costs. This should eventually translate to better repairability, longer battery lifespan expectations, and overall more durable phones.

The consumer benefit isn't immediate gratification. It's the opposite: it's permission to not participate in the upgrade treadmill.

Industry Consolidation and Market Realities

Nothing's decision also reflects harsh market realities that aren't often discussed.

The smartphone market is consolidating. Apple and Samsung dominate. Google has a small but devoted following. Everyone else is fighting for scraps.

Nothing entered this market with a compelling design story and strong differentiation. The company's glyph interface was genuinely novel. The design was striking. But no amount of design innovation can overcome the fundamental physics of the market: there's only room for a few major players.

Nothing's decision to skip Phone 4 might reflect realistic assessment of the company's market position. Rather than compete in the annual release treadmill against manufacturers with 10x the resources, Nothing is positioning as a premium alternative that releases deliberately.

This is smart positioning. It aligns with Nothing's brand—the company stands for transparency and authenticity. An annual flagship grind would contradict that positioning.

Other smaller manufacturers might follow. OnePlus has essentially abandoned the main flagship race and shifted to mid-range dominance. Motorola has done the same. These companies realize they can't compete on the same terms as Apple and Samsung.

The annual flagship cycle was always a game smaller manufacturers could never win. Now that it's ending, smaller manufacturers have opportunity to compete differently.

The Role of AI and Software Innovation

If hardware innovation is plateauing, software and AI might drive the next cycle.

Apple's AI features, Samsung's Galaxy AI, Google's Pixel AI—all of these represent a shift toward software-based differentiation. A phone from 2023 with modern AI features might be more valuable than a phone from 2024 without them.

This is genuinely interesting because AI software can update faster than hardware cycles. Apple can release new features on existing iPhones through software updates. Google can do the same with Pixels.

This breaks the hardware release cycle entirely. If a phone from 2021 can receive significant feature updates through AI in 2025, the hardware refresh becomes optional.

Nothing hasn't leaned heavily into AI marketing yet, but the company will likely need to. Software differentiation is more sustainable long-term than hardware specs that converge annually.

The interesting question: will AI development sustain hardware cycles? Or will AI make hardware specs matter even less, further eroding the case for annual upgrades?

Most likely scenario: AI accelerates the shift away from hardware-focused innovation. Phones will be upgraded less for processing power and more for software capabilities. The flagship cycle will give way to software update cycles.

Samsung is shifting focus from flagship hardware to software features and mid-range models, reflecting market demand. (Estimated data)

Potential Risks of Abandoning Annual Cycles

There are legitimate risks to spacing out flagship releases.

First, market perception. For fifteen years, consumers expected yearly phones. Skipping a year might feel like a failure or lack of innovation capacity. The optics matter, even if the reality is different.

Nothing addressed this by being transparent. The CEO's statement wasn't apologetic. It was confident: "we want every upgrade to feel significant." That messaging flip turns a potential weakness into a strength.

Second, competitive pressure. If Apple and Samsung continue annual releases, they maintain market momentum and user attention. A phone released every year stays in the conversation. A phone released every two years disappears from headlines.

Nothing mitigates this through strong design and software differentiation. If the Phone 4 is genuinely better than competitors' 2025 offerings, the wait will have been worth it.

Third, engineering momentum. Large engineering teams need consistent projects. An annual release cycle justifies team size and budget allocation. Skipping a year could create internal challenges around resource allocation.

Nothing's team is smaller, so this is less of a problem. But larger manufacturers would struggle with this internally.

Fourth, supply chain relationships. Annual releases justify manufacturing partnerships and supplier commitments. Skipping a year could strain these relationships.

For Nothing, this is manageable. For Samsung or Apple, this would be massively disruptive.

These risks exist. But they're largely structural and incentive-based, not product-based. Companies that overcome them might actually compete better in the long run.

What Competitors Should Do

If the flagship cycle is genuinely ending, here's what other manufacturers should consider:

First, be honest about innovation cycles. Stop pretending marginal improvements are revolutionary. Consumers see through it. The credibility cost of exaggerating improvements exceeds the marketing benefit.

Second, invest in software differentiation. Hardware converges. Software can remain differentiated for years. Focus engineering resources on unique software features, not chasing Snapdragon version numbers.

Third, embrace longer OS support. If phones release every two years instead of one, promise six to eight years of updates. This gives consumers confidence in their purchase and extends phone lifespan.

Fourth, develop clear upgrade paths. Not everyone bought the last flagship. Mid-cycle refreshes and variants create upgrade options for people on different timelines.

