Warner Bros. Discovery Rejects Paramount Skydance Bid: Why Netflix Won [2025]

Something genuinely wild just happened in Hollywood. And I'm not talking about the latest superhero movie bombing at the box office.

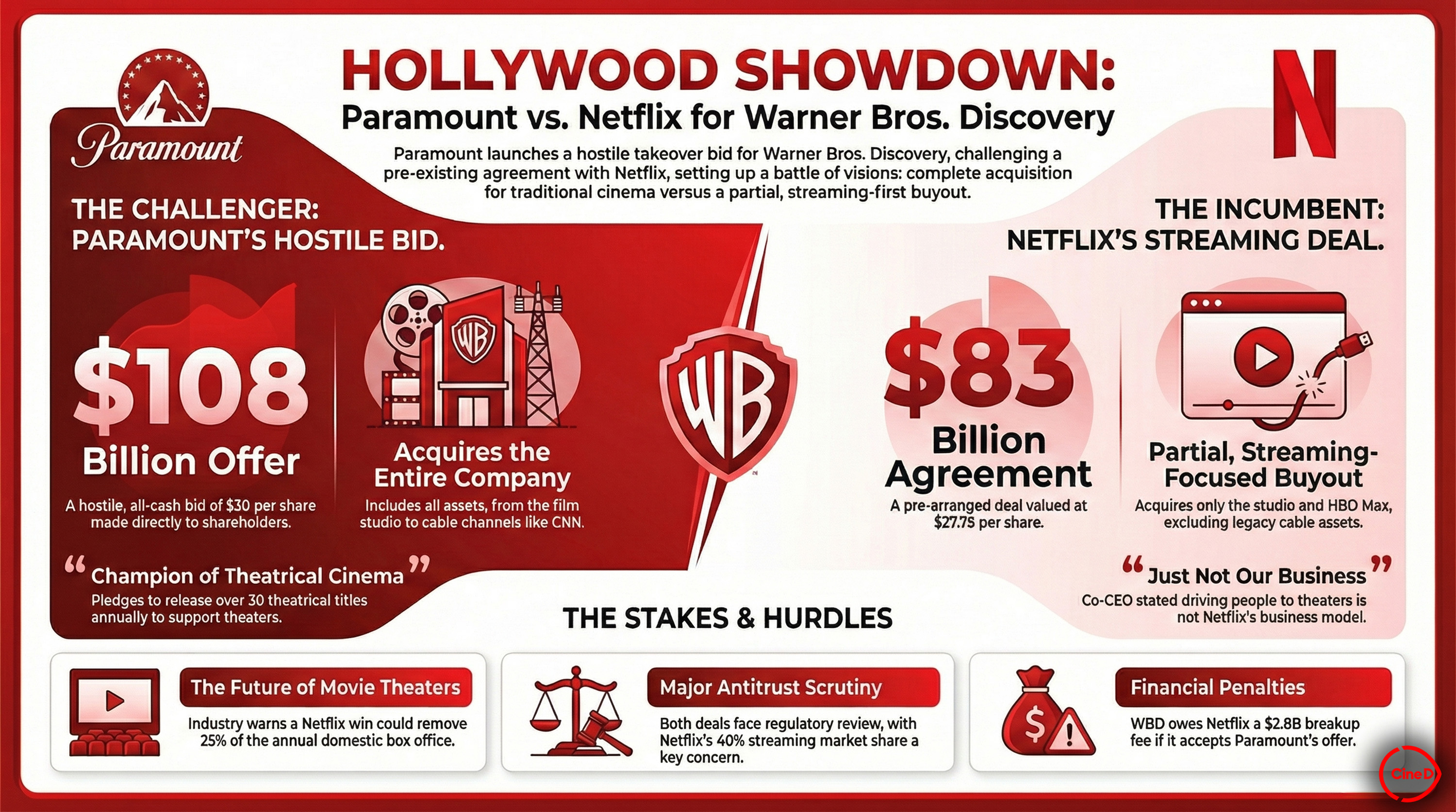

Warner Bros. Discovery's board just threw down the gauntlet. They're telling shareholders to reject Paramount Skydance's $108 billion hostile takeover bid. All of them. Unanimously. No hedging, no "we'll consider it," just a flat no.

Instead, they're backing Netflix. A streaming company that doesn't even own premium cable networks is now positioned to snap up one of the biggest media empires on Earth.

Let's break down what actually happened here, because this isn't just corporate drama. This is a pivotal moment that's reshaping the entire entertainment industry. The outcome will determine who controls HBO, CNN, HGTV, Food Network, and the rest of Warner Bros. Discovery's sprawling portfolio. It'll affect which shows get made, which networks survive, and honestly, what you watch next year.

I'm going to walk you through the competing bids, the financing nightmares, the regulatory hurdles, and why the board decided that Netflix's offer was worth more than Paramount Skydance's cash-heavy proposal. We'll also dig into what this means for the streaming wars, the cable industry, and the future of content consolidation in Hollywood.

Here's the thing: this deal isn't done yet. Not even close. But understanding why the WBD board moved the way they did gives you a window into how modern mega-deals actually work.

TL; DR

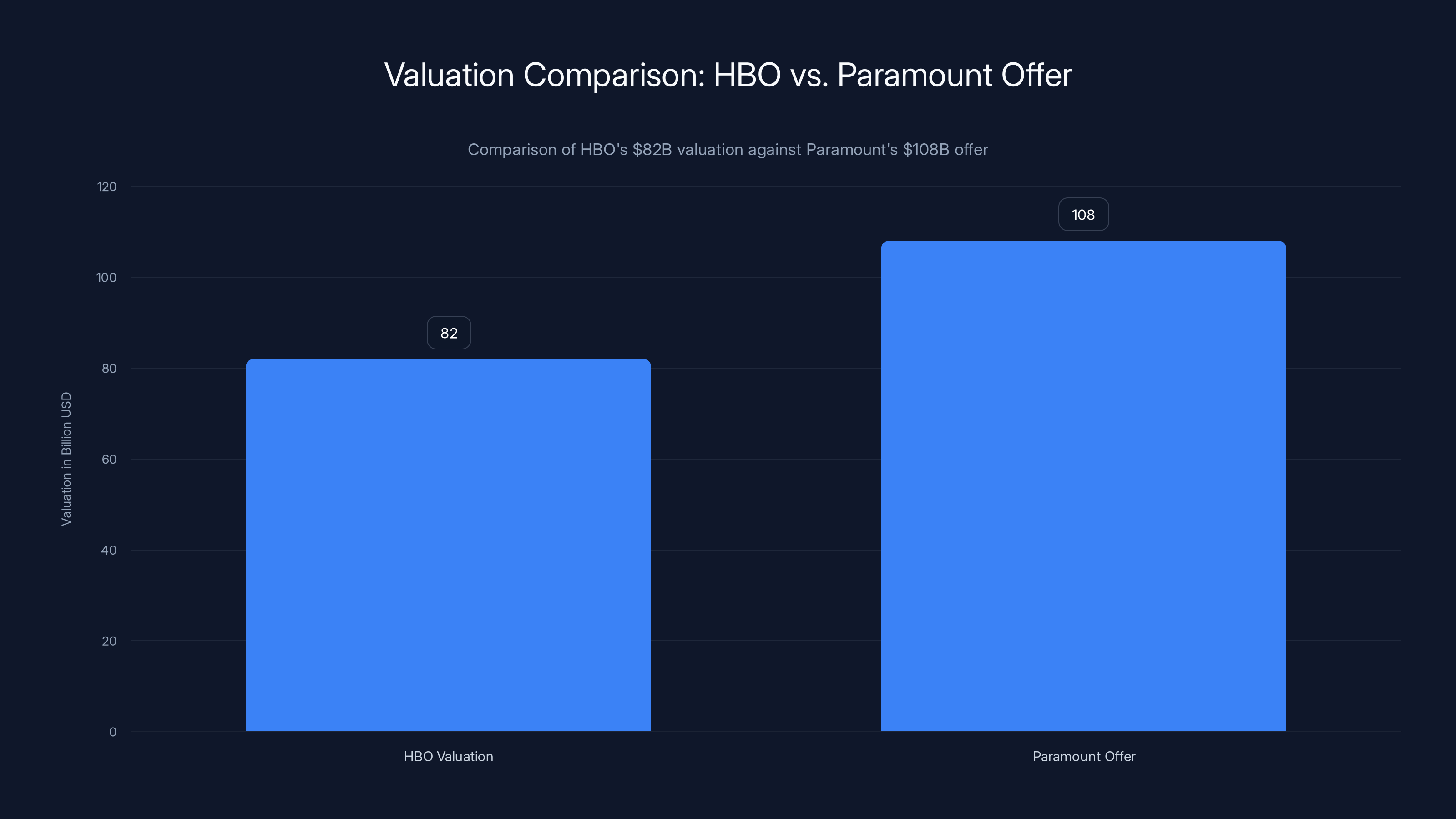

- Netflix's bid wins: $82 billion for HBO, Warner Bros., and HBO Max divisions—WBD board backing it unanimously

