Introduction: When A Boxer's Phone Company Became A Presidential Blueprint

When most people think about Trump Mobile, they picture a straightforward business transaction: a sitting president decides to launch a phone company bearing his name, rolls out phones with his branding, and taps into a dedicated base of supporters willing to pay for his label. But the real story is far messier, more calculated, and infinitely more interesting.

The truth is that Trump Mobile didn't spring from the mind of Donald Trump or any Trump Organization executive. Instead, it emerged from a surprisingly pragmatic marketing playbook tested years earlier with someone completely unexpected: Canelo Álvarez, the Mexican professional boxer who became the undisputed middleweight champion of the world.

This isn't a story about innovation. It's a story about replication. It's about how executives at Liberty Mobile, a cellular MVNO (Mobile Virtual Network Operator) business, recognized a successful formula in celebrity-branded services and simply repurposed it. Five years before Trump Mobile would become a household name, Canelo Mobile was attempting the exact same thing: wrapping affordable cellular service in celebrity packaging, targeting a specific demographic, and selling the promise that association with a famous name meant something tangible.

When Don Hendrickson and Eric Thomas, two of the key Trump Mobile executives, first revealed the origins of Trump Mobile in recent interviews, they opened a window into how modern celebrity-commerce actually works. And what they revealed was that this wasn't about Trump at all. It was about Liberty Mobile's ability to scale a proven model.

The implications are significant. Understanding Trump Mobile requires understanding Canelo Mobile first. And understanding both requires looking at how MVNOs use celebrity branding as a substitute for actual differentiation, how they target specific populations through trusted figures, and why this model keeps getting recycled despite historical evidence that it rarely delivers lasting value. This article explores the complete history of how a Mexican boxer's failed phone venture became the blueprint for a presidential one, what both ventures got right, where they went wrong, and what it tells us about celebrity commerce in the 2020s.

TL; DR

- Canelo Mobile preceded Trump Mobile by five years: Liberty Mobile tested the celebrity-branded MVNO strategy with world champion boxer Canelo Álvarez in May 2020 before approaching the Trump Organization with the same playbook

- Trump didn't originate the idea: Don Hendrickson and Eric Thomas from Liberty Mobile pitched the Trump Mobile concept to Trump executives, not the other way around

- Identical infrastructure, different faces: Both ventures used Liberty Mobile's network infrastructure, the same accessory partnerships, and comparable marketing strategies targeting specific demographic groups

- Generic phones with celebrity wrapping: Both Canelo Mobile and Trump Mobile disguised budget handsets (originally from Hotpepper) with celebrity branding and preloaded apps rather than proprietary hardware

- Repeated pattern suggests recurring playbook: Liberty Mobile appears to use celebrity partnerships as a scalable strategy for creating perceived differentiation in the commodity MVNO market

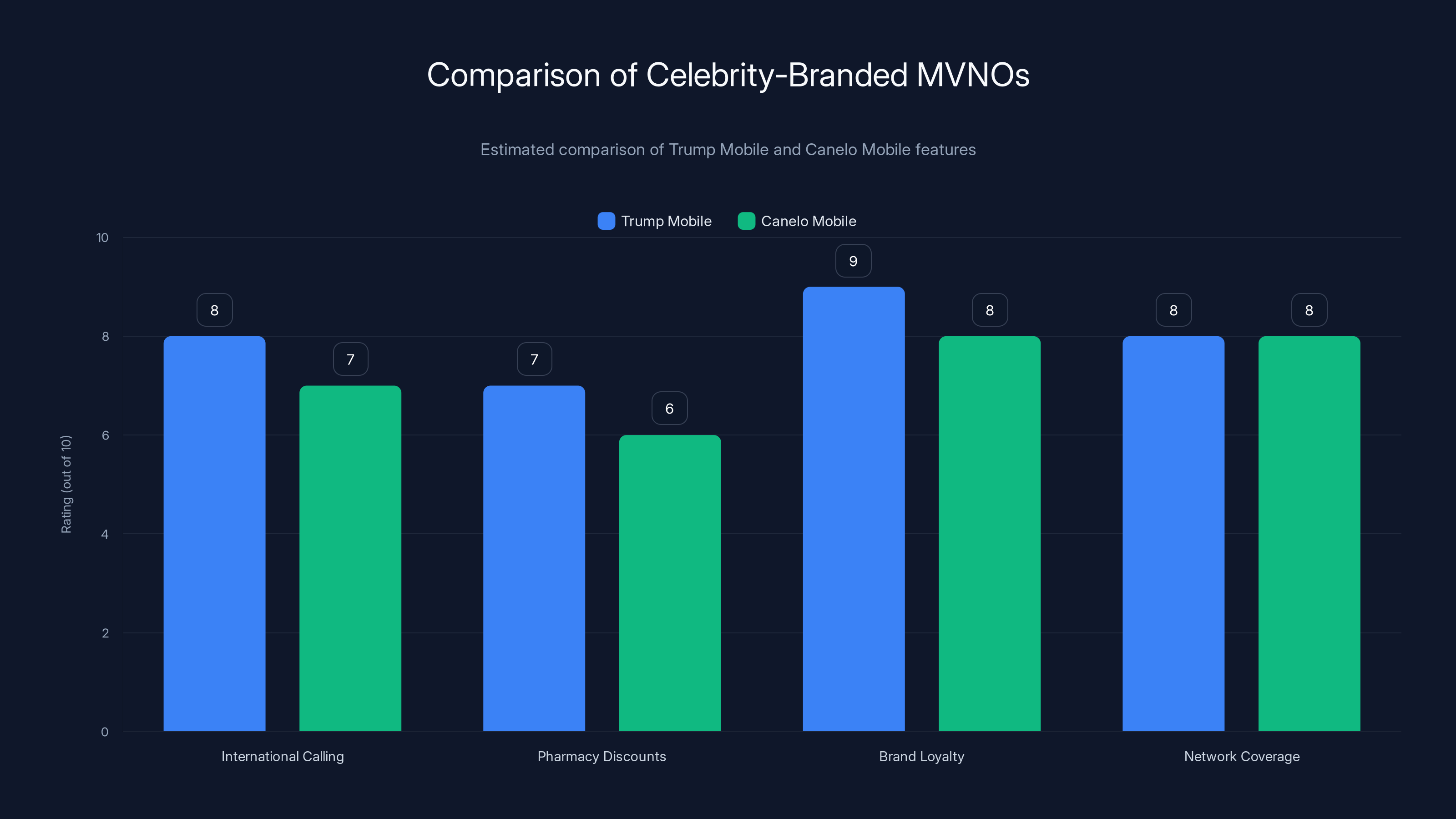

Estimated data shows that both Canelo Mobile and Trump Mobile are priced slightly above the competitor average in each tier, leveraging brand value over cost leadership.

The MVNO Market: Why Celebrity Branding Became A Strategy

Before diving into Trump Mobile or Canelo Mobile, you need to understand the broader context of the MVNO industry itself. MVNO stands for Mobile Virtual Network Operator, which sounds complex but actually describes something straightforward: companies that don't own cellular infrastructure. Instead, they lease access to existing networks (typically from major carriers like Verizon, AT&T, or T-Mobile) and resell service to customers.

This is where things get interesting. In the MVNO space, actual differentiation is nearly impossible. Every MVNO selling on Verizon's network provides roughly identical coverage because they're all using Verizon's towers. Every MVNO on T-Mobile's infrastructure gets the same speeds and reliability. The service itself becomes a commodity.

When the product is indistinguishable from competitors, how do you create perceived value? You rebrand it. You add customer service options. You throw in freebies. And increasingly over the past decade, you attach a celebrity name.

MVNOs have experimented with this for years. Republic Wireless tried targeting privacy-conscious consumers. Google Fi positioned itself as the tech-forward option. But the celebrity angle was different. It meant you weren't just selling a service, you were selling association. You were saying: buy this phone plan and you're supporting (and aligned with) someone famous.

