Sarah Bond Leaves Xbox: Microsoft Gaming Undergoes Seismic Leadership Shift

Something big just shifted at Microsoft. Microsoft's leadership structure for gaming is getting a complete overhaul, and the timing tells you everything you need to know about where the company is headed.

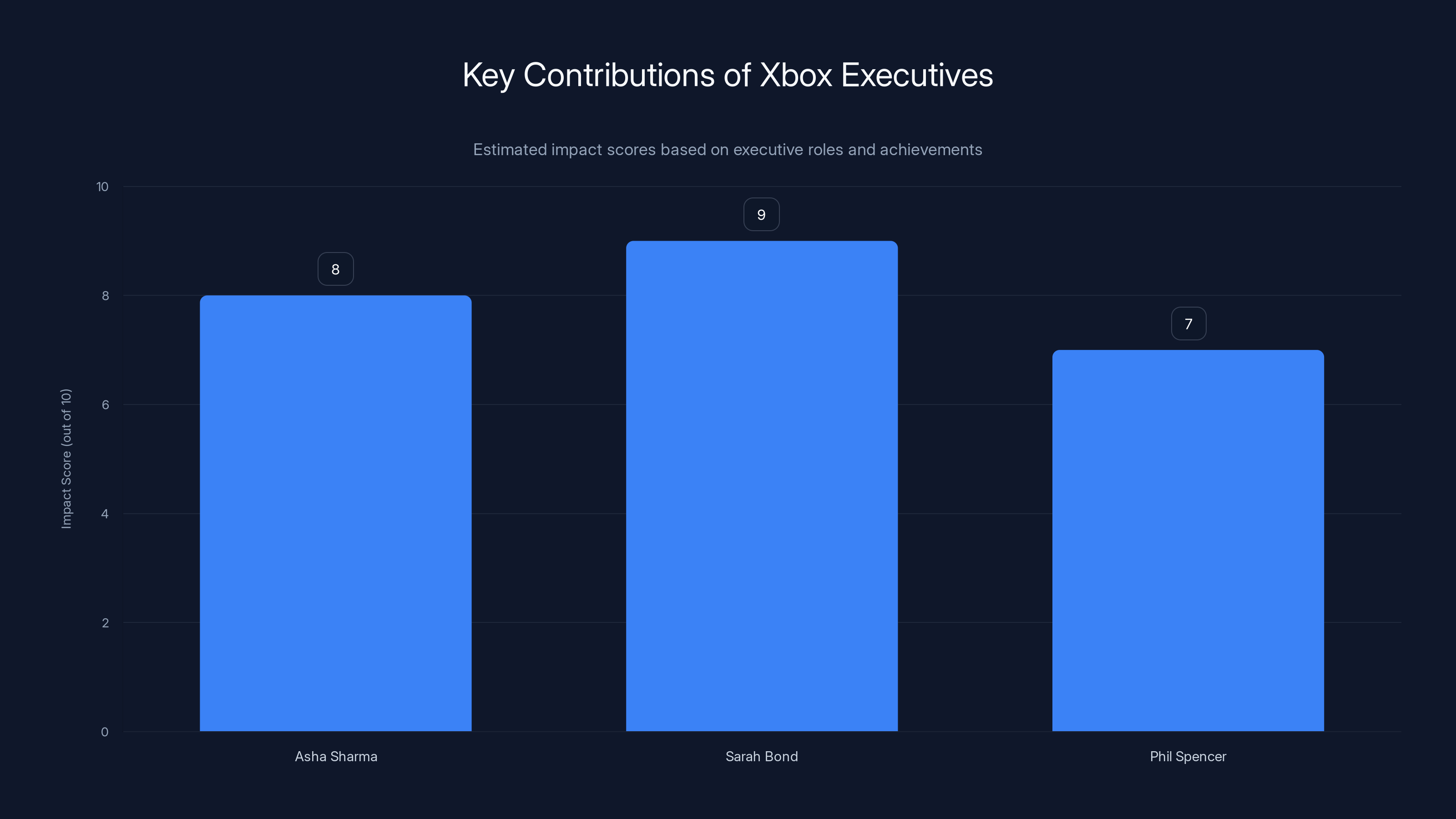

Sarah Bond, president of Xbox and COO, is stepping down. Phil Spencer, the CEO of Microsoft Gaming who's been the public face of Xbox strategy for years, is leaving too. They're departing simultaneously, which signals this isn't a messy departure or internal conflict—it's a planned transition. Asha Sharma is stepping up as the new EVP and CEO of Gaming. Matt Booty gets promoted to EVP and chief content officer.

On the surface, this looks like normal executive rotation. But dig deeper and you'll see something more profound: Microsoft is fundamentally restructuring how it competes in gaming. The company is merging Xbox and Windows closer together. It's betting heavily on handheld devices like the Xbox Ally. It's shifting away from the traditional console wars and toward a platform-agnostic approach where gaming happens everywhere—phones, PCs, tablets, handhelds, the cloud.

Bond's departure matters because she was the architect of modern Xbox strategy. She shaped Game Pass into a subscription powerhouse. She pushed cloud gaming when others were skeptical. She oversaw hardware launches and navigated the company through some of its roughest periods. Spencer's exit signals an even bigger shift: a new era for Microsoft Gaming that's less about Xbox as a monolithic console brand and more about Microsoft as an omnichannel gaming giant.

Here's what you need to understand about why this is happening now and what comes next.

TL; DR

- Sarah Bond and Phil Spencer are both leaving Microsoft Gaming, ending an era of console-focused strategy

- Asha Sharma becomes the new gaming CEO, signaling a shift toward mobile, PC, and cloud-first approaches

- Microsoft is merging Xbox and Windows closer together, preparing for devices like the Xbox Ally handheld

- The company faced major challenges: studio layoffs, game delays, and subscription pressure all contributed to the shake-up

- This restructuring positions Microsoft for a post-console gaming landscape where hardware matters less than the ecosystem

