The Great SSD Rebrand: What Happened to Your WD Drives

You've probably seen the name "WD Blue" or "WD Black" stamped on storage drives at Best Buy. Those iconic blue and black labels have been fixtures of consumer storage for years. But here's the thing: Western Digital effectively retired those names in 2026, replacing them with something new. And unless you follow storage news obsessively, you might not have realized it happened.

San Disk just announced a complete rebrand of its mainstream and high-performance SSD lineup. The WD Blue is now the San Disk Optimus. The WD Black is now the San Disk Optimus GX. The top-tier WD Black became the San Disk Optimus GX Pro. Same drives, same specifications, different branding. The model numbers stayed the same, which is helpful for people already searching for replacement drives. But the rebrand signals something much bigger: the fundamental reorganization of Western Digital that's been quietly reshaping the storage industry for the past two years.

This isn't just cosmetic. The rebrand reflects the completion of a massive corporate split that undid a decade-old acquisition. It shows how storage companies are repositioning themselves in a market where AI data centers are driving unprecedented demand for NAND flash memory. And it raises real questions about what this means for consumers buying SSDs right now.

Let's break down what actually changed, why it matters, and whether you should care about any of this if you're just trying to buy a fast drive for your gaming PC or laptop.

The Western Digital Split: Why This Rebrand Happened in the First Place

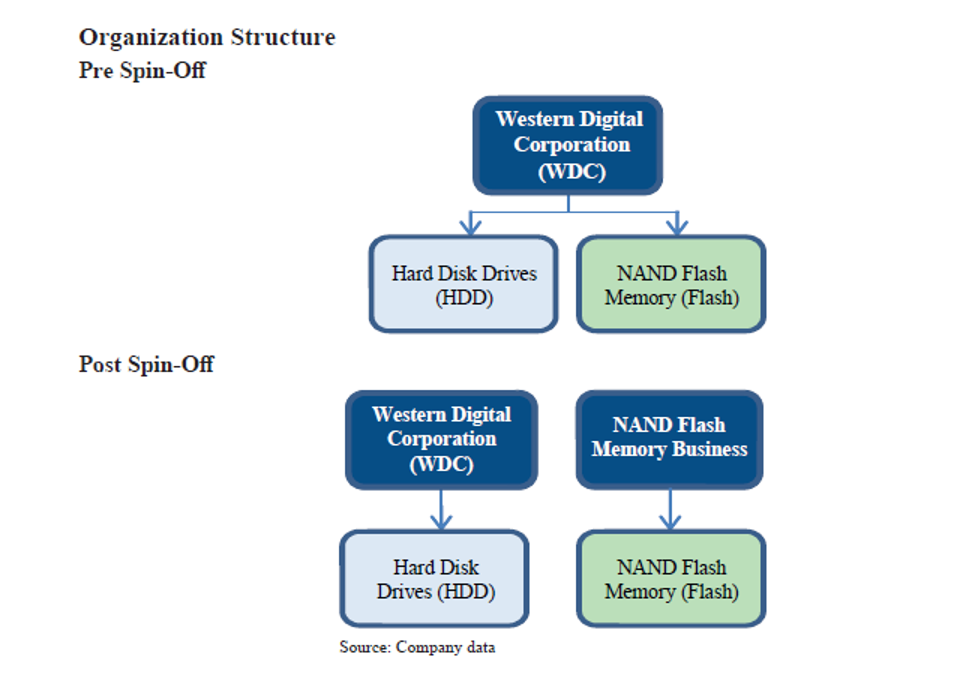

To understand why San Disk just rebranded its entire SSD portfolio, you need to go back to late 2023. Western Digital announced a massive corporate split. After more than a decade of operating as a single company, WD decided to break itself in two. The decision shocked the industry, because it effectively reversed what Western Digital had done in 2016 when it acquired San Disk for $19 billion.

Back then, consolidation made perfect sense. Western Digital manufactured spinning hard drives for data centers and creative professionals. San Disk made flash memory and SSDs. By combining them, WD created a unified storage company that could serve every market: consumer laptops, data centers, NAS systems, everything. For nearly a decade, that strategy worked. WD sold drives under multiple brand names: Blue for consumers, Black for gamers, Green for low-power applications, Red for NAS devices, and Gold for data centers.

But by 2023, the calculus had changed. Spinning hard drives were becoming obsolete in consumer systems. Nobody buys a new laptop and expects it to have a mechanical drive. But data centers still needed spinning drives for cold storage and backup systems. Meanwhile, NAND flash memory had become the bottleneck in the supply chain. AI companies were buying every SSD they could get their hands on. NAND prices were spiking. The two halves of Western Digital needed completely different strategies.