Liberty Mobile understood this dynamic perfectly. By 2019-2020, they had the infrastructure figured out. They had carrier relationships. They had distribution channels. What they needed was a reason for customers to choose them over dozens of competing MVNOs offering nearly identical service at similar prices. Canelo Álvarez became that reason.

Why Canelo Álvarez specifically? The choice wasn't random. Álvarez had massive appeal in Mexican-American communities, a demographic that represents a significant share of mobile phone customers in the United States. He was a world champion, globally recognized, and carried cultural weight in communities that MVNOs often overlooked. If you could attach his name to a phone service and market it specifically to that community, you created both emotional connection and demographic targeting.

The formula seemed sound in theory. Let's see how it worked in practice.

Canelo Mobile: The Test Run That Failed Quietly

Canelo Mobile launched in May 2020, emerging into a world already disrupted by the COVID-19 pandemic. The timing itself is notable, because launching a new cellular brand during a crisis suggests either bold confidence or desperation to deploy capital. Liberty Mobile positioned Canelo Mobile as a service specifically targeting Mexican-American communities, backed by a champion they knew would resonate with that audience.

The service promised the standard MVNO offerings: coverage across major networks (through Liberty Mobile's infrastructure), affordable plans, and a celebrity name on the front of the package. But Canelo Mobile also bundled additional perks that would become eerily familiar when Trump Mobile rolled out years later. Free international calling topped the list, which made strategic sense given the target demographic. Roadside assistance came courtesy of Drive America, the same service that would later be included with Trump Mobile plans.

The phones themselves were where Canelo Mobile's strategy became transparent. Rather than commissioning custom hardware or working with a major manufacturer to create Canelo-branded devices, Liberty Mobile took an off-the-shelf approach. The phones were manufactured by Hotpepper, a budget phone maker that produces generic Android handsets for various MVNOs and budget carriers. You've likely never heard of Hotpepper because they intentionally stay invisible, supplying devices to carriers like Visible, Metro, and the federal Lifeline program.

Canelo Mobile released three initial models: The Legend, The Champ, and The Contender. These names attempted to create a boxer-related narrative, but the hardware told a different story. There was no Canelo Álvarez logo on the phones themselves. Instead, Hotpepper's distinctive chili logo remained visible, a branding failure that immediately signaled what these phones actually were: cheap, generic devices with a celebrity name slapped on the box.

This wasn't a massive oversight. It was almost certainly intentional. Creating custom hardware is expensive and requires massive manufacturing commitments. Using existing hardware and focusing the celebrity branding on accessories and packaging was the economical play.

Where Canelo Mobile tried harder: The accessory game. Canelo Mobile sold branded merchandise at a level that phone manufacturers typically reserve for luxury brands. Branded over-ear headphones bearing Álvarez's lettermark. Bluetooth speakers. Earbuds. Baseball caps. Keychains. The accessory strategy made sense: they could manufacture or rebrand existing audio products far cheaper than custom phones, and every branded accessory reinforced the Canelo connection.

The software layer is where Canelo Mobile attempted to create actual differentiation. Pre-installed apps came with the phones, curated specifically for the boxer-to-customer story. This included:

- Broxel: A money-sending app that happened to be sponsored by Álvarez, allowing customers to send funds internationally (useful for the target demographic)

- I Can Workout: Canelo's branded fitness app, marketed to align customers' health aspirations with the champion

- Canelo Rx: A discount prescription drug platform, a strategy Trump would later replicate directly

- Various other utility and lifestyle apps selected to create a coherent brand ecosystem

The strategy was sound: lock customers in with software they'd use regularly, and the Canelo branding would remain active in their daily lives. It's the same reason why manufacturers pre-install apps on new phones. But unlike standard manufacturer bloatware, these apps theoretically offered value by connecting to services and products Álvarez actually endorsed.

By most metrics, Canelo Mobile was a legitimate business attempt. It had distribution. It had a clear target market. It had a celebrity figure with genuine cultural resonance in that market. So why did virtually nobody remember Canelo Mobile by 2024?

The answer is straightforward: it failed. Not spectacularly, not with a dramatic implosion, but through quiet attrition. The I Can Workout app, once marketed aggressively through Instagram, eventually disappeared from both the Apple App Store and Google Play. By late 2024, there was virtually no marketing noise around Canelo Mobile. The initiative that had seemed promising in 2020 had become a forgotten experiment.

Multiple factors likely contributed. The MVNO market remained brutally competitive, with established players like Mint Mobile and Visible offering comparable service at similar or better prices. Celebrity branding alone wasn't enough to overcome the lack of meaningful service differentiation. The pre-installed apps may have felt like bloatware to customers who didn't use them. And perhaps most importantly, a boxer's celebrity, while culturally significant, didn't translate into the kind of devoted customer base that would stick with a mediocre service out of pure loyalty.

Both CaneloRx and Trump Mobile offer pharmacy discount programs, providing estimated savings of 20-25% off retail prices. (Estimated data)

Enter The Trump Organization: Same Playbook, Different Face

By 2024, Don Hendrickson had learned exactly what worked and what didn't from the Canelo Mobile experiment. The playbook was clear: celebrity branding could create initial awareness and targeted appeal, but the underlying service needed to be compelling enough to retain customers. Liberty Mobile had the infrastructure. They had the distribution. They had the payment processing. What they needed was a celebrity figure that could move the needle in an entirely different demographic.

Enter the Trump Organization.

According to Hendrickson himself, the initiative to create Trump Mobile didn't originate from Trump or any Trump executive. Instead, Hendrickson and the Liberty Mobile marketing team developed the concept internally, recognized it as potentially powerful, and then took the entrepreneurial risk of pitching it directly to Trump's organization.

Hendrickson's description of the pitch is deliberately informal and casual. He got on a plane to Florida, met with Eric Trump and his team, and laid out the opportunity. The pitch wasn't about innovation or new technology. It was straightforward commerce: here's how we can serve the American people while building a successful business under the Trump brand.

What made this pitch different from random entrepreneurs pitching ideas to celebrity figures is that Hendrickson came with proof of concept. He had already run the exact same playbook with Canelo Álvarez. He understood MVNO economics. He had existing infrastructure. He wasn't asking the Trump Organization to build something from scratch; he was asking them to license their brand to an already-functioning operation.

The Trump Organization said yes.

From a business perspective, this made sense on both sides. For Liberty Mobile and Hendrickson, the Trump brand represented exponential reach compared to Canelo Álvarez's appeal. Trump had been president and retained a devoted following measured in the tens of millions. His name alone carried political and cultural weight that would generate media coverage and initial customer interest.

For the Trump Organization, the deal represented a revenue stream requiring minimal involvement. They weren't building infrastructure or handling customer service. They were licensing their name to an existing operational entity and taking a cut. It was, fundamentally, a deal between professionals who understood how to monetize celebrity in the MVNO space.

