Ubisoft's Stunning Decision to Cancel Prince of Persia: What It Means for Gaming

When Ubisoft announced it was killing the Prince of Persia: The Sands of Time remake, the gaming community didn't exactly look shocked. They looked exhausted. This wasn't some surprise cancellation that came out of nowhere. It was the culmination of years of false starts, missed deadlines, and a company desperately trying to figure out what it actually wants to make.

But here's what makes this moment significant: it's not just about one failed remake. It's about Ubisoft fundamentally restructuring how it operates as a game publisher, and the Prince of Persia cancellation is just the visible tip of a much larger iceberg.

The company is closing studios, laying off employees, delaying seven games, and completely reorganizing its creative leadership around five new "Creative Houses." This isn't a minor adjustment. This is a company in transition, betting big on open-world games and live service titles while abandoning everything else.

So what went wrong with Prince of Persia? Why is Ubisoft making these drastic changes? And what does this mean for the future of the gaming industry? Let's dig into the details.

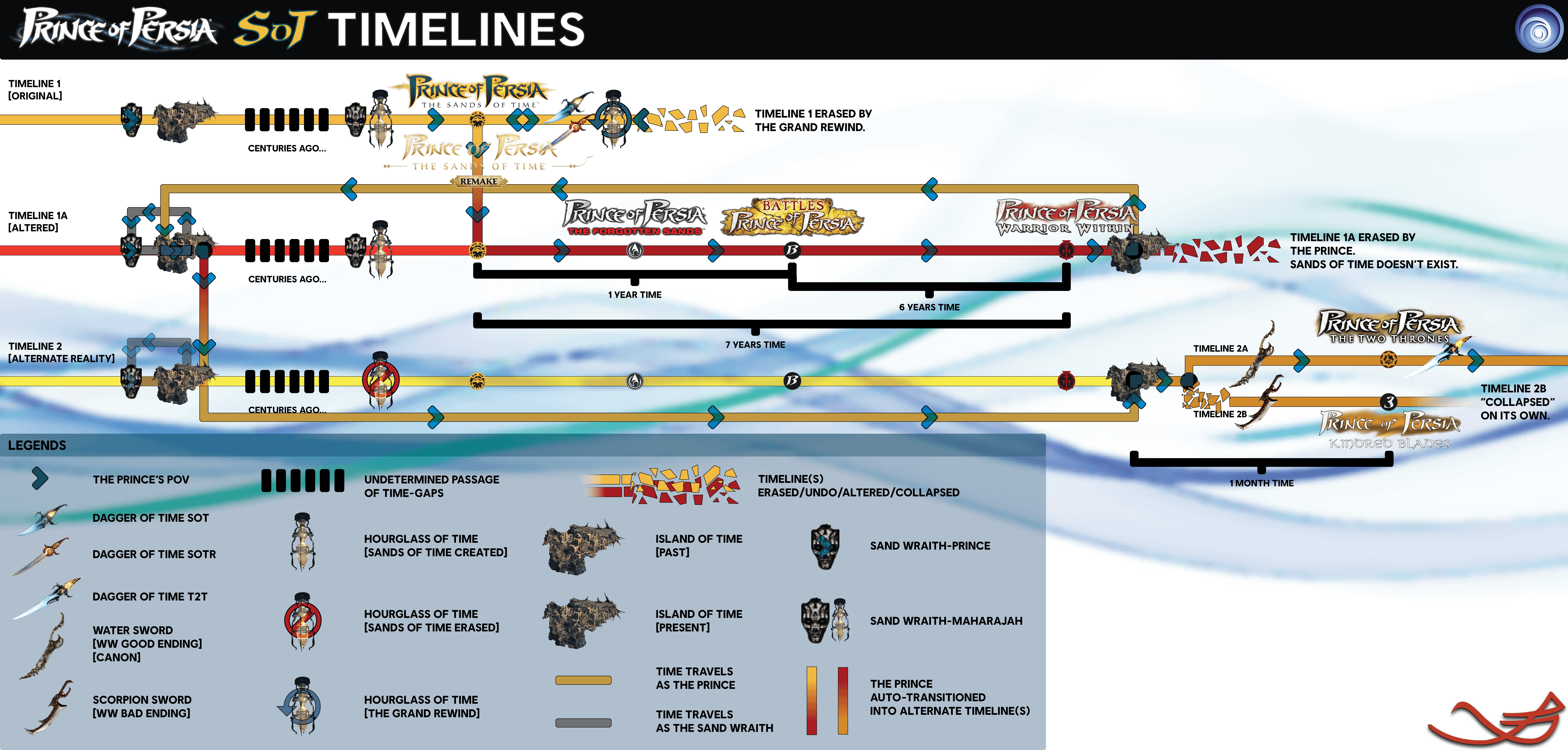

The Prince of Persia Remake: A Timeline of Failure

The Prince of Persia: The Sands of Time remake was announced back in 2021. That's right, 2021. We're now in 2025, and the game has nothing to show for those four years except a canceled development cycle and a lot of wasted resources.

