What Startups & VCs Should Expect in 2026: Investor Predictions

Every year around this time, something interesting happens in venture capital. Investors look in the mirror, audit their bets, and start making predictions about what's coming next. Some years they're eerily accurate. Other years, the IPO market stays frozen when everyone predicted a thaw, or AI adoption moves slower than the hype suggests.

But here's what's different about the predictions coming into 2026: there's an unusual degree of consensus among top venture investors about the fundamental shift happening right now. And it's not what most founders think.

It's not about artificial intelligence being everywhere. We already knew that. It's not about valuations rebounding or the IPO market returning. Those are nice-to-haves. What's really changing is how investors evaluate companies, what they reward, and what they've stopped caring about entirely.

For founders preparing to raise capital in the next 18 months, this shift is everything. For investors managing dry powder and deploying capital, it's reshaping their investment theses. For everyone watching the startup ecosystem, understanding these predictions reveals where the real opportunities and risks actually are.

We talked to five major investors from different markets—Black Ops VC, M13, Endeavor Catalyst, Flybridge Capital, and Dawn Capital. They manage billions in assets, they've backed companies across industries, and they're seeing patterns that matter. Here's what they're preparing for in 2026.

The New Bar for Raising Capital: Why Traction Isn't Enough Anymore

Remember 2023? When having a good idea in AI was basically a venture capital golden ticket? When "we're building something with transformers" could fund three rounds of meetings? That era is over. Completely over.

The shift is subtle but brutal. It's not that investors stopped caring about traction. It's that traction by itself became table stakes. Like, you don't get a seat at the table without it. But a seat at the table doesn't mean you'll get funded.

James Norman from Black Ops VC describes the evolution this way: what used to work was being "visionary." You had a compelling narrative about the future, data was secondary, and capital itself became your moat. You'd raise $10M, hire aggressively, and outrun everyone else to the finish line. The best-funded company often won.

That's dead.

What he's seeing now is founders stuck in what the industry calls "pilot purgatory." This is where enterprises test AI solutions endlessly without any real intention to buy. A Fortune 500 company will let you set up a pilot for six months, watch it work beautifully, then go radio silent. Nothing happened. They didn't reject you. They just don't have an urgent business problem you're solving, so the pilot never converts to a customer. According to RTInsights, this pilot-to-paid conversion problem is reshaping how investors evaluate enterprise AI companies.

Investors are getting smarter about spotting this situation before funding it. And when they spot it, they pass. Because pilots that don't convert to revenue are expensive science experiments, not businesses.

So what does work now? Distribution advantage. Repeatable sales engines. Proprietary workflow improvements. Deep subject matter expertise that actually holds up against the reality of deployment.

Morgan Blumberg from M13 puts it differently but means the same thing: the market has formed capital moats around crowded sectors. You can't just be another AI application in a category where thirty other startups are building the same thing with the same tech stack. You need something that's uniquely yours.

For very early stage founders, especially in AI application software, mega seed rounds are getting rarer. Not impossible. Just rarer. The founders raising big checks at the seed stage are the ones with distribution channels that already exist, or perspectives on problems that nobody else has thought about, or access to markets that competitors can't easily replicate.

It sounds obvious when you say it out loud. But in practice, this represents a massive cultural shift in how capital allocation works. You can't bullshit your way through a VC meeting anymore by showing beautiful demos and talking about TAM. Investors are digging into the specifics: How will you actually acquire customers? Why is that acquisition channel defensible? What breaks if a bigger company with more resources decides to compete with you?

These are uncomfortable questions. But they're the ones that matter now.