- Paramount's aggressive play: $108 billion for all of WBD's assets (including CNN, HGTV, Food Network), but financing looks fragile

- The debt problem: Paramount's 108 billion deal, even with Larry Ellison's $40 billion guarantee

- Regulatory uncertainty: Both deals face U.S. and European regulatory scrutiny before anything is final

- Shareholder value: Board argues Netflix's stock component offers better long-term upside than Paramount's cash-heavy structure

- Termination costs: Going with Paramount would cost WBD shareholders over $4 billion in Netflix deal-breaking fees

Paramount Skydance's

The Setup: How We Got Here

Paramount Skydance didn't just wake up one day and decide to make an offer for Warner Bros. Discovery. They knocked on the door three separate times before WBD even opened the process to competing bidders.

The first two approaches were early feelers. Nothing serious, just testing the water. But the third offer came in around $24 per share, and suddenly people started paying attention. That wasn't a friendly conversation starter—that was a real bid.

Then, in early December, something shifted. Netflix and the WBD board had their moment. The two companies had been talking, and Netflix made its move: $82 billion specifically for the crown jewels. HBO. Warner Bros. The entire HBO Max streaming platform. Not the cable networks. Not CNN. Just the premium content divisions that actually print money in the streaming era.

The WBD board looked at that offer and said yes. They selected it over everyone else.

But Paramount Skydance wasn't going to take that lying down. They came back with their hostile bid. $108 billion. For everything. All of it. They wanted to scoop up the entire company, spin off the Discovery networks, and run the whole thing.

The board said no. Then they made it official: shareholders should reject Paramount's offer too.

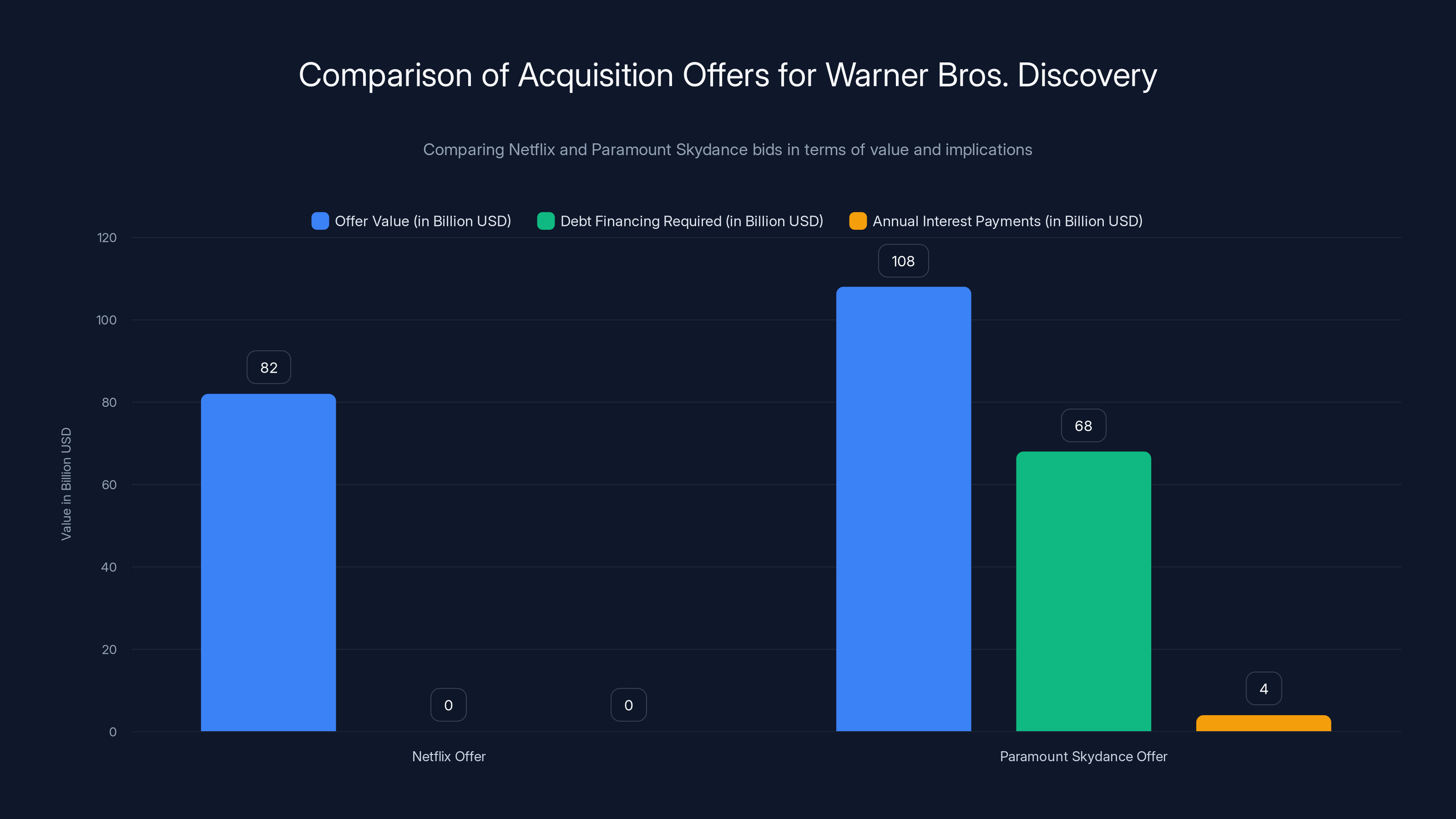

Understanding the Numbers: 108 Billion

On the surface, this looks simple. Paramount is offering $26 billion more. Why wouldn't the board take it?

Because money isn't everything. Structure matters. Financing matters. And the long-term value of what you're getting matters more than the headline number.

