Introduction: Another Year, Another Price Hike

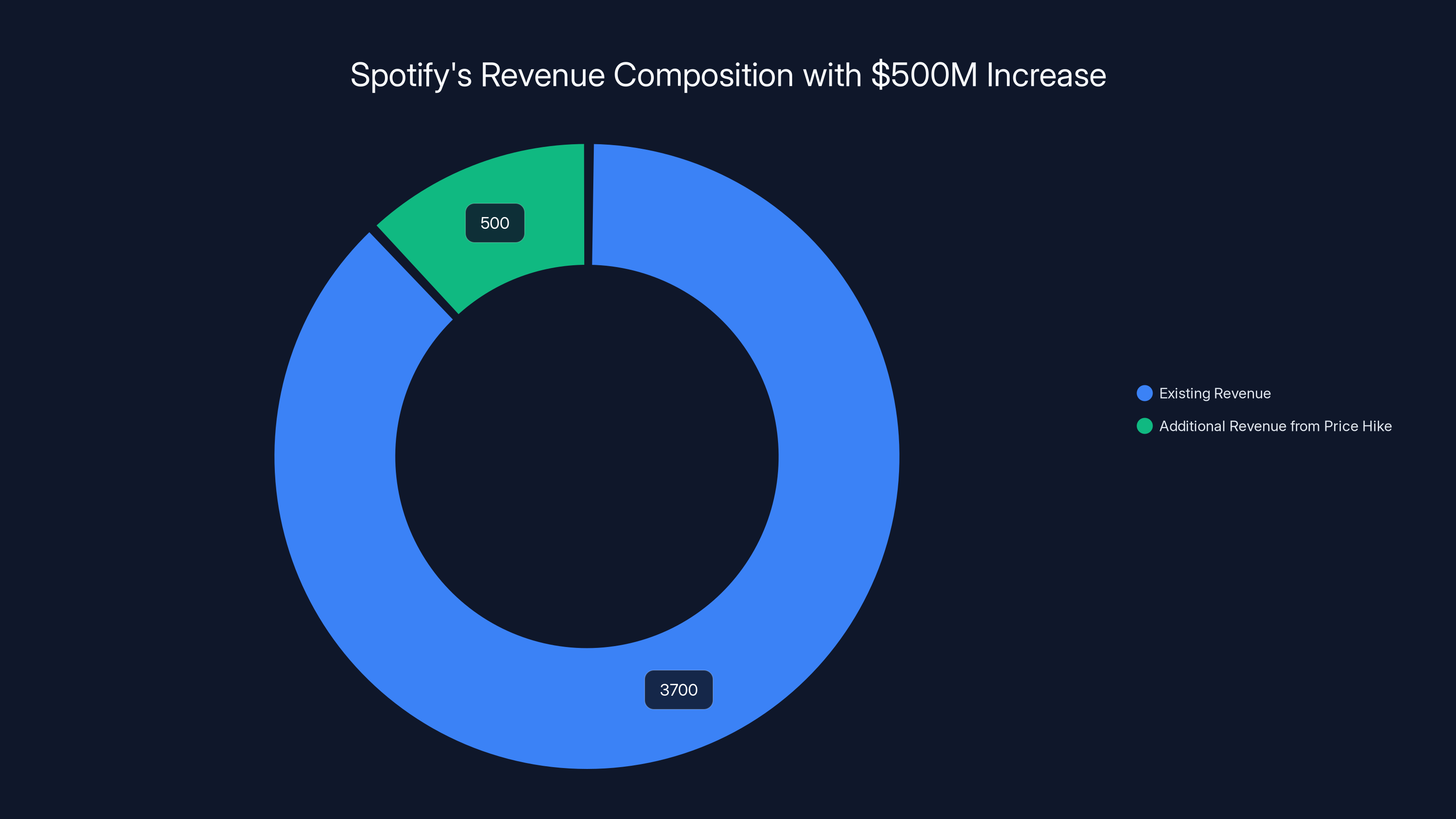

If you've been using Spotify for the past three years, you've noticed something: the price keeps going up. And it just happened again. In early 2026, Spotify announced yet another subscription price increase in the United States, bumping the individual Premium plan from

Think about it. Three years ago, Spotify Premium cost

Spotify sent out emails notifying users of the change, which takes effect on the next monthly billing cycle for affected subscribers. The company framed it the same way it always does: as a necessary investment to keep the service running, support artists, and maintain the "best possible experience." But that messaging masks something more interesting about what's happening in the streaming music business.

This price increase reveals three things worth understanding. First, it shows how streaming companies are learning to optimize revenue as subscriber growth slows down. Second, it demonstrates the shifting economics of music licensing, artist payouts, and content costs. Third, it raises questions about how much consumers will actually pay before they start canceling.

Let's dig into what's really happening behind this price increase, why it matters, and what it means for the future of music streaming. Because this isn't just about Spotify anymore. Every streaming service is watching how consumers react to this move, and they're taking notes.

