PS5 Holiday Sales Drop 16% Year-Over-Year: What It Means for Gaming

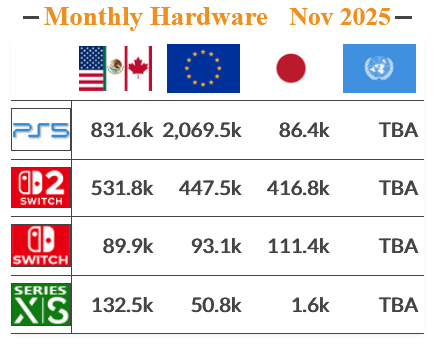

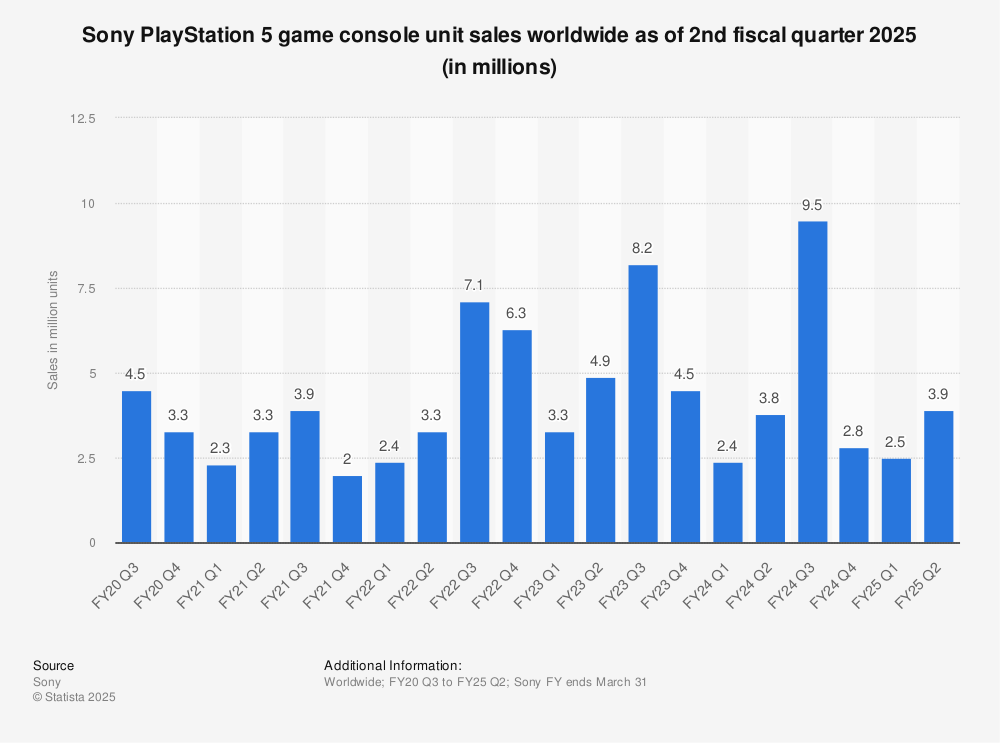

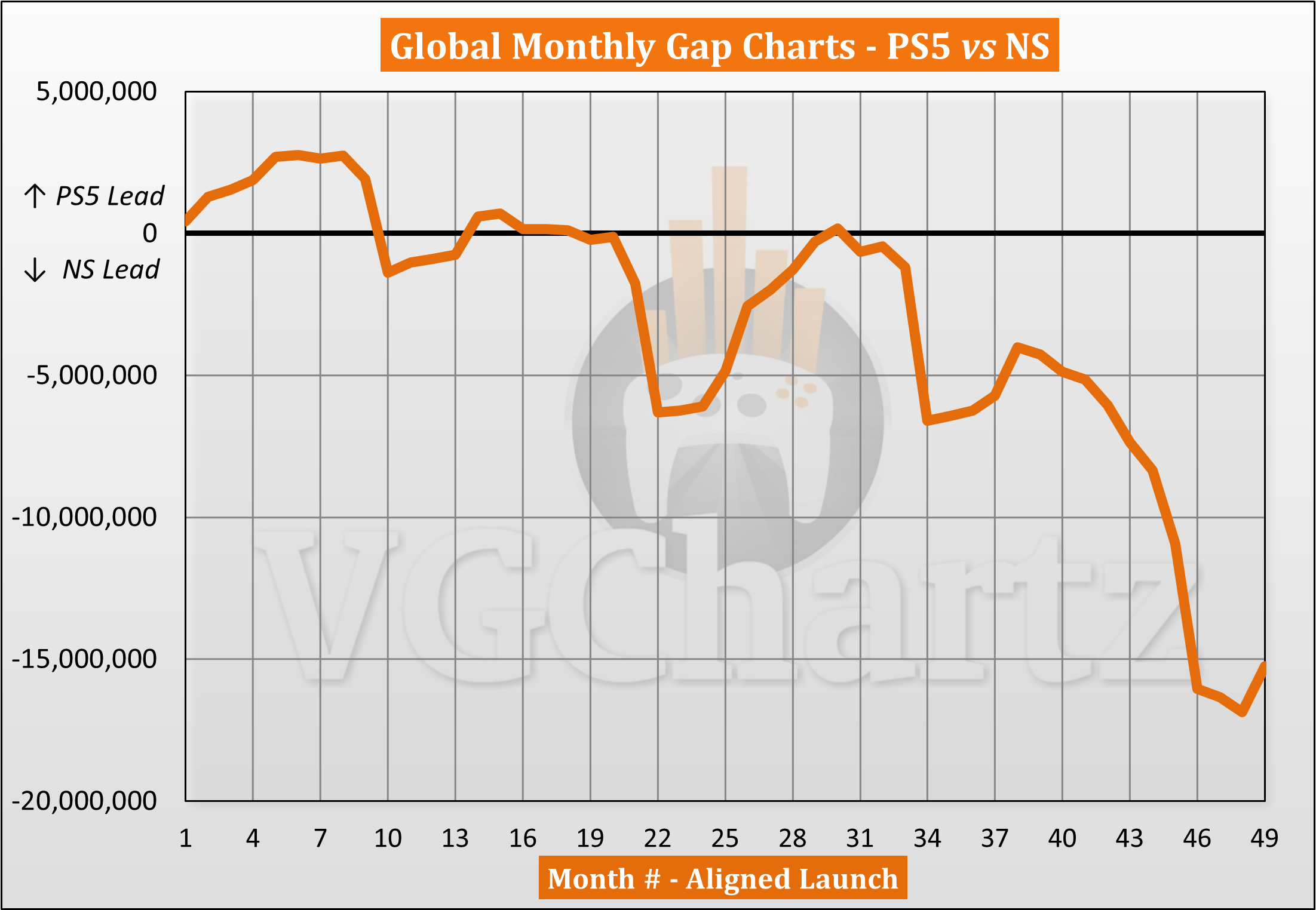

Sony just dropped some surprising numbers. During the critical holiday season—the period most gaming companies live and die by—the company shipped 8 million PlayStation 5 consoles. That's 1.5 million fewer units than the same quarter last year, marking a 16 percent decline during the most lucrative shopping window of the entire year.