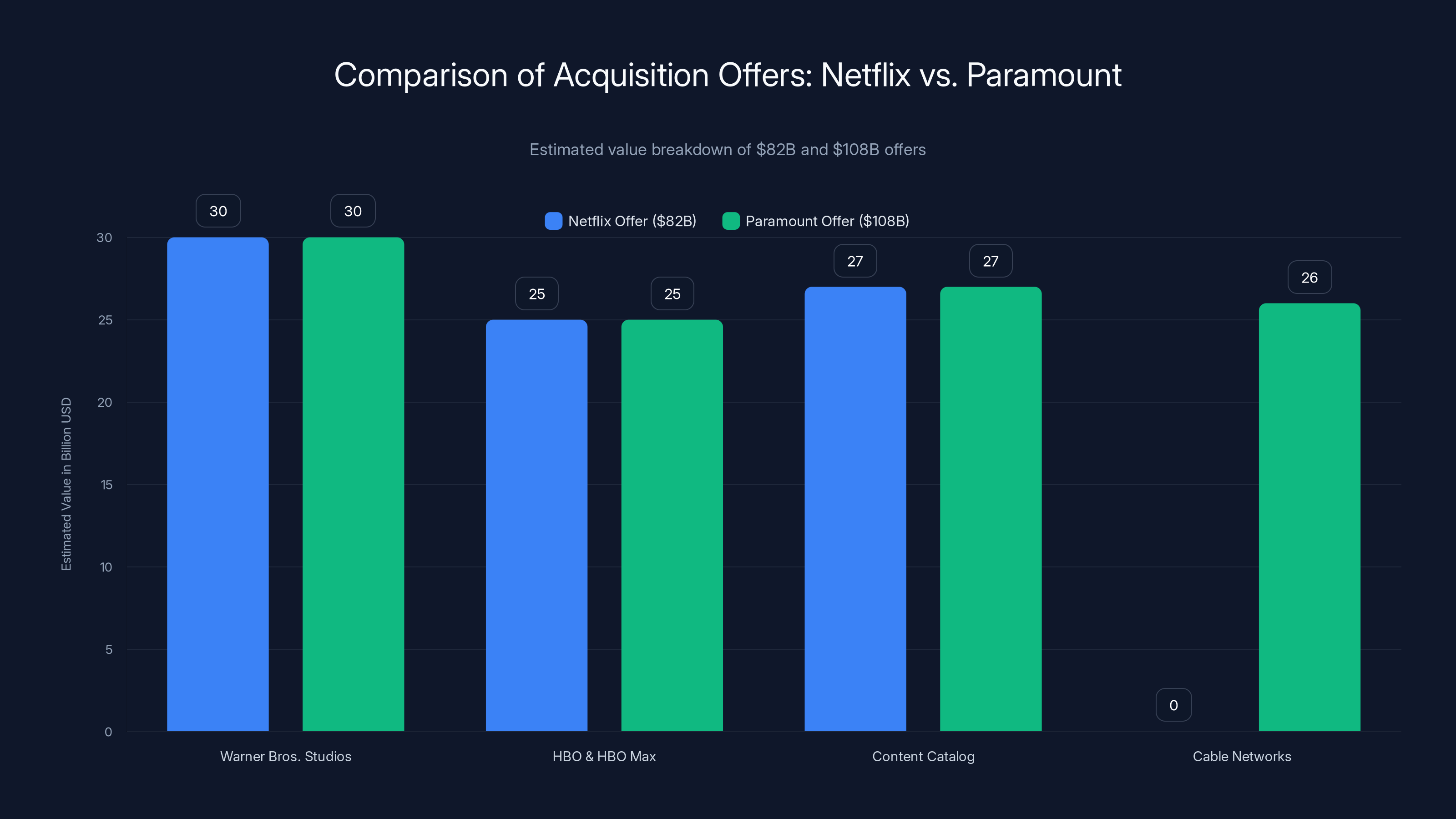

Let's start with what Netflix is actually buying. The $82 billion gets you:

- Warner Bros. Studios: The entire production engine that made Batman, Harry Potter, and The Matrix. This alone generates billions annually

- HBO and HBO Max: The premium streaming platform with over 60 million subscribers and the prestige content that moves markets

- The content catalog: Decades of premium television, movies, and original series

What doesn't transfer: CNN, HGTV, Food Network, Discovery Channel, Animal Planet, and the rest of the cable networks. Those stay with WBD shareholders through a spinoff called Discovery Global.

Now let's look at what Paramount is offering. $108 billion, but for all of it. Everything. The streaming assets, the cable networks, the production studios, the everything. It's a full acquisition, not a cherry-picked deal.

So which is worth more? That's where the board's analysis gets interesting. They're saying Netflix's offer is superior despite the lower headline number. Why?

The Netflix Premium

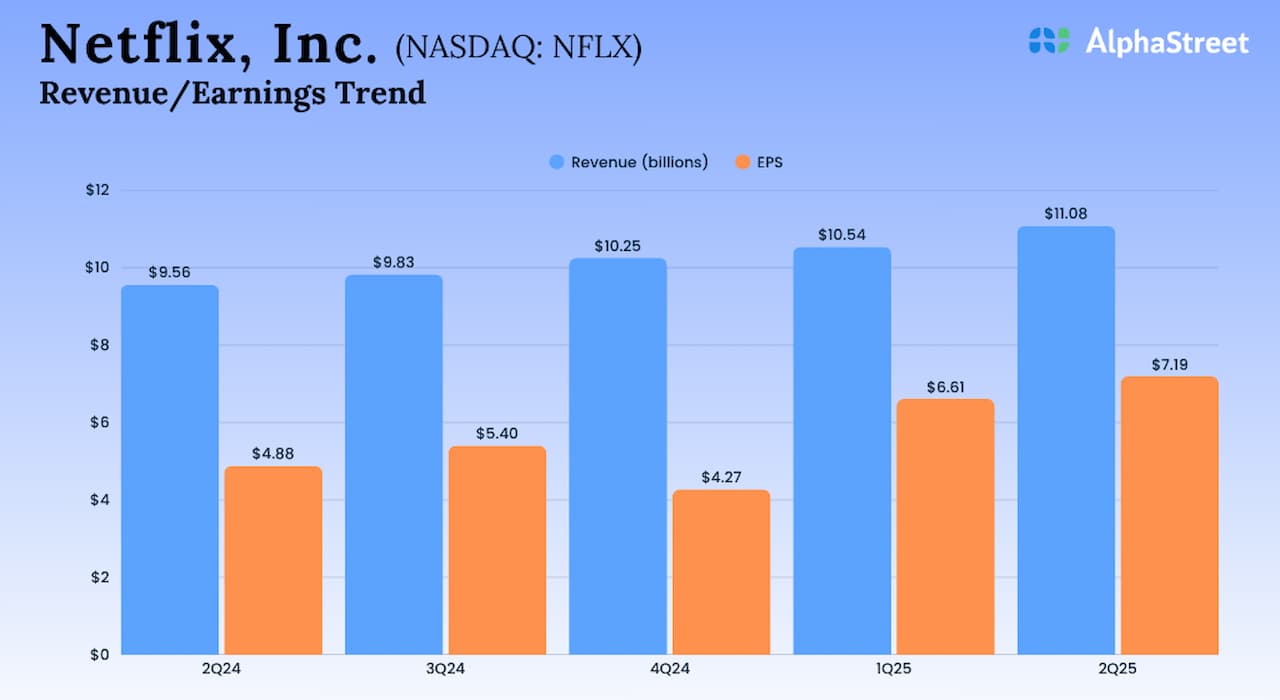

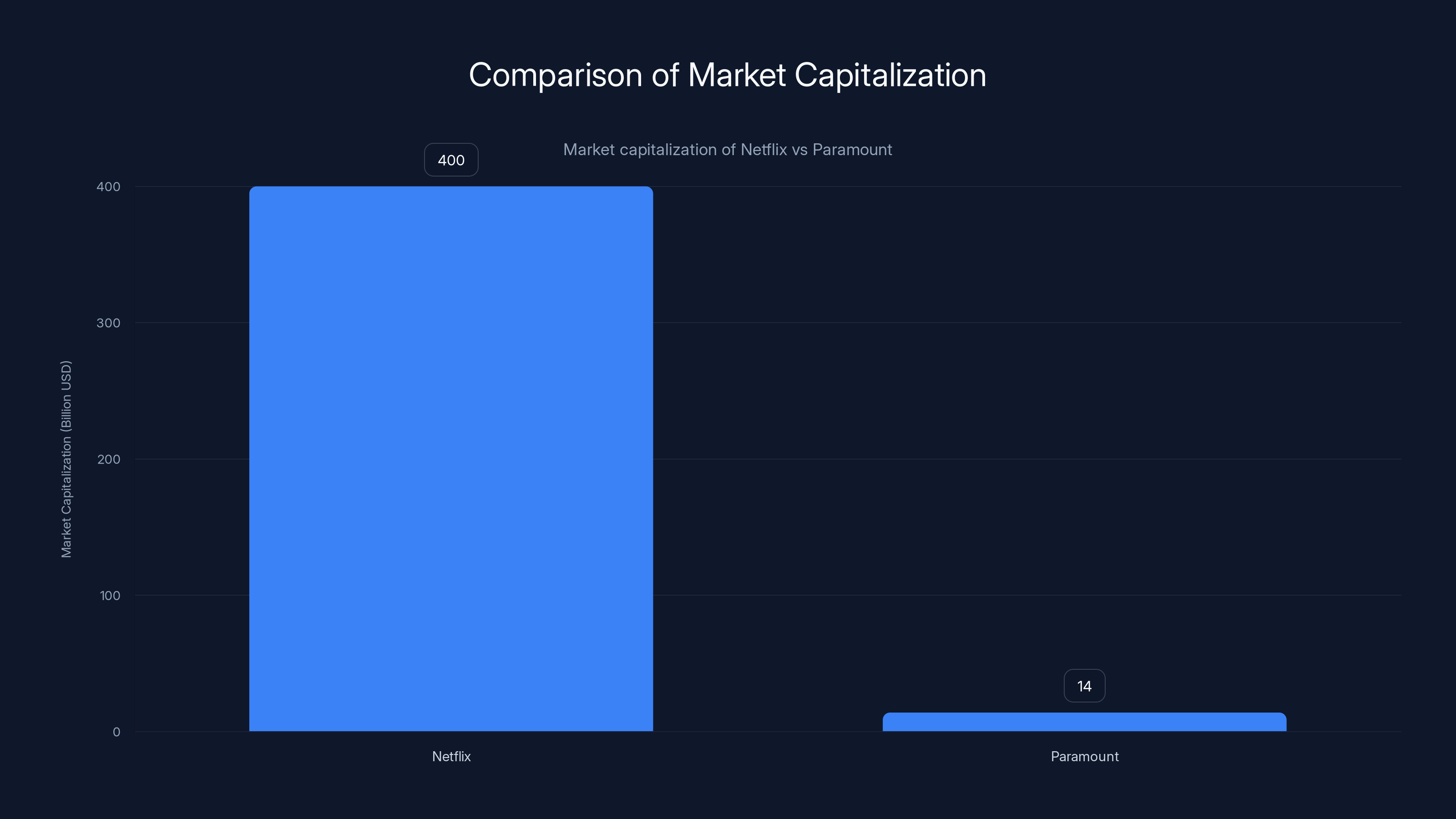

Netflix is paying in multiple forms. Some cash, sure, but also Netflix stock. And that stock has been on an absolute tear. Netflix's market cap is over $400 billion. Their stock has real momentum.