TL; DR

- Third hike in three years: Spotify's individual plan jumped from 10.99 (July 2023) to12.99 (January 2026)

- Revenue impact: JPMorgan analysts predicted this could add $500 million in annual revenue to Spotify

- Global expansion: Price increases are also hitting Estonia, Latvia, UK, and Switzerland

- Scale matters: Spotify has 281 million paid subscribers globally, with 25% from North America

- Bottom line: The price jump reflects both streaming economics and Spotify's shift from growth to profitability

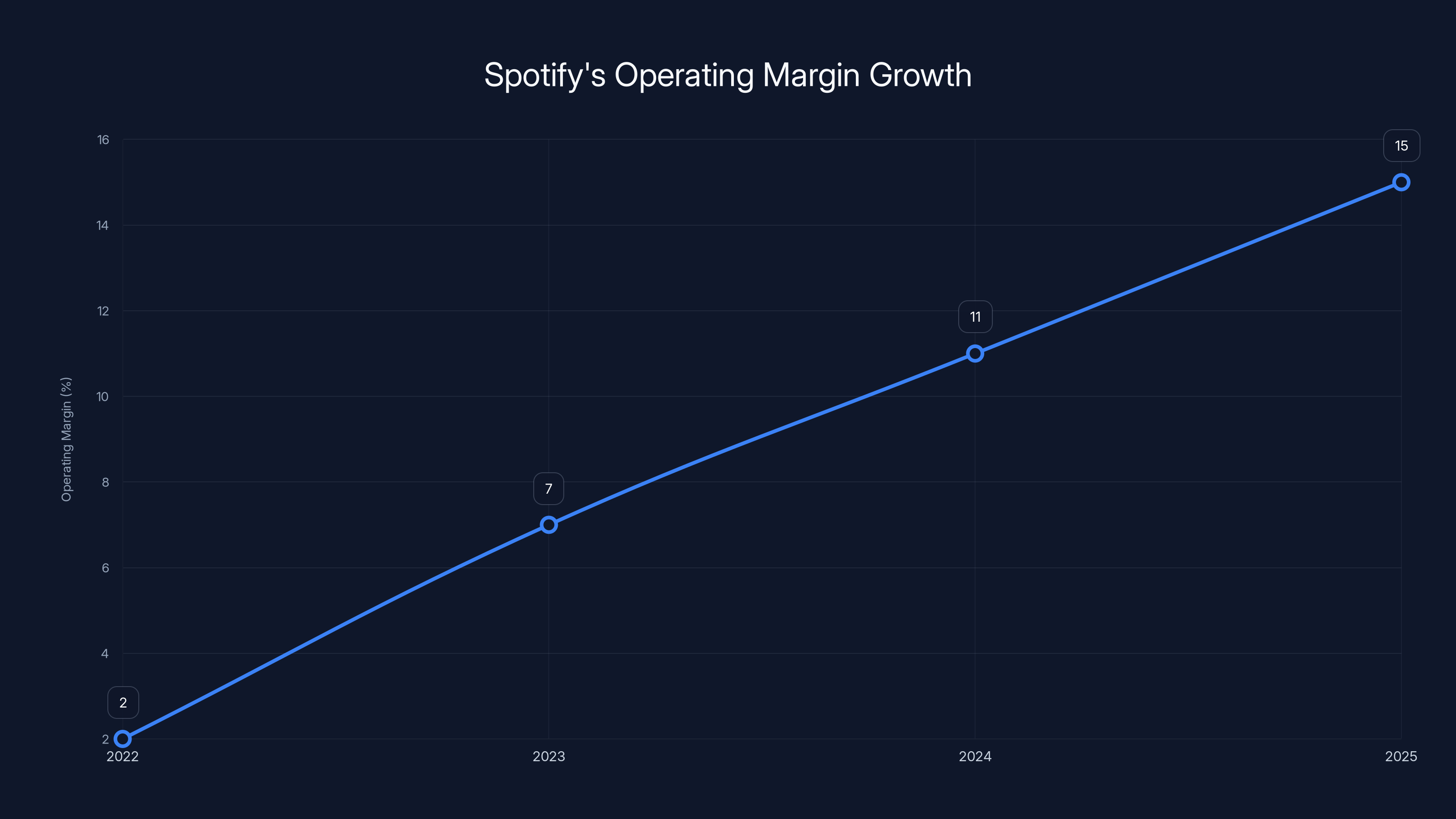

Spotify's operating margin has significantly improved from 2% in 2022 to over 15% in 2025, driven by pricing strategies and leveraging existing infrastructure. Estimated data.

The Timeline: How We Got Here

Understanding Spotify's current pricing strategy requires looking at the actual history. The company didn't wake up in 2026 and decide to raise prices everywhere at once. This has been a methodical, strategic climb.

Back in July 2023, Spotify raised the U.S. Premium plan from

Then in June 2024, just eleven months later, Spotify did it again. Another dollar increase, bringing the price to $11.99. This time, the backlash was louder. People noticed the pattern. But again, retention held up better than expected.

Now in early 2026, the company moved the needle again. To $12.99. That's three price increases in roughly two and a half years.

What's interesting is that Spotify didn't stop at the U.S. The company has also raised prices in Estonia, Latvia, the UK, and Switzerland. This tells you something important: this isn't a localized test. This is a global strategy. Spotify is raising prices everywhere it can get away with it.

The timing matters too. These increases happen roughly every 12-18 months. That's long enough for new subscriber onboarding cycles to forget about the previous increase, but frequent enough that the company can keep extraction revenue growth even when subscriber growth starts to plateau.

Estimated data shows a gradual 30% increase in subscription prices over three years, illustrating the common strategy of incremental price hikes.

