Trump Mobile's T1 Phone: Everything You Need to Know About the Controversial Smartphone [2025]

When Trump Mobile first announced plans to create its own smartphone, the promise was simple: an American-made device that would challenge the dominance of mainstream tech giants. That vision has undergone some significant changes. Recent reporting reveals that the T1 smartphone, still months away from a release date that keeps getting pushed back, looks nothing like the original marketing materials promised. The camera design has been completely overhauled, manufacturing won't happen entirely in the USA as initially claimed, and pricing has become murkier than ever.

This isn't just another smartphone launch story. The T1 represents something more complex: a political project wrapped in tech packaging, combining business ambitions with controversial messaging. Understanding what's happening with this phone requires digging into the actual product decisions, the pricing strategy that's shifting beneath public attention, and what the delays mean for a company making bold claims while struggling with execution.

The situation has become increasingly complicated because the promises made during the initial announcement have quietly changed. The executives behind Trump Mobile have had to grapple with manufacturing realities, market pricing pressures, and the challenge of delivering a competitive device. What was supposed to be a straightforward American-made alternative has become something much more textured and contested.

Let's break down what's actually happening with Trump Mobile's T1 phone, why the changes matter, and what this tells us about the state of the smartphone market in 2025.

The Original Trump Mobile Vision vs. Current Reality

When Trump Mobile first launched its concept, the messaging was unambiguous. The company positioned itself as a patriotic alternative to Chinese-made smartphones and what executives viewed as politically biased American tech companies. The marketing emphasized that the T1 would be proudly designed and built entirely within the United States, creating jobs and supporting American manufacturing.

That specific claim appeared prominently in the initial press materials and on the company's website. It resonated with a particular audience segment that prioritizes American-made products and views mainstream tech companies with skepticism. The promise of manufacturing jobs, domestic production, and a device built entirely by American workers became central to the brand's identity.

But the gap between the promise and the achievable reality has proven substantial. Manufacturing a smartphone is extraordinarily complex, involving supply chains spread across multiple continents, intricate assembly processes requiring specialized equipment, and economies of scale that don't work for small production runs. Even major manufacturers struggle with this.

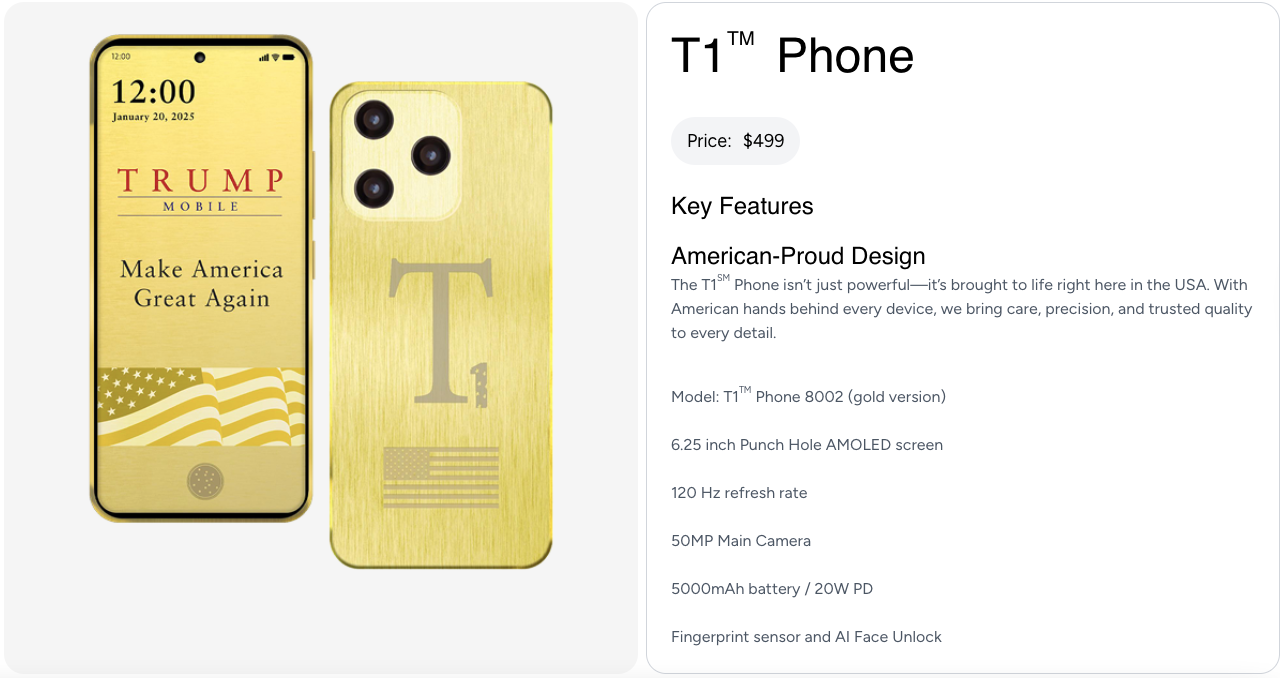

Trump Mobile's executives have now shifted the messaging. The updated website language states that the T1 will have "American hands behind every device" rather than being "proudly designed and built in the United States." This is a meaningful distinction. Final assembly will occur in Miami, but that doesn't mean the components are sourced domestically or that the manufacturing process starts on American soil.

The change reflects a hard economic reality: producing a smartphone entirely in the USA would result in prohibitively expensive manufacturing costs. Smartphone components like processors, memory chips, and display panels require highly specialized manufacturing environments that exist primarily overseas. Even if Trump Mobile wanted to build everything domestically, the supply chains don't exist in the United States to make it economically viable.

This pivot matters because it reveals something fundamental about the smartphone industry: the globalization of electronics manufacturing is so complete that truly domestic production isn't feasible for competitive pricing. Trump Mobile faces the same constraints as every other manufacturer.

The Trump Mobile T1 offers a significant discount for early adopters at

The Camera Redesign: What Changed and Why

One of the most visible changes to the T1 shows up in how the phone's rear camera array has been redesigned. The original concept featured a camera module that echoed the i Phone's iconic design, with cameras arranged in a neat square or rectangular pattern. This aesthetic choice borrowed visual language that consumers associate with premium smartphones.

The new design shows a stark departure: three cameras stacked vertically in a misaligned arrangement. From a pure aesthetics standpoint, this is less refined. The three lenses don't line up neatly, creating a asymmetrical appearance that feels less carefully considered than the original concept.

Why would a company choose to make a product look worse? The answer involves manufacturing constraints, cost considerations, and the realities of sourcing components. A perfectly aligned, symmetrical camera array requires specific lens modules arranged in a specific order. Changes to component availability, supplier decisions, or cost reduction targets can force manufacturers to adapt the physical arrangement.