Now, before you declare the PS5 dead, here's the thing: it's way more complicated than a simple sales number. The context matters enormously. Last year's holiday was exceptional, not normal. The comparison year saw 9.5 million units ship, far and away the best quarter since the console launched in November 2020. We're not comparing against typical performance. We're comparing against an outlier.

But the decline still raises genuine questions. Is the PS5 losing momentum? Have we hit peak adoption for this generation? What does this mean for the future of console gaming? And perhaps most importantly, what does it tell us about where the industry is heading in 2025 and beyond?

This article breaks down what's actually happening with PS5 sales, why the numbers matter less than you think, and what the real story is underneath the headline. Because spoiler alert: the real story is actually about software, user engagement, and a gaming market that's fundamentally changing shape.

TL; DR

- PS5 shipped 8 million units in Q3 2024, down 1.5 million (16%) from last year's exceptional 9.5 million

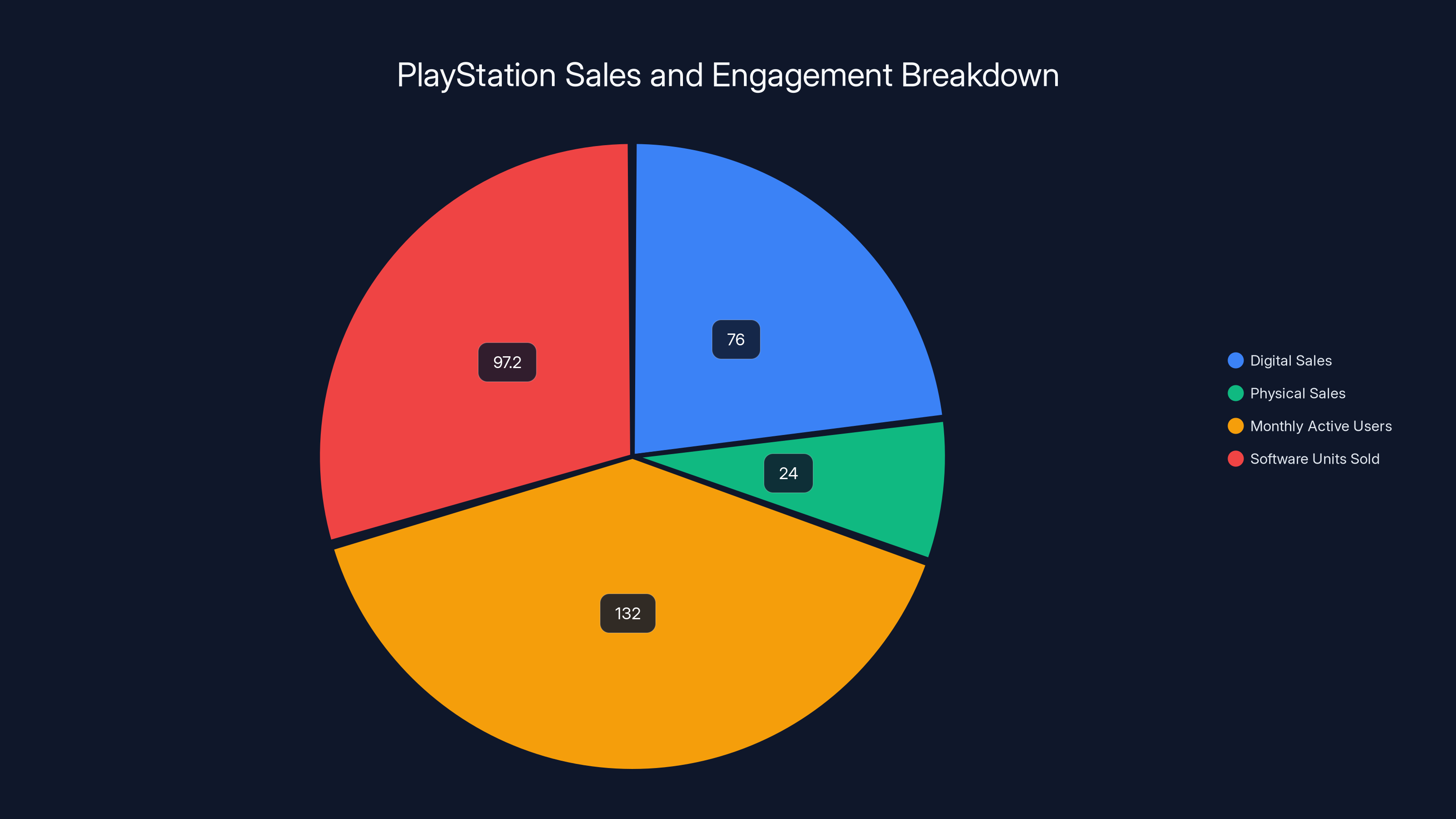

- Software sales actually surged to 97.2 million games, up from 95.9 million—the real growth metric

- Digital sales now represent 76% of all PlayStation sales, up 2% year-over-year, showing clear platform shift

- PlayStation Network hit a record 132 million monthly active users, indicating strong ecosystem engagement

- PS6 likely years away due to strong software performance, high RAM costs, and recent hardware updates

- Incoming blockbuster releases (Resident Evil Requiem, Avowed, Marathon) signal continued lifecycle strength

While PS5 hardware sales decreased to 8 million units, software sales increased by 1.3 million units, digital penetration reached 76%, and monthly active users hit a record 132 million, indicating strong ecosystem engagement.

Understanding the Holiday Sales Decline: Context Is Everything

When Sony announced an 8 million unit shipment for Q3—their fiscal third quarter covering October, November, and December—the immediate reaction was panic. "PS5 sales collapse!" the headlines screamed. But panic isn't warranted. In fact, it's a misunderstanding of the numbers themselves.

Let's talk about what happened last year. The 2023 holiday season was extraordinary. Nine and a half million PS5 units shipped during that single quarter. That's not normal. That's exceptional. Since the PS5 launched in November 2020, that quarter represented the console's single best performance ever. It was an absolute peak.

So when this year came in at 8 million units, was it actually bad? Or was it simply normal performance compared to an unusually strong year? The answer depends on your perspective, but the data suggests it's mostly the latter. Sony's first two fiscal quarters of 2024 actually saw increases in PS5 shipments compared to their respective prior-year periods. The trend going into Q3 was positive. The decline happened specifically in the holiday window.

Multiple factors contributed to this slowdown. The console launched over four years ago. Anyone who desperately wanted a PS5 already owns one. The hardware refresh (PS5 Pro) had just launched, potentially cannibalizing standard PS5 sales from price-conscious consumers waiting for clarity. Competing entertainment options are stronger than ever. Gaming competition from other platforms has intensified. And frankly, console hardware is becoming less central to gaming than it was five years ago.

But here's what makes this analysis incomplete: the hardware numbers alone don't tell the real story of PS5's health.

The Real Story: Software Sales Shattered Expectations

While everyone was focusing on the hardware decline, Sony's software division posted exceptional results. That's where the actual profit lives in gaming.

During the same Q3 period, PlayStation shipped 97.2 million software units. Compare that to 95.9 million in the prior year. That's an increase of 1.3 million games sold. In percentage terms, it's a 1.4 percent gain, but the direction matters. While hardware slipped, software accelerated.

