Silicon Valley's Real Exodus: Why the Wealth Tax Terrifies Founders

You've probably seen the headlines. Larry Page buying Miami real estate, Peter Thiel's team leasing office space in South Florida, and Elon Musk making noise about leaving. And if you're like most people, you've thought: "They're just dodging a 5% tax—what's the big deal?"

That's wrong.

The actual fear driving Silicon Valley into Signal chats called "Save California" isn't about income taxes at all. It's about something much darker for founders: a proposed wealth tax that doesn't care what percentage of a company you own. It cares what percentage you control.

Here's the nightmare scenario that's keeping founders awake: You build a startup. You raise money. You maintain voting control through dual-class stock structure—a completely legal, incredibly common tool that lets you keep the company's direction while bringing in capital. Then California passes a ballot initiative that taxes you on that voting control, not on your actual economic ownership.

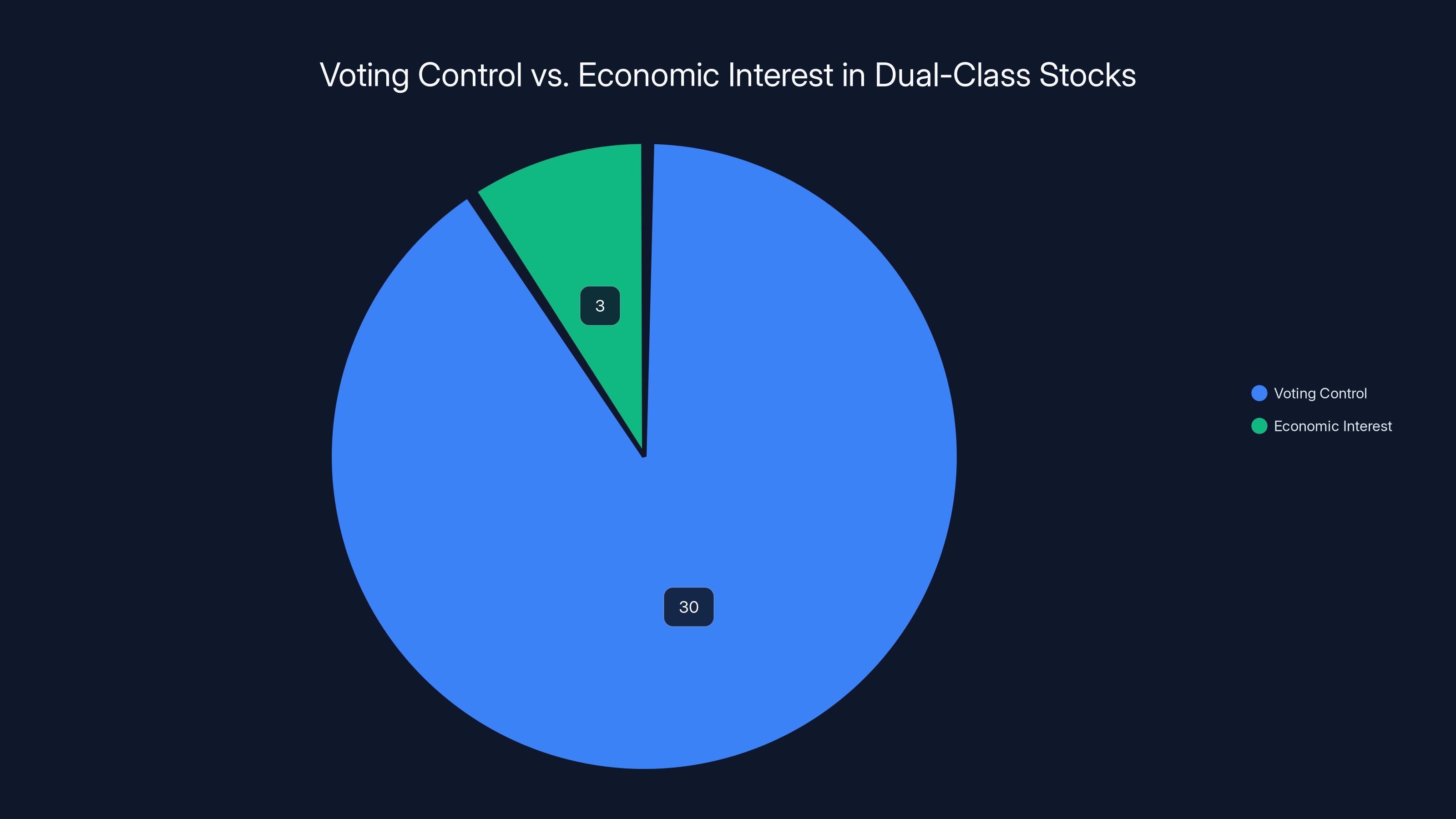

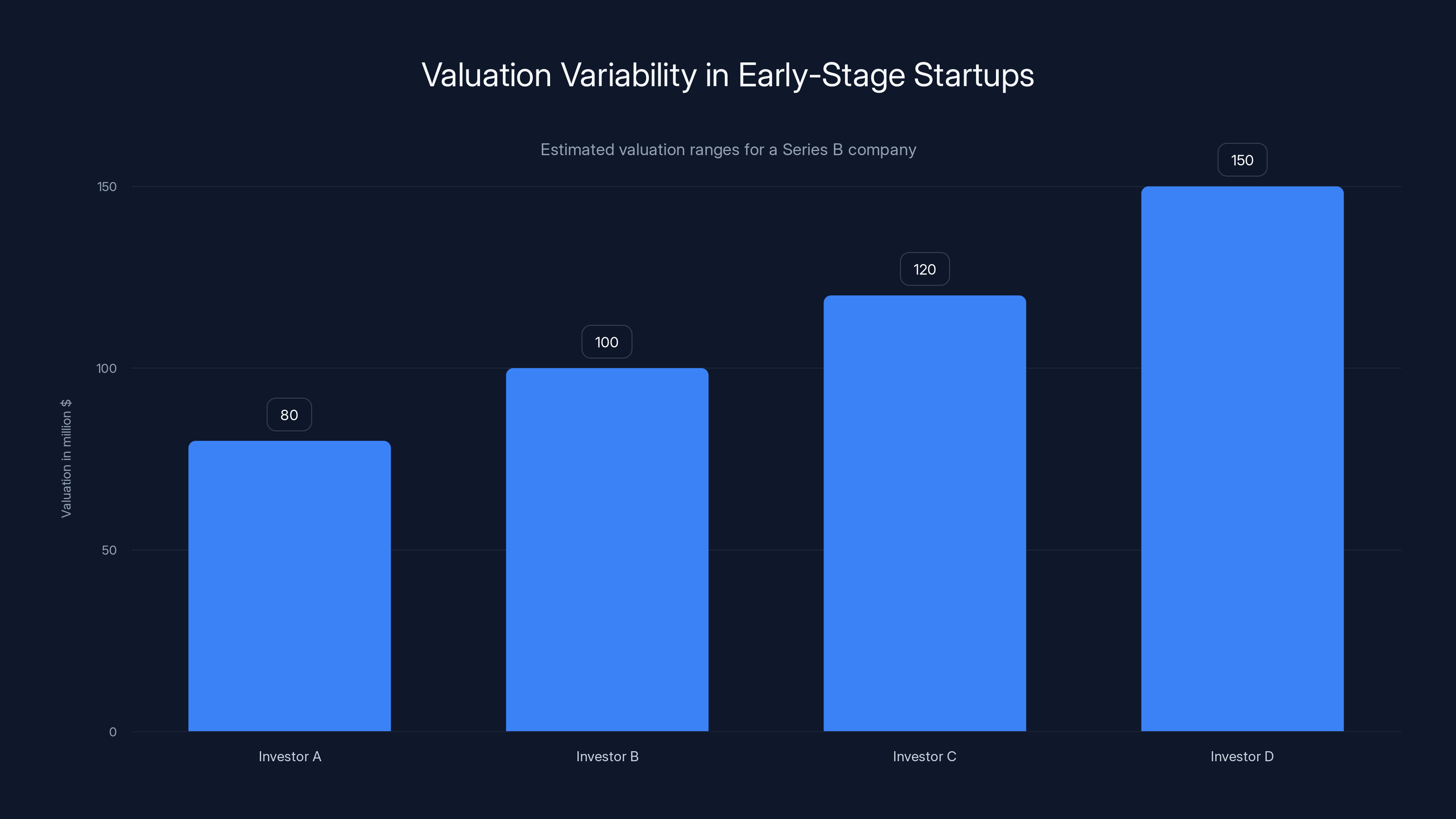

Say you own 3% of your company but control 30% through voting shares. California wants 5% of that 30%. Every year. On wealth you haven't actually realized. On a valuation that might be completely wrong.

One Space X engineer-turned-founder got a rough calculation from tax lawyers last month. His company was at Series B. The wealth tax bill would have wiped out his entire holdings. Not his yearly income. His entire stake in the company he built.

That's not a tax controversy. That's an existential threat to how venture-backed startups actually work.

