Trump Mobile's Hidden Owner: How Liberty Mobile Controls Everything

When Trump announced his mobile carrier, most people assumed it was a new company built from scratch. They were wrong. Behind the red-white-and-blue branding sits Liberty Mobile, a freedom-themed MVNO that's been quietly running mobile networks for years, and it controls far more than anyone initially realized.

The connection isn't just superficial. It's foundational. The three executives publicly representing Trump Mobile—Don Hendrickson, Eric Thomas, and Pat O'Brien—aren't employees hired to run the carrier. They're the actual owners of Liberty Mobile. And when you dig into what that means, you realize that Liberty Mobile doesn't just power Trump Mobile. Liberty Mobile is Trump Mobile's entire operation.

This matters because understanding Trump Mobile requires understanding how MVNOs actually work, why Liberty Mobile's existing infrastructure made it the natural choice, and what this concentration of power says about celebrity-branded telecommunications in 2025. It's a story about technology, politics, and the business of shortcuts.

TL; DR

- Trump Mobile is powered by Liberty Mobile: The same three executives own both companies, and Liberty Mobile handles 100% of the technical, legal, and financial operations

- Liberty Mobile is an MVNO: It pays larger carriers for network capacity, meaning Trump Mobile doesn't own or build any infrastructure

- Liberty Mobile did this before: The company previously branded itself as Canelo Mobile for Mexican boxer Canelo Álvarez, proving it's a reusable platform

- The business model is cheap: Liberty Mobile's operating costs are minimal because it relies entirely on resold network capacity from larger carriers

- Nothing is custom: Trump Mobile's phone, service plans, and network are all powered by Liberty Mobile's existing systems with different branding

