Spotify's Latest Price Increase: Everything You Need to Know About the 2026 Hike

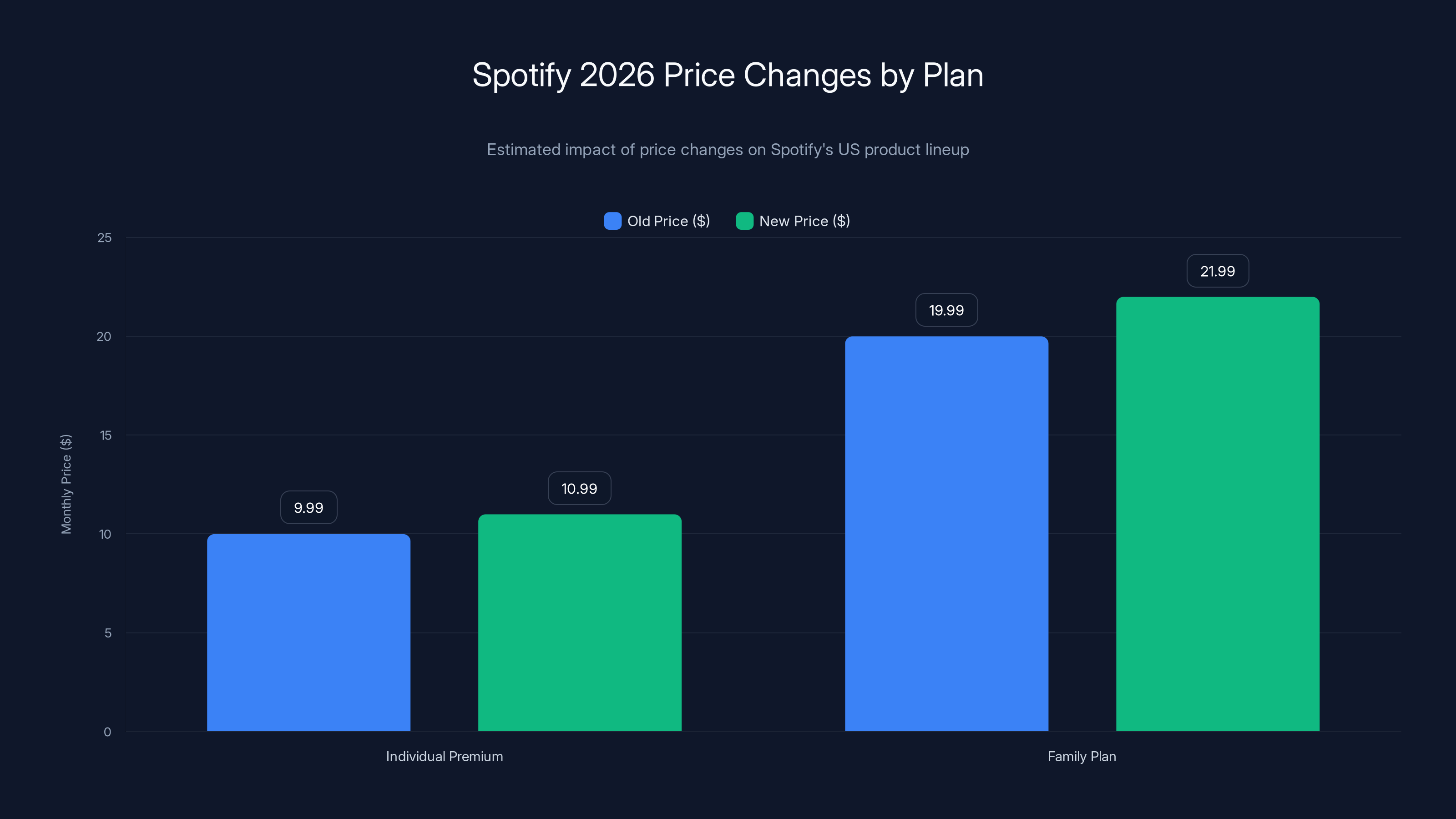

It's happened again. Just when you thought your streaming subscription costs had stabilized, Spotify announced another price increase. This time, Premium plans in the US are jumping from

But this isn't just about a dollar more per month. It's part of a larger pattern that's reshaping how we think about subscription streaming. Over the past three years, we've watched streaming services raise prices so aggressively that many people are questioning whether the entire model is sustainable. Spotify's move signals something bigger: the era of cheap streaming is officially over.

What makes this particular increase noteworthy isn't just the dollar amount. It's the frequency. Spotify maintained the same pricing for 12 years straight. Then something shifted. Starting in 2023, the service began regular price adjustments, first in the US, then spreading globally. By 2026, we're looking at a situation where annual price increases have become the norm rather than the exception.

The company justifies these increases by pointing to the value they're delivering: AI-powered features, improved audio quality, and the cost of licensing music from artists and labels. It's a reasonable argument on paper. But for subscribers, it adds up to real money. If you're on a Family plan, you're now paying

This article breaks down everything about Spotify's 2026 price hike: what's changing, why it's happening, how it compares to competitors, and what your actual options are. By the end, you'll understand not just the numbers, but the economics driving them.

TL; DR

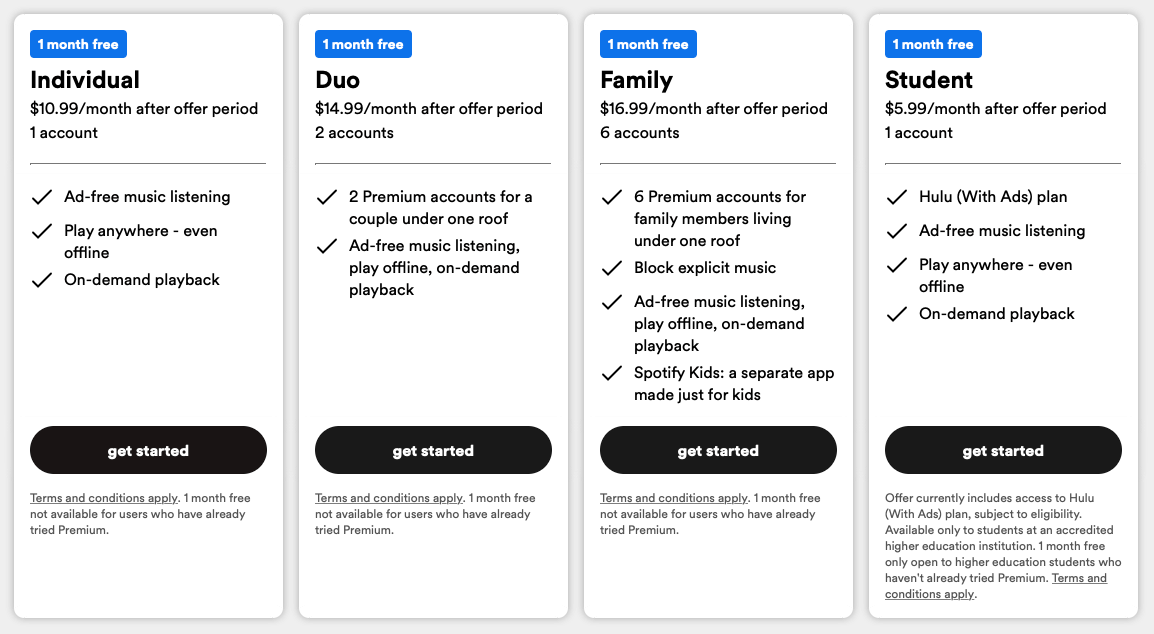

- **Spotify Premium is jumping to 11.99, effective with your next billing cycle

- **Family plans hit 19.99), making multi-person subscriptions significantly more expensive