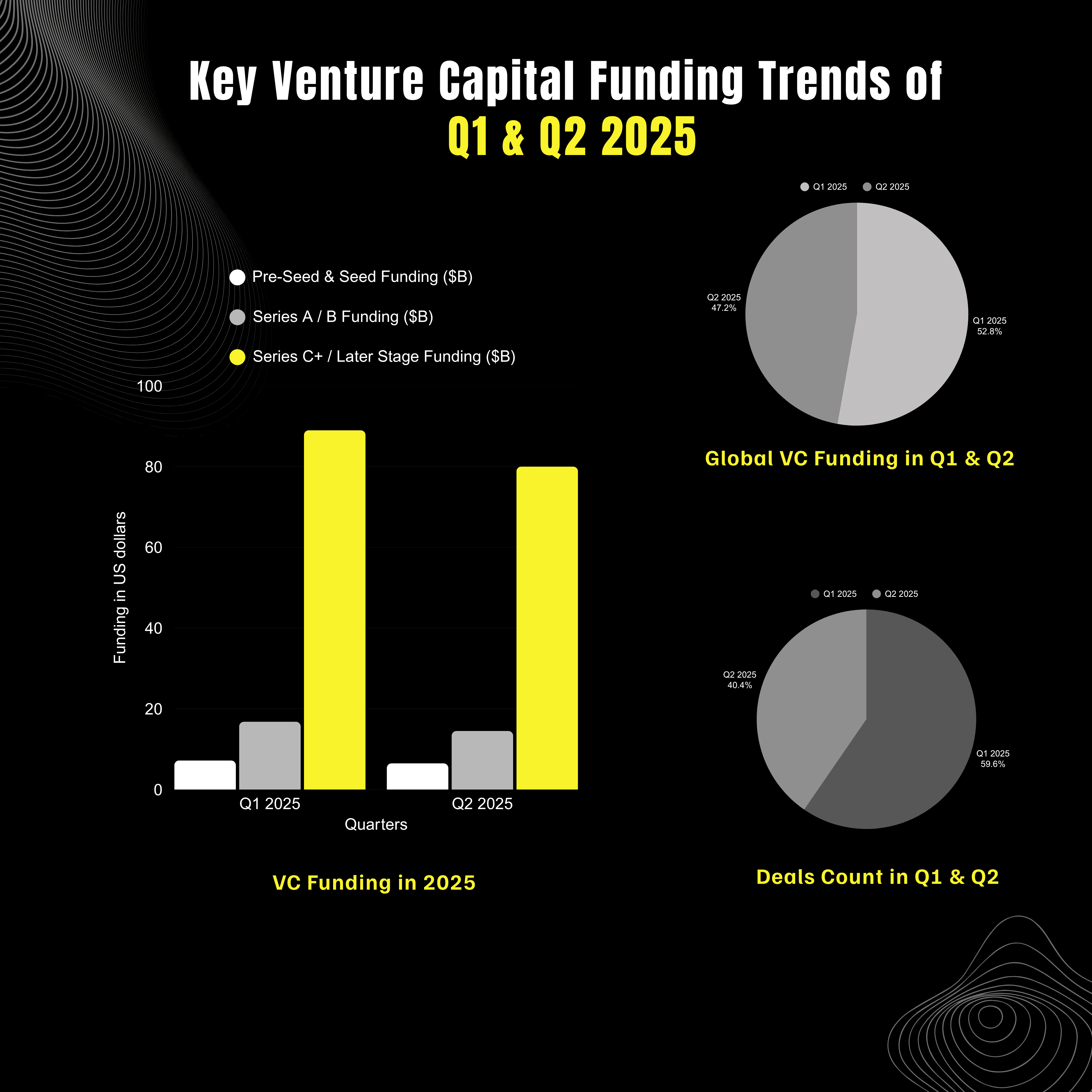

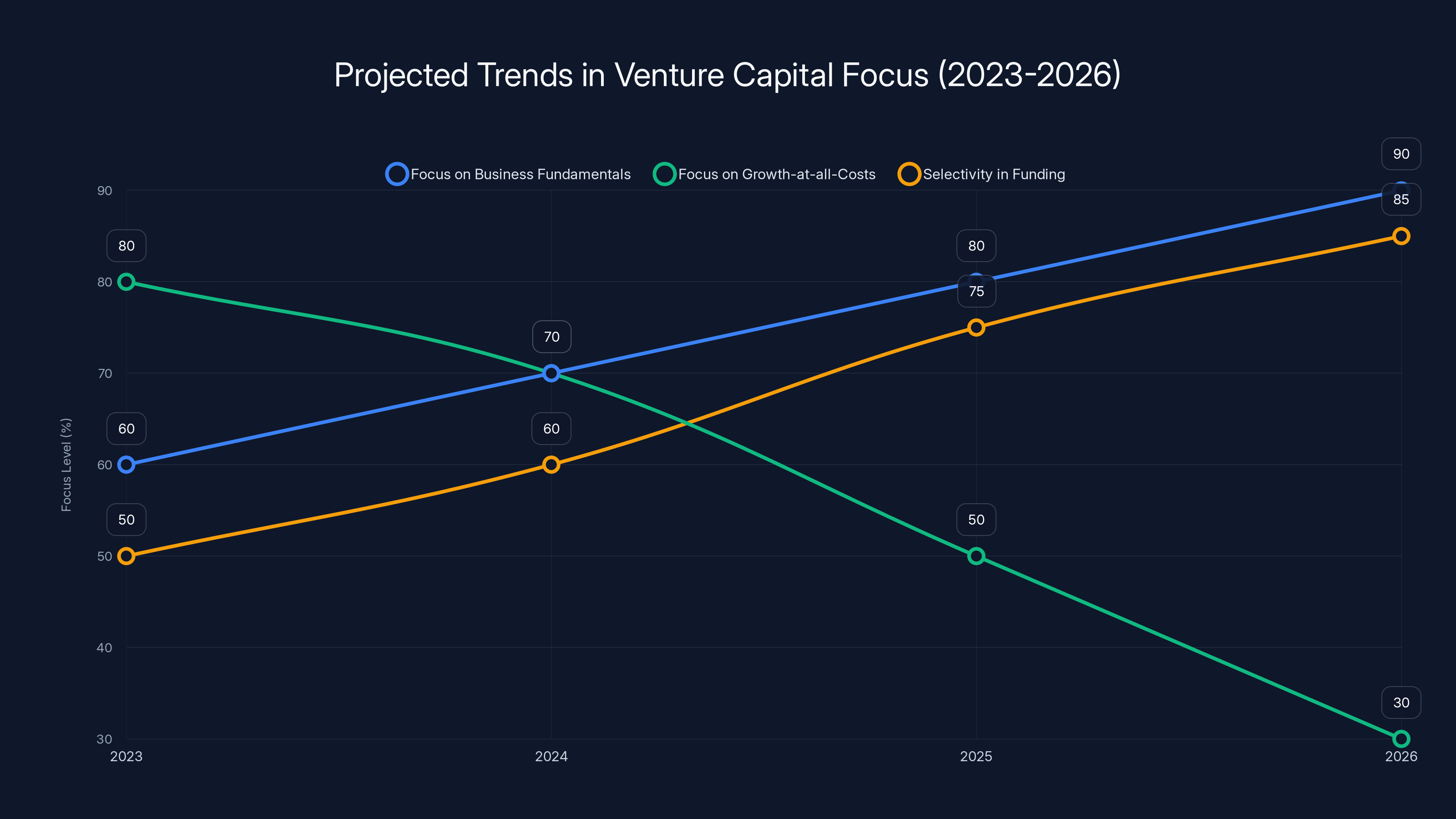

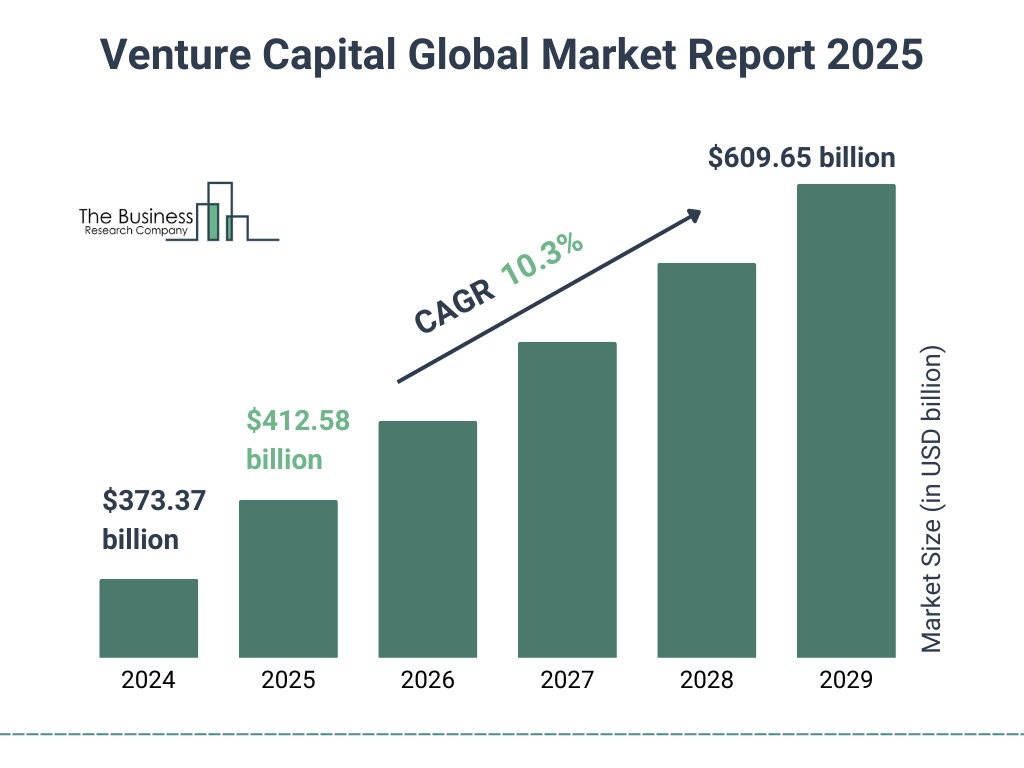

The venture capital landscape is projected to shift towards a greater emphasis on business fundamentals and selectivity in funding by 2026, while the focus on growth-at-all-costs is expected to decline. (Estimated data)

Series A and B: The Explosive Momentum Requirement

Once you've proven early traction and you're ready to scale, the bar doesn't just get higher—it shifts to a completely different dimension.

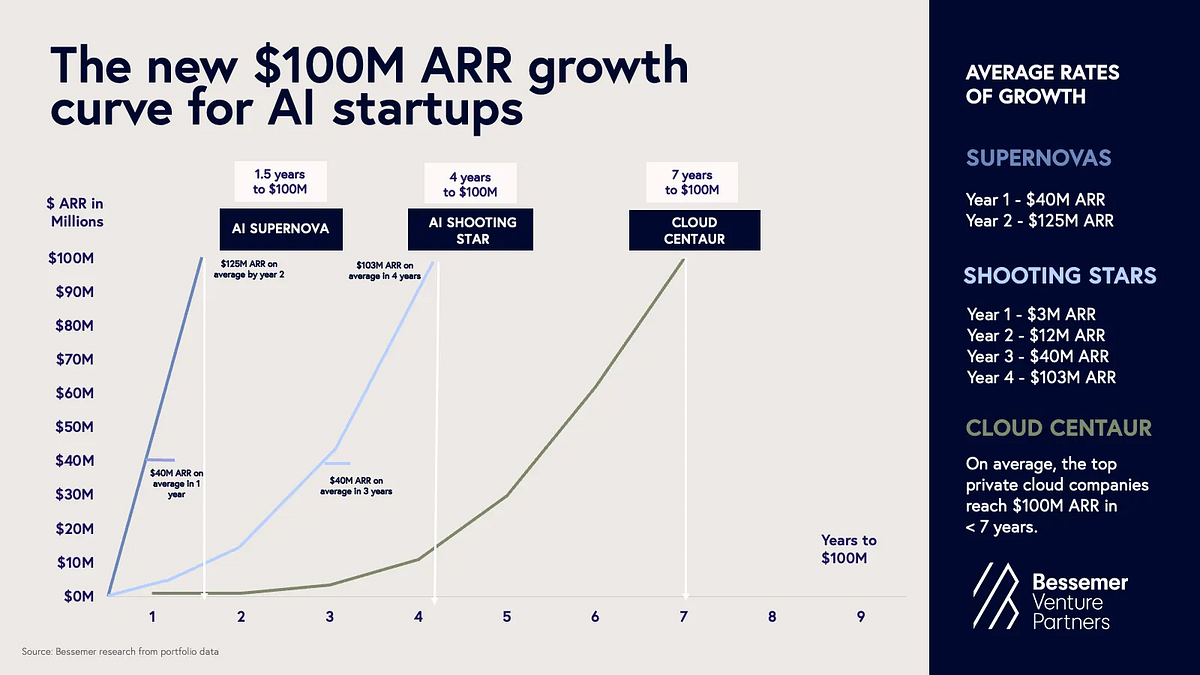

At the Series A and B stages, investors are now looking for what they call "explosive momentum." This isn't modest growth. It's not "we grew 20% month over month, which is healthy." It's revenue that's accelerating, customer acquisition that's working, unit economics that make sense, and a product-market fit story that's so clear you don't have to explain it.

