Introduction: The 2025 Television Market Landscape

The television industry in 2025 stands at an inflection point. While previous years focused on incremental improvements and resolution chasing, 2025 marks a pivotal shift toward practical innovation and consumer-centric features. The display technology market has matured significantly, revealing clear winners and losers based on real-world performance rather than spec-sheet promises.

OLED (Organic Light-Emitting Diode) technology has cemented its position as the premium standard, driven by meaningful brightness enhancements that address one of the technology's historical limitations. Manufacturers have engineered sophisticated optical systems and improved panel efficiency to deliver OLED screens that rival or exceed traditional LED backlighting in peak brightness while maintaining the superior contrast, color accuracy, and viewing angles that made OLED revolutionary.

Meanwhile, 8K television—once positioned as the inevitable future of home entertainment—continues to languish in commercial irrelevance. Despite years of investment and hype, the convergence of limited content availability, astronomical pricing, and minimal performance benefits over 4K has relegated 8K to a niche product category appealing only to specialized professional applications.

This comprehensive analysis examines the 2025 television ecosystem, identifying which technologies, manufacturers, and approaches are thriving and which are struggling. We'll explore the technical innovations driving the market, analyze pricing strategies, discuss real-world performance implications, and identify alternatives that consumers should consider. Whether you're a home theater enthusiast, casual viewer, or evaluating solutions for content creation, understanding these market dynamics helps you make informed purchasing decisions aligned with your actual needs and budget.

The stakes matter because television purchases represent significant capital expenditures. Most consumers replace their TVs every 5-10 years, making it essential to understand not just current performance but also longevity, software support, and long-term value preservation.

OLED Brightness Revolution: How and Why It Matters

The Technical Foundation of OLED Brightness Improvements

OLED technology operates on fundamentally different principles than LED-backlit LCDs. Each pixel in an OLED display emits its own light, eliminating the need for a backlight layer. This architecture provides inherent advantages: perfect blacks (pixels simply turn off), infinite contrast ratios, superior color accuracy, and exceptional viewing angles. However, this same architecture historically limited brightness because individual pixels can only be so bright before degrading the panel's lifespan.

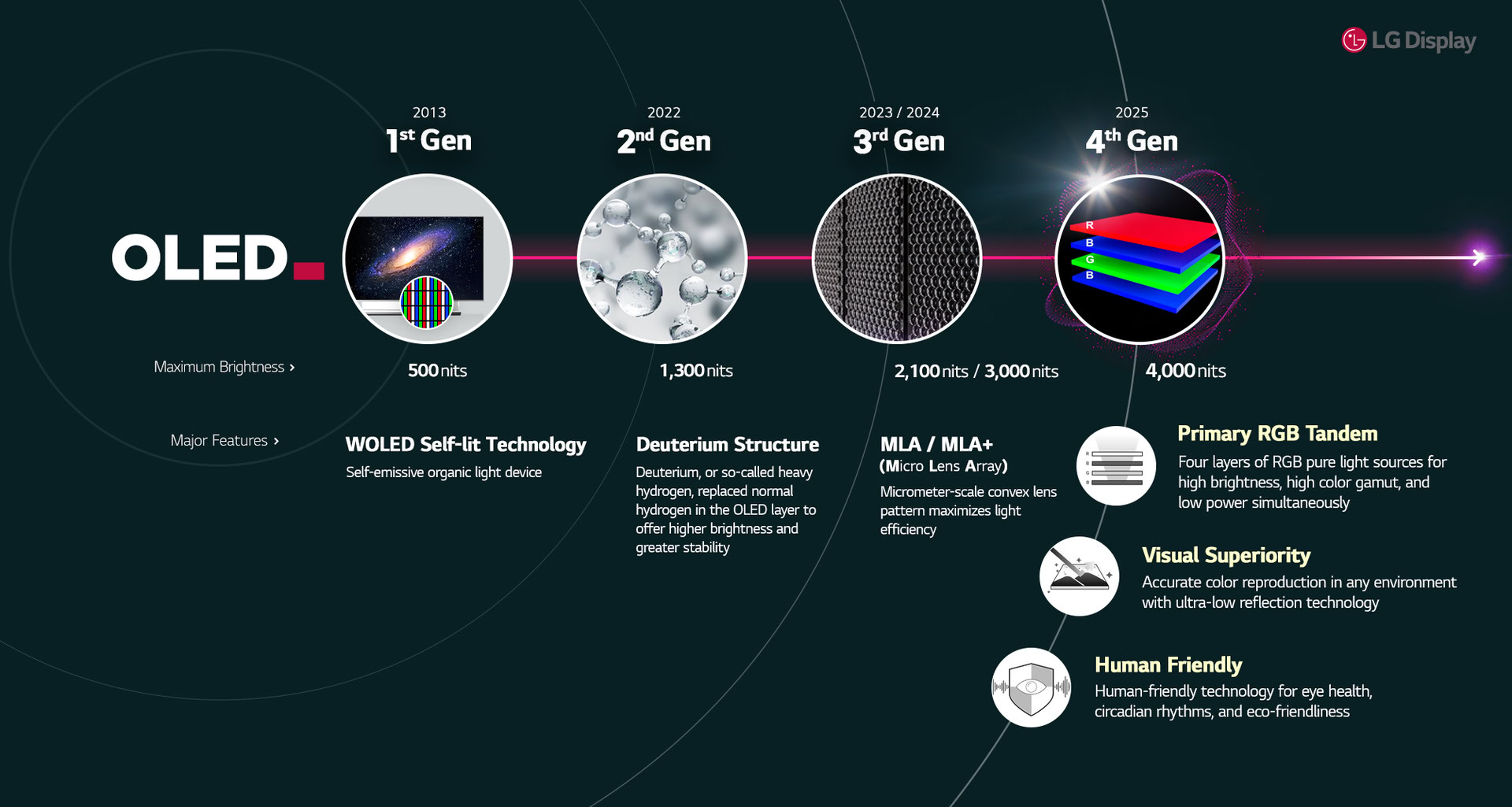

2025 has witnessed breakthrough improvements addressing this constraint. Manufacturers have implemented multiple technologies in combination: improved emissive materials with higher quantum efficiency, better heat dissipation architecture, advanced pixel designs that concentrate light output, and sophisticated algorithmic management of pixel brightness to prevent localized degradation. The result is OLED panels achieving 2,000-3,000 nits peak brightness in HDR highlights, compared to 800-1,200 nits in previous generations.

This technical achievement matters profoundly. Peak brightness determines how effectively a display can render highlights in high dynamic range (HDR) content. A sunset scene, a reflection on water, or a bright window requires sufficient peak brightness to appear convincing and impactful. Without adequate brightness, the display's superior contrast and black levels become undermined—the bright elements don't "pop" because they lack sufficient luminance compared to the surrounding darker elements.

Manufacturers achieved these gains through proprietary technologies. LG Display developed improved OLED panel structures with better light extraction. Samsung implemented QD-OLED (Quantum Dot OLED) technology, embedding quantum dots in the organic layer to enhance brightness and efficiency. Sony focused on optical design with specialized lens arrays that direct light more efficiently toward the viewer. Each approach produces different characteristics, but all represent genuine technical progress rather than marketing exaggeration.

Peak Brightness vs. Full-Screen Brightness: The Critical Distinction

Understanding the difference between peak brightness and sustained brightness proves essential for realistic expectations. Peak brightness refers to the maximum luminance a display can achieve, typically measured in a small window (often 3-10% of the screen). Full-screen brightness describes the brightness when the entire display shows white—a much more demanding scenario because it requires every pixel to emit maximum light simultaneously.

2025 OLED TVs achieve impressive peak brightness figures—often exceeding 2,500 nits in controlled measurement conditions. However, full-screen brightness remains considerably lower, typically in the 200-400 nits range. This distinction matters because real-world viewing involves a mix of peak highlights and surrounding darker elements. The HDR mastering process in professional content takes this characteristic into account, using peak brightness for impactful highlights while maintaining the visual composition through careful cinematography.

For consumers evaluating displays, understanding this specification prevents disappointment. A 3,000-nit peak brightness OLED will deliver stunning highlights in HDR content—cinema films, nature documentaries, gaming sequences. However, if you're watching a bright daytime scene with the entire screen relatively light, the displayed brightness will be lower due to thermal constraints and panel protection mechanisms.

This engineering limitation exists across all display technologies. LED-backlit displays with high full-screen brightness often sacrifice black level performance and contrast. OLED maintains superior contrast while strategically optimizing brightness for the viewing patterns humans actually experience. The 2025 improvements represent optimization rather than defying physics—engineers worked within constraints to deliver maximum real-world performance.

Real-World Performance in Different Viewing Environments

Brightness improvements address a legitimate criticism of previous-generation OLED: struggles in very bright rooms. A living room with multiple windows, significant ambient light, or outdoor viewing presented challenges because OLED's peak brightness, while excellent for HDR highlights, couldn't achieve the sustained brightness of LED-backlit displays in high-ambient-light scenarios.

2025 OLED brightness enhancements meaningfully improve performance in bright environments. The increased peak brightness translates to better sustained brightness through the HDR tone-mapping process. Additionally, many 2025 OLED models incorporate improved anti-glare coatings and local brightness optimization algorithms that intelligently boost brightness in specific screen regions when the ambient light sensor detects high ambient illumination.

However, realistic expectations remain important. An OLED TV in a south-facing room with direct afternoon sunlight won't match the performance of a high-brightness LED-backlit display in the same environment. For these scenarios, brighter LED-backlit TVs or professional display solutions prove more appropriate. For typical living rooms, family rooms, and home theater environments (the vast majority of consumer scenarios), 2025 OLED performance satisfies viewing needs across a range of lighting conditions.

Gaming on OLED has similarly benefited from brightness improvements. Modern gaming often features HDR implementation with high peak brightness requirements. Previous-generation OLED sometimes produced noticeably dimmer highlights than competing technologies in gaming scenarios. 2025 improvements narrow this gap substantially, making OLED increasingly competitive for gaming enthusiasts.