The misaligned vertical stack might reflect changes to which camera sensors the company is using. Different suppliers provide different dimensions and mechanical interfaces. When Trump Mobile determined it needed to adjust suppliers due to availability, cost, or technical requirements, the physical layout had to change accordingly.

From a functional standpoint, the vertical arrangement isn't inherently worse. Multiple smartphones use similar layouts. But from a marketing standpoint, it undermines one of the design elements that differentiated the T1 from existing options. The aesthetic change signals that compromises have been made.

This also hints at potential delays in finalization. If the company had settled on final components and manufacturing partners earlier, the camera module design would have been locked in. The fact that it's still changing this late in the development cycle suggests the product has faced unexpected complications.

The Trump Mobile T1 offers a significant discount for early supporters at

The Pricing Structure That Nobody Expected

Perhaps the most significant shift involves pricing, and it's structured in a way that's frankly designed to hide the true cost from many consumers. This is where Trump Mobile's strategy becomes particularly noteworthy.

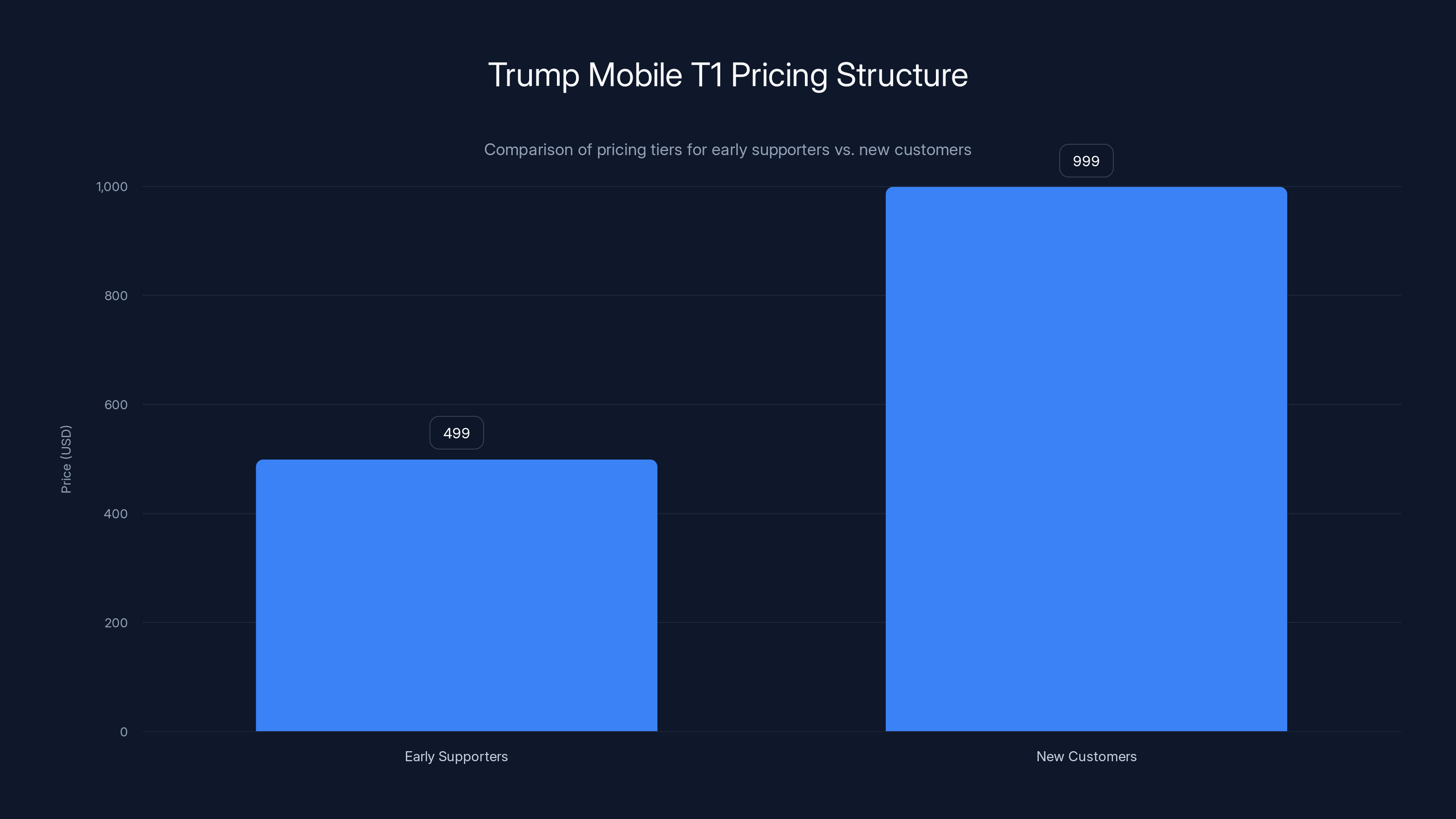

Here's how it works: Anyone who has already paid the

Let's think about what this pricing structure actually does. It creates a two-tier system where early adopters and the most enthusiastic supporters get a meaningful discount, while later customers pay essentially double. This isn't unusual in product launches, but the magnitude of the difference is substantial.