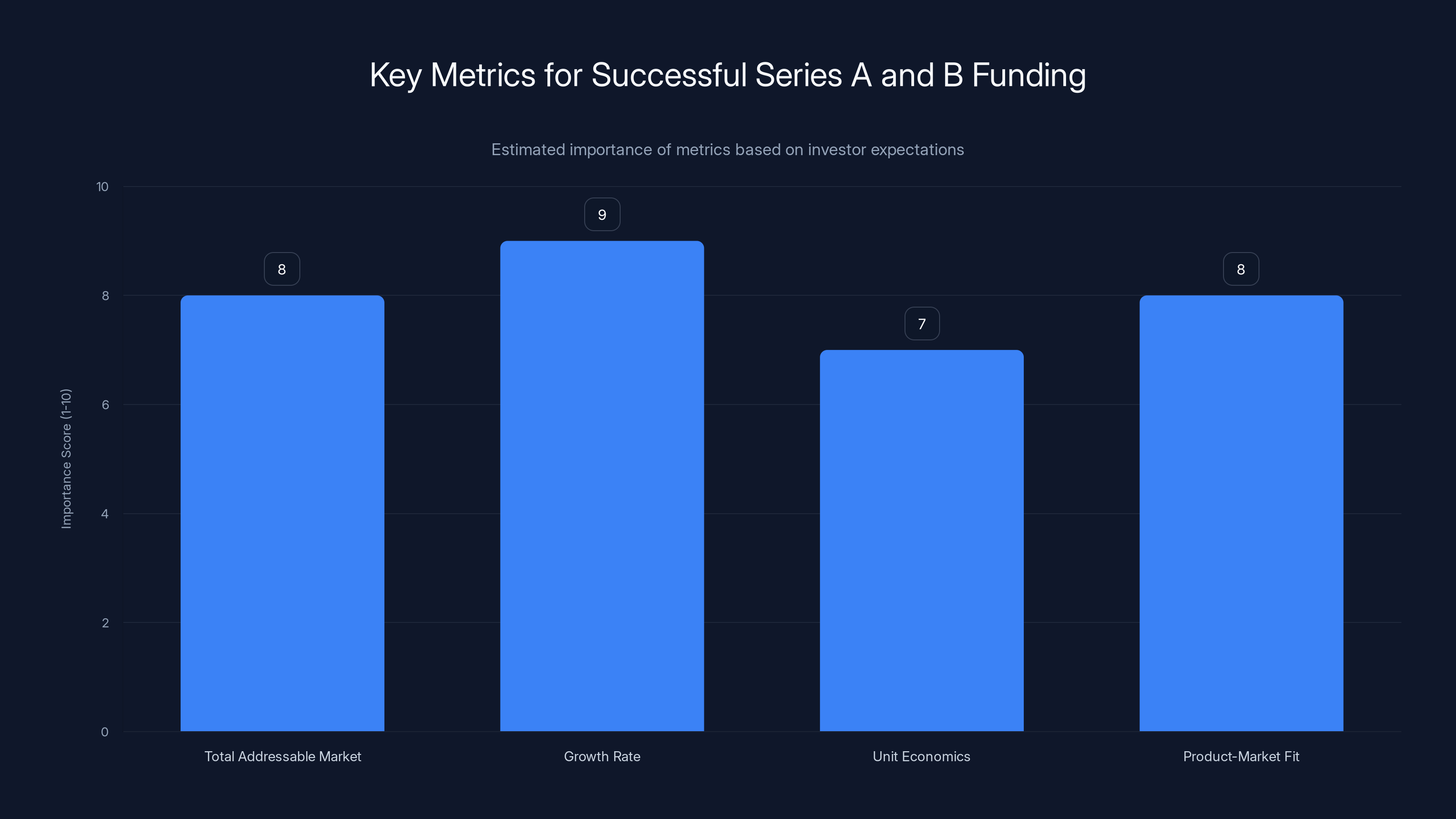

Allen Taylor from Endeavor Catalyst frames it around three metrics: bigger total addressable market, faster growth, better unit economics. That's the tripod. If you're missing any one of these, you're going to face serious skepticism from investors who've already deployed capital in competitive spaces.

The sustainability question has become crucial. Investors are scarred from watching companies that grew like crazy and then collapsed because the growth was propped up by unit economics that didn't work. Burn money on acquisition? Sure. But if the lifetime value of a customer is less than the cost to acquire them, that's not a business. That's a customer acquisition experiment with a time limit.

What's interesting is that Endeavor Catalyst alone made 50 investments across 25 countries last year. So they're seeing founders at vastly different stages in vastly different markets. And the pattern that holds is consistent: the founders who raise successfully at Series A and B are the ones who can paint a credible picture of where the company is in 12, 18, or 24 months.

Real revenue and real customers still matter. They absolutely matter. But they're no longer sufficient on their own. You need to show investors that this isn't a fluke. You've found something repeatable, you understand how to scale it, and you have a realistic path to the size of business that justifies venture capital returns.

This is where many founders stumble. They hit early traction, maybe they've got decent revenue, but then they can't convince investors that the traction will accelerate. The sales process is still manual. Customer acquisition requires founder-led selling. There's no clear path to scale without the founder personally involved in every deal.

That's a deal killer at Series A. It's a data point that says: this founder has built something that works, but they haven't built something that scales.

Investors prioritize growth rate and product-market fit in Series A and B funding. Estimated data based on investor focus areas.

AI Has Leveled the Playing Field—So Differentiation Is Fiercer Than Ever

Here's a paradox that's messing with a lot of founders right now: AI coding tools have become so good that the technical barrier to building software has basically vanished. You can spin up a fully functional product in weeks that would have taken a team of engineers months to build five years ago.

Dorothy Chang from Flybridge Capital is seeing this play out constantly. It's easier than ever to build a new thing because the tools do most of the work for you. But that same advantage is available to everyone else. So the competition isn't about who can build fastest anymore. The competition is about who's building something that matters, that they're uniquely positioned to own.

This creates a weird situation. The commoditization of development actually makes the non-technical factors more important. Because if anyone can build anything quickly, then what separates winners from losers?

Three things, according to investors seeing this clearly:

First, you need to be tackling something that's genuinely big. Not something that's just easy to build. Not something that feels like a natural fit for AI-augmented code generation. Something that, if you solve it, actually changes an industry or creates massive value. The difference between a features and a business is whether you're solving a small problem very well or a big problem adequately.

Second, you need to be uniquely positioned to win in that space. This is where distribution advantage, domain expertise, existing relationships, or proprietary access to data comes in. If you're just another software engineer building yet another tool in an existing category, why would anyone bet on you instead of the person who's been in that industry for fifteen years?

Third, you need something that can't easily be replicated. This could be a contrarian approach backed by deep insights. Proprietary access to data or datasets that competitors can't easily license. Deep networks and relationships in your market. A technological advantage that took you years to build. Some kind of moat, in other words.

Shamillah Bankiya from Dawn Capital is emphasizing this too. The stakes have gotten higher. The expectations are higher. You can't rely on any single advantage being sufficient anymore. You need to be building something that's big, where you have unique position, using technology that you control.

That's a high bar. But it's also clarifying. It tells you exactly what you need to figure out before you raise capital.

The Enterprise Sales Reality: Proving ROI Is Non-Negotiable

If you're selling to enterprises, you're playing a different game than if you're building for SMBs or consumers. And investors know this. They're calibrating their expectations differently.

The good news: everyone in the enterprise space now understands what AI can do. You don't have to explain the concept anymore. No more meetings where you're teaching executives about transformer models or large language models. They get it. They've probably tested it already.

The bad news: because everyone understands it, the bar for implementation and ROI proof is extremely high. You can't sell on potential anymore. You're selling on measurable results.