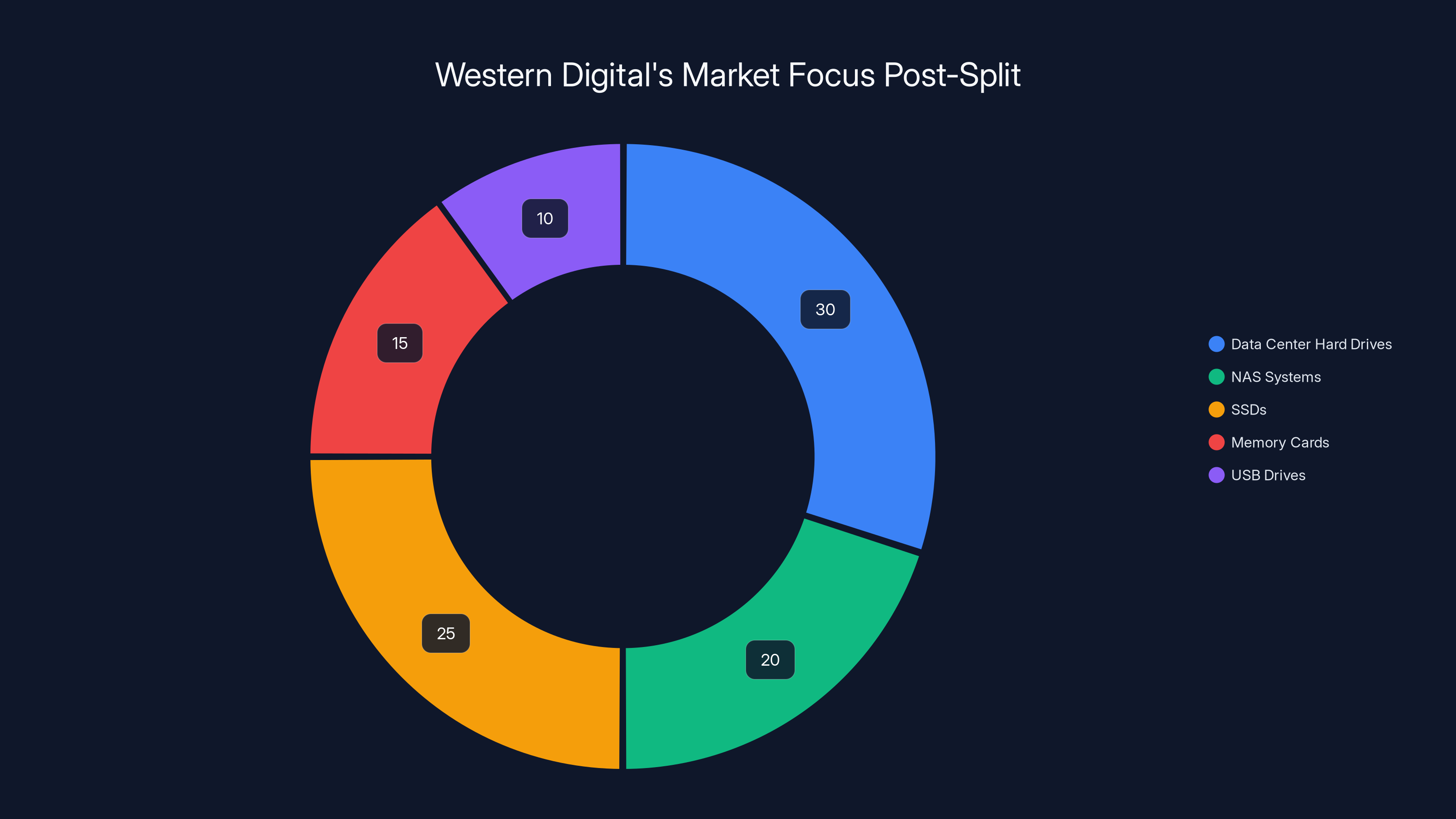

Western Digital decided to split. One company, still called Western Digital, would focus on hard drives for data centers and NAS systems. The other, a reorganized San Disk, would handle solid-state storage: SSDs, memory cards, USB drives, and everything else flash-based. The split was supposed to complete by 2025. It's now 2026, and the rebrand we're seeing is the first major consumer-facing signal that the split is actually happening.

Here's what makes this split different from a typical corporate separation: Western Digital isn't just divorcing itself on paper. The two companies need fundamentally different supply chains, manufacturing strategies, and market positions. Hard drive companies need scale and efficiency to survive on razor-thin margins. San Disk needs flexibility to serve AI companies willing to pay premium prices for high-end NAND. The split gives each company the freedom to optimize for their actual customers.

For consumers, this means something important: the SSD market is about to change. A newly independent San Disk can finally make aggressive moves in premium storage without worrying about cannibalizing Western Digital's hard drive business. That could mean faster innovation, more competitive pricing, or more storage options tailored to specific use cases. Or it could mean price increases as San Disk restructures its business. The early signals are mixed.

Estimated data shows Western Digital's post-split focus: 50% on data center and NAS hard drives, and 50% on SSDs and other flash-based products.

The New Optimus Lineup: What's Actually Different

Okay, so WD Blue becomes San Disk Optimus. WD Black becomes San Disk Optimus GX. Confusing? Yes. But there's actually logic here once you understand the tiering system.

The new naming scheme works like this: fewer words in the name means a lower-tier drive. More words means premium features. The entry-level San Disk Optimus is your everyday drive. The San Disk Optimus GX is the mid-tier performance drive. The San Disk Optimus GX Pro is the high-end option. It's cleaner than the old branding, where "WD Black" meant "high performance" but "WD Blue" meant "something else, maybe gaming, maybe not, who knows."

But here's where it gets important: the drives themselves haven't changed. San Disk is keeping the exact same model numbers. The Optimus 5100 is the rebadged WD Blue SN5100. The Optimus GX 7100 replaces the WD Black SN7100. The Optimus GX Pro 850X and 8100 take over from the WD Black SN850X and 8100.

So what's the actual difference between these drives?

The Optimus 5100 (formerly WD Blue SN5100) uses QLC flash memory. That's quad-level cell, meaning each cell stores four bits of data. It's cheaper to manufacture but also slower and less durable than higher-tier options. You'll see read speeds around 6,400 MB/s. For everyday tasks, that's plenty. For heavy video editing or competitive gaming, you'll notice the difference. This drive pairs with PCIe 4.0 speeds, so it's not a bottleneck, but it's not pushing the limits either.

The Optimus GX 7100 (formerly WD Black SN7100) steps up to TLC flash memory. Triple-level cell means better performance and durability. You're looking at closer to 7,000 MB/s read speeds. The drive uses PCIe 4.0, same as the entry-level option, but the faster flash makes a real difference in daily use. This is where most gamers and power users should be looking.