This is the metric that actually matters to game publishers, developers, and Sony's bottom line. Hardware sales are often a loss-leader in console gaming. The real money flows from software—the games people buy, the subscriptions they maintain, the digital purchases they make. A PS5 sitting in a living room without software purchases is essentially worthless.

The fact that software sales increased even as hardware declined tells you something crucial: the PlayStation 5 userbase is growing more engaged, not less. People own PS5s. They're buying games for them. They're playing more. The console's attach rate—the average number of games purchased per console—is improving.

Breaking this down further reveals even more interesting data. Digital sales now represent 76 percent of all PlayStation software sales, up 2 percentage points from last year. That means three out of every four games sold on PlayStation are digital downloads, not physical copies. The industry's slow-motion shift away from physical media is now nearly complete on PlayStation.

Digital sales margins are dramatically higher than physical sales. There's no manufacturing cost. There's no retail distribution. There's no resale market cutting into second-hand revenue. When a customer buys a game digitally, Sony and publishers capture nearly the entire transaction value. This shift is transforming PlayStation's profitability even as unit sales remain flat or decline.

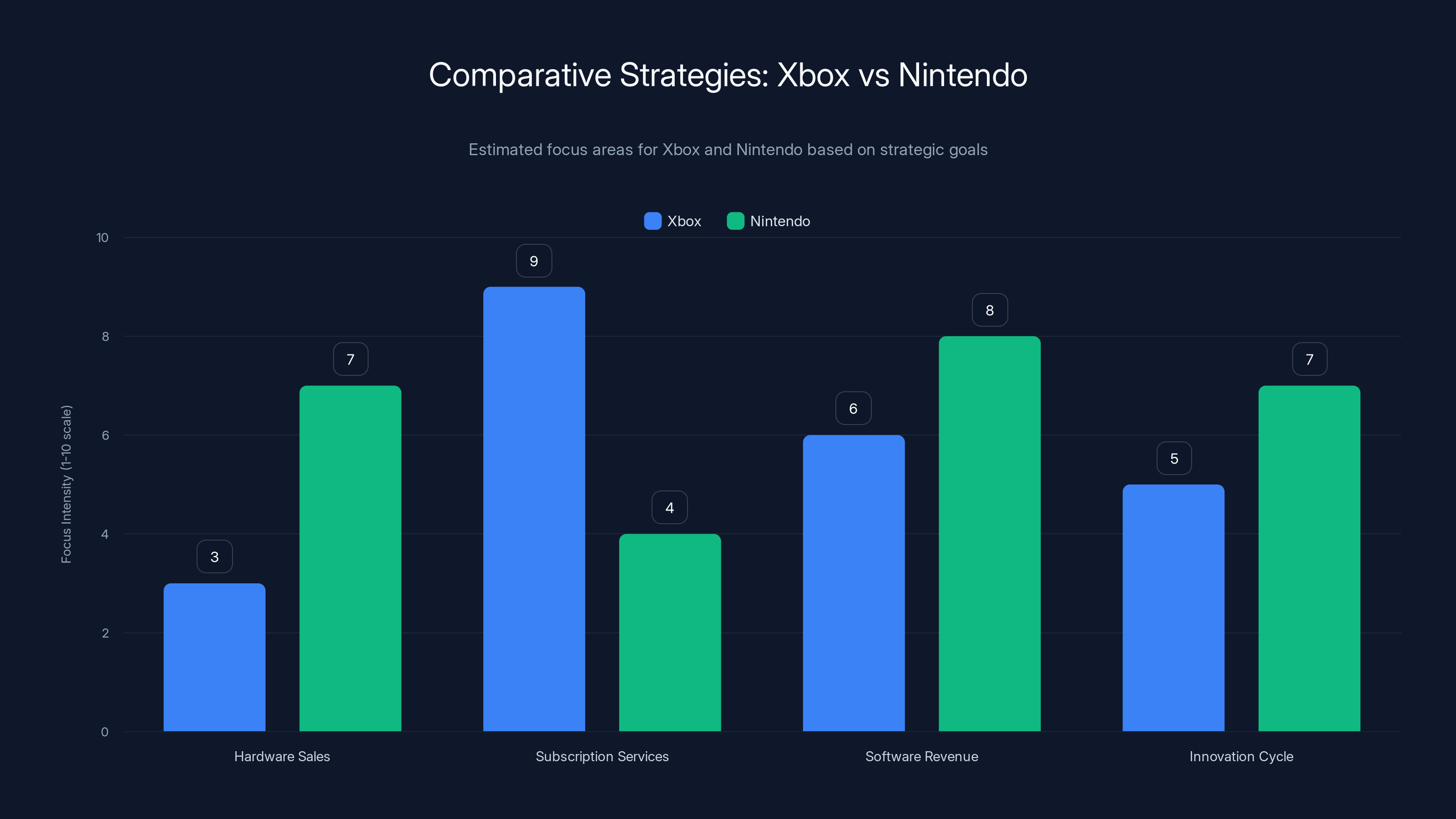

Xbox focuses heavily on subscription services like Game Pass, while Nintendo emphasizes hardware sales and software revenue. Estimated data based on strategic insights.

PlayStation Network Growth: The Ecosystem Expansion

Software sales numbers are important, but they don't capture the full scope of PlayStation's growth. Monthly active users on the PlayStation Network hit a record 132 million during Q3. That's a staggering figure. That's nearly two billion monthly hours being played on PlayStation services, across all regions and demographics.

Monthly active users—often abbreviated as MAU—represent the most engaged part of any gaming ecosystem. These aren't people who bought a PS5 and abandoned it. These are people actively logging in, playing games, using the platform monthly. For context, the entire global population is roughly 8 billion people. A PlayStation Network that reaches 132 million people monthly represents penetration that would make any platform jealous.

This metric grows independently of hardware sales because people keep using their existing consoles longer. Older PS5 owners remain active. Plus, PlayStation Network extends beyond PS5. The PS4 installed base is still enormous—over 100 million units sold during its lifetime. People on PS4 count toward MAU numbers. Mobile phone access to PlayStation services counts. The ecosystem has expanded beyond just counting console sales.

The reason this matters: advertising revenue, subscription services, and ecosystem lock-in are increasingly important to gaming companies. Every person actively using PlayStation Network is a potential customer for PlayStation Plus subscriptions, PlayStation Store purchases, cloud gaming services, and whatever Sony announces next. The 132 million number represents market power that translates into leverage with game publishers and negotiating power with platform partners.