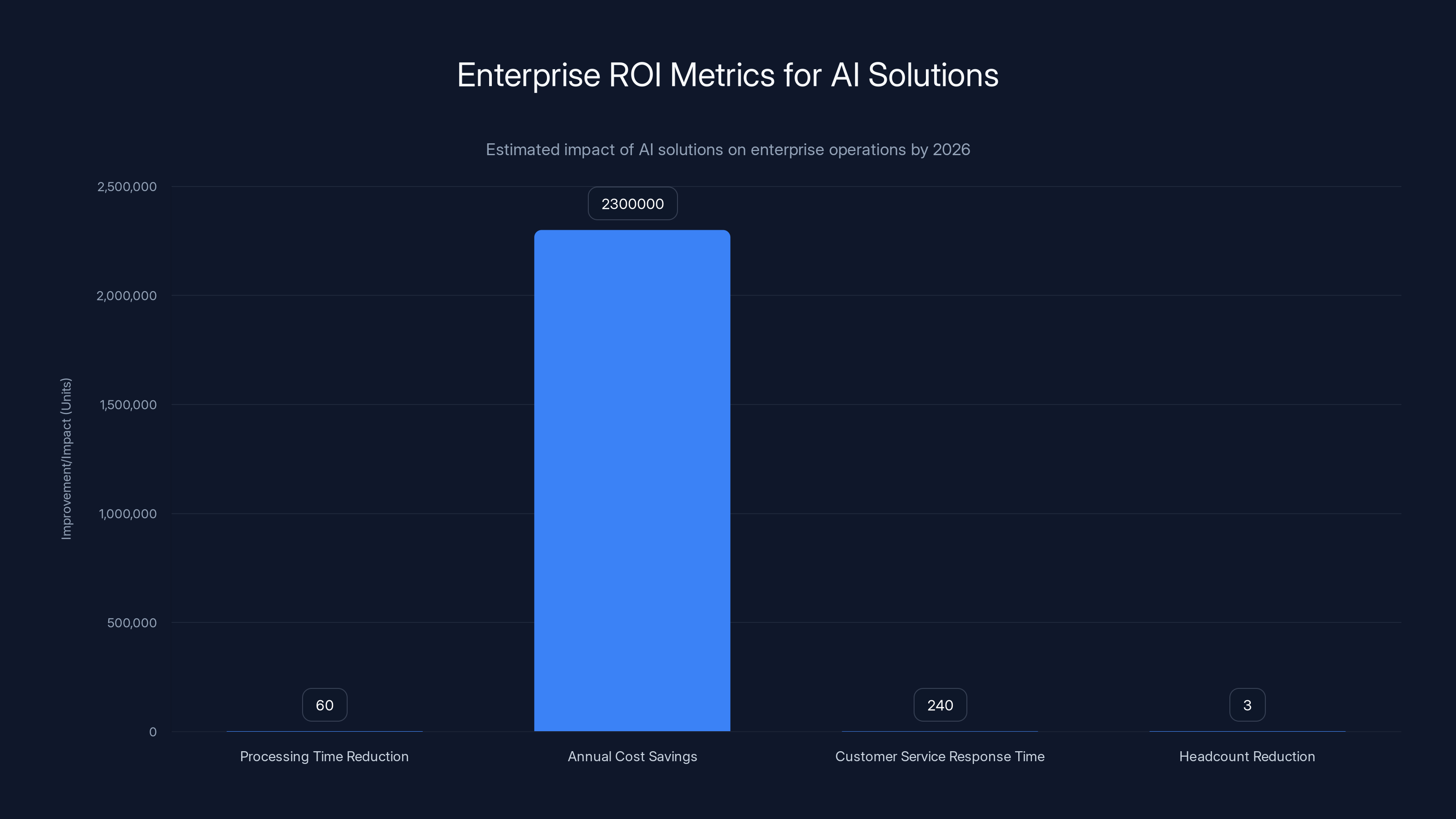

Founders who can show line of sight to clear ROI have the strongest position in 2026. Not "we think this will save time." Actual numbers. "This will reduce processing time by 60%, which means at your transaction volume, you'll save $2.3M annually." Or "we'll cut customer service response time from 4 hours to 6 minutes, which lets you reduce headcount by 3 FTEs while improving customer satisfaction scores."

This matters because it ties the software to business outcomes that executives care about. And business outcomes are the only thing that gets budget approved at enterprise companies. You can't spend

For founders, this means you need to understand your customer's P&L. You need to know what their pain is costing them right now. You need to be able to quantify the before and after. And you need to have case studies or pilots that prove this works at the scale your prospect operates at.

Investors aren't just looking at whether you can sell to enterprises. They're looking at whether you understand how to sell to enterprises. And selling to enterprises in 2026 is a math problem, not a vision problem.

Estimated data shows AI solutions can reduce processing time by 60%, save $2.3M annually, cut response time by 240 minutes, and reduce headcount by 3 FTEs in enterprises by 2026.

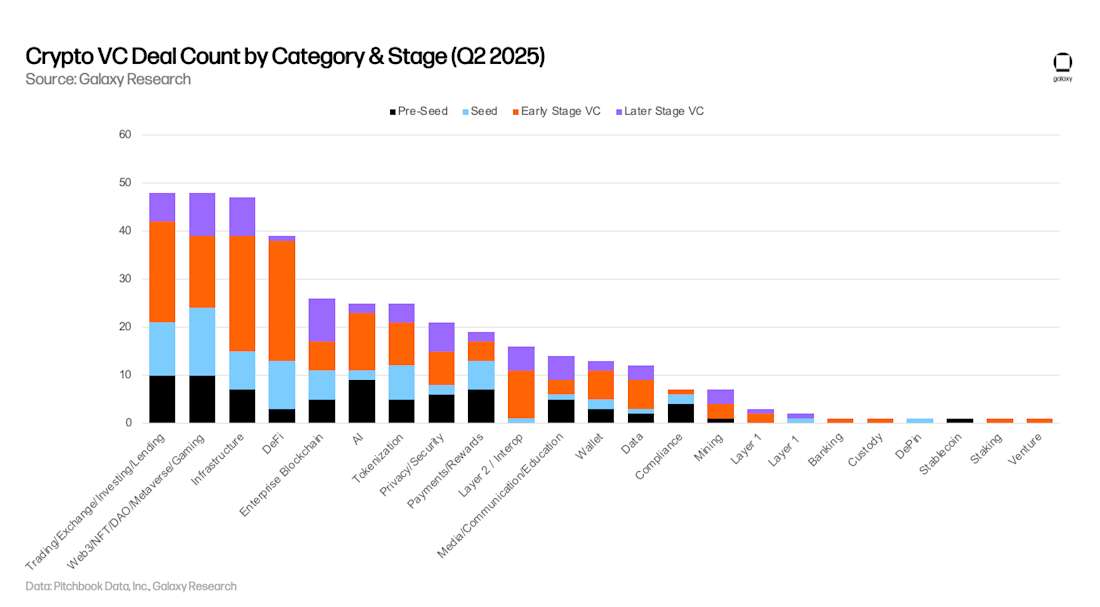

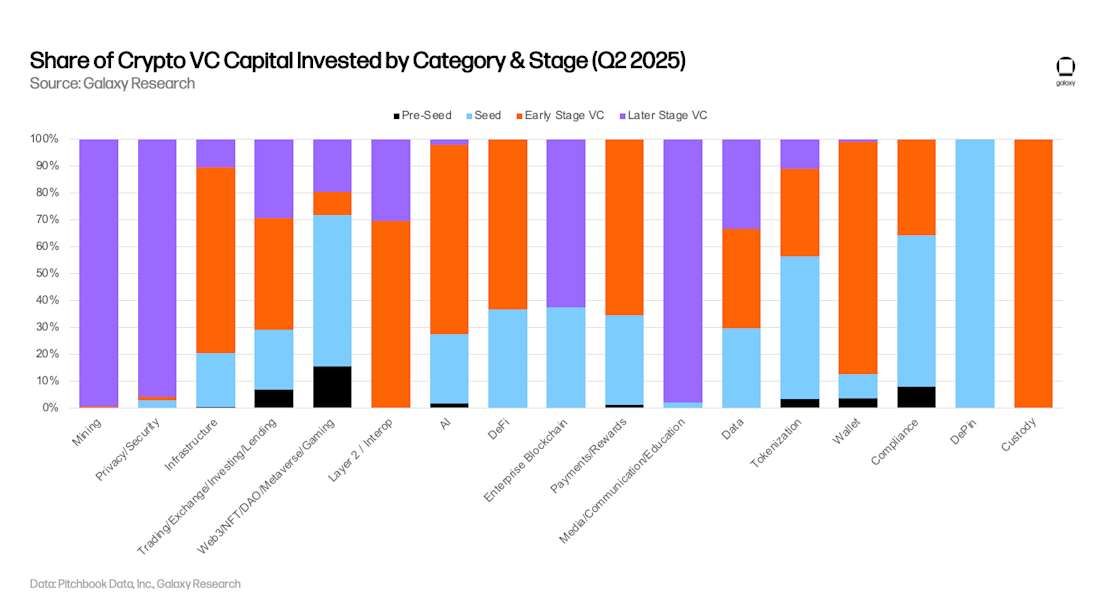

Where Are Investors Deploying Capital in 2026?

The Rise of High-Context Founders and Deep Domain Expertise

There's a clear pattern emerging about who investors want to back in 2026: people they're calling "high-context founders."

This is slightly different from how the industry used to describe successful founders. It's not just about being scrappy or smart or visionary. It's specifically about having lived experience in complex industries. Years spent in the trenches. Bespoke expertise in a specific domain that can't be easily replicated just by hiring smart people.

Think about it this way: the person who spent a decade in enterprise infrastructure, who knows all the technical debt in legacy systems, who understands why companies are slow to migrate to new platforms—that person is now incredibly valuable to investors. Because they can build something that solves a real problem in that domain, they already have relationships with the buyers, and they understand the regulatory and compliance landscape.

Compare that to a generalist engineer who just thinks enterprise infrastructure is interesting and wants to build something in the space. Same smart engineer, probably. But the one with domain expertise has a 10x advantage.

Investors are explicitly looking for the marriage of deep subject matter expertise with what they call "day zero distribution advantage." This means founders don't just know what to build. They already know exactly who is going to buy it. They've got relationships. They understand the specific pain points. They might even have customers waiting for a product.