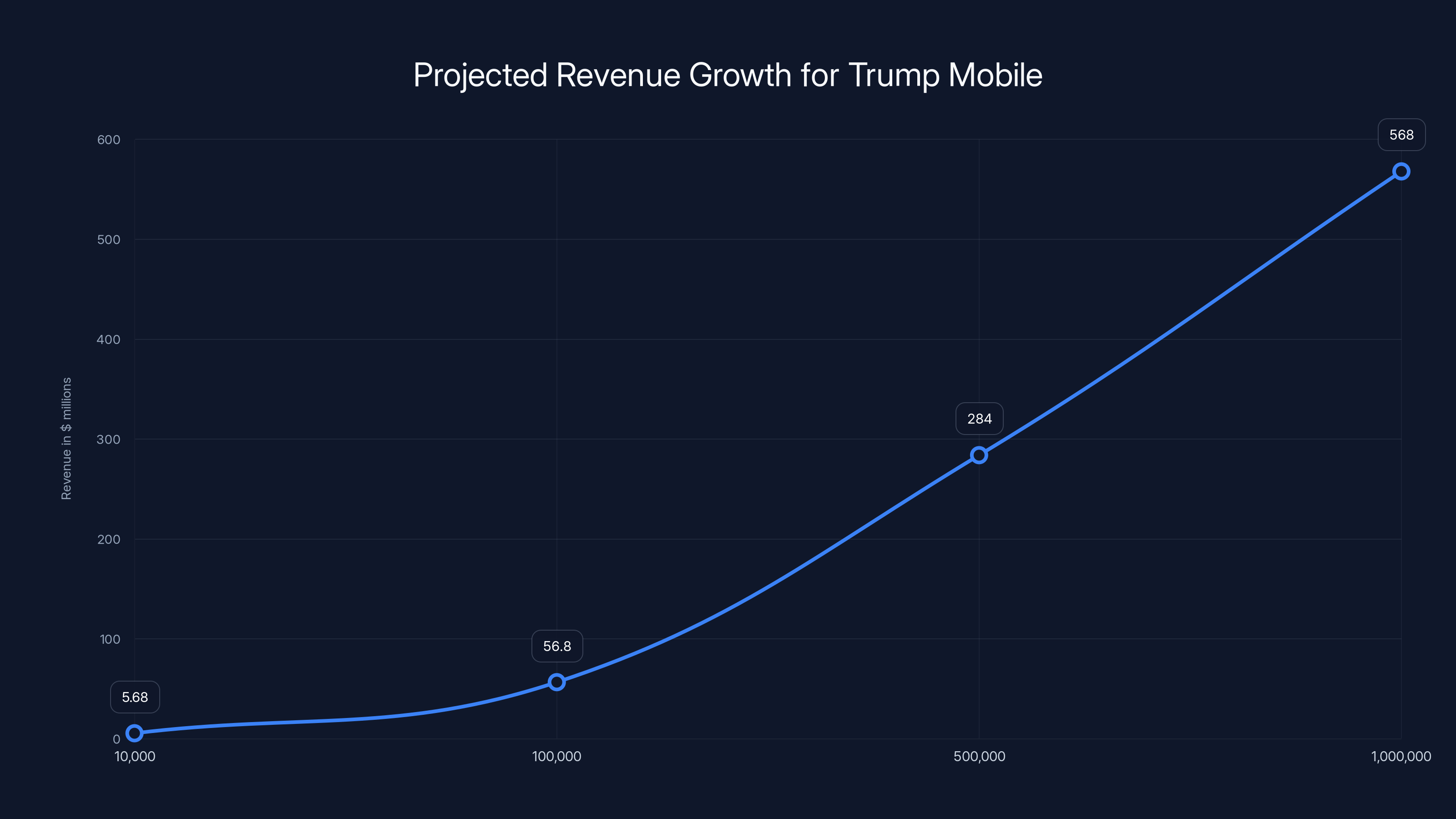

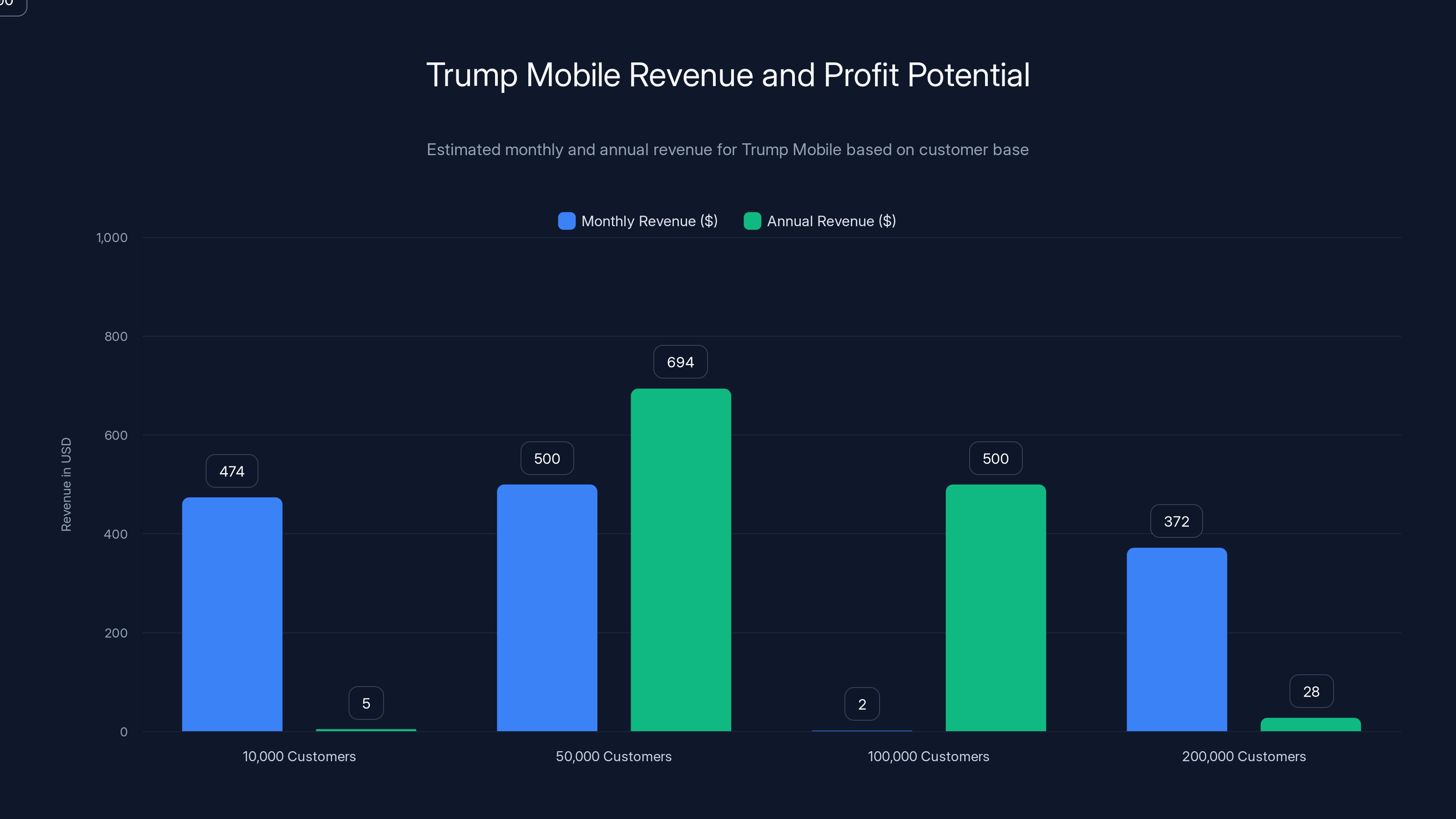

Estimated data shows Trump Mobile's potential revenue growth from

What Is an MVNO, and Why Does It Matter?

Before we talk about Trump Mobile specifically, let's talk about how mobile networks actually work in the United States. It's not what most people think.

There are only four companies that own physical cellular infrastructure in the U.S.: Verizon, AT&T, T-Mobile, and U.S. Cellular. These companies maintain towers, fiber, switching equipment, and all the physical backbone that makes cellular networks work.

Everyone else? They're renters.

An MVNO—mobile virtual network operator—is a company that buys wholesale access to one of these networks, then rebrands and resells it to customers. Think of it like this: Verizon builds the highway. An MVNO buys the right to operate a rest stop on that highway and charges drivers to use it.

The MVNO model has huge advantages for startups and niche brands. You don't need billions of dollars to build cellular infrastructure. You don't need to hire massive engineering teams to maintain towers. You don't need to negotiate with governments for spectrum licenses. You just need a wholesale relationship with an existing carrier, some marketing, and a customer acquisition strategy.

This is why celebrity-branded carriers and politically-themed MVNOs can exist. The barrier to entry is low enough that a small team with connections can launch a service in weeks, not years.

Liberty Mobile understood this well. Instead of building infrastructure, Liberty Mobile built a platform that could be rebranded for different audiences. The same network, the same engineers, the same billing system, the same regulatory structure. Just different logos and different marketing.

For Trump Mobile, this meant that instead of starting from zero, Liberty Mobile could take its existing MVNO infrastructure and rebrand it. No new network to build. No new regulatory filings to make. Just a new website, new marketing, and a new phone to put the Trump brand on.

Liberty Mobile's Quiet History

Liberty Mobile didn't start with Trump. It didn't even start with political branding in mind. The company's actual origins are somewhat murky—intentionally so—but what's clear is that it's been operating as an MVNO since at least the early 2020s, focusing on a specific market segment: conservatives who value both affordability and alignment with their political worldview.

The company's branding is unmissable: a Liberty Bell logo in red, white, and blue, slogans about freedom and independence, and messaging that appeals directly to people who see cellular carriers as part of corporate America's political establishment. This isn't neutral telecommunications. This is telecommunications with a perspective.

But Liberty Mobile's approach wasn't always political. Before Trump Mobile, the company did something almost nobody remembers: it launched Canelo Mobile.

Canelo Álvarez is a famous Mexican boxer, one of the most successful pound-for-pound fighters of the past decade. In 2024, Liberty Mobile struck a partnership with Álvarez to create a co-branded MVNO specifically targeted at Mexican Americans. The branding was different—sports-focused instead of politically-focused—but the underlying infrastructure was identical to Liberty Mobile.

This is the crucial insight that proves Liberty Mobile's actual business model. The company isn't in the telecommunications business. It's in the white-label MVNO business. It builds a platform once, then reuses it for different target markets with different branding.

Canelo Mobile failed to gain traction—you probably never heard of it—but that's not the point. The point is that Liberty Mobile had already proven it could create celebrity-branded MVNOs before Trump Mobile ever existed.

When Don Hendrickson, Eric Thomas, and Pat O'Brien decided to launch Trump Mobile, they didn't need to build anything new. They already had the playbook. They already had the infrastructure. They already had the relationships with larger carriers. They just needed to swap out the branding.