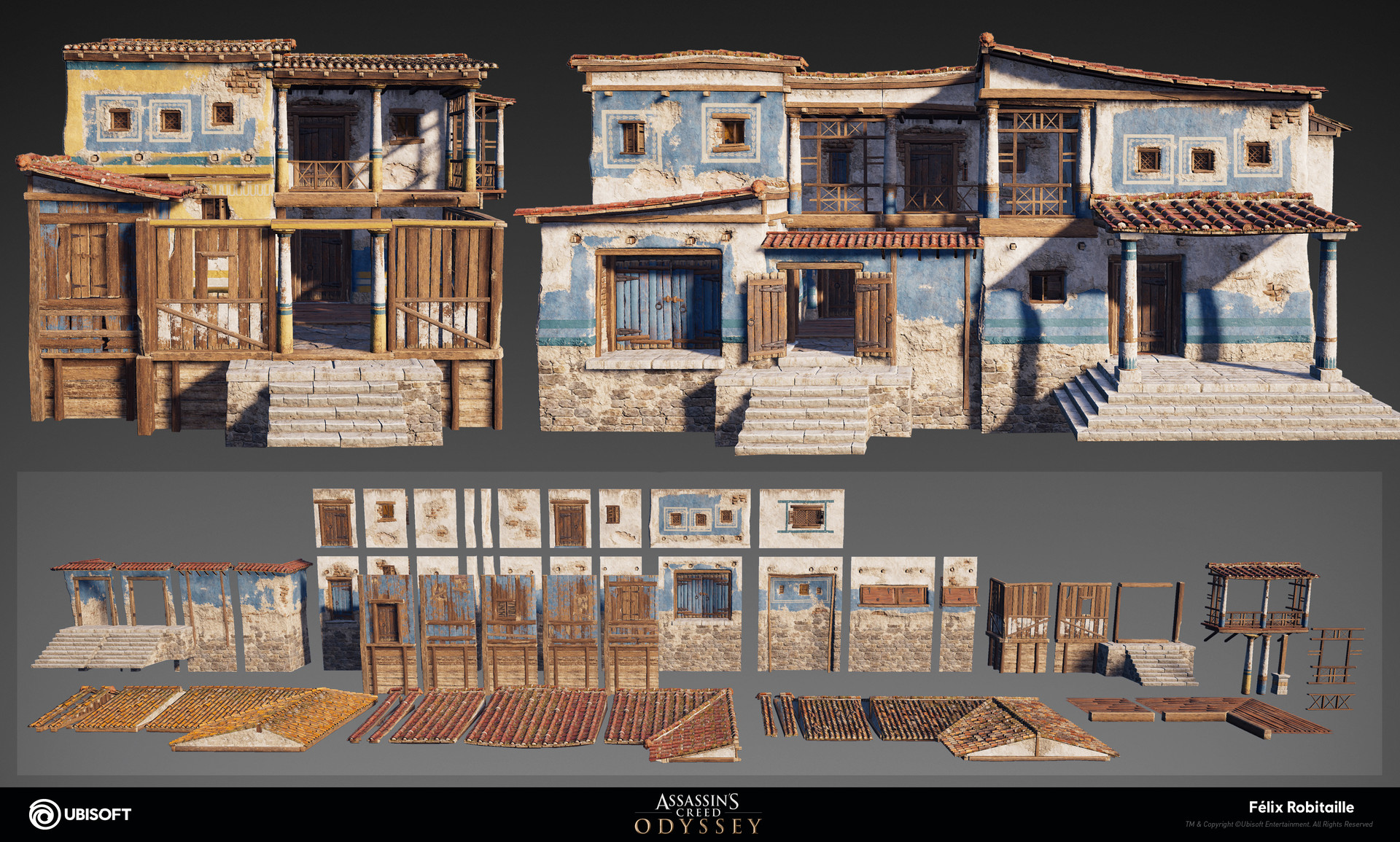

Ubisoft handed the remake to Ubisoft Montreal, the legendary studio behind the Assassin's Creed franchise. On paper, this made sense. Montreal had proven they could handle massive open-world projects with complex narratives. In practice, the project became a nightmare. Development dragged on. No substantial gameplay footage ever appeared. The company went silent about progress for months at a time.

In 2023, rumors started circulating that the remake had run into serious trouble. Then in 2024, Ubisoft admitted the game wasn't meeting internal expectations. The writing was on the wall. A remake of a beloved 2003 game needs to justify its existence, and by 2024, the Prince of Persia remake simply wasn't doing that.

The problem wasn't just management or a lack of direction. The fundamental issue was that Ubisoft had invested millions into a game that didn't fit neatly into the company's new strategic vision. Prince of Persia is a single-player, story-driven experience. Ubisoft's new strategy? Focus on games that generate continuous revenue through live service mechanics, seasonal content, and multiplayer experiences.

You can see the mismatch immediately. A traditionally-built Prince of Persia remake doesn't fit that model. It never did.