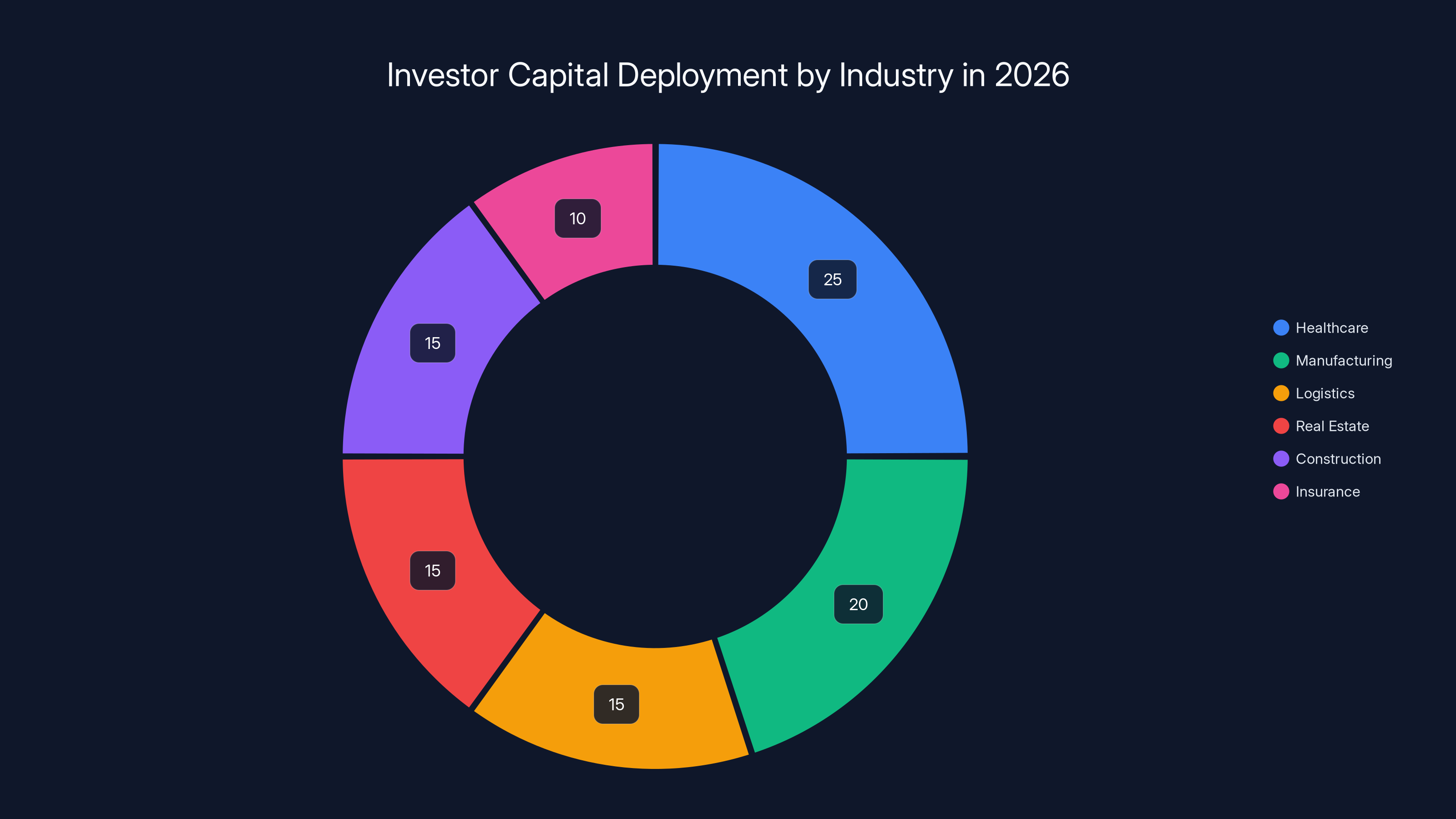

This has major implications for which industries are attractive to venture investors in 2026. It means sleepy industries. Legacy industries. Boring industries that sit outside the core tech founder appetite. Healthcare, manufacturing, logistics, real estate, construction, insurance. Industries where an AI-enabled step change in ROI could drive massive adoption, but where there's less competition because most venture capitalists would rather fund another B2B SaaS startup than figure out how to sell to hospital administrators.

These markets have lower competition and higher barriers to entry, precisely because the barriers are domain-specific complexity, not technical complexity. An AI engineer can copy your code. They can't copy your fifteen years of industry relationships.

Infrastructure for Foundation Models: The Unsexy Play That's Actually Hot

Something that doesn't get as much media attention as it should: investors are very interested in infrastructure supporting foundational model development.

This is not consumer-facing. This is not flashy. You won't see a TechCrunch headline about it. But it's serious capital deployment.

Why? Because foundation models are still being developed. OpenAI is still training new models. Anthropic is competing. Google, Meta, and other major tech companies are all building their own models. And they all need better infrastructure to do it more efficiently, more cheaply, with better inference speeds.

The companies that solve infrastructure problems for model training and inference are positioned to capture significant value. Not venture-return-sized value maybe, but solid, sustainable, well-funded value.

For founders, this is an interesting space to watch if you have machine learning expertise and want to work on unsexy but important problems. For investors, it's a category where there's clear customer demand and multiple billion-dollar TAM opportunities.

Frontier Research Categories: Embodied AI and World Models

There's also investor interest in what they're calling "frontier research categories." This includes embodied AI (training AI systems to control physical robots and understand physical space) and world models (AI systems that build internal representations of how the world works).

These are further away from commercialization than large language models. But they're the next frontier. And investors know that the companies that crack these problems early will be positioned to dominate the next decade of AI.

This is higher risk, higher upside capital. It's the kind of bet that only works if you're playing venture capital over a 10-15 year horizon. But if you believe that embodied AI and physical robots are part of the future, then seeding the companies that will build that infrastructure makes sense.

Healthcare: Still the Biggest Opportunity

Healthcare remains a major focus for venture investors, and it's easy to understand why.

There are clear signs of buyer demand. Hospitals, clinics, insurance companies, and health systems all have urgent problems: documentation burden, clinical decision support, patient engagement, operational efficiency. AI can solve all of these. And unlike some domains where buyers aren't sure if they actually need what you're building, healthcare buyers are actively looking.

Plus, the regulatory framework is becoming clearer. FDA guidance on AI medical devices is published. Insurance reimbursement is starting to happen. You can't build a healthcare company without understanding regulation and reimbursement, but the landscape is increasingly legible.

From an investor's perspective, healthcare is also attractive because the TAM is massive and recurring. People need healthcare every year, forever. If you solve a healthcare problem, the customer lifetime value is enormous.

The trade-off is complexity and longer sales cycles. But investors are used to that in healthcare. And they're increasingly comfortable with the complexity because the upside is so clear.

The Capital Arms Race: Why Speed and Execution Matter More Than Raw Dollar Amount

It's interesting that investors are no longer impressed by the size of funding rounds. A

What matters is whether you're using capital efficiently and whether you're executing faster than competitors. In a crowded space with multiple well-funded competitors, the winner is often the company that can execute 20% faster, not the one with 20% more capital.

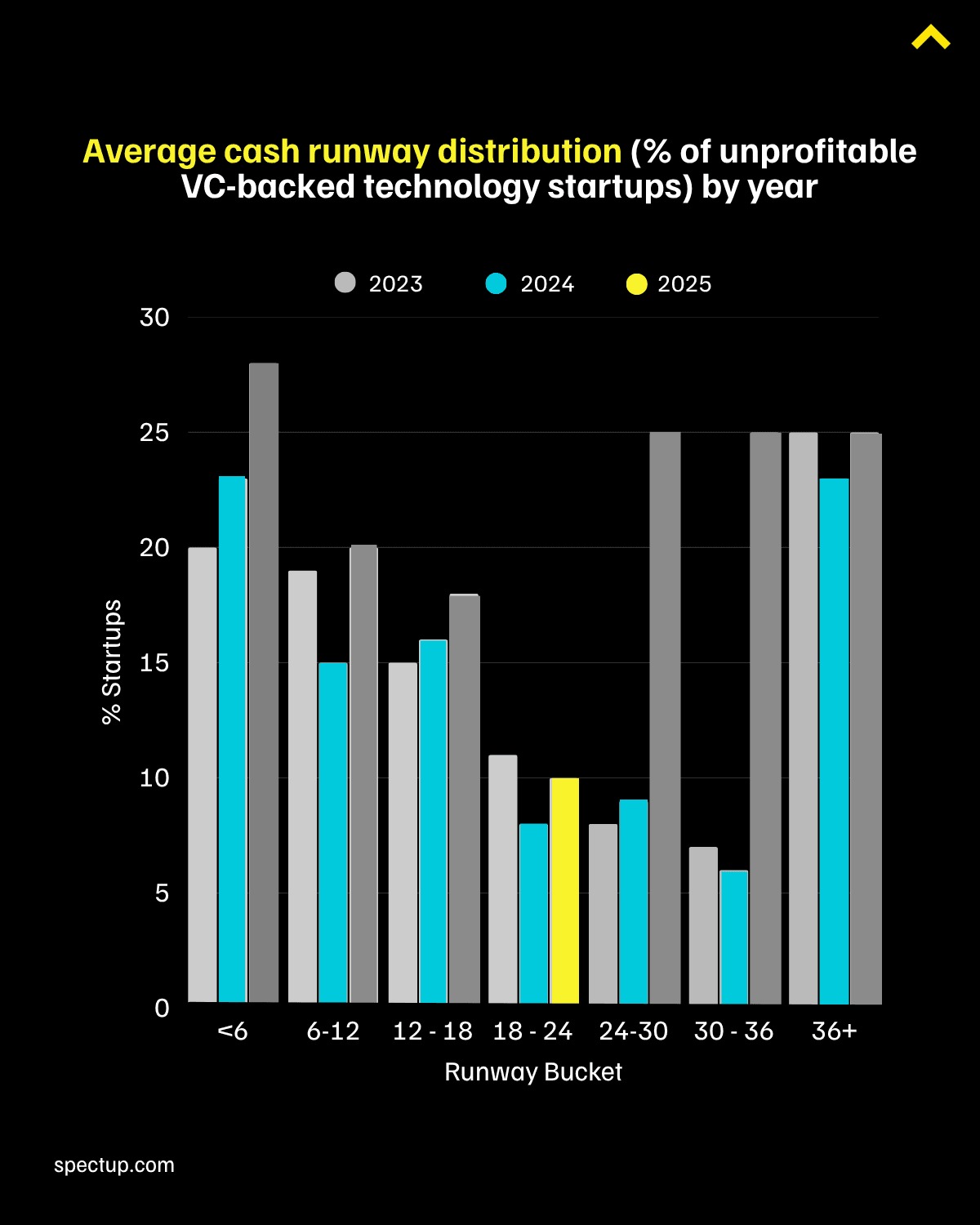

This shifts the founder-investor dynamic in interesting ways. It's no longer about raising the biggest check possible. It's about raising the right amount and deploying it with ruthless focus. It's about being disciplined about burn rate even when capital is available.