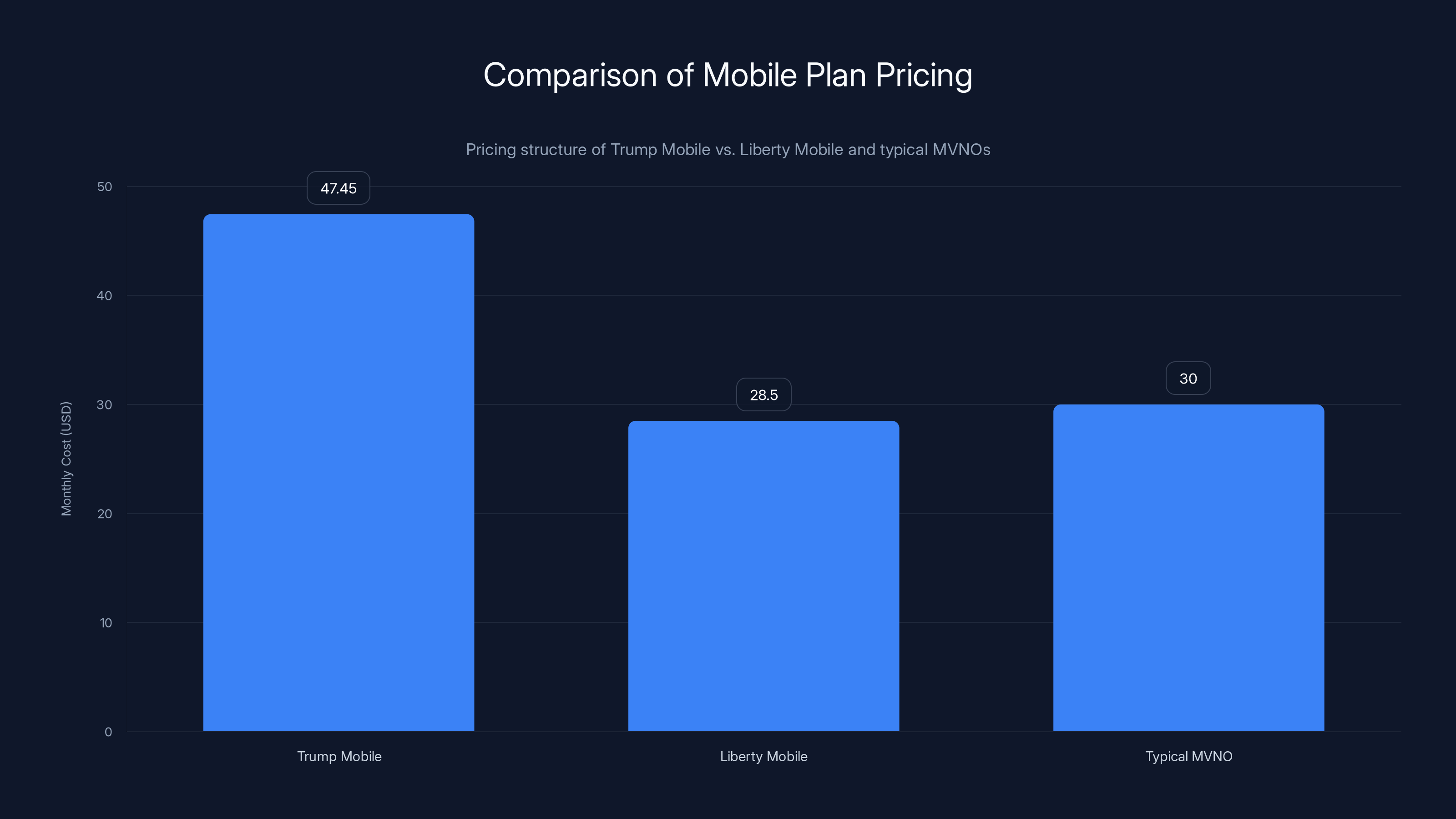

Trump Mobile charges $47.45/month, higher than MVNOs and Liberty Mobile, but lower than T-Mobile. Estimated data for MVNO average.

The Three Executives Behind the Curtain

Don Hendrickson, Eric Thomas, and Pat O'Brien are the public faces of Trump Mobile. They've been interviewed, photographed, and quoted in major publications. They're the ones who have shown off the Trump phone to journalists. They're the ones who explain the company's vision and roadmap.

But here's what's important: they're not employees. They're not hired hands brought in to run the company on someone else's behalf. They're the owners.

Specifically, these three men own Liberty Mobile. That means they own the MVNO platform that powers Trump Mobile. That means Trump Mobile isn't a separate entity they run—it's a rebrand of a company they already control completely.

This changes everything about understanding Trump Mobile. When a company launches a new product, typically there's a corporate structure: a CEO answers to a board, the board answers to investors, investors have specific financial expectations. There are checks and balances, oversight, and distributed decision-making.

With Trump Mobile, there are no checks. Hendrickson, Thomas, and O'Brien own the company outright. They make all decisions. They keep all profits. They decide strategy. There's no separation between the people promoting the brand and the people owning the assets.

Pat O'Brien's involvement is particularly interesting because his company, Ensurety Ventures, is the investment vehicle that acquired Liberty Mobile in 2024. This means the acquisition happened right before Trump Mobile was launched. It's not clear if Trump Mobile was the original plan for Liberty Mobile or if Trump's interest in a branded carrier created a new opportunity. But the timeline suggests that O'Brien, working through Ensurety Ventures, acquired Liberty Mobile specifically to position it as Trump Mobile's infrastructure.

Hendrickson and Thomas, meanwhile, are the ones who are most visibly driving the Trump Mobile narrative. Thomas shows off the phone. Hendrickson explains the technical details of how Liberty Mobile powers Trump Mobile. They're the ones doing interviews and building public enthusiasm for the launch.

But they're not employees describing their employer's strategy. They're owners describing their own company's strategy.

Liberty Mobile's Complete Control Over Operations

This is where things get really interesting. Trump Mobile isn't just powered by Liberty Mobile in the technical sense. Liberty Mobile controls literally everything about Trump Mobile's operations.

Here's what that means in practice:

Regulatory Compliance: Liberty Mobile is the entity registered with all 50 states. When a state requires a telecommunications provider to file specific paperwork, pay specific fees, or maintain specific infrastructure, that responsibility falls to Liberty Mobile, not Trump Mobile. Trump Mobile is just a brand operating under Liberty Mobile's regulatory umbrella.

Tax Obligations: Every state and local tax, fee, and regulatory assessment goes to Liberty Mobile. The E911 fees that every carrier must pay—the fees that fund emergency services—Liberty Mobile pays those. The universal service tax that subsidizes rural telecommunications—Liberty Mobile pays that. The state-specific telecom taxes that vary wildly from state to state—Liberty Mobile handles all of it.

Engineering and Infrastructure: When customers use Trump Mobile, they're using networks that Liberty Mobile manages. Liberty Mobile has the engineers who work with Verizon, AT&T, and T-Mobile to negotiate rates and maintain service. Liberty Mobile has the algorithms that route traffic, optimize coverage, and ensure customers get the best available signal. Liberty Mobile has the teams that monitor network performance and respond when something breaks.

Customer Service: When a Trump Mobile customer calls with a problem, Liberty Mobile's customer service infrastructure handles that call. The phone system, the support staff, the ticketing system, the escalation processes—all Liberty Mobile.

Billing and Finance: Liberty Mobile maintains the billing systems that charge customers every month. Liberty Mobile processes payments, handles refunds, manages account balances, and maintains the financial records. Trump Mobile customers never interact with Liberty Mobile directly, but Liberty Mobile processes every financial transaction.

This isn't a partnership where Liberty Mobile provides some services and Trump Mobile provides others. This is complete, total operational control. Trump Mobile exists only as a brand layered on top of Liberty Mobile's existing infrastructure.

Hendrickson's description captures this perfectly. He calls Liberty Mobile the "backbone" of Trump Mobile. Thomas calls it the "enabler." These aren't metaphors. These are accurate descriptions of complete structural dependence.