The Dual-Class Stock Problem Nobody's Talking About

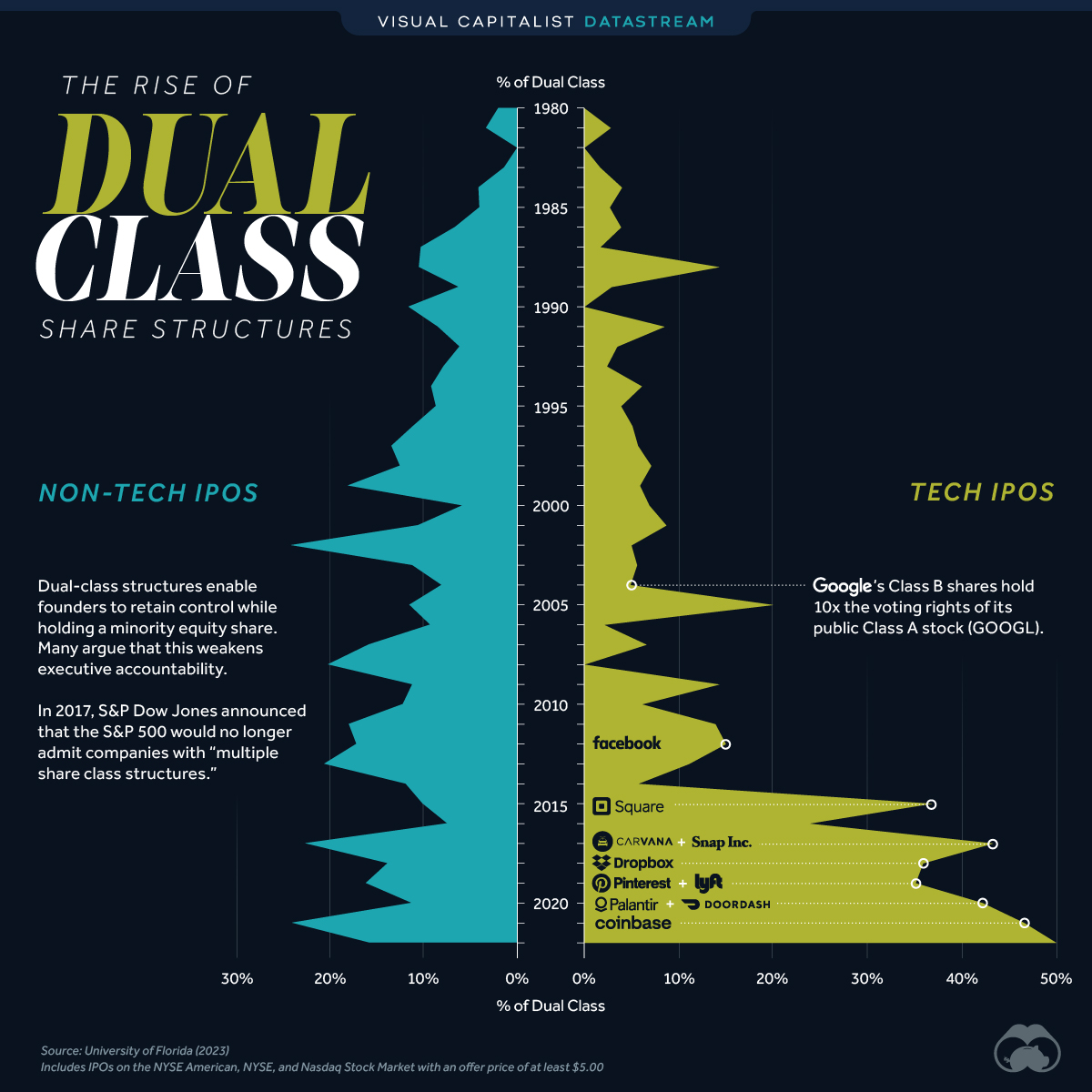

Let's start with the structure that's causing all this panic. Dual-class stock isn't some Silicon Valley loophole. It's a fundamental tool for founders who want to build long-term companies.

Google uses it, Facebook uses it, and Berkshire Hathaway uses it. The point is simple: founders get super-voting shares. Investors get regular shares. The founder controls the company. The investors get the upside. It's how Sergey Brin and Larry Page kept Google focused on moonshots instead of quarterly earnings. It's how Mark Zuckerberg made decisions about Facebook's business model without constant board pressure.

Without dual-class structures, founders face constant pressure to sell. Investors eventually want exits. Boards push for profitable decisions. The long-term vision gets murdered by quarterly metrics.

But here's where it gets dangerous with California's proposed wealth tax: the tax would be calculated on voting control, not economic interest.

Larry Page owns about 3% of Google. But through dual-class shares, he controls roughly 30% of the company's votes. Under the proposal, California would tax him on that 30% valuation. Google's market cap is over

Even at a 5% annual rate, that's $30 billion California expects to collect from one person. Every year. For wealth he can't sell without losing control of his company.

The union pushing this says founders are overreacting. They argue there are workarounds: appraisals from independent valuers, deferral accounts for illiquid assets, payment plans. But that's where the proposal falls apart in practice.