The Money: What $500 Million Actually Means

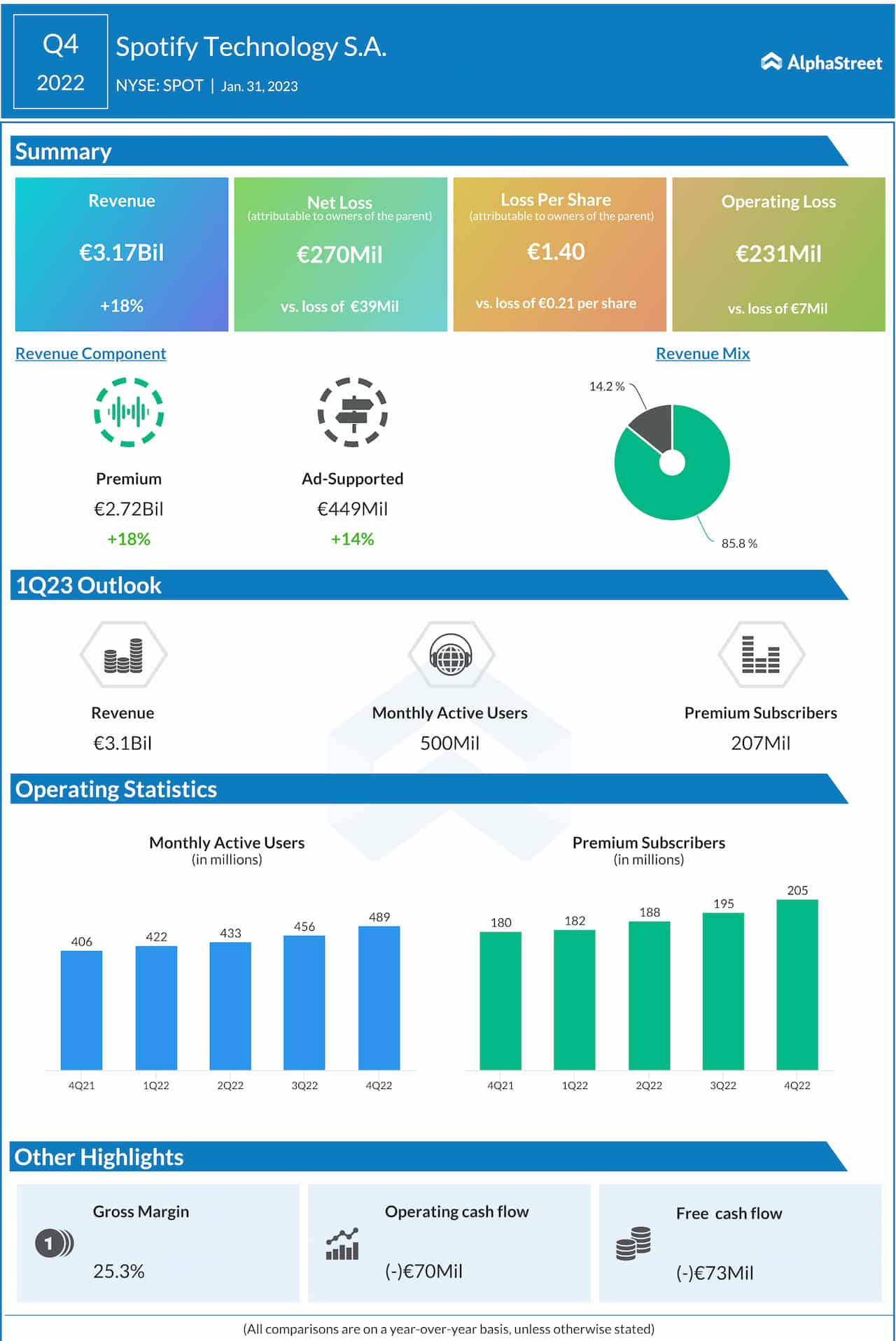

JPMorgan Chase analysts published research suggesting this price hike could generate around $500 million in additional annual revenue for Spotify. That's not a small number. But it's also important to understand what that means in context.

Spotify's total revenue in Q3 2025 was approximately

But here's the math that actually matters: Spotify achieved that $500 million increase without needing to acquire a single new subscriber. It's pure margin improvement from the existing user base. The company doesn't need to spend customer acquisition costs to realize this revenue. It doesn't need to build new features or market new capabilities. It just needs existing users to accept a higher price.

From a business perspective, that's incredibly attractive. And from Spotify's perspective, it suggests the price elasticity of demand for music streaming is lower than it was five years ago. In other words, people are becoming less price-sensitive to Spotify than they used to be.

There are a few reasons why. First, switching costs have increased. You've built playlists on Spotify. You've made recommendations. You've linked it to your car, your smart home, your phone. Moving to Apple Music or Amazon Music means rebuilding all of that. Second, Spotify has become table-stakes for music consumption. It's not a luxury anymore. It's expected. Like electricity or internet. That shifts psychological price perception.

Third, and most importantly, Spotify has very few genuine competitors at price points that matter. Apple Music costs the same. YouTube Music costs the same. Amazon Music is slightly cheaper but offers less. So there's no real escape hatch. If you want a full-featured, comprehensive music streaming service, you're paying around $12 per month now.

Artist Payouts: The Real Constraint

When Spotify announces price increases, the company always mentions supporting artists. The phrasing is always similar: "We're raising prices to continue offering the best experience for artists." But that statement deserves scrutiny, because artist payouts are actually one of the biggest pressures driving price increases across the entire streaming industry.

Spotify pays artists per stream. The exact rate is complicated, but on average, Spotify pays between

In 2023, Spotify users streamed over 1.3 trillion songs. By 2025, that number had grown to over 1.8 trillion. That's a 38% increase in streams. But subscriber growth has been slower, around 20-25% in the same period. This creates a squeeze: more music is being played per subscriber, but revenue per subscriber isn't growing fast enough to cover the increased licensing costs.

There's another wrinkle too. Major record labels have been pushing Spotify to increase artist payouts. They argue, not unreasonably, that Spotify's payouts are too low compared to other platforms or traditional music sales. Artists and songwriters have also been vocal about this. Some of the biggest artists have removed their music from Spotify at various points to protest payout rates.

So Spotify is caught in a squeeze: artists and labels are demanding higher payouts, but subscriber growth is slowing. The solution? Raise prices on subscribers. This increases revenue per user, which in theory can fund higher artist payouts without cutting into margins.

But here's where it gets complicated. Spotify has been remarkably opaque about whether this money actually goes to artists or just flows to the bottom line. The company publishes "artist payouts" numbers, but those are opaque. What percentage of the price increase actually goes to artists versus operations and profit? Nobody knows for sure.