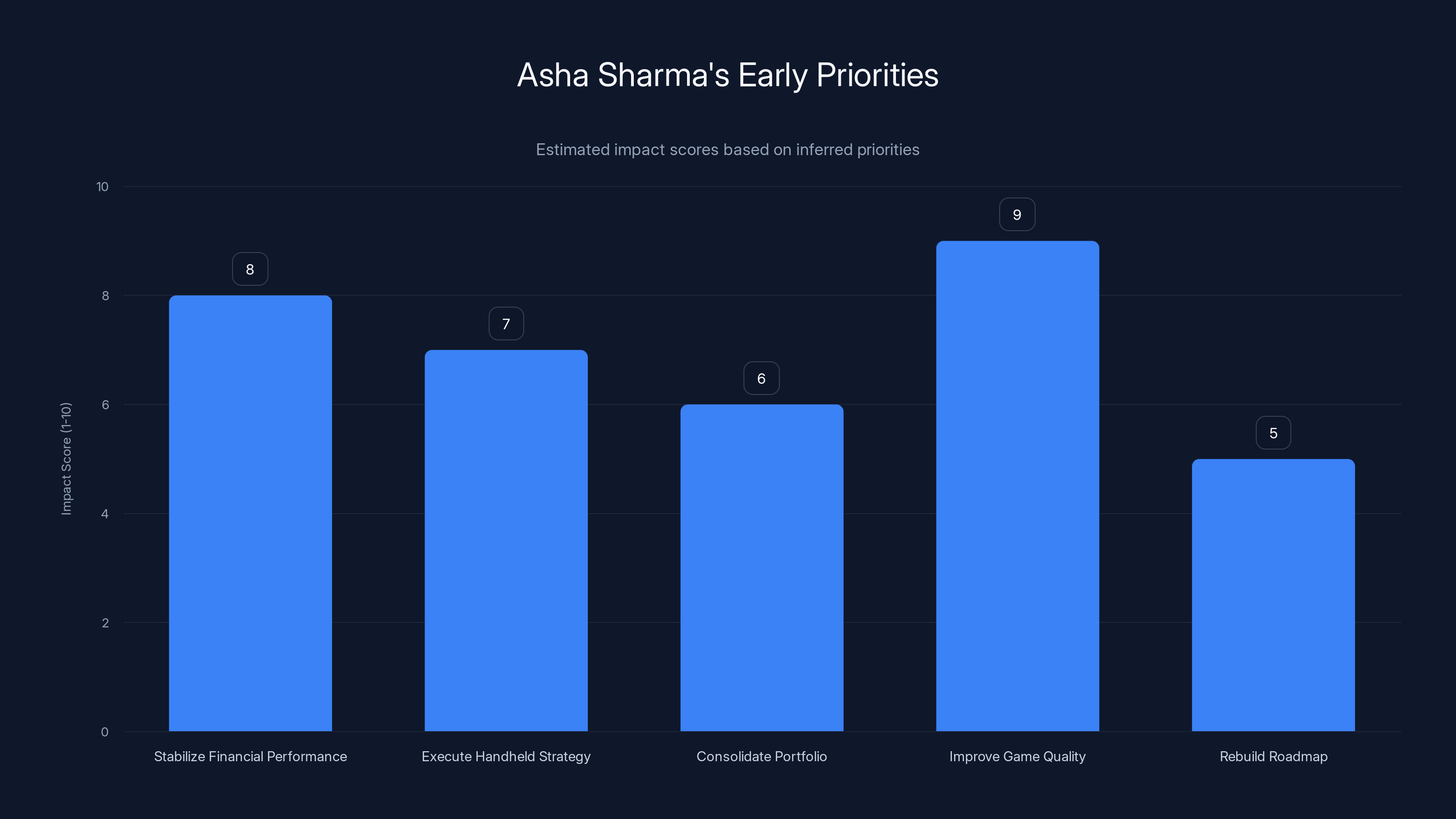

Sarah Bond had the highest impact score due to her role in transforming Xbox's strategy towards services and subscriptions. Estimated data.

Who Was Sarah Bond and What Did She Actually Do?

Sarah Bond wasn't a household name for most gamers, but her fingerprints are all over the Xbox experience you know today. She joined Microsoft back in 2017 as a Corporate Vice President focused on gaming partnerships and business development. That's corporate speak for "go figure out how to make Xbox relevant through deals and strategy."

From 2017 through early 2023, Bond worked the behind-the-scenes strategy layer. She wasn't streaming games or announcing exclusives at E3. Instead, she was building the architecture that made Xbox Game Pass function as a business model. She negotiated partnerships with publishers to put their games on Game Pass day one. She mapped out which games would drive subscriber growth. She helped define the roadmap for cloud gaming when people still thought it was science fiction.

Then in 2023, Phil Spencer promoted her to President of Xbox. This was a massive jump. She went from strategic planning to running the entire division. Spencer's memo at the time emphasized her responsibility for "teams including devices, player and creator experiences, strategy, and business planning." Translation: she now owned everything from the Xbox controller design to how players experienced the platform to where the next generation of hardware would go.

What made Bond effective was her ability to translate business logic into gaming products. She understood that Game Pass wasn't just about having 300 games available. It was about subscription retention curves, player lifetime value, and how to compete with Sony's Play Station Plus and Nintendo's Switch Online. She grasped that cloud gaming wasn't a replacement for local hardware—it was an enabler for playing anywhere, on any device.

During her tenure as president, Bond navigated Xbox through turbulent waters. Xbox was losing the console generational war to Play Station. Play Station had better exclusive games, stronger third-party support, and superior mindshare among hardcore gamers. Bond's response was to stop fighting that battle head-to-head and instead expand the playing field. Why compete on console sales when you can compete on services, cloud, mobile, and ecosystem reach?

Bond's real achievement was making Xbox feel less like a console manufacturer and more like a gaming company. The company started investing in mobile. It expanded the Game Pass library with cloud-streaming options. It experimented with handheld gaming through the Xbox Ally partnership. These weren't console-first moves. They were platform-agnostic moves.

But here's the thing: even with all that strategic vision, Xbox still faced headwinds. Game delays happened. Studios had trouble shipping AAA titles. The subscription growth curve flattened. These pressures didn't create themselves—they revealed limitations in the strategy Bond helped build. Sometimes the architecture you construct becomes the ceiling you hit.

Phil Spencer's Legacy and Why His Exit Matters More

Phil Spencer is a different story. He's not the architect of modern Xbox strategy—he's the face of it. For the better part of a decade, Spencer has been the public voice of Xbox, the CEO who sits in developer interviews, who announces games at industry events, who shows up in memes and gaming discourse.

Spencer became Executive Vice President of Xbox in 2014, right when the division needed serious leadership intervention. The Xbox One had launched badly. It was underpowered compared to Play Station 4. It was expensive. It came bundled with Kinect, a peripheral nobody wanted. The messaging was confused. Microsoft was in crisis mode, and Spencer was brought in to stabilize the ship.

What Spencer did over the next decade was remarkable. He shifted Xbox from a closed ecosystem to an open one. He made Xbox Game Pass a viable competitor to Netflix for gaming. He invested billions in gaming studios and acquisitions. He rebuilt relationships with developers that Microsoft had damaged during the Xbox One era. He made Xbox feel like it was building something instead of defending something.

But Spencer also inherited structural problems that no amount of good management could fully solve. Play Station has cultural dominance in gaming. Developers prefer building for Play Station first because that's where the players are. Sony's exclusive game library is objectively stronger (at least, it has been until very recently). Nintendo owns the handheld and casual segments. Microsoft's bet on services and cloud was innovative, but it never translated into console market share.

Spencer's exit is significant because it signals that Microsoft has decided the old playbook isn't enough. Spencer was the CEO of the Game Pass era, the subscription revolution era, the "gaming is a service" era. Whoever comes next—likely Asha Sharma—will be the CEO of the handheld/mobile/cloud-first era. That's not a subtle shift. That's a fundamental redirection.

When CEOs step down from publicly visible roles, it usually means one of three things: they're leaving because they disagree with the new direction, they're burned out from the pressure, or they've accomplished what they set out to do and want to move on. Spencer hasn't given detailed public comments, but the timing and context suggest he's stepping back so Microsoft can pursue a strategy that requires new leadership DNA.