Fiscal Performance: The Gaming Division Outperformed Expectations

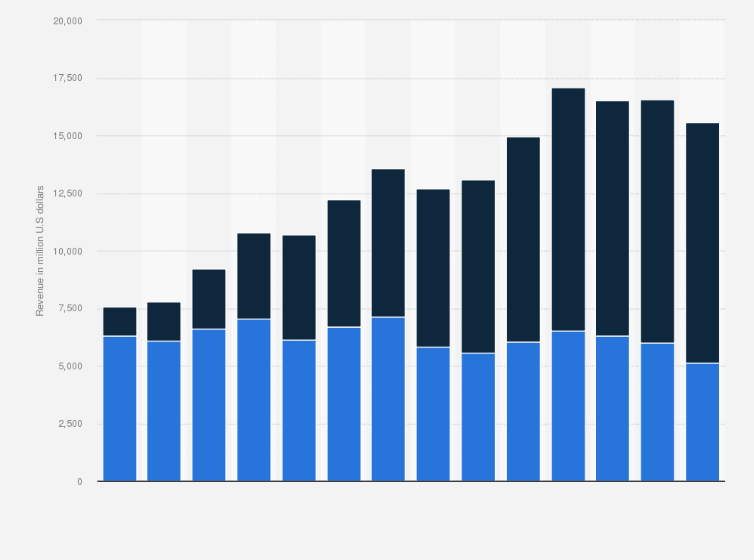

Despite the hardware sales decline, Sony's gaming division actually increased profit during Q3. How? Partly through the software metrics mentioned above. Partly through increased average selling prices. But also through currency benefits.

The Japanese yen weakened significantly during the fiscal period. When your company is based in Japan but sells products globally, currency fluctuations become a massive factor in profitability. A weaker yen means PlayStation hardware manufactured in Japan becomes cheaper for international consumers. It increases competitiveness in foreign markets. It amplifies profit margins on international sales when revenues are converted back to yen.

Sony's financial team explicitly mentioned that currency benefits contributed meaningfully to gaming division profit growth. In other words, without that yen weakness, the profit increase might not have happened. This highlights an often-overlooked reality of console gaming: currency volatility, manufacturing costs, and macroeconomic factors shape profitability just as much as actual demand.

The gaming division remains Sony's most profitable sector. Entertainment revenue is stable, but gaming generates the highest margins. This explains why Sony continues investing heavily in PS5, acquiring game studios, and pushing subscription services. The money is good, and the outlook remains strong.

The Console Cycle Question: Is PS5 in Its Prime?

The elephant in the room after any hardware sales decline is this: when is the next console coming?

Historically, console cycles last 5-7 years. The PS4 launched in November 2013 and remained the current generation console until the PS5 arrived in November 2020. That's seven years. By that math, we might expect the PS6 around November 2027—roughly three years from now.

But multiple factors suggest a longer cycle this time. First, software sales and user engagement remain strong. There's no sign that developers or players are abandoning the PS5. When a console enters decline, publishers start shifting resources to next-generation titles. We're not seeing that yet. New games continue launching regularly. Even smaller publishers still commit resources to PS5 releases.

Second, manufacturing costs have shifted. RAM is expensive right now. High-bandwidth memory (HBM) that would power a next-generation console is in short supply and high demand from AI companies. Building a PS6 with the kind of generational leap everyone expects would be expensive. Waiting a few more years for manufacturing costs to stabilize makes financial sense.

Third, the PS5 Pro launched relatively recently with significant performance upgrades. Sony positioned this as a mid-cycle console refresh, allowing the company to capture consumers who want better performance without abandoning the entire product line. This suggests internal planning for an extended PS5 lifecycle, not a rush to PS6.

When the PS6 does arrive, industry analysts expect it will offer roughly triple the raw performance of the PS5. Current generation consoles deliver games at 4K resolution, 60-120 frames per second, with ray-traced lighting. The next generation will push toward 8K, 120+ frames per second as standard, with dramatically improved rendering quality and AI-assisted visual effects.

But that technological leap is less important than the architecture question. The PS6 will likely adopt AMD's latest RDNA architecture, improved CPU cores, and next-generation manufacturing processes. It will probably ship with 1-2 terabytes of SSD storage as standard. Backwards compatibility with PS5 games will be nearly universal, matching the pattern established with PS4 to PS5.

The most important question isn't when PS6 arrives, but what it means for the console market overall. The traditional console market is maturing. Innovation is slowing. Competition from PC gaming, mobile gaming, and subscription services is increasing. The PS6 won't be a revolution. It will be an evolution.

Estimated data shows manufacturing efficiency and software revenue as major contributors to profit growth, highlighting strategic areas for Sony's gaming division.

Incoming Blockbuster Releases and Content Pipeline

Sony's software momentum looks strong heading into 2025. Multiple major releases are scheduled within the first few months of the year, each positioning PlayStation as the destination for major gaming franchises.

Resident Evil Requiem launches February 27. This is the latest entry in Capcom's flagship survival horror franchise. Resident Evil remains one of gaming's most recognizable brands. New entries consistently sell millions of copies. The February launch gives RE fans something major to play during early 2025.

Avowed arrives February 17, coming from Obsidian Entertainment. This is a fantasy RPG in a world that many players know from video games and tabletop campaigns. It represents substantial production values and significant consumer anticipation. Obsidian's previous work (The Outer Worlds, Baldur's Gate 3 partnership development) positioned them as a serious developer.

Marathon releases March 5. Bungie—legendary developer behind Halo, Destiny, and Destiny 2—is launching this new IP as a free-to-play competitive shooter. Bungie has massive credibility in gaming. Any new game from them attracts massive attention. A free-to-play model means low barrier to entry for PS5 owners.

These three games alone represent tens of millions of potential sales during Q1 2025. They showcase different genres: horror, RPG, and competitive multiplayer. They appeal to different player demographics. Together, they represent a content pipeline designed to keep PS5 engagement high and drive software sales even if hardware sales decline.

Beyond Q1, the pipeline includes unannounced sequels and new IP from major studios. Sony's game acquisition strategy over the past three years—buying Insomniac, Bungie, and others—means a steady flow of exclusive content developed specifically for PlayStation platforms.