- This is the third US price hike since 2023, ending a 12-year period of stable pricing

- **Student plans increase to 5 to just $1 lower than regular Premium

- Duo and regional pricing (Estonia, Latvia) also see increases, with Duo jumping to $18.99

- Bottom line: Streaming costs are no longer budget-friendly; you need to evaluate whether the service justifies the expense

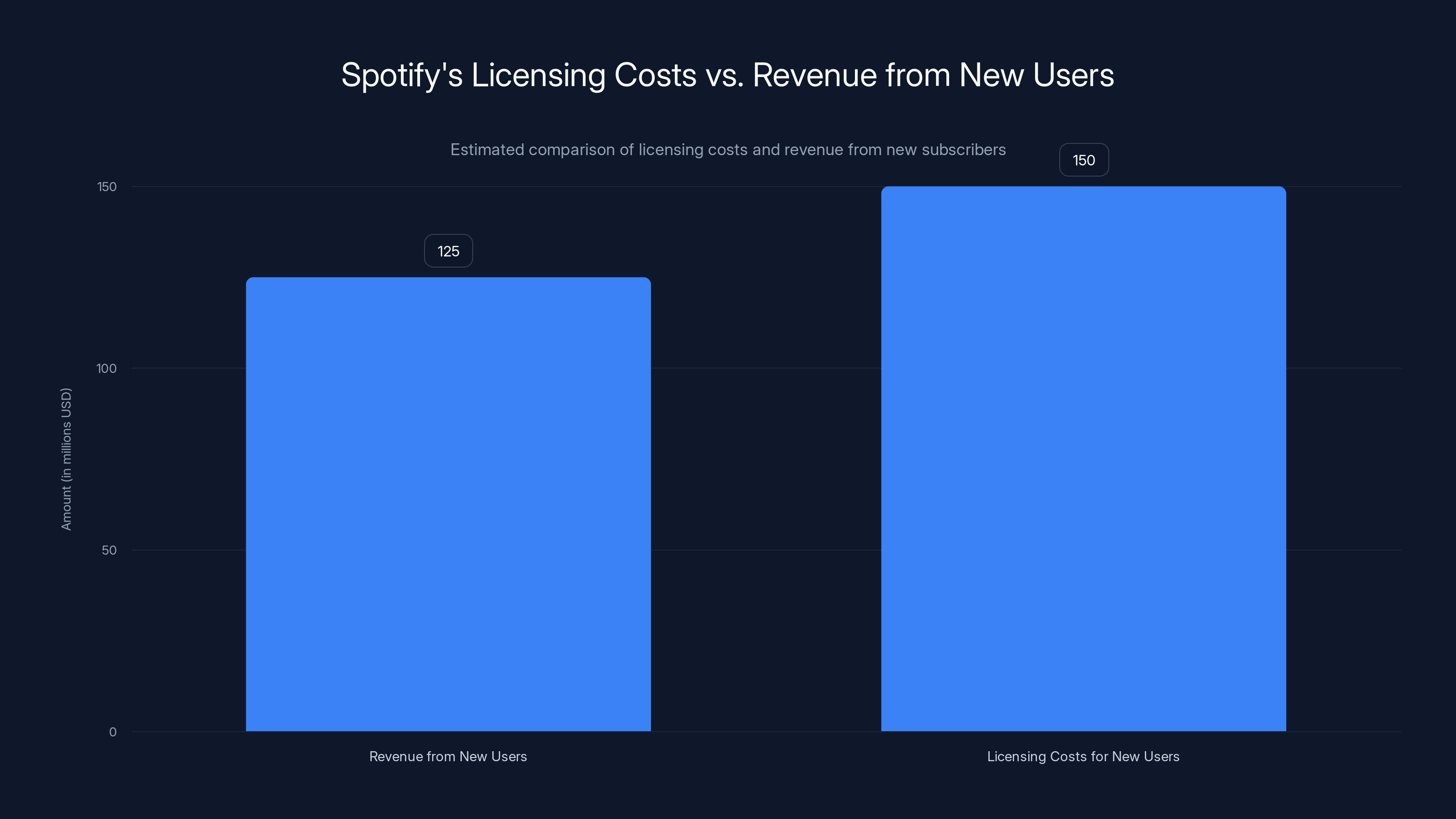

Estimated data shows that licensing costs for new users can exceed the revenue they generate, highlighting a financial challenge for Spotify.