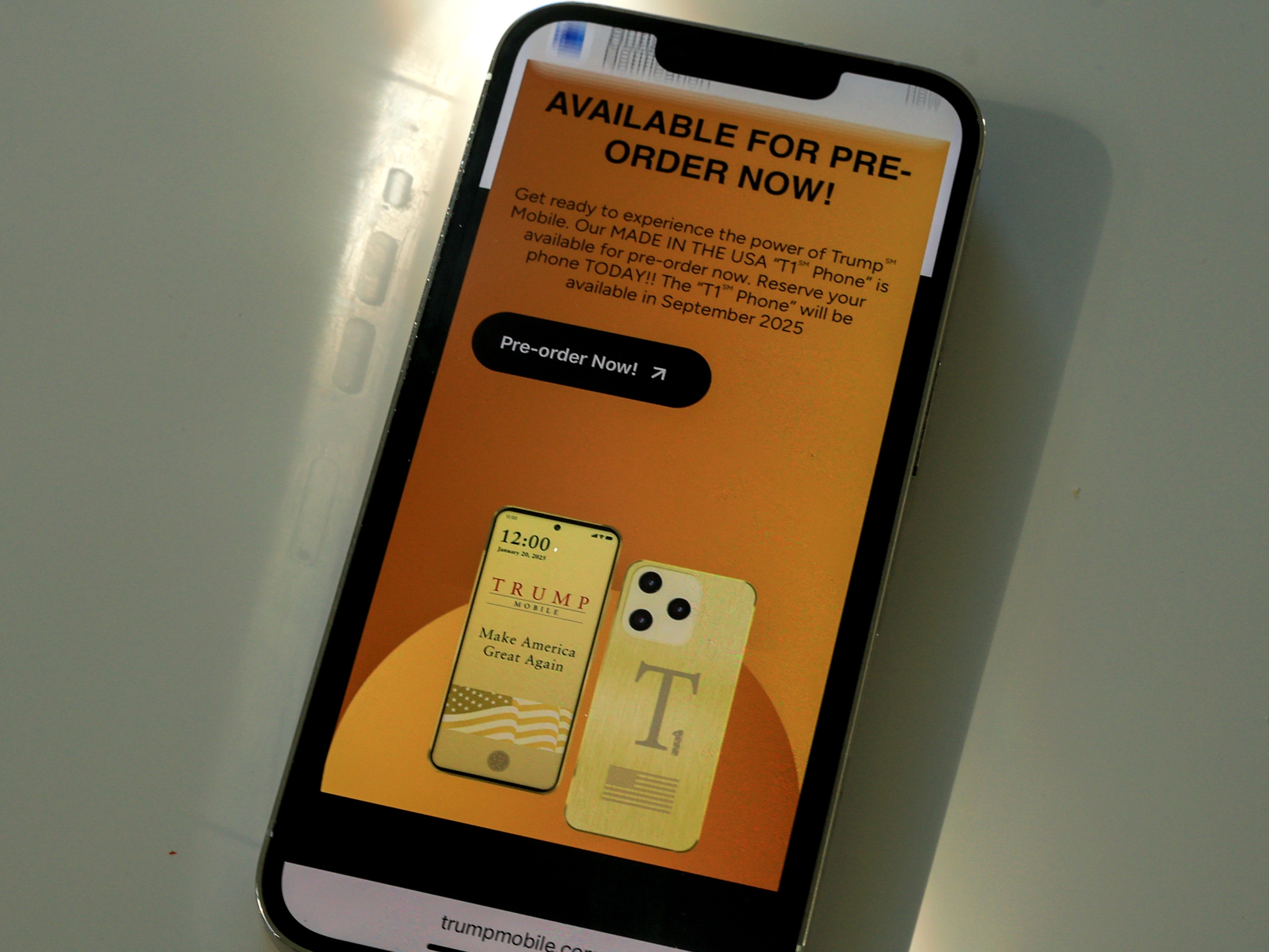

The Trump Mobile T1 Phone: Iteration, Not Innovation

When Hendrickson and Eric Thomas finally revealed details of the Trump Mobile hardware to the public, they positioned it as a "near-final version" of the T1 Phone, implying significant development and refinement. The dramatic reveal language suggested something engineered specifically for the Trump brand.

The reality was more prosaic.

Like Canelo Mobile before it, Trump Mobile didn't involve custom-designed hardware. Instead, it took an existing device, applied Trump branding, and created a package that felt exclusive to customers unfamiliar with the MVNO playbook.

The T1 Phone received a gold color option, which created visual differentiation from standard Android devices. Custom software included pre-installed apps, though the specific apps differed from Canelo Mobile's selection. The Trump Organization leveraged its existing business connections to create an app ecosystem that felt coherent with Trump's brand identity and business interests.

Hendrickson emphasized the branding and packaging strategy repeatedly in interviews. The phrase he used was "open the kimono," revealing the workings of the company. But what he was actually revealing was that Trump Mobile operated according to the same playbook Liberty Mobile had established with Canelo Mobile: rent network infrastructure, slap a celebrity name on it, create custom software and accessories, and target a demographic that had emotional investment in the celebrity figure.

The hardware itself wasn't the differentiator. The branding and targeting were.

This matters because it cuts through much of the marketing mythology around Trump Mobile. This wasn't a carefully engineered phone designed specifically for Trump's vision of connectivity. It was a pragmatic business application of a proven model. Buy wholesale or manufacture basic devices, apply gold coloring and Trump branding, pre-load specific apps, price aggressively, and target conservative customers who would value the Trump association enough to switch providers.

Network Infrastructure: The Hidden Backbone That Matters

One of the most important details that gets glossed over in casual discussions of Trump Mobile is the fundamental truth that both Trump Mobile and Canelo Mobile sit on the same infrastructure: Liberty Mobile's network operations.

Hendrickson described this relationship explicitly and revealingly. Liberty Mobile is "umbilically connected" to Trump Mobile, he stated, using language that suggested deep, essential dependency. This isn't just a hosting arrangement or a service provider relationship. It's fundamental integration.

What this means in practice is that every call placed on Trump Mobile routes through Liberty Mobile's infrastructure. Every data connection uses Liberty Mobile's network management systems. Every customer service inquiry, technical issue, and billing problem is handled by Liberty Mobile's operational teams. The Trump brand is the interface; Liberty Mobile is the entire backend.

For customers, this creates an interesting dynamic. You're paying for service branded as Trump Mobile, but the actual network experience is indistinguishable from Liberty Mobile's other offerings. Coverage is the same. Speeds are the same. Reliability is the same. The only variable is the brand experience and the marketing narrative.

This dynamic was slightly more transparent with Canelo Mobile, where Liberty Mobile co-branded the service explicitly alongside Álvarez. For Trump Mobile, the connection is more opaque. Most Trump Mobile customers probably don't know that Liberty Mobile is operating their service in the background. The brand positioning suggests that Trump himself is somehow driving the network operations.

This infrastructure relationship is crucial to understanding why these celebrity MVNO ventures work the way they do. The celebrity figure isn't providing network innovation or service differentiation. They're providing brand recognition and customer acquisition. The actual network operations remain invisible and unchanging.