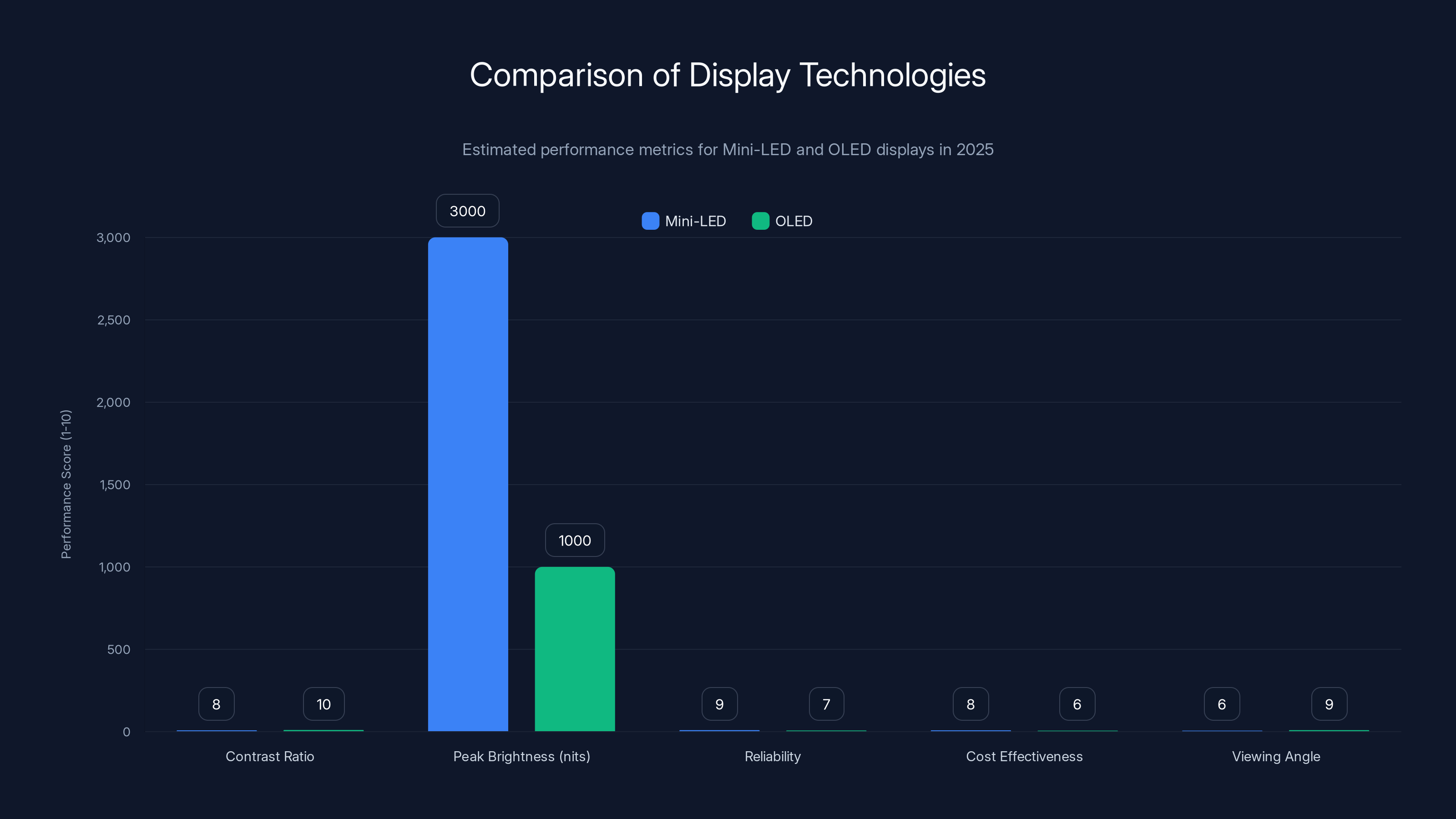

OLED TVs achieve higher peak brightness (2,000-3,000 nits) for highlights, while Mini-LED TVs offer higher sustained brightness (600 nits) across the full screen. Estimated data.

The 8K Problem: Why Resolution Advancement Stalled

The Fundamental Content Shortage

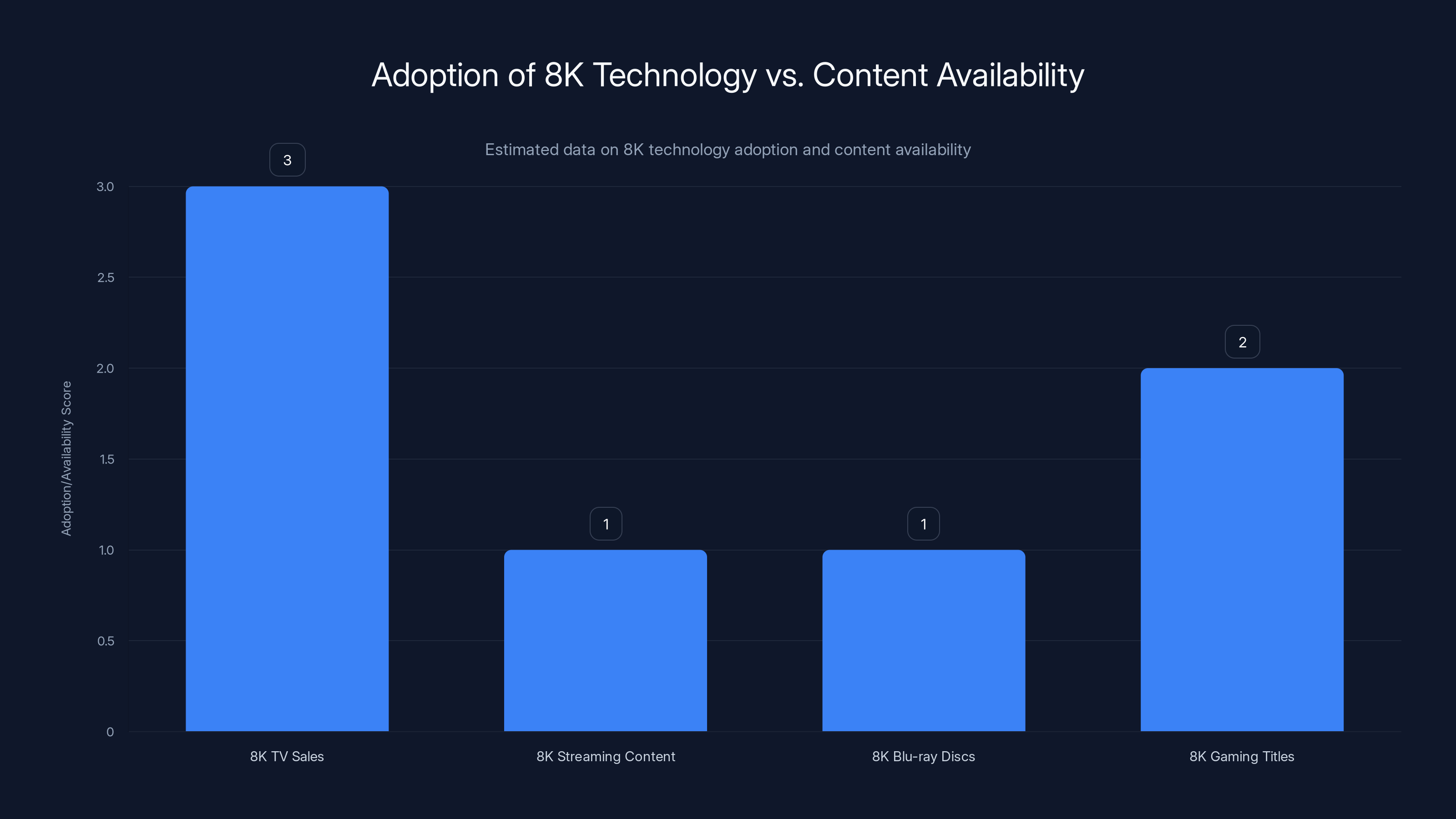

8K television promised to revolutionize home viewing with four times the pixel density of 4K (7680×4320 pixels versus 3840×2160). Yet eight years after initial 8K TV releases, adoption remains negligible. The primary cause is simple: virtually no consumer content exists in native 8K resolution.

Streamers like Netflix, Amazon Prime Video, Disney+, and HBO Max offer 4K content as their highest standard. Even cutting-edge sources like YouTube's 8K channel provides only a handful of videos, mostly technical demonstrations rather than commercial entertainment. Broadcast television worldwide has not transitioned to 8K. Blu-ray discs—already replaced by streaming for most consumers—never achieved widespread 8K adoption. Gaming, despite supporting higher resolutions, primarily targets 4K or lower on consumer displays.

This content drought reflects economic realities. Producing 8K content requires specialized cameras (far more expensive than 4K equipment), massive storage infrastructure, complex post-production workflows, and higher bandwidth transmission. For streaming services operating on thin profit margins, the investment doesn't justify the returns given that most subscribers access content on 1080p or 4K displays. Professional film production in 8K exists for specialized applications (documentary creation with extreme color grading flexibility, virtual reality experiences), but doesn't extend to mainstream entertainment.

The disconnect between 8K display availability and 8K content exemplifies a classic technology adoption failure. Products that leap too far ahead of supporting ecosystem infrastructure often fail regardless of technical merit. Without content to display, 8K TVs become expensive decorations in living rooms.

Upscaling Limitations and Realistic Performance Gains

Manufacturers argue that 8K displays upscale 4K content to impressive effect, using advanced algorithms to interpolate pixels and enhance detail. Technically valid, this approach provides marginal improvements at best—and often introduces artifacts when upscaling crosses resolution boundaries.

Consider the mathematics: 4K content provides 8.8 million pixels displayed across a screen. 8K displays contain 33.2 million pixels—roughly 3.75 times more. When upscaling 4K to 8K, the system must guess at content for three-quarters of the pixels. Advanced algorithms may make educated guesses based on surrounding pixels and machine learning models, but they cannot recover information that doesn't exist in the source material.