When the board gets Netflix shares as part of the deal, those shares come with upside. Netflix's subscriber base is massive. Their pricing power is real. Investors believe in Netflix's future in a way they increasingly don't believe in legacy cable networks.

When you get Netflix stock, you're not just getting paid today. You're getting a piece of a company that could be worth significantly more in two years, five years, ten years.

Paramount is offering mostly cash. Which sounds safe, until you realize they have to finance it somehow.

The Financing Nightmare: How Paramount's Deal Falls Apart

Here's where Paramount Skydance's bid starts looking like fiction.

Paramount's market capitalization is about

Math doesn't work there.

Yes, Larry Ellison stepped in. The Oracle founder, David Ellison's father (David is Paramount's CEO), is guaranteeing $40 billion of the financing. That's real money from a real billionaire. Respect to that.

But that still leaves roughly $68 billion that needs to come from somewhere. Debt markets. Bank financing. Other creative structures. And you know what banks ask for when a small company tries to borrow that much money to buy something that massive? They ask really hard questions.

The board flagged this explicitly. They're concerned about the extraordinary amount of debt Paramount would need to take on. Debt that would hang over the combined company like a sword of Damocles.

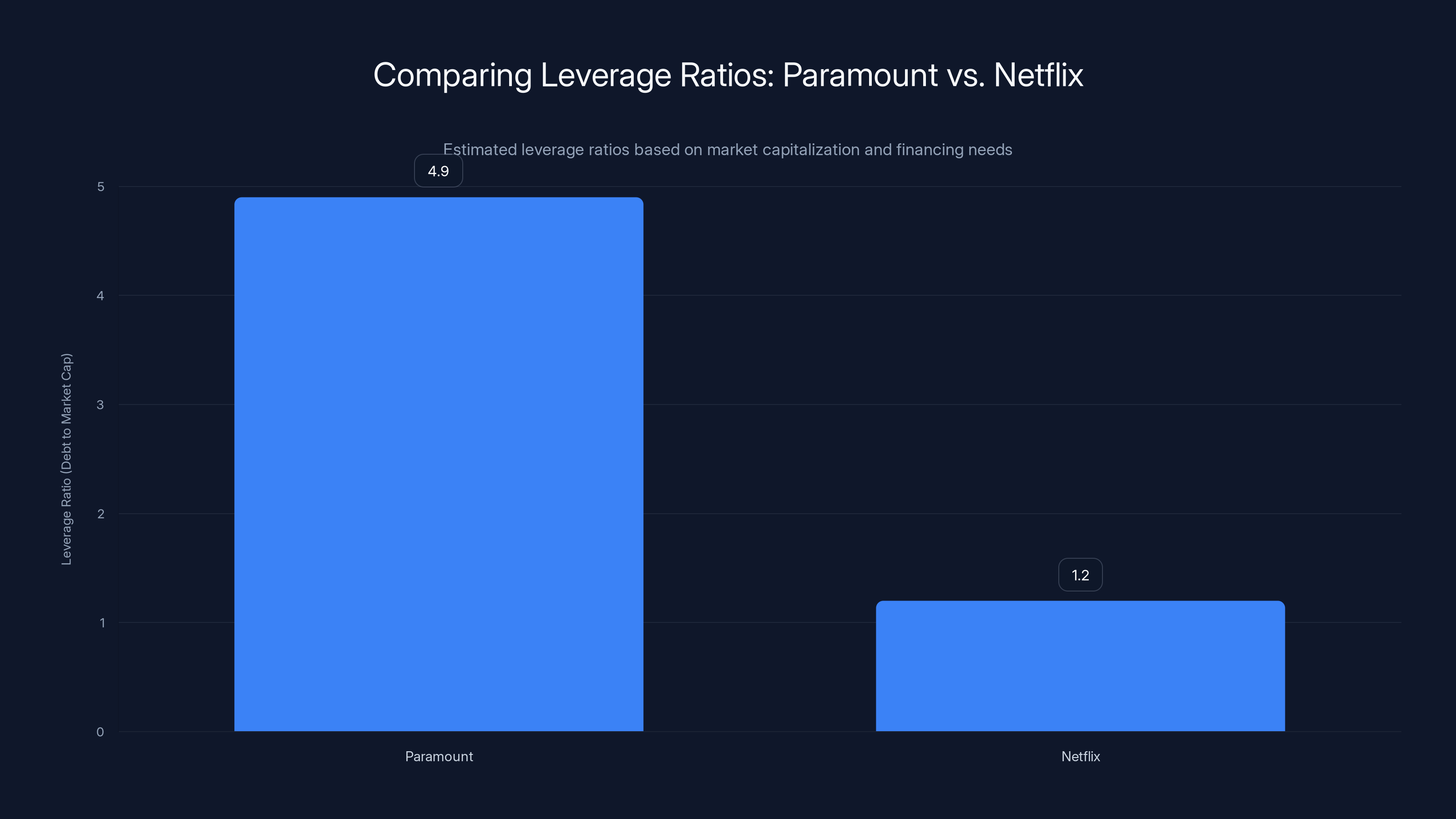

Here's the leverage problem: Netflix's market cap is over $400 billion. They could theoretically finance a much larger deal. They have options. They have creditworthiness. They have multiple paths to liquidity.