Market Share and Console Competition Dynamics

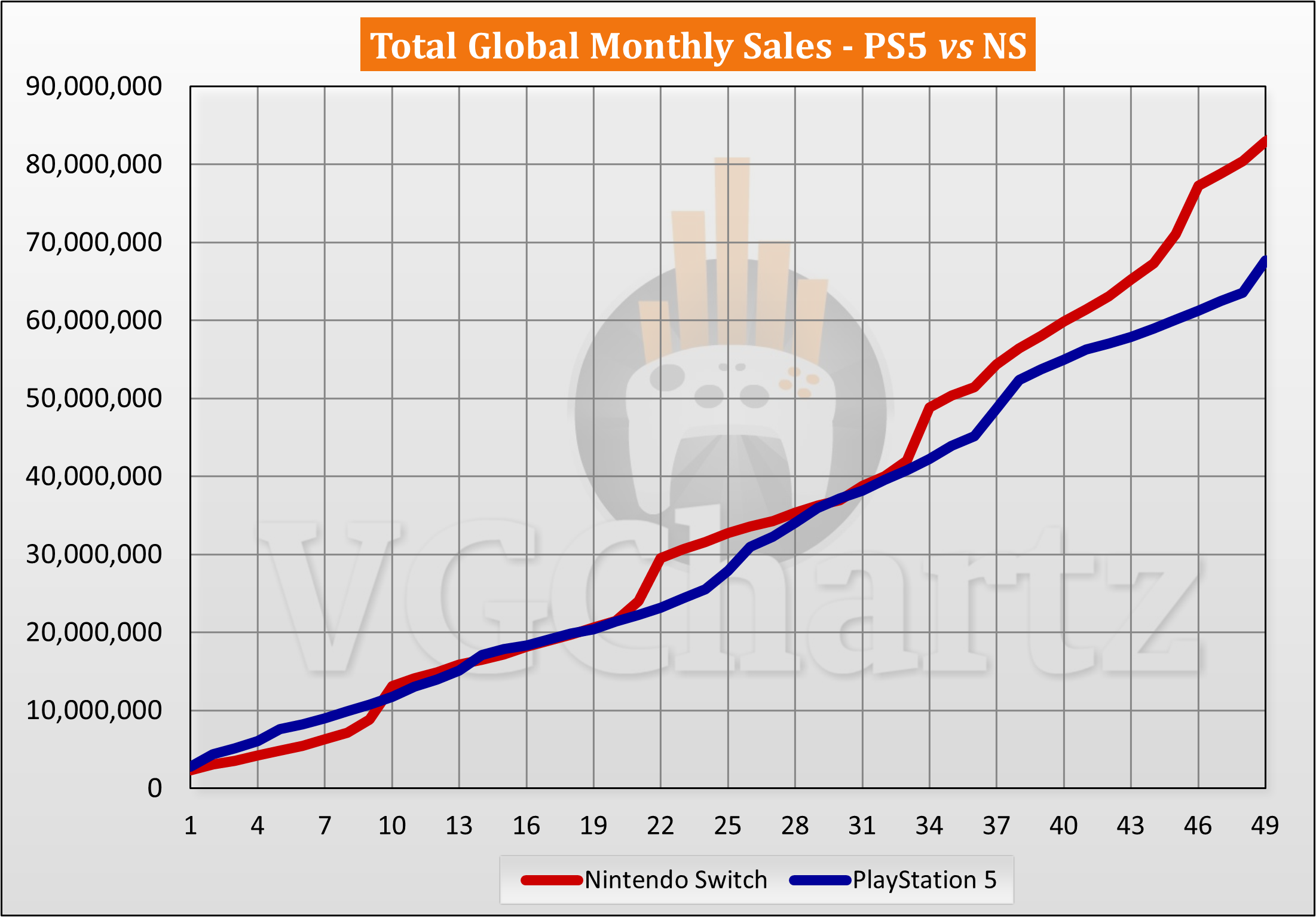

The broader gaming console market is smaller than many people realize. The PS5 and Xbox Series X/S dominate hardware, but Nintendo Switch continues commanding a significant portion of sales through its unique hybrid form factor and massive installed base.

PlayStation maintains roughly 45-50% of the console market. Xbox holds roughly 25-30%. Nintendo Switch claims the remaining 20-25%. These percentages vary by region—PlayStation dominates in Japan and Europe, Xbox is stronger in North America, Switch is massive in certain demographics like casual gamers.

What's interesting is that the total addressable market for dedicated gaming consoles is actually shrinking in percentage terms. More people play games on phones. More people game on PCs. Cloud gaming services are growing, though adoption remains early. The console market isn't dying, but it's becoming a smaller portion of overall gaming.

This context matters for understanding the PS5 decline. It's not just that fewer people want PS5s. It's that the console market itself is maturing and fragmenting. A 16% decline year-over-year during the holiday quarter might be catastrophic for a product in growth phase. But for a console in mid-cycle maturity, it's normal variance.

Xbox Series X/S have faced similar challenges, though Microsoft has taken a different strategic approach through Game Pass subscriptions and cloud gaming emphasis. Nintendo Switch is experiencing its own sales decline as the hardware ages and the Switch 2 awaits announcement.

The console market remains profitable and competitive. But the days of explosive year-over-year growth are over. Mature market management and ecosystem engagement matter more than chasing new hardware sales.

Software Developer Response and Industry Trends

One underrated signal of console health is how game developers respond. Are major publishers committing resources to the platform? Are independent developers interested in development? Is the platform growing or shrinking in the minds of creators?

For PlayStation 5, the answer is clearly growth and continued commitment. Major publishers like EA, Activision Blizzard, Take-Two, and others continue developing games for PS5. Smaller studios see PS5 as a viable platform. Indie developers get tools and support from Sony.

This creates a virtuous cycle. Strong software support attracts players. Players attract more developers. More developers create more games. More games attract more players. The PS5 is firmly in this positive cycle.

Compare that to what happened with Xbox Original or Dreamcast—consoles that saw publisher support collapse, creating a vicious cycle. PS5 shows zero signs of losing developer support. Quite the opposite.

The trend toward live-service games and ongoing content updates also benefits console lifespans. Games like Destiny 2, Fortnite, and Call of Duty's multiplayer keep players engaged for years. Console owners with these titles installed don't feel pressure to upgrade. This extends hardware lifecycles naturally.

Developers are also experimenting with cross-platform play and services that transcend individual platforms. A player might own a PS5 but play with friends on PC or other consoles through cross-platform matchmaking. This flexibility reduces the pressure to own every platform, but it also means console loyalty depends more on exclusives and community than raw performance.

PS5 holiday sales peaked in 2021 with 9.5 million units, followed by a 16% decline to 8 million units in 2023. Estimated data for 2020 shows initial launch impact.

Digital Distribution and The End of Physical Games

The march toward 76% digital sales represents a fundamental industry shift happening in real-time. Five years ago, physical game sales still dominated. Today, digital is overwhelmingly the primary distribution method.

This shift benefits game publishers and platform holders immensely. Manufacturing costs vanish. Distribution costs drop to essentially zero. Retail markup disappears. DRM can be enforced through platform control. Used game markets can be eliminated. Price control is absolute.

The drawback: consumer choice decreases. You can't resell a digital game. You can't lend it to a friend. You can't buy it used from a cheaper source. You don't own it—you license it. If the digital storefront closes in 20 years, your access potentially disappears.

But consumers have overwhelmingly chosen convenience over ownership. Digital games install faster, take up less physical space, and never get damaged or lost. The friction of going to a store to buy a physical game is gone. Parents can buy games remotely for their kids. Players can access their entire library from any PS5. The convenience is real.

This trend will continue until physical games are essentially obsolete for console gaming. Nintendo still moves significant physical volumes through retailers, but even that is declining. The future is entirely digital, which means platform loyalty and digital storefront security become increasingly important.