Fifth, compete on repairability and sustainability. If phones are kept longer, durability and repair options become genuine selling points. This differentiates on real consumer needs.

Sixth, stop the spec race. Processor speeds, megapixel counts, and battery capacity are converging. These numbers don't drive purchase decisions anymore. Real-world benefits do.

Nothing's approach, whether intentional or accidental, aligns with all of these principles. The company is positioning optimally for a smartphone market that's maturing.

The Future of Smartphone Releases

What does the smartphone market look like in five years if annual flagships end?

Most likely scenario: stratified release cycles. Apple releases every 18-24 months. Samsung does the same. Google continues event-based releases. Nothing and others release deliberately.

Alternatively, the software update cycle becomes more important than hardware releases. Phones update through software features instead of new hardware. Major hardware refreshes happen every 3-4 years.

The mid-range becomes the actual flagship market. Most people buy $500-700 phones. Premium phones exist but become more niche.

Smaller manufacturers focus on different categories. Instead of competing in phones, they build watches, headphones, tablets. The phone market becomes locked into three major players.

Or, AI drives true differentiation and phones become platforms for AI computing rather than communication devices. Software becomes the product. Hardware is just substrate.

Most likely: a combination of these. Slower release cycles, more software focus, stronger mid-range, and AI as differentiator.

Nothing's decision is the first public acknowledgment that the old model is done. Others will follow quietly. Then it becomes the new normal.

Lessons for Other Industries

The smartphone industry is mature. Other technology industries are approaching similar points. What smartphones learn now, laptops and tablets will learn later.

Laptop manufacturers still release annual models. But the improvements are so marginal that most businesses replace machines on four to five-year cycles, not yearly. The market reality doesn't match the release schedule.

Tablets face the same issue. Apple's iPad Pro hasn't changed meaningfully in years, yet the company releases annual variants.

Smartwatch manufacturers are at the transition point now. Yearly releases are becoming common, but the improvements don't justify the cost.

The pattern is clear: when hardware matures, release cycles slow. Annual cycles work when real innovation exists. When innovation plateaus, slower cycles become inevitable.

Nothing is just ahead of the curve in acknowledging this.

The Strategic Brilliance of Honesty

Ultimately, Nothing's decision to skip Phone 4 this year is strategically brilliant precisely because it's honest.

The smartphone industry has spent fifteen years selling marginal upgrades as major innovations. Marketing hype exceeds product reality. Consumers have grown skeptical.

Nothing's CEO openly stated the company won't release a phone that doesn't feel like a significant upgrade. That's the opposite of the industry norm. That's trust-building.

Companies that earn consumer trust in an era of skepticism have enormous advantage. Nothing is positioning itself as the manufacturer that tells the truth about innovation instead of marketing hype.

This strategy only works if backed by genuine product improvement when phones do release. But if Nothing's next flagship is substantially better than competitors' offerings, the waiting period becomes proof of integrity.

That's the real innovation: a smartphone manufacturer that prioritizes product substance over marketing cycles.

Conclusion: The Flagship Era Is Actually Over

Nothing's CEO confirmation that there will be no Phone 4 this year isn't a delay or a setback. It's a watershed moment.

The annual flagship cycle that defined smartphones for fifteen years is over. Not because something broke, but because it matured past the point of justification.

Hardware innovation has plateaued. Consumer upgrade cycles have lengthened. Market saturation means most people have perfectly functional phones. The marginal improvements between generations don't justify new releases.

Nothing recognized this reality and had the courage to say it publicly. Other manufacturers recognize it too but are trapped by investor expectations and supply chain commitments.

The future of smartphones isn't dramatic annual releases. It's deliberate updates when they matter. It's longer OS support. It's software differentiation instead of hardware chasing. It's mid-range phones that compete with flagships. It's companies like Nothing that admit the emperor is wearing no clothes.

For consumers, this is genuinely good news. You can keep your phone longer without it becoming obsolete. You're not missing out if you skip an upgrade cycle. The pressure to participate in the treadmill is loosening.

For the industry, this is a reckoning. The business model of incremental hardware cycles isn't sustainable. Companies will need to find value elsewhere: software, services, ecosystem, sustainability.

Nothing's decision to skip Phone 4 this year signals this shift. It won't be the last manufacturer to make a similar choice. It will become the new normal.

The flagship era didn't end with a bang. It ended with a CEO calmly explaining that meaningful upgrades matter more than calendar dates.