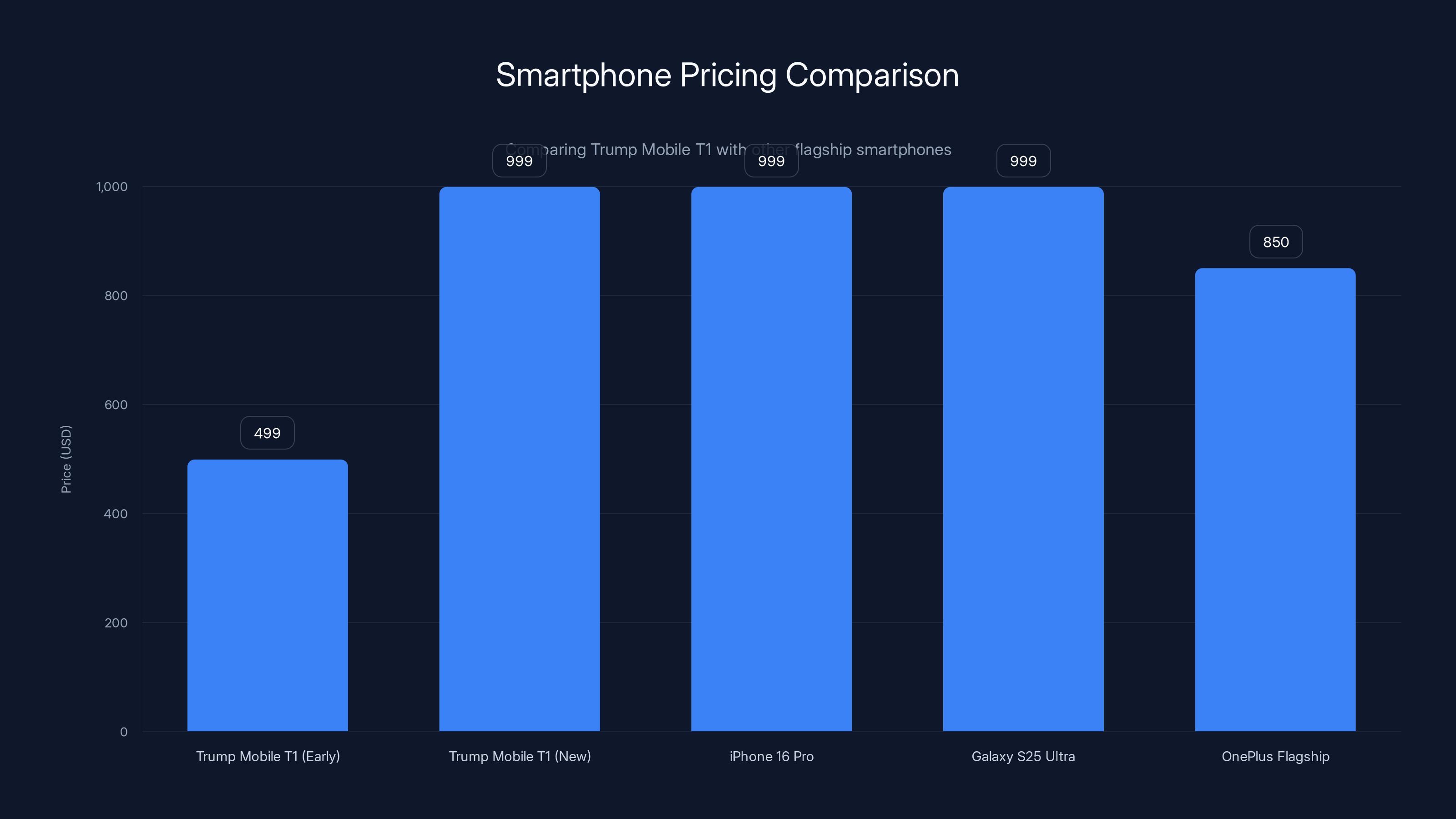

For context, here's how this compares to mainstream smartphone pricing:

That's a 100% premium for new customers compared to early adopters. A new i Phone 16 Pro starts at

The two-tier pricing is smart marketing psychology. It rewards the base of early supporters and gives them a sense of having made a wise investment decision. They paid $100 for access to a special deal, which makes them feel like insiders. But it also means that once the company's core supporters have purchased the device, it needs to convince mainstream consumers to pay nearly twice as much.

That's a difficult position to be in. Trump Mobile would need to demonstrate substantial technical advantages or unique capabilities that justify the $999 price point. Without that differentiation, the company faces a sales cliff once initial demand from supporters is satisfied.

Manufacturing and the "American Hands" Messaging

The shift in manufacturing language represents a calculated retreat from an original promise. The company's website now emphasizes that American workers will have hands "behind" the device, rather than claiming the device is made in America. It's a subtle distinction with significant implications.

Final assembly in Miami is genuinely something. It means factory jobs exist, at least for the assembly phase. But it also means that the vast majority of the value creation happens elsewhere. The sophisticated manufacturing of processors, memory, and other complex components still happens overseas. The intellectual property design comes from the company's leadership, but the bulk of the manufacturing expertise and production happens at contract manufacturers who have been doing this for decades.

This is how modern electronics manufacturing actually works. Companies like Apple, Samsung, and Google don't manufacture their phones domestically either. They contract with companies like Foxconn, Pegatron, and other manufacturers who operate massive facilities in Asia. The final assembly step is just one small part of an enormously complex supply chain.

Where Trump Mobile differs from these companies is in its marketing positioning. Apple, Samsung, and Google don't claim their phones are made in America. They're transparent about global manufacturing. Trump Mobile built its brand identity partly on a claim of American manufacturing, which has now shifted.

That messaging change will resonate differently with different audiences. Some supporters might view it as a necessary pragmatic compromise. Others might feel misled. And mainstream consumers evaluating the phone purely on specifications and price will likely ignore the manufacturing story entirely.