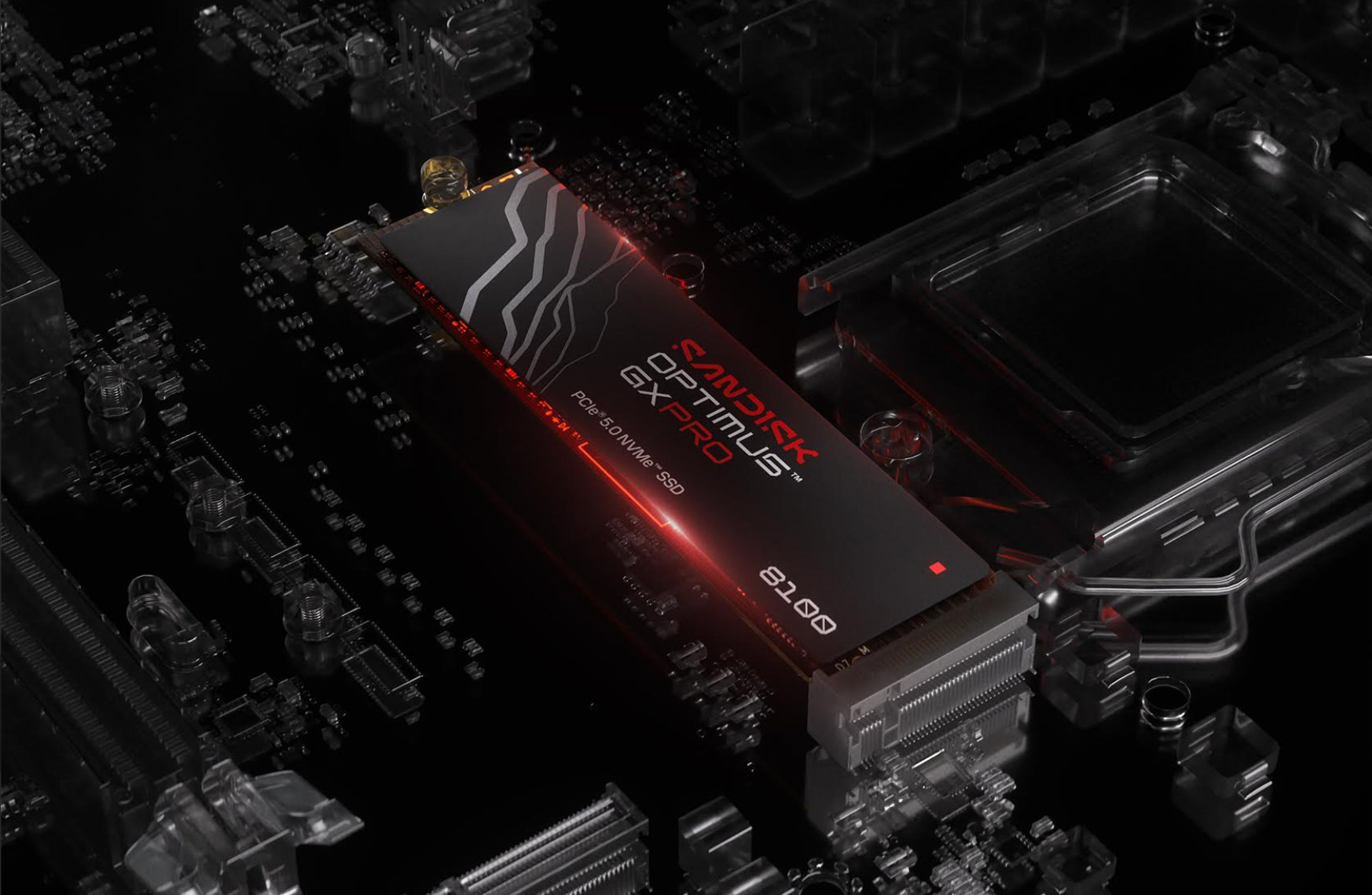

The Optimus GX Pro lineup represents the high-end options. There are actually two versions here. The 850X keeps the dedicated DRAM cache but stays with PCIe 4.0, offering a kind of "premium experience on yesterday's interface." The 8100 is the top-tier option with PCIe 5.0 support and maximum performance. We're talking 12,400 MB/s read speeds. For most people, this is overkill. For content creators working with enormous files or developers building with frequent drive access, it's transformative.

The key performance differences in one chart:

Optimus 5100: QLC Flash | PCIe 4.0 | 6,400 MB/s | Budget-friendly

Optimus GX 7100: TLC Flash | PCIe 4.0 | 7,000 MB/s | Balanced performance

Optimus GX Pro 850X: TLC Flash | PCIe 4.0 | 7,100 MB/s | Premium feels outdated

Optimus GX Pro 8100: TLC Flash | PCIe 5.0 | 12,400 MB/s | Cutting-edge speeds

San Disk kept the same model numbers, which actually helps during this transition period. If you've already got a WD Blue SN5100 in your system and the drive dies, you can search for "SN5100" and find the same drive now sold as the Optimus 5100. You won't accidentally buy something different. That's smart design on the rebrand.

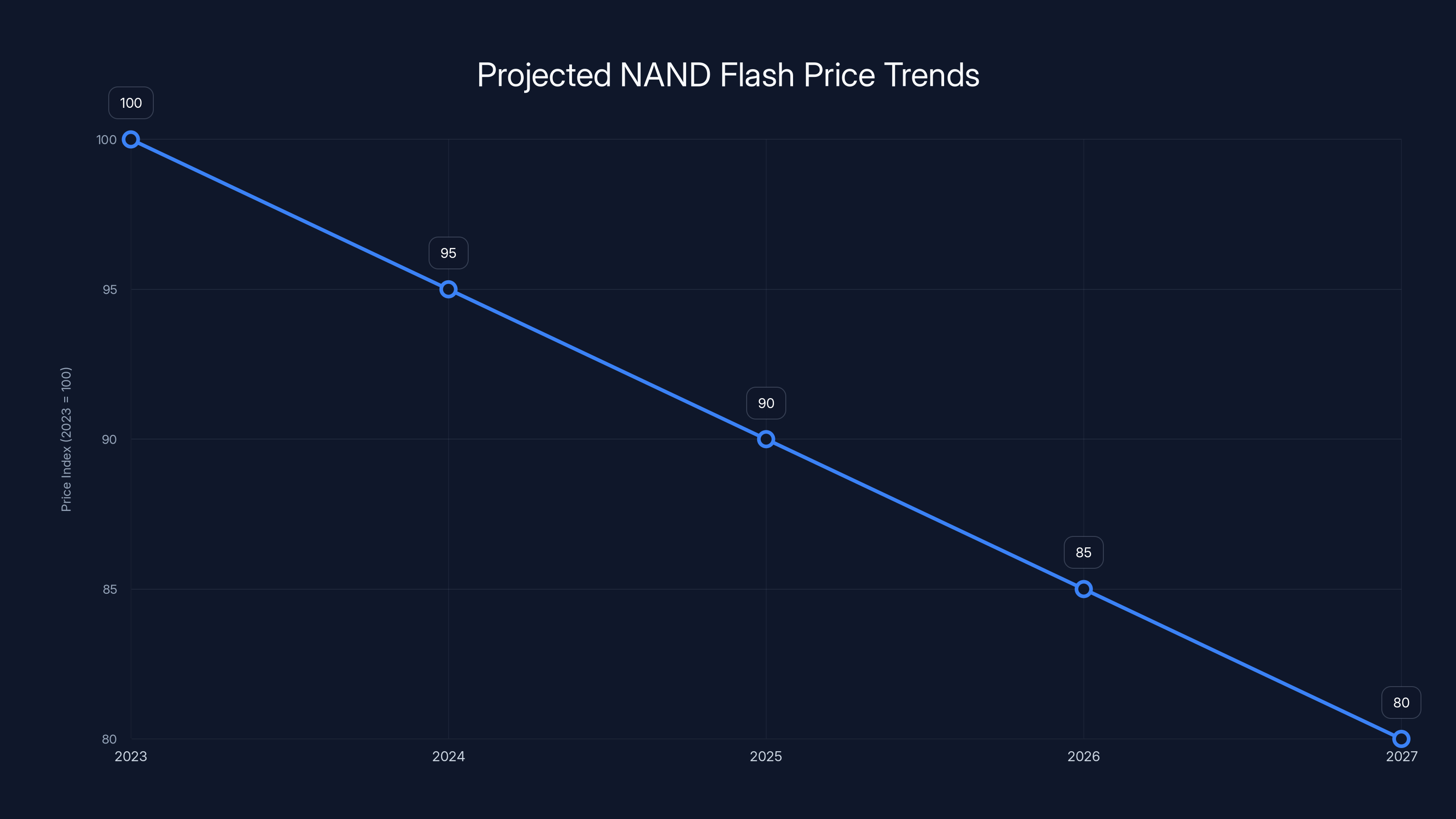

Estimated data suggests NAND flash prices might gradually decrease by 2027 as supply normalizes, following current elevated levels due to AI data center demand.