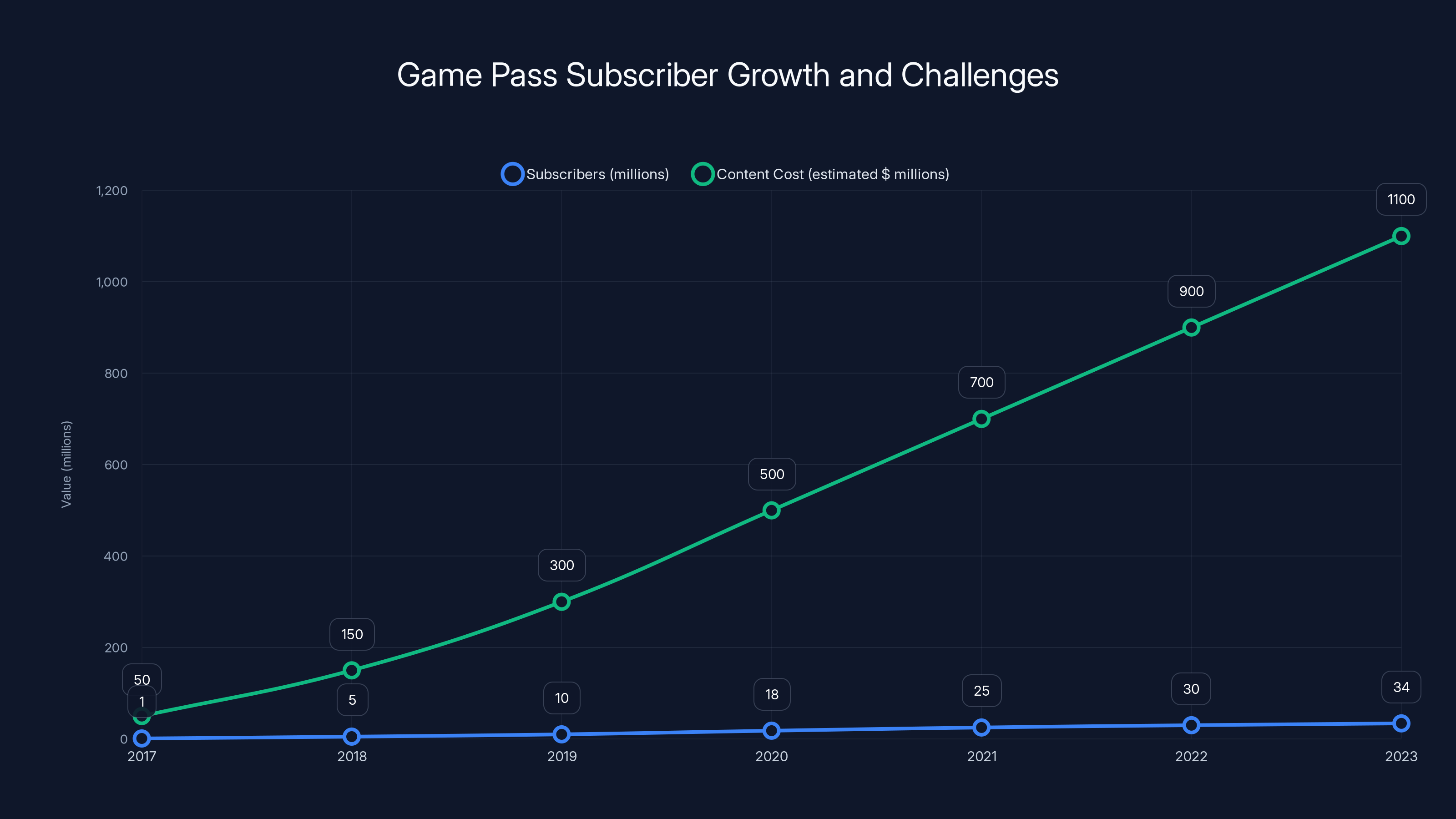

Game Pass saw rapid subscriber growth from 2017 to 2023, reaching 34 million. However, the increasing cost of content acquisition posed significant challenges. (Estimated data)

Asha Sharma: The New Leader and What Her Appointment Signals

Asha Sharma is getting promoted into the role vacated by both Bond and Spencer. She's becoming EVP and CEO of Gaming, which makes her one of the most powerful executives at Microsoft in the gaming space.

Unlike Bond and Spencer, Sharma isn't a household name in gaming circles. But that's almost the point. She's coming in fresh, without the institutional memory of past strategies, past decisions, past limitations. She's not defending Game Pass at launch or explaining why Xbox One had problems. She's building the next thing.

What we know about Sharma's background: she's spent time in Microsoft's business and operations side. She understands how to scale consumer services. She's comfortable working in growing categories. She hasn't been the public face of any major initiative, which means she can chart her own course without fighting against established expectations.

Her appointment signals several things. First, Microsoft wants someone who will prioritize execution over strategy innovation. Bond and Spencer were idea people. Sharma appears to be an execution person. Second, the company wants someone who won't be emotionally invested in "Xbox as console brand" surviving. Sharma can kill things Bond built if the data says they're not working. Third, Microsoft is signaling that the next era will be less about public messaging and more about product results.

The question is: what does Sharma do differently? Likely, she focuses the gaming division more tightly on high-ROI initiatives. Game Pass gets stricter about which games get added. Mobile gaming gets acceleration. Cloud gaming infrastructure gets investment. The Xbox Ally gets treated as a major platform instead of an experiment. Studios that can't ship get reorganized or shut down.

Sharma's been given a clear mandate: make Microsoft Gaming profitable and clear about its mission. She inherited a division that's been shedding money on game development, subscription growth that flatlined, and unclear messaging about what Xbox even is anymore.

Matt Booty's New Role as Chief Content Officer

Matt Booty is being promoted to EVP and chief content officer of gaming. This is a crucial position that often gets overlooked.

Booty's previous role was overseeing game development and studios—he was responsible for first-party Xbox game output. The new title, chief content officer, is broader. It signals that Microsoft's gaming strategy is shifting from "we make games for our console" to "we make content for our ecosystem."

Content officer is a media industry title. Netflix has chief content officers. Disney has chief content officers. These executives think about content across all platforms, all distribution channels, all audience segments. They're not tied to a specific device or service.

By promoting Booty to chief content officer, Microsoft is signaling that game development is now a platform-agnostic endeavor. A game developed by an Xbox studio isn't developed "for Xbox." It's developed "for Microsoft Gaming," which includes console, PC, mobile, cloud, and handheld.

This matters because it changes incentive structures. Game teams can no longer design games solely for a console's capabilities. They need to design for cross-platform play and progression. Games need to work on lower-spec handheld devices. They need to stream to phones. They need to sync progress across platforms.

Booty's background in shepherding Halo, Gears of War, and Forza makes him well-suited to this role. He understands what it takes to build franchises that last. He understands player communities. But now he's responsible for those franchises succeeding not just on Xbox, but everywhere Microsoft Gaming operates.