The $500 million increase represents about 12% of Spotify's Q3 2025 revenue, highlighting a significant margin improvement without new subscribers. Estimated data.

The Subscriber Math: When Does Churn Matter?

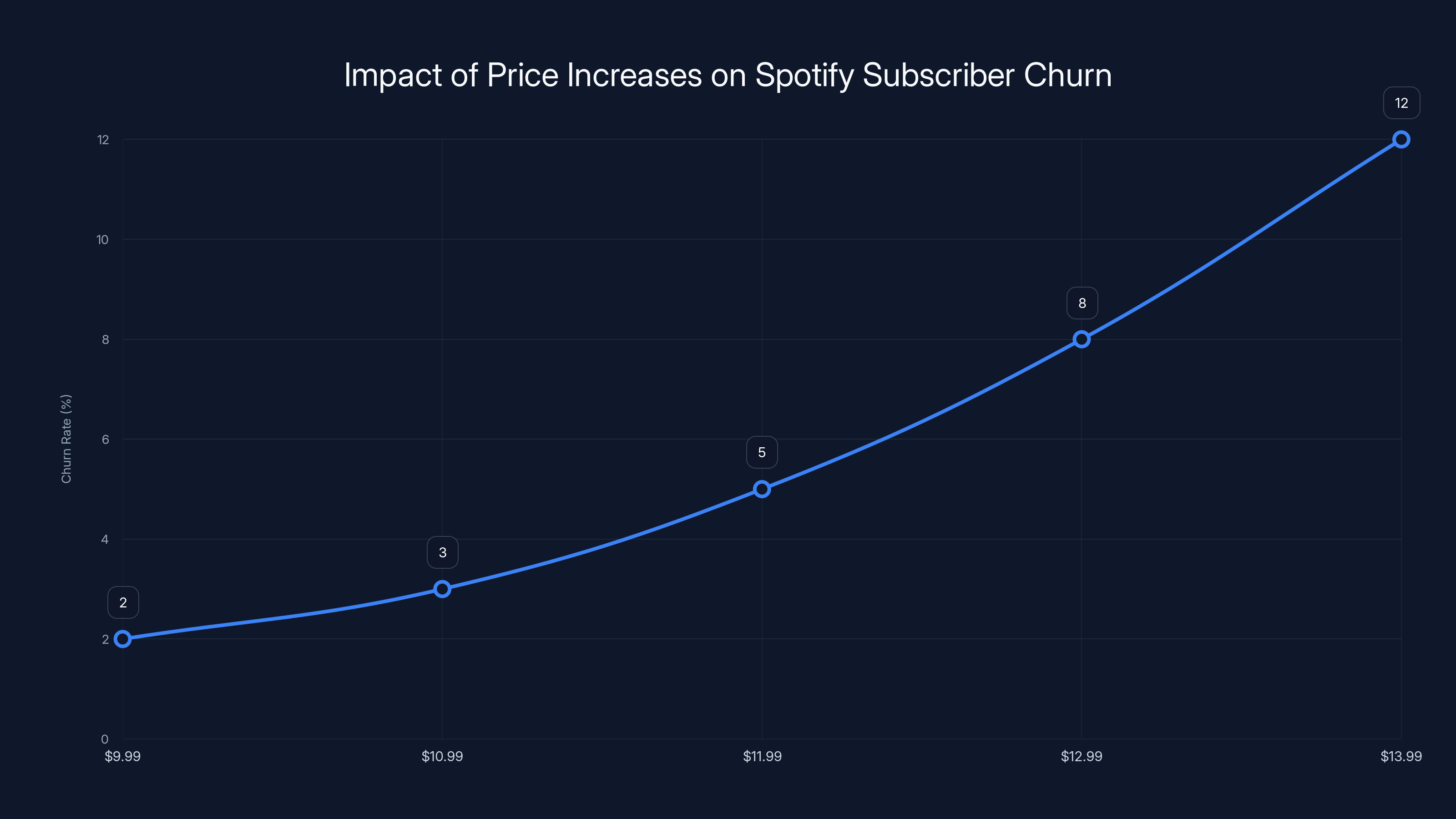

Here's the uncomfortable question that Spotify's investors are asking: at what price point do subscribers actually start canceling in meaningful numbers?

It's not a rhetorical question. Spotify has done this math. So have Wall Street analysts. And the answer is surprisingly important for the streaming industry.

When Spotify raised prices by $1 in July 2023, the company disclosed that churn increased slightly but was within acceptable ranges. When it raised prices again in June 2024, the same thing happened. This gave Spotify confidence that there's still room to raise prices further.

But there are limits. At some point, price increases start driving meaningful cancellations. That's when the revenue math breaks down. If you increase prices by 10% but lose 15% of subscribers, you've actually lost money.

Where is that breaking point for Spotify? Hard to say precisely, but

This creates a psychological pricing problem. When people are deciding how to allocate their subscription budget, they're comparing Spotify to all of these other services. At

The company is betting that the network effects of Spotify (playlists, shared recommendations, social features, audio quality) are sticky enough to retain most subscribers even at higher prices. It might be right. But it's also a bet.

Regional Strategy: Why Some Markets Go First

Spotify doesn't raise prices everywhere at once. The company is strategic about which markets get the increase first and when. Looking at the 2026 price increases, we see the U.S., UK, Estonia, and Latvia getting increases. But not Germany, France, or Canada yet.

Why? There are several factors at play.

First, market maturity and competition. The U.S., UK, and parts of Northern Europe are mature markets where Spotify has dominant market share and less aggressive competition. Apple Music has made inroads, but Spotify's brand loyalty is still strong. In markets like India or Brazil, where price is more sensitive, Spotify moves more cautiously.

Second, regulatory environment. The EU has been more aggressive about digital platform regulation, but music streaming specifically hasn't been heavily regulated on pricing. So Spotify can test the market. In the U.S., there's almost no regulatory constraint on subscription pricing.