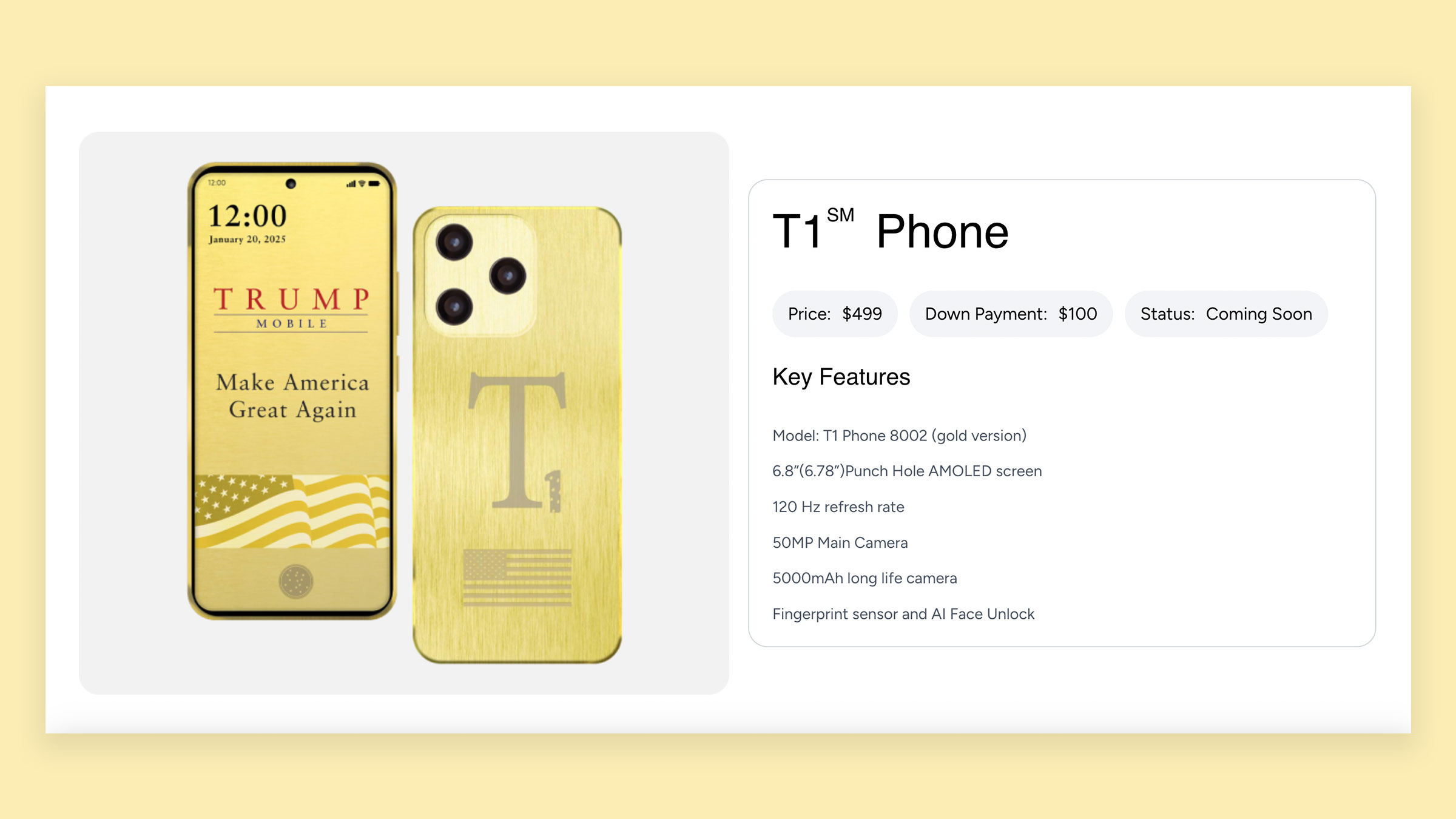

The Trump Phone: Rebranded, Not Redesigned

One of the key marketing hooks for Trump Mobile is the Trump phone. Images and renders have shown a device with a gold finish, prominent Trump branding, and a design that stands out from conventional smartphones.

But here's what's important to understand: the Trump phone doesn't represent new technology. It represents a partnership with an existing phone manufacturer to take existing phones and rebrand them.

This is standard practice in the industry. Carriers regularly partner with manufacturers to create co-branded phones with custom software, unique colors, or special finishes. Samsung does this with carriers. Apple does this with carriers. Motorola does this with carriers.

The Trump phone is the exact same concept. It's a phone that's been manufactured by an existing company, finished in gold or another distinctive color, branded with Trump's name and logo, and configured with Trump Mobile's network settings.

There's nothing wrong with this. Co-branded phones are completely legitimate. But it's important to understand that the Trump phone isn't a custom-built device created specifically for Trump Mobile. It's an existing phone with custom branding.

When Trump Mobile launches—potentially as soon as the timing allows—customers will activate their Trump phones on Liberty Mobile's network. They'll use the same infrastructure that powered Canelo Mobile, the same systems that power thousands of other MVNO brands, and the same carrier relationships that any other MVNO relies on.