In side-by-side comparisons at typical viewing distances (6-10 feet from a 65-75 inch display), the human eye struggles to detect difference between native 4K and upscaled-to-8K content. The resolution threshold where humans perceive individual pixels on a 4K TV at normal viewing distance is approximately 200+ pixels per degree of visual angle—well beyond the capability of human vision at practical home theater distances. A 65-inch 4K TV viewed from 8 feet away presents approximately 35 pixels per degree, below human perception threshold.

Upscaling quality varies by implementation quality, with premium TVs performing better than budget models through superior algorithms and processing power. However, even the best upscaling provides subtle improvements—sometimes imperceptible to most viewers. This explains why professional content creators and videophiles remain unimpressed with 8K for consumer applications.

Price-to-Performance Ratios and Consumer Mathematics

8K TVs in 2025 command significant premiums over equivalent 4K models. A 65-inch premium 8K TV from a leading manufacturer typically costs

Consider the economics: A consumer purchasing a TV in 2025 should expect 8-10 years of service before replacement. Over this decade, will the content ecosystem shift to 8K? Current projections from industry analysts suggest 8K broadcast infrastructure remains 10+ years away, streaming platforms show no timeline for 8K adoption, and gaming focuses on higher refresh rates rather than extreme resolution. The probability that 8K content becomes meaningfully available during the TV's service lifetime remains low.

Meanwhile, 4K displays continue improving in other dimensions: brightness, color accuracy, processing sophistication, and smart TV platforms. A consumer spending

The mathematics become even clearer when considering smaller screen sizes. An 8K TV becomes increasingly pointless below 55 inches, where pixel density already exceeds human visual acuity at normal viewing distances. Yet 8K carries mandatory cost premium regardless of screen size, making small 8K TVs particularly poor value propositions.

Niche Applications Where 8K Provides Legitimate Value

While consumer 8K remains problematic, specific professional and specialized applications benefit from 8K resolution. Cinema mastering workflows sometimes employ 8K acquisition for source material, enabling post-production flexibility and future-proofing. Large-format displays in museums, exhibition spaces, and command centers (where viewing distances are extreme or multiple viewers observe from varying angles) can justify 8K's pixel density.

Virtual reality experiences benefit from 8K because the extreme field of view and proximity of displays to eyes create demanding viewing geometry. Some high-end gaming PCs connected to 8K displays for demanding applications (architectural visualization, complex data analysis with text-heavy interfaces) see marginal benefits from the additional pixels.

Professional video editing systems sometimes employ 8K workflows for archival and creative purposes—once content exists in 8K, maintaining that resolution through production pipelines makes sense. However, professional applications represent a tiny fraction of TV sales. For the 99%+ of consumers making living room television purchases, 8K remains an unnecessary premium feature.

Despite the availability of 8K TVs, the lack of native 8K content across streaming, Blu-ray, and gaming has led to low adoption scores. Estimated data.

Mini-LED and Quantum Dot Technologies: The LED Response

Mini-LED Backlighting Architecture and Performance Implications

As OLED ascended, LED-backlit display manufacturers invested in improving their own technology rather than ceding premium segments to OLED. Mini-LED represents the most significant evolution—replacing traditional LED backlighting (where several dozen LEDs behind the entire panel create ambient lighting) with thousands of individually addressable mini-LED zones across the backlight layer.

A typical premium Mini-LED TV in 2025 features 500-1,000+ individual backlight zones, each controlled independently. When displaying dark scenes, zones behind those regions dim substantially while zones behind bright elements maintain full output. This local dimming capability dramatically improves contrast compared to traditional LED-backlit displays, approaching (but not quite matching) OLED's contrast performance.

Mini-LED technology delivers genuine advantages: peak brightness exceeding OLED (sometimes reaching 3,000+ nits sustained brightness), proven reliability over decades of LED manufacturing, cost advantages enabling competitive pricing, and mature supply chains. A well-implemented 1,000-zone Mini-LED display shows subtle "blooming" (where bright elements on dark backgrounds show slight halo effects from backlight zone bleed) but for most viewing content, the performance approaches OLED quality at lower price points.

The technical tradeoff involves thickness and viewing angles. Mini-LED displays require physical space for the backlight layer and control electronics, making them inherently thicker than OLED panels (which require no backlight). Viewing angle performance remains inferior to OLED because light passes through the LCD layer before reaching the viewer—at extreme angles, image quality degrades more noticeably than OLED.

For consumers prioritizing brightness, reliability, and cost-effectiveness over absolute contrast and viewing angle performance, Mini-LED represents a compelling alternative to OLED. Content that benefits from sustained brightness—sports broadcasts, well-lit daytime scenes, bright gaming environments—often appears more impactful on Mini-LED than OLED, where the sustained brightness limitation may result in dimmer visuals.

Quantum Dot Enhancement: Color and Brightness Synergies

Quantum Dot technology embeds nano-sized particles (quantum dots) in the backlight layer or LCD layer. These dots absorb light from LED backlights and re-emit that light at specific wavelengths, enabling ultra-pure color primaries. The result is dramatically expanded color gamut—traditional LED-backlit displays struggle to reproduce pure, saturated colors because the LED spectrum doesn't perfectly align with ideal red, green, and blue primaries. Quantum dots solve this through wavelength conversion.

Quantum Dot also improves brightness efficiency. The quantum dot conversion process, when optimized, directs more light toward the viewer compared to traditional filters. Displays combining Mini-LED backlighting with quantum dot technology achieve substantial brightness improvements—often 20-30% more brightness than comparable non-quantum-dot designs at equivalent power consumption.

2025 implementations increasingly combine these technologies with OLED: QD-OLED uses quantum dots in the organic layer itself, delivering both OLED's superior black levels and contrast with improved brightness and color saturation compared to traditional OLED. Samsung's primary 2025 flagship TVs rely on QD-OLED technology, representing the convergence of these approaches.

Quantum Dot displays excel with HDR content and color-critical applications. Streaming content with wide color gamut (cinema packages on Disney+, professional color-graded films on Apple TV+) displays with exceptional vibrancy on quantum dot displays. The technology also benefits photographers and content creators who require accurate color reproduction.

Market Dynamics: Which Manufacturers Thrived in 2025

OLED Ascendance and Market Share Consolidation

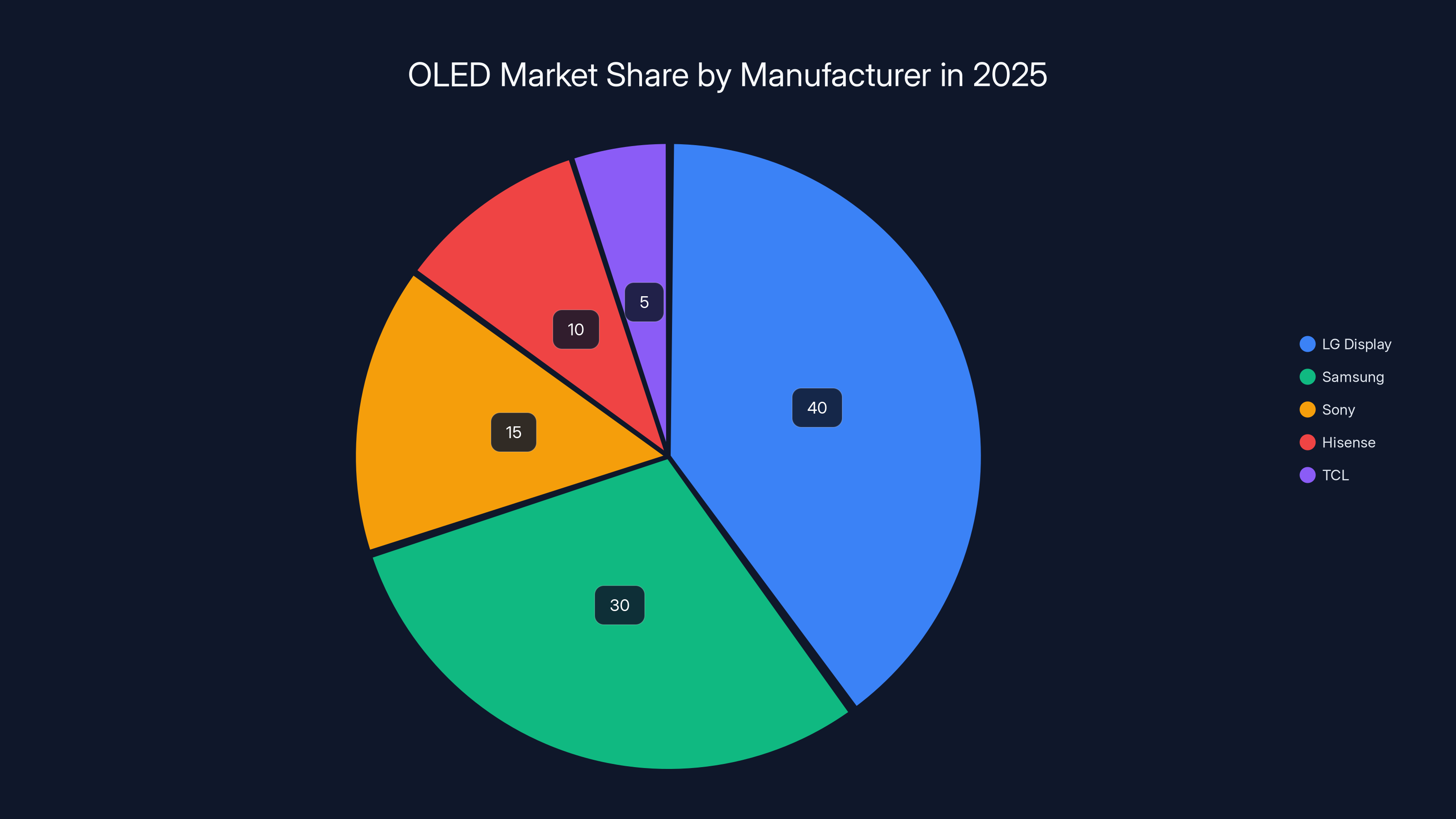

LG and Samsung solidified their OLED dominance throughout 2025. LG Display, as the primary OLED panel manufacturer supplying both its own TV division and competitors, controls the supply chain for WOLED (white OLED with color filters) technology. This market position enabled LG to expand OLED adoption across its product lineup, extending OLED availability into lower price tiers while maintaining healthy margins.