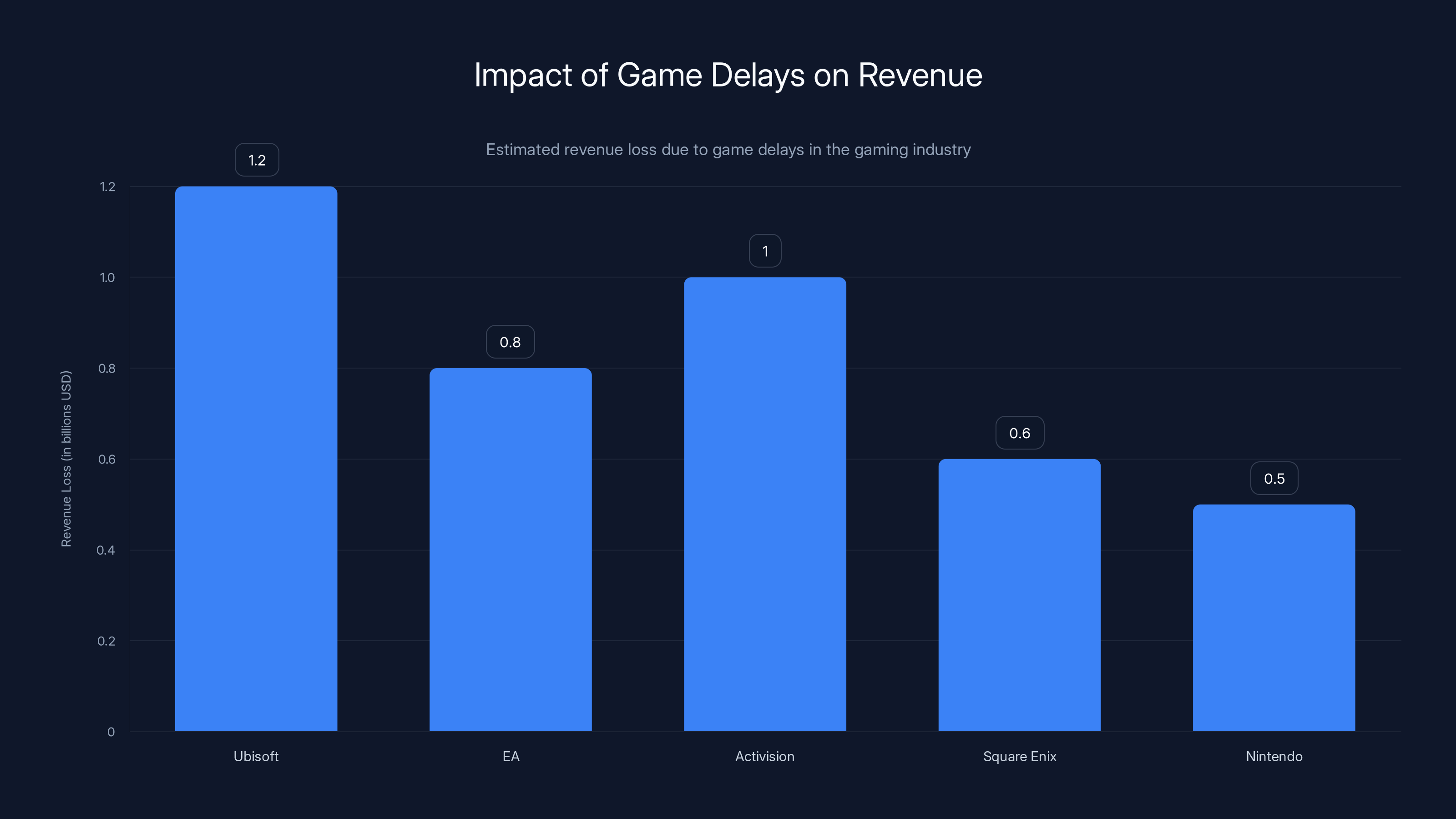

Game delays can significantly impact revenue, with Ubisoft potentially losing an estimated $1.2 billion due to delayed releases. Estimated data based on industry trends.

Understanding Ubisoft's New Creative House Model

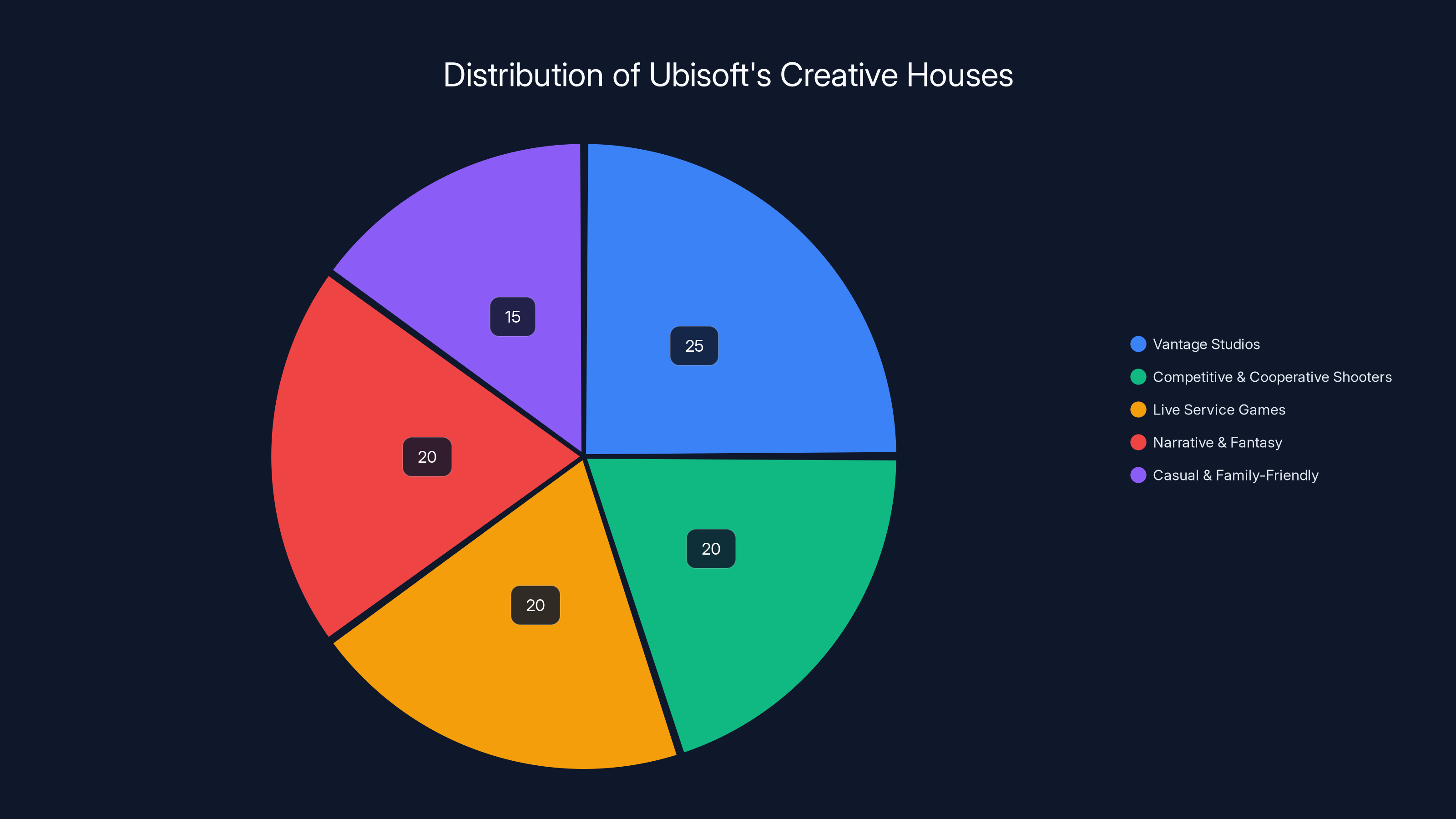

Let's talk about what Ubisoft is actually doing here, because the announcement was dense and easy to misunderstand. The company is reorganizing around five "Creative Houses," each with a different mandate and different franchises to manage.

Creative House 1 (Vantage Studios) focuses on scaling the biggest franchises into annual releases that generate billions in revenue. We're talking Assassin's Creed, Far Cry, and Rainbow Six. These are the franchises Ubisoft is willing to bet on aggressively.

Creative House 2 handles competitive and cooperative shooters. The Division, Ghost Recon, and Splinter Cell live here. This is Ubisoft's play in the multiplayer and esports space.