The Crisis Context: Why This Leadership Shakeup Was Inevitable

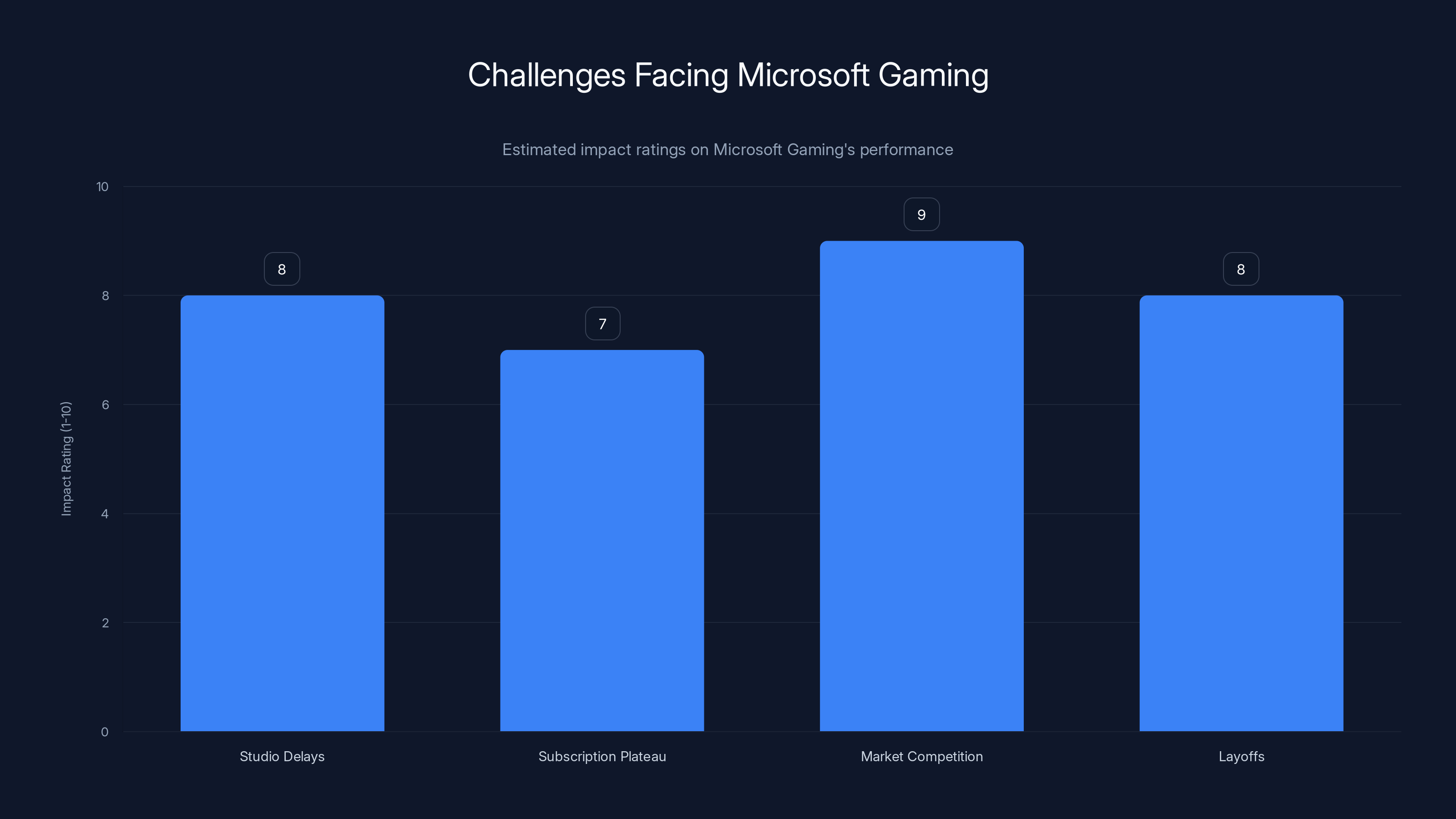

These departures didn't happen in a vacuum. Xbox and Microsoft Gaming have been under serious pressure.

First, the studio problem. Microsoft acquired companies like Obsidian Entertainment, Arcane Augmented Reality, and Playground Games with the goal of building a pipeline of exclusive first-party titles. Instead, these studios faced delays, production problems, and mounting pressure. Starfield launched to mixed reviews and underperformed relative to expectations. Halo Infinite's live service tanked. Perfect Dark got stuck in development. The AAA game output machine that Microsoft built didn't deliver the games.

Second, the subscription plateau. Game Pass growth hit a wall. The service reached somewhere around 34 million subscribers and then... stopped growing much. Why? Because everyone who wanted Game Pass already had it. The service was optimized for growth, not profitability. Microsoft started raising prices and adding advertising tiers to squeeze more revenue, which is never a sign that things are going well.

Third, the market reality. Play Station is still winning the console war. Nintendo is unstoppable in handhelds and casual gaming. Mobile gaming (through companies like Tencent, King Digital, and others) is a bigger market than console gaming and always will be. Microsoft's bet that it could win by bundling services and cloud gaming was sound strategically, but execution has been messy.

Fourth, the layoffs. In 2024, Microsoft Gaming went through massive layoffs. Thousands of employees were cut across studios. Bethesda took a hit. Zeni Max took a hit. Smaller studios closed. This signals desperation, not confidence. You don't lay off thousands of game developers when things are going well.

Given all this, Bond and Spencer's departure makes sense. The old strategy has constraints. New leadership with a different perspective might be able to break through. Or it might be that Microsoft gaming is just fundamentally constrained by competition and market structure, and no leadership change fixes that. But change was necessary because the status quo was untenable.

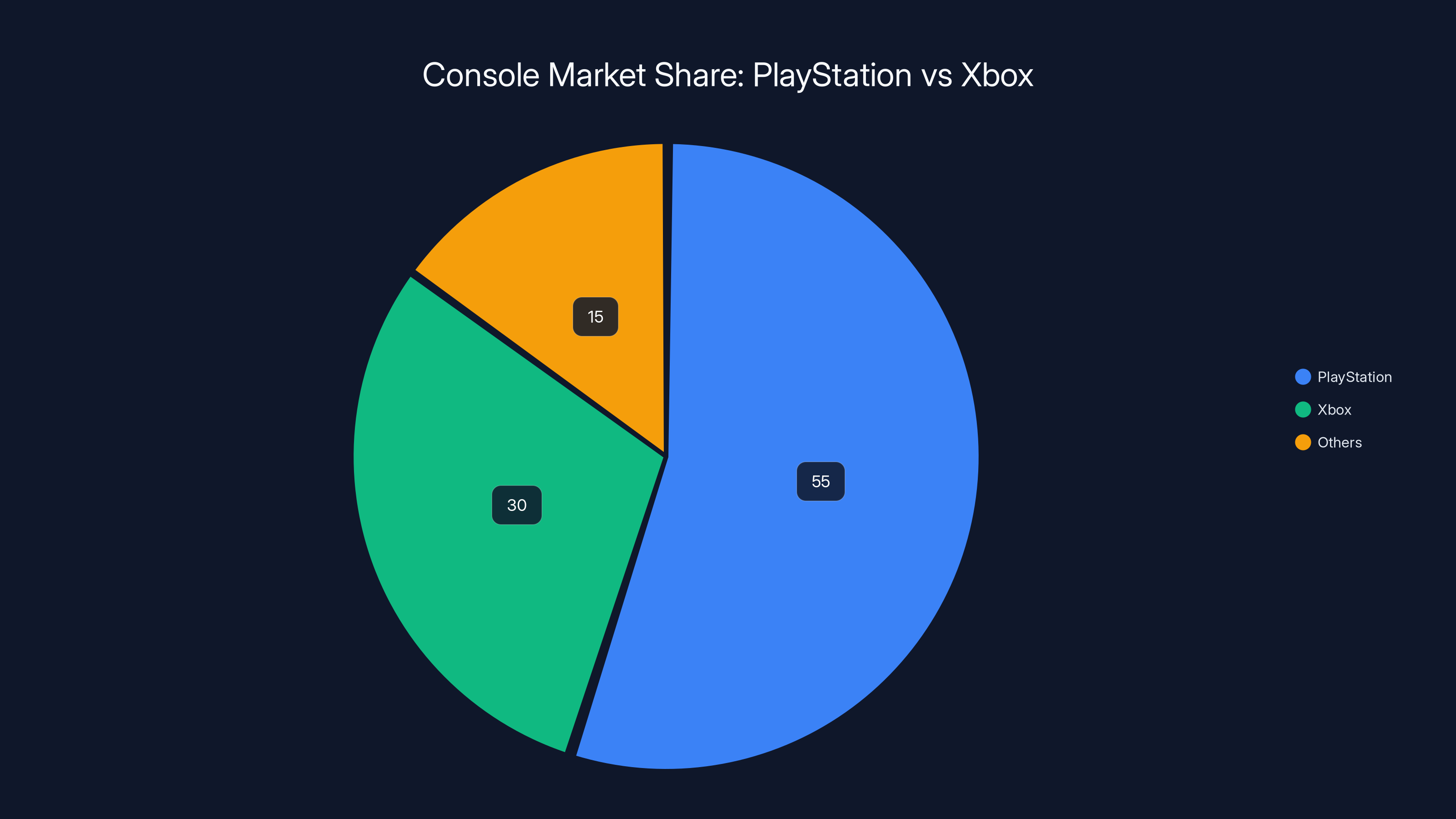

PlayStation holds a significant lead in the console market with an estimated 55% share, while Xbox trails at 30%. Estimated data based on sales and user base.