Samsung's transition to QD-OLED represented a strategic gamble—developing their own OLED panel manufacturing rather than relying on LG's supply. This strategy provides competitive advantages: proprietary technology, supply chain independence, and potential superior performance through optimized panel-to-TV-design integration. 2025 results validated this approach, with Samsung's QD-OLED TVs receiving acclaim for brightness and color performance.

Other manufacturers including Sony, LG Electronics (distinct from LG Display), Hisense, and TCL increasingly adopted OLED panels in premium segments. TCL's partnership with Omnivision on Mini-LED research positioned them as a cost-effective alternative, while Sony maintained their premium positioning through software enhancements and processing algorithms.

Traditional strongholds for non-OLED premium products (Panasonic in certain markets, Vizio in North America) faced increasing pressure. Vizio's continued commitment to Mini-LED and edge-lit LED technology allowed them to maintain competitive pricing but gradually lost share in the premium segment. Panasonic's exit from the North American TV market reflected broader consolidation in the industry, where only manufacturers with significant scale or unique positioning survive profitably.

Chinese Manufacturers and Value-Segment Dominance

Chinese manufacturers (TCL, Hisense, Skyworth, Changhong) achieved unprecedented market penetration in 2025, particularly in value and mid-range segments. These manufacturers leveraged manufacturing cost advantages, vertical integration, and aggressive pricing to capture consumers unwilling to pay OLED premiums.

TCL's performance particularly impressed: the company simultaneously invested in advanced technologies (Mini-LED, OLED, gaming features) while maintaining prices 20-40% below Western equivalents. This strategy enabled TCL to gain share in North America, Europe, and Asia-Pacific simultaneously—a remarkable achievement requiring operational excellence and supply chain mastery.

Hisense followed similar playbook but differentiated through sports and live TV optimization, securing partnerships with sports leagues and streaming services. This positioning resonated with consumers prioritizing live content and sports viewing over prestige brand affiliations.

The success of value manufacturers reflects market maturation. Television technology has become sufficiently commoditized that manufacturing capability, supply chain optimization, and software implementation matter more than brand heritage. A TCL Mini-LED TV delivers genuinely competitive picture quality compared to Western brands at substantially lower prices, making Western premium positioning increasingly vulnerable.

Premium Brands and Positioning: Differentiation Beyond Hardware

Sony, Panasonic (in markets where they remain), and Bang & Olufsen pursued different positioning strategies emphasizing software, processing, and audio integration rather than raw hardware advancement. Sony's BRAVIA TVs incorporated superior processing algorithms optimizing upscaling, motion handling, and color management—invisible differences in specifications but noticeable in real-world performance.

Bang & Olufsen's ultra-premium positioning targeted consumers prioritizing aesthetics and integration as much as performance. Premium pricing reflected design engineering, material quality, and seamless smart home integration rather than superior raw display performance versus OLED competitors.

These premium positioning strategies proved sustainable but captured niche segments rather than volume. For most consumers, the performance difference between a TCL Mini-LED TV at

In 2025, LG Display and Samsung dominated the OLED market, with LG holding the largest share at 40%, followed by Samsung at 30%. Estimated data.

Gaming Optimization: The Emerging Differentiator

Variable Refresh Rate and Input Lag Advances

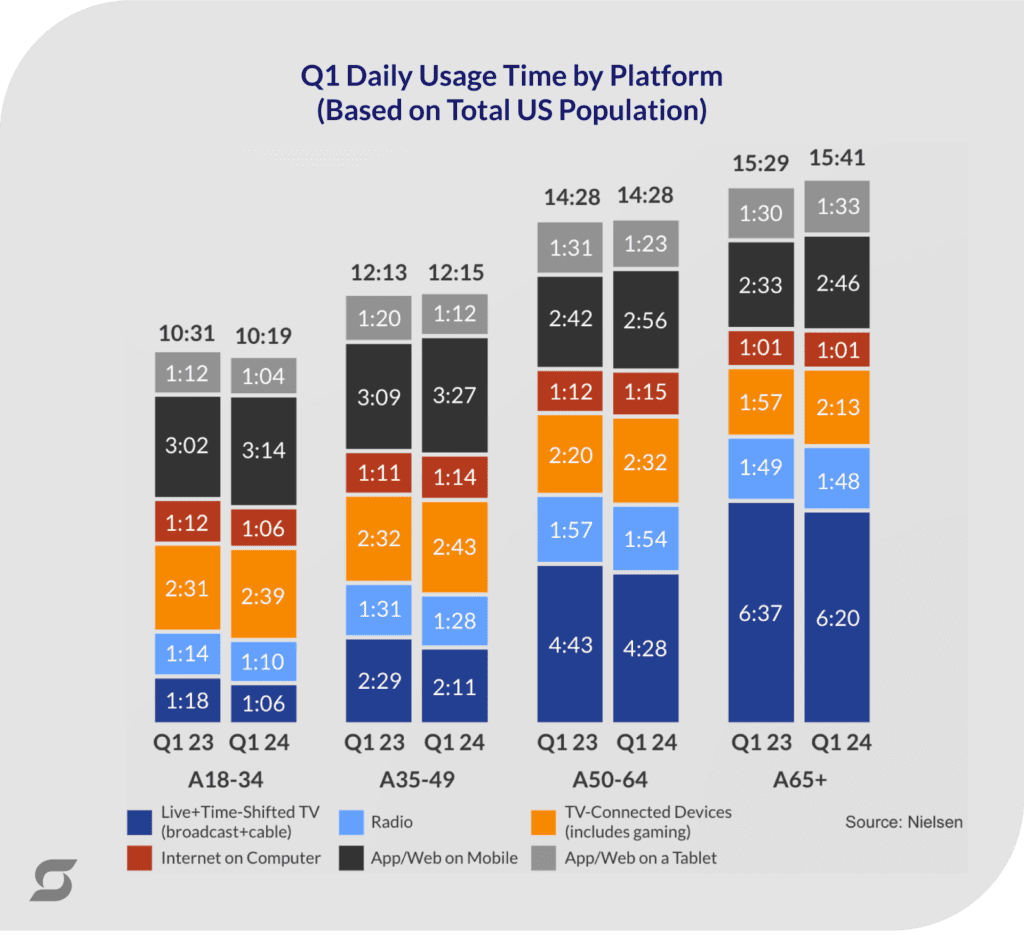

2025 witnessed gaming becoming a primary optimization focus for television manufacturers, driven by the console generation (PlayStation 5, Xbox Series X/S) now established in millions of homes and PC gaming remaining strong. Variable refresh rate (VRR) technology, which adjusts screen refresh rate to match the frame rate output by gaming devices, reduces visual artifacts and provides smoother perceived motion.

OLED's fundamental characteristics make it exceptionally well-suited for gaming: minimal input lag (the time between controller input and on-screen response), superior contrast enabling visibility in dark game environments, and the pixel-level color control enabling rich, vibrant gaming visuals. 2025 OLED TVs featured input lag measurements of 1-3 milliseconds in gaming modes—competitive with gaming monitors while providing the large-screen immersive experience that monitors cannot match.

Mini-LED TVs from TCL and Hisense incorporated gaming-specific features: 144 Hz refresh rate support (doubling the traditional 60 Hz television standard), variable refresh rate compliance with gaming console specifications, and reduced input lag through processor optimization. These features enable smoother gaming experiences comparable to traditional gaming monitors but at television-like form factors and prices.

The gaming optimization trend benefited both OLED and Mini-LED manufacturers, as gamers' performance priorities aligned with what these technologies delivered well: rapid response, smooth motion, and low input lag. Traditional edge-lit LED technology, by contrast, struggled to meet gaming performance requirements, further pressuring manufacturers still committed to that aging architecture.

120 Hz and Beyond: Diminishing Practical Returns

2025 brought increased availability of 120 Hz display refresh rates in TVs, promising smoother motion in content and gaming. While 120 Hz provides genuine improvements over 60 Hz for certain content types (sports broadcasts with high motion, fast-paced gaming), practical benefits diminish beyond this threshold.

Streaming content delivers at 24 Hz (cinema film standard), 30 Hz, or 60 Hz. Broadcast television globally uses either 50 Hz or 60 Hz standards. Gaming consoles output at 60 Hz or 120 Hz depending on game and console capability. True 240 Hz, 360 Hz, or higher refresh rates require source content matching those framerates—virtually nonexistent in consumer entertainment except specialized gaming scenarios.

Manufacturers address this through interpolation, inserting artificial frames between native frames to simulate higher framerates. This "Tru Motion," "Motion Flow," or whatever marketing name manufacturers use, sometimes improves perception of smooth motion but also risks introducing artifacts in certain content. Professional content creators sometimes disable interpolation to preserve original cinematography intent.

For consumers, 120 Hz capability represents a worthwhile specification for gaming and high-motion content, but diminishing returns beyond that threshold make extreme refresh rate specifications marketing-driven rather than performance-driven.

Software, Smart TV Platforms, and Long-Term Value

Operating System Fragmentation and Support Sustainability

2025 revealed concerning fragmentation in smart TV operating systems. LG's webOS, Samsung's Tizen, Sony's Google TV, Hisense's VIDAA, and TCL's Google TV represented incompatible ecosystems with varying feature sets, app availability, and update support.

Software maturity and longevity increasingly determine television satisfaction beyond the first 2-3 years of ownership. A TV that receives regular software updates, maintains app compatibility, and introduces new features aging gracefully delivers better long-term value than hardware that becomes obsolete after manufacturers cease support. Yet many manufacturers provided unclear timelines for update support—some committing to 4-5 years of regular updates while others offered minimal guarantees.