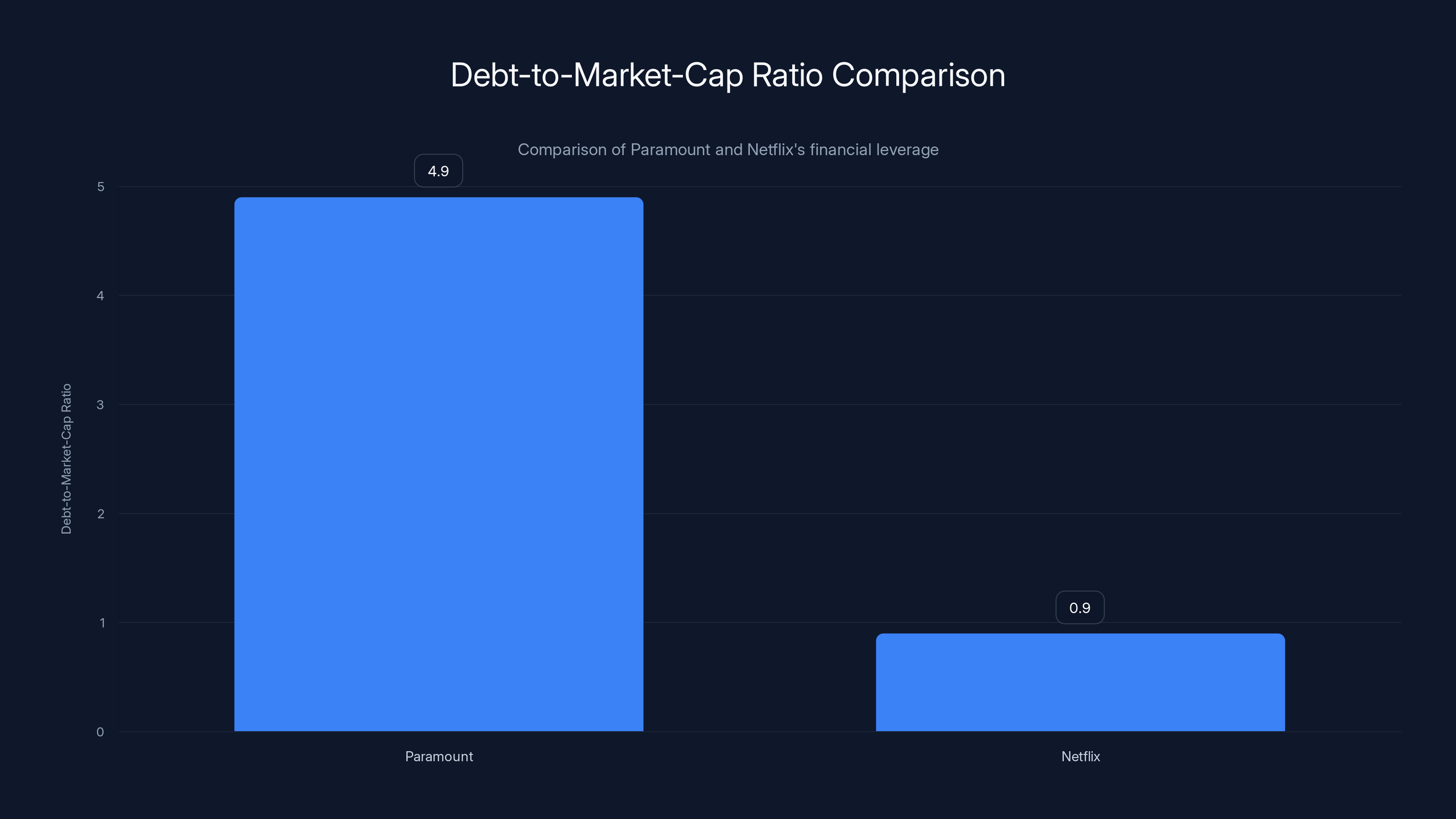

Paramount borrows $68 billion, and suddenly they're operating a mega-company while managing a debt burden that's nearly 5x their market cap. That's not a business structure. That's a financial tightrope.

The Debt Cascade Problem

When you take on that much debt to finance an acquisition, you don't just feel it at closing. You feel it every quarter. Every single quarter.

You've got interest payments. You've got covenant restrictions that prevent you from doing certain things. You've got refinancing risks as debt matures. You've got the slow creep of financial discipline that comes with being highly leveraged.

Content companies are famously hard to run. They're capital intensive. They require constant investment to keep producing quality shows. When you're underwater with debt, you can't invest aggressively in content. You can't take risks. You're managing a balance sheet, not running a media company.

The board sees this. They understand that Paramount's deal doesn't just fail at the capital structure level. It fails at the operational level. A highly leveraged Paramount would be forced to make conservative decisions about content spending, production, and long-term investment.

Netflix can invest aggressively. Netflix can take bets. Netflix can compete.

Highly leveraged Paramount would be checking box scores and cutting budgets.

Paramount's estimated leverage ratio is significantly higher at 4.9x compared to Netflix's 1.2x, indicating a much riskier financial structure for Paramount. Estimated data.

The Termination Fee Trap: $4 Billion Reasons to Say No

Here's something the board mentioned almost in passing, but it's actually a huge deal.

If WBD shareholders vote yes on the Paramount bid, WBD has to pay Netflix $4 billion to break the merger agreement they already signed.

Four. Billion. Dollars.

That comes out of shareholder value immediately. It's gone. It's a termination fee, and it's non-negotiable.

So when you're comparing the bids, you don't compare

The gap closes. A lot.

And remember, Netflix's $82 billion includes the stock component that has upside potential. Paramount's bid is heavily cash, with the debt financing nightmare we just discussed.

Suddenly,

The Discovery Global Wildcard: What Happens to the Cable Networks?

With Netflix's deal, there's a twist. The cable networks don't go to Netflix. They don't go to Paramount. They stay with WBD shareholders.

The board is planning to spin them off into a new company: Discovery Global. This would be a separate, publicly traded entity that includes CNN, HGTV, Food Network, Animal Planet, and all the other cable properties.

Is that good news or bad news for shareholders? It depends on your timeline.

Short term, it's dilutive. You own shares in Netflix (through the merger) plus shares in Discovery Global. If you wanted to own Netflix, you've got what you wanted. If you want exposure to cable networks in 2025, you've got that too. But you didn't choose it.

Long term, cable networks are struggling. They're not the growth story they used to be. Cord-cutting is real. Younger audiences don't watch CNN the way they used to. HGTV's audience is aging. These aren't sexy assets.

With Paramount's deal, all of that stays together. Paramount takes on the cable networks along with the streaming assets. Is that good or bad? It's unclear. You're buying a cable company that's losing relevance plus a streaming company trying to compete with Netflix.

The board clearly thinks shareholders are better off getting Netflix stock (pure growth story) and getting to own Discovery Global as a separate entity (where cable networks might actually be managed properly, or shareholders can eventually sell their stake).

Paramount thinks they can turn the cable networks into something valuable. Maybe they can. But the board isn't betting on it.

The Regulatory Wildcard: Both Deals Face Scrutiny

Here's the part that neither the board nor Paramount nor Netflix can fully control: regulators.

In the United States, the Federal Trade Commission and the Department of Justice would need to clear this deal. Are they going to let Netflix, already a streaming titan, acquire HBO and Warner Bros. Studios? That's a concentration question. That's an antitrust question.

Europe has the European Commission. They're even more skeptical of mega-mergers. They've blocked or heavily restricted mega-deals before. They could do it here.

For Paramount's deal, the concentration questions are different but equally serious. You're merging two legacy media companies (Paramount and WBD) into a single mega-entity. That raises different antitrust questions, but they're not easier to answer.

Both deals need regulatory approval before they close. Neither one is guaranteed. This isn't a "done deal" situation. This is a "the board thinks this is the best offer, and now we need the government to agree" situation.

That's a significant risk for both sides. And the board factored that into their recommendation.

The Netflix Edge: Why This Deal Actually Makes Sense

Here's what Netflix brings to the table that Paramount can't:

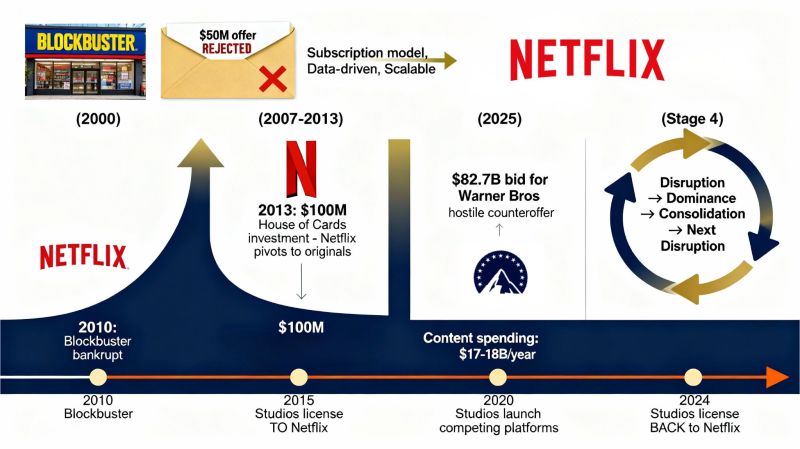

Streaming credibility. Netflix invented modern streaming. They have 280+ million subscribers globally. They understand the business. They've made it work. They've turned streaming into a profitable business model. That's not trivial. Most streaming services are still bleeding money. Netflix prints cash.

Content synergy that matters. Netflix needs premium content. HBO content is premium. Warner Bros. produces premium content. This isn't a marriage of convenience. This is Netflix saying, "We need what you have, and we can make it better." That alignment matters operationally.

No existential threats. Netflix isn't trying to bolt a failing cable business onto a streaming service. Netflix isn't juggling multiple business models. Netflix is a pure-play streaming company, acquiring pure-play streaming assets. That's clean. That's simple. That's why leverage is manageable.

Global reach. Netflix has distribution in nearly every country on Earth. HBO has incredible content but more limited international distribution. Put Netflix's distribution with HBO's content, and you've got something that can genuinely compete globally.

Paramount is trying to do something harder. They're trying to merge two legacy companies and somehow make them work together while managing massive debt and a declining cable business.

Netflix's deal is simpler. Simpler usually wins.

Paramount's debt-to-market-cap ratio is significantly higher than Netflix's, indicating a much heavier debt burden relative to its market value.