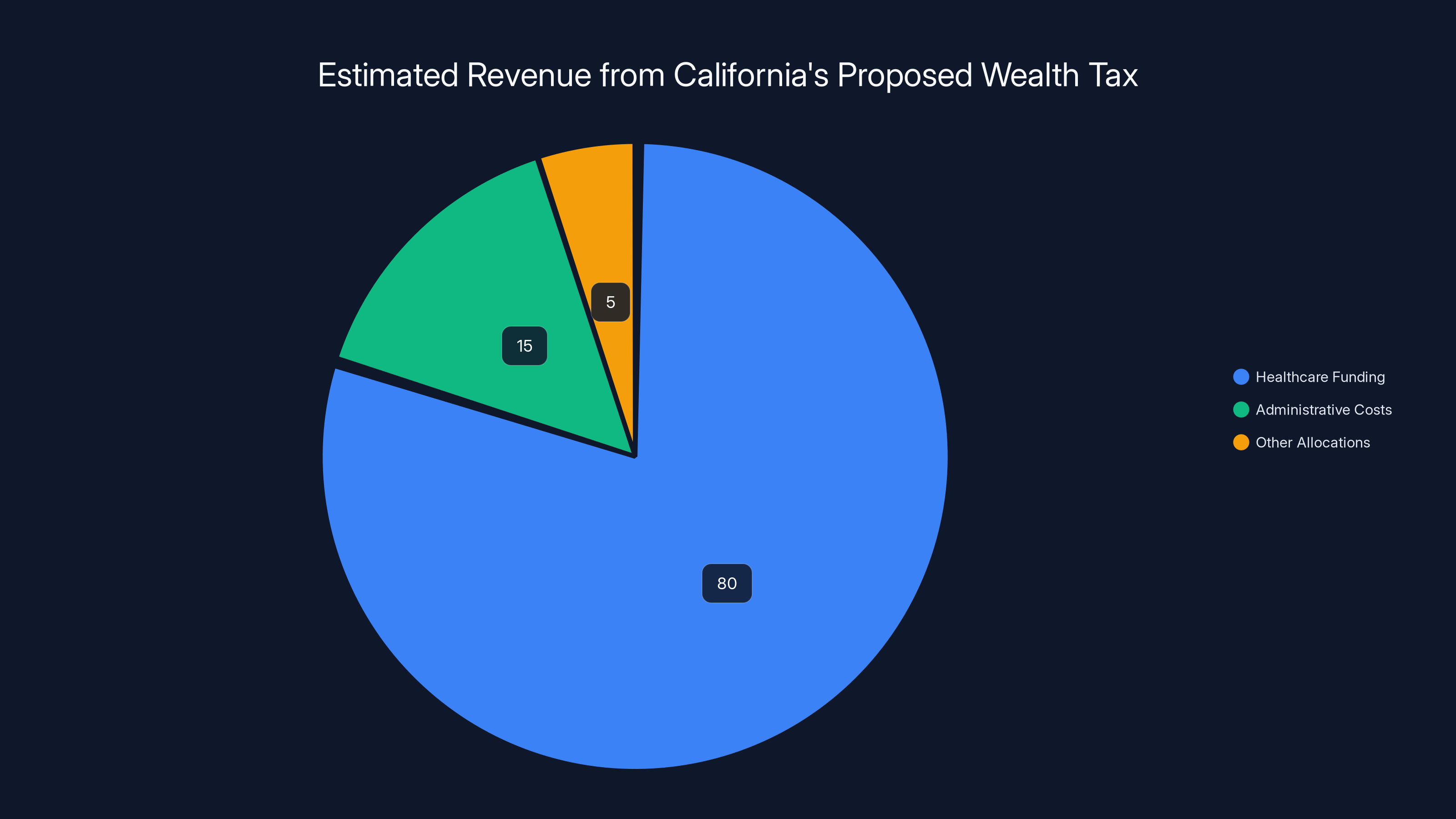

The proposed wealth tax is estimated to raise $100 billion, with 80% allocated to healthcare funding, 15% to administrative costs, and 5% to other allocations. Estimated data.

The Appraisal Problem: Making Up Numbers

Here's what the proposal's architect, law professor David Gamage from the University of Missouri, says founders should do: get an independent appraisal. Instead of using the voting-control formula, hire a certified appraiser to say what those shares would actually sell for on the open market.

Sound reasonable? It's not.