Google TV adoption by multiple manufacturers (Sony, TCL, Hisense partnerships) offered potential standardization benefits, leveraging Google's ongoing development and broad app ecosystem. However, manufacturers still implemented proprietary customizations and processing layers that sometimes contradicted Google's design philosophy, reducing standardization benefits.

LG's webOS maintained superior integration between hardware and software optimization—webOS developers could optimize precisely for LG's panel technology, processing capabilities, and hardware architecture. This tight integration enabled superior performance but locked consumers into LG's ecosystem, limiting upgrade optionality.

The fragmentation trend poses risks for consumers: software support termination could render features obsolete, app compatibility might break over time, and proprietary ecosystems prevent easy device replacement without losing integration benefits. This emerging concern should influence purchase decisions as much as hardware specifications—a TV's longevity depends as much on software support as display technology.

AI Processing and Upscaling Advancements

All major manufacturers incorporated AI-powered processing in 2025, using machine learning models to enhance image quality. These systems analyze incoming video signals and apply real-time adjustments: contrast optimization, color enhancement, motion interpolation, and upscaling from lower resolutions to native display resolution.

The quality of these implementations varied substantially. Premium implementations from Samsung, Sony, and LG incorporated proprietary AI models trained on vast content libraries, optimizing for natural enhancement without obvious artifacts. Budget implementations sometimes applied generic filters that either made imperceptible changes or introduced noticeable distortions.

AI-powered upscaling specifically showed promise in 2025. Rather than the simple interpolation of previous-generation upscalers, AI models trained on authentic high-resolution content could theoretically reconstruct detail more convincingly. In controlled tests, premium AI upscaling improved 1080p and 4K content apparent detail compared to non-AI upscaling. However, realistic expectations remained important—no upscaling fundamentally recovers information absent from source material.

The trend toward AI processing required computational power, necessitating more sophisticated chipsets and power consumption. Premium TVs in 2025 incorporated specialized AI processors, increasing cost but enabling real-time processing of intensive algorithms. This innovation proved most valuable for gaming (where low input lag requirements demand fast processing) and streaming content enhancement (where upscaling applies to all content without specialized source requirements).

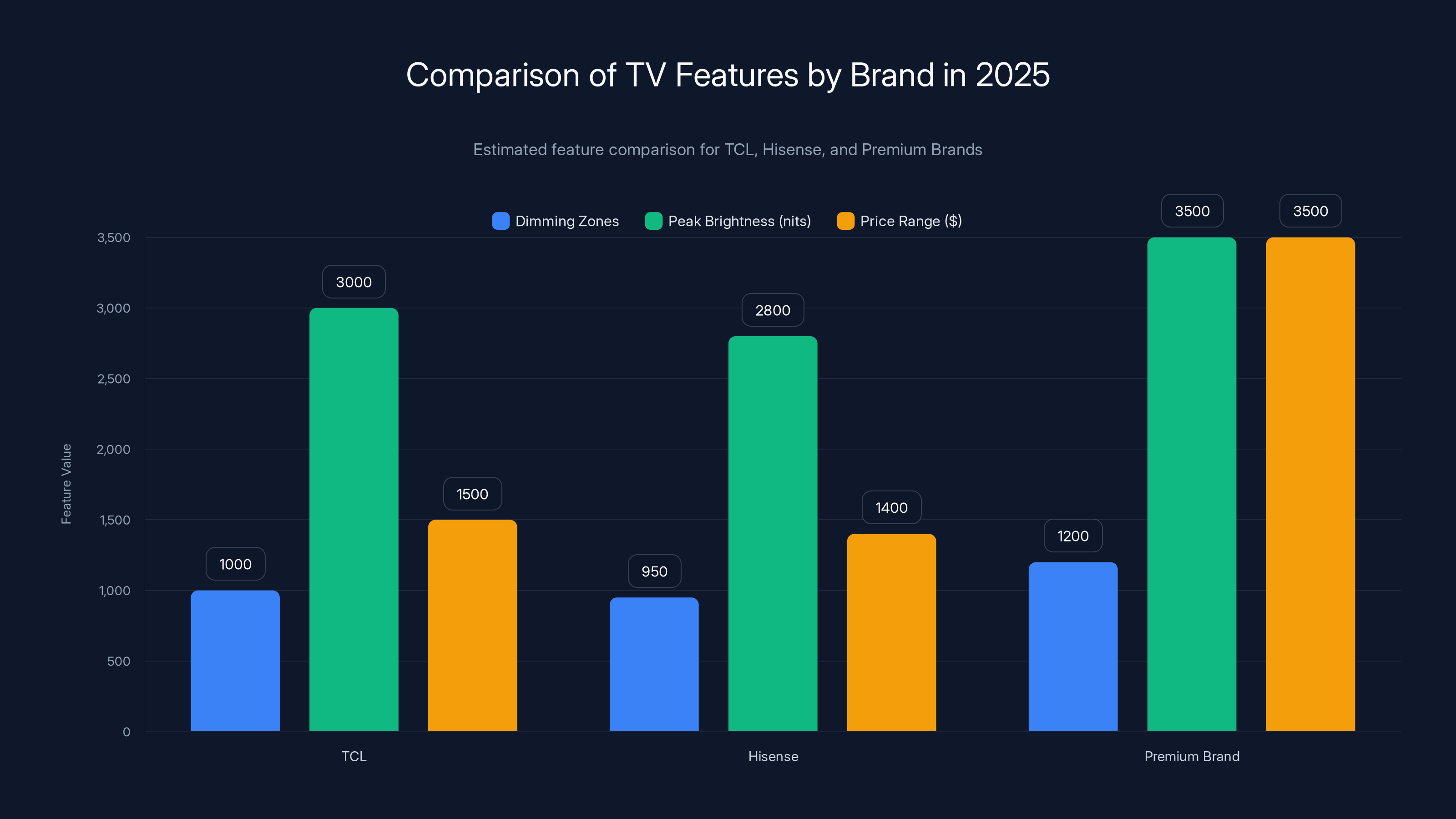

In 2025, TCL and Hisense offered competitive features like dimming zones and peak brightness at lower price points compared to premium brands. (Estimated data)

Content Format Evolution: HDR, Dolby Vision, and Standards Complexity

HDR Mainstream Adoption and Implementation Quality Variation

HDR (High Dynamic Range) adoption reached mainstream status in 2025, with major streaming platforms implementing HDR as standard for premium content tiers and almost all 4K content. HDR's expanded brightness range, color gamut, and tone mapping creates substantially more impactful visuals when properly implemented and viewed on capable displays.

However, HDR implementation quality varies dramatically across content sources, production pipelines, and display capabilities. Professional cinema HDR mastering (HDR10, Dolby Vision) creates stunning results when viewed on displays capable of reproducing the intended brightness and color space. Consumer-produced HDR (often poorly tone-mapped for streaming delivery, optimized for various display capabilities) sometimes produces unintended results—either washed-out brightness or excessive local contrast.

Displays must meet minimum specifications to properly render HDR: peak brightness sufficient to show intended highlights, color gamut wide enough to reproduce intended colors, and tone-mapping processing sophisticated enough to adapt HDR content to the display's capabilities. A 2025 budget TV claiming HDR support but capable of only 400 nits peak brightness will display HDR content significantly darker than intended. Premium displays with optimized tone-mapping and sufficient brightness deliver the dramatic visual improvements that made HDR adoption worthwhile.

This quality variation creates purchasing confusion: all 2025 TVs claim HDR support, but meaningful performance variation exists between entry-level and premium implementations. Testing HDR content on display units before purchase provides essential perspective on what HDR actually delivers for specific display capabilities.

Dolby Vision vs. HDR10: Practical Differences and Content Availability

Dolby Vision, the proprietary HDR format developed and licensed by Dolby Laboratories, provides dynamic metadata that allows per-shot tone-mapping adjustments. Rather than assuming fixed tone-mapping throughout a video file, Dolby Vision embeds instructions with each shot specifying desired brightness, contrast, and color characteristics. This approach theoretically enables superior results across diverse display capabilities.

HDR10, the industry-standard open HDR format, uses static metadata and relies on displays' built-in tone-mapping algorithms to optimize for display capabilities. This approach requires less metadata overhead but provides less control over final visual presentation.

In practice, the differences matter less than marketing suggests. Content producers creating professional cinema content (theatrical releases, high-budget streaming originals) implement both Dolby Vision and HDR10, with Dolby Vision mastering performed by colorists optimizing for the dynamic metadata system. Consumer streaming platforms including Disney+, Apple TV+, and Netflix deploy Dolby Vision for qualifying content.

However, Dolby Vision adoption remains inconsistent. Some streaming platforms (YouTube, many free ad-supported services) lack Dolby Vision support. Gaming consoles (PlayStation 5, Xbox Series X) support HDR10 but not Dolby Vision, making Dolby Vision irrelevant for gaming applications. The licensing costs for Dolby Vision support deterred some manufacturers, particularly in budget segments.

For consumers, Dolby Vision represents a nice-to-have feature but not essential. HDR10 support is mandatory for modern TV purchases. Dolby Vision support adds marginal value primarily for consumers heavily using Apple TV+ and Disney+ content on capable displays. For everyone else, the practical differences prove minimal.

Budget and Value Alternatives: The Rise of Non-Premium Options

TCL and Hisense's Value Proposition Evolution

Value-brand television quality improved dramatically in 2025, driven by commoditization of display technology, improved Chinese manufacturing excellence, and vertical integration enabling cost reduction. TCL's 2025 Mini-LED TVs competing at

Hisense similarly advanced, combining Mini-LED technology with aggressive feature sets and competitive pricing. The company's partnerships with sports leagues and streaming services integrated native optimizations, benefiting viewers prioritizing live sports and entertainment.

These manufacturers' success stemmed from ruthless cost engineering: simplified designs eliminating unnecessary features, efficient manufacturing processes, supply chain optimization, and direct-to-consumer sales channels reducing distribution costs. A TCL Mini-LED TV cost substantially less than competitive OLED models not because OLED technology proves inherently expensive, but because OLED pricing reflected brand positioning, perceived prestige, and lower production volumes commanding higher margins.