The Dashboard Switch: Software Integration and Firmware Updates

One thing people often overlook during rebrandings is the software ecosystem. WD had the WD Dashboard, a utility that let users check drive health, update firmware, and monitor performance. That software was formally discontinued a year ago.

Now, both WD-branded and San Disk-branded drives will use the San Disk Dashboard instead. This is actually an improvement for users who own both types of drives. Instead of managing two separate utilities, everything flows through one dashboard.

But here's the catch: if you're the kind of person who never updates firmware and assumes your drive just works forever, this doesn't matter. Most people fall into this category. They buy a drive, install it, and never think about it again until something breaks.

But if you're someone who cares about drive longevity, you should update firmware periodically. SSD firmware updates can improve performance, fix stability issues, and sometimes add features. They also address security vulnerabilities. The fact that San Disk consolidated the dashboard software means fewer places to check for updates. That's actually a quality-of-life improvement.

One concern: what happens to people who already have WD Dashboard installed? San Disk says users of both WD-branded and San Disk-branded drives should be able to use San Disk Dashboard to check for updates and perform maintenance. The transition should be seamless, but during any software migration, there's always potential for confusion or compatibility issues. San Disk would have been smarter to explicitly commit to automatically redirecting WD Dashboard users to the new San Disk Dashboard rather than just saying "should be able to use."

What About WD Green and WD Red? The Unanswered Questions

Here's what San Disk explicitly didn't announce: anything about WD Green or WD Red-branded SSDs. WD Green targets budget-conscious consumers who want basic SSD functionality without premium features. WD Red targets NAS systems where multiple drives work together in a storage array.

When contacted for comment, San Disk representatives said they had nothing to announce about those drives. Silence. That's concerning because it suggests one of two possibilities: either San Disk hasn't yet decided how to rebrand those drives, or they're considering discontinuing them entirely.

If San Disk discontinues WD Green, budget shoppers lose an entry-level option. SSDs have gotten cheap enough that most new PCs come with at least 512 GB of storage, but external SSD options for backup or expansion are still price-sensitive. Pulling WD Green leaves that market to Crucial, Intel, and other manufacturers.

If they discontinue WD Red, that's worse. NAS users specifically need drives tested and certified for multi-drive arrays. Those drives are specially tuned to work in RAID configurations without causing performance bottlenecks or compatibility issues. They're not expensive, but they're essential for certain use cases. An open-ended comment like "we have nothing to announce" suggests San Disk is still figuring this out.

This is a risk for consumers who depend on those product lines. If you own a NAS system and were planning to upgrade your WD Red drives, don't wait. Stockpile drives or understand what alternatives exist before WD Red gets discontinued. Micron already made a similar move, discontinuing its Crucial-branded consumer SSDs and RAM, further tightening the market.

Rebranding typically follows a pattern where consumer awareness and market stability gradually increase over time. Estimated data based on historical trends.

The Broader Storage Market: When Supply Chains Go Weird

San Disk's rebrand didn't happen in a vacuum. It happened during one of the strangest periods in storage industry history. NAND flash prices have been spiking since late 2024, driven primarily by artificial intelligence data centers consuming massive quantities of high-end storage.

AI companies aren't buying consumer SSDs. They're buying enterprise-grade NVMe drives by the thousands. But enterprise demand pushes up overall NAND prices, which cascades down to consumer pricing. At the same time, consumers and companies are panic-buying SSDs because they assume prices will climb even higher. Self-fulfilling prophecy.