Geographic Performance Variations and Regional Markets

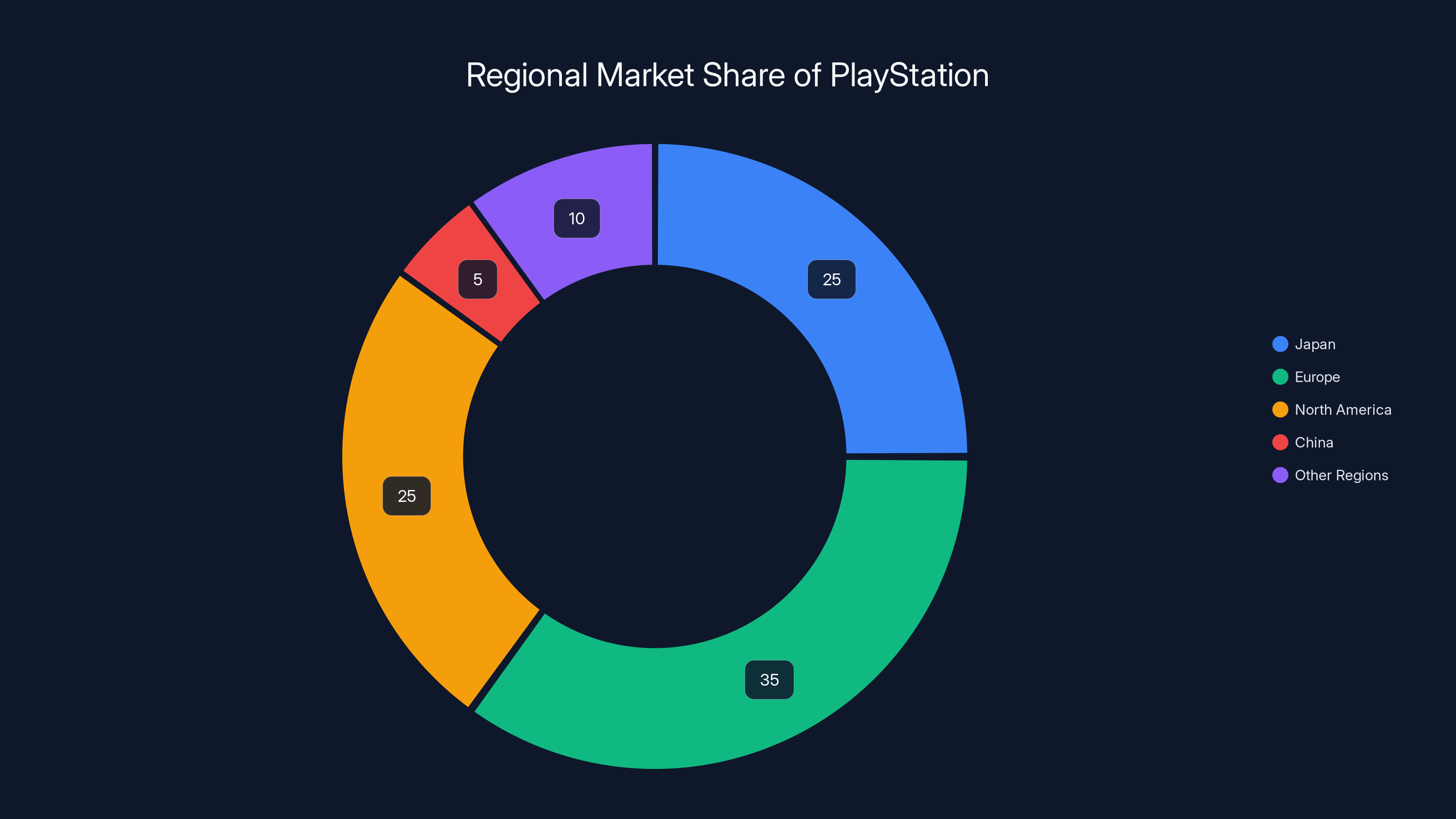

Sony doesn't break down Q3 sales by region in most earnings reports, but the global 8 million figure masks significant regional variation. PlayStation performs differently in different parts of the world.

Japan is a PlayStation stronghold. Nintendo Switch dominates casual and family gaming, but PlayStation owns the hardcore enthusiast market. Japanese developers create PlayStation exclusive titles that don't launch elsewhere. The franchise loyalty runs deep.

Europe is PlayStation's strongest market overall. UK, Germany, France, and Spain heavily favor PlayStation. Xbox has always struggled in Europe against the PlayStation brand. Nintendo Switch finds its audience through family titles, but PlayStation owns the core gaming market.

North America is more competitive. Xbox has stronger presence there, partly through Game Pass and Halo franchise loyalty. The market is split more evenly. But PlayStation still commands significant share, especially on the strength of franchises like God of War, The Last of Us, and Spider-Man.

China represents a complex market. PlayStation has historically had limited presence due to console gaming restrictions. But emerging mobile and cloud gaming services from Chinese companies create different competitive dynamics.

The global holiday season variation also matters. Not every region celebrates Christmas. Not every region has the same retail patterns. Some regions peak in different quarters. These variations average out to 8 million units globally, but the underlying regional dynamics vary significantly.

Understanding regional variance is important because it suggests where growth is possible. If certain regions are declining while others grow, that tells you something about global market dynamics.

Production and Supply Chain Considerations

Console hardware is manufactured through complex global supply chains. Semiconductor shortages, logistics disruption, and manufacturing capacity all influence how many PS5s Sony can ship in any given period.

The semiconductor shortage that plagued 2020-2022 has largely resolved. PlayStation can manufacture PS5s at full capacity now. Supply constraints are no longer a limiting factor. If PS5 sales are declining, it's due to demand, not supply.

Different storage technologies, manufacturing processes, and component sourcing affect costs. The PS5 Pro uses enhanced cooling solutions and improved power management. These cost more to manufacture. Sony prices the Pro at a premium to offset increased BOM (bill of materials) cost.

Semiconductor manufacturing improvements and cost reductions take time. The advanced processes used in console CPUs and GPUs are expensive. Shifting to newer, cheaper processes requires redesigns. This explains why manufacturers space out hardware revisions by years, not months.

Long-term, manufacturing costs will drive pricing and upgrade cycles. Waiting for costs to fall before launching PS6 makes economic sense. Pushing out the launch gives supply chain costs time to normalize.

Estimated data shows Europe as the strongest market for PlayStation, followed by Japan and North America. China and other regions have smaller shares due to various market dynamics.

Profitability Analysis: Why the Gaming Division Thrived

Sony's gaming division increased profit in Q3 despite hardware sales declines. This happened through a combination of factors working together.

First, software revenue increased. More games sold equals more money. The 1.3 million additional games sold at probably $30-70 per game represents substantial additional revenue.

Second, digital sales margins are higher. 76% digital sales means higher profit per transaction. The shift to digital automatically increases margins even if unit volume is flat.

Third, PlayStation Plus subscription revenue continues growing. Not all subscription growth gets reported, but increasing MAU numbers strongly suggest growing subscription revenue. Subscriptions are recurring, predictable revenue—the most valuable kind in business.

Fourth, the yen weakness increased profit margins on global sales. A weaker yen makes Japanese-made products cheaper internationally, increasing volume in foreign markets. When those revenues convert back to yen, they're worth more. This pure currency benefit to profits happened automatically.

Fifth, manufacturing efficiency improved. Longer production runs of PS5 reduce per-unit manufacturing costs. Sony optimized the supply chain over four years. Manufacturing a PS5 today is cheaper than manufacturing one in 2020.

Combine all these factors—software growth, digital shift, subscription increases, currency benefits, and manufacturing efficiency—and you get profit growth even with flat hardware sales. This is mature product management.

The Competitive Landscape: Xbox and Nintendo Comparisons

Understanding PS5 sales decline requires understanding what happened with competitors.

Xbox Series X/S faced similar or steeper hardware sales declines. Microsoft hasn't publicly detailed Q3 shipments, but analyst estimates suggest Xbox hardware sales are down year-over-year by similar magnitudes, possibly steeper. However, Microsoft's strategy differs fundamentally. Game Pass subscriptions are Microsoft's primary goal, not hardware unit sales.

This matters enormously. Microsoft essentially subsidizes Xbox hardware to drive Game Pass subscriptions. They're willing to lose money on hardware if it means winning subscription revenue. PlayStation pursues both approaches—maximize hardware profit while growing software and subscription revenue. Different strategies, different metrics of success.