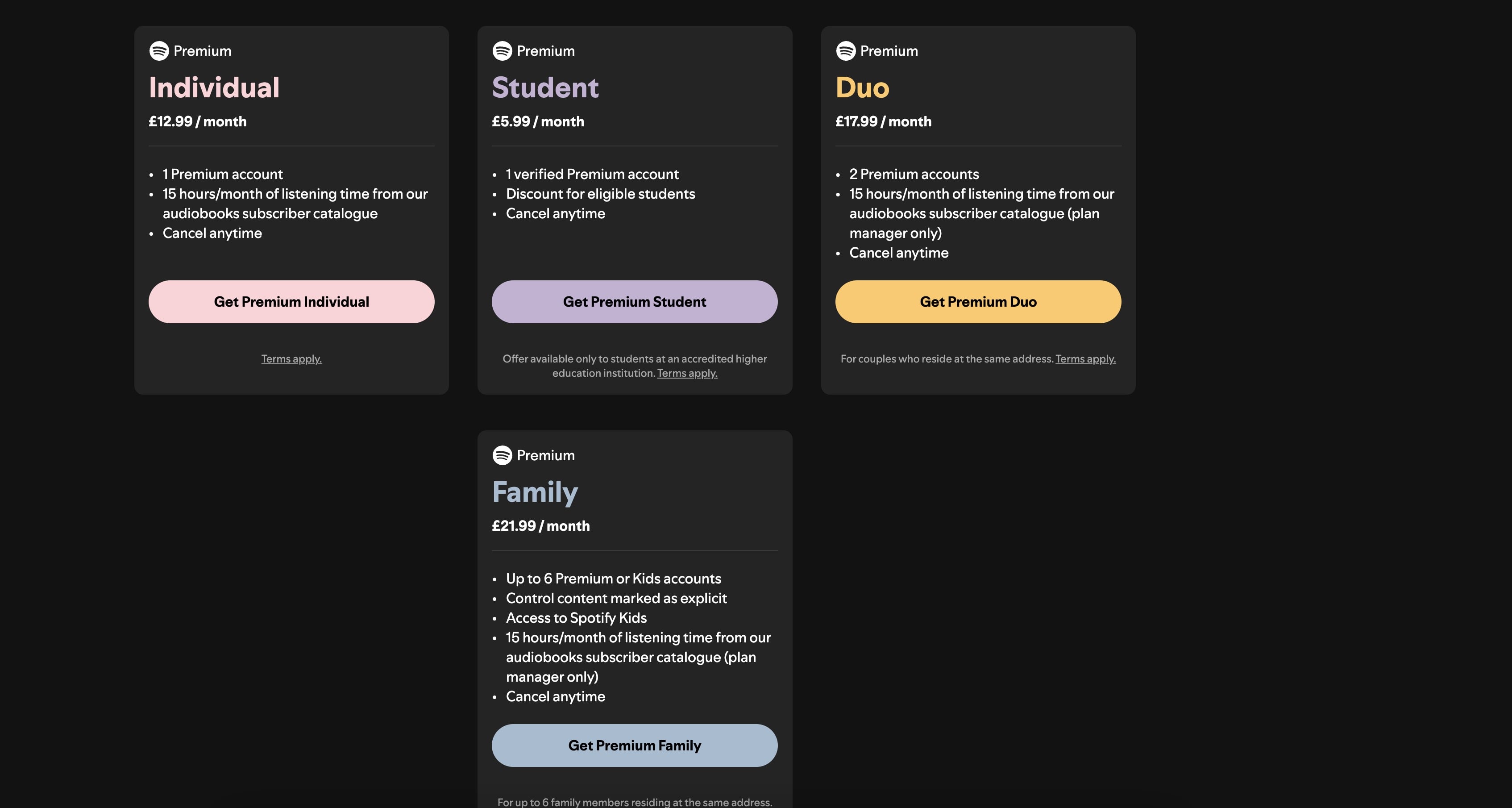

The Full Scope of Spotify's 2026 Price Changes

When Spotify announces a price increase, it doesn't just affect Premium users. The company is raising prices across its entire US product lineup, and the impact varies significantly depending on which plan you currently use.

Individual Premium Plan

The most basic tier is seeing a

But here's the thing: not everyone values these additions equally. If you're someone who just wants to stream music without discovering new songs or caring about audio quality beyond standard compression, the Premium plan's core value hasn't changed dramatically. You're still getting ad-free listening, unlimited skips, and offline downloads. The $1 increase essentially funds features you may never use.

Family Plan: The Biggest Hit

Family plans absorb a

For families with tight budgets, this changes the calculation entirely. You're now paying essentially the same as two individual Premium subscriptions. The math is simple: two Premium users at

This is particularly frustrating for families that have been loyal Spotify users for years. Many people chose Family plans precisely because they felt like a good deal for multi-person households. That value proposition is degrading with each price hike.

Student Plans: The Vanishing Discount

Student plans are increasing from

But the practical impact is more dramatic. Many students graduate and discover they can afford to keep their subscription. But as the student discount narrows, fewer people in that stage of life feel like they need the student tier. You're essentially paying just $1 less than the full Premium experience, which makes the step-up to premium feel inevitable for anyone who can afford it.

Duo Plans and Regional Markets

Duo plans, designed for two household members, are jumping from

Estonia and Latvia are also seeing increases, though the exact amounts vary by local currency and economic conditions. This international expansion of price hikes signals that Spotify is confident in its market position globally, not just in the US.

Spotify maintained a stable price of $9.99 for 12 years before increasing prices three times from 2023 to 2026, totaling a 30% rise. Estimated data suggests further increases by 2027 or 2028.

Why Spotify Is Raising Prices: The Economics Behind the Numbers

Spotify doesn't raise prices randomly. The company is a publicly traded entity answering to investors, and the decisions made by its finance team are grounded in specific economics. Understanding the "why" behind these increases requires looking at how Spotify actually makes money.

Music Licensing Costs Keep Rising

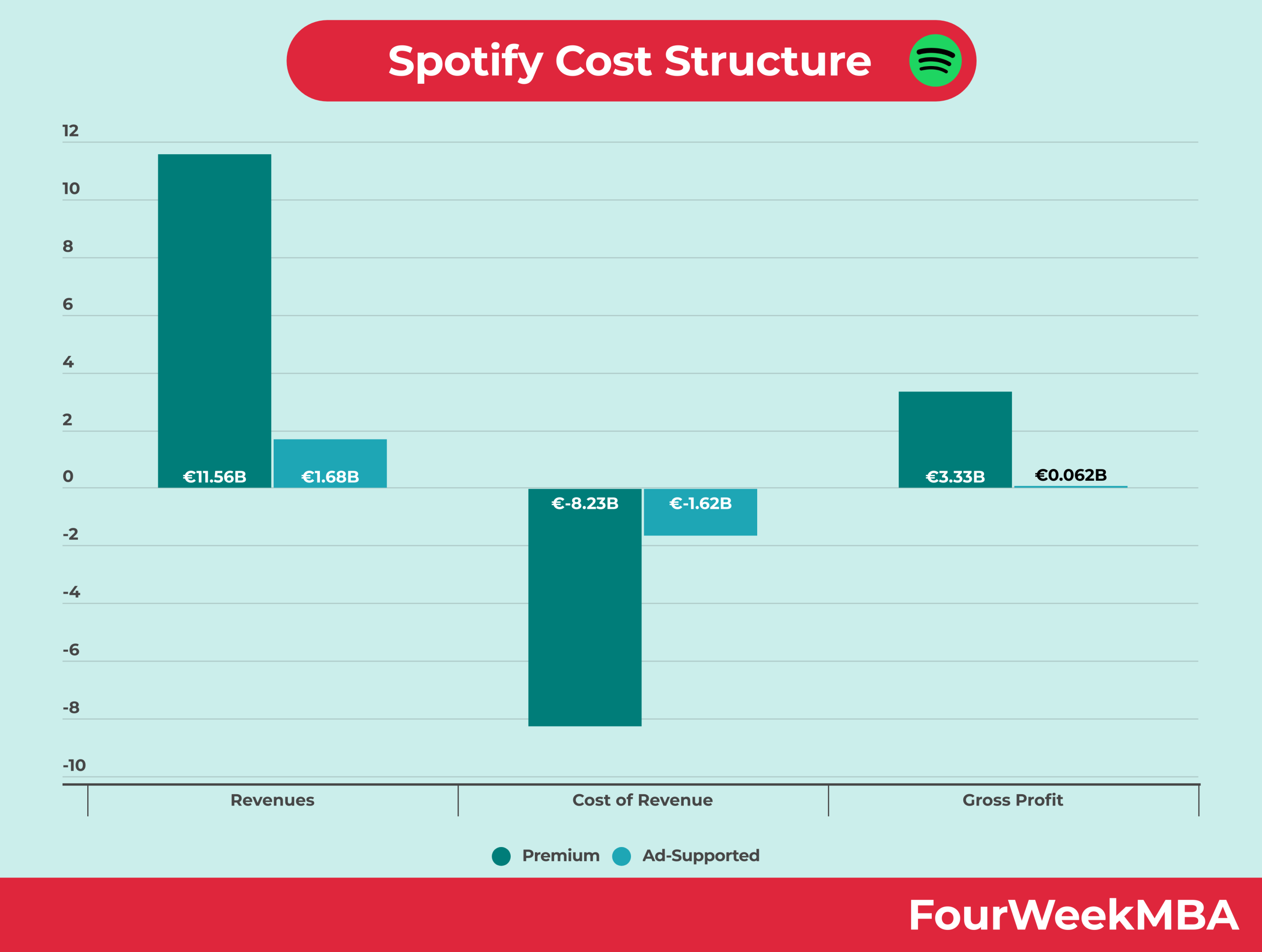

The single largest expense for any streaming service is music licensing. Spotify pays rights holders—record labels, publishers, and artists—based on how many times a song is streamed. The more users on the platform, and the more they listen, the higher the payouts.

Here's the brutal math: as Spotify's user base grows, licensing costs grow faster than revenue from new subscribers. If you onboard 10 million new users, those users generate subscription revenue of maybe

This is why Spotify has pushed so aggressively on features like ad-supported tiers and podcasts. Podcasts aren't subject to the same per-stream licensing rates, so they're far more profitable. But most users aren't switching to ad-supported tiers when paying tiers exist.