Creative House 3 manages live service games. For Honor, The Crew, Riders Republic, and Brawlhalla all fall into this category. If a game is designed to generate continuous engagement, it lives here.

Creative House 4 is the narrative and fantasy-focused house. Anno, Might & Magic, Rayman, Prince of Persia, and Beyond Good & Evil are under this umbrella. This is interesting because Prince of Persia is part of a house focused on "immersive fantasy worlds and narrative-driven universes." The irony is brutal: Ubisoft put Prince of Persia in this category but then canceled it anyway.

Creative House 5 handles casual and family-friendly games. Just Dance, Idle Miner Tycoon, and games from the Hasbro partnership live here. This is Ubisoft's attempt to reclaim the casual gaming market.

Each Creative House will be supported by a "Creative Network" that provides shared resources, development tools, and backend services. In theory, this creates efficiency. In practice, it's a massive corporate restructuring that requires significant time to execute properly.

The Six Games Ubisoft Canceled (And Why It Matters)

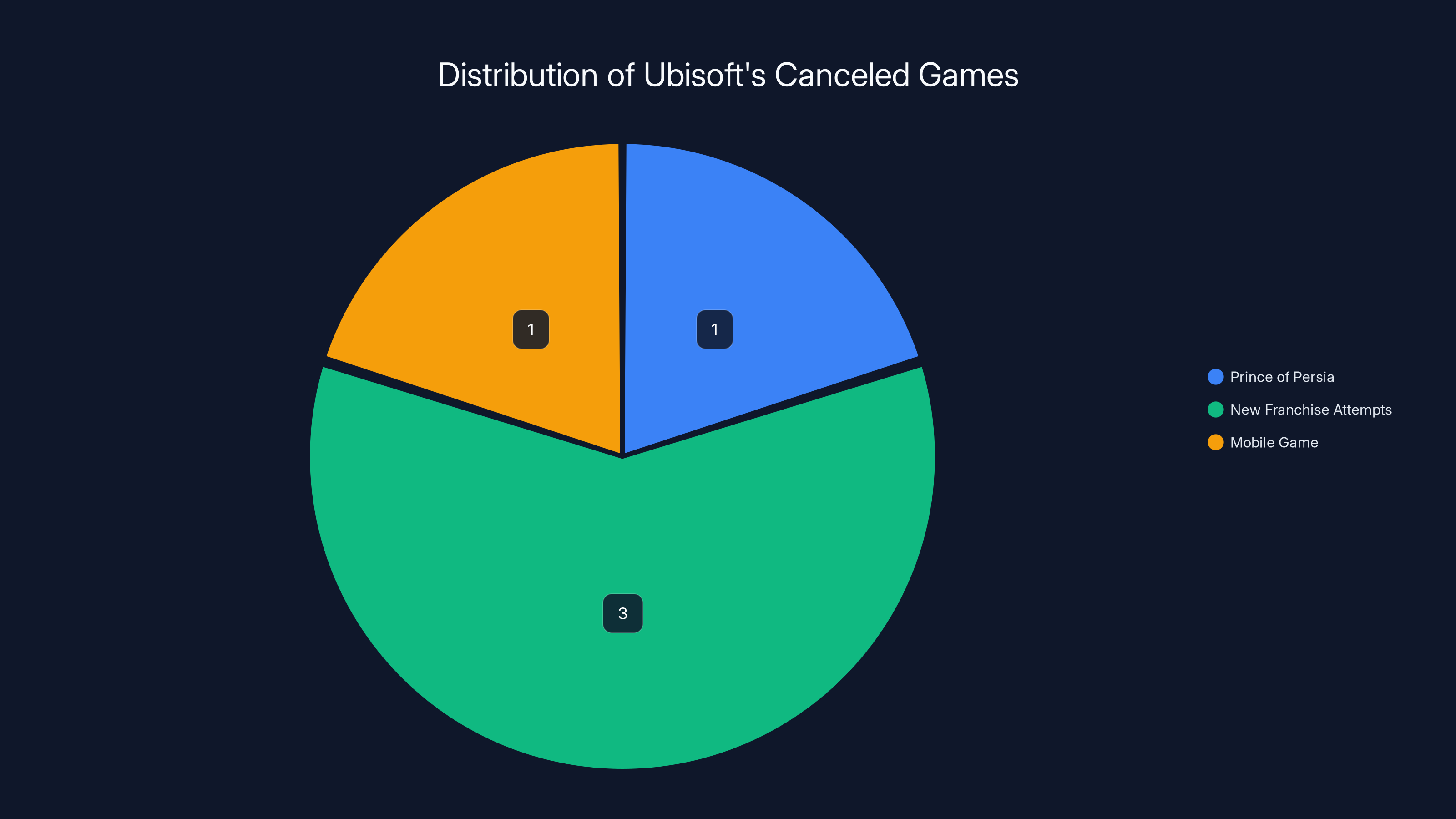

Prince of Persia is the headline casualty, but it's not alone. Ubisoft canceled six games total as part of this reorganization. Here's what we know:

Besides Prince of Persia, the company canceled four unannounced games. Three of these were new franchise attempts, and one was a mobile game. This tells you something important about Ubisoft's priorities: experimental and new intellectual property is being cut loose.

Why? Because new IPs are risky. They require massive investment, years of development, and they don't have an established audience. Ubisoft would rather double down on what works: Assassin's Creed, Far Cry, Rainbow Six. These franchises have loyal fanbases, proven monetization strategies, and clear paths to profitability.

The cancellations are brutal for developers. When you cancel six games, you're not just losing time and money. You're disrupting teams, fragmenting workforces, and sending a message to the industry that making new games at Ubisoft has become a lot riskier.

Each of Ubisoft's five Creative Houses manages a distinct category of games, ensuring a balanced focus across different gaming genres.

Seven Games Are Being Delayed: The Ripple Effects

Beyond cancellations, Ubisoft is delaying seven games. Some of these delays are pushing release dates from fiscal year 2026 into fiscal year 2027. That's a full year of missing revenue for some titles.

Ubisoft didn't announce which games are being delayed, but the timing matters. Game delays typically mean one of three things: the game needs more development time, the release schedule is too crowded, or corporate wants to spread out revenue projections across multiple quarters.