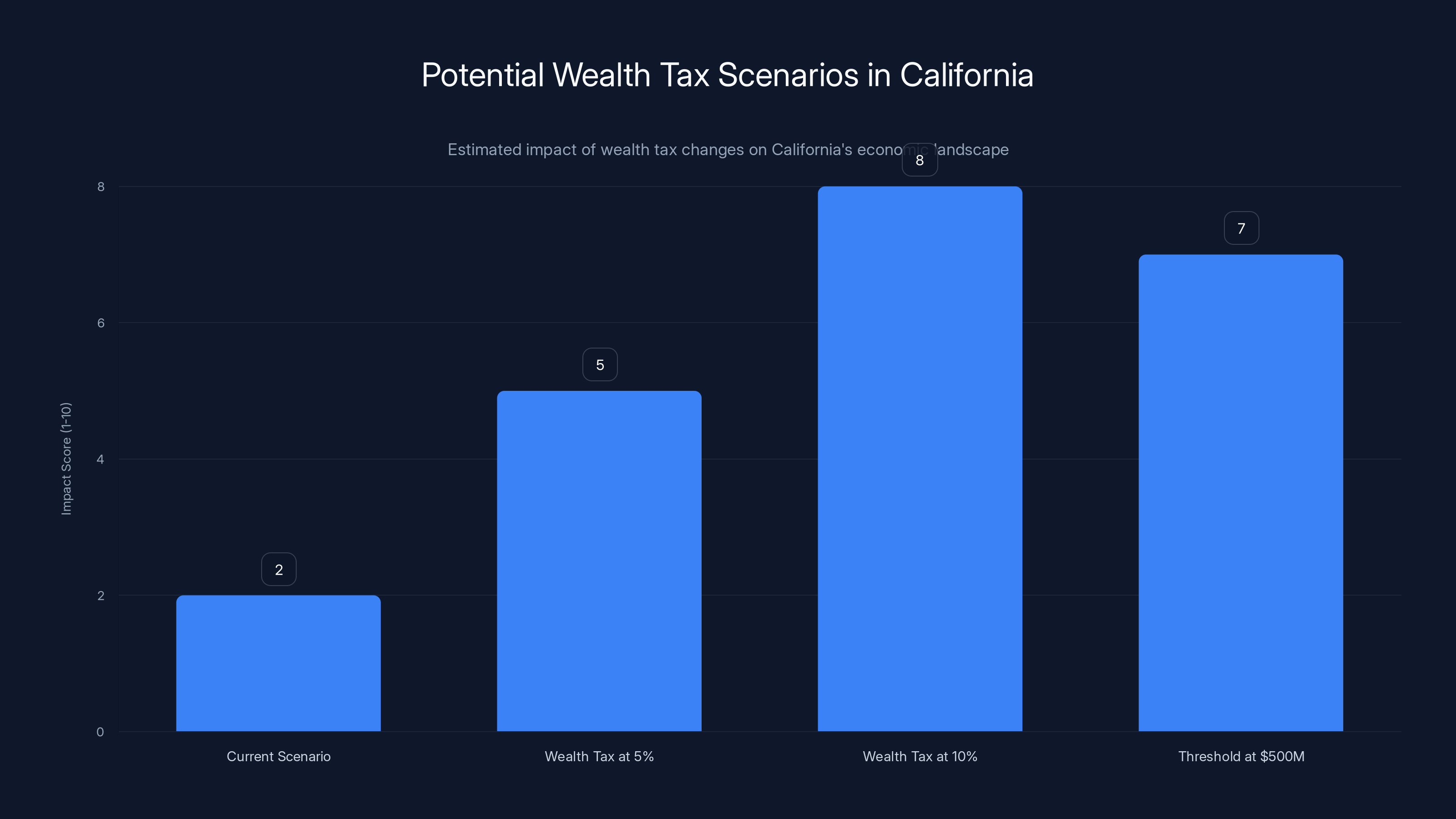

Private company valuations are guesses. Educated guesses, sometimes, but guesses. A Series B company with a

But there's a catch that Gamage hasn't adequately addressed: if the state disagrees with your appraisal, they don't just argue about the number. They can also penalize the person who did the valuation.

You hire a firm to appraise your company at

How many certified appraisers will take that risk?

More importantly: what stops the state from just hiring appraisers known to value things high, creating a system where the state's preferred valuers get business while conservative valuers get sued? It's a perverse incentive structure dressed up as a fairness mechanism.

For founders with private companies—which is basically all of Silicon Valley outside the mega-caps—this creates an impossible situation. You can't opt out. You can't appeal based on illiquidity alone. You either find a way to pay or you leave.

This pie chart highlights the disparity between voting control and economic interest in Google's dual-class stock structure, where Larry Page controls 30% of votes but owns only 3% of the company.

The Deferral Trap: Paying Later Isn't Better

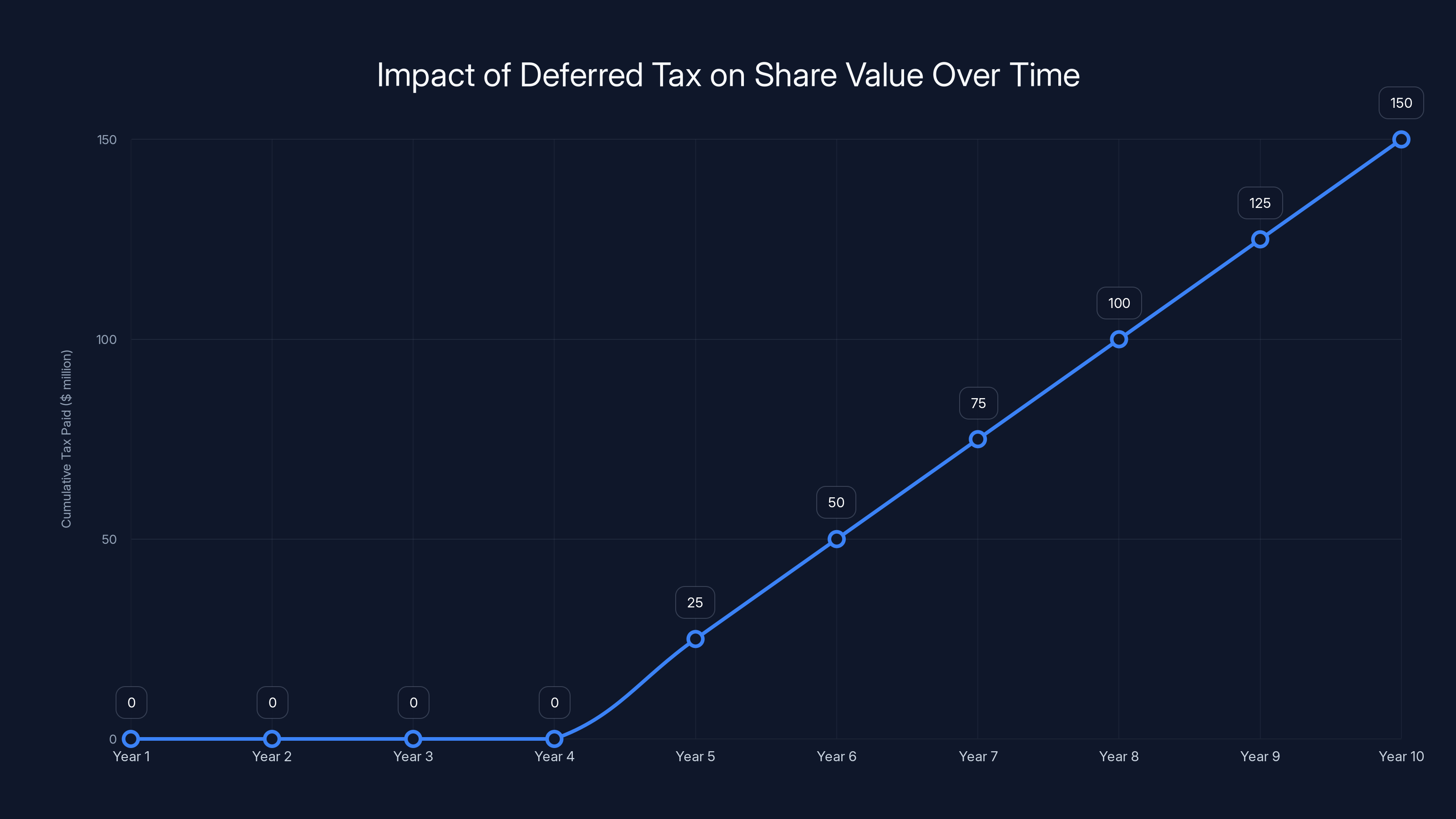

Okay, so the proposal says you can defer taxes. You don't have to pay every year on illiquid assets. Instead, California will take 5% when you eventually sell those shares.