Some of the strongest founders in 2026 are going to be the ones who raised enough to be dangerous, but not so much that they started assuming unlimited runway. Constraints breed focus. And focus breeds execution.

Investors know this. They're looking for founders who are running lean, who understand their unit economics, who are saying no to opportunities that don't move the needle. Not because capital is scarce—capital is available for good founders—but because that discipline is correlated with eventual success.

Investors in 2026 are focusing on industries like healthcare and manufacturing, driven by founders with deep domain expertise. Estimated data.

Differentiation in Crowded Markets: How to Stand Out

One of the most common founder frustrations in 2025 and heading into 2026 is this: I've got a good idea, but so does everyone else. How do I differentiate?

The answer from investors is pretty consistent: you can't differentiate in the product alone anymore. Not in AI. Not in software. The product gets copied quickly. The distribution, the team, the unique perspective—that's where differentiation lives.

So what does this look like in practice?

It means knowing your customer better than anyone else knows them. Having conversations with hundreds of them before you even start building. Understanding their existing workflows so deeply that you can identify friction that they don't even realize exists.

It means building something that solves a specific, acute problem for a specific, identifiable customer segment. Not "AI for business productivity." Specific. Acute. Identifiable. If you can't draw a clear picture of who your customer is and why they need you, your product is too generic.

It means being willing to go deep in one vertical instead of broad across many. Most founders want to build horizontal platforms because the TAM is larger. But horizontal platforms face way more competition. Vertical solutions, built specifically for an industry, are way more defensible.

It means having a distribution advantage that competitors can't easily replicate. This could be a partnership with a major vendor. It could be brand credibility in a specific industry. It could be access to data. It could be a sales team made up of people who used to work in that industry and have Rolodexes.

It means building a moat. Not with network effects or data—those take time to build. But with switching costs, complex implementation, regulatory compliance requirements, or deep customization that makes it hard for someone to move to a competitor.

None of these are new concepts. But the market is now punishing generalists and rewarding specialists. If you're building something for "everyone," investors assume you're building something for "no one specific."

The Venture Capital Thesis Evolution: From Growth to Efficiency

There's been a fundamental philosophical shift in venture capital over the past 18 months. It's not about growth at any cost anymore. It's about growth with solid fundamentals.

This shift came from a simple realization: companies that grew 500% annually but had terrible unit economics and required massive cash infusions to maintain growth didn't deliver great returns. In fact, many of them either shut down when capital dried up or had to raise at flat valuations because the business model didn't work.

The companies that delivered good returns were the ones that found product-market fit, figured out repeatable unit economics, and then scaled. Not the other way around.

So investor theses are changing. More focus on unit economics. More focus on gross margin. More focus on whether customers are actually sticky or if you're just paying to acquire people who churn immediately.

For founders, this is actually good news. It means investors are looking at deeper metrics. It means there are multiple ways to win. It's not just "who can burn through the most capital fastest." It's "who can build something people actually want to keep using."

But it also means you need to know your metrics. Every founder should be able to recite their CAC, LTV, payback period, net revenue retention, gross margin, and burn rate. If you don't know these cold, you're flying blind.

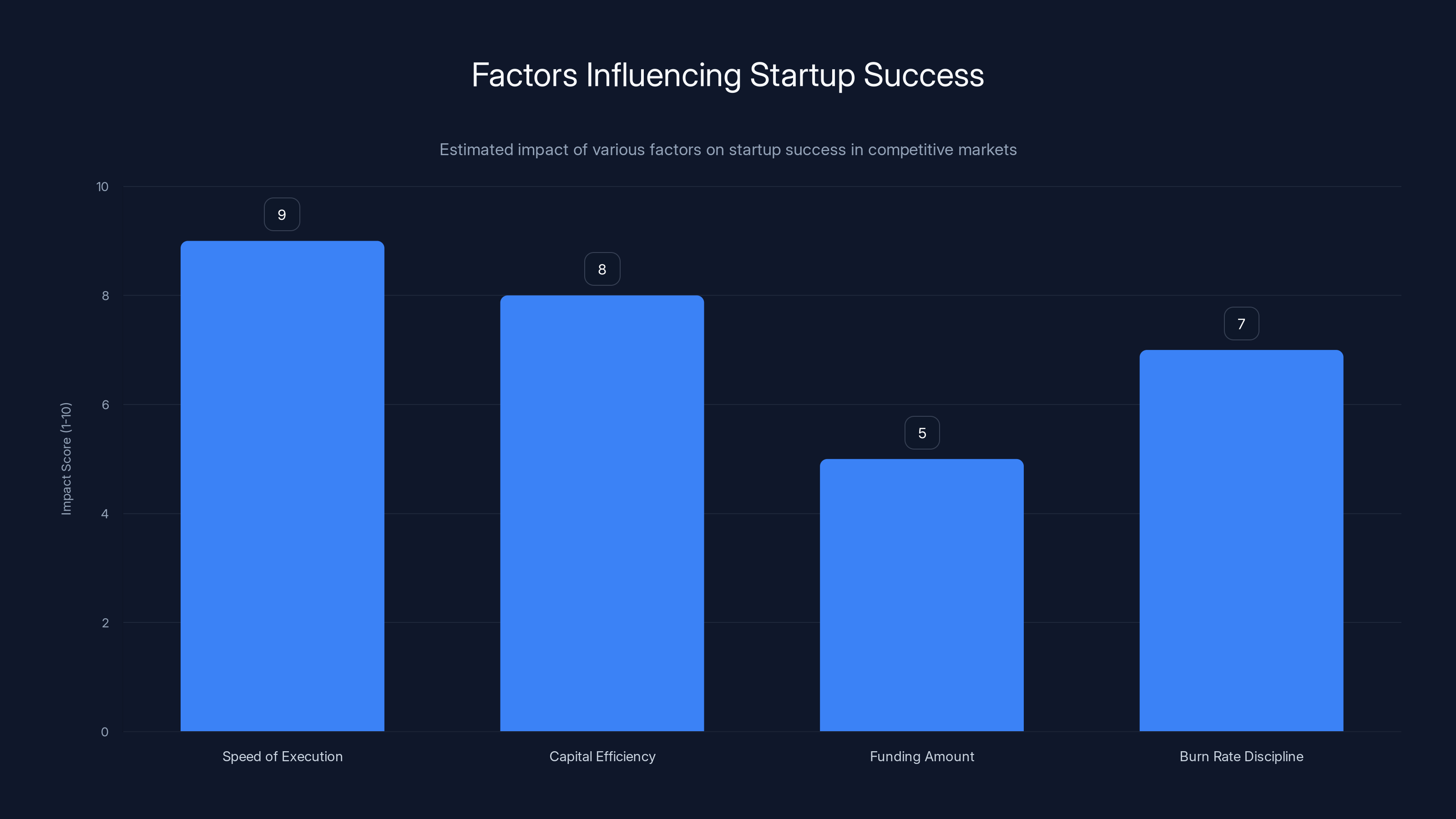

Speed of execution and capital efficiency are more critical to startup success than the sheer size of funding. Estimated data reflects current market insights.

Looking Beyond 2026: What Are the Long-Term Trends?

Investors aren't just thinking about 2026. They're thinking about 2026 as a waypoint on a longer journey. What's going to matter in 2027, 2028, 2029?

A few patterns are clear:

First, the concentration of capital is increasing. The best founders will raise easily. Everyone else will have a harder time. This is normal. This is how venture capital works. But it means the bar for differentiation is higher than it used to be.

Second, domain expertise and vertical expertise will be increasingly valuable as a founder. As AI becomes table stakes, the founder's edge is more likely to be industry expertise than technical expertise. This is a major shift from the past decade where technical founders dominated.

Third, regulatory frameworks are becoming more important. AI regulation at the federal level will probably land in 2026 or 2027. Data privacy regulations are evolving. Sector-specific regulations (healthcare, financial services, etc.) are being updated for AI. Founders who understand and can navigate the regulatory landscape will be at a major advantage.

Fourth, the consolidation of AI models into a few dominant providers will accelerate. You're not going to see fifty viable foundation models. You're probably going to see three to five. This means the AI applications being built on top of those models need to be incredibly differentiated. You can't just be "Chat GPT but for X." You need to be "the best solution for X, powered by AI."