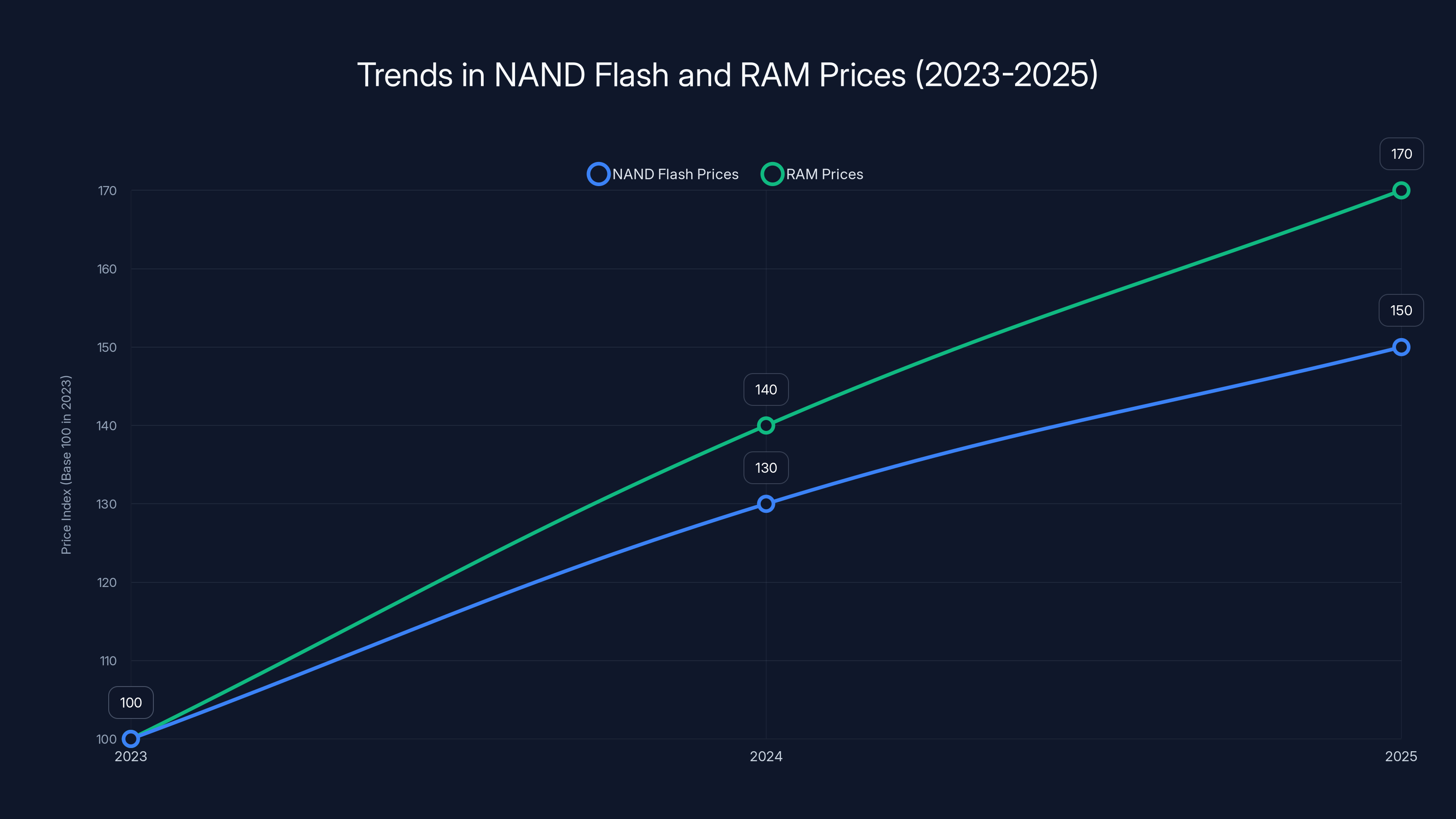

RAM has been affected even more dramatically. RAM prices spiked to five-year highs, making new PCs and laptops more expensive. SSD prices haven't increased quite as much, but they're definitely elevated compared to 2023.

Into this market chaos steps Micron. Last month, Micron announced it would discontinue its Crucial-branded consumer SSDs and RAM. This is significant because Crucial was one of the few remaining consumer-focused SSD brands offering genuine variety in pricing and performance tiers. By pulling Crucial, Micron essentially said "we're focusing on enterprise and data center storage, not consumer products."

That leaves the consumer SSD market to Samsung, Western Digital (spinning drives) and San Disk (SSDs), Intel, Kingston, and a few smaller players. Less competition typically means less pressure to innovate and more room for price increases.

Here's the pattern: Major storage companies are repositioning for an AI-dominated world. Consumer storage is becoming less important. The profit margins are better in enterprise and data center storage. So companies are either consolidating consumer lineups (like San Disk with its rebrand) or exiting consumer markets entirely (like Micron with Crucial).

For consumers, this is a warning sign. Stock up on consumer drives if you're happy with your current options. Once these rebrandings settle out, availability might be more limited. Prices are already elevated and show no signs of dropping quickly.

How to Navigate the Rebrand: A Practical Guide for Buyers

If you're actually shopping for an SSD right now, here's what you need to know to avoid confusion.

First, understand that WD-branded and Optimus-branded drives are the same products, just with different labels. If you see a WD Blue SN5100 and a San Disk Optimus 5100 on the shelf for the same price, grab whichever one is available. They're identical. The WD branding is older inventory; the Optimus branding is new stock. Eventually, all WD labels will disappear and only Optimus will remain.

Second, the naming tier system actually works. More words in the name means better performance. Optimus is entry-level. Optimus GX is mid-tier. Optimus GX Pro is high-end. This is objectively clearer than the old WD Blue/Black system, which confused people because the names didn't obviously indicate performance differences.

Third, don't panic about needing to buy now. Prices are elevated, but that's not unique to San Disk. Every NAND manufacturer is facing supply constraints and pricing pressure. Whether you buy a San Disk drive or a Samsung drive, you're paying inflated prices. Waiting probably won't help unless you can wait until late 2026 or 2027.

Fourth, check what software you're actually using. If you've been using WD Dashboard, know that you'll need to transition to San Disk Dashboard. If you've never used either, don't worry about it. Most users never update firmware or monitor drive health anyway.

Fifth, be cautious about WD Green and WD Red. If you specifically need those product lines, buy now while they're still available. Once discontinuation is official, your options narrow significantly.

Here's a practical decision tree:

- Are you upgrading an existing WD Blue or WD Black drive? Buy the Optimus equivalent with the same model number. Instant compatibility.

- Are you buying for a gaming PC or laptop? Go with Optimus GX 7100. That's where the price-to-performance sweet spot is for most users.

- Are you a professional working with large files? Consider Optimus GX Pro 8100. The PCIe 5.0 speeds actually matter for your workflow.

- Are you on a strict budget? Optimus 5100 is fine for everyday tasks, but expect slightly slower performance than GX.

- Are you setting up a NAS or backup system? Don't buy a consumer drive. Look for WD Red alternatives or enterprise options. Consumer drives aren't designed for this.

NAND flash and RAM prices have been rising since 2023, driven by AI data center demand. RAM prices have increased more sharply than NAND flash prices. (Estimated data)

Performance in Real-World Use: Does the Rebrand Change Anything?

Here's the honest truth: in real-world use, most people won't notice the difference between Optimus 5100 and Optimus GX 7100. Both are fast. Both are faster than the mechanical drives that used to come standard. Both will boot Windows or mac OS in under 20 seconds. Both can transfer files at speeds that max out USB 3.0 bandwidth.

Where you notice the difference is in specific scenarios. If you're rendering 4K video, the higher-tier drive's sustained write speeds matter. If you're moving gigabytes of files around frequently, the faster read speeds add up. If you're compiling code or running heavy simulations, the extra performance shaves meaningful time off the operation.

But if you're browsing the web, using Office, and watching Netflix, your 2023 SSD is just as fast as a 2026 flagship. Storage performance is one of those areas where good enough is genuinely good enough for most people.

The rebrand doesn't change this equation. A Optimus 5100 performs exactly like the WD Blue SN5100 it replaces. There's no mysterious software tuning making the new brand faster. It's literally the same hardware.

What might change is availability and pricing. If San Disk streamlines its manufacturing to focus on fewer SKUs, that could improve availability and potentially lower prices. Or it could mean you have fewer options and higher prices. The early signals aren't clear yet.

One thing worth watching: San Disk's warranty policies. Sometimes when companies rebrand, they use the rebrand as an opportunity to change terms. Check the warranty on Optimus drives compared to WD Blue equivalents. Hopefully they're identical, but it's worth verifying.

The Supply Chain Implications: Why This Matters Beyond Marketing

This rebrand isn't just a marketing exercise. It's an operational restructuring. By consolidating SSD branding under Optimus, San Disk simplifies its supply chain. Fewer distinct products means fewer manufacturing variants, fewer SKUs to track, fewer packaging designs.

In a supply-constrained market, simplification actually matters. Every efficiency gain means more drives can be manufactured with the same NAND allocation. It also means San Disk can respond faster to market demands. If enterprise customers suddenly want more high-end drives, San Disk can shift production without worrying about maintaining Blue/Black/Green/Red inventory balances.

But simplification also means standardization. If you've got a specific need that doesn't fit into the Optimus/GX/GX Pro tiers, you're out of luck. The rebrand trades flexibility for efficiency.