Microsoft's New Strategy: Windows and Xbox Converging

Underlying these leadership changes is a strategic shift that's been brewing for a while: Windows and Xbox are merging.

Not merging in the literal sense—you won't see Windows vanish or Xbox rebrand. But strategically and operationally, Microsoft is collapsing the distinction between them. The company is treating Windows as a gaming platform in the same way it treats Xbox. And Xbox is becoming less about the console and more about the ecosystem running on Windows, mobile, and cloud.

Why? Because the console market is mature and declining. Console shipments have been falling for years. Younger gamers play on mobile. PC gaming is stable and profitable. Handheld devices are getting more powerful. The traditional console—a dedicated black box under your TV running proprietary software—is a shrinking share of total gaming.

Microsoft's bet is that by unifying Windows and Xbox, it can compete everywhere. Your gaming library follows you from PC to handheld to cloud. You buy games once, play them everywhere. Your friends list, achievements, and progress are unified. This is a direct threat to Play Station's ecosystem, even though it looks less like a direct console competitor.

The Xbox Ally handheld is the tangible expression of this strategy. The device runs Windows 11. It has access to Game Pass. It streams games from the cloud. It connects to a library of games built on Windows. This isn't a traditional handheld competing with Nintendo Switch. It's a Windows 11 portable computer that emphasizes gaming. That's a different product category entirely.

Bond helped build this strategy. But executing it requires different priorities than what made Game Pass successful. Game Pass was about acquiring subscribers through content volume. The Windows/Xbox convergence is about ecosystem lock-in and cross-platform convenience. Different game, different playbook.

Game Pass: The Service That Changed Everything (and Ran Into Limits)

Game Pass deserves its own analysis because it's simultaneously Microsoft Gaming's greatest success and biggest constraint.

When Game Pass launched in 2017, it was genuinely innovative. Pay a monthly subscription, get access to hundreds of games. It was subscription pricing for games, which wasn't new (World of Warcraft had been doing this), but it was new at the scale and breadth Microsoft offered.

The strategy worked. Subscribers loved having access to so many games without buying individually. Publishers appreciated the guaranteed revenue from Game Pass payments. Players could experiment with games they'd never buy individually. The service grew to 34 million subscribers—a genuine achievement.

But here's where the limits kicked in. Game Pass was fundamentally dependent on content volume. You need new games constantly feeding the service to keep people subscribed. But the AAA game market moves slowly. It takes 3-5 years to build a major game. Microsoft's own first-party studios couldn't produce games fast enough to meet the content hunger that Game Pass created.

Meanwhile, the economics never worked out. You can't sustainably run a service where you're paying

What Game Pass actually did was train gamers to expect cheap access to content. But that same expectation made it harder for Game Pass to generate profit. Publishers got smarter about their Game Pass deals. Microsoft's own games got scrutinized harder on ROI. The growth curve plateaued because there's a limit to how many people will pay for another gaming subscription when they already have Play Station Plus and Nintendo Switch Online.

Bond inherited a service with massive momentum. She helped scale it. But scaling into a wall is a real problem, and that's where Game Pass ran into reality. The service is still profitable in some regions, still growing slowly in others, but it's no longer the growth story that justifies Microsoft's gaming investments.

Cloud Gaming: The Technology That's Still Waiting For Its Moment

Cloud gaming was supposed to be Xbox's killer advantage. Stream any game to any device. No hardware limits. No waiting for downloads. Instant access. The technology promised to fundamentally reshape gaming.

Except it hasn't. Not yet. Cloud gaming is technically possible now—Microsoft's cloud streaming works, Nvidia Ge Force Now works, Play Station Plus cloud streaming works. But adoption has been slow. Why?

Network latency is part of it. Streaming games requires sub-50ms latency to feel responsive. That's achievable in cities with good broadband, but it's impossible in rural areas and problematic even in some suburban regions. Internet infrastructure in much of the world just isn't there yet.

But it's more than that. Gamers like owning their hardware. A console in your living room is tactile, controlled, guaranteed. Cloud gaming means you're dependent on a company's servers staying up, internet connectivity being stable, your ISP not throttling bandwidth, and your service provider not going out of business. That's a lot of dependencies for gamers to accept.

Also, cloud gaming fundamentally doesn't solve the game library problem. You're still limited to whatever games the service offers. You can't buy a cloud game and own it forever. You rent it from a streaming provider. That's a psychological barrier that's been hard to overcome.

Microsoft invested heavily in cloud gaming infrastructure. The technology works. But market adoption has been disappointing. This is one reason why the Xbox Ally is positioned as having a local GPU—so users can play demanding games locally, then stream less demanding games. It's an admission that cloud-only gaming isn't ready for primetime yet.

Under Sharma's leadership, expect a recalibration. Cloud gaming will remain a feature, not the primary draw. The focus will be on hybrid approaches where games run locally but leverage cloud for saves, multiplayer, and optional streaming for backward compatibility titles.

The chart illustrates the estimated impact of various challenges on Microsoft Gaming, with market competition and studio delays being the most significant issues. (Estimated data)

The Studio Acquisition Experiment: Billions Spent, Mediocre Returns

Microsoft spent somewhere in the range of $70-80 billion acquiring gaming studios and publishers over the last decade. The theory was sound: own the studios, own the content pipeline, guarantee first-party games that drive hardware sales and subscription growth.

But the execution was harder. Studio acquisitions require cultural integration, creative autonomy management, and realistic timeline expectations. Microsoft got some of this right and some wrong.

Bethesda is a good example of complicated ROI. Microsoft acquired Bethesda for $7.5 billion in 2020. The theory was that games like The Elder Scrolls and Fallout would drive Xbox and Game Pass adoption. But Bethesda's game development timelines are notoriously long. Starfield took until 2023 to launch and was middling commercially. Elder Scrolls VI is probably still years away. The acquisition hasn't driven the hardware or subscription growth Microsoft hoped for.

Playground Games, the Forza studio, has been similarly challenging. The game is excellent, but it's a franchise that already existed. It didn't expand the portfolio so much as consume resources.

Obsidian Entertainment has been more successful—Greedfall and Starfield DLC showed quality potential—but the studio is still relatively small in output.

Meanwhile, all these studios faced layoffs in 2024. Microsoft spent $70+ billion acquiring them, then cut thousands of workers. That signals a recognition that acquisition strategy alone doesn't generate sufficient returns. The issue isn't that the studios are bad; it's that the game industry just doesn't work the way Microsoft's spreadsheets thought it would.

Under Sharma's leadership, expect a fundamental rethinking of studio strategy. Some studios will likely be folded or divested. Microsoft will focus on fewer, bigger bets. The acquisition mania will likely cool. The company will prioritize high-ROI franchises like Halo, Forza, and Gears of War and let go of lower-performing properties.

Handheld Gaming and the Xbox Ally Gambit

The Xbox Ally is Microsoft's most interesting hardware bet in years. It's a handheld device—basically a portable PC—that runs Windows 11 and emphasizes gaming.

This is important because it represents a pivot away from traditional console gaming and toward portable/hybrid gaming. Nintendo proved the hybrid model works with the Switch. Microsoft is betting it can capture the PC handheld segment that doesn't exist at scale yet.

The Ally runs actual Windows, which is a huge advantage and disadvantage. Advantage: you have access to the entire Windows gaming library—Steam, Epic Games Store, Game Pass, everything. You're not locked into a proprietary ecosystem. Disadvantage: Windows is bloated, complex, and not optimized for gaming on a 7-inch screen.