Third, currency and purchasing power. The company often times price increases to account for currency fluctuations and local economic conditions. When the dollar is strong, it's a good time to raise prices in dollar markets.

Fourth, subscriber elasticity. Spotify monitors churn by region and by cohort. They know exactly how price-sensitive different segments are. English-speaking markets (U.S., UK, Australia) tend to have lower price sensitivity than others. So those markets get increased first.

This regional strategy reveals something important about Spotify's business model: it's not really a music streaming company. It's a pricing optimization company that delivers music streaming. The core competency isn't the audio quality or the playlist curation. It's the ability to extract maximum revenue from different markets while staying just below the price point that triggers massive churn.

Estimated data suggests that as Spotify's price approaches $12.99, churn rates increase significantly, indicating a potential breaking point where further price hikes could lead to revenue loss.

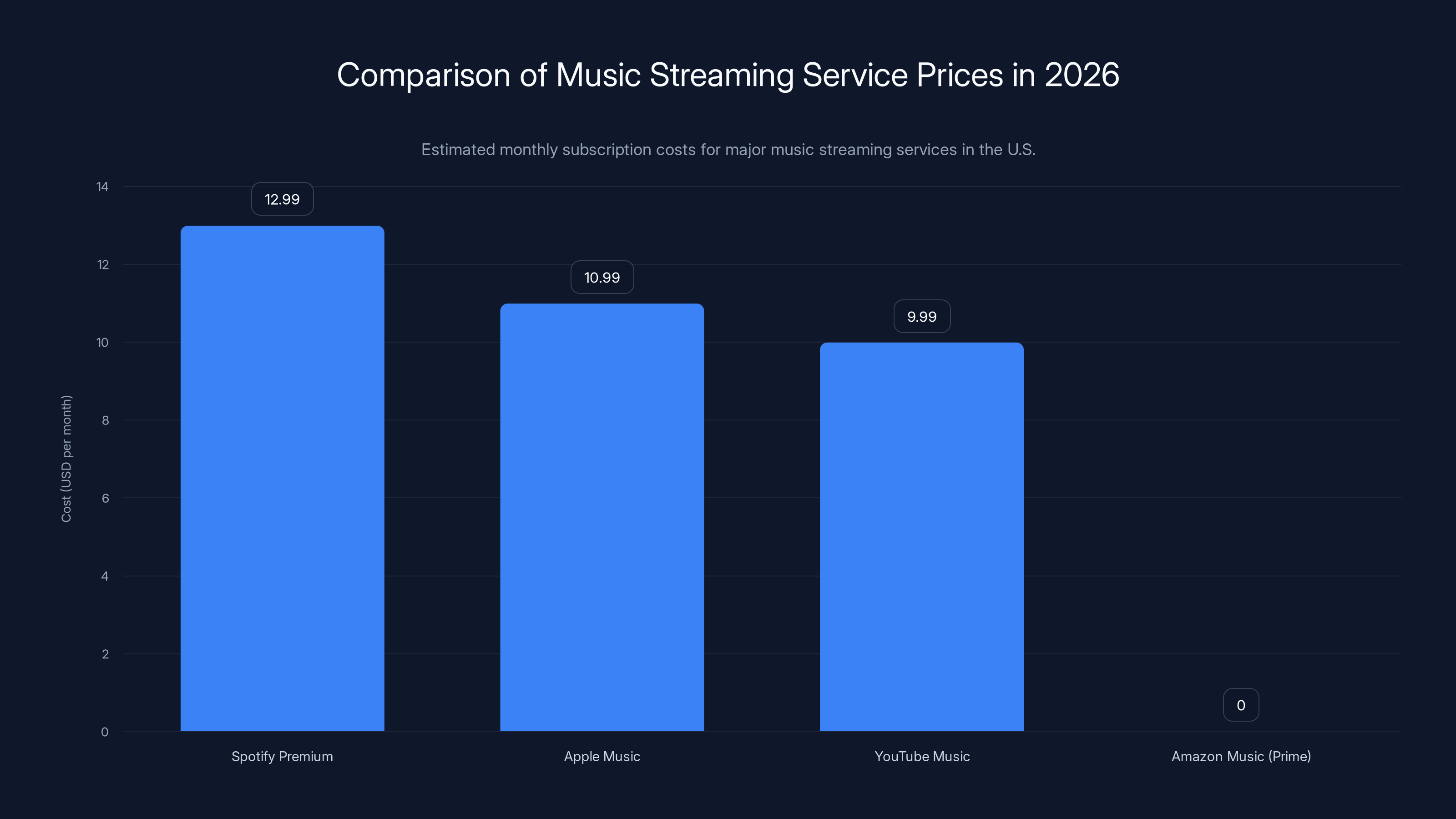

The Competitive Pressure: Apple, Amazon, YouTube

One might expect Spotify's competitors to use aggressive pricing as a weapon against these increases. But they haven't.

Apple Music remains at

Why hasn't Apple undercut Spotify? Probably because Apple Music is a secondary product for Apple. The company makes money on hardware, software, and services subscriptions. Music streaming is a nice add-on but not a core business. So there's no incentive to wage a price war.

Amazon Music is similarly positioned. The company offers music streaming bundled with Prime, but it also has a standalone tier that's cheaper than Spotify. Yet Amazon hasn't aggressively marketed Amazon Music as a cheaper alternative to Spotify. Why? Because Amazon Prime is already a bundle product, and the company wants to avoid drawing attention to the fact that Spotify costs more than the music streaming component of Prime.

YouTube Music is cheaper than Spotify and offers music videos plus audio, which is a genuine advantage. But YouTube Music's user experience is messier than Spotify's, and the company hasn't done much marketing to position it as a Spotify alternative.