Fifth, AI will be boring. This is good. Boring means mature. Mature markets are where profitable companies get built. The days of hype-driven valuations are ending. The days of companies that prove strong business fundamentals and good market fit getting funded are starting.

What Founders Should Do Right Now If They're Planning to Raise in 2026

If you're a founder and you're planning to raise capital in the next 18 months, here's what the investor feedback is telling you to focus on:

Get real traction. Not vanity metrics. Revenue. Customers paying you. Or really strong evidence of product-market fit (retention, engagement, organic growth).

Understand your customer obsessively. Know who you're serving, what problems you're solving for them, and why they would pay for your solution. This should come from talking to hundreds of customers, not from speculation.

Build a repeatable sales engine. Show that you can acquire customers at a reasonable cost, that they stick around, and that they generate enough lifetime value to justify the acquisition cost.

Have a defensible moat. Some reason why you'll win and competitors will lose. It could be technology, it could be relationships, it could be data, it could be distribution. But you need to be able to articulate it.

Know your numbers. Be able to recite metrics from memory. Investors will ask about CAC, LTV, payback period, burn rate, gross margin. If you fumble these, they'll lose confidence in your ability to run a business.

Build a great team around you. Raw technical talent is table stakes. You need people who understand sales, operations, fundraising, and customer success.

Have a clear story about why now. Why is 2026 the right time to build this? Why will you win when others won't? Why should we believe you over someone else building in the same space?

The investors saying these things aren't being rhetorical. They're being literal. This is what they're looking for. This is what separates fundable founders from talented people who aren't ready to raise.

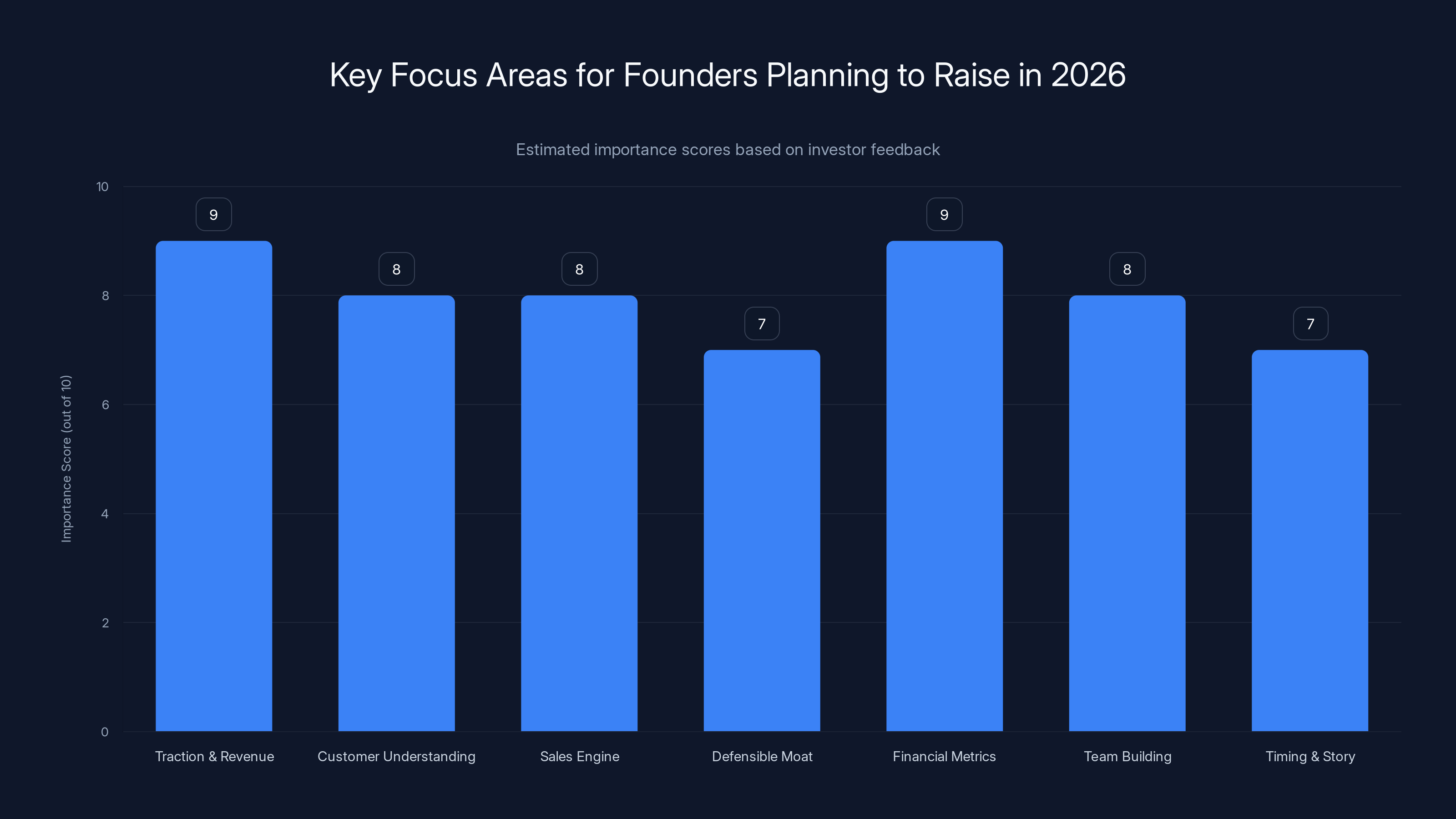

Founders should prioritize traction, financial metrics, and customer understanding to attract investors in 2026. Estimated data based on typical investor priorities.

The Role of Micro-VCs and Emerging Fund Managers in 2026

While the mega-funds are getting more selective and more focused on proven winners, there's interesting activity happening at the micro-VC and emerging fund manager level.

Smaller funds—focused on seed and Series A—are often more willing to take risks on first-time founders with good ideas. They're also more focused on specific verticals or geographies. An emerging fund manager focused on AI for healthcare is probably going to be more committed to your healthcare AI startup than a mega-fund that's agnostic across all verticals.

This creates opportunities for founders who don't fit the mega-fund mold. If you're building something interesting but you haven't proven explosive growth yet, a focused micro-VC is often a better fit than raising from a generalist mega-fund.

The trade-off is that micro-VCs have less capital and less brand name. But they can be incredibly active operators and they might have better industry relationships than a mega-fund. Sometimes that's worth way more than the name on the check.

AI's Impact on VC Itself: How Investors Are Using AI to Make Better Decisions

It's not just founders using AI to build products. Investors are also using AI to improve their decision-making.

Some VCs are using AI to analyze market trends, identify emerging categories, and spot founders who are outperforming their peers. Some are using natural language processing to read through pitch decks and flag the most promising founders. Some are using AI to build models that predict which companies are most likely to exit successfully.

This creates an interesting dynamic: founders are competing for capital from investors who are increasingly using AI to evaluate them. The same technologies that level the playing field for software development are also leveling the playing field for venture capital analysis.

What this means in practice is that it's harder to game the system. AI investors are looking at multiple signals, not just the pitch. They're trying to identify patterns that correlate with success. So the best strategy as a founder is simple: actually build something good, find real customers, prove that they value your solution. You can't fool AI analysis by being a good presenter or having a compelling story. The data has to back it up.

The Importance of Founder-Investor Alignment in 2026

With capital more available for proven founders, there's an opportunity for founders to be more selective about who they take money from.

This is a significant shift from 2022-2023, when every founder was grateful to raise from anyone. In 2026, the best founders should be thinking about which investors will actually help them build a great business, not just which investor will give them the most money.

This means asking hard questions: Does this investor have domain expertise in my space? Have they backed successful companies in this category? Are they actually going to be helpful, or just another board member taking their pro-rata?

Investors know this too. They know that the best founders have options. So investors are increasingly differentiating on the value they bring beyond capital. Some are bringing customer relationships. Some are bringing operational expertise. Some are bringing strategic guidance. Some are just being available to help and not trying to control the company.

For founders, this is good. It means you're not powerless. You have agency. You can choose investors who align with your vision and can actually help you.

Economic Headwinds and Geopolitical Uncertainty: What Could Go Wrong

Investor predictions are always made with some uncertainty baked in. And in early 2026, there are real headwinds.

Interest rates could go up, which makes VC returns less attractive relative to other investments. The economy could slow down, which affects company growth and extends sales cycles. Trade policy could change, which affects companies with international operations. AI regulation could be more restrictive than expected, which affects certain AI companies.

These aren't predictions. They're risks. And investors are hedging against them by being more careful with capital allocation, by looking for companies with clear unit economics that don't require perpetual growth to work, and by investing in sectors and geographies that are less exposed to these headwinds.

For founders, this means: don't assume that the easy capital of 2024 will continue. Build a company that works on solid fundamentals, not one that only makes sense if capital remains cheap and plentiful.

The Shift From Silicon Valley Dominance to Global Venture Capital

Investors are increasingly deploying capital outside Silicon Valley. Endeavor Catalyst alone made 50 investments across 25 countries last year.