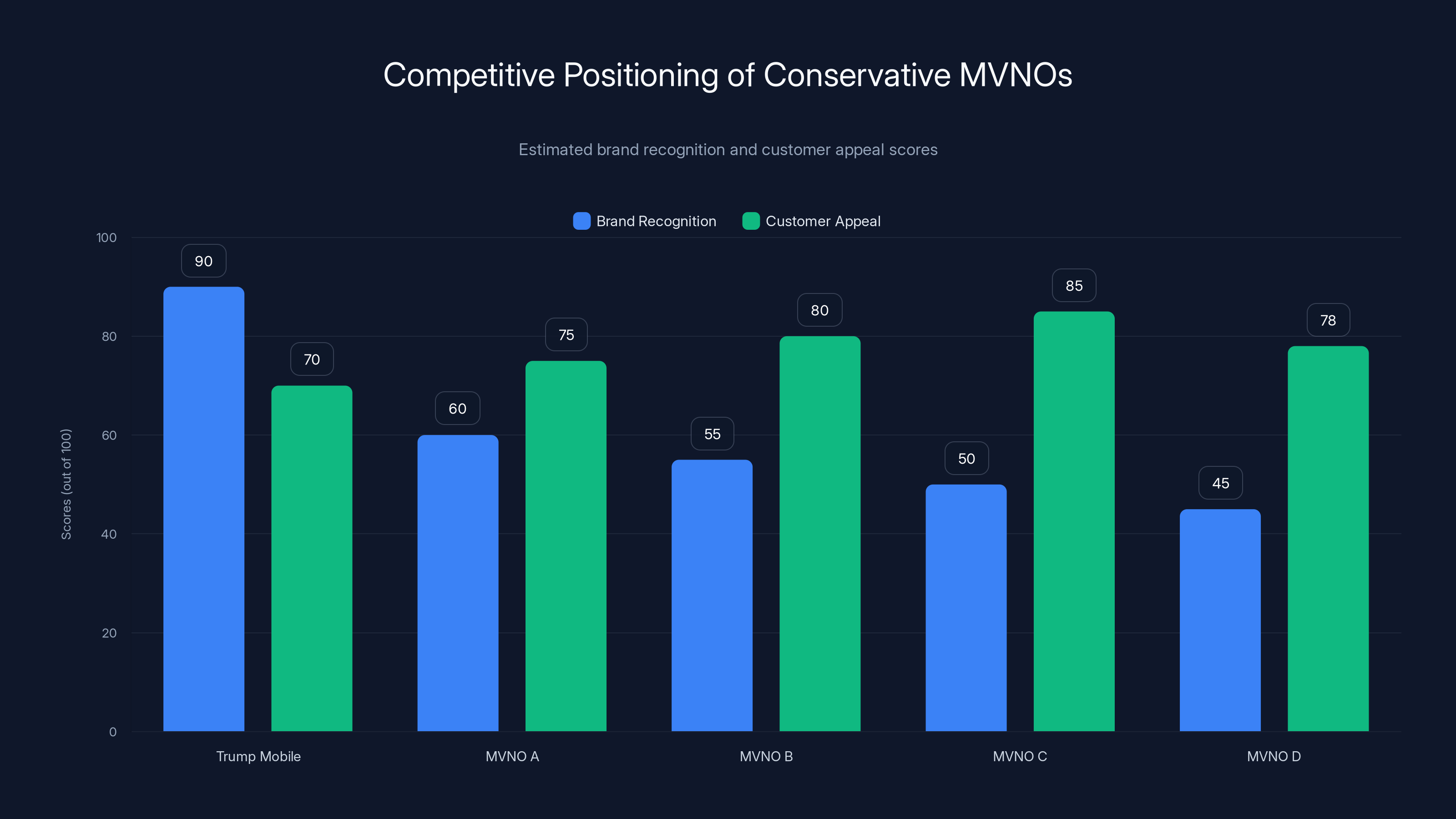

Trump Mobile leads in brand recognition due to Trump's personal brand but has varied customer appeal compared to other conservative MVNOs. Estimated data.

Pricing Strategy: Expensive Compared to Competition

Trump Mobile's pricing is interesting because it reveals a lot about the company's actual strategy and target market.

The single Trump Mobile plan costs

Trump Mobile is charging premium pricing for what is technically a commodity service: resold network capacity.

The justification, according to the company, is that the Trump plan includes extras that other plans don't. There's roadside assistance if your car breaks down. There's device coverage if your phone gets damaged. There's telehealth access for doctor consultations. These are useful add-ons, and they justify some additional cost.

But the price premium over Liberty Mobile's own plans is significant. Liberty Mobile's plans range from

This pricing structure reveals something crucial about Trump Mobile's actual business model. The company isn't trying to compete on price. It's competing on brand alignment and political messaging. The target customer isn't someone looking for the cheapest possible plan. It's someone willing to pay a premium to align their telecommunications spending with their political values.

This is the exact same strategy that every politically-aligned business uses. Chick-fil-A charges more than competitors and justifies it with messaging about corporate values. Duck Duck Go charges more for privacy-focused search than Google charges for the same basic service. When customers are buying identity alignment, they're willing to accept premium pricing.

The question is whether Trump Mobile customers will actually accept this pricing long-term. Telehealth access and roadside assistance are nice perks, but if customers find themselves paying

Regulatory Structure: Trump Mobile Hides Behind Liberty Mobile

Understanding the regulatory structure is crucial to understanding why Liberty Mobile is so important to Trump Mobile.

When you sign up for a mobile service in the United States, you're entering into contracts governed by state laws, federal laws, and FCC regulations. Every carrier—or in this case, every MVNO—must comply with these regulations or face fines, cease-and-desist orders, or forced shutdown.

Regulatory responsibilities include:

State Registration: Every state requires telecommunications providers to register and maintain compliance with state-specific rules. This involves paperwork, ongoing reporting, and regular compliance audits.

Licensing: Some states require specific licenses or permits to operate a telecommunications service. These must be obtained and renewed regularly.

Tax Collection: Every state and local jurisdiction sets specific tax rates and collection requirements for telecommunications services. Getting these wrong results in penalties.

Universal Service Fund: The FCC requires carriers to contribute a percentage of revenues to the Universal Service Fund, which subsidizes service in rural areas and provides access to low-income populations. Calculating and paying this correctly is complex.

E911 Compliance: Every carrier must ensure that emergency calls from their customers can be accurately routed to the correct 911 service center. This requires technical infrastructure, regular testing, and documentation.

Customer Proprietary Network Information (CPNI): Carriers are required to protect customer data and only use it in specific, limited ways. Violations can result in major fines.

Number Resource Management: Carriers must properly manage their phone number allocations and ensure that numbers are only assigned to active customers.

All of these responsibilities fall to Liberty Mobile, not Trump Mobile. Trump Mobile is essentially a white-label brand operating under Liberty Mobile's regulatory framework.

This is actually why Liberty Mobile being the owner of both brands matters so much. If Liberty Mobile were just a service provider that Trump Mobile hired to handle these duties, there would be more separation and potentially more risk for Trump Mobile. But because Liberty Mobile owns Trump Mobile, there's complete alignment—Liberty Mobile can make any decision necessary to ensure compliance without needing Trump Mobile's approval.

The Business Model: Minimal Risk, Maximum Leverage

When you look at Trump Mobile from a pure business perspective, it's actually a remarkably efficient model.

Traditional carriers have massive capital requirements. Building a cellular network costs tens of billions of dollars. Maintaining infrastructure requires constant investment. Hiring and managing thousands of engineers, technicians, and customer service representatives requires substantial ongoing expense.

Trump Mobile has none of these costs because it's an MVNO. The only capital Trump Mobile needs is enough to:

- Pay Liberty Mobile (or be owned by Liberty Mobile, in this case) for network access

- Purchase phones to inventory and sell

- Fund marketing and brand building

- Support initial customer service and operations overhead

This means Trump Mobile could theoretically be profitable on a small customer base. A traditional carrier would need millions of customers to break even. An MVNO can be profitable with tens of thousands of customers.

From Liberty Mobile's perspective, Trump Mobile represents pure upside. The company already has the infrastructure in place. Adding Trump Mobile as another brand doesn't require significant new investment. It's just another customer segment using the same network.

The revenue model is straightforward: every Trump Mobile customer pays $47.45 per month. Liberty Mobile receives a portion of that as the network operator, while the remainder covers marketing, customer acquisition, customer service, regulatory compliance, and profit.

If Trump Mobile acquires 100,000 customers, that's

The risk is also minimal. If Trump Mobile fails, Liberty Mobile loses some revenue, but the company still operates perfectly fine. The infrastructure that powers Trump Mobile also powers other brands and is valuable independent of any single customer segment.

This is why Liberty Mobile was the perfect platform for Trump Mobile. It had the operational excellence already built, the regulatory framework already in place, and the ability to scale without significant additional investment.