The Historical Context: Why Media Mega-Mergers Keep Failing

Paramount is betting that they can do what so many media companies have failed to do: successfully merge two large, complex organizations and create value.

The history here is brutal. Look at the AOL-Time Warner merger. Considered the worst merger in history. Destroyed shareholder value. Created cultural chaos. Never worked.

Look at Comcast-NBC Universal. It worked better than AOL-Time Warner, but it was still messy. Took years to extract value.

Look at Disney-Fox. That's worked reasonably well, but Disney had to completely remake Fox's leadership, culture, and direction. It wasn't a merger. It was an acquisition and a purge.

Merging large media companies is hard. Really hard. It's not like merging two tech companies where you can rationalize engineering teams and data centers. With media, you're merging cultures, talent relationships, creative processes, and business models that might be fundamentally incompatible.

The board has seen this movie before. They know how it ends. Usually, it doesn't end well.

Netflix's deal sidesteps this problem. Netflix isn't trying to merge with Warner Bros. Discovery. Netflix is acquiring assets that fit into Netflix's existing operating model. That's way simpler.

The Shareholder Rebellion: Why This Matters

Here's the thing: the board's recommendation matters, but it's not the final say.

Shareholders vote on this. And shareholder votes on mega-mergers are often unpredictable.

If you're a WBD shareholder in the Netflix deal, you're trading your WBD stock for Netflix stock plus a stake in Discovery Global. That's not guaranteed to be better. Netflix could underperform. Discovery Global could surprise to the upside. Who knows?

If you're a WBD shareholder and Paramount comes through with a successful tender offer (hostile bids can work if enough shareholders are convinced), you get cash. Real cash. Today's money. That's appealing if you're skeptical about Netflix or worried about the regulatory path.

The board is betting shareholders will trust their analysis. But shareholder votes on contested mergers are genuinely unpredictable. People vote differently than you'd expect. They get emotional. They second-guess. They do weird things.

Paramount is banking on some shareholders voting for their deal despite the board's recommendation. It only takes a certain percentage to flip. Hostile bids have worked before.

This vote isn't over. Not even close.

The Cable Network Question: Is Anyone Going to Miss CNN?

CNN is a fascinating asset in this context. It's incredibly valuable from a news credibility perspective. It reaches millions of people. It's part of the global conversation.

But financially? CNN is complicated. It's not a growth business. It's a legacy business that's trying to figure out its role in a streaming, digital-first media landscape.

With the Netflix deal, CNN goes to Discovery Global. It doesn't go to Netflix because Netflix doesn't want it. That tells you something interesting.

Netflix is focused on entertainment and documentary content. They're not trying to build a news network. They tried that with some news documentaries, but they didn't go all-in on breaking news coverage.

Paramount is more open to the cable ecosystem. They understand cable news in a way that Netflix doesn't. If Paramount took over WBD, they'd probably invest in CNN, try to differentiate it, maybe lean into opinion programming or long-form investigations. But they'd be managing a news network while trying to compete in streaming.

The board thinks that's Paramount's problem to solve, not Netflix's problem.

But here's the interesting thing: what happens to CNN matters to the broader media landscape. It affects who controls news infrastructure in America. That's not just a business question. That's a governance question.

Regulators might care about this. European regulators definitely care about media concentration and control of news. U.S. regulators might too, depending on the political climate.

This is one reason the regulatory uncertainty is so high. It's not just about streaming competition. It's about media ownership consolidation and control of information.

The International Dimension: Why Europe and Global Markets Matter

Warner Bros. Discovery is a global company. HBO operates internationally. Warner Bros. produces movies that sell globally. The streaming services reach multiple countries.

When you're merging companies this large, you don't just need U.S. regulatory approval. You need European approval. You might need approval from other markets too.

Europe has been increasingly aggressive about blocking or conditioning media mergers. The European Commission has blocked some significant deals in recent years. They care about media plurality, cultural diversity, and preventing excessive concentration.

A Paramount-WBD merger would create a massive European media company. That would draw serious regulatory scrutiny.

A Netflix-WBD deal would make Netflix more dominant in streaming, but Netflix is already everywhere. They already have massive European presence. The incremental concentration is less dramatic.

That said, both deals could face European resistance. Both deals would be heavily conditioned. Both deals might require significant divestitures or commitments.

The board's analysis probably factors in the regulatory risk for both sides. Netflix might have an easier path in Europe because they're a tech/streaming company, not a traditional media company. But that's not guaranteed.

Netflix's

The Alternative: What If Shareholders Reject Netflix Too?

Here's a scenario that keeps some market observers up at night.

What if shareholders vote against the Netflix deal? What if they reject the board's recommendation?

Paramount's hostile bid is still technically on the table. But if the shareholder vote goes sideways, if neither deal gets through, then what?

WBD would be left in a weird position. They'd have a board that tried to merge with Netflix, lost, and then had to manage the fallout. They'd be an independent company again, probably facing the same pressures that made them seek a merger in the first place.

But here's the thing: once a company opens itself up to acquisition, it's hard to close that door. Other bidders might show up. The stock gets volatile. Management becomes distracted. It's not a comfortable place to be.

That's why the board made their recommendation so strong. They're trying to send a message: this is the best deal we're going to get. Vote yes. Trust us.

But shareholder votes are genuinely unpredictable, especially in contested situations where the acquiring company (Paramount) is actively campaigning shareholders to reject the board's recommendation.

The Streaming Wars Connection: What This Merger Means for Competition

Here's the broader context: Netflix, Disney+, Amazon Prime Video, Paramount+, and a bunch of other services are all fighting for subscriber attention and advertising dollars.

Netflix has largely won the subscriber war. They have the most subscribers. They have the most international reach. They're profitable.

But they need content. Premium content. The kind of content that justifies a subscription and prevents churn.

HBO content does that. HBO is the gold standard for prestige television. Game of Thrones. Succession. The Wire. These are shows people subscribe specifically to watch.

When Netflix acquires HBO, they're acquiring a content engine that can compete with anything Disney+ can offer. They're investing in quality at a scale that makes them harder to compete against.

For Paramount, the story is different. Paramount is trying to be the last standing traditional media company. They want to compete with Netflix and Disney by owning a mega-portfolio of assets: streaming, movies, cable networks, production studios. They think scale and portfolio breadth is how you win.

But the market is increasingly skeptical that cable networks add value. The market is skeptical that you can manage a hybrid legacy-media-plus-streaming business successfully.

Netflix's thesis is simpler: streaming is the future, premium content is the edge, we have distribution, you have content, let's combine.

Paramount's thesis is harder: we can make this all work together, even though it's complicated and debt-heavy.

Simpler usually beats more complicated.

The Deal Structure Deep Dive: How Netflix's Offer Actually Works

Netflix is paying $82 billion. But how?

Some of it is cash. But a significant portion is Netflix stock. That's important because it changes the tax treatment and the risk profile for shareholders.

When you receive Netflix stock in a merger, you're no longer fully cashed out. You're making a bet on Netflix's future. If Netflix's stock goes up, you benefit. If it goes down, you lose.

But Netflix's stock has momentum. Netflix has shown they can execute in streaming. Netflix is profitable. Their subscribers are growing. Their price increases are sticking. From a tax and risk perspective, Netflix shares are actually pretty attractive.

Paramount's deal is more cash-heavy. Which sounds safer, until you realize that Paramount has to borrow the money. So you're getting cash, but that cash comes from debt financing. The risk is just shifted from you to Paramount, and Paramount will pass that risk back to you as a shareholder in the combined company.

Netflix's structure is: you own Netflix stock, you own some assets that Netflix will operate better, everyone wins.

Paramount's structure is: you own heavily leveraged Paramount, they're managing cable networks that are declining, they're trying to compete in streaming while managing debt, it's complicated.

The board is saying the Netflix structure is better. And structurally, on paper, they're right.

The Timeline Question: When Will This Actually Close?

This isn't a deal that happens overnight.

First, shareholders have to vote. That takes weeks to organize and execute.

Then, regulators have to approve. In the U.S., that's FTC/DOJ. In Europe, it's the European Commission. That's not a quick process. That's typically 6-12 months of back-and-forth, negotiation, potential conditions, possible requests for divestitures.

Then there's integration. If this deal closes, Netflix doesn't just wake up owning HBO. They have to integrate systems, figure out how to run it operationally, make decisions about organizational structure.

Best case scenario: shareholder vote in early 2025, regulatory approval by late 2025 or early 2026, closing in 2026. That's if everything goes smoothly.