This reflects a genuine shift in where entrepreneurship and innovation is happening. The tech industry is genuinely becoming global. There are great founders everywhere. And the best capital should flow to the best founders, regardless of geography.

For founders outside Silicon Valley, this is actually good news. You're not at a disadvantage anymore if you're not in SF or NYC. You can build a great company anywhere. You can raise capital from investors who are looking globally, not just locally.

But it also means more competition globally. If you're the best founder in your country, you're now competing against founders from every other country. The stakes have gotten higher. The bar has gotten higher. But the opportunities have gotten bigger too.

What About the IPO Market? Is 2026 Finally the Year?

One of the perennial predictions from investors is "the IPO market is coming back next year." It's been wrong before. It might be wrong again.

But the conditions are slightly more favorable in 2026 than they were in 2024-2025. More companies are profitable or close to profitable. The public market is less hostile to growth. Investor appetite for growth stocks is returning slightly.

That said, the IPO market is never coming back to what it was in 2021. That was a bubble. The future IPO market will likely be more selective, with fewer companies going public, but those companies will be better quality.

For founders building with the intention to go public, this means you need to be building something that will work as a public company. Good unit economics. Real revenue. A clear path to profitability. Public markets don't care about your vision. They care about earnings.

For investors, the recovery of the IPO market means more exit opportunities, which means their capital gets returned, which means they can deploy new capital. So there's incentive to help portfolio companies move toward IPO readiness.

FAQ

What exactly are investors looking for in founders in 2026?

Investors are looking for founders who combine three things: deep domain expertise or unique market insight, proof of repeatable, scalable customer acquisition, and ability to articulate a clear path to significant business size. Beyond that, they want to see founders who understand their numbers—CAC, LTV, payback period—and can show that their business fundamentals are strong. The days of funding founders primarily on vision and charisma are ending. The days of funding founders who can prove business model durability are beginning.

Why is distribution advantage so important right now?

Distribution advantage is important because product advantages are temporary. If you build something good, competitors can copy it, especially in an AI-first world where tooling is commoditized. But distribution—relationships, customer access, brand credibility, channel partnerships—is much harder to replicate. Investors know that the company that wins isn't necessarily the one with the best product. It's the one who can get their product in front of customers faster and cheaper than competitors can.

What does "pilot purgatory" mean and why should founders care?

Pilot purgatory happens when enterprises agree to test your product and the test goes well, but the company never commits to buying. They loved it. They tested it thoroughly. But they didn't have an urgent enough business problem to justify purchase, so the pilot just ends. Investors care because pilots that don't convert to revenue are expensive learning experiences, not businesses. If your sales process is heavily dependent on pilots that might never convert, investors will pass. Founders should focus on selling to customers with acute, urgent problems, not aspirational buyers who might want to optimize something eventually.

How has AI commoditization changed what investors value?

AI commoditization changed everything. Five years ago, having an AI engineer was a major competitive advantage. Now it's table stakes. The technical bar is higher, but it's also higher for everyone. So having good engineers is no longer a differentiator. What differentiates is having engineers who understand an industry deeply, or having access to unique data, or having customer relationships that competitors can't easily replicate. It shifted the competitive advantage from technical superiority to market positioning and execution speed.

Should founders focus on raising the biggest check possible?

No. Bigger checks sound good but they bring pressure and expectations. The best strategy is to raise enough capital to execute your plan effectively, but not so much that you get complacent or that the pressure becomes paralyzing. VCs often recommend raising 18-24 months of runway at the seed stage, and enough to reach the next meaningful milestone at Series A and beyond. More capital doesn't guarantee success. Better execution does. Sometimes constraints actually improve execution because they force focus.

What's the most important metric investors look at before deciding to fund?

It depends on the stage. At seed, it's product-market fit indicators: retention, engagement, organic growth, or early revenue traction. At Series A, it's unit economics and customer acquisition proof. At Series B and beyond, it's revenue growth rate and customer lifetime value. But across all stages, the underlying question is the same: Is this founder building something people actually want to keep using, and is the business model sound? If you can show that clearly in your metrics, everything else is secondary.

Is there still venture capital available for first-time founders in 2026?

Yes, but with higher bars. First-time founders who can show strong product-market fit, clear customer demand, good retention, and a smart approach to the market can still raise. But vanilla first-time founders with just an idea and a good pitch are going to struggle. The competitive advantage of first-time founders used to be that they were hungry and naive enough to take risks. But now non-founders with founder-level ambition and domain expertise are competing for the same capital. First-time founders need to be exceptional in their own right, not just ambitious.

How should founders approach the investor landscape if they're not based in Silicon Valley?

The geographic landscape is shifting. Investors are increasingly deploying globally. But this means you're competing globally too. Your advantage isn't that you're the best founder in your city. Your advantage has to be that you've solved something important and have found product-market fit. Geographic proximity to VCs used to matter much more than it does now. What matters more is having a business that works and investors who understand your market.

What's the most important thing to fix about a startup pitch?

Most founders spend too much time explaining their vision and not enough time showing their metrics. Investors don't need to hear why you think AI is going to change the world. They need to see that you've built something people actually use. They need to see your numbers. If your pitch is all narrative and no data, you're going to lose sophisticated investors. The winning pitch combines a great story with strong metrics that prove the story is actually happening.

Conclusion: Navigating the 2026 Venture Capital Landscape

The predictions from top venture investors heading into 2026 paint a consistent picture: the easy capital era is ending, the exuberant growth-at-all-costs era is ending, and the era of proving fundamental business soundness is beginning.

For founders, this is clarifying. It means the bar is high, but the path is clear. You need to build something people actually want, find a way to acquire customers at a reasonable cost, and prove that your business model works. The bar is higher, but it's also more objective. You're not competing on pitch skills or charisma. You're competing on execution and fundamentals.

For investors, it's a return to first principles. They're looking for founders who can build durable, profitable businesses, not just fast-growing companies that might blow up. They're looking for domain expertise and distribution advantage. They're focused on sectors with clear buyer demand and regulatory clarity. They're deploying capital globally but being more selective about which founders get funded.

The meta-pattern underlying all of this is simple: the venture capital industry is maturing. Like all maturing industries, it's becoming more efficient, more selective, more focused on fundamental value creation rather than hype and growth. This is actually good news for the startup ecosystem in the long run. It means the capital that flows to startups is more likely to flow to founders who can use it wisely. It means the companies that survive and grow will have better fundamentals. It means the IPO market might actually return because the companies going public will be genuinely strong.

But in the short term, it's a harder environment for marginal founders and mediocre ideas. And that's fine. Venture capital was never supposed to be easy access. It was supposed to be capital for exceptional founders solving important problems. The market is starting to function more like that again.

If you're a founder building in 2025 and planning to raise in 2026, the best thing you can do is stop worrying about what investors want and start focusing on building something genuinely valuable. Build something that solves a real problem for a specific customer. Find distribution that other people can't easily replicate. Get profitable, or at least get to unit-level profitability quickly. Understand your metrics and what they mean.

Do those things, and capital will be available. Skip any of them, and no amount of pitching will help.

The venture capital game in 2026 is not about who raises the biggest check. It's about who builds the best business. That might sound obvious, but it's a refreshing change from the last few years when the game seemed to be more about hype and hope.

Hope is finally out. Execution is in.

Note on Using Runable for Startup Growth:

If you're a founder preparing investor materials, pitch decks, financial reports, or business documentation for 2026 fundraising, Runable can significantly accelerate your content creation workflow. The platform uses AI to help you generate professional presentations, documents, and reports from raw business data—exactly what you need when preparing for investor conversations. Starting at $9/month, it's accessible for early-stage founders building while bootstrapped. You can create pitch decks, annual reports, financial summaries, and investor updates in a fraction of the time manual creation would take.

Use Case: Generate polished investor pitch decks and financial reports in minutes, freeing you to focus on building product and acquiring customers instead of spending hours in Google Slides.

Try Runable For Free

Key Takeaways

- Investors now require proven unit economics and repeatable sales engines, not just traction and narrative

- Distribution advantage has become more valuable than product advantage, making industry expertise and relationships key

- Pilot purgatory is a major concern for enterprise AI companies—investors focus on contracts that convert, not extended trials

- Domain expertise and high-context founders are preferred over pure technical talent in 2026 funding landscape

- Capital is available for best founders, but the bar for proving business fundamentals is significantly higher than 2024-2025

Related Articles

- Why Apple Won't Make a Foldable iPhone Until They're Perfect [2025]

- Best iPad Accessories for Every User [2026]

- Watch Death in Paradise 2025 Christmas Special Online [2025]

- Best PS5 Accessories [2025]: 15 Must-Have Extras for Your Setup

- How to Change Your Gmail Address: The Complete Guide [2025]

- Best Books of 2025: The Year's Most Impactful Reads [2025]

![What Startups & VCs Should Expect in 2026: Investor Predictions [2025]](https://techcrunch.com/wp-content/uploads/2024/12/2025-vc-predictions.jpg?resize=1200,800)