Music licensing rates themselves have been increasing. Record labels have demanded higher per-stream payouts as Spotify's market power has grown. When the service had 100 million users, labels were more flexible. Now, with 600+ million active users, the major labels have leverage to demand bigger cuts.

Competition and the Push for Premium Features

Spotify faces increasing competition from Apple Music, Amazon Music, and YouTube Music. Each service is investing heavily in exclusive content, high-fidelity audio, and AI-powered features. Lossless audio development, AI DJ, and personalization algorithms all require significant R&D spending.

When Spotify says it needs to raise prices to "continue offering the best possible experience," part of that is genuinely true. Developing and maintaining cutting-edge music streaming technology isn't cheap. The company needs to invest in infrastructure, AI research, and talent acquisition to stay competitive.

But there's also a chicken-and-egg problem: Spotify invests in features to justify price increases, then uses the features as justification for raising prices further. If a feature increases your value perception by 5%, but the price increase is 8%, users ultimately feel worse off.

Shareholder Pressure and Profitability

Spotify went public in 2018, and for years the company prioritized growth over profitability. That era is ending. Investors now expect the service to generate consistent profits, not just add users. Price increases are the most direct lever to improve margins.

Consider the math: if Spotify raises the average price per user by

This is why price increases are accelerating. Spotify has learned that it can raise prices, absorb some churn, and still come out ahead. The pricing power is intoxicating for management and shareholders.

The Historical Context: From Stability to Rapid Escalation

What makes this 2026 increase different isn't just the number—it's the pattern. For 12 years, Spotify maintained remarkably stable pricing. The Premium plan stayed at $9.99 per month from 2011 through 2023. That's longer than most technology companies maintain any product price.

Then, in 2023, everything changed. Spotify raised US prices for the first time, moving Premium from

The progression looks like this:

- 2011-2023: $9.99 (12 years of stability)

- July 2023: $10.99 (first increase)

- June 2024: $11.99 (second increase)

- 2026: $12.99 (third increase)

That's a 30% increase in three years. The pattern is accelerating, and the time between increases is shrinking. If this trend continues, you can expect another increase in 2027 or 2028.

What changed in 2023? Several factors converged. First, the post-pandemic economic reality set in, and many SaaS companies realized they'd been underpriced relative to the value delivered. Second, inflation hit harder than expected, and companies needed to pass costs to consumers. Third, and perhaps most important, Spotify's data showed that price increases didn't significantly harm subscriber retention.

The stable pricing era is gone. In its place, we're entering a period of regular, annual or bi-annual price adjustments. This is how mature tech companies operate: incremental price increases every 12-18 months, each increase small enough to avoid mass exodus but large enough to materially improve profitability.