Nintendo Switch is experiencing its own challenges as the hardware ages toward the end of its lifecycle. Rumors of Switch 2 have circulated for years. When it finally arrives, it will reset the Switch platform's momentum. Nintendo operates on longer hardware cycles than competitors, and Switch has performed spectacularly, so the company can afford to be patient.

PC gaming remains a wild card. Steam, Epic Games Store, and other PC platforms take increasing share of gaming revenue. Gaming PCs are expensive but far more flexible than consoles. The barrier between console gaming and PC gaming continues blurring.

Cloud gaming via services like Xbox Cloud Gaming, PlayStation Now, and others represents the future but remains early. Adoption is lower than many predicted. Latency and data limits remain issues for many players. But the trend toward cloud is inevitable.

In this competitive landscape, PS5 sales decline is less about PlayStation losing than the entire console market maturing. Hardware sales are slowing across all platforms. Software and services are where growth happens.

Future Outlook: What 2025 Holds for PlayStation

Heading into 2025, PlayStation enters its fifth full year of PS5 generation. History suggests that mid-cycle years are typically strong software years. Developers have mastered the hardware. New tools and engines optimize performance. Budgets are fully allocated. Results appear on shelves.

We should expect strong software releases, growing subscription revenue, and continued ecosystem engagement. Hardware sales might continue declining as adoption plateaus, but that's normal for mid-cycle consoles.

The real test will be whether PlayStation can sustain software innovation and exclusives. If developers' focus shifts toward PS6 development and away from PS5 optimization, that's a sign the console cycle is ending. We're probably 2-3 years from that happening.

The announcement of PS6 won't happen until at least 2026, likely 2027. When it arrives, PS5 will have an installed base of 110-120 million units. That's enough to keep developers supporting it for another 5+ years after PS6 launch, similar to what happened with PS3 to PS4.

Subscription services like PlayStation Plus Extra and Premium are likely to see expanded offerings. Competition from Game Pass forces Sony to improve subscription value. Expect more day-one game releases and possibly exclusive content for subscribers.

Cloud gaming will receive more investment. PlayStation Now shows promise but remains behind competitors in optimization. Improving cloud performance and latency is crucial for long-term platform strategy.

Mobile and online services will expand. PlayStation is exploring mobile gaming through partnerships and new titles. This extends the PlayStation ecosystem beyond consoles into markets that console hardware never reaches.

Digital sales dominate at 76%, with 132 million monthly active users and 97.2 million software units sold, indicating a shift to a service-driven model.

Strategic Implications for Developers and Publishers

The PS5 sales data sends clear signals to game developers and publishers about platform strategy.

First, PS5 remains the primary console development target. With 92.2 million units sold and 132 million monthly active users, PS5 represents the largest addressable market for console games. Any major publisher ignoring PlayStation is leaving significant revenue on the table.

Second, software quality matters more than hardware power. The transition from generation to generation happens slowly. PS4 to PS5 titles still launch years after PS5 release. Developers take time to fully utilize new hardware capabilities. This extends console lifecycles and means hardware generational jumps are less dramatic than marketing suggests.

Third, live service games matter. Evergreen titles like Destiny 2, Fortnite, and Apex Legends keep players engaged between major new releases. Publishers increasingly plan for post-launch support and content updates. Single-player games require planning for engagement long after launch.

Fourth, digital distribution and platform control are valuable. Sony's shift toward digital software increases platform power and profit margins. Developers see this and optimize their distribution accordingly. The indie developer relationship with Sony continues strengthening as tools improve and revenue sharing becomes clearer.

Fifth, subscription services represent growth. Game Pass forced the industry to think differently about revenue models. PlayStation Plus needs to evolve to compete. Publishers increasingly assume some sales will come through subscription rather than individual purchases.

Consumer Behavior Trends and Player Demographics

The 8 million PS5 sales and 97.2 million software units sold reflect deeper consumer behavior trends.

Players are keeping consoles longer. The average lifespan from purchase to replacement has extended. Older hardware collectors exist now—people with multiple consoles, retro gaming setups, and libraries of physical games. The hardcore enthusiast retains their PS5 through the entire generation.

Casual players have shifted toward mobile and free-to-play games. Console exclusivity is no longer as valuable for casual audiences. Nintendo Switch captures casual players through affordability and library accessibility. PlayStation chases dedicated enthusiasts with exclusive story-driven experiences.

Family gaming has shifted toward Switch. PlayStation markets to young adults and adult gamers. The demographic split is increasingly clear—PlayStation: core gamers, Xbox: subscription seekers and multiplayer players, Switch: families and casual players.

Social gaming drives engagement more than solo experiences. Multiplayer, online cooperation, and streaming-friendly games see greater investment. Single-player narratives remain valuable but increasingly feel niche compared to service games.

Cross-platform play is becoming standard expectation. Players expect to play with friends regardless of platform. PlayStation's initial resistance to cross-platform play now seems quaint. Industry-wide acceptance of cross-play is nearly universal.

Regulatory Environment and Gaming Industry Shifts

Console gaming operates in an increasingly regulatory environment. Data privacy laws, spending controls, geographic restrictions, and consumer protection regulations shape industry strategy.

The UK and EU have considered regulations on loot boxes, spending controls, and digital ownership. These potentially affect console gaming profitability. Sony and others lobby against excessive regulation while attempting some self-regulation to avoid harsher rules.

Antitrust scrutiny of big tech companies includes gaming. Microsoft's acquisition of Activision Blizzard faced massive regulatory review. Future consolidation in gaming will face similar scrutiny. This affects industry consolidation strategy and acquisition planning.

Access to development tools and storefronts is increasingly contested. Epic Games' fight with Apple over app store fees represents broader industry tensions. Console makers maintain walled gardens that give them control but invite regulatory attention.

Geographic variations in regulation create complexity. A game or service legal in one region faces restrictions elsewhere. PlayStation supports this through regional storefronts and content filtering. But complexity increases costs.

These regulatory trends probably won't dramatically change console sales trajectories in 2025. But they influence long-term strategy, acquisition decisions, and service design.

Lessons from Historical Console Cycles

Console history provides context for understanding PS5's current position.

The PS2 remained the dominant console for over a decade. It saw hardware sales decline after year 5-6, but software support continued strong through year 10. The installed base remained huge and valuable.

The PS4 followed similar patterns. After initial rapid growth, sales leveled off and eventually declined. But the console thrived for 7+ years due to software quality and ecosystem strength.

The Xbox 360 experienced similar lifecycle. Rapid growth, plateau, decline—but tremendous profit throughout because of strong software and online services.

Nintendo 64 had shorter lifespan but remained strong with a smaller audience. Game Cube had weak software support that accelerated its decline. Dreamcast lacked strong publisher support and died relatively quickly.

The difference between successful and failed consoles: software support and ecosystem quality. Hardware power matters less than whether developers want to create for the platform.

PS5 shows all the signs of a successful long-term console. Strong software, growing developer commitment, huge installed base, and engaged player community. The hardware sales decline doesn't change those fundamentals.