This is the paradox of consolidation: It makes things clearer for average consumers and more efficient for manufacturers, but it eliminates niche products that specialized users depend on. WD Green served a purpose for people building energy-efficient systems. WD Red served a specific purpose for NAS users. By potentially eliminating those categories, San Disk is basically saying "those markets aren't important to our strategy anymore."

For the storage industry as a whole, this represents a philosophical shift. Companies are optimizing for high-volume, high-performance scenarios, not edge cases. That's rational from a business perspective, but it's worth noting as a consumer or IT professional who might depend on those edge cases.

SSD prices are projected to remain elevated through 2026 due to supply constraints and market dynamics, with a potential drop in Q1 2027 as NAND supply improves. Estimated data.

Timeline: When Will WD Blue and Black Actually Disappear?

Here's the thing San Disk didn't explicitly state: there's a transition period where both WD and Optimus branding will coexist. You'll see WD Blue drives in retail stores for months, maybe longer. These are old inventory that retailers are slowly selling through. Some smaller retailers might stock WD-branded drives for years if they don't have high turnover.

But from a manufacturing perspective, the switch is immediate. San Disk isn't making new WD Blue drives anymore. Every WD Blue sold is from existing inventory. Every new drive rolling off the manufacturing line comes with Optimus branding.

For consumers buying right now, this means you might find WD Blue drives at slightly discounted prices as retailers try to clear old stock. It's worth checking multiple retailers and comparing WD Blue to Optimus GX pricing. If there's a 10-15% discount on the WD Blue, grab it. If pricing is identical, go Optimus because at least the packaging and documentation won't be outdated.

The timeline matters for another reason: driver and firmware support. San Disk needs to support WD-branded drives for at least several years after the rebrand, otherwise it's abandoning existing customers. San Disk Dashboard should work with both WD and Optimus drives indefinitely. But as time passes, it's inevitable that support becomes less prioritized.

Lessons from Previous Rebrands: What History Teaches Us

This isn't the first time a major storage company rebranded its lineup. When Crucial took over Intel's consumer SSD business years ago, there was a similar transition period. When Seagate acquired certain product lines from competitors, there were consolidations. These rebrands usually follow a pattern:

- Announcement and confusion (now): Current customers don't understand what's happening, some buy duplicate products by accident, retailers have to clear old stock.

- Gradual transition (next 6-12 months): Old branding slowly disappears from retail, support for both brands continues, pricing normalizes.

- Stabilization (1-2 years): New branding dominates, old products are obsolete, customers accept the new names.

- Optimization (2+ years): Company streamlines product lines, discontinues slow sellers, raises prices on popular models.

San Disk is right at the beginning of step one. We're in the confusion phase. The practical advice is to wait for step two if you don't urgently need an SSD. By mid-2026, the market will have sorted itself out, availability will be more predictable, and you'll have better information about which Optimus models are actually worth buying.

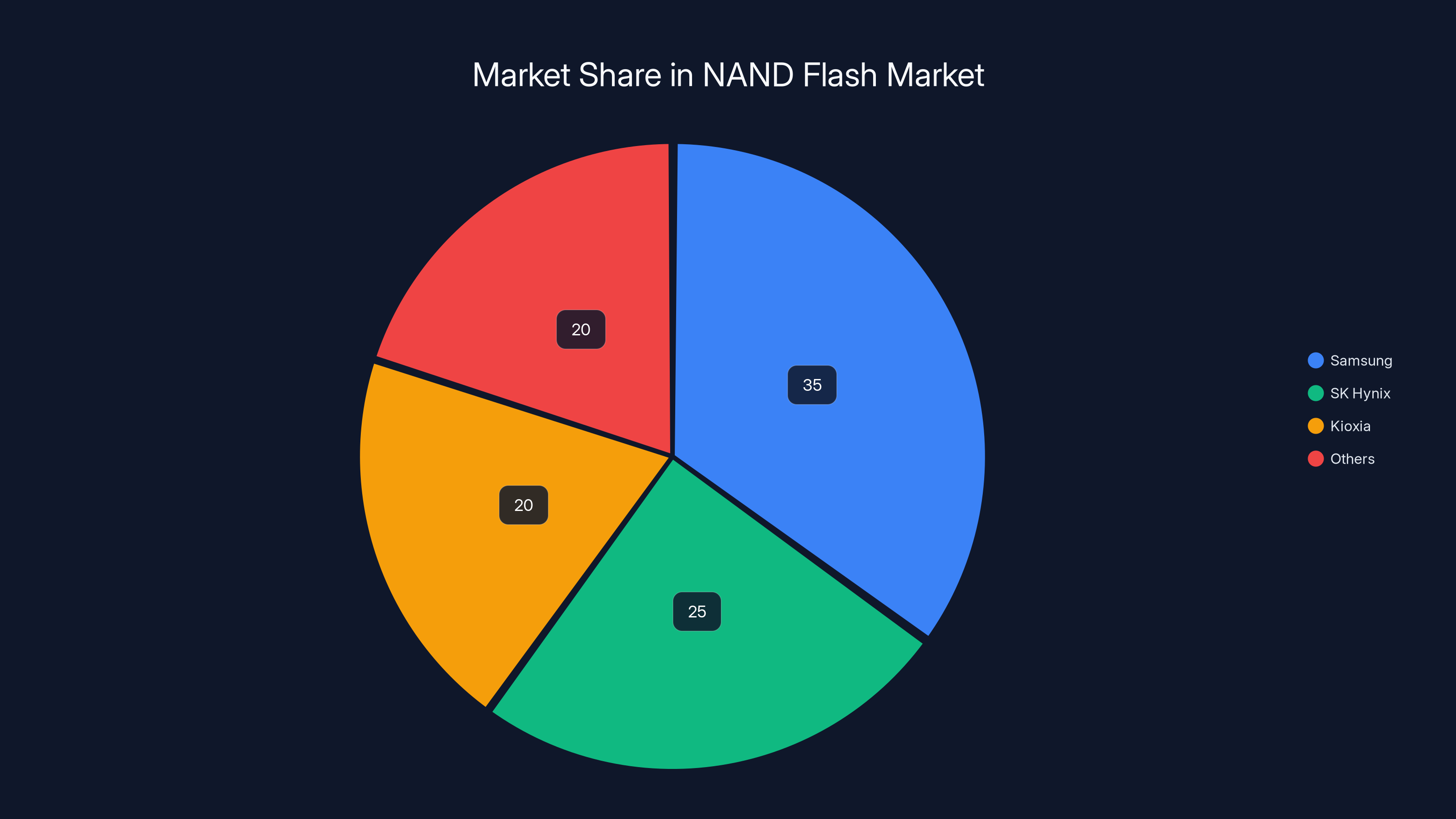

Estimated data shows Samsung, SK Hynix, and Kioxia dominating the NAND flash market, collectively holding 80% of the market share. This consolidation limits consumer choices.