Spotify's 2026 price changes show a

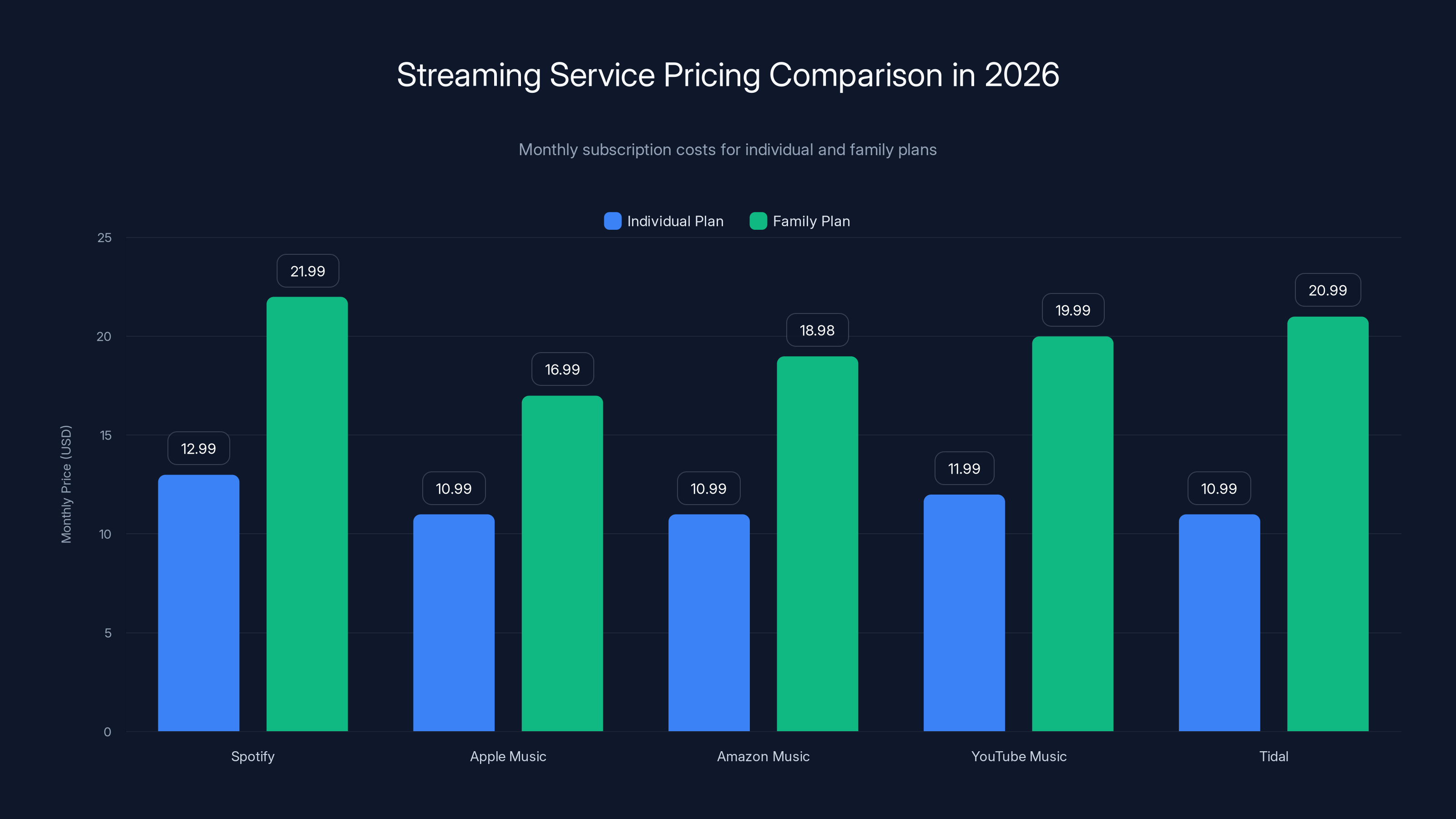

How Spotify's Pricing Compares to Competitors in 2026

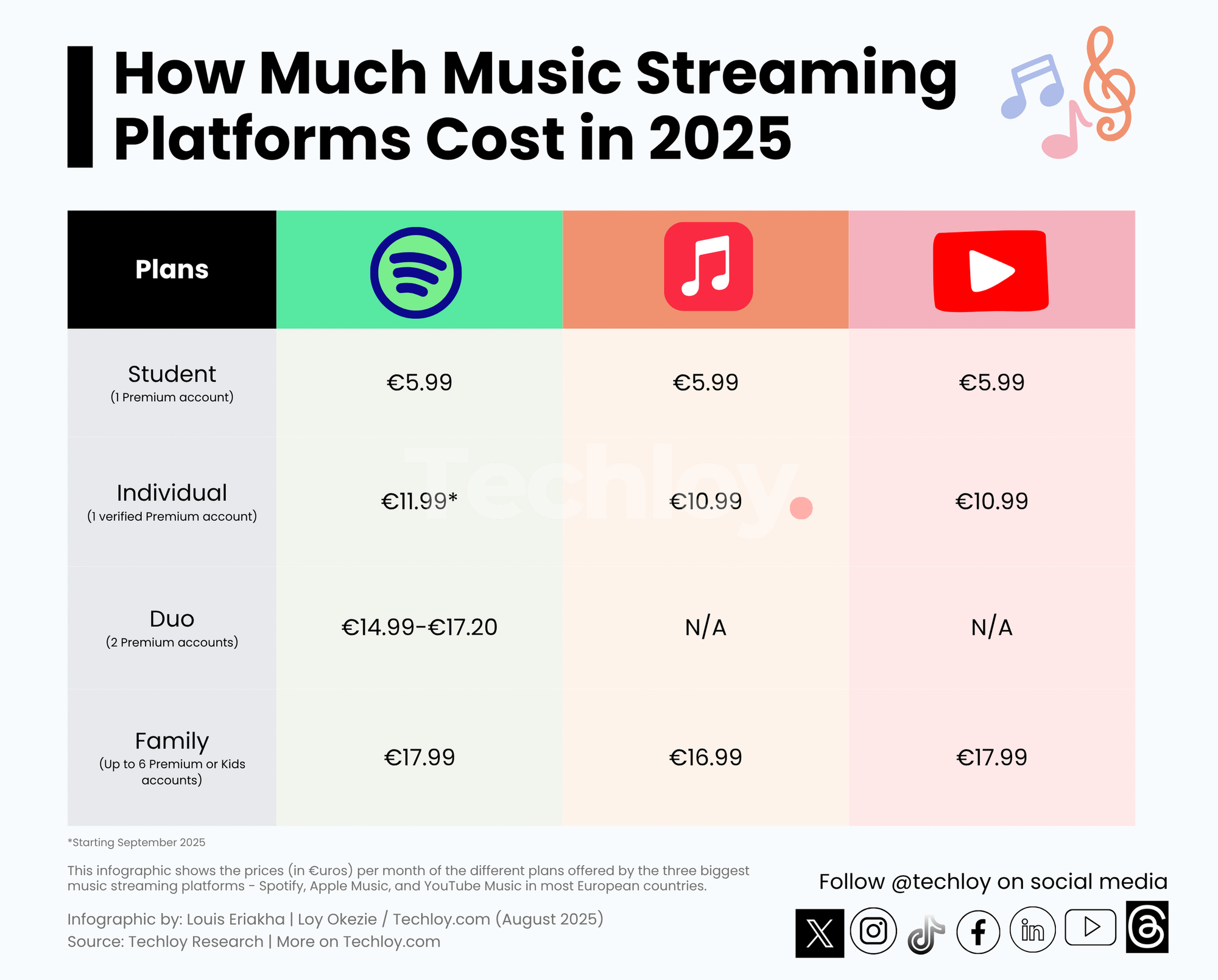

There's no point evaluating Spotify's price in isolation. The real question is whether $12.99 per month is competitive relative to alternatives. The streaming wars aren't primarily about features anymore—they're about pricing and music selection, both of which are nearly identical across services.

Apple Music

Apple Music sits at

Apple's strategy is interesting. The company bundles Music with other services (iCloud, TV+, fitness content) and offers discounts when you subscribe to multiple services. For someone in the Apple ecosystem, the total cost of ownership for Music is lower than standalone pricing would suggest.

Amazon Music

Amazon Music is

The Family plan is

YouTube Music

YouTube's advantage is music video integration. If you want to watch official videos, lyric videos, or live performances, YouTube Music has no equal. Spotify doesn't offer this at all.

Tidal

Tidal is the premium alternative, starting at $10.99 for high-fidelity audio. The service has been positioning itself as the artist-friendly alternative, offering higher per-stream payouts. However, Tidal has struggled to gain market share, hovering around 3-5 million paid subscribers versus Spotify's 220+ million.

Tidal's problem isn't pricing or features—it's the switching cost. Once you've invested time in Spotify's algorithm and playlists, leaving feels like starting over. Tidal hasn't cracked the retention problem.

Summary: The Competitive Landscape

Spotify is now the most expensive major option on a pure pricing basis. Apple Music is cheaper for families. Amazon Music undercuts on price if you're a Prime member. YouTube Music offers integrated video content. Yet Spotify maintains the largest market share.

This suggests that Spotify's pricing power isn't based solely on value—it's based on network effects and switching costs. Once you're in Spotify, your playlists, follow list, and algorithm are baked into the service. Switching means losing all that investment. Spotify is banking on that stickiness.