What's Next: 2025-2027 Predictions

Based on current trends and historical patterns, several outcomes seem likely for PlayStation over the next 2-3 years.

Q4 2024 and Q1 2025 will see strong software sales from the mentioned blockbuster releases (Resident Evil Requiem, Avowed, Marathon). These will drive player engagement and software sales metrics up.

Hardware sales will probably continue declining slightly as adoption reaches saturation. By 2027, when PS6 arrives, PS5 shipments might drop to 3-5 million units annually. That's normal for aging hardware.

PlayStation Plus subscription growth will continue. The service has value proposition advantages that Game Pass doesn't in certain areas (exclusive PS5 game day-one launches). Subscription margins are excellent, driving platform economics.

Cloud gaming will improve but won't replace console gaming in the timeframe. Technology remains 5-10 years away from cloud dominance for serious gamers. But streaming options will expand.

PS6 announcement will likely come in 2027. Launch will follow 2-3 years later, probably 2029 or later. The extended timeline gives manufacturing costs time to normalize and game developers time to prepare sophisticated launch titles.

Mobile gaming expansion will continue. PlayStation might announce mobile-exclusive titles or partnerships. This expands the ecosystem without cannibalizing console revenue.

Genre diversification will continue. Exclusive PlayStation titles span action, horror, RPG, strategy, and others. This appeal to different player preferences strengthens overall ecosystem.

FAQ

Why did PS5 sales drop 16 percent during the holidays?

Multiple factors contributed to the decline. Last year's holiday quarter saw 9.5 million units, an exceptional peak, not normal baseline. This year's 8 million units represents normal mid-cycle demand. The PS5 Pro launch may have cannibalized standard model sales. Four-year-old hardware naturally sees declining growth as adoption reaches saturation. Competing entertainment options and cross-platform gaming reduce console exclusivity value.

Is the PS5 dying if hardware sales are declining?

No. Hardware sales decline is expected and normal for consoles in mid-cycle maturity. The real health indicators are software sales (up 1.3 million units), digital penetration (76%), and monthly active users (record 132 million). These metrics show strong engagement and growing ecosystem value despite hardware sales decline. Profit increased despite hardware decline, showing the business remains healthy. Historical precedent shows consoles thrive with declining hardware sales through strong software support, which PlayStation demonstrates.

What does the PlayStation Network monthly active user record mean?

The 132 million monthly active users represent people logging into PlayStation services monthly across all platforms—PS5, PS4, mobile apps, and web services. This metric indicates ecosystem engagement independent of hardware sales. Growing monthly active users means more people using PlayStation services, creating opportunities for software sales, subscriptions, advertising, and digital revenue. For platform companies, MAU is often more valuable than hardware shipments because it represents customer engagement and monetization opportunities.

When will PS6 arrive?

No official announcement has been made. Industry analysis suggests 2027-2029 as likely timeframe. The PS4 lasted 7 years before PS5 launched. The PS5 will likely have an extended lifecycle due to strong software performance, expensive RAM manufacturing costs, and continued developer support. Waiting longer allows manufacturing costs to decline and gives developers more time to optimize current generation games. When PS6 does arrive, it will likely offer triple the raw performance of PS5 with 8K gaming and advanced ray-tracing capabilities.

Will PS5 continue getting new games after PS6 launches?

Yes. Historically, PlayStation consoles receive support years after next-generation launch. The PS4 still receives new games today, five years after PS5 launched. The PS5's 92+ million installed base is too valuable to abandon immediately. Publishers will continue creating PS5 titles through at least 2032-2035. However, major AAA releases will gradually shift to PS6, beginning 2-3 years after PS6 launch. Cross-generation releases (simultaneous PS5 and PS6 versions) will be common in the transition period.

Why is digital sales growth more important than hardware sales?

Digital sales have dramatically higher profit margins than physical sales. Manufacturing and distribution costs for physical games are eliminated with digital purchases. Used game markets can't undercut pricing on digital sales. Platform holders capture nearly 100% of transaction value on digital sales versus 20-30% after retailer markups on physical sales. As digital penetration increases (now 76% on PlayStation), average profit per game sold increases significantly. This explains why software revenue increased despite only 1.4% unit growth in games sold.

What impact do upcoming game releases have on PS5 sales?

Blockbuster game releases drive hardware and software sales. Resident Evil Requiem, Avowed, and Marathon arriving in Q1 2025 will attract players and drive console purchases from people wanting to play these titles. Quality exclusive content creates differentiation between PlayStation and competitors. A strong release pipeline signals platform health to developers and consumers. The three mentioned Q1 2025 releases represent tens of millions of potential sales and strong engagement signals heading into spring 2025. This counters the narrative of declining momentum.

How does PlayStation's performance compare to Xbox and Switch?

PlayStation maintains market leadership with roughly 45-50% console market share. Xbox holds 25-30%, Nintendo Switch captures 20-25%. However, each platform optimizes for different success metrics. Xbox emphasizes Game Pass subscriptions over hardware sales. Nintendo Switch captures casual and family markets. PlayStation focuses on exclusive narrative experiences and core gaming. All three face hardware sales slowdown as console gaming market matures. The competition remains intense but split along demographic and preference lines rather than pure sales volume.

Key Takeaways

The PS5's 16 percent holiday sales decline doesn't signal platform trouble—it reflects normal mid-cycle maturation after an exceptional prior-year comparison. Software sales actually increased, monthly active users hit records, and the gaming division grew profit despite hardware decline. Digital sales now dominate (76%), indicating a fundamental shift in how PlayStation operates and where profitability comes from. PlayStation Plus subscriptions and ecosystem engagement matter more than pure hardware shipments. The console lifecycle likely extends 2-3 more years before PS6 announcement, giving PS5 a potential 9-10 year lifespan. The real story isn't about declining sales—it's about transitioning from a hardware-driven business to an ecosystem and services-driven one.

Sony's gaming division demonstrates mature product management. Declining hardware sales during mid-lifecycle are acceptable if software quality, ecosystem engagement, and profit margins increase. That's exactly what Sony is achieving. The 132 million monthly active users, 97.2 million software units sold, and record 76% digital penetration show a platform entering its strongest years, not its final ones.

For players, this means strong software continues arriving. For developers, it means PS5 remains the primary console development target. For investors, it means gaming remains Sony's most profitable segment. For industry observers, it confirms that console gaming is maturing into a sustainable, profitable niche rather than maintaining explosive growth.

The age of explosive console growth is over. The age of console maturity and optimization has begun. PlayStation is managing that transition well.

Related Articles

- Nintendo Switch Becomes Best-Selling Console Ever [2025]

- Why Sony Is Pushing PS4 Players to PS5 Right Now [2025]

- Microsoft's Next-Gen Xbox 2027 Launch: What AMD Just Revealed [2025]

- Why Obsidian Cancelled The Outer Worlds 3: Inside The Studio's Strategic Shift [2025]

- Game UK Stores Closing: The Death of Physical Game Retail [2025]

- PS Plus February 2025 Games: Undisputed, Subnautica & More [2025]

![PS5 Holiday Sales Drop 16% Year-Over-Year: What It Means for Gaming [2025]](https://tryrunable.com/blog/ps5-holiday-sales-drop-16-year-over-year-what-it-means-for-g/image-1-1770298605633.jpg)