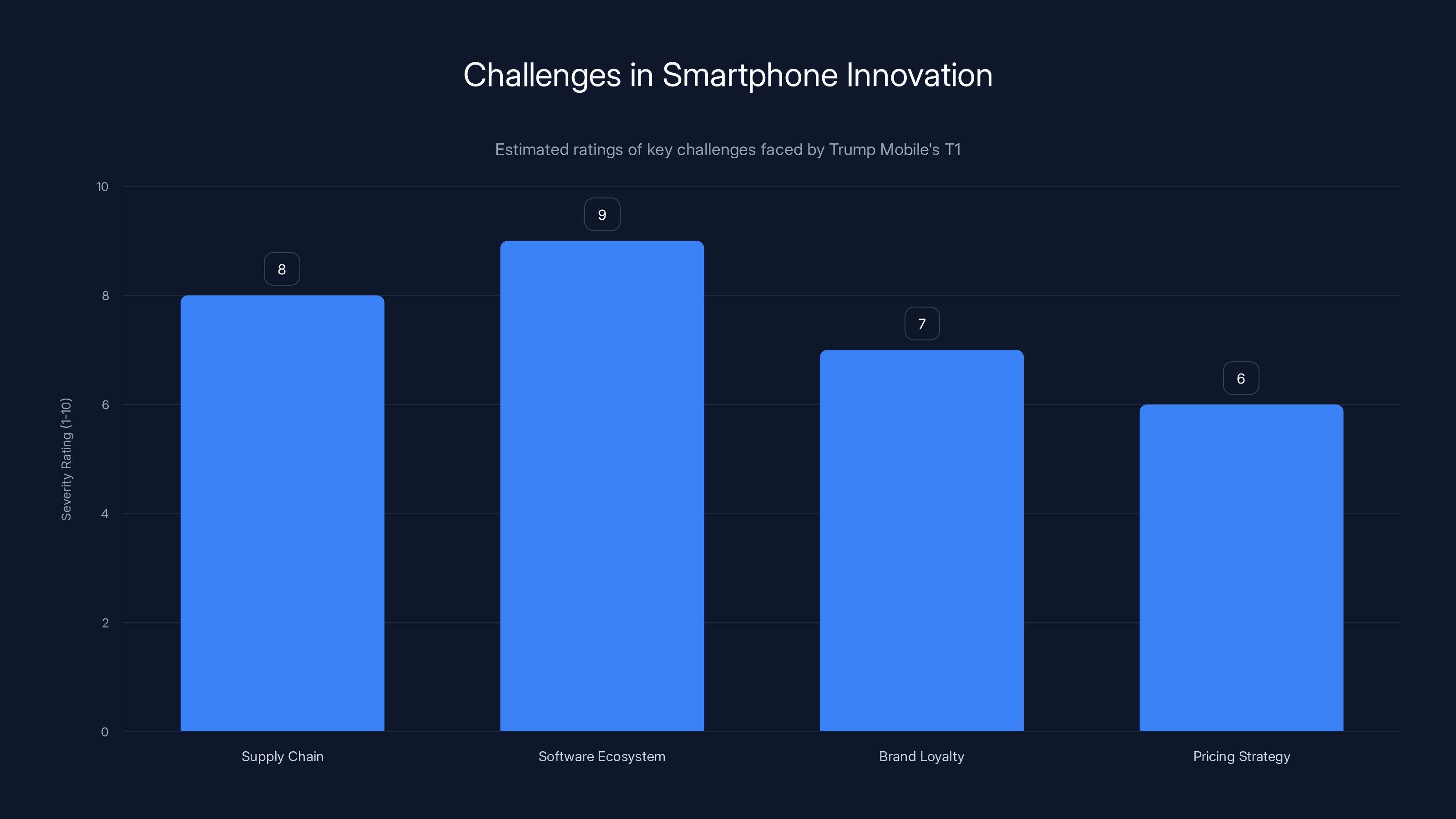

The T1 faces significant challenges, particularly in software ecosystem and supply chain, which are rated highest in severity. Estimated data.

What We Know About the Actual Specifications

Interestingly, Trump Mobile has been cagey about releasing detailed technical specifications for the T1. This is a notable choice because smartphones are ultimately evaluated primarily on their technical capabilities. Processor speed, camera quality, display characteristics, battery life, and software all matter far more to most consumers than the manufacturing location.

The company has released some basic information, but nothing that allows for detailed comparison with competitors. We don't have confirmed processor details, RAM specifications, storage options, or display specifications. We don't have camera sensor information, battery capacity, or software details. This reticence is striking because it suggests Trump Mobile might be uncertain about how the specifications compare to competitors at the announced price point.

Without this information, potential consumers can't make informed comparisons. A

The absence of specifications also makes it impossible to evaluate whether the company is using existing off-the-shelf components or custom hardware. Is the T1 based on existing smartphone designs modified for Trump Mobile branding, or is it a ground-up custom design? The answer matters significantly for both development cost and manufacturing complexity.

Based on typical smartphone development timelines and the apparent late-stage design changes, it seems likely that Trump Mobile adapted an existing reference design rather than developing a completely new platform. This would be the logical choice for a company with limited smartphone manufacturing experience. But confirmation on this point remains absent.

The Release Date Problem: Why It Keeps Getting Pushed

Trump Mobile's website states that the T1 will be released "later this year." That statement has appeared on their website for quite some time now. The vagueness of this timeline is itself telling. Established manufacturers announce specific release dates, sometimes to the exact day. The broad "later this year" window suggests uncertainty about when the device will actually be ready.

Smartphone development typically follows a consistent timeline. Design phase, component sourcing, prototype manufacturing, testing, refinement, tooling production, and manufacturing all need to happen in sequence. Each phase requires 3-6 months typically. A smartphone announced in the way Trump Mobile announced the T1 would normally have a specific release date nailed down.

The ongoing design changes we've discussed, including the camera redesign, suggest that the product is still in development refinement rather than manufacturing preparation. If the phone was ready for production, the design would be locked. The fact that design elements are still changing this late indicates the timeline might slip further.

There's also a supply chain dimension to consider. During the years since Trump Mobile first announced the T1, the smartphone supply chain has faced enormous challenges. Semiconductor shortages, shipping disruptions, geopolitical tensions affecting component sourcing, and the rise of advanced manufacturing in the US have all created complications. A small manufacturer like Trump Mobile might struggle more with supply chain navigation than established players with longstanding vendor relationships.

The delay also reflects a broader reality about the smartphone market. The barriers to entry are extraordinarily high. You need massive capital for tooling and initial manufacturing runs. You need established relationships with component suppliers. You need software expertise to compete with i OS and Android. You need customer support infrastructure. Trump Mobile doesn't have decades of experience with any of these areas.