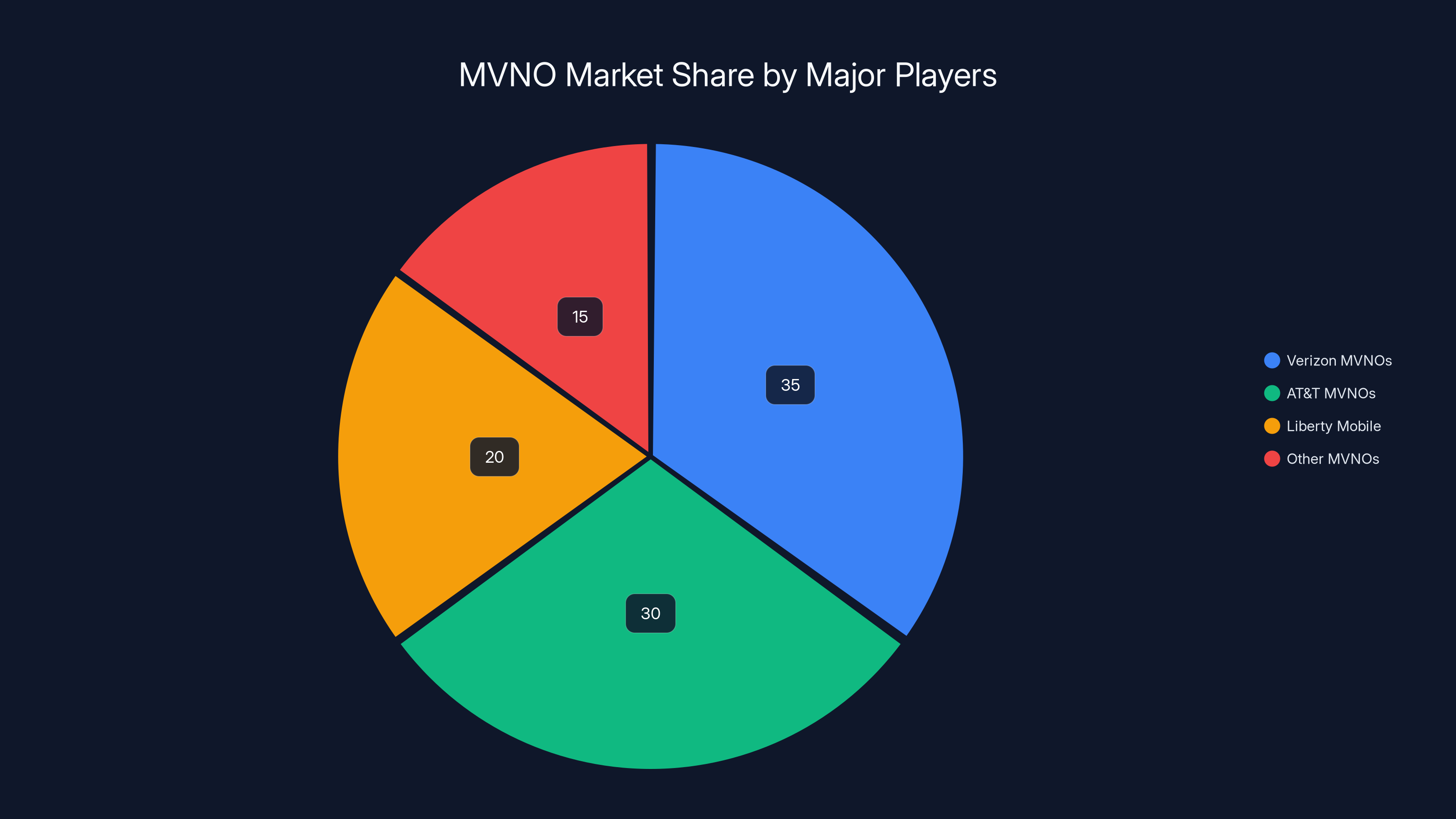

Estimated data shows Verizon and AT&T MVNOs dominate the market, with Liberty Mobile and others holding smaller shares. This reflects the consolidation trend and competitive pressures in the MVNO industry.

The Accessories Strategy: Where Branding Creates Revenue

Both Canelo Mobile and Trump Mobile recognized an important principle of celebrity brand commerce: hardware devices are expensive to manufacture and improve in meaningful ways. But accessories are cheap, reproducible, and carry perceived value.

Canelo Mobile's accessory strategy was extensive. Over-ear headphones bearing Álvarez's lettermark. Bluetooth speakers. Earbuds. Baseball caps. Keychains. Each accessory reinforced the Canelo brand while creating multiple revenue opportunities. A customer who bought one accessory became more invested in the ecosystem and more likely to purchase others.

Trump Mobile would inevitably pursue a similar strategy. Branded cases. Screen protectors. Chargers. Possibly even merchandise extending into the lifestyle category: MAGA-branded anything tends to sell within Trump's supporter base.

From a business perspective, accessories are where celebrity brands make real money. The phone itself might sell at minimal margin, locked into carrier subsidy economics. But a

This is why both Canelo Mobile and Trump Mobile invested in accessories early. Not because they genuinely believed a Canelo-branded earbud provided superior sound quality, but because accessories were the path to non-network revenue.

Pre-Installed Apps: The Software Ecosystem Play

One area where Trump Mobile could theoretically improve upon Canelo Mobile was in the pre-installed app strategy. Canelo Mobile's apps served the celebrity narrative reasonably well (fitness apps for a boxer, money-sending apps for international transactions), but they were somewhat constrained by what made sense in the Álvarez brand context.

Trump Mobile had far broader flexibility. The Trump brand encompasses real estate, hospitality, media, retail, food and beverage, political influence, and financial services. The app ecosystem could theoretically be far richer.

The inclusion of Canelo Rx, a discount prescription drug platform, on Canelo Mobile was particularly notable because Trump Mobile would later replicate this exact strategy. Both services recognized that bundling pharmaceutical discount programs created value for customers (or at least created the perception of value) while providing data and customer relationships to the underlying platform operators.

Pre-installed apps work on a simple principle: the longer customers use your device and ecosystem, the stickier they become. Even if they could theoretically switch to a different MVNO, switching costs the familiarity and convenience of existing installed apps. This is why manufacturers like Samsung can pre-install proprietary apps that consumers don't always want but grudgingly accept.

For Trump Mobile, the app strategy likely included:

- Financial services applications (investment apps, payment processors)

- Social media and communication apps

- Business or productivity tools branded with Trump-adjacent messaging

- Potentially Trump-specific news or media aggregation

- Commerce and shopping applications leveraging Trump brand business interests

The exact app selection matters less than the principle: create software ecosystem dependency to reduce churn and create data relationships.

International Calling and Cross-Border Demographics

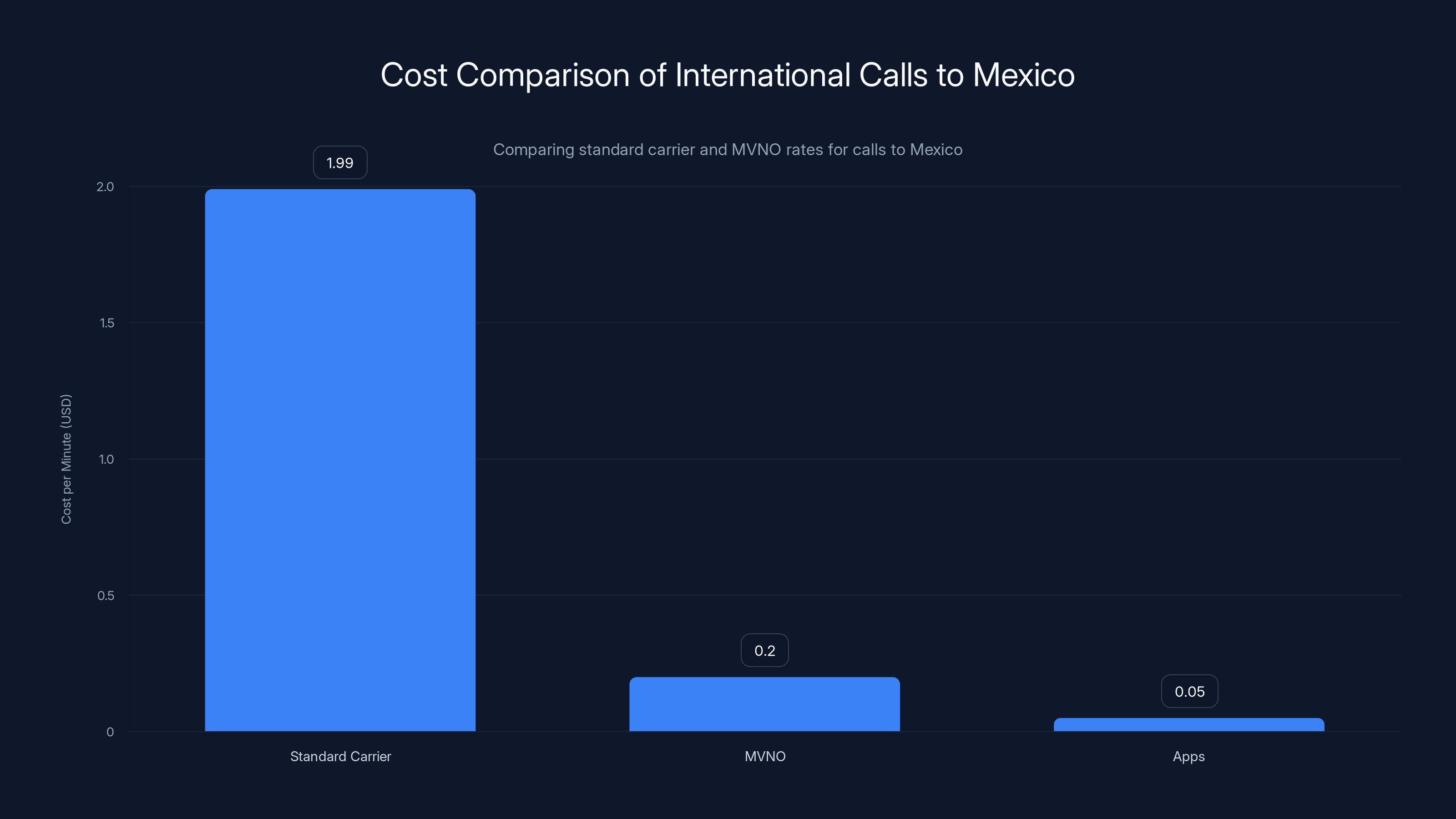

One recurring feature in both Canelo Mobile and Trump Mobile plans was international calling, typically offered free or at significant discounts. This seemed random until you understood the target demographics.