This sounds reasonable until you think about what it actually means.

Say you've got

But here's what happens: You take the company public in five years. Now those shares are liquid. California demands its 5%. That's $25 million in year five. Then it wants 5% of the new valuation in year six. And year seven.

In practice, this means you can never sell. You can never go public. You can never take liquidity events because each one triggers a massive tax bill.

One founder told people in tech circles last month that he calculated the numbers: if California passes this, he can't go public. If his company gets acquired, the acquirer would need to pay a premium just to cover his tax liability. If he tries to hold long-term, he's paying 5% every year until he dies, at which point his heirs inherit a company with massive unfunded tax liability.

The only rational move is to move the company or move himself. Preferably both.

Why This Is Worse Than You Think: Retroactive Application

Here's the detail that sent founders into Signal chats with billionaires and venture capitalists: the tax would apply retroactively.

If the measure passes in November 2025, it taxes anyone who was a California resident on January 1, 2026. Whether you founded your company in California. Whether you built your wealth in California. If you lived here on that date, you're on the hook.

Larry Page isn't living in California right now. But his company is headquartered there. His early wealth came from building there. The wealth tax doesn't care about any of that. You were here on January 1? You owe.

This is different from standard income or capital gains taxes, which apply prospectively. This is wealth accumulated before the law existed, now subject to a new tax retroactively. That's legally aggressive in a way that makes the entire founding class nervous.

The fear isn't really about one payment. It's about precedent. If this passes, what's next? A 10% wealth tax? A property tax on private company shares? Once you establish the principle that California can tax wealth retroactively, the ceiling is unlimited.

Venture capitalists in the Signal chat called "Save California" (the irony of that name isn't lost on anyone) aren't hiding in Miami because they hate California. They're positioning themselves because they've seen what happens when a government decides founders are ATMs.

Estimated data shows how valuations can vary significantly based on investor perspective, with potential swings of up to $70 million.

The 200 People Problem: Why $100 Billion in Revenue Depends on Keeping Them

California's health care union estimates this tax would hit roughly 200 individuals. They say it'll raise

But it's not evenly distributed. It's not like 200 people with $500 million each. It's more like 20 people with billions and 180 people with hundreds of millions.

The economic impact isn't abstract. These 200 people don't just control capital. They control companies. Hundreds of companies. Thousands of jobs.

Larry Page isn't just an individual. He's the person who, through voting control, ultimately decides what Google does next. Elon Musk isn't just a billionaire. He controls Tesla's strategy. Peter Thiel controls his investment firm's portfolio. These aren't passive assets. These are operational control systems.

If even 20 of them leave California—relocate, move their companies' voting control out of state, establish residency elsewhere—California loses effective governance over some of the most important companies in the world.

Google's headquarters is in Mountain View. But Google runs on decisions made by people at the top. If those people become non-residents, California loses tax revenue. More importantly, it loses influence over how those companies operate.

That's the real fear. Not the money. The lack of control.

The Miami Signal: What the Real Estate Tells Us

Larry Page bought $173.4 million in Miami waterfront properties across January and early February. That's not speculation. That's a residency claim.

Peter Thiel's firm leasing office space in Miami isn't about working out of Miami. Thiel has had ties to the city for years. The unusual press release announcing the move? That was a signal. He's moving. Or he's planning to move.

When billionaires start announcing their relocations through press releases, that's not accidental. That's a message to accountants, lawyers, and state officials: "I'm establishing residency elsewhere. Good luck collecting on that retroactive wealth tax."

Miami has no state income tax. Florida has no wealth tax. More importantly, if you're not a California resident, California's wealth tax doesn't apply to you.

So what happens if the 20 richest people in the state relocate? California loses $10-20 billion in annual revenue. But more than that, it loses a major lever of influence. The companies they control still operate globally, but their voting decisions aren't made by Californians anymore.

Governor Newsom said this week he's "relentlessly working behind the scenes" to defeat the proposal. He's right to be nervous. If this passes and the wealth tax actually collects

Neither outcome is good for the state's long-term relationship with its richest residents.

Estimated data suggests that increasing the wealth tax rate or lowering the threshold could significantly impact California's economic environment, potentially influencing business decisions and state revenue.

The Bipartisan Exodus: This Isn't a Political Thing

Here's what should worry California more than the actual tax: the people opposing it have nothing in common politically.

David Sacks is Trump's crypto czar. Chris Larsen is a Kamala Harris mega-donor. They're in the same Signal chat called "Save California," united against one proposal.

When Republicans and Democrats agree something is a threat, it usually is.

They've called the proposal "Communism" and "poorly defined." One called it a threat to the entire venture capital system. Another said it proves California doesn't understand how startups work.

But the real tell is what they're actually doing, not what they're saying. They're not lobbying. They're not fighting the proposal through normal channels. They're moving. Or preparing to move.