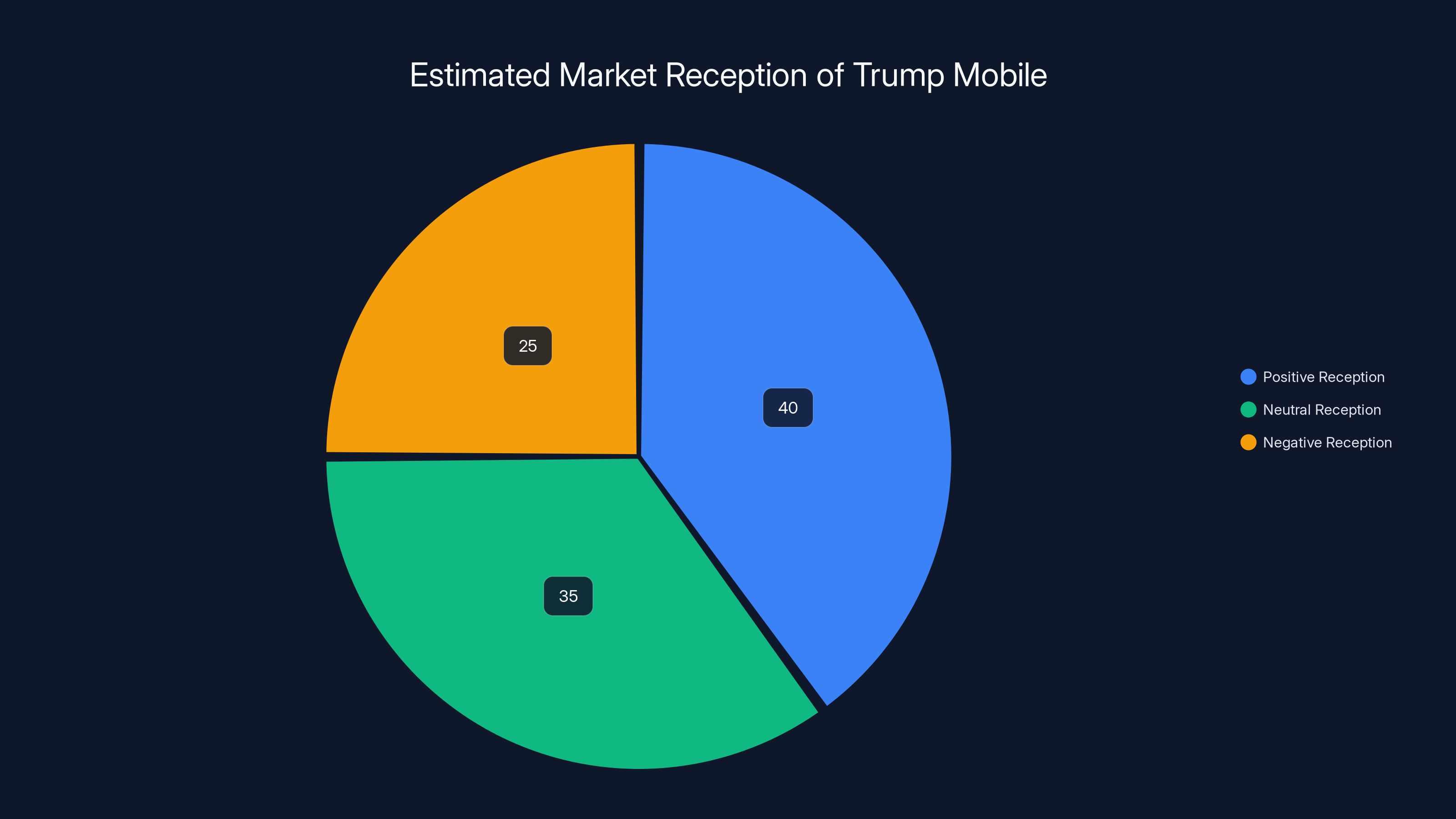

Estimated data suggests a mixed market reception for Trump Mobile, with a significant portion of potential customers remaining neutral or negative. Estimated data.

Comparing the T1 to Actual Market Alternatives

To understand whether the T1 represents a genuine market opportunity, it's worth considering what consumers can actually buy right now at various price points.

At $499, the phone would compete directly with mid-range flagships. Samsung's Galaxy A-series offers excellent value in this price range. Google's Pixel 7a provides outstanding camera performance. One Plus's mid-range devices offer strong performance. These phones all have mature software, established support networks, and proven reliability. A user could buy any of them with confidence they'll work well.

At $999, the phone enters flagship territory where it competes with i Phone 16, Galaxy S25, and Pixel 9. These devices have years of software support, massive app ecosystems, proven security records, and mature manufacturing processes. They're more expensive than the T1, but only slightly, and they offer far more certainty of quality.

The problem for Trump Mobile is that the company hasn't established enough credibility to overcome the price premium and feature uncertainty. A first-generation phone from a company with no smartphone manufacturing history is inherently riskier than buying from Samsung, Apple, or Google. Consumers pay premiums for that risk reduction.

There's also the software question. What operating system will the T1 use? Is it Android with custom modifications? Is it a custom operating system? Will it have access to the Google Play Store or app stores? These details matter enormously and haven't been clearly communicated.

The Deposit Strategy and Early Adopter Psychology

Trump Mobile's decision to collect $100 deposits from interested customers was clever marketing. It served multiple purposes simultaneously. First, it identified genuinely interested customers willing to commit money. Second, it generated a revenue stream to fund development. Third, it created psychological commitment among supporters who'd already paid money.

People who've paid a deposit have a natural inclination to justify their decision. They've become emotionally invested in the product's success. They're more likely to remain engaged with the company, defend the product against criticism, and ultimately purchase the phone when it launches. This is basic behavioral psychology, and Trump Mobile clearly understood it.

The downside is that it creates obligations. Those deposit-holders expect the phone to actually materialize. They expect the promised pricing. They expect the quality and capabilities they imagined when they handed over $100. If the final product disappoints, they become sources of negative word-of-mouth rather than enthusiastic advocates.

The two-tier pricing structure reinforces this dynamic. Deposit-holders get their promised

This is the company's fundamental challenge: beyond the core group of political supporters and early adopters who've already paid the deposit, there's a much larger potential market of consumers who will evaluate the T1 purely on merit. Those consumers will compare specs, pricing, reliability, and support against Samsung, Apple, and Google. Winning their business requires the T1 to be genuinely competitive on those dimensions.

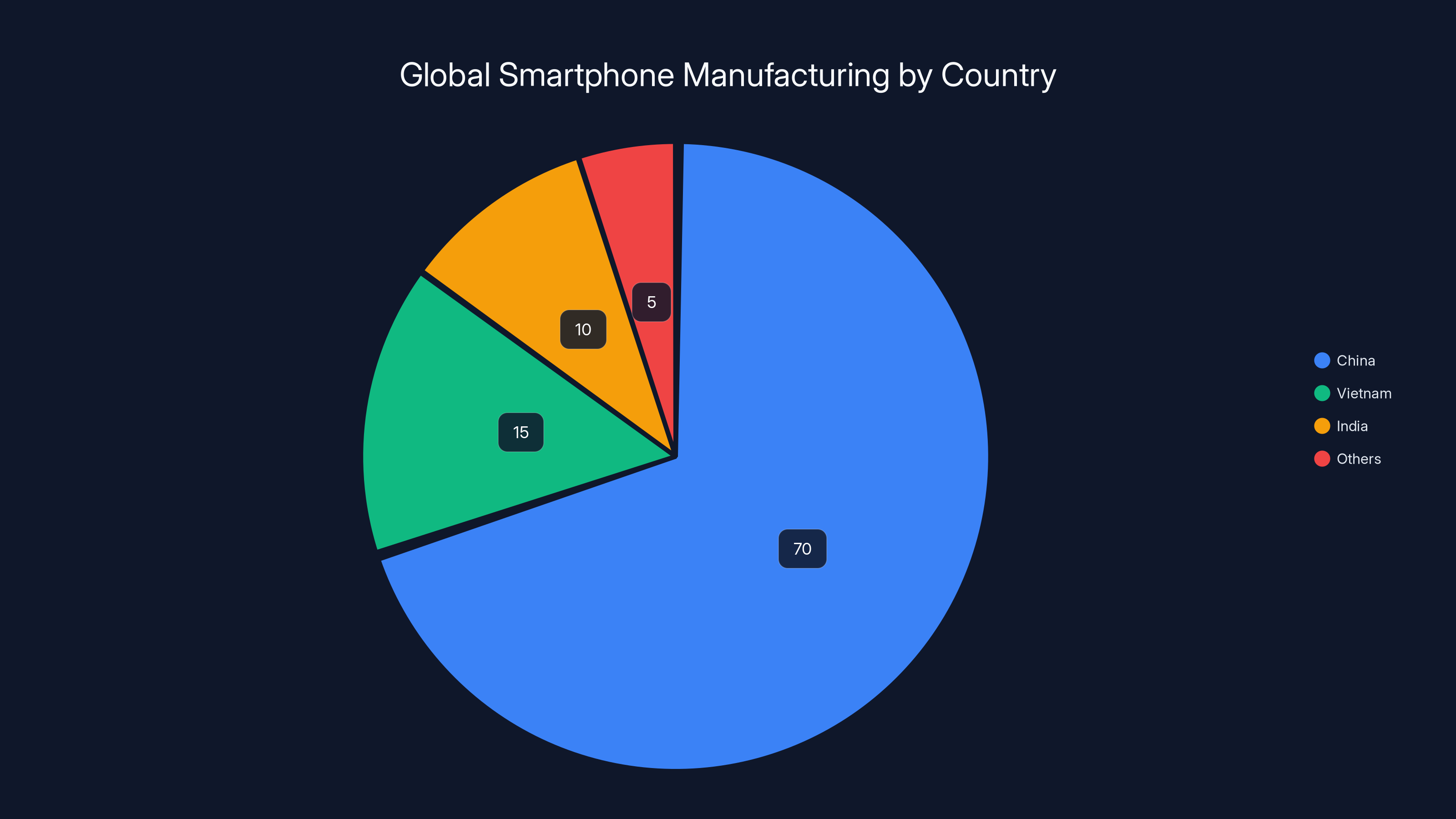

Most smartphones are manufactured in China, Vietnam, and India, which together account for over 95% of global production. Estimated data.