Value-brand improvements forced premium manufacturers to justify pricing through superior performance measurable in real-world conditions. This competitive pressure benefited consumers as the performance floor for affordable TVs rose substantially, reducing the risk of disappointing budget purchases.

What Value Brands Sacrifice for Lower Prices

Value manufacturers achieved cost reduction partly through eliminating features beyond core display performance. Many budget 2025 TVs sacrificed: premium audio systems (budget models incorporate basic internal speakers), comprehensive smart TV ecosystems (limited app selection compared to premium platforms), software update support duration (3 years versus 5+ for premium brands), build quality and materials, warranty coverage, and customer service responsiveness.

These tradeoffs prove meaningful in long-term ownership. A budget TV delivering excellent picture quality for 3-4 years might frustrate viewers when software support ceases and critical apps stop functioning. Premium devices with 5-year software support extend usable life significantly. Build quality differences appear in reliability rates: value TVs typically show higher failure rates after 5-7 years than premium models with superior component quality and thermal management.

For consumers viewing TVs as 2-3 year devices before upgrade, value-brand options represent exceptional propositions. For those expecting 7-10 year ownership (increasingly common as replacement cycles lengthen), premium models' superior durability and software support justify higher prices through extended lifespan and reduced frustration.

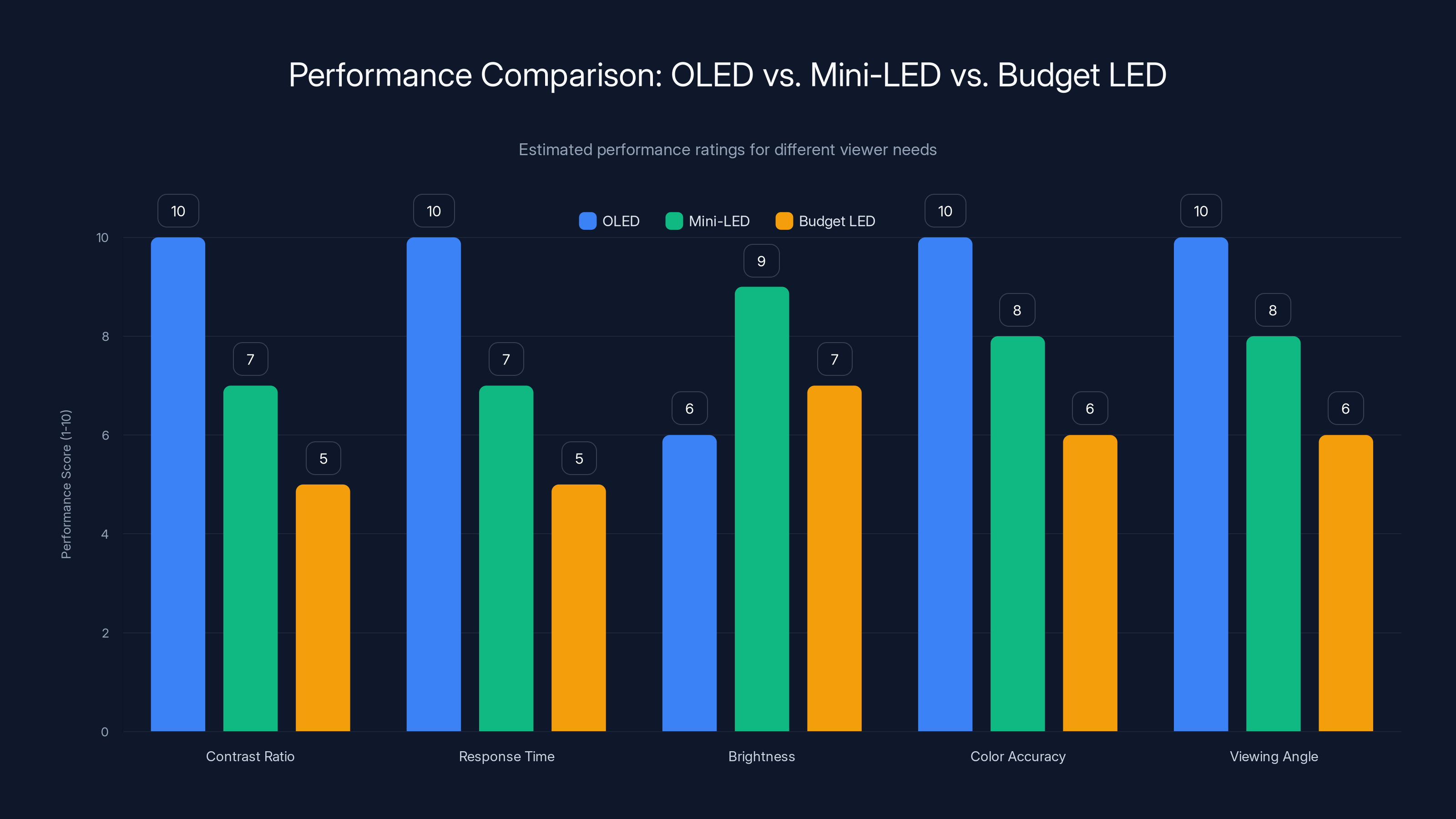

OLED excels in contrast, response time, and color accuracy, making it ideal for premium viewers. Mini-LED offers strong brightness and value, while Budget LED provides basic performance at a lower cost. Estimated data.

Professional and Specialized Applications: When Premium Makes Sense

Color-Critical Work and Content Creation

Content creators, photographers, and cinematographers require displays with exceptional color accuracy, gamut coverage, and calibration capabilities. 2025 developments in this space included improved calibration tools, expanded color gamut options, and processor sophistication enabling real-time adjustment.

Sony's BRAVIA Professional Display line and Panasonic's remaining professional displays (in markets where offered) represented category leaders. These monitors prioritize color accuracy and stability over brightness and size, incorporating specialized features: modular designs enabling quick reference monitoring, embedded measurement tools, and professional-grade color management integration.

For casual content creators and photographers, 2025 premium consumer TVs from LG, Samsung, and Sony offered "creator mode" optimizations: expanded color gamut, accurate grayscale, minimal processing, and reference mode constraints. While not approaching professional monitor accuracy, these implementations enabled meaningful creative work on consumer displays.

The practical distinction mattered: a filmmaker editing on a professional broadcast monitor receives guaranteed color accuracy across viewing sessions and devices. A content creator using a premium consumer TV with color management might achieve reasonable accuracy if properly calibrated but faces inconsistencies across devices and viewing conditions. This reliability tradeoff explains why professional production facilities invest in dedicated monitoring rather than consumer displays.

Large-Scale Deployment and Commercial Applications

Retail locations, command centers, conference rooms, and public information displays deploy televisions at large scale, requiring different specifications than consumer living room viewing. Commercial deployments prioritize reliability, serviceability, brightness for varied lighting conditions, and extended warranty support.

Manufacturers developed commercial display lines specifically for these applications. LG's commercial displays, Samsung's outdoor-rated signage TVs, and specialized manufacturers like Panasonic focused on durability, serviceability, and deployment support rather than consumer features like streaming apps.

These specialized applications rarely influence consumer purchasing, but understanding their existence clarifies why consumer TVs sometimes prove suboptimal for commercial use—consumer designs optimize for home theater viewing rather than bright retail environments or reliability-critical control rooms. Deployments in these categories should source appropriate commercial products rather than adapting consumer TVs.

Future Trends: What Happens After 2025

Micro LED: The Next-Generation Display Technology

Micro LED technology, using arrays of microscopic light-emitting diodes, promises superior characteristics versus current options: pixel-level light emission like OLED with superior brightness like LED, wider color gamut, longer operational lifespan than OLED, and scalability to extreme sizes. Theoretical advantages are compelling.

However, practical barriers remain substantial. Manufacturing billions of microscopic LEDs with consistent performance and yield rates exceeds current capability. Cost projections for Micro LED displays approach or exceed OLED pricing currently, without the established supply chains and manufacturing volume. Color conversion challenges (pure red, green, and blue microscopic LEDs prove difficult to produce consistently) require solving.

Manufacturers including Samsung and Apple (in limited applications) deployed small Micro LED displays in specialized products, validating basic technology but highlighting manufacturing challenges. Consumer television availability likely remains 3-5 years away, with initial options occupying ultra-premium segments where marginal cost matters less.

Transparent and Flexible Displays

Laboratory demonstrations of transparent OLED and flexible OLED surfaces suggest future possibilities: displays embedded in windows, curved surfaces, and form factors impossible with traditional rigid displays. Samsung demonstrated bendable OLED displays in 2020s, with manufacturing gradually scaling toward consumer viability.

However, practical consumer applications for transparent or flexible displays in television remain unclear. Most viewers prefer focused viewing on purpose-built screens rather than displays integrated into other surfaces. Manufacturing complexity, durability concerns (flexible displays must survive countless flex cycles), and cost barriers positioned these technologies for future rather than near-term consumer adoption.

AI Integration and Autonomous Content Optimization

AI processing will advance beyond current upscaling and image enhancement toward more autonomous optimization. Future systems might analyze viewer preferences, viewing history, and content characteristics to autonomously adjust settings—brightness based on time of day and content type, color profiles optimized for specific genres, motion handling adjusted for viewer preference.

This trajectory risks over-automation if not carefully managed. Content creators make intentional visual decisions that AI systems shouldn't override without explicit user approval. Future development requires balancing improvement potential against respecting creative intent.

Mini-LED displays offer superior brightness and reliability compared to OLED, but OLED excels in contrast and viewing angles. Estimated data for 2025.

Viewing Distance and Screen Size Considerations

Calculating Ideal Screen Sizes Based on Resolution and Distance

The relationship between screen size, viewing distance, and resolution determines whether viewers perceive individual pixels (limiting perceived quality) or whether resolution sufficiently exceeds human visual acuity, providing a seamless image. The calculation involves relatively simple geometry.