In this case, it's probably a combination of factors. A major reorganization creates chaos internally. Studios are being restructured. Leadership is changing. In that environment, delaying games makes sense. It gives teams time to adjust to new reporting structures and new creative direction.

But delays also cost money. Marketing campaigns need to shift. Retailers need different allocation. Other games scheduled around that release need to move. Each delay creates a domino effect that ripples through Ubisoft's entire portfolio.

Studio Closures and Restructuring: The Human Cost

This is where the Ubisoft reorganization gets real. The company closed its Halifax mobile studio completely. That's a studio being shuttered, which means people losing jobs.

Ubisoft also closed its Stockholm studio. For a company with a global presence, losing two physical locations sends a message about priorities. Mobile gaming and indie-style experiences are being deprioritized.

Beyond closures, the company is restructuring its Abu Dhabi studio, its Red Lynx studio (which makes Trials games), and its Massive Entertainment studio. Restructuring is corporate-speak for "things are changing and some positions won't survive."

The human impact here is significant. Game development is already a precarious industry with crunch culture, low pay relative to other tech sectors, and frequent layoffs. A restructuring of this scale at a company as large as Ubisoft affects hundreds of people. Some developers will be reassigned. Others will leave voluntarily. Some will be laid off.

It also affects the industry's reputation. When major publishers like Ubisoft make aggressive cuts, it sends a signal to the entire gaming industry. It tells smaller studios that downsizing is acceptable. It tells developers that their jobs are less secure than they thought. It affects the culture and stability of the entire ecosystem.

The Return-to-Office Mandate: Ubisoft's Culture Shift

Here's something that didn't get as much attention as it deserved: Ubisoft is requiring employees to return to the office five days per week. This is a significant change, especially for a company that had been more flexible with remote work.

The company is offering an annual allowance of work-from-home days, but the default is office-based. This is interesting from a corporate culture perspective. Remote work became standard during the pandemic, and many creative industries proved they could maintain productivity with distributed teams.

Ubisoft's decision to reverse this suggests management believes in-person collaboration is essential for the creative process. Whether that's true or just corporate preference is debatable. But the message is clear: Ubisoft wants its teams physically present, working together, every single day.

This also affects recruitment. Game developers in cities without Ubisoft offices will need to relocate. This makes Ubisoft less attractive as an employer compared to companies that allow remote work. In an industry already struggling with talent retention, this is another headwind.

Ubisoft's new model distributes focus across five Creative Houses, with Vantage Studios leading in scaling major franchises. Estimated data based on franchise focus.

Why Live Service and Open-World Games?

The thread running through Ubisoft's entire reorganization is obvious: the company wants to focus on games with recurring revenue. Live service games generate money through season passes, battle passes, cosmetics, and ongoing content updates. Open-world games create the space for these mechanics to thrive.

Look at the Creative House structure. The largest house (CH1) focuses on scaling the biggest franchises. Assassin's Creed, Far Cry, and Rainbow Six are all open-world games with live service components. Creative House 2 handles competitive shooters with multiplayer ecosystems. Creative House 3 explicitly focuses on live service games.

When you add it up, Ubisoft's five Creative Houses are really just repackagings of the same core philosophy: prioritize games that generate continuous engagement and continuous monetization.