Trump Mobile's plan costs

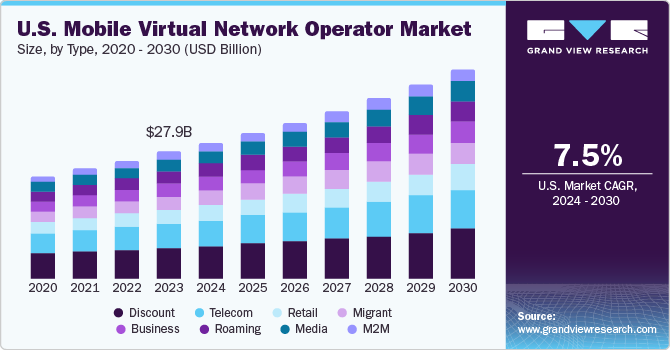

MVNOs in the Broader Market

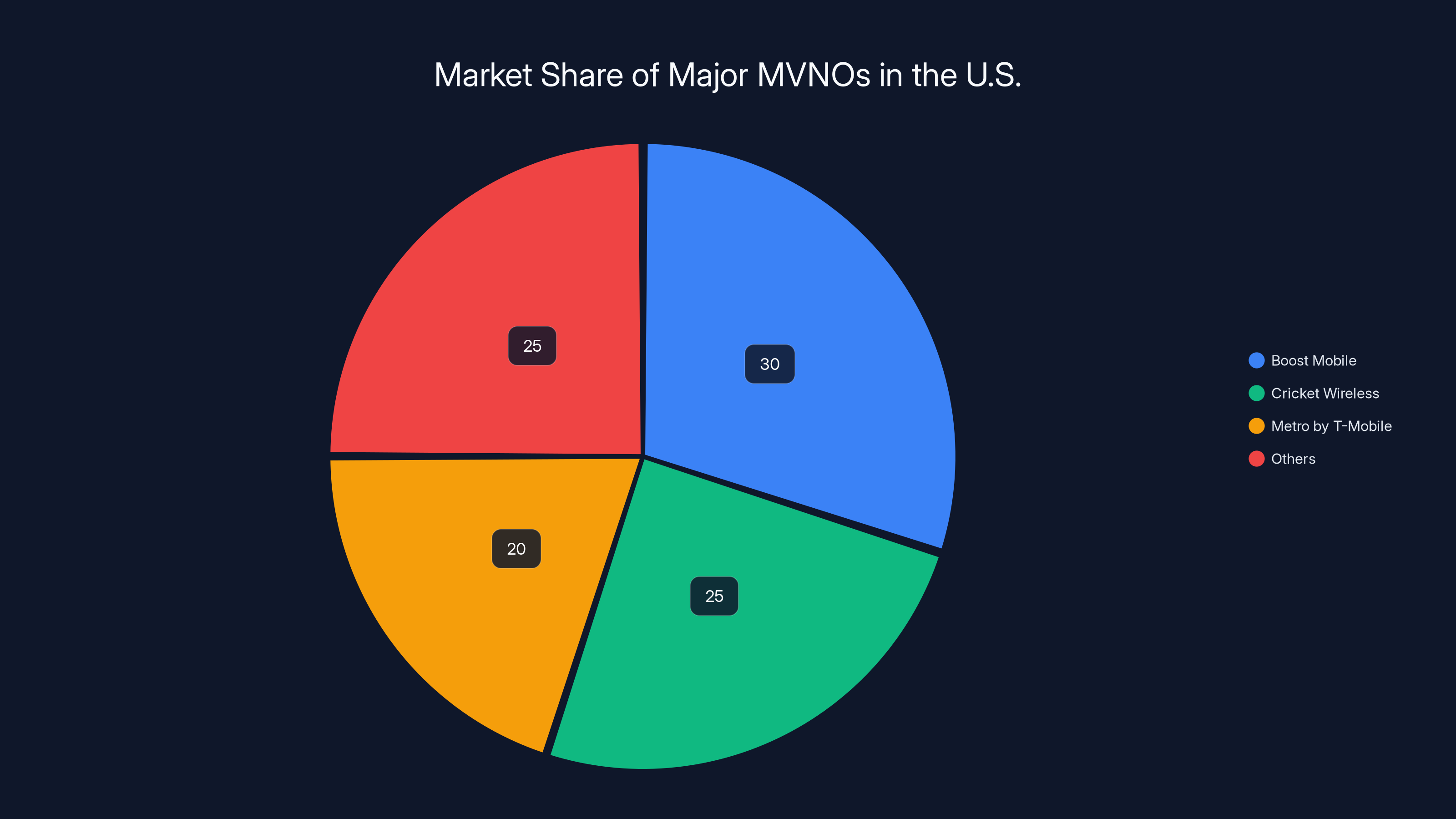

Trump Mobile's existence as an MVNO isn't unique or novel. In fact, it's part of a larger trend of carriers becoming increasingly fragmented and specialized.

The MVNO market has grown substantially over the past decade. Early MVNOs focused on price competition—brands like Boost Mobile and Straight Talk offered cheap plans to cost-conscious customers.

More recently, MVNOs have become increasingly niche and segmented. There are MVNOs for students, MVNOs for seniors, MVNOs for international travelers, MVNOs for businesses, and MVNOs for specific communities.

Politically-aligned MVNOs have existed for years. Conservative-focused carriers emerged in the early 2020s, and progressive-focused carriers exist as well. These brands market themselves explicitly around political values and worldview alignment.

Trump Mobile is just the highest-profile example of this trend because Trump has such a distinctive personal brand. But structurally, it's not different from dozens of other niche MVNOs operating in the same market.

What makes Trump Mobile different is the amount of attention it's receiving and the personal involvement of high-profile executives who are willing to publicly advocate for the brand.

Why Liberty Mobile's White-Label Approach Matters

The fact that Liberty Mobile was willing and able to create both Canelo Mobile and Trump Mobile reveals something important about modern telecommunications infrastructure.

The barrier to entry for creating a branded mobile carrier is now extremely low. A company doesn't need to build infrastructure, develop technology, or make massive capital investments. A company just needs:

- A white-label MVNO platform already built and operational

- A partnership with a celebrity, political figure, or community to provide the brand

- Marketing budget to acquire customers

- Enough operational expertise to handle compliance and customer service

Liberty Mobile has all of these. The company's business model is essentially: build the MVNO infrastructure once, then license and rebrand it repeatedly to different partners and customer segments.

This is efficient from a cost perspective but creates some interesting dynamics. When multiple brands share identical underlying infrastructure, customer experience becomes almost identical regardless of which brand you use. The only real difference is marketing, pricing, and a few add-on services.

This means that for Trump Mobile customers, their actual experience—signal quality, data speeds, coverage maps, customer service processes—will be almost identical to what Canelo Mobile customers experienced or what any other Liberty Mobile brand offers.

The differentiation is purely psychological and brand-based. Customers choose Trump Mobile because they want to align their spending with their political values, not because the underlying service is technically superior to alternatives.

The Launch Timeline and Operational Challenges

Trump Mobile was originally supposed to launch in August 2024. It didn't. The launch has now been pushed to potentially "as soon as next month" without a specific date being confirmed.

Delay is typical in MVNO launches, especially for brand-new services with high visibility. There are regulatory approvals needed, technical integrations that take longer than expected, marketing campaigns that need fine-tuning, and customer service infrastructure that needs testing before going live at scale.