Canelo Mobile's target market was Mexican-American communities with economic ties to Mexico. International calling became a direct value proposition: stay connected to family and business relationships across the border without overpaying for long-distance rates. This is a genuine customer need, and bundling international calling created actual differentiation compared to standard MVNO plans.

Trump Mobile's targeting was different but also sophisticated. Trump's core supporter base includes first-generation immigrants and entrepreneurs with international business interests. It includes Americans with family ties globally. It includes business owners engaged in international commerce. For this demographic, international calling at favorable rates represents genuine value.

Both services also bundled roadside assistance through Drive America, suggesting another shared insight: their target demographics included people concerned with personal security, travel safety, and emergency preparedness. These are attributes of both Mexican-American families maintaining close ties to home countries and Trump supporters with particular demographic profiles.

This reveals something important about celebrity MVNO strategies: they're not actually built on the celebrity figure being magically interesting. They're built on understanding the specific demographic most likely to be attracted to that celebrity and then bundling features that demographic actually values.

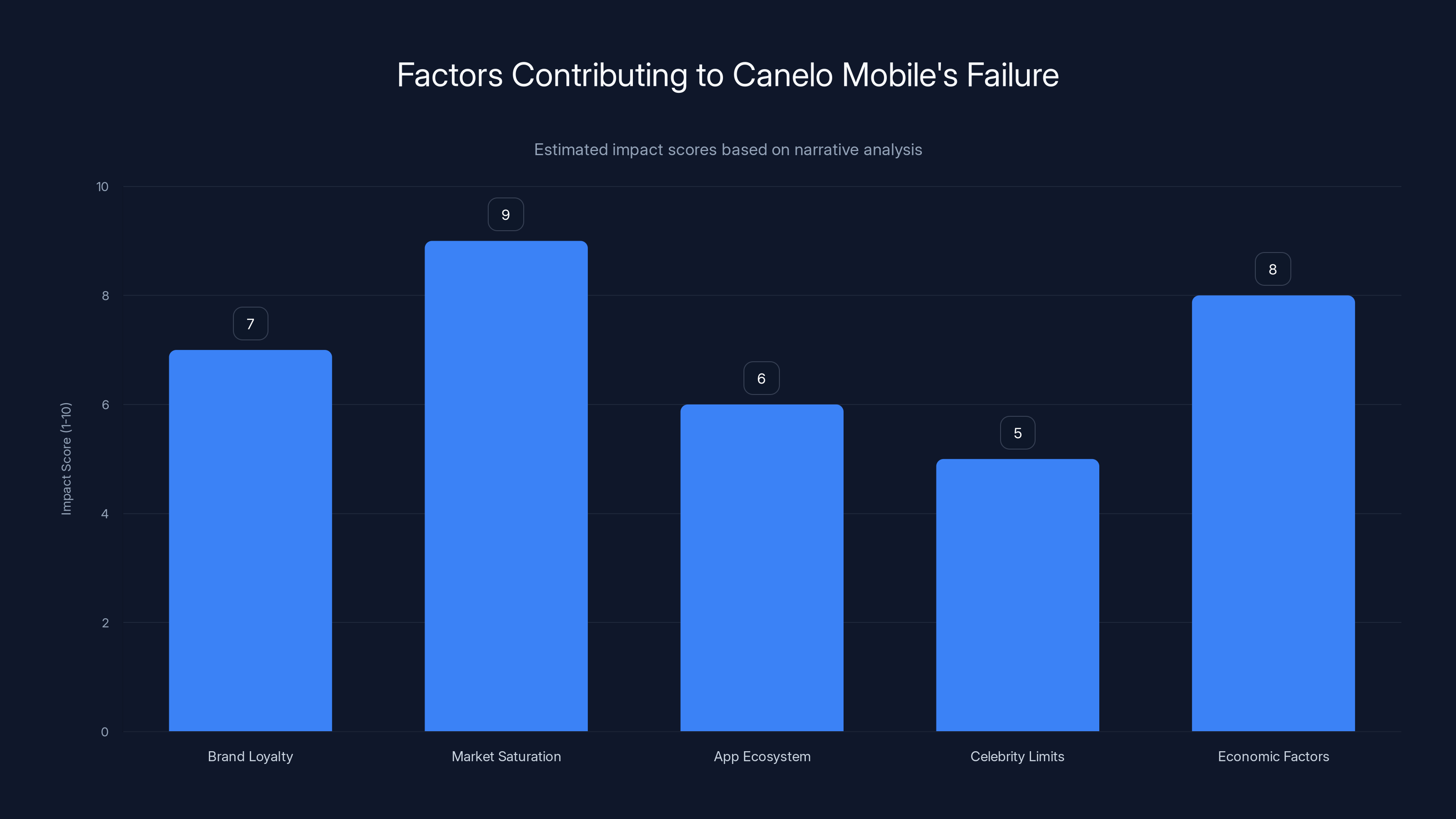

Market saturation and economic factors were the most significant contributors to Canelo Mobile's quiet failure. Estimated data based on narrative analysis.

The Discount Pharmacy Strategy: Canelo Rx and Beyond

One of the most interesting parallels between Canelo Mobile and Trump Mobile is the inclusion of pharmaceutical discount programs. Canelo Mobile included Canelo Rx, a discount prescription drug platform. Trump Mobile has pursued similar pharmacy partnerships, aligning with Trump's broader interest in healthcare economics and cost reduction.

This wasn't coincidental. The discount pharmacy model represents a genuine pain point for many customers, particularly those without robust insurance coverage. A significant segment of both the Mexican-American demographic (targeted by Canelo Mobile) and Trump supporters (Trump Mobile's target) contain individuals struggling with pharmaceutical costs.

By bundling a discount prescription program, both services achieved several things:

- Perceived value addition: Customers saw the MVNO service as providing something beyond connectivity

- Data relationships: The pharmacy partnerships generated health-related data on customer behavior and needs

- Demographic confirmation: People using discount pharmacy programs fit the financial profile both brands were targeting

- Cross-selling opportunities: Pharmacy data enabled more sophisticated marketing and customer service refinement

The pharmacy strategy also revealed both services' understanding of healthcare economics. Neither brand was trying to disrupt pharmaceutical pricing (which would require federal action). Instead, they were capturing arbitrage opportunities: existing discount programs that offered 10-30% savings off retail prices, bundling these programs and receiving kickback revenue from the pharmacy networks.

This is pragmatic commerce. It's not revolutionary, but it creates genuine incremental value for customers while adding revenue streams for the MVNO operator.

Market Segmentation: Why Celebrity Branding Works

The decision to target Mexican-American communities with Canelo Mobile and conservative Trump supporters with Trump Mobile wasn't arbitrary. Both reflected sophisticated understanding of how celebrity branding actually drives customer acquisition and retention in commodity markets.

In markets where the actual product is indistinguishable from competitors, brand identity and cultural alignment become the primary decision factors. A customer choosing between three MVNOs offering identical coverage, identical speeds, and similar pricing will often choose based on non-product factors: which brand do I trust? Which brand aligns with my values? Which brand's logo do I want to see when I'm using my phone?