This competitive situation actually favors Spotify. None of its competitors are fighting aggressively on price or features. They're all treating music streaming as a secondary business. This gives Spotify unusual pricing power.

But it also creates an opportunity. If a competitor really wanted to disrupt Spotify, they could offer significantly better pricing, superior audio quality (lossless, Dolby Atmos), or unique features that Spotify doesn't have. Nobody has done that yet, but it's possible.

The Bundling Question: Family Plans and Student Discounts

Spotify's price increases have been concentrated on the individual Premium plan. But what about bundled products?

The Spotify Family plan costs

This creates an interesting dynamic. If you're price-sensitive about Spotify, you can reduce your effective cost by joining a Family plan or qualifying for the Student discount. This is Spotify's way of price-segmenting its user base. Heavy users with more disposable income pay $12.99. Price-sensitive users share a Family plan at a lower per-person cost. Students get a discount because they have lower income.

It's a sophisticated pricing strategy. It allows Spotify to increase revenue without alienating price-sensitive segments. But it also reveals something: the company knows that $12.99 is too much for many people. The bundled plans prove it.

Here's what's likely to happen next: Spotify will eventually raise Family and Student prices too. But it will do so more gradually and with smaller increases, to avoid triggering massive churn in price-sensitive segments.

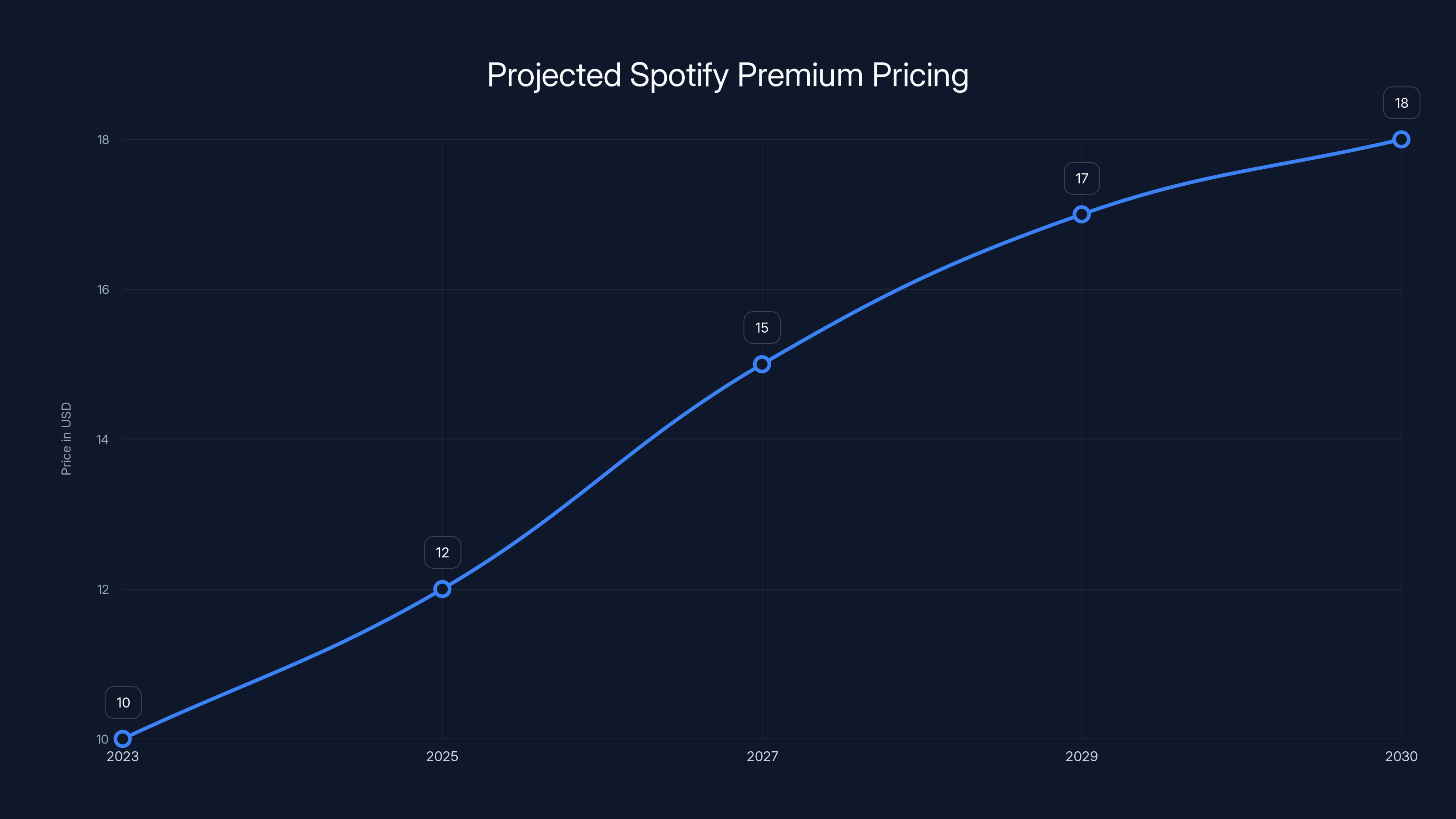

Estimated data suggests Spotify Premium could reach $18 by 2030 if price increases continue at the current rate.

The Profitability Angle: Why Now?

One more thing worth understanding: why is Spotify raising prices right now, in early 2026? The answer has to do with profitability and the company's business cycle.

Spotify went public in 2018 and has since been on a journey from growth company to profitable company. The company achieved profitability in 2022 and has maintained it since. Investors now expect Spotify to continue growing profits, not just subscribers.

Subscriber growth is slowing. Everyone knows this. Spotify is approaching saturation in developed markets. So the path to profit growth is pricing power. Raise prices per user, keep subscribers steady, and profit grows.