But for Trump Mobile specifically, the delays might indicate additional complexity. The company is operating with exceptionally high visibility—every delay is noticed and commented on publicly. There's pressure to launch perfectly, with no service outages or customer issues on day one.

When an MVNO launches without major issues, customers barely notice. When it launches with problems—dropped calls, billing errors, slow data—those problems are amplified by media attention and social media criticism.

Liberty Mobile's experience with Canelo Mobile was presumably less visible and therefore more forgiving of minor launch issues. Trump Mobile launches into a fishbowl.

This might explain some of the caution. The executives want the launch to be as smooth and problem-free as possible. This means extensive testing, careful planning, and willingness to delay rather than rush a broken product to market.

Boost Mobile, Cricket Wireless, and Metro by T-Mobile dominate the U.S. MVNO market, collectively holding about 75% of the market share. Estimated data.

Competitive Positioning Against Other MVNOs

When Trump Mobile launches, it will be competing directly with other MVNOs in the conservative-focused segment.

There are roughly 10-15 explicitly conservative-branded MVNOs operating in the United States. These carriers market themselves around themes of freedom, patriotism, American values, and political alignment with conservative politics.

Most of these carriers charge similar prices to Trump Mobile—in the $30-50 range for unlimited plans. Most offer similar add-on benefits like device protection and roadside assistance. Most use similar branding language and similar marketing messaging.

The differentiation Trump Mobile brings is primarily Trump's personal brand. He's more famous, more controversial, and more personally involved in politics than any other figure who has branded an MVNO. This creates both advantages and disadvantages.

Advantage: Massive brand recognition and earned media attention. Every announcement gets covered by major news outlets. This creates awareness and familiarity that traditional marketing might not achieve.

Disadvantage: The political controversy surrounding Trump creates a polarizing effect. Some potential customers will be interested specifically because of Trump. Others will be actively hostile to the brand specifically because of Trump. There's no neutral ground.

Competing MVNOs can position themselves as patriotic and politically-aligned without the polarization factor. For customers who want to support conservative values but don't want to engage with Trump specifically, alternatives exist.

Trump Mobile's competitive advantage is Trump himself, not technical superiority or better pricing. This makes the brand vulnerable to market shifts—if Trump's political standing changes significantly, it could impact customer acquisition and retention.

Customer Service and Support Structure

When you call Trump Mobile customer service, you're calling Liberty Mobile's customer service infrastructure. The people answering your call may be trained specifically in Trump Mobile customer service, but they're part of Liberty Mobile's larger operation.

This creates both advantages and challenges.

Advantage: Liberty Mobile has experience running customer service for multiple brands. They understand how to onboard new brands, train staff, and maintain service quality across different customer segments.

Challenge: Customer service quality depends entirely on Liberty Mobile's operational excellence. If Liberty Mobile's customer service is good, Trump Mobile's will be good. If Liberty Mobile's customer service is mediocre, Trump Mobile's will be mediocre. There's no separation or ability for Trump Mobile to run a separate, better-quality operation.

For Trump Mobile customers, this means that your actual customer service experience will be essentially identical to what Canelo Mobile customers experienced on Liberty Mobile's network. The brand name might be different, but the people, systems, and processes are the same.

Liberty Mobile publishes limited information about its customer service quality metrics, so there's no easy way to compare before signing up. You'd have to rely on customer reviews from other Liberty Mobile brands to get a sense of actual experience.

The Broader Implications for Branded MVNOs

Trump Mobile's structure—where a white-label MVNO platform is rebranded for different customers—reveals an important truth about modern telecommunications:

The ability to create a "branded carrier" is now a commodity skill that can be replicated at will. It doesn't require innovation. It doesn't require technical breakthroughs. It requires only a platform already built, a brand to attach to it, and marketing funding to acquire customers.

This has massive implications for the industry. It means that any celebrity, politician, organization, or community that wants to create a "branded carrier" can do so relatively easily. The actual infrastructure and technical challenges are solved by existing MVNO platforms.

This democratizes carrier creation in some ways—you don't need billions of dollars and decades of infrastructure investment. But it also commoditizes the offering—all branded MVNOs using the same underlying platform offer essentially identical service.

In the long term, this might lead to consolidation and platform specialization. Instead of dozens of competing white-label MVNO platforms, maybe we'll see a handful of dominant platforms that power 80% of all branded MVNOs.

Or it might lead to increasing differentiation, where different platforms add specialized features to attract specific brands and customer segments.

Either way, Trump Mobile's existence proves that the barrier to creating a "new carrier" is now low enough that it's accessible to entrepreneurs and high-profile figures who can attract media attention and customer interest.

Trump Mobile can achieve significant revenue with a relatively small customer base due to its MVNO model. Estimated data shows potential monthly and annual revenues for varying customer numbers.

Understanding the Financial Relationships

The financial relationships between Trump Mobile and Liberty Mobile are opaque. The three executives own both companies, but the specific terms—how much Trump Mobile pays Liberty Mobile for network access, what margin Liberty Mobile keeps, how profits are distributed—aren't public information.

Based on typical MVNO economics, here's how it probably works:

Every Trump Mobile customer paying

Trump Mobile's expenses include marketing, customer acquisition cost (possibly $20-50 per customer), customer service salaries and infrastructure, phone inventory, and regulatory compliance costs.

With these numbers, Trump Mobile needs scale to be profitable. At 10,000 customers, even with 60% margin, you're looking at $2.4 million in annual gross profit before operating expenses. After paying salaries, running customer service, and acquiring new customers, the actual net profit might be modest.

At 100,000 customers, the math becomes much better. At 500,000 customers, Trump Mobile becomes a genuinely significant business.

For context, conservative-focused MVNOs generally range from 10,000 to 500,000 customers depending on age and marketing effectiveness. Some have plateaued at low numbers. Some have reached substantial scale.

Trump Mobile's potential customer base is almost certainly measured in the millions—there are tens of millions of conservative Americans who engage politically. Capturing even 5% of that potential market would create a $130+ million annual revenue business.

But acquisition costs, retention challenges, and competitive dynamics will determine whether Trump Mobile can actually achieve that potential.

The Transparency Problem

One of the most notable aspects of Trump Mobile and Liberty Mobile is how opaque both companies are about their operations.

Neither company publishes detailed financial information, customer numbers, network quality metrics, or operational transparency that would allow prospective customers to make informed comparisons.

For example, you can check T-Mobile's detailed coverage maps. You can't do that for Trump Mobile because the service hasn't launched yet, and Liberty Mobile doesn't publish this information on its website.

You can check Verizon's network quality reports from independent auditors. You can't do that for Liberty Mobile—the company doesn't publish third-party audits or quality metrics.

You can read customer reviews of thousands of carriers. There are almost no customer reviews of Liberty Mobile because it's not a well-known brand, and most customers don't know they're using Liberty Mobile—they only know the brand it's rebranded as.

This transparency gap is typical for MVNOs. Traditional carriers have regulatory obligations to publish more information and face more scrutiny. MVNOs operate with less transparency and less regulatory oversight.