Canelo Álvarez represented cultural pride, athletic achievement, and Mexican-American identity. For communities where representation in mainstream business remains limited, having a world champion attached to a business enterprise created psychological investment. It meant something to align yourself with success and cultural visibility.

Trump represents a different set of values for his core supporters: political identity, anti-establishment positioning, business success narrative, and alignment with particular worldviews. For this demographic, choosing Trump Mobile wasn't about better connectivity. It was about using their phone service as a signal: I support this brand and what it represents.

This is the actual genius of the celebrity MVNO playbook, and it has nothing to do with phones or networks. It's about identity marketing. Both services understood that in commodity markets, you don't compete on product differentiation. You compete on brand identity differentiation.

Why Canelo Mobile Failed (Quietly)

Understanding why Canelo Mobile ultimately failed offers critical insights into what Trump Mobile faces. The failure wasn't dramatic. There was no public scandal or lawsuit. Instead, Canelo Mobile simply ceased being a viable business and disappeared from the market.

Multiple factors likely contributed to this outcome:

Insufficient brand loyalty: While Canelo Álvarez is undoubtedly famous and beloved in Mexican-American communities, that fame didn't translate into the kind of brand loyalty required to overcome service disappointment. If a customer had a bad experience with customer service or network issues, Canelo Mobile's brand association wasn't strong enough to retain them.

Market saturation with better competitors: By 2020, the MVNO market already contained established, well-funded competitors like Mint Mobile and Visible. These had more sophisticated marketing, better customer retention infrastructure, and lower customer acquisition costs. Canelo Mobile entered a commodified market without any meaningful competitive advantage.

App ecosystem failure: The pre-installed apps that were supposed to create ecosystem stickiness didn't achieve their goal. The I Can Workout app failed to maintain active user engagement and eventually disappeared entirely. When the supporting software ecosystem deteriorated, customers lost even the perceived differentiator.

Boxer celebrity has limits: Canelo Álvarez's celebrity, while significant, remained somewhat confined to sports communities and Mexican-American demographics. His brand identity didn't extend naturally into telecommunications or technology in the way that, for example, a tech industry figure or broader celebrity might.

Economic factors: The post-pandemic recession and economic pressure on consumers shifted purchasing priorities. Saving $5-10 monthly on a phone service became less important than other financial concerns.

The combination of these factors created an inexorable decline. Not a crash, but gradual customer attrition and decreased marketing investment as Liberty Mobile recognized the business model wasn't scaling the way they'd hoped.

MVNOs offer significantly lower international calling rates compared to standard carriers, with apps providing the lowest cost option. Estimated data for app rates.

Trump Mobile's Advantages Over The Canelo Blueprint

Understanding where Trump Mobile differs from Canelo Mobile reveals why the Trump venture might achieve different results (though success remains uncertain).

Broader demographic appeal: Trump's brand extends across age groups, geographic regions, and business sectors in ways that Canelo Álvarez's fundamentally doesn't. Trump appeals to older Americans, younger conservatives, entrepreneurs, and working-class supporters across the country. This creates a larger addressable market.

Political identity is stickier than sports identity: A customer might stop caring about Canelo Álvarez's boxing record or his latest fight. But a customer invested in Trump's political movement has identity-level reasons to stick with the brand. The MVNO choice becomes a political statement, not just a consumer decision.

Media penetration and controversy drive awareness: Trump Mobile generates constant media coverage and cultural conversation in a way that Canelo Mobile never did. Even negative press creates awareness. Trump supporters know about Trump Mobile. Skeptics know about Trump Mobile. The brand penetration is orders of magnitude larger.

Financial resources: The Trump Organization, despite its financial complexities, has far greater resources than whatever backing Canelo Mobile received. This enables more sophisticated marketing, more customer retention investment, and the ability to weather market downturns.

Cross-selling opportunities: The Trump brand extends into real estate, hospitality, retail, finance, and media. Trump Mobile customers can theoretically be leveraged into Trump-branded hotels, Trump-branded real estate services, and other business opportunities. This cross-brand synergy creates additional stickiness.

First-mover advantage in political MVNOs: While Canelo Mobile was testing celebrity MVNOs, Trump Mobile may be the first major political figure to seriously attempt this. This creates novelty and differentiation.

These advantages are genuine and meaningful. However, they don't guarantee success. Canelo Mobile had advantages too, and still couldn't sustain the business. Trump Mobile faces identical structural challenges: commodity service differentiation, competitive market saturation, and the fundamental question of whether brand loyalty alone can retain customers who could get identical service cheaper elsewhere.

The Broader MVNO Industry Context

To properly evaluate Trump Mobile's prospects, you need to understand what's happening in the broader MVNO market. This isn't a growth industry. It's a commoditizing industry where margins are declining and customer acquisition costs are rising.

Major carriers like Verizon and AT&T are increasingly aggressive about protecting the MVNO market opportunity. They've learned that MVNOs cannibalize their own customer base without adding value. A customer switching from Verizon directly to Verizon's network infrastructure (through an MVNO) generates revenue for Verizon but loses the service differentiation premium Verizon could have charged.

Access to premium networks is also increasingly expensive. As carriers compete for spectrum and 5G deployment, wholesale rates to MVNOs are rising. This compresses margins for MVNO operators like Liberty Mobile, forcing them to either increase prices (losing competitive advantage) or maintain prices while reducing margins.

The MVNO market in 2024-2025 is no longer where venture capital or ambitious entrepreneurs focus. It's been consolidated into a relatively small number of players, many of which are held by larger companies or private equity groups. Innovation has largely stopped, and competition has devolved into pure price competition on commodity service.

Into this market comes Trump Mobile, backed by celebrity branding but facing the same structural limitations as every other MVNO. The question isn't whether Trump Mobile is innovative or well-designed. The question is whether Trump's brand loyalty can overcome the fundamental commodity nature of cellular service.

Hotpepper and Generic Hardware: The Reality of MVNO Phones

The phones used by both Canelo Mobile and Trump Mobile point to a broader reality about MVNO economics: custom hardware is prohibitively expensive, so celebrity MVNOs simply rebrand existing devices.

Hotpepper, the manufacturer supplying devices to Canelo Mobile (and potentially Trump Mobile), operates in what's called the "white label" phone space. They manufacture generic Android devices intended for resale through various channels: budget carriers, federal assistance programs, promotional offerings.

These devices aren't bad. They function perfectly adequately for standard smartphone use. But they're also not differentiated. The same Hotpepper device chassis is used by dozens of different carriers and resellers. Hotpepper keeps manufacturing costs low by simplifying software, reducing component quality, and maximizing volume.

The irony of Canelo Mobile was particularly stark: phones branded with the name of a world-class athlete and nicknamed "The Champ" were actually budget devices wearing a chili logo from a generic phone manufacturer. The disconnect between the brand promise and the hardware reality was immediately apparent to anyone who looked closely.

Trump Mobile avoided this aesthetic mistake by applying gold coloring to mask the generic hardware and creating a distinctive visual identity. But the underlying device is still likely from a similar supply chain: a budget phone manufacturer producing thousands of units at minimal cost, with the Trump branding applied at the final stage.

This matters because it reveals where celebrity MVNO cost structures concentrate: not on hardware or network innovation, but on marketing and brand management. Both services probably spent more on advertising that Canelo Álvarez and Trump would approve their phones than they spent on the phones themselves.

Estimated data shows Trump Mobile and Canelo Mobile share similar features, with Trump Mobile having a slight edge in brand loyalty due to political alignment.

The Software Bloat Problem: Why Pre-Installed Apps Fail

One persistent challenge for pre-installed app strategies is that consumers hate bloatware. Apps that manufacturers install without user choice, that can't be easily removed, and that serve the manufacturer's interests rather than the user's, create friction and negative perception.

Canelo Mobile's I Can Workout app exemplifies this problem. The app was theoretically relevant to the brand (Canelo is a boxer) and offered fitness training value. But users who weren't interested in boxing training or who preferred other fitness apps found it an unwanted addition to their devices. Over time, as the app failed to maintain active engagement, it became essentially defunct bloatware.