For Microsoft, the handheld strategy signals several things. First, consoles are less important to the future than mobile and portable devices. Second, the company is willing to compete directly with Nintendo in form factor, if not in market positioning. Third, Microsoft's future is software and services (Windows, Game Pass, cloud), not hardware exclusivity.

The Ally gives context to Bond's departure and Sharma's appointment. Bond helped conceptualize the handheld strategy. But executing a hardware play of this magnitude requires different expertise—manufacturing, supply chain, retail partnerships. That's operational excellence, not strategic vision. Sharma's background suggests she's being brought in to make the Ally real, not just a good idea.

Expect the Ally to remain a niche device that appeals to PC gamers who want portability, not a mass-market competitor to Switch. But it establishes Microsoft as a player in every hardware segment except traditional consoles. That's the actual strategy.

Play Station's Dominance and Why Xbox Still Struggles to Close the Gap

Let's be honest: Play Station is winning. Play Station has better exclusive games. Play Station has stronger cultural cachet with gamers. Play Station's player base is larger and more loyal. In every console generational comparison, Play Station outsells Xbox significantly.

This isn't a marketing failure or a temporary setback. This is structural. Developers prefer building for Play Station first because that's where the installed base is. Publishers give Play Station exclusivity deals because Play Station players have higher spending per user. Third-party publishers are more likely to fund exclusive content for Play Station than Xbox.

Xbox has tried multiple strategies to overcome this. Better hardware specs didn't work because Play Station matched them. Aggressive acquisition strategy didn't work because you can't buy your way to game quality fast enough. Subscription pricing didn't work because it trained users to expect cheap access. Cloud gaming didn't work because adoption is too slow.

The brutal reality that Bond and Spencer have probably accepted (and Sharma definitely needs to accept) is that Xbox will never win the console war. It will always be #2 in consoles, and that's okay. The strategy isn't to beat Play Station on consoles. It's to make the console irrelevant by competing everywhere else.

This is why handheld matters. This is why cloud matters. This is why Windows matters. This is why Game Pass matters—not as a console driver, but as a way to lock players into the Microsoft ecosystem regardless of hardware.

The leadership change reflects acceptance of this reality. Bond and Spencer were trying to win consoles through different tactics. Sharma is being brought in to accept the console market reality and build Microsoft Gaming for a post-console world.

Estimated impact scores suggest improving game quality is the most challenging priority for Asha Sharma, while rebuilding the roadmap is crucial but less immediate. Estimated data.

Nintendo's Handheld Dominance and Microsoft's Challenge

If Play Station dominates consoles, Nintendo dominates handhelds. The Switch has sold over 139 million units. Nothing comes close.

Nintendo understood something before anyone else: people want to game anywhere, not just at home. The Switch proved this at massive scale. Every gaming device maker has been trying to replicate Switch's success since 2017.

Microsoft's handheld answer comes late. The Ally is being positioned against the next Nintendo device (likely a Switch 2 or successor), not the current Switch. By the time Ally ships at scale, Nintendo's next hardware will probably already be on store shelves.

Moreover, Nintendo has something money can't buy: cultural relevance with casual and family gamers. Nobody is trying to convince their mom to play Game Pass. Everyone's mom knows Mario. This isn't a gap that strategy or marketing can close. It's a durability advantage Nintendo has earned through decades of excellence.

Microsoft's realistic goal in handheld gaming isn't to beat Nintendo. It's to be a credible alternative for hardcore PC gamers who want portability. The Ally serves that segment. That's a victory condition that doesn't require beating Nintendo.

The PC Gaming Opportunity and Windows Advantage

PC gaming is the one market where Microsoft has a legitimate advantage, and it's also the one market that's large and growing. This is a thesis that should anchor Microsoft's gaming strategy going forward.

Windows runs on hundreds of millions of PCs. Gamers have already installed Windows. They have Steam libraries, Epic Games accounts, game libraries distributed across multiple platforms. Microsoft's Game Pass for PC is bundled with Game Pass Ultimate. The company has leverage.

PC gaming generates more revenue than console gaming now. It's where competitive gaming happens. It's where new game technology gets pioneered. It's where the most engaged hardcore gamers live.

Bond understood this in theory. But Game Pass strategy was console-first, PC-second. Sharma should flip that priority. PC is where Microsoft owns the platform (Windows), where the audience is massive, where third-party publishers are most eager to partner, and where profitability is achievable.

Strategy under Sharma should be: make PC the center of Microsoft Gaming. Bundle Game Pass with Windows aggressively. Invest in PC game development. Make Windows the hub where everything connects—cloud saves, cloud streaming for impossible games, cross-platform play, friend lists. The console is secondary. Handheld is experimental. But PC is core.

This is a different vision than Bond articulated. But it might be the right one given market realities.

Industry Consolidation and What It Means For Gamers

The backdrop for Microsoft's leadership change is broader industry consolidation. Gaming is consolidating into fewer, larger companies.

Tencent is the world's largest gaming company by revenue, with major stakes in countless publishers. Microsoft, Sony, and Nintendo control console gaming. Activision Blizzard (now Microsoft), Electronic Arts, and Take-Two control major franchises. Independent developers are being squeezed from both sides: competing for publishing and development resources, competing for audience attention.

Microsoft's strategy is to consolidate vertically (owning studios, publishers, distribution channels) and horizontally (being on every platform). The strategy makes sense from a business perspective. But it has implications for game diversity, creative independence, and what kinds of games get made.

When Microsoft Gaming undergoes leadership change with the explicit goal of improving profitability, that usually means: fewer experimental games, more franchises, more sequels, more focus on engagement metrics and monetization. The next 5 years of Microsoft Gaming will likely be more conservative than the last 5 years.

Gamers should care about this because it affects the kinds of games that get funded and published. Unique, experimental, mid-budget games from independent studios become harder to fund when major publishers are consolidating and prioritizing AAA franchises with proven ROI.