Realistic scenario: everything takes longer than expected. Shareholders have concerns. Regulators ask hard questions. Competitors challenge the deal. This stretches into 2026 or 2027.

Worst case scenario: the deal dies somewhere along the way. Regulators block it. Shareholder vote goes sideways. Something unexpected happens. The deal never closes.

That timeline uncertainty matters. WBD shareholders don't know when they're actually going to get paid. Netflix doesn't know when they're actually going to own HBO. There's a long period of uncertainty and operating limbo.

Paramount's deal would face similar timeline challenges and probably even more regulatory complications.

HBO's board considers

The CEO Angle: David Ellison's Leverage Play

David Ellison is Paramount CEO. His father, Larry Ellison, is Oracle founder and one of the world's richest people.

Larry stepping in to guarantee $40 billion of financing is a power move. It shows commitment. It shows that Paramount is serious.

But it also reveals a weakness: Paramount alone can't finance this deal without daddy's help. That's not a strength. That's actually a red flag.

David Ellison is betting his career on making this work. He's pushing hard because if he pulls off the acquisition of Warner Bros. Discovery, he becomes a major media mogul. His legacy changes.

But if he fails, if shareholders reject the deal or regulators block it, he's positioned himself as the guy who swung for the fences and missed. That affects his credibility going forward.

The board is betting that the long-term shareholders of WBD see through this. They see the debt risk. They see the operational complexity. They see that David Ellison's ambition might not align with shareholder value maximization.

That's the case the board is making. And so far, at least in the official record, the board's recommendation is standing.

The Precedent: What This Sets for Future Media M&A

If Netflix's deal closes, it's a statement. It's a statement that says: pure-play streaming companies can acquire legacy media assets and create value.

If Paramount somehow pulls off their hostile bid, it's a different statement. It says: traditional media consolidation still works, and size and portfolio breadth still matter.

The outcome here affects every other media company watching this situation. Disney is watching. Amazon is watching. Even smaller streamers are watching.

If Netflix wins, you see more consolidation around streaming pure-plays. Content acquisitions accelerate. Legacy cable networks get isolated and potentially sold off cheaply.

If Paramount wins, you might see different consolidation patterns. You might see traditional media companies doubling down on their hybrid strategies. You might see other companies try to compete with Netflix by scale rather than by focused execution.

The board understands this. They're not just making a decision about WBD. They're making a bet on what the future of media looks like.

They think the future is streaming. They think pure-play is better than hybrid. They think Netflix's model scales better than Paramount's model.

That's a big bet. But every board at every media company is making some version of this same bet right now.

The Activist Angle: Why Shareholders Might Surprise You

WBD has activist shareholders. Investors who own stakes and aren't afraid to push for changes.

Activists typically want one of three things: maximize the current stock price, push for a strategic acquisition, or push for breaking up the company.

In this case, the Netflix deal does two of those things: it maximizes (in the board's view) the current stock price, and it is a strategic acquisition.

But some activists might want something different. Some might think Paramount's offer is actually better because it's higher and includes growth potential. Some might think both deals are bad and the company should stay independent.

Activist shareholders have outsize influence in contested votes. They campaign. They talk to other shareholders. They make their positions known. If they're split, it could swing the vote.

The board is betting that when they explain their analysis, activists will understand. When they see the financing risks and the debt concerns and the regulatory uncertainty, they'll agree that Netflix is the better deal.

But activism is unpredictable. You never know how shareholders will actually vote until they vote.

The Winner-Take-Most Dynamics in Streaming

Streaming has winner-take-most dynamics. You don't need five equal competitors. You need one or two dominant platforms.

Netflix is already one of the dominant platforms. They're not quite at the point where they've "won," but they're much closer than anyone else.

When Netflix acquires HBO's content, they're consolidating their position. They're making it harder for Paramount to compete. They're reducing the number of must-have subscriptions a consumer needs.

For Netflix shareholders, this is great. It's a win. It's consolidation that benefits Netflix.

For the broader streaming market, it might be less great. It could accelerate Netflix's dominance and reduce real competition.

Regulators might care about this. They might view Netflix-WBD as anticompetitive consolidation. They might block it or condition it heavily.

But the board's argument is simple: Netflix is going to dominate anyway, whether they acquire HBO or not. At least if they acquire HBO, HBO's shareholders get paid and HBO's content gets produced at the scale and quality it deserves.

It's not a defense against antitrust concerns necessarily. It's just a practical argument that this is how the industry is evolving anyway.

Netflix's market capitalization is significantly larger than Paramount's, highlighting its financial strength and strategic flexibility.

The Cable Network Twilight: HGTV, Food Network, and the Death of Traditional TV

One of the assets that would go to Discovery Global: HGTV and Food Network.

These are cable networks that have real audiences. But those audiences are aging, and the replacement viewers aren't coming. Cord-cutting is real. Streaming is where younger audiences go.

HGTV's core audience is 50+. Food Network's core audience is 45+. That's not a younger demographic that's going to grow with time.

Netflix doesn't want these networks because Netflix doesn't do cable TV. Netflix does streaming, documentaries, and prestige programming.

Paramount wants to keep them because Paramount has a cable footprint and knows how to operate cable networks. But Paramount is also underwater with debt in any scenario.

Discovery Global, as a separate company, would have to figure out how to compete with streaming while owning declining cable networks. That's a tough mandate.

But maybe it's the right mandate. Maybe these networks need to be owned by a company focused on cable and linear TV, not by a streaming giant.

The board's thinking here is: Netflix doesn't want them, Paramount can have them (along with all the debt), and WBD shareholders can own Discovery Global as a separate entity.

It's not a perfect outcome for Discovery Global shareholders. But it's probably better than trying to run HGTV and Food Network as part of a Netflix empire, where they'd be deprioritized.

The Global Expansion Play: Why International Markets Matter

Warner Bros. Discovery operates in multiple countries. They have HBO services in Europe, Latin America, Asia. It's genuinely global.

Netflix wants to expand content. Their international strategy depends on local content and local partnerships. Acquiring HBO gives them premium local content engines in multiple countries.

Paramount wants scale. They want to be a global competitor to Netflix. But they need distribution. They need local partnerships. They need local content.

Both companies see international markets as critical to their future. But Netflix's path to international dominance is cleaner (distribution plus content). Paramount's path is messier (consolidation plus figuring out local dynamics).

The board probably thinks Netflix's path is more likely to succeed.

The Valuation Question: Is $82 Billion a Fair Price?

The board is saying yes. They're saying $82 billion for HBO, Warner Bros. Studios, and HBO Max is fair value, especially when you factor in the Netflix stock component and the upside potential.

Paramount is saying no, implying their $108 billion offer is more fair. But remember, that's for everything, including assets Netflix doesn't want.

What is HBO actually worth? That's the fundamental question.

HBO has:

- 60+ million subscribers

- Prestige content catalog

- Global distribution infrastructure

- Premium positioning

- Consistent cash generation

- Growth in advertising revenue

Those are valuable things. Are they worth $82 billion? The board says yes. Netflix says yes. Markets are probably split.

But the board is saying they negotiated hard, and this is the best price they could get. So unless Paramount's offer is objectively better (and the board argues it isn't, when you factor in debt and financing), shareholders should accept it.

The Regulatory Scenario Planning: Multiple Paths Forward

Let's say the shareholder vote goes for Netflix. What happens next?

Scenario 1: FTC/DOJ clears it without conditions. European Commission clears it without conditions. Deal closes in 2026.

Scenario 2: FTC/DOJ asks for conditions (maybe some international divestitures, maybe content commitments). European Commission does the same. Deal closes with changes in 2026-2027.

Scenario 3: FTC/DOJ clears it, but European Commission blocks or heavily conditions it. Deal gets renegotiated or dies.

Scenario 4: FTC/DOJ blocks it. Deal dies.

Each scenario has different probabilities and different implications. The board factored this in, but they're not certain what happens.

With Paramount's deal, the scenarios are similar but with higher regulatory risk (more consolidation concerns, more media concentration concerns).

The board is betting Netflix has a better regulatory path. That's a calculated bet, not a certainty.

The Employee Perspective: What Happens to the Workforce?

When mega-mergers happen, people lose jobs. That's just reality.

Netflix would acquire HBO, Warner Bros., and HBO Max. Redundant functions would be eliminated. Finance, HR, IT, even some creative functions could be consolidated.

When that happens, HBO employees might report to Netflix leadership. Warner Bros. employees might integrate with Netflix operations. There's organizational chaos for a while.