The Software and Ecosystem Question

One of the most important aspects of the T1 remains almost completely unclear: what operating system and ecosystem does it use? This might seem like a technical detail, but it fundamentally affects the phone's usability and market viability.

If the T1 runs Android (customized or otherwise), it will have access to millions of apps. It can function as a relatively normal smartphone for most people's use cases. If it uses a custom operating system or a heavily modified version of Android, it could face app compatibility issues and user experience inconsistencies.

The ecosystem dimension extends beyond software. Does Trump Mobile plan to establish its own app store, or will it use Google's Play Store? Will it offer cloud storage, email services, and other ecosystem services? Will it compete with Apple's integrated hardware-software approach or follow Android's more open model?

These decisions have enormous implications for the product's competitiveness. Apple's success partly stems from an integrated ecosystem where hardware, software, and services work seamlessly together. Android's success comes from openness and compatibility with multiple manufacturers and service providers. Trump Mobile needs to decide where it falls on that spectrum.

The lack of clear communication on these points suggests either ongoing decisions within the company or reluctance to discuss a software strategy that might alienate some potential customers. Neither situation is ideal for a company trying to build consumer confidence in a brand-new product.

Manufacturing Partnerships and Component Sourcing

While Trump Mobile has confirmed final assembly in Miami, questions remain about which companies are actually manufacturing the phone's components and what partnerships exist. This information would clarify how serious the company is about production timelines and whether the necessary supply chains are in place.

Manufacturing a smartphone requires relationships with dozens of suppliers. Someone needs to produce the processor, memory chips, display panel, camera modules, battery, connectors, and hundreds of other components. Someone needs to manage quality assurance across all of these suppliers. Someone needs to handle logistics and inventory management for component delivery.

Established manufacturers have teams of people dedicated entirely to supply chain management. They've spent years building relationships with suppliers, negotiating contracts, and establishing preferred vendor programs. Trump Mobile is presumably building these relationships from scratch.

This isn't impossible, but it's difficult and time-consuming. It's another factor that could contribute to timeline slips. A supplier issue with a critical component could delay the entire project. A quality problem with a batch of processors or display panels could force design changes and restart testing cycles.

The choice of manufacturing partner also matters. Is Trump Mobile working with an established contract manufacturer like Foxconn or Pegatron? These companies have done this thousands of times. Or is it working with a smaller operation less experienced with smartphone manufacturing? The answer affects quality control, timeline reliability, and cost efficiency.

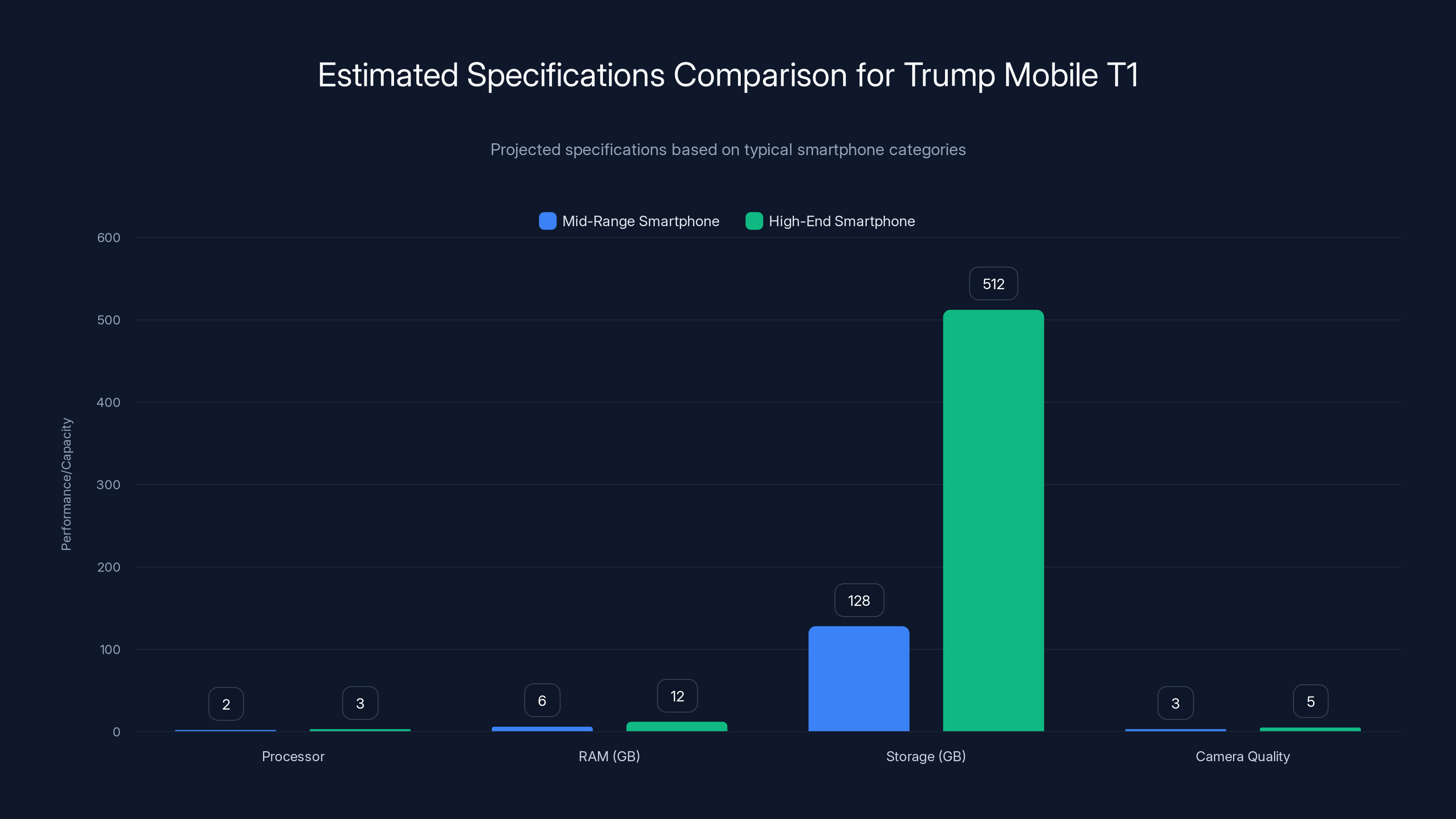

Estimated data shows the potential range of specifications for the Trump Mobile T1, highlighting the uncertainty in its market positioning. Estimated data.