One founder in the group told people that his law firm recommended he establish residency in Nevada immediately. Not because he's definitely moving. But because "it's cheap insurance." By establishing residency before the law passes, if it ever comes after him for the retroactive tax, he'll argue he wasn't a resident on January 1, 2026.

That's not overreacting. That's smart planning given an existential threat.

What the Union Is Actually Trying to Do

Let's be fair to the other side for a moment. California's health care union isn't being malicious. They're responding to a real problem.

Trump cut Medicaid. Slashed ACA subsidies. Eliminated funding streams for emergency rooms. California has a healthcare crisis, and the people who work in healthcare are seeing it happen in real time.

When you watch an emergency room close because there's no funding, and you see billionaires buying second homes in Miami, the math feels obvious. There's money. There's need. Therefore, take the money to fix the need.

The union's spokesperson said: "We're simply trying to keep emergency rooms open and save patient lives. The few who left have shown the world just how outrageously greedy they truly are."

That's not wrong as a diagnosis of the moral problem. But it's completely wrong as a policy solution.

You can't solve healthcare funding by taxing people into leaving. You just end up with healthcare funding crisis and brain drain. Founders and investors aren't trees. They can be moved.

But the union has 875,000 signatures to collect to get the proposal on the November ballot. They might actually do it. And if they do, the vote might actually pass. California is not a red state. Taxing billionaires polls incredibly well.

So even if the proposal fails, it's already won. It's already caused a significant percentage of the state's most productive people to either move or seriously plan to move. California loses the tax revenue and the talent and the companies.

Illustrates how deferring taxes on a

The Valuation Trap: Why These Numbers Don't Mean What They Sound Like

California estimates 200 billionaires will be hit by the wealth tax. Let's think about what "billionaire" actually means when we're talking about voting control.

If you founded Google and maintain voting control through dual-class shares, your "net worth" according to public valuations might be $100 billion. But here's the thing: you can't sell it. If you sell your voting shares, you lose control. If you lose control, someone else runs the company.

So that $100 billion isn't wealth in the normal sense. It's power. It's the ability to direct a trillion-dollar company. It's control over thousands of employees and billions in annual revenue.

A wealth tax treats it like it's the same as cash in a bank account. That's the fundamental disconnect.

California wants to collect

It's not reasonable. It's a forced sale of control. And every founder knows that forced sales never get good prices.

The Precedent Problem: If California Does This, What's Next?

Let's say the wealth tax passes. Founders panic. Some move. Some stay. Some try to fight it legally.

What's California's next step? They've proven they can tax wealth that exists within state boundaries. Why not raise the rate to 10%? Why not apply it to people worth over

Once you establish the principle that wealth itself is taxable—not income, not gains, but the mere fact of holding value—the ceiling is unlimited.

This is why venture capitalists are genuinely freaked out. It's not about money. It's about precedent.

If California successfully implements a wealth tax and collects meaningful revenue without causing total economic collapse, you'll see other states do the same. Federal government might consider it. Suddenly, founders have nowhere to hide.

The fear is that this one ballot initiative is the beginning of a systematic shift toward taxing wealth directly instead of income and gains. That would fundamentally change how venture capital works, how startups are structured, and where founders are willing to build.

Why Newsom Is Fighting His Own State

Governor Newsom might be the most interesting player in this whole drama. He's supposedly a progressive Democrat in one of America's most progressive states. And he's actively working against a ballot initiative that would tax billionaires.

Why? Because he actually understands the second-order effects.

Newsom knows that if you drive out the people who control major companies, you lose the jobs those companies provide. You lose the tax revenue from employees. You lose the political influence. You lose the talent ecosystem.

California's economy is entirely dependent on the venture capital ecosystem. The wealth tax would destroy that ecosystem.

So Newsom is fighting the union. Behind the scenes, his office is probably calling donors and political allies asking them to oppose the measure. When it gets on the ballot, he'll probably campaign against it.

The fact that a Democratic governor is publicly fighting what polls show as a popular measure tells you everything you need to know about how bad the proposal actually is for the state's long-term interests.

The Exodus Is Already Happening

Here's the thing: you don't need the wealth tax to pass for the exodus to happen. The threat of it is already causing real movement.

Larry Page isn't buying Miami property because the wealth tax exists. He's buying it because it might exist. That's enough.

Founders are calling tax lawyers. VCs are establishing Florida residency. Companies are considering relocating headquarters. This is happening now, while the proposal is still just a potential ballot measure.

Even if California defeats the measure—and Newsom's working to do exactly that—the damage is partly done. The founders and investors have made a calculation: California is willing to target them. California doesn't see them as partners in building companies. California sees them as sources of revenue.

Once you believe that, you start making plans. You start moving money. You start thinking about where else you could build.

The real exodus isn't about the tax. It's about trust. And California broke that in one proposal.

What This Means for the Future of Silicon Valley

Let's zoom out for a second. The question isn't really about one tax proposal in California. The question is: what happens when you tax founders at levels where they can't actually pay?

If California collects $100 billion from 200 people, that's foundational. That's enough to fund healthcare for a decade. It's enough to prove that you can tax wealth effectively.

But if the tax is structured in a way that forces people to either sell their companies or leave the state, it's a self-defeating policy. California gets less revenue and loses more companies.