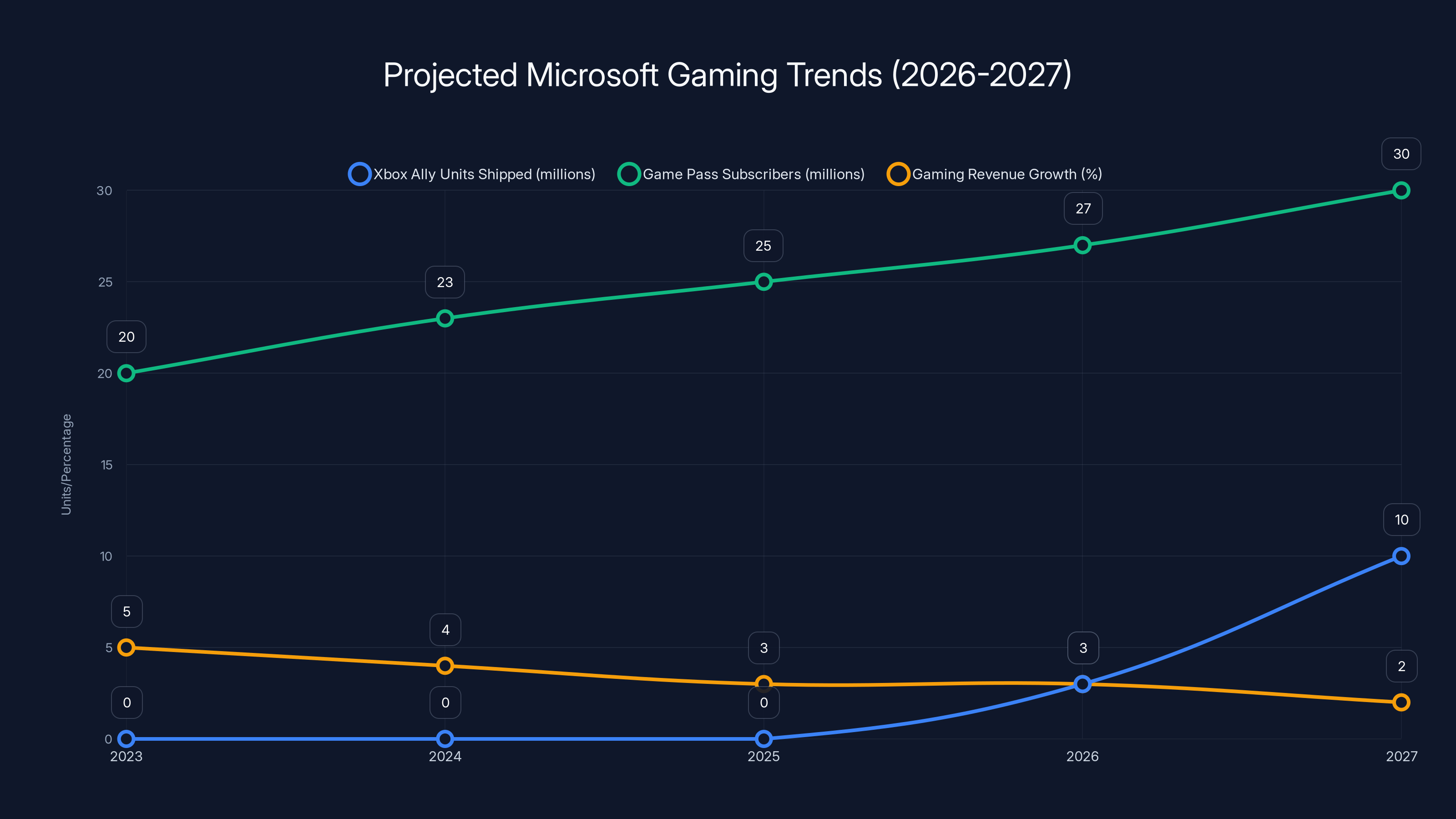

By 2027, Xbox Ally could ship over 10 million units, while Game Pass stabilizes at 30 million subscribers. Gaming revenue growth slows but profitability improves. (Estimated data)

What Gamers Should Actually Care About

All of this corporate drama matters for one reason: it affects what games you can play, where you can play them, and how much it costs.

Immediately, nothing changes. Game Pass keeps running. Xbox hardware keeps working. Games keep shipping. But over the next 2-3 years, expect changes.

First, Game Pass pricing probably goes up further and the service gets segmented more aggressively. The free tier shrinks. The standard tier costs more. The premium tier bundles cloud gaming and adds exclusive benefits. Microsoft will optimize for revenue per subscriber instead of subscriber growth.

Second, game releases slow down. Microsoft burned through massive cash on game development and saw slower returns than expected. Sharma will likely slow the spending, which means fewer games being announced and more delays for games in production.

Third, Microsoft will consolidate studios. Some will close. Others will be folded into larger development groups. The idea of "multiple small studios pursuing different visions" will likely shift toward "fewer larger studios pursuing high-ROI franchises."

Fourth, expect more aggressive platform bundling. Game Pass on mobile. Game Pass integrated with Windows. Game Pass on cloud devices. But the core offer becomes narrower—better monetized, more controlled, less about unlimited choice.

Fifth, the user experience will shift from "choose any game" to "here are the games we recommend for you." Algorithmic curation replaces exhaustive catalogs. This is better for casual players (simpler choice) but worse for players seeking specific games.

Overall, Microsoft Gaming probably becomes less interesting to hardcore gamers and more focused on casual monetization. That's the business logic that Sharma will likely pursue.

The Broader Question: Is Console Gaming Dead?

The leadership change at Microsoft raises a deeper question: is console gaming actually dying?

Console sales are declining. Console install base is becoming less important as distribution channel. Younger gamers play on mobile and PC more than consoles. The installed user bases on Play Station and Xbox are aging.

But console gaming isn't dead. It's matured. Maturity in a market means: stable revenue, slow growth, predictable player behavior, entrenched competitors. The console market looks like the car market or the PC market—not exciting, but profitable and durable.

What's changing is that console gaming is no longer the center of the gaming industry. It's one segment among several. Mobile is bigger by user count and revenue. PC is big and growing. Cloud and streaming are emerging. Handheld is becoming competitive again.

Microsoft's structural challenge is that it's a console company in an industry where consoles matter less every year. The leadership change is an attempt to become something else—a software and services company that happens to sell some hardware.

Whether that works depends on whether Microsoft can execute the vision. Bond and Spencer articulated the vision. Sharma has to build it. That's a different challenge entirely.

What We Know About Asha Sharma's Early Priorities

We don't have detailed insight into Sharma's plans, but we can infer from organizational context.

Likely Priority 1: Stabilize financial performance. Game Pass growth has plateaued. Studio spending hasn't generated sufficient returns. Sharma will likely implement austerity—cut costs, focus on profitable franchises, improve unit economics.

Likely Priority 2: Execute the handheld strategy. The Xbox Ally is Microsoft's big bet. Sharma will need to make sure manufacturing, distribution, and marketing work so the device reaches scale.

Likely Priority 3: Consolidate the portfolio. Some studios will be closed or sold. Some games in development will be canceled. Microsoft will narrow its focus to 5-7 flagship franchises instead of trying to be everything.

Likely Priority 4: Improve first-party game quality. This is the hardest one. Microsoft's studios have been underperforming relative to investment. Sharma will need to either fix this or accept that Microsoft won't compete in first-party game quality with Sony or Nintendo.

Likely Priority 5: Rebuild the roadmap. What games are actually coming to Xbox in 2025, 2026, 2027? Right now, that roadmap is pretty thin beyond known franchises. Sharma needs visibility into the pipeline and confidence in shipping dates.

None of these are exciting. They're not visionary. But they're necessary after a period of expansive spending without proportional returns.

Looking Forward: What Microsoft Gaming Looks Like in 2026-2027

Projecting forward, Microsoft Gaming in 2026-2027 probably looks quite different.

The Xbox Ally launches and establishes itself as a viable handheld for PC gamers. Not a mass-market device like Switch, but a credible premium handheld. Microsoft ships 3-5 million units in year one, ramps to 10+ million if it succeeds.

Game Pass stabilizes at 25-30 million subscribers but with higher revenue per subscriber. The service becomes more curated, less focused on volume.

Windows becomes the explicit center of Microsoft's gaming strategy. Game Pass integration with Windows improves. New Windows features emphasize gaming. The line between "Windows" and "Xbox" blurs further.

Microsoft ships fewer games, but the games that ship are higher quality and have longer lifespans. Live service games get better support. Single-player games focus on replay value. The hit-rate on new releases improves.

Cloud gaming remains a feature for niche use cases (playing on low-spec devices, instant access to backlog) rather than a mainstream platform.

Studios are restructured. Some close. Big franchises consolidate to fewer, larger teams. The portfolio looks smaller but more focused.

Microsoft's gaming revenue stabilizes or modestly grows, but profitability improves because costs are controlled and monetization is optimized. The company stops chasing subscriber growth and optimizes for shareholder returns.

Formatted this way, Microsoft Gaming is still a major player in the industry. It's not going anywhere. But it's also not the growth story it was pretending to be over the last 5 years.

The Succession Question: Why Now?

One more thing to consider: why did Bond and Spencer step down simultaneously? Timing matters.

One theory: they'd accomplished the strategic framework change they wanted (moving toward services, cloud, handheld) and recognized that execution requires different skills. Founders often step back when their vision is clear because they can't execute the execution as well as someone trained in operations.