The Market Reception and Pre-Order Situation

Beyond the executives' statements and official announcements, actual market data would be incredibly informative. How many people have actually paid the $100 deposit? How many people are actively engaged with Trump Mobile's community? What's the sentiment among the audience segments Trump Mobile is targeting?

These numbers would reveal whether the company has genuine market traction or whether enthusiasm has already peaked among the core group of supporters. They'd show whether the business model is viable or whether it's already hitting friction points.

The company has been understandably quiet about exact numbers, which could indicate either healthy progress or softer-than-expected demand. Public companies in this situation typically release customer numbers to build confidence. A private company like Trump Mobile has no obligation to do so.

Market reception also depends heavily on successful launch execution. First impressions matter enormously in smartphone purchases. If the T1 launches with software issues, supply constraints, or missing features, it could struggle to gain traction beyond initial supporters. If it launches smoothly with strong performance and reliability, it could build momentum through positive word-of-mouth.

The smartphone market has seen numerous failures from companies that entered with political messaging or controversial positioning. The product ultimately needs to compete on actual features and performance, not just brand messaging. Trump Mobile's success will depend on whether the T1 can deliver on that fundamental requirement.

The Political Dimension and Market Positioning

Trump Mobile exists within a specific political context. The company's messaging, branding, and positioning all reference themes that resonate with particular political constituencies. This creates both opportunities and challenges.

The opportunity is clear: there's a substantial audience segment that feels underserved by mainstream technology companies and actively seeks alternatives from companies that align with their worldview. This audience has shown willingness to support Trump-branded products, media, and services. Trump Mobile benefits from this existing community and their inclination to support ventures within their political ecosystem.

The challenge is that this positioning simultaneously limits the market. Consumers outside that political coalition might be reluctant to purchase a product explicitly branded as a Trump initiative. They might worry about privacy implications, question the company's technical competence, or simply prefer to avoid the political associations. This dramatically reduces the potential addressable market compared to a politically neutral smartphone from Samsung or Google.

Historically, successful consumer electronics products have maintained political neutrality or at least broad appeal across political lines. A smartphone explicitly positioned as a Republican or conservative alternative naturally alienates everyone else. That's a significant market limitation.

Trump Mobile's executives presumably understand this trade-off. They're deliberately choosing to appeal intensely to a specific audience rather than trying to appeal broadly to everyone. This is a legitimate business strategy, but it means the company can't rely on mainstream consumer acceptance. It needs to achieve profitability through a smaller but more committed customer base.

What Success Would Actually Look Like

For Trump Mobile to be considered successful with the T1, certain benchmarks would need to be hit. Understanding these benchmarks helps clarify what's actually at stake.

First, the phone needs to actually launch. Vaporware doesn't create value. The company needs to move from announcements to actual products in consumer hands. Given the delays and design changes already visible, hitting a 2025 release date would represent meaningful progress.

Second, the product needs to function reliably. A smartphone that crashes frequently, has significant battery drain, or exhibits widespread quality issues would be a failure regardless of its specification. Early adopters are paying a premium partly on faith that the product will work, which creates significant pressure on Trump Mobile to deliver quality.

Third, the company needs to establish some form of competitive differentiation. What makes the T1 notably better than alternatives? Is it the camera performance? The processor? The design? The software features? Without some meaningful advantage, customers will choose more established brands.

Fourth, Trump Mobile needs to build sufficient sales volume to achieve profitability. The company could successfully sell 500,000 units to core supporters and still ultimately fail if the economics don't work. Manufacturing costs, distribution, support, and development need to be justified by actual revenue.

Fifth, the company needs to maintain customer satisfaction and build a positive reputation. Early reviews will shape perception for years. If tech reviewers and early buyers praise the T1, momentum builds. If they criticize it, the company spends years recovering trust.

The Broader Smartphone Market Context

Trump Mobile's T1 enters a market that's increasingly mature and crowded. The days of breakthrough innovation in smartphones have largely passed. Incremental improvements in processing speed, camera quality, and battery life drive the market now. Genuine differentiation is difficult to achieve.

The market is also increasingly bifurcated. Premium flagships from Apple, Samsung, and Google occupy the high end. Mid-range phones from these manufacturers and competitors like One Plus, Xiaomi, and Motorola dominate the middle. Budget options provide functionality at accessible prices. There's room for innovation, but the large players have enormous resources and established customer loyalty.

New entrants face a brutal environment. They need superior technology to overcome brand disadvantages, or they need to find underserved market segments where they can build advantage. Trump Mobile's positioning as a politically alternative option is an attempt at the latter. The question is whether that niche is large enough to sustain a viable business.

The smartphone market is also consolidating around software ecosystems. i OS and Android dominate so completely that alternative operating systems struggle. A new smartphone with unproven software would face adoption challenges regardless of hardware quality. This creates a significant barrier to entry that goes beyond manufacturing or pricing.

Timeline Expectations and Realistic Delivery

Based on typical smartphone development and manufacturing timelines, what should people realistically expect? The company has stated the T1 will launch "later this year," but this timeline has been stated for quite some time.

Smartphone development from concept to manufacturing typically requires 18-24 months for an experienced company with established supply chains. Trump Mobile is presumably further along than concept stage, but the ongoing design changes suggest the company is still in refinement phases.

If the company is seriously aiming for a 2025 release, manufacturing tooling needs to be finalized and initial production needs to begin within months. The fact that design elements are still changing suggests this timeline might be optimistic.

A more realistic expectation might be early 2026 for initial manufacturing runs and retail availability. This would still be impressive for a company with no previous smartphone experience. But it would also mean another year of waiting for customers who've already paid the $100 deposit.

There's also the question of initial production volume. Even if Trump Mobile successfully launches the T1, initial inventory will likely be limited. Established manufacturers struggle with supply constraints at launch. A new manufacturer with less negotiating power will have it even harder. Early customers might need to wait weeks or months for their pre-orders to ship.

FAQ

What is Trump Mobile and why is it making a smartphone?

Trump Mobile is a new technology company announced to produce a smartphone called the T1. The company's positioning emphasizes creating an American alternative to mainstream smartphone brands, with messaging that appeals to conservative and Republican consumers who feel underrepresented by existing technology companies.

What happened to the original "made in America" promise for the T1?