Human vision resolves approximately 1 arc-minute of visual angle under ideal conditions—roughly 1/60th of a degree. For a 65-inch 4K television viewed from 8 feet away, the pixel density results in approximately 38 pixels per degree of visual angle, well exceeding human acuity. At this viewing distance and resolution, pixels become imperceptible, and the display provides a seamless image.

For 8K displays, this calculation becomes more complex. A 65-inch 8K display viewed from the same 8 feet provides approximately 76 pixels per degree—exceeding human acuity by roughly 2x, providing no perceivable advantage versus 4K. However, an 85-inch 8K display at the same distance provides roughly 100 pixels per degree, where the extreme pixel density might provide marginal benefits in peripheral vision (where acuity decreases) or for viewers with exceptional eyesight.

These calculations suggest that for typical living room distances (6-10 feet), 4K resolution on 65-75 inch screens hits the "sweet spot" where resolution exceeds human perception limits while avoiding excessive display size. 8K provides marginal benefits only on very large displays (85+ inches) at standard viewing distances, or smaller displays viewed from very close distance.

Room-Specific Considerations and Placement Optimization

Room characteristics profoundly influence television performance: ambient lighting, wall colors and reflectivity, seating arrangements, and acoustic properties interact with display technology to determine real-world results. An OLED TV in a bright living room with north-facing windows might struggle, whereas the same TV in a dark home theater performs exceptionally.

Room calibration—optimizing display settings for specific environmental conditions—improves performance substantially. Adjusting brightness and contrast for ambient lighting, reducing blue light emission in dark viewing environments, and optimizing color temperature for the room's lighting color all contribute to optimal performance.

These considerations often receive insufficient attention during purchasing, despite significant impact on satisfaction. Testing displays in-home (using liberal return policies) before committing reveals how technology performs in your specific environment, avoiding expensive mistakes from showroom testing in artificial conditions.

Sustainability and Environmental Considerations

Manufacturing Impact and Supply Chain Concerns

Television manufacturing involves resource-intensive processes: mining rare earth elements for displays and electronics, manufacturing of specialized materials, energy consumption during production, and packaging and transportation. Manufacturing a single television generates approximately 40-80 kg of CO2 equivalent depending on size, technology, and production location.

OLED manufacturing specifically requires specialized materials and processes, increasing manufacturing energy consumption versus traditional LED displays. Simultaneously, OLED's superior efficiency in actual use (no backlight, pixel-level light control) reduces power consumption during operation. The manufacturing-versus-use tradeoff results in roughly equivalent lifetime carbon footprints between OLED and efficient Mini-LED displays when accounting for full lifecycles.

Manufacturer sustainability commitments increased in 2025, with some producers committing to renewable energy manufacturing, recycled materials in packaging, and reduced toxic substance use. However, enforcing these commitments across global supply chains remains challenging, with transparency limited for consumers attempting to make environmentally responsible choices.

E-Waste and Recycling Infrastructure

OLD televisions frequently end up in landfills, where toxic materials (mercury in CCFL backlights, rare earth elements, heavy metals) contaminate soil and water. Electronics recycling infrastructure exists in developed nations but remains inadequate for the volume of discarded televisions, with many recycling facilities lacking capabilities to recover valuable materials.

Purchasing decisions influence downstream e-waste: selecting durable, long-lifespan TVs reduces replacement frequency and overall waste generation. Supporting manufacturers implementing take-back programs and responsible recycling encourages broader infrastructure development. Understanding local e-waste regulations and recycling options enables responsible end-of-life device management.

Longer device lifespans reduce environmental impact dramatically—keeping a TV for 8 years rather than replacing every 4-5 years cuts manufacturing-related environmental impact by half. This sustainability consideration reinforces recommendations toward premium, durable products for consumers able to afford them: superior longevity justifies higher cost through reduced environmental footprint and landfill impact.

Comparison: OLED vs. Mini-LED vs. Budget LED for Different Viewers

The OLED Case: When Premium Investment Makes Sense

Ideal OLED Customers:

- Home theater enthusiasts prioritizing image quality above all other factors

- Viewers in controlled lighting environments enabling OLED brightness to excel

- Gamers requiring rapid response times and minimal input lag

- Movie enthusiasts wanting best possible contrast and black level performance

- Long-term owners planning 8+ years of ownership, justifying higher upfront cost

- Consumers with budgets allowing 3,500+ for 65-75 inch models

OLED Performance Profile:

- Exceptional contrast ratios and black level performance

- Rapid response times and low input lag (1-3ms)

- Wide viewing angles with minimal color shift

- Excellent color accuracy and saturation

- Superior performance in dark viewing environments

- Adequate brightness for typical room lighting (struggles in very bright environments)

- Premium pricing but long operational lifespan

The Mini-LED Alternative: Value-Conscious Performance

Ideal Mini-LED Customers:

- Budget-conscious buyers wanting significant quality without OLED premiums

- Viewers in bright environments (outdoor patios, bright living rooms)

- Sports enthusiasts prioritizing brightness for vivid image impact

- Gaming-focused players on tighter budgets (Mini-LED gaming TVs offer solid performance at lower cost)

- Content creators wanting color gamut without OLED investment

- Viewers replacing TVs within 5-year timeframes

- Buyers prioritizing reliability and proven technology over cutting-edge innovation

Mini-LED Performance Profile:

- Good contrast ratios (500:1 to 5,000:1 depending on zone count) without OLED levels

- Slower response times than OLED (12-20ms) but adequate for most purposes

- Excellent sustained brightness (often exceeding OLED)

- Wide color gamut with quantum dot enhancement

- Superior brightness for bright environments

- Thicker/heavier than OLED due to backlight layer

- Moderate pricing with strong value proposition

- Proven reliability and manufacturing maturity

Budget LED: The Careful Entry

Ideal Budget Customers:

- First-time TV buyers establishing initial quality baseline

- Temporary solutions (dorm rooms, apartments with planned moves)

- Secondary TVs for bedrooms or recreation rooms (where premium performance less critical)

- Viewers with strict 800 budgets unable to save for better options

- Casual viewers with low expectations for image quality

- Buyers planning replacement within 3-4 years

Budget LED Performance Profile:

- Poor contrast ratios due to edge lighting or basic backlighting

- Adequate brightness for typical use

- Limited color gamut, sometimes appearing unsaturated

- Basic smart TV platforms with occasional app compatibility issues

- High failure rates after 4-5 years of ownership

- Minimal software update support (often ceases after 2-3 years)

- Entry-level customer support and warranty coverage

- Significantly lower cost but substantial limitations in longevity and performance

Selecting Your Ideal TV: A Decision Framework

Step One: Establish Budget Parameters

Determine maximum spending capacity, accounting for: screen size desired, technology preference, extended warranty options, and installation/mounting costs. This establishes your primary constraint, immediately eliminating options outside your range. Be realistic—most consumers underestimate total television costs when accounting for full setup.

Step Two: Assess Room Characteristics

Evaluate your viewing environment: ambient lighting levels throughout the day, room dimensions, viewing distances from primary seating, and content priorities. A room with significant ambient light demands higher brightness than dark home theaters. Viewing distance determines appropriate screen size. Content preferences (movies, sports, gaming, general viewing) influence technology priority.

Step Three: Identify Critical Performance Factors

Rank performance characteristics by importance: contrast, brightness, color accuracy, response time, smart TV platform quality, and design aesthetics. Different viewers weight these factors differently—gamers prioritize response time, sports viewers prioritize brightness, movie enthusiasts prioritize contrast. No single TV excels at everything; strategic tradeoffs prove essential.

Step Four: Evaluate Longevity and Support Factors

Investigate software update commitment, warranty coverage, manufacturer reputation for long-term support, build quality indicators, and common reliability issues. TVs purchased with expectation of 5-10 year ownership require more careful evaluation than short-term purchases. Extended warranty options provide valuable insurance for expensive purchases.

Step Five: Research and Test

Read detailed professional reviews from multiple sources examining specific performance characteristics relevant to your priorities. Test options in-home when possible, viewing actual content in your specific environment before committing. Showroom testing under artificial lighting conditions often fails to accurately predict home performance.

Step Six: Decide and Purchase

Make your decision based on comprehensive evaluation rather than emotional appeal or marketing messaging. Verify warranty terms, return policies, and installation requirements before finalizing purchase. Document purchase details for warranty registration and future reference.

Looking Beyond Television: Alternative Display Solutions

Projector-Based Home Theater Systems

Projector systems offer advantages for specific applications: extremely large image sizes (120+ inches) impossible for conventional TVs, cinema-optimized presentation, minimal ambient light requirements, and creative installation flexibility. Quality projectors from manufacturers including Epson, Sony, JVC, and Optoma deliver exceptional performance for dedicated home theater spaces.

Projector disadvantages include: higher initial cost for quality systems, bulb replacement requirements and ongoing maintenance, ambient light sensitivity (dedicated dark rooms necessary), smaller peak brightness limiting usage in bright environments, and lack of integrated smart features (requiring separate media devices).

For consumers with dedicated home theater spaces (basements, media rooms) prioritizing extreme image size and cinema presentation, projector systems merit serious consideration as alternatives to television-based systems. For casual living room viewing, conventional TVs prove more practical.

Gaming-Specific Monitors for Console Gaming

PC gaming monitors optimized for performance (high refresh rates, low input lag, specialized gaming features) sometimes appeal to console gamers seeking gaming-optimized displays. However, modern televisions increasingly incorporate gaming features matching or exceeding monitor performance, making the monitor advantage less pronounced.

Monitor disadvantages for console gaming include: smaller screen sizes (typically 27-32 inches versus 55-75 inch TVs), higher per-inch cost, complex audio solutions (monitors lack quality speakers), and aesthetic factors (monitors appear less integrated into living spaces than televisions).

For dedicated console gamers in budget-limited situations, premium gaming monitors might offer better performance-per-dollar than televisions. For most viewers, televisions with gaming optimization provide better overall experience at lower cost.