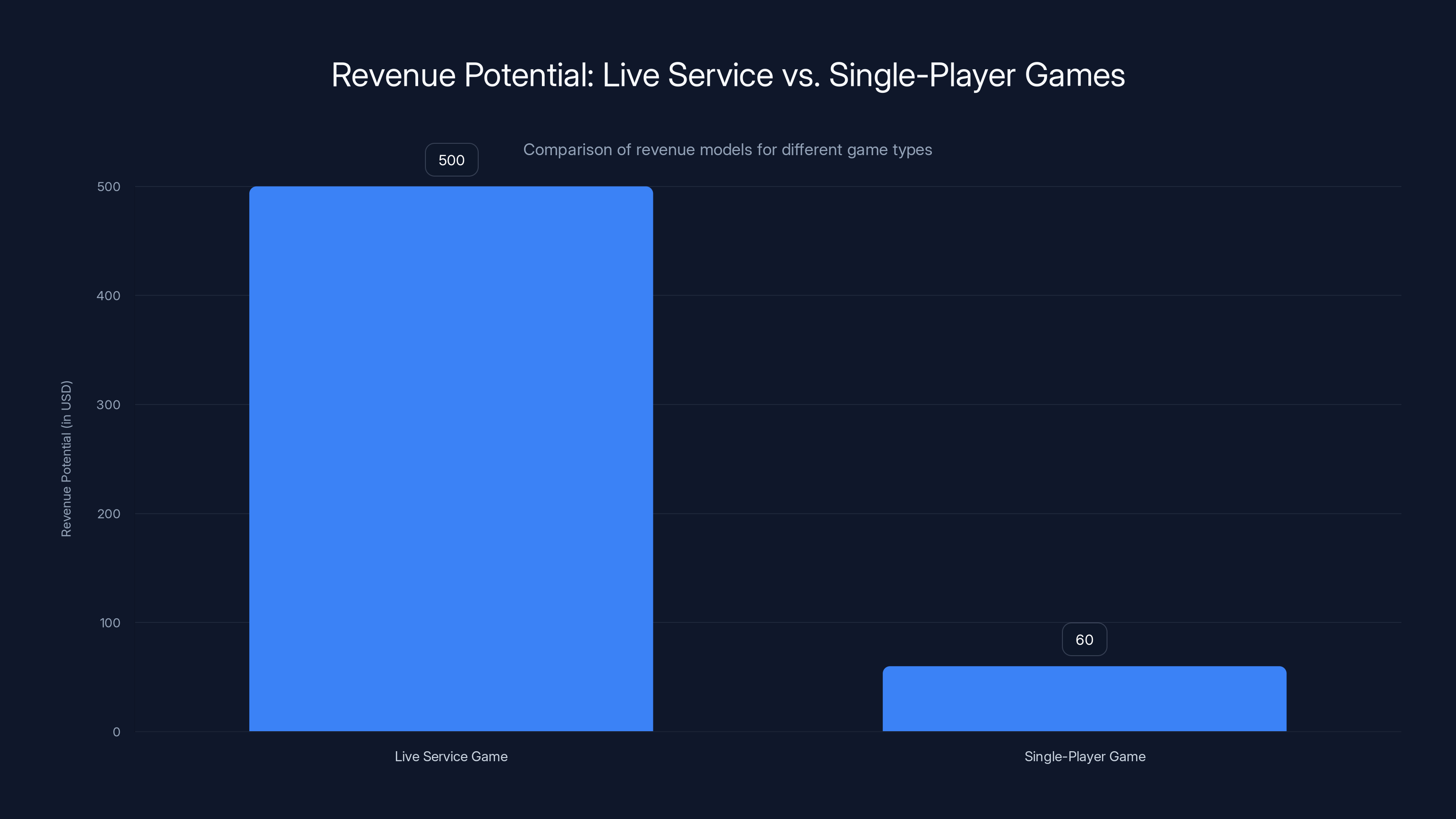

This strategy makes business sense from a revenue perspective. Live service games can generate more lifetime value than single-player experiences. A game you play for 200 hours and finish is worth less than a game you play for 20 hours a month for five years. The math works in favor of live service models.

But it also explains why single-player, narrative-driven games like the Prince of Persia remake get canceled. They don't fit the model. They require massive upfront investment, they have a defined ending, and they generate revenue once when players finish them. Then they're done.

A live service game, by contrast, keeps generating revenue indefinitely if it's engaging enough. That's what Ubisoft wants to build.

The Broader Gaming Industry Context

Ubisoft's reorganization doesn't happen in a vacuum. It reflects larger trends across the entire gaming industry. Every major publisher is chasing the same thing: recurring revenue models.

Electronic Arts abandoned single-player games years ago in favor of live service titles like Apex Legends and The Old Republic. Rockstar Games is milking Grand Theft Auto Online for every penny it can extract. Activision Blizzard has live service games embedded throughout its portfolio.

Even Microsoft, with its Game Pass subscription model, is thinking about recurring revenue. The entire industry has shifted toward monetization strategies that prioritize lifetime engagement over one-time purchases.

The consequence is that traditional, single-player, story-driven games are becoming less common. Publishers view them as riskier investments. They're harder to monetize. They require different approaches to design and business models.

Ubisoft's choices reflect this industry-wide trend. By canceling Prince of Persia and focusing on live service games, Ubisoft is just being explicit about what the entire industry is already doing.

What Happens to the Franchises Under Creative House 4?

Here's the uncomfortable reality: Creative House 4, which houses Prince of Persia, Might & Magic, Rayman, Anno, and Beyond Good & Evil, got a death sentence the moment it was created.

Creative House 4 is described as focusing on "immersive fantasy worlds and narrative-driven universes." That sounds nice until you remember that Ubisoft's strategic vision is focused on scaling franchises, driving live service engagement, and generating annual revenue.

Narrative-driven games don't generate annual revenue cycles. They can't be monetized the same way live service games can. They require traditional development cycles that don't fit neatly into Ubisoft's new structure.

Prince of Persia is just the first casualty. If Ubisoft doesn't figure out how to turn Creative House 4 franchises into live service experiences, more cancellations are probably coming.

Beyond Good & Evil has been in development hell for years. Anno is more of a niche management game. Might & Magic has a smaller audience. Rayman is the strongest brand in the house, but even that franchise has struggled in recent years.

Creative House 4 was probably created specifically to manage these legacy franchises while the company figures out what to do with them. The answer appears to be: cancel them or transform them into something that fits the live service model.

Live service games can generate significantly more revenue over time compared to single-player games due to ongoing monetization strategies. Estimated data.

The Amazon March of Giants Deal: What Changed?

Ubisoft is developing four new franchises, including March of Giants, a MOBA that Amazon originally developed before shutting down its gaming division.

This is fascinating because it shows how the gaming industry's consolidation affects development. Amazon invested in March of Giants, realized it didn't fit their strategy, and offloaded it to Ubisoft. Ubisoft is now taking a chance on it.

But here's what's interesting: Ubisoft is pursuing a MOBA, which is a live service game by nature. MOBAs generate revenue through cosmetics, seasonal passes, and battle passes. They're designed for continuous engagement. This fits perfectly into Ubisoft's new strategy.

Meanwhile, traditional single-player games are getting cut. The inverse is also true: Ubisoft is acquiring and developing live service titles even when they come from failed corporate initiatives elsewhere.

It's a clear signal about where the company's priorities lie.

Fiscal Impact: Understanding Ubisoft's Financial Pressure

Why is Ubisoft making these aggressive changes? The simple answer is financial pressure. Game development is expensive. Live service games are more expensive than ever to maintain. And Ubisoft's recent portfolio hasn't been performing as well as investors want.

Star Wars Outlaws underperformed expectations. Skull and Bones took years to develop and never lived up to hype. Avatar: Frontiers of Pandora sold okay but wasn't a blockbuster. Ubisoft needed to reduce costs and focus resources on proven franchises.

The reorganization is, in many ways, an admission that Ubisoft overextended itself. It tried to fund too many projects. Some of them failed. Now it's consolidating, cutting expenses, and doubling down on franchises that have proven track records.

From a business perspective, this is rational. From a creative perspective, it's limiting. But that's the tradeoff Ubisoft has decided to accept.

The Message to Game Developers

When a company like Ubisoft makes cuts this severe, it sends a message throughout the entire industry. It tells developers:

-

New ideas are risky. If you want to make a new game at a major publisher, be prepared for possible cancellation. Ubisoft would rather invest in proven franchises.

-

Remote work is optional. The days of distributed teams are over (at least at Ubisoft). If you want to work there, you need to be in an office.

-

Live service is where the money is. Single-player, story-driven experiences are becoming luxury items that only indie studios and well-established franchises can afford.

-

Corporate restructuring is constant. Studios will be closed, teams will be reorganized, and positions will disappear. Job security in game development is lower than ever.

These aren't encouraging messages for people thinking about joining the industry or staying in it.

Ubisoft canceled six games, focusing cuts on new franchises and a mobile game, highlighting a strategic shift towards established IPs. Estimated data based on content.

Indie Games and the Prince of Persia Void

Here's an interesting thought experiment: what happens to the games that major publishers cancel?