The company has shifted its messaging from the T1 being "proudly designed and built in the United States" to having "American hands behind every device." This change reflects manufacturing realities: final assembly occurs in Miami, but component manufacturing happens overseas through global supply chains, just like most smartphones.

How much will the Trump Mobile T1 actually cost?

The pricing is structured in two tiers: customers who already paid the

When will the Trump Mobile T1 actually be available for purchase?

The company states the T1 will be released "later this year," but this timeline has remained vague for an extended period. Given ongoing design changes and typical smartphone development timelines, a realistic expectation would be early 2026. The repeated delays and design modifications suggest manufacturing is still being finalized.

What are the specifications and features of the T1 smartphone?

Trump Mobile has been remarkably cagey about detailed specifications. The company hasn't released confirmed processor details, RAM specifications, storage options, display characteristics, battery capacity, or software details. This lack of transparency makes it impossible to accurately compare the T1 to competitive alternatives at similar price points.

What operating system will the T1 use and will it have access to apps?

The operating system choice hasn't been clearly communicated. If it runs standard Android, it will have Play Store access and broad app compatibility. If it uses a custom or heavily modified OS, it could face app limitations. This fundamental question about usability remains unanswered despite the phone being in late-stage development.

How does the T1 compare to the i Phone 16, Galaxy S25, or other flagship phones?

Directly comparing the T1 to established flagships is difficult without detailed specifications, but at the $999 price point, consumers would be choosing between the T1 and proven alternatives from Apple, Samsung, or Google. Those companies offer years of software support, massive app ecosystems, proven reliability, and established support infrastructure. The T1 offers brand alignment with conservative messaging and the appeal of an alternative to mainstream tech. Actual product quality and features would determine which represents better value.

What makes someone want to buy a Trump Mobile T1 phone?

The T1 appeals to consumers who feel politically aligned with Trump and his supporters and who view mainstream tech companies like Apple and Google with skepticism or distrust. The phone represents an alternative within the consumer's political and cultural ecosystem. Beyond this positioning, the actual product differentiation remains unclear since comprehensive specifications haven't been shared.

Is the Trump Mobile T1 a legitimate product or vaporware?

The company has made enough progress to appear legitimate, including confirming manufacturing partnerships and announcing specific pricing structures. However, the repeated timeline delays, ongoing design changes, and lack of detailed specifications raise legitimate questions about whether the company is ready for manufacturing. The T1 appears to be a real product in development, but it's further from launch than the company's public messaging suggests.

What happens if I paid the $100 deposit and Trump Mobile never releases the T1?

That scenario would be devastating for customers and would raise significant legal questions about refund obligations. The company has stated that deposit-holders will receive the phone at the $499 price, but if manufacturing never happens, disputes about whether the deposit would be refunded would likely arise. This risk represents another reason to be cautious about committing money to a first-generation product from an unproven company.

Conclusion: The T1 and the Challenges of Smartphone Innovation

Trump Mobile's T1 smartphone represents an ambitious attempt to compete in one of the world's most competitive and capital-intensive industries. The company has demonstrated enough progress to be taken seriously, but the ongoing challenges visible in design changes, pricing adjustments, and vague timelines reveal the enormous complexity of smartphone manufacturing.

The fundamental disconnect between the initial promises and the current reality deserves attention not because it's surprising, but because it's instructive. Manufacturing smartphones competitively at scale is extraordinarily difficult. The supply chains don't exist domestically to support fully American-made production without catastrophic cost increases. The software ecosystem is dominated by i OS and Android, creating challenges for any alternative. The brand loyalty and support infrastructure established by Samsung, Apple, and Google represent genuine competitive advantages.

Trump Mobile's strategy of appealing to a specific political constituency is intellectually honest about these market realities. Rather than trying to compete head-to-head with Apple on technology and design, the company is appealing to customers who value political and cultural alignment. This is a defensible business model, but it limits the potential market significantly.

The pricing strategy of

For consumers evaluating whether to purchase the T1, several critical pieces of information remain missing. Detailed specifications would clarify how the phone compares to competitors at similar price points. Operating system details would address fundamental usability questions. Manufacturing timeline clarification would help potential customers understand whether waiting is realistic. A compelling explanation of product differentiation would justify the pricing against more established alternatives.

Until these details emerge, the T1 remains a product defined partly by what's uncertain about it. That uncertainty is a feature, not a bug, for the company's core audience, who are making purchasing decisions based on brand alignment and political identity. But for mainstream consumers evaluating the phone purely on product merit, that uncertainty represents significant risk.

The smartphone market needs competition and innovation. If Trump Mobile successfully launches the T1 and delivers a quality product, it will have earned its place in the market through actual execution rather than hype. If the company fails to deliver, it will join a long list of smartphone ventures that didn't survive contact with market realities.

What happens with the T1 over the next year will determine not just whether Trump Mobile succeeds, but what's actually possible for new entrants attempting to compete in smartphones. The company's choices about whether to cut corners on quality to hit timelines, whether to prioritize support for its political base over mainstream appeal, and whether to be transparent about challenges versus optimistic in messaging will all shape the product's ultimate success or failure.

The most likely scenario involves a successful launch for core supporters, solid initial sales from the deposit-holder base, and slower adoption from mainstream consumers who prioritize brand-neutral product quality. Whether that proves sufficient for long-term profitability depends on factors still being decided within the company. What's certain is that the gap between initial promises and current reality has only widened, and closing that gap will require more than marketing messaging.

Key Takeaways

- Trump Mobile's T1 shifted from 'made in USA' to 'American hands behind' messaging, reflecting manufacturing realities of global smartphone supply chains

- Two-tier pricing structure offers 999 for new customers, a 100% premium that signals difficulty converting mainstream consumers

- Camera design underwent major redesign from original squared arrangement to misaligned vertical stack, suggesting late-stage development complications

- Company hasn't released detailed specifications despite late-stage development, making competitive comparison impossible and raising concerns about differentiation

- Realistic timeline expectations point to early 2026 for manufacturing rather than late 2025, despite company's vague 'later this year' messaging

- Success depends on whether T1 can achieve product quality sufficient to justify premium pricing against proven alternatives from Samsung, Apple, and Google

Related Articles

- Nvidia's $100B OpenAI Gamble: What's Really Happening Behind Closed Doors [2025]

- Samsung Galaxy Z Trifold: Restock Info & Best Alternatives [2025]

- Trump Phone T1 Ultra: Everything We Know [2025]

- Apple's AI Pin Strategy: Why It Matters [2025]

- Samsung Galaxy Unpacked 2026: Complete Guide to Expected Announcements [2026]

- OnePlus Denies Demise Rumors: What's Really Happening [2025]

![Trump Mobile T1 Phone: Release Date, Price & Specs [2025]](https://tryrunable.com/blog/trump-mobile-t1-phone-release-date-price-specs-2025/image-1-1770492937902.jpg)