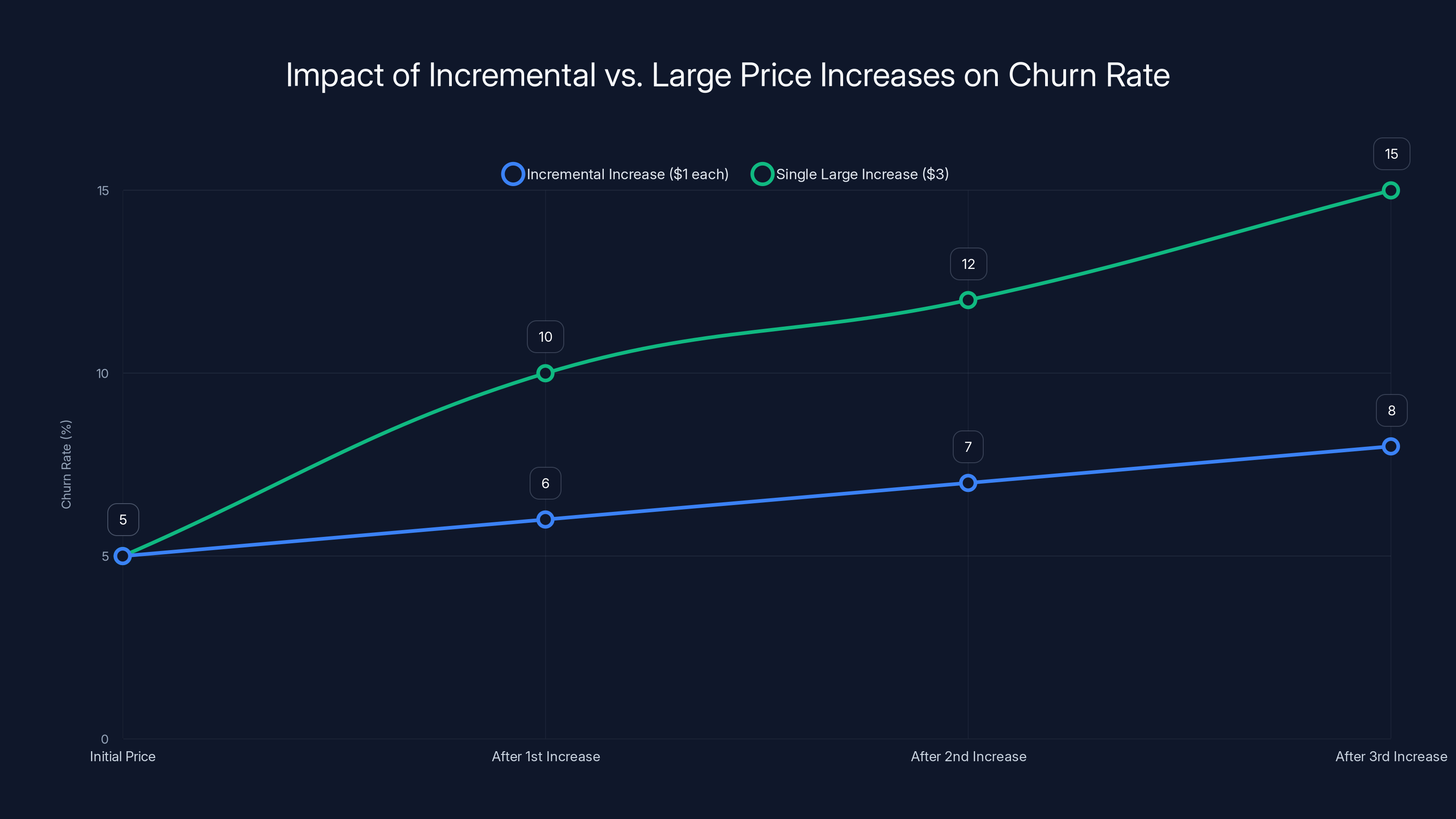

The Psychology of Incremental Price Increases

Why does Spotify raise prices by

This strategy is called "price anchoring," and it's been studied extensively. When companies raise prices incrementally, consumers adjust their mental reference point gradually. If Spotify had announced a

Research on subscription services shows that churn rates increase sharply with large price increases but remain relatively stable with incremental small increases, even if the total dollar impact is identical. Spotify's management has clearly internalized this lesson.

There's also the anchoring effect. Spotify can justify a $1 increase by pointing to new features, improvements, or cost inflation. Each increase seems reasonable in isolation. But the cumulative effect—a 30% price hike in three years—would shock users if presented as a single event.

This is why companies strategically space out price increases. Netflix uses the same playbook. So does Adobe. So do most SaaS platforms that can maintain pricing power. It's not malicious, but it's absolutely calculated.

The psychological trick is that by the time users realize the cumulative impact, they've already accepted three smaller increases. Undoing that psychological acceptance requires a significant trigger event, like a feature removal or major service degradation. A price increase alone, no matter how large cumulatively, rarely causes mass exodus if it's incremental.

Spotify's individual plan is the most expensive at $12.99, while its family plan is also higher than competitors, making it less competitive in terms of pricing. Estimated data for Tidal family plan.

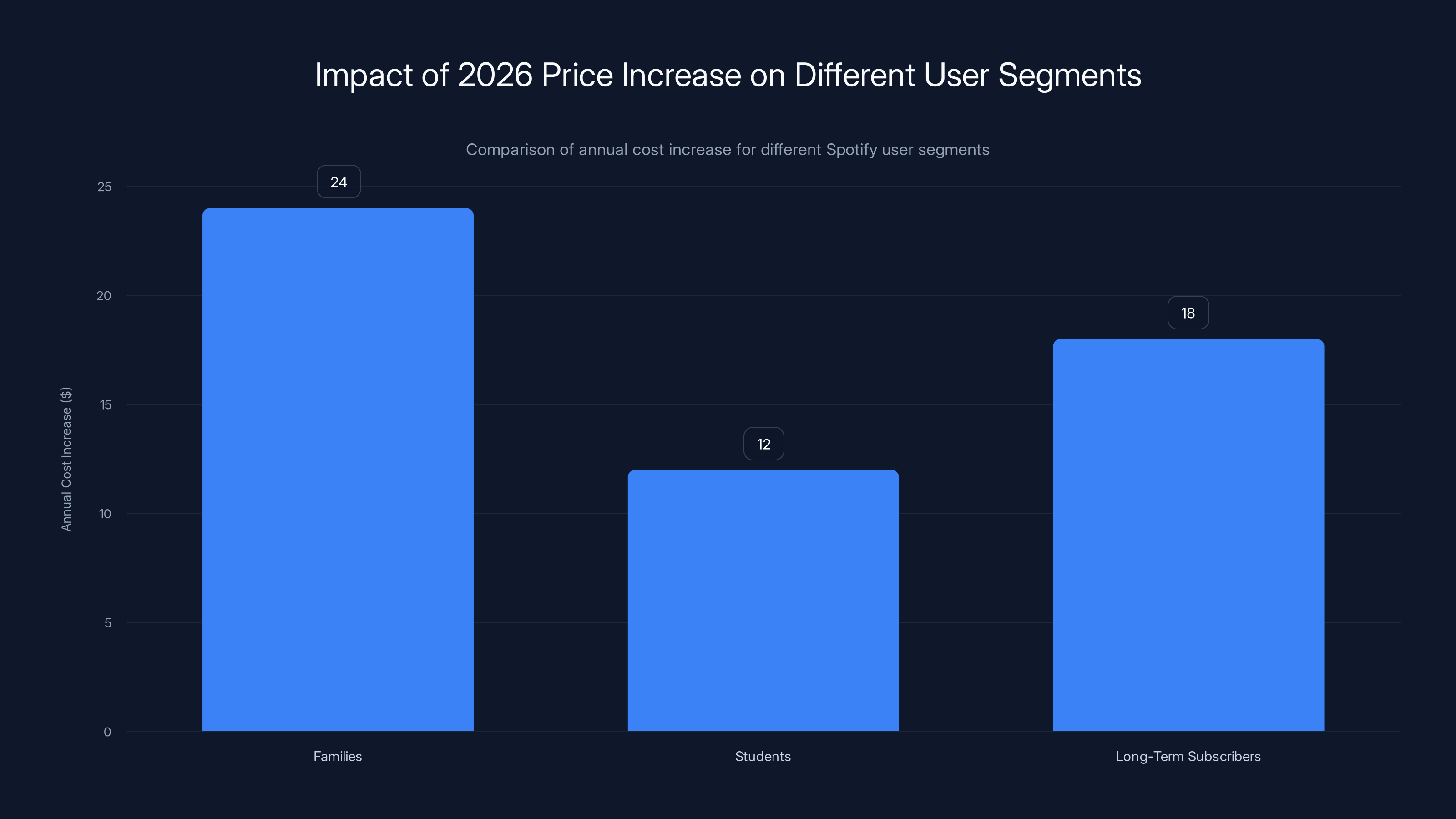

Who Gets Hit Hardest by the 2026 Price Increase

Price increases aren't equally painful for everyone. Different user segments are impacted differently, and some have more viable alternatives than others.

Families and Households

Family plans see the largest absolute increase (

Families also have the most viable alternatives. A household might consider switching to Apple Music Family (

Student Subscribers

Students face a particular dilemma. The student discount is shrinking as a percentage, making the upgrade path to regular Premium feel inevitable. But the absolute difference is meaningful on a student budget. An extra

Students also have the longest time horizon ahead of them. If you subscribe to Spotify as a student and stay for 20 years, you'll be paying significantly more than if the pricing had remained stable. The compounding effect of regular price increases over a long customer lifetime is substantial.

Long-Term Subscribers

Paradoxically, loyal Spotify users are the most vulnerable to price increases. They've invested time and energy into the platform, built massive playlists, and potentially even used Spotify Family to onboard other household members. The switching cost is highest for people who've been using the service the longest.

New users, by contrast, have no sunk investment. They can easily try competitors before committing to Spotify. But existing users are trapped. Spotify knows this, and it's part of why the company feels comfortable raising prices.