But it creates a trust challenge. Prospective Trump Mobile customers don't have easy access to information about what they're actually getting. They're buying based on Trump's brand and marketing messaging, not based on transparent operational information.

When (and if) Trump Mobile launches, the actual customer experience will determine success or failure. If service quality is good, word of mouth will build. If service quality is mediocre, customers will leave for alternatives.

What This Means for the Future of Branded Carriers

Trump Mobile's dependence on Liberty Mobile suggests something important about the future of branded carriers: they're going to become increasingly common and increasingly commoditized.

When creating a branded carrier requires only building a white-label platform and then licensing it to different brands, the barrier to entry becomes very low. This means we should expect to see more celebrity carriers, more politically-aligned carriers, and more niche carriers in the coming years.

Each of these will offer essentially identical service—resold network capacity from larger carriers—but with different branding and different marketing messaging.

This creates both opportunities and challenges:

Opportunity: For entrepreneurs and celebrities who want to build a business around brand loyalty, a white-label MVNO is now a viable option. You don't need to be a telecommunications expert or have massive capital. You just need a brand people care about.

Challenge: As more brands compete in the same market, differentiation becomes harder. You can't differentiate on network quality if you're all using the same underlying network. You can't differentiate on technical features if you're all using the same infrastructure. You can only differentiate on marketing, pricing, and brand identity.

In the long term, this might lead to consolidation where only brands with strong identity and loyal customers can sustain high pricing. Other brands will either fail or be forced to compete primarily on price.

Trump Mobile has a strong identity and a potentially loyal customer base. Whether that's enough to sustain the brand long-term will depend on execution and market conditions.

The Bottom Line

Trump Mobile is not an independent carrier. It's Liberty Mobile with Trump branding.

The three executives who are publicly associated with Trump Mobile aren't hired employees. They're the owners of both companies. The infrastructure that powers Trump Mobile—the engineering teams, the billing systems, the customer service processes—is the same infrastructure that powered Canelo Mobile and that powers Liberty Mobile's own brand.

The regulatory structure means that Liberty Mobile is responsible for compliance, taxation, and operations. The MVNO model means that Trump Mobile doesn't own or control any actual network infrastructure.

The pricing is premium compared to MVNO alternatives because customers are buying brand identity alignment, not technical superiority.

The business model is efficient and relatively low-risk because it reuses existing infrastructure. But it's also entirely dependent on Liberty Mobile's continued operational excellence.

Understanding these facts doesn't make Trump Mobile good or bad. It just makes the company understandable. You're buying access to a resold network service from Liberty Mobile, rebranded with Trump's name, and charged at a premium price justified by political and cultural identity alignment.

When the phone launches—and it will eventually—you'll be using Liberty Mobile's network. You'll be paying Liberty Mobile's bills. You'll be using Liberty Mobile's systems. The Trump brand will be on your phone and on your bill, but behind the scenes, Liberty Mobile will be running everything.

That's not necessarily a problem. It's just the reality of how modern branded carriers actually work.

FAQ

What is Liberty Mobile, and how does it relate to Trump Mobile?

Liberty Mobile is a mobile virtual network operator (MVNO) that provides the complete infrastructure, technical operations, and regulatory compliance framework for Trump Mobile. The same three executives—Don Hendrickson, Eric Thomas, and Pat O'Brien—own both companies, meaning Liberty Mobile isn't just a service provider to Trump Mobile; it's the actual foundation that runs everything. Without Liberty Mobile, Trump Mobile wouldn't exist.

Does Trump Mobile own its own cellular network infrastructure?

No. Trump Mobile doesn't own, operate, or maintain any cellular network infrastructure. As an MVNO, Trump Mobile leases network capacity from larger carriers like Verizon, AT&T, or T-Mobile through Liberty Mobile. This is how most branded carriers work—they rebrand resold network capacity rather than building their own infrastructure.

Why did Liberty Mobile rebrand as Trump Mobile instead of using its own brand?

Trump's personal brand has far greater market awareness and media attention than Liberty Mobile's brand. By creating Trump Mobile, the three executives can market directly to Trump's supporters who want to align their spending with his brand, while potentially achieving higher customer acquisition rates than marketing Liberty Mobile's existing political branding would generate.

How is Trump Mobile's pricing structured, and what do you get for $47.45 per month?

Trump Mobile charges

What regulatory authority is responsible for Trump Mobile's compliance?

Liberty Mobile is the entity legally registered with all 50 states, responsible for all regulatory compliance, tax payments, E911 fees, universal service fund contributions, and all other legal obligations associated with operating a telecommunications service. Trump Mobile operates under Liberty Mobile's regulatory framework and licensing structure.

Will Trump Mobile's service quality be different from Liberty Mobile's service quality?

No. Because both brands use the exact same infrastructure, engineering teams, billing systems, and carrier relationships, the underlying service quality will be identical. The only differences will be branding, customer service messaging, and the specific add-on services included in different plans.

What happened to Canelo Mobile, and why is that relevant?

Canelo Mobile was a previous MVNO brand launched by the same Liberty Mobile infrastructure and the same three executives. It was designed as a celebrity-branded carrier for Mexican boxer Canelo Álvarez and targeted Mexican Americans. The fact that Liberty Mobile successfully created Canelo Mobile proves the company's capability to rebrand and relaunch the same MVNO infrastructure for different target audiences—exactly what's happening with Trump Mobile.

When will Trump Mobile actually launch, and what should customers expect?

Trump Mobile was originally scheduled to launch in August 2024 but has been delayed. The timeline is currently uncertain, with executives indicating "as soon as next month" without confirming a specific date. When it does launch, customers should expect a standard MVNO onboarding experience: signing up online, choosing a plan, potentially purchasing a Trump-branded phone, and activating service on Liberty Mobile's network infrastructure.

Related Topics to Explore

If you're interested in understanding the broader telecommunications landscape, consider exploring how MVNOs have disrupted traditional carrier models, comparing MVNO pricing strategies across different brands, examining the regulatory framework that governs wireless carriers, or investigating other celebrity-branded services that follow similar white-label business models.

Key Takeaways

- Trump Mobile is entirely powered by Liberty Mobile, an MVNO (mobile virtual network operator) that the same three executives own

- Liberty Mobile handles 100% of technical operations, regulatory compliance, tax obligations, customer service infrastructure, and billing systems for Trump Mobile

- Trump Mobile doesn't own any cellular network infrastructure; it's a white-label rebrand of Liberty Mobile's existing MVNO platform, just like Canelo Mobile before it

- At 17-40 plans because customers are buying political brand alignment, not technical superiority

- The MVNO model means Trump Mobile has minimal startup costs and operational complexity, but is entirely dependent on Liberty Mobile's infrastructure quality

![Trump Mobile's Hidden Owner: How Liberty Mobile Controls Everything [2025]](https://tryrunable.com/blog/trump-mobile-s-hidden-owner-how-liberty-mobile-controls-ever/image-1-1771612687467.jpg)