What This Means for the Broader Industry: Consolidation and Strategy

The San Disk rebrand is one piece of a larger industry consolidation. In storage, we're seeing fewer companies, more specialized product lines, and increasing focus on high-margin enterprise and AI markets.

Western Digital was one of the last integrated storage companies serving both consumer and data center markets simultaneously. By splitting into two companies, WD is essentially conceding that you can't optimize for both markets anymore. Data centers want volume, efficiency, and cost. Consumers want performance, features, and variety. Those are incompatible goals.

Once San Disk fully separates, it can aggressively pursue enterprise and AI markets without the hard drive business holding it back. Western Digital can optimize hard drives for data centers without worrying about consumer SSDs. It's actually a smarter strategy than trying to serve everyone.

But for consumers, it means fewer choices long-term. As storage companies consolidate, you're left with fewer options at each price point. This is already happening in SSDs: Samsung, SK Hynix, and Kioxia dominate the NAND flash market. Adding consolidation at the SSD level (fewer brands, fewer product tiers) further narrows consumer choice.

The good news: competition between the remaining players should still drive innovation. Samsung still aggressively competes with San Disk, Intel still invests in storage R&D, and smaller players like Kingston and Crucial (while exiting some markets) still compete in others.

The bad news: consolidation typically leads to price increases eventually. When there are only three or four major players instead of ten, margins improve. Those improved margins often come from price increases, not efficiency gains.

Firmware, Longevity, and Long-Term Support Questions

One aspect of the rebrand that San Disk glossed over: firmware support for older WD drives. If you bought a WD Blue in 2023 and own it for five years, will San Disk still provide firmware updates? The company says it should be able to do this through San Disk Dashboard, but that's not a guarantee.

Historically, storage companies maintain firmware support for 5-7 years after a drive's release. That's how long it typically takes for a drive to become technologically obsolete. A 2023 WD Blue should receive firmware support until around 2030.

But here's where rebranding creates uncertainty: if San Disk stops identifying products by WD branding in its support systems, it might accidentally drop support for older drives. Or it might deliberately terminate support for WD-branded products to force users to buy new Optimus drives.

This is unlikely, but it's something to monitor. If you're buying a WD Blue now, keep documentation proving you own it. Take screenshots of the drive's specifications and serial number. In five years, if San Disk claims it doesn't support your WD Blue anymore, you'll have proof of what you actually own.

This also matters for warranty claims. San Disk inherits WD's warranty obligations for WD-branded products, but sometimes rebrands complicate warranty processes. Make sure you have documentation of your drive's warranty period and original purchase date before the rebrand fully completes.

The Environmental and E-Waste Implications

Rebranding millions of drives has an environmental cost. Every drive that gets relabeled, repackaged, or re-marketed generates waste. Retailers have to dispose of old packaging. Warehouses full of WD Blue inventory need to be moved to make room for Optimus stock. This inefficiency has real environmental consequences.

It also extends the life of products in landfills. Old marketing materials, packaging, and documentation all end up as waste. For a company like San Disk operating at scale, this adds up quickly.

There's a better way to handle rebrands: minimal packaging changes, digital-first marketing, and keeping old product documentation online indefinitely. But most companies don't prioritize this, and San Disk hasn't indicated it will be different.

The silver lining: SSDs are substantially more energy-efficient than the mechanical drives they replace. The environmental cost of manufacturing and shipping some extra packaging is negligible compared to the energy savings from millions of users switching to solid-state storage. But it's still worth noting that rebranding isn't cost-free from an environmental perspective.

Price Predictions: Where Will SSD Costs Go?

San Disk isn't announcing price changes with this rebrand, which is good. But that doesn't mean prices will stay stable. Several factors suggest upward pressure on SSD pricing in the coming months.

NAND supply constraints: AI companies are buying every available NAND chip. Fabrication plants can't manufacture fast enough. Until AI demand softens or new fabrication capacity comes online, NAND will be expensive.

Consolidation effects: Micron dropping Crucial is reducing competition. Fewer competitors typically means less pressure to lower prices.

Market confidence: Storage companies that successfully execute rebrands often use that moment to test price increases. If customers accept the new branding, companies are more confident raising prices.

Geopolitical factors: Storage manufacturing is concentrated in South Korea, Japan, and Taiwan. Any geopolitical disruption cascades through the entire supply chain. Companies build price premiums to hedge against this risk.

Based on historical patterns, expect SSD prices to hold steady or increase slightly through 2026, then potentially drop in 2027 when NAND supply normalizes and AI demand moderates. If you're flexible on timing, waiting until Q4 2026 or Q1 2027 might get you better pricing. If you need storage now, accept that prices are inflated and buy accordingly.

Here's a rough projection:

- Now (Q1 2026): Prices elevated, supply uncertain

- Q2-Q3 2026: Prices stabilize, supply improves slightly

- Q4 2026: Holiday demand pushes prices up

- Q1 2027: Prices drop as new NAND capacity comes online

This is an educated guess based on historical patterns, not a guarantee. Global events could change this timeline significantly.

How to Check If Your Drive Is WD or Optimus: Practical Identification Tips

If you currently own a drive and want to know what you actually have, there are several ways to check:

Physical inspection: Look at the label. If it says "WD Blue" or "WD Black," that's the old branding. If it says "San Disk Optimus," it's the new branding.

Model number check: Your drive has a model number like "SN5100" or "SN7100." That model number is identical between WD and Optimus versions. You can look up that model number online and find specifications regardless of branding.

Software identification: Open San Disk Dashboard or WD Dashboard on your computer. It should identify your drive correctly and show you the exact model and firmware version.

Windows device manager: Press Windows+R, type "devmgmt.msc," and look under "Disk Drives." Your SSD will be listed with its model number visible.

The reason this matters: if you need a replacement drive, knowing your exact model number ensures you get something compatible. It's less about WD versus Optimus branding and more about confirming you have the right specifications.

Looking Forward: What's Next for San Disk After This Rebrand

This rebrand is just the beginning. Once San Disk fully separates from Western Digital and stabilizes the Optimus lineup, it can actually start differentiating products. Right now, it's just rebranding existing offerings. But a newly independent San Disk can develop completely new SSD architectures optimized for specific use cases.

Expect San Disk to eventually release:

- Optimus AI Edition: SSDs optimized for machine learning workloads, with specialized features for high-frequency random access patterns

- Optimus Creator: Drives targeting video editors and 3D artists, with massive cache and sustained performance

- Optimus Gaming: Purpose-built for gaming with fast load times and optimized for game file access patterns

- Optimus Enterprise: Separate product line for data centers and servers

These don't exist yet because WD Blue/Black branding forced all of them into generic categories. Once Optimus is established, San Disk has room to innovate.