This is a classic business pattern. When companies transition from "growth at any cost" to "profitable growth," they shift strategies. Instead of acquiring customers at any cost, they extract more value from existing customers. Spotify is at exactly that inflection point.

The company is also hedging against potential recession. If economic conditions worsen in 2026, Spotify wants to have already captured the high-price equilibrium. It's easier to cut prices later if you need to than to raise them again.

There's also a signal to Wall Street. By raising prices and maintaining churn within acceptable ranges, Spotify is demonstrating that the business has pricing power. That makes the stock more attractive because it shows the company can grow profits even without subscriber growth.

User Sentiment: What Are People Actually Saying?

When Spotify announced the price increase, the reaction was predictable: people complained on Twitter, Reddit, and YouTube. But the complaints were surprisingly less intense than the previous two price increases.

Why? Probably because people are getting tired of complaining about subscription prices. Or because

There's also a resignation factor. People know they can complain all they want, but Spotify isn't going to reverse the price increase. So what's the point? Either you pay it or you don't.

But here's what's interesting: very few people are actually canceling. Some are. But the vast majority are just accepting it and continuing their subscription. This is exactly what Spotify's pricing model predicts: price increases will drive some churn, but the network effects of the platform are strong enough that most users will stick around.

There's one exception: student and family plan users are more sensitive to price. There's more discussion about switching to Apple Music or YouTube Music among these segments. If Spotify raises prices on Family and Student plans, that's where we'll see the most churn.

Spotify Premium is the most expensive at

What This Means for Music Artists

Here's something that gets lost in the Spotify pricing debate: what does this mean for musicians?

Theoretically, higher subscription prices mean higher revenues that could flow to artists. But in practice, the relationship is complicated.

First, Spotify's payouts to artists have remained relatively static even as the company has raised prices. So there's no guarantee that increased subscriber revenue flows to artists. It might just flow to the bottom line.

Second, Spotify's payment model is fundamentally problematic for most artists. Payments are per-stream, not per-subscriber. So even if total revenue increases, payments per stream might stay the same. Artists benefit only if total streams increase faster than the number of paying subscribers.

Third, the economics heavily favor big artists over emerging ones. Superstar artists get preferential treatment and higher payouts. Emerging artists get squeezed. Spotify's pricing increases don't change this fundamental imbalance.

The real impact on artists is indirect: if Spotify's price increases drive users away to cheaper or free alternatives, streams decrease, and artist payouts go down. This is the real risk from aggressive pricing.

The Broader Streaming Economics: A Fragmented Market

Spotify's price increases need to be understood in the context of a broader shift in streaming economics.

The streaming market has evolved in unexpected ways. Instead of having one dominant streaming service (like Netflix for video), the music industry has fragmented into multiple competing platforms: Spotify, Apple Music, YouTube Music, Amazon Music, Tidal, and niche services like SoundCloud and Bandcamp.

This fragmentation is actually problematic for users. Instead of paying

This is why subscription fatigue is becoming a real issue. People are noticing that their total subscription bill is climbing into the hundreds per month. Spotify price increases are adding to this fatigue.

But from Spotify's perspective, the company doesn't care if you're also subscribed to Apple Music. Spotify wants to maximize the revenue it extracts from users who do subscribe to Spotify. The company is essentially saying: "You pay for Spotify, Apple Music, YouTube Music, and Netflix anyway. So why not pay a little more for Spotify?"

It's a rational strategy in a fragmented market. But it's also unsustainable long-term if people start dropping services one by one.

The Technical Infrastructure Argument

When Spotify justifies price increases, the company often mentions the cost of maintaining its infrastructure. The argument goes: streaming music to 281 million people requires servers, bandwidth, and engineering resources. These costs have been rising.

There's truth to this. Spotify's infrastructure is genuinely expensive. The company has data centers and edge servers around the world. It's constantly upgrading to maintain audio quality and reduce latency.

But here's the thing: infrastructure costs grow linearly with users, not exponentially. If you double your users, you roughly double your infrastructure costs. But Spotify's subscriber growth has been slowing, so per-user infrastructure costs should be decreasing, not increasing.

This suggests that infrastructure cost inflation isn't really the driver of these price increases. The real driver is profit extraction. The infrastructure argument is a convenient justification, but it's not the fundamental reason.

That said, there are real technology costs that have increased. Audio quality expectations have increased. Users expect lossless audio and spatial audio. These require more bandwidth and processing. So there is a genuine technical cost component.

But it's probably 20-30% of the price increase. The rest is profit.

Future Projections: Where Does This End?

If Spotify continues raising prices by $1 every 12-18 months, where does this trajectory end?

At this rate, Spotify Premium would hit

Likely, Spotify will slow the pace of price increases before reaching those levels. The company will find a pricing equilibrium somewhere around $14-15 per month. At that point, churn will stabilize at a level the company finds acceptable, and Spotify will hold prices steady.

We might also see Spotify introduce a premium "lossless" tier at a higher price point, allowing the company to maintain its current pricing for basic Premium while upselling audio enthusiasts on a higher tier.

Another possibility: Spotify might bundle with other Spotify services like podcasting or audiobooks to justify higher pricing. The company already includes podcasts in the basic Premium plan, but it could develop these into premium add-ons.

Longer term, if AI-generated music becomes viable (which it probably will), this could significantly reduce Spotify's music licensing costs. If that happens, the company might lower prices to maintain market share. Or it might keep prices high and increase margins. Given Spotify's recent trajectory, the latter seems more likely.

Lessons for the Broader Subscription Economy

Spotify's price increases aren't happening in isolation. The broader subscription economy is experiencing the same dynamics.

Netflix raised prices repeatedly and trained users to accept increases. Disney+ raised prices and bundled with Hulu. Apple raised prices for Apple Care. Software companies have been aggressive about price increases everywhere.