Sometimes, nothing. The IP sits in a vault and nobody touches it for years. But increasingly, indie developers are licensing dormant franchises and bringing them back to life on their own terms.

Could an indie studio take Prince of Persia and make something interesting with it? Potentially. Ubisoft might license the IP for a fraction of what the remake cost. An indie team with lower overhead could make a really creative game.

But Ubisoft's corporate structure makes this unlikely. The company wants control over its franchises. It wants to monetize them directly, not through licensing deals with studios it can't fully control.

So Prince of Persia will probably sit dormant for years. Eventually, maybe Ubisoft will revisit it. Or maybe they'll forget about it entirely and focus on the franchises that actually generate revenue.

What About Single-Player Games?

There's a broader question lurking beneath all of this: are single-player games dying?

The answer is nuanced. Single-player games aren't dead, but they're definitely in trouble at major publishers. Ubisoft's restructuring reflects an industry-wide belief that single-player experiences don't generate the lifetime revenue that live service games do.

But here's the thing: single-player games still sell. Baldur's Gate 3 was hugely successful. Black Myth: Wukong was a phenomenon. Elden Ring is still generating engagement years after release. So there's clearly demand.

The issue is that major publishers like Ubisoft are built around a specific economic model: continuous revenue streams, quarterly earnings targets, and shareholder expectations. Single-player games don't fit that model as neatly as live service games do.

Smaller publishers and indie studios have more flexibility. They can make single-player games without worrying about quarterly earnings. They can take longer development cycles. They can focus on creative vision over monetization.

So single-player games aren't dying. They're just moving away from major publishers and toward smaller studios. The creative energy is shifting. That's not necessarily bad, but it's definitely a change.

Timeline: From Announcement to Implementation

Ubisoft's reorganization goes into effect in April 2025. That's just a few months away from the announcement. The company is moving fast, which suggests urgency.

A few months is actually a short timeline for a reorganization of this scale. Shuffling reporting structures, closing studios, and shifting teams to new Creative Houses typically takes longer. The fact that Ubisoft is doing it so quickly suggests the decision came from the top and there's pressure to execute.

It also means some of this is probably still being figured out. The five Creative Houses sound organized in theory, but in practice, there will be friction. Teams will need to understand their new mandates. Leadership will need to establish new processes. There will be growing pains.

The reorganization period will probably last 6-12 months. By mid-2026, Ubisoft should have stabilized around the new structure. Then we'll see if it actually works.

Competitive Positioning: How This Affects Ubisoft's Rivals

Ubisoft's reorganization affects not just Ubisoft but the entire competitive landscape of gaming. If Ubisoft is successful with its focus on live service and open-world games, other publishers will follow.

Microsoft's Xbox is already deep into live service games. Sony's Play Station is pushing live service titles aggressively. Nintendo is more selective but still investing in online and service-based games.

The entire industry is moving in this direction. Ubisoft's reorganization is just the most explicit statement of intent so far.

For players, this means fewer traditional single-player games from major publishers. It means more games built around cosmetics, battle passes, and seasonal content. It means games designed to be played for years rather than finished in 20-30 hours.

Whether that's good or bad depends on your preferences. Some players love the endless engagement of live service games. Others miss the narrative-driven, complete experiences that single-player games offer.

The Broader Lesson: Corporate Strategy Shapes Creative Output

The Prince of Persia cancellation is ultimately a story about how corporate strategy shapes creative output. Ubisoft didn't cancel Prince of Persia because the game was creatively unsound. It canceled it because the game didn't fit the company's financial model.

This is a crucial insight. In modern game development, business strategy comes first. Creative vision comes second. If a game doesn't fit the business model, it gets canceled, regardless of how good it might be.

This isn't unique to Ubisoft. It's how the entire entertainment industry works. Major studios make decisions based on financial models, not creative merit. And when business models shift, creative decisions shift with them.

The consequence is that certain types of games become harder to make at major publishers. Experimental titles. Games that don't fit standard monetization models. Games with smaller audiences. All of these become riskier investments.

Ubisoft's restructuring is essentially the company saying: "We're going to focus on the games that make the most money, and we're going to abandon everything else."

Is that a reasonable business decision? Probably. Is it good for the gaming industry as a whole? That's a more complicated question.

Looking Forward: What's Next for Ubisoft

Ubisoft's next 12-18 months will be crucial. The reorganization needs to deliver results. If it doesn't, there will be more cuts.

The company needs to deliver games from its major franchises: new Assassin's Creed, new Far Cry, new Rainbow Six entries. These need to sell well and maintain their live service audiences. If they don't, the entire strategy falls apart.

Meanwhile, Creative House 4 (the narrative and fantasy house) needs to figure out how to survive in a company that's clearly not prioritizing narrative-driven experiences. Either the house needs to transform its franchises into live service games, or those franchises are heading toward abandonment.

Ubisoft is also developing four new franchises, including March of Giants. These need to launch successfully and prove that Ubisoft can still innovate. If they all fail, the company will become even more conservative and focused purely on established franchises.

The next few years will tell us whether Ubisoft's reorganization was the right call or a mistake that further constrains the company's creative output.

TL; DR

-

Prince of Persia Remake Canceled: After four years in development with nothing to show, Ubisoft canceled the Prince of Persia: The Sands of Time remake as part of a major corporate reorganization focusing on live service and open-world games.

-

Five Creative Houses Formed: Ubisoft is reorganizing around five Creative Houses, each with different mandates. Creative House 1 focuses on scaling the biggest franchises into annual releases; CH2 handles competitive shooters; CH3 manages live service games; CH4 covers narrative-driven experiences; CH5 handles casual and family games.

-

Six Games Canceled, Seven Delayed: Beyond Prince of Persia, Ubisoft canceled four other unannounced games (three new franchises and one mobile game) and delayed seven titles, some pushing into fiscal year 2027.

-

Studios Closed and Restructured: Ubisoft closed its Halifax and Stockholm studios completely and is restructuring Abu Dhabi, Red Lynx, and Massive Entertainment. The company is also mandating five-day-per-week office returns.