Casual Listeners

Casual listeners—people who stream 5-10 hours per week—are the ones most likely to cancel when prices increase. They don't derive enough value from Spotify to justify premium pricing. These users often migrate to free tiers with ads or competitor services with better pricing.

Spotify acknowledges this by maintaining the free tier with ads, though the company has been quietly reducing the quality of the free tier to push conversions to paid. This is a deliberate strategy: make free worse, paid cheaper (relatively) by comparison.

The Ad-Supported Alternative: Why It Matters Now

Spotify's ad-supported tier is experiencing explosive growth, particularly in developed markets. For price-conscious users, the ad tier is becoming increasingly attractive as Premium pricing rises.

The ad-supported tier is $0 per month (with ads) or costs nothing if you're already subscribed. You get all the same music, but you can't download for offline listening, and you have lower quality playback (96 kbps instead of 320 kbps). For casual listeners, these trade-offs are acceptable.

What's interesting is that Spotify's ad inventory is becoming increasingly sophisticated. The company isn't running generic display ads—it's using your listening data to deliver hyper-targeted ads from music-related companies, merchandise sellers, and live event promoters. Listening to indie rock? You'll see ads for independent record labels and alternative music merchandise.

From Spotify's perspective, the ad-supported tier is more profitable than you'd expect. Even though ad revenue per user is lower than subscription revenue, the overall margin is higher because Spotify doesn't have to pay per-stream licensing fees to the same extent. It's a genuinely interesting business model.

The downside for Premium users is that Spotify is quietly degrading the free tier to push conversions. Slower song loading, worse recommendations, and random playlist interruptions are now common on the free tier. This is deliberate—the company is making free worse to make paid feel like better value.

Estimated data shows that incremental price increases result in a lower churn rate compared to a single large increase, highlighting the psychological impact of gradual adjustments.

What New Features Justify the Price Increase?

Spotify's argument is that new features launched since the last price increase justify the cost increase. Let's examine whether that claim holds up.

AI DJ

AI DJ is Spotify's generated playlist feature that combines music with AI-generated introductions from a synthetic host. It's genuinely impressive from a technology perspective, but it solves a problem most users didn't know they had. The feature is interesting to try once or twice, then most users go back to their normal playlists.

Unlike Discover Weekly or Release Radar, AI DJ doesn't feel essential. It's a gimmick that demonstrates Spotify's technical capabilities but doesn't materially improve the core listening experience for most people.

Listening Insights and Stats

Spotify has been gradually improving user analytics, showing you detailed breakdowns of your listening habits, top artists, and discovery patterns. This is genuinely useful for self-reflection and creating shareable content. But is it worth a $1 monthly increase? Most users wouldn't say yes.

Lossless Audio (Coming)

This is the feature Spotify keeps promising but hasn't delivered. Lossless audio would provide bit-for-bit perfect reproductions of studio masters instead of compressed MP3-quality files. Theoretically, this should be a major feature.

But in practice, lossless audio is worth far less than you'd think. Most people can't hear the difference between 320 kbps MP3 and lossless audio, especially through wireless earbuds or phone speakers. You need expensive headphones and a quiet environment to appreciate the difference. For the 99% of users listening through AirPods or phone speakers, lossless is pointless.

Yet Spotify keeps promising it to justify price increases. The feature has been "coming soon" for years.

Collaborations and Social Features

Spotify has improved collaborative playlist features, letting multiple users edit a shared playlist in real-time. This is useful for group settings, but it's not a premium feature—it's table stakes for any modern music service.

Reality Check

Honestly? The features launched since the last price increase don't justify a $1 monthly increase. AI DJ is interesting but unnecessary. Lossless audio never shipped. Listening insights are nice but not essential. Collaborative playlists are expected.

Spotify's real justification for price increases is operating leverage and profit margins, not new features. The company is simply charging what it can get away with.

The Streaming Wars and Price Consolidation

We're witnessing a fundamental shift in how streaming services think about pricing. The era of race-to-the-bottom pricing is ending. Services are consolidating around pricing tiers that reflect the true value of music streaming.

This consolidation looks like this: individual plans between

But premium positioning only works if you deliver premium value. Spotify's advantage over competitors is purely network effects—more users, better algorithm, larger library. It doesn't offer the best audio quality (Tidal), the best family pricing (Apple), or the best bundling (Amazon). It's just the most popular.

Popularity is powerful, but it's fragile. Once Spotify is perceived as overpriced, the switching dynamics change. New users try competitors. Existing users get angry. The network effects start to reverse.

The smart move for Spotify would be to maintain pricing leadership while improving features. Instead, the company is taking the opposite approach: raising prices while delivering marginal feature improvements. This is the classic mistake large platforms make when they have market dominance—they confuse temporary advantages with permanent pricing power.

Families face the highest annual cost increase of

How to Respond to Spotify's Price Increase

You have real options when Spotify announces a price increase. Here's how to evaluate them.

Option 1: Stay and Accept the Increase

If you're deeply invested in Spotify—large playlists, followed artists, algorithm personalization—the switching cost is real. For many users, staying put despite the price increase is the path of least resistance.

Before accepting, audit whether you actually use Spotify enough to justify $12.99. If you listen less than 10 hours per week, the value calculation changes. Free tiers or cheaper competitors start looking reasonable.

Option 2: Switch to a Competitor

Apple Music remains the best alternative for most users, especially if you're in the Apple ecosystem. YouTube Music offers integrated video content. Amazon Music is bundled with Prime membership. Tidal offers higher audio quality.

Migrating playlists is easier than you think. Services like Soundiiz handle the transfer in minutes. Yes, you lose the algorithm investment, but you also break free from future price increases.

Option 3: Use Ad-Supported Tier

If you don't need offline downloads or higher audio quality, Spotify's ad-supported tier is genuinely functional. You get access to all 70+ million songs without paying. Yes, you'll hear ads, but they're targeted and relatively non-intrusive.

For casual listeners, this is the optimal choice. You keep your Spotify account, avoid the price increase, and only sacrifice features you probably don't use.

Option 4: Negotiate with Bundled Services

If you have Amazon Prime, Apple One, or other service bundles, the economics of streaming change. A

Check whether your current subscriptions include music tiers you're not using. Many people pay for services without realizing they have music included.

Option 5: Use Family Plans Strategically

If you live with roommates or family members who also use Spotify, splitting a Family plan is still cheaper than individual subscriptions. Even at

The key is to actually use a shared plan rather than paying separately. Many people don't realize they can split costs with people outside their immediate family.

The Broader Pattern: SaaS Pricing Escalation

Spotify's price increases aren't unique. They're part of a broader trend across software-as-a-service. Netflix, Adobe, Microsoft, and virtually every major SaaS company has raised prices multiple times in the past 3-5 years.

What's happening is a correction. Many SaaS companies, in their rush to gain market share, underpriced their services. They relied on growth to offset thin margins. Now that market competition has stabilized, companies are realizing they can charge more.

The pattern works like this:

- Company launches at aggressive price point to gain users

- Network effects lock users in

- Company gradually raises prices, betting on stickiness

- Users absorb increases through inertia

- Competitors do the same, so there's nowhere to flee

- Prices eventually stabilize at a new, higher equilibrium

We're in step 3-4 of this cycle for streaming services. Prices will continue rising until either a new competitor undercuts the incumbents, or user frustration reaches a breaking point.