With Paramount's deal, a different set of integrations would happen. But the fundamental reality is the same: mergers create job losses.

The board's recommendation doesn't address this much. It can't. The board's fiduciary duty is to shareholders, not employees. But from an operational perspective, Netflix's cleaner integration might mean less disruption than Paramount's more complex merger.

That's not nothing. A cleaner integration means less talent flight, less institutional knowledge loss, less operational disruption.

The Dark Horse Scenario: What If Neither Deal Happens?

Shareholders could reject both deals. Or regulators could block both deals.

If that happens, Warner Bros. Discovery is independent again. They have to compete in streaming against Netflix, Disney+, Amazon. They have cable networks that are declining. They have massive scale but unclear strategic direction.

That's actually a really uncomfortable position. It's why the board pushed so hard to get a deal done.

Once you've opened yourself to acquisition, it's hard to go back. The market loses confidence. Your stock gets volatile. Your best talent wonders what's next.

The board is betting that shareholders understand this. Approve the Netflix deal, and you get certainty. Reject it, and you're back in a tough independent position.

That's actually one of the board's strongest arguments.

The Financing Wall: Why Paramount's Numbers Don't Actually Work

Let's do some math on Paramount's financing:

- Total deal value: $108 billion

- Larry Ellison's guarantee: $40 billion

- Remaining to finance: $68 billion

- Paramount's market cap: $14 billion

- Debt-to-market-cap ratio: 4.9x

For context, Netflix's debt-to-market-cap ratio is under 1x. That's a massive difference.

When you borrow money, you have to pay interest. Let's say Paramount's cost of debt is 6% (probably higher given risk):

- Annual interest on 4.08 billion

Paramount's annual revenue is roughly $30 billion. So they'd be paying 13%+ of revenue just on interest. That's crushing.

They'd have to cut costs. They'd have to reduce content spending. They'd have to make conservative decisions. They'd look weak compared to Netflix for years.

The board sees this. They're saying this deal doesn't work financially, even if the headline number is bigger.

It's math. Simple math. And it's why the board's recommendation is so firm.

FAQ

What is the Warner Bros. Discovery and Netflix merger about?

Netflix is acquiring Warner Bros., HBO, and HBO Max from Warner Bros. Discovery for $82 billion in a combination of cash and stock. This deal allows Netflix to expand its content portfolio with premium HBO content while keeping WBD's cable networks in a separate spinoff company (Discovery Global) for shareholders to manage independently.

How does Paramount Skydance's competing bid work?

Paramount Skydance is offering

Why did the WBD board reject Paramount's higher offer?

The board cited several concerns: Paramount's

What happens to WBD's cable networks under the Netflix deal?

Under Netflix's $82 billion offer, the premium content assets (HBO, Warner Bros. Studios, HBO Max) go to Netflix. The cable networks—CNN, HGTV, Food Network, Discovery Channel, Animal Planet, and others—remain with WBD shareholders through a newly created spinoff company called Discovery Global. This separation allows Netflix to focus on streaming while keeping traditional cable networks as a separate, independently managed entity.

What is Discovery Global and why is it important?

Discovery Global is a new publicly traded company that would be created from the spinoff of WBD's cable networks and linear television assets. It represents the declining but still meaningful cable TV business, with networks like CNN, HGTV, and Food Network. WBD shareholders would receive Discovery Global shares as part of their Netflix merger compensation, giving them exposure to both Netflix's streaming growth and cable networks' stability (or decline).

How much debt would Paramount need to finance this deal?

Paramount needs approximately

What are the regulatory risks for both deals?

Both mergers require approval from the U.S. Federal Trade Commission and the European Commission. Netflix's deal faces antitrust questions about streaming consolidation, while Paramount's deal faces questions about traditional media concentration and control of news infrastructure (through CNN). The European Commission has blocked previous major media mergers and tends to be skeptical of deals that reduce media plurality. Timeline for regulatory approval is estimated at 6-12 months each, pushing any closing to 2026 or 2027.

Why is Netflix's stock component valuable in this merger?

Netflix's $400+ billion market capitalization and strong stock performance (Netflix is profitable and growing subscribers) mean that Netflix shares received in the merger have real upside potential. Rather than getting purely cash (which is static), shareholders get exposure to Netflix's future growth. Netflix stock momentum and proven execution in streaming make those shares more valuable long-term than Paramount's cash offer, which requires expensive debt financing.

What happens to HBO after the Netflix acquisition?

HBO would be fully integrated into Netflix's operations. Netflix would control HBO's content production, distribution, and strategic direction. HBO Max subscribers would transition to Netflix's platform. Netflix would likely increase content production budgets and leverage HBO's prestige brand alongside Netflix's global distribution network to compete more effectively with Disney+, Amazon Prime Video, and other streaming platforms.

Could shareholders reject both deals and force WBD to stay independent?

Yes, shareholders could vote against the Netflix deal, and regulators could ultimately block either deal. However, once a company opens itself to acquisition, staying independent becomes challenging—stock volatility increases, talent uncertainty grows, and the market loses confidence. The board is essentially saying that approving the Netflix deal provides certainty and shareholder value maximization, while rejection would leave WBD in a weakened, uncertain position competing independently against Netflix and Disney.

What Comes Next: The Real Timeline

The next steps are straightforward, even if the timeline is uncertain.

First, WBD shareholders vote. That happens relatively soon, likely in early 2025. The board is pushing shareholders to vote yes on the Netflix deal.

Second, Paramount shareholders vote. Paramount's shareholders might reject management's approach or they might support the aggressive play for WBD. Either way, Paramount has to deal with their own stakeholders.

Third, regulators get involved. FTC/DOJ review in the U.S. European Commission review in Europe. This is where the real uncertainty lives. You can have the best deal in the world, but if regulators block it, it doesn't happen.

Fourth, assuming votes and regulatory approvals go through, integration. Netflix takes control of HBO and Warner Bros. Discovery integrates the cable networks into Discovery Global.

Fifth, the market adjusts. Subscribers figure out what the new landscape looks like. Competitors respond. The streaming wars continue with a new set of dynamics.

That's the path forward. It's not quick. It's not certain. But it's the path the board is charting.

The Bottom Line: Why This Matters Beyond Wall Street

This isn't just corporate drama. This deal determines who controls some of the most iconic media properties on Earth.

It determines whether HBO stays premium and well-funded or gets absorbed into a streaming service alongside thousands of other titles.

It determines whether CNN stays independent or becomes part of a Paramount mega-company.

It determines whether streaming consolidation continues (Netflix wins) or whether traditional media fights back through scale (Paramount wins).

It determines which business model for media actually works long-term: focused streaming excellence or diversified media conglomerates.

The WBD board has made their choice. They believe focused streaming (Netflix) beats diversified media (Paramount). They believe

They're betting on simplicity over complexity, on pure-play streaming over hybrid models, on Netflix's execution over Paramount's ambition.

Shareholders will vote. Regulators will decide. The media landscape will shift.

And whatever happens, this moment—where a board chose a streaming company over a traditional media company—tells you everything you need to know about where media is actually going.

The future isn't cable networks with streaming attached. The future is streaming networks that occasionally own assets. Netflix understood that before anyone else. Paramount is still trying to prove the other model works.

The board thinks Netflix is right. And they're betting WBD shareholders will agree.

Key Takeaways

- WBD board unanimously rejected Paramount's 82B offer despite the lower headline number

- Paramount's financing structure requires 4.08B annual interest payments

- Netflix's offer includes valuable stock component with upside potential, while Paramount's offer requires expensive debt financing that would constrain operations

- Accepting Paramount's bid would cost WBD shareholders $4 billion in Netflix termination fees, narrowing the effective price difference

- Netflix's deal keeps cable networks (CNN, HGTV, Food Network) in separate Discovery Global spinoff, while Paramount's offer bundles declining assets with growth streaming

- Regulatory approval represents significant risk for both deals, with European Commission particularly skeptical of media consolidation and plurality concerns

- Shareholder vote and regulatory approvals will determine deal success, with potential timeline extending into 2026-2027 for closing

- Netflix's simpler pure-play streaming model requires less complex integration than Paramount's hybrid legacy-media-plus-streaming structure

![Warner Bros. Discovery Rejects Paramount Skydance Bid: Why Netflix Won [2025]](https://tryrunable.com/blog/warner-bros-discovery-rejects-paramount-skydance-bid-why-net/image-1-1767796698261.png)