-

Live Service Strategy Dominates: The reorganization reflects an industry-wide shift toward games that generate continuous revenue through cosmetics, battle passes, and seasonal content rather than one-time purchases of narrative-driven experiences.

-

Bottom Line: Ubisoft's reorganization signals that single-player, story-driven games are becoming increasingly difficult to justify financially at major publishers, while live service and open-world games are where the future revenue lies.

FAQ

Why did Ubisoft cancel Prince of Persia after four years of development?

Ubisoft canceled the Prince of Persia remake because it didn't align with the company's new strategic focus on live service games and open-world titles that generate continuous revenue. After four years of development at Ubisoft Montreal with little to show publicly, the game failed to meet internal expectations. The fundamental issue was that a traditional single-player remake doesn't fit Ubisoft's monetization model, which prioritizes games with battle passes, seasonal content, and cosmetic transactions rather than one-time purchases.

What are the five Creative Houses and what games do they manage?

Ubisoft's five Creative Houses are: CH1 (Vantage Studios) manages annual franchises like Assassin's Creed, Far Cry, and Rainbow Six; CH2 handles competitive shooters including The Division, Ghost Recon, and Splinter Cell; CH3 operates select live service games like For Honor, The Crew, and Brawlhalla; CH4 focuses on narrative-driven experiences and includes Prince of Persia, Anno, Might & Magic, and Rayman; and CH5 manages casual games like Just Dance and mobile titles.

How many games did Ubisoft cancel and delay in this reorganization?

Ubisoft canceled six games total, including the Prince of Persia remake and four unannounced titles (three new franchise attempts and one mobile game). The company also delayed seven games, pushing some release dates from fiscal year 2026 into fiscal year 2027.

What studios did Ubisoft close as part of this reorganization?

Ubisoft closed its Halifax mobile studio and its Stockholm studio entirely. The company also restructured its Abu Dhabi studio, Red Lynx (known for Trials games), and Massive Entertainment (the studio behind The Division).

Why is Ubisoft requiring employees to return to the office five days per week?

Ubisoft believes in-person collaboration is essential for the creative process and wants teams physically present to work together daily. The company is offering an annual allowance of work-from-home days but defaulting to office-based work. This shift reflects management's belief that distributed teams are less effective for creative industries, though it may impact recruitment and talent retention in a competitive industry.

What does the reorganization tell us about the gaming industry's future?

The reorganization reflects an industry-wide trend toward live service monetization over single-player experiences. It signals that major publishers increasingly prioritize games generating continuous revenue through cosmetics and seasonal content rather than traditional narrative-driven games. This shift means single-player experiences are moving toward indie studios and smaller publishers, while major publishers concentrate on franchises that fit recurring revenue models.

Is single-player gaming dying?

Single-player games aren't dying, but they're facing challenges at major publishers like Ubisoft. Games like Baldur's Gate 3, Black Myth: Wukong, and Elden Ring prove there's strong demand for narrative-driven experiences. However, major publishers are moving away from single-player games because they don't generate the lifetime revenue that live service games do. Single-player gaming is shifting toward indie studios and smaller publishers that have more flexibility in their business models.

When does the reorganization take effect?

Ubisoft's reorganization is scheduled to take effect in April 2025, just a few months after the announcement. The company is moving quickly on the restructuring, suggesting urgency and pressure from leadership to execute the new strategy rapidly.

What is March of Giants and why is Ubisoft developing it?

March of Giants is a MOBA that Amazon originally developed before the company shut down its gaming division. Ubisoft acquired the project and is developing it as part of four new franchises. MOBAs are inherently live service games, generating revenue through cosmetics and seasonal content, making them a perfect fit for Ubisoft's new strategic focus on games with recurring monetization.

How does Ubisoft's strategy compare to other major publishers?

Ubisoft's shift toward live service games mirrors strategies already adopted by Electronic Arts (Apex Legends, Old Republic), Activision Blizzard, and Microsoft (Game Pass subscription model). All major publishers are prioritizing continuous engagement and recurring revenue over one-time game purchases. Sony's Play Station is also aggressively pursuing live service titles. The entire industry is moving in this direction, with Ubisoft's reorganization being the most explicit statement of intent so far.

What This Means for Gaming's Future

The Prince of Persia cancellation is just the visible signal of something much larger happening in the gaming industry. We're witnessing a fundamental shift in how major publishers allocate resources and make creative decisions. Financial models now drive creative output more than ever before.

For players, this means the type of games available from major publishers is changing. For developers, it means job security is shakier and creative constraints are tighter. For the industry, it means innovation and experimentation are being sacrificed for predictable revenue streams.

Ubisoft's reorganization is a bet that this strategy will work. Whether it does remains to be seen. But regardless of the outcome, the company has made its priorities crystal clear: live service games with open worlds. Everything else is secondary.

Key Takeaways

- Ubisoft canceled the Prince of Persia remake after four years because it didn't fit the company's focus on live service and open-world games that generate continuous revenue

- The company is reorganizing around five Creative Houses, each managing different game types, with Creative House 1 focusing on scaling major franchises into annual releases

- Beyond Prince of Persia, Ubisoft canceled six games total, delayed seven others, and closed studios in Halifax and Stockholm while restructuring multiple development facilities

- The reorganization reflects an industry-wide trend toward games with recurring monetization (battle passes, cosmetics, seasonal content) over traditional single-player experiences

- Single-player and narrative-driven games are increasingly difficult to justify financially at major publishers but remain viable for indie studios and smaller publishers with different business models

Related Articles

- Krafton's Quest for the Next PUBG: Inside 26 Games in Development [2025]

- Amazon's New World: Aeternum Shutting Down in 2027 [2026]

- Donkey Kong Country Returns HD Update [2025]: New Features, Fixes & Switch 2 Enhancements

- Arc Raiders Out-of-Bounds Exploits: Why Players Still Can't Trust Stella Montis [2025]

- Marathon Release Date 2026: Everything You Need to Know [2025]

- Bungie's Marathon Extraction Shooter Launches March 5th: Complete Guide [2025]

![Ubisoft Cancels Prince of Persia Remake: Inside the Major Gaming Restructure [2025]](https://tryrunable.com/blog/ubisoft-cancels-prince-of-persia-remake-inside-the-major-gam/image-1-1769017041203.jpg)