The timeline for innovation probably stretches into 2027-2028 as San Disk completes the split from Western Digital and reorganizes internally. But the direction is clear: specialized products for specialized markets, not generic drives trying to serve everyone.

Conclusion: Making Sense of Change in Storage Market

San Disk's rebrand of WD Blue and Black drives to Optimus isn't major news for most consumers. It's a continuation of a corporate reorganization announced years ago. But it does signal important shifts in how storage companies are positioning themselves in an AI-dominated world.

The summary: WD Blue becomes San Disk Optimus. WD Black becomes San Disk Optimus GX. Specifications don't change, just branding. A newly independent San Disk can optimize for premium and enterprise markets without balancing the needs of a hard drive business.

For you as a consumer, this means:

- If you're buying an SSD now: Accept elevated prices, they're industry-wide. Go with Optimus GX 7100 unless you have specific needs.

- If you own WD drives: They'll work fine. Software support should transition smoothly to San Disk Dashboard.

- If you depend on WD Green or Red: Be cautious. San Disk hasn't clarified their future, so consider buying extras now.

- If you're waiting to buy: Q4 2026 or Q1 2027 might offer better pricing as NAND supply normalizes.

Storage is one of those technology categories where understanding the business dynamics helps you make better purchasing decisions. This rebrand is mostly business dynamics playing out in public. Understand the strategy, and you understand why the change happened and what it means for your options going forward.

The drives are solid. The rebrand is logical. The market is complex. And like most technology shifts, the actual impact on your daily computing experience will be minimal, even if the corporate implications are significant.

FAQ

What exactly changed with the WD Blue and Black rebrand?

The drives themselves haven't changed at all. San Disk simply rebranded them with new names: WD Blue is now San Disk Optimus, WD Black is now San Disk Optimus GX, and top-tier WD Black is now San Disk Optimus GX Pro. The model numbers stayed the same, so if you search for an "SN5100," you'll find it under both the old WD Blue branding and new Optimus branding. It's the same hardware with different labeling.

Why did this rebrand happen in the first place?

San Disk rebranded after Western Digital completed a corporate split announced in 2023. Western Digital separated itself into two independent companies: one focused on hard drives (traditional Western Digital), and one focused on solid-state storage (reorganized San Disk). The rebrand reflects the completion of that separation, allowing San Disk to operate as an independent company with its own branding strategy rather than using the Western Digital name for consumer SSDs.

Should I wait to buy an SSD or buy now?

NAND flash prices are currently elevated due to AI data center demand, but this isn't unique to San Disk drives. All major SSD manufacturers are experiencing supply constraints and pricing pressure. If you need storage urgently, buy now rather than waiting, because prices are unlikely to drop significantly in the next few months. If you're flexible, waiting until late 2026 or early 2027 might get you better pricing as NAND supply normalizes. However, no one can predict exactly when that normalization happens.

Will my existing WD Dashboard software still work with the new Optimus drives?

San Disk says that users of both WD-branded and San Disk-branded drives should be able to use the San Disk Dashboard software to check for firmware updates and perform maintenance. However, the transition may not be seamless, so be prepared to uninstall WD Dashboard and install San Disk Dashboard separately. The transition should be straightforward, but it's worth planning ahead if you currently use WD Dashboard.

What's the performance difference between the Optimus tiers?

Optimus 5100 uses slower QLC flash and delivers about 6,400 MB/s read speeds, making it fine for everyday use. Optimus GX 7100 uses faster TLC flash and reaches around 7,000 MB/s, offering noticeably better gaming and creative performance. Optimus GX Pro uses even faster TLC flash and adds either PCIe 5.0 support (850X and 8100 models) with speeds up to 12,400 MB/s, making it suitable for professional workflows. For most people, Optimus GX 7100 hits the sweet spot between price and performance.

What happened to WD Green and WD Red SSDs?

San Disk hasn't announced any changes to WD Green (entry-level) or WD Red (NAS-specific) drives. The company told Ars Technica it has nothing to announce about those product lines, which creates uncertainty. If you specifically depend on either product, consider buying replacement drives now while they're still available, as discontinuation may be coming but hasn't been officially announced.

How long will San Disk provide firmware updates and support for WD-branded drives?

San Disk hasn't provided a specific timeline, but historically storage companies maintain firmware support for 5-7 years after a drive's release. The company says both WD and Optimus drives will be supported through San Disk Dashboard, but as time passes, prioritization will naturally shift toward newer Optimus products. Document your WD drives' model numbers and serial numbers now so you have proof of ownership if warranty or support issues arise later.

Can I directly replace a WD Blue with an Optimus GX 7100?

Yes, as long as you're replacing the same model number. If you have a WD Blue SN5100 and buy an Optimus 5100 (which is the rebranded version of the same drive), compatibility is 100% guaranteed because it's identical hardware. If you want to upgrade to a better drive, Optimus GX 7100 is compatible with any system that currently has a WD Blue, as both use PCIe 4.0 and fit the same M.2 slot. However, buying a different model from the GX Pro line requires checking your motherboard's capability to actually support PCIe 5.0 if you go for the newer version.

How does this rebrand affect SSD market competition?

This rebrand reduces visible competition somewhat, since there are now fewer distinct consumer SSD brands in retail. Combined with Micron's recent decision to discontinue Crucial consumer SSDs, the number of companies serving consumer storage has shrunk. Fewer competitors typically means less pricing pressure long-term, though Samsung and Intel still actively compete in the consumer SSD market. The consolidation also suggests storage companies are focusing more on enterprise and AI markets than consumer products, which could lead to less innovation in consumer SSDs going forward.

Key Takeaways

- WD Blue is now SanDisk Optimus; WD Black becomes Optimus GX; specs remain identical with rebranded packaging

- The rebrand reflects Western Digital's completed corporate split separating hard drives and SSDs into independent companies

- NAND flash prices remain elevated due to AI data center demand; expect prices to stabilize in late 2026 or 2027

- SanDisk consolidated dashboard software into SanDisk Dashboard, retiring the WD Dashboard after formal discontinuation

- Storage market consolidation continues: Micron discontinued Crucial consumer SSDs, reducing competition and expanding choices in premium segments

- Optimus GX 7100 offers the best price-to-performance ratio for most consumers; Optimus GX Pro targets professionals with PCIe 5.0 performance

- WD Green and Red drives status remains unclear; consumers depending on those product lines should consider buying now while available

![SanDisk Optimus SSDs Replace WD Blue & Black: What You Need to Know [2025]](https://tryrunable.com/blog/sandisk-optimus-ssds-replace-wd-blue-black-what-you-need-to-/image-1-1767643600197.jpg)