The pattern is consistent: introduce a service at a low introductory price, build habit and lock-in, then raise prices gradually. Each increase is $1-2, which feels acceptable in isolation. But over three years, users end up paying 30% more without noticing it happening gradually.

This is classic price discrimination. Companies are testing how much they can extract from existing users before churn becomes unacceptable. Spotify is just one example, but it's the most transparent example.

For users, the lesson is: subscription prices will keep increasing until you cancel. So be intentional about which subscriptions you actually need and use. If you're paying for something out of habit, it's time to cancel.

For investors, the lesson is: subscription businesses are incredibly profitable once they reach scale, because churn is lower than people expect and price elasticity of demand is lower than traditional economic theory predicts.

For competitors, the lesson is: there's an opportunity to disrupt a market leader by offering significantly better pricing or features. But execution matters. YouTube Music tried and hasn't gained serious traction. There might be room for a new entrant if they get it right.

FAQ

What is the new Spotify Premium price in the U.S.?

Why is Spotify raising prices again?

Spotify cites increased costs of supporting artists and maintaining infrastructure as reasons for the price increase. However, financial analysts also point to the company's shift from growth to profitability, noting that the increase could generate approximately $500 million in additional annual revenue. Spotify is likely using price increases to grow profits when subscriber growth is slowing.

How does Spotify's new price compare to competitors?

Spotify Premium at

Will Spotify raise Family or Student plan prices?

Family and Student plan prices have not yet increased as of early 2026, though price increases for these tiers are likely coming. Spotify Family costs

How much more are artists getting paid from these price increases?

It's unclear exactly how much of the price increase flows to artist payouts. While Spotify justifies increases by citing support for artists, the company has not transparently disclosed whether artist per-stream rates have increased or if higher revenues from price increases actually reach musicians. Artist advocacy groups have criticized Spotify for maintaining low per-stream rates despite raising user subscription prices.

What percentage of users have actually cancelled Spotify due to price increases?

Spotify has not disclosed exact churn numbers related to price increases, but the company has indicated that churn levels following previous price increases (2023 and 2024) remained within acceptable ranges. This suggests that the vast majority of users accept price increases rather than cancel, though some price-sensitive users do switch to competitors or downgrade to free versions.

Is there a way to pay less for Spotify?

Yes. Spotify Student costs

When should I expect the next Spotify price increase?

Based on historical patterns, the next Spotify price increase likely won't occur until mid-2027 at the earliest. Spotify typically waits 12-18 months between price increases to allow new subscriber onboarding cycles and to avoid appearing to raise prices too frequently. However, unexpected economic factors or increased licensing costs could accelerate this timeline.

Conclusion: The Long Game on Pricing Power

Spotify's 2026 price increase to $12.99 is significant, but not because it's shocking. It's significant because it reveals how the streaming music industry has matured and where the real value extraction is happening.

Three years ago, Spotify was a growth company chasing new subscribers at any cost. Today, it's a profitable company optimizing revenue per user. That shift in strategy explains everything about the price increases.

The fact that most users are absorbing these increases without canceling suggests that Spotify has succeeded in building a service with genuine switching costs and lock-in effects. Your playlists, your listening history, your recommendations are all on Spotify. Moving to Apple Music or YouTube Music means starting over.

But this pricing power isn't unlimited. At some point, higher prices will trigger meaningful churn, especially among price-sensitive segments. That breaking point is probably somewhere around $14-15 per month, which means Spotify still has room for one or two more increases before hitting resistance.

For users, the practical lesson is simple: evaluate whether Spotify is worth $12.99 per month to you personally. If it is, keep the subscription. If it isn't, switch to Apple Music or YouTube Music, or downgrade to the free tier. Don't pay for something just because you've always had it.

For the broader streaming industry, Spotify's success with price increases will likely inspire other services to do the same. Expect price increases across Netflix, Disney+, Apple Music, and other subscription services. The era of introductory pricing is over. We're entering the era of optimized pricing.

The question for the industry is whether this pricing strategy is sustainable long-term. If churn accelerates or new competitors emerge offering significantly better pricing, Spotify might be forced to moderate. But based on current trends, the company has more room to raise prices before hitting that resistance.

For now, Spotify is betting on its network effects, brand loyalty, and lack of serious competition to justify the higher prices. It's a bet that's working. Whether it continues to work depends on factors beyond Spotify's control: economic conditions, competitive responses, and user tolerance for subscription inflation.

Key Takeaways

- Spotify raised Premium to 9.99 in just three years (three price hikes total)

- JPMorgan analysts estimate this hike generates ~$500M in additional annual revenue without acquiring new subscribers

- Price increases reveal Spotify's shift from subscriber growth to profit extraction as market saturation approaches

- Spotify now costs more than Apple Music ($10.99) despite competitors offering comparable features

- Artist payout transparency remains unclear; higher subscription prices don't guarantee increased artist compensation

- Churn from previous increases suggests users have high switching costs and price tolerance due to network effects

- Regional pricing strategy shows Spotify raises prices first in mature, competitive markets with higher price elasticity

Related Articles

- Spotify Price Hike February 2025: What Changed & Your Options [2025]

- Netflix's Video Podcast Strategy: Challenging YouTube With Original Shows [2025]

- Amazon & Roku's 50 Free Streaming Channels: Complete Guide [2025]

- Freemium for AI Products: The 50 Million User Reality [2025]

- Fender Play on Samsung TV: 2025 Guide, Features & Learning Alternatives

- Disney+ Hulu Bundle Deal: Everything You Need to Know [2025]

![Spotify's Price Hike to $12.99 in 2026: What It Means for Subscribers [2025]](https://tryrunable.com/blog/spotify-s-price-hike-to-12-99-in-2026-what-it-means-for-subs/image-1-1768489554035.jpg)