This created a downward spiral: reduced engagement meant reduced reasons to keep the app installed, which meant users actively uninstalled it, which reduced the network effects and reduced its utility. By late 2024, the app had vanished from app stores entirely.

Trump Mobile will face identical challenges. Any pre-installed Trump-branded apps will be judged on actual utility, not on Trump's celebrity. If they provide genuine value (news aggregation, social networking, financial services), users might engage. If they're pure propaganda or marketing vehicles, users will uninstall them.

The lesson that MVNO operators haven't fully internalized is that forcing users into software they don't want creates negative brand associations. It would be better to offer optional Trump-branded apps through normal app store channels, allowing interested users to download them, rather than forcing them into every device.

International Calls and Remittances: A Genuine Value Proposition

One feature that both Canelo Mobile and Trump Mobile included—international calling—represents one of the few genuinely differentiated services that celebrity MVNOs can offer. This is worth understanding because it's one area where these services provide real consumer value rather than just brand association.

International calling rates remain stubbornly high on standard carrier plans. A call to Mexico on a standard Verizon plan might cost

For customers with legitimate reasons to make international calls (family abroad, business relationships, immigration-related communications), this represents genuine savings. A customer calling Mexico weekly could save $50-100 monthly through international calling bundles.

Canelo Mobile recognized this particular value for the Mexican-American demographic, many of whom have direct family ties and economic relationships in Mexico. Trump Mobile recognized this for their base, which includes immigrants, business owners with international operations, and Americans with family ties abroad.

This is the one area where MVNO differentiation can transcend pure celebrity branding. By bundling specific service features that address genuine needs of your target demographic, you can create actual reasons for customer retention beyond brand loyalty.

However, international calling is also increasingly commoditized. Apps like WhatsApp, Skype, and Google Voice offer near-free international calling over data. Every major carrier now offers international plans. The competitive advantage from bundled international calling has diminished significantly since 2020 when Canelo Mobile launched.

The Subscription Economy and Plan Pricing Strategy

Both Canelo Mobile and Trump Mobile have been built on an economic model where recurring subscription revenue is the primary driver. Monthly plans generate predictable revenue and customer lifetime value calculations.

But the subscription plan market is also increasingly commoditized and competitive. The same

MVNO pricing strategies typically include:

- Loss leader tiers: Cheap plans ($10-15 monthly) that lose money on a per-customer basis but drive volume

- Mid-tier plans: Standard $25-35 plans that provide baseline margins

- Premium tiers: Unlimited plans at $50+ that require either customer overage or genuinely premium service

Canelo Mobile's pricing strategy, from available information, positioned Canelo service as competitive but not aggressively cheap. This is actually rational: if you're using celebrity branding, you're trying to justify a premium price (or at least comparable price), not compete on raw cost.

Trump Mobile has similarly positioned itself as competitively priced but not as the absolute cheapest option. The value proposition is the brand association, not the cost savings.

But this creates a customer retention challenge. A customer who initially signs up because of brand loyalty will eventually run their own cost comparison. If they discover they can save $5-10 monthly by switching to a cheaper MVNO, and if they haven't developed genuine ecosystem dependency (through apps, integrated services, or other features), that monthly savings often wins out.

This is why Canelo Mobile's customer churn likely accelerated over time. Initial customers were drawn by the celebrity branding. But when their first bill arrived and they realized they could save money elsewhere, many started their exit process.

Data Privacy and Customer Information: An Overlooked Advantage

One aspect of celebrity MVNO strategy that deserves more attention is the value of customer data. When a customer signs up for Canelo Mobile, Liberty Mobile gains demographic information (Mexican-American, interested in boxing, concerned about affordability), location data, usage patterns, and phone behavior.

This data is valuable. It can be used for more sophisticated marketing. It can be sold or licensed to third parties. It can be used to predict churn and intervene with retention offers. And for political MVNOs like Trump Mobile, it provides direct information about Trump supporters' locations, demographics, and communication patterns.

Both Canelo Mobile and Trump Mobile likely included terms of service that allowed fairly extensive data collection and usage. This isn't illegal or uniquely concerning to these services (all MVNOs and carriers collect data), but it's worth noting that the user's data has value independent of the phone service revenue.

In some ways, the MVNO service itself might be the vehicle for data collection, not the primary business. A customer paying

For Trump Mobile specifically, this data value is particularly meaningful. A list of proven Trump supporters who own mobile phones is extraordinarily valuable to political organizations, campaign committees, and other political entities.

The Path Forward: Will Trump Mobile Succeed Where Canelo Failed?

Predicting whether Trump Mobile achieves greater success than Canelo Mobile requires evaluating several factors.

Factors supporting Trump Mobile success:

- Larger addressable market with stronger political identity

- More extensive cross-brand opportunities

- Greater media penetration and brand awareness

- Stronger financial backing

- First-mover advantage in political MVNOs

Factors supporting Trump Mobile failure (following Canelo Mobile's path):

- Identical underlying business model (MVNO commodity service)

- Increasing competition in MVNO space

- Declining margins for wholesale network access

- Pre-installed software bloatware challenges

- Risk of customer churn when brand loyalty encounters pricing pressure

- Regulatory uncertainty around Trump Organization businesses

The most likely scenario is something between spectacular success and complete failure. Trump Mobile probably acquires initial customers attracted by the brand. Some remain due to genuine loyalty or ecosystem dependency. But customer acquisition costs remain high, and churn accelerates when customers recognize the service is indistinguishable from cheaper competitors.

Canelo Mobile serves as a cautionary tale: celebrity branding can drive initial market interest, but it can't overcome fundamental commodity market dynamics. The MVNO space isn't where innovation happens anymore. It's where utility service operates at minimal margins.

Trump Mobile might ultimately succeed as a small but profitable niche service serving Trump's core supporters, generating recurring revenue and valuable customer data. Or it might follow Canelo Mobile's trajectory: initial interest, declining engagement, and quiet disappearance as customers migrate to cheaper or more convenient options.

The wildcard variable is Trump's actual involvement and commitment. If Trump actively promotes Trump Mobile through his social networks and media platforms, that could drive adoption at scale. If Trump Mobile becomes merely a background business while Trump focuses on politics, it will likely struggle.

The Bigger Picture: Celebrity Commerce in 2025

Understanding Trump Mobile requires zooming out to see how celebrity branding functions in contemporary commerce more broadly.

We live in an era where celebrity figures routinely launch business ventures in categories completely unrelated to their original fame. Athletes launch food brands. Musicians launch fashion lines. Politicians launch tech companies. Each of these leverages celebrity attention and customer loyalty to create initial market adoption.

But markets have become increasingly sophisticated at distinguishing between celebrity branding and actual product value. Consumers know that Canelo Álvarez didn't personally design the boxer-branded Bluetooth speaker. They understand that Trump Mobile's network infrastructure doesn't benefit from Trump's business acumen.

What celebrity can provide is attention, trust signaling, and identity alignment. If those factors create enough customer stickiness to overcome the commodity nature of the underlying service, celebrity commerce succeeds. If not, it becomes a failed experiment.

Canelo Mobile failed. That failure probably taught Liberty Mobile executives valuable lessons about the limits of celebrity in commodity markets. But those lessons apparently didn't dissuade them from trying again with Trump. This suggests either that they believe Trump's brand is sufficiently different to succeed where Canelo failed, or that they're betting on data monetization and customer acquisition value even if the MVNO service itself doesn't generate primary revenue.

The Trump Mobile story is ultimately less about phones or networks and more about how business, celebrity, and commerce intersect in 2025. It's a story about understanding commodities, targeting demographics, and finding value in unexpected places.

FAQ

What is Trump Mobile and where did the idea originate?