Neither seems likely in the near term. Most new streaming competitors lack the capital to compete at scale. And user frustration, while real, hasn't translated into exodus—Spotify still grew users despite price increases.

The Future of Spotify Pricing: What to Expect

Based on the pattern of recent increases and industry trends, we can make educated guesses about future Spotify pricing.

Expect annual or bi-annual increases of

Individual Premium could reasonably reach

Spotify will also likely introduce new premium tiers. The company may create a "Spotify Lossless" tier at

Families and students will face the toughest decisions. The value proposition for these segments erodes with each price increase. By 2028, a family might genuinely be better off switching to Apple Music Family or using individual subscriptions to competitors.

Should You Stay or Go? A Decision Framework

Here's how to think about whether Spotify is worth $12.99 to you:

Calculate your monthly listening hours. If you listen 5+ hours per week, that's roughly 20 hours per month. At

If you listen fewer than 5 hours per week, the value equation changes. You might be paying $1+ per hour, which is harder to justify.

Assess your switching costs. How many playlists do you have? How dependent are you on Spotify's algorithm? Have you shared your account with family members? Higher switching costs make staying more rational.

Evaluate alternatives. If Apple Music, YouTube Music, or Amazon Music offer better total value when bundled with other services you already use, switching might be the right move.

Consider the trajectory. If Spotify's pricing trajectory continues, Premium could be $15+ by 2028. Are you comfortable with that? If not, switching now while you still have options might make sense.

Check your usage patterns. If you primarily listen through a browser on your desktop, YouTube Music offers better integration. If you watch music videos, YouTube Music is superior. If you're in the Apple ecosystem, Apple Music makes more sense. Default to Spotify only if it's genuinely the best service for your specific use case.

The Bigger Picture: What This Means for Streaming

Spotify's price increases aren't just about Spotify. They're a signal about the future of streaming media. We're transitioning from the "bargain era" of streaming—where services competed on price and features—to the "maturity era" where services consolidate around profitable pricing.

This is healthy in some ways. Sustainable pricing means services can invest in better features and pay artists fairly. But it's painful for consumers who got used to $10 unlimited music access.

The reality is that the

What's unclear is whether consumers will accept

The streaming wars aren't over. They're just shifting from competing on price to competing on features and positioning. Spotify's move to raise prices signals that it's betting on its network effects to maintain market share despite higher costs. We'll see if that bet pays off.

FAQ

When does Spotify's price increase take effect?

Spotify began notifying US subscribers about the price increase in January 2026, with the increase taking effect at each user's next billing cycle. This means different users will see the increase hit at different times depending on their billing anniversary. Premium individual plans jump from

How much is Spotify Premium now after the 2026 increase?

Spotify Premium is now

Is there a way to avoid Spotify's price increase?

Yes, you have several options. You can switch to the ad-supported free tier, which remains free but includes advertisements. You can migrate to a competitor like Apple Music, YouTube Music, or Amazon Music, all of which offer competitive pricing. You can also downgrade to a free tier with ads while keeping your Spotify account active, allowing you to avoid the price increase while maintaining your library and playlists.

How does Spotify's new pricing compare to Apple Music and other competitors?

Spotify Premium at

Will Spotify continue raising prices after 2026?

Based on recent patterns, price increases appear to be becoming regular. Spotify raised prices in 2023, again in 2024, and now in 2026. If this pattern continues, expect another increase within 12-24 months. Each increase is typically justified by new features, licensing cost increases, or inflation. The trajectory suggests Premium could reach $15+ within 2-3 years if increases continue at the current rate.

Are the new Spotify prices the same in other countries?

No, Spotify is implementing price increases in select markets initially. The US, Estonia, and Latvia are seeing increases in January 2026. Other regions may see increases at different times depending on local market conditions, currency fluctuations, and regional licensing agreements. The company typically rolls out increases market-by-market rather than globally all at once.

What features justify the Spotify price increase?

Spotify justifies the increase by citing new features like AI DJ (AI-generated playlists with synthetic host introductions), improved listening insights, and lossless audio support (which is still in development). However, most users would argue these features don't justify a $1 monthly increase. The actual driver appears to be rising music licensing costs, increased competition, and pressure from investors to improve profit margins rather than new consumer-facing features.

Can I negotiate or get a discount on the new Spotify pricing?

Spotify doesn't offer negotiation or discounts on individual Premium plans. However, the company does offer regular promotions for new subscribers. If you're an existing user facing a price increase, you could try canceling and re-subscribing to get a promotional rate (if available). You can also check whether bundled services like Apple One, Amazon Prime, or other platforms offer music streaming at a better value.

What's the cheapest way to use Spotify after the 2026 price increase?

The cheapest official way to use Spotify is the free tier with ads, which is completely free. If you want ad-free premium features, splitting a Family plan with roommates or family members is optimal—even at $21.99, it's cheaper per person than individual subscriptions. Competitors like Amazon Music bundled with Prime membership may also offer better overall value depending on your other subscriptions.

Should I switch services because of the Spotify price increase?

Whether to switch depends on your specific situation. Calculate your monthly listening hours and compare price-to-value. If you listen 20+ hours monthly, Spotify at $12.99 is still reasonable. If you listen fewer than 10 hours monthly or are in a family situation, competitors may offer better value. Try a competitor's free tier for two weeks to evaluate whether switching is worth the effort of transferring your library and adjusting to a new algorithm.

The Bottom Line: What Comes Next

Spotify's 2026 price increase marks another step in the long march toward higher streaming subscription costs. We're watching the economics of the industry play out in real time. Licensing costs are real, competition is fierce, and investor pressure is relentless.

For most users, the question isn't whether the price is fair—it's whether the service is worth $12.99 to you personally. That's an individual calculation based on your usage, your ecosystem, and your alternatives.

What's clear is that the era of stable, low-cost streaming is over. Whether that's a problem depends on your perspective. From one angle, it's frustrating that music streaming has become more expensive. From another angle, the music industry finally has sustainable economics, which means artists get paid fairly and services can invest in better features.

The real test will come in 2027 or 2028, when Spotify likely announces another increase. By then, we'll know whether consumers have accepted this new pricing paradigm or whether the backlash will finally push them to alternatives. Until then, most users will grumble, pay up, and continue listening to music.

That's the power of network effects. They're not unbreakable, but they're formidable.

Key Takeaways

- Spotify Premium increases to $12.99/month in 2026, the third US hike since 2023 ending 12 years of price stability

- Family plans see the largest impact at 16.99 significantly more attractive

- Music licensing costs drive pricing pressure, consuming 70-80% of streaming revenue and increasing with user growth

- Spotify's market dominance (35%+ global share) creates pricing power despite aggressive competitor pricing from Apple, YouTube, and Amazon

- Viable alternatives exist including free ad-supported tier, competitor services, and strategic family plan sharing to avoid paying full premium price

Related Articles

- Best Streaming Services 2026: Complete Guide & Comparison

- Paramount vs Warner Bros Discovery: Netflix Merger Battle [2025]

- MTV Rewind: The Developer-Built Tribute to 24/7 Music Channels [2025]

- Egypt vs Benin AFCON 2025: Free Streaming Guide & Watch Options

- Disney Bundle Deal: Save Big on Premium Streaming [2025]

![Spotify's 2026 Price Hike: What You Need to Know About Streaming Costs [2025]](https://tryrunable.com/blog/spotify-s-2026-price-hike-what-you-need-to-know-about-stream/image-1-1768482543151.jpg)