The union wants healthcare funding. Founders want to keep their companies. These aren't compatible under the current proposal.

The only way forward is a different approach. One that funds healthcare without destroying the capital structure that makes venture possible. One that taxes wealth but doesn't force liquidation. One that recognizes that founders and the state are partners, not enemies.

Right now, neither side sees it that way. The union sees greedy billionaires avoiding taxes. The founders see a hostile state trying to confiscate control.

Somewhere in the middle is a policy that could work. But we're not there yet. And every day the current proposal exists, more founders move and more companies relocate.

California created one of the most innovative ecosystems in the world. If this proposal passes, it might be the thing that destroys it.

FAQ

What is California's proposed wealth tax?

California's proposed wealth tax, pushed by the state health care union, would impose a one-time 5% tax on anyone worth over

How is the wealth tax calculated on dual-class stock?

The wealth tax would be calculated based on voting control percentages rather than actual ownership stakes. For example, if a founder owns 3% of a company but controls 30% through dual-class voting shares, California would tax them on the 30% voting value, not the 3% economic value. This creates enormous discrepancies between actual wealth and taxable wealth, particularly for founders who used dual-class structures to maintain company control while accepting investor capital.

What are alternative valuations and deferrals under the proposal?

The proposal allows founders to get independent appraisals from certified valuers, which could show shares are worth less than the voting-control formula suggests. Additionally, founders could defer taxes on illiquid assets, paying the 5% when shares are eventually sold. However, appraisers who undervalue shares can be penalized by the state, and deferral effectively prevents founders from ever taking liquidity events without triggering massive tax bills.

Why are tech leaders leaving California because of this proposal?

Tech leaders are leaving or planning to leave because the wealth tax creates an impossible choice: either pay taxes on wealth they can't liquidate without losing company control, or relocate to avoid the tax. For founders with voting control, the math doesn't work. A Series B company might face a tax bill equal to the founder's entire stake. Relocation to states like Florida, which have no wealth tax and no state income tax, becomes the only rational option.

Who is actually opposing this proposal in California?

Opposition to the wealth tax is bipartisan and includes both conservative investors like David Sacks (Trump's crypto czar) and liberal donors like Chris Larsen (Kamala Harris mega-donor). Even Governor Gavin Newsom, a Democrat in a progressive state, is actively working behind the scenes to defeat the proposal because he understands it would drive out the people who control California's most important companies and devastate the venture capital ecosystem.

How many signatures does the proposal need to reach the ballot?

The proposal needs 875,000 signatures to qualify for California's November 2025 ballot. If it makes the ballot, it would need only a simple majority to pass. California's progressive voter base makes it plausible the measure could succeed, even though it would likely cause significant economic damage to the state's tech and venture capital sectors.

What's the difference between wealth tax and income tax?

Income tax applies to earnings, and capital gains tax applies to profits from selling assets. Wealth tax applies to the total value of assets you own, whether or not you've sold them or made money from them. This matters enormously for founders because they might not have income or realized gains, but they have substantial value in company shares. A wealth tax forces taxation of unrealized gains on assets you're holding for long-term control.

Could founders pay a wealth tax without selling their companies?

In theory, yes. The proposal includes deferral options and appraisals. In practice, no. If a founder defers taxes, they can't take the company public or accept acquisition offers without triggering massive tax bills. If they use appraisals, they're gambling that certified valuers won't be penalized by the state. There's no realistic payment mechanism that doesn't involve either liquidating control or leaving the state.

What makes this different from previous tax increases in California?

This is different because it's retroactive, applies to unrealized wealth, targets voting control instead of economic value, and is structured in a way that essentially forces relocation. Previous tax increases applied prospectively to income or realized gains. This tax applies to people who became wealthy before the law existed, taxing wealth they haven't actually sold.

Could this wealth tax drive entire companies out of California?

Yes, absolutely. If founders relocate to avoid the tax, companies often follow because voting control determines strategic decisions. A founder in Florida can run a California-headquartered company, but the real operational control is wherever the founder lives. Multiple companies have already started exploring relocation or leadership changes in response to the proposal.

How Runable Can Help Your Company Navigate Tax and Legal Complexity

When facing complex policy shifts like California's proposed wealth tax, having clear documentation and analysis becomes crucial. Runable enables you to rapidly create comprehensive reports, analysis documents, and presentations that explain intricate scenarios to stakeholders, legal teams, and financial advisors.

Use Case: Generate detailed financial impact analysis and tax scenario reports automatically to present to your board and legal counsel.

Try Runable For FreeFounders dealing with dual-class stock structures, complex valuations, and tax scenarios need to communicate their situations clearly to investors, employees, and legal teams. Runable's AI-powered document and presentation tools help you build these materials in minutes rather than hours, ensuring your analysis is current and your communication is professional.

Key Takeaways

- California's proposed wealth tax targets voting control percentages, not actual economic ownership, creating impossible tax burdens for founders using legal dual-class stock structures.

- One Series B founder faced a tax bill equal to his entire company stake under the proposal, forcing either liquidation of control or relocation.

- The tax applies retroactively to anyone living in California on January 1, 2026, driving immediate relocation planning among founders and VCs.

- Even Democratic Governor Newsom is actively fighting the proposal because he understands it would drive out the people who control California's most important companies.

- Bipartisan opposition from Trump-aligned and Harris-aligned tech leaders united in the 'Save California' Signal chat reveals how existential the threat feels to the founding class.