Second theory: pressure from Microsoft's leadership and board. Profitability missed targets. Game delays continued. Subscriber growth stalled. The board probably wanted fresh leadership to reset expectations and improve execution.

Third theory: both saw the consolidation of the industry and realized Xbox will never beat Play Station and concluded the game wasn't worth playing. Better to step aside for a new leader with fresh energy than stay and defend a deteriorating position.

Most likely, it's all three. The timing works. The messaging works. The organizational logic makes sense. This isn't a surprise forced departure; it's a planned succession that both leaders probably welcomed.

The question is whether Sharma can deliver on the promise of a leaner, more focused, more profitable Microsoft Gaming. She has the mandate. She has the resources. But execution in game development is notoriously hard—timelines slip, quality is unpredictable, market reception is uncertain.

Let's see how this plays out.

FAQ

Who is Asha Sharma and why was she promoted to CEO of Microsoft Gaming?

Asha Sharma is an executive with significant experience in Microsoft's business and operations divisions. She was promoted to EVP and CEO of Gaming to lead the company's next era focused on execution, profitability, and multi-platform distribution. Her appointment signals a shift away from the Game Pass growth-at-all-costs strategy toward a more disciplined, results-oriented approach to gaming investments.

What was Sarah Bond's main contribution to Xbox?

Sarah Bond served as President of Xbox from 2023-2025 and was instrumental in building Game Pass into a major subscription service, negotiating publisher partnerships, launching cloud gaming initiatives, and strategizing Xbox's evolution beyond traditional consoles. She shaped modern Xbox strategy around services, subscriptions, and cross-platform play rather than console hardware as the primary differentiator.

Why did Phil Spencer leave Microsoft Gaming after being CEO?

Phil Spencer stepped down as CEO of Microsoft Gaming after a period of leadership during Game Pass expansion, subscription growth, and major studio acquisitions. His departure likely reflects a strategic transition point where Microsoft wants new leadership with different priorities—particularly around handheld devices, mobile gaming, and mobile/cloud-first strategy—rather than the console and service-focused approach Spencer championed.

What does the Windows and Xbox convergence actually mean for gamers?

The convergence means Microsoft is treating Windows PCs and Xbox hardware as a unified gaming ecosystem rather than separate platforms. Games and Game Pass subscriptions work across both. Player progression, achievements, and friends lists sync seamlessly. This positions Microsoft as a multi-device gaming company rather than a console manufacturer, letting players game on PC, handheld, console, and cloud with unified accounts and libraries.

How does the Xbox Ally strategy fit into Microsoft's new direction?

The Xbox Ally represents Microsoft's bet that the future of gaming isn't tied to traditional home consoles but instead distributed across PC, handheld, and cloud devices. By creating a Windows-based handheld that accesses Game Pass and the broader Windows gaming ecosystem, Microsoft is positioning itself to compete in a post-console world while leveraging its Windows dominance and Game Pass subscription service.

What should players expect from Microsoft Gaming over the next 2-3 years?

Expect Game Pass pricing increases, smaller but more curated game selections, fewer experimental titles, and more focus on flagship franchises (Halo, Forza, Gears of War). Microsoft will likely ship fewer games but with better quality and longer live-service support. The company will consolidate studios, pursue handheld expansion with the Xbox Ally, and deepen Windows integration. Overall, the service will shift from "unlimited choice" to "curated recommendations" and from growth focus to profitability focus.

Is Xbox still trying to beat Play Station in the console war?

No, not in a meaningful sense. Play Station maintains a structural advantage in exclusive game quality and cultural relevance that Xbox cannot overcome through hardware or services alone. Microsoft's actual strategy is to make the console war irrelevant by competing on platforms where it has advantages—PC through Windows dominance, handheld through the Xbox Ally, cloud services, and cross-platform play that makes console choice less critical to the gaming experience.

Will Game Pass remain a good value subscription?

Game Pass remains valuable for players who consume games from diverse genres and don't already own most titles in the service's library. However, expect the service to become more expensive and more segmented. The free tier will shrink, standard pricing will increase, and higher tiers will bundle more premium features. The value proposition shifts from "all games for cheap" to "curated selections at premium pricing with bundled services."

What happened to all the studios Microsoft acquired?

Microsoft spent $70+ billion acquiring studios like Bethesda, Obsidian Entertainment, and others with the goal of building a game pipeline. These studios faced delays, production challenges, and management struggles. In 2024, Microsoft laid off thousands of gaming employees across multiple studios. Under new leadership, expect further consolidation—some studios closing, others folding into larger teams, and the portfolio narrowing toward proven franchises with reliable ROI.

Should I buy an Xbox Series X today or wait for the next generation?

If you want to play Xbox games today, the Series X remains a solid console. However, Microsoft's strategy is shifting away from hardware exclusivity toward multi-platform distribution. Games are coming to PC, cloud, and eventually handheld. If you have a decent gaming PC, you get most of the Xbox library through Game Pass for PC. The next Xbox hardware generation is probably 2027-2028, but the focus will shift toward specialized devices (handheld, cloud) rather than a traditional home console competitor to Play Station 6.

What This Means for Gaming's Future

The departure of Sarah Bond and Phil Spencer from Microsoft Gaming is significant not because of who they are, but because of what it signals about the future.

Console gaming isn't dying, but it's no longer the center of the industry. Mobile gaming, PC gaming, cloud gaming, and handheld gaming are growing in importance. Microsoft's leadership change reflects a company accepting this reality and reorganizing to compete in a fragmented, multi-platform gaming landscape instead of defending the console market.

Asha Sharma's appointment suggests Microsoft's next era will prioritize profitability over growth, execution over innovation, and consolidation over expansion. That's not exciting as a narrative, but it might be necessary as business strategy.

For gamers, the implications are real. Expect fewer experimental games from Microsoft, more focus on proven franchises, and a shift toward algorithmic curation instead of unlimited library choice. Game Pass remains valuable but becomes more expensive and less generous. The handheld future through Xbox Ally becomes more real, especially if Nintendo's next device doesn't ship immediately.

The industry is consolidating. Microsoft is consolidating. Individual gamers have less choice but more interconnectedness across platforms. That's the trade-off of the post-console era.

Bond and Spencer took Xbox through a transformation period. Sharma will execute the next phase. It's not as romantic a narrative as the scrappy underdog trying to beat the market leader. But it's the narrative that probably makes business sense.

Watch what happens with handheld gaming and Windows integration over the next year. Those are the real indicators of whether Microsoft's new direction works.

Key Takeaways

- Sarah Bond and Phil Spencer departed Microsoft Gaming simultaneously, signaling a planned strategic transition rather than crisis-driven leadership change

- Asha Sharma becomes new Gaming CEO with mandate to improve profitability, execute handheld strategy, and consolidate the gaming studio portfolio

- Microsoft is merging Windows and Xbox into unified platform strategy, deprioritizing traditional console competition with PlayStation

- Game Pass subscriber growth plateaued at 34 million users, forcing Microsoft to shift from growth-focused to profitability-focused business model

- The leadership restructuring reflects broader gaming industry shift from console-centric to multi-platform (PC, handheld, cloud) gaming ecosystems

- Xbox will likely never beat PlayStation in consoles, so strategy focuses instead on making consoles less important through cross-platform distribution

- Expect fewer experimental games, more franchise consolidation, reduced studio count, and higher Game Pass pricing under new leadership

- The Xbox Ally handheld represents Microsoft's most important hardware bet, signaling commitment to portable gaming beyond traditional home consoles

![Sarah Bond Leaves Xbox: What It Means for Microsoft Gaming's Future [2025]](https://tryrunable.com/blog/sarah-bond-leaves-xbox-what-it-means-for-microsoft-gaming-s-/image-1-1771619826162.jpg)