Trump Mobile is a mobile virtual network operator (MVNO) that leases network infrastructure from existing carriers and resells service under the Trump brand. Contrary to popular assumption, the idea didn't originate from Trump or the Trump Organization. Instead, executives Don Hendrickson and Eric Thomas from Liberty Mobile developed the concept and pitched it to the Trump Organization, leveraging a similar business model they had previously tested with boxer Canelo Álvarez.

How is Trump Mobile related to Canelo Mobile?

Trump Mobile directly evolved from Liberty Mobile's earlier attempt to build a celebrity-branded MVNO called Canelo Mobile, which launched in May 2020 with Mexican boxer Canelo Álvarez. Both services used the identical infrastructure from Liberty Mobile, offered similar features like international calling and pharmacy discounts, and relied on generic phones from manufacturers like Hotpepper with celebrity branding applied. Hendrickson and Thomas learned what worked and what didn't from Canelo Mobile, then applied those lessons to Trump Mobile.

Why do MVNOs use celebrity branding?

MVNOs use celebrity branding because the underlying cellular service itself is completely commodified. Every MVNO on Verizon's network provides identical coverage and speeds. To differentiate in this commodity market, MVNOs attach celebrity names that create emotional connection and identity alignment with target customers. A customer might stay with Trump Mobile because they support Trump politically, not because the service is technically superior. This brand loyalty substitutes for actual product differentiation.

What phones does Trump Mobile actually use?

Like Canelo Mobile before it, Trump Mobile doesn't manufacture custom phones. Instead, it uses generic Android devices from budget phone manufacturers (likely similar suppliers to those used by Canelo Mobile), applies Trump branding and a distinctive gold color, and creates custom software. The phones themselves are indistinguishable from budget devices used by other MVNOs, but the packaging and branding create the perception of something exclusive to Trump Mobile customers.

What happened to Canelo Mobile and why did it fail?

Canelo Mobile quietly declined and disappeared from the market between 2020 and 2024. The service failed because celebrity branding alone couldn't overcome the commodity nature of MVNO service. When customers experienced service issues or discovered cheaper competitors offering identical service, brand loyalty wasn't strong enough to retain them. The pre-installed Canelo app ecosystem deteriorated, and the service gradually lost relevance. The experience demonstrated that celebrity cannot overcome fundamental market economics in commodity industries.

Is Trump Mobile using Liberty Mobile for its network?

Yes. Hendrickson stated that Liberty Mobile is "umbilically connected" to Trump Mobile, meaning all network operations, infrastructure, customer service, and backend systems rely entirely on Liberty Mobile's operations. Trump Mobile customers are actually using Liberty Mobile's network but paying for the Trump brand identity. This identical infrastructure arrangement was also used for Canelo Mobile.

What additional services beyond cellular does Trump Mobile offer?

Both Canelo Mobile and Trump Mobile bundle additional services beyond base cellular coverage. These typically include free or discounted international calling (valuable for their target demographics), roadside assistance through Drive America, and access to discount prescription drug platforms (Canelo Rx for Canelo Mobile, similar programs for Trump Mobile). These bundled services create perceived additional value and help justify premium or comparable pricing.

Could Trump Mobile succeed where Canelo Mobile failed?

Trump Mobile has genuine advantages over Canelo Mobile's model. Trump's brand reaches a larger demographic with stronger political identity, commanding greater media attention and cross-selling opportunities. However, Trump Mobile faces identical structural challenges: the MVNO market is commoditized, margins are declining, and customer churn accelerates when brand loyalty encounters pricing pressure. Trump Mobile's success depends on whether Trump's political identity creates sufficient stickiness to overcome these commodity market dynamics and retain customers despite cheaper alternatives.

What data does Trump Mobile collect from customers?

Like all MVNOs and carriers, Trump Mobile collects extensive customer data including demographics, location information, call patterns, and usage behavior. This data has significant value independent of cellular service revenue, particularly for political organizations. The data collected from Trump Mobile customers (proven Trump supporters with contact information) is arguably more valuable than the recurring subscription revenue from the service itself.

How does Trump Mobile compare to traditional carriers and other MVNOs?

Trump Mobile provides identical network coverage, speeds, and technical service as any other MVNO on the same underlying network. The primary differences are brand identity, bundled services like international calling, and pre-installed software. Trump Mobile doesn't offer superior technology or innovation compared to carriers or competing MVNOs. Its value proposition is entirely brand-based: customers pay to align with the Trump brand identity.

Conclusion: The Playbook, Repeated

The story of Trump Mobile's origins is fundamentally a story about replication, not innovation. Liberty Mobile discovered a playbook for creating perceived value in a commodity market: attach a celebrity name, target a specific demographic, bundle relevant services, create distinctive branding, and let brand loyalty substitute for actual product differentiation.

With Canelo Mobile, that playbook showed promise initially. A world champion boxer, deep cultural connection, international calling for the target demographic, branded accessories, and software ecosystem. It seemed like it could work.

But it didn't. Canelo Mobile demonstrated that celebrity alone can't overcome commodity market fundamentals. Customers eventually discover that cheaper competitors exist. Brand loyalty can only retain so many people when the core service is identical. Pre-installed apps become bloatware. The initial novelty wears off.

Understanding why Canelo Mobile failed is essential to evaluating Trump Mobile's prospects. Both services operate on the same infrastructure, use the same business model, and rely on celebrity branding to drive initial adoption. But Trump Mobile has advantages Canelo Mobile never had: a larger demographic, stronger political identity, and exponentially greater media penetration.

Those advantages matter. They might be enough to carry Trump Mobile to success, at least as a niche service serving Trump's core supporters. But they don't change the underlying economics. Every phone placed on Trump Mobile generates commodity revenue from cellular service. Customer acquisition costs are high. Churn is endemic to MVNO markets. Margins are razor-thin.

What makes Trump Mobile potentially different from Canelo Mobile isn't the phones or the network. It's the customer data. A verified list of tens of millions of Trump supporters with phone numbers, locations, and communication patterns has value that transcends cellular service revenue. If Trump Mobile's true business model is harvesting and monetizing that customer data rather than providing cellular service, the calculus changes entirely.

But if Trump Mobile is actually meant to succeed as a profitable, customer-retaining MVNO service that competes head-to-head with Mint Mobile, Visible, and other established players, then Canelo Mobile's quiet failure offers a cautionary template. Celebrity branding is real. It can drive initial awareness and customer acquisition. But in commodity markets, it's ultimately customer service quality, pricing, and actual differentiation that retain customers and build sustainable business.

The Trump Mobile story is still unfolding. Its success or failure will ultimately teach important lessons about celebrity commerce, MVNO economics, and the real limits of brand loyalty in 2025.

Key Takeaways

- Trump Mobile's concept originated from Liberty Mobile executives, not Trump or the Trump Organization, using a playbook previously tested with Canelo Mobile.

- Both Trump Mobile and Canelo Mobile operate on identical Liberty Mobile infrastructure and use generic phones from manufacturers like Hotpepper with celebrity branding applied.

- Canelo Mobile failed between 2020-2024 because celebrity branding alone couldn't overcome commodity market dynamics when competitors offered identical service cheaper.

- Trump Mobile has advantages over Canelo Mobile (larger demographic, stronger political identity, greater media reach) but faces identical structural MVNO market challenges.

- The real value of celebrity MVNOs may be customer data monetization rather than cellular service revenue, particularly for political brands like Trump Mobile.

Related Articles

- Trump Mobile's Silent Treatment: Inside the Executive Ghosting [2025]

- Trump Mobile T1 Phone: Release Date, Price & Specs [2025]

- Trump Phone T1 Ultra: Everything We Know [2025]

- Verizon's 365-Day Phone Lock: What You Need to Know [2025]

- T-Mobile Better Value Plan: Netflix, Hulu & Savings Guide [2025]

- How to Claim Verizon's $20 Credit After the 2025 Outage [Complete Guide]

![Trump Mobile's Surprising Origins: The Canelo Álvarez Connection [2025]](https://tryrunable.com/blog/trump-mobile-s-surprising-origins-the-canelo-lvarez-connecti/image-1-1771002603814.jpg)