Streaming Devices and Smart TV Interfaces

Separate streaming devices (Apple TV, Roku, Fire TV, NVIDIA Shield) connected to dumb displays sometimes offered advantages when smart TV interfaces proved limiting or unreliable. However, 2025 developments in smart TV operating systems (especially Google TV adoption and webOS/Tizen improvements) reduced this advantage, as integrated smart TVs became increasingly capable.

Separate devices still offer benefits for consumers: flexibility to upgrade media devices without replacing displays, advanced features (sophisticated file serving, emulation, advanced codecs) exceeding built-in smart TV capabilities, and independence from manufacturer software support limitations.

For most consumers, integrated smart TVs prove convenient and adequate. For technically advanced users prioritizing maximum flexibility, separate streaming device systems provide alternative approaches worth considering.

Making Peace with Television Complexity

Television technology has become simultaneously more sophisticated and more complicated for consumers to evaluate. Understanding the ecosystem—knowing the differences between OLED and Mini-LED, recognizing when 8K promises prove hollow, evaluating true cost of ownership beyond initial purchase price—enables informed decisions aligned with actual needs.

The good news: quality options exist across price ranges. A budget TCL Mini-LED TV delivers genuine performance advantages versus a mediocre television from five years ago. A premium OLED television provides performance approaching theoretical limits of current technology. Mid-range options offer compelling value propositions for consumers balancing performance with budget constraints.

The essential practice: resist marketing pressure, evaluate honestly against your actual viewing environment and habits, and select technology matching your real needs rather than impressive specifications you won't utilize. These principles guide wise television purchasing across all price ranges and technology options.

FAQ

What is the practical difference between OLED and Mini-LED brightness in real-world viewing?

OLED TVs achieve higher peak brightness for small highlights (2,000-3,000 nits), but their sustained full-screen brightness remains lower (200-400 nits). Mini-LED TVs deliver lower peak brightness but higher sustained brightness across the full screen. In typical content mixing highlights with surrounding elements, the practical difference depends on content type—HDR movies show OLED advantages for impact, while bright daytime scenes may appear brighter on Mini-LED. For most viewers in normal lighting, the functional difference proves subtle after initial purchases, with other factors like contrast and color accuracy providing more noticeable distinctions.

Why does 8K television continue to exist if content is unavailable?

8K televisions persist primarily through manufacturer investment in premium positioning and the psychological appeal of higher resolution numbers. Some consumers purchase based on specifications alone without understanding that virtually no consumer content exists in 8K. Additionally, some professional applications and early adopters support niche demand. However, realistic projections suggest 8K consumer adoption remains 10+ years away, making 8K purchases poor financial decisions for most consumers. Manufacturers maintain 8K offerings partly as aspirational products and partly hoping eventual content availability validates past R&D investments.

How do I know if my current TV is worth replacing with a 2025 model?

Replacement makes sense if your current TV lacks: HDR support (limiting modern content enjoyment), unreliable smart TV platform (app compatibility breaking regularly or support ceased), or fundamental performance issues (failing hardware, excessive backlight bleed, dead pixels). If your TV performs adequately for viewing habits, newer models offer incremental improvements unlikely justifying replacement cost. Monitor performance degradation—if brightness noticeably decreases, color accuracy shifts, or reliability issues emerge—these indicate replacement timing. Most consumers benefit from 5-8 year replacement cycles rather than aggressive upgrading, as technology improvements often prove marginal across consecutive generations.

What should I prioritize when choosing between budget and premium televisions?

For short-term ownership (3-4 years) or secondary viewing spaces, budget options deliver adequate performance if brand reputation and warranty terms seem acceptable. For primary living room viewing or long-term ownership (7+ years), premium options justify higher cost through superior durability, longer software support, and better reliability. Additionally, evaluate room characteristics—bright environments may warrant premium brightness regardless of budget because budget models typically sacrifice brightness for cost. Test viewing actual content in your specific environment rather than making judgments based on specifications alone.

How critical is gaming optimization for non-gaming viewers?

For consumers not planning gaming on their televisions, gaming features (120 Hz support, variable refresh rate, low input lag modes) provide no practical benefit and represent unnecessary cost increases. However, even casual consumers sometimes use gaming features incidentally—Netflix animations, video tutorials with rapid scene changes—where response time impacts perceived smoothness. For purely non-gaming viewers, prioritizing gaming features proves unnecessary, but it doesn't hurt inclusion if pricing allows.

What's the relationship between panel technology and smart TV operating system quality?

Panel technology (OLED, Mini-LED, LED) and smart TV software operate independently—excellent displays can pair with mediocre operating systems, and vice versa. A premium OLED TV using outdated, unstable software disappoints despite superior hardware. Evaluate both aspects separately when comparing models, rather than assuming premium display technology indicates quality across all dimensions. Research smart TV platform reputation, app availability, and manufacturer commitment to software updates as carefully as display specifications.

Should I invest in professional wall mounting installation, or handle mounting myself?

For most viewers, professional installation justifies cost through proper weight distribution, electrical integration, wire concealment, and optimal height/angle positioning. DIY installation risks improper weight bearing (potentially catastrophic if mounting hardware fails), suboptimal viewing position, messy wiring, and personal injury from heavy display handling. Installation costs typically run

How does color accuracy matter for casual viewers compared to content creators?

Casual viewers experience color primarily through psychological factors—if colors appear vivid and engaging, they perceive quality regardless of technical accuracy. Professional creators need calibrated accuracy enabling consistent results across multiple devices and viewing contexts. Budget televisions sometimes display oversaturated colors that appeal to casual viewers despite inaccuracy. For home theater viewing, accurate color proves less critical than perceived impact. For any content creation work, color accuracy becomes essential, justifying professional displays or careful calibration of premium consumer options.

What's the total cost of ownership for a television beyond the purchase price?

Calculate: purchase price + installation/mounting + extended warranty (optional,

How will television technology change after 2025?

Expect continued brightness improvements in OLED through materials science advances, gradual Micro LED commercialization for ultra-premium segments (3-5 years), increasingly sophisticated AI processing for upscaling and image enhancement, and potential transparent/flexible display applications in 5+ years. Content-side developments should include gradual 8K adoption in professional and specialized applications (but not mainstream consumer). Software convergence around Google TV and webOS for smart platform standardization. Sustainability improvements through manufacturing efficiency and material recovery. These changes will likely prove incremental rather than revolutionary for the next 3-5 years, suggesting that high-quality 2025 purchases will remain highly competitive with offerings through 2028-2030.

Conclusion: Making Your Television Decision with Confidence

The 2025 television market reflects technology maturation, where practical rather than speculative innovations drive the winners and losers. OLED ascendance reflects deserved success—genuine technical breakthroughs in brightness, manufacturing scale, and algorithmic optimization created displays justifying premium positioning. The technology's expansion beyond elite luxury segments into mainstream availability accelerates market transformation.

Simultaneously, Mini-LED and advanced LED technologies demonstrate that traditional LCD-based displays remain competitive when implemented thoughtfully. Manufacturers like TCL and Hisense proved that engineering excellence, cost optimization, and consumer-focused feature selection can deliver compelling value propositions without requiring cutting-edge panel technology. The competitive dynamics benefit consumers through meaningful choice across price ranges.

8K's continued struggle provides a valuable cautionary tale about technology disconnected from practical utility. Impressive specifications prove meaningless without supporting content ecosystems, real-world performance advantages, or adoption incentives. The 8K experience illustrates why consumers should evaluate televisions based on viewing habits, content sources, and room characteristics rather than aspirational specifications.

Smart TV platforms and software support increasingly influence long-term satisfaction as much as display technology. A gorgeous OLED television becomes frustrating if software support ceases, app compatibility breaks, and the operating system deteriorates. Purchasing decisions should weigh software track record and manufacturer support commitment equally with display specifications.

The practical purchasing advice remains consistent: establish realistic budgets, understand your viewing environment and priorities, test options in your specific context, and select based on alignment with actual needs rather than marketing hype. OLED makes genuine sense for home theater enthusiasts, well-lit gamers, and consumers seeking long-term, premium performance. Mini-LED provides excellent value for budget-conscious viewers and bright environments. Budget options suffice for temporary solutions or secondary spaces, provided brand reputation and warranty terms prove acceptable.

Television purchases often involve significant capital expenditure affecting daily entertainment quality for years. Taking time to evaluate options thoroughly, resisting emotional decision-making, and aligning choices with realistic long-term plans produces satisfaction far exceeding purchases driven by showroom enthusiasm or marketing persuasion.

The 2025 market offers genuinely excellent options across price ranges—unprecedented quality at every segment, from budget

With this comprehensive understanding of market dynamics, technology tradeoffs, and purchasing principles, you're positioned to make television decisions you'll be satisfied with for years to come—whether selecting an entry-level budget option, mid-range value proposition, or premium technology investment.

Key Takeaways

- OLED brightness improvements in 2025 represent genuine technical breakthroughs addressing historical limitations

- 8K television remains commercially irrelevant without supporting content ecosystem, making premium pricing unjustifiable for consumers

- Mini-LED technology delivers compelling value, with Chinese manufacturers challenging premium brand dominance

- Gaming optimization has become legitimate television differentiator, benefiting both OLED and Mini-LED implementations

- Smart TV software support and longevity increasingly influence satisfaction as much as display technology performance

- Optimal television purchasing requires evaluating actual viewing environment, habits, and content sources rather than specifications alone

- Total cost of ownership over 7-10 years often favors premium models despite higher initial purchase price

- Value-brand televisions from TCL and Hisense deliver genuine performance exceeding traditional expectations for budget options

- Quantum Dot enhancement and advanced color management technologies benefit diverse price segments

- Transparency about performance tradeoffs (peak vs. sustained brightness, viewing angles, ambient light performance) enables informed decisions

Related Articles

- Best PS Plus & Gift Card Deals for PS5 Pro [2025]

- Best After-Christmas TV Sales & Deals [2025]

- Best Distraction Blockers for Focus and Productivity [2025]

- PlayStation in 2025: Sony's Strategic Pause and What's Next [2025]

- How to Set Up a PS5 for a Child: Complete Parental Controls Guide [2025]

- RAM Upgrade Costs Are Rising: What You Need to Know [2025]