That's probably the most honest thing anyone in the smartphone industry has said in years.

FAQ

What does Nothing's decision to skip Phone 4 mean for the smartphone industry?

Nothing's decision signals that the traditional annual flagship release cycle is no longer sustainable. The company is prioritizing meaningful product improvements over predictable yearly launches, which indicates that hardware innovation has plateaued to the point where marginal annual upgrades don't justify new releases. This likely marks the beginning of a broader industry shift toward longer release cycles, which other manufacturers will eventually need to adopt.

Why has smartphone innovation slowed down?

Smartphone hardware has matured significantly. Processors are fast enough for any mobile application, cameras capture exceptional quality, battery technology hasn't fundamentally improved in a decade, and displays have reached the point of diminishing returns. These components no longer offer the generational leaps they did in the 2010s. Additionally, physics limits how much improvement is possible within the same physical constraints, meaning continued incremental advances consume massive resources for minimal gains.

How long are people keeping their smartphones now?

Average smartphone replacement cycles have extended to approximately 4-5 years, with some data suggesting closer to 5.4 years for flagship devices. This represents a dramatic shift from the 2-3 year cycles common in the early 2010s. Longer retention is driven by phones remaining functional and performant well beyond previous obsolescence timelines, combined with reduced tangible performance improvements justifying annual upgrades.

What's the advantage of mid-range phones compared to flagship phones?

Mid-range phones now offer 85-90% of flagship performance at 50-60% of the cost. Since hardware components converge across price tiers, a

Will other smartphone manufacturers follow Nothing's lead?

It's likely, though established manufacturers face different pressures. Companies like Apple and Samsung have shareholder expectations and massive supply chains that currently require annual releases. However, larger manufacturers are already stretching meaningful innovation cycles while maintaining release cadences through iterative variants. Smaller, more agile manufacturers will probably adopt Something's approach more openly and quickly, as they lack the structural constraints of larger players.

How will software and AI change the phone upgrade cycle?

AI and software features could decouple from hardware release cycles entirely. Features can be distributed through software updates to existing phones, reducing the need for new hardware. A phone from 2023 could receive significant capability improvements through AI features in 2025 without hardware upgrades. This fundamentally changes the device refresh logic from hardware-based to software-based, potentially extending the useful lifespan of physical devices even further.

What should I do if I'm considering upgrading my phone?

If your current phone functions well and meets your needs, there's less pressure to upgrade annually than ever before. Phones remain functional and performant for 4-5 years easily. Consider upgrading only when your device actually becomes slow, the battery degrades significantly, or you need specific new features. The traditional annual upgrade cycle is no longer industry standard or necessary for most users.

Is the flagship phone market dying?

The flagship market isn't dying, but it's transforming. High-end phones will continue to exist, but they'll be differentiated by software, design, and ecosystem rather than raw performance specs. Release cycles will slow. The products will improve more substantially between releases. The marketing will shift from incremental specs to meaningful capabilities. Flagships will remain premium options, but the annual upgrade treadmill that defined them is ending.

Key Takeaways

- Nothing's decision to skip Phone 4 signals the end of the 15-year annual flagship cycle driven by diminishing hardware innovation

- Smartphone hardware has matured: processors are overkill, cameras are excellent, batteries unchanged in a decade, creating minimal generational improvements

- Consumer phone replacement cycles have extended from 2-3 years to 4-5 years because phones remain fully functional longer

- Mid-range phones now deliver 85-90% of flagship performance at 50% of the cost, fundamentally eroding premium device value

- Future competitiveness depends on software and AI differentiation rather than hardware specs that converge across manufacturers

- Manufacturers face a choice: continue unsustainable annual cycles or follow Nothing's lead with longer, more meaningful release schedules

Related Articles

- Nothing Phone 4 Delayed: What Carl Pei's Strategy Means for 2026 [2025]

- Best Foldable Phones 2025: Complete Buyer's Guide [2025]

- Small Phones Are Making a Comeback in 2025 [2025]

- LG Wing: The Foldable Phone That Changed Everything [2025]

- Clicks Communicator: The BlackBerry Revival That Actually Works [2025]

- Motorola Razr Fold: The Foldable Phone Game Changer [2025]

![Nothing CEO Confirms No Phone 4 This Year: The End of the Annual Flagship Cycle [2025]](https://tryrunable.com/blog/nothing-ceo-confirms-no-phone-4-this-year-the-end-of-the-ann/image